Dynamic Pricing and Commission Strategies in Live-Stream: An Incentive Mechanism Analysis

Abstract

1. Introduction

2. Literature Review

2.1. Live-Stream Commerce

2.2. Streamer Type and Power Structure

2.3. Dynamic Commission

3. Problem Description

3.1. The Structure of Dynamic Wholesale Price and Commission Rate

3.2. Manufacturer-Dominating Scenarios

3.2.1. Model EM

3.2.2. Model DWM

3.2.3. Model DDM

3.3. Streamer-Dominating Scenarios

3.3.1. Model ES

3.3.2. Model DWS

3.3.3. Model DDS

3.4. Equilibrium Analysis

4. Model Extension: The Impact of Spillover Effect

5. Numerical Study

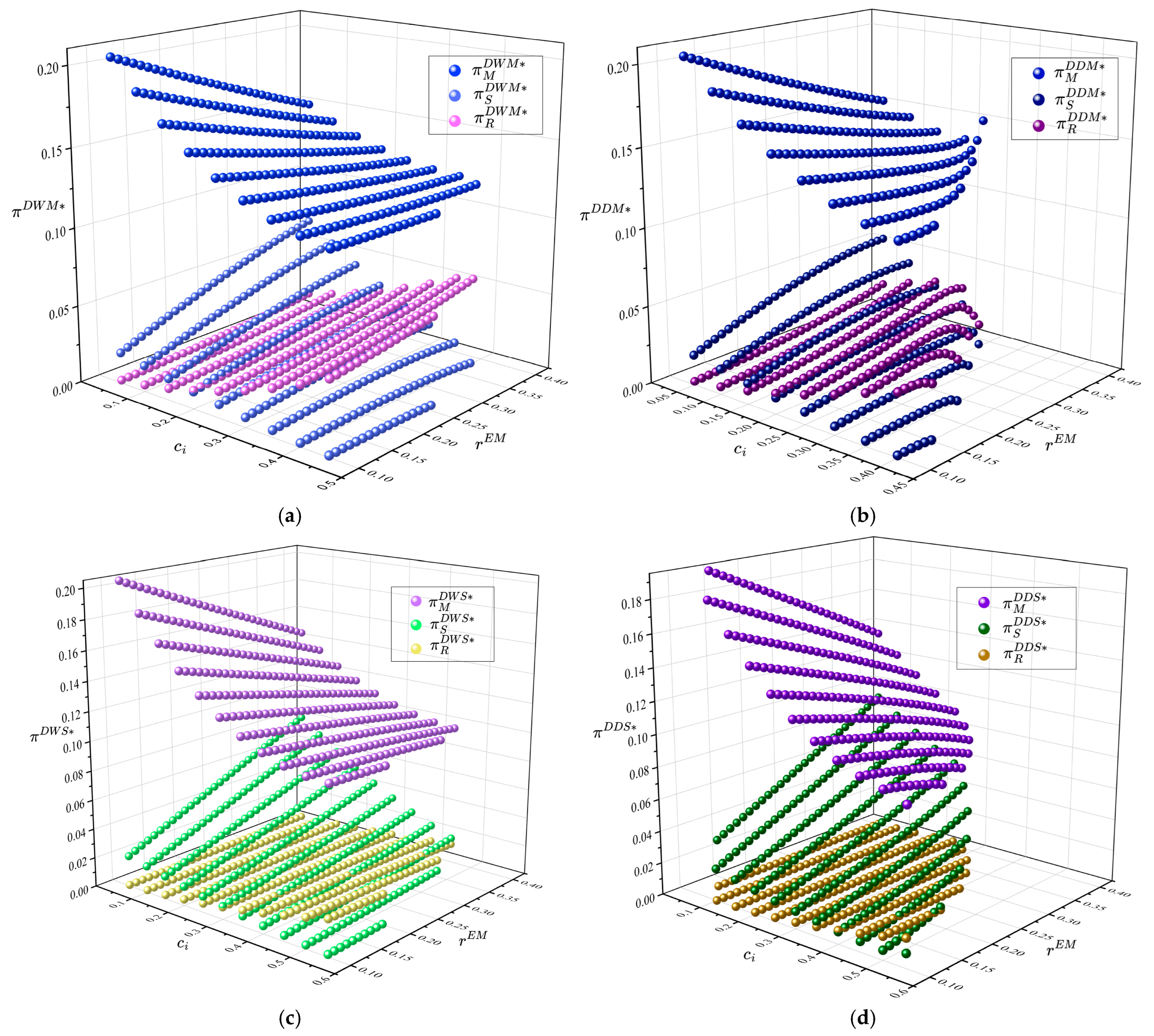

5.1. Comparison Among Dynamic Models

5.2. Product Type

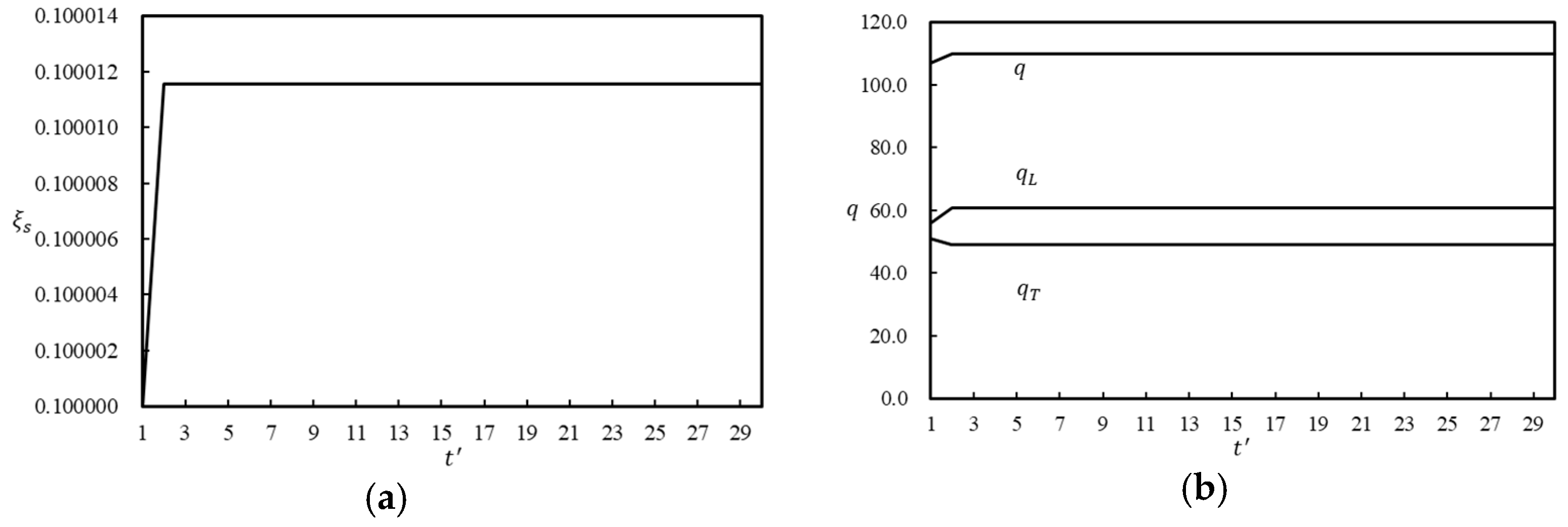

5.3. Validation of Dynamic Commission Rate

6. Conclusions Summary

6.1. Conclusions

6.2. Managerial Insights

- (i)

- When selecting the appropriate commission structure, manufacturers operating in manufacturer-dominated scenarios can significantly improve their profits by adopting dynamic wholesale pricing or a dual dynamic mechanism. This approach also benefits retailers, as collaborative alignment increases overall efficiency. However, manufacturers should be mindful that dynamic commission rates may diminish the incentives for streamers in the live-streaming channel, potentially affecting long-term channel performance.

- (ii)

- In terms of product type and channel management, choosing products with moderate hassle costs and a higher disutility factor proves advantageous. Such products enhance the manufacturer’s profits by optimizing performance across both live-stream and traditional channels. Balancing these product characteristics helps ensure that channel management strategies are effective and contribute to sustained profitability.

- (iii)

- For partner selection, manufacturers generally favor L-streamers. This preference enables them to reduce commission costs while retaining stronger control over the traditional retail channel. By partnering with less influential streamers, manufacturers can achieve better coordination and maximize profits across both live-stream and traditional sales channels.

- (iv)

- The dual effect of dynamic mechanisms must also be carefully considered. While dynamic wholesale prices reliably contribute to the manufacturer’s profitability, dynamic commission rates can have adverse effects under certain conditions. Manufacturers must thoroughly evaluate these combined effects to determine the best approach to maximizing overall profits and sustaining channel growth.

- (v)

- Lastly, the stability of long-term partnerships is reinforced by the fact that all dynamic models eventually reach a steady state. This convergence not only ensures long-term supply chain sustainability but also provides a predictable foundation for ongoing profitability. Manufacturers should leverage these dynamic adjustments to maintain stable partnerships and foster a resilient supply chain over time.

6.3. Limitations

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. For “Dynamic Pricing and Commission Strategies in Live-Stream: An Incentive Mechanism Analysis”

- (i)

- ...

- (ii)

- ① .② ; it is obvious that , so we only judge the sign of the function , and it is rewritten as a linear function of , The signs of linear terms and constant terms need to be judged, and , . , , , , , ; the constant term is always a negative value. There exists a value to make when and when . When , the linear term is positive and the constant term is negative, and the intersection with x-axis , ; therefore, when , . When , the linear term and constant term are all negative; therefore, .③ . . A quadratic function on is obtained with two intersections with the x-axis: ; it is verified that the bigger intersection , so the bigger intersection is less than 1. When , then ; when , then . □

| Decision Variables | |

|---|---|

| , | |

| , | |

| , | |

| , | |

| , | |

| , | |

| , | |

| , | |

| , | |

| , | |

| . |

References

- Wongkitrungrueng, A.; Assarut, N. The role of live streaming in building consumer trust and engagement with social commerce sellers. J. Bus. Res. 2020, 117, 543–556. [Google Scholar]

- Chen, H.; Dou, Y.; Xiao, Y. Understanding the Role of Live Streamers in Live-Streaming E-Commerce. Electron. Commer. Res. Appl. 2023, 59, 101266. [Google Scholar]

- Pan, R.; Feng, J.; Zhao, Z. Fly with the wings of live-stream selling—Channel strategies with/without switching demand. Prod. Oper. Manag. 2022, 30, 3387–3399. [Google Scholar]

- Zhang, Z.; Chen, Z.; Wan, M.; Zhang, Z. Dynamic quality management of live streaming e-commerce supply chain considering streamer type. Comput. Ind. Eng. 2023, 182, 109357. [Google Scholar] [CrossRef]

- Thepaper. 2024. Available online: https://www.thepaper.cn/newsDetail_forward_27890414 (accessed on 29 June 2024).

- Agri.cn. Available online: http://www.agri.cn/sj/jcyj/ (accessed on 25 March 2025).

- Mbalib.com. Available online: https://www.mbalib.com/ask/question-6bdf2e72435e2ef4bad7aaf556c33d1e.html (accessed on 15 February 2025).

- Toutiao. 2024. Available online: https://www.toutiao.com/article/7424452540441428519/ (accessed on 11 October 2024).

- Qu, Y. Judicial Empirical Research on Disputes over Online Live Streaming with Goods. Acad. J. Bus. Manag. 2023, 5, 96–104. [Google Scholar]

- Simchi-Levi, D.; Zheng, Z.; Zhu, F. Offline Planning and Online Learning Under Recovering Rewards. Manag. Sci. 2024, 71, 298–317. [Google Scholar]

- Lu, S.; Yao, D.; Chen, X.; Grewal, R. Do Larger Audiences Generate Greater Revenues under Pay What You Want? Evidence from a Live-stream Platform. Manag. Sci. 2021, 40, 813–1007. [Google Scholar]

- Zhao, K.; Lu, Y.; Hu, Y.; Hong, Y. Direct and indirect spillovers from content providers’ switching: Evidence from online livestreaming. Inf. Syst. Res. 2023, 34, 847–866. [Google Scholar]

- Kang, K.; Lu, J.; Guo, L.; Li, W. The dynamic effect of interactivity on customer engagement behavior through tie strength: Evidence from live streaming commerce platforms. Int. J. Inf. Manag. 2021, 56, 102251. [Google Scholar]

- Cui, X.; Li, Y.; Li, X.; Fang, S. Livestream e-commerce in a platform supply chain: A product-fit uncertainty reduction perspective. Int. J. Prod. Econ. 2023, 258, 108796. [Google Scholar]

- Xie, P.; Shi, R.; Xu, D. Retailer service strategy on livestreaming platforms considering free riding behavior. Ann. Oper. Res. 2023, 344, 647–677. [Google Scholar]

- Huang, L.; Liu, B.; Zhang, R. Channel strategies for competing retailers: Whether and when to introduce live stream? Eur. J. Oper. Res. 2024, 312, 413–426. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, C.W.; Ming, L.; Cheng, Y. The sales impacts of traffic acquisition promotion in live-stream commerce. Prod. Oper. Manag. 2024. [Google Scholar] [CrossRef]

- Hou, J.; Shen, H.; Xu, F. A Model of Livestream Selling with Online Influencers. Soc. Sci. Res. Netw. 2021. [Google Scholar] [CrossRef]

- Ji, G.; Fu, T.; Li, S. Optimal selling format considering price discount strategy in live-streaming commerce. Eur. J. Oper. Res. 2023, 309, 529–544. [Google Scholar]

- Hao, C.; Yang, L. Resale or Agency Sale? Equilibrium Analysis on the Role of Live-stream Selling. Eur. J. Oper. Res. 2023, 307, 1117–1134. [Google Scholar]

- Wang, J.; Zhang, X. The value of influencer channel in an emerging livestreaming e-commerce model. J. Oper. Res. Soc. 2023, 74, 112–124. [Google Scholar] [CrossRef]

- Huang, M.X.; Ye, Y.Q.; Wang, W. The interaction effect of broadcaster and product type on consumers’ purchase intention and behaviors in livestreaming shopping. Nankai Bus. Rev. 2021, 26, 188–198. [Google Scholar]

- Niu, B.; Chen, Y.; Zhang, J.; Chen, K.; Jin, Y. Brands’ Livestream Selling with Influencers’ Converting Fans into Consumers. Omega 2024, 131, 103195. [Google Scholar] [CrossRef]

- Ye, F.; Ji, L.; Ning, Y.; Li, Y. Influencer selection and strategic analysis for live streaming selling. J. Retail. Consum. Serv. 2024, 77, 103673. [Google Scholar] [CrossRef]

- Zhang, W.; Yu, L.; Wang, Z. Live-streaming selling modes on a retail platform. Transp. Res. Part E Logist. Transp. Rev. 2023, 173, 103096. [Google Scholar]

- Qi, A.; Sethi, S.; Wei, L.; Zhang, J. Top or regular influencer? Contracting in live streaming platform selling. Soc. Sci. Res. Netw. 2022. [Google Scholar] [CrossRef]

- Wang, X.; Tao, Z.; Liang, L.; Gou, Q. An analysis of salary mechanisms in the sharing economy: The interaction between streamers and unions. Int. J. Prod. Econ. 2019, 214, 106–124. [Google Scholar]

- Yang, X.; Gou, Q.; Wang, X.; Zhang, J. Does bonus motivate streamers to perform better? An analysis of compensation mechanisms for live-stream platforms. Transp. Res. Part E Logist. Transp. Rev. 2022, 164, 102758. [Google Scholar]

- Liu, S.; Hua, G.; Cheng, T.E.; Choi, T.M. Optimal pricing and quality decisions in supply chains with consumers’ anticipated regret and online celebrity retailers. IEEE Trans. Eng. Manag. 2024, 71, 1115–1129. [Google Scholar]

- Huang, H.; Ke, H.; Wang, L. Equilibrium analysis of pricing competition and cooperation in supply chain with one common manufacturer and duopoly retailers. Int. J. Prod. Econ. 2016, 178, 12–21. [Google Scholar]

- Li, G.; Li, L.; Liu, M.; Sethi, S.P. Impact of power structures in a subcontracting assembly system. Ann. Oper. Res. 2020, 291, 475–498. [Google Scholar]

- Hu, Y.; Qu, S.; Li, G.; Sethi, S.P. Power structure and channel integration strategy for online retailers. Eur. J. Oper. Res. 2021, 294, 951–964. [Google Scholar]

- Chen, Z.; Fan, Z.-P.; Zhao, X. Offering return-freight insurance or not: Strategic analysis of an e-seller’s decisions. Omega 2021, 103, 102447. [Google Scholar]

- Zhang, Z.; Xu, H.; Chen, K.; Zhao, Y.; Liu, Z. Channel mode selection for an e-platform supply chain in the presence of a secondary marketplace. Eur. J. Oper. Res. 2023, 305, 1215–1235. [Google Scholar]

- Tian, L.; Vakharia, A.J.; Tan, Y.; Xu, Y. Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Prod. Oper. Manag. 2018, 28, 1595–1610. [Google Scholar]

- Yan, Y.; Zhao, R.; Xing, T. Strategic introduction of the marketplace channel under dual upstream disadvantages in sales efficiency and demand information. Eur. J. Oper. Res. 2019, 273, 968–982. [Google Scholar]

- Liu, H.; Xu, T.; Jing, S.; Liu, Z.; Wang, S. The interplay between logistics strategy and platform’s channel structure design in b2c platform market. Eur. J. Oper. Res. 2023, 310, 812–833. [Google Scholar]

- Geng, X.; Tan, Y.; Wei, L. How add-on pricing interacts with distribution contracts. Prod. Oper. Manag. 2018, 27, 605–623. [Google Scholar]

- Ha, A.Y.; Tong, S.; Wang, Y. Channel structures of online retail platforms. Manuf. Serv. Oper. Manag. 2022, 24, 1547–1561. [Google Scholar]

- Zhen, X.; Xu, S.; Li, Y.; Shi, D. When and how should a retailer use third-party platform channels? the impact of spillover effects. Eur. J. Oper. Res. 2022, 301, 624–637. [Google Scholar]

- Wei, J.; Lu, J.; Zhao, J. Interactions of competing manufacturers’ leader-follower relationship and sales format on online platforms. Eur. J. Oper. Res. 2019, 280, 508–522. [Google Scholar]

- Li, L.; Fang, X.; Lim, Y.F. Asymmetric information of product authenticity on c2c e-commerce platforms: How can inspection services help? Manuf. Serv. Oper. Manag. 2023, 25, 631–647. [Google Scholar]

- Hu, H.; Zheng, Q.; Pan, X.A. Agency or wholesale? The role of retail pass-through. Manag. Sci. 2022, 68, 7538–7554. [Google Scholar]

- Wei, Y.; Dong, Y. Product distribution strategy in response to the platform’s marketplace introduction. Eur. J. Oper. Res. 2022, 303, 886–896. [Google Scholar]

- Wang, L.; Chen, J.; Song, H. Marketplace or reseller? platform strategy in the presence of customer returns. Transp. Res. Part E Logist. Transp. Rev. 2021, 153, 102452. [Google Scholar] [CrossRef]

- Abhishek, V.; Jerath, K.; Zhang, Z.J. Agency selling or reselling? Channel structures in electronic retailing. Manag. Sci. 2016, 62, 2259–2280. [Google Scholar]

- Yang, L.; Guo, J.; Zhou, Y.W.; Cao, B. Equilibrium analysis for competing o2o supply chains with spillovers: Exogenous vs. endogenous consignment rates. Comput. Ind. Eng. 2021, 162, 107690. [Google Scholar] [CrossRef]

- Tsunoda, Y.; Zennyo, Y. Platform information transparency and effects on third–party suppliers and offline retailers. Prod. Oper. Manag. 2021, 30, 4219–4235. [Google Scholar] [CrossRef]

- Liu, W.; Yan, X.; Li, X.; Wei, W. The impacts of market size and data-driven marketing on the sales mode selection in an internet platform based supply chain. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101914. [Google Scholar] [CrossRef]

- Popescu, I.; Wu, Y. Dynamic pricing strategies with reference effects. Oper. Res. 2007, 55, 413–429. [Google Scholar]

- Chen, X.; Hu, P.; Shum, S.; Zhang, Y. Dynamic stochastic inventory management with reference price effects. Oper. Res. 2016, 64, 1529–1536. [Google Scholar] [CrossRef]

- Wang, Z. Technical note–intertemporal price discrimination via reference price effects. Oper. Res. 2016, 64, 290–296. [Google Scholar] [CrossRef]

- Cao, P.; Zhao, N.; Wu, J. Dynamic pricing with bayesian demand learning and reference price effect. Eur. J. Oper. Res. 2019, 279, 540–556. [Google Scholar] [CrossRef]

- Zhao, N.; Wang, Q.; Cao, P.; Wu, J. Dynamic pricing with reference price effect and price-matching policy in the presence of strategic consumers. J. Oper. Res. Soc. 2019, 70, 2069–2083. [Google Scholar] [CrossRef]

- Zhang, J.; Chiang, W.-Y.K. Durable goods pricing with reference price effects. Omega 2020, 91, 102018. [Google Scholar]

- Chen, J.; Pun, H.; Zhang, Q. Eliminate demand information disadvantage in a supplier encroachment supply chain with information acquisition. Eur. J. Oper. Res. 2023, 305, 659–673. [Google Scholar] [CrossRef]

- Tang, Y.; Sethi, S.P.; Wang, Y. Games of supplier encroachment channel selection and e-tailer’s information sharing. Prod. Oper. Manag. 2023, 32, 3650–3664. [Google Scholar] [CrossRef]

- Sun, S.; Zheng, X.; Sun, L. Multi-period pricing in the presence of competition and social influence. Int. J. Prod. Econ. 2020, 227, 107662. [Google Scholar] [CrossRef]

- Chen, K.; Zha, Y.; Alwan, L.C.; Zhang, L. Dynamic pricing in the presence of reference price effect and consumer strategic behaviour. Int. J. Prod. Res. 2019, 58, 546–561. [Google Scholar] [CrossRef]

- Chen, Q.; Yan, X.; Bian, Y.; Han, X. Live Streaming Channel and Product Assortment with both National and Store Brand products. Omega 2024, 131, 103212. [Google Scholar]

- Yu, T.; Guan, Z.; Dong, J. Research on Live E-Commerce Supply Chain Decision-Making Considering Social Media Influencer’s Marketing Efforts under Different Power Structures. Chin. J. Manag. 2022, 19, 714–722. [Google Scholar]

- Li, Y.; Ning, Y.; Fan, W.; Kumar, A.; Ye, F. Channel Choice in Live Streaming Commerce. Prod. Oper. Manag. 2024, 11, 2221–2240. [Google Scholar] [CrossRef]

- Li, S.L.; Kenneth, C.H.; Yong, J. Optimal distribution strategy for enterprise software: Retail, saas, or dual channel? Prod. Oper. Manag. 2018, 27, 1928–1939. [Google Scholar]

- Matsui, K. Optimal bargaining timing of a wholesale price for a manufacturer with a retailer in a dual-channel supply chain. Eur. J. Oper. Res. 2020, 287, 225–236. [Google Scholar]

- Shen, B.; Xu, X.; Guo, S. The impacts of logistics services on short life cycle products in a global supply chain. Transp. Res. Part E Logist. Transp. Rev. 2019, 131, 153–167. [Google Scholar]

- Dong, S.; Qin, Z.; Yan, Y. Effects of online-to-offline spillovers on pricing and quality strategies of competing firms. Int. J. Prod. Econ. 2022, 244, 108376. [Google Scholar]

- Hsieh, C.; Lathifah, A. Exploring the spillover effect and supply chain coordination in dual-channel green supply chains with blockchain-based sales platform. Comput. Ind. Eng. 2023, 187, 109801. [Google Scholar]

- Yang, W.; Govindan, K.; Zhang, J. Spillover effects of live streaming selling in a dual-channel supply chain. Transp. Res. Part E Logist. Transp. Rev. 2023, 180, 103298. [Google Scholar]

| Author | Year | Research Branch | Decision Variables | Exogenous | Endogenous | Single/Multi-Period | Multi-Period | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LC | ST/PS | DC | Y/N | Influential Factor | Y/N | |||||||

| Ji et al. [19] | 2023 | - | - | Retail Price | Y | BP | Single | N | N/A | N/A | ||

| Pan et al. [3] | 2022 | - | - | Retail Price | - | N | N/A | Single | N | N/A | N/A | |

| Chen et al. [56] | 2023a | - | - | Retail Price | N/A | N | N/A | Single | N | N/A | N/A | |

| Wang and Zhang [21] | 2023 | - | Retail price | - | Y | MP, ME, SC, TC | Single | N | N/A | N/A | ||

| Tang et al. [57] | 2023 | - | Sales volume | Y | Selling cost | Single | N | N/A | N/A | |||

| Hu et al. [43] | 2022 | - | - | Retail price | - | Y | Marginal cost | Single | N | N/A | N/A | |

| Sun et al. [58] | 2020 | - | - | - | Retail Price | N/A | N | N.A. | Multiple | Y | - | - |

| Chen et al. [59] | 2019 | - | - | - | Retail Price | N/A | N | N.A. | Multiple | Y | - | |

| Liu et al. [29] | 2024 | - | - | Retail Price | - | N | N.A. | Single | N | N/A | N/A | |

| Liu et al. [49] | 2020 | - | - | - | Sales volume | Y | Market size | Single | N | N/A | N/A | |

| Chen et al. [60] | 2024 | - | - | Retail Price | - | N | N/A | Single | N | N/A | N/A | |

| Niu et al. [23] | 2024 | - | Retail Price | N | N/A | Single | N | N/A | N/A | |||

| Hou et al. [18] | 2021 | - | Retail Price | N | N/A | Single | N | N/A | N/A | |||

| Yu et al. [61] | 2022 | - | Retail Price | N | N/A | Single | N | N/A | N/A | |||

| Zhang et al. [4] | 2023 | - | QIE, QTE | N | N/A | Single | N | N/A | N/A | |||

| Zhang et al. [25] | 2023b | - | Retail Price | N | N.A. | Single | N | N/A | N/A | |||

| This paper | 2024 | Sales volume | Sales volume, commission | Multiple | Y | |||||||

| Notations | Description |

|---|---|

| . | |

| Superscript of extended models | |

| Subscript of manufacturer, streamer, and retailer | |

| The commission rate paid by the manufacturer to the H- and L-streamers | |

| . | |

| . | |

| The profits of the manufacturer, streamer, and retailer under steady states | |

| The profits under positive and negative spillover effects | |

| Decision Variables | Description |

| The sales volume of the traditional online channel and the live-stream channel | |

| The wholesale price | |

| period sales volume of the traditional online channel and the live-stream channel | |

| period wholesale price |

| Decision Variables | EM | ES |

|---|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, T. Dynamic Pricing and Commission Strategies in Live-Stream: An Incentive Mechanism Analysis. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 61. https://doi.org/10.3390/jtaer20020061

Wang T. Dynamic Pricing and Commission Strategies in Live-Stream: An Incentive Mechanism Analysis. Journal of Theoretical and Applied Electronic Commerce Research. 2025; 20(2):61. https://doi.org/10.3390/jtaer20020061

Chicago/Turabian StyleWang, Tong. 2025. "Dynamic Pricing and Commission Strategies in Live-Stream: An Incentive Mechanism Analysis" Journal of Theoretical and Applied Electronic Commerce Research 20, no. 2: 61. https://doi.org/10.3390/jtaer20020061

APA StyleWang, T. (2025). Dynamic Pricing and Commission Strategies in Live-Stream: An Incentive Mechanism Analysis. Journal of Theoretical and Applied Electronic Commerce Research, 20(2), 61. https://doi.org/10.3390/jtaer20020061