Strategic Bidding of Retailers in Wholesale Markets: Continuous Intraday Markets and Hybrid Forecast Methods †

Abstract

:1. Introduction

- To analyse a hybrid model for the intraday market, based on daily auctions and a continuous procedure.

- To analyse a strategic process for retailers submitting bids to the wholesale market.

- To present a computational study that illustrates and tests both the aforementioned market design and the strategic bidding process of retailers; the study involves six retailer agents with different risk attitudes.

2. Literature Review

3. Bilateral Contracting, Risk Management and Portfolio Optimization

- Risk assessment phase: players recognize the risk factors and identify the deterministic and stochastic variables.

- Risk characterization phase: risk is measured using different methods, such as correlation, regression, value-at-risk (VaR), or conditional VaR (CVaR); VaR measures the potential losses of investors to a certain degree of confidence in a given time interval; CVaR has a higher dimension than VaR, because it considers the case when the worst scenario is surpassed; VaR only computes the expected loss of the worst scenario.

- Risk mitigation phase: players select the best set of market products to reduce the risk of their transactions.

4. Strategic Bidding in Wholesale Markets

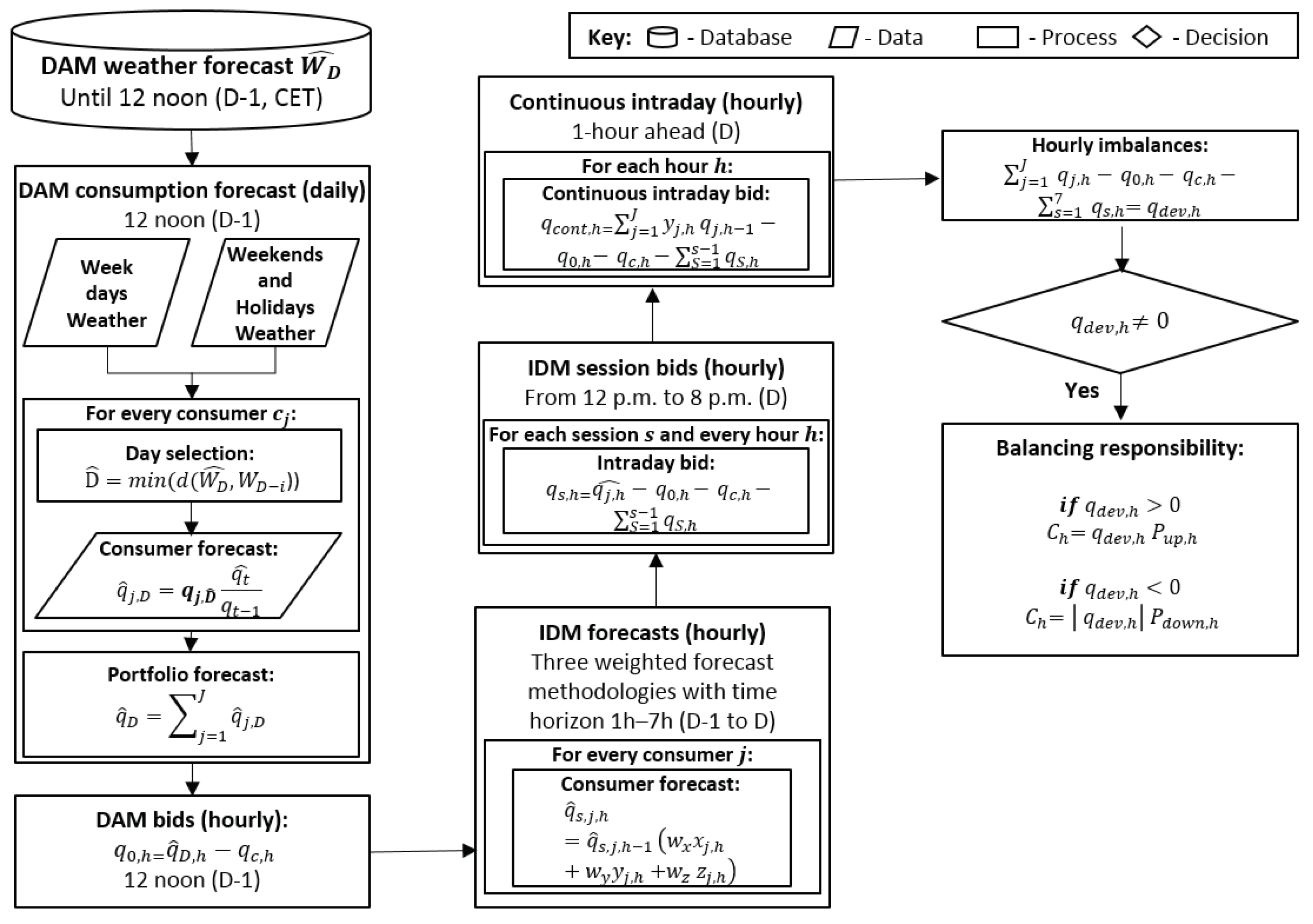

- Retailers determine the consumption forecast for guiding the submission of bids to the DAM. For each consumer, j, they select the past day, , with the minimum Euclidean distance, d, between the historical weather data of a particular past day, , and the weather forecast of the target day, , by considering one or more weather variables (e.g., temperature and humidity):They compute the expected consumption, , by determining the consumption of the past day, , and comparing the consumption forecast of the current year, , with the consumption of the past year :They compute the hourly consumption forecast of the portfolio, , by adding the forecasts of each consumer for each time period, h, of day D:where is the forecast of consumer j.

- Retailers determine the bids submitted to the DAM by taking into account the energy of the whole portfolio, . For each time period, they can sign several contracts, , involving an energy quantity, , so that:where is the energy associated with contract . For a particular time period, in case the quantity of energy guaranteed through bilateral contracts, , is higher than the energy forecasted, , retailers try to sell the excess in a specific session of the the IDM. The associated bids are defined by following a simple strategy. If retailers are buying energy they offer the price-cap (maximum price) of the market to guarantee that they buy the energy required to satisfy the needs associated with their portfolios. Otherwise, they offer the price of the bilateral contracts to avoid economic losses.

- Retailers compute the consumption forecast, , for bidding at each session, s, of the IDM, by considering a procedure that considers the meteorological conditions, the bids submitted to the DAM, , the growth-rate method for a short-run period of 1 to 7 h, , and the average consumption behaviour of each consumer between adjacent time periods, :where j denotes a specific consumer and J the total number of consumers. For time period, h, this formula considers the real consumption of the previous time period, if it exists, or its forecast, , and also the weight, w, of a particular method from a set of three methods. One method considers the bids submitted to the DAM, and , at time periods and h, respectively:Another method considers the traditional behaviour of each consumer (obtained by analyzing the historical consumption data):The last method considers the traditional behaviour and the last consumption tendency (to increase/decrease) of each consumer:

- Retailers compute the bids to submit to each intraday session, , at time period, h, by considering the short-run forecasts and all energy traded in the DAM, , in the previous intraday sessions, , and by bilateral contracts, :where s denotes a specific intraday session.

- Retailers compute the bids to submit to the continuous intraday market. The energy price, , is assumed to be the day-ahead price, . The energy quantity, , is computed as follows:

- Retailers compute the imbalances, , for time period h by considering the real-time consumption of each customer of the portfolio, :

- Retailers compute their balance responsibility, , for time period h by considering their deviations, , and the prices of the excess, , or lack of, , energy, in cases of up or down deviations, respectively:Now, we note that a bilateral contract corresponds to an energy price, , and the associated investment, , of retailers is computed as follows:The profit of retailers per time period is:The return of the investment (ROI) is a performance indicator to measure the profitability of investments, and is computed as follows:The following three indicators are used to evaluate the performance of the forecast methods:where is the maximum consumption (per time period) associated with the portfolio. MAPE is one of the most used indicators. NRMSE is used to evaluate energy forecasts, but overvalues high errors concerning low errors. MAE indicates the absolute error of forecast methods and also the average demand to be balanced. However, it cannot be used to compare results between different data sets.

5. Computational Study

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CET | Central European Time |

| CVaR | conditional VaR |

| DAM | day-ahead market |

| EROP | Equal Return Optimization |

| ERTMC | ER Tariff Market-Costs |

| ETOMaxR | Equal Tariff Optimization at a Maximum Return |

| ETOMinR | ETO at a Minimum Return |

| IDM | intraday market |

| MAE | mean absolute error |

| MAPE | mean absolute percentage error |

| MIBEL | Iberian market |

| MTS | multivariate time series |

| NRMSE | normalized root mean square error |

| ROI | return on investment |

| Indices | |

| contract number | |

| D | target day |

| selected past day | |

| h | period of the tariff |

| i | period number |

| j | consumer number |

| t | year |

| s | IDM session |

| Parameters | |

| consumer agent | |

| quantity acquired in the DAM | |

| quantity in contracts | |

| imbalanced quantity | |

| consumer consumption | |

| bid to each IDM session | |

| maximum quantity | |

| C | retailer’s cost |

| yearly electricity consumption | |

| investment | |

| P | electricity price |

| down deviation price | |

| up deviation price | |

| return | |

| retailer agent | |

| tariff | |

| quantity forecasts | |

| w | weight |

References

- Shahidehpour, M.; Yamin, H.; Li, Z. Market Operations in Electric Power Systems; Wiley: Chichester, UK, 2002. [Google Scholar]

- Lopes, F.; Coelho, H. Concession Behaviour in Automated Negotiation. In E-Commerce and Web Technologies; Springer: Berlin/Heidelberg, Germany, 2010; pp. 184–194. [Google Scholar]

- Algarvio, H. Risk-Sharing Contracts and risk management of bilateral contracting in electricity markets. Int. J. Electr. Power Energy Syst. 2023, 144, 108579. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F.; Couto, A.; Estanqueiro, A. Participation of Wind Power Producers in Day-ahead and Balancing Markets: An Overview and a Simulation-based Study. Wiley Interdiscip. Rev. Energy Environ. 2019, 8, e343. [Google Scholar] [CrossRef]

- Lopes, F.; Coelho, H. Electricity Markets with Increasing Levels of Renewable Generation: Structure, Operation, Agent-Based Simulation and Emerging Designs; Springer International Publishing: Cham, Switzerland, 2018. [Google Scholar]

- Strbac, G.; Papadaskalopoulos, D.; Chrysanthopoulos, N.; Estanqueiro, A.; Algarvio, H.; Lopes, F.; de Vries, L.; Morales-España, G.; Sijm, J.; Hernandez-Serna, R.; et al. Decarbonization of Electricity Systems in Europe: Market Design Challenges. IEEE Power Energy Mag. 2021, 19, 53–63. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F.; Couto, A.; Estanqueiro, A.; Santana, J. Effects of regulating the European internal market on the integration of variable renewable energy. Wiley Interdiscip. Rev. Energy Environ. 2019, 8, e346. [Google Scholar] [CrossRef]

- EC. Regulation 2019/943. Off. J. Eur. Union 2019, L158, 54–124. [Google Scholar]

- EC. Directive 2019/944. Off. J. Eur. Union 2019, L158, 125–199. [Google Scholar]

- Algarvio, H.; Couto, A.; Lopes, F.; Estanqueiro, A. Changing the day-ahead gate closure to wind power integration: A simulation-based study. Energies 2019, 12, 2765. [Google Scholar] [CrossRef]

- EC. Regulation 2015/1222. Off. J. Eur. Union 2015, L197, 24–72. [Google Scholar]

- Algarvio, H.; Lopes, F.; Sousa, J.; Lagarto, J. Multi-agent electricity markets: Retailer portfolio optimization using Markowitz theory. Electr. Power Syst. Res. 2017, 148, 282–294. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F. Agent-based Retail Competition and Portfolio Optimization in Liberalized Electricity Markets: A Study Involving Real-World Consumers. Int. J. Electr. Power Energy Syst. 2022, 137, 107687. [Google Scholar] [CrossRef]

- Algarvio, H. Multi-step optimization of the purchasing options of power retailers to feed their portfolios of consumers. Int. J. Electr. Power Energy Syst. 2022, 142, 108260. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F. Strategic Bidding of Retailers in Wholesale Energy Markets: A Model Using Hybrid Forecast Methods. In Highlights in Practical Applications of Agents, Multi-Agent Systems, and Complex Systems Simulation: The PAAMS Collection; Springer: Cham, Switzerland, 2022; pp. 295–305. [Google Scholar]

- Lopes, F.; Algarvio, H.; Santana, J. Agent-based simulation of electricity markets: Risk management and contracts for difference. In Agent-Based Modeling of Sustainable Behaviors; Springer: Cham, Switzerland, 2017; pp. 207–225. [Google Scholar]

- Lopes, F. MATREM: An Agent-based Simulation Tool for Electricity Markets. In Electricity Markets with Increasing Levels of Renewable Generation: Structure, Operation, Agent-Based Simulation and Emerging Designs; Springer: Cham, Switzerland, 2018; pp. 189–225. [Google Scholar]

- Hatami, A.; Seifi, H.; Kazem, M. Optimal selling price and energy procurement strategies for a retailer in an electricity market. Electr. Power Syst. Res. 2009, 79, 246–254. [Google Scholar] [CrossRef]

- Hatami, A.; Seifi, H.; Kazem, M. A Stochastic-Based Decision-Making Framework for an Electricity Retailer: Time-of-Use Pricing and Electricity Portfolio Optimization. IEEE Trans. Power Syst. 2011, 26, 1808–1816. [Google Scholar] [CrossRef]

- Kettunen, J.; Salo, A.; Bunn, D. Optimization of electricity retailer’s contract portfolio subject to risk preferences. IEEE Trans. Power Syst. 2010, 25, 117–128. [Google Scholar] [CrossRef]

- Nojavan, S.; Nourollahi, R.; Pashaei-Didani, H.; Zare, K. Uncertainty-based electricity procurement by retailer using robust optimization approach in the presence of demand response exchange. Int. J. Electr. Power Energy Syst. 2019, 105, 237–248. [Google Scholar] [CrossRef]

- Ayón, X.; Gruber, J.; Hayes, B.; Usaola, J.; Prodanovic, M. An optimal day-ahead load scheduling approach based on the flexibility of aggregate demands. Appl. Energy 2017, 198, 1–11. [Google Scholar] [CrossRef]

- Wei, N.; Li, C.; Peng, X.; Zeng, F.; Lu, X. Conventional models and artificial intelligence-based models for energy consumption forecasting: A review. J. Pet. Sci. Eng. 2019, 181, 106187. [Google Scholar] [CrossRef]

- Koponen, P.; Ikäheimo, J.; Koskela, J.; Brester, C.; Niska, H. Assessing and comparing short term load forecasting performance. Energies 2020, 13, 2054. [Google Scholar] [CrossRef]

- Shah, I.; Iftikhar, H.; Ali, S. Modeling and forecasting electricity demand and prices: A comparison of alternative approaches. J. Math. 2022, 2022, 3581037. [Google Scholar] [CrossRef]

- Aven, T.; Renn, O. Risk Management and Governance: Concepts, Guidelines and Applications; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Hopkin, P. Fundamentals of Risk Management: Understanding, Evaluating and Implementing Effective Risk Management; Kogan Page: London, UK, 2012. [Google Scholar]

- Rodrigues, F.; Trindade, A. Load forecasting through functional clustering and ensemble learning. Knowl. Inf. Syst. 2018, 57, 229–244. [Google Scholar] [CrossRef]

| Retailer | Risk Attitude | Pricing Strategy | Tariff Type | Number of Clients | Yearly Energy (GWh) | Expected ROI (%) | VaR (%) |

|---|---|---|---|---|---|---|---|

| High aversion | EROP | 3-rate | 5 | 2.76 | 3.75 | 3.42 | |

| Moderate aversion | ETOMaxR | 3-rate | 22 | 475.17 | 3.95 | 3.78 | |

| Small aversion | EROP | Single | 13 | 30.46 | 7.54 | 3.99 | |

| Small seeking | ERTMC | 3-rate | 32 | 290.99 | 7.93 | 4.13 | |

| Moderate seeking | ETOMinR | 3-rate | 13 | 48.58 | 7.79 | 4.19 | |

| High seeking | ETOMinR | 3-rate | 227 | 917.03 | 9.95 | 4.59 |

| Retailer | IDM (Sessions) (%) | MAE (MWh) | MAPE (%) | NRMSE (%) | IDM (Cont.) (%) | Direction (%) | MAE (MWh) | MAPE (%) | NRMSE (%) |

|---|---|---|---|---|---|---|---|---|---|

| 33.08 | 0.04 | 15.61 | 6.75 | 9.73 | −1.57 | 0.03 | 8.94 | 4.23 | |

| 27.71 | 5.77 | 13.62 | 5.92 | 8.55 | −1.89 | 3.68 | 8.13 | 4.08 | |

| 13.31 | 0.22 | 7.02 | 3.55 | 7.79 | −1.25 | 0.16 | 4.86 | 2.82 | |

| 11.79 | 2.18 | 7.08 | 4.45 | 5.82 | −1.26 | 1.17 | 3.75 | 2.37 | |

| 12.17 | 0.28 | 5.07 | 3.19 | 3.46 | −0.71 | 0.19 | 3.32 | 2.43 | |

| 6.56 | 2.42 | 2.43 | 2.03 | 1.62 | 0.18 | 1.57 | 1.55 | 1.35 |

| Retailer | Optimal ROI (%) | ROI (Sessions) (%) | Expected ROI (%) | ROI (cont.) (%) | IR(%) |

|---|---|---|---|---|---|

| 6.82 | 5.24 | 3.75 | 5.79 | 54.40 | |

| 7.25 | 5.98 | 3.95 | 6.42 | 62.53 | |

| 11.92 | 10.97 | 7.54 | 11.19 | 48.41 | |

| 12.34 | 11.36 | 7.93 | 11.73 | 37.20 | |

| 9.86 | 9.16 | 7.79 | 9.30 | 19.38 | |

| 11.88 | 11.51 | 9.95 | 11.59 | 16.48 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Algarvio, H.; Lopes, F. Strategic Bidding of Retailers in Wholesale Markets: Continuous Intraday Markets and Hybrid Forecast Methods. Sensors 2023, 23, 1681. https://doi.org/10.3390/s23031681

Algarvio H, Lopes F. Strategic Bidding of Retailers in Wholesale Markets: Continuous Intraday Markets and Hybrid Forecast Methods. Sensors. 2023; 23(3):1681. https://doi.org/10.3390/s23031681

Chicago/Turabian StyleAlgarvio, Hugo, and Fernando Lopes. 2023. "Strategic Bidding of Retailers in Wholesale Markets: Continuous Intraday Markets and Hybrid Forecast Methods" Sensors 23, no. 3: 1681. https://doi.org/10.3390/s23031681

APA StyleAlgarvio, H., & Lopes, F. (2023). Strategic Bidding of Retailers in Wholesale Markets: Continuous Intraday Markets and Hybrid Forecast Methods. Sensors, 23(3), 1681. https://doi.org/10.3390/s23031681