Beyond Strict Regulations to Achieve Environmental and Economic Health—An Optimal PM2.5 Mitigation Policy for Korea

Abstract

1. Introduction

2. Current Policy and Case Study

2.1. Comprehensive Measures for Particulate Matter Management in Korea

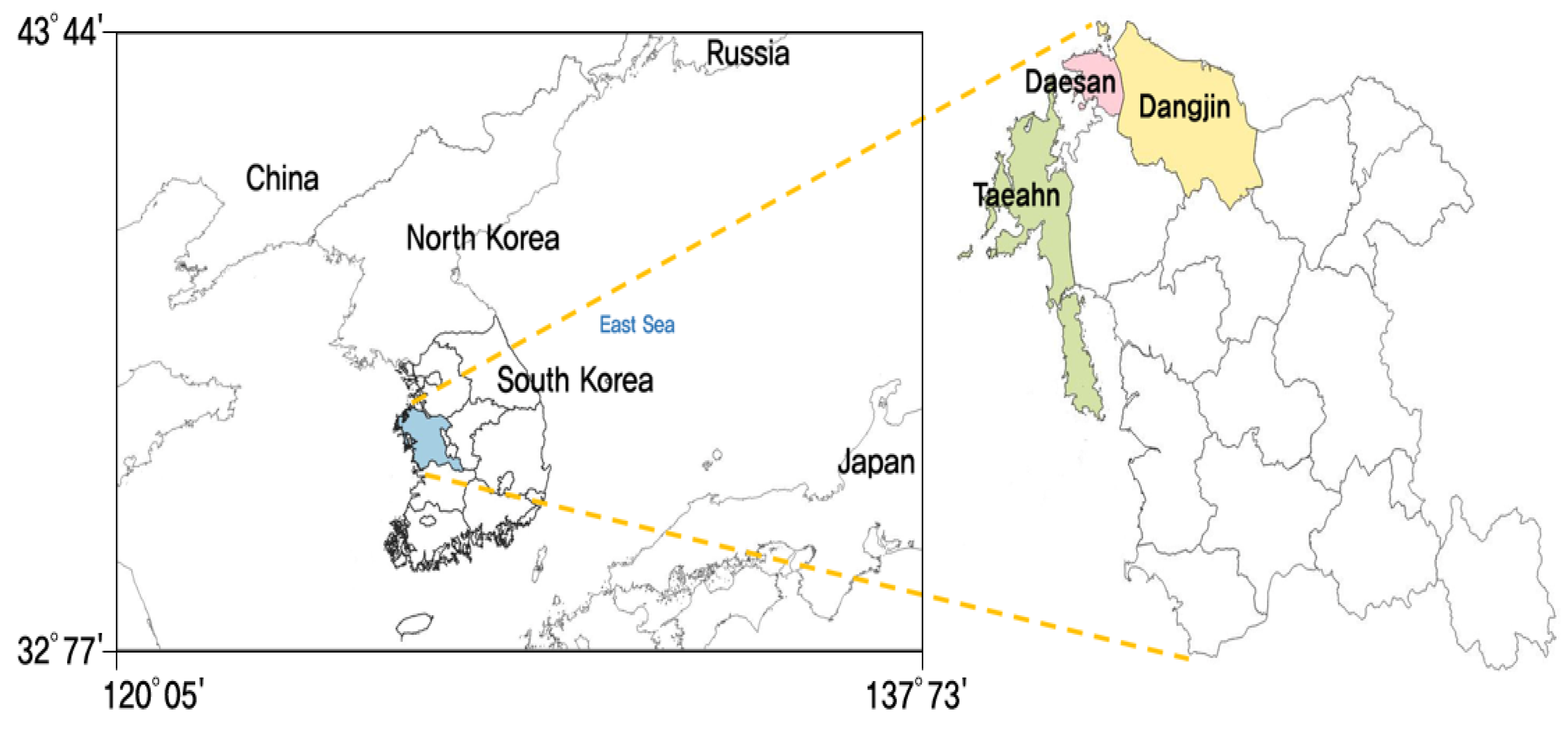

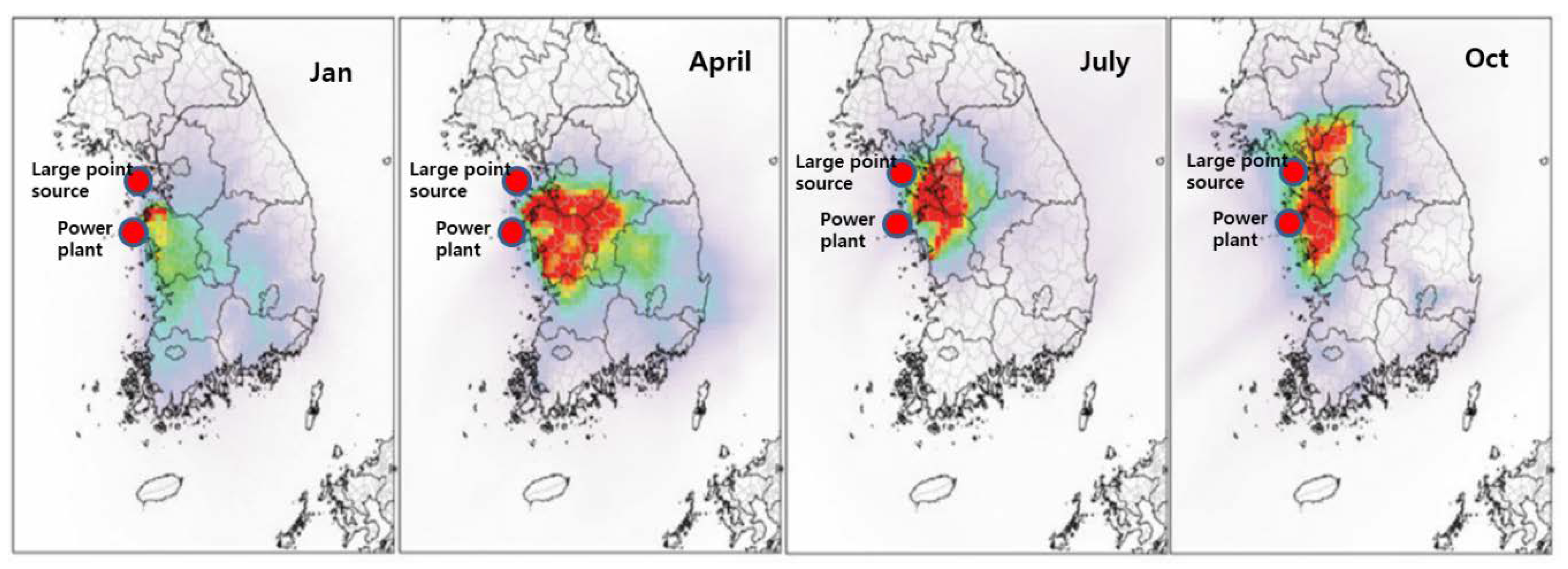

2.2. Case Study: Chungcheongnam-Do and Korea

3. Methodology and Data

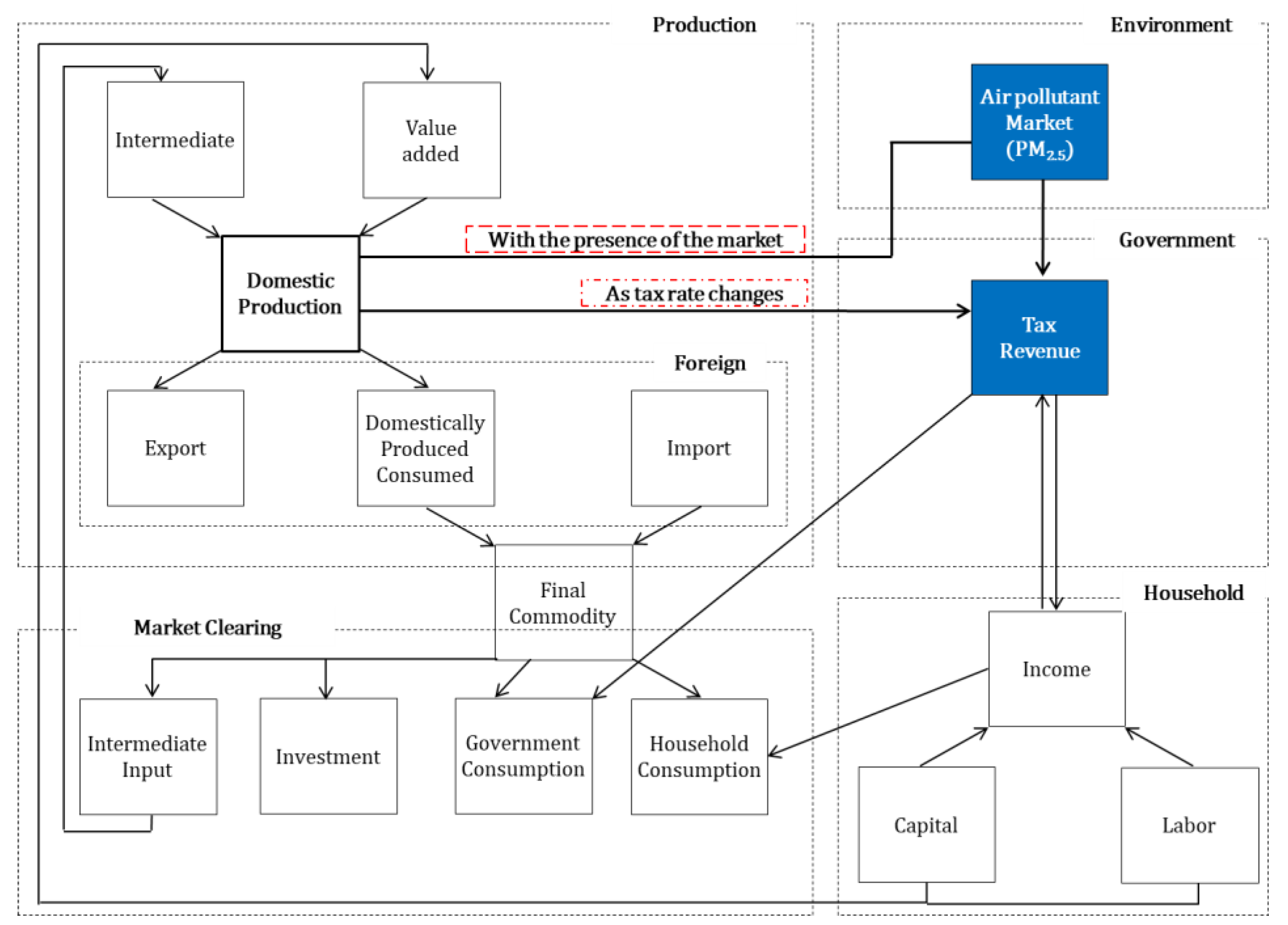

3.1. Regional Computable General Equilibrium Model

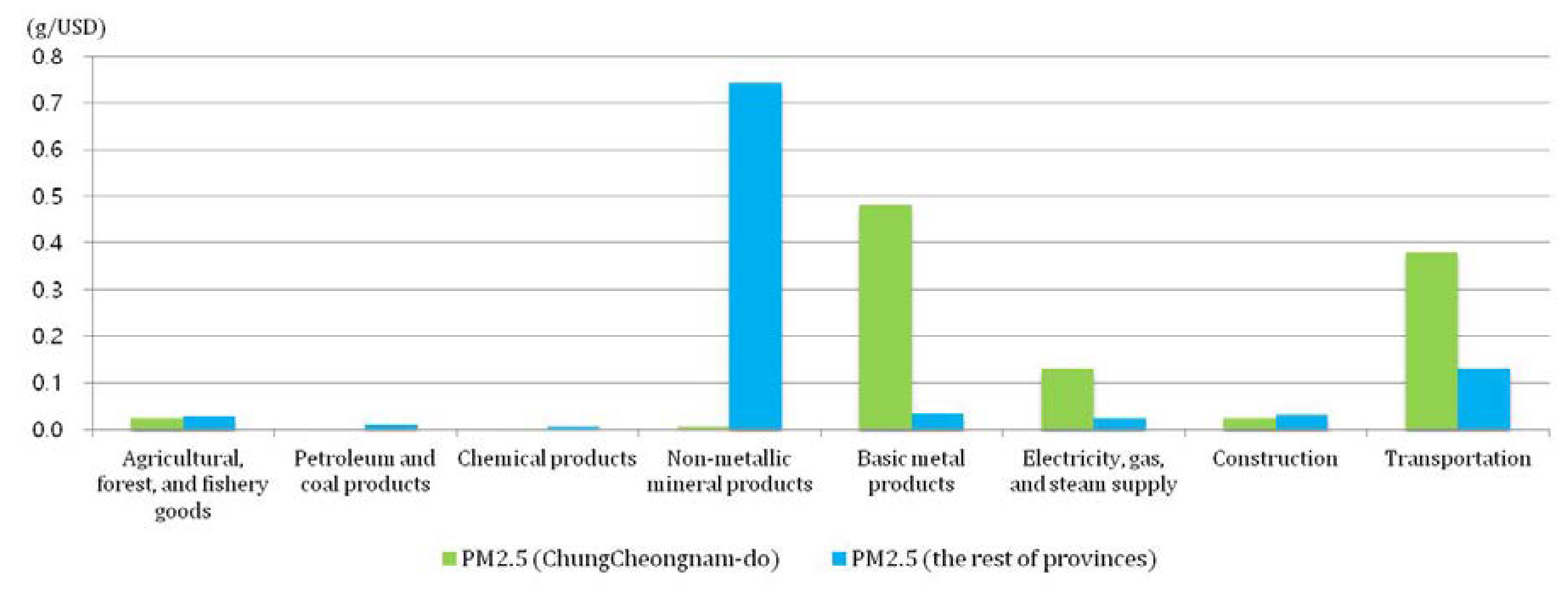

3.2. Sector Classification

4. Scenario Building and Results

4.1. Scenarios

4.2. Economic Impact

4.3. Environment Impact

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Region | Power Generation (10 GWh, %) | ||||

|---|---|---|---|---|---|

| Hydro | Thermal | Nuclear | Renewable | Total | |

| Seoul | 0 | 29 | 0 | 41 | 70 |

| Busan | 0 | 842 | 1287 | 41 | 2170 |

| Daegu | 0 | 250 | 0 | 9 | 259 |

| Incheon | 4 | 5803 | 0 | 42 | 5849 |

| Gwangju | 1 | 60 | 0 | 8 | 69 |

| Daejeon | 0 | 38 | 0 | 1 | 39 |

| Ulsan | 0 | 1747 | 1106 | 4 | 2857 |

| Gyeonggi-do | 56 | 7333 | 0 | 124 | 7513 |

| Gangwon-do | 115 | 1832 | 0 | 220 | 2167 |

| Chungcheongbuk-do | 39 | 35 | 0 | 38 | 112 |

| Chungcheongnam-do | 6 | 11,650 | 0 | 631 | 12,287 |

| Jeollabuk-do | 53 | 862 | 0 | 109 | 1024 |

| Jeollanam-do | 4 | 2405 | 3102 | 416 | 5927 |

| Gyeongsangbuk-do | 130 | 200 | 4943 | 334 | 5607 |

| Gyeongsangnam-do | 58 | 5139 | 0 | 47 | 5244 |

| Jeju-do | 0 | 232 | 0 | 81 | 313 |

| Sejong | 0 | 342 | 0 | 3 | 345 |

| Total | 466 | 38,799 | 10,438 | 2149 | 51,852 |

| Industry Classification | CN | RP | |||||

|---|---|---|---|---|---|---|---|

| Emissions (Tons/Year) | Emission Intensity | Emission (Tons/Year) | Emission Intensity | ||||

| PM10 | PM2.5 | PM2.5 | PM10 | PM2.5 | PM2.5 | ||

| 1; 31 | Agricultural, forest, and fishery goods | 207.5 | 180.1 | 23.64 | 1575.8 | 1339.0 | 27.43 |

| 2; 32 | Mined and quarried goods | 0.2 | 0.1 | 0.37 | 81.5 | 29.2 | 7.31 |

| 3; 33 | Food, beverages and tobacco products | 1.2 | 1.0 | 0.09 | 735.0 | 263.2 | 2.87 |

| 4; 34 | Textile and leather products | 0.3 | 0.2 | 0.12 | 279.0 | 99.2 | 1.31 |

| 5; 35 | Wood and paper products, printing and reproduction of recorded media | 0.8 | 0.6 | 0.21 | 189.0 | 78.0 | 2.21 |

| 6; 36 | Petroleum and coal products | 47.0 | 13.4 | 0.59 | 2487.7 | 1266.2 | 9.51 |

| 7; 37 | Chemical products | 39.3 | 26.9 | 0.69 | 1699.8 | 1123.6 | 4.95 |

| 8; 38 | Non-metallic mineral products | 34.0 | 28.1 | 4.50 | 43,077.1 | 22,508.1 | 742.94 |

| 9; 39 | Basic metal products | 26,715.9 | 14,213.3 | 479.25 | 9958.3 | 6056.5 | 33.39 |

| 10; 40 | Fabricated metal products, except machinery and furniture | 1.0 | 0.8 | 0.11 | 398.4 | 148.2 | 1.71 |

| 11; 41 | Machinery and equipment | 0.6 | 0.5 | 0.06 | 281.0 | 102.6 | 0.93 |

| 12; 42 | Electronic and electrical equipment | 4.3 | 3.6 | 0.06 | 569.4 | 231.2 | 0.75 |

| 13; 43 | Precision instruments | 0.3 | 0.2 | 0.11 | 178.7 | 64.3 | 2.67 |

| 14; 44 | Transportation equipment | 1.4 | 1.2 | 0.06 | 418.9 | 157.8 | 0.71 |

| 15; 45 | Other manufactured products and outsourcing services | 1.8 | 1.3 | 0.33 | 150.0 | 58.7 | 1.07 |

| 16; 46 | Electricity, gas, and steam supply | 1883.1 | 1376.3 | 130.36 | 2551.6 | 2153.5 | 23.83 |

| 17; 47 | Water supply, sewage and waste management | 12.8 | 10.8 | 6.12 | 229.8 | 191.2 | 9.29 |

| 18; 48 | Construction | 440.0 | 404.8 | 22.70 | 5755.7 | 5295.3 | 30.65 |

| 19; 49 | Wholesale and retail trade | 0.7 | 0.5 | 0.10 | 26.5 | 17.1 | 0.07 |

| 20; 50 | Transportation | 1483.0 | 1364.3 | 377.72 | 18,149.4 | 16,697.4 | 129.40 |

| 21; 51 | Food services and accommodation | 0.6 | 0.4 | 0.09 | 19.9 | 12.8 | 0.14 |

| 22; 52 | Communications and broadcasting | 0.3 | 0.2 | 0.13 | 9.8 | 6.3 | 0.06 |

| 23; 53 | Finance and insurance | 0.5 | 0.3 | 0.12 | 18.9 | 12.2 | 0.09 |

| 24; 54 | Real estate and leasing | 0.3 | 0.2 | 0.07 | 10.8 | 7.0 | 0.05 |

| 25; 55 | Professional, scientific, and technical services | 0.3 | 0.2 | 0.06 | 11.7 | 7.5 | 0.07 |

| 26; 56 | Business support services | 0.5 | 0.3 | 0.25 | 17.3 | 11.1 | 0.27 |

| 27; 57 | Public administration and defense | 0.0 | 0.0 | 0.006 | 1.6 | 1.0 | 0.010 |

| 28; 58 | Educational services | 0.0 | 0.0 | 0.002 | 0.6 | 0.4 | 0.004 |

| 29; 59 | Health and social work | 0.1 | 0.0 | 0.013 | 2.6 | 1.7 | 0.017 |

| 30; 60 | Cultural and other services | 0.3 | 0.2 | 0.05 | 11.6 | 7.5 | 0.10 |

References

- World Health Organization. Ambient Air Pollution: A Global Assessment of Exposure and Burden of Disease; World Health Organization: Geneva, Switzerland, 2016. [Google Scholar]

- Brook, R.D.; Rajagopalan, S.; Pope Iii, C.A.; Brook, J.R.; Bhatnagar, A.; Diez-Roux, A.V.; Holguin, F.; Hong, Y.; Luepker, R.V.; Mittleman, M.A. Particulate matter air pollution and cardiovascular disease: An update to the scientific statement from the American Heart Association. Circulation 2014, 121, 2331–2378. [Google Scholar] [CrossRef] [PubMed]

- Great Britain Ministry of Health. Mortality and Morbidity during the London Fog of December 1952; Great Britain Ministry of Health: London, UK, 1954.

- Apte, J.S.; Marshall, J.D.; Cohen, A.J.; Brauer, M. Addressing global mortality from ambient PM2. 5. Environ. Sci. Technol. 2015, 49, 8057–8066. [Google Scholar] [CrossRef] [PubMed]

- National Institute for Environment Research. Report of Transboundary Air Pollutants over East Asia; National Institute for Environment Research: Incheon, Korea, 2019.

- Oh, I.; Yoo, W.-J.; Yoo, Y. Impact and interactions of policies for mitigation of air pollutants and Greenhouse gas emissions in Korea. Int. J. Environ. Res. Public Health 2019, 16, 1161. [Google Scholar] [CrossRef]

- Zhang, K.; Zhao, C.; Fan, H.; Yang, Y.; Sun, Y. To ward understanding the differences of PM 2.5 characteristics among five China Urban Cities. Asia-Pac. J. Atmos. Sci. 2019, 1–10. [Google Scholar] [CrossRef]

- Fan, H.; Zhao, C.; Yang, Y. A comprehensive analysis of the spatio-temporal variation of urban air pollution in China during 2014–2018. Atmos. Environ. 2020, 220, 117066. [Google Scholar] [CrossRef]

- OECD. Air Quality and Health: Exposure to PM2.5 Fin Particles-Countries and Regions; Organization for Economic Co-operation and Development (OECD): Paris, France, 2018. [Google Scholar]

- The Government of Korea. The First Basic Plan for Climate Change Response; The Government of Korea: Seoul, Korea, 2020.

- A Standard Computable General Equilibrium (CGE) Model in GAMS. Available online: https://ageconsearch.umn.edu/record/42483/?ln=en (accessed on 6 August 2020).

- Nam, K.-M.; Waugh, C.J.; Paltsev, S.; Reilly, J.M.; Karplus, V.J. Synergy between pollution and carbon emissions control: Comparing China and the United States. Energy Econ. 2014, 46, 186–201. [Google Scholar] [CrossRef]

- Xiao, B.; Niu, D.; Guo, X.; Xu, X. The impacts of environmental tax in China: A dynamic recursive multi-sector CGE model. Energies 2015, 8, 7777–7804. [Google Scholar] [CrossRef]

- Wu, L.; Zhong, Z.; Liu, C.; Wang, Z. Examining PM2.5 emissions embodied in China? Supply Chain using a Multiregional Input-Output analysis. Sustainability 2017, 9, 727. [Google Scholar] [CrossRef]

- Ministry of Environment in Korea. Comprehensive Measures for Particulate Matter Management; Joint Korean Ministries, Ed.; Ministry of Environment in Korea: Sejong, Korea, 2019.

- Ministry of Environment in Korea. The Special Law for Mitigating Particulate Matter (PM) Pollution; Ministry of Envrionment in Korea: Sejong, Korea, 2019.

- Shim., C.; Gong, S.Y.; Choi, K.C.; Hahn, J.S.; Lee, J.S.; Lee, S.M.; Shin, D.W.; Jung, E.H.; Hahn, J.H. The Study on Integrated Control Strategies for Particulate Matter (PM) Pollution; Korea Environment Institute (KEI): Sejong, Korea, 2019. [Google Scholar]

- Ministry of Environment in Korea. Basic Plan of Air Quality Management for Regional Air Pollution Management Area; Ministry of Environment in Korea: Sejong, Korea, 2020.

- Kim, B.-U.; Kim, O.; Kim, H.C.; Kim, S. Influence of fossil-fuel power plant emissions on the surface fine particulate matter in the Seoul Capital Area, South Korea. J. Air Waste Manag. Assoc. 2016, 66, 863–873. [Google Scholar] [CrossRef] [PubMed]

- Korea Electric Power Corporation. The Monthly Report on Major Electric Power Statistics; Korea Electric Power Corporation: Naju, Korea, 2020. [Google Scholar]

- Statistic of National Gross Domestic Product Korean Statistical Information Service, 2020. Available online: https://kosis.kr/eng/ (accessed on 6 August 2020).

- Statistics of Fine Dust (National Center for Fine Dust Information), 2020. Available online: http://www.koreaherald.com/view.php?ud=20191219000684 (accessed on 6 August 2020).

- Hosoe, N.; Gasawa, K.; Hashimoto, H. Textbook of Computable General Equilibrium Modeling: Programming and Simulations; Springer: Berlin, Germany, 2010. [Google Scholar]

- Armington, P.S. A theory of demand for products distinguished by place of production. Staff Papers 1969, 16, 159–178. [Google Scholar] [CrossRef]

- Horridge, M.; Wittwer, G. SinoTERM, A multi-regional CGE model of China. China Econ. Rev. 2008, 19, 628–634. [Google Scholar] [CrossRef]

- Bank of Korea. Regional Input-Output Table 2013; Bank of Korea: Seoul, Korea, 2015. [Google Scholar]

- Kwon, O.-S.; Han, M.; Ban, K.; Yoon, J. Constructing an Energy-extended KLEM DB and Estimating the Nested CES Production Functions for Korea. Environ. Resour. Econ. Rev. 2018, 27, 29–66. [Google Scholar]

- Kim, J.-D.; Cha, J.-H. A Study on the Regional Resources Facilities Tax. J. Korea Acad.-Ind. Coop. Soc. 2013, 14, 3223–3231. [Google Scholar] [CrossRef]

- Newel, R.G.; Rogers, K. Leaded gasoline in the United States: The breakthrough of permit trading. In Choosing Environmental Policy: Comparing Instruments and Outcomes in the United States and Europe; Routledge: New York, NY, USA, 2004; pp. 175–191. [Google Scholar]

| Industry Classification | Industry Classification | ||||

|---|---|---|---|---|---|

| 1; 31 | Agricultural, forestry, and fishery goods | 1.014 | 16; 46 | Electricity, gas, and steam supply | 1.004 |

| 2; 32 | Mined and quarried goods | 0.902 | 17; 47 | Water supply, sewage, and waste management | 0.992 |

| 3; 33 | Food, beverages, and tobacco products | 0.995 | 18; 48 | Construction | 0.992 |

| 4; 34 | Textile and leather products | 1.005 | 19; 49 | Wholesale and retail trade | 0.999 |

| 5; 35 | Wood and paper products, printing, and reproduction of recorded media | 0.998 | 20; 50 | Transportation | 1.009 |

| 6; 36 | Petroleum and coal products | 1.101 | 21; 51 | Food services and accommodation | 0.971 |

| 7; 37 | Chemical products | 0.999 | 22; 52 | Communications and broadcasting | 1.01 |

| 8; 38 | Non-metallic mineral products | 0.998 | 23; 53 | Finance and insurance | 1.004 |

| 9; 39 | Basic metal products | 0.976 | 24; 54 | Real estate and leasing | 0.931 |

| 10; 40 | Fabricated metal products, except machinery, and furniture | 1.004 | 25; 55 | Professional, scientific, and technical services | 0.995 |

| 11; 41 | Machinery and equipment | 0.985 | 26; 56 | Business support services | 1.011 |

| 12; 42 | Electronic and electrical equipment | 1.001 | 27; 57 | Public administration and defense | 1.001 |

| 13; 43 | Precision instruments | 1.001 | 28; 58 | Educational services | 1.002 |

| 14; 44 | Transportation equipment | 0.985 | 29; 59 | Health and social work | 0.987 |

| 15; 45 | Other manufactured products and outsourcing services | 1.002 | 30; 60 | Cultural and other services | 0.999 |

| Scenario | Description | Tax Rate (Cent/kWh) | Permit Market |

|---|---|---|---|

| Status quo (baseline) | Current situation | 0.03 | No |

| Current + M | Implementing permit market only | 0.03 | Yes |

| Hyd | Applying regional development tax of hydropower | 0.20 | No |

| Hyd + M | Applying regional development tax of hydropower and implementing permit market simultaneously | 0.20 | Yes |

| Mod | Applying regional development tax higher than hydropower | 0.50 | No |

| Mod + M | Applying regional development tax higher than hydropower and implementing permit market simultaneously | 0.50 | Yes |

| Stro | Applying regional development tax significantly higher than hydropower | 1.00 | No |

| Stro + M | Applying regional development tax significantly higher than hydropower and implementing permit market simultaneously | 1.00 | Yes |

| Scenario | Status Quo | Hyd | Mod | Stro | Hyd + M | Mod + M | Stro + M |

|---|---|---|---|---|---|---|---|

| National GDP (billion USD) | 1303.20 | 1303.21 | 1303.22 | 1303.24 | 1303.22 | 1303.24 | 1303.26 |

| GRDP in CN (billion USD) | 81.00 | 80.96 | 81.02 | 81.20 | 81.12 | 81.21 | 81.39 |

| % change in GRDP | N/A | −0.04 | +0.03 | +0.24 | +0.15 | +0.27 | +0.48 |

| % change in household | −0.17 | −0.48 | −1.01 | −0.21 | −0.56 | −1.18 | |

| % change in government | +2.05 | +5.92 | +13.03 | +3.07 | +8.29 | +18.15 | |

| % change in investment | −0.07 | −0.20 | −0.43 | −0.13 | −0.35 | −0.77 | |

| GRDP in RP (billion USD) | 1222.21 | 1222.24 | 1222.20 | 1222.04 | 1222.10 | 1222.02 | 1221.87 |

| % change in GRDP | NA | +0.0032 | −0.0004 | −0.0135 | −0.0088 | −0.0150 | −0.0277 |

| % change in household | −0.08 | −0.22 | −0.48 | −0.10 | −0.27 | −0.58 | |

| % change in government | +0.31 | +0.86 | +1.80 | +0.44 | +1.18 | +2.51 | |

| % change in investment | −0.07 | −0.20 | −0.43 | −0.13 | −0.35 | −0.76 |

| Scenario | Status Quo | Hyd | Mod | Stro | Hyd + M | Mod + M | Stro + M |

|---|---|---|---|---|---|---|---|

| National emissions (tons) | 75,565 | 75,486 | 75,339 | 75,081 | 75,234 | 74,741 | 73,791 |

| Total % changes | −0.10 | −0.30 | −0.64 | −0.44 | −1.09 | −2.35 | |

| Emissions in CN (tons) | 17,626 | 17,593 | 17,534 | 17,431 | 17,511 | 17,336 | 17,004 |

| Total % change | −0.19 | −0.52 | −1.11 | −0.65 | −1.64 | −3.53 | |

| % change in 5 high-emission industries | 17,383 | −0.19 | −0.53 | −1.12 | −0.66 | −1.67 | −3.58 |

| % change in the 25 other industries | 243 | −0.05 | −0.12 | −0.24 | −0.01 | −0.07 | −0.16 |

| Emissions in RP (tons) | 57,939 | 57,893 | 57,805 | 57,650 | 57,724 | 57,405 | 56,787 |

| Total % change | −0.08 | −0.23 | −0.50 | −0.37 | −0.92 | −1.99 | |

| % change in 5 high-emission industries | 52,703 | −0.08 | −0.24 | −0.51 | −0.40 | −0.99 | −2.14 |

| % change in the 25 other industries | 5236 | −0.06 | −0.17 | −0.38 | −0.08 | −0.21 | −0.43 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, K.; Yoon, T.; Shim, C.; Kang, E.; Hong, Y.; Lee, Y. Beyond Strict Regulations to Achieve Environmental and Economic Health—An Optimal PM2.5 Mitigation Policy for Korea. Int. J. Environ. Res. Public Health 2020, 17, 5725. https://doi.org/10.3390/ijerph17165725

Park K, Yoon T, Shim C, Kang E, Hong Y, Lee Y. Beyond Strict Regulations to Achieve Environmental and Economic Health—An Optimal PM2.5 Mitigation Policy for Korea. International Journal of Environmental Research and Public Health. 2020; 17(16):5725. https://doi.org/10.3390/ijerph17165725

Chicago/Turabian StylePark, Kyungwon, Taeyeon Yoon, Changsub Shim, Eunjin Kang, Yongsuk Hong, and Yoon Lee. 2020. "Beyond Strict Regulations to Achieve Environmental and Economic Health—An Optimal PM2.5 Mitigation Policy for Korea" International Journal of Environmental Research and Public Health 17, no. 16: 5725. https://doi.org/10.3390/ijerph17165725

APA StylePark, K., Yoon, T., Shim, C., Kang, E., Hong, Y., & Lee, Y. (2020). Beyond Strict Regulations to Achieve Environmental and Economic Health—An Optimal PM2.5 Mitigation Policy for Korea. International Journal of Environmental Research and Public Health, 17(16), 5725. https://doi.org/10.3390/ijerph17165725