An Exploratory Study of the Association between Housing Price Trends and Antidepressant Use in Taiwan: A 10-Year Population-Based Study

Abstract

:1. Introduction

1.1. Mental Disorders and Socioeconomic Stress

1.2. Housing Prices as a Proxy for Macroeconomics Conditions

1.3. Antidepressant Prescription as an Indicator of Mental Disorder

1.4. Strength of Current Study

2. Materials and Methods

2.1. Data Sources

2.2. Study Sample

2.2.1. Therapeutic Indications for Antidepressant Use

2.2.2. Proxy for Housing Price Trajectory

2.2.3. Urbanization and Socioeconomic Status

2.2.4. Statistical Analysis

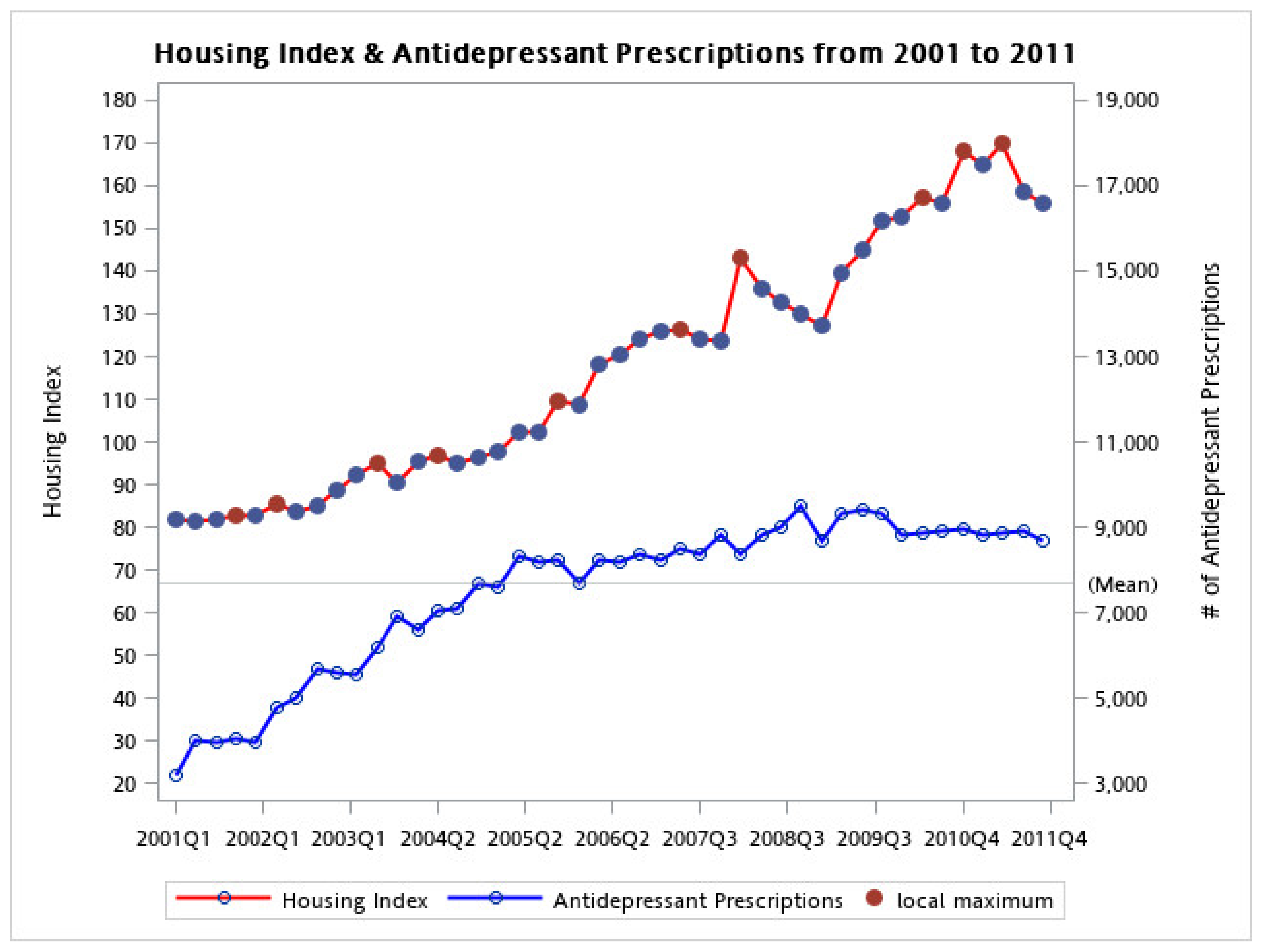

3. Results

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- World Health Organization. Mental Health Action Plan 2013–2020; World Health Organization: Geneva, Switzerland, 2013. [Google Scholar]

- Steinhausen, H.-C.; Metzke, C.W.; Meier, M.; Kannenberg, R. Prevalence of child and adolescent psychiatric disorders: The Zurich Epidemiological Study. Acta Psychiatr. Scand. 1998, 98, 262–271. [Google Scholar] [CrossRef]

- Brody, D.J.; Pratt, L.A.; Hughes, J.P. Prevalence of Depression among Adults Aged 20 and Over: United States, 2013–2016; US Department of Health and Human Services, Centers for Disease Control: Atlanta, GA, USA, 2018. [Google Scholar]

- Roehrig, C. Mental disorders top the list of the most costly conditions in the United States: $201 billion. Health Aff. 2016, 35, 1130–1135. [Google Scholar] [CrossRef]

- National Institute of Mental Health. Any Mental Illness (AMI) among Adults. Available online: http://www.nimh.nih.gov/health/statistics/prevalence/any-mental-illness-ami-among-adults.shtml (accessed on 22 April 2014).

- Lin, T.Y. A study of incidence of mental disorders in Chinese and other cultures. Psychiatry 1953, 16, 315–335. [Google Scholar] [CrossRef]

- Chien, I.-C.; Chou, Y.-J.; Lin, C.-H.; Bih, S.-H.; Chou, P. Prevalence of psychiatric disorders among National Health Insurance enrollees in Taiwan. Psychiatr. Serv. 2004, 55, 691–697. [Google Scholar] [CrossRef]

- Compton, W.M.; Helzer, J.E.; Hwu, H.G.; Yeh, E.K.; McEvoy, L.; Tipp, J.E.; Spitznagel, E.L. New methods in cross-cultural psychiatry: Psychiatric illness in Taiwan and the United States. Am. J. Psychiatry 1991, 148, 1697–1704. [Google Scholar]

- Fu, T.S.; Lee, C.; Gunnell, D.; Lee, W.; Cheng, A.T. Changing trends in the prevalence of common mental disorders in Taiwan: A 20-year repeated cross-sectional survey. Lancet 2013, 381, 235–241. [Google Scholar] [CrossRef]

- Goldman-Mellor, S.J.; Saxton, K.B.; Catalano, R.C. Economic contraction and mental health: A review of the evidence, 1990-2009. Int. J. Mental Health 2010, 39, 6–31. [Google Scholar] [CrossRef]

- Barstad, A. Explaining changing suicide rates in Norway 1948–2004: The role of social integration. Soc. Indic. Res. 2008, 87, 47–64. [Google Scholar] [CrossRef]

- Neumayer, E. Recessions lower (some) mortality rates: Evidence from Germany. Soc. Sci. Med. 2004, 58, 1037–1047. [Google Scholar] [CrossRef] [Green Version]

- Gili, M.; Roca, M.; Basu, S.; McKee, M.; Stuckler, D. The mental health risks of economic crisis in Spain: Evidence from primary care centres, 2006 and 2010. Eur. J. Public Health 2013, 23, 103–108. [Google Scholar] [CrossRef] [PubMed]

- Giorgi, G.; Arcangeli, G.; Mucci, N.; Cupelli, V. Economic stress in the workplace: The impact of fear of the crisis on mental health. Work 2015, 51, 135–142. [Google Scholar] [CrossRef] [PubMed]

- Rohde, N.; Tang, K.K.; Osberg, L.; Rao, P. The effect of economic insecurity on mental health: Recent evidence from Australian panel data. Soc. Sci. Med. 2016, 151, 250–258. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mian, A.; Sufi, A.; Trebbi, F. Foreclosures, house prices, and the real economy. J. Financ. 2015, 70, 2587–2634. [Google Scholar] [CrossRef]

- Aizenman, J.; Jinjarak, Y.; Zheng, H. House Valuations and Economic Growth: Some International Evidence; National Bureau of Economic Research: Cambridge, MA, USA, 2016. [Google Scholar]

- Mohamad Zukri, M.F. Determinants That Influence the Movement of Housing Price in Malaysia. 2018. Available online: https://ir.uitm.edu.my/id/eprint/20942/ (accessed on 6 April 2021).

- Zheng, Q.; Zhang, H. Does housing investment lead economic growth in China? SSRN Electron. J. 2012, 2. [Google Scholar] [CrossRef]

- Catalano, R.; Goldman-Mellor, S.; Saxton, K.; Margerison-Zilko, C.; Subbaraman, M.; LeWinn, K.; Anderson, E. The health effects of economic decline. Annu. Rev. Public Health 2011, 32, 431–450. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Zhang, Q.; Zheng, H. Housing policies in Greater China and Singapore. Econ. Political Stud. 2020, 8, 41–64. [Google Scholar] [CrossRef]

- Li, J.; Liu, Z.J.C. Housing stress and mental health of migrant populations in urban China. Cities 2018, 81, 172–179. [Google Scholar] [CrossRef]

- Bentley, R.; Baker, E.; Mason, K.; Subramanian, S.V.; Kavanagh, A.M. Association between housing affordability and mental health: A longitudinal analysis of a nationally representative household survey in Australia. Am. J. Epidemiol. 2011, 174, 753–760. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Otrok, C.; Terrones, M.E. House Prices, Interest Rates and Macroeconomic Fluctuations: International Evidence; International Monetary Fund: Washington, DC, USA, 2005. [Google Scholar]

- Chen, M.C.; Kawaguchi, Y.; Patel, K. An analysis of the trends and cyclical behaviours of house prices in the Asian markets. J. Prop. Investig. Financ. 2004, 22, 55–75. [Google Scholar] [CrossRef]

- Chen, P.F.; Chien, M.S.; Lee, C.C. Dynamic modeling of regional house price diffusion in Taiwan. J. Hous. Econ. 2011, 20, 315–332. [Google Scholar] [CrossRef]

- Hsieh, C.; Su, C.; Shao, S.; Sung, S.; Lin, S.; Yang, Y.K.; Lai, E.C. Taiwan’s national health insurance research database: Past and future. Clin. Epidemiol. 2019, 11, 349–358. [Google Scholar] [CrossRef] [Green Version]

- Wu, C.; Shau, W.; Chan, H.; Lee, Y.; Lai, Y.; Lai, M. Utilization of antidepressants in Taiwan: A nationwide population based survey from 2000 to 2009. Pharmacoepidemiol. Drug Saf. 2012, 21, 980–988. [Google Scholar] [CrossRef] [PubMed]

- Hsing, S.; Jin, Y.; Tzeng, N.; Chung, C.; Chen, T.; Chang, H.; Kao, Y.; Chien, W. Is Agomelatine Associated with Less Sedative-Hypnotic Usage in Patients with Major Depressive Disorder? A Nationwide, Population-Based Study. Neuropsychiatr. Dis. Treat. 2020, 16, 1727. [Google Scholar] [CrossRef]

- Lin, C.; Hsiao, F.; Liu, Y.; Gau, S.S.; Wang, C.; Shen, L. Antidepressants and Valvular Heart Disease: A Nested Case–Control Study in Taiwan. Medicine 2016, 95, e3172. [Google Scholar] [CrossRef]

- Nguyen, T.T.; Wang, K.M. Causality between housing returns, inflation and economic growth with endogenous breaks. J. Chin. Econ. Bus. Stud. 2010, 8, 95–115. [Google Scholar] [CrossRef]

- Lin, Y.J.; Tian, W.H.; Chen, C.C. Urbanization and the utilization of outpatient services under National Health Insurance in Taiwan. Health Policy 2011, 103, 236–243. [Google Scholar] [CrossRef] [PubMed]

- Gasparrini, A. Distributed lag linear and non-linear models in R: The package dlnm. J. Stat. Softw. 2011, 43, 1. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Allen, M.J.; Sheridan, S.C. Mortality risks during extreme temperature events (ETEs) using a distributed lag non-linear model. Int. J. Biometeorol. 2018, 62, 57–67. [Google Scholar] [CrossRef]

- Guo, Y.; Barnett, A.G.; Pan, X.; Yu, W.; Tong, S. The impact of temperature on mortality in Tianjin, China: A case-crossover design with a distributed lag nonlinear model. Environ. Health Perspect. 2011, 119, 1719–1725. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Yang, D.; Dalton, J.E. A unified approach to measuring the effect size between two groups using SAS®. In Proceedings of the SAS Global Forum 2012, Lake Buena Vista, FL, USA, 22–25 April 2012. [Google Scholar]

- Cohen, S. Perceived Stress in a Probability Sample of the United States. In The Claremont Symposium on Applied Social Psychology; Sage Publications, Inc.: New York, NY, USA, 1988. [Google Scholar]

- Bacher, J.C. Keeping to the Marketplace: The Evolution of Canadian Housing Policy; McGill-Queen’s University Press: Montreal, QC, Canada, 1993. [Google Scholar]

- Belsky, E.S.; Goodman, J.; Drew, R. Measuring the Nations’s Rental Housing Affordability Problems; Harvard University: Cambridge, MA, USA, 2005. [Google Scholar]

- Hulchanski, J.D. The concept of housing affordability: Six contemporary uses of the housing expenditure to income ratio. Hous. Stud. 1995, 10, 471–491. [Google Scholar] [CrossRef]

- Nwuba, C.C.; Kalu, I.U. Measuring housing affordability: The two approaches. ATBU J. Environ. Technol. 2018, 11, 127–143. [Google Scholar]

- Kopp, M.S.; Skrabski, A.; Székely, A.; Stauder, A.; Williams, R. Chronic stress and social changes: Socioeconomic determination of chronic stress. Ann. N. Y. Acad. Sci. 2007, 1113, 325–338. [Google Scholar] [CrossRef] [PubMed]

- Mohacsy, I.; Lefer, H. Money and sentiment: A psychodynamic approach to behavioral finance. J. Am. Acad. Psychoanal. Dyn. Psychiatry 2007, 35, 455–475. [Google Scholar] [CrossRef]

- Cherry, D.K.; Albert, M.; McCaig, L.F. Mental Health-Related Physician Office Visits by Adults Aged 18 and Over: United States, 2012–2014; US Department of Health and Human Services, Centers for Disease Control: Atlanta, GA, USA, 2018. [Google Scholar]

- Fryers, T.; Melzer, D.; Jenkins, R.; Brugha, T. The distribution of the common mental disorders: Social inequalities in Europe. Clin. Pract. Epidemiol. Ment. Health 2005, 1, 14. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lund, C.; Breen, A.; Flisher, A.J.; Kakuma, R.; Corrigall, J.; Joska, J.A.; Swartz, L.; Patel, V. Poverty and common mental disorders in low and middle income countries: A systematic review. Soc. Sci. Med. 2010, 71, 517–528. [Google Scholar] [CrossRef] [Green Version]

- McManus, S.; Bebbington, P. Adult Psychiatric Morbidity in England, 2007: Results of a Household Survey; National Centre for Social Research: London, UK, 2009. [Google Scholar]

- Zheng, H.; Zhang, Q. Property Tax in China: Is It Effective in Curbing Housing Price? Econ. Bull. 2013, 33, 2465–2474. [Google Scholar]

- Bao, T.; Ding, L. Nonrecourse Mortgage and Housing Price Boom, Bust, and Rebound. Real Estate Econ. 2016, 44, 584–605. [Google Scholar] [CrossRef] [Green Version]

- Ministry of Health and Welfare. Status Quo of Psychiatric Outpatients. Available online: https://www.mohw.gov.tw/mp-1.html (accessed on 8 May 2020).

- Ramírez, I.J.; Lee, J. Mapping Ecosyndemic Risk and Social Vulnerability in Guatemala during the 2014–2016 El Niño: An Exploratory GIS Analysis. In Proceedings of the 2nd International Electronic Conference on Environmental Health Sciences, Sciforum, 4–29 November 2019. [Google Scholar]

| All (n = 531,281) | Females (n = 329,752) | Males (n = 201,529) | SMD | |

|---|---|---|---|---|

| n | 531,281 | 329,752 | 201,529 | |

| Age group, years (%) | 0.146 | |||

| <25 | 22,426 (4.2) | 11,727 (3.6) | 10,699 (5.3) | |

| 25~34 | 67,397 (12.7) | 37,902 (11.5) | 29,495 (14.6) | |

| 35~44 | 94,592 (17.8) | 60,342 (18.3) | 34,250 (17.0) | |

| 45~54 | 118,522 (22.3) | 75,229 (22.8) | 43,293 (21.5) | |

| 55~64 | 98,617 (18.6) | 62,583 (19.0) | 36,034 (17.9) | |

| 65~74 | 59,046 (11.1) | 39,191 (11.9) | 19,855 (9.9) | |

| ≥75 | 70,681 (13.3) | 42,778 (13.0) | 27,903 (13.8) | |

| Geography 2 (%) | 0.111 | |||

| Eastern | 21,361 (4.0) | 12,064 (3.7) | 9297 (4.6) | |

| Central | 82,986 (15.6) | 52,176 (15.8) | 30,810 (15.3) | |

| Northern | 248,098 (46.7) | 157,841 (47.9) | 90,257 (44.8) | |

| Southern | 171,838 (32.3) | 104,582 (31.7) | 67,256 (33.4) | |

| Monthly salary | 13,912.34 ± 16,366.54 | 12,484.67 ± 14,411.60 | 16,272.26 ± 18,931.0 | 0.225 |

| Administrative district (%) | 0.094 | |||

| Other | 225,886 (42.5) | 135,403 (41.1) | 90,483 (44.9) | |

| Kaohsiung | 71,580 (13.5) | 43,478 (13.2) | 28,102 (13.9) | |

| Taichung City | 53,280 (10.0) | 34,275 (10.4) | 19,005 (9.4) | |

| Taipei City | 107,691 (20.3) | 69,327 (21.0) | 38,364 (19.0) | |

| Taipei County | 72,844 (13.7) | 47,269 (14.3) | 25,575 (12.7) | |

| Monthly salary (%) | 0.242 | |||

| High | 105,751 (19.9) | 55,270 (16.8) | 50,481 (25.0) | |

| Low | 164,500 (31.0) | 112,847 (34.2) | 51,653 (25.6) | |

| Middle | 261,030 (49.1) | 161,635 (49.0) | 99,395 (49.3) | |

| Urbanization (%) | 0.112 | |||

| 1 (most urbanized) | 170,385 (32.1) | 109,857 (33.3) | 60,528 (30.0) | |

| 2 | 162,331 (30.6) | 102,753 (31.2) | 59,578 (29.6) | |

| 3 | 72,020 (13.6) | 43,799 (13.3) | 28,221 (14.0) | |

| 4 | 64,263 (12.1) | 37,738 (11.4) | 26,525 (13.2) | |

| 5 (least urbanized) | 10,579 (2.0) | 5648 (1.7) | 4931 (2.4) | |

| Age (mean (SD)) | 52.86 (17.43) | 53.33 (16.95) | 52.07 (18.15) | 0.072 |

| Housing index | 122.325 ± 28.33 | |||

| Yearly change | 9.196 ± 7.617 |

| Male | Female | All | |||||||

|---|---|---|---|---|---|---|---|---|---|

| RRd | Lower RR | Upper RR | RR | Lower RR | Upper RR | RR | Lower RR | Upper RR | |

| Peaka | 1.082 | 0.988 | 1.185 | 1.069 | 0.976 | 1.170 | * 1.133 | 1.009 | 1.273 |

| lag1 | 0.739 | 0.241 | 2.266 | 0.724 | 0.239 | 2.196 | * 1.333 | 1.021 | 1.742 |

| lag2 | 1.557 | 0.008 | >999 | 1.770 | 0.011 | 291.704 | 0.887 | 0.644 | 1.220 |

| lag3 | 0.718 | 0.000 | >999 | 1.184 | 0.000 | >999 | 1.112 | 0.896 | 1.380 |

| lag4 | 1.156 | 0.014 | 93.726 | 0.632 | 0.009 | 44.292 | 1.022 | 0.962 | 1.086 |

| Housing Indexb | 1.012 | 0.030 | 34.351 | 1.009 | 0.989 | 1.029 | 0.731 | 0.081 | 6.621 |

| lag1 | 0.000 | 0.000 | >999 | 0.649 | 0.405 | 1.039 | 0.000 | 0.000 | 24.105 |

| lag2 | >999 | 0.000 | >999 | 6.027 | 0.881 | 41.234 | >999 | 0.039 | >999 |

| lag3 | 0.000 | 0.000 | >999 | 0.086 | 0.006 | 1.280 | 0.001 | 0.000 | 0.475 |

| lag4 | >999 | 0.000 | >999 | 2.937 | 0.857 | 10.068 | 0.622 | 0.204 | 1.890 |

| High Seasonc | * 1.151 | 1.005 | 1.319 | * 1.379 | 1.213 | 1.567 | 1.121 | 0.980 | 1.282 |

| lag1 | 0.351 | 0.007 | 16.598 | 0.064 | 0.002 | 2.273 | 0.961 | 0.039 | 23.738 |

| lag2 | 1.233 | 0.000 | >999 | >999 | 0.000 | >999 | 0.004 | 0.000 | >999 |

| lag3 | 43.967 | 0.000 | >999 | 0.000 | 0.000 | >999 | >999 | 0.000 | >999 |

| lag4 | 0.041 | 0.000 | >999 | 102.611 | 0.000 | >999 | 0.001 | 0.000 | >999 |

| Linear Trend | 1.019 | 0.968 | 1.072 | * 1.101 | 1.047 | 1.159 | * 1.433 | 1.302 | 1.577 |

| quarterQ2 | 1.086 | 1.003 | 1.176 | 1.017 | 0.941 | 1.099 | * 1.090 | 1.004 | 1.185 |

| quarterQ3 | 1.104 | 1.012 | 1.206 | 1.061 | 0.973 | 1.156 | * 1.167 | 1.080 | 1.261 |

| quarterQ4 | * 1.207 | 1.118 | 1.303 | * 1.234 | 1.145 | 1.330 | * 1.332 | 1.234 | 1.439 |

| SARSe | 0.974 | 0.829 | 1.145 | 1.062 | 0.903 | 1.249 | 1.036 | 0.889 | 1.207 |

| Yearly Changef | 0.991 | 0.970 | 1.011 | 0.977 | 0.958 | 0.997 | 0.995 | 0.982 | 1.008 |

| Stockg | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Crisish | 0.865 | 0.728 | >999 | 0.731 | 0.620 | 0.861 | 0.989 | 0.841 | 1.163 |

| Low Income | Middle Income | High Income | ||||

|---|---|---|---|---|---|---|

| β | p Value | β | p Value | β | p Value | |

| Peak a | 0.171 | * 0.003 | 0.068 | 0.149 | 0.093 | 0.363 |

| lag1 | 0.309 | 0.052 | 0.057 | 0.937 | −1.517 | 0.399 |

| lag2 | −0.001 | 0.997 | −0.412 | 0.911 | 6.954 | 0.402 |

| lag3 | −0.037 | 0.762 | 0.194 | 0.975 | −10.170 | 0.429 |

| lag4 | 0.05 | 0.139 | 0.024 | 0.994 | 4.695 | 0.458 |

| Housing Index b | 0.002 | 0.836 | −0.036 | 0.064 | −0.030 | 0.279 |

| lag1 | −0.052 | 0.211 | 0.567 | 0.203 | 0.559 | 0.385 |

| lag2 | 0.036 | 0.418 | −1.853 | 0.294 | −1.884 | 0.467 |

| lag3 | −0.019 | 0.384 | 2.09 | 0.389 | 2.2 | 0.538 |

| lag4 | −0.003 | 0.467 | −0.754 | 0.488 | −0.844 | 0.598 |

| High Season c | 0.248 | * <0.001 | 0.187 | * 0.035 | −0.014 | 0.893 |

| lag1 | −0.113 | 0.769 | −2.481 | 0.335 | 0.116 | 0.18 |

| lag2 | −0.624 | 0.334 | 9.972 | 0.438 | 0.095 | 0.263 |

| lag3 | 0.358 | 0.439 | −15.640 | 0.453 | 0.341 | 0.073 |

| lag4 | 0.127 | 0.243 | 7.986 | 0.45 | −6.747 | 0.144 |

| Linear Trend | 0.072 | 0.113 | 0.093 | 0.102 | 30.56 | 0.19 |

| quarterQ2 | 0.106 | * 0.030 | 0.129 | * 0.023 | −47.480 | 0.204 |

| quarterQ3 | 0.298 | * <0.001 | 0.086 | 0.085 | 23.39 | 0.211 |

| quarterQ4 | 0.216 | * <0.001 | 0.042 | 0.142 | −0.005 | 0.951 |

| SARS d | 0.013 | 0.873 | 0.02 | 0.841 | −0.080 | 0.619 |

| Yearly Change e | −0.012 | 0.166 | 0.023 | 0.171 | 0.019 | 0.404 |

| Stock f | 0.001 | * 0.047 | 0.001 | * 0.002 | 0 | 0.931 |

| Crisis g | −0.108 | 0.15 | 0.349 | * 0.023 | 0.013 | 0.942 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, C.-Y.; Chen, P.-H.; Lin, Y.-K. An Exploratory Study of the Association between Housing Price Trends and Antidepressant Use in Taiwan: A 10-Year Population-Based Study. Int. J. Environ. Res. Public Health 2021, 18, 4839. https://doi.org/10.3390/ijerph18094839

Lee C-Y, Chen P-H, Lin Y-K. An Exploratory Study of the Association between Housing Price Trends and Antidepressant Use in Taiwan: A 10-Year Population-Based Study. International Journal of Environmental Research and Public Health. 2021; 18(9):4839. https://doi.org/10.3390/ijerph18094839

Chicago/Turabian StyleLee, Chen-Yin, Pao-Huan Chen, and Yen-Kuang Lin. 2021. "An Exploratory Study of the Association between Housing Price Trends and Antidepressant Use in Taiwan: A 10-Year Population-Based Study" International Journal of Environmental Research and Public Health 18, no. 9: 4839. https://doi.org/10.3390/ijerph18094839