How Government Size Expansion Can Affect Green Innovation—An Empirical Analysis of Data on Cross-Country Green Patent Filings

Abstract

1. Introduction

2. Literature Review

2.1. Factors That Influence Green Innovation

2.2. Government and Green Innovation

2.3. Hypothesis

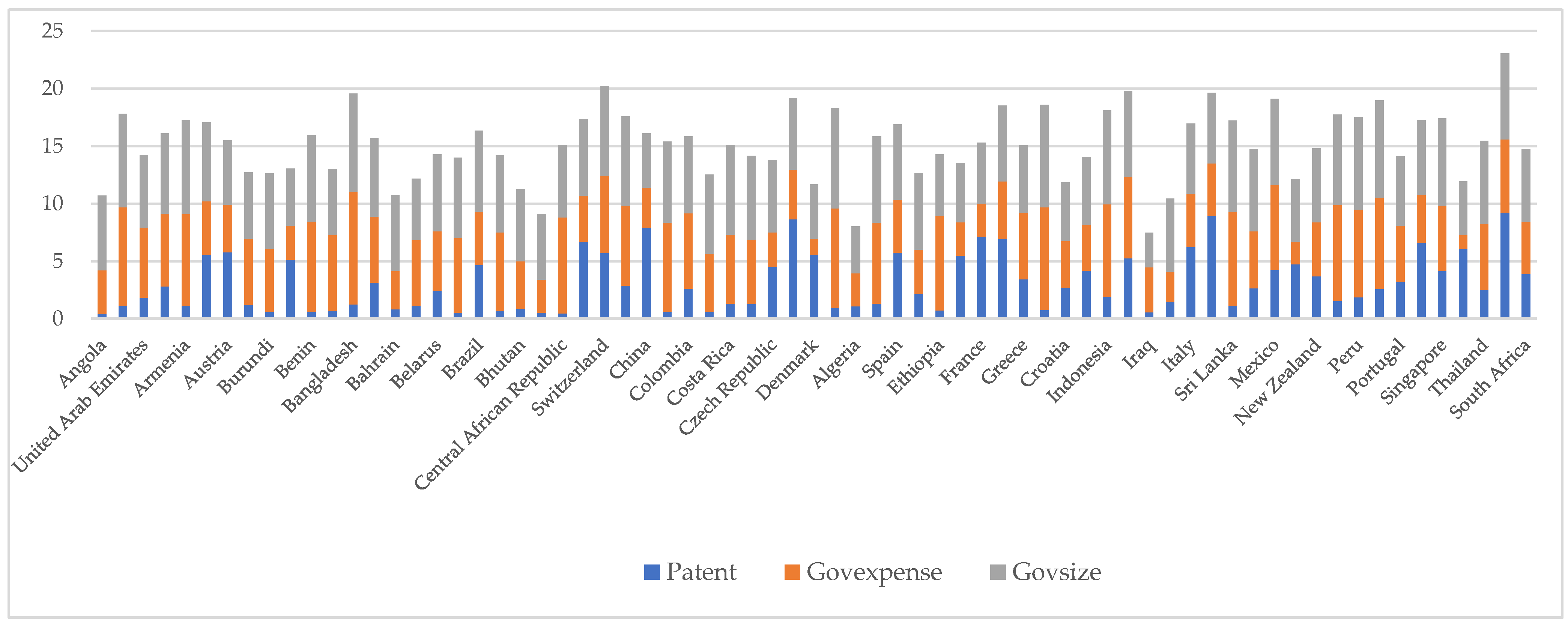

3. Data and Methods

3.1. Explained Variable

3.2. Explanatory Variables

3.3. Control Variables

3.4. Descriptive Statistics

3.5. Model Setting

4. Empirical Analysis

4.1. Benchmark Regression

4.2. Mechanism Test

4.2.1. Environmental Regulations

4.2.2. Financial Support

4.3. Heterogeneity Test

4.3.1. Heterogeneity Results in Countries with Different Levels of Organizational Inertia

4.3.2. Heterogeneity Results in Countries with Different Levels of R&D Expenditure

4.4. Robustness Tests

4.4.1. Replace the Explained Variable

4.4.2. Add New Control Variables

4.4.3. Poisson Test and Negative Binomial Test

4.4.4. Systematic GMM Test

4.4.5. Driscoll and Kraay Standard Errors

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kuenkel, P. Transformation literacy as a collective stewardship task. Cadmus 2021, 4, 167–173. [Google Scholar]

- Harrould-Kolieb, E.R. (Re)Framing ocean acidification in the context of the United Nations Framework Convention on Climate Change (UNFCCC) and Paris Agreement. Clim. Policy 2019, 19, 1225–1238. [Google Scholar] [CrossRef]

- Li, Y.; Tong, Y.; Ye, F.; Song, J. The choice of the government green subsidy scheme: Innovation subsidy vs. product subsidy. Int. J. Prod. Res. 2020, 58, 4932–4946. [Google Scholar] [CrossRef]

- Smirnova, O.; Strumsky, D.; Qualls, A.C. Do federal regulations beget innovation? Legislative policy and the role of executive orders. Energy Policy 2021, 158, 112570. [Google Scholar] [CrossRef]

- Moore, J.N. Freedom and authority: “Right-sizing” government. Cato J. 2020, 40, 1–13. [Google Scholar]

- Newman, P. Modern Monetary Theory: An Austrian Interpretation of Recrudescent Keynesianism. Atl. Econ. J. 2020, 48, 23–31. [Google Scholar] [CrossRef]

- Benarroch, M.; Pandey, M. The relationship between trade openness and government size: Does disaggregating government expenditure matter? J. Macroecon. 2012, 34, 239–252. [Google Scholar] [CrossRef]

- Bergh, A.; Fink, G.; Öhrvall, R. More politicians, more corruption: Evidence from Swedish municipalities. Public Choice 2017, 172, 483–500. [Google Scholar] [CrossRef]

- Doig, A. Good government and sustainable anti-corruption strategies: A role for independent anti-corruption agencies? Public Adm. Dev. 1995, 15, 151–165. [Google Scholar] [CrossRef]

- Fike, R.; Gwartney, J. Public Choice, Market Failure, and Government Failure in Principles Textbooks. J. Econ. Educ. 2015, 46, 207–218. [Google Scholar] [CrossRef]

- Popp, D. Promoting Clean Energy Innovation at the State and Local Level. Agric. Resour. Econ. Rev. 2020, 49, 360–373. [Google Scholar] [CrossRef]

- Lim, J.N. The government as marketer of innovation. Eng. Constr. Archit. Manag. 2014, 21, 551–570. [Google Scholar] [CrossRef]

- Kiman, K.; Choi, S.O.; Lee, S. The effect of a financial support on firm innovation collaboration and output: Does policy work on the diverse nature of firm innovation? J. Knowl. Econ. 2021, 12, 645–675. [Google Scholar]

- Lixinski, L. Trialogical Subsidiarity in International and Comparative Law: Engagement with International Treaties by Sub-State Entities as Resistance or Innovation. Can. Yearb. Int. Law 2018, 55, 1–32. [Google Scholar] [CrossRef]

- Daube, M. Altruism and Global Environmental Taxes. Environ. Resour. Econ. 2018, 73, 1049–1072. [Google Scholar] [CrossRef]

- Li, Y.; Cheng, E. Market Socialism in Belarus: An Alternative to China’s Socialist Market Economy. World Rev. Political Econ. 2020, 11, 428–454. [Google Scholar] [CrossRef]

- Sharmelly, R.; Ray, P.K. Managing resource-constrained innovation in emerging markets: Perspectives from a business model. Technol. Soc. 2021, 65, 101538. [Google Scholar] [CrossRef]

- Siyu, M.; Yair, T. Licensing of a new product innovation with risk averse agents. Rev. Ind. Organ. 2021, 59, 79–102. [Google Scholar]

- Tjahjadi, B.; Soewarno, N.; Hariyati, H. The Role of Green Innovation between Green Market Orientation and Business Performance: Its Implication for Open Innovation. J. Open Innov. Technol. 2020, 6, 173. [Google Scholar] [CrossRef]

- Ball, C.; Kittler, M. Removing environmental market failure through support mechanisms: Insights from green start-ups in the British, French and German energy sectors. Small Bus. Econ. 2017, 52, 831–844. [Google Scholar] [CrossRef]

- Chunkai, Z.; Deng, M.; Xiguang, C. Does haze pollution damage urban innovation? Empirical evidence from China. Environ. Sci. Pollut. Res. Int. 2021, 28, 16334–16349. [Google Scholar]

- Novitasari, M.; Agustia, D. Green supply chain management and firm performance: The mediating effect of green innovation. J. Ind. Eng. Manag. 2021, 14, 391–403. [Google Scholar] [CrossRef]

- Rajarathinam, N.; Chandrasekaran, S.; Arunachalam, T. Electronic waste generation, regulation and metal recovery: A review. Environ. Chem. Lett. 2021, 19, 1347–1368. [Google Scholar]

- Lampel, J.; Miller, R.; Floricel, S. Information asymmetries and technological innovation in large engineering construction projects. R&D Manag. 1996, 26, 357–369. [Google Scholar] [CrossRef]

- Kukuk, M.; Stadler, M. Financing Constraints and the Timing of Innovations in the German Services Sector. Empirica 2001, 28, 277–292. [Google Scholar] [CrossRef]

- Timeus, K.; Gascó, M. Increasing innovation capacity in city governments: Do innovation labs make a difference? J. Urban Aff. 2018, 40, 992–1008. [Google Scholar] [CrossRef]

- Sein, Y.; Prokop, V. Mediating Role of Firm R&D in Creating Product and Process Innovation: Empirical Evidence from Norway. Economies 2021, 9, 56. [Google Scholar] [CrossRef]

- Indrawati, H. Barriers to technological innovations of SMEs: How to solve them? Int. J. Innov. Sci. 2020, 12, 545–564. [Google Scholar] [CrossRef]

- Mamuneas, T.; Nadiri, M.I. Public R&D policies and cost behavior of the US manufacturing industries. J. Public Econ. 1996, 63, 57–81. [Google Scholar] [CrossRef]

- Marino, M.; Lhuillery, S.; Parrotta, P.; Sala, D. Additionality or crowding-out? An overall evaluation of public R&D subsidy on private R&D expenditure. Res. Policy 2016, 45, 1715–1730. [Google Scholar] [CrossRef]

- Kuz’Min, M.I.; Kuznetsova, A.N. Ecological-Geologic Risks Related to the Development of Resource Regions. Geogr. Nat. Resour. 2018, 39, 95–102. [Google Scholar] [CrossRef]

- Horbach, J. Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef]

- Chamuah, A.; Singh, R. Responsibly regulating the civilian unmanned aerial vehicle deployment in India and Japan. Aircr. Eng. Aerosp. Technol. 2021, 93, 629–641. [Google Scholar] [CrossRef]

- Szekely, F.; Strebel, H. Incremental, radical and game-changing: Strategic innovation for sustainability. Corp. Gov. Int. J. Bus. Soc. 2013, 13, 467–481. [Google Scholar] [CrossRef]

- Ahuja, G. Collaboration Networks, Structural Holes, and Innovation: A Longitudinal Study. Adm. Sci. Q. 2000, 45, 425–455. [Google Scholar] [CrossRef]

- Dumbrell, N.P.; Adamson, D.; Wheeler, S.A. Is social license a response to government and market failures? Evidence from the literature. Resour. Policy 2020, 69, 101827. [Google Scholar] [CrossRef]

- Havercroft, J. The British academy Brian Barry prize essay: Why is there no just riot theory? Br. J. Political Sci. 2021, 51, 909–923. [Google Scholar] [CrossRef]

- Amar, G.; Kose, J.; Nair, V.B.; Senbet, L.W. Taxes, institutions, and innovation: Theory and international evidence. J. Int. Bus. Stud. 2020, 51, 1413–1442. [Google Scholar]

- Xu, S.; He, X.; Xu, L. Market or government: Who plays a decisive role in R&D resource allocation? China Financ. Rev. Int. 2019, 9, 110–136. [Google Scholar]

- Slijepčević, S.; Rajh, E.; Budak, J. Determinants of corruption pressures on local government in the E.U.: Znanstveno-strucni casopis. Ekon. Istraz. 2020, 33, 3492–3508. [Google Scholar] [CrossRef]

- Damanpour, F.; Schneider, M. Characteristics of Innovation and Innovation Adoption in Public Organizations: Assessing the Role of Managers. J. Public Adm. Res. Theory 2008, 19, 495–522. [Google Scholar] [CrossRef]

- Lestari, E.R.; Dania, W.A.P.; Indriani, C.; Firdausyi, I.A. The impact of customer pressure and the environmental regulation on green innovation performance. IOP Conf. Ser. Earth Environ. Sci. 2021, 733, 012048. [Google Scholar] [CrossRef]

- Wang, P.; Dong, C.; Chen, N.; Qi, M.; Yang, S.; Nnenna, A.B.; Li, W. Environmental Regulation, Government Subsidies, and Green Technology Innovation—A Provincial Panel Data Analysis from China. Int. J. Environ. Res. Public Health 2021, 18, 11991. [Google Scholar] [CrossRef]

- Khan, S.U.; Shah, A.; Rizwan, M.F. Do Financing Constraints Matter for Technological and Non-technological Innovation? A (Re)examination of Developing Markets. Emerg. Mark. Finance Trade 2019, 57, 2739–2766. [Google Scholar] [CrossRef]

- Liu, Y.; Li, Z.; Yin, X. The effects of three types of environmental regulation on energy consumption—evidence from China. Environ. Sci. Pollut. Res. 2018, 25, 27334–27351. [Google Scholar] [CrossRef] [PubMed]

- Jin, S.; Lee, K. The Government R&D Funding and Management Performance: The Mediating Effect of Technology Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 94. [Google Scholar] [CrossRef]

- Anwar, M.; Shuangjie, L. Spurring competitiveness, financial and environmental performance of SMEs through government financial and non-financial support. Environ. Dev. Sustain. 2021, 23, 7860–7882. [Google Scholar] [CrossRef]

- Shuman, Z.; Changhong, Y.; Chen, H. Industry–university–research alliance portfolio size and firm performance: The contingent role of political connections. J. Technol. Transf. 2020, 45, 1505–1534. [Google Scholar]

- Coates, D.; Mirkina, I. Economic freedom of the Russian federation. J. Reg. Anal. Policy 2021, 51, 14–28. [Google Scholar] [CrossRef]

- Doran, C.; Stratmann, T. The Relationship between Economic Freedom and Poverty Rates: Cross-Country Evidence. J. Institutional Theor. Econ. 2020, 176, 686–707. [Google Scholar] [CrossRef]

- Teague, M.V.; Storr, V.H.; Fike, R. Economic freedom and materialism: An empirical analysis. Const. Politi Econ. 2020, 31, 1–44. [Google Scholar] [CrossRef]

- Li, X.; Lai, X.; Zhang, F. Research on green innovation effect of industrial agglomeration from perspective of environmental regulation: Evidence in China. J. Clean. Prod. 2020, 288, 125583. [Google Scholar] [CrossRef]

- Petruzzelli, A.M.; Dangelico, R.M.; Rotolo, D.; Albino, V. Organizational factors and technological features in the development of green innovations: Evidence from patent analysis. Innovation 2011, 13, 291–310. [Google Scholar] [CrossRef]

- Chen, A.; Chen, H. Decomposition Analysis of Green Technology Innovation from Green Patents in China. Math. Probl. Eng. 2021, 2021, 6672656. [Google Scholar] [CrossRef]

- Scarpellini, S.; Portillo-Tarragona, P.; Marin-Vinuesa, L. Green patents: A way to guide the eco-innovation success process? Academia 2019, 32, 225–243. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Bahmani, S.; Bennett, S.E. The innovation- growth link in OECD countries: Could other macroeconomic variables matter? Technol. Soc. 2017, 51, 113–123. [Google Scholar] [CrossRef]

- Ocran, M.K. Fiscal policy and economic growth in South Africa. J. Econ. Stud. 2011, 38, 604–618. [Google Scholar] [CrossRef]

- Murphy, R.H. Economic freedom variables endogenous to business cycles. J. Financial Econ. Policy 2019, 12, 65–75. [Google Scholar] [CrossRef]

- Tudor, C.; Sova, R. On the Impact of GDP per Capita, Carbon Intensity and Innovation for Renewable Energy Consumption: Worldwide Evidence. Energies 2021, 14, 6254. [Google Scholar] [CrossRef]

- Wen, J.; Deng, P.; Zhang, Q.; Chun-Ping, C. Is higher government efficiency bringing about higher innovation? Technol. Econ. Dev. Econ. 2021, 27, 626–655. [Google Scholar] [CrossRef]

- Liu, L.; Zhao, L. The Influence of Ethical Leadership and Green Organizational Identity on Employees’ Green Innovation Behavior: The Moderating Effect of Strategic Flexibility. IOP Conf. Series: Earth Environ. Sci. 2019, 237, 052012. [Google Scholar] [CrossRef]

- Liu, J.; Zhao, M. Study on Evolution and Interaction of Service Industry Agglomeration and Efficiency of Hebei Province China. Complexity 2020, 2020, 1750430. [Google Scholar] [CrossRef]

- Jirakraisiri, J.; Badir, Y.F.; Frank, B. Translating green strategic intent into green process innovation performance: The role of green intellectual capital. J. Intellect. Cap. 2021, 22, 43–67. [Google Scholar] [CrossRef]

- Bae, J.W.; Elkamhi, R. Global Equity Correlation in International Markets. Manag. Sci. 2021, 67, 7262–7289. [Google Scholar] [CrossRef]

- Katusiime, L. Mobile Money Use: The Impact of Macroeconomic Policy and Regulation. Economies 2021, 9, 51. [Google Scholar] [CrossRef]

- Hansen, E.G.; Schmitt, J.C. Orchestrating cradle-to-cradle innovation across the value chain: Overcoming barriers through innovation communities, collaboration mechanisms, and intermediation. J. Ind. Ecol. 2021, 25, 627–647. [Google Scholar] [CrossRef]

- Colombo, L.; Dawid, H.; Kabus, K. When do thick venture capital markets foster innovation? An evolutionary analysis. J. Evol. Econ. 2010, 22, 79–108. [Google Scholar] [CrossRef][Green Version]

- Ritter, B.J.R. Innovation and communication: Signaling with partial disclosure. J. Financ. Quant. Anal. 1980, 15, 853–854. [Google Scholar]

- West, K.D. Dividend Innovations and Stock Price Volatility. Econometrica 1988, 56, 37–61. [Google Scholar] [CrossRef]

- Singh, S.G.; Vasantha, K.S. Dealing with multicollinearity problem in analysis of side friction characteristics under urban heterogeneous traffic conditions. Arab. J. Sci. Eng. Sect. B Eng. 2021, 46, 10739–10755. [Google Scholar] [CrossRef]

- Melese, M.B.; Fogarassy, C. Examining the economic impacts of climate change on net crop income in the Ethiopian Nile basin: A Ricardian fixed effect approach. Sustainability 2021, 13, 7243. [Google Scholar]

- Wen, J.; Waheed, A.; Muhammad, Y.B.; Hussain, H. Examining the determinants of green innovation adoption in SMEs: A PLS-SEM approach. Eur. J. Innov. Manag. 2021, 24, 67–87. [Google Scholar]

- Taghizadeh, S.K.; Rahman, S.A.; Hossain, M.; Haque, M. Characteristics of organizational culture in stimulating service innovation and performance. Mark. Intell. Plan. 2019, 38, 224–238. [Google Scholar] [CrossRef]

- Ashok, M.; Al Badi Al Dhaheri, M.S.M.; Madan, R.; Dzandu, M.D. How to counter organizational inertia to enable knowledge management practices adoption in public sector organizations. J. Knowl. Manag. 2021, 25, 2245–2273. [Google Scholar] [CrossRef]

- Sanz-Valle, R.; Naranjo-Valencia, J.C.; Jiménez-Jiménez, D.; Perez-Caballero, L. Linking organizational learning with technical innovation and organizational culture. J. Knowl. Manag. 2011, 15, 997–1015. [Google Scholar] [CrossRef]

- Alexandre, G.; Petit-Romec, A. Engaging employees for the long run: Long-term investors and employee-related CSR: JBE. J. Bus. Ethics 2021, 174, 35–63. [Google Scholar]

- Chen, G. Government R&D expenditure, knowledge accumulation, and regional innovation capability: Evidence of a threshold effect model from China. Complexity 2021, 27, 68–85. [Google Scholar]

- Henry, H.F.; Suk, W.A. Sustainable exposure prevention through innovative detection and remediation technologies from the NIEHS Superfund Research Program. Rev. Environ. Health 2017, 32, 35–44. [Google Scholar] [CrossRef]

- Urbaniec, M.; Tomala, J.; Martinez, S. Measurements and Trends in Technological Eco-Innovation: Evidence from Environment-Related Patents. Resources 2021, 10, 68. [Google Scholar] [CrossRef]

- Tauhidur, R.; Chhangte, R.L. A new ground motion model (GMM) for northeast India (NEI) and its adjacent countries for interface earthquakes considering both strong motion records and simulated data. Pure Appl. Geophys. 2021, 178, 1021–1045. [Google Scholar]

- Vogelsang, T.J. Heteroskedasticity, autocorrelation, and spatial correlation robust inference in linear panel models with fixed-effects. J. Econ. 2012, 166, 303–319. [Google Scholar] [CrossRef]

| Variable | Observations | Mean | S.D. | Min | Median | Max |

|---|---|---|---|---|---|---|

| Patent | 2497 | 2.808 | 2.325 | 0.131 | 2.110 | 9.791 |

| Govexp | 2497 | 5.809 | 2.137 | 0.029 | 6.000 | 12.957 |

| Govsize | 2497 | 1.875 | 0.222 | 0.010 | 1.911 | 2.245 |

| GDP | 2497 | 13.103 | 14.333 | 5.331 | 10.909 | 16.831 |

| Pop | 2497 | 3.659 | 4.943 | 0.019 | 2.217 | 7.264 |

| HCI | 2497 | 2.455 | 0.693 | 1.049 | 2.532 | 4.154 |

| Xr | 2497 | 6.442 | 8.767 | 0.001 | 2.192 | 12.870 |

| CPI | 2497 | 0.509 | 0.518 | 0.084 | 0.442 | 23.123 |

| Cp | 2497 | 0.553 | 0.770 | 0.006 | 0.500 | 33.371 |

| Sp | 2497 | 0.448 | 0.503 | 0.065 | 0.367 | 20.322 |

| Variable | Govexp | Govsize | Pop | HCI | Xr | CPI | Cp | Sp | VIF | Tolerance |

|---|---|---|---|---|---|---|---|---|---|---|

| Govexp | 1 | 2.94 | 0.339 | |||||||

| Govsize | 0.651 | 1 | 2.28 | 0.438 | ||||||

| GDP | −0.107 | −0.069 | 2.06 | 0.486 | ||||||

| Pop | 0.003 | −0.055 | 1 | 2.07 | 0.482 | |||||

| HCI | −0.486 | −0.184 | −0.053 | 1 | 1.87 | 0.534 | ||||

| Xr | 0.235 | 0.189 | 0.041 | −0.196 | 1 | 1.07 | 0.936 | |||

| CPI | −0.537 | −0.306 | −0.104 | 0.626 | −0.203 | 1 | 4.03 | 0.248 | ||

| Cp | −0.316 | −0.220 | −0.095 | 0.432 | −0.128 | 0.646 | 1 | 2.16 | 0.463 | |

| Sp | −0.441 | −0.271 | −0.104 | 0.586 | −0.184 | 0.831 | 0.748 | 1 | 4.74 | 0.211 |

| Variable | Patent | Patent | Patent | Patent | Patent | Patent |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Govexp | 0.086 * | 0.111 ** | 0.114 ** | |||

| (1.72) | (2.24) | (2.28) | ||||

| Govexp2 | −0.013 *** | −0.016 *** | −0.016 *** | |||

| (−3.04) | (−3.86) | (−3.88) | ||||

| Govsize | 0.939 ** | 1.216 *** | 1.224 *** | |||

| (1.98) | (2.60) | (2.61) | ||||

| Govsize2 | −0.345 ** | −0.485 *** | −0.490 *** | |||

| (−2.31) | (−3.28) | (−3.30) | ||||

| GDP | −0.000 ** | −0.000 ** | −0.000 | −0.000 | ||

| (−2.13) | (−2.19) | (−0.80) | (−0.77) | |||

| Pop | 0.008 *** | 0.008 *** | 0.007 *** | 0.007 *** | ||

| (7.64) | (7.59) | (6.45) | (6.32) | |||

| HCI | 0.396 *** | 0.391 *** | 0.700 *** | 0.684 *** | ||

| (2.90) | (2.84) | (5.00) | (4.84) | |||

| Xr | −0.000 | −0.000 | −0.000 | −0.000 | ||

| (−0.30) | (−0.35) | (−0.10) | (−0.18) | |||

| CPI | −0.094 | −0.279 ** | ||||

| (−0.77) | (−2.20) | |||||

| Cp | 0.032 | −0.006 | ||||

| (0.58) | (−0.09) | |||||

| Sp | 0.107 | 0.205 | ||||

| (0.88) | (1.60) | |||||

| _cons | 2.278 *** | 0.992 *** | 0.984 ** | 1.700 *** | −0.306 | −0.192 |

| (14.35) | (2.70) | (2.57) | (4.29) | (−0.58) | (−0.36) | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 1820 | 1726 | 1720 | 1936 | 1797 | 1791 |

| R2 | 0.416 | 0.468 | 0.469 | 0.384 | 0.447 | 0.450 |

| Variable | Er | Er | Er | Er |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Govexp | 0.772 *** | 0.803 *** | ||

| (4.47) | (4.80) | |||

| Govexp2 | −0.069 *** | −0.068 *** | ||

| (−4.81) | (−4.94) | |||

| Govsize | 2.379 ** | 1.900 * | ||

| (2.28) | (1.81) | |||

| Govsize2 | −0.192 ** | −0.148 * | ||

| (−2.31) | (−1.76) | |||

| _cons | −0.538 | 2.209 | −5.927 * | −1.171 |

| (−1.15) | (0.87) | (−1.81) | (−0.29) | |

| Control variables | No | Yes | No | Yes |

| Year | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes |

| N | 1444 | 1444 | 1445 | 1445 |

| R2 | 0.310 | 0.396 | 0.277 | 0.359 |

| Variable | Fs | Fs | Fs | Fs |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Govexp | 0.030 | 0.053 * | ||

| (1.14) | (1.88) | |||

| Govexp2 | −0.006 *** | −0.007 *** | ||

| (−3.04) | (−3.36) | |||

| Govsize | 0.103 ** | 0.118 ** | ||

| (2.22) | (2.39) | |||

| Govsize2 | −0.008 ** | −0.007 * | ||

| (−2.08) | (−1.70) | |||

| _cons | 3.279 *** | 3.484 *** | 2.684 *** | 2.879 *** |

| (38.86) | (16.24) | (18.62) | (11.29) | |

| Control variables | No | Yes | No | Yes |

| Year | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes |

| N | 2361 | 2170 | 2617 | 2330 |

| R2 | 0.304 | 0.316 | 0.347 | 0.349 |

| Variable | Patent | Patent | Patent | Patent | Patent | Patent | Patent | Patent |

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Panel A: Developed Countries | Panel B: Developing Countries | |||||||

| Govexp | 0.396 *** | 0.435 *** | 0.019 | 0.077 | ||||

| (4.90) | (5.32) | (0.19) | (0.71) | |||||

| Govexp2 | −0.051 *** | −0.055 *** | −0.007 | −0.013 | ||||

| (−5.37) | (−5.77) | (−0.95) | (−1.61) | |||||

| Govsize | 4.608 | 6.971 ** | 0.912 | 0.874 | ||||

| (1.36) | (1.97) | (1.44) | (1.62) | |||||

| Govsize2 | −1.405 | −2.084 ** | −0.341 * | −0.345 * | ||||

| (−1.44) | (−2.03) | (−1.72) | (−1.89) | |||||

| _cons | 3.841 *** | 1.569 * | 0.769 | −2.451 | 1.572 *** | 0.115 | 0.889 | −2.741 *** |

| (19.41) | (1.65) | (0.26) | (−0.79) | (4.52) | (0.12) | (1.51) | (−2.81) | |

| Control variables | No | Yes | No | Yes | No | Yes | No | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 537 | 537 | 537 | 537 | 1283 | 1183 | 1399 | 1254 |

| R2 | 0.643 | 0.664 | 0.624 | 0.644 | 0.361 | 0.428 | 0.334 | 0.346 |

| Variable | Patent | Patent | Patent | Patent | Patent | Patent | Patent | Patent |

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Panel A: H_R&D | Panel B: L_R&D | |||||||

| Govexp | 0.174 *** | 0.187 *** | −0.169 | −0.109 | ||||

| (3.36) | (3.66) | (−0.55) | (−0.46) | |||||

| Govexp2 | −0.020 *** | −0.023 *** | 0.010 | 0.005 | ||||

| (−4.55) | (−5.22) | (0.46) | (0.29) | |||||

| Govsize | 0.856 * | 1.205 ** | 0.548 | 0.758 | ||||

| (1.76) | (2.52) | (0.44) | (0.54) | |||||

| Govsize2 | −0.304 ** | −0.459 *** | −0.207 | −0.164 | ||||

| (−1.98) | (−3.00) | (−0.49) | (−0.31) | |||||

| _cons | 2.168 *** | 1.547 *** | 1.818 *** | 0.250 | 2.535 ** | −0.545 | 1.549 * | −2.226 |

| (13.66) | (3.90) | (4.46) | (0.45) | (2.25) | (−0.16) | (1.91) | (−0.74) | |

| Control variables | No | Yes | No | Yes | No | Yes | No | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 1396 | 1328 | 1500 | 1394 | 424 | 392 | 436 | 397 |

| R2 | 0.457 | 0.506 | 0.405 | 0.472 | 0.345 | 0.441 | 0.340 | 0.437 |

| Variable | Patent1 | Patent1 | Patent1 | Patent1 | Patent2 | Patent2 | Patent2 | Patent2 |

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Govexp | 0.182 *** | 0.184 *** | 0.120 ** | 0.153 *** | ||||

| (3.01) | (3.05) | (2.34) | (2.97) | |||||

| Govexp2 | −0.021 *** | −0.023 *** | −0.017 *** | −0.022 *** | ||||

| (−4.11) | (−4.42) | (−3.99) | (−5.03) | |||||

| Govsize | 0.773 | 1.013 * | 0.949 * | 1.267 *** | ||||

| (1.35) | (1.79) | (1.91) | (2.58) | |||||

| Govsize2 | −0.314 * | −0.398 ** | −0.372 ** | −0.543 *** | ||||

| (−1.73) | (−2.17) | (−2.39) | (−3.50) | |||||

| GDP | −0.000 *** | −0.000 *** | −0.000 | 0.000 | ||||

| (−4.24) | (−3.10) | (−0.71) | (0.64) | |||||

| Pop | 0.008 *** | 0.007 *** | 0.007 *** | 0.006 *** | ||||

| (6.26) | (5.28) | (6.56) | (5.32) | |||||

| HCI | 0.715 *** | 0.946 *** | 0.387 *** | 0.565 *** | ||||

| (4.39) | (5.68) | (2.78) | (3.91) | |||||

| Xr | −0.000 | −0.000 | −0.000 | −0.000 | ||||

| (−0.56) | (−0.18) | (−0.31) | (−0.04) | |||||

| CPI | −0.299 | −0.590 *** | 0.058 | −0.145 | ||||

| (−1.47) | (−2.91) | (0.47) | (−1.13) | |||||

| Cp | 0.066 | 0.038 | 0.023 | −0.024 | ||||

| (1.04) | (0.57) | (0.42) | (−0.41) | |||||

| Sp | 0.266 | 0.368 ** | −0.033 | 0.118 | ||||

| (1.48) | (2.00) | (−0.26) | (0.90) | |||||

| _cons | 2.120 *** | 0.022 | 2.010 *** | −0.707 | 1.953 *** | 0.686 * | 1.486 *** | −0.112 |

| (11.13) | (0.05) | (4.23) | (−1.09) | (12.11) | (1.76) | (3.58) | (−0.20) | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 1513 | 1452 | 1594 | 1498 | 1742 | 1649 | 1847 | 1714 |

| R2 | 0.243 | 0.289 | 0.217 | 0.280 | 0.484 | 0.531 | 0.445 | 0.507 |

| Variable | Patent | Patent | Patent | Patent | Patent | Patent |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Govexp | 0.145 ** | 0.152 ** | 0.164 ** | |||

| (2.30) | (2.38) | (2.58) | ||||

| Govexp2 | −0.017 *** | −0.017 *** | −0.017 *** | |||

| (−3.17) | (-3.18) | (−3.29) | ||||

| Govsize | 1.111 ** | 1.142 ** | 1.143 ** | |||

| (2.20) | (2.22) | (2.24) | ||||

| Govsize2 | −0.337 ** | −0.331 * | −0.332 ** | |||

| (−2.01) | (−1.95) | (−1.97) | ||||

| GDP | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 ** | −0.000 ** | −0.000 *** |

| (−3.09) | (−3.05) | (−4.15) | (−2.13) | (−2.16) | (−3.32) | |

| Pop | 0.009 *** | 0.009 *** | 0.004 ** | 0.008 *** | 0.008 *** | 0.003 |

| (7.90) | (7.82) | (1.99) | (6.67) | (6.63) | (1.41) | |

| HCI | 0.014 | −0.004 | −0.007 | 0.356 * | 0.337 | 0.337 |

| (0.07) | (−0.02) | (−0.03) | (1.73) | (1.61) | (1.61) | |

| Xr | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (1.10) | (1.15) | (0.37) | (1.33) | (1.35) | (0.59) | |

| CPI | 0.199 | 0.195 | 0.211 | 0.051 | 0.059 | 0.073 |

| (1.34) | (1.31) | (1.42) | (0.33) | (0.37) | (0.46) | |

| Cp | 0.044 | 0.053 | 0.046 | 0.015 | 0.021 | 0.015 |

| (0.78) | (0.93) | (0.82) | (0.26) | (0.34) | (0.24) | |

| Sp | −0.111 | −0.116 | −0.124 | −0.004 | −0.016 | −0.025 |

| (−0.68) | (−0.70) | (−0.75) | (−0.02) | (−0.09) | (−0.15) | |

| Industry | 0.005 | 0.005* | 0.006 * | 0.005 | 0.005 | 0.005 |

| (1.60) | (1.71) | (1.74) | (1.43) | (1.41) | (1.44) | |

| Openess | −0.001 | −0.001 | −0.000 | −0.000 | ||

| (−1.04) | (−1.27) | (−0.28) | (−0.46) | |||

| Emp | 0.022 *** | 0.022 *** | ||||

| (3.15) | (3.02) | |||||

| _cons | 1.211 ** | 1.258 ** | 0.954 * | −0.205 | −0.230 | −0.482 |

| (2.21) | (2.25) | (1.69) | (−0.31) | (−0.33) | (−0.70) | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 986 | 961 | 961 | 1035 | 1008 | 1008 |

| R2 | 0.462 | 0.464 | 0.470 | 0.429 | 0.431 | 0.437 |

| Variable | Patent | Patent | Patent | Patent |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Model | Poisson | Poisson | Nbreg | Nbreg |

| Govexp | 0.193 ** | 0.233 *** | ||

| (2.09) | (4.54) | |||

| Govexp2 | −0.015 * | −0.028 *** | ||

| (−1.71) | (−5.93) | |||

| Govsize | 6.089 ** | 4.378 ** | ||

| (2.39) | (2.19) | |||

| Govsize2 | −1.754 ** | −1.301 ** | ||

| (−2.37) | (−2.31) | |||

| GDP | −0.000 *** | −0.000 *** | −0.000 *** | −0.000 *** |

| (−4.81) | (−5.60) | (−4.35) | (−4.04) | |

| Pop | 0.008 *** | 0.008 *** | 0.008 *** | 0.008 *** |

| (5.53) | (6.11) | (10.85) | (8.87) | |

| HCI | 0.758 *** | 0.817 *** | 0.564 *** | 0.693 *** |

| (3.66) | (4.04) | (3.42) | (3.97) | |

| Xr | −0.000 | −0.000 | 0.000 | 0.000 |

| (−1.01) | (−0.58) | (0.29) | (0.66) | |

| CPI | 0.310 * | 0.357 ** | −0.293 * | −0.565 *** |

| (1.71) | (1.97) | (−1.87) | (−3.11) | |

| Cp | −0.242 | −0.283 | 0.069 *** | 0.045 |

| (−0.47) | (−0.54) | (2.85) | (1.59) | |

| Sp | 0.134 | 0.216 | −0.135 | 0.043 |

| (0.38) | (0.60) | (−1.03) | (0.32) | |

| _cons | −3.426 *** | −8.582 *** | −2.857 *** | −6.378 *** |

| (−11.05) | (−3.86) | (−12.04) | (−3.61) | |

| Year | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes |

| N | 1720 | 1791 | 1720 | 1791 |

| Variable | Patent | Patent | Patent | Patent |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| L. Patent | 0.628 *** | 0.690 *** | 0.555 *** | 0.665 *** |

| (28.62) | (45.32) | (17.98) | (74.49) | |

| Govexp | 0.287 *** | 0.259 *** | ||

| (3.61) | (4.66) | |||

| Govexp2 | −0.029 *** | −0.018 *** | ||

| (−3.76) | (−2.87) | |||

| Govsize | 8.874 ** | 11.112 *** | ||

| (2.32) | (9.80) | |||

| Govsize2 | −2.167 ** | −3.028 *** | ||

| (−2.07) | (−9.77) | |||

| GDP | 0.001 | 0.001 | −0.001 | 0.001 |

| (0.51) | (0.52) | (−0.45) | (1.61) | |

| Pop | 0.002 * | 0.008 *** | 0.003 *** | 0.009 *** |

| (1.95) | (3.89) | (3.45) | (7.62) | |

| HCI | 0.294 *** | 0.434 *** | 0.761 *** | 0.318 *** |

| (2.62) | (7.42) | (4.60) | (3.62) | |

| Xr | −0.001 *** | −0.001 *** | −0.001 *** | −0.001 *** |

| (−3.42) | (−7.30) | (−5.75) | (-15.20) | |

| CPI | 0.465 * | -0.319 *** | 0.608 * | −0.231 *** |

| (1.85) | (-3.84) | (1.92) | (−4.80) | |

| Cp | −0.659 ** | −1.171 *** | −0.533 | −0.547 *** |

| (−2.10) | (−4.47) | (−1.49) | (−2.95) | |

| Sp | 0.182 | 1.580 *** | −0.127 | 0.679 *** |

| (1.41) | (6.91) | (−0.81) | (3.77) | |

| _cons | −0.213 | −1.161 *** | −9.705 *** | −9.919 *** |

| (−0.60) | (−6.14) | (−2.62) | (−11.11) | |

| Year | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes |

| AR(1)-P | 0.000 | 0.000 | 0.000 | 0.000 |

| Sargan-P | 0.697 | 1.000 | 0.987 | 1.000 |

| Hasen-P | 0.145 | 0.351 | 0.176 | 0.439 |

| N | 1720 | 1791 | 1720 | 1791 |

| Variable | Patent | Patent | Patent | Patent | Patent | Patent |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Govexp | 0.086 ** | 0.111 *** | 0.114 *** | |||

| (2.73) | (2.97) | (2.92) | ||||

| Govexp2 | −0.013 *** | −0.016 *** | −0.016 *** | |||

| (−3.51) | (−3.70) | (−3.66) | ||||

| Govsize | 0.939 | 1.216 * | 1.224 * | |||

| (1.60) | (1.93) | (1.98) | ||||

| Govsize2 | −0.345 * | −0.485 ** | −0.490 ** | |||

| (−2.08) | (−2.67) | (−2.76) | ||||

| GDP | −0.000 | −0.000 | −0.000 | −0.000 | ||

| (−1.57) | (−1.67) | (−0.65) | (−0.65) | |||

| Pop | 0.008 *** | 0.008 *** | 0.007 *** | 0.007 *** | ||

| (9.52) | (9.45) | (9.01) | (8.64) | |||

| HCI | 0.396 *** | 0.391 *** | 0.700 *** | 0.684 *** | ||

| (3.69) | (3.59) | (4.87) | (4.70) | |||

| Xr | −0.000 | −0.000 | −0.000 | −0.000 | ||

| (−0.37) | (−0.43) | (−0.13) | (−0.23) | |||

| CPI | −0.094 | −0.279 | ||||

| (−0.61) | (−1.66) | |||||

| Cp | 0.032 | −0.006 | ||||

| (1.50) | (−0.25) | |||||

| Sp | 0.107 | 0.205 | ||||

| (0.70) | (1.44) | |||||

| _cons | 2.278 *** | 0.992 *** | 0.984 *** | 1.700 *** | −0.306 | −0.192 |

| (27.24) | (3.19) | (3.15) | (3.18) | (−0.44) | (−0.27) | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Country | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 1820 | 1726 | 1720 | 1936 | 1797 | 1791 |

| R2 | 0.416 | 0.467 | 0.467 | 0.384 | 0.447 | 0.449 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wen, J.; Li, L.; Zhao, X.; Jiao, C.; Li, W. How Government Size Expansion Can Affect Green Innovation—An Empirical Analysis of Data on Cross-Country Green Patent Filings. Int. J. Environ. Res. Public Health 2022, 19, 7328. https://doi.org/10.3390/ijerph19127328

Wen J, Li L, Zhao X, Jiao C, Li W. How Government Size Expansion Can Affect Green Innovation—An Empirical Analysis of Data on Cross-Country Green Patent Filings. International Journal of Environmental Research and Public Health. 2022; 19(12):7328. https://doi.org/10.3390/ijerph19127328

Chicago/Turabian StyleWen, Jun, Lingxiao Li, Xinxin Zhao, Chenyang Jiao, and Wenjie Li. 2022. "How Government Size Expansion Can Affect Green Innovation—An Empirical Analysis of Data on Cross-Country Green Patent Filings" International Journal of Environmental Research and Public Health 19, no. 12: 7328. https://doi.org/10.3390/ijerph19127328

APA StyleWen, J., Li, L., Zhao, X., Jiao, C., & Li, W. (2022). How Government Size Expansion Can Affect Green Innovation—An Empirical Analysis of Data on Cross-Country Green Patent Filings. International Journal of Environmental Research and Public Health, 19(12), 7328. https://doi.org/10.3390/ijerph19127328