Tax Policy and Total Factor Carbon Emission Efficiency: Evidence from China’s VAT Reform

Abstract

:1. Introduction

2. Background and Research Hypothesis

2.1. Background of VAT Reform in China

2.2. Research Hypothesis

2.2.1. Basic Hypothesis

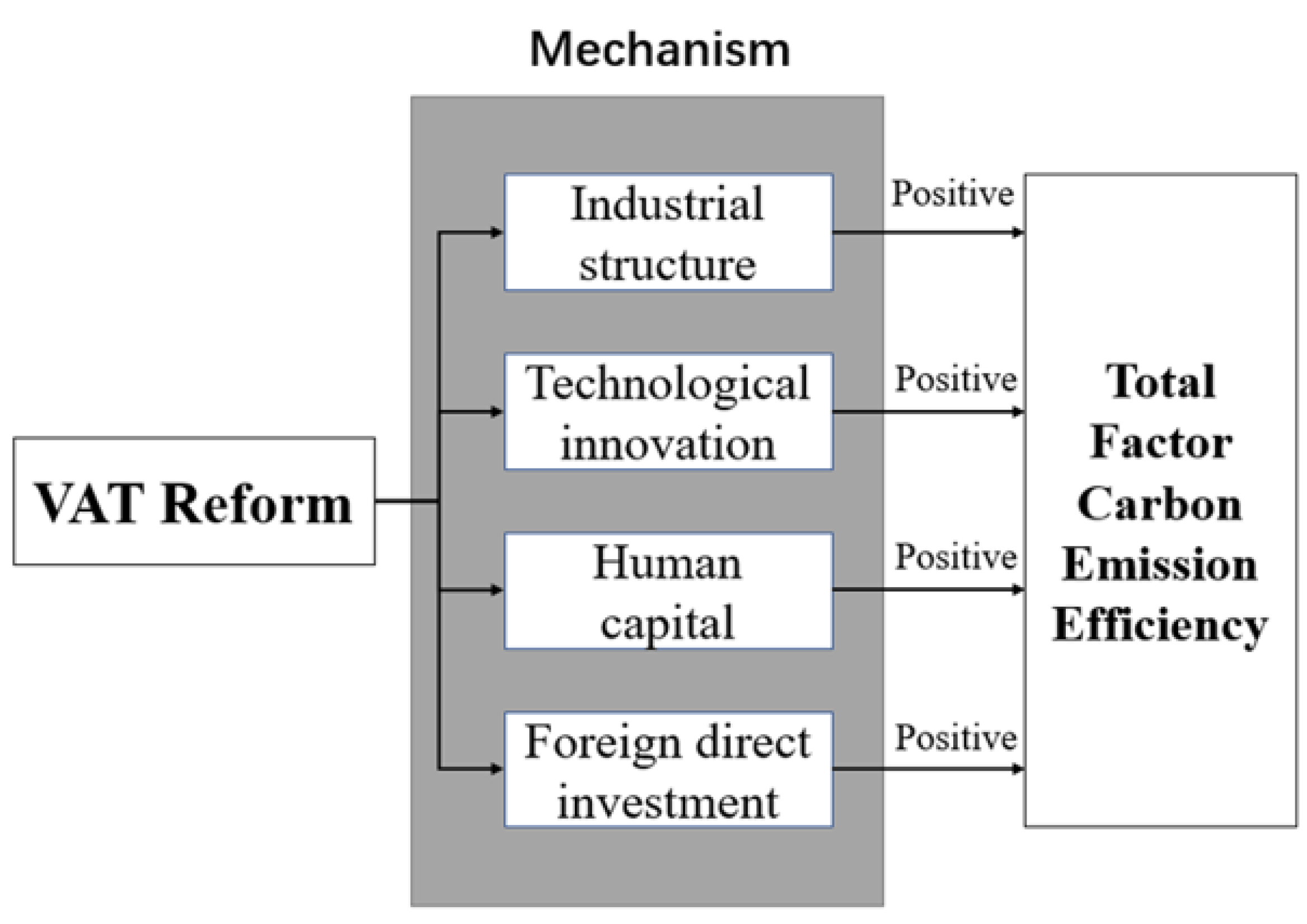

2.2.2. Mechanism Hypothesis

3. Methodology and Data

3.1. Model Setting

3.2. Variables and Data

3.2.1. Variables

Dependent Variable

Independent Variable

Mechanism Variables

Control Variable

3.2.2. Data Source and Descriptive Statistics

4. Empirical Result

4.1. The Impact of VAT Reform on TFCEE

4.2. Parallel Trend and Placebo Test

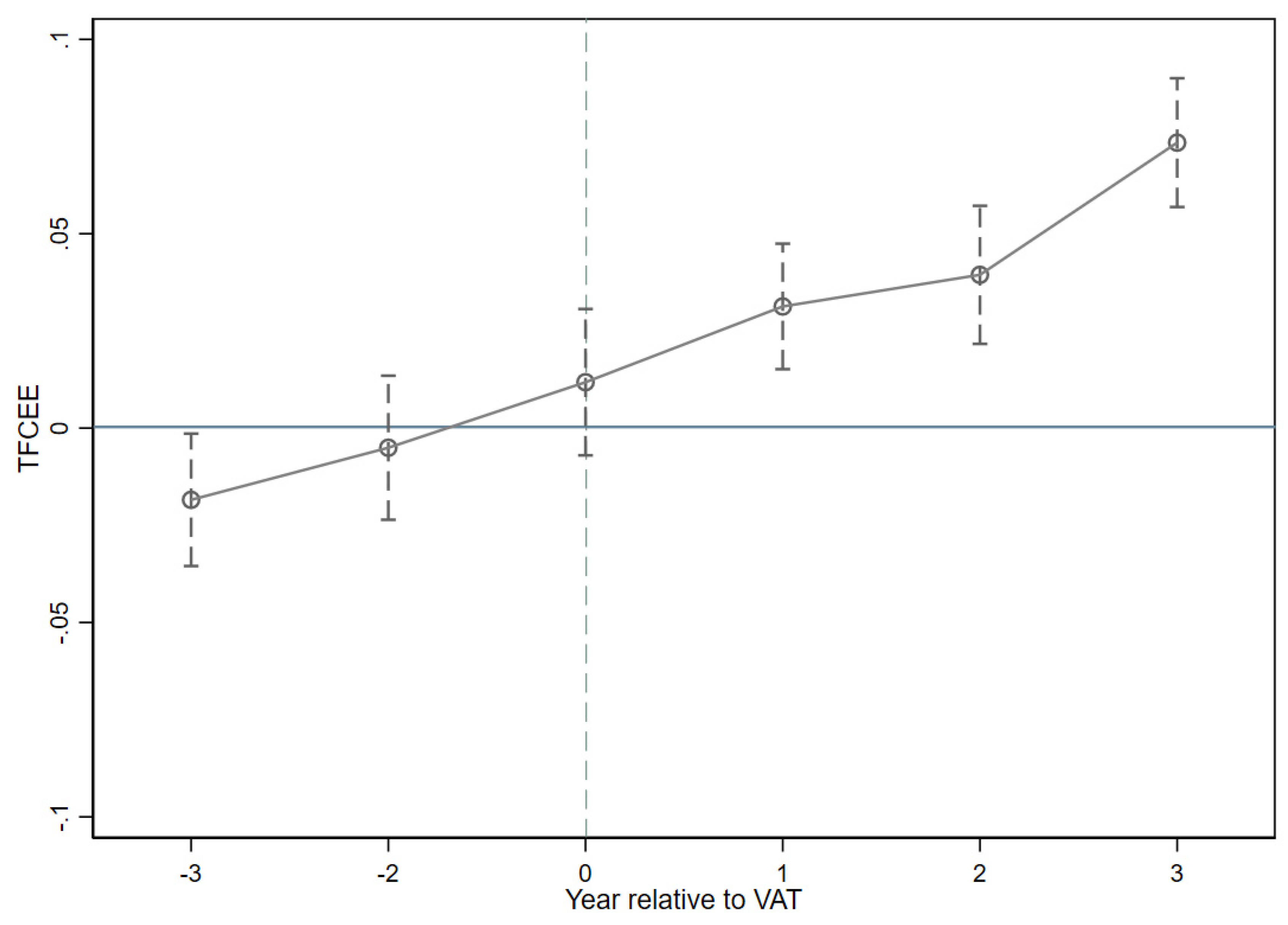

4.2.1. Parallel Trend Test

4.2.2. Placebo Test

4.3. Robustness Checks

4.4. Mechanisms Analysis

4.5. Heterogeneity Analysis

4.5.1. Location of the City

4.5.2. Scale of the City

5. Discussion

6. Policy Implications

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Yu, S.; Zheng, S.; Li, X.; Li, L. China can peak its energy-related carbon emissions before 2025: Evidence from industry restructuring. Energy Econ. 2018, 73, 91–107. [Google Scholar] [CrossRef]

- Le, Q.; Andrew, R.M.; Friedlingstein, P.; Sitch, S.; Hauck, J.; Pongratz, J.; Pickers, P.A.; Korsbakken, J.I.; Peters, G.P.; Canadell, J.G.; et al. Global Carbon Budget 2018. Earth Syst. Sci. Data 2018, 10, 2141–2194. [Google Scholar]

- Huang, J.; Cai, X.; Huang, S.; Tian, S.; Lei, H. Technological factors and total factor productivity in China: Evidence based on a panel threshold model. China Econ. Rev. 2019, 54, 271–285. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. Economic growth model, structural transformation, and green productivity in China. Appl. Energy 2017, 187, 489–500. [Google Scholar] [CrossRef]

- Li, J.; Ma, J.; Wei, W. Analysis and Evaluation of the Regional Characteristics of Carbon Emission Efficiency for China. Sustainability 2020, 12, 3188. [Google Scholar] [CrossRef] [Green Version]

- Wang, W.; Xie, H.; Jiang, T.; Zhang, D.; Xie, X. Measuring the Total-Factor Carbon Emission Performance of Industrial Land Use in China Based on the Global Directional Distance Function and Non-Radial Luenberger Productivity Index. Sustainability 2016, 8, 336. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.-J.; Sun, Y.-F.; Huang, J. Energy efficiency, carbon emission performance, and technology gaps: Evidence from CDM project investment. Energy Policy 2018, 115, 119–130. [Google Scholar] [CrossRef]

- Gao, Y.; Zhang, M.; Zheng, J. Accounting and determinants analysis of China’s provincial total factor productivity considering carbon emissions. China Econ. Rev. 2021, 65, 101576. [Google Scholar] [CrossRef]

- Guo, X.; Wang, X.; Wu, X.; Chen, X.; Li, Y. Carbon Emission Efficiency and Low-Carbon Optimization in Shanxi Province under “Dual Carbon” Background. Energies 2022, 15, 2369. [Google Scholar] [CrossRef]

- Zhang, F.; Jin, G.; Li, J.; Wang, C.; Xu, N. Study on Dynamic Total Factor Carbon Emission Efficiency in China’s Urban Agglomerations. Sustainability 2020, 12, 2675. [Google Scholar] [CrossRef] [Green Version]

- Wang, M.; Xu, M.; Ma, S. The effect of the spatial heterogeneity of human capital structure on regional green total factor productivity. Struct. Chang. Econ. Dyn. 2021, 59, 427–441. [Google Scholar] [CrossRef]

- Gao, D.; Li, G.; Li, Y.; Gao, K. Does FDI improve green total factor energy efficiency under heterogeneous environmental regulation? Evidence from China. Environ. Sci. Pollut. Res. Int. 2022, 29, 25665–25678. [Google Scholar] [CrossRef]

- Curtis, E.M.; Lee, J.M. When do environmental regulations backfire? Onsite industrial electricity generation, energy efficiency and policy instruments. J. Environ. Econ. Manag. 2019, 96, 174–194. [Google Scholar] [CrossRef]

- Zhou, Q.; Li, T.; Gong, L. The effect of tax incentives on energy intensity: Evidence from China’s VAT reform. Energy Econ. 2022, 108, 105887. [Google Scholar] [CrossRef]

- Hassett, K.A.; Hubbard, R.G. Tax Policy and Bussiness Investment. Handb. Public Econ. 2002, 3, 1293–1343. [Google Scholar]

- Liu, Y.; Mao, J. How Do Tax Incentives Affect Investment and Productivity? Firm-Level Evidence from China. Am. Econ. J. Econ. Policy 2019, 11, 261–291. [Google Scholar] [CrossRef] [Green Version]

- Hicks, M.J.; LaFaive, M. The Influence of Targeted Economic Development Tax Incentives on County Economic Growth: Evidence from Michigan’s MEGA Credits. Econ. Dev. Q. 2011, 25, 193–205. [Google Scholar] [CrossRef]

- Zhang, Z.; Guo, J.e.; Qian, D.; Xue, Y.; Cai, L. Effects and mechanism of influence of China’s resource tax reform: A regional perspective. Energy Econ. 2013, 36, 676–685. [Google Scholar] [CrossRef]

- Yu, H. The influential factors of China’s regional energy intensity and its spatial linkages: 1988–2007. Energy Policy 2012, 45, 583–593. [Google Scholar] [CrossRef]

- Adua, L.; Clark, B.; York, R. The ineffectiveness of efficiency: The paradoxical effects of state policy on energy consumption in the United States. Energy Res. Soc. Sci. 2021, 71, 101806. [Google Scholar] [CrossRef]

- Kong, D.; Xiong, M. Unintended consequences of tax incentives on export product quality: Evidence from a natural experiment in China. Rev. Int. Econ. 2020, 29, 802–837. [Google Scholar] [CrossRef]

- Liu, Q.; Lu, Y. Firm investment and exporting: Evidence from China’s value-added tax reform. J. Int. Econ. 2015, 97, 392–403. [Google Scholar] [CrossRef] [Green Version]

- Li, S. A structural model of productivity, uncertain demand, and export dynamics. J. Int. Econ. 2018, 115, 1–15. [Google Scholar] [CrossRef]

- Xu, X.; Xu, X.; Chen, Q.; Che, Y. The impact on regional “resource curse” by coal resource tax reform in China—A dynamic CGE appraisal. Resour. Policy 2015, 45, 277–289. [Google Scholar] [CrossRef]

- Fang, C.; Cheng, J.; Zhu, Y.; Chen, J.; Peng, X. Green total factor productivity of extractive industries in China: An explanation from technology heterogeneity. Resour. Policy 2021, 70, 101933. [Google Scholar] [CrossRef]

- Zhang, N.; Wei, X. Dynamic total factor carbon emissions performance changes in the Chinese transportation industry. Appl. Energy 2015, 146, 409–420. [Google Scholar] [CrossRef]

- Gao, Y.; Zhang, M. The measure of technical efficiency of China’s provinces with carbon emission factor and the analysis of the influence of structural variables. Struct. Chang. Econ. Dyn. 2019, 49, 120–129. [Google Scholar] [CrossRef]

- Gao, D.; Li, Y.; Yang, Q. Can pollution charges reform promote industrial SO2 emissions reduction?—Evidence from 189 China’s cities. Energy Environ. 2020, 32, 96–112. [Google Scholar] [CrossRef]

- Liang, G.; Yu, D.; Ke, L. An Empirical Study on Dynamic Evolution of Industrial Structure and Green Economic Growth—Based on Data from China’s Underdeveloped Areas. Sustainability 2021, 13, 8154. [Google Scholar] [CrossRef]

- Chen, Y.; Xu, W.; Zhou, Q.; Zhou, Z. Total Factor Energy Efficiency, Carbon Emission Efficiency, and Technology Gap: Evidence from Sub-Industries of Anhui Province in China. Sustainability 2020, 12, 1402. [Google Scholar] [CrossRef] [Green Version]

- Yao, X.; Zhou, H.; Zhang, A.; Li, A. Regional energy efficiency, carbon emission performance and technology gaps in China: A meta-frontier non-radial directional distance function analysis. Energy Policy 2015, 84, 142–154. [Google Scholar] [CrossRef]

- Zhu, J.; Niu, L.; Ruth, M.; Shi, L. Technological Change and Energy Efficiency in Large Chinese Firms. Ecol. Econ. 2018, 150, 241–250. [Google Scholar] [CrossRef]

- Hu, J.; Wang, Z.; Huang, Q.; Zhang, X. Environmental Regulation Intensity, Foreign Direct Investment, and Green Technology Spillover—An Empirical Study. Sustainability 2019, 11, 2718. [Google Scholar] [CrossRef] [Green Version]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef] [Green Version]

- Bai, Y.; Deng, X.; Jiang, S.; Zhang, Q.; Wang, Z. Exploring the relationship between urbanization and urban eco-efficiency: Evidence from prefecture-level cities in China. J. Clean. Prod. 2018, 195, 1487–1496. [Google Scholar] [CrossRef]

- Xiong, S.; Ma, X.; Ji, J. The impact of industrial structure efficiency on provincial industrial energy efficiency in China. J. Clean. Prod. 2019, 215, 952–962. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J.; Zhang, H. Total-factor carbon emission efficiency of China’s provincial industrial sector and its dynamic evolution. Renew. Sustain. Energy Rev. 2018, 94, 330–339. [Google Scholar] [CrossRef]

- Jiang, H.; Jiang, P.; Wang, D.; Wu, J. Can smart city construction facilitate green total factor productivity? A quasi-natural experiment based on China’s pilot smart city. Sustain. Cities Soc. 2021, 69, 102809. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Ho, M.S. How do market reforms affect China’s responsiveness to environmental policy? J. Dev. Econ. 2007, 82, 200–233. [Google Scholar] [CrossRef]

- Gao, D.; Li, Y.; Li, G. Boosting the green total factor energy efficiency in urban China: Does low-carbon city policy matter? Environ. Sci. Pollut. Res. 2022, 1–16. [Google Scholar] [CrossRef]

| July 2004 | Liaoning Province, Jilin Province, and Heilongjiang Province. |

| July 2007 | Twenty-six cities located in the middle six provinces. Specifically, the cities are Taiyuan, Datong, Yangquan, and Chang Zhi in Shanxi Province; Hefei, Maan shan, Bengbu, Wuhu, and Huainan in Anhui Province; Nanchang, Ping xiang, Jingdezhen, and Jiu Jiang in Jiangxi Province; Zhengzhou, Luoyang, Jiaozuo, Ping ding shan, and Kaifeng in Henan Province; Wuhan, Huang shi, Xiang fan, and Shi yan in Hubei Province; and Changsha, Zhuzhou, Xiangtan, and Hengyang in Hunan Province |

| July 2008 | Four cities in Inner Mongolia, namely Hulunbuir, Xingan, Tongliao, Chifeng, and Xilingele, and fifty-one counties that suffered from the Wen chuan earthquake. The counties are located in Guangyuan, Mianyang, and Deyang city in Sichuan Province; Longnan city in Gansu province; and Baoji in Shanxi Province |

| January, 2009 | Nation-wide |

| Input-Output | Variable | Measurement | Unit |

|---|---|---|---|

| Input | Labor force | The total number of employees of each city | 10,000 people |

| Capital | The capital stock of each city by using the perpetual inventory method | CNY 10,000 | |

| Energy | Total energy consumption of each city | 10,000 tons | |

| Desirable Output | Economic value | Real gross domestic production (GDP) of each city treated with the located provincial GDP deflator | CNY 10,000 |

| Undesirable Output | CO2 | Total carbon emissions of each city | 10,000 tons |

| Variable | Symbol | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Total Factor Carbon Emission Efficiency | TFCEE | 4794 | 0.291 | 0.106 | 0.106 | 1 |

| GDP per capita | Gpc | 4776 | 37,659.013 | 31,754.193 | 99 | 467,749 |

| Industrial structural | Is | 4787 | 256,758.56 | 453,702.770 | 8300 | 6,810,780 |

| Human capital | Hc | 4787 | 1.134 | 4.050 | 0.010 | 106.8 |

| Sulfur dioxide | SO2 | 4609 | 52,348.155 | 56,987.843 | 2 | 683,162 |

| FDI | FDI | 3764 | 3,926,520.5 | 12,749,891 | 0 | 1.511 × 108 |

| Technological innovation | Ti | 4786 | 3318.954 | 9663.539 | 1 | 166,609 |

| Population density | Pd | 3662 | 425.668 | 323.456 | 4.7 | 2661.54 |

| Variable | (1) | (2) |

|---|---|---|

| TFCEE | TFCEE | |

| VAT | 0.0459 *** | 0.0309 *** |

| (0.00511) | (0.00450) | |

| Gpc | 1.31 × 10−6 *** | |

| (7.30 × 10−8 ) | ||

| Pd | 7.24 × 10−5 *** | |

| (1.40 × 10−5 ) | ||

| SO2 | −1.79 × 10−7 *** | |

| (4.07 × 10−8 ) | ||

| Constant | 0.259 *** | 0.212 *** |

| (0.00366) | (0.00738) | |

| Year-FE | YES | YES |

| City-FE | YES | YES |

| Observations | 4794 | 3631 |

| R-squared | 0.688 | 0.794 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| TFCEE-DDF | TFCEE-EBM | TFCEE-SBM (year < 2009) | |

| VAT | 0.0837 *** | 0.0709 *** | 0.0091 ** |

| (0.0059) | (0.0047) | (0.0043) | |

| Constant | 0.598 *** | 0.339 *** | 0.287 *** |

| (0.0042) | (0.0034) | (0.0014) | |

| Controls | YES | YES | YES |

| Year-FE | YES | YES | YES |

| City-FE | YES | YES | YES |

| Observations | 4794 | 4794 | 1974 |

| R-squared | 0.764 | 0.771 | 0.921 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Is | Ln (Is) | Ti | Ln (Ti) | Hc | Ln (Hc) | FDI | Ln (FDI) | |

| VAT | 47,108 *** | 0.105 *** | 2434 *** | 0.569 *** | 0.281 * | 0.190 *** | 960,625 ** | 0.0785 |

| (14,645) | (0.0125) | (505.2) | (0.0346) | (0.150) | (0.0250) | (422,847) | (0.0512) | |

| Constant | 224,038 *** | 11.97 *** | 1629 *** | 5.960 *** | 0.939 *** | −1.014 *** | 3.323 × 106 *** | 13.00 *** |

| (10,481) | (0.0089) | (361.5) | (0.0248) | (0.107) | (0.0179) | (278,453) | (0.0339) | |

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| Year-FE | YES | YES | YES | YES | YES | YES | YES | YES |

| City-FE | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 4787 | 4787 | 4786 | 4786 | 4787 | 4787 | 3760 | 3743 |

| R-squared | 0.861 | 0.966 | 0.636 | 0.956 | 0.817 | 0.938 | 0.872 | 0.936 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Coastal City | Coastal City | Coastal City | Inland City | Inland City | Inland City | |

| SBM | EBM | DDF | SBM | EBM | DDF | |

| VAT | 0.0587 *** | 0.130 *** | 0.0867 *** | 0.0434 *** | 0.0618 *** | 0.0835 *** |

| (0.0204) | (0.0150) | (0.0166) | (0.0049) | (0.0049) | (0.0066) | |

| Constant | 0.289 *** | 0.369 *** | 0.644 *** | 0.253 *** | 0.333 *** | 0.589 *** |

| (0.0144) | (0.011) | (0.012) | (0.0035) | (0.0035) | (0.0045) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Year-FE | YES | YES | YES | YES | YES | YES |

| City-FE | YES | YES | YES | YES | YES | YES |

| Observations | 748 | 748 | 748 | 4046 | 4046 | 4046 |

| R-squared | 0.646 | 0.817 | 0.792 | 0.703 | 0.742 | 0.756 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Large Cities and Megacities | Large Cities and Megacities | Large Cities and Megacities | Small and Medium-Cities | Small and Medium-Cities | Small and Medium-Cities | |

| SBM | EBM | DDF | SBM | EBM | DDF | |

| VAT | 0.0820 *** | 0.129 *** | 0.0900 *** | 0.0449 *** | 0.0673 *** | 0.0843 *** |

| (0.0205) | (0.0187) | (0.0171) | (0.0047) | (0.0046) | (0.0061) | |

| Constant | 0.233 *** | 0.361 *** | 0.583 *** | 0.260 *** | 0.337 *** | 0.599 *** |

| (0.0149) | (0.0136) | (0.0125) | (0.0035) | (0.0033) | (0.0044) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Year-FE | YES | YES | YES | YES | YES | YES |

| City-FE | YES | YES | YES | YES | YES | YES |

| Observations | 357 | 357 | 357 | 4437 | 4437 | 4437 |

| R-squared | 0.817 | 0.879 | 0.897 | 0.713 | 0.769 | 0.754 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, D.; Mo, X.; Xiong, R.; Huang, Z. Tax Policy and Total Factor Carbon Emission Efficiency: Evidence from China’s VAT Reform. Int. J. Environ. Res. Public Health 2022, 19, 9257. https://doi.org/10.3390/ijerph19159257

Gao D, Mo X, Xiong R, Huang Z. Tax Policy and Total Factor Carbon Emission Efficiency: Evidence from China’s VAT Reform. International Journal of Environmental Research and Public Health. 2022; 19(15):9257. https://doi.org/10.3390/ijerph19159257

Chicago/Turabian StyleGao, Da, Xinlin Mo, Ruochan Xiong, and Zhiliang Huang. 2022. "Tax Policy and Total Factor Carbon Emission Efficiency: Evidence from China’s VAT Reform" International Journal of Environmental Research and Public Health 19, no. 15: 9257. https://doi.org/10.3390/ijerph19159257

APA StyleGao, D., Mo, X., Xiong, R., & Huang, Z. (2022). Tax Policy and Total Factor Carbon Emission Efficiency: Evidence from China’s VAT Reform. International Journal of Environmental Research and Public Health, 19(15), 9257. https://doi.org/10.3390/ijerph19159257