The Prediction of Public Risk Perception by Internal Characteristics and External Environment: Machine Learning on Big Data

Abstract

:1. Introduction

2. Literature Review

2.1. Factors Influencing Risk Perception

2.1.1. Internal Characteristics

- 1.

- Personal Characteristics

- 2.

- Risk Experience

- 3.

- Cultural and Economic Characteristics

2.1.2. External Environment

- 1.

- Crisis Information

- 2.

- Risk Characteristics

2.2. Big Data Measurement Method of Risk Perception

2.3. Prediction of Risk Perception

3. Data and Research Methods

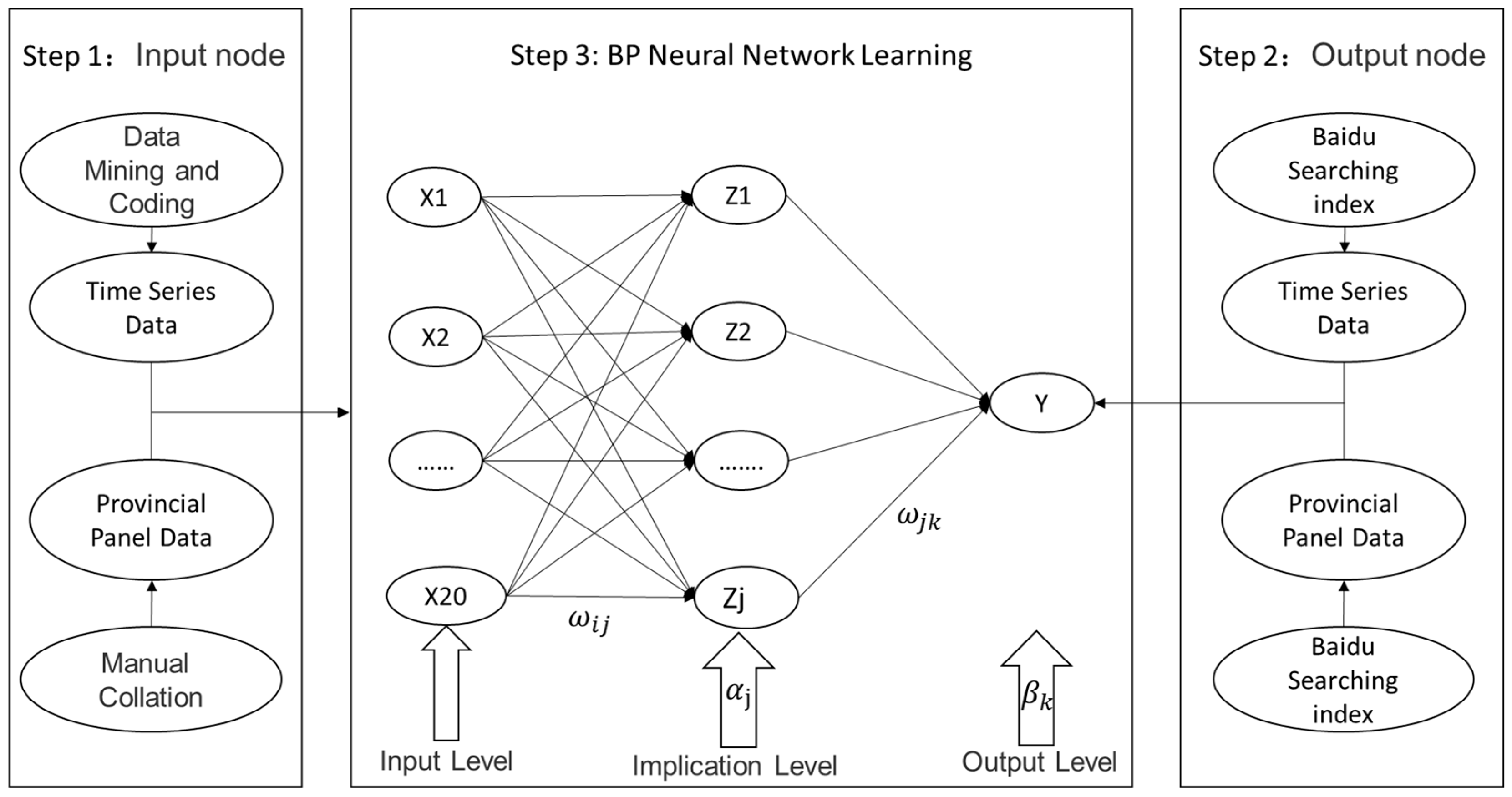

3.1. Acquisition of Input Node

3.1.1. Internal Characteristic Index

3.1.2. External Environment Indexes

3.2. Acquisition of Output Node

3.3. Learning of BP Neural Network

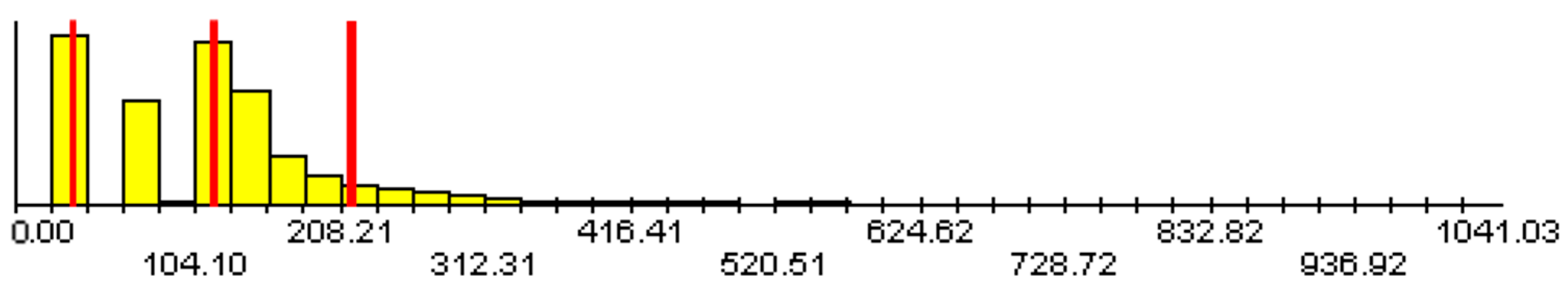

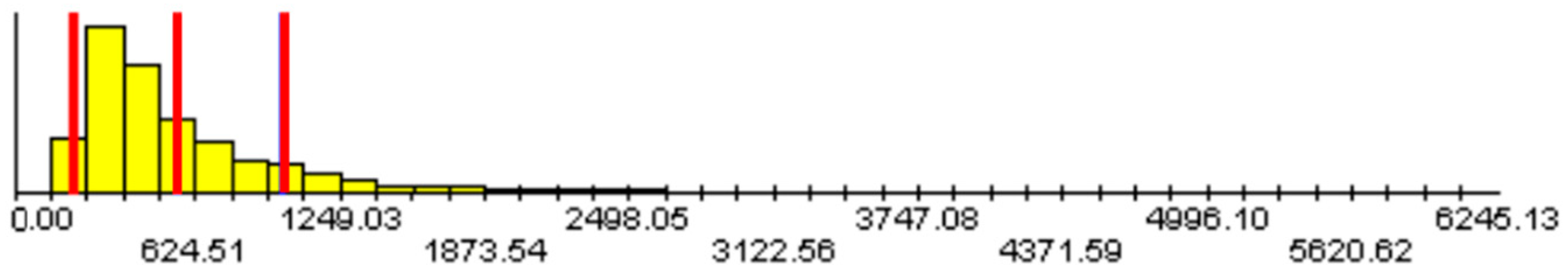

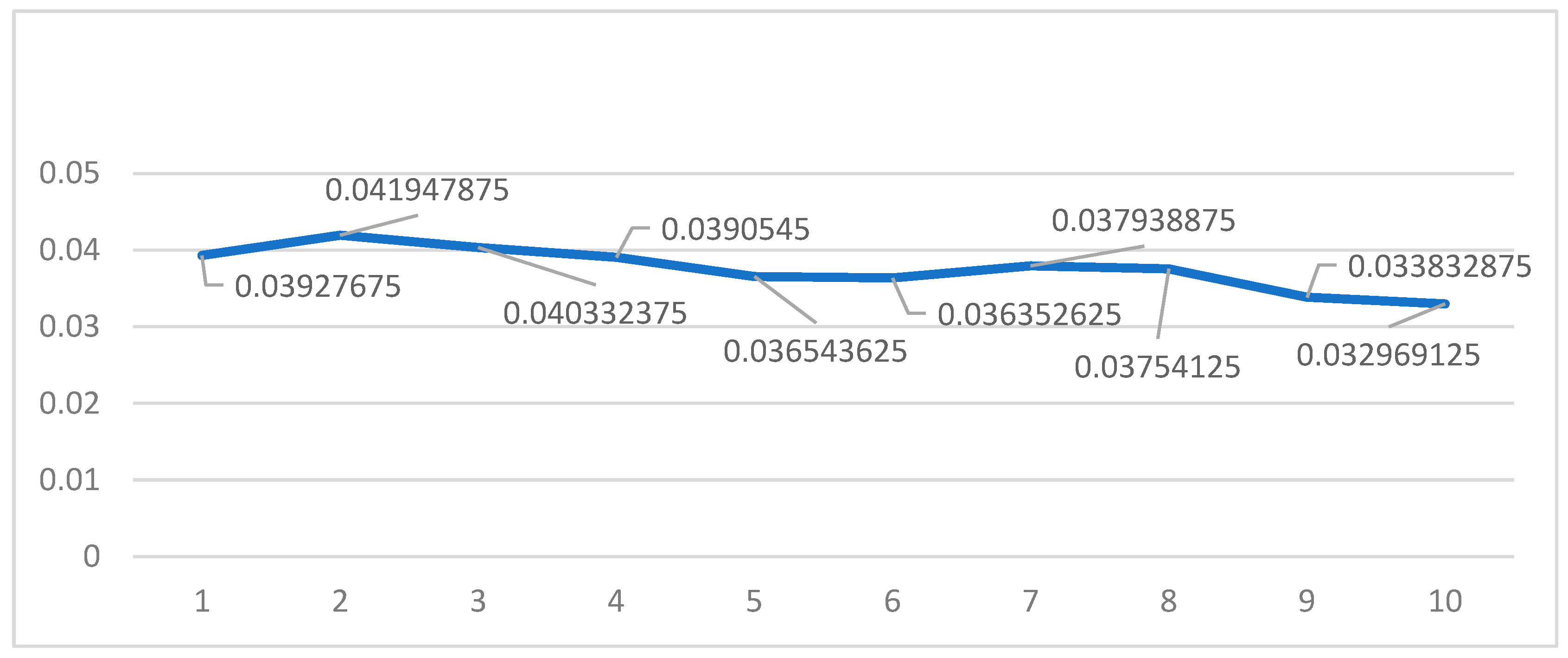

3.3.1. Calculation of Node Number of Implication Level

3.3.2. Performance Test of BP Neural Network

3.3.3. Computation of Every Input Node Weight

4. Research Results

4.1. Calculation Results of Implication Level Nodes

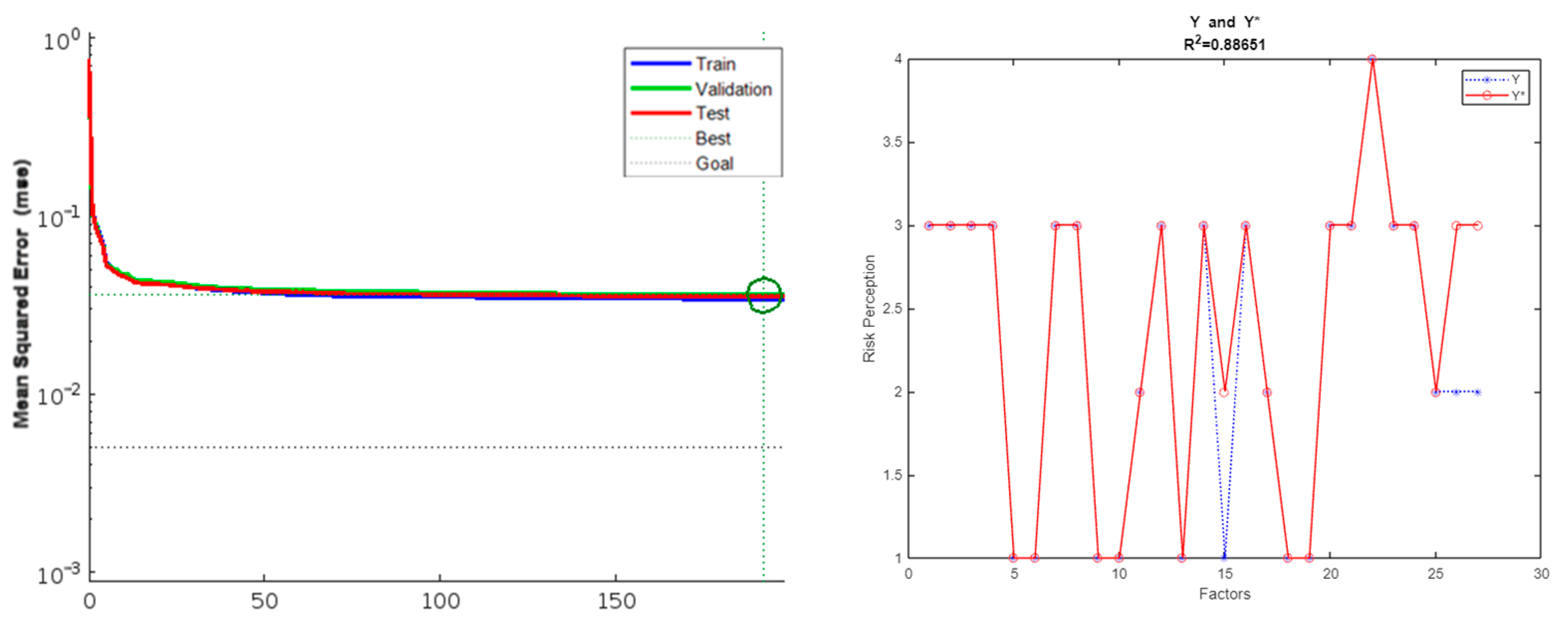

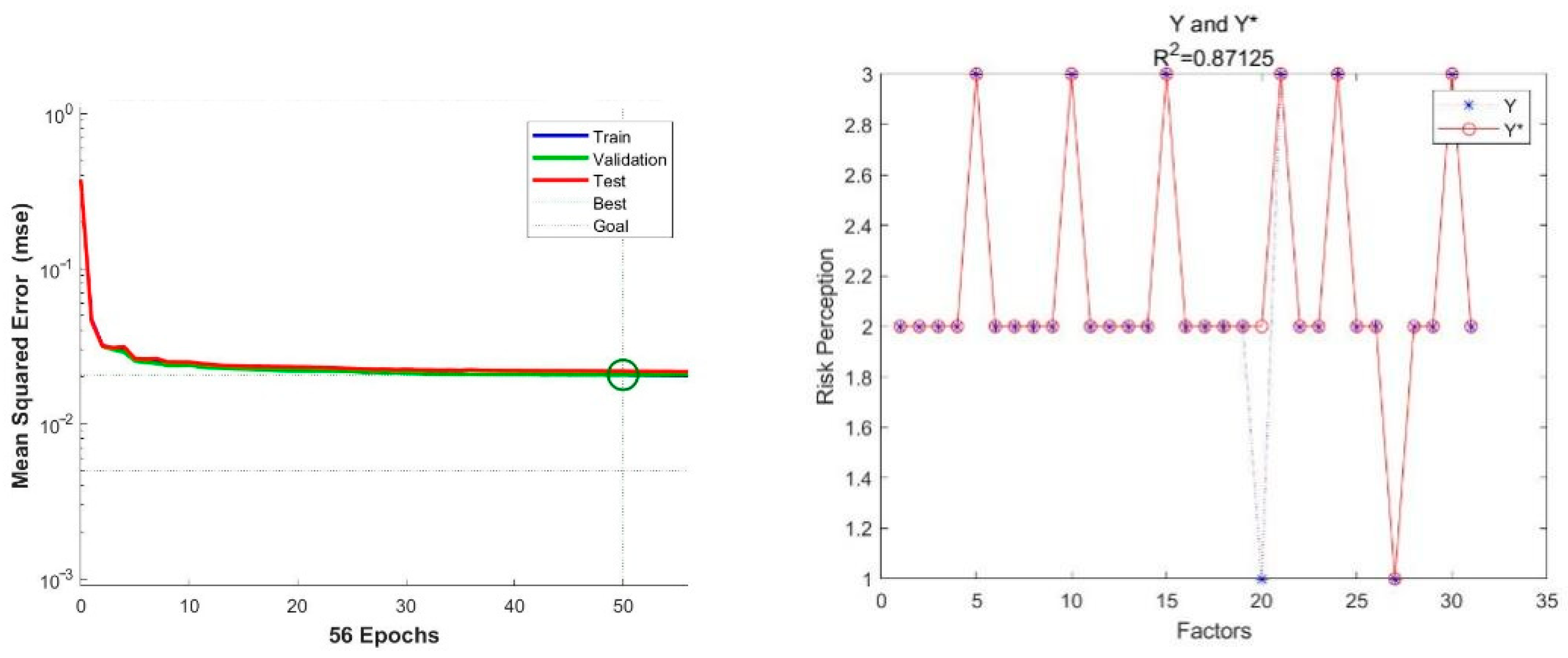

4.2. Performance Test Results of BP Model

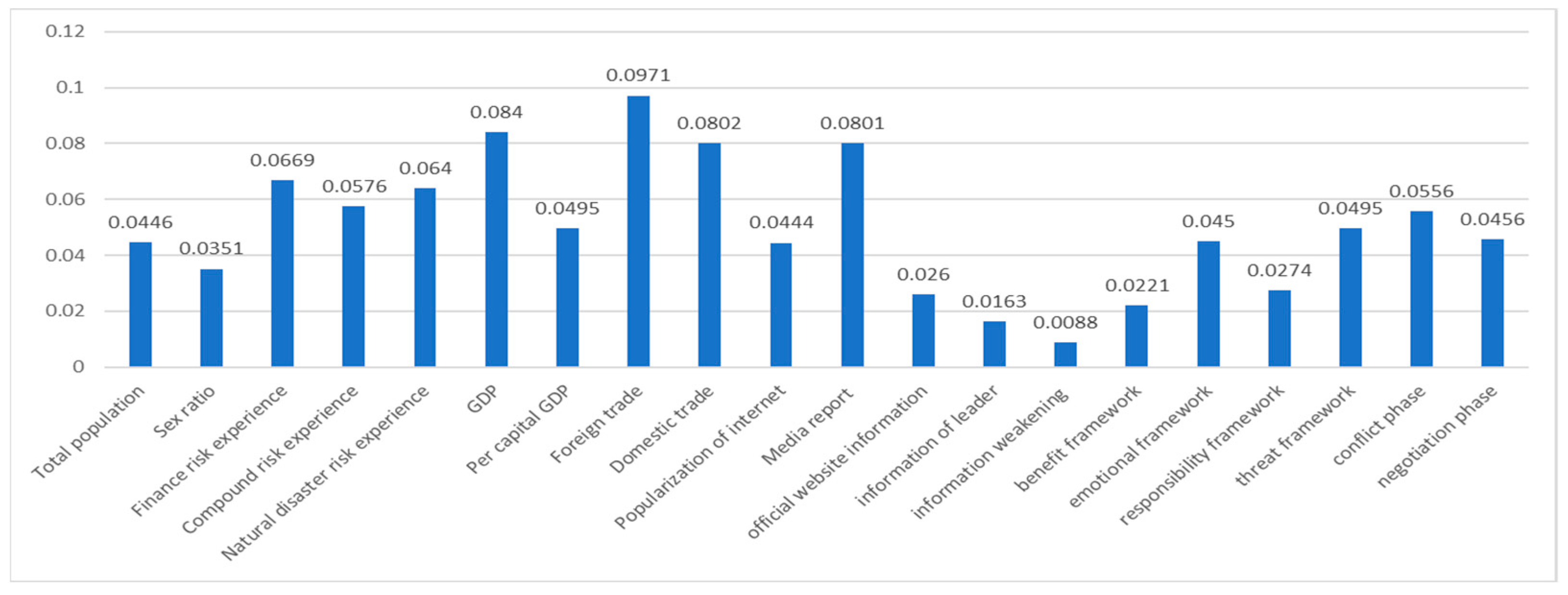

4.3. Determining the Weight of Every Prediction Index

4.3.1. Index Weight in the Sino–US Trade Friction

4.3.2. Index Weight in the COVID-19 Pandemic

5. Conclusions

5.1. Major Findings and Contributions

5.1.1. Influence Factors can Effectively Predict Public Risk Perception of Topical Issues

5.1.2. External Environment Can Effectively Lead Public Risk Perception of Topical Issues

5.2. Limitations and Suggestions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- McKinsey. Available online: https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/big-data-the-next-frontier-for-innovation (accessed on 28 July 2022).

- Reimer, A.P.; Madigan, E.A. Veracity in big data: How good is good enough. Health Inform. J. 2019, 25, 1290–1298. [Google Scholar] [CrossRef] [PubMed]

- Renn, O.; Rohrmann, B. Cross-Cultural Risk Perception, 1st ed.; Springer: New York, NY, USA, 2000. [Google Scholar]

- Douglas, M.; Wildavsky, A. Risk and Culture: An. Essay on the Selection of Technological and Environmental Dangers, 1st ed.; University of California Press: Berkeley, CA, USA, 1983. [Google Scholar] [CrossRef]

- Lash, S.; Wang, W.L. The Risk Society and Risk Culture. Marx. Real. 2002, 4, 52–63. (In Chinese) [Google Scholar]

- Sjöberg, L.; Moen, B.E.; Rundmo, T. Explaining risk perception. An evaluation of the psychometric paradigm in risk perception research. Rotunde Publ. Rotunde 2004, 84, 55–76. [Google Scholar]

- Slovic, P. Perception of risk. Science 1987, 236, 280–285. [Google Scholar] [CrossRef] [PubMed]

- Cutter, S.L. The forgotten casualties: Women, children, and environmental change. Glob. Env. Chang. 1995, 5, 181–194. [Google Scholar] [CrossRef]

- Sitkin, S.B.; Pablo, A.L. Reconceptualizing the determinants of risk behavior. Acad. Manag. Rev. 1992, 17, 9–38. [Google Scholar] [CrossRef]

- Dake, K.; Wildavsky, A. Individual Differences in Risk Perception and Risk-Taking Preferences, 1st ed.; Springer: New York, NY, USA, 1991. [Google Scholar]

- Vellappally, S.; Naik, S.; Alsadon, O.; Al-Kheraif, A.A.; Alayadi, H.; Alsiwat, A.J.; Kumar, A.; Hashem, M.; Varghese, N.; Thomas, N.G.; et al. Perception of COVID-19 Booster Dose Vaccine among Healthcare Workers in India and Saudi Arabia. Int. J. Environ. Res. Public Health 2022, 19, 8942. [Google Scholar] [CrossRef] [PubMed]

- Liu, H.; Li, J.; Li, H.; Li, H.; Mao, P.; Yuan, J. Risk Perception and Coping Behavior of Construction Workers on Occupational Health Risks—A Case Study of Nanjing, China. Int. J. Environ. Res. Public Health 2021, 18, 7040. [Google Scholar] [CrossRef]

- Wiedemann, P.M.; Freudenstein, F.; Böhmert, C.; Wiart, J.; Croft, R.J. RF EMF risk perception revisited: Is the focus on concern sufficient for risk perception studies? Int. J. Environ. Res. Public Health 2017, 14, 620. [Google Scholar] [CrossRef] [Green Version]

- Zhang, S.; Hua, X.; Huang, G.; Shi, X.; Li, D. What Influences Miners’ Safety Risk Perception? Int. J. Environ. Res. Public Health 2022, 19, 3817. [Google Scholar] [CrossRef] [PubMed]

- Durant, R.F.; Legge, J.S., Jr. Public opinion, risk perceptions, and genetically modified food regulatory policy: Reassessing the calculus of dissent among European citizens. Eur. Union Politics 2005, 6, 181–200. [Google Scholar] [CrossRef]

- Seeger, M.W.; Novak, J.M. Modeling the recall and warning process in the foodborne contamination event: Perspectives from disaster warnings and crisis communication. Int. J. Mass Emergencies Disasters 2010, 28, 115–144. [Google Scholar]

- Cutter, S.L.; Tiefenbacher, J.; Solecki, W.D. En-gendered fears: Femininity and technological risk perception. Ind. Crisis Q. 1992, 6, 5–22. [Google Scholar] [CrossRef]

- Lindell, M.K.; Hwang, S.N. Households’ perceived personal risk and responses in a mul-tihazard environment. Risk Anal. 2008, 28, 539–556. [Google Scholar] [CrossRef] [PubMed]

- Hakes, J.K.; Viscusi, W.K. Dead reckoning: Demographic determinants of the accuracy of mortality risk perceptions. Risk Anal. 2004, 24, 651–664. [Google Scholar] [CrossRef] [PubMed]

- Sjöberg, L. Distal factors in risk perception. J. Risk Res. 2003, 6, 187–211. [Google Scholar] [CrossRef] [Green Version]

- Siegrist, M.; Árvai, J. Risk perception: Reflections on 40 years of research. Risk Anal. 2020, 40, 2191–2206. [Google Scholar] [CrossRef]

- Siebeneck, L.K.; Cova, T.J. Spatial and temporal variation in evacuee risk perception throughout the evacuation and return-entry process. Risk Anal. 2012, 32, 1468–1480. [Google Scholar] [CrossRef] [PubMed]

- Weinstein, N.D. Effects of personal experience on self-protective behavior. Psychol. Bull. 1989, 105, 31. [Google Scholar] [CrossRef] [PubMed]

- Mutz, D.C. Mass media and the depoliticization of personal experience. Am. J. Political Sci. 1992, 36, 483–508. [Google Scholar] [CrossRef]

- Slovic, P.; Fischhoff, B.; Lichtenstein, S. Rating the Risks. Environ. Sci. Policy Sustain. Dev. 1981, 21, 14–39. [Google Scholar] [CrossRef]

- Rowe, G.; Wright, G. Differences in expert and lay judgments of risk: Myth or reality? Risk Anal. 2001, 21, 341–356. [Google Scholar] [CrossRef] [PubMed]

- Johnson, B.B.; Covello, V.T. The Social and Cultural Construction of Risk: Essays on Risk Selection and Perception, 1st ed.; Kluwer Academic Publishers: Hague, The Netherlands, 1987. [Google Scholar]

- Knight, A.J.; Warland, R. Determinants of food safety risks: A multi-disciplinary approach. Rural Sociol. 2005, 70, 253–275. [Google Scholar] [CrossRef]

- Yang, J. The influence of culture on Koreans’ risk perception. J. Risk Res. 2015, 18, 69–92. [Google Scholar] [CrossRef]

- van Manen, S.M. Hazard and risk perception at Turrialba volcano (Costa Rica); implications for disaster risk management. Appl. Geogr. 2014, 50, 63–73. [Google Scholar] [CrossRef]

- Gaillard, J.C. Alternative paradigms of volcanic risk perception: The case of Mt. Pinatubo in the Philippines. J. Volcanol. Geotherm. Res. 2008, 172, 315–328. [Google Scholar] [CrossRef]

- Zhang, J.; Zheng, Z.; Zhang, L.; Qin, Y.; Duan, J.; Zhang, A. Influencing factors of environmental risk perception during the COVID-19 epidemic in China. Int. J. Environ. Res. Public Health 2021, 18, 9375. [Google Scholar] [CrossRef] [PubMed]

- Mileti, D.S.; Peek, L. The social psychology of public response to warnings of a nuclear power plant accident. J. Hazard. Mater. 2000, 75, 181–194. [Google Scholar] [CrossRef]

- Wang, Z.Y.; Liang, J.; Liu, X.D. A review of risk perception of the public in emergencies. J. Intell. 2018, 37, 161–166. (In Chinese) [Google Scholar] [CrossRef]

- Weinberg, A.M. Is nuclear energy acceptable? Bull Sci. 1977, 33, 54–60. [Google Scholar] [CrossRef]

- Xie, X.F.; Wang, M.; Zhang, R.G.; Li, J.; Yu, Q.Y. The role of emotions in risk co-mmunication. Risk Anal. 2011, 31, 450–465. [Google Scholar] [CrossRef] [PubMed]

- Wang, X. The role of personal experience and media exposure on personal and impersonal risk perceptions and policy support: The case of global warming. Int. J. Glob. Warm. 2018, 16, 320–336. [Google Scholar] [CrossRef]

- He, D. Study on Influence of Using Social Media Based on Amplification Framework of Risk Society on Public Risk Perception. J. Mass Commun. 2016, 18, 45–52. (In Chinese) [Google Scholar]

- Einwiller, S.A.; Carroll, C.E.; Korn, K. Under what conditions do the news media influence corporate reputation? The roles of media dependency and need for orientation. Corp. Reput. Rev. 2010, 12, 299–315. [Google Scholar] [CrossRef]

- Giddens, A. The Consequences of Modernity, 1st ed.; Stanford University Press: Stanford, MT, USA, 1990. [Google Scholar]

- Vandermoere, F. Hazard perception, risk perception, and the need for decontamination by residents exposed to soil pollution: The role of sustainability and the limits of expert knowledge. Risk Anal. 2008, 28, 387–398. [Google Scholar] [CrossRef]

- Moser, C.; Stauffacher, M.; Krütli, P.; Scholz, R.W. The influence of linear and cyclical temporal representations on risk perception of nuclear waste: An experimental study. J. Risk Res. 2012, 15, 459–476. [Google Scholar] [CrossRef]

- Wei, J.; Wang, F.; Zhao, D. A risk perception model: Simulating public response to news reports in China. Inf. Res. 2012, 17, 17-2. [Google Scholar]

- Grothmann, T.; Reusswig, F. People at risk of flooding: Why some residents take precauti-onary action while others do not. Nat. Hazards 2006, 38, 101–120. [Google Scholar] [CrossRef]

- Xue, T.; Liu, H. The prediction of petition based on big data. Inf. Discov. Deliv. 2019, 47, 135–142. [Google Scholar] [CrossRef]

- Hogarth, R.M.; Portell, M.; Cuxart, A.; Kolev, G.I. Emotion and reason in everyday risk perception. J. Behav. Decis. Mak. 2011, 24, 202–222. [Google Scholar] [CrossRef] [Green Version]

- Bengio, Y.; Lee, H. Editorial introduction to the neural networks special issue on deep learning of representations. Neural Netw. 2015, 64, 1–3. [Google Scholar] [CrossRef] [PubMed]

- Da, Z.; Engelberg, J.; Gao, P. In search of attention. J. Financ. 2011, 66, 1461–1499. [Google Scholar] [CrossRef]

- Mao, H.; Counts, S.; Bollen, J. Predicting Financial Markets: Comparing Survey, News, Twitter and Search Engine Data. arXiv 2011, arXiv:1112.1051. [Google Scholar] [CrossRef]

- Zhang, J.D.; Liao, W.; Zhang, R.W. The effect of ordinary investors’ attention on volume and price of stock market: Empirical evidence based on Baidu index. Account. Res. 2014, 8, 52–59. (In Chinese) [Google Scholar]

- Chen, T.; Lin, J. Comparative analysis of temporal-spatial evolution of online public opinion based on search engine attention—Cases of Google Trends and Baidu Index. J. Intell. 2013, 3, 7–16. (In Chinese) [Google Scholar]

- Hu, X.N.; Guo, X.S.; Lian, C.H.; Zhao, H.Z. Study on the Risk Information Seeking and Processing of Public Policy: A Case Study of Disaster Resettlement Policy in Southern Shaanxi. J. Intell. 2019, 38, 172–180. (In Chinese) [Google Scholar] [CrossRef]

- Van der Linden, S. The social-psychological determinants of climate change risk perceptions: Towards a comprehensive model. J. Env. Psychol. 2015, 41, 112–124. [Google Scholar] [CrossRef]

- Zhang, Y.R.; Tian, M.; Shen, Y.H.; Qiu, Y.; Li, K.Y. Study on drought risk perception of farmers in mountainous areas of Yunnan Plateau—A case study of Yuanmou County. Areal Res. Dev. 2021, 40, 156–160. (In Chinese) [Google Scholar] [CrossRef]

- Li, L. Research on Measurement of China’s Economic Uncertainty and Regional Economic Risk. Master’s Thesis, Jilin University, Changchun, China, 2021. (In Chinese). [Google Scholar]

- Zhang, Z.G. Regional Natural Disaster Risk Assessment Based on the Universal Risk Model. Master’s Thesis, Henan Polytechnic University, Jiaozuo, China, 2020. (In Chinese). [Google Scholar]

- Hofstede, G.; Bond, M.H. The Confucius connection: From cultural roots to economic growth. Organ. Dyn. 1988, 16, 5–21. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. Does culture affect economic outcomes? J. Econ. Perspect 2006, 20, 23–48. [Google Scholar] [CrossRef] [Green Version]

- Johnson, J.P.; Lenartowicz, T. Culture, freedom and economic growth: Do cultural values explain economic growth? J. World Bus. 1998, 33, 332–356. [Google Scholar] [CrossRef]

- Boin, A.; Hart, P.; Stern, E.; Sundelius, B. The Politics of Crisis Management: Public Leadership under Pressure, 1st ed.; Cambridge University Press: Cambridge, UK, 2005; pp. 69–87. [Google Scholar]

- Dacin, M.T.; Munir, K.; Tracey, P. Formal dining at Cambridge colleges: Linking ritual performance and institutional maintenance. Acad. Manag. J. 2010, 53, 1393–1418. [Google Scholar] [CrossRef]

- Luther, C.A.; Zhou, X. Within the boundaries of politics: News framing of SARS in China and the United States. J. Mass Commun. Q. 2005, 82, 857–872. [Google Scholar] [CrossRef]

- Eldridge, R.D.; Midford, P. Japanese Public Opinion and the War on Terrorism, 1st ed.; Palgrave Macmillan: New York, NY, USA, 2008; p. 8. [Google Scholar]

- CSDN Blog. Available online: http://blog.csdn.net/google19890102/article/details/32723459 (accessed on 30 June 2022). (In Chinese).

- Zhang, Y.; Qi, J.; Fang, B.; Li, Y. The indicator system based on BP neural network model for net-mediated public opinion on unexpected emergency. China Commun. 2011, 8, 42–51. [Google Scholar]

| Predictor Variable | Measurable Variable/Input Node | Source | Input Value of Index |

|---|---|---|---|

| Internal characteristics | |||

| Demographic characteristics | X1 Total population | National Bureau of Statistics of China | Value |

| X2 Sex ratio (male/female) | National Bureau of Statistics of China | Value | |

| Risk experience | X3 Finance risk experience | More financial crisis experience, less natural disaster experience | 0.1 |

| X4 Compound risk experience | More financial crisis and natural disaster experience | 0.1 | |

| X5 Natural disaster risk experience | More natural disaster experience, less financial crisis experience | 0.1 | |

| Economic characteristics | X6 GDP | National Bureau of Statistics of China | Value |

| X7 Per capital GDP | National Bureau of Statistics of China | Value | |

| X8 Foreign trade | National Bureau of Statistics of China | Value | |

| X9 Domestic trade | National Bureau of Statistics of China | Value | |

| External environment | |||

| Media intervention | X10 Popularization of Internet | Statistical Reports on Internet Development in China, http://www.cnnic.net.cn/ (accessed on 1 June 2022) | Value |

| X11 Media report | Baidu Media index; http://index.baidu.com (accessed on 1 June 2022) | Value | |

| Government intervention | X12 Posts information on official website or not | Manual encoding | 0.1 |

| X13 Provides information about leader or not | Manual encoding | 0.1 | |

| X14 Uses information weakening strategy or not | Manual encoding | 0.1 | |

| X15 Uses the benefit frame or not | Manual encoding | 0.1 | |

| X16 Uses the emotion frame or not | Manual encoding | 0.1 | |

| X17 Uses the responsibility frame or not | Manual encoding | 0.1 | |

| X18 Uses the threat frame or not | Manual encoding | 0.1 | |

| Risk characteristics | X19 Is in the conflict phase or not | Manual encoding | 0.1 |

| X20 Is in the cooling-off phase or not | Manual encoding | 0.1 | |

| N | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.03843 | 0.041288 | 0.04026 | 0.037899 | 0.036723 | 0.03695 | 0.041334 | 0.041546 | 0.035998 | 0.035452 |

| 2 | 0.038797 | 0.040899 | 0.040164 | 0.040001 | 0.036203 | 0.034511 | 0.038502 | 0.039368 | 0.033054 | 0.031881 |

| 3 | 0.037166 | 0.042028 | 0.041301 | 0.037746 | 0.036064 | 0.036079 | 0.03839 | 0.03994 | 0.033773 | 0.032317 |

| 4 | 0.040197 | 0.043781 | 0.038962 | 0.038004 | 0.038816 | 0.03644 | 0.038882 | 0.035211 | 0.035942 | 0.033913 |

| 5 | 0.038399 | 0.042905 | 0.039712 | 0.037565 | 0.03704 | 0.036506 | 0.037156 | 0.037334 | 0.03319 | 0.0336 |

| 6 | 0.039094 | 0.041749 | 0.042155 | 0.043736 | 0.037535 | 0.03787 | 0.035949 | 0.036542 | 0.032057 | 0.033272 |

| 7 | 0.040387 | 0.041865 | 0.039723 | 0.040224 | 0.034747 | 0.038156 | 0.039725 | 0.037975 | 0.035863 | 0.033655 |

| 8 | 0.042235 | 0.043282 | 0.041622 | 0.042796 | 0.037872 | 0.036668 | 0.037521 | 0.038288 | 0.034709 | 0.032697 |

| 9 | 0.041834 | 0.042483 | 0.041492 | 0.041177 | 0.036453 | 0.036274 | 0.037597 | 0.037562 | 0.033135 | 0.032562 |

| 10 | 0.041744 | 0.042366 | 0.041045 | 0.03982 | 0.037584 | 0.037393 | 0.039514 | 0.03805 | 0.034882 | 0.033769 |

| S | 0.041834 | 0.043282 | 0.041622 | 0.042796 | 0.037872 | 0.03787 | 0.039725 | 0.03994 | 0.035942 | 0.033913 |

| M | 0.042235 | 0.043781 | 0.042155 | 0.043736 | 0.038816 | 0.038156 | 0.041334 | 0.041546 | 0.035998 | 0.035452 |

| A | 0.039277 | 0.041948 | 0.040332 | 0.039055 | 0.036544 | 0.036353 | 0.037939 | 0.037541 | 0.033833 | 0.032969 |

| N | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.024931 | 0.023911 | 0.022735 | 0.023191 | 0.02281 | 0.022264 | 0.021038 | 0.021993 | 0.022286 | 0.02226 |

| 2 | 0.024628 | 0.023652 | 0.024554 | 0.021627 | 0.021808 | 0.022545 | 0.021293 | 0.023511 | 0.021676 | 0.021454 |

| 3 | 0.024593 | 0.024658 | 0.022684 | 0.022838 | 0.021443 | 0.024211 | 0.022768 | 0.021613 | 0.020995 | 0.022321 |

| 4 | 0.024709 | 0.023674 | 0.021766 | 0.021945 | 0.021509 | 0.022157 | 0.022252 | 0.021199 | 0.021362 | 0.020565 |

| 5 | 0.023643 | 0.022454 | 0.021477 | 0.023813 | 0.023024 | 0.022271 | 0.021368 | 0.022018 | 0.021549 | 0.021106 |

| 6 | 0.022591 | 0.023708 | 0.022449 | 0.024008 | 0.022284 | 0.022097 | 0.022242 | 0.022135 | 0.021545 | 0.021935 |

| 7 | 0.026123 | 0.022861 | 0.022823 | 0.022809 | 0.022792 | 0.022608 | 0.020362 | 0.020633 | 0.021154 | 0.02112 |

| 8 | 0.023222 | 0.024408 | 0.022363 | 0.024112 | 0.021709 | 0.022643 | 0.02243 | 0.023532 | 0.019564 | 0.022017 |

| 9 | 0.024576 | 0.022226 | 0.02271 | 0.023301 | 0.023679 | 0.02156 | 0.020604 | 0.022579 | 0.020798 | 0.019582 |

| 10 | 0.023498 | 0.025131 | 0.024482 | 0.022234 | 0.020913 | 0.021021 | 0.021403 | 0.022615 | 0.020855 | 0.020869 |

| S | 0.024931 | 0.024658 | 0.024482 | 0.024008 | 0.023024 | 0.022643 | 0.02243 | 0.023511 | 0.021676 | 0.02226 |

| M | 0.026123 | 0.025131 | 0.024554 | 0.024112 | 0.023679 | 0.024211 | 0.022768 | 0.023532 | 0.022286 | 0.022321 |

| A | 0.023933 | 0.023362 | 0.022376 | 0.02272 | 0.021909 | 0.022065 | 0.02132 | 0.021848 | 0.020978 | 0.021081 |

| Time | Location | Actual Value | Predicted Value | Time | Location | Actual Value | Predicted Value |

|---|---|---|---|---|---|---|---|

| 31 October 2019 | Beijing | 3 | 3 | 31 October 2019 | Jiangxi | 3 | 3 |

| 31 October 2019 | Tianjin | 3 | 3 | 31 October 2019 | Shandong | 1 | 2 |

| 31 October 2019 | Hebei | 3 | 3 | 31 October 2019 | Henan | 3 | 3 |

| 31 October 2019 | Shanxi | 3 | 3 | 31 October 2019 | Hubei | 2 | 2 |

| 31 October 2019 | Inner Mongolia | 1 | 1 | 31 October 2019 | Hunan | 1 | 1 |

| 31 October 2019 | Liaoning | 1 | 1 | 31 October 2019 | Guangdong | 1 | 1 |

| 31 October 2019 | Jilin | 3 | 3 | 31 October 2019 | Guangxi | 3 | 3 |

| 31 October 2019 | Heilongjiang | 3 | 3 | 31 October 2019 | Hainan | 3 | 3 |

| 31 October 2019 | Shanghai | 1 | 1 | 31 October 2019 | Chongqing | 4 | 4 |

| 31 October 2019 | Jiangsu | 1 | 1 | 31 October 2019 | Sichuan | 3 | 3 |

| 31 October 2019 | Zhejiang | 2 | 2 | 31 October 2019 | Guizhou | 3 | 3 |

| 31 October 2019 | Anhui | 3 | 3 | 31 October 2019 | Yunnan | 2 | 2 |

| 31 October 2019 | Fujian | 1 | 1 | 31 October 2019 | Tibet | 2 | 3 |

| 31 October 2019 | Shaanxi | 2 | 3 |

| Time | Location | Actual Value | Predicted Value | Time | Location | Actual Value | Predicted Value |

|---|---|---|---|---|---|---|---|

| 31 August 2021 | Anhui | 2 | 2 | 31 August 2021 | Liaoning | 2 | 2 |

| 31 August 2021 | Beijing | 2 | 2 | 31 August 2021 | Inner Mongolia | 2 | 2 |

| 31 August 2021 | Fujian | 2 | 2 | 31 August 2021 | Ningxia | 2 | 2 |

| 31 August 2021 | Gansu | 2 | 2 | 31 August 2021 | Qinghai | 1 | 2 |

| 31 August 2021 | Guangdong | 3 | 3 | 31 August 2021 | Shandong | 3 | 3 |

| 31 August 2021 | Guangxi | 2 | 2 | 31 August 2021 | Shanxi | 2 | 2 |

| 31 August 2021 | Guizhou | 2 | 2 | 31 August 2021 | Shaanxi | 2 | 2 |

| 31 August 2021 | Hainan | 2 | 2 | 31 August 2021 | Shanghai | 3 | 3 |

| 31 August 2021 | Hebei | 2 | 2 | 31 August 2021 | Sichuan | 2 | 2 |

| 31 August 2021 | Henan | 3 | 3 | 31 August 2021 | Tianjin | 2 | 2 |

| 31 August 2021 | Heilongjiang | 2 | 2 | 31 August 2021 | Tibet | 1 | 1 |

| 31 August 2021 | Hubei | 2 | 2 | 31 August 2021 | Xinjiang | 2 | 2 |

| 31 August 2021 | Hunan | 2 | 2 | 31 August 2021 | Yunnan | 2 | 2 |

| 31 August 2021 | Jilin | 2 | 2 | 31 August 2021 | Zhejiang | 3 | 3 |

| 31 August 2021 | Jiangsu | 3 | 3 | 31 August 2021 | Chongqing | 2 | 2 |

| 31 August 2021 | Jiangxi | 2 | 2 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, Q.; Xue, Y. The Prediction of Public Risk Perception by Internal Characteristics and External Environment: Machine Learning on Big Data. Int. J. Environ. Res. Public Health 2022, 19, 9545. https://doi.org/10.3390/ijerph19159545

Xie Q, Xue Y. The Prediction of Public Risk Perception by Internal Characteristics and External Environment: Machine Learning on Big Data. International Journal of Environmental Research and Public Health. 2022; 19(15):9545. https://doi.org/10.3390/ijerph19159545

Chicago/Turabian StyleXie, Qihui, and Yanan Xue. 2022. "The Prediction of Public Risk Perception by Internal Characteristics and External Environment: Machine Learning on Big Data" International Journal of Environmental Research and Public Health 19, no. 15: 9545. https://doi.org/10.3390/ijerph19159545

APA StyleXie, Q., & Xue, Y. (2022). The Prediction of Public Risk Perception by Internal Characteristics and External Environment: Machine Learning on Big Data. International Journal of Environmental Research and Public Health, 19(15), 9545. https://doi.org/10.3390/ijerph19159545