Borderland Economic Resilience under COVID-19: Evidence from China–Russia Border Regions

Abstract

1. Introduction

2. Literature Review and Theoretical Framework

2.1. Economic Characteristics of Border Regions

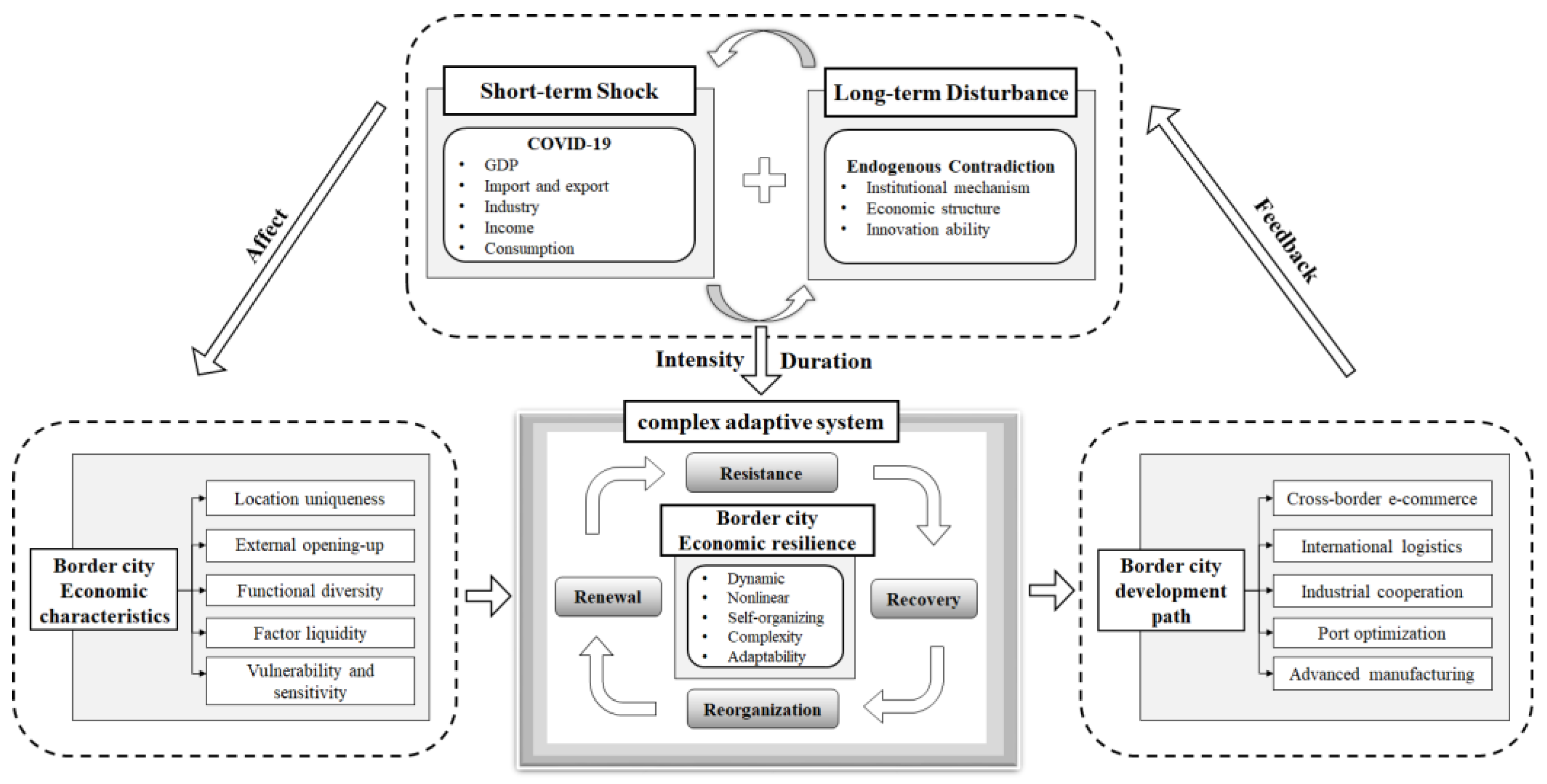

2.2. Theorizing Economic Resilience for Border Regions amidst the COVID-19 Pandemic

- Being affected by a disturbance or stressors—including sudden shock (earthquake, flood, financial crisis, and a COVID-19 pandemic) and slow-burn decline (population shrinkage, industrial decline, and economic recession).

- The ability to maintain, repair, and quickly return to regional system stability.

- The ability to successfully resist internal and external disturbances or stressors, and recover, adapt, and reorganize the regional structure from these negative influences.

3. Methods and Data

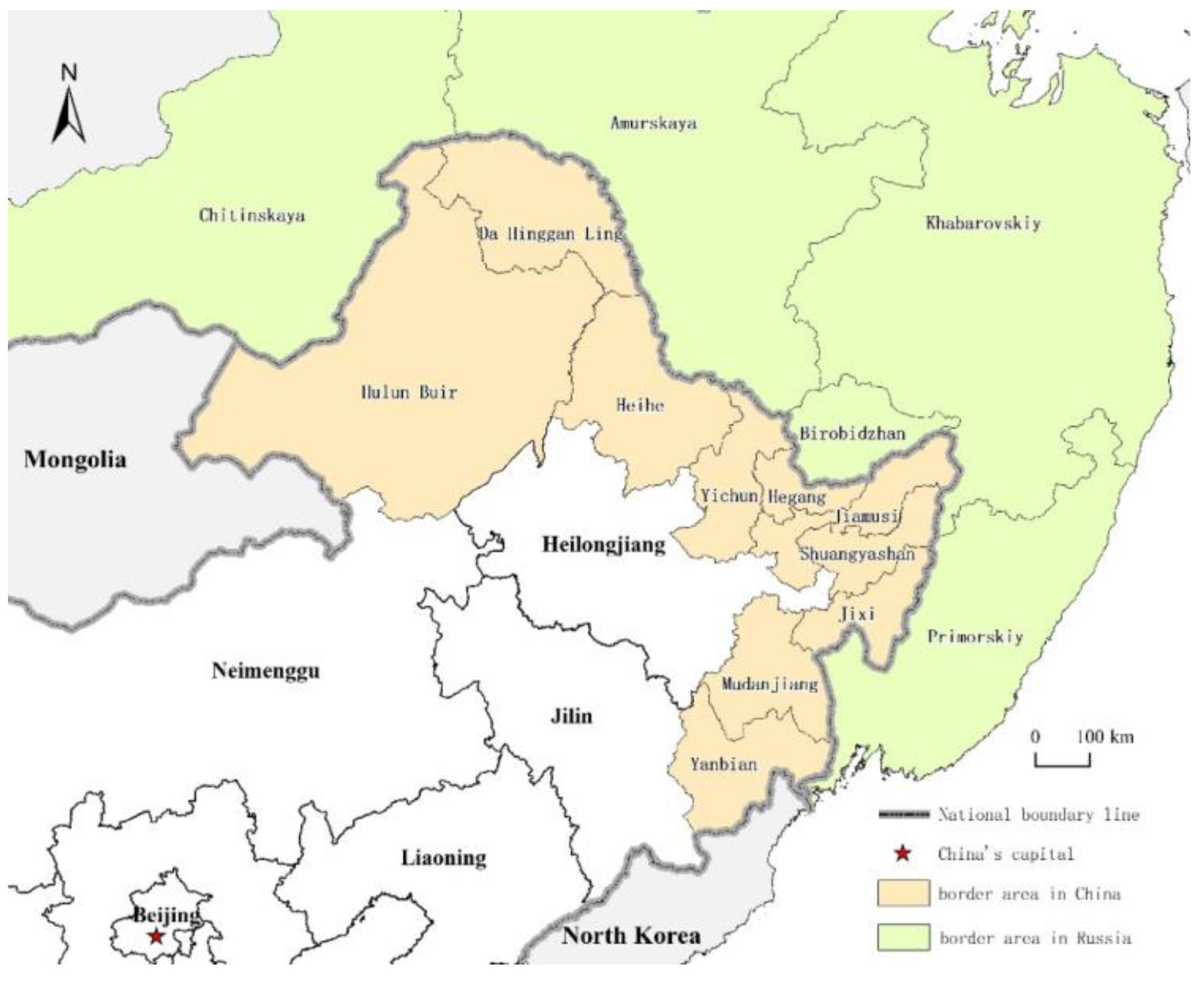

3.1. Study Area

3.2. Methodology and Data

3.2.1. Methodology

- (1)

- Economic Resilience Measurement

- (2)

- Geographical Detector Model

3.2.2. Data Sources

4. Results

4.1. Diffe rentiated Economic Resilience under COVID-19

4.1.1. Economic Variation in the Border Region

4.1.2. GDP Resilience

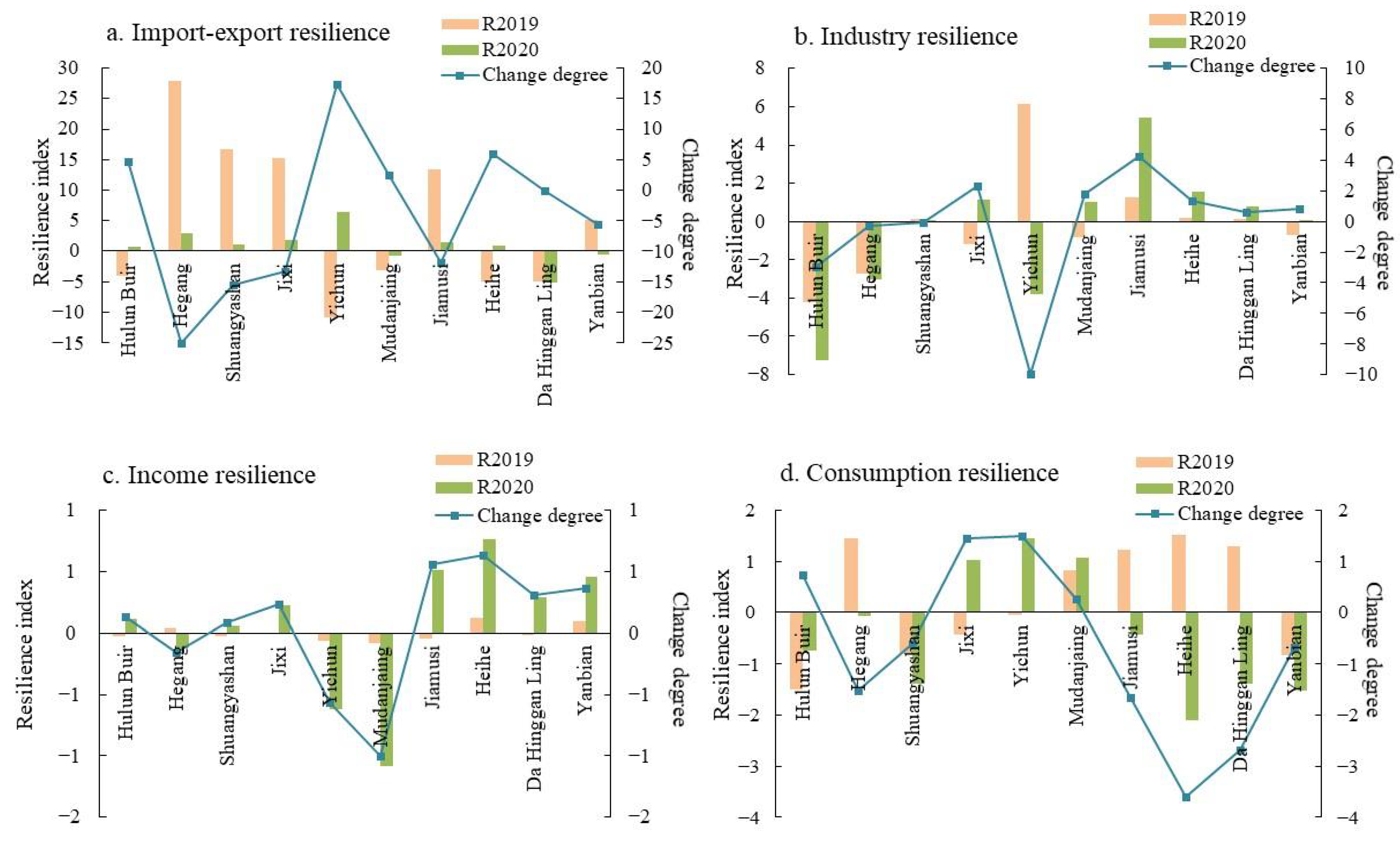

4.1.3. Multi-Dimensional Economic Resilience

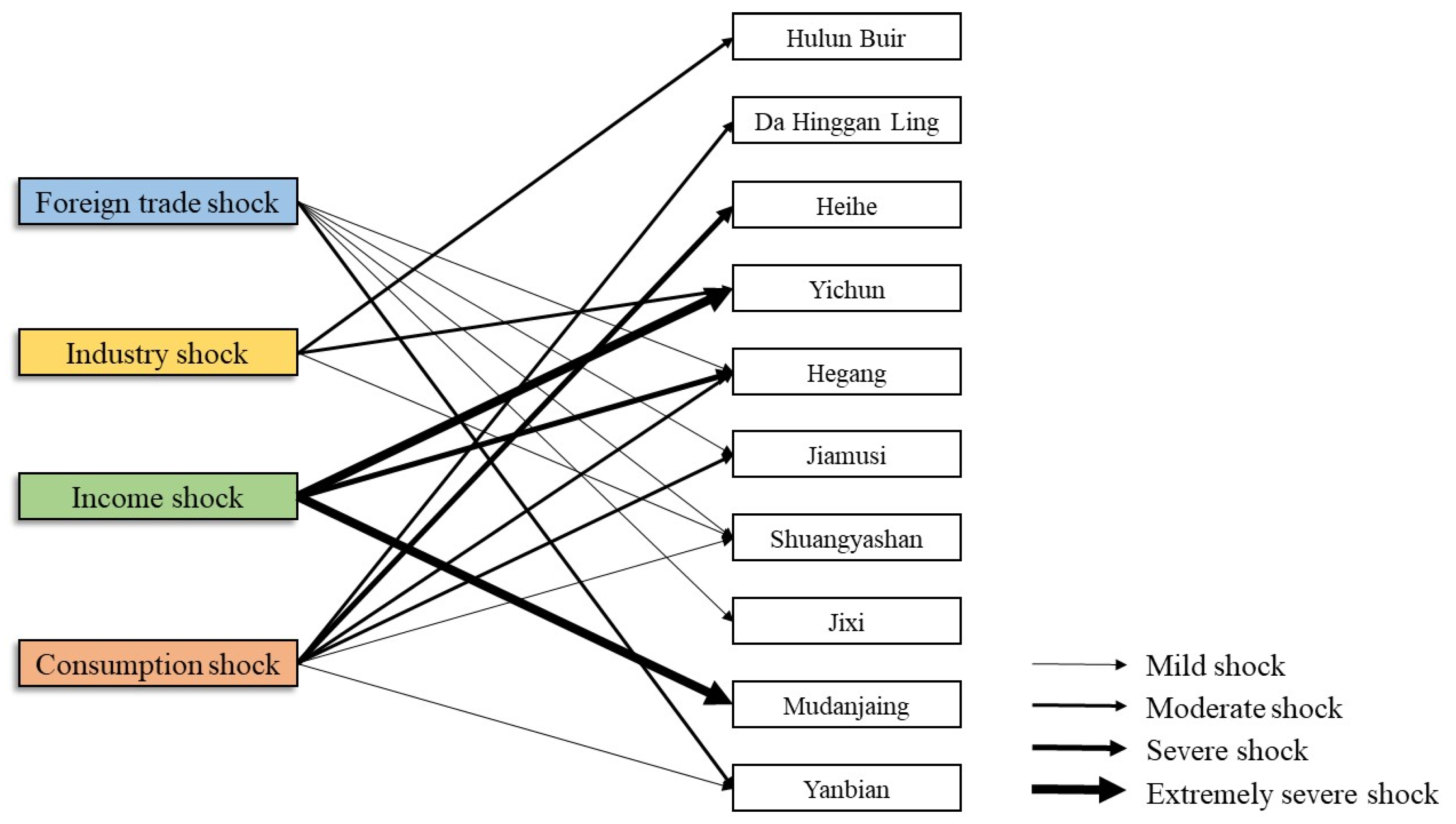

4.1.4. Classification of Border Regions by Shocks

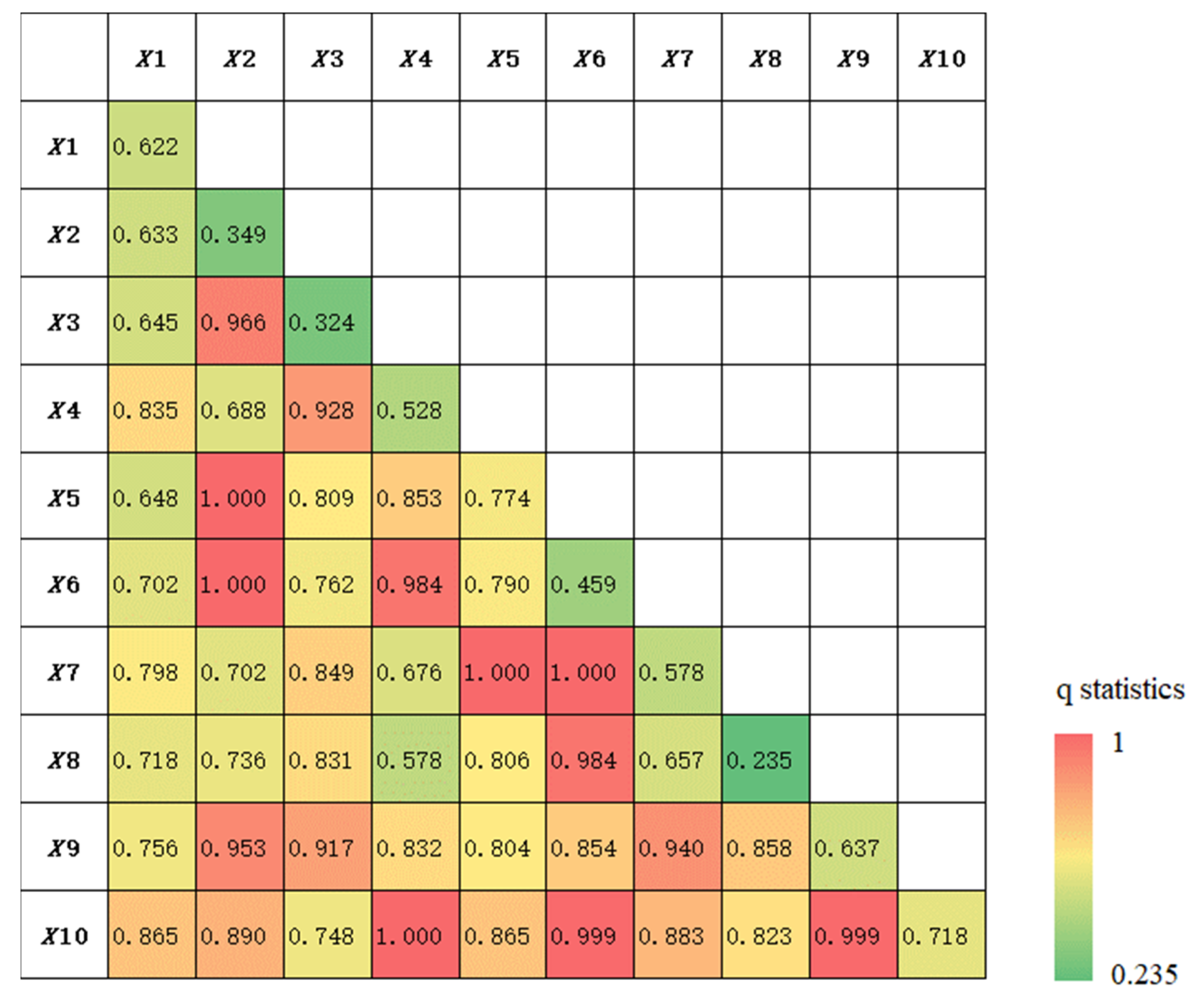

4.2. Heterogeneity of Economic Resilience against COVID-19: What Matters?

4.2.1. Driving Factors of Resilience in the Whole Area

4.2.2. How Factors Matter for Economic Resilience and Different Types of Economic Shock

5. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nicola, M.; Alsafi, Z.; Sohrabi, C.; Kerwan, A.; AI-Jabir, A.; Iosifidis, C.; Agha, M.; Agha, R. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. Int. J. Surg. 2020, 78, 185–193. [Google Scholar] [CrossRef] [PubMed]

- Vidya, C.T.; Prabheesh, K.P. Implications of COVID-19 pandemic on the global trade networks. Emerg. Mark. Financ. Trade 2020, 56, 2408–2421. [Google Scholar] [CrossRef]

- Barlow, P.; van Schalkwyk, M.C.; McKee, M.; Labonté, R.; Stuckler, D. COVID-19 and the collapse of global trade: Building an effective public health response. Lancet Planet. Health 2021, 5, e102–e107. [Google Scholar] [CrossRef]

- Harrison, J.; Delgado, M.; Derudder, B.; Anguelovski, I.; Montero, S.; Bailey, D.; de Propris, L. Pushing regional studies beyond its borders. Reg. Stud. 2020, 54, 129–139. [Google Scholar] [CrossRef]

- Prokkola, E.K. Border-regional resilience in EU internal and external border areas in Finland. Eur. Plan. Stud. 2019, 27, 1587–1606. [Google Scholar] [CrossRef]

- Li, H.; Lo, K.; Zhang, P. Population shrinkage in resource-dependent cities in China: Processes, patterns and drivers. Chin. Geogr. Sci. 2020, 30, 1–15. [Google Scholar] [CrossRef]

- Hossain, M.P.; Junus, A.; Zhu, X.; Jia, P.; Wen, T.H.; Pfeiffer, D.; Yuan, H.Y. The effects of border control and quarantine measures on the spread of COVID-19. Epidemics 2020, 32, 100397. [Google Scholar] [CrossRef]

- Radil, S.M.; Castan Pinos, J.; Ptak, T. Borders resurgent: Towards a post-Covid-19 global border regime? Space Polity 2021, 25, 132–140. [Google Scholar] [CrossRef]

- Kajta, J.; Opiłowska, E. The Impact of Covid-19 on Structure and Agency in a Borderland. The Case of Two Twin Towns in Central Europe. J. Borderl. Stud. 2021, 37, 699–721. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Giannakis, E.; Bruggeman, A. Regional disparities in economic resilience in the European Union across the urban–rural divide. Reg. Stud. 2020, 54, 1200–1213. [Google Scholar] [CrossRef]

- Hassink, R. Regional resilience: A promising concept to explain differences in regional economic adaptability? Camb. J. Reg. Econ. Soc. 2010, 3, 45–58. [Google Scholar] [CrossRef]

- Hu, X.H.; Hassink, R. Adaptation, adaptability and regional economic resilience: A conceptual framework. Handbook on Regional Economic Resilience; Edward Elgar: Cheltenham, UK, 2020; pp. 54–68. [Google Scholar]

- Martin, R.; Sunley, P. Regional economic resilience: Evolution and evaluation. In Handbook on Regional Economic Resilience; Bristow, G., Healy, A., Eds.; Edward Elgar: Cheltenham, UK, 2020; pp. 10–35. [Google Scholar]

- Tan, J.T.; Hu, X.H.; Hassink, R.; Ni, J. Industrial structure or agency: What affects regional economic resilience? Evidence from resource-based cities in China. Cities 2020, 106, 102906. [Google Scholar] [CrossRef]

- Hu, X.H.; Li, L.G.; Dong, K. What matters for regional economic resilience amid COVID-19? Evidence from cities in Northeast China. Cities 2022, 120, 103440. [Google Scholar] [CrossRef]

- Golunov, S.; Smirnova, V. Russian border controls in times of the COVID-19 pandemic: Social, political, and economic implications. Probl. Post-Communism 2022, 69, 71–82. [Google Scholar] [CrossRef]

- Sun, J.W. The impact of the new crown pneumonia epidemic on China’s regional economic development. Reg. Econ. Rev. 2020, 35, 8–11. [Google Scholar]

- Shao, S. Analysis of China’s novel coronavirus pneumonia epidemic based on previous PHEIC events. Int. Invent. Sci. J. 2020, 4, 1008–1015. [Google Scholar]

- Wen, Y.; Zhang, T.; Du, Q.Y. Quantifying the Covid-19 economic impact. SSRN Electron. J. 2020, 1–16. [Google Scholar]

- Song, T. Research framework of border geography from the perspective of geo-economics. Sci. Technol. Her. 2018, 36, 49–54. [Google Scholar]

- Song, T.; Liu, W.D.; Li, L. International research on the border regions with a geopolitical perspective and revelation. Prog. Geogr. 2016, 35, 276–285. [Google Scholar]

- Song, T.; Cheng, Y.; Liu, W.D.; Liu, H. The spatial disparity and impact mechanism of geo-economy in the border areas of China. Acta Geogr. Sin. 2017, 72, 1731–1745. [Google Scholar]

- Kolosov, V.; Sebentsov, A. Russian borderlands: Contemporary problems and challenges. Reg. Sci. Policy Pract. 2020, 12, 671–687. [Google Scholar] [CrossRef]

- Song, Z.Y.; Zhu, Q.L. Spatio-temporal pattern and driving forces of urbanization in China’s border areas. Acta Geogr. Sin. 2020, 75, 1603–1616. [Google Scholar] [CrossRef]

- Zhu, Y.Y.; Wang, S.J.; Feng, Z.X. The central place system structure and formation mechanism research of the Chinese Northeastern border area center. Econ. Geogr. 2011, 31, 724–729. [Google Scholar]

- Cong, Z.; Yu, T. The investigation of the frontier ports economy of the East of Northeast. Econ. Geogr. 2010, 30, 1937–1943. [Google Scholar]

- Zhou, D.J.; Xu, S. The Spatial Development Path of China’s Border Areas in the 14th Five-Year Plan Period. Urban Dev. Stud. 2021, 28, 34–38. [Google Scholar]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Grabner, S.M. Regional economic resilience: Review and outlook. In Economic Resilience in Regions and Organisations; Wink, R., Ed.; Springer: Berlin, Germany, 2021; pp. 21–55. [Google Scholar]

- Robert, H.; Gong, H.W. Regional resilience. International Encyclopedia of Human Geography, 2nd ed.; Kobayashi, A., Ed.; Elsevier: Oxford, UK, 2020; pp. 351–355. [Google Scholar]

- Hu, X.H.; Hassink, R. Exploring adaptation and adaptability in uneven economic resilience: A tale of two Chinese mining regions. Camb. J. Reg. Econ. Soc. 2017, 10, 527–541. [Google Scholar] [CrossRef]

- Chen, M.Y. An international literature review of regional economic resilience: Theories and practices based on the evolutionary perspective. Prog. Geogr. 2017, 36, 1435–1444. [Google Scholar]

- Pike, A.; Dawley, S.; Tomaney, J. Resilience, adaptation and adaptability. Camb. J. Reg. Econ. Soc. 2010, 3, 59–70. [Google Scholar] [CrossRef]

- Joachim, M. Governance for the Sustainable Development Goals: Exploring an Integrative Framework of Theories, Tools and Competencies; Springer: Singapore, Singapore, 2019. [Google Scholar]

- Li, Y.; Chen, W.; Sun, Y. New thinking on regional resilience analysis of geography from the perspective of correlation evolution. Geogr. Res. 2019, 38, 1694–1704. [Google Scholar]

- Martin, R.L. Shocking aspects of regional development: Towards an economic geography of resilience. In The New Oxford Handbook of Economic Geography; Oxford University: Oxford, UK, 2018; pp. 839–864. [Google Scholar]

- Boschma, R. Towards an evolutionary perspective on regional resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- Simmie, J.; Martin, R. The economic resilience of regions: Towards an evolutionary approach. Camb. J. Reg. Econ. Soc. 2010, 3, 27–43. [Google Scholar] [CrossRef]

- Li, L.G.; Zhang, P.Y.; Li, X. Regional economic resilience of the old industrial bases in China—A case study of Liaoning Province. Sustainability 2019, 11, 723. [Google Scholar] [CrossRef]

- Klimanov, V.V.; Kazakova, S.M.; Mikhaylova, A.A. Economic and fiscal resilience of Russia’s regions. Reg. Sci. Policy Pract. 2020, 12, 627–640. [Google Scholar] [CrossRef]

- Tan, J.T.; Zhao, H.B.; Liu, W.X.; Zhang, P.Y.; Qiu, F.D. Regional economic resilience and influential mechanism during economic crises in China. Sci. Geogr. Sin. 2020, 40, 173–181. [Google Scholar]

- Ivanov, D.; Dolgui, A. Viability of intertwined supply networks: Extending the supply chain resilience angles towards survivability. A position paper motivated by COVID-19 outbreak. Int. J. Prod. Res. 2020, 58, 2904–2915. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyler, P. How regions react to recessions: Resilience and the role of economic structure. Reg. Stud. 2016, 50, 561–585. [Google Scholar] [CrossRef]

- Wang, Z.X.; Wei, W. Regional economic resilience in China: Measurement and determinants. Reg. Stud. 2021, 55, 1228–1239. [Google Scholar] [CrossRef]

- Lawreniuk, S. Necrocapitalist networks: COVID-19 and the ‘dark side’ of economic geography. Dialogues Hum. Geogr. 2020, 10, 199–202. [Google Scholar] [CrossRef]

- David, L. Agency and resilience in the time of regional economic crisis. Eur. Plan. Stud. 2018, 26, 1041–1059. [Google Scholar] [CrossRef]

- Manca, A.R.; Benczur, P.; Giovannini, E. Building a scientific narrative towards a more resilient EU society. JRC Sci. Policy Rep. 2017, 137. [Google Scholar]

- Mattana, E.; Smeets, V.; Warzynski, F. Changing skill structure and Covid-19. Covid Econ. 2020, 45, 1–30. [Google Scholar]

- Wink, R. Introduction: Covid-19 pandemic as new challenge for regional resilience research? In Economic Resilience in Regions and Organisations; Wink, R., Ed.; Springer: Berlin, Germany, 2021; pp. 1–20. [Google Scholar]

- Harris, J.L.; Sunley, P.; Evenhuis, E.; Martin, R.; Pike, A.; Harris, R. The Covid-19 crisis and manufacturing: How should national and local industrial strategies respond? Local Econ. 2020, 35, 403–415. [Google Scholar] [CrossRef]

- Li, L.G.; Zhang, P.Y.; Lo, K.; Liu, W.X.; Li, J. The evolution of regional economic resilience in the old industrial bases in China: A case study of Liaoning Province, China. Chin. Geogr. Sci. 2020, 30, 340–351. [Google Scholar] [CrossRef]

- Liu, Y.; Ji, J.H.; Zhang, Y.F.; Yang, Y. Economic resilience and spatial divergence in the Guangdong-Hong Kong-Macao Greater Bay Area in China. Geogr. Res. 2020, 39, 2029–2043. [Google Scholar]

- Wu, F.; Liu, G.J.; Guo, N.L.; Li, Z.H.; Deng, X.Z. The effects of COVID-19 epidemic on regional economy and industry in China. Acta Geogr. Sin. 2021, 76, 1034–1048. [Google Scholar]

- Vishnevskii, D.S.; Demyanenko, A.N. Russian Far East: Macroeconomic zoning. Reg. Res. Russ. 2012, 2, 116–124. [Google Scholar] [CrossRef]

- Martin, R.; Gardiner, B. The resilience of cities to economic shocks: A tale of four recessions (and the challenge of Brexit). Pap. Reg. Sci. 2019, 98, 1801–1832. [Google Scholar] [CrossRef]

- Wang, J.F.; Xu, C.D. Geodetector: Principle and prospective. Acta Geogr. Sin. 2017, 72, 116–134. [Google Scholar]

- Brown, L.; Greenbaum, R.T. The role of industrial diversity in economic resilience: An empirical examination across 35 years. Urban Stud. 2017, 54, 1347–1366. [Google Scholar] [CrossRef]

- The Standard Map Service. Available online: http://bzdt.ch.mnr.gov.cn/ (accessed on 10 November 2021).

- The Russian Federal State Statistics Service. Available online: http://www.gks.ru/ (accessed on 10 November 2021).

- Gereffi, G. What does the COVID-19 pandemic teach us about global value chains? The case of medical supplies. J. Int. Bus. Policy 2020, 3, 287–301. [Google Scholar] [CrossRef]

- Bryson, J.R.; Vanchan, V. COVID-19 and alternative conceptualizations of value and risk in GPN research. Ijdschrift Econ. En Soc. Geograhie 2020, 111, 530–542. [Google Scholar] [CrossRef] [PubMed]

- Grundy-Warr, C.; Lin, S. COVID-19 geopolitics: Silence and erasure in Cambodia and Myanmar in times of pandemic. Eurasian Geogr. Econ. 2020, 61, 4–5. [Google Scholar] [CrossRef]

- Ezcurra, R.; Rios, V. Quality of government and regional resilience in the European Union. Evidence from the great recession. Pap. Reg. Sci. 2019, 98, 1267–1290. [Google Scholar] [CrossRef]

- Peng, R.X.; Liu, T.; Cao, G.Z. Spatial pattern of urban economic resilience in eastern coastal China and industrial explanation. Geogr. Res. 2021, 40, 1732–1748. [Google Scholar]

- Klimanov, V.V.; Kazakova, S.M.; Mikhaylova, A.A. Retrospective analysis of the resilience of Russian regions as socio-economic systems. Vopr. Ekon. 2019, 5, 46–64. [Google Scholar] [CrossRef]

- Gong, H.W.; Hassink, R.; Tan, J.T.; Huang, D. Regional resilience in times of a pandemic crisis: The case of COVID-19 in China. Tijdschr. Econ. En Soc. Geogr. 2020, 111, 497–512. [Google Scholar] [CrossRef]

| Province | Prefecture-Level City | Port Name | Type |

|---|---|---|---|

| Inner Mongolia | Hulun Buir | Manzhouli | Railway, Highway |

| Heishantou | Highway | ||

| Shiwei | Highway | ||

| Heilongjiang | Hegang | Luobei | Waterway |

| Shuangyashan | Raohe | Waterway | |

| Jixi | Hulin | Highway | |

| Mishan | Highway | ||

| Yichun | Jiayin | Waterway | |

| Mudanjiang | Suifenhe | Railway, Highway | |

| Dongning | Highway | ||

| Jiamusi | Fujin | Waterway | |

| Tongjiang | Waterway | ||

| Fuyuan | Waterway | ||

| Heihe | Heihe | Waterway | |

| Sunwu | Waterway | ||

| Xunke | Waterway | ||

| Da Hinggan Ling | Mohe | Waterway | |

| Huma | Waterway | ||

| Jilin | Yanbian | Hunchun | Railway, Highway |

| Classification | Variable | Definition | Unit |

|---|---|---|---|

| Development Foundation | Geographical Location | Distance from provincial capital city | km |

| Urbanization Rate | Urban population/Total population | % | |

| Economic Structure | Industrial Diversity | Herfindahl-Hirschman index | / |

| Industrial Advanced | Second and third industries added value/GDP | % | |

| Financial Environment | Economic Openness | Actual utilization of foreign capital/GDP | % |

| Market Potential | Population density | person/km2 | |

| Innovation Capability | Research Input | Science-technology expenditure/Public financial expenditure | % |

| Education Input | Education expenditure/Public financial expenditure | % | |

| Policy Support | Assets Investment | Per capita fixed assets investment | 104 CNY |

| Fiscal Expenditure | Per capita local fiscal expenditure | 104 CNY |

| Variable | q Statistic | p-Value |

|---|---|---|

| Geographical Location (X1) | 0.622 (+) | 0.056 |

| Urbanization rate (X2) | 0.349 (−) | 0.549 |

| Industrial Diversity (X3) | 0.324 (+) | 0.570 |

| Industrial Advancement (X4) | 0.528 (−) | 0.123 |

| Economic Openness (X5) | 0.774 (+) ** | 0.004 |

| Market Potential (X6) | 0.459 (+) | 0.230 |

| Research Input (X7) | 0.578 (−) | 0.144 |

| Education Input (X8) | 0.235 (−) | 0.629 |

| Assets Investment (X9) | 0.637 (−) * | 0.048 |

| Fiscal Expenditure (X10) | 0.718 (−) * | 0.033 |

| Foreign Trade Shock | Industry Shock | Income Shock | Consumption Shock | |

|---|---|---|---|---|

| Geographical location (X1) | 0.532 (−) | 0.669 (+) | 0.981 ** (+) | 0.633 * (+) |

| Urbanization rate (X2) | 0.387 (−) | 0.626 (−) | 0.144 (−) | 0.246 (−) |

| Industrial diversity (X3) | 0.737 (+) | 0.981 ** (−) | 0.977 ** (−) | 0.685 * (−) |

| Industrial advancement (X4) | 0.926 * (−) | 0.855 (−) | 0.635 (+) | 0.467 (+) |

| Economic openness (X5) | 0.975 ** (+) | 0.586 (+) | 0.976 * (+) | 0.962 ** (+) |

| Market potential (X6) | 0.980 ** (+) | 0.992 * (+) | 0.948 * (+) | 0.729 * (+) |

| Research input (X7) | 0.748 (−) | 0.578 (−) | 0.812 (−) | 0.505 (−) |

| Education input (X8) | 0.020 (−) | 0.440 (−) | 0.271 (−) | 0.410 (+) |

| Assets investment (X9) | 0.555 (−) | 0.104 (−) | 0.902 * (−) | 0.259 (−) |

| Fiscal expenditure (X10) | 0.949 (−) | 0.991 * (−) | 0.366 (−) | 0.497 (−) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Zhang, P.; Lo, K.; Tan, J.; Yang, Q. Borderland Economic Resilience under COVID-19: Evidence from China–Russia Border Regions. Int. J. Environ. Res. Public Health 2022, 19, 13042. https://doi.org/10.3390/ijerph192013042

Li Y, Zhang P, Lo K, Tan J, Yang Q. Borderland Economic Resilience under COVID-19: Evidence from China–Russia Border Regions. International Journal of Environmental Research and Public Health. 2022; 19(20):13042. https://doi.org/10.3390/ijerph192013042

Chicago/Turabian StyleLi, Yuxin, Pingyu Zhang, Kevin Lo, Juntao Tan, and Qifeng Yang. 2022. "Borderland Economic Resilience under COVID-19: Evidence from China–Russia Border Regions" International Journal of Environmental Research and Public Health 19, no. 20: 13042. https://doi.org/10.3390/ijerph192013042

APA StyleLi, Y., Zhang, P., Lo, K., Tan, J., & Yang, Q. (2022). Borderland Economic Resilience under COVID-19: Evidence from China–Russia Border Regions. International Journal of Environmental Research and Public Health, 19(20), 13042. https://doi.org/10.3390/ijerph192013042