Agricultural Insurance and Agricultural Economic Growth: The Case of Zhejiang Province in China

Abstract

:1. Introduction

1.1. Research Background

1.2. Research Problem and Significance

1.3. Research Content and Innovation

2. Literature Review

2.1. Impact of Agricultural Insurance on the Investment, Technology Adoption, and Production of Agriculture

2.2. Classification of Agricultural Insurance and Regional Differences in Its Impact

2.3. Impact of Agricultural Insurance on the Agricultural Environment

2.4. Impact of Agricultural Insurance on Poverty Reduction

2.5. Factors Affecting Farmers’ Willingness to Take Out Agricultural Insurance

2.6. Difference of Farmers’ Preference for Insurance

2.7. Summary and Prospect

3. The Theoretical Analysis on the Mechanism of AI Affecting AEG

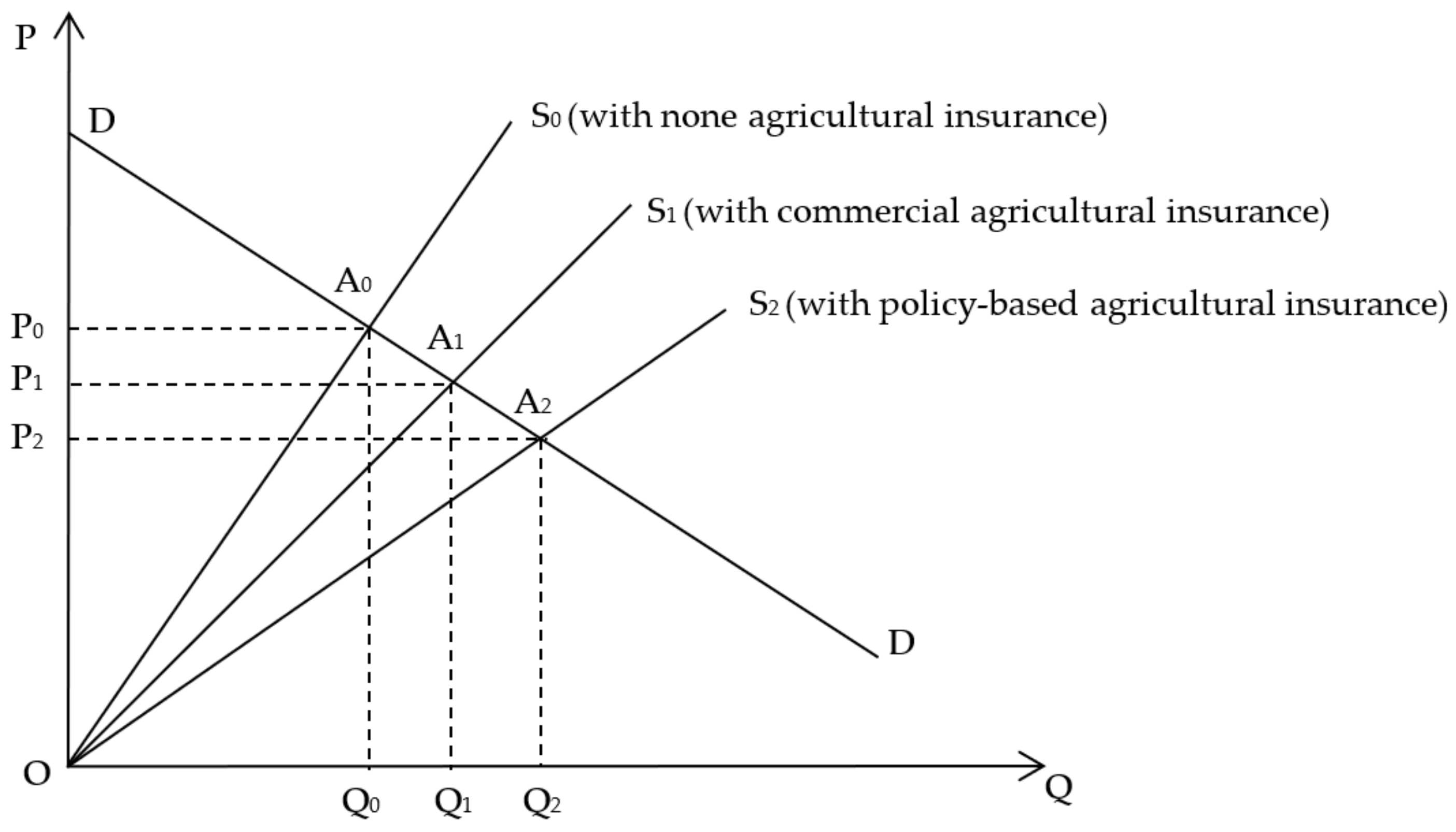

3.1. Welfare Effect of Agricultural Insurance Based on the Theory of Welfare Economics

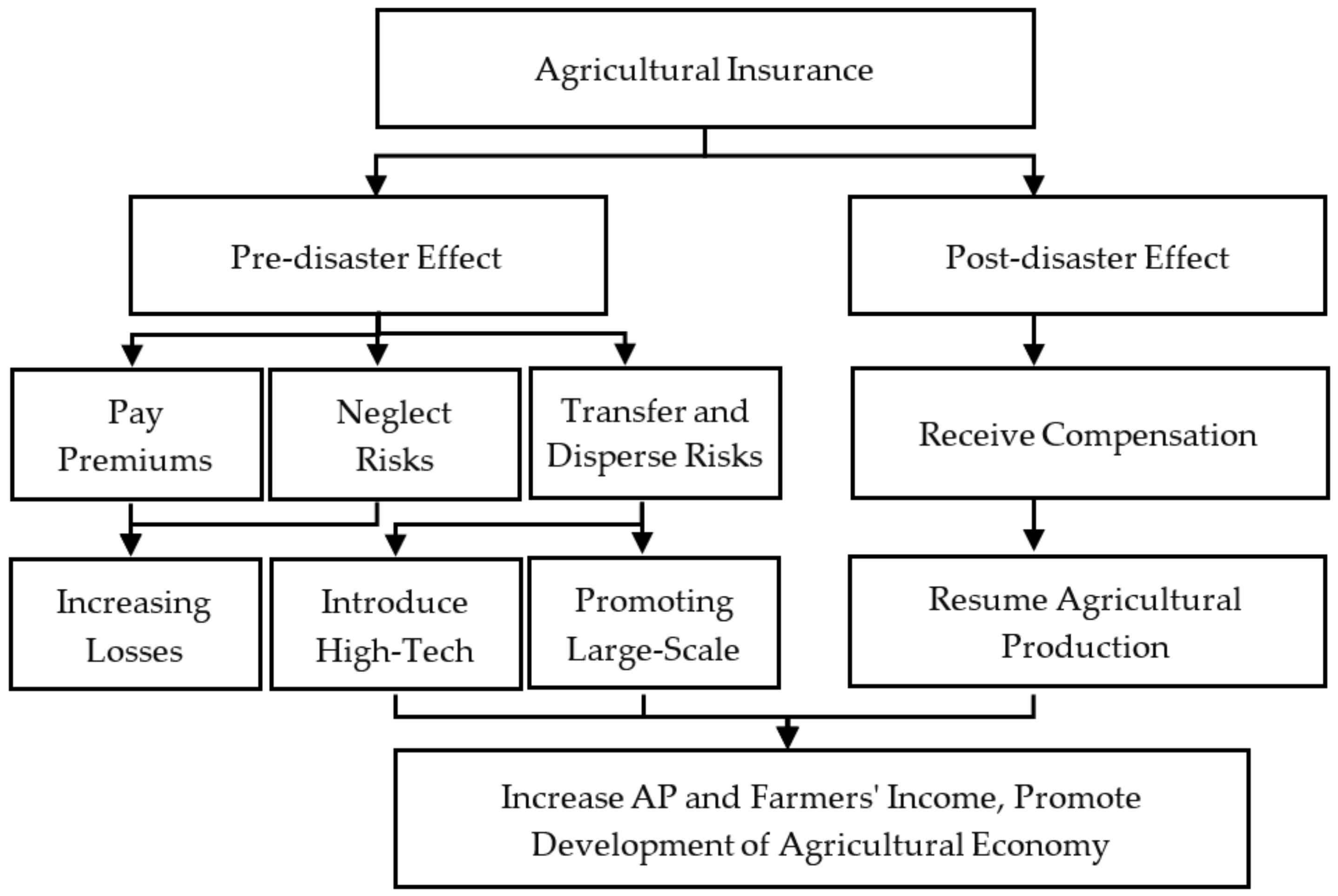

3.2. The Mechanism of Agricultural Insurance Affecting Agricultural Economic Growth

3.2.1. The Pre-Disaster Effect of Agricultural Insurance

3.2.2. The Post-Disaster Effect of Agricultural Insurance

4. The Status Quo of Agricultural Insurance and Agricultural Economic Growth in Zhejiang Province

4.1. Current Situation of Agricultural Insurance in Zhejiang Province

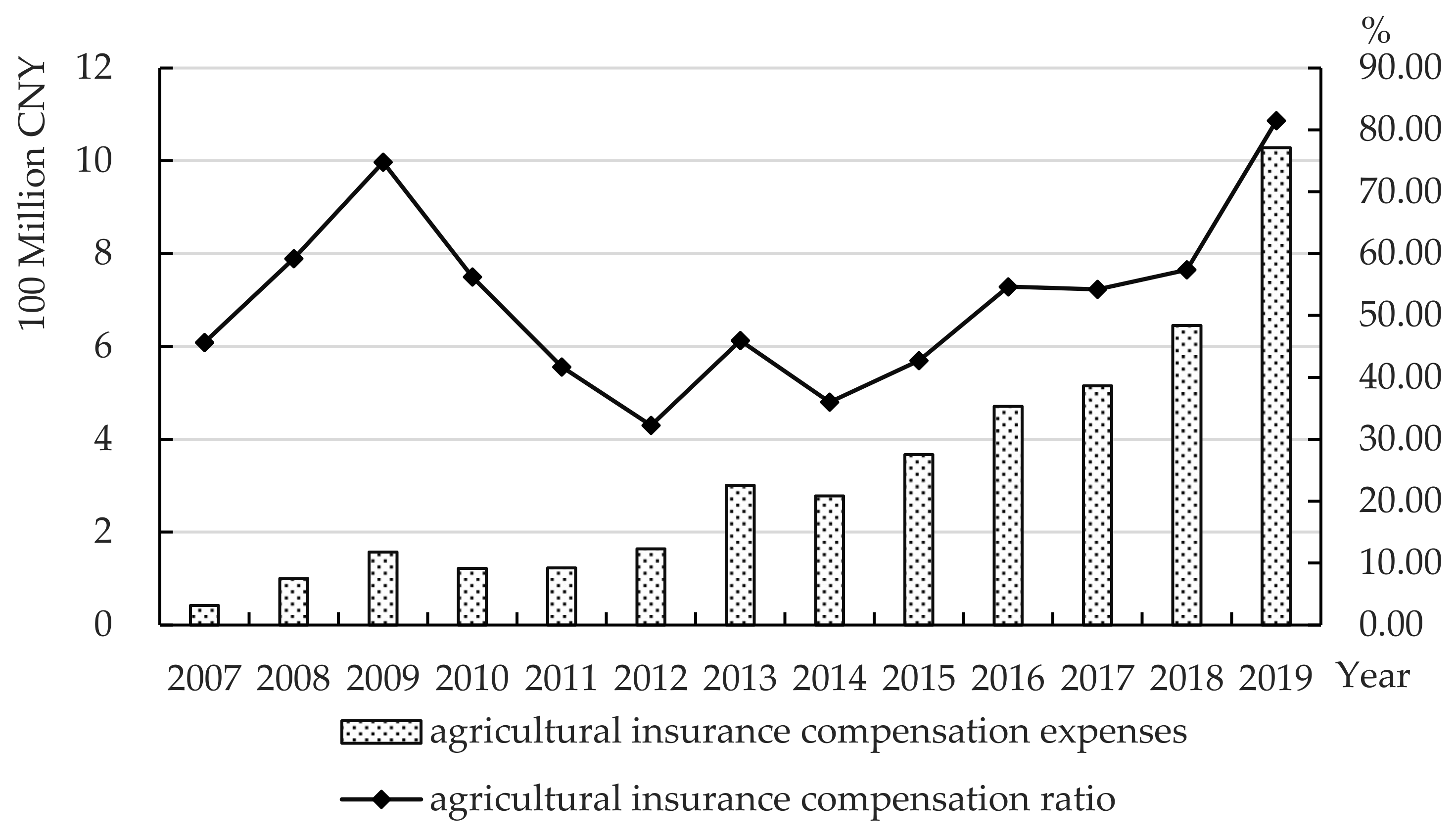

4.1.1. Agricultural Insurance Premium Income and Compensation Expenses

4.1.2. The Coverage of Agricultural Insurance in Zhejiang Province

4.1.3. Agricultural Insurance Policies in Zhejiang Province

4.2. Current Situation of Agricultural Economic Development in Zhejiang Province

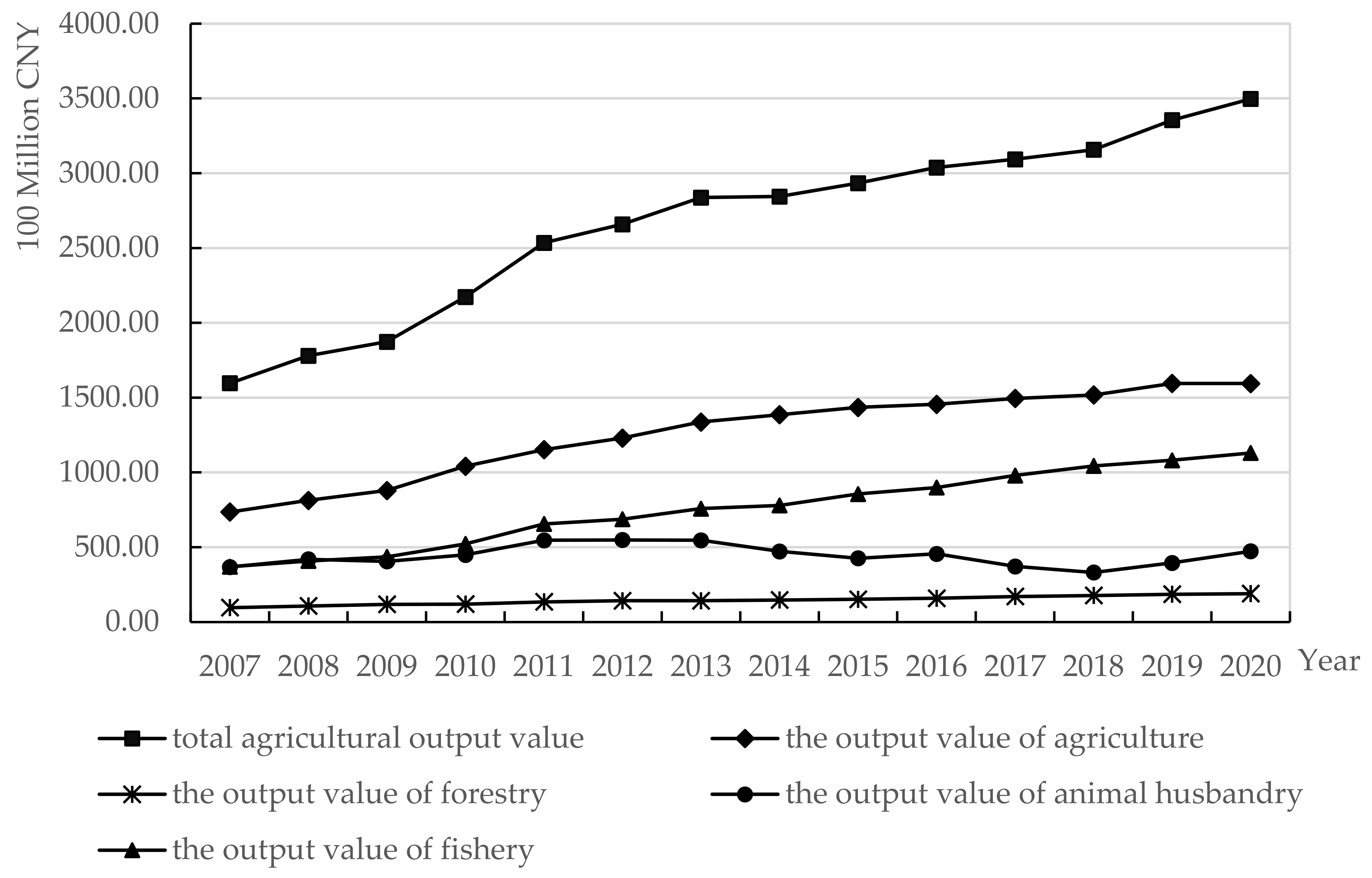

4.2.1. The Total Agricultural Output Value of Zhejiang Province

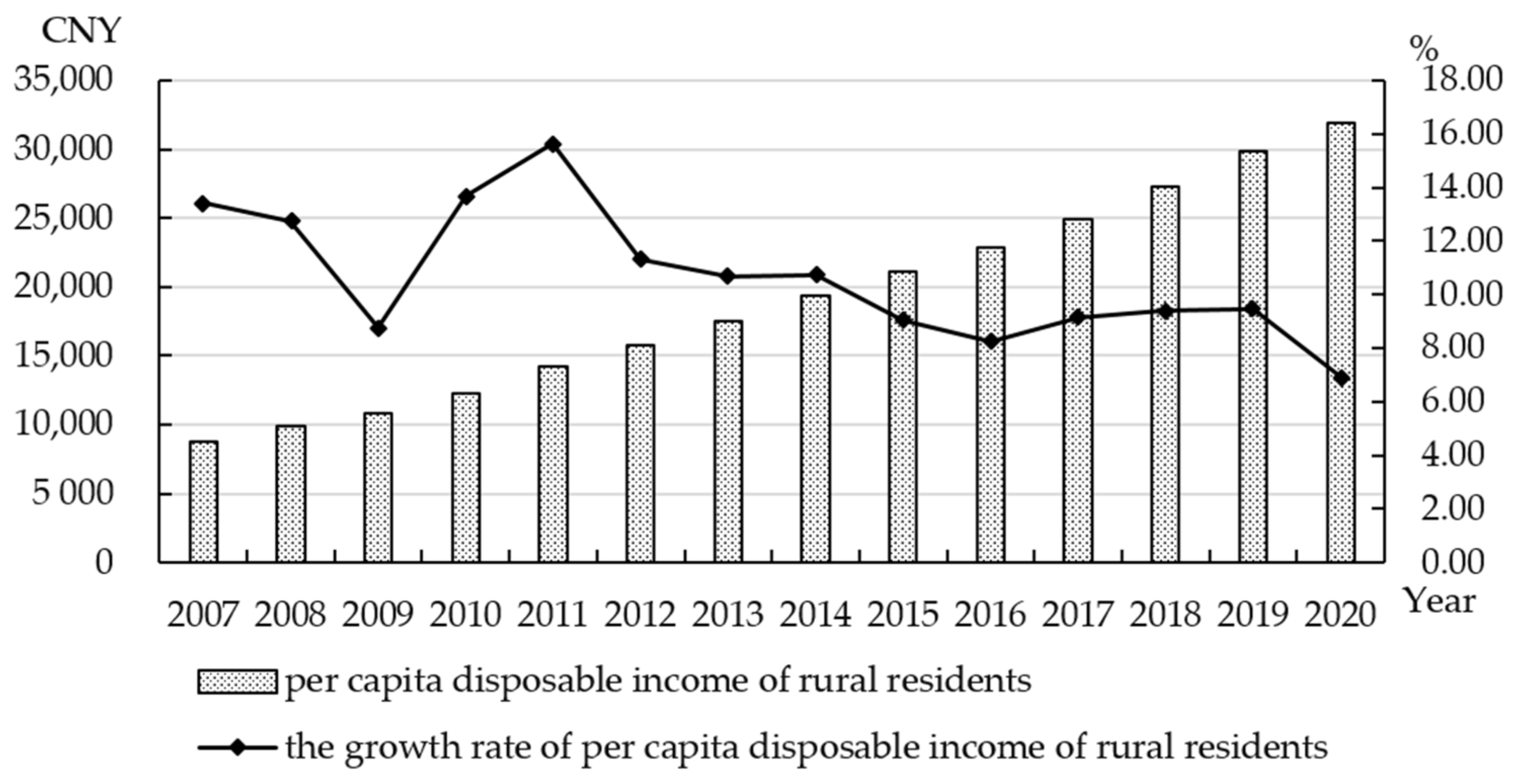

4.2.2. Per Capita Disposable Income of Rural Residents in Zhejiang Province

5. Empirical Analysis of Agricultural Insurance’s Influence on Agricultural Economic Growth

5.1. Variable Selection and Data Source

5.1.1. Variable Selection

5.1.2. Data Source

5.2. Proposition Hypothesis and Model Construction

5.2.1. Proposition Hypothesis

5.2.2. Model Construction

5.3. Empirical Results

5.3.1. Variables

5.3.2. Correlation Analysis of Variables

5.3.3. Multicollinearity Test for Variables

5.3.4. Regression Model Selection

5.3.5. Empirical Result

5.3.6. Lagged Effect Test

6. Conclusions and Recommendations

6.1. Conclusions

6.2. Policy Recommendations

6.2.1. Recommendations for Government

6.2.2. Recommendations for Insurance Companies

6.2.3. Recommendations for Farmers

6.3. Research Deficiencies

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| Abbreviations | Key Term |

| AI | (the) agricultural insurance |

| AEG | agricultural economic growth |

| AP | agricultural production |

| AO | agricultural output |

| AE | agricultural economy |

| AIPI | agricultural insurance premium income |

| REC | rural electricity consumption |

| TPAM | total power of agricultural machinery |

| CSA | crop-sown area |

| AGTFP | agricultural green total factor productivity |

| PAI | policy-based agricultural insurance |

| GOVA | gross output value of agriculture, forestry, animal husbandry, and fishery |

| AWR | (the) area of waterlogging removal |

References

- Zou, B.; Ren, Z.; Mishra, A.K.; Hirsch, S. The role of agricultural insurance in boosting agricultural output: An aggregate analysis from Chinese provinces. Agribusiness 2022. [Google Scholar] [CrossRef]

- Oguz, C.; Diyanah, S. The analysis of factors affecting farmers to take out agricultural insurance: A case study of Altinekin district, Konya Province of Turkey. Eur. Countrys. 2021, 13, 806–818. [Google Scholar] [CrossRef]

- Marin, L. Classification of risks in agricultural insurance. Sci. Pap.-Ser. Manag. Econ. Eng. Agric. Rural Dev. 2019, 19, 173–178. [Google Scholar]

- Zhou, Y. An Introduction to the Development and Regulation of Agricultural Insurance in China. Geneva Pap. Risk Insur.-Issues Pract. 2009, 34, 78–84. [Google Scholar] [CrossRef] [Green Version]

- Piljan, I.; Cogoljević, D.; Piljan, T. Insurance as a factor for the development of the agricultural sector in the Republic of Serbia. Int. Rev. 2018, 1–2, 131–137. [Google Scholar] [CrossRef]

- Hosseini, S.M.; Dourandish, A.; Ghorbani, M.; Kakhki, M.D. Agricultural Insurance and Intensification Investment: Case Study of Khorasan Razavi Province. J. Agric. Sci. Technol. 2017, 19, 1–10. [Google Scholar]

- Gulseven, O.; Kucuksenel, S.; Nas, S.E. Trends in agricultural insurance: Past, present and future. Actual Probl. Econ. 2011, 120, 316–320. [Google Scholar]

- Cukur, F.; Cukur, T.; Kizilaslan, N.; Kizilaslan, H. Determination of factors affecting hazelnut farmers’ agricultural insurance by data mining algorithms. Alinteri J. Agric. Sci. 2021, 36, 77–83. [Google Scholar] [CrossRef]

- Habtemariam, L.T.; Will, M.; Mueller, B. Agricultural insurance through the lens of rural household dietary diversity. Glob. Food Secur. 2021, 28, 100485. [Google Scholar] [CrossRef]

- Kumar, S.; Baliyan, S.K. Emerging trends, patterns of agricultural risk and insurance in Uttar Pradesh: Farm level evidence from Bundelkhand Region. Indian J. Econ. Dev. 2021, 17, 35–44. [Google Scholar] [CrossRef]

- Fang, L.; Hu, R.; Mao, H.; Chen, S. How crop insurance influences agricultural green total factor productivity: Evidence from Chinese farmers. J. Clean. Prod. 2021, 321, 128977. [Google Scholar] [CrossRef]

- Kath, J.; Mushtaq, H.; Henry, R.; Adeyinka, A.; Stone, R. Index insurance benefits agricultural producers exposed to excessive rainfall risk. Weather. Clim. Extrem. 2018, 22, 1–9. [Google Scholar] [CrossRef]

- Tang, L.; Luo, X. Can agricultural insurance encourage farmers to apply biological pesticides? Evidence from rural China. Food Policy 2021, 105, 102174. [Google Scholar] [CrossRef]

- Kenderdine, T. Insurance plus futures: Agricultural commodity price reform in China. Asia Pac. Policy Stud. 2018, 5, 331–346. [Google Scholar] [CrossRef]

- Vyas, S.; Dalhaus, T.; Kropff, M.; Aggarwal, P.; Meuwissen, M.P.M. Mapping global research on agricultural insurance. Environ. Res. Lett. 2021, 16, 103003. [Google Scholar] [CrossRef]

- Yildirak, K.; Gulseven, O. Indemnity payments in agricultural insurance: Risk exposure of EU states. Actual Probl. Econ. 2012, 127, 381–388. [Google Scholar]

- Kong, Q.; Li, R.; Peng, D.; Wong, Z. Does the policy of financial subsidies for agricultural insurance contribute to ensuring food security for poverty alleviation? Evid. China. Singap. Econ. Rev. 2021. [Google Scholar] [CrossRef]

- Li, Y.; Wang, Z. Analysis on the effect of farmer income of policy-based agricultural insurance. Acta Agric. Scand. Sect. B-Soil Plant Sci. 2022, 72, 386–400. [Google Scholar] [CrossRef]

- King, M.; Singh, A.P. Understanding farmers’ valuation of agricultural insurance: Evidence from Vietnam. Food Policy 2020, 94, 101861. [Google Scholar] [CrossRef] [Green Version]

- Cole, S.A.; Xiong, W.; Aghion, P.; Rey, H. Agricultural insurance and economic development. Annu. Rev. Econ. 2017, 9, 235–262. [Google Scholar] [CrossRef]

- Li, C.; Liu, C.; Zhang, Y. Determinants of agricultural household demand for insurance in China from 2004 to 2007. China Agric. Econ. Rev. 2017, 9, 660–667. [Google Scholar] [CrossRef]

- Gao, Y.; Shu, Y.; Cao, H.; Zhou, S.; Shi, S. Fiscal policy dilemma in resolving agricultural risks: Evidence from China’s agricultural insurance subsidy pilot. Int. J. Environ. Res. Public Health 2021, 18, 7577. [Google Scholar] [CrossRef] [PubMed]

- Xu, J.; Liao, P. Crop Insurance, premium subsidy and agricultural output. J. Integr. Agric. 2014, 13, 2537–2545. [Google Scholar] [CrossRef] [Green Version]

- Ding, Y.; Sun, C. Does agricultural insurance promote primary industry production? Evidence from a quasi-experiment in China. Geneva Pap. Risk Insur.-Issues Pract. 2022, 47, 434–459. [Google Scholar] [CrossRef]

- Sibiko, K.W.; Qaim, M. Weather index insurance, agricultural input use, and crop productivity in Kenya. Food Secur. 2020, 12, 151–167. [Google Scholar] [CrossRef]

- Njegomir, V.; Pejanovic, L.; Kekovic, Z. Agricultural entrepreneurship, environmental protection and insurance. Econ. Agric. 2017, 64, 1035–1047. [Google Scholar] [CrossRef]

- Russo, S.; Caracciolo, F.; Salvioni, C. Effects of insurance adoption and risk aversion on agricultural production and technical efficiency: A panel analysis for Italian grape growers. Economies 2022, 10, 20. [Google Scholar] [CrossRef]

- Tang, Y.; Yang, Y.; Ge, J.; Chen, J. The impact of weather index insurance on agricultural technology adoption evidence from field economic experiment in china. China Agric. Econ. Rev. 2019, 11, 622–641. [Google Scholar] [CrossRef]

- Li, H.; Tang, M.; Cao, A.; Guo, L. Assessing the relationship between air pollution, agricultural insurance, and agricultural green total factor productivity: Evidence from China. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Lu, F.; Wang, W.; Liu, M.; Liu, M.; Qi, D. The non-linear effect of agricultural insurance on agricultural green competitiveness. Technol. Anal. Strateg. Manag. 2022. [Google Scholar] [CrossRef]

- Huang, Z.; Alec, Z.; Sun, J.; Guo, Y. Potato farmers’ preference for agricultural insurance in China: An investigation using the choice experimental method. J. Integr. Agric. 2020, 19, 1137–1148. [Google Scholar] [CrossRef]

- Lou, W.; Sun, S. Design of agricultural insurance policy for tea tree freezing damage in Zhejiang Province, China. Theor. Appl. Climatol. 2013, 111, 713–728. [Google Scholar] [CrossRef]

- Binswanger, M.H.P. Is there too much hype about index-based agricultural insurance? J. Dev. Stud. 2012, 48, 187–200. [Google Scholar] [CrossRef]

- Sarris, A. Weather index insurance for agricultural development: Introduction and overview. Agric. Econ. 2013, 44, 381–384. [Google Scholar] [CrossRef]

- Adeyinka, A.A.; Kath, J.; Nguyen-Huy, T.; Mushtaq, S.; Souvignet, M.; Range, M.; Barratt, J. Global disparities in agricultural climate index-based insurance research. Clim. Risk Manag. 2022, 35, 100394. [Google Scholar] [CrossRef]

- Jensen, N.; Barrett, C. Agricultural index insurance for development. Appl. Econ. Perspect. Policy 2017, 39, 199–219. [Google Scholar] [CrossRef] [Green Version]

- Tiemtore, A. Examining the effects of agricultural income insurance on farmers in Burkina Faso. Geneva Pap. Risk Insur.-Issues Pract. 2021, 46, 422–439. [Google Scholar] [CrossRef]

- Smith, V.H.; Glauber, J.W. Agricultural insurance in developed countries: Where have we been and where are we going? Appl. Econ. Perspect. Policy 2012, 34, 363–390. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Z.; Xu, H.; Shan, S.; Liu, Q.; Lu, Y. Whether the agricultural insurance policy achieves green income growth-evidence from the implementation of China’s total cost insurance pilot program. Int. J. Environ. Res. Public Health 2022, 19, 852. [Google Scholar] [CrossRef]

- Zubor-Nemes, A.; Fogarasi, J.; Molnar, A.; Kemeny, G. Farmers’ responses to the changes in Hungarian agricultural insurance system. Agric. Financ. Rev. 2018, 78, 275–288. [Google Scholar] [CrossRef]

- Fu, X.; Li, X.; Xu, X.; Wang, Y.; Liang, P. Does policy-supported agricultural insurance reduce non-point source pollution? Evidence from China. Fresenius Environ. Bull. 2020, 9, 5228–5237. [Google Scholar]

- Li, S.; Yu, W. The Dual—Driven Impact of “Internet plus Agricultural Insurance” on the Agricultural Carbon Welfare Performance in China. Pol. J. Environ. Stud. 2022, 31, 2183–2196. [Google Scholar] [CrossRef]

- Niu, Z.; Yi, F.; Chen, C. Agricultural Insurance and Agricultural Fertilizer Non-Point Source Pollution: Evidence from China’s Policy-Based Agricultural Insurance Pilot. Sustainability 2022, 14, 2800. [Google Scholar] [CrossRef]

- Liao, P.; Zhou, X.; Fan, Q. Does agricultural insurance help farmers escape the poverty trap? Research based on multiple equilibrium models. Geneva Pap. Risk Insur.-Issues Pract. 2020, 45, 203–223. [Google Scholar] [CrossRef]

- Kutlar, I.; Akcaoz, H. Inclinations of greenhouse farmers in Turkey toward agricultural insurance. Cienc. Rural 2022, 52, e20200704. [Google Scholar] [CrossRef]

- Bao, X.; Zhang, F.; Guo, S.; Deng, X.; Song, J.; Xu, D. Peer effects on farmers’ purchases of policy-based planting farming agricultural insurance: Evidence from Sichuan Province, China. Int. J. Environ. Res. Public Health 2022, 19, 7411. [Google Scholar] [CrossRef]

- Jin, J.; Wang, W.; Wang, X. Farmers’ risk preferences and agricultural weather index insurance uptake in rural China. Int. J. Disaster Risk Sci. 2016, 7, 366–373. [Google Scholar] [CrossRef] [Green Version]

- Capitanio, F.; Antonio, D.P. Measures of Efficiency of Agricultural Insurance in Italy, Economic Evaluations. Risks 2018, 6, 126. [Google Scholar] [CrossRef] [Green Version]

- Nastase, M.; Radulescu, C.V.; Ioan, I. Climate change, agricultural insurance and governmental support. Metal. Int. 2010, 14, 118–122. [Google Scholar]

- Liu, F.; Corcoran, C.P.; Tao, J.; Cheng, J. Risk perception, insurance recognition and agricultural insurance behavior-An empirical based on dynamic panel data in 31 provinces of China. Int. J. Disaster Risk Reduct. 2016, 20, 19–25. [Google Scholar] [CrossRef]

- Yoshida, K.; Srisutham, M.; Sritumboon, S.; Suanburi, D.; Janjirauttikul, N.; Suanpaga, W. Evaluation of economic damages on rice production under extreme climate and agricultural insurance for adaptation measures in Northeast Thailand. Eng. J.-Thail. 2019, 23, 451–460. [Google Scholar] [CrossRef]

- Guo, X.; Zhao, Y.; Arshad, M.U.; Gong, Y. Farmers’ willingness to pay a high premium for different types of agricultural insurance: Evidence from Inner Mongolia, China. Discret. Dyn. Nat. Soc. 2022, 2022, 8476087. [Google Scholar] [CrossRef]

- Zhang, Y.; Ju, G.; Zhan, J. Farmers using insurance and cooperatives to manage agricultural risks: A case study of the swine industry in China. J. Integr. Agric. 2019, 18, 2910–2918. [Google Scholar] [CrossRef]

- Carrer, M.J.; da Silveira, R.L.; Vinholis, M.D.B.; De Souza, H.M. Determinants of agricultural insurance adoption: Evidence from farmers in the state of Sao Paulo, Brazil. Rausp Manag. J. 2020, 55, 547–566. [Google Scholar] [CrossRef]

- Oladipo, F.O.; Olayode, O.O.; Adesoji, S.A. Fish farmers’ attitude toward agricultural insurance scheme in Ondo State Nigeria. J. Agric. Ext. 2018, 22, 97–108. [Google Scholar] [CrossRef] [Green Version]

- Hazell, P.B.R.; Hess, U. Drought insurance for agricultural development and food security in dryland areas. Food Secur. 2010, 2, 395–405. [Google Scholar] [CrossRef]

- Dalhaus, T.; Barnett, B.J.; Finger, R. Behavioral weather insurance: Applying cumulative prospect theory to agricultural insurance design under narrow framing. PLoS ONE 2020, 15, e0232267. [Google Scholar] [CrossRef]

- Zhu, W.; Tan, K.; Porth, L. Agricultural Insurance Ratemaking: Development of a New Premium Principle. N. Am. Actuar. J. 2019, 23, 512–534. [Google Scholar] [CrossRef]

- Tekin, A.; Karli, B.; Gul, M. Development of implementation of agricultural insurance in turkey. Sci. Pap.-Ser. Manag. Econ. Eng. Agric. Rural Dev. 2017, 17, 355–364. [Google Scholar]

| City | AIPI (Million CNY) | Proportion (%) |

|---|---|---|

| Hangzhou | 290.73 | 23.03 |

| Ningbo | 266.26 | 21.09 |

| Quzhou | 121 | 9.58 |

| Jiaxing | 104.2 | 8.25 |

| Jinhua | 95.74 | 7.58 |

| Huzhou | 82.64 | 6.55 |

| Shaoxing | 79.76 | 6.32 |

| Taizhou | 78.69 | 6.23 |

| Wenzhou | 76.52 | 6.06 |

| Lishui | 53.19 | 4.21 |

| Zhoushan | 13.71 | 1.09 |

| City | Total AO (100 Million CNY) | Proportion (%) |

|---|---|---|

| Ningbo | 534.08 | 15.55 |

| Taizhou | 520.03 | 15.14 |

| Hangzhou | 500.65 | 14.58 |

| Shaoxing | 331.39 | 9.65 |

| Zhoushan | 280.88 | 8.18 |

| Wenzhou | 254.06 | 7.40 |

| Jinhua | 253.01 | 7.37 |

| Huzhou | 238.94 | 6.96 |

| Jiaxing | 211.46 | 6.16 |

| Lishui | 161.78 | 4.71 |

| Quzhou | 148.33 | 4.32 |

| Variable | Abbreviations | Definition |

|---|---|---|

| y | GOVA | Gross output value of agriculture, forestry, animal husbandry, and fishery, which is equal to the total amount of agricultural, forestry, animal husbandry, and fishery products measured in currency. |

| x1 | AIPI | Agricultural insurance premium income, which is the agricultural insurance expenditures that farmers invest in order to diversify agricultural risks and protect agricultural production and business activities. |

| x2 | AWR | The area of waterlogging removal, which refers to the area of farmland where the waterlogging-prone cultivated land is exempted from waterlogging due to the construction of waterlogging control projects or the installation of waterlogging machinery and other water conservancy facilities. |

| x3 | REC | Rural electricity consumption, which refers to the total electricity consumption of rural production and living, deducting the electricity consumption of state-owned industry, transportation, infrastructure, and other state-owned entities in the countryside. |

| x4 | TPAM | Total power of agricultural machinery, which refers to the total power of various power machinery mainly used in agriculture, forestry, animal husbandry, and fishery. |

| x5 | CSA | Crop-sown area, which refers to the area actually sown or transplanted with crops at the end of a certain production season. |

| Variable | Observations | Mean | Std. Dev. | Minimum | Maximum |

|---|---|---|---|---|---|

| ny | 143 | 5.363 | 0.459 | 4.348 | 6.229 |

| lnx1 | 143 | 3.465 | 1.202 | 0.077 | 5.672 |

| lnx2 | 143 | 3.337 | 1.203 | 0.920 | 4.897 |

| lnx3 | 143 | 3.862 | 1.166 | 1.356 | 5.459 |

| lnx4 | 143 | 5.282 | 0.364 | 4.539 | 6.143 |

| lnx5 | 143 | 5.276 | 0.764 | 2.599 | 6.000 |

| Variable | lny | lnx1 | lnx2 | lnx3 | lnx4 | lnx5 |

|---|---|---|---|---|---|---|

| lny | 1.000 | |||||

| lnx1 | 0.593 *** | 1.000 | ||||

| lnx2 | 0.572 *** | 0.359 *** | 1.000 | |||

| lnx3 | 0.777 *** | 0.448 *** | 0.801 *** | 1.000 | ||

| lnx4 | 0.697 *** | 0.241 *** | 0.369 *** | 0.700 *** | 1.000 | |

| lnx5 | 0.272 *** | 0.532 *** | 0.528 *** | 0.532 *** | 0.380 *** | 1.000 |

| Variable | VIF | 1/VIF |

|---|---|---|

| lnx3 | 6.486 | 0.154 |

| lnx2 | 3.794 | 0.264 |

| lnx4 | 2.582 | 0.387 |

| lnx5 | 1.782 | 0.561 |

| lnx1 | 1.540 | 0.649 |

| Mean VIF | 3.237 |

| Variable | (1) Mixed Effects Parameters | (2) Fixed Effects Parameters | (3) Random Effects Parameters |

|---|---|---|---|

| lnx1 | 0.196 *** | 0.156 *** | 0.166 *** |

| (0.016) | (0.019) | (0.015) | |

| lnx2 | 0.090 *** | −0.218 | −0.050 |

| (0.024) | (0.130) | (0.066) | |

| lnx3 | 0.105 ** | 0.411 *** | 0.325 *** |

| (0.033) | (0.098) | (0.065) | |

| lnx4 | 0.594 *** | 0.296 ** | 0.287 *** |

| (0.067) | (0.088) | (0.079) | |

| lnx5 | −0.268 *** | −0.343 ** | −0.281 *** |

| (0.026) | (0.110) | (0.065) | |

| cons | 2.257 *** | 4.212 *** | 3.666 *** |

| (0.303) | (0.864) | (0.428) | |

| Observations | 143 | 143 | 143 |

| R-squared | 0.853 | 0.814 | 0.810 |

| Prob (F-statistic) | 0.000 | 0.000 | |

| Prob (Hausman) | 0.207 |

| Variable | Random Effects Parameters | Lag 1 Period Parameter |

|---|---|---|

| lnx1 | 0.166 *** | |

| (0.0147) | ||

| lnx2 | −0.0504 | −0.0901 |

| (0.0660) | (0.0696) | |

| lnx3 | 0.325 *** | 0.375 *** |

| (0.0652) | (0.0689) | |

| lnx4 | 0.287 *** | 0.218 * |

| (0.0791) | (0.0993) | |

| lnx5 | −0.281 *** | −0.249 *** |

| (0.0651) | (0.0702) | |

| L.lnx1 | 0.135 *** | |

| (0.0164) | ||

| _cons | 3.666 *** | 3.947 *** |

| (0.428) | (0.510) | |

| Observations | 143 | 132 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zeng, S.; Qi, B.; Wang, M. Agricultural Insurance and Agricultural Economic Growth: The Case of Zhejiang Province in China. Int. J. Environ. Res. Public Health 2022, 19, 13062. https://doi.org/10.3390/ijerph192013062

Zeng S, Qi B, Wang M. Agricultural Insurance and Agricultural Economic Growth: The Case of Zhejiang Province in China. International Journal of Environmental Research and Public Health. 2022; 19(20):13062. https://doi.org/10.3390/ijerph192013062

Chicago/Turabian StyleZeng, Shaolong, Bingying Qi, and Minglin Wang. 2022. "Agricultural Insurance and Agricultural Economic Growth: The Case of Zhejiang Province in China" International Journal of Environmental Research and Public Health 19, no. 20: 13062. https://doi.org/10.3390/ijerph192013062