The Genetics of Risk Aversion: A Systematic Review

Abstract

:1. Introduction

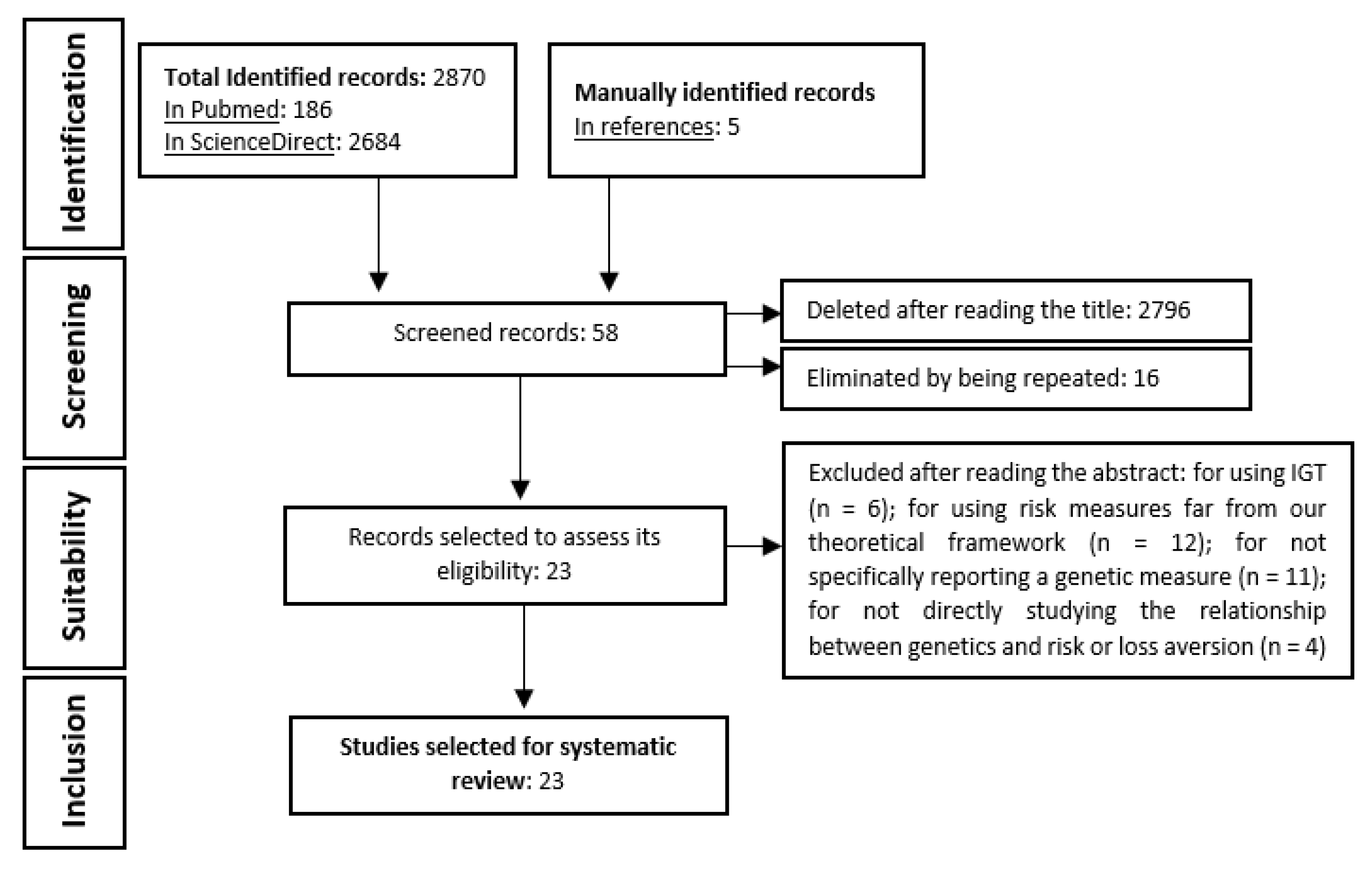

2. Materials and Methods

2.1. First Searches

2.2. Systematic Search

2.2.1. Inclusion Criteria

- −

- Empirical research and not revisions, single case studies, theoretical frameworks, books or manuals.

- −

- That specifically and directly report genetic measures (e.g., how different alleles of a polymorphism are related to risk aversion levels).

- −

- That use human samples.

- −

- That study risk aversion, framing effect, and loss aversion understood within the economic framework.

- −

- That measure risk aversion, framing effect, and loss aversion with economic tasks.

2.2.2. Exclusion Criteria

- −

- Those that approach risk aversion, framing effect, or loss aversion from a far perspective from economics (e.g., risk taking related to sexual risk behavior, gambling disorder or substance abuse).

- −

- Those who use non-economic tasks or use self-reports of risk preferences (i.e., questionnaires).

- −

- Those that are studied in twins, or in terms of biological aspects, but do not report specific genetic measures.

- −

- Those who study risk aversion with Iowa Gambling Task (IGT) [37]. As recently noted Lin et al. [38], the measure of risk inferred from this task is not as direct and is influenced by other factors, such as reward-learning or the sensitivity to feedbacks, which may make it difficult to interpret results in this review. In addition, IGT can be considered a decision-making measure in the face of ambiguity rather than risk, which is a different approach to this study [39].

2.3. Manual Search

3. Results

3.1. Risk-Aversion

3.1.1. Single Nucleotide Polymorphisms

3.1.2. SLC6A4 Candidate Gene

3.1.3. DRD4 Candidate Gene

3.1.4. ANKK1 Candidate-Gene

3.1.5. MAOA Candidate Gene

3.1.6. SLC6A3 Candidate-Gene

3.1.7. COMT Candidate-Gene

3.1.8. Multiple Candidate Genes at Once

3.2. Loss-Aversion

4. Discussion

4.1. Risk Aversion

4.1.1. Risk Aversion and Dopaminergic Pathways

4.1.2. Risk Aversion and Serotoninergic Pathways

4.2. Loss Aversion

4.3. Limitations and Future Research

- In line with Gao et al. [53], since risk and loss aversion are complex behaviors, studies should address multiple candidate genes at once. In addition, they should be open to testing other genes outside the dopaminergic and serotonergic pathways to avoid confirmation bias.

- Sufficient samples should be included to ensure that the multiple contrasts required have adequate power. More samples imply more effort, but only then will the studies be valuable.

- It is necessary to control all possible confusing variables that could alter the genes–behavior relationship. Other behavioral and health measurements should be provided, but it would also be useful to rely on neuroimaging techniques and other means to measure or infer the level of neurotransmitters that is available.

- It should be checked whether the relationship between genes and risk aversion is affected depending on whether tasks or questionnaires are used.

- To discriminate between risk and loss aversion, it would be advisable to use only tasks whose risk does not include losses.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Thaler, R.H. Behavioral economics: Past, present, and future. Rev. Econ. Inst. 2018, 20, 9–43. [Google Scholar] [CrossRef] [Green Version]

- Morgan, M.S. Economic Man as Model Man: Ideal Types, Idealization and Caricatures. Camb. Rev. Int. Aff. 2006, 28, 1–27. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Choices, Values, and Frames. Am. Psychol. 1984, 39, 341–350. [Google Scholar] [CrossRef]

- Rabin, M.; Thaler, R.H. Anomalies, Risk Aversion. J. Econ. Perspect. 2001, 15, 219–232. [Google Scholar] [CrossRef] [Green Version]

- Bernoulli, D. Specimen theoriae novae de mensura sortis. Comment. Acad. Sci. Imp. Petropolitanae 1738, 5, 175–192. [Google Scholar]

- Bernoulli, D. Exposition of a New Theory on the Measurement of Risk. Econometrica 1954, 22, 23–36. [Google Scholar] [CrossRef] [Green Version]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef] [Green Version]

- De Martino, B.; Kumaran, D.; Seymour, B.; Dolan, R.J. Frames, Biases, and Rational Decision-Making in the Human Brain. Science 2006, 313, 684–687. [Google Scholar] [CrossRef] [Green Version]

- Kahneman, D. Maps of Bounded Rationality: Psychology for Behavioral Economics. Am. Econ. Rev. 2003, 93, 1449–1475. [Google Scholar] [CrossRef] [Green Version]

- von Neumann, J.; Morgenstern, O. Theory of Games and Economic Behavior; Princeton University Press: Princeton, NJ, USA, 1944. [Google Scholar] [CrossRef]

- Starcke, K.; Brand, M. Decision making under stress: A selective review. Neurosci. Biobehav. Rev. 2012, 36, 1228–1248. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in prospect theory: Cumulative representation of uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Sokol-Hessner, P.; Camerer, C.F.; Phelps, E.A. Emotion regulation reduces loss aversion and decreases amygdala responses to losses. Soc. Cogn. Affect. Neurosci. 2013, 8, 341–350. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kahneman, D.; Knetsch, J.L.; Thaler, R.H. Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias. J. Econ. Perspect. 1991, 5, 193–206. [Google Scholar] [CrossRef] [Green Version]

- Molins, F.; Serrano, M.A. Bases neurales de la aversión a las pérdidas en contextos económicos: Revisión sistemática según las directrices PRISMA. Rev. Neurol. 2019, 68, 47. [Google Scholar] [CrossRef]

- Sokol-Hessner, P.; Rutledge, R.B. The Psychological and Neural Basis of Loss Aversion. Curr. Dir. Psychol. Sci. 2019, 28, 20–27. [Google Scholar] [CrossRef]

- Christopoulos, G.I.; Tobler, P.; Bossaerts, P.; Dolan, R.; Schultz, W. Neural Correlates of Value, Risk, and Risk Aversion Contributing to Decision Making under Risk. J. Neurosci. 2009, 29, 12574–12583. [Google Scholar] [CrossRef] [Green Version]

- Dreber, A.; Apicella, C.L.; Eisenberg, D.T.; Garcia, J.R.; Zamore, R.S.; Lum, J.K.; Campbell, B. The 7R polymorphism in the dopamine receptor D4 gene (DRD4) is associated with financial risk taking in men. Ethol. Sociobiol. 2009, 30, 85–92. [Google Scholar] [CrossRef]

- Wu, Y.; Van Dijk, E.; Aitken, M.; Clark, L. Missed losses loom larger than missed gains: Electrodermal reactivity to decision choices and outcomes in a gambling task. Cogn. Affect. Behav. Neurosci. 2016, 16, 353–361. [Google Scholar] [CrossRef] [Green Version]

- Persson, E.; Asutay, E.; Hagman, W.; Västfjäll, D.; Tinghög, G. Affective Response Predicts Risky Choice for Fast, but Not Slow, Decisions. J. Neurosci. Psychol. Econ. 2018, 11, 197–212. [Google Scholar] [CrossRef] [Green Version]

- Klumpp, H.; Angstadt, M.; Phan, K.L. Insula reactivity and connectivity to anterior cingulate cortex when processing threat in generalized social anxiety disorder. Biol. Psychol. 2012, 89, 273–276. [Google Scholar] [CrossRef]

- Phelps, E.A. Emotion and Cognition: Insights from Studies of the Human Amygdala. Annu. Rev. Psychol. 2006, 57, 27–53. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Dalgleish, T. The emotional brain. Nat. Rev. Neurosci. 2004, 5, 583–589. [Google Scholar] [CrossRef]

- LeDoux, J.E. Emotion Circuits in the Brain. Annu. Rev. Neurosci. 2000, 23, 155–184. [Google Scholar] [CrossRef] [PubMed]

- Thayer, J.F.; Lane, R.D. Claude Bernard and the heart–brain connection: Further elaboration of a model of neurovisceral integration. Neurosci. Biobehav. Rev. 2009, 33, 81–88. [Google Scholar] [CrossRef] [PubMed]

- Harrati, A. Characterizing the Genetic Influences on Risk Aversion. Biodemography Soc. Biol. 2014, 60, 185–198. [Google Scholar] [CrossRef] [PubMed]

- Le, A.T.; Miller, P.W.; Slutske, W.S.; Martin, N. Are Attitudes Towards Economic Risk Heritable? Analyses Using the Australian Twin Study of Gambling. Twin Res. Hum. Genet. 2010, 13, 330–339. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Cesarini, D.; Dawes, C.T.; Johannesson, M.; Lichtenstein, P.; Wallace, B. Genetic Variation in Preferences for Giving and Risk Taking. Q. J. Econ. 2009, 124, 809–842. [Google Scholar] [CrossRef]

- Zhong, S.; Israel, S.; Xue, H.; Ebstein, R.P.; Chew, S.H. Monoamine Oxidase A Gene (MAOA) Associated with Attitude Towards Longshot Risks. PLoS ONE 2009, 4, e8516. [Google Scholar] [CrossRef] [Green Version]

- Kuhnen, C.M.; Chiao, J.Y. Genetic Determinants of Financial Risk Taking. PLoS ONE 2009, 4, e4362. [Google Scholar] [CrossRef]

- He, Q.; Xue, G.; Chen, C.; Lu, Z.; Dong, Q.; Lei, X.; Ding, N.; Li, J.; Li, H.; Chen, C.; et al. Serotonin transporter gene-linked polymorphic region (5-HTTLPR) influences decision making under ambiguity and risk in a large Chinese sample. Neuropharmacology 2010, 59, 518–526. [Google Scholar] [CrossRef]

- Voigt, G.; Montag, C.; Markett, S.; Reuter, M. On the genetics of loss aversion: An interaction effect of BDNF Val66Met and DRD2/ANKK1 Taq1a. Behav. Neurosci. 2015, 129, 801–811. [Google Scholar] [CrossRef] [PubMed]

- Crişan, L.G.; Pană, S.; Vulturar, R.; Heilman, R.M.; Szekely, R.; Drugă, B.; Dragoş, N.; Miu, A.C. Genetic contributions of the serotonin transporter to social learning of fear and economic decision making. Soc. Cogn. Affect. Neurosci. 2009, 4, 399–408. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kelley, A.E.; Schiltz, C.A.; Landry, C.F. Neural systems recruited by drug- and food-related cues: Studies of gene activation in corticolimbic regions. Physiol. Behav. 2005, 86, 11–14. [Google Scholar] [CrossRef] [PubMed]

- Wise, R.A. Brain Reward Circuitry: Insights from Unsensed Incentives. Neuron 2002, 36, 229–240. [Google Scholar] [CrossRef] [Green Version]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 Statement: An Updated Guideline for Reporting Systematic Reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef]

- Bechara, A.; Damasio, A.R.; Damasio, H.; Anderson, S.W. Insensitivity to future consequences following damage to human prefrontal cortex. Cognition 1994, 50, 7–15. [Google Scholar] [CrossRef]

- Lin, C.-H.; Song, T.-J.; Chen, Y.-Y.; Lee, W.-K.; Chiu, Y.-C. Reexamining the Validity and Reliability of the Clinical Version of the Iowa Gambling Task: Evidence from a Normal Subject Group. Front. Psychol. 2013, 4, 220. [Google Scholar] [CrossRef] [Green Version]

- Bechara, A.; Damasio, A.R. The somatic marker hypothesis: A neural theory of economic decision. Games Econ. Behav. 2005, 52, 336–372. [Google Scholar] [CrossRef]

- Fukunaga, R.; Brown, J.; Bogg, T.; Browna, J.; Bogg, T. Decision Making in the Balloon Analogue Risk Task (BART): Anterior Cingulate Cortex Signals Loss-Aversion but not the Infrequency of Risky Choices. Cogn. Affect. Behav. Neurosci. 2012, 14, 384–399. [Google Scholar] [CrossRef] [Green Version]

- Beauchamp, J.P.; Cesarini, D.; Johannesson, M.; van der Loos, M.J.H.M.; Koellinger, P.D.; Groenen, P.J.F.; Fowler, J.H.; Rosenquist, J.N.; Thurik, A.R.; Christakis, N.A. Molecular Genetics and Economics. J. Econ. Perspect. 2011, 25, 57–82. [Google Scholar] [CrossRef]

- Gao, X.; Gong, P.; Liu, J.; Hu, J.; Li, Y.; Yu, H.; Gong, X.; Xiang, Y.; Jiang, C.; Zhou, X. COMTVal158Met polymorphism influences the susceptibility to framing in decision-making: OFC-amygdala functional connectivity as a mediator. Hum. Brain Mapp. 2016, 37, 1880–1892. [Google Scholar] [CrossRef] [PubMed]

- Roiser, J.P.; De Martino, B.; Tan, G.C.Y.; Kumaran, D.; Seymour, B.; Wood, N.W.; Dolan, R.J. A Genetically Mediated Bias in Decision Making Driven by Failure of Amygdala Control. J. Neurosci. 2009, 29, 5985–5991. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Zhong, S.; Israel, S.; Xue, H.; Sham, P.C.; Ebstein, R.; Chew, S.H. A neurochemical approach to valuation sensitivity over gains and losses. Proc. R. Soc. B Biol. Sci. 2009, 276, 4181–4188. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Dreber, A.; Rand, D.; Wernerfelt, N.; Garcia, J.; Vilar, M.G.; Lum, J.K.; Zeckhauser, R. Dopamine and risk choices in different domains: Findings among serious tournament bridge players. J. Risk Uncertain. 2011, 43, 19–38. [Google Scholar] [CrossRef]

- Eisenegger, C.; Knoch, D.; Ebstein, R.P.; Gianotti, L.R.; Sándor, P.S.; Fehr, E. Dopamine Receptor D4 Polymorphism Predicts the Effect of L-DOPA on Gambling Behavior. Biol. Psychiatry 2010, 67, 702–706. [Google Scholar] [CrossRef]

- Frydman, C.; Camerer, C.; Bossaerts, P.; Rangel, A. MAOA-L carriers are better at making optimal financial decisions under risk. Proc. R. Soc. B Boil. Sci. 2011, 278, 2053–2059. [Google Scholar] [CrossRef]

- Amstadter, A.; MacPherson, L.; Wang, F.; Banducci-Barker, A.; Reynolds, E.; Potenza, M.; Gelernter, J.; Lejuez, C.W. The Relationship between Risk-Taking Propensity and the COMT Val158 Met Polymorphism Among Early Adolescents as a Function of Sex. J. Psychiatr. Res. 2012, 46, 940–945. [Google Scholar] [CrossRef] [Green Version]

- Dreber, A.; Rand, D.G.; Wernerfelt, N.; Montgomery, C.; Malhotra, D.K. Genetic Correlates of Economic and Social Risk Taking. SSRN Electron. J. 2012. [Google Scholar] [CrossRef]

- Heitland, I.; Oosting, R.S.; Baas, J.M.P.; Massar, S.A.A.; Kenemans, J.L.; Böcker, K.B.E. Genetic polymorphisms of the dopamine and serotonin systems modulate the neurophysiological response to feedback and risk taking in healthy humans. Cogn. Affect. Behav. Neurosci. 2012, 12, 678–691. [Google Scholar] [CrossRef] [Green Version]

- Mata, R.; Hau, R.; Papassotiropoulos, A.; Hertwig, R. DAT1 Polymorphism Is Associated with Risk Taking in the Balloon Analogue Risk Task (BART). PLoS ONE 2012, 7, e39135. [Google Scholar] [CrossRef]

- Anderson, A.; Dreber, A.; Vestman, R. Risk taking, behavioral biases and genes: Results from 149 active investors. J. Behav. Exp. Financ. 2015, 6, 93–100. [Google Scholar] [CrossRef]

- Gao, X.; Liu, J.; Gong, P.; Wang, J.; Fang, W.; Yan, H.; Zhu, L.; Zhou, X. Identifying new susceptibility genes on dopaminergic and serotonergic pathways for the framing effect in decision-making. Soc. Cogn. Affect. Neurosci. 2017, 12, 1534–1544. [Google Scholar] [CrossRef] [PubMed]

- Wagels, L.; Votinov, M.; Radke, S.; Clemens, B.; Montag, C.; Jung, S.; Habel, U. Blunted insula activation reflects increased risk and reward seeking as an interaction of testosterone administration and the MAOA polymorphism. Hum. Brain Mapp. 2017, 38, 4574–4593. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Muda, R.; Kicia, M.; Michalak-Wojnowska, M.; Ginszt, M.; Filip, A.; Gawda, P.; Majcher, P. The Dopamine Receptor D4 Gene (DRD4) and Financial Risk-Taking: Stimulating and Instrumental Risk-Taking Propensity and Motivation to Engage in Investment Activity. Front. Behav. Neurosci. 2018, 12, 34. [Google Scholar] [CrossRef] [Green Version]

- Neukam, P.T.; Kroemer, N.B.; Araujo, Y.I.D.; Hellrung, L.; Pooseh, S.; Rietschel, M.; Witt, S.H.; Schwarzenbolz, U.; Henle, T.; Smolka, M.N. Risk-seeking for losses is associated with 5-HTTLPR, but not with transient changes in 5-HT levels. Psychopharmacology 2018, 235, 2151–2165. [Google Scholar] [CrossRef] [PubMed]

- Ernst, M.; Plate, R.C.; Carlisi, C.O.; Gorodetsky, E.; Goldman, D.; Pine, D.S. Loss aversion and 5HTT gene variants in adolescent anxiety. Dev. Cogn. Neurosci. 2014, 8, 77–85. [Google Scholar] [CrossRef] [Green Version]

- Roe, B.E.; Tilley, M.R.; Gu, H.H.; Beversdorf, D.; Sadee, W.; Haab, T.C.; Papp, A.C. Financial and Psychological Risk Attitudes Associated with Two Single Nucleotide Polymorphisms in the Nicotine Receptor (CHRNA4) Gene. PLoS ONE 2009, 4, e6704. [Google Scholar] [CrossRef]

- Smolka, M.; Schumann, G.; Wrase, J.; Grüsser, S.M.; Flor, H.; Mann, K.; Braus, D.F.; Goldman, D.; Büchel, C.; Heinz, A. Catechol-O-Methyltransferase val158met Genotype Affects Processing of Emotional Stimuli in the Amygdala and Prefrontal Cortex. J. Neurosci. 2005, 25, 836–842. [Google Scholar] [CrossRef] [Green Version]

- Williams, L.M.; Gatt, J.M.; Grieve, S.M.; Dobson-Stone, C.; Paul, R.H.; Gordon, E.; Schofield, P.R. COMT Val108/158Met polymorphism effects on emotional brain function and negativity bias. NeuroImage 2010, 53, 918–925. [Google Scholar] [CrossRef]

- Nguyen, Y.; Noussair, C.N. Risk Aversion and Emotions. Pac. Econ. Rev. 2014, 19, 296–312. [Google Scholar] [CrossRef] [Green Version]

- Van den Bos, R.; Harteveld, M.; Stoop, H. Stress and decision-making in humans: Performance is related to cortisol reactivity, albeit differently in men and women. Psychoneuroendocrinology 2009, 34, 1449–1458. [Google Scholar] [CrossRef] [PubMed]

- Ernst, M.; Luciana, M. Neuroimaging of the dopamine/reward system in adolescent drug use. CNS Spect. 2015, 20, 427–441. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Pierce, R.C.; Kumaresan, V. The mesolimbic dopamine system: The final common pathway for the reinforcing effect of drugs of abuse? Neurosci. Biobehav. Rev. 2006, 30, 215–238. [Google Scholar] [CrossRef] [PubMed]

- Peterson, R.L. The neuroscience of investing: fMRI of the reward system. Brain Res. Bull. 2005, 67, 391–397. [Google Scholar] [CrossRef]

- Adriani, W.; Boyer, F.; Gioiosa, L.; Macrì, S.; Dreyer, J.-L.; Laviola, G. Increased impulsive behavior and risk proneness following lentivirus-mediated dopamine transporter over-expression in rats’ nucleus accumbens. Neuroscience 2009, 159, 47–58. [Google Scholar] [CrossRef] [Green Version]

- MacKillop, J.; Menges, D.P.; E McGeary, J.; A Lisman, S. Effects of craving and DRD4 VNTR genotype on the relative value of alcohol: An initial human laboratory study. Behav. Brain Funct. 2007, 3, 11. [Google Scholar] [CrossRef] [Green Version]

- Congdon, E.; Lesch, K.-P.; Canli, T. Analysis of DRD4 and DAT polymorphisms and behavioral inhibition in healthy adults: Implications for impulsivity. Am. J. Med. Genet. Part B Neuropsychiatr. Genet. 2008, 147, 27–32. [Google Scholar] [CrossRef]

- Garcia, J.R.; MacKillop, J.; Aller, E.L.; Merriwether, A.M.; Wilson, D.S.; Lum, J.K. Associations between Dopamine D4 Receptor Gene Variation with Both Infidelity and Sexual Promiscuity. PLoS ONE 2010, 5, e14162. [Google Scholar] [CrossRef] [Green Version]

- Knutson, B.; Adams, C.M.; Fong, G.W.; Hommer, D. Anticipation of Increasing Monetary Reward Selectively Recruits Nucleus Accumbens. J. Neurosci. Off. J. Soc. Neurosci. 2001, 21, RC159. [Google Scholar] [CrossRef]

- Knutson, B.; Cooper, J.C. Functional magnetic resonance imaging of reward prediction. Curr. Opin. Neurol. 2005, 18, 411–417. [Google Scholar] [CrossRef]

- Attenburrow, M.-J.; Williams, C.; Odontiadis, J.; Reed, A.; Powell, J.; Cowen, P.J.; Harmer, C.J. Acute administration of nutritionally sourced tryptophan increases fear recognition. Psychopharmacology 2003, 169, 104–107. [Google Scholar] [CrossRef] [PubMed]

- Browning, M.; Reid, C.; Cowen, P.; Goodwin, G.; Harmer, C. A single dose of citalopram increases fear recognition in healthy subjects. J. Psychopharmacol. 2007, 21, 684–690. [Google Scholar] [CrossRef] [PubMed]

- Burghardt, N.S.; Bush, D.; McEwen, B.; Ledoux, J.E. Acute SSRIs Increase Conditioned Fear Expression: Blockade with a 5-HT2C Receptor Antagonist N.S. Biol. Psychiatry 2007, 62, 1111–1118. [Google Scholar] [CrossRef] [Green Version]

- Harmer, C.J.; Rogers, R.D.; Tunbridge, E.; Cowen, P.; Goodwin, G.M. Tryptophan depletion decreases the recognition of fear in female volunteers. Psychopharmacology 2003, 167, 411–417. [Google Scholar] [CrossRef] [PubMed]

- Blair, K.S.; Finger, E.; Marsh, A.A.; Morton, J.; Mondillo, K.; Búzás, B.; Goldman, D.; Drevets, W.C.; Blair, R.J.R. The role of 5-HTTLPR in choosing the lesser of two evils, the better of two goods: Examining the impact of 5-HTTLPR genotype and tryptophan depletion in object choice. Psychopharmacology 2008, 196, 29–38. [Google Scholar] [CrossRef]

- Campos-Vazquez, R.M.; Cuilty, E. The role of emotions on risk aversion: A Prospect Theory experiment. J. Behav. Exp. Econ. 2014, 50, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Bush, G.; Luu, P.; Posner, M.I. Cognitive and emotional influences in anterior cingulate cortex. Trends Cogn. Sci. 2000, 4, 215–222. [Google Scholar] [CrossRef]

- Davis, K.D.; Taylor, K.S.; Hutchison, W.D.; Dostrovsky, J.O.; McAndrews, M.P.; Richter, E.O.; Lozano, A. Human Anterior Cingulate Cortex Neurons Encode Cognitive and Emotional Demands. J. Neurosci. 2005, 25, 8402–8406. [Google Scholar] [CrossRef] [Green Version]

- Etkin, A.; Egner, T.; Peraza, D.M.; Kandel, E.R.; Hirsch, J. Resolving Emotional Conflict: A Role for the Rostral Anterior Cingulate Cortex in Modulating Activity in the Amygdala. Neuron 2006, 51, 871–882. [Google Scholar] [CrossRef] [Green Version]

- Stevens, F.L.; Hurley, R.A.; Taber, K.H. Anterior Cingulate Cortex: Unique Role in Cognition and Emotion. J. Neuropsychiatry Clin. Neurosci. 2011, 23, 121–125. [Google Scholar] [CrossRef]

- Shiv, B.; Loewenstein, G.; Bechara, A.; Damasio, H.; Damasio, A.R. Investment Behavior and the Negative Side of Emotion. Psychol. Sci. 2005, 16, 435–439. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z.J.; Panfilova, E.; Mikhaylov, A.; Kurilova, A. Assessing Stability in the Relationship Between Parties in Crowfunding and Crowdsourcing Projects During the COVID-19 Crisis. J. Glob. Inf. Manag. 2022, 30, 1–18. [Google Scholar]

- Barykin, S.E.; Mikheev, A.A.; Kiseleva, E.G.; Putikhin, Y.E.; Alekseeva, N.S.; Mikhaylov, A.Y. An Empirical Analysis of Russian Regions’ Debt Sustainability. Economies 2022, 10, 106. [Google Scholar] [CrossRef]

- Mikhaylov, A.Y. Development of Friedrich von Hayek’s Theory of Private Money and Economic Implications for Digital Currencies. Terra Econ. 2021, 19, 53–62. [Google Scholar] [CrossRef]

- Sen, S.; Burmeister, M.; Ghosh, D. Meta-analysis of the association between a serotonin transporter promoter polymorphism (5-HTTLPR) and anxiety-related personality traits. Am. J. Med. Genet. 2004, 127B, 85–89. [Google Scholar] [CrossRef] [Green Version]

- Sokol-Hessner, P.; Hsu, M.; Curley, N.G.; Delgado, M.R.; Camerer, C.F.; Phelps, E.A. Thinking like a trader selectively reduces individuals’ loss aversion. Proc. Natl. Acad. Sci. USA 2009, 106, 5035–5040. [Google Scholar] [CrossRef] [Green Version]

- De Martino, B.; Camerer, C.F.; Adolphs, R. Amygdala damage eliminates monetary loss aversion. Proc. Natl. Acad. Sci. USA 2010, 107, 3788–3792. [Google Scholar] [CrossRef] [Green Version]

- Stancak, A.; Xie, Y.; Fallon, N.; Bulsing, P.; Giesbrecht, T.; Thomas, A.; Pantelous, A.A. Unpleasant odors increase aversion to monetary losses. Biol. Psychol. 2015, 107, 1–9. [Google Scholar] [CrossRef]

- Lönnqvist, J.-E.; Verkasalo, M.; Walkowitz, G.; Wichardt, P.C. Measuring individual risk attitudes in the lab: Task or ask? An empirical comparison. J. Econ. Behav. Organ. 2015, 119, 254–266. [Google Scholar] [CrossRef] [Green Version]

- Holt, C.; Laury, S. Risk aversion and incentive effects. Am. Econ. Rev. 2002, 92, 1644–1655. [Google Scholar] [CrossRef]

| Authors | Sample | Genetical Measures | Health & Behavioral Profile | Risk Aversion Measures | Results |

|---|---|---|---|---|---|

| Crişan et al. [33] | 32 participants (23 women, M = 26.75 years, SD = 6.69) | Genotyping for the 5-HTTLPR: s/s, s/l and l/l | Healthy volunteers *. s-carriers show higher anxiety trait. No other behavioral variables were reported | Risk-taking with BART; Framing effect with a gambling task | The s-carriers showed higher risk aversion and framing effect than l-homozygotes, without controlling for anxiety trait |

| Khunen and Chiao, [30] | 65 participants (48 women, M = 22.4 years, SD = 4.9) | Genotyping for the 5-HTTLPR: s/s, s/l and l/l; and for the DRD4: 7R+ vs. 7R− allele | No health or behavioral variables were reported | Risk-taking with investment task | s/s homozygotes took less risk than s/l or l/l-; 7R+ carriers took more risk than 7R− carriers |

| Roe et al. [42] | 67 participants (29 women, M = 20.6 years, SD = 3.2) | Genotyping for COMT Val158Met: Met/Met, Met/Val and Val/Val | 55 healthy volunteers * and 12 participants diagnosed with depression, bipolar disorder or another. No other behavioral variables were reported | Risk attitudes with a gambling task | Risk attitudes were not associated with COMT polymorphism. Analysis did not control for the pathological conditions |

| Roiser et al. [43] | 30 participants | Genotyping for the 5-HTTLPR: s/s and l/l | Healthy volunteers *. Personality, impulsiveness and state-trait anxiety were not reported, but controlled in further analysis | Framing effect with a gambling task | The s/s genotype group exhibited a greater amygdala activity and framing effect while making choices than s/l or l/l genotype (controlling for behavioral and health variables) |

| Zhong et al. [44] | 350 participants (188 women, M = 28.2, SD = 10.8) | Genotyping for the 5-HTTLPR: s/s, s/l and l/l; and for the DAT1: 9R vs. 10R allele | No health or behavioral variables were reported | Risk attitudes with multiple price list design | l-carriers of 5-HTTLPR tended to be (not significant) more risk-tolerant over losses than s-carriers; 9R carriers of DAT1 were more risk-tolerant over gains than 10R |

| Dreber et al. [18] | 98 male participants (ranging from 18 to 23 years) | Genotyping for the DRD4: 7R+ vs. 7R− allele; and for the DRD2 Taq1a/ANKK1: A1+ vs. A1- | Healthy volunteers *. No other behavioral or health variables were reported | Risk preferences with an investment task | No associations were found between the A1+ carriers and risk preferences. 7R+ carriers were more risk loving than 7R− |

| Dreber et al. [45] | 237 participants | Genotyping for the DRD4: 7R+ vs. 7R− allele | No health or behavioral variables were reported | Risk-taking in the card game bridge, and an investment task | 7R+ men showed higher risk-taking in bridge and investment task than 7R−. No effects in women |

| Eisenegger et al. [46] | 205 male participants (M = 23.5 years, SD = 3.6) | Genotyping for the DRD4: 7R+ vs. 7R− allele | Healthy volunteers *. No other behavioral or health variables were reported | Risk-taking with a gambling task | No relation between genotype and risk-taking was found directly, but 7R+ carriers showed an increased gambling propensity after dopaminergic stimulation |

| Frydman et al. [47] | 83 male participants | Genotyping for the 5-HTTLPR: s/s, s/l and l/l; for the DRD4: 7R+ vs. 7R− allele; and for the MAOA: MAOA-H vs. MAOA-L | No health or behavioral variables were reported | Risk-taking with a gambling task | MAOA-L carriers were more likely to take financial risks. No differences among the 5-HTTLPR and DRD4 polymorphisms |

| Amstadter et al. [48] | 223 children (44.4% female, M = 11.3 years) | Genotyping for the COMT Val158Met: Met/Met, Met/Val and Val/Val | Healthy * volunteers. No other behavioral or health variables were reported | Risk-taking with BART | Females Met-carriers, but not males, showed higher risk taking compared to Val homozygotes |

| Dreber et al. [49] | 135 participants (women 8%, median age was 43 years) | Genotyping for the DRD4: 7R+ vs. 7R− allele; and for MAOA gene: MAOA-H vs. MAOA-L | No health or behavioral variables were reported | Risk-taking with an investment task | No significant relations were found between genes and risk-taking |

| Heitland et al. [50] | 60 females (M = 20.87 years, SD = 1.98) | Genotyping for the DAT1: 9R+ vs. 9R− allele; for the COMT Val158Met: Met/Met, Met/Val and Val/Val; and for the 5-HTTLPR: s/s, s/l and l/l | Healthy volunteers *. No other behavioral or health variables were reported | Risk-taking with a gambling task | DAT1 9R+ allele showed a trend toward increased risk-taking following losses (no significant effect). Genotypes of COMT did not show any relation with risk-taking. 5-HTTLPR s-carriers showed decreased risk-taking following gains. |

| Mata et al. [51] | 322 participants (234 women; M = 23.8 years, SD = 6.2) | Genotyping for the DAT1: 9R vs. 10R allele | Healthy volunteers *. No other behavioral or health variables were reported | Risk-taking with BART | 10R allele showed increased risk-taking respect to 9R |

| Harrati, [26] | 10,455 adults | Over 2.5 million Single Nucleotide Polymorphisms (SNPs) from respondents | No health or behavioral variables were reported | Risk aversion through responses to a series of hypothetical gambles on lifetime income from HRS | None of the single-nucleotide polymorphisms were found to be determinants of risk aversion |

| Anderson et al. [52] | 174 participants | Genotyping for the 5-HTTLPR polymorphism: s/s, s/l and l/l; and for the DRD4 gene: 7R+ vs. 7R− allele | No health or behavioral variables were reported | Risk-taking with a multiple price listing | No significant correlations between the two genes and risk-taking |

| Gao et al. [53] | 111 students (36% women, M = 21.78 years, SD = 61.92) | Genotyping for the COMT Val158Met: Met/Met, Met/Val and Val/Val | Healthy volunteers *. No other behavioral or health variables were reported | Framing effect with a gambling task | The Met-carriers showed greater framing effect than Val/Val homozygotes and this was mediated by resting-connectivity between orbitofrontal cortex and bilateral amygdala |

| Gao et al. [42] | 1582 students (80.1% women, M = 18.66 years, SD = 60.90) | Gene-based approach considering 26 genes from the serotoninergic and dopaminergic pathways | Healthy volunteers *. Normal range of depressive and anxiety symptoms. No other behavioral or health variables were reported | Framing effect with a gambling task | Genetic variations of the SLC6A4, the COMT and DDC genes were associated with the framing-effect |

| Wagels et al. [54] | 105 male participants | Genotyping for the MAOA LPR: MAOA-S vs. MAOA-L | Healthy volunteers *. Anxiety and aggressiveness were not reported but controlled in further analysis. No other behavioral or health variables were reported | Risk-taking with BART | MAOA s-carriers showed less automatic harm avoidance, but no differences were found in BART. MAOA s-carriers were more risk-taking after testosterone administration. These results were found controlling for anxiety and aggressiveness |

| Muda et al. [55] | 113 investors, M = 33.70 years, SD = 9.95 & 104 non-investors, M = 32.34, SD = 10.00) | Genotyping for the DRD4: 7R+ vs. 7R− allele | No health or behavioral variables were reported | Risk-taking with a gambling task | No differences in risk-taking between 7R+ and 7R− individuals |

| Neukam et al. [56] | 577 participants | Genotyping for the 5-HTTLPR: s/s and l/l | Healthy volunteers *. No other behavioral or health variables were reported | Risk-taking with Value-based decision-making battery | s/s homozygotes were more risk-seeking for losses compared to s/l and l/l |

| Authors | Sample | Genetical Measures | Health & Behavioral Profile | Loss Aversion Measures | Results |

|---|---|---|---|---|---|

| He et al. [31] | 572 participants (312 females, M = 20.47 years, SD = 1.01) | Genotyping for the 5-HTTLPR: s/s, s/l and l/l | Healthy volunteers *. No other behavioral or health variables were reported | Loss aversion with a mixed gamble task | s/s individuals had higher loss aversion and these effects were stronger for males than females |

| Ernst et al. [57] | 66 adolescents | Genotyping for the 5-HTTLPR: s/s, s/l and l/l | 27 participants with (only) anxiety disorder and 39 healthy *. No other behavioral or health variables were reported. | Loss aversion with a mixed gamble task | No differences between genotypes in healthy controls. Lower loss aversion in l/l anxious individuals. No effect in s/s anxious adolescents |

| Anderson et al. [52] | 174 participants | Genotyping for the 5-HTTLPR: s/s, s/l and l/l; and for the DRD4: 7R+ vs. 7R− allele | No health or behavioral variables were reported | Loss aversion with hypothetical choices in a survey | No significant correlations between the two genes and loss aversion |

| Voigt et al. [32] | 143 participants (114 females, M = 21.8 years, SD = 4.04) | Genotyping for the BDNF Val66Met: Val/Val, Val/Met and Met/Met; and for the DRD2 Taq1a/ANKK1: A1A1, A1A2 and A2A2 | No health or behavioral variables were reported | Loss aversion with a mixed gamble task | Significant interaction of the 2 polymorphisms: carriers of the genetic constellation Met+/A1+ show the lowest loss aversion |

| Neukam et al. [56] | 611 participants | Genotyping for the 5-HTTLPR: s/s, s/l and l/l | Healthy volunteers *. No other behavioral or health variables were reported | Loss aversion with a mixed gamble task | No significant results were found |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Molins, F.; Sahin, F.; Serrano, M.Á. The Genetics of Risk Aversion: A Systematic Review. Int. J. Environ. Res. Public Health 2022, 19, 14307. https://doi.org/10.3390/ijerph192114307

Molins F, Sahin F, Serrano MÁ. The Genetics of Risk Aversion: A Systematic Review. International Journal of Environmental Research and Public Health. 2022; 19(21):14307. https://doi.org/10.3390/ijerph192114307

Chicago/Turabian StyleMolins, Francisco, Fatmanur Sahin, and Miguel Ángel Serrano. 2022. "The Genetics of Risk Aversion: A Systematic Review" International Journal of Environmental Research and Public Health 19, no. 21: 14307. https://doi.org/10.3390/ijerph192114307