Air Pollution and Corporate Green Financial Constraints: Evidence from China’s Listed Companies

Abstract

:1. Introduction

2. Institutional Background

3. Literature Review

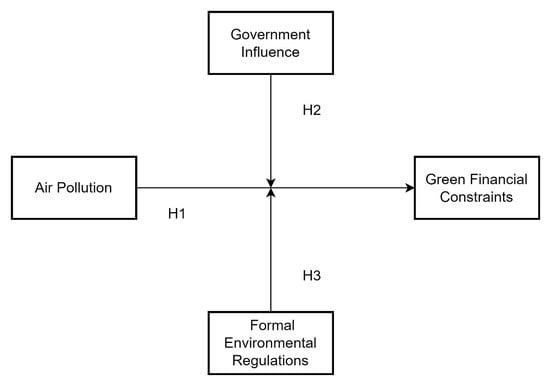

4. Hypotheses Development

4.1. Air Pollution and Financial Constraints of Green Investment

4.2. The Moderating Effect of Government Influence

5. Methods

5.1. Sample Selection and Data Sources

5.2. Variables

5.2.1. Financial Constraints of Green Investments

5.2.2. Air Pollution

5.2.3. Government Influence and Formal Environmental Regulations

5.3. Model

6. Results

6.1. Descriptive Statistics of Variables

6.2. Regression Analysis

6.3. Robust Tests

6.4. Further Analysis

7. Discussion

7.1. Theoretical and Practical Implications

7.2. Limitations and Future Research

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Brammer, S.; Hoejmose, S.; Marchant, K. Environmental management in SME s in the UK: Practices, pressures and perceived benefits. Bus. Strategy Environ. 2012, 21, 423–434. [Google Scholar] [CrossRef]

- D’Orazio, P.; Valente, M. The role of finance in environmental innovation diffusion: An evolutionary modeling approach. J. Econ. Behav. Organ. 2019, 162, 417–439. [Google Scholar] [CrossRef]

- He, L.; Liu, R.; Zhong, Z.; Wang, D.; Xia, Y. Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Qin, J.; Zhao, Y.; Xia, L. Carbon emission reduction with capital constraint under greening financing and cost sharing contract. Int. J. Environ. Res. Public Health 2018, 15, 750. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Huang, W.; Luo, Y.; Wang, X.; Xiao, L. Controlling shareholder pledging and corporate ESG behavior. Res. Int. Bus. Financ. 2022, 61, 101655. [Google Scholar] [CrossRef]

- Greening, D.W.; Gray, B. Testing a model of organizational response to social and political issues. Acad. Manag. J. 1994, 37, 467–498. [Google Scholar] [CrossRef]

- Liao, Z. Institutional pressure, knowledge acquisition and a firm’s environmental innovation. Bus. Strategy Environ. 2018, 27, 849–857. [Google Scholar] [CrossRef]

- Chang, L.; Li, W.; Lu, X. Government engagement, environmental policy, and environmental performance: Evidence from the most polluting Chinese listed firms. Bus. Strategy Environ. 2015, 24, 1–19. [Google Scholar] [CrossRef]

- Quan, Y.; Wu, H.; Li, S.; Ying, S.X. Firm sustainable development and stakeholder engagement: The role of government support. Bus. Strategy Environ. 2018, 27, 1145–1158. [Google Scholar] [CrossRef]

- Hao, Y.; Peng, H.; Temulun, T.; Liu, L.-Q.; Mao, J.; Lu, Z.-N.; Chen, H. How harmful is air pollution to economic development? New evidence from PM2.5 concentrations of Chinese cities. J. Clean. Prod. 2018, 172, 743–757. [Google Scholar] [CrossRef]

- Chen, H.; Tan, X.; Qun, C. Air pollution, auditors’ pessimistic bias and audit quality: Evidence from China. Sustain. Account. Manag. Policy J. 2020, 12, 74–104. [Google Scholar] [CrossRef]

- Huang, J.; Xu, N.; Yu, H. Pollution and performance: Do investors make worse trades on hazy days? Manag. Sci. 2020, 66, 4455–4476. [Google Scholar] [CrossRef]

- Chang, T.Y.; Graff Zivin, J.; Gross, T.; Neidell, M. The effect of pollution on worker productivity: Evidence from call center workers in China. Am. Econ. J. Appl. Econ. 2019, 11, 151–172. [Google Scholar] [CrossRef] [Green Version]

- Fan, F.; Lian, H.; Liu, X.; Wang, X. Can environmental regulation promote urban green innovation Efficiency? An empirical study based on Chinese cities. J. Clean. Prod. 2021, 287, 125060. [Google Scholar] [CrossRef]

- Musah, M.; Owusu-Akomeah, M.; Kumah, E.A.; Mensah, I.A.; Nyeadi, J.D.; Murshed, M.; Alfred, M. Green investments, financial development, and environmental quality in Ghana: Evidence from the novel dynamic ARDL simulations approach. Environ. Sci. Pollut. Res. 2022, 29, 31972–32001. [Google Scholar] [CrossRef] [PubMed]

- Singh, S.K.; Del Giudice, M.; Chierici, R.; Graziano, D. Green innovation and environmental performance: The role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Change 2020, 150, 119762. [Google Scholar] [CrossRef]

- Yin, J.; Zhang, Y. Institutional dynamics and corporate social responsibility (CSR) in an emerging country context: Evidence from China. J. Bus. Ethics 2012, 111, 301–316. [Google Scholar] [CrossRef]

- Liu, Q. Corporate governance in China: Current practices, economic effects and institutional determinants. CESifo Econ. Stud. 2006, 52, 415–453. [Google Scholar] [CrossRef]

- Zheng, D.; Shi, M. Multiple environmental policies and pollution haven hypothesis: Evidence from China’s polluting industries. J. Clean. Prod. 2017, 141, 295–304. [Google Scholar] [CrossRef]

- Pan, X.; Chen, X.; Sinha, P.; Dong, N. Are firms with state ownership greener? An institutional complexity view. Bus. Strategy Environ. 2020, 29, 197–211. [Google Scholar] [CrossRef]

- Zhong, M.; Lu, F.; Zhu, Y.; Chen, J. What Corporate Social Responsibility (CSR) Disclosures Do Chinese Forestry Firms Make on Social Media? Evidence from WeChat. Forests 2022, 13, 1842. [Google Scholar] [CrossRef]

- Hanlon, W.W. Coal Smoke and the Costs of the Industrial Revolution; National Bureau of Economic Research: Cambridge, MA, USA, 2016. [Google Scholar]

- Hanna, R.; Oliva, P. The effect of pollution on labor supply: Evidence from a natural experiment in Mexico City. J. Public Econ. 2015, 122, 68–79. [Google Scholar] [CrossRef] [Green Version]

- Dong, R.; Fisman, R.; Wang, Y.; Xu, N. Air pollution, affect, and forecasting bias: Evidence from Chinese financial analysts. J. Financ. Econ. 2021, 139, 971–984. [Google Scholar] [CrossRef]

- Hu, N.; Xue, X.; Liu, L. The impact of air pollution on financial reporting quality: Evidence from China. Account. Financ. 2022, 62, 3609–3644. [Google Scholar] [CrossRef]

- Wang, L.; Xing, F.; Yu, Y.; Dai, Y. Does severe air pollution affect firm innovation: Evidence from China. Appl. Econ. Lett. 2021, 28, 551–558. [Google Scholar] [CrossRef]

- Chen, J.; Wang, L.; Li, Y. Natural resources, urbanization and regional innovation capabilities. Resour. Policy 2020, 66, 101643. [Google Scholar] [CrossRef]

- Chan, K.C.; Chen, T.; Liu, B.; Wu, J. Air pollution and CEO compensation: Evidence from China. J. Econ. Manag. Strategy 2022, 31, 448–469. [Google Scholar] [CrossRef]

- Deng, D.; Li, C.; Zu, Y.; Liu, L.Y.J.; Zhang, J.; Wen, S. A Systematic Literature Review on Performance Evaluation of Power System from the Perspective of Sustainability. Front. Environ. Sci. 2022, 10, 925332. [Google Scholar] [CrossRef]

- Chen, J.; Wang, L.; Li, Y. Research on the Impact of Multi-dimensional Urbanization on China’s Carbon Emissions under the Background of COP21. J. Environ. Manag. 2020, 273, 111123. [Google Scholar] [CrossRef]

- Attig, N.; Cleary, S.W.; El Ghoul, S.; Guedhami, O. Corporate legitimacy and investment–cash flow sensitivity. J. Bus. Ethics 2014, 121, 297–314. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef] [Green Version]

- Zhang, B.; Yang, Y.; Bi, J. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. J. Environ. Manag. 2011, 92, 1321–1327. [Google Scholar] [CrossRef] [PubMed]

- Li, L.; Chen, J.; Gao, H.; Xie, L. The certification effect of government R&D subsidies on innovative entrepreneurial firms’ access to bank finance: Evidence from China. Small Bus. Econ. 2019, 52, 241–259. [Google Scholar] [CrossRef]

- Wu, J.; Chen, X. Home country institutional environments and foreign expansion of emerging market firms. Int. Bus. Rev. 2014, 23, 862–872. [Google Scholar] [CrossRef]

- Song, Z.; Nahm, A.; Yang, J. Institutional environment, political connections of partial state ownership, and performance: An empirical study on listed private sector firms in China. Int. J. Soc. Econ. 2016, 43, 856–870. [Google Scholar] [CrossRef]

- Zhong, M.; Zhao, W.; Shahab, Y. The philanthropic response of substantive and symbolic corporate social responsibility strategies to COVID-19 crisis: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 339–355. [Google Scholar] [CrossRef]

- Child, J.; Tse, D.K. China’s transition and its implications for international business. J. Int. Bus. Stud. 2001, 32, 5–21. [Google Scholar] [CrossRef]

- Brandt, L.; Li, H. Bank discrimination in transition economies: Ideology, information, or incentives? J. Comp. Econ. 2003, 31, 387–413. [Google Scholar] [CrossRef] [Green Version]

- Chen, S.; Sun, Z.; Tang, S.; Wu, D. Government intervention and investment efficiency: Evidence from China. J. Corp. Financ. 2011, 17, 259–271. [Google Scholar] [CrossRef]

- Zhao, W.; Zhong, M.; Liao, X.; Ye, C.; Deng, D. Board Network and CSR Decoupling: Evidence From China. Front. Psychol. 2022, 13. [Google Scholar] [CrossRef]

- Fazzari, S.; Hubbard, R.G.; Petersen, B.C. Financing constraints and corporate investment. Brook. Pap. Econ. Act. 1987, 1, 141–206. [Google Scholar] [CrossRef]

- Li, W.; Lu, X. Institutional interest, ownership type, and environmental capital expenditures: Evidence from the most polluting Chinese listed firms. J. Bus. Ethics 2016, 138, 459–476. [Google Scholar] [CrossRef]

- Patten, D.M. The impact of the EPA’s TRI disclosure program on state environmental and natural resource expenditures. J. Account. Public Policy 1998, 17, 367–382. [Google Scholar] [CrossRef]

- Song, C.; He, J.; Wu, L.; Jin, T.; Chen, X.; Li, R.; Ren, P.; Zhang, L.; Mao, H. Health burden attributable to ambient PM2.5 in China. Environ. Pollut. 2017, 223, 575–586. [Google Scholar] [CrossRef] [PubMed]

- Van Donkelaar, A.; Martin, R.V.; Brauer, M.; Hsu, N.C.; Kahn, R.A.; Levy, R.C.; Lyapustin, A.; Sayer, A.M.; Winker, D.M. Global estimates of fine particulate matter using a combined geophysical-statistical method with information from satellites, models, and monitors. Environ. Sci. Technol. 2016, 50, 3762–3772. [Google Scholar] [CrossRef] [PubMed]

- Anenberg, S.C.; Miller, J.; Minjares, R.; Du, L.; Henze, D.K.; Lacey, F.; Malley, C.S.; Emberson, L.; Franco, V.; Klimont, Z. Impacts and mitigation of excess diesel-related NOx emissions in 11 major vehicle markets. Nature 2017, 545, 467–471. [Google Scholar] [CrossRef] [PubMed]

- Xie, R.; Sabel, C.E.; Lu, X.; Zhu, W.; Kan, H.; Nielsen, C.P.; Wang, H. Long-term trend and spatial pattern of PM2.5 induced premature mortality in China. Environ. Int. 2016, 97, 180–186. [Google Scholar] [CrossRef]

- Zhan, Y.; Luo, Y.; Deng, X.; Chen, H.; Grieneisen, M.L.; Shen, X.; Zhu, L.; Zhang, M. Spatiotemporal prediction of continuous daily PM2.5 concentrations across China using a spatially explicit machine learning algorithm. Atmos. Environ. 2017, 155, 129–139. [Google Scholar] [CrossRef]

- Chen, Y.; Jin, G.Z.; Kumar, N.; Shi, G. The promise of Beijing: Evaluating the impact of the 2008 Olympic Games on air quality. J. Environ. Econ. Manag. 2013, 66, 424–443. [Google Scholar] [CrossRef]

- Du, X.; Weng, J.; Zeng, Q.; Chang, Y.; Pei, H. Do lenders applaud corporate environmental performance? Evidence from Chinese private-owned firms. J. Bus. Ethics 2017, 143, 179–207. [Google Scholar] [CrossRef]

- Wang, Q.; Wong, T.-J.; Xia, L. State ownership, the institutional environment, and auditor choice: Evidence from China. J. Account. Econ. 2008, 46, 112–134. [Google Scholar] [CrossRef]

- Wang, Y.; Delgado, M.S.; Khanna, N.; Bogan, V.L. Good news for environmental self-regulation? Finding the right link. J. Environ. Econ. Manag. 2019, 94, 217–235. [Google Scholar] [CrossRef]

- Chen, X.; Yi, N.; Zhang, L.; Li, D. Does institutional pressure foster corporate green innovation? Evidence from China’s top 100 companies. J. Clean. Prod. 2018, 188, 304–311. [Google Scholar] [CrossRef]

- Wang, X.; Wang, L. State-enterprise relation, local economic priority, and corporate environmental responsibility. Appl. Econ. 2019, 51, 995–1009. [Google Scholar] [CrossRef]

- Bansal, P.; Roth, K. Why companies go green: A model of ecological responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar] [CrossRef]

- Maxwell, J.W.; Decker, C.S. Voluntary environmental investment and responsive regulation. Environ. Resour. Econ. 2006, 33, 425–439. [Google Scholar] [CrossRef]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of environmental innovation in US manufacturing industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Adopting proactive environmental strategy: The influence of stakeholders and firm size. J. Manag. Stud. 2010, 47, 1072–1094. [Google Scholar] [CrossRef]

- Buchard, V.; Da Silva, A.; Randles, C.; Colarco, P.; Ferrare, R.; Hair, J.; Hostetler, C.; Tackett, J.; Winker, D. Evaluation of the surface PM2.5 in Version 1 of the NASA MERRA Aerosol Reanalysis over the United States. Atmos. Environ. 2016, 125, 100–111. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The central role of the propensity score in observational studies for causal effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Andrews, S.Q. Inconsistencies in air quality metrics: ‘Blue Sky’ days and PM10 concentrations in Beijing. Environ. Res. Lett. 2008, 3, 034009. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

| Variable | Name | Measurement |

|---|---|---|

| Dependent Variable | ||

| Environmental Investment | EPI | Environmental capital expenditure/initial fixed assets |

| Independent Variables | ||

| Net cash flow | CF | Operating cash flow/initial fixed assets |

| Air pollution | AIR | PM2.5 concentrations in each city |

| Control Variables | ||

| Size | Size | The natural logarithm of the total assets |

| Leverage | Lev | The ratio of total liabilities to total assets |

| Cash | Cash | The ratio of cash balance to total assets |

| Tobin’s Q ratio | Q | (Market value of equity + book value of liability)/total assets |

| Growth | Growth | Operating income growth/previous operating income |

| Fixed assets ratio | PPE | The ratio of fixed assets over total assets |

| Majority shareholder | First | Percentage of shares held by the largest shareholder |

| CEO Duality | Dual | If the chairman and CEO are the same person, 1, otherwise 0 |

| State | State | If the firm belongs to state-owned firm, State = 1, 0 otherwise |

| Age | Age | Years elapsed since the firm was listed |

| Economic growth | GDP | The natural logarithm of regional GDP |

| Government influence-market | GI-market | The marketization index |

| Government influence-region | GI-Region | If the register place of the firm locates in the eastern region, GI_Region = 1, 0 otherwise |

| Formal environmental regulations | Elaw | The number of the newly formulated environmental regulations in each province |

| Net debt financing | DF | Net debt financing/initial fixed assets |

| Industry | Indus | Industry dummy variables |

| Year | Year | Year dummy variables |

| Variable | N | Mean | Std. Dev. | Median | Min | Max |

|---|---|---|---|---|---|---|

| EPI | 2248 | 0.045 | 0.158 | 0.004 | 0 | 1.780 |

| CF | 2248 | 0.229 | 0.657 | 0.174 | −5.020 | 8.870 |

| AIR | 2248 | 0.412 | 0.163 | 0.401 | 0.026 | 0.926 |

| Size | 2248 | 21.700 | 1.370 | 21.600 | 18.400 | 25.700 |

| Lev | 2248 | 0.500 | 0.180 | 0.515 | 0.048 | 0.928 |

| Cash | 2248 | 0.147 | 0.102 | 0.119 | 0.004 | 0.616 |

| Q | 2248 | 2.100 | 1.370 | 1.690 | 0.795 | 15.10 |

| Growth | 2248 | 0.268 | 1.790 | 0.060 | −0.928 | 49.200 |

| PPE | 2248 | 0.382 | 0.238 | 0.354 | 0.008 | 3.330 |

| First | 2248 | 0.382 | 0.159 | 0.364 | 0.051 | 0.840 |

| Dual | 2248 | 0.145 | 0.352 | 0 | 0 | 1 |

| State | 2248 | 0.688 | 0.463 | 1 | 0 | 1 |

| Age | 2248 | 10.600 | 5.360 | 11 | 1 | 23 |

| GDP | 2248 | 9.810 | 0.845 | 9.860 | 6.820 | 11.300 |

| GI-market | 2248 | 7.300 | 1.870 | 7.160 | 2.330 | 11.700 |

| GI-region | 2248 | 0.502 | 0.500 | 1 | 0 | 1 |

| Elaw | 2248 | 2.190 | 2.780 | 1 | 0 | 23 |

| DF | 2248 | 1.640 | 4.420 | 0.817 | 0 | 101.000 |

| Sector | N | Percent | Mean | Median | Min | Max |

|---|---|---|---|---|---|---|

| Agriculture | 60 | 2.67% | 0.012 | 0.002 | 0 | 0.142 |

| Mining and quarrying | 100 | 4.45% | 0.030 | 0.004 | 0 | 1.210 |

| Manufacture of foods | 196 | 8.72% | 0.007 | 0.003 | 0 | 0.073 |

| Manufacture of textiles, clothing, and related products | 84 | 3.74% | 0.044 | 0.005 | 0 | 1.270 |

| Manufacture of paper and related products | 98 | 4.36% | 0.034 | 0.004 | 0 | 1.530 |

| Manufacture of petroleum and chemical raw material production | 373 | 16.59% | 0.053 | 0.006 | 0 | 1.780 |

| Pharmaceuticals | 175 | 7.78% | 0.032 | 0.004 | 0 | 1.530 |

| Manufacture of chemicals (fiber, rubber, plastic, etc.) | 149 | 6.63% | 0.039 | 0.006 | 0 | 0.991 |

| Smelting and processing of metal | 253 | 11.25% | 0.026 | 0.007 | 0 | 0.852 |

| Manufacture of machinery (general/special purpose) | 157 | 6.98% | 0.041 | 0.006 | 0 | 1.090 |

| Manufacture of equipment (electrical and electronic equipment) communication equipment manufacturing | 146 | 6.49% | 0.070 | 0.004 | 0 | 1.780 |

| Utilities (electric power, heat power, gas, tap water) | 193 | 8.59% | 0.040 | 0.003 | 0 | 0.991 |

| Construction | 37 | 1.65% | 0.110 | 0.013 | 0 | 0.978 |

| Wholesale and retail trades | 40 | 1.78% | 0.052 | 0.003 | 0 | 0.991 |

| Transport, storage, and postal services | 36 | 1.60% | 0.003 | 0.001 | 0 | 0.067 |

| Real estate | 36 | 1.56% | 0.088 | 0.032 | 0 | 0.682 |

| Administration of water, environment, and public facilities | 43 | 1.60% | 0.126 | 0.072 | 0 | 1.110 |

| Other services | 72 | 2.72% | 0.066 | 0.002 | 0 | 1.310 |

| Total | 2248 | 100.00 | 0.045 | 0.004 | 0 | 1.780 |

| Variables | EPI | CF | AIR | Size | Lev | Cash | Q | Growth |

|---|---|---|---|---|---|---|---|---|

| EPI | 1.000 | |||||||

| CF | 0.124 * | 1.000 | ||||||

| AIR | −0.003 | 0.013 | 1.000 | |||||

| Size | −0.110 * | 0.080 * | 0.034 | 1.000 | ||||

| Lev | −0.035 | −0.055 * | 0.034 | 0.403 * | 1.000 | |||

| Cash | 0.141 * | 0.077 * | 0.012 | −0.078 * | −0.305 * | 1.000 | ||

| Q | 0.086 * | 0.069 * | −0.049 | −0.214 * | −0.334 * | 0.179 * | 1.000 | |

| Growth | 0.021 | −0.023 | 0.016 | −0.091 * | 0.029 | 0.030 | 0.039 | 1.000 |

| PPE | −0.090 * | −0.066 * | −0.024 | 0.097 * | 0.044 | −0.330 * | −0.082 * | −0.139 * |

| First | −0.012 | 0.023 | 0.058 * | 0.300 * | 0.033 | −0.003 | −0.067 * | −0.022 |

| Dual | 0.061 * | 0.008 | −0.012 | −0.102 * | −0.086 * | 0.060 * | 0.075 * | −0.029 |

| State | −0.084 * | −0.040 | 0.054 | 0.206 * | 0.231 * | −0.154 * | −0.174 * | 0.019 |

| Age | −0.076 * | −0.038 | −0.025 | 0.228 * | 0.240 * | −0.206 * | −0.067 * | 0.001 |

| GDP | −0.009 | 0.017 | 0.306 * | 0.130 * | −0.090 * | 0.082 * | 0.061 * | −0.059 * |

| Market | −0.000 | 0.017 | 0.364 * | −0.019 | −0.111 * | 0.100 * | −0.056 * | −0.008 |

| PPE | First | Dual | State | Age | GDP | Market | ||

| PPE | 1.000 | |||||||

| First | 0.148 * | 1.000 | ||||||

| Dual | −0.020 | −0.126 * | 1.000 | |||||

| State | 0.191 * | 0.240 * | −0.189 * | 1.000 | ||||

| Age | −0.017 | −0.121 * | −0.080 * | 0.211 * | 1.000 | |||

| GDP | −0.137 * | −0.135 * | 0.101 * | −0.222 * | 0.097 * | 1.000 | ||

| Market | −0.154 * | −0.071 * | 0.073 * | −0.184 * | −0.043 | 0.604 * | 1.000 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CF | 0.074 *** | 0.080 *** | 0.075 *** | 0.081 *** |

| (14.59) | (15.60) | (14.68) | (15.76) | |

| AIR × CF | −0.227 *** | −0.232 *** | ||

| (−6.53) | (−6.80) | |||

| AIR | 0.003 | 0.027 | ||

| (0.13) | (1.18) | |||

| Size | −0.016 *** | −0.017 *** | ||

| (−4.81) | (−5.08) | |||

| Lev | 0.082 *** | 0.081 *** | ||

| (3.52) | (3.53) | |||

| Cash | 0.185 *** | 0.186 *** | ||

| (4.90) | (4.98) | |||

| Q | 0.002 | 0.002 | ||

| (0.50) | (0.52) | |||

| Growth | 0.000 | 0.001 | ||

| (0.13) | (0.37) | |||

| PPE | −0.023 | −0.020 | ||

| (−1.36) | (−1.19) | |||

| First | 0.018 | 0.014 | ||

| (0.75) | (0.59) | |||

| Dual | 0.017 * | 0.017 * | ||

| (1.80) | (1.76) | |||

| State | −0.008 | −0.010 | ||

| (−0.99) | (−1.19) | |||

| Age | −0.001 | −0.001 | ||

| (−0.84) | (−0.79) | |||

| GDP | −0.016 ** | −0.017 ** | ||

| (−2.28) | (−2.44) | |||

| Market | 0.004 | 0.003 | ||

| (1.34) | (1.00) | |||

| Cons | −0.037 | −0.040 | 0.341 *** | 0.362 *** |

| (−1.31) | (−1.41) | (4.21) | (4.48) | |

| Sigma_cons | 0.154 *** | 0.153 *** | 0.152 *** | 0.150 *** |

| (63.99) | (64.00) | (63.93) | (63.94) | |

| Industry fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 2248 | 2248 | 2248 | 2248 |

| χ2-statistic | 318.300 | 360.621 | 392.904 | 440.431 |

| Variables | High Marketization Region (Low Government Influence) | Low Marketization Region (High Government Influence) | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| CF | 0.127 *** | 0.129 *** | 0.034 *** | 0.052 *** |

| (16.25) | (15.59) | (5.40) | (7.08) | |

| AIR × CF | 0.047 | −0.216 *** | ||

| (0.79) | (−4.61) | |||

| AIR | −0.039 | 0.023 | ||

| (−1.09) | (0.72) | |||

| Size | −0.023 *** | −0.023 *** | −0.007 * | −0.007 * |

| (−4.80) | (−4.82) | (−1.76) | (−1.68) | |

| Lev | 0.116 *** | 0.117 *** | 0.035 | 0.032 |

| (3.51) | (3.55) | (1.15) | (1.06) | |

| Cash | 0.131 ** | 0.133 ** | 0.151 *** | 0.161 *** |

| (2.38) | (2.43) | (3.10) | (3.31) | |

| Q | −0.001 | −0.001 | −0.001 | 0.000 |

| (−0.16) | (−0.18) | (−0.21) | (0.02) | |

| Growth | 0.001 | 0.001 | −0.016 * | −0.015 * |

| (0.62) | (0.62) | (−1.93) | (−1.91) | |

| PPE | 0.003 | 0.003 | −0.020 | −0.014 |

| (0.17) | (0.17) | (−0.74) | (−0.51) | |

| First | −0.008 | −0.007 | 0.041 | 0.037 |

| (−0.26) | (−0.22) | (1.25) | (1.12) | |

| Dual | 0.028 ** | 0.027 ** | 0.003 | 0.001 |

| (2.00) | (1.98) | (0.21) | (0.10) | |

| State | −0.013 | −0.012 | −0.005 | −0.005 |

| (−1.10) | (−1.06) | (−0.48) | (−0.45) | |

| Age | −0.000 | −0.000 | −0.002 | −0.001 |

| (−0.11) | (−0.04) | (−1.49) | (−1.46) | |

| GDP | −0.008 | −0.002 | −0.015* | −0.012 |

| (−0.66) | (−0.14) | (−1.76) | (−1.43) | |

| Market | 0.014 * | 0.015 ** | 0.001 | 0.000 |

| (1.95) | (2.09) | (0.20) | (0.08) | |

| Cons | 0.340 *** | 0.298 *** | 0.260 ** | 0.233 * |

| (3.16) | (2.64) | (2.02) | (1.80) | |

| Sigma_cons | 0.151 *** | 0.151 *** | 0.137 *** | 0.135 *** |

| (46.43) | (46.43) | (43.93) | (43.93) | |

| Industrial fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 1183 | 1183 | 1065 | 1065 |

| χ2-statistic | 385.850 | 387.664 | 182.676 | 204.103 |

| Variables | Eastern Region (Low Government Influence) | Non-Eastern Region (High Government Influence) | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| CF | 0.127 *** | 0.131 *** | 0.033 *** | 0.051 *** |

| (16.08) | (15.64) | (5.25) | (7.15) | |

| AIR × CF | 0.075 | −0.231 *** | ||

| (1.25) | (−5.06) | |||

| AIR | −0.050 | 0.027 | ||

| (−1.30) | (0.90) | |||

| Size | −0.023 *** | −0.023 *** | −0.007 | −0.006 |

| (−4.86) | (−4.89) | (−1.63) | (−1.49) | |

| Lev | 0.115 *** | 0.117 *** | 0.034 | 0.029 |

| (3.40) | (3.44) | (1.16) | (0.97) | |

| Cash | 0.126 ** | 0.131 ** | 0.148 *** | 0.157 *** |

| (2.29) | (2.38) | (3.07) | (3.27) | |

| Q | −0.001 | −0.001 | −0.001 | −0.001 |

| (−0.20) | (−0.28) | (−0.33) | (−0.14) | |

| Growth | −0.001 | −0.001 | −0.001 | −0.000 |

| (−0.22) | (−0.28) | (−0.53) | (−0.12) | |

| PPE | 0.008 | 0.008 | −0.015 | −0.010 |

| (0.39) | (0.38) | (−0.58) | (−0.40) | |

| First | −0.005 | −0.003 | 0.032 | 0.026 |

| (−0.15) | (−0.10) | (1.02) | (0.84) | |

| Dual | 0.033 ** | 0.033 ** | −0.001 | −0.001 |

| (2.30) | (2.29) | (−0.04) | (−0.10) | |

| State | −0.019 | −0.019 | 0.003 | 0.003 |

| (−1.62) | (−1.56) | (0.30) | (0.28) | |

| Age | −0.000 | −0.000 | −0.002 * | −0.002 |

| (−0.30) | (−0.20) | (−1.66) | (−1.56) | |

| GDP | −0.012 | −0.005 | −0.009 | −0.007 |

| (−1.03) | (−0.39) | (−1.05) | (−0.77) | |

| Market | 0.014 ** | 0.016 ** | 0.000 | −0.001 |

| (1.98) | (2.22) | (0.07) | (−0.13) | |

| Cons | 0.394 *** | 0.344 *** | 0.169 | 0.141 |

| (3.60) | (3.02) | (1.31) | (1.10) | |

| Sigma_cons | 0.151 *** | 0.151 *** | 0.137 *** | 0.135 *** |

| (45.54) | (45.54) | (44.85) | (44.86) | |

| Industry fixed effect | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes |

| Observations | 1140 | 1140 | 1108 | 1108 |

| χ2-statistic | 392.250 | 395.459 | 172.927 | 199.281 |

| Variables | Fewer Formal Environmental Institutions | More Formal Environmental Institutions | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| CF | 0.083 *** | 0.093 *** | 0.055 *** | 0.056 *** |

| (11.34) | (12.78) | (8.07) | (8.15) | |

| AIR × CF | −0.396 *** | −0.053 | ||

| (−7.15) | (−1.29) | |||

| Air | −0.052 | 0.037 | ||

| (−1.23) | (1.51) | |||

| Size | −0.011 ** | −0.013 ** | −0.008 ** | −0.008 ** |

| (−2.08) | (−2.44) | (−2.20) | (−2.24) | |

| Lev | 0.087 ** | 0.076 ** | 0.040 | 0.039 |

| (2.18) | (1.97) | (1.59) | (1.52) | |

| Cash | 0.006 | −0.033 | 0.123 *** | 0.124 *** |

| (0.08) | (−0.51) | (3.00) | (3.02) | |

| Q | 0.004 | 0.002 | −0.001 | −0.000 |

| (0.78) | (0.44) | (−0.24) | (−0.13) | |

| Growth | 0.001 | 0.001 | −0.004 | −0.004 |

| (0.09) | (0.13) | (−0.94) | (−0.97) | |

| PPE | −0.084 ** | −0.068 ** | −0.041 ** | −0.039 ** |

| (−2.53) | (−2.12) | (−2.29) | (−2.18) | |

| First | −0.017 | −0.012 | 0.007 | 0.004 |

| (−0.41) | (−0.30) | (0.28) | (0.16) | |

| Dual | −0.018 | −0.021 | 0.027 *** | 0.027 *** |

| (−1.08) | (−1.32) | (2.60) | (2.59) | |

| State | 0.010 | 0.010 | −0.016 * | −0.017 * |

| (0.67) | (0.72) | (−1.71) | (−1.82) | |

| Age | −0.002 | −0.001 | −0.000 | −0.000 |

| (−1.29) | (−1.09) | (−0.39) | (−0.30) | |

| GDP | 0.010 | 0.012 | −0.021 *** | −0.024 *** |

| (0.70) | (0.90) | (−2.75) | (−3.03) | |

| Market | −0.003 | −0.002 | 0.006 * | 0.006 * |

| (−0.76) | (−0.40) | (1.81) | (1.73) | |

| Cons | 0.113 | 0.110 | 0.238 *** | 0.255 *** |

| (0.79) | (0.79) | (2.72) | (2.90) | |

| Sigma_cons | 0.145 *** | 0.140 *** | 0.131 *** | 0.131 *** |

| (37.20) | (37.22) | (51.12) | (51.11) | |

| Industry fixed effect | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes |

| Observations | 766 | 766 | 1427 | 1427 |

| χ2-statistic | 228.474 | 279.714 | 268.232 | 272.213 |

| Variables | OLS | FE |

|---|---|---|

| (1) | (2) | |

| CF | 0.077 *** | 0.070 *** |

| (15.79) | (13.86) | |

| AIR × CF | −0.223 *** | −0.224 *** |

| (−6.91) | (−6.38) | |

| AIR | 0.031 | 0.073 |

| (1.42) | (1.01) | |

| Size | −0.020 *** | −0.030 *** |

| (−6.20) | (−3.05) | |

| Lev | 0.076 *** | −0.018 |

| (3.48) | (−0.50) | |

| Cash | 0.158 *** | 0.275 *** |

| (4.43) | (5.55) | |

| Q | 0.001 | −0.001 |

| (0.41) | (−0.21) | |

| Growth | 0.000 | −0.001 |

| (0.13) | (−0.35) | |

| PPE | −0.029 * | −0.002 |

| (−1.82) | (−0.09) | |

| First | 0.010 | 0.056 |

| (0.45) | (0.98) | |

| Dual | 0.017 * | −0.010 |

| (1.88) | (−0.75) | |

| State | −0.013 * | 0.018 |

| (−1.69) | (0.84) | |

| Age | −0.000 | −0.026 |

| (−0.46) | (−0.61) | |

| GDP | −0.017 *** | 0.017 |

| (−2.58) | (0.53) | |

| Market | 0.003 | −0.002 |

| (1.02) | (−0.22) | |

| Cons | 0.460 *** | 0.534 |

| (6.03) | (1.58) | |

| Industry fixed effect | Yes | |

| Year fixed effect | Yes | Yes |

| Firm fixed effect | Yes | |

| Observations | 2248 | 2248 |

| R2 | 0.182 | 0.158 |

| F-statistic | 11.157 | 10.838 |

| Variables | First-Stage Regressions | Second-Stage Regressions | |

|---|---|---|---|

| AIR | AIR × CF | EPI | |

| (1) | (2) | (3) | |

| PR | −0.003 | −0.000 | |

| (−1.35) | (−0.53) | ||

| RH | −0.064 *** | −0.009 * | |

| (−4.81) | (−1.70) | ||

| PR × CF | 0.001 | 0.004 * | |

| (0.14) | (1.87) | ||

| RH × CF | −0.018 | −0.148 *** | |

| (−0.87) | (−10.90) | ||

| CF | −0.001 | 0.032 *** | 0.022 *** |

| (−0.35) | (10.23) | (3.13) | |

| AIR × CF | −0.290 * | ||

| (−1.85) | |||

| AIR | −0.227 | ||

| (−1.11) | |||

| Size | 0.002 | −0.003 * | −0.014 *** |

| (0.93) | (−1.62) | (−3.95) | |

| Lev | 0.065 *** | −0.000 | 0.075 *** |

| (3.05) | (−0.02) | (2.77) | |

| Cash | 0.039 | −0.002 | 0.180 *** |

| (1.13) | (−0.11) | (4.62) | |

| Q | 0.003 | −0.001 | 0.005 * |

| (1.16) | (−0.61) | (1.75) | |

| Growth | 0.001 | 0.002 ** | −0.000 |

| (0.40) | (2.14) | (−0.08) | |

| PPE | −0.011 | 0.008 | −0.046 *** |

| (−0.71) | (0.84) | (−2.67) | |

| First | 0.108 *** | −0.010 | 0.041 |

| (4.95) | (−0.76) | (1.19) | |

| Dual | −0.003 | −0.005 | 0.018* |

| (−0.44) | (−0.96) | (1.88) | |

| State | 0.0031 *** | −0.002 | −0.010 |

| (4.07) | (−0.52) | (−0.98) | |

| Age | 0.000 | 0.000 | −0.000 |

| (0.62) | (0.23) | (−0.32) | |

| GDP | 0.063 *** | 0.000 | 0.004 |

| (9.84) | (0.19) | (0.27) | |

| Market | 0.015 *** | −0.002 | 0.003 |

| (5.89) | (−1.55) | (0.81) | |

| Cons | −0.181 ** | 0.105* | 0.237 * |

| (−1.98) | (1.77) | (1.89) | |

| Observations | 2241 | 2241 | 2241 |

| F-statistic | 7.47 | 29.88 | 4.54 |

| Variables | PSM | Alternative AIR Variable |

|---|---|---|

| (1) | (2) | |

| CF | 0.067 *** | 0.013 * |

| (9.15) | (1.83) | |

| AIR × CF | −0.283 *** | |

| (−7.34) | ||

| AQI × CF | −0.001 *** | |

| (−3.09) | ||

| AIR | 0.092 *** | 0.000 |

| (4.42) | (0.04) | |

| Size | −0.009 *** | 0.000 |

| (−3.00) | (0.10) | |

| Lev | 0.038 * | 0.070 ** |

| (1.76) | (2.40) | |

| Cash | 0.116 *** | 0.042 |

| (3.38) | (0.81) | |

| Q | −0.002 | 0.012 *** |

| (−0.76) | (2.84) | |

| Growth | 0.000 | −0.000 |

| (0.09) | (−0.14) | |

| PPE | −0.008 | −0.122 *** |

| (−0.53) | (−4.29) | |

| First | −0.022 | −0.039 |

| (−1.01) | (−1.28) | |

| Dual | 0.020 *** | −0.006 |

| (2.58) | (−0.55) | |

| State | −0.010 | 0.016 |

| (−1.23) | (1.58) | |

| Age | −0.001 | 0.000 |

| (−0.92) | (0.51) | |

| GDP | −0.021 *** | 0.003 |

| (−3.24) | (0.34) | |

| Market | 0.005 * | −0.000 |

| (1.74) | (−0.14) | |

| Cons | 0.270 *** | −0.041 |

| (3.42) | (−0.34) | |

| Sigma_cons | 0.109 *** | 0.105 *** |

| (51.18) | (35.01) | |

| Industry fixed effect | Yes | Yes |

| Year fixed effect | Yes | Yes |

| Observations | 1438 | 673 |

| χ2-statistic | 244.478 | 178.434 |

| Variables | AIR_G = 0 (Regions with Poor Air Quality) | AIR_G = 1 (Regions with Non-Poor Air Quality) | Mean-Diff. | t-Test for Diff. in Means | ||

|---|---|---|---|---|---|---|

| Obs | Mean | Obs | Mean | |||

| EPI | 1138 | 0.043 | 1110 | 0.046 | −0.003 | −0.551 |

| Variables | Dependent Variable: DF | Dependent Variable: EPI | |

|---|---|---|---|

| (1) | (2) | (3) | |

| AIR | 0.837 ** | 0.027 | −0.007 |

| (1.98) | (1.18) | (−0.33) | |

| AIR × CF | −0.232 *** | −0.063 ** | |

| (−6.80) | (−2.10) | ||

| AIR × DF | −0.048 *** | ||

| (−2.69) | |||

| CF | 0.081 *** | 0.027 *** | |

| (15.76) | (5.61) | ||

| DF | 0.011 *** | ||

| (12.36) | |||

| Size | 0.041 | −0.016 *** | 0.000 |

| (0.59) | (−4.81) | (0.10) | |

| Lev | 3.545 *** | 0.082 *** | 0.070 ** |

| (7.59) | (3.52) | (2.40) | |

| Cash | −5.453 *** | 0.185 *** | 0.042 * |

| (−6.08) | (4.90) | (1.81) | |

| Q | −0.105 | 0.002 | 0.012 *** |

| (−1.53) | (0.50) | (2.84) | |

| Growth | 0.048 | 0.000 | −0.000 |

| (0.97) | (0.13) | (−0.14) | |

| PPE | −6.019 *** | −0.023 | −0.122 *** |

| (−11.97) | (−1.36) | (−4.29) | |

| First | 0.583 | 0.018 | −0.039 |

| (1.15) | (0.75) | (−1.28) | |

| Dual | 0.303 | 0.017 * | −0.006 |

| (1.54) | (1.80) | (−0.55) | |

| State | −0.148 | −0.008 | 0.016 |

| (−0.84) | (−0.99) | (1.58) | |

| Age | −0.003 | −0.001 | 0.000 |

| (−0.22) | (−0.84) | (0.51) | |

| GDP | −0.670 *** | −0.016 ** | 0.003 |

| (−4.46) | (−2.28) | (0.34) | |

| Market | 0.278 *** | 0.004 | −0.000 |

| (4.56) | (1.34) | (−0.14) | |

| Cons | 5.202 *** | 0.341 *** | 0.168 ** |

| (3.02) | (4.21) | (2.19) | |

| Sigma_cons | 3.527 *** | 0.152 *** | 0.156 *** |

| (71.67) | (63.93) | (70.71) | |

| Industry fixed effect | Yes | yes | Yes |

| Year fixed effect | Yes | yes | Yes |

| Observations | 2248 | 2248 | 2248 |

| χ2-statistic | 966.793 | 392.904 | 415.207 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shen, Y.; Lyu, M.; Zhu, J. Air Pollution and Corporate Green Financial Constraints: Evidence from China’s Listed Companies. Int. J. Environ. Res. Public Health 2022, 19, 15034. https://doi.org/10.3390/ijerph192215034

Shen Y, Lyu M, Zhu J. Air Pollution and Corporate Green Financial Constraints: Evidence from China’s Listed Companies. International Journal of Environmental Research and Public Health. 2022; 19(22):15034. https://doi.org/10.3390/ijerph192215034

Chicago/Turabian StyleShen, Yi, Minghan Lyu, and Jiali Zhu. 2022. "Air Pollution and Corporate Green Financial Constraints: Evidence from China’s Listed Companies" International Journal of Environmental Research and Public Health 19, no. 22: 15034. https://doi.org/10.3390/ijerph192215034

APA StyleShen, Y., Lyu, M., & Zhu, J. (2022). Air Pollution and Corporate Green Financial Constraints: Evidence from China’s Listed Companies. International Journal of Environmental Research and Public Health, 19(22), 15034. https://doi.org/10.3390/ijerph192215034