In this section, we first lay down the basic roles of our two-sector equilibrium, which includes households and retailers, to analyze the arousal and the effect of panic buying; then, a full-fledged small SIR model is developed to characterize the variation of the actual workforce under the shock of COVID-19. To unambiguously describe the dissimilarities of agent’s decisions over different occasions, such as when medical resources are undersupplied or otherwise, the model starts with the outlines of households.

2.1. Households

The household sector is assumed to be heterogeneous over a continuum of measure such that

, where

h is the individual household and

i denotes the

i-th one. Take arbitrary

i as an illustration; one needs to allocate their resources on consumption goods

and surgical masks

, and also dedicate the labor supply

if they are not infected (or detected) with COVID-19. The basic utility function of

i takes the form of

where

is the household utility at time

t and

is the discount factor that transforms the future utilities into today; thus, a household aims to seek an optimal allocation path over

to maximize its lifetime utility. Single period utility

has a few properties such that

these properties also suggest that

i is risk aversion. We assume that the above-specified utility function is identical across the whole household sector.

To be precise, if i is neither infected nor diagnosed at time t, they shall earn the income from both labor supply at competitive wage and the payback interest of bond . With all the income i has, they need to choose the quantities of non-durable goods for consumption, saving for the next period, and surgical masks to keep away from COVID-19 infections given the maximization of the lifetime utility. In order to deliberately characterize the stylized facts during the onset of this pandemic, a few assumptions are in made.

Assumption 1. Without the loss in generality, assume that

- (i)

Resources for producing masks are relatively steady;

- (ii)

Surgical mask depreciates at the rate of δ;

- (iii)

Onlyfraction of mask demand () in each household is satisfied;

- (iv)

Mask restocking is only for balancing the mask consumption.

Assumption 1–(i) says that the surgical mask

is durable but depreciating at rate

in each period. If

are the masks

i obtained at the beginning of time

t, then the depreciation

equals to the masks

i used in period

t, so that

quantifies the size of masks remaining unused from

t to

. The way that households use masks across periods resembles peeling an onion. For instance, given a certain number of masks

at time

t, the depreciation rate is

for the masks used at time

t; so, the remaining number at

should have

to be used and

stays unused. Forward iterate this for

n periods, the used and unused masks are given by

and

; so, if

n is sufficiently big, then all the masks given from time t are consumed. To fully cover the “mask shortage” in reality, the total output of masks in mainland China of 2019 is 5 billion according to China’s industrial statistics, where the surgical masks comprise 54% of this number, which is 2.7 billion. However, regarding the mask demand, assuming one man consumes one mask for a day from China’s secondary industry, transportation industry, as well as medics, the total number of masks used was 238 million per day in 2019 according to

The Fourth National Economic Census and

China Health Statistics Yearbook 2019, implying that the surgical mask stock only maintains for 11 days (

) if the workforce from preceding industries decides to return to work during the epidemic, which most of them did from 20 January. Meanwhile, more than half of the mask factories were in a state of stagnation due to the Chinese new year. Assumption 1–(ii) states that only relatively low fractions of masks can be purchased by

i from the market in each period, suggesting that masks could be undersupplied and the stabilizations are highly dependent on the market statutes and related policies. Take Shenzhen as an example, roughly 10 million netizens take a lottery draw every two days for 20 thousand surgical masks freely supplied by the government, while the surgical masks have been sold out in most of the pharmacies, and even in the city with multiple local surgical mask factories. To survive the pandemic as best as possible,

i manages to restock a certain number of masks that is in line with their economic decisions in each period; this is the intuition behind Assumption 1–(iii). Mathematically, the transition law of mask without shortage can be expressed as

where

denotes the restock at time

t according to Assumption 1–(i,iii). Since we acknowledge the possibility of mask undersupply, a wedge is introduced to decay the mask accumulation such that

where

is the “mask shortage gap”, which helps pin down the exact number of masks

i should restock at time

t. According to Assumption 1-(ii),

i can only restock

fraction of masks at most—that is,

with

; hence, (

1) is further transformed into an inequality constraint as follows:

Note that constraint (

2) binds whenever masks are insufficient to

i, and

when the mask shortage situation disappeared. Moreover, with the help of Equations (

1) and (

2), we can develop the budget constraint for

i such that

where

is deemed as the authentic mask shortage gap, which stays as a real variable in (

3), as we will verify that

when mask supply is relatively low and

otherwise. To gain more insight, first rewrite (

2) into

and then plug it into (

3) with the condition of

; hence, we obtain

As can be concluded by (

4), term

represents the willingness of

i to buy a mask: the expense for purchasing a mask is lower than the value of the mask itself if

, indicating that it stimulates buying of the mask.

If

i is infected and also diagnosed, however, they will receive medical treatment at a hospital, and it temporarily blocks their ability to work. Moreover, we also assume that

i will not need a mask during their time in hospital. Under such a case, the utility function of

i is given by

and the associated budget constraint is

2.3. Matching and Bargaining

Matching and bargaining between households and mask retailers as the key factor of our model is detailed in this subsection. There are two reasons for us to build up this mechanism: first, as the assumption stated, only a fraction of mask demand in each household is met; second, matching and bargaining offer a practical and tractable way to endogenize the mask shortage situation, and further helps us analytically explore how shortage interacts with infected household.

To underline the heterogeneity in households, we assume that every household may reserve a different valuation on masks such that with distribution for , where we choose the partial derivative of utility u to mask M as the valuation criterion and given any level of M due to utility function u satisfying Inada conditions. Moreover, given the marginal cost of providing a mask from firms at time t, , we let for ruling out the case of market freeze. Likewise, we further define as the reservation value such that households are willing to buy masks if and only if . Above the reservation value, a buying price offer is derived from a household, ; the specific form of this buying price offer will be discussed below.

In line with the buying fractions

in (

1), the arrival rates for households (buyers) meeting retailers (sellers) are equivalent to the fractions that meet their restocking plan on average—that is,

where we used the expressions of

and

. Denote

as the value function for the household who preserves valuation

; hence, the value this kind of household places on buying masks is given by

where

is the discount factor. The first term on the RHS of Equation (

8) is the probability of a household obtaining a mask supply

over Poisson distribution, while the second term says, otherwise, it is at probability

, where

stands for the value function of the next period.

Unlike the households, retailers face numerous buying quote ubiquitously due to mask shortages; hence, the arrival rates for retailers (sellers) to meet households (buyers) are constantly number 1. Moreover, it is useful to consider the whole retailer sector as a representative agent due to lacking of dissimilarities across retailers; then, the associated Bellman equation is given by

These two Bellman equations can also be interpreted into continuous time form. Suppose the interval of time is sufficient small; then, Equation (

8) becomes

where

r is net interest. Likewise, Equation (

9) gives us

Nash bargaining is employed to assume the endogenous retail price. Obviously, the surplus of type

households is

, while the surplus of retailers is

; then, the bargaining problem is

where the bargaining power of households is given by

, and the solution to this bargaining problem implies that

The following lemma helps summarize all the related properties for the sake of our discussion.

Lemma 1. In the neighbourhood of steady state, the following conditions hold if and only if :

- (i)

The retail price is equal to the reservation value,;

- (ii)

The value function of households and retailers are , respectively.

Proof. Given the fact that

, the integral in Equation (

9) implies

; hence, we have

. Substituting this condition into Equation (

10) gives

, and the steady state of Equation (

8) is

The preceding equation implies that

and

. Moreover, by condition of

, we therefore have

. □

One thing that should be noted about Lemma 1 is that all the surplus in the trade goes to retailers when the equilibrium price is . Consider two cases for the understanding of this result. First, assume that . The steady state implies the value of type is negative, i.e., ; then, households would utilize their bargaining capacity to prevent a negative value from occurring, this effort is denoted . Second, assume , a type household would prefer trading with retailers since their surplus is increasing in mask purchasing, i.e., . This circumstance gives rise to buying competition and eventually increases the bargaining capacity of firms, resulting in the soaring of retail price until . These two cases have described the mechanism behind Lemma 1, despite this representing the worst-case scenario for the households.

To obtain more insight, we next compute the steady states of two value functions alongside retail price. In doing so, first, inserting (

10) into (

8) yields the value of households for all

:

Likewise, substituting (

10) into (

9) yields

where we use

. Moreover, combine (

8) and (

10) to obtain

There are two aspects we would like to underline.

Remark 1. At steady state or in the neighborhood of steady state, a household’s value is increasing in bargaining power θ and the marginal utility on mask, while it is decreasing in firm value and marginal cost . In comparison, firm value is increasing in its bargaining power and marginal utility u but decreasing in reservation value μ.

Remark 2. Given the reservation value μ, retail price p is increasing in a household’s marginal utility u; hence, holds for every .

Remark 2 is crucial to the mask shortage characterization in our model. Assume the reservation value is equal to 1, ; then, every valuation above the reservation should be , and the authentic price of mask for non-reservation household is lower than 1 due to . Moreover, according to Inada conditions, the marginal utility should be much bigger than 1 when masks are undersupplied, implying and , which would further trigger “panic buying” and intensify market tightness. Given this logic, we obtain Proposition 1.

Proposition 1. Given the critical value , any valuation above the reservation echoing the authentic price of masks of less than 1, i.e., , will further escalate the mask shortage circumstance.

A few things about Proposition 1 are worth commenting on; however, we first need to discuss the mask shortage equilibrium.

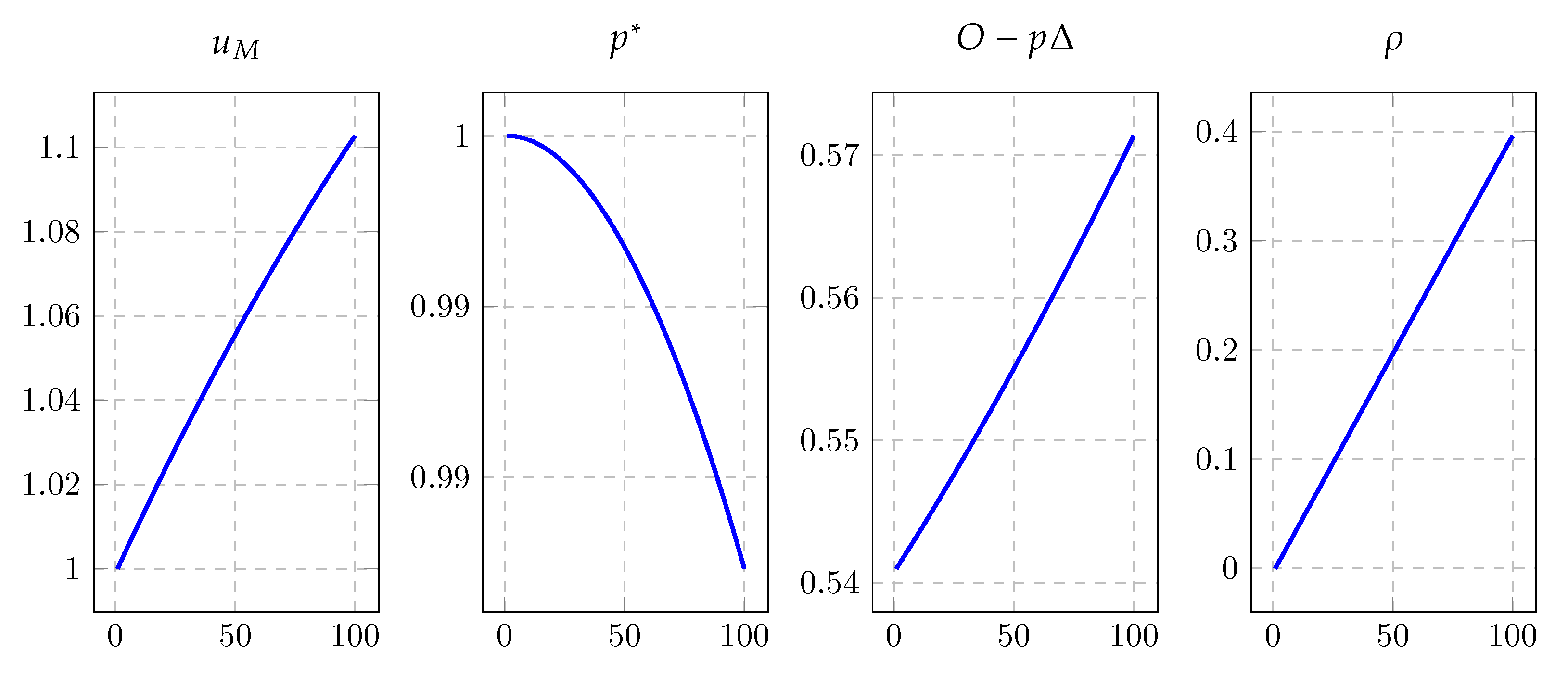

Figure 1 displays the basic mask shortage equilibrium trends along with the changes of depreciation rate, where we set parameter

from 0.54 to 0.6. As can be seen, the demand of masks rises when the pandemic arouses: for one thing, the restocking for an arbitrary household in each period, denoted by

, increases from 0.54 to 0.57; for another, the marginal utility roughly rises from 1 to 1.1 due to the mask stock

M running low, resulting in the pushing up of retail price

and the downfall of authentic price

according to Equation (

13). Moreover, the fraction of masks that households could not restock,

, increases from 0 to 0.3961, where the shortage gap is widened by the excessive demand. One remark is on the order. Apparently, the fraction of masks that households could not restock slides toward 0 as the retail price and authentic price approach 1, where the mask market is Walrasian, and the arrival rates for households to meet retailers become 1 as

. Alternatively speaking, along with the authentic price

dropping down from 1 household realizing that the mask would be cheaper than its fixed value 1 when all other agents expect the market to become tightened based the soaring demand of masks, then households are triggered to a buying competition, which as the original cause of the mask shortage, i.e., an increase in

also increases the mask restocking quantities,

. However, the illustration is not straightforward since the panic buying effect under this scenario is always mixed with the effect of depreciation rate, indicating that more details should be characterized to explain Proposition 1.

Figure 2 is supplementary to

Figure 1. The left panel anatomizes Proposition 1 in concreteness, where the blue line is the function of

and the green line is

, and the equilibrium for pair

is in sequence from nodes

to

. Set an initial state on the green line, which gives

from the retailers’ supply, where

is defined as

. However, since the price level

only represents the fraction of mask supply that can be met by the demand on the blue line, i.e., state

from households, then retailers would re-optimize their authentic prices according to the demand

, which drags the supply state from node

to node

. At the time that retailers reset their price

in node

, the demand state from households deviates from node

to node

, and the increment of masks

is equal to the quantities of panic buying. Moreover, from Equation (

9), we know that retailers are more willing to sell only when

p is greater than the marginal cost

, and the marginal cost in our model is constantly 1, as no nominal rigidities are embedded in the retailer sector; hence, the case of

is ruled out. Meanwhile, we also omit the case of

, where the retail price is totally fixed and marginal utility stays in constant at equilibrium.

The right panel of

Figure 2 gives an illustration of retail price shifting. To be more specific, we shift the retail price curve

downward to

by lifting the reservation value

from 1 to 1.01, echoing the case that households suddenly consider masks to be more valuable than ever. However, at the same time, we leave the utility function curve

unchanged. As the rising of retail price

p, i.e., the decreasing of authentic price

, the utility function

is intersected at nodes

and

, where

and

denote the exact quantities of the masks households possessed under two different retail prices, and

holds as

is decreasing in

M. Obviously,

as an embodiment of panic buying from mask price rising.

2.4. Hospital and Quarantine

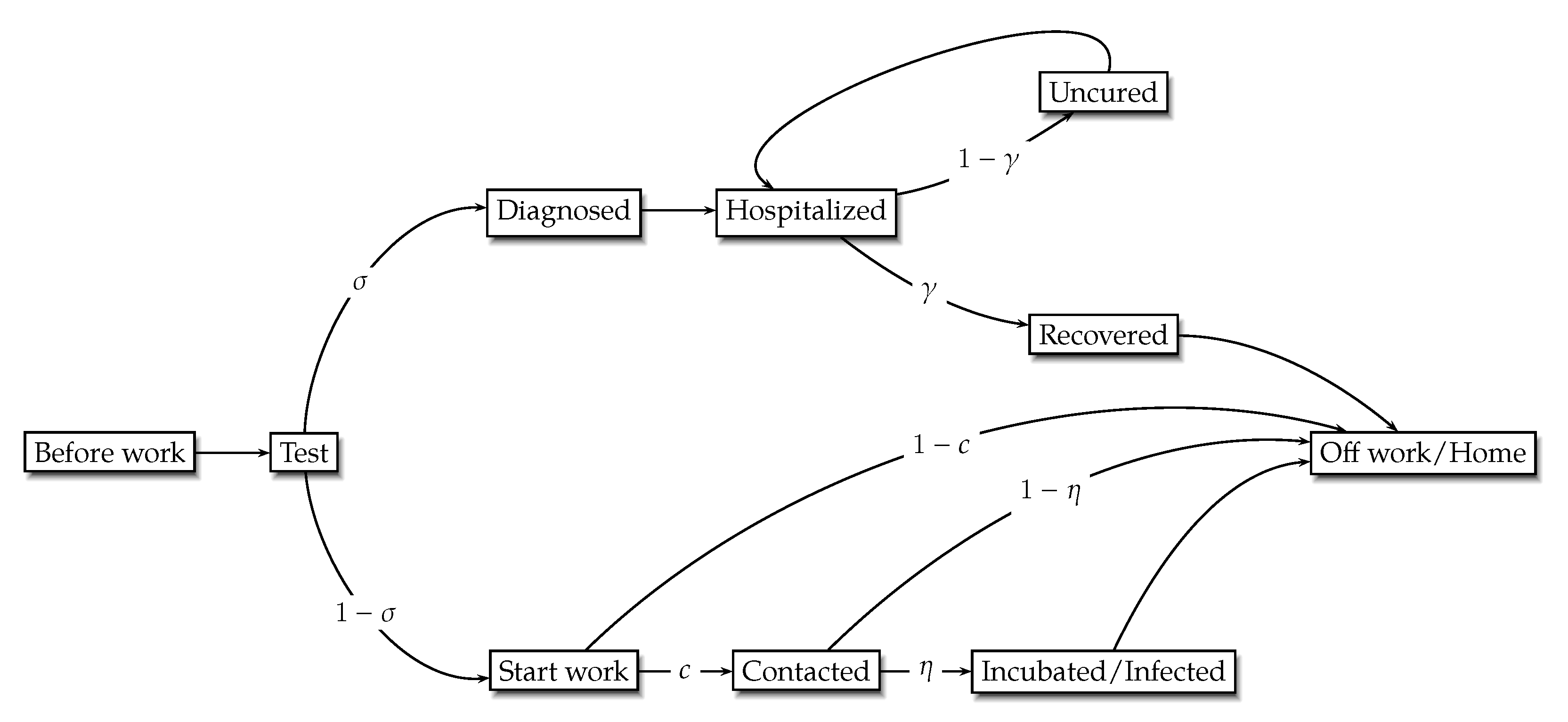

Figure 3 gives a brief road map of the COVID-19 transmission. At the beginning of each period, buyers leave home to participate in manufacturing at retailers; meanwhile, a necessary test for infection is held before buyers start their work. If a buyer is negative to infection, they may continue to work but with a certain probability of contracting the virus and then becoming infected; after that, they return from work and back to home at the end of the period. If a buyer’s test result is positive, they will be considered as a diagnosed case and sent to hospital (or quarantine zone) for medical treatment, where the patient has a certain probability to recover and be free to leave. One assumption that should be underlined is that the masks are not necessary as long as the buyer stays in hospital.

Next, we transform the preceding transmission into mathematical details. Assume the total working force in time

t is

, where

denotes the newly emerging workforce, including the ones who have recovered from medical treatment at

, not contacted or been infected at

, and those of the debuted labor force in the current period, while

are the negative cases to test from

to

t, who might have been infected during work. As stated,

would be diagnosed as infected with the probability of

at the beginning of time

t. The rest of those are entering daily work, and the probability of the debuted labor force be diagnosed is 0. Within the work part, the workforce may directly expose themselves to the incubated with probability of

c, and become infected with the probability of

. Therefore, the transition law of

is as follows:

where the first term on the RHS denotes the labor workers who make contact and eventually become infected, and the second term is the existing group that does not get diagnosed at time

t.

For these who are diagnosed,

, the associated medical treatments are offered by the hospital, and the probability of restoring a patient to health is

. Hence, the dynamic equation for the diagnosed patient

is

where the first term on the RHS is the new cases, and the second is the cases that remain uncured.

Last but not the least, the change of the size of recovered patient

is equal to the number of the diagnosed cases that get cured, i.e.,

Moreover, the summation of

should equal the size of households—that is,

and

is normalized to 1 for simplicity. Given equations (

14)–(

17), we obtain the following Lemma:

Lemma 2. is

- (i)

Taking the whole labor force, expect the ones who are diagnosed only when and ;

- (ii)

Increasing in contact rate c, while decreasing in uncured rate .

Proof. Substituting Equations (

15)–(

17) into (

14) and by forward iteration yields

where the parameter

is the short symbol for

. The first term on the RHS is negligible given

and when

t is sufficient big. Now, let

—that is,

the probability for a household eventually getting infected is equal to the odds in favor of not getting diagnosed. Therefore, the equation of

turns into

indicating that all households are negative to test expect for the newly diagnosed and quarantined ones.

Moreover, given the specification of (

15), forward iterating gives

Combining (

18) and (

19) yields

where in the last step we used Abel’s summation as well as the conditions for

such that

and

when

. Define coefficient term

; then, the last dynamic summation of

is simplified into

Obviously,

and

hold due to

and

. □

Lemma 2 presents the basic properties that the COVID-19 transmission embodies. We next conclude two remarks for the intuitive interpretation of this Lemma.

Remark 3. Lemma 2–(i) describes the worst-case scenario of virus spread; the total number of labor forces, expect for the diagnosed and quarantined ones, are potentially infected as . Normally, the current negative cases will fit the parameter condition of , i.e., the probability of labor force becoming infected is lower than the odds in favor of not getting diagnosed. From Lemma 2–(ii), we also know that is increasing in contact rate c; hence, the parameter inequality morphs into equality alongside the uprising of contact rate. Intuitively, we can simply rewrite the parameter condition intowhich implies that the speed of infection, as measured by , is faster than the varying of existing negative cases, , as the contact rate increases, so that the truly uninfected ones are sliding into negative cases and being fully crowded out. Remark 4. Lemma 2–(ii) has exposited how the parameters of contact rate and uncured rate influence the quantities of negative cases. As a consequence, negative cases are increasing in contact rate c, while decreasing in uncured rate . The message of the former one is not hard to comprehend: the more people exposed to the virus, the less uninfected cases there will be. As a matter of fact, Wuhan city has paid the price for indulging its citizens in holding gatherings, such as traditional large banquets and annual meetings including those of enterprises and local government, until the city was locked down on 23 January. Meanwhile, the disclosure of the number of infected was “technically censored” by an unauthorized medical emergency guide from Wuhan municipal health commission during 10–15 February. At the end of 15 March, the official number of diagnosed was roughly 50 thousand. However, the intuition behind the latter fact was slightly implicit. The uncured rate defined in our model is the chance that the diagnosed patients are not fully recovered from the virus even after the medical treatment, which also says that the uncured ones have to be kept in quarantine and away from the exposure of the virus again. Therefore, the larger the uncured rate , the more people will become quarantined, and the less people will be exposed to the virus and infected in the future. This theoretical claim is in line with the following facts: (1) As the epicenter, Wuhan City and Hubei Province declared national emergencies as well as board lockdowns on 23 January at 10 a.m. to contain the spread of COVID-19; meanwhile, a nationwide self-quarantine was asked of the citizens who were in the other 31 provinces and autonomous regions. (2) All the schools including universities in mainland postponed their spring semester regarding this epidemic, and most of the employees from different industries were not allowed to return to work until early March. (3) Closed-off management has been implemented in the residential communities of first-tier and second-tier cities.