The Threshold Effect of FDI on CO2 Emission in Belt and Road Countries

Abstract

:1. Introduction

2. Literature Review and Theoretical Framework

3. FDI-CO2 Relationship: Toward a Threshold Specification

4. Data Description

5. Discussion

5.1. Estimation and Specification Tests

5.2. PTSR Model Results and Discussion

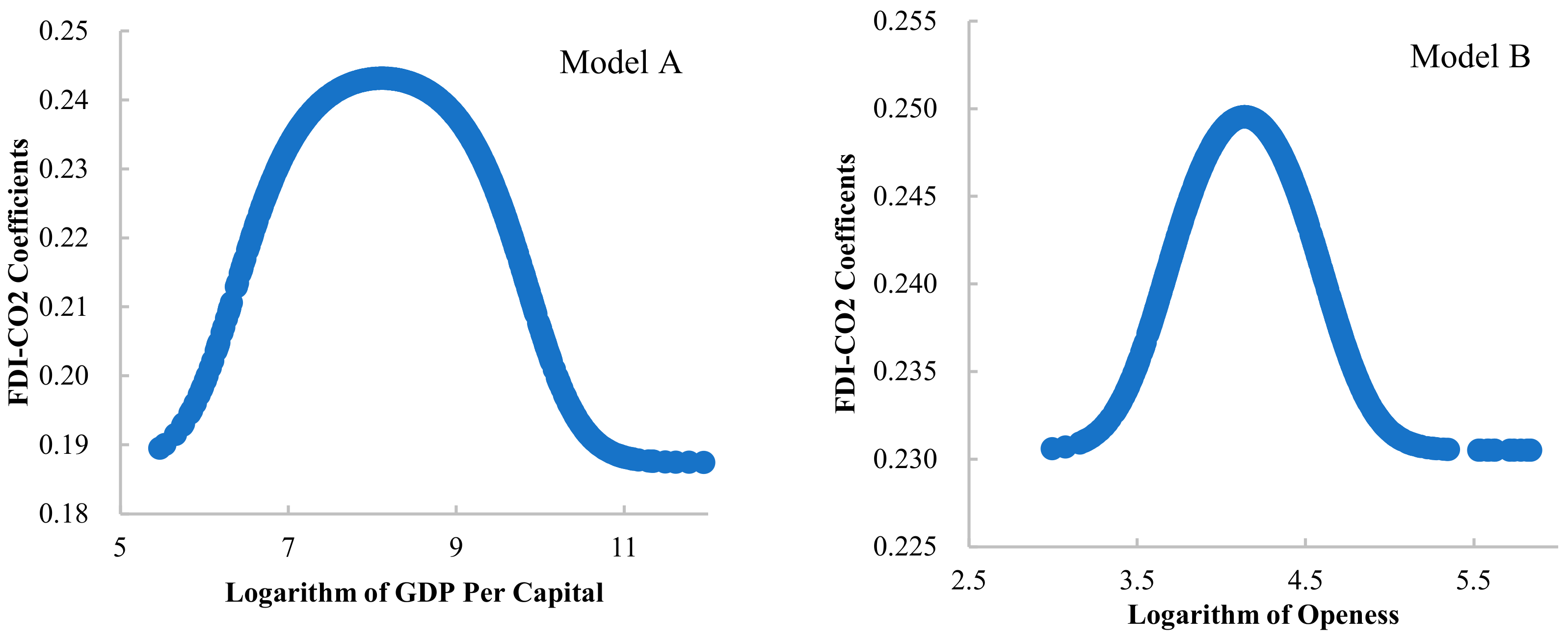

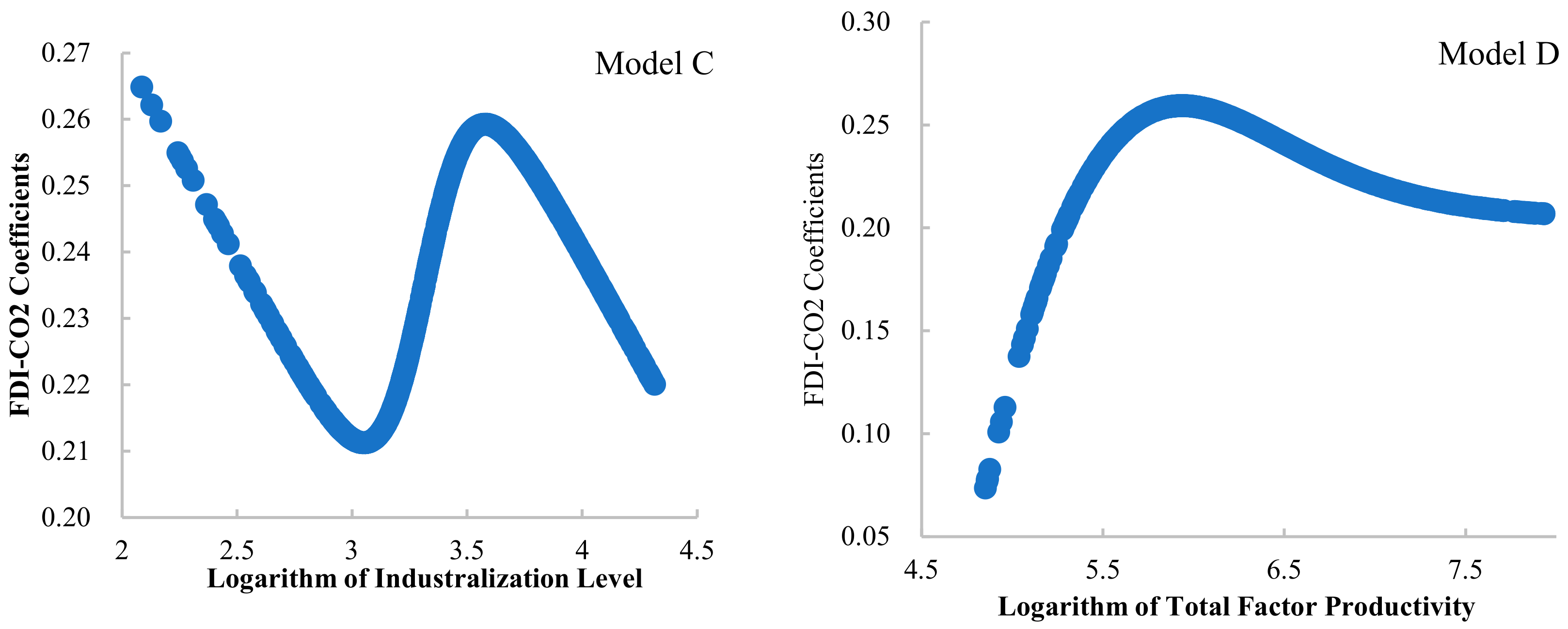

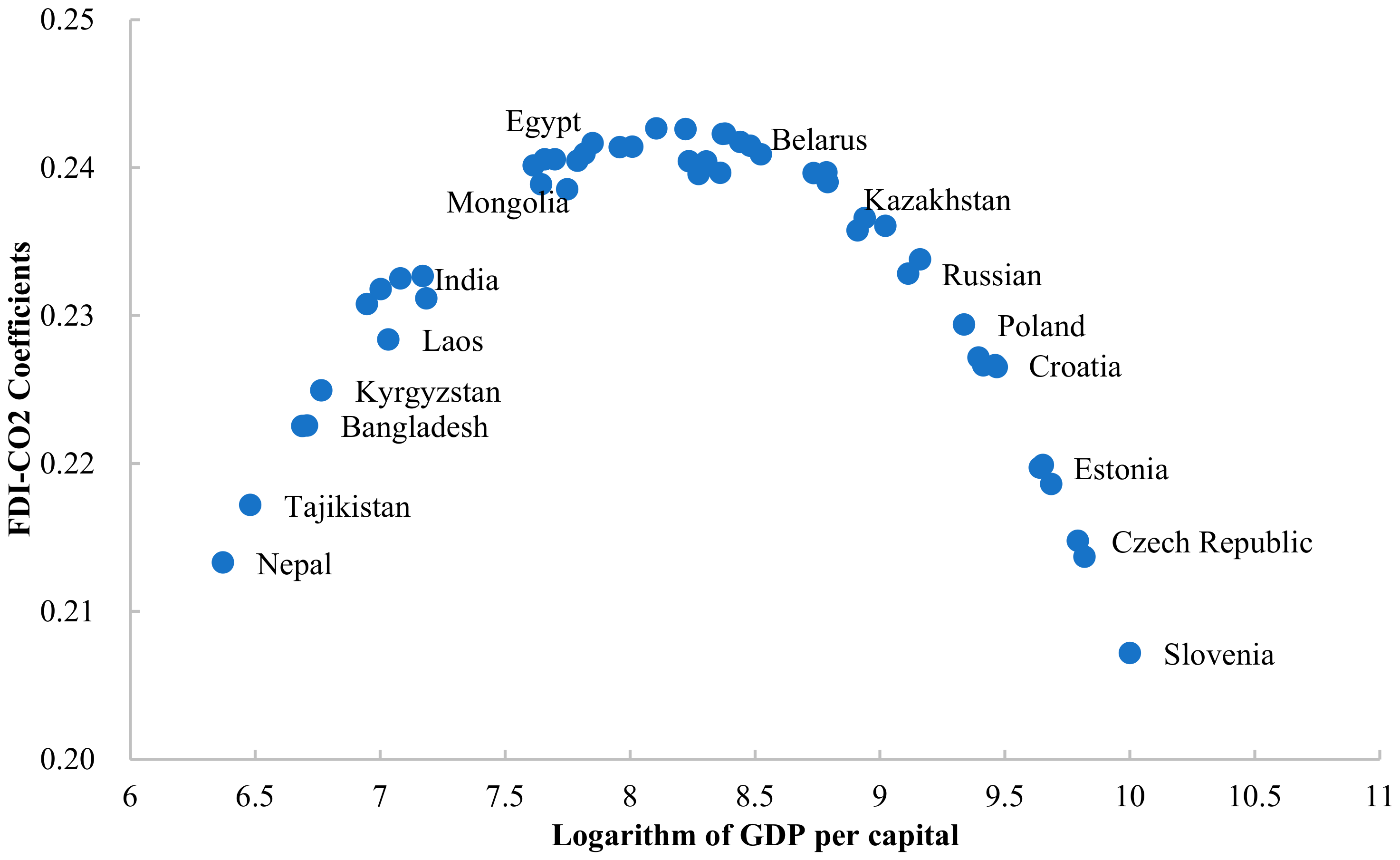

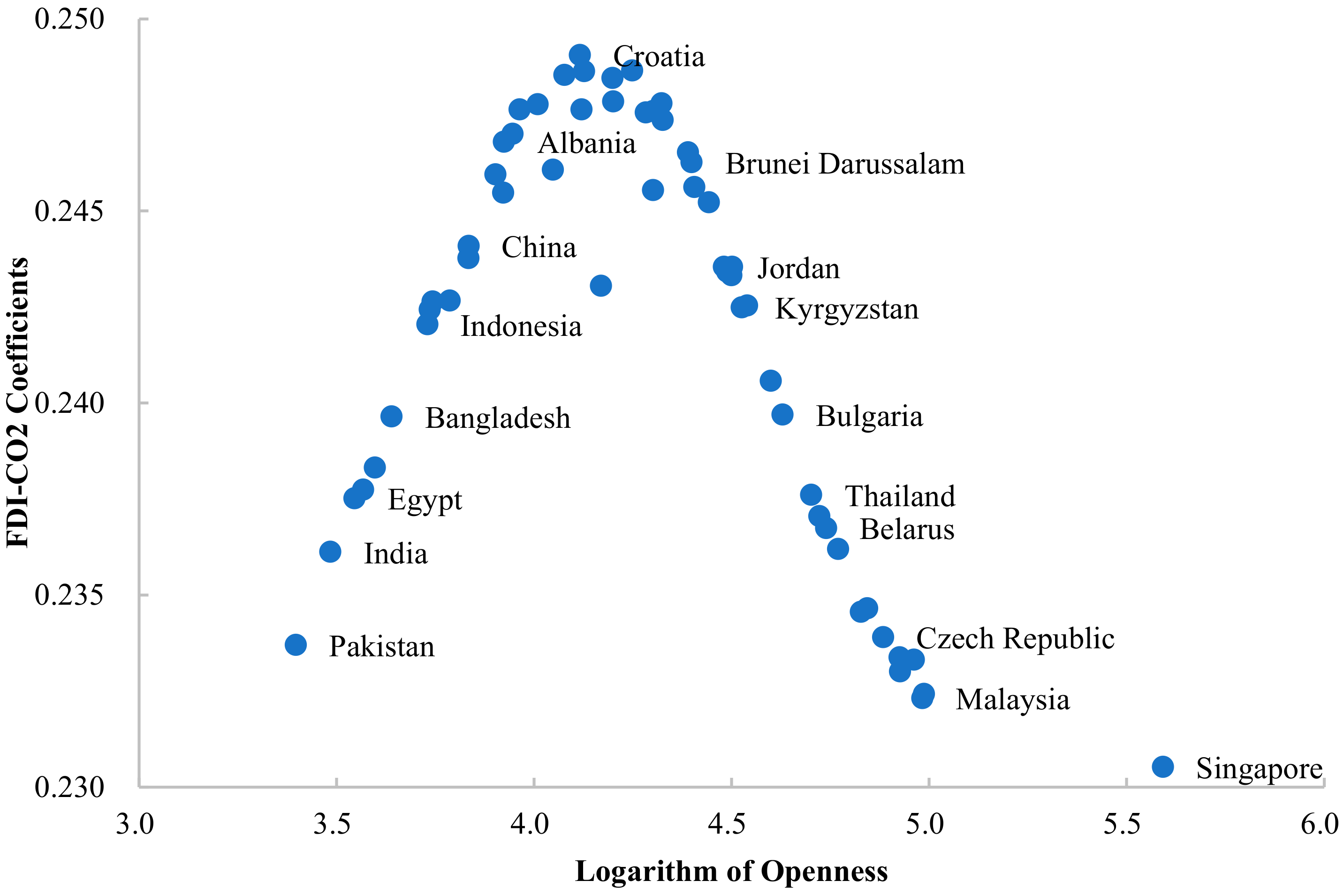

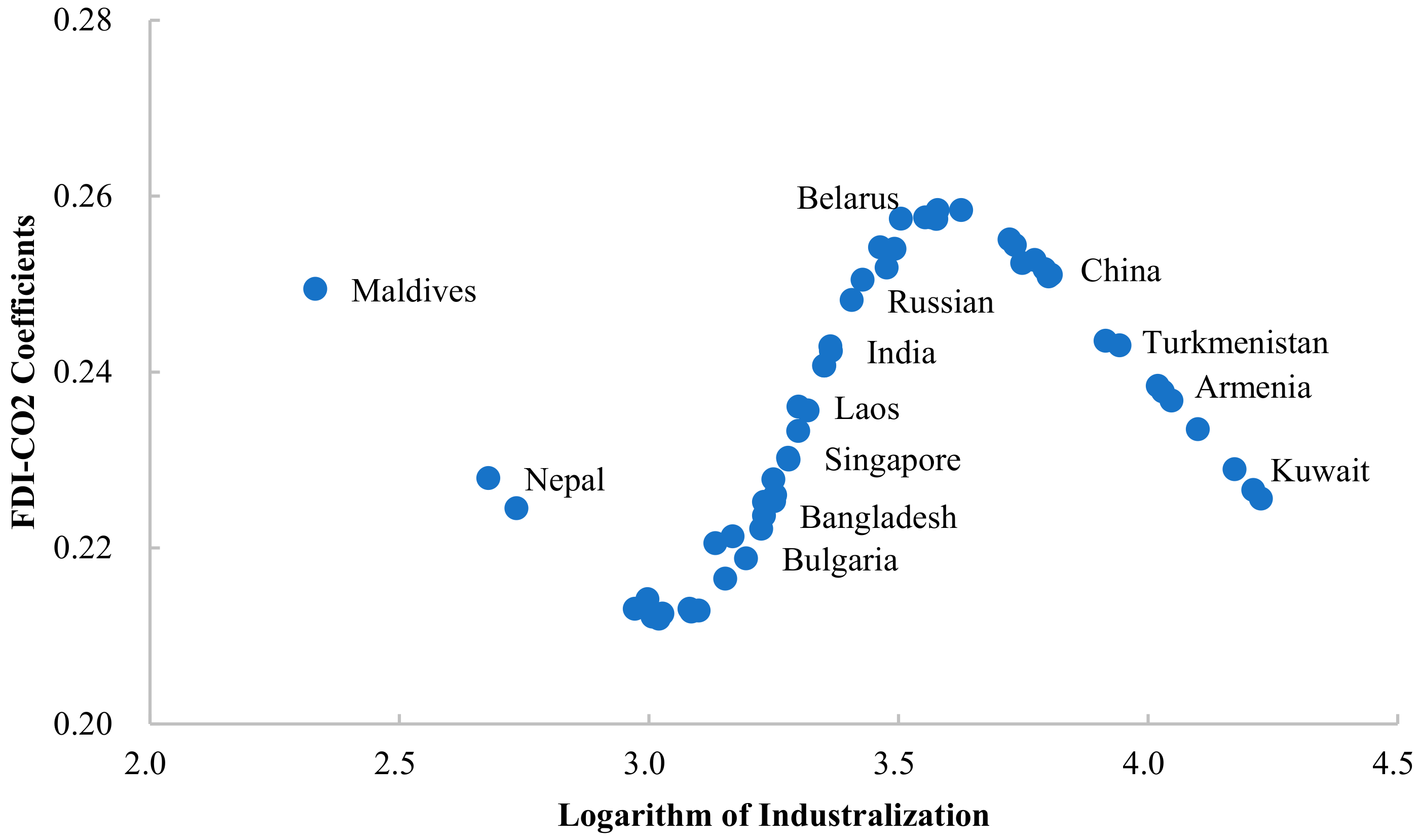

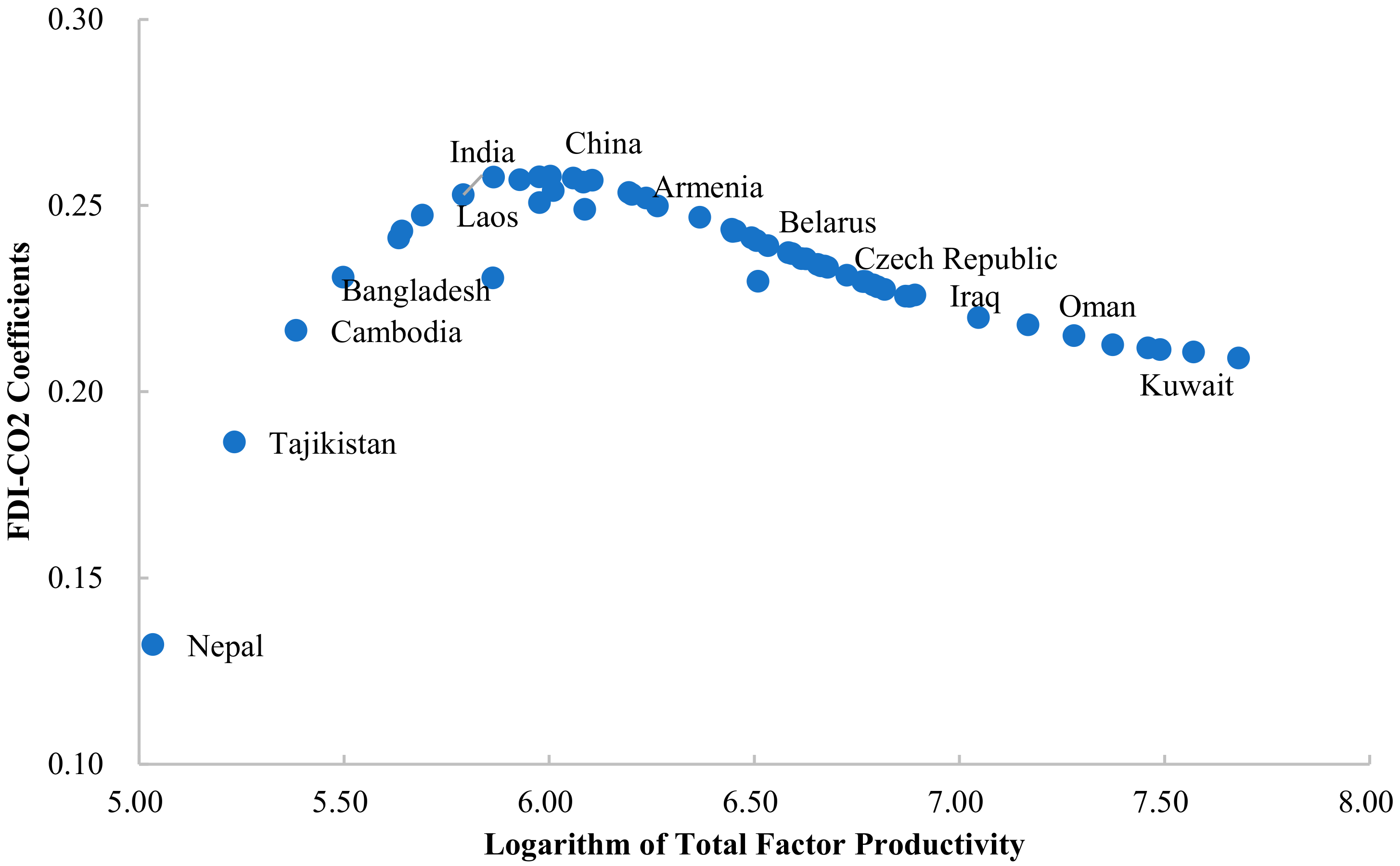

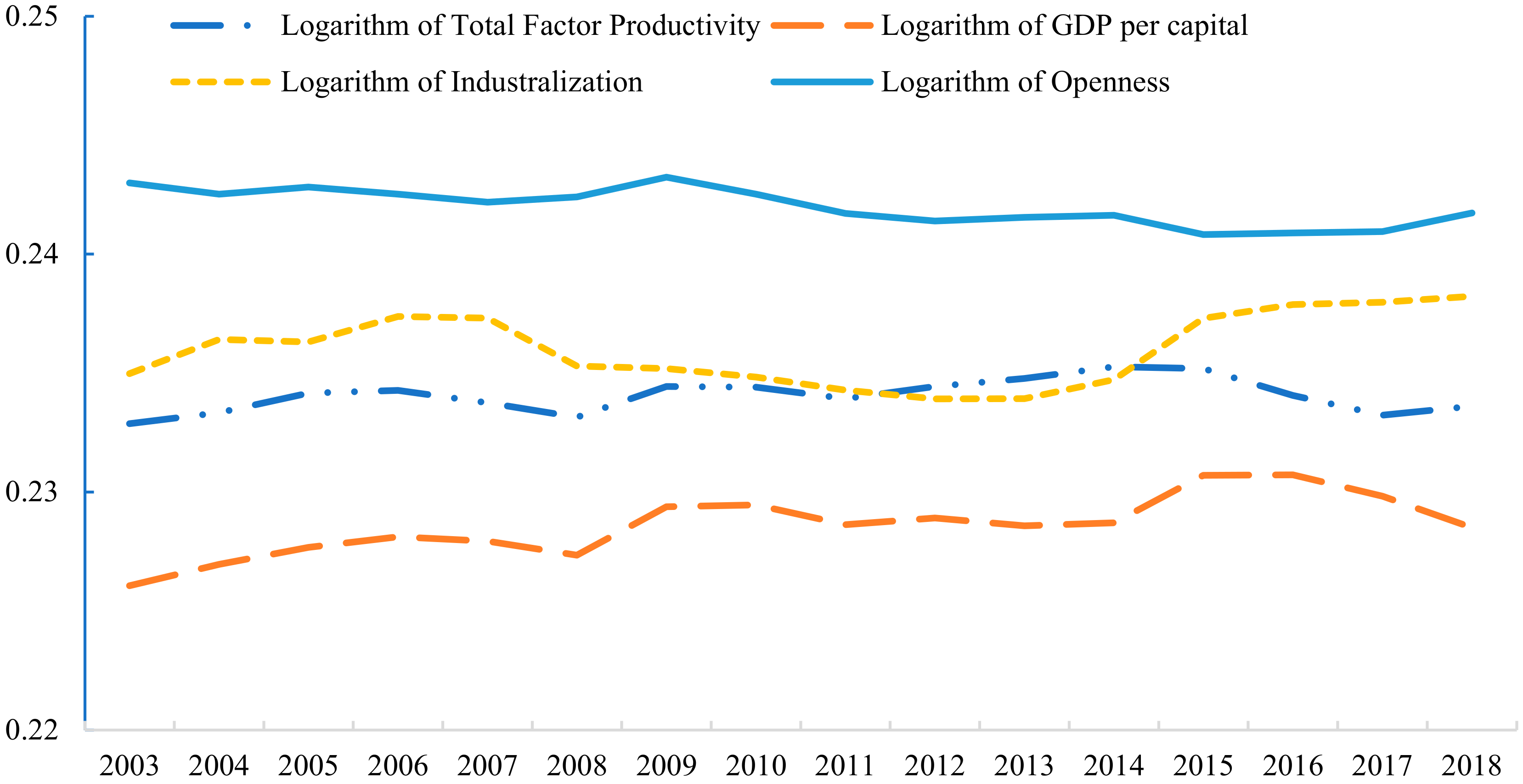

5.3. Nonlinear Marginal Analysis of the PSTR Model

6. Policy Implications

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Liu, Q.; Ren, D.; Liu, Q. The Spatial Spillover Effect of FDI on the Economic Growth of the Countries Along “The Belt and Road”: An Expansion Model Based on Regional Externalities. J. Yunnan Univ. Financ. Econ. 2020, 36, 36–50. [Google Scholar]

- Azam, M.; Raza, A. Does foreign direct investment limit trade-adjusted carbon emissions: Fresh evidence from global data. Environ. Sci. Pollut. Res. 2022, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Xie, Q.; Sun, Q. Assessing the impact of FDI on PM2.5 concentrations: A nonlinear panel data analysis for emerging economies. Environ. Impact Assess. Rev. 2020, 80, 106314. [Google Scholar] [CrossRef]

- Shahbaz, M.; Gozgor, G.; Adom, P.K.; Hammoudeh, S. The Technical Decomposition of Carbon Emissions and the Concerns about FDI and Trade Openness Effects in the United States. Int. Econ. 2019, 159, 56–73. [Google Scholar] [CrossRef] [Green Version]

- Birdsall, N.; Wheeler, D. Trade Policy and Industrial Pollution in Latin America: Where Are the Pollution Havens? In International Trade and the Environment; Routledge: London, UK, 2017. [Google Scholar]

- Pazienza, P. The impact of FDI in the OECD manufacturing sector on CO2 emission: Evidence and policy issues. Environ. Impact Assess. Rev. 2019, 77, 60–68. [Google Scholar] [CrossRef]

- Qamruzzaman, M. Nexus between environmental quality, institutional quality and trade openness through the channel of FDI: An application of common correlated effects estimation (CCEE), NARDL, and asymmetry causality. Environ. Sci. Pollut. Res. 2021, 28, 52475–52498. [Google Scholar] [CrossRef] [PubMed]

- Walter, I.; Ugelow, J.L. Environmental Policies in Developing Countries. Ambio 1979, 8, 102–109. [Google Scholar]

- Pethig, R. Pollution, welfare, and environmental policy in the theory of Comparative Advantage. J. Environ. Econ. Manag. 1976, 2, 160–169. [Google Scholar] [CrossRef]

- Liu, Y.; Hao, Y.; Gao, Y. The environmental consequences of domestic and foreign investment: Evidence from China. Energy Policy 2017, 108, 271–280. [Google Scholar] [CrossRef]

- Nasir, M.A.; Huynh, T.L.D.; Tram, H.T.X. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. J. Environ. Manag. 2019, 242, 131–141. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 2011, 36, 685–693. [Google Scholar] [CrossRef]

- Zhu, H.; Duan, L.; Guo, Y.; Yu, K. The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 2016, 58, 237–248. [Google Scholar] [CrossRef] [Green Version]

- Zhang, C.; Zhou, X. Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sustain. Energy Rev. 2016, 58, 943–951. [Google Scholar] [CrossRef]

- Sung, B.; Song, W.-Y.; Park, S.-D. How foreign direct investment affects CO2 emission levels in the Chinese manufacturing industry: Evidence from panel data. Econ. Syst. 2018, 42, 320–331. [Google Scholar] [CrossRef]

- Xu, S.-C.; Li, Y.-W.; Miao, Y.-M.; Gao, C.; He, Z.-X.; Shen, W.-X.; Long, R.-Y.; Chen, H.; Zhao, B.; Wang, S.-X. Regional differences in nonlinear impacts of economic growth, export and FDI on air pollutants in China based on provincial panel data. J. Clean. Prod. 2019, 228, 455–466. [Google Scholar] [CrossRef]

- Fereidouni, H.G. Foreign direct investments in real estate sector and CO2 emission: Evidence from emerging economies. Manag. Environ. Qual. Int. J. 2013, 24, 463–476. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold Effects in Non-dynamic Panels: Estimation, Testing, and Inference. J. Econ. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Sarkodie, S.A.; Strezov, V. Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci. Total Environ. 2019, 646, 862–871. [Google Scholar] [CrossRef] [PubMed]

- Xie, Q.; Wang, X.; Cong, X. How does foreign direct investment affect CO2 emissions in emerging countries?New findings from a nonlinear panel analysis. J. Clean. Prod. 2019, 249, 119422. [Google Scholar] [CrossRef]

- Kozul-Wright, R.; Fortunato, P. International Trade and Carbon Emissions. Eur. J. Dev. Res. 2012, 24, 509–529. [Google Scholar] [CrossRef]

- Kosztowniak, A. Verification of the relationship between FDI and GDP in Poland. Acta Oecon. 2016, 66, 307–332. [Google Scholar] [CrossRef]

- Leifei, L. The Effect of FDI on Economic Growth and Environmental Pollution: Evidence from the Emerging Market; Chongqing University: Chongqing, China, 2018. [Google Scholar]

- Nations, U. The Role of International Investment Agreements in Attracting Foreign Direct Investment to Developing Countries. Maris Bv 2011, 3, 885–890. [Google Scholar]

- Pei, H.E.; Liu, Y. The Effect of FDI on China’s Environmental Pollution: A Research Based on Instrument of Geographical Distance. J. Cent. Univ. Financ. Econ. 2016, 06, 79–86. [Google Scholar]

- Vasile, V.; Tefan, D.; Comes, C.A.; Bunduchi, E.; Tefan, A.B. FDI or remittances for sustainable external financial inflows. theoretical delimitations and practical evidence using granger causality. Rom. J. Econ. Forecast. 2020, 23, 131–153. [Google Scholar]

- Ntom, E.; Kamil, A.; Zaydn, O. Environmental performance of Turkey amidst foreign direct investment and agriculture: A time series analysis. J. Public Aff. 2020, e2441. [Google Scholar]

- He, F.; Chang, K.-C.; Li, M.; Li, X.; Li, F. Bootstrap ARDL Test on the Relationship among Trade, FDI, and CO2 Emissions: Based on the Experience of BRICS Countries. Sustainability 2020, 12, 1060. [Google Scholar] [CrossRef] [Green Version]

- Managi, S.; Hibiki, A.; Tsurumi, T. Does trade openness improve environmental quality? J. Environ. Econ. Manag. 2009, 58, 346–363. [Google Scholar] [CrossRef]

- Lin, F. Trade openness and air pollution: City-level empirical evidence from China. China Econ. Rev. 2017, 45, 78–88. [Google Scholar] [CrossRef]

- Hasanov, F.J.; Liddle, B.; Mikayilov, J. The Impact of International Trade on CO2 Emissions in Oil Exporting Countries: Territory vs. Consumption Emissions Accounting. Energy Econ. 2018, 74, 343–350. [Google Scholar] [CrossRef]

- Pan, X.; Zhang, J.; Li, C.; Quan, R.; Li, B. Exploring Dynamic Impact of Foreign Direct Investment on China’s CO2 Emissions Using Markov-Switching Vector Error Correction Model. Comput. Econ. 2017, 52, 1139–1151. [Google Scholar] [CrossRef]

- Yong, J. Does Inward Foreign Direct Investment Affect Productivity across Industries in Korea? East Asian Economic Review. Korea Inst. Int. Econ. Policy 2021, 25, 151–174. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef] [Green Version]

- Ben Lahouel, B.; Taleb, L.; Ben Zaied, Y.; Managi, S. Does ICT change the relationship between total factor productivity and CO2 emissions? Evidence based on a nonlinear model. Energy Econ. 2021, 101, 105406. [Google Scholar] [CrossRef]

- Ghosh, T.; Parab, P.M. Assessing India’s productivity trends and endogenous growth: New evidence from technology, human capital and foreign direct investment. Econ. Model. 2021, 97, 182–195. [Google Scholar] [CrossRef]

- Hui, W.; Hui, S.; Hanyue, X.; Long, X. Relationship between environmental policy uncertainty, two-way FDI and low-carbon TFP. China Popul. Resour. Environ. 2020, 30, 75–86. [Google Scholar]

- Zhang, S.; Hu, B.; Zhang, X. Have FDI quantity and quality promoted the low-carbon development of science and technology parks (STPs)? The threshold effect of knowledge accumulation. PLoS ONE 2021, 16, e0245891. [Google Scholar] [CrossRef] [PubMed]

- Dong, H.; Xue, M.; Xiao, Y.; Liu, Y. Do carbon emissions impact the health of residents? Considering China’s industrialization and urbanization. Sci. Total Environ. 2021, 758, 143688. [Google Scholar] [CrossRef] [PubMed]

- Oware, K.M. Economic Growth, Industrialization, Trade, Electricity Production and Carbon Dioxide Emissions: Evidence from Ghana. J. Econ. Res. 2021, 4, 13. [Google Scholar] [CrossRef]

- Xuejie, B.; Xiaolin, W. Effect of Industrialization Level on FDI Carbon Productivity. J. Shanxi Univ. Financ. Econ. 2020, 42, 14. [Google Scholar]

- González, A.; Teräsvirta, T.; Dijk, D. Panel Smooth Transition Regression Models; Technical Report No. 604; SSE/EFI Working Paper Series in Economics and Finance; Stockholm School of Economics, The Economic Research Institute (EFI): Stockholm, Sweden, 2005. [Google Scholar]

- Wang, D.; Du, K.; Yan, Z. Does Low-carbon Technology Innovation Effectively Curb Carbon Emission? Empirical Analysis Based on PSTR Model. J. Nanjing Univ. Financ. Econ. 2018, 6, 1–14. [Google Scholar]

- Gollin, D. Getting Income Shares Right. J. Polit. Econ. 2002, 110, 458–474. [Google Scholar] [CrossRef] [Green Version]

- Luukkonen, R.; Saikkonen, P.; Teräsvirta, T. Testing Linearity Against Smooth Transition Autoregressive Models. Biometrika 1988, 75, 491–499. [Google Scholar] [CrossRef]

- Colletaz, G.; Hurlin, C. Threshold Effects of the Public Capital Productivity: An International Panel Smooth Transition Approach. HAL Open Sci. 2006, halshs-00008056. [Google Scholar]

| Ch-Mon-Rus | Central Asia | West Asia and North Africa | Central and Eastern Europe | Southeast Asia | South Asia |

|---|---|---|---|---|---|

| China Mongolia Russian | Kazakhstan Kyrgyzstan Tajikistan Turkmenistan Uzbekistan | United Arab Emirates Oman Azerbaijan Egypt Pakistan Bahrain Georgia Qatar Kuwait Lebanon Saudi Arabia Turkey Armenia Yemen Iraq Iran Israel Jordan | Albania Estonia Belarus Bulgaria Bosnia Poland Czech Croatia Latvia Lithuania Romania North Macedonia Moldova Slovakia Slovenia Ukraine Hungary | Philippines Cambodia Laos Malaysia Myanmar Thailand Brunei Singapore Indonesia Vietnam | Bhutan Maldives Bangladesh Nepal Sri Lanka India |

| Series | N | Obs. | Mean | Std. | Min. | Max. | Source |

|---|---|---|---|---|---|---|---|

| lnCO2 | 59 | 944 | 3.732 | 1.829 | −1.171 | 9.210 | World Development Indicator |

| lnFDI | 59 | 944 | 9.606 | 2.344 | −11.513 | 14.286 | UNCTAD |

| lnPGDP | 59 | 944 | 8.558 | 1.264 | 5.471 | 11.951 | World Development Indicator |

| lnIND | 59 | 944 | 3.428 | 0.402 | 2.087 | 4.315 | World Development Indicator |

| lnTFP | 59 | 944 | 6.433 | 0.616 | 4.853 | 7.933 | Penn World Tables |

| lnOPEN | 59 | 944 | 4.232 | 0.734 | −1.624 | 5.839 | World Development Indicator |

| Model | Model A | Model B | Model C | Model D | |

|---|---|---|---|---|---|

| Threshold Variable | lnPGDP | lnOPEN | lnIND | lnTFP | |

| Linearity Test | LMF (H0: r = 0, H1: r = 1) | 53.733 *** (0.000) | 6.911 *** (0.000) | 23.120 *** (0.000) | 68.508 *** (0.000) |

| Remaining non-linearity Test | LMF (H0: r = 1, H1: r = 2) | 0.670 (0.512) | 0.372 (0.690) | 21.493 *** (0.000) | 29.617 *** (0.000) |

| LMF (H0: r = 2, H1: r = 3) | −0.000 (1.000) | 0.020 (0.888) | |||

| Model Tests | 9.710 *** (0.000) | 3.204 ** (0.023) | 14.075 *** (0.000) | 38.935 *** (0.000) | |

| 29.166 *** (0.000) | 3.420 ** (0.017) | 6.196 *** (0.000) | 23.657 *** (0.000) | ||

| 6.063 *** (0.000) | 0.248 (0.863) | 2.391 * (0.067) | 2.305 * (0.075) | ||

| Final Model Selection | m = 2, r = 1 | m = 2, r = 1 | m = 1, r = 2 | m = 1, r = 2 |

| Specification | Model A | Model B | Model C | Model D |

|---|---|---|---|---|

| Threshold Variable | lnPGDP | lnOPEN | lnIND | lnTFP |

| r | 1 | 1 | 2 | 2 |

| m | 2 | 2 | 1 | 1 |

| Parameter β0 | 0.252 *** (0.014) | 0.269 *** (0.017) | 0.741 *** (1.056) | −0.888 *** (0.110) |

| Parameter β1 | −0.065 *** (0.007) | −0.038 *** (0.007) | 0.000 *** (0.000) | −0.240 *** (0.020) |

| Parameter β2 | −1.481 *** (2.112) | 1.332 *** (0.122) | ||

| Location parameters | 6.558 | 4.1387 | 3.315 | 4.218 |

| Location parameters | 9.675 | 4.1388 | 5.824 | 6.033 |

| Slopes parameters | 0.747 | 4.720 | 9.538 | 1.630 |

| Slopes parameters | 0.000 | 1.974 | ||

| AIC criterion | −3.368 | −3.301 | −3.359 | −3.452 |

| Schwarz criterion | −3.342 | −3.275 | −3.322 | −3.416 |

| Number of obs. | 944 | 944 | 944 | 944 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nie, Y.; Liu, Q.; Liu, R.; Ren, D.; Zhong, Y.; Yu, F. The Threshold Effect of FDI on CO2 Emission in Belt and Road Countries. Int. J. Environ. Res. Public Health 2022, 19, 3523. https://doi.org/10.3390/ijerph19063523

Nie Y, Liu Q, Liu R, Ren D, Zhong Y, Yu F. The Threshold Effect of FDI on CO2 Emission in Belt and Road Countries. International Journal of Environmental Research and Public Health. 2022; 19(6):3523. https://doi.org/10.3390/ijerph19063523

Chicago/Turabian StyleNie, Ying, Qingjie Liu, Rong Liu, Dexiao Ren, Yao Zhong, and Feng Yu. 2022. "The Threshold Effect of FDI on CO2 Emission in Belt and Road Countries" International Journal of Environmental Research and Public Health 19, no. 6: 3523. https://doi.org/10.3390/ijerph19063523