Does Environmental Regulation Help Mitigate Factor Misallocation?—Theoretical Simulations Based on a Dynamic General Equilibrium Model and the Perspective of TFP

Abstract

1. Introduction

2. Literature Review

2.1. The Sources of Factor Misallocation

2.2. The Effects of Environmental Regulation

2.3. The Brief Comments

3. The Model

3.1. Product Market Equilibrium

3.2. Factor Misallocation and TFP Losses Shocked by Environmental Regulation

4. Numerical Simulation

4.1. Basic Assumptions and Parameter Settings

- The elasticity of substitution between firm value-added is set to . Estimates of the substitutability among competing firms typically range from 3–10 in the vast literature on productivity studies [72,73]. Broda and Weinstein (2006) argued that lower elasticities for more differentiated goods, so we made this choice for conservatively [72]. Besides, we will also use a relatively moderate elasticity and a more extreme elasticity in simulations as robustness analysis. Table A1, Table A2, Table A3 and Table A4 in Appendix A show these results.

- As mentioned, we supposed that firm 1 in our model faced misallocation but not for firm 2. It is well known that misallocation leads to a loss of firm productivity, and thus we have good reasons to assume that the physical productivity of firm 1 is lower than firm 2. Based on this, we standardized the physical total factor productivity of the two firms as and .

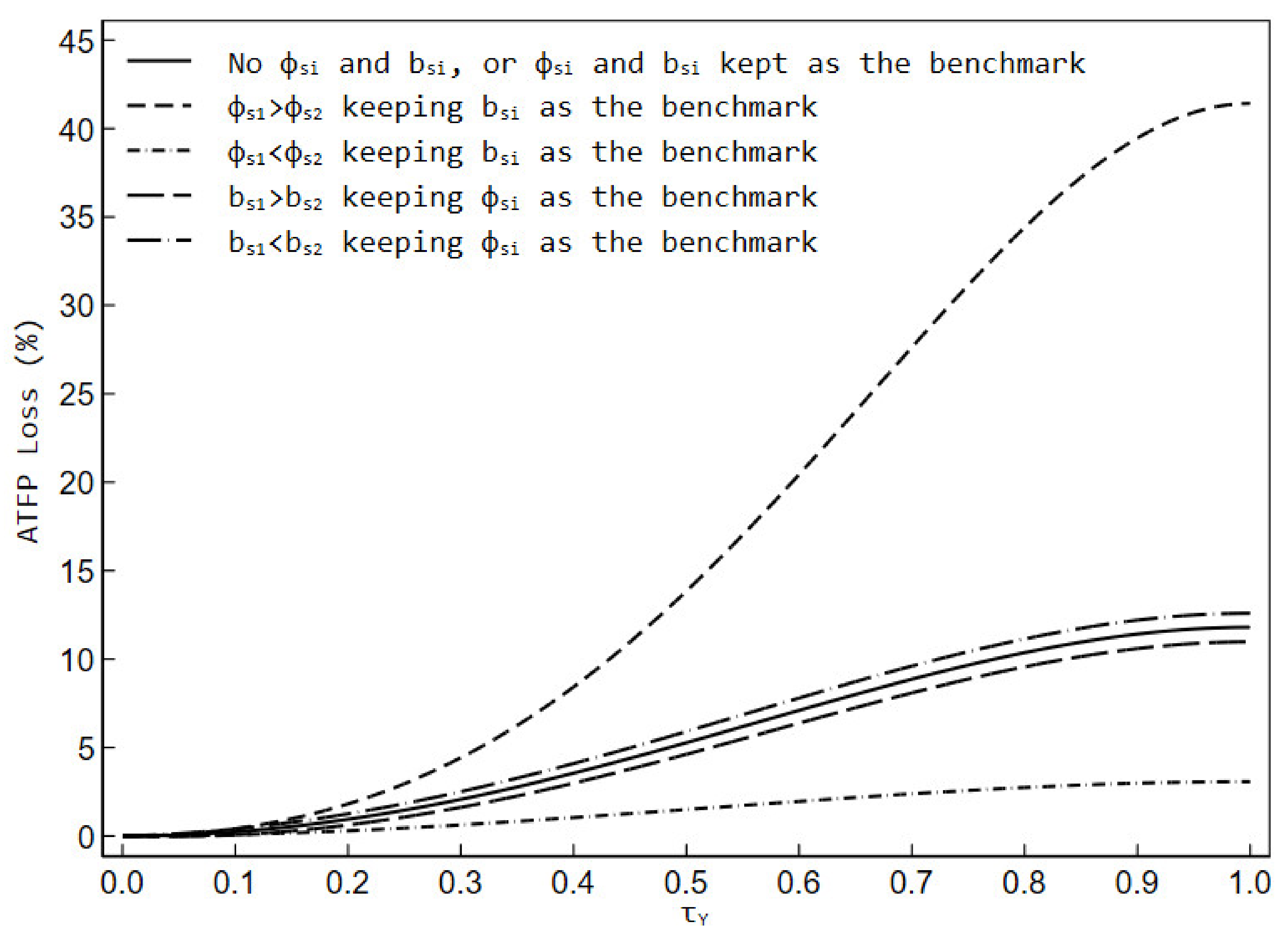

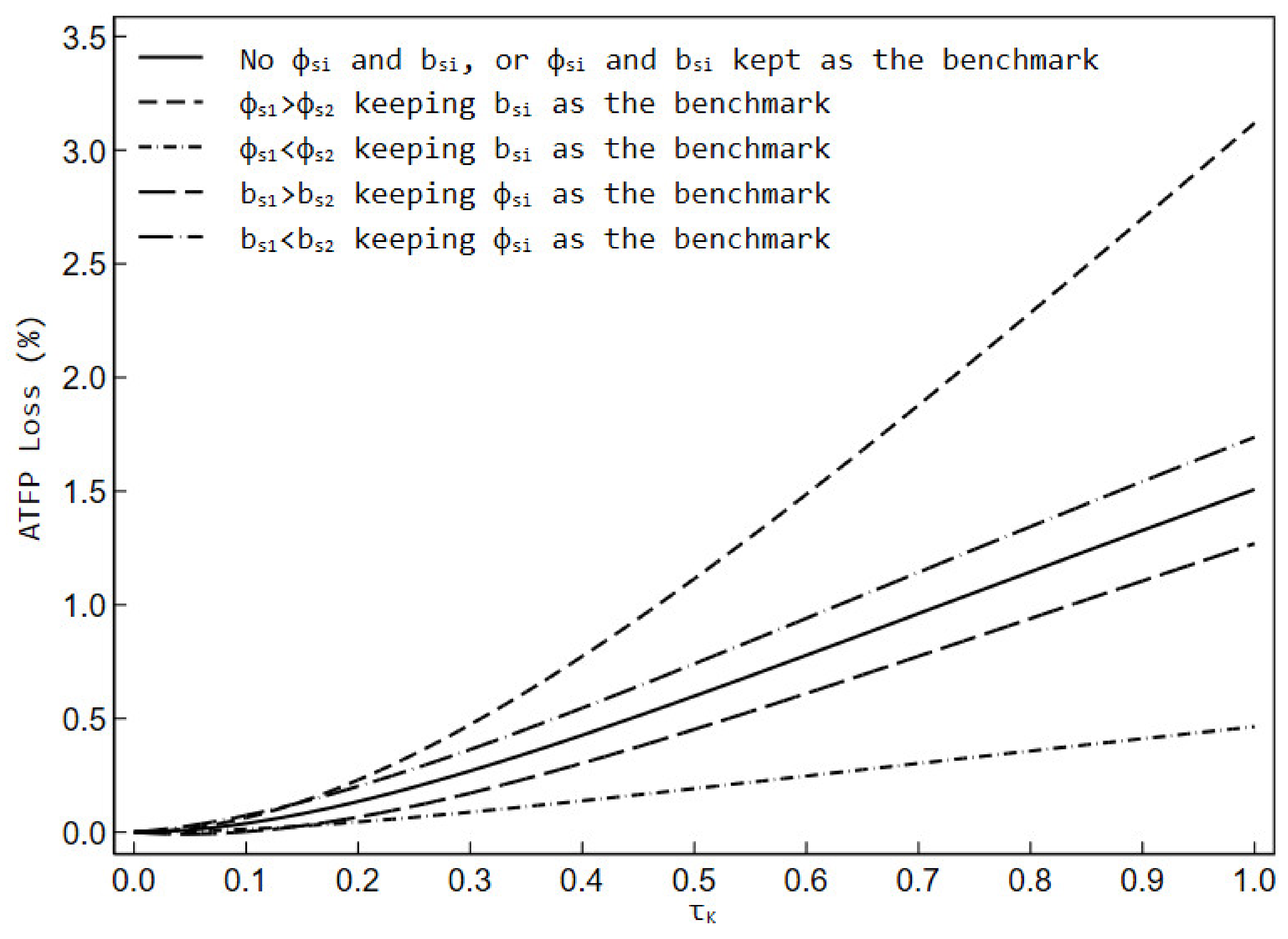

- Environmental regulation is an external policy shock, thus, government tends to differentiate policies according to the wide heterogeneity of firms so that the extent of the shock may be different for different firms [76]. Firstly, we set a benchmark for the environmental regulatory shock—firm 1 and firm 2 face a unit shock at the same time, i.e., . Secondly, we distinguish two alternative options: (1) firm 1 is subjected to a weaker environmental regulatory shock, defined as half the intensity of the benchmark; (2) firm 1 is subjected to a stronger environmental regulatory shock, defined as two times the intensity of the benchmark. Finally, assume that the industry-level environmental regulatory shock () is the geometric mean at the firm level.

- Similar to the parameterization of environmental regulatory shock, we first consider a base case where firm1 and firm 2 have the same overhead labor share, set as . Next, let the overhead labor share of firm 1 be half of the base case as one simulation option, and let the overhead labor share of firm 2 be half of the base case as another simulation option. In addition, the industry-level overhead labor share is also assumed as the firm-level geometric mean.

4.2. The Impacts of on ATFP in the Absence/Presence of Environmental Regulatory Shock and Overhead Labor

4.3. The Impacts of on ATFP in the Absence/Presence of Environmental Regulatory Shock and Overhead Labor

5. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Numerical Simulation Results Using Other Alternative Elasticities of Substitution

| 0 | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1. No and | |||||||||||

| effective ATFP | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 |

| distorted ATFP | 1.015 | 1.014 | 1.011 | 1.008 | 1.005 | 1.003 | 1.001 | 1.000 | 1.000 | 1.000 | 1.000 |

| ATFP Loss (%) | 0.000 | 0.116 | 0.384 | 0.701 | 0.997 | 1.231 | 1.389 | 1.478 | 1.517 | 1.526 | 1.527 |

| Scenario 2. Keep and as the benchmark | |||||||||||

| effective ATFP | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 |

| distorted ATFP | 1.015 | 1.014 | 1.011 | 1.008 | 1.005 | 1.003 | 1.001 | 1.000 | 1.000 | 1.000 | 1.000 |

| ATFP Loss (%) | 0.000 | 0.116 | 0.384 | 0.701 | 0.997 | 1.231 | 1.389 | 1.478 | 1.517 | 1.526 | 1.527 |

| Scenario 3. keeping as the benchmark | |||||||||||

| effective ATFP | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 |

| distorted ATFP | 0.841 | 0.835 | 0.818 | 0.792 | 0.764 | 0.740 | 0.722 | 0.713 | 0.708 | 0.707 | 0.707 |

| ATFP Loss (%) | 0.000 | 0.677 | 2.797 | 6.146 | 10.059 | 13.687 | 16.402 | 18.014 | 18.721 | 18.907 | 18.921 |

| Scenario 4. keeping as the benchmark | |||||||||||

| effective ATFP | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 |

| distorted ATFP | 1.416 | 1.415 | 1.415 | 1.415 | 1.415 | 1.414 | 1.414 | 1.414 | 1.414 | 1.414 | 1.414 |

| ATFP Loss (%) | 0.000 | 0.008 | 0.026 | 0.046 | 0.065 | 0.079 | 0.089 | 0.095 | 0.097 | 0.097 | 0.098 |

| Scenario 5. keeping as the benchmark | |||||||||||

| effective ATFP | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 |

| distorted ATFP | 1.028 | 1.028 | 1.026 | 1.023 | 1.020 | 1.018 | 1.016 | 1.015 | 1.015 | 1.015 | 1.015 |

| ATFP Loss (%) | 0.000 | 0.030 | 0.240 | 0.521 | 0.796 | 1.018 | 1.171 | 1.258 | 1.296 | 1.306 | 1.307 |

| Scenario 6. keeping as the benchmark | |||||||||||

| effective ATFP | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 |

| distorted ATFP | 0.996 | 0.994 | 0.991 | 0.987 | 0.984 | 0.982 | 0.980 | 0.979 | 0.979 | 0.979 | 0.979 |

| ATFP Loss (%) | 0.000 | 0.198 | 0.521 | 0.873 | 1.189 | 1.433 | 1.597 | 1.688 | 1.726 | 1.737 | 1.737 |

| 0 | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1. No and | |||||||||||

| effective ATFP | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 |

| distorted ATFP | 1.015 | 1.015 | 1.015 | 1.014 | 1.014 | 1.013 | 1.012 | 1.012 | 1.011 | 1.011 | 1.010 |

| ATFP Loss (%) | 0.000 | 0.018 | 0.059 | 0.112 | 0.170 | 0.230 | 0.288 | 0.345 | 0.399 | 0.450 | 0.498 |

| Scenario 2. Keep and as the benchmark | |||||||||||

| effective ATFP | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 | 1.015 |

| distorted ATFP | 1.015 | 1.015 | 1.015 | 1.014 | 1.014 | 1.013 | 1.012 | 1.012 | 1.011 | 1.011 | 1.010 |

| ATFP Loss (%) | 0.000 | 0.018 | 0.059 | 0.112 | 0.170 | 0.230 | 0.288 | 0.345 | 0.399 | 0.450 | 0.498 |

| Scenario 3. keeping as the benchmark | |||||||||||

| effective ATFP | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 | 0.841 |

| distorted ATFP | 0.841 | 0.840 | 0.838 | 0.835 | 0.832 | 0.828 | 0.825 | 0.821 | 0.817 | 0.813 | 0.809 |

| ATFP Loss (%) | 0.000 | 0.088 | 0.319 | 0.652 | 1.055 | 1.504 | 1.980 | 2.471 | 2.965 | 3.458 | 3.942 |

| Scenario 4. keeping as the benchmark | |||||||||||

| effective ATFP | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 | 1.416 |

| distorted ATFP | 1.416 | 1.416 | 1.416 | 1.415 | 1.415 | 1.415 | 1.415 | 1.415 | 1.415 | 1.415 | 1.415 |

| ATFP Loss (%) | 0.000 | 0.001 | 0.004 | 0.008 | 0.011 | 0.015 | 0.019 | 0.023 | 0.027 | 0.030 | 0.033 |

| Scenario 5. keeping as the benchmark | |||||||||||

| effective ATFP | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 | 1.028 |

| distorted ATFP | 1.028 | 1.028 | 1.028 | 1.028 | 1.027 | 1.027 | 1.026 | 1.026 | 1.025 | 1.025 | 1.024 |

| ATFP Loss (%) | 0.000 | 0.007 | 0.014 | 0.050 | 0.094 | 0.142 | 0.190 | 0.238 | 0.284 | 0.328 | 0.370 |

| Scenario 6. keeping as the benchmark | |||||||||||

| effective ATFP | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 |

| distorted ATFP | 0.996 | 0.995 | 0.995 | 0.994 | 0.993 | 0.993 | 0.992 | 0.991 | 0.991 | 0.990 | 0.990 |

| ATFP Loss (%) | 0.000 | 0.041 | 0.101 | 0.170 | 0.242 | 0.313 | 0.382 | 0.447 | 0.509 | 0.567 | 0.621 |

| 0 | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1. No and | |||||||||||

| effective ATFP | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 |

| distorted ATFP | 1.000487 | 1.000378 | 1.000213 | 1.000096 | 1.000034 | 1.00001 | 1.000002 | 1 | 1 | 1 | 1 |

| ATFP Loss (%) | 0 | 0.010944 | 0.027448 | 0.039172 | 0.045299 | 0.047791 | 0.048559 | 0.048724 | 0.048744 | 0.048745 | 0.048745 |

| Scenario 2. Keep and as the benchmark | |||||||||||

| effective ATFP | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 |

| distorted ATFP | 1.000487 | 1.000378 | 1.000213 | 1.000096 | 1.000034 | 1.00001 | 1.000002 | 1 | 1 | 1 | 1 |

| ATFP Loss (%) | 0 | 0.010944 | 0.027448 | 0.039172 | 0.045299 | 0.047791 | 0.048559 | 0.048724 | 0.048744 | 0.048745 | 0.048745 |

| Scenario 3. keeping as the benchmark | |||||||||||

| effective ATFP | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 |

| distorted ATFP | 0.771105 | 0.762412 | 0.742278 | 0.723915 | 0.713294 | 0.708831 | 0.707443 | 0.707145 | 0.707108 | 0.707107 | 0.707107 |

| ATFP Loss (%) | 0 | 1.140293 | 3.883673 | 6.518717 | 8.104904 | 8.785585 | 8.998994 | 9.044871 | 9.050515 | 9.050772 | 9.050773 |

| Scenario 4. keeping as the benchmark | |||||||||||

| effective ATFP | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 |

| distorted ATFP | 1.414216 | 1.414216 | 1.414215 | 1.414214 | 1.414214 | 1.414214 | 1.414214 | 1.414214 | 1.414214 | 1.414214 | 1.414214 |

| ATFP Loss (%) | 0 | 4.29 × 10−5 | 0.000108 | 0.000153 | 0.000177 | 0.000187 | 0.00019 | 0.000191 | 0.000191 | 0.000191 | 0.000191 |

| Scenario 5. keeping as the benchmark | |||||||||||

| effective ATFP | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 |

| distorted ATFP | 1.015151 | 1.01513 | 1.014999 | 1.014894 | 1.014837 | 1.014812 | 1.014805 | 1.014803 | 1.014803 | 1.014803 | 1.014803 |

| ATFP Loss (%) | 0 | 0.00213 | 0.014976 | 0.025341 | 0.03103 | 0.033403 | 0.034147 | 0.034308 | 0.034328 | 0.034329 | 0.034329 |

| Scenario 6. keeping as the benchmark | |||||||||||

| effective ATFP | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 |

| distorted ATFP | 0.979487 | 0.979298 | 0.979102 | 0.978975 | 0.978911 | 0.978886 | 0.978878 | 0.978876 | 0.978876 | 0.978876 | 0.978876 |

| ATFP Loss (%) | 0 | 0.019297 | 0.039267 | 0.052279 | 0.058822 | 0.061426 | 0.062217 | 0.062385 | 0.062406 | 0.062407 | 0.062407 |

| 0 | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1. No and | |||||||||||

| effective ATFP | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 |

| distorted ATFP | 1.000487 | 1.00047 | 1.000433 | 1.000391 | 1.00035 | 1.000313 | 1.000279 | 1.000249 | 1.000222 | 1.000199 | 1.000179 |

| ATFP Loss (%) | 0 | 0.001767 | 0.005425 | 0.0096 | 0.013697 | 0.017479 | 0.02087 | 0.023865 | 0.026493 | 0.028792 | 0.030802 |

| Scenario 2. Keep and as the benchmark | |||||||||||

| effective ATFP | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 | 1.000487 |

| distorted ATFP | 1.000487 | 1.00047 | 1.000433 | 1.000391 | 1.00035 | 1.000313 | 1.000279 | 1.000249 | 1.000222 | 1.000199 | 1.000179 |

| ATFP Loss (%) | 0 | 0.001767 | 0.005425 | 0.0096 | 0.013697 | 0.017479 | 0.02087 | 0.023865 | 0.026493 | 0.028792 | 0.030802 |

| Scenario 3. keeping as the benchmark | |||||||||||

| effective ATFP | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 | 0.771105 |

| distorted ATFP | 0.771105 | 0.770048 | 0.767357 | 0.763685 | 0.759542 | 0.75528 | 0.751123 | 0.747199 | 0.743571 | 0.740261 | 0.737266 |

| ATFP Loss (%) | 0 | 0.137301 | 0.488497 | 0.971617 | 1.522417 | 2.095265 | 2.660278 | 3.199436 | 3.703012 | 4.166756 | 4.589863 |

| Scenario 4. keeping as the benchmark | |||||||||||

| effective ATFP | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414216 |

| distorted ATFP | 1.414216 | 1.414216 | 1.414216 | 1.414216 | 1.414215 | 1.414215 | 1.414215 | 1.414215 | 1.414215 | 1.414215 | 1.414215 |

| ATFP Loss (%) | 0 | 6.95 × 10−6 | 2.13 × 10−5 | 3.77 × 10−5 | 5.37 × 10−5 | 6.85 × 10−5 | 8.18 × 10−5 | 9.35 × 10−5 | 1.04 × 10−4 | 1.13 × 10−4 | 1.21 × 10−4 |

| Scenario 5. keeping as the benchmark | |||||||||||

| effective ATFP | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 | 1.015151 |

| distorted ATFP | 1.015151 | 1.015166 | 1.015153 | 1.015127 | 1.015099 | 1.015071 | 1.015044 | 1.01502 | 1.014998 | 1.014979 | 1.014962 |

| ATFP Loss (%) | 0 | 0.000109 | 0.001457 | 0.002362 | 0.005175 | 0.007969 | 0.010585 | 0.012965 | 0.015096 | 0.01699 | 0.018666 |

| Scenario 6. keeping as the benchmark | |||||||||||

| effective ATFP | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 | 0.979487 |

| distorted ATFP | 0.979487 | 0.97944 | 0.979382 | 0.979326 | 0.979274 | 0.979228 | 0.979187 | 0.979152 | 0.979122 | 0.979096 | 0.979073 |

| ATFP Loss (%) | 0 | 0.004822 | 0.010671 | 0.016459 | 0.021774 | 0.026493 | 0.030617 | 0.034196 | 0.037294 | 0.039976 | 0.042303 |

References

- Lang, K.; Liu, Q. The Causes, Trends and Decomposition of Resource Misallocation. China J. Econ. 2021, 8, 1–25. [Google Scholar] [CrossRef]

- Hsieh, C.T.; Klenow, P.J. Misallocation and Manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef]

- Bartelsman, E.; Haltiwanger, J.; Scarpetta, S. Cross-Country Differences in Productivity: The Role of Allocation and Selection. Am. Econ. Rev. 2013, 103, 305–334. [Google Scholar] [CrossRef]

- Zhu, S.; Li, W. Does Environmental Regulation Promote the Correction of Factor Misallocations in the Industrial Sector? An Empirical Evidence from Micro-data of Chinese Industrial Enterprises. Macroeconomics 2021, 2, 149–161. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Berman, E.; Bui, L.T.M. Environmental regulation and productivity: Evidence from oil refineries. Rev. Econ. Stat. 2001, 83, 498–510. [Google Scholar] [CrossRef]

- Hamamoto, M. Environmental Regulation and the Productivity of Japanese Manufacturing Industries. Resour. Energy Econ. 2006, 28, 299–312. [Google Scholar] [CrossRef]

- Atkinson, S.; Tietenberg, T. Market Failure in Incentive-based Regulation—The Case of Emissions Trading. J. Environ. Econ. Manag. 1991, 21, 17–31. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. A Tale of Two Market Failures: Technology and Environmental Policy. Ecol. Econ. 2005, 54, 164–174. [Google Scholar] [CrossRef]

- Tombe, T.; Winter, J. Environmental Policy and Misallocation: The Productivity Effect of Intensity Standards. J. Environ. Econ. Manag. 2015, 72, 137–163. [Google Scholar] [CrossRef]

- Geng, C.X.; Cui, Z.Y. Analysis of Spatial Heterogeneity and Driving Factors of Capital Allocation Efficiency in Energy Conservation and Environmental Protection Industry under Environmental Regulation. Energy Policy 2020, 137, 12. [Google Scholar] [CrossRef]

- Buera, F.J.; Shin, Y. Financial Frictions and the Persistence of History: A Quantitative Exploration. J. Political Econ. 2013, 121, 221–272. [Google Scholar] [CrossRef]

- Guo, S.; Jiang, Z.; Shi, H.M. The business cycle implications of bank discrimination in China. Econ. Model. 2018, 73, 264–278. [Google Scholar] [CrossRef]

- Ruziev, K.; Webber, D.J. Does connectedness improve SMEs’ access to formal finance? Evidence from post-communist economies. Post-Communist Econ. 2019, 31, 258–278. [Google Scholar] [CrossRef]

- Jovanovic, B. Misallocation and Growth. Am. Econ. Rev. 2014, 104, 1149–1171. [Google Scholar] [CrossRef]

- Gai, Q.; Zhu, X.; Cheng, M.; Shi, Q. Factor Market’s Distortion, Markup and TFP. Econ. Res. J. 2015, 50, 61–75. [Google Scholar]

- Munshi, K.; Rosenzweig, M. Networks and Misallocation: Insurance, Migration, and the Rural-Urban Wage Gap. Am. Econ. Rev. 2016, 106, 46–98. [Google Scholar] [CrossRef]

- Zhao, S.; Yu, Y. Land Lease, Resource Misallocation and Total Factor Productivity. J. Finan. Econ. 2019, 45, 73–85. [Google Scholar] [CrossRef]

- Le, K. Land Use Restrictions, Misallocation in Agriculture, and Aggregate Productivity in Vietnam. J. Dev. Econ. 2020, 145, 22. [Google Scholar] [CrossRef]

- Peek, J.; Rosengren, E.S. Unnatural selection: Perverse incentives and the misallocation of credit in Japan. Am. Econ. Rev. 2005, 95, 1144–1166. [Google Scholar] [CrossRef]

- Caballero, R.J.; Hoshi, T.; Kashyap, A.K. Zombie Lending and Depressed Restructuring in Japan. Am. Econ. Rev. 2008, 98, 1943–1977. [Google Scholar] [CrossRef]

- Whalley, J.; Zhang, S.M. A numerical simulation analysis of (Hukou) labour mobility restrictions in China. J. Dev. Econ. 2007, 83, 392–410. [Google Scholar] [CrossRef]

- Ranasinghe, A. Property Rights, Extortion and the Misallocation of Talent. Eur. Econ. Rev. 2017, 98, 86–110. [Google Scholar] [CrossRef]

- Melitz, M.J.; Ottaviano, G.I.P. Market size, trade, and productivity. Rev. Econ. Stud. 2008, 75, 295–316. [Google Scholar] [CrossRef]

- Epifani, P.; Gancia, G. Trade, markup heterogeneity and misallocations. J. Int. Econ. 2011, 83, 1–13. [Google Scholar] [CrossRef]

- Tombe, T. The Missing Food Problem: Trade, Agriculture, and International Productivity Differences. Am. Econ. J. Macroecon. 2015, 7, 226–258. [Google Scholar] [CrossRef]

- Zhou, H.; Hu, H.; Xie, C.; Dai, M. Regional Resource Misallocation and Transportation Infrastructure: Empirical Evidence from China. Ind. Econ. Res. 2017, 1, 100–113. [Google Scholar] [CrossRef]

- Shao, Y.; Bu, X.; Zhang, T. Resource Misallocation and TFP of Chinese Industrial Enterprises: A Recalculation based on Chinese Industrial Enterprises Database. China Ind. Econ. 2013, 12, 39–51. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, K.; Si, H. Zombie Companies, Resource Misallocation and Firm TFP: Evidence From Chinese Industrial Enterprises. Res. Financ. Econ. Issue 2019, 7, 57–66. [Google Scholar] [CrossRef]

- Chen, B.; Jin, X.; Ouyang, D. Housing Prices, Resource Misallocation and Productivity of Chinese Industrial Enterprises. J. World Econ. 2015, 38, 77–98. [Google Scholar]

- Fiorino, D.J. The New Environmental Regulation; Mit Press: Cambridge, MA, USA, 2006. [Google Scholar]

- Mitchell, G.; Norman, P.; Mullin, K. Who Benefits from Environmental Policy? An Environmental Justice Analysis of Air Quality Change in Britain, 2001–2011. Environ. Res. Lett. 2015, 10, 19. [Google Scholar] [CrossRef]

- Li, B.; Wu, S.S. Effects of Local and civil Environmental Regulation on Green Total Factor Productivity in China: A spatial Durbin Econometric Analysis. J. Clean. Prod. 2017, 153, 342–353. [Google Scholar] [CrossRef]

- Wang, Y.; Shen, N. Environmental Regulation and Environmental Productivity: The Case of China. Renew. Sustain. Energy Rev. 2016, 62, 758–766. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Wang, H.; Wheeler, D. Confronting the Environmental Kuznets Curve. J. Econ. Perspect. 2002, 16, 147–168. [Google Scholar] [CrossRef]

- Rivers, L.; Dempsey, T.; Mitchell, J.; Gibbs, C. Environmental Regulation and Enforcement: Structures, Processes and the Use of Data for Fraud Detection. J. Environ. Assess. Policy Manag. 2015, 17, 1550033. [Google Scholar] [CrossRef]

- Marconi, D. Environmental Regulation and Revealed Comparative Advantages in Europe: Is China a Pollution Haven? Rev. Int. Econ. 2012, 20, 616–635. [Google Scholar] [CrossRef]

- Solarin, S.A.; Al-Mulali, U.; Musah, I.; Ozturk, I. Investigating the Pollution Haven Hypothesis in Ghana: An Empirical Investigation. Energy 2017, 124, 706–719. [Google Scholar] [CrossRef]

- Huo, W.; Li, J.; Chen, R. Study on Environmental Effects of Green Development and FDI—Data Demonstration from “Pollution Paradise” to “Pollution Halo”. Financ. Econ. 2019, 4, 106–119. [Google Scholar]

- Wang, S.J.; Zhou, H.Y. High Energy-Consuming Industrial Transfers and Environmental Pollution in China: A Perspective Based on Environmental Regulation. Int. J. Environ. Res. Public Health 2021, 18, 1866. [Google Scholar] [CrossRef]

- Yang, H.R.; Zheng, H.; Liu, H.G.; Wu, Q. Nonlinear Effects of Environmental Regulation on Eco-Efficiency under the Constraint of Land Use Carbon Emissions: Evidence Based on a Bootstrapping Approach and Panel Threshold Model. Int. J. Environ. Res. Public Health 2019, 16, 1679. [Google Scholar] [CrossRef]

- White, H.L.; Nichols, S.J.; Robinson, W.A.; Norris, R.H. More for Less: A Study of Environmental Flows during Drought in Two Australian Rivers. Freshw. Biol. 2012, 57, 858–873. [Google Scholar] [CrossRef]

- Galloway, E.; Johnson, E.P. Teaching an Old Dog New Tricks: Firm Learning from Environmental Regulation. Energy Econ. 2016, 59, 1–10. [Google Scholar] [CrossRef]

- Xu, Y.; Qi, Y. Re-evaluate the Impact of Environmental Regulation on Enterprise Productivity and Its Mechanism. Financ. Trade Econ. 2017, 38, 147–161. [Google Scholar]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental Regulation and Competitiveness: Empirical Evidence on the Porter Hypothesis from European Manufacturing Sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef]

- Shen, K.; Jin, G.; Fang, X. Does Environmental Regulation Cause Pollution to Transfer Nearby? Econ. Res. J. 2017, 52, 44–59. [Google Scholar]

- Creti, A.; Sanin, M.E. Does Environmental Regulation Create Merger Incentives? Energy Policy 2017, 105, 618–630. [Google Scholar] [CrossRef]

- Wu, Y.H.; Yu, S.M.; Duan, X.D. The Impact of Environmental Regulation on the Location of Pollution-Intensive Industries in China under Agglomeration Effect. Int. J. Environ. Res. Public Health 2021, 18, 4045. [Google Scholar] [CrossRef]

- Su, B.; Ding, W.; Xiao, F. Impact of Environmental Regulation and Green Innovation on High-quality Economic Development. Innov. Sci. Technol. 2020, 20, 22–32. [Google Scholar] [CrossRef]

- Zhong, M.; Li, M.; Du, W. Can Environmental Regulation Force Industrial Structure Adjustment:An Empirical Analysis Based on Provincial Panel Data. China Popul. Resour. Environ. 2015, 25, 107–115. [Google Scholar]

- Shen, L.; Fan, R.J.; Wang, Y.Y.; Yu, Z.Q.; Tang, R.Y. Impacts of Environmental Regulation on the Green Transformation and Upgrading of Manufacturing Enterprises. Int. J. Environ. Res. Public Health 2020, 17, 7680. [Google Scholar] [CrossRef]

- Chen, C. China’s Industrial Green Total Factor Productivity and its Determinants—An Empirical Study Based on ML Index and Dynamic Panel Data Model. Stat. Res. 2016, 33, 53–62. [Google Scholar] [CrossRef]

- Li, T.H.; Ma, J.H.; Mo, B. Does Environmental Policy Affect Green Total Factor Productivity? Quasi-Natural Experiment Based on China’s Air Pollution Control and Prevention Action Plan. Int. J. Environ. Res. Public Health 2021, 18, 8216. [Google Scholar] [CrossRef]

- Jing, W.; Zhang, L. Environmental Regulation, Economic Opening and China’s Industrial Green Technology Progress. Econ. Res. J. 2014, 49, 34–47. [Google Scholar]

- Xie, J.; Sun, Q.; Wang, S.H.; Li, X.P.; Fan, F. Does Environmental Regulation Affect Export Quality? Theory and Evidence from China. Int. J. Environ. Res. Public Health 2020, 17, 8237. [Google Scholar] [CrossRef]

- Liu, L.Y.; Zhao, Z.Z.; Zhang, M.M.; Zhou, C.X.; Zhou, D.Q. The Effects of Environmental Regulation on Outward Foreign Direct Investment’s Reverse Green Technology Spillover: Crowding Out or Facilitation? J. Clean Prod. 2021, 284, 12. [Google Scholar] [CrossRef]

- Finger, S.R.; Gamper-Rabindran, S. Testing the Effects of Self-regulation on Industrial Accidents. J. Regul. Econ. 2013, 43, 115–146. [Google Scholar] [CrossRef]

- Shan, W.; Wang, J.Y. The Effect of Environmental Performance on Employment: Evidence from China’s Manufacturing Industries. Int. J. Environ. Res. Public Health 2019, 16, 2232. [Google Scholar] [CrossRef]

- Walker, W.R. Environmental Regulation and Labor Reallocation: Evidence from the Clean Air Act. Am. Econ. Rev. 2011, 101, 442–447. [Google Scholar] [CrossRef]

- Li, S. The Effects of Environmental Regulation on the Structure of Employment Skills:An Analysis Based on Industrial Dynamic Panel Data. Chin. J. Popul. Sci. 2016, 5, 90–100. [Google Scholar]

- Wang, Q.; Lu, F. The Spatial Characteristics of Environmental Regulation Affecting the Employment of Migrant Workers. Res. Econ. Manag. 2019, 40, 56–71. [Google Scholar] [CrossRef]

- Wang, Y.; Shi, M.; Li, J. Impact of Environmental Regulation on Employment: An Analysis Based on Panel Data of China’s Industrial Sectors. Chin. J. Popul. Sci. 2013, 3, 54–64. [Google Scholar]

- Zhou, R.M.; Zhang, Y.S.; Gao, X.C. The Spatial Interaction Effect of Environmental Regulation on Urban Innovation Capacity: Empirical Evidence from China. Int. J. Environ. Res. Public Health 2021, 18, 4470. [Google Scholar] [CrossRef] [PubMed]

- Bento, A.; Freedman, M.; Lang, C. Who Benefits from Environmental Regulation? Evidence from the Clean Air Act Amendments. Rev. Econ. Stat. 2015, 97, 610–622. [Google Scholar] [CrossRef]

- Choi, J.; Kim, I. Regional Total Factor Productivity and Local Employment Growth: Evidence from Korea. Asia-Pac. J. Reg. Sci. 2017, 1, 511–518. [Google Scholar] [CrossRef]

- Xu, S.; Chen, X.; Yuan, D.-l. Environmental Regulation, Political Connection and Resource allocation of R&D Innovation. Rev. Ind. Econ. 2018, 1, 24–39. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter Hypothesis at 20: Can Environmental Regulation Enhance Innovation and Competitiveness? Rev. Environ. Econ. Policy 2013, 7, 2–22. [Google Scholar] [CrossRef]

- Dong, X.; Yang, Y.L.; Zhao, X.M.; Feng, Y.J.; Liu, C.G. Environmental Regulation, Resource Misallocation and Industrial Total Factor Productivity: A Spatial Empirical Study Based on China’s Provincial Panel Data. Sustainability 2021, 13, 2390. [Google Scholar] [CrossRef]

- Han, C.; Zhang, W.; Feng, Z. How Does Environmental Regulation Remove Resource Misallocation -- An Analysis of the First Obligatory Pollution Control in China. China Ind. Econ. 2017, 4, 115–134. [Google Scholar] [CrossRef]

- Liu, B.; Yan, W.; Huang, X. Analysis of the Impact of Loan Misallocation on China’s Green Technology Innovation: From the Perspective of Regional Environment Regulation Discrepancies. Contemp. Financ. Econ. 2019, 9, 60–71. [Google Scholar] [CrossRef]

- Foster, L.; Haltiwanger, J.; Syverson, C. Reallocation, Firm Turnover, and Efficiency: Selection on Productivity or Profitability? Am. Econ. Rev. 2008, 98, 394–425. [Google Scholar] [CrossRef]

- Broda, C.; Weinstein, D.E. Globalization and the Gains from Variety. Q. J. Econ. 2006, 121, 541–585. [Google Scholar] [CrossRef]

- Hendel, I.; Nevo, A. Measuring the Implications of Sales and Consumer Inventory Behavior. Econometrica 2006, 74, 1637–1673. [Google Scholar] [CrossRef]

- Cooper, R.W.; Haltiwanger, J.C. On the Nature of Capital Adjustment Costs. Rev. Econ. Stud. 2006, 73, 611–633. [Google Scholar] [CrossRef]

- Brandt, L.; Tombe, T.; Zhu, X.D. Factor Market Distortions across Time, Space and Sectors in China. Rev. Econ. Dyn. 2013, 16, 39–58. [Google Scholar] [CrossRef]

- Zhao, X.M.; Liu, C.J.; Yang, M. The Effects of Environmental Regulation on China’s Total Factor Productivity: An Empirical Study of Carbon-intensive Industries. J. Clean Prod. 2018, 179, 325–334. [Google Scholar] [CrossRef]

| 0 | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1. No and | |||||||||||

| effective ATFP | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 |

| distorted ATFP | 1.118 | 1.115 | 1.108 | 1.095 | 1.080 | 1.062 | 1.044 | 1.027 | 1.013 | 1.004 | 1.000 |

| ATFP Loss (%) | 0.000 | 0.239 | 0.943 | 2.072 | 3.551 | 5.275 | 7.102 | 8.863 | 10.367 | 11.413 | 11.803 |

| Scenario 2. Keep and as the benchmark | |||||||||||

| effective ATFP | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 |

| distorted ATFP | 1.118 | 1.115 | 1.108 | 1.095 | 1.080 | 1.062 | 1.044 | 1.027 | 1.013 | 1.004 | 1.000 |

| ATFP Loss (%) | 0.000 | 0.239 | 0.943 | 2.072 | 3.551 | 5.275 | 7.102 | 8.863 | 10.367 | 11.413 | 11.803 |

| Scenario 3. keeping as the benchmark | |||||||||||

| effective ATFP | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| distorted ATFP | 1.000 | 0.996 | 0.982 | 0.958 | 0.922 | 0.878 | 0.830 | 0.784 | 0.744 | 0.717 | 0.707 |

| ATFP Loss (%) | 0.000 | 0.414 | 1.812 | 4.427 | 8.428 | 13.842 | 20.440 | 27.628 | 34.408 | 39.466 | 41.421 |

| Scenario 4. keeping as the benchmark | |||||||||||

| effective ATFP | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 |

| distorted ATFP | 1.458 | 1.457 | 1.453 | 1.449 | 1.443 | 1.436 | 1.430 | 1.424 | 1.419 | 1.415 | 1.414 |

| ATFP Loss (%) | 0.000 | 0.079 | 0.298 | 0.629 | 1.040 | 1.495 | 1.957 | 2.386 | 2.744 | 2.988 | 3.078 |

| Scenario 5. keeping as the benchmark | |||||||||||

| effective ATFP | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 |

| distorted ATFP | 1.126 | 1.125 | 1.119 | 1.108 | 1.094 | 1.077 | 1.059 | 1.042 | 1.028 | 1.018 | 1.015 |

| ATFP Loss (%) | 0.000 | 0.071 | 0.623 | 1.619 | 2.986 | 4.620 | 6.378 | 8.091 | 9.565 | 10.597 | 10.983 |

| Scenario 6. keeping as the benchmark | |||||||||||

| effective ATFP | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 |

| distorted ATFP | 1.102 | 1.098 | 1.089 | 1.075 | 1.059 | 1.041 | 1.022 | 1.006 | 0.992 | 0.982 | 0.979 |

| ATFP Loss (%) | 0.000 | 0.402 | 1.253 | 2.509 | 4.097 | 5.908 | 7.801 | 9.608 | 11.141 | 12.201 | 12.595 |

| 0 | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1. No and | |||||||||||

| effective ATFP | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 |

| distorted ATFP | 1.118 | 1.118 | 1.117 | 1.115 | 1.113 | 1.111 | 1.109 | 1.107 | 1.105 | 1.103 | 1.101 |

| ATFP Loss (%) | 0.000 | 0.039 | 0.135 | 0.269 | 0.427 | 0.599 | 0.778 | 0.962 | 1.145 | 1.328 | 1.507 |

| Scenario 2. Keep and as the benchmark | |||||||||||

| effective ATFP | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 | 1.118 |

| distorted ATFP | 1.118 | 1.118 | 1.117 | 1.115 | 1.113 | 1.111 | 1.109 | 1.107 | 1.105 | 1.103 | 1.101 |

| ATFP Loss (%) | 0.000 | 0.039 | 0.135 | 0.269 | 0.427 | 0.599 | 0.778 | 0.962 | 1.145 | 1.328 | 1.507 |

| Scenario 3. keeping as the benchmark | |||||||||||

| effective ATFP | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| distorted ATFP | 1.000 | 0.999 | 0.998 | 0.995 | 0.992 | 0.989 | 0.985 | 0.982 | 0.978 | 0.974 | 0.970 |

| ATFP Loss (%) | 0.000 | 0.063 | 0.230 | 0.473 | 0.773 | 1.115 | 1.486 | 1.879 | 2.285 | 2.700 | 3.119 |

| Scenario 4. keeping as the benchmark | |||||||||||

| effective ATFP | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 | 1.458 |

| distorted ATFP | 1.458 | 1.458 | 1.457 | 1.456 | 1.456 | 1.455 | 1.454 | 1.453 | 1.453 | 1.452 | 1.451 |

| ATFP Loss (%) | 0.000 | 0.013 | 0.045 | 0.089 | 0.138 | 0.192 | 0.247 | 0.303 | 0.358 | 0.411 | 0.464 |

| Scenario 5. keeping as the benchmark | |||||||||||

| effective ATFP | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 | 1.126 |

| distorted ATFP | 1.126 | 1.126 | 1.126 | 1.124 | 1.123 | 1.121 | 1.119 | 1.118 | 1.116 | 1.114 | 1.112 |

| ATFP Loss (%) | 0.000 | 0.002 | 0.067 | 0.172 | 0.304 | 0.452 | 0.610 | 0.774 | 0.940 | 1.105 | 1.269 |

| Scenario 6. keeping as the benchmark | |||||||||||

| effective ATFP | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 | 1.102 |

| distorted ATFP | 1.102 | 1.101 | 1.100 | 1.098 | 1.096 | 1.094 | 1.092 | 1.090 | 1.088 | 1.085 | 1.083 |

| ATFP Loss (%) | 0.000 | 0.074 | 0.202 | 0.364 | 0.546 | 0.741 | 0.941 | 1.143 | 1.344 | 1.543 | 1.737 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, X.; Yang, Y.; Zhuang, Q.; Xie, W.; Zhao, X. Does Environmental Regulation Help Mitigate Factor Misallocation?—Theoretical Simulations Based on a Dynamic General Equilibrium Model and the Perspective of TFP. Int. J. Environ. Res. Public Health 2022, 19, 3642. https://doi.org/10.3390/ijerph19063642

Dong X, Yang Y, Zhuang Q, Xie W, Zhao X. Does Environmental Regulation Help Mitigate Factor Misallocation?—Theoretical Simulations Based on a Dynamic General Equilibrium Model and the Perspective of TFP. International Journal of Environmental Research and Public Health. 2022; 19(6):3642. https://doi.org/10.3390/ijerph19063642

Chicago/Turabian StyleDong, Xu, Yali Yang, Qinqin Zhuang, Weili Xie, and Xiaomeng Zhao. 2022. "Does Environmental Regulation Help Mitigate Factor Misallocation?—Theoretical Simulations Based on a Dynamic General Equilibrium Model and the Perspective of TFP" International Journal of Environmental Research and Public Health 19, no. 6: 3642. https://doi.org/10.3390/ijerph19063642

APA StyleDong, X., Yang, Y., Zhuang, Q., Xie, W., & Zhao, X. (2022). Does Environmental Regulation Help Mitigate Factor Misallocation?—Theoretical Simulations Based on a Dynamic General Equilibrium Model and the Perspective of TFP. International Journal of Environmental Research and Public Health, 19(6), 3642. https://doi.org/10.3390/ijerph19063642