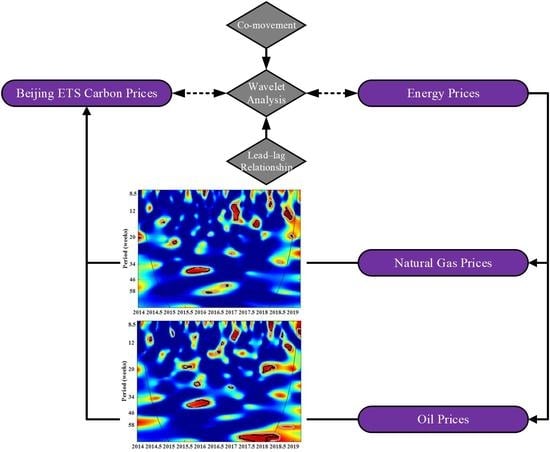

Co-Movement between Carbon Prices and Energy Prices in Time and Frequency Domains: A Wavelet-Based Analysis for Beijing Carbon Emission Trading System

Abstract

:1. Introduction

2. Beijing Carbon Market

3. Literature Review

4. Methods and Data

4.1. Research Methods

4.1.1. Continuous Wavelet Transform

4.1.2. Wavelet Power Spectrum

4.1.3. Wavelet Coherency Coefficient and Wavelet Phase Difference

4.2. Data

5. Empirical Results

5.1. Empirical Findings of Self-Wavelet Power Spectrum

5.2. Empirical Findings of Multiple-Wavelet Power Spectrum

5.3. Empirical Results of Partial Wavelet Coherency and Partial Phase Differences

6. Conclusions and Policy Recommendations

- (1)

- Investors in the carbon market should pay close attention to energy markets that are strongly coherent with the carbon market. Our findings suggest that the relationship between carbon prices in the Beijing carbon market and the natural gas and oil markets is more influenced by short-term shocks than by long-term persistent factors. In the short term, gas prices and carbon market prices are negatively correlated. Moreover, natural gas prices move earlier than carbon market prices. Although oil price movements are positively correlated with carbon market price movements in the short term, the leadership of the two prices is not certain. This suggests that investors should take full account of the sources of carbon price changes and trends in energy market influences when making long- and short-term investment decisions about the carbon market. Investors can not only use price changes in natural gas to predict carbon price changes in the carbon market, but they can also hedge their risk by investing in the natural gas market for risk control purposes.

- (2)

- Companies should adjust their energy consumption structure to achieve the optimal carbon emission reduction strategy based on the coherency and fluctuation mechanism between the carbon and energy markets. Our findings suggest that in the short term, the carbon price in the carbon market is negatively correlated with the price of natural gas and positively correlated with the price of oil. Therefore, companies may consider reducing their carbon emissions by increasing the proportion of natural gas in their energy consumption to compress costs when the carbon price rises.

- (3)

- Regulatory institutions should pay close attention to the possible negative effects of the carbon market bubble. Our findings show that although the trend of carbon price volatility in the Beijing carbon market has been relatively stable overall, strong local fluctuations have emerged. Therefore, regulators should carry out effective risk control by establishing a sound market supervision mechanism so that the carbon emissions trading market can effectively achieve energy saving and emission reduction.

- (4)

- Governments need to ensure price stability and secure supply of energy. Our findings show that energy markets are closely linked to carbon markets, and that stability in energy markets helps to ensure the effective functioning of carbon markets. Therefore, in order to fulfil the role of carbon markets in environmental sustainability, it is necessary to ensure a stable and secure supply of energy and to continue to promote the use of renewable energy.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, H.; Chen, W. Modeling of energy transformation pathways under current policies, NDCs and enhanced NDCs to achieve 2-degree target. Appl. Energy 2019, 250, 549–557. [Google Scholar] [CrossRef]

- Calel, R.; Dechezlepretre, A. Environmental Policy and Directed Technological Change: Evidence from the European Carbon Market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef] [Green Version]

- Li, M.Y.; Weng, Y.Y.; Duan, M.S. Emissions, energy and economic impacts of linking China’s national ETS with the EU ETS. Appl. Energy 2019, 235, 1235–1244. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Marcantonini, C.; Zaklan, A. The European Union Emissions Trading System: Ten Years and Counting. Rev. Environ. Econ. Policy 2015, 10, 89–107. [Google Scholar] [CrossRef] [Green Version]

- McAfee, K. Green economy and carbon markets for conservation and development: A critical view. Int. Environ. Agreem. Politics Law Econ. 2016, 16, 333–353. [Google Scholar] [CrossRef]

- Wang, C.; Wang, W.; Huang, R. Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. J. Clean. Prod. 2017, 152, 271–280. [Google Scholar] [CrossRef]

- Yi, L.; Li, Z.P.; Yang, L.; Liu, J.; Liu, Y.R. Comprehensive evaluation on the “maturity” of China’s carbon markets. J. Clean. Prod. 2018, 198, 1336–1344. [Google Scholar] [CrossRef]

- Li, W.; Lu, C. The research on setting a unified interval of carbon price benchmark in the national carbon trading market of China. Appl. Energy 2015, 155, 728–739. [Google Scholar] [CrossRef]

- Jiang, J.; Xie, D.; Ye, B.; Shen, B.; Chen, Z. Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Appl. Energy 2016, 178, 902–917. [Google Scholar] [CrossRef]

- Mo, J.-L.; Agnolucci, P.; Jiang, M.-R.; Fan, Y. The impact of Chinese carbon emission trading scheme (ETS) on low carbon energy (LCE) investment. Energy Policy 2016, 89, 271–283. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, X. Energy policies for managing China’s carbon emission. Renew. Sustain. Energy Rev. 2015, 50, 470–479. [Google Scholar] [CrossRef]

- Nai, P.; Luo, Y.; Yang, G. The establishment of carbon trading market in People’s Republic of China: A legislation and policy perspective. Int. J. Clim. Change Strateg. Manag. 2017, 9, 138–150. [Google Scholar] [CrossRef]

- Chang, C.-L.; Mai, T.-K.; McAleer, M. Establishing national carbon emission prices for China. Renew. Sustain. Energy Rev. 2019, 106, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Lu, M.; Wang, X.; Speeckaert, R. Price bubbles in Beijing carbon market and environmental policy announcement. Commun. Stat. -Simul. Comput. 2021, 1–15. [Google Scholar] [CrossRef]

- Zeng, S.; Nan, X.; Liu, C.; Chen, J. The response of the Beijing carbon emissions allowance price (BJC) to macroeconomic and energy price indices. Energy Policy 2017, 106, 111–121. [Google Scholar] [CrossRef]

- Zhang, N.; Liu, Z.; Zheng, X.; Xue, J. Carbon footprint of China’s belt and road. Science 2017, 357, 1107. [Google Scholar] [CrossRef] [PubMed]

- Huang, R.; Zhang, S.; Wang, P. Key areas and pathways for carbon emissions reduction in Beijing for the “Dual Carbon” targets. Energy Policy 2022, 164, 112873. [Google Scholar] [CrossRef]

- Zhu, B.; Ye, S.; Han, D.; Wang, P.; He, K.; Wei, Y.-M.; Xie, R. A multiscale analysis for carbon price drivers. Energy Econ. 2019, 78, 202–216. [Google Scholar] [CrossRef]

- Wang, J.; Gu, F.; Liu, Y.; Fan, Y.; Guo, J. Bidirectional interactions between trading behaviors and carbon prices in European Union emission trading scheme. J. Clean. Prod. 2019, 224, 435–443. [Google Scholar] [CrossRef]

- Fan, Y.; Jia, J.-J.; Wang, X.; Xu, J.-H. What policy adjustments in the EU ETS truly affected the carbon prices? Energy Policy 2017, 103, 145–164. [Google Scholar] [CrossRef]

- Song, Y.; Liang, D.; Liu, T.; Song, X. How China’s current carbon trading policy affects carbon price? An investigation of the Shanghai Emission Trading Scheme pilot. J. Clean. Prod. 2018, 181, 374–384. [Google Scholar] [CrossRef]

- Li, X.; Li, Z.; Su, C.-W.; Umar, M.; Shao, X. Exploring the asymmetric impact of economic policy uncertainty on China’s carbon emissions trading market price: Do different types of uncertainty matter? Technol. Forecast. Soc. Chang. 2022, 178, 121601. [Google Scholar] [CrossRef]

- Bento, N.; Gianfrate, G. Determinants of internal carbon pricing. Energy Policy 2020, 143, 111499. [Google Scholar] [CrossRef]

- Hintermann, B. Allowance price drivers in the first phase of the EU ETS. J. Environ. Econ. Manag. 2010, 59, 43–56. [Google Scholar] [CrossRef] [Green Version]

- Tan, X.; Sirichand, K.; Vivian, A.; Wang, X. How connected is the carbon market to energy and financial markets? A systematic analysis of spillovers and dynamics. Energy Econ. 2020, 90, 104870. [Google Scholar] [CrossRef]

- Yu, J.; Mallory, M.L. Exchange rate effect on carbon credit price via energy markets. J. Int. Money Financ. 2014, 47, 145–161. [Google Scholar] [CrossRef]

- Adekoya, O.B.; Oliyide, J.A.; Noman, A. The volatility connectedness of the EU carbon market with commodity and financial markets in time-and frequency-domain: The role of the US economic policy uncertainty. Resour. Policy 2021, 74, 102252. [Google Scholar] [CrossRef]

- Sun, X.; Fang, W.; Gao, X.; An, H.; Liu, S.; Wu, T. Complex causalities between the carbon market and the stock markets for energy intensive industries in China. Int. Rev. Econ. Financ. 2022, 78, 404–417. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, M.; Tian, L. The market-linkage of the volatility spillover between traditional energy price and carbon price on the realization of carbon value of emission reduction behavior. J. Clean. Prod. 2019, 245, 118682. [Google Scholar] [CrossRef]

- Asl, M.G.; Adekoya, O.B.; Oliyide, J.A. Carbon market and the conventional and Islamic equity markets: Where lays the environmental cleanliness of their utilities, energy, and ESG sectoral stocks? J. Clean. Prod. 2022, 351, 131523. [Google Scholar] [CrossRef]

- Moutinho, V.; Oliveira, H.; Mota, J. Examining the long term relationships between energy commodities prices and carbon prices on electricity prices using Markov Switching Regression. Energy Rep. 2022, 8, 589–594. [Google Scholar] [CrossRef]

- Adekoya, O.B. Predicting carbon allowance prices with energy prices: A new approach. J. Clean. Prod. 2021, 282, 124519. [Google Scholar] [CrossRef]

- Cao, G.; Xu, W. Nonlinear structure analysis of carbon and energy markets with MFDCCA based on maximum overlap wavelet transform. Phys. A Stat. Mech. Appl. 2016, 444, 505–523. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Sun, Y.F. The dynamic volatility spillover between European carbon trading market and fossil energy market. J. Clean. Prod. 2016, 112, 2654–2663. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D.Y.; Geng, J.B. Information linkage, dynamic spillovers in prices and volatility between the carbon and energy markets. J. Clean. Prod. 2018, 198, 972–978. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Lahiani, A.; Nguyen, D.K.; Sousa, R.M. An empirical analysis of energy cost pass-through to CO2 emission prices. Energy Econ. 2015, 49, 149–156. [Google Scholar] [CrossRef]

- Jiang, W.; Chen, Y. The time–Frequency connectedness among carbon, traditional/new energy and material markets of China in pre-and post-COVID-19 outbreak periods. Energy 2022, 246, 123320. [Google Scholar] [CrossRef]

- Guo, W. Factors impacting on the price of China’s regional carbon emissions based on adaptive Lasso method. China Popul. Resour. Environ. 2015, S1. Available online: http://en.cnki.com.cn/Article_en/CJFDTotal-ZGRZ2015S1077.htm (accessed on 20 January 2021).

- Wang, Z.; Zhu, Y.; Zhu, Y.; Shi, Y. Energy structure change and carbon emission trends in China. Energy 2016, 115, 369–377. [Google Scholar] [CrossRef]

- Dong, F.; Long, R.; Li, Z.; Dai, Y. Analysis of carbon emission intensity, urbanization and energy mix: Evidence from China. Nat. Hazards 2016, 82, 1375–1391. [Google Scholar] [CrossRef]

- Wagner, G.; Kåberger, T.; Olai, S.; Oppenheimer, M.; Rittenhouse, K.; Sterner, T. Energy policy: Push renewables to spur carbon pricing. Nature 2015, 525, 27–29. [Google Scholar] [CrossRef] [Green Version]

- Zhou, K.; Li, Y. An Empirical Analysis of Carbon Emission Price in China. Energy Procedia 2018, 152, 823–828. [Google Scholar] [CrossRef]

- Li, H.; Lei, M. The influencing factors of China carbon price: A study based on carbon trading market in Hubei Province. In IOP Conference Series: Earth and Environmental Science; IOP Publishing: Bristol, UK, 2018; p. 052073. [Google Scholar]

- Li, W.; Sun, W.; Li, G.; Jin, B.; Wu, W.; Cui, P.; Zhao, G. Transmission mechanism between energy prices and carbon emissions using geographically weighted regression. Energy Policy 2018, 115, 434–442. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, D.K.; Sousa, R.M. What explain the short-term dynamics of the prices of CO2 emissions? Energy Econ. 2014, 46, 122–135. [Google Scholar] [CrossRef]

- Sousa, R.; Aguiar-Conraria, L.; Soares, M.J. Carbon financial markets: A time–Frequency analysis of CO2 prices. Phys. A Stat. Mech. Appl. 2014, 414, 118–127. [Google Scholar] [CrossRef]

- Vacha, L.; Barunik, J. Co-movement of energy commodities revisited: Evidence from wavelet coherence analysis. Energy Econ. 2012, 34, 241–247. [Google Scholar] [CrossRef] [Green Version]

- Ortas, E.; Álvarez, I. The efficacy of the European Union Emissions Trading Scheme: Depicting the co-movement of carbon assets and energy commodities through wavelet decomposition. J. Clean. Prod. 2016, 116, 40–49. [Google Scholar] [CrossRef]

- Bilgili, F.; Öztürk, İ.; Koçak, E.; Bulut, Ü.; Pamuk, Y.; Muğaloğlu, E.; Bağlıtaş, H.H. The influence of biomass energy consumption on CO2 emissions: A wavelet coherence approach. Environ. Sci. Pollut. Res. 2016, 23, 19043–19061. [Google Scholar] [CrossRef] [PubMed]

- Kamdem, J.S.; Nsouadi, A.; Terraza, M. Time-Frequency Analysis of the Relationship between EUA and CER Carbon Markets. Environ. Model. Assess. 2016, 21, 279–289. [Google Scholar] [CrossRef]

- Daubechies, I. The wavelet transform, time–frequency localization and signal analysis. IEEE Trans. Inf. Theory 1990, 36, 961–1005. [Google Scholar] [CrossRef] [Green Version]

- Khanna, N.; Kaushik, S.; Jarrah, A. Wavelet packets: Uniform approximation and numerical integration. Int. J. Wavelets Multiresolut. Inf. Process. 2020, 18, 2050004. [Google Scholar] [CrossRef]

- Zhang, D. Wavelet transform. In Fundamentals of Image Data Mining; Springer: Berlin/Heidelberg, Germany, 2019; pp. 35–44. [Google Scholar]

- Khanna, N.; Kumar, V.; Kaushik, S. Wavelet packet approximation. Integral Transform. Spec. Funct. 2016, 27, 698–714. [Google Scholar] [CrossRef]

- Kirby, J.; Swain, C. Power spectral estimates using two-dimensional Morlet-fan wavelets with emphasis on the long wavelengths: Jackknife errors, bandwidth resolution and orthogonality properties. Geophys. J. Int. 2013, 194, 78–99. [Google Scholar] [CrossRef] [Green Version]

- Addison, P.S. The Illustrated Wavelet Transform Handbook: Introductory Theory and Applications in Science, Engineering, Medicine and Finance; CRC Press: Boca Raton, FL, USA, 2017. [Google Scholar]

- Mallat, S. A Wavelet Tour of Signal Processing; Academic Press: New York, NY, USA, 1998. [Google Scholar]

- Aguiar-Conraria, L.; Soares, M.J.; Sousa, R. California’s Carbon Market and Energy Prices: A Wavelet Analysis. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2018, 376, 20170256. [Google Scholar] [CrossRef] [Green Version]

- He, Y.; Wang, B.; Wang, J.; Xiong, W.; Xia, T. Correlation between Chinese and international energy prices based on a HP filter and time difference analysis. Energy Policy 2013, 62, 898–909. [Google Scholar] [CrossRef]

- Mu, X. Weather, storage, and natural gas price dynamics: Fundamentals and volatility. Energy Econ. 2007, 29, 46–63. [Google Scholar] [CrossRef] [Green Version]

- Reboredo, J.C.; Rivera-Castro, M.A.; Ugolini, A. Wavelet-based test of co-movement and causality between oil and renewable energy stock prices. Energy Econ. 2017, 61, 241–252. [Google Scholar] [CrossRef]

- Baumeister, C.; Kilian, L. Forty years of oil price fluctuations: Why the price of oil may still surprise us. J. Econ. Perspect. 2016, 30, 139–160. [Google Scholar] [CrossRef] [Green Version]

- Duan, K.; Ren, X.; Shi, Y.; Mishra, T.; Yan, C. The marginal impacts of energy prices on carbon price variations: Evidence from a quantile-on-quantile approach. Energy Econ. 2021, 95, 105131. [Google Scholar] [CrossRef]

- Batten, J.A.; Maddox, G.E.; Young, M.R. Does weather, or energy prices, affect carbon prices? Energy Econ. 2021, 96, 105016. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, R.; Li, Y.; Wang, Z.; Sun, M. Co-Movement between Carbon Prices and Energy Prices in Time and Frequency Domains: A Wavelet-Based Analysis for Beijing Carbon Emission Trading System. Int. J. Environ. Res. Public Health 2022, 19, 5217. https://doi.org/10.3390/ijerph19095217

Luo R, Li Y, Wang Z, Sun M. Co-Movement between Carbon Prices and Energy Prices in Time and Frequency Domains: A Wavelet-Based Analysis for Beijing Carbon Emission Trading System. International Journal of Environmental Research and Public Health. 2022; 19(9):5217. https://doi.org/10.3390/ijerph19095217

Chicago/Turabian StyleLuo, Rundong, Yan Li, Zhicheng Wang, and Mengjiao Sun. 2022. "Co-Movement between Carbon Prices and Energy Prices in Time and Frequency Domains: A Wavelet-Based Analysis for Beijing Carbon Emission Trading System" International Journal of Environmental Research and Public Health 19, no. 9: 5217. https://doi.org/10.3390/ijerph19095217

APA StyleLuo, R., Li, Y., Wang, Z., & Sun, M. (2022). Co-Movement between Carbon Prices and Energy Prices in Time and Frequency Domains: A Wavelet-Based Analysis for Beijing Carbon Emission Trading System. International Journal of Environmental Research and Public Health, 19(9), 5217. https://doi.org/10.3390/ijerph19095217