Implications of a Carbon Tax Mechanism in Remanufacturing Outsourcing on Carbon Neutrality

Abstract

:1. Introduction

- How do carbon taxes levied on different agents impact the decisions of remanufacturing outsourcing?

- Which taxpayer is more beneficial for economic performance?

- Which taxpayer is more beneficial for environmental sustainability?

2. Literature Review

3. Model Formulation and Solution

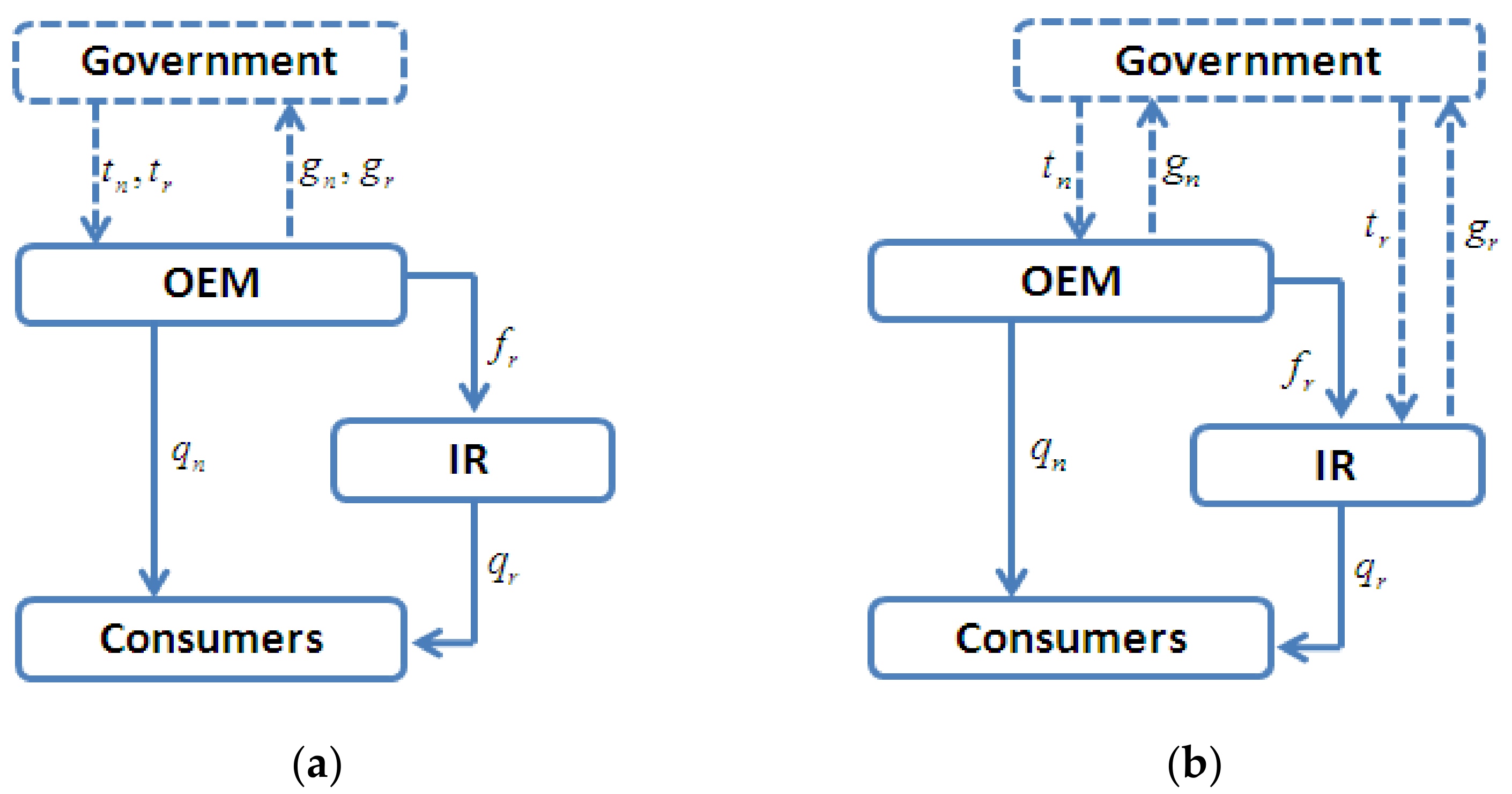

3.1. Problem Description

3.2. Methodologies and Assumptions

3.3. Model Solution

3.3.1. Model C

3.3.2. Model I

4. Result and Discussion

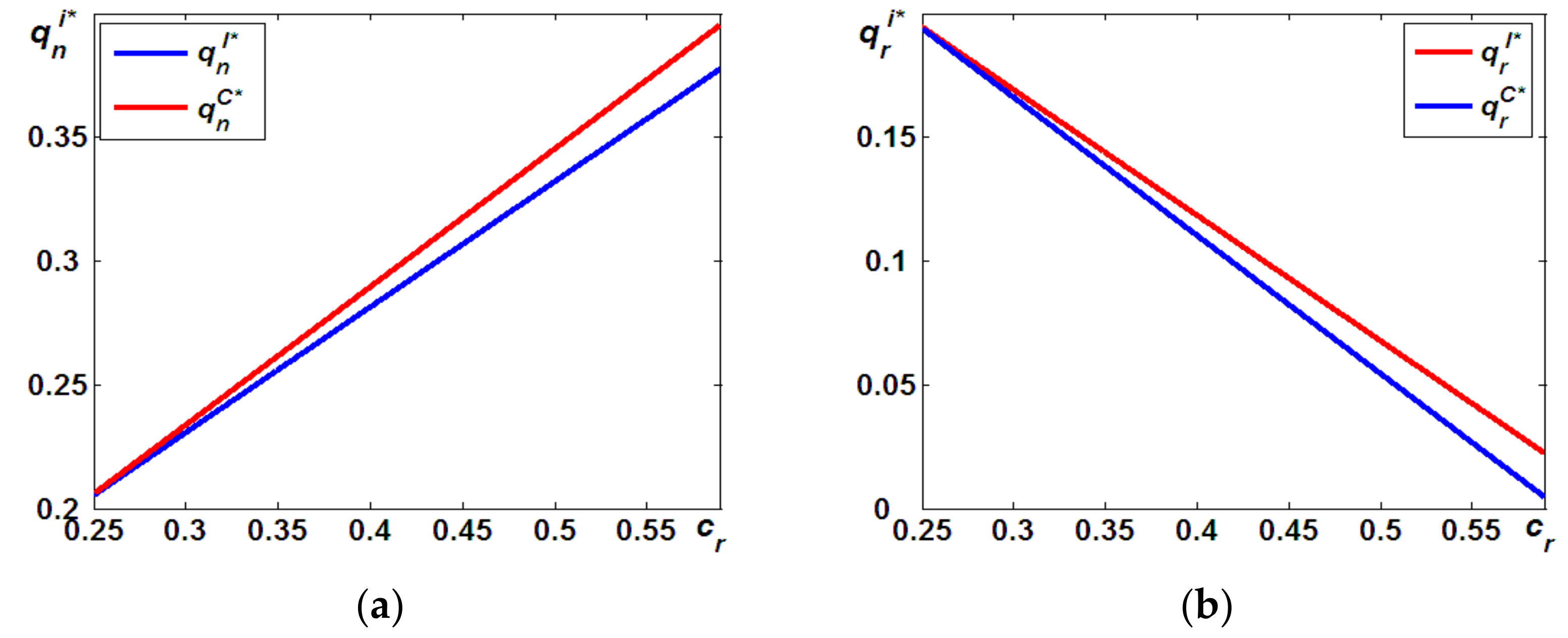

4.1. Analysis of Optimal Decisions

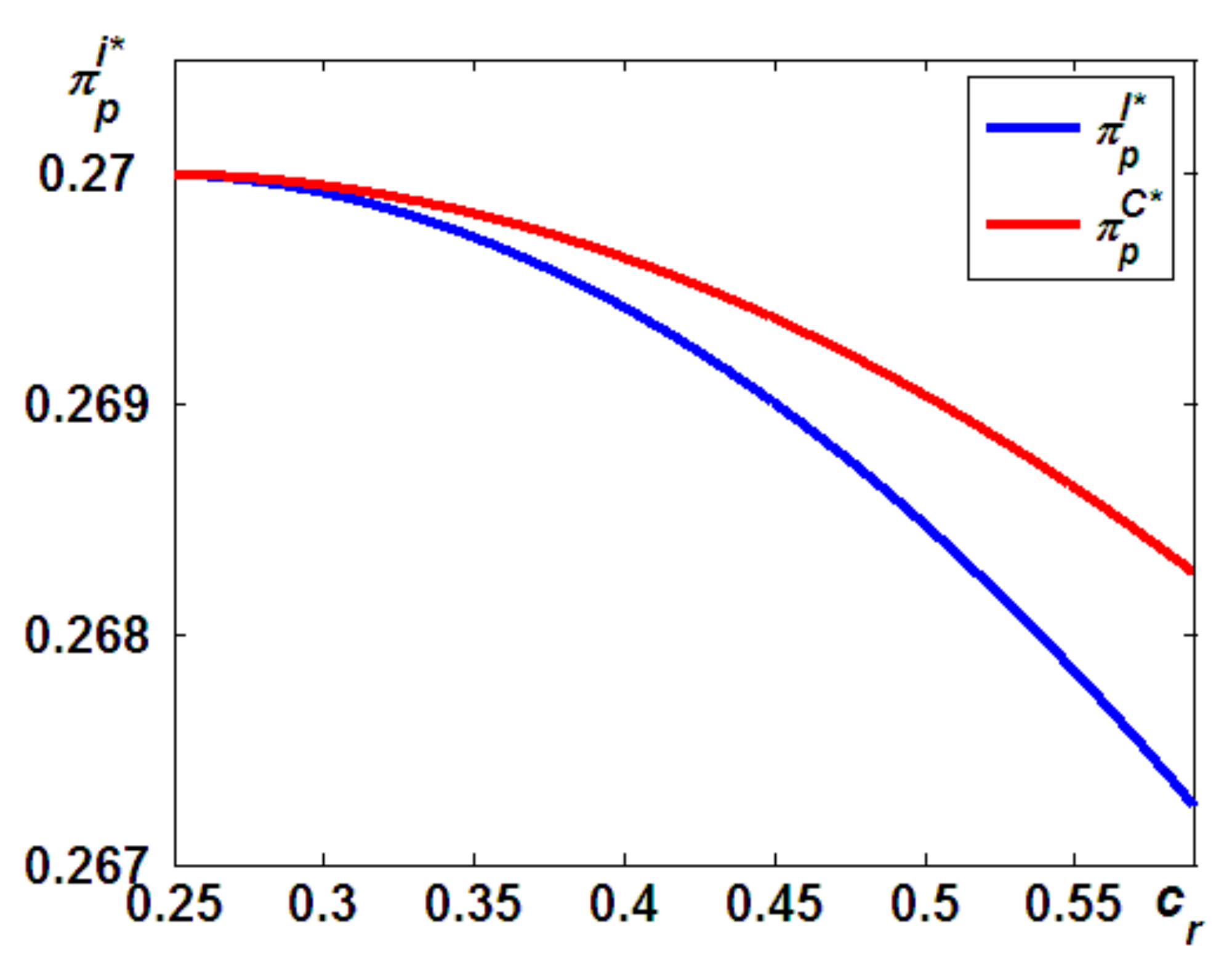

4.2. Analysis of Economic Performance

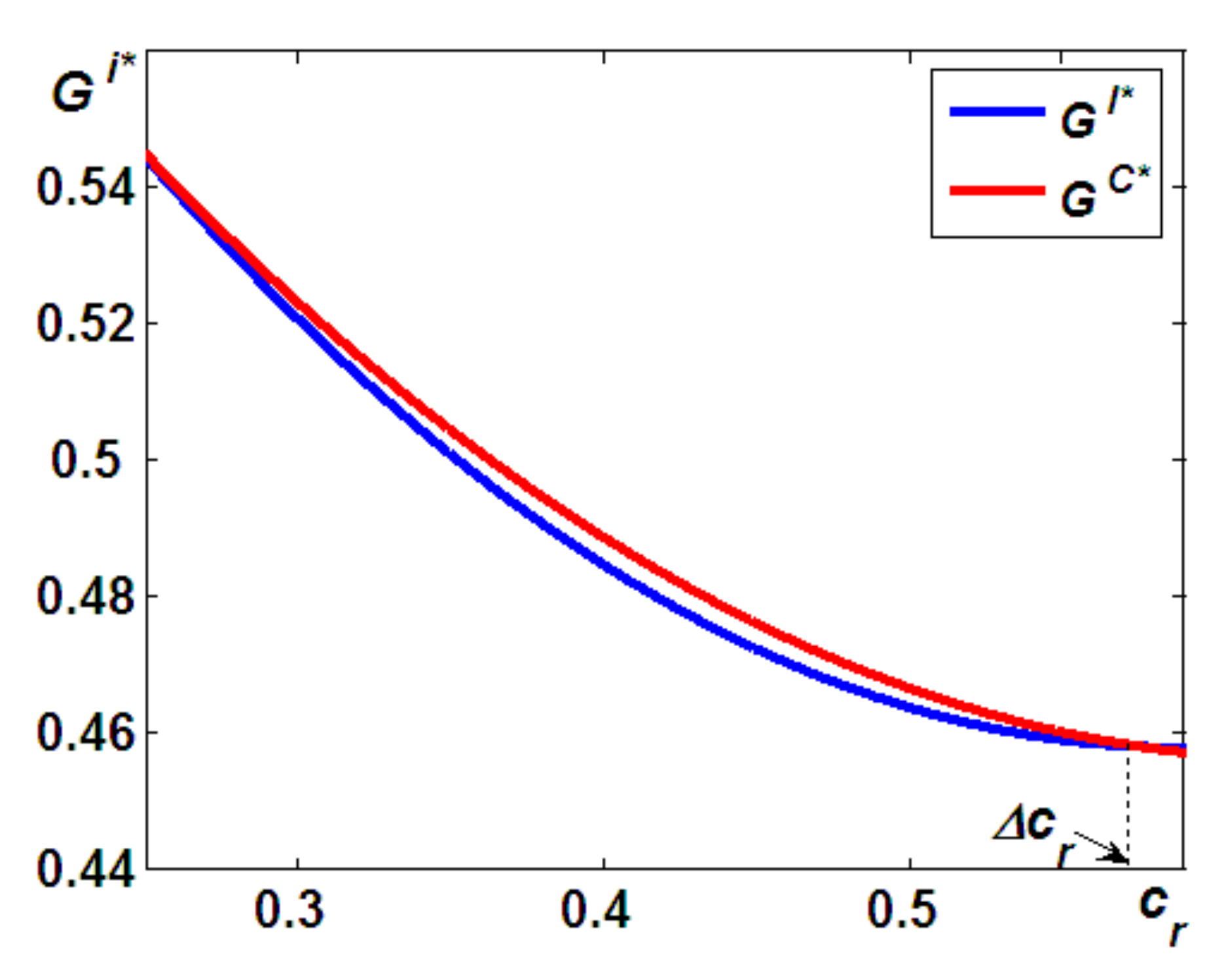

4.3. Analysis of Environmental Sustainability

5. Conclusions, Discussion, and Future Research Opportunities

5.1. Discussion of Theoretical Implications

5.2. Discussion of Managerial Implications

5.3. Future Research Opportunities

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Derivation of the Optimal Decisions

Appendix A.1. Derivation of the Optimal Decisions under Model C

Appendix A.2. Derivation of the Optimal Decisions under Model I

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

Appendix G

References

- IPCC; Core Writing Team. AR6 Synthesis Report: Climate Change 2021; Pachauri, R.K., Reisinger, A., Eds.; IPCC: Geneva, Switzerland, 2021. [Google Scholar]

- Liu, Z.; Li, K.W.; Tang, J.; Gong, B.-G.; Huang, J. Optimal operations of a closed-loop supply chain under a dual regulation. Int. J. Prod. Econ. 2021, 233, 107991. [Google Scholar] [CrossRef]

- Britannica’s Editors. COP21, Paris Agreement under the United Nations Framework on Climate Change, Paris Climate Agreement. 2022. Available online: https://www.britannica.com/topic/Paris-Agreement-2015 (accessed on 18 February 2022).

- China Daily.com.cn. Xi Urges Developed Countries to Lead by Example on Emissions Reduction. 2021. Available online: http://www.chinadaily.com.cn/a/202110/30/WS617d3b49a310cdd39bc7250d.html (accessed on 28 February 2022).

- Ekins, P.; Vos, H.; Gee, D.; Kai, S.; Andersen, M.S. Environmental Taxes: Implementation and Environmental Effectiveness; Publications Office of the European Union: Luxembourg, 1996. [Google Scholar]

- Lin, B.; Li, X. The effect of carbon tax on per capita CO2 emissions. Energy Policy 2011, 39, 5137–5146. [Google Scholar] [CrossRef]

- Li, W.K.; Liu, Z.; Li, X. Special Issue Decision Models for Sustainable Development in the Carbon Neutrality Era. 2008. Available online: https://www.mdpi.com/journal/ijerph/special_issues/Decis_Model (accessed on 18 February 2022).

- Kim, D.; Ryu, H.; Lee, J.; Kim, K.-K. Balancing risk: Generation expansion planning under climate mitigation scenarios. Eur. J. Oper. Res. 2022, 297, 665–679. [Google Scholar] [CrossRef]

- Chambers, A. SWEPCO makes first factory EV pickup. Power Engineering 1997, 101, 10. [Google Scholar]

- Foundation Ellen Macarthur. What Is a Circular Economy? 2021. Available online: https://ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview (accessed on 2 February 2022).

- Foundation Ellen Macarthur. Circular Examples Collection: Government and Policy. 2021. Available online: https://ellenmacarthurfoundation.org/circular-examples-collection-government-and-policy (accessed on 29 November 2021).

- Yan, W.; Xiong, Y.; Xiong, Z.; Guo, N. Bricks vs. clicks: Which is better for marketing remanufactured products? Eur. J. Oper. Res. 2015, 242, 434–444. [Google Scholar] [CrossRef]

- Ferguson, M.E.; Souza, G.C. Closed-Loop Supply Chains: New Developments to Improve the Sustainability of Business Practices; Taylor & Francis: Abingdon, UK, 2010. [Google Scholar]

- Zhang, F.; Chen, H.; Xiong, Y.; Yan, W.; Liu, M. Managing collecting or remarketing channels: Different choice for cannibalisation in remanufacturing outsourcing. Int. J. Prod. Res. 2020, 59, 1–16. [Google Scholar] [CrossRef]

- The Fabricator. Caterpillar, Land Rover Form Alliance. 2005. Available online: https://www.thefabricator.com/thefabricator/news/shopmanagement/caterpillar-land-rover-form-alliance (accessed on 9 January 2022).

- Hauser, W.M.; Lund, R.T. The Remanufacturing Industry: Anatomy of a Giant: a View of Remanufacturing in America Based on a Comprehensive Survey across the Industry. Department of Manufacturing Engineering. 2008. Available online: www.bu.edu/reman2008 (accessed on 18 October 2017).

- Ayu, P. The Impact of Carbon Tax Application on the Economy and Environment of Indonesia. Eur. J. Econ. Bus. Stud. 2018, 10, 116. [Google Scholar] [CrossRef]

- Dou, G.; Guo, H.; Zhang, Q.; Li, X. A two-period carbon tax regulation for manufacturing and remanufacturing production planning. Comput. Ind. Eng. 2019, 128, 502–513. [Google Scholar] [CrossRef]

- Chai, J.; Li, H.; Lee, C.H.; Tsai, S.B.; Chen, H. Shareholding operation of product remanufacturing—From a sustainable production perspective. RAIRO-Oper. Res. 2021, 55, S1529–S1549. [Google Scholar] [CrossRef]

- Huang, H.; Meng, Q.; Xu, H.; Zhou, Y. Cost information sharing under competition in remanufacturing. Int. J. Prod. Res. 2019, 57, 1–14. [Google Scholar] [CrossRef]

- Chung, H.S.; Weaver, R.D.; Friesz, T.L. Strategic response to pollution taxes in supply chain networks: Dynamic, spatial, and organizational dimensions. Eur. J. Oper. Res. 2013, 231, 314–327. [Google Scholar] [CrossRef]

- Canton, J.; Antoine, S.; Stahn, H. Environmental Taxation and Vertical Cournot Oligopolies: How Eco-industries Matter. Environ. Resour. Econ. 2008, 40, 369–382. [Google Scholar] [CrossRef]

- Wang, X.; Zhu, Y.; Sun, H.; Jia, F. Production decisions of new and remanufactured products: Implications for low carbon emission economy. J. Clean. Prod. 2018, 71, 1225–1243. [Google Scholar] [CrossRef]

- Zhou, J.; Deng, Q.; Li, T. Optimal acquisition and remanufacturing policies considering the effect of quality uncertainty on carbon emissions. J. Clean. Prod. 2018, 186, 180–190. [Google Scholar] [CrossRef]

- Liu, B.; Holmbom, M.; Segerstedt, A.; Chen, W. Effects of carbon emission regulations on remanufacturing decisions with limited information of demand distribution. Int. J. Prod. Res. 2015, 53, 532–548. [Google Scholar] [CrossRef]

- Chai, Q.; Xiao, Z.; Lai, K.H.; Zhou, G. Can carbon cap and trade mechanism be beneficial for remanufacturing? Int. J. Prod. Econ. 2018, 203, 311–321. [Google Scholar] [CrossRef]

- Basse Mama, H.; Mandaroux, R. Do investors care about carbon emissions under the European Environmental Policy? Bus. Strategy Environ. 2022, 31, 268–283. [Google Scholar] [CrossRef]

- Wang, L.; Cai, G.G.; Tsay, A.A.; Vakharia, A.J. Design of the Reverse Channel for Remanufacturing: Must Profit-Maximization Harm the Environment? Prod. Oper. Manag. 2017, 26, 1585–1603. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhou, H.; Wang, Y. Outsourcing remanufacturing and collecting strategies analysis with information asymmetry. Comput. Ind. Eng. 2021, 160, 107561. [Google Scholar] [CrossRef]

- Zou, Z.B.; Wang, J.J.; Deng, G.S.; Chen, H. Third-party remanufacturing mode selection: Outsourcing or authorization? Transp. Res. Part E Logist. Transp. Rev. 2016, 87, 1–19. [Google Scholar] [CrossRef]

- Lee, C.-M.; Woo, W.-S.; Roh, Y.-H. Remanufacturing: Trends and issues. Int. J. Precis. Eng. Manuf.-Green Technol. 2017, 4, 113–125. [Google Scholar] [CrossRef]

- Zheng, X.-X.; Li, D.-F.; Liu, Z.; Jia, F.; Lev, B. Willingness-to-cede behaviour in sustainable supply chain coordination. Int. J. Prod. Econ. 2021, 240, 108207. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. A supply chain transparency and sustainability technology appraisal model for blockchain technology. Int. J. Prod. Res. 2020, 58, 2142–2162. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Vecchio, P.D.; Oropallo, E.; Secundo, G. Blockchain Technology for Bridging Trust, Traceability and Transparency in Circular Supply Chain. Available online: https://e-tarjome.com/storage/panel/fileuploads/2021-08-31/1630392743_E15591.pdf (accessed on 18 October 2017).

- Saberi, S.; Kouhizadeh, M.; Sarkis, J. Blockchains and the Supply Chain: Findings from a Broad Study of Practitioners. IEEE Eng. Manag. Rev. 2019, 47, 95–103. [Google Scholar] [CrossRef]

- Zhang, F.; Zhang, R. Trade-in Remanufacturing, Customer Purchasing Behavior, and Government Policy. Manuf. Serv. Oper. Manag. 2018, 20, 601–616. [Google Scholar] [CrossRef]

- Talat, S.G.; Pietro, D.G. Closed-loop supply chain games with innovation-led lean programs and sustainability. Int. J. Prod. Econ. 2020, 219, 440–456. [Google Scholar]

- Guide, J.; Daniel, V.R.; Li, J. The Potential for Cannibalization of New Products Sales by Remanufactured Products*. Decis. Sci. 2010, 41, 547–572. [Google Scholar] [CrossRef]

- Genc, T.S.; Giovanni, P.D. Optimal Return and Rebate Mechanism in a Closed-loop Supply Chain Game. Eur. J. Oper. Res. 2018, 269, 661–681. [Google Scholar] [CrossRef] [Green Version]

- Yang, X.; Jiang, P.; Pan, Y. Does China’s carbon emission trading policy have an employment double dividend and a Porter effect? Energy Policy 2020, 142, 111492. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Wassenhove, L.N.V. Closed-Loop Supply Chain Models with Product Remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef] [Green Version]

- Ferguson, M.E.; Toktay, L.B. The Effect of Competition on Recovery Strategies. Prod. Oper. Manag. 2010, 15, 351–368. [Google Scholar] [CrossRef] [Green Version]

| Governance on Carbon Emissions | Remanufacturing Outsourcing | Carbon Taxes | Sustainability Issues | |

|---|---|---|---|---|

| Wang, et al. [23], Zhou, et al. [24], Liu, et al. [25], Chai, et al. [26], Basse Mama and Mandaroux [27] | √ | × | × | × |

| Wang, et al. [28], Zhao, et al. [29], Zhang, et al. [14], Zou, et al. [30] | × | √ | × | × |

| Chung, et al. [21], Joan, et al. [22] | × | × | √ | × |

| Zheng, et al. [32], Bai and Sarkis [33], Centobelli, et al. [34], Sara, et al. [35] | × | × | × | √ |

| This paper | √ | √ | √ | √ |

| Symbol | Definition |

|---|---|

| Unit cost for producing/remanufacturing | |

| Value of discount for remanufactured products | |

| Quantities of new/remanufactured products | |

| Tax rate of carbon emissions | |

| Unit patent license fee for remanufacturing outsourcing | |

| Levels of incentive for carbon emission reductions of new/remanufactured products | |

| refers to Models C and I | |

| Scaling parameter of investment |

| Optimal Outcomes of Model C |

|---|

| Optimal Outcomes of Model I |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deng, J.; Luo, X.; Hu, M. Implications of a Carbon Tax Mechanism in Remanufacturing Outsourcing on Carbon Neutrality. Int. J. Environ. Res. Public Health 2022, 19, 5520. https://doi.org/10.3390/ijerph19095520

Deng J, Luo X, Hu M. Implications of a Carbon Tax Mechanism in Remanufacturing Outsourcing on Carbon Neutrality. International Journal of Environmental Research and Public Health. 2022; 19(9):5520. https://doi.org/10.3390/ijerph19095520

Chicago/Turabian StyleDeng, Jie, Xuwei Luo, and Mengsi Hu. 2022. "Implications of a Carbon Tax Mechanism in Remanufacturing Outsourcing on Carbon Neutrality" International Journal of Environmental Research and Public Health 19, no. 9: 5520. https://doi.org/10.3390/ijerph19095520