Welfare Implications of Border Carbon Adjustments on the Trade of Harvested Wood Products

Abstract

:1. Introduction

2. Literature Review

3. Methods and Basic Assumptions

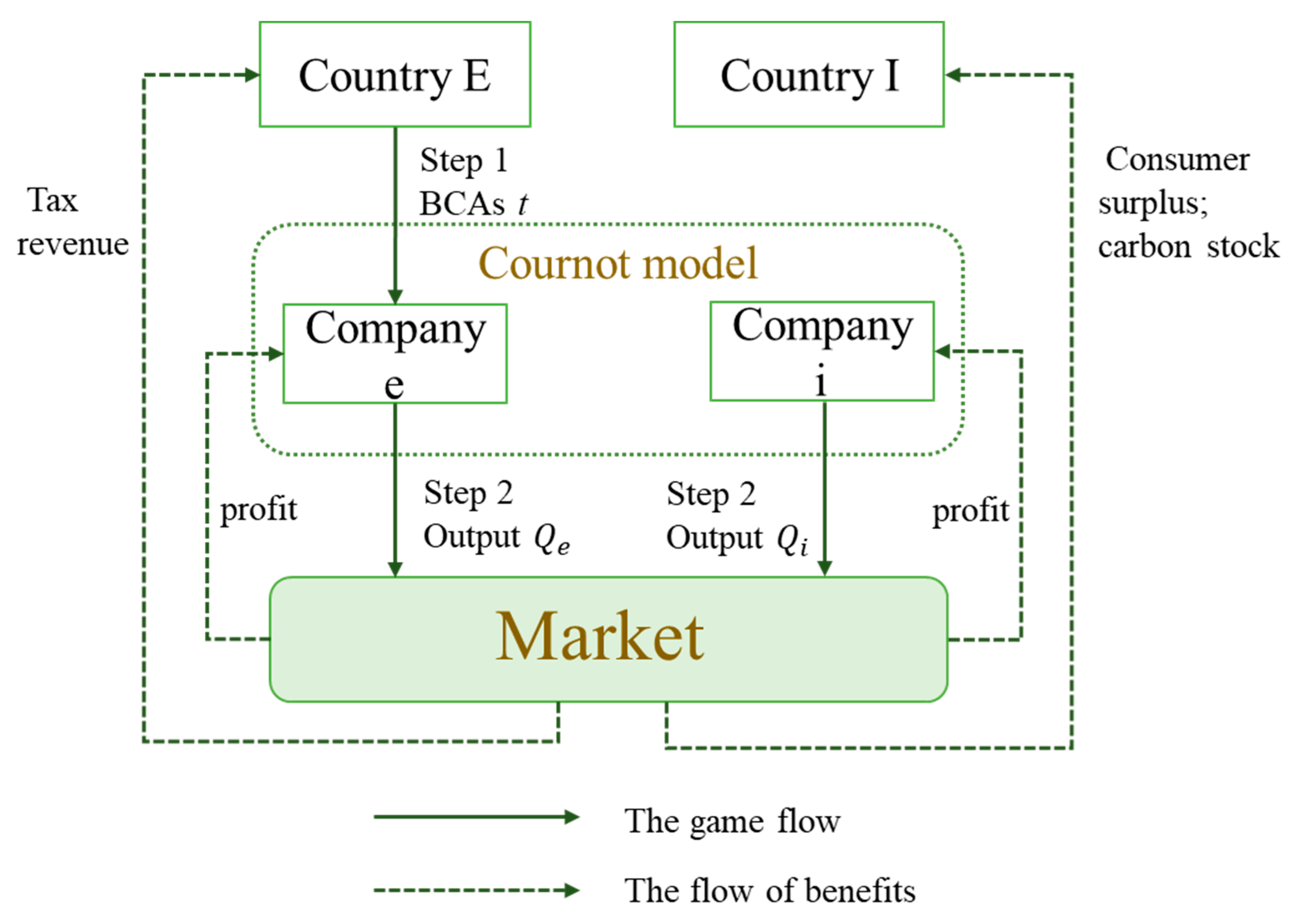

4. Game Process and Results

4.1. Game without BCAs

4.2. Game with BCAs

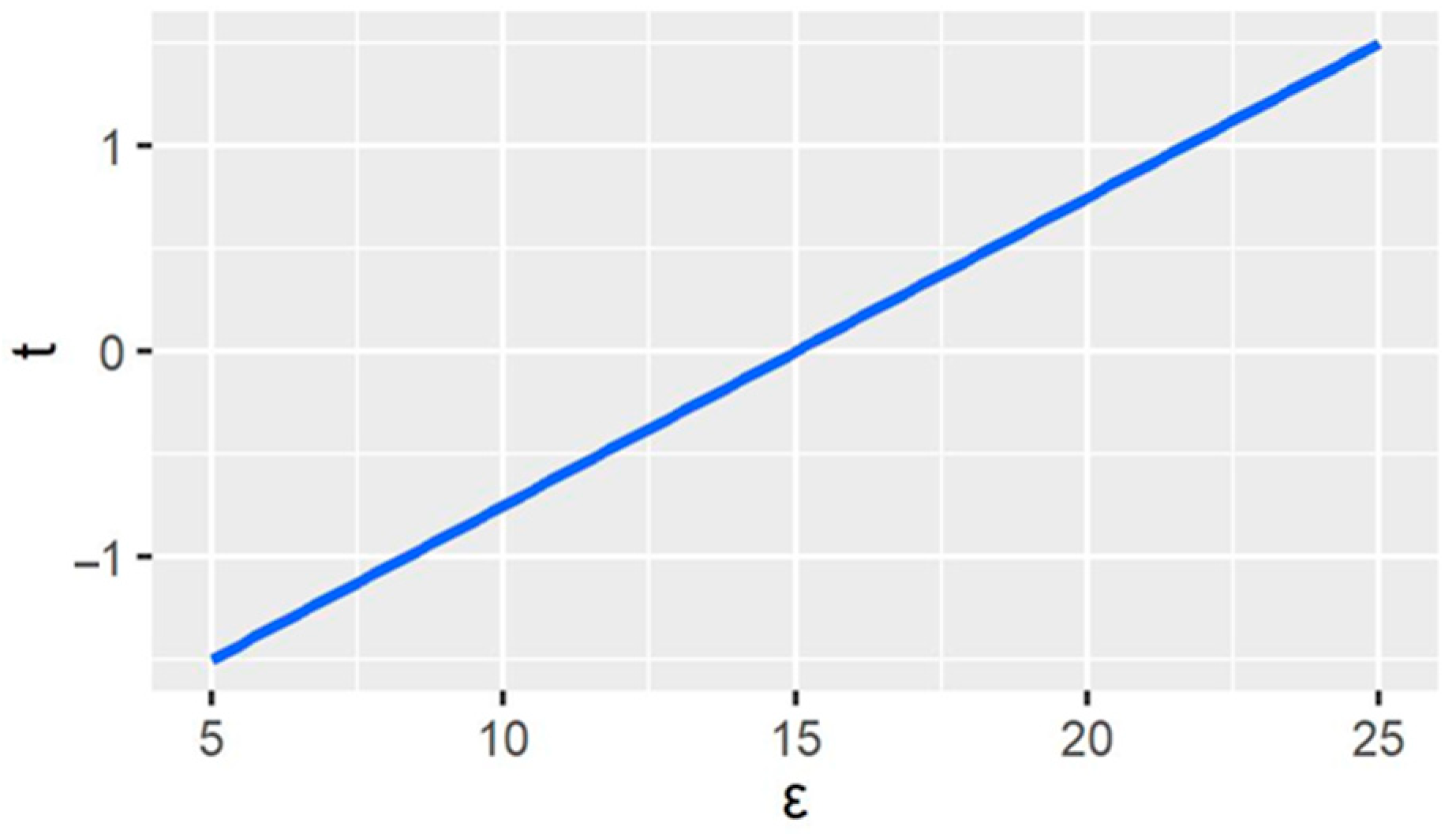

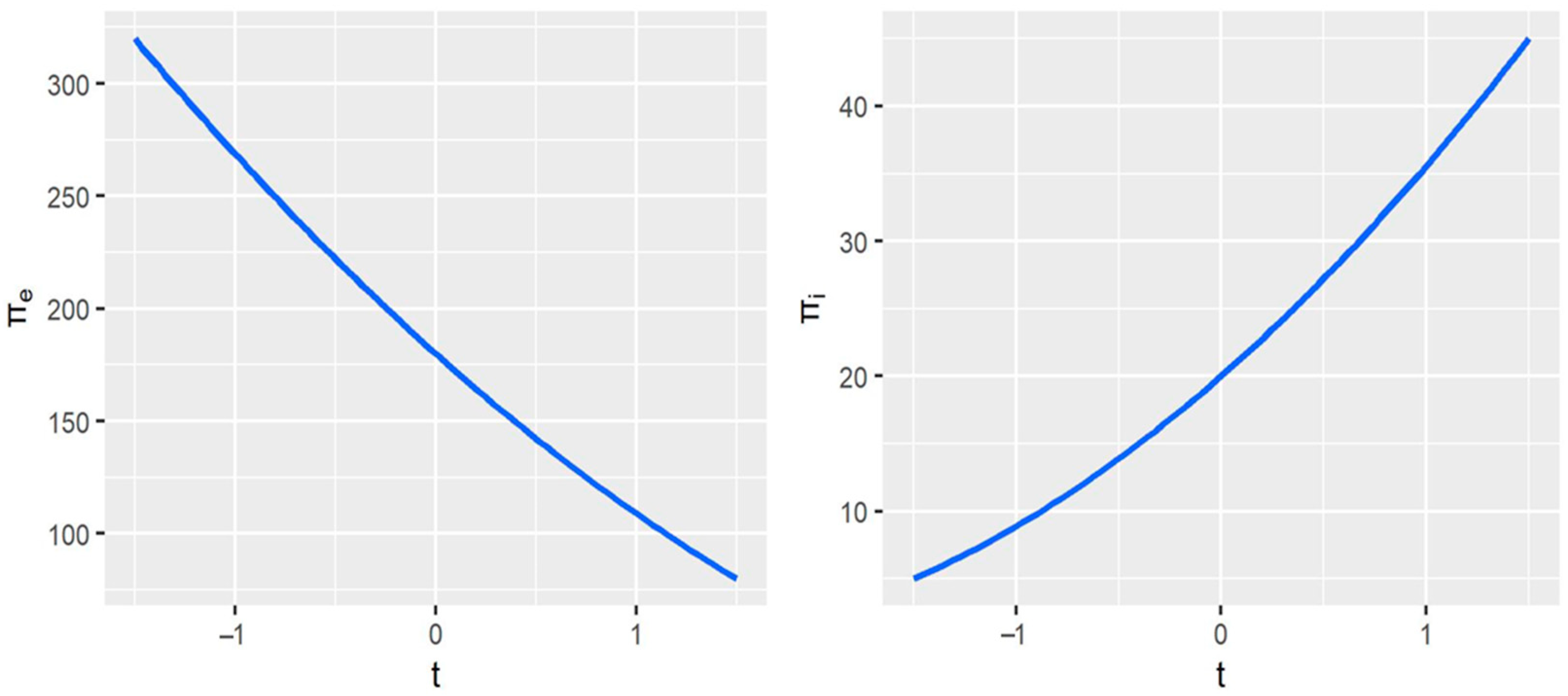

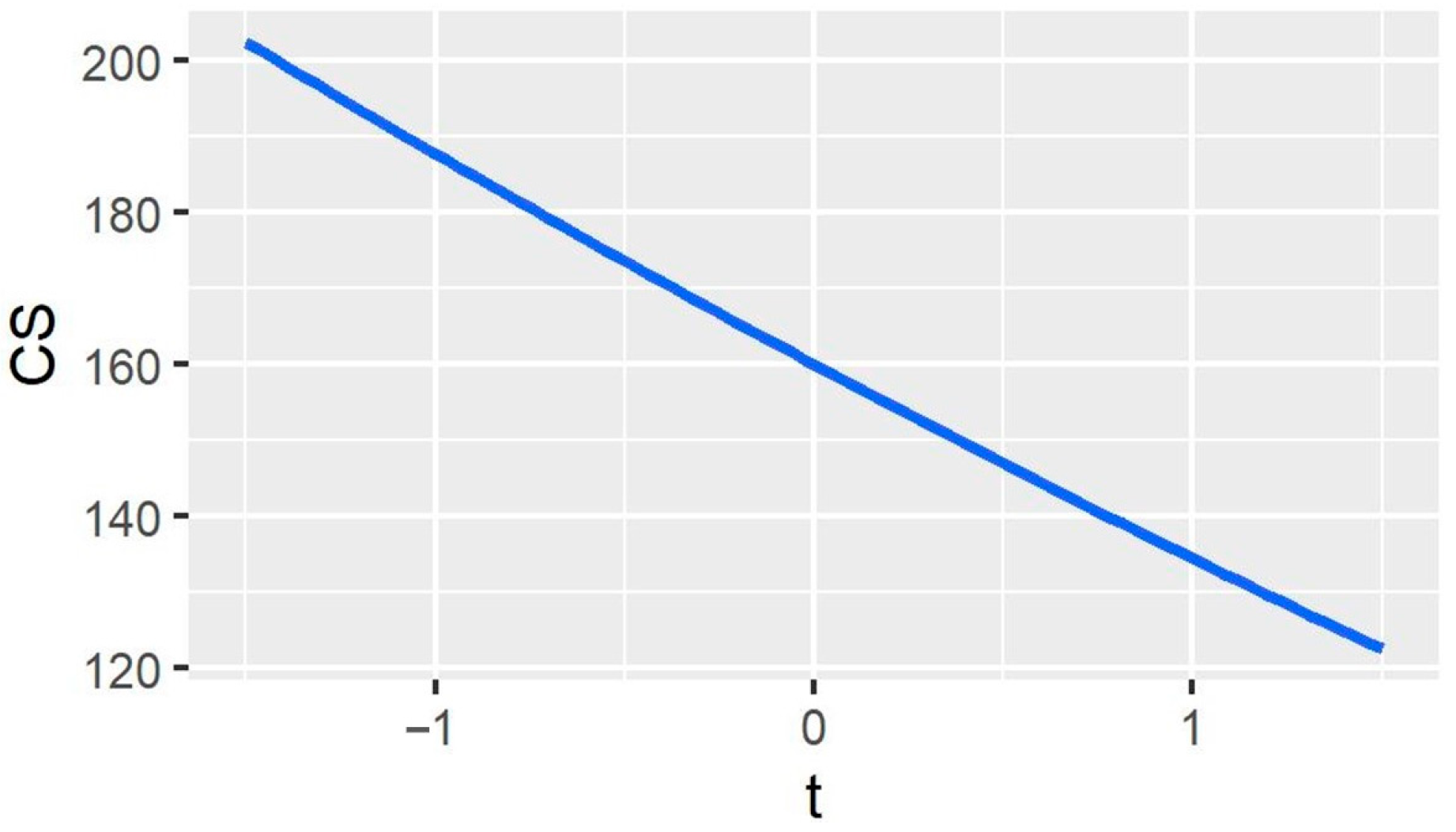

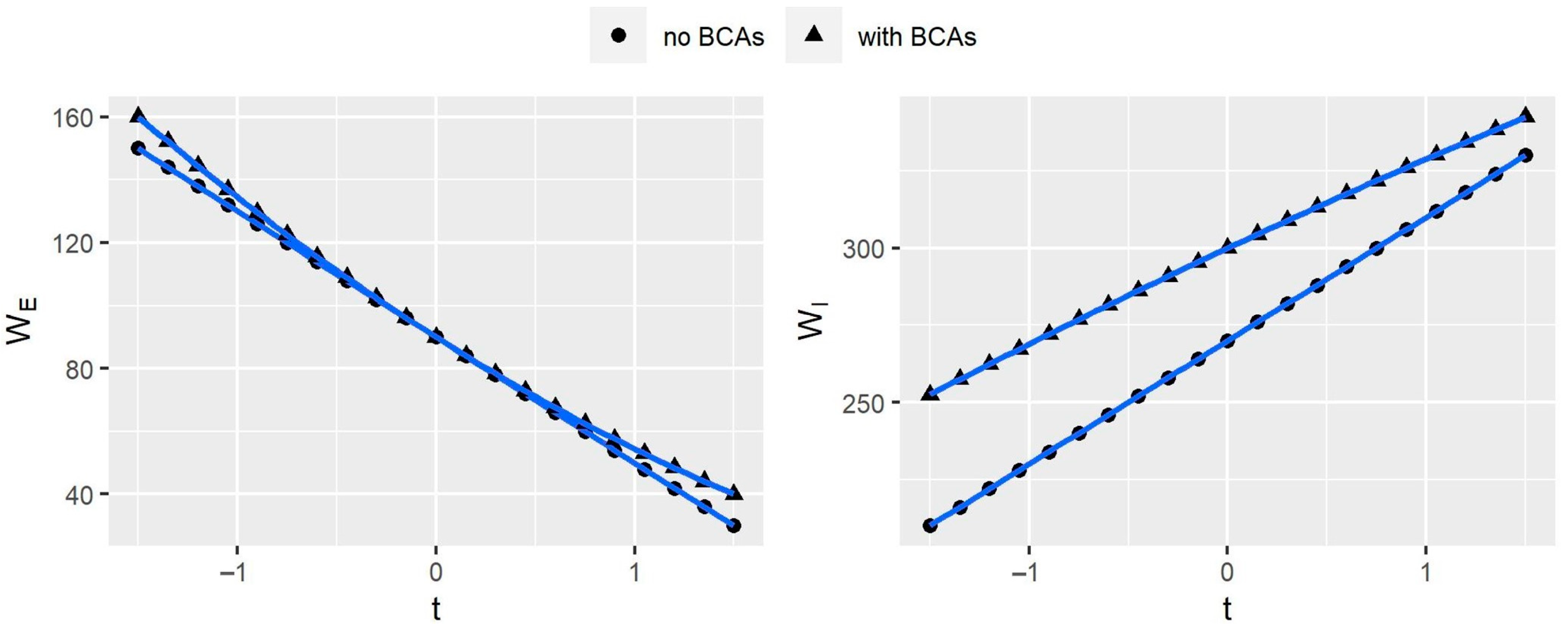

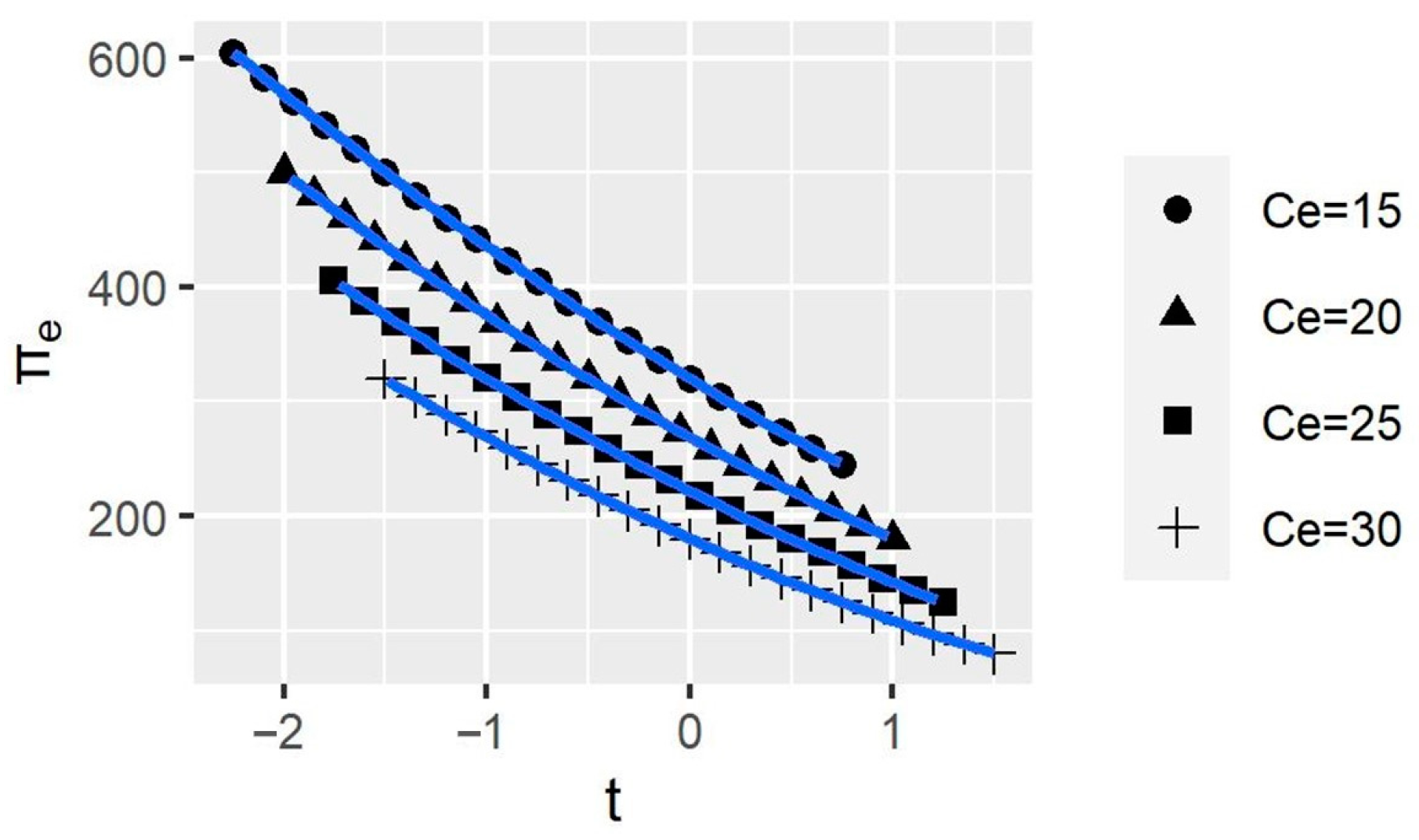

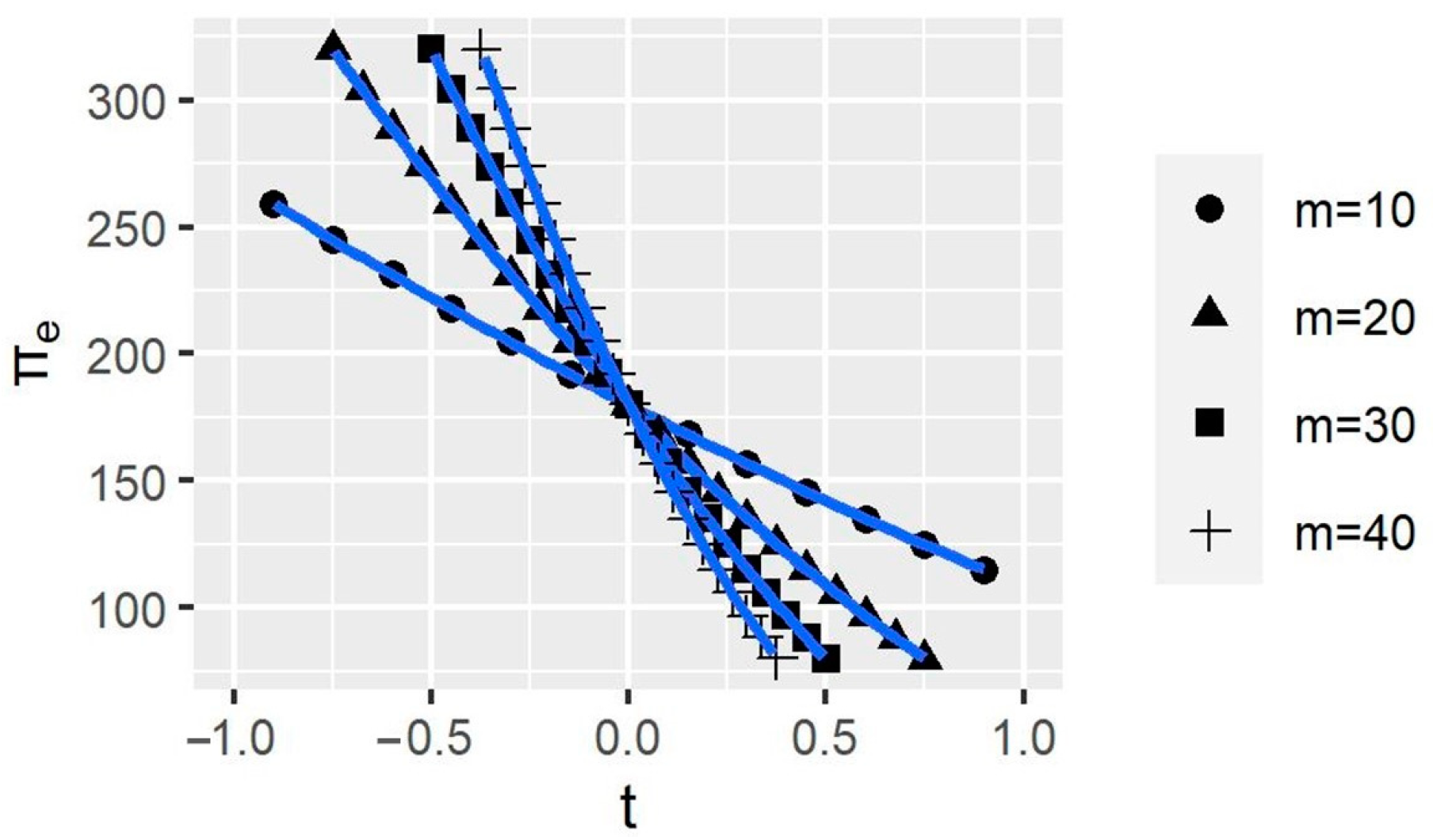

4.3. Numerical Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Veel, P.-E. Carbon tariffs and the WTO: An evaluation of feasible policies. J. Int. Econ. Law 2009, 12, 749–800. [Google Scholar] [CrossRef] [Green Version]

- Böhringer, C.; Balistreri, E.J.; Rutherford, T.F. The role of border carbon adjustment in unilateral climate policy: Overview of an Energy Modeling Forum study (EMF 29). Energy Econ. 2012, 34, S97–S110. [Google Scholar] [CrossRef]

- Böhringer, C.; Fischer, C.; Rosendahl, K.E.; Rutherford, T.F. Potential impacts and challenges of border carbon adjustments. Nat. Clim. Chang. 2022, 12, 22–29. [Google Scholar] [CrossRef]

- Grainger, A.; Smith, G. The role of low carbon and high carbon materials in carbon neutrality science and carbon economics. Curr. Opin. Environ. Sustain. 2021, 49, 164–189. [Google Scholar] [CrossRef]

- Hong, M.; Song, C.; Kim, M.; Kim, J.; Lee, S.G.; Lim, C.H.; Lee, W.K. Application of integrated Korean forest growth dynamics model to meet NDC target by considering forest management scenarios and budget. Carbon Balance Manag. 2022, 17, 1–18. [Google Scholar] [CrossRef]

- Lin, B.; Ge, J. Carbon sinks and output of China’s forestry sector: An ecological economic development perspective. Sci. Total Environ. 2019, 655, 1169–1180. [Google Scholar] [CrossRef]

- Lipiäinen, S.; Sermyagina, E.; Kuparinen, K.; Vakkilainen, E. Future of forest industry in carbon-neutral reality: Finnish and Swedish visions. Energy Rep. 2022, 8, 2588–2600. [Google Scholar] [CrossRef]

- Lin, J.; Du, M.; Chen, L.; Feng, K.; Liu, Y.; Martin, R.V.; Hubacek, K. Carbon and health implications of trade restrictions. Nat. Commun. 2019, 10, 1–12. [Google Scholar] [CrossRef] [Green Version]

- Petersson, H.; Ellison, D.; Mensah, A.A.; Berndes, G.; Egnell, G.; Lundblad, M.; Lundmark, T.; Lundström, A.; Stendahl, J.; Wikberg, P. On the role of forests and the forest sector for climate change mitigation in Sweden. GCB Bioenergy 2022, 14, 793–813. [Google Scholar] [CrossRef]

- Donlan, J.; Skog, K.; Byrne, K.A. Carbon storage in harvested wood products for Ireland 1961–2009. Biomass Bioenergy 2012, 46, 731–738. [Google Scholar] [CrossRef]

- Jasinevičius, G.; Lindner, M.; Pingoud, K.; Tykkylainen, M. Review of models for carbon accounting in harvested wood products. Int. Wood Prod. J. 2015, 6, 198–212. [Google Scholar] [CrossRef]

- Johnston, C.M.; Radeloff, V.C. Global mitigation potential of carbon stored in harvested wood products. Proc. Natl. Acad. Sci. USA 2019, 116, 14526–14531. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kayo, C.; Kalt, G.; Tsunetsugu, Y.; Hashimoto, S.; Komata, H.; Noda, R.; Oka, H. The default methods in the 2019 Refinement drastically reduce estimates of global carbon sinks of harvested wood products. Carbon Balance Manag. 2021, 16, 1–13. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Yang, H. Advances and frontiers in global forest and harvested wood products carbon science. J. Nanjing For. Univ. (Nat. Sci. Ed.) 2018, 42, 1–8. Available online: https://kns.cnki.net/kcms/detail/32.1161.s.20180326.1718.006.html (accessed on 26 September 2022). (In Chinese).

- Jasinevičius, G.; Lindner, M.; Cienciala, E.; Tykkyläinen, M. Carbon accounting in harvested wood products: Assessment using material flow analysis resulting in larger pools compared to the IPCC default method. J. Ind. Ecol. 2018, 22, 121–131. [Google Scholar] [CrossRef]

- Zhang, L.; Sun, Y.; Song, T.; Xu, J. Harvested Wood Products as a Carbon Sink in China, 1900–2016. Int. J. Environ. Res. Public Health 2019, 16, 445. [Google Scholar] [CrossRef] [Green Version]

- Chayaporn, P.; Sasaki, N.; Venkatappa, M.; Abe, I. Assessment of the overall carbon storage in a teak plantation in Kanchanaburi province, Thailand–Implications for carbon-based incentives. Clean. Environ. Syst. 2021, 2, 100023. [Google Scholar] [CrossRef]

- Xie, S.H.; Kurz, W.A.; McFarlane, P.N. Inward-versus outward-focused bioeconomy strategies for British Columbia’s forest products industry: A harvested wood products carbon storage and emission perspective. Carbon Balance Manag. 2021, 16, 1–22. [Google Scholar] [CrossRef]

- Guan, Z.; Guo, Z.; Liu, Y. Carbon flows from trade in harvested wood products using different accounting approaches. Carbon Manag. 2021, 12, 521–529. [Google Scholar] [CrossRef]

- Ji, C.; Yang, H.; Nie, Y.; Hong, Y. Carbon sequestration and carbon flow in harvested wood products for China. Int. For. Rev. 2013, 15, 160–168. [Google Scholar] [CrossRef]

- Wakelin, S.J.; Searles, N.; Lawrence, D.; Paul, T.S.H. Estimating New Zealand’s harvested wood products carbon stocks and stock changes. Carbon Balance Manag. 2022, 15, 1–14. [Google Scholar] [CrossRef] [PubMed]

- Peng, T.; Ning, Z.; Yang, H. Embodied CO2 in China’s trade of harvested wood products based on an MRIO model. Ecol. Indic. 2022, 137, 108742. [Google Scholar] [CrossRef]

- Manley, B.; Evison, D. An estimate of carbon stocks for harvested wood products from logs exported from New Zealand to China. Biomass Bioenergy 2018, 113, 55–64. [Google Scholar] [CrossRef]

- Pan, W.; Kim, M.K.; Ning, Z.; Yang, H. Carbon leakage in energy/forest sectors and climate policy implications using meta-analysis. For. Policy Econ. 2020, 115, 102161. [Google Scholar] [CrossRef]

- Zhang, X.; Chen, J.; Dias, A.; Yang, H. Improving carbon stock estimates for in-use harvested wood products by linking production and consumption—A global case study. Environ. Sci. Technol. 2020, 54, 2565–2574. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kallio, A.M.I.; Solberg, B.; Käär, L.; Päivinen, R. Economic impacts of setting reference levels for the forest carbon sinks in the EU on the European forest sector. For. Policy Econ. 2018, 92, 193–201. [Google Scholar] [CrossRef]

- Zhang, L.; Yu, C.; Cheng, B.; Yang, C.; Chang, Y. Mitigating climate change by global timber carbon stock: Accounting, flow and allocation. Renew. Sustain. Energy Rev. 2020, 131, 109996. [Google Scholar] [CrossRef]

- Li, R.; Wei, Y.; Yi, M.; Zhang, L.; Cheng, B.; Yu, C. Timber carbon stocks and influencing factors in the “Belt and Road Initiative” region. J. Clean. Prod. 2022, 359, 132026. [Google Scholar] [CrossRef]

- Böhringer, C.; Carbone, J.C.; Rutherford, T.F. The strategic value of carbon tariffs. Am. Econ. J. Econ. Policy 2016, 8, 28–51. [Google Scholar] [CrossRef] [Green Version]

- Eyland, T.; Zaccour, G. Carbon tariffs and cooperative outcomes. Energy Policy 2014, 65, 718–728. [Google Scholar] [CrossRef]

- Helm, D.; Hepburn, C.; Ruta, G. Trade, climate change, and the political game theory of border carbon adjustments. Oxf. Rev. Econ. Policy 2012, 28, 368–394. [Google Scholar] [CrossRef]

- Kuik, O.; Hofkes, M. Border adjustment for European emissions trading: Competitiveness and carbon leakage. Energy Policy 2010, 38, 1741–1748. [Google Scholar] [CrossRef]

- Winchester, N.; Paltsev, S.; Reilly, J.M. Will border carbon adjustments work? BE J. Econ. Anal. Policy 2011, 11, 7. [Google Scholar] [CrossRef]

- Zhang, K.U.N.; Liang, Q.M.; Liu, L.J.; Xue, M.M.; Yu, B.Y.; Wang, C.E.; Wei, Y.M. Impacts of mechanisms to promote participation in climate mitigation: Border carbon adjustments versus uniform tariff measures. Clim. Chang. Econ. 2020, 11, 2041007. [Google Scholar] [CrossRef]

- Fang, Y.; Yu, Y.; Shi, Y.; Lin, J. The effect of carbon tariffs on global emission control: A global supply chain model. Transp. Res. Part E Logist. Transp. Rev. 2020, 133, 101818. [Google Scholar] [CrossRef]

- Larch, M.; Wanner, J. Carbon tariffs: An analysis of the trade, welfare, and emission effects. J. Int. Econ. 2017, 109, 195–213. [Google Scholar] [CrossRef] [Green Version]

- Sutherland, B.R. Economic impact of a unilateral carbon price. Joule 2020, 4, 298–300. [Google Scholar] [CrossRef]

- Atkinson, G.; Hamilton, K.; Ruta, G.; Van Der Mensbrugghe, D. Trade in ‘virtual carbon’: Empirical results and implications for policy. Glob. Environ. Chang. 2011, 21, 563–574. [Google Scholar] [CrossRef] [Green Version]

- Sheng, Y.; Wang, Q. Influence of carbon tariffs on China’s export trade. Environ. Sci. Pollut. Res. 2022, 29, 24651–24659. [Google Scholar] [CrossRef]

- Böhringer, C.; Müller, A.; Schneider, J. Carbon tariffs revisited. J. Assoc. Environ. Resour. Econ. 2015, 2, 629–672. [Google Scholar] [CrossRef] [Green Version]

- Hong, S.; Sim, S.G.; Obashi, A.; Tsuruta, Y. Global Warming and Border Carbon Adjustments. Asian J. Law Econ. 2022, 13, 195–208. [Google Scholar] [CrossRef]

- Mörsdorf, G. A simple fix for carbon leakage? Assessing the environmental effectiveness of the EU carbon border adjustment. Energy Policy 2022, 161, 112596. [Google Scholar] [CrossRef]

- Yang, S.; Wei, S. Export Subsidies Or Export Levies?: A Game Analysis Of Trade Policies And Timing Choices Based On Carbon Tariff. Int. Econ. Trade Res. 2014, 30, 39–51. (In Chinese) [Google Scholar] [CrossRef]

- Wang, M.; Liu, J.; Chan, H.L.; Choi, T.M.; Yue, X. Effects of carbon tariffs trading policy on duopoly market entry decisions and price competition: Insights from textile enterprises of developing countries. Int. J. Prod. Econ. 2016, 181, 470–484. [Google Scholar] [CrossRef]

- Hou, Y.; Jia, M.; Chen, T.; Sun, C.; Zhu, L.; Wei, K. Research on the Optimal Emission-Abatement R&D Subsidy Policy under Carbon Tariff. Ecol. Econ. 2016, 32, 52–58. (In Chinese) [Google Scholar]

- Huang, T.; Liu, Z.; Zhao, T. Evolutionary Game Analysis of Responding to the EU’s Carbon Border Adjustment Mechanism. Energies 2022, 15, 427. [Google Scholar] [CrossRef]

- Rustico, E.; Dimitrov, S. Environmental taxation: The impact of carbon tax policy commitment on technology choice and social welfare. Int. J. Prod. Econ. 2022, 243, 108328. [Google Scholar] [CrossRef]

- García, J.H.; Orlov, A.; Aaheim, A. Negative leakage: The key role of forest management regimes. J. For. Econ. 2018, 33, 8–13. [Google Scholar] [CrossRef]

- Zhang, L.; Yu, C.; Yue, D.; Yang, C.; Cheng, B.; Diao, G.; Chang, Y. The value of global timber carbon stock and impacts on product price. Resour. Conserv. Recycl. 2020, 161, 104966. [Google Scholar] [CrossRef]

- Peng, T.; Ning, Z. Border Adjustments on Carbon Flows of Harvested Wood Products Trade: Insights and Controversies of Carbon Tariffs. World For. Res. 2021, 34, 118–123. (In Chinese) [Google Scholar]

- Patel, U.R. Optimal policies in a dynamic oligopoly model of international trade. Econ. Lett. 1994, 45, 207–212. [Google Scholar] [CrossRef]

- Wei, S.; Wang, Q. Research on the Effects of Environmental Policies of North and South Countries: Based on Game Analysis of Carbon Tax and Carbon Tariff. Financ. Trade Econ. 2015, 11, 148–159. (In Chinese) [Google Scholar] [CrossRef]

- Green, C.; Avitabile, V.; Farrell, E.P.; Byrne, K.A. Reporting harvested wood products in national greenhouse gas inventories: Implications for Ireland. Biomass Bioenergy 2006, 30, 105–114. [Google Scholar] [CrossRef]

- Bateman, I.J.; Lovett, A.A. Estimating and valuing the carbon sequestered in softwood and hardwood trees, timber products and forest soils in Wales. J. Environ. Manag. 2000, 60, 301–323. [Google Scholar] [CrossRef]

- Brunet-Navarro, P.; Jochheim, H.; Muys, B. The effect of increasing lifespan and recycling rate on carbon storage in wood products from theoretical model to application for the European wood sector. Mitig. Adapt. Strateg. Glob. Chang. 2017, 22, 1193–1205. [Google Scholar] [CrossRef] [Green Version]

- Hecht, M.; Peters, W. Border adjustments supplementing nationally determined carbon pricing. Environ. Resour. Econ. 2019, 73, 93–109. [Google Scholar] [CrossRef]

- Andaluz, J.; Elsadany, A.A.; Jarne, G. Dynamic Cournot oligopoly game based on general isoelastic demand. Nonlinear Dyn. 2020, 99, 1053–1063. [Google Scholar] [CrossRef]

- Hong, Z.; Peng, Z.; Zhang, L. Game analysis on the choice of emission trading among industrial enterprises driven by data. Energy 2022, 239, 122447. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, H.; Guo, S. Research on Dynamic Game Model and Application of China’s Imported Soybean Price in the Context of China-US Economic and Trade Friction. Complexity 2019, 2019, 6048186. [Google Scholar] [CrossRef]

- Ouardighi, F.E.; Jørgensen, S.; Pasin, F. A dynamic game with monopolist manufacturer and price-competing duopolist retailers. OR Spectr. 2013, 35, 1059–1084. [Google Scholar] [CrossRef]

- Eyland, T.; Zaccour, G. Strategic effects of a border tax adjustment. Int. Game Theory Rev. 2012, 14, 1250016. [Google Scholar] [CrossRef]

- Böhringer, C.; Bye, B.; Fæhn, T.; Rosendahl, K.E. Targeted carbon tariffs: Export response, leakage and welfare. Resour. Energy Econ. 2017, 50, 51–73. [Google Scholar] [CrossRef]

- Paluš, H.; Parobek, J.; Moravčík, M.; Kovalčík, M.; Dzian, M.; Murgaš, V. Projecting Climate Change Potential of Harvested Wood Products under Different Scenarios of Wood Production and Utilization: Study of Slovakia. Sustainability 2020, 12, 2510. [Google Scholar] [CrossRef]

- Tian, M.; Wang, F.; Feng, Q. Impact of International Timber Forest Product Price Fluctuations on China’s Import and Export of Timber Forest Products. J. Agro-For. Econ. Manag. 2022, 21, 67–77. (In Chinese) [Google Scholar]

- Liu, F.; Wheiler, K.; Ganguly, I.; Hu, M. Sustainable Timber Trade: A Study on Discrepancies in Chinese Logs and Lumber Trade Statistics. Forests 2020, 11, 205. [Google Scholar] [CrossRef] [Green Version]

- Ministry of Finance of the People’s Republic of China. Available online: http://gss.mof.gov.cn/gzdt/zhengcefabu/201908/t20190823_3372928.htm (accessed on 23 September 2022).

- Keen, M.; Parry, I.; Roaf, J. Border carbon adjustments: Rationale, design and impact. Fisc. Stud. 2022, 43, 209–234. [Google Scholar] [CrossRef]

- Steel, E.A.; Officer, F.; Ashley, F.A.O. Carbon storage and climate change mitigation potential of harvested wood products. In Food and Agricultural Organization (FAO) of the United Nations Forest Products and Statistics Team; FAO: Rome, Italy, 2021. [Google Scholar]

| Parameter | Definition | Value |

|---|---|---|

| The limit price when HWPs’ supply tends to zero | 100 | |

| Sensitivity of HWPs prices to supply | 5 | |

| The production cost of Company e | 30 | |

| The production cost of Company i | 50 | |

| Carbon storage value | 5~25 | |

| Carbon storage in unit HWPs | 10 | |

| The price of HWPs | –––– | |

| The output of Company | –––– | |

| The output of Company | –––– | |

| The profit of Company | –––– | |

| The profit of Company | –––– | |

| The welfare of Country E | –––– | |

| The welfare of Country I | –––– | |

| The consumer surplus | –––– |

| Without BCAs | With BCAs | |

|---|---|---|

| Price | ||

| Welfare of Country E | ||

| Changes in the welfare of Country E | ||

| Tariff revenue or subsidies | —— | |

| Welfare of Country I | ||

| Profit of Company e | ||

| Changes in profit of Company e | ||

| Profit of company i | ||

| Changes in profit of Company i | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liao, X.; Ning, Z. Welfare Implications of Border Carbon Adjustments on the Trade of Harvested Wood Products. Int. J. Environ. Res. Public Health 2023, 20, 790. https://doi.org/10.3390/ijerph20010790

Liao X, Ning Z. Welfare Implications of Border Carbon Adjustments on the Trade of Harvested Wood Products. International Journal of Environmental Research and Public Health. 2023; 20(1):790. https://doi.org/10.3390/ijerph20010790

Chicago/Turabian StyleLiao, Xinxin, and Zhuo Ning. 2023. "Welfare Implications of Border Carbon Adjustments on the Trade of Harvested Wood Products" International Journal of Environmental Research and Public Health 20, no. 1: 790. https://doi.org/10.3390/ijerph20010790