Does China’s Pilot Carbon Market Cause Carbon Leakage? New Evidence from the Chemical, Building Material, and Metal Industries

Abstract

1. Introduction

2. Literature Review

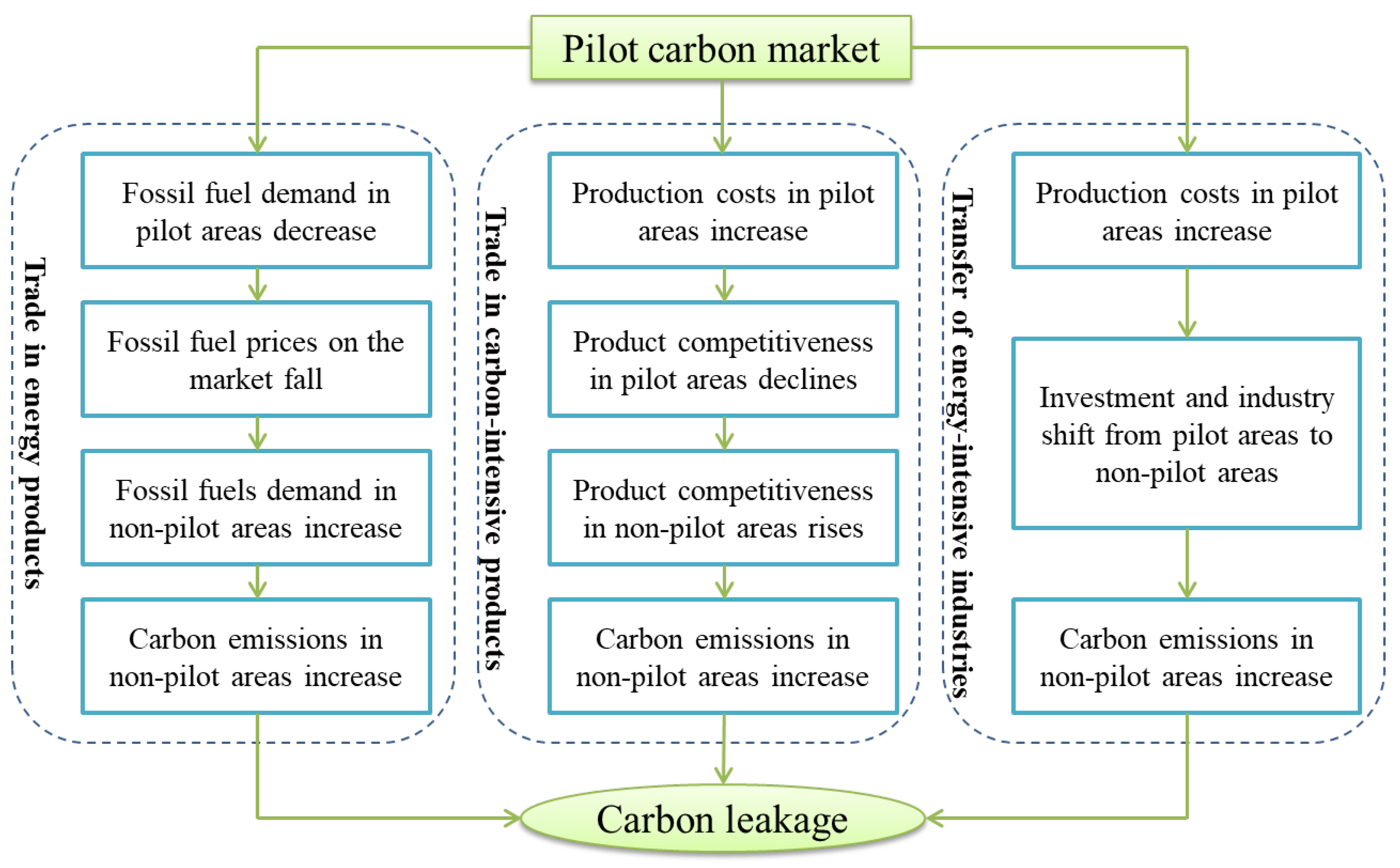

3. Theoretical Mechanism

4. Methodology and Data

4.1. Carbon Emissions of Production- and Consumption-Based and Transfer in and out

4.2. Difference-in-Differences Model

4.3. Data

4.3.1. Research Industry Selection

4.3.2. Variables and Data

5. Empirical Analysis

5.1. Results Based on DID Method

5.1.1. Empirical Results

5.1.2. Robustness Checks

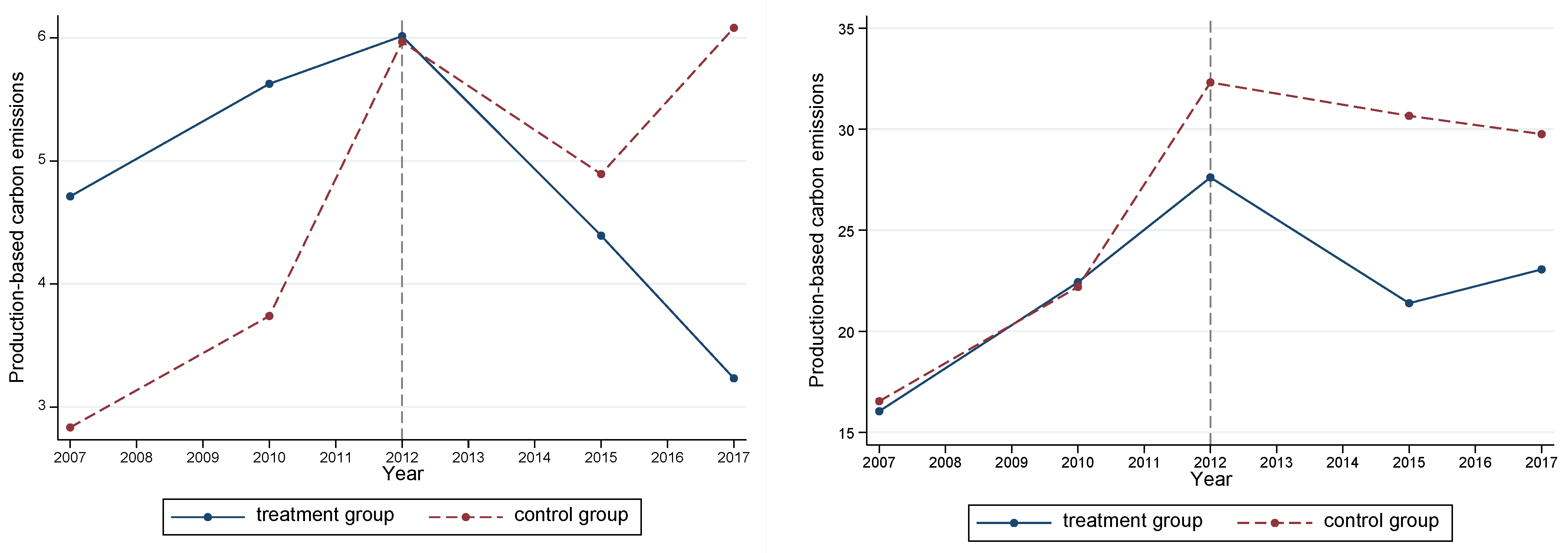

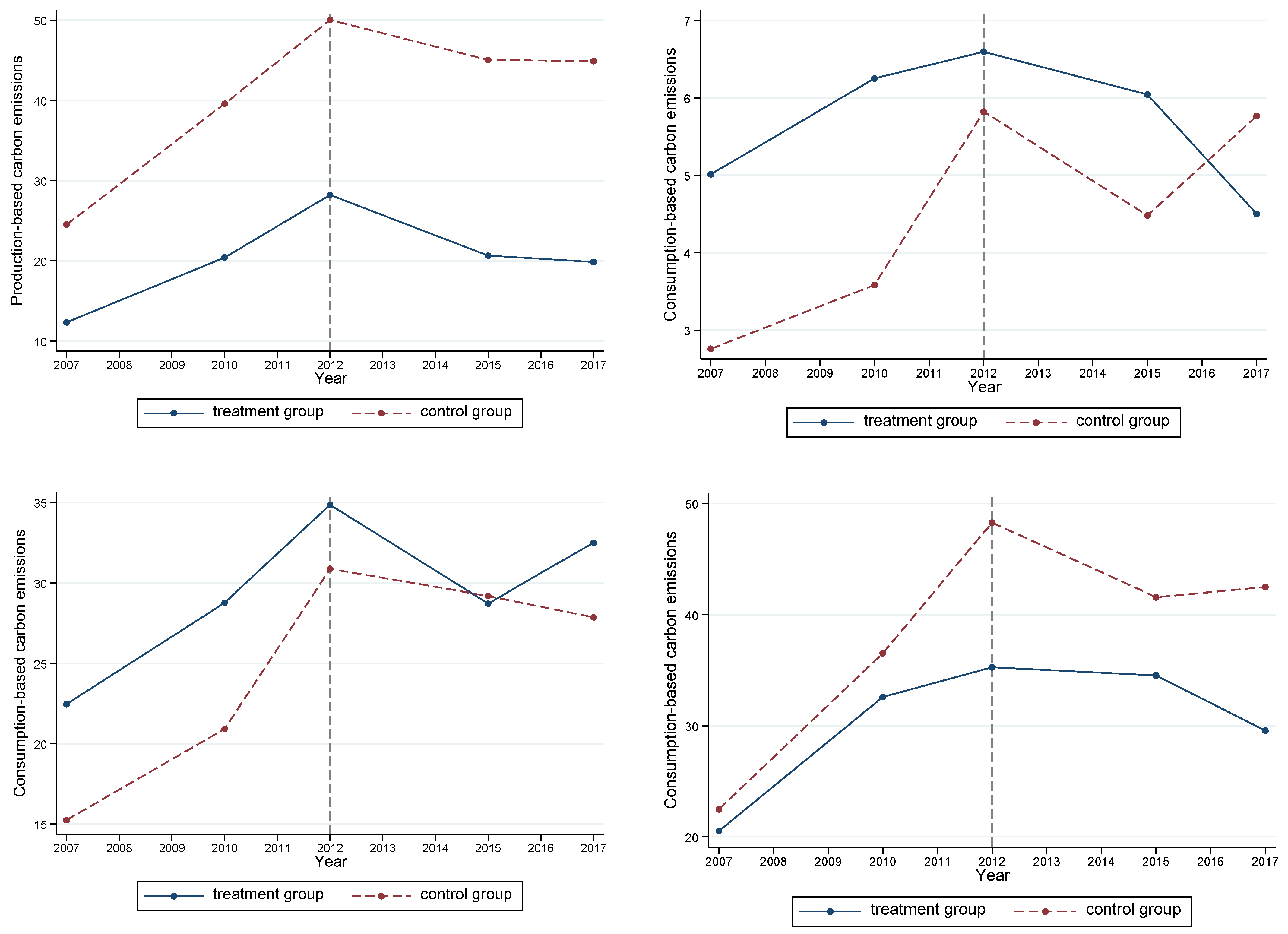

Parallel-Trend Test

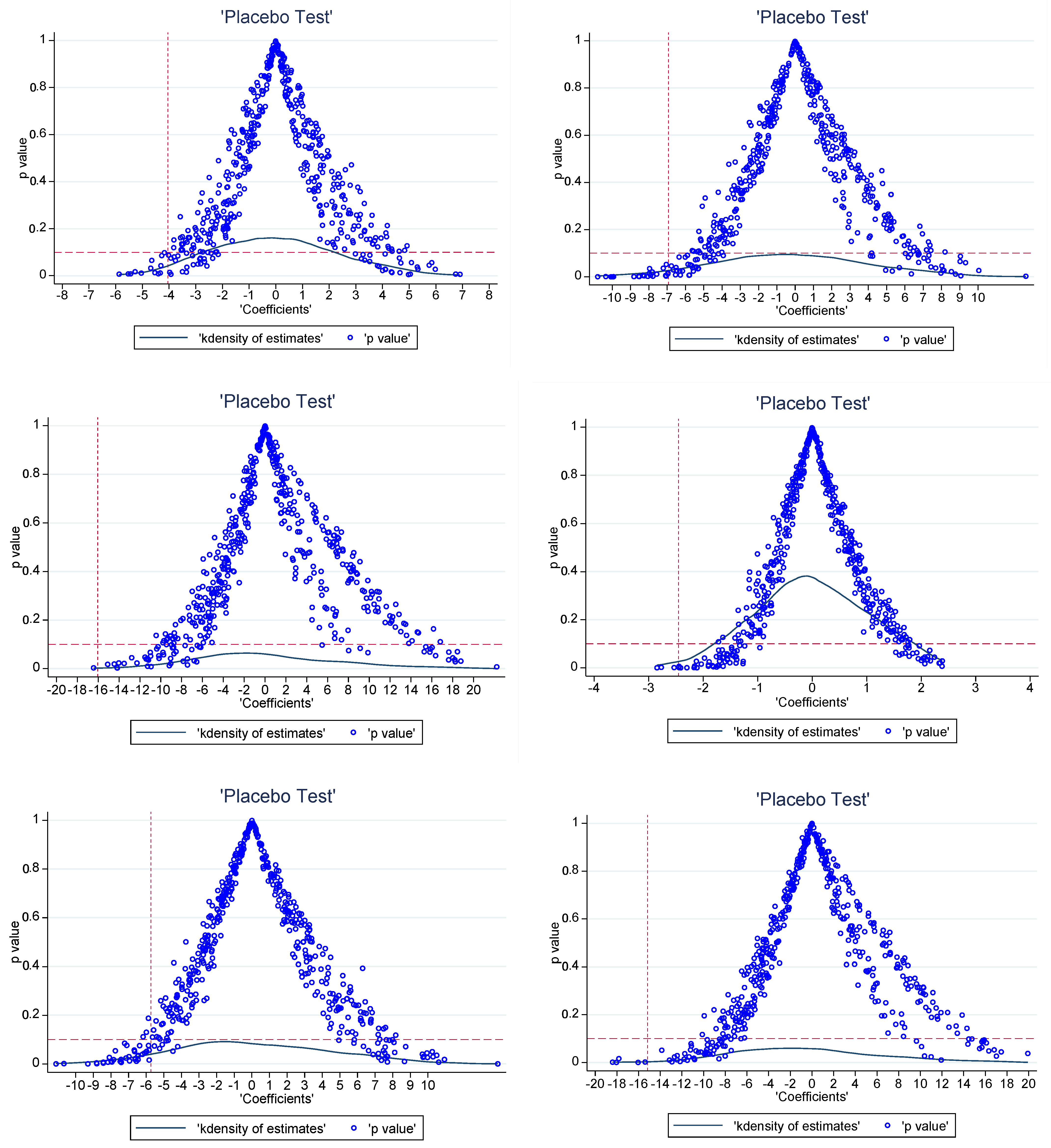

Placebo Test

5.2. Carbon Leakage Path Analysis

6. Discussion

7. Conclusions and Policy Implications

7.1. Conclusions

7.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- International Carbon Action Partnership (ICAP). Emissions Trading Worldwide: Status Report 2022. Available online: https://icapcarbonaction.com/en/publications/emissions-trading-worldwide-2022-icap-status-report (accessed on 29 March 2022).

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W.; Zhang, N.; Yu, Y. Carbon mitigation effects and potential cost savings from carbon emissions trading in China’s regional industry. Technol. Forecast. Soc. Chang. 2019, 141, 1–11. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, C.; Song, H.; Wang, Q. How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci. Total Environ. 2019, 676, 514–523. [Google Scholar] [CrossRef] [PubMed]

- Wang, K.; Li, S. China’s Carbon Market: Reviews and Prospects. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2022, 24, 33–42. (In Chinese) [Google Scholar] [CrossRef]

- Gao, Y.; Li, M.; Xue, J.; Liu, Y. Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ. 2020, 90, 104872. [Google Scholar] [CrossRef]

- Yu, B.; Zhao, Q.; Wei, Y.M. Review of carbon leakage under regionally differentiated climate policies. Sci. Total Environ. 2021, 782, 146765. [Google Scholar] [CrossRef]

- Peng, S.J.; Zhang, W.C. International Trade and climate change: A literature review. J. World Econ. 2016, 39, 167–192. (In Chinese) [Google Scholar]

- Yu, P.; Cai, Z.; Sun, Y. Does the emissions trading system in developing countries accelerate carbon leakage through OFDI? Evidence from China. Energy Econ. 2021, 101, 105397. [Google Scholar] [CrossRef]

- Paroussos, L.; Fragkos, P.; Capros, P.; Fragkiadakis, K. Assessment of carbon leakage through the industry channel: The EU perspective. Technol. Forecast. Soc. Chang. 2015, 90, 204–219. [Google Scholar] [CrossRef]

- Rey, F.; Madiès, T. Addressing the concerns about carbon leakage in the implementation of carbon pricing policies: A focus on the issue of competitiveness. J. Ind. Bus. Econ. 2021, 48, 53–75. [Google Scholar] [CrossRef]

- Zhao, Y.H.; Fan, J.W.; Yi, J.C. Empirical Study of Carbon Leakage from EU to China. Chin. J. Popul. Resour. 2011, 21, 113–117. (In Chinese) [Google Scholar] [CrossRef]

- Zhou, H.; Sheng, J.C. Has EU ETS caused carbon leakage in the EU carbon-intensive industries? A study from the perspective of bilateral trade. Chin. J. Popul. Resour. 2014, 13, 132–138. [Google Scholar] [CrossRef]

- Di, Y.N. Influence and measurement of carbon leakage from the EU to China based on the world input-output database. Resour. Sci. 2016, 38, 2307–2315. (In Chinese) [Google Scholar] [CrossRef]

- Rocco, M.V.; Golinucci, N.; Ronco, S.M.; Colombo, E. Fighting carbon leakage through consumption-based carbon emissions policies: Empirical analysis based on the world trade model with bilateral trades. Appl. Energy 2020, 274, 115301. [Google Scholar] [CrossRef]

- Wen, W.; Wang, Q. Re-examining the realization of provincial carbon dioxide emission intensity reduction targets in China from a consumption-based accounting. J. Clean Prod. 2020, 244, 118488. [Google Scholar] [CrossRef]

- Wiedmann, T. A review of recent multi-region input–output models used for consumption-based emission and resource accounting. Ecol. Econ. 2009, 69, 211–222. [Google Scholar] [CrossRef]

- Jakob, M. Climate policy and international trade–A critical appraisal of the literature. Energy Policy 2021, 156, 112399. [Google Scholar] [CrossRef]

- Barker, T.; Junankar, S.; Pollitt, H.; Summerton, P. Carbon leakage from unilateral environmental tax reforms in Europe, 1995–2005. Energy Policy 2007, 35, 6281–6292. [Google Scholar] [CrossRef]

- Böhringer, C.; Carbone, J.C.; Rutherford, T.F. Embodied carbon tariffs. Scand. J. Econ. 2018, 120, 183–210. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, C.; Wang, Q.; Zhou, D. Does emission trading lead to carbon leakage in China? Direction and channel identifications. Renew. Sustain. Energy Rev. 2020, 132, 110090. [Google Scholar] [CrossRef]

- Boutabba, M.A.; Lardic, S. EU emissions trading scheme, competitiveness and carbon leakage: New evidence from cement and steel industries. Ann. Oper. Res. 2017, 255, 47–61. [Google Scholar] [CrossRef]

- Demailly, D.; Quirion, P. European Emission Trading Scheme and competitiveness: A case study on the iron and steel industry. Energy Econ. 2008, 30, 2009–2027. [Google Scholar] [CrossRef]

- Healy, S.; Schumacher, K.; Eichhammer, W. Analysis of Carbon Leakage under Phase III of the EU Emissions Trading System: Trading Patterns in the cement and aluminium sectors. Energies 2018, 11, 1231. [Google Scholar] [CrossRef]

- Naegele, H.; Zaklan, A. Does the EU ETS cause carbon leakage in European manufacturing. J. Environ. Econ. Manag. 2019, 93, 125–147. [Google Scholar] [CrossRef]

- Ponssard, J.P.; Walker, N. EU emissions trading and the cement sector: A spatial competition analysis. Clim. Policy 2008, 8, 467–493. [Google Scholar] [CrossRef]

- Fu, J.Y.; Zhang, C.J. International trade, carbon leakage, and CO2 emissions of manufacturing industry. Chin. J. Popul. Resour. 2015, 13, 139–145. [Google Scholar] [CrossRef]

- Lin, B.Q.; Li, A.J. Is Carbon Motivated Border Tax Justifiable. Econ. Res. J. 2012, 47, 118–127. (In Chinese) [Google Scholar]

- Yang, X.; Peng, S.J. Does Carbon Tariff Prevent Carbon Leakage and Competitiveness Losses? Analyses Based on the Trade Models with Firm Heterogeneity. Econ. Res. J. 2017, 52, 60–74. (In Chinese) [Google Scholar]

- Lin, W.B.; Gu, A.L.; Liu, B.; Wang, Z.X.; Zhou, L.L. Carbon market, sector competitiveness and carbon leakage: Steel sector case. Adv. Clim. Chang. Res. 2019, 15, 427–435. (In Chinese) [Google Scholar] [CrossRef]

- Cao, J.; Ho, M.S.; Ma, R.; Teng, F. When carbon emission trading meets a regulated industry: Evidence from the electricity sector of China. J. Public Econ. 2021, 200, 104470. [Google Scholar] [CrossRef]

- Pan, A. Foreign Trade, Interregional Trade and Carbon Emissions Transfer: Analysis Based on China’ Regional Input-output Tables. J. Financ. Econ. 2017, 43, 57–69. (In Chinese) [Google Scholar] [CrossRef]

- Turner, K.; Lenzen, M.; Wiedmann, T.; Barrett, J. Examining the global environmental impact of regional consumption activities—Part 1: A technical note on combining input–output and ecological footprint analysis. Ecol. Econ. 2007, 62, 37–44. [Google Scholar] [CrossRef]

- Hu, Y.B. Spatial and Industrial Transfer Pathways of Embodied CO2 Emissions in Chinese Provinces. Technol. Econ. 2019, 38, 130–137. (In Chinese) [Google Scholar]

- Han, Z.; Chen, Y.H.; Shi, Y. To Measure and Decompose Consumption-Based Carbon Emission from the Perspective of International Final Demand. J. Quant. Tech. Econ. 2018, 35, 114–129. (In Chinese) [Google Scholar] [CrossRef]

- Zhang, H.J.; Duan, M.S. Evaluation of the carbon emission reduction effect of China’s pilot ETSs: Analysis based on the data of energy-intensive industrial sub-sectors by province. Adv. Clim. Chang. Res. 2021, 17, 579–589. (In Chinese) [Google Scholar] [CrossRef]

- Chen, S.; Shi, A.; Wang, X. Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: The mediating roles of technique effect, composition effect and allocation effect. J. Clean. Prod. 2020, 264, 121700. [Google Scholar] [CrossRef]

- Xu, Y.Z.; Wu, H.M. Development, Change and Countermeasures of China’s Iron and Steel Industry—A Dynamic Research Based on the Input—Output Analysis. Econ. Probl. 2010, 5, 36–41. (In Chinese) [Google Scholar]

- Yuan, L.J. Input—output Analysis of Circular Economy Based on Technological Innovation: A Case Study of Iron and Steel Industry. Res. Financ. Econ. Issues 2012, 7, 29–37. (In Chinese) [Google Scholar] [CrossRef]

| Variable | Definition | Mean | Std. | Max | Min |

|---|---|---|---|---|---|

| P-emission | Production-based emissions (chemical industry) | 4.722 | 5.395 | 36.704 | 0.072 |

| C-emission | Consumption-based emissions (chemical industry) | 4.722 | 3.762 | 18.207 | 0.135 |

| P-emission | Production-based emissions (building material) | 25.595 | 17.923 | 67.762 | 0.275 |

| C-emission | Consumption-based emissions (building material) | 25.595 | 15.883 | 79.648 | 1.233 |

| P-emission | Production-based emissions (metal) | 36.712 | 45.448 | 277.267 | 0.018 |

| C-emission | Consumption-based emissions (metal) | 36.712 | 26.972 | 126.700 | 0.880 |

| pop | Population | 4.505 | 2.752 | 12.141 | 0.552 |

| pgdp | Per capita GDP | 4.047 | 2.384 | 13.620 | 0.784 |

| urban | Urban population/total population | 0.543 | 0.136 | 0.915 | 0.282 |

| trade | Total import and export/regional GDP | 0.312 | 0.359 | 1.670 | 0.018 |

| industry | Added value of secondary industry/regional GDP | 0.434 | 0.081 | 0.607 | 0.169 |

| coal | Coal consumption/energy consumption | 0.672 | 0.282 | 1.529 | 0.049 |

| tec | Total technology turnover/regional GDP | 0.011 | 0.023 | 0.150 | 0.0002 |

| evir | Investment in environmental pollution control/regional GDP | 0.015 | 0.008 | 0.043 | 0.004 |

| industry_input | Initial industry input per capita (chemical industry) | 0.176 | 0.122 | 0.610 | 0.029 |

| industry_prod | Total industry output per capita (chemical industry) | 0.752 | 0.620 | 3.129 | 0.096 |

| industry_input | Initial industry input per capita (building material) | 0.075 | 0.053 | 0.277 | 0.007 |

| industry_prod | Total industry output per capita (building material) | 0.289 | 0.209 | 1.044 | 0.029 |

| industry_input | Initial industry input per capita (metal) | 0.140 | 0.112 | 0.578 | 0.001 |

| industry_prod | Total industry output per capita (metal) | 0.693 | 0.568 | 3.600 | 0.004 |

| Variable | Chemical Industry | Variable | Building Material | Variable | Metal |

|---|---|---|---|---|---|

| DID | −4.05 ** (−2.22) | DID | −6.93 ** (−2.25) | DID | −16.04 *** (−2.61) |

| industry | 10.65 (0.78) | pop | 1.09 (0.33) | pop | 10.84 * (1.70) |

| tec | 85.5 (1.34) | pgdp | 1.89 (1.34) | industry | −36.69 (−0.83) |

| indusry_input | 24.65 * (1.71) | trade | 14.88 * (1.83) | industry_prod | 14.82 ** (2.27) |

| industry_prod | −5.39 * (−1.76) | industry | 56.69 ** (2.53) | envir | −304.77 (−1.20) |

| coal | −37.59 ** (−2.26) | ||||

| Constant | −2.86 (−0.45) | Constant | −24.24 (−1.44) | Constant | 14.93 (0.41) |

| Province fixed | Yes | Province fixed | Yes | Province fixed | Yes |

| Year fixed | Yes | Year fixed | Yes | Year fixed | Yes |

| Observations | 150 | Observations | 150 | Observations | 150 |

| Adjusted R2 | 0.14 | Adjusted R2 | 0.58 | Adjusted R2 | 0.40 |

| Variable | Chemical Industry | Variable | Building Material | Variable | Metal |

|---|---|---|---|---|---|

| DID | −2.45 ** (−2.43) | DID | −5.73 (−1.39) | DID | −15.17 *** (−3.09) |

| industry | 8.676 (1.14) | pop | 10.81 ** (2.44) | pop | 13.76 *** (2.70) |

| tec | 24.89 (0.71) | pgdp | −0.90 (−0.48) | industry | 21.14 (0.60) |

| indusry_input | 11.22 (1.41) | trade | 11.20 (1.03) | industry_prod | 6.48 (1.24) |

| industry_prod | −3.95 ** (−2.33) | industry | 25.25 (0.84) | envir | 66.06 (0.33) |

| coal | −41.43 *** (−3.12) | ||||

| Constant | −0.57 (−0.16) | Constant | 44.53 ** (−1.98) | Constant | −22.33 (−0.76) |

| Province fixed | Yes | Province fixed | Yes | Province fixed | Yes |

| Year fixed | Yes | Year fixed | Yes | Year fixed | Yes |

| Observations | 150 | Observations | 150 | Observations | 150 |

| Adjusted R2 | 0.27 | Adjusted R2 | 0.43 | Adjusted R2 | 0.40 |

| Variable | Chemical Industry | Variable | Building Material | Variable | Metal |

|---|---|---|---|---|---|

| DID | −0.23 (−0.14) | DID | 1.38 (0.35) | DID | 0.76 (0.44) |

| industry | 14.51 (0.75) | pop | −3.17 (−0.46) | pop | −3.55 (−1.21) |

| tec | −60.08 (−0.71) | pgdp | −0.68 (−0.21) | industry | 7.63 (0.40) |

| indusry_input | 7.08 (0.44) | trade | 7.84 (0.61) | industry_prod | 4.22 * (1.75) |

| industry_prod | 2.02 (0.52) | industry | 117.69 *** (2.91) | envir | 48.24 (0.74) |

| coal | 9.19 (1.54) | ||||

| Constant | −4.65 (−0.51) | Constant | −25.34 (−0.63) | Constant | 6.44 (0.37) |

| Province fixed | Yes | Province fixed | Yes | Province fixed | Yes |

| Year fixed | Yes | Year fixed | Yes | Year fixed | Yes |

| Observations | 150 | Observations | 150 | Observations | 150 |

| Adjusted R2 | 0.26 | Adjusted R2 | 0.70 | Adjusted R2 | 0.32 |

| Variable | Chemical Industry | Variable | Building Material | Variable | Metal |

|---|---|---|---|---|---|

| DID | −0.23 (−0.24) | DID | 2.36 (0.49) | DID | 0.22 (0.22) |

| industry | 10.99 (1.00) | pop | 1.69 (0.20) | pop | −1.35 (−0.79) |

| tec | −8.63 (−0.18) | pgdp | −5.85 (−1.48) | industry | 8.83 (0.80) |

| indusry_input | 5.10 (0.55) | trade | 6.08 (0.39) | industry_prod | 1.80 (1.28) |

| industry_prod | 0.54 (0.24) | industry | 86.49 * (1.77) | envir | 18.86 (0.50) |

| coal | 3.56 (1.02) | ||||

| Constant | −2.57 (−0.50) | Constant | −20.37 (−0.42) | Constant | 1.59 (0.16) |

| Province fixed | Yes | Province fixed | Yes | Province fixed | Yes |

| Year fixed | Yes | Year fixed | Yes | Year fixed | Yes |

| Observations | 150 | Observations | 150 | Observations | 150 |

| Adjusted R2 | 0.48 | Adjusted R2 | 0.61 | Adjusted R2 | 0.50 |

| Province | Chemical Industry | Proportion | Building Materials | Proportion | Metal Industry | Proportion |

|---|---|---|---|---|---|---|

| Hebei | 0.64 | 5.08% | 6.83 | 11.26% | 30.52 | 27.47% |

| Shanxi | 0.20 | 1.59% | 0.42 | 0.70% | 6.15 | 5.54% |

| Inner Mongolia | 0.94 | 7.43% | 3.58 | 5.90% | 3.75 | 3.38% |

| Liaoning | 0.39 | 3.07% | 2.74 | 4.51% | 10.40 | 9.36% |

| Jilin | 0.55 | 4.40% | 1.61 | 2.65% | 1.49 | 1.34% |

| Heilongjiang | 0.62 | 4.93% | 0.46 | 0.76% | 0.59 | 0.53% |

| Jiangsu | 1.15 | 9.12% | 3.90 | 6.43% | 9.57 | 8.62% |

| Zhejiang | 0.51 | 4.02% | 3.81 | 6.28% | 0.98 | 0.89% |

| Anhui | 0.63 | 5.03% | 3.03 | 5.00% | 3.71 | 3.34% |

| Fujian | 0.22 | 1.71% | 2.08 | 3.42% | 1.29 | 1.16% |

| Jiangxi | 0.12 | 0.95% | 2.66 | 4.38% | 2.98 | 2.68% |

| Shandong | 0.85 | 6.72% | 2.43 | 4.01% | 4.60 | 4.14% |

| Henan | 0.65 | 5.17% | 7.58 | 12.49% | 8.07 | 7.26% |

| Hunan | 0.88 | 7.00% | 4.59 | 7.56% | 2.87 | 2.58% |

| Guangxi | 0.27 | 2.11% | 5.76 | 9.49% | 6.22 | 5.60% |

| Hainan | 0.08 | 0.67% | 0.35 | 0.58% | 0.02 | 0.02% |

| Sichuan | 0.48 | 3.83% | 3.42 | 5.64% | 2.82 | 2.54% |

| Guizhou | 0.19 | 1.53% | 1.64 | 2.70% | 2.03 | 1.83% |

| Yunnan | 0.37 | 2.95% | 0.47 | 0.78% | 4.50 | 4.05% |

| Shaanxi | 0.57 | 4.56% | 1.98 | 3.27% | 2.34 | 2.10% |

| Gansu | 0.14 | 1.14% | 0.46 | 0.75% | 2.92 | 2.63% |

| Qinghai | 0.28 | 2.20% | 0.11 | 0.18% | 0.56 | 0.50% |

| Ningxia | 0.29 | 2.31% | 0.27 | 0.45% | 0.80 | 0.72% |

| Xinjiang | 1.57 | 12.49% | 0.21 | 0.35% | 1.92 | 1.73% |

| Tianjin | 0.30 | 0.49% |

| Pilot Areas | Time Frame | Quota Allocation Method | Average Transaction Price (yuan/ton) | Total Quota/100 Million Tons | Punishment Mechanism |

|---|---|---|---|---|---|

| Beijing | 28 November 2013—31 December 2017 | Historical method and baseline method | 50.4 | 0.5 | A fine of not less than 30,000 yuan but not more than 50,000 yuan shall be imposed if the reporting obligation is not fulfilled; if it fails to fulfill the obligation of quota settlement, it shall be fined not less than three times but not more than five times the average market price. |

| Shanghai | 19 December 2013—31 December 2017 | Historical method and baseline method | 26.7 | 1.6 | A fine of not less than 10,000 yuan but not more than 30,000 yuan shall be imposed for failing to fulfill the reporting obligation; a fine of not less than 50,000 yuan but not more than 100,000 yuan shall be imposed for failing to fulfill the obligation of quota settlement. |

| Tianjin | 26 December 2013—31 December 2017 | Historical method and baseline method | 21.0 | 1.6 | Within 3 years, no preferential policies related to circular economy, energy conservation, and emission reduction are allowed. |

| Guangdong | 19 December 2013—31 December 2017 | Historical method and baseline method, paid distribution of some quotas | 27.1 | 4.2 | A fine of not less than 10,000 yuan but not more than 30,000 yuan shall be imposed for failing to fulfill the reporting obligation; if the quota-clearing obligation is not fulfilled, the quota of the next year shall be deducted twice as much as the quota of the part not fully cleared, and a fine of 50,000 yuan shall be imposed. |

| Hubei | 2 April 2014—31 December 2017 | Historical method and baseline method | 20.8 | 2.5 | A fine of not less than 10,000 yuan but not more than 30,000 yuan shall be imposed for failure to fulfill the reporting obligation; if the company fails to fulfill the obligation of quota settlement, it shall impose a fine of not less than one time but not more than three times the difference according to the average market price of carbon emission quota in the current year, but not more than 150,000 yuan. |

| Chongqing | 19 June 2014—31 December 2017 | The combination of total government control and enterprise competition game | 18.7 | 1.3 | Failure to fulfill the obligation of clearing and payment of quotas shall be punished according to three times the average trading price of quotas in the month before the expiration of the clearing and payment period. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cong, J.; Wang, H.; Hu, X.; Zhao, Y.; Wang, Y.; Zhang, W.; Zhang, L. Does China’s Pilot Carbon Market Cause Carbon Leakage? New Evidence from the Chemical, Building Material, and Metal Industries. Int. J. Environ. Res. Public Health 2023, 20, 1853. https://doi.org/10.3390/ijerph20031853

Cong J, Wang H, Hu X, Zhao Y, Wang Y, Zhang W, Zhang L. Does China’s Pilot Carbon Market Cause Carbon Leakage? New Evidence from the Chemical, Building Material, and Metal Industries. International Journal of Environmental Research and Public Health. 2023; 20(3):1853. https://doi.org/10.3390/ijerph20031853

Chicago/Turabian StyleCong, Jianhui, Huimin Wang, Xiaoxiao Hu, Yongbin Zhao, Yingying Wang, Weiqiang Zhang, and Ling Zhang. 2023. "Does China’s Pilot Carbon Market Cause Carbon Leakage? New Evidence from the Chemical, Building Material, and Metal Industries" International Journal of Environmental Research and Public Health 20, no. 3: 1853. https://doi.org/10.3390/ijerph20031853

APA StyleCong, J., Wang, H., Hu, X., Zhao, Y., Wang, Y., Zhang, W., & Zhang, L. (2023). Does China’s Pilot Carbon Market Cause Carbon Leakage? New Evidence from the Chemical, Building Material, and Metal Industries. International Journal of Environmental Research and Public Health, 20(3), 1853. https://doi.org/10.3390/ijerph20031853