1. Introduction

There have been increasing concerns on the issue of environmental pollution [

1]. To solve the environmental pollution problem, countries around the world are vigorously promoting a green transformation of their economies [

2]. In this context, green growth is gaining attention worldwide. Green growth is defined as resilient, clean, and energy-efficient economic growth and is centred on the reconciliation of economic growth with the ecological environment [

3].

Technological innovation plays a key role in solving environmental problems and promoting green growth. The importance of technological innovation in facilitating production transformation and increasing the total factor productivity of firms has been repeatedly highlighted by scholars [

4]. Long-term solutions to environmental problems require technological innovation, especially green innovation [

5]. Khan et al. [

6] found that green innovation contributed to green growth by reducing CO

2 emissions and promoting economic and industrial structural transformation using data from G7 countries. Danish and Ulucak [

7] found that environmental technology innovation significantly contributed to green growth in Brazil, Russia, India, China, and South Africa, collectively known as BRICS countries.

Green finance contributes to environmental protection and economic growth. On the one hand, financial development can mobilise savings, promote capital accumulation, and improve capital allocation, and thus contribute to economic growth [

8]. On the other hand, financial development can reduce greenhouse gas emissions and contribute to environmental protection [

9]. As a financial innovation, green finance is essentially the same as traditional finance, with the main difference being that green finance has an environmental purpose [

10]. Green finance provides support for environmental protection and pollution reduction, through financial instruments and products, such as credit, insurance, and securities [

11].

The relationship between green finance and technological innovation has an impact on whether green finance policies and technological innovation can be fully effective and is important for solving the environmental pollution problem and promoting green growth. China has implemented green finance policies and is committed to promoting green growth [

12]. The Chinese government issued the ‘Green Credit Guidelines’ (hereinafter referred to as ‘the Guidelines’) on 29 January 2012, which explicitly require banking financial institutions to adjust their credit to address environmental risks and support green growth. As banks dominate the Chinese financial system, green credit plays an important part in China’s green finance [

13].

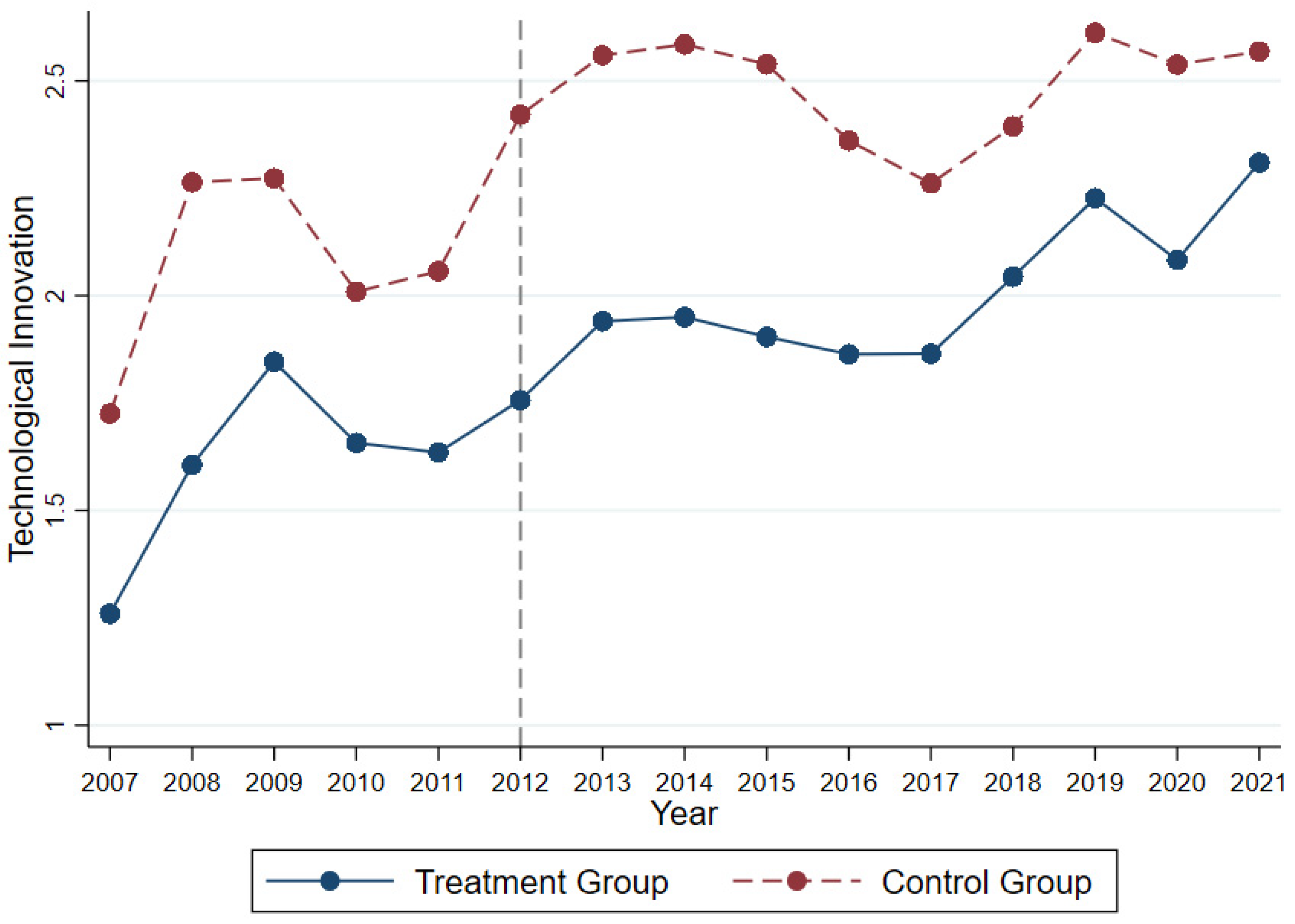

Therefore, we regarded the release of the Guidelines as the implementation of green financial policy and, using the data of Chinese listed companies from 2007 to 2021, explored the relationship between green finance and technological innovation. The innovations of this study are as follows: First, this study identified the heterogeneous effects of green finance policies on technological innovation. Second, this study indicated the crucial role of policy signal in the influence of green finance on technological innovation. Third, this study determined the influencing factors of banks and enterprises.

The remainder of the paper is organised as follows:

Section 2 and

Section 3 review the literature and analyse the interaction between green finance and technological innovation in theoretical terms, respectively.

Section 4 and

Section 5 introduce the empirical model and report the empirical results, respectively.

Section 6 and

Section 7 discuss the mediating effects and moderating effects, respectively. Finally,

Section 8 presents the conclusions.

3. Theoretical Analysis

3.1. Technological Innovation and Green Finance

In this study, the compliance cost effects, innovation compensation effects, and policy signalling effects of green financial policies were analysed.

As a market-led environmental regulation policy, the Guidelines require banks to use firms’ environmental performance as an important basis for credit allocation, thus prompting firms to increase their environmental expenditures to obtain loans. Given the limited resources, the increase in environmental protection costs may crowd-out funds for other production activities, including R&D. Therefore, the Guidelines may have a ‘cost compliance effect’, creating a disincentive for technological innovation. In contrast, the Guidelines increase the environmental costs of obtaining credit, thereby increasing cost pressures on firms. Under this pressure, firms may seek technological innovations to improve productivity and thus compensate for the increased environmental costs. Thus, the Guidelines may have an ‘innovation compensation effect’ and promote technological innovation.

As R&D activities are characterised by long investment cycles, high capital requirements, and uncertain outcomes [

24], sustained and sufficient R&D investment is required to generate applicable technological innovations. If the market environment deteriorates in the future and a company cannot continue to invest in R&D and does not achieve an applicable technological innovation, then the initial R&D investment will become a sunk cost. In a deteriorating market environment, even if the R&D investment is successful, the products will still face sale problems and it will be difficult to translate into a competitive advantage for the company. Therefore, under the pressure of increasing environmental costs, it is in the interest of companies to invest technological innovation only if the industry has a broad market space in the future. However, the introduction of the Guidelines has signalled that the government will tighten restrictions on heavily polluting industries and enterprises. These industries are pessimistic about whether R&D investment will bring effective ‘innovation compensation’.

In general, the ‘compliance cost effect’ of green finance policies can inhibit technological innovation, while the ‘innovation compensation effect’ promotes it. The ‘policy signalling effect’ inhibits the ‘innovation compensation effect’. Therefore, green finance policies generally discourage technological innovation.

Accordingly, we proposed Hypothesis 1:

Hypothesis 1 (H1). Green financial policies in general behave as a disincentive to technological innovation.

3.2. Mechanisms by Which Green Financial Policies Affect Technological Innovation

3.2.1. Bank Loan Intermediation Effects

The Guidelines require banking financial institutions to develop specific credit policies for restricted industries, such as heavily polluting industries, and to deny credit for non-compliance with environmental performance. This reduces the lending banks do to heavily polluting industries. There is a problem of excessive credit in China’s heavily polluting industries [

25], and a reduction in bank lending could weaken banks’ restrictions on technological innovation, and thus increase innovation. Banks lend to firms at a fixed interest rate based on the amount of the loan, and even if the firm succeeds in technological innovation and achieves greater economic benefits, the bank does not receive a share of the additional revenue. If a company fails to innovate and has serious financial problems, bank loans are at risk. Therefore, banks tend to restrict firms’ innovative behaviour [

26].

Accordingly, we proposed Hypothesis 2:

Hypothesis 2 (H2). Green financial policies promote technological innovation by reducing bank loans and weakening constraints on technological innovation of companies.

3.2.2. Loan Term Intermediation Effects

In the case of short loan terms, changes in business conditions and market demand are small and loans can be recovered; therefore, the loan risk is manageable. However, for longer loan terms, the business conditions, market demand, and policy direction may change significantly, and the loan risk is more variable. The policy signals released by the Guidelines have made banks aware of the potential for further tightening of policy restrictions on heavily polluting industries in the future, which could increase the financial risk of enterprises and the associated credit risk for banks. Therefore, under the influence of the Guidelines, banks have tended to shorten the maturity of credit to hedge potential policy risks. As the maturity structure of debt needs to match the asset structure [

27] and technological innovation requires long-term funding, shorter credit maturities may discourage technological innovation.

Accordingly, we proposed Hypothesis 3:

Hypothesis 3 (H3). Green financial policies discourage technological innovation by shortening the term of loans.

3.2.3. Management Motivation Mediating Effects

The implementation of the Guidelines has prompted banks to strengthen their supervision of companies and reduce the incentive of their management. First, banks have strengthened their oversight of corporate environmental practices. The Guidelines require banking institutions to dynamically assess and classify the environmental risks of their clients, with the relevant results serving as an important basis for their ratings and credit access. Second, banks have strengthened their supervision of business operations. Banks are an important player in corporate governance [

28] and can monitor and influence the operations of borrowers. Green finance policies increase the environmental costs and release policy signals that are unfavourable to traditional companies, and thus increase the risk of bank loans. Banks will inevitably strengthen their supervision of the business management process and increase restrictions on corporate behaviour, which will reduce room for autonomous decision-making by corporate management and reduce motivation. As R&D innovation is characterised by long investment cycles, large amounts of money, and high risks, the demonstration and implementation of R&D projects require professional management skills and corresponding decision-making responsibilities. Therefore, if management loses motivation, they will reduce technological innovation activities.

Accordingly, we proposed Hypothesis 4:

Hypothesis 4 (H4). Green financial policies reduce the scope for corporate autonomy and reduce the incentive of corporate management, and thereby discourage technological innovation.

3.2.4. Business Confidence Mediating Effects

Business confidence is a composite judgement made by firms based on their understanding of the current situation and economic information [

29]. Government support can provide protection for business development and financial support can provide funding for business development, both of which have a significant impact on business confidence. The introduction of the Guidelines indicates the government’s desire to restrict heavily polluting industries and use financial instruments to enhance the financing constraints of enterprises. These changes will inevitably lead to a decline in the confidence of enterprises in heavily polluting industries. When enterprises are pessimistic, they generally have ‘high risk, low return’ expectations of investment projects and tend to reduce their investment [

30].

Accordingly, we proposed Hypothesis 5:

Hypothesis 5 (H5). Green financial policies discourage technological innovation by weakening business confidence.

3.3. Moderating Mechanisms for Green Financial Policies to Influence Technological Innovation

Operational capability indicates the efficiency of an enterprise’s use of resources to achieve its management objectives. First, companies with strong operational capabilities can allocate their assets in a rational manner, and thus can reduce the crowding out of R&D investment by environmental costs and focus more resources on R&D. Second, in the face of a deteriorating market environment, companies with strong operational capabilities are more confident of surviving the strong market competition in the future and therefore have a greater willingness to engage in technological innovation.

Accordingly, we proposed Hypothesis 6:

Hypothesis 6 (H6). The stronger the operational capacity of the enterprise, the weaker the inhibitory performance of green financial policies on technological innovation.

8. Conclusions

In this study, multiple effects of green financial policies were analysed from three perspectives: compliance cost effect, innovation compensation effect, and policy signalling effect. The mediating and moderating effects of green financial policies on technological innovation were also analysed. Furthermore, an empirical test was conducted using the difference-in-differences method. The following conclusions were drawn. First, green finance inhibited technological innovation owing to the pessimistic attitude of heavily polluting firms towards the returns expected from technological innovation. Second, green financial policies weakened the constraints of banks on technological innovation by lowering bank loans, and thus promoted technological innovation. Third, green financial policies resulted in shorter credit terms, lower management incentives, and weaker business confidence, and thus discouraged technological innovation. Fourth, the stronger the operating capacity of enterprises, the weaker the policy’s inhibiting effect on technological innovation.

Accordingly, the following recommendations are made for improving green financial policies and using technological innovation to achieve green growth. First, avoid the wholesale rejection of heavily polluting industries and emphasise green transformation and upgrading. It is not reasonable to shut down heavily polluting industries across the board; therefore, guiding enterprise transformation is a necessary step to combat environmental pollution while considering economic development. The emphasis on transformation and upgrading can give confidence to the industry while curbing the blind expansion and sloppy development of heavily polluting industries. This can guide market players to be proactive rather than passive and motivate enterprises to address the contradiction between maximising profits and environmental constraints through technological innovation. Second, banks should be guided to adjust their credit maturity structure for enterprises in heavily polluting industries. Owing to their own interests, banks lack the incentive to extend the credit maturity of enterprises in heavily polluting industries. Therefore, the green financial policy should strengthen the guidance and constraint for banks to increase the proportion of long-term loans to provide stable financial security for R&D and innovation. Finally, banks should be guided to reduce their intervention in the normal operation of enterprises while strengthening their environmental review. Banks’ loan reviews and interventions can impact the normal business activities of enterprises. Green financial policies should guide and restrain the behaviour of banks to avoid excessive intervention in business activities [

31,

32,

33,

34].

In the study, we analysed the significance of technological innovation and green finance with regards to promoting green growth and reducing environmental pollution, as well as their relationships. However, this study also had some limitations. First, this study was based on the Green Credit Guidelines from China, and different countries have different green financial policies; therefore, the applications of the findings of this study to other countries require further analysis. Second, owing to word limit, this study did not specifically analyse the heterogeneous role of technological innovation in different industries. Further research can be done in the future in the above two respects.