Does Environmental Education Always Contribute to Remanufacturing Supply Chain Development?

Abstract

1. Introduction

2. Literature Review

2.1. Remanufactured Products

2.2. Yield Uncertainty

2.3. Environmental Education

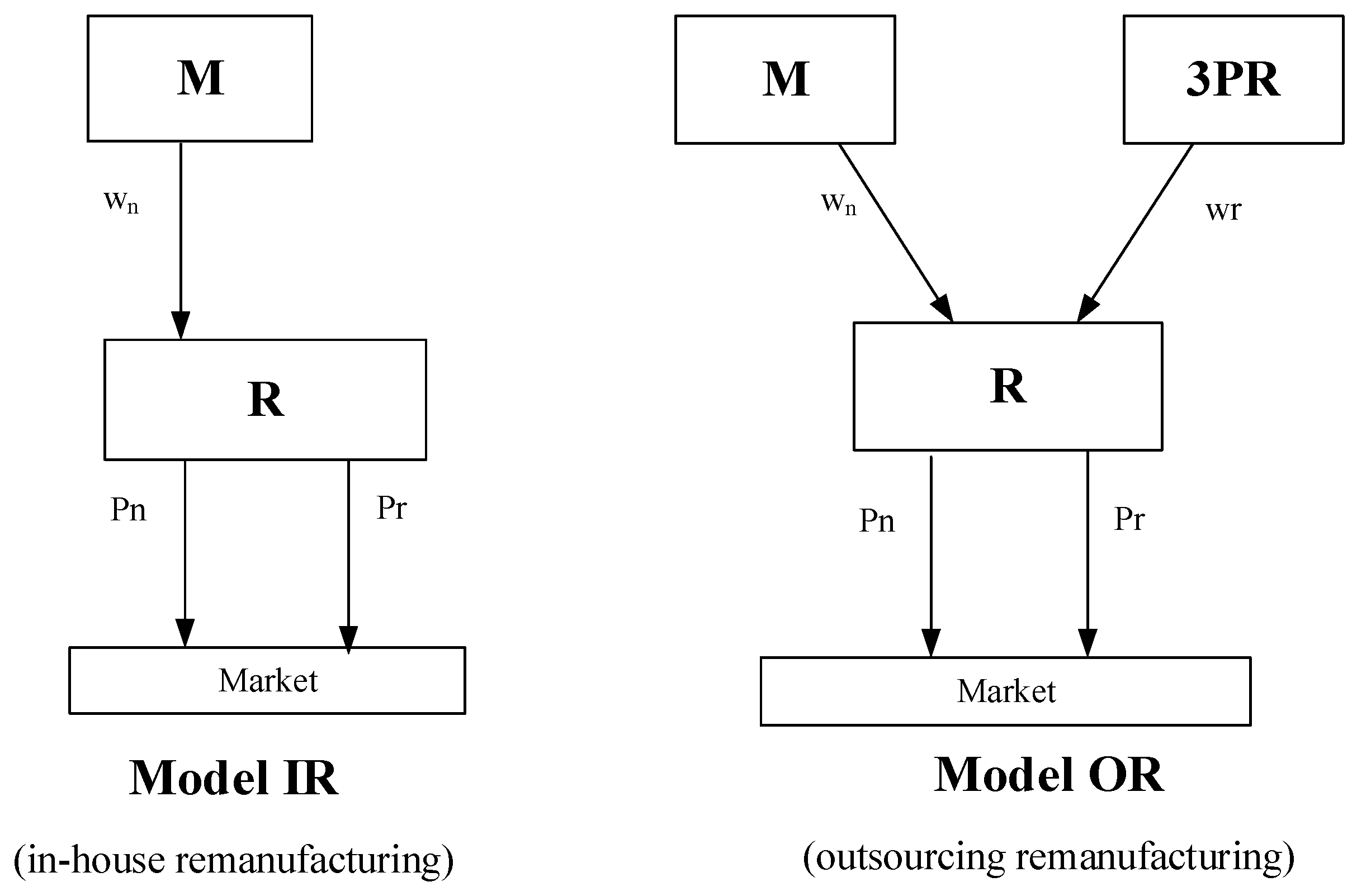

3. Model

4. Analysis

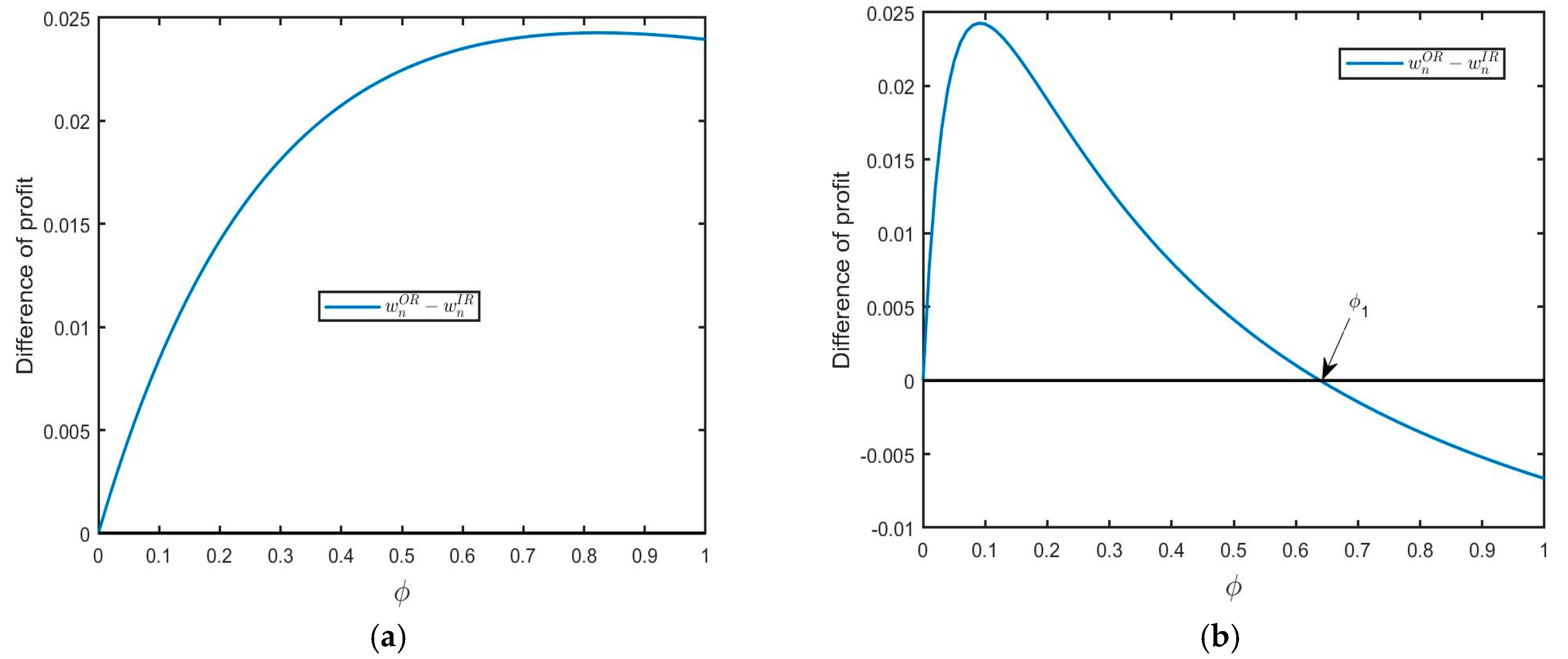

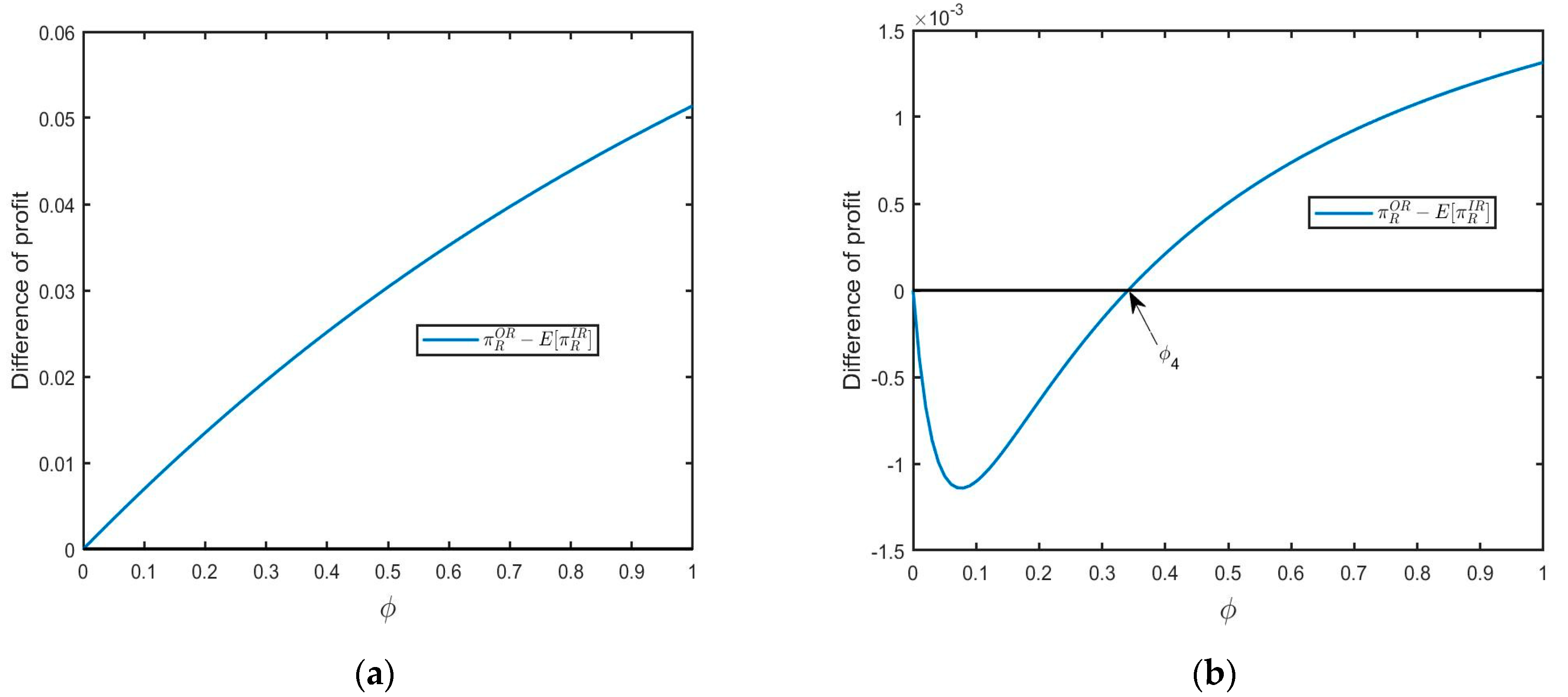

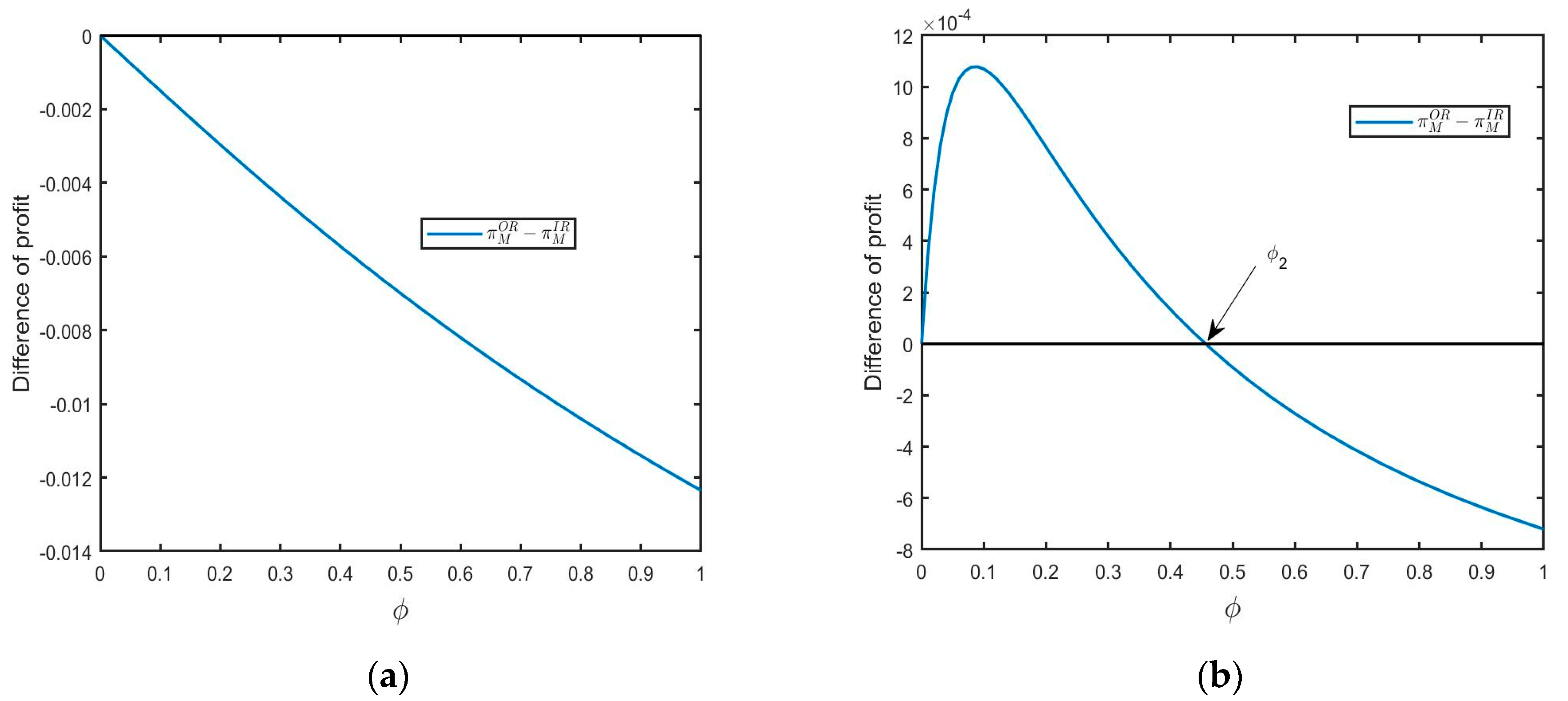

4.1. Wholesale Price

4.2. Order Quantity

4.3. Remanufacturing Choice

- (i)

- if , or and .

- (ii)

- if , , and or and . Here, and .

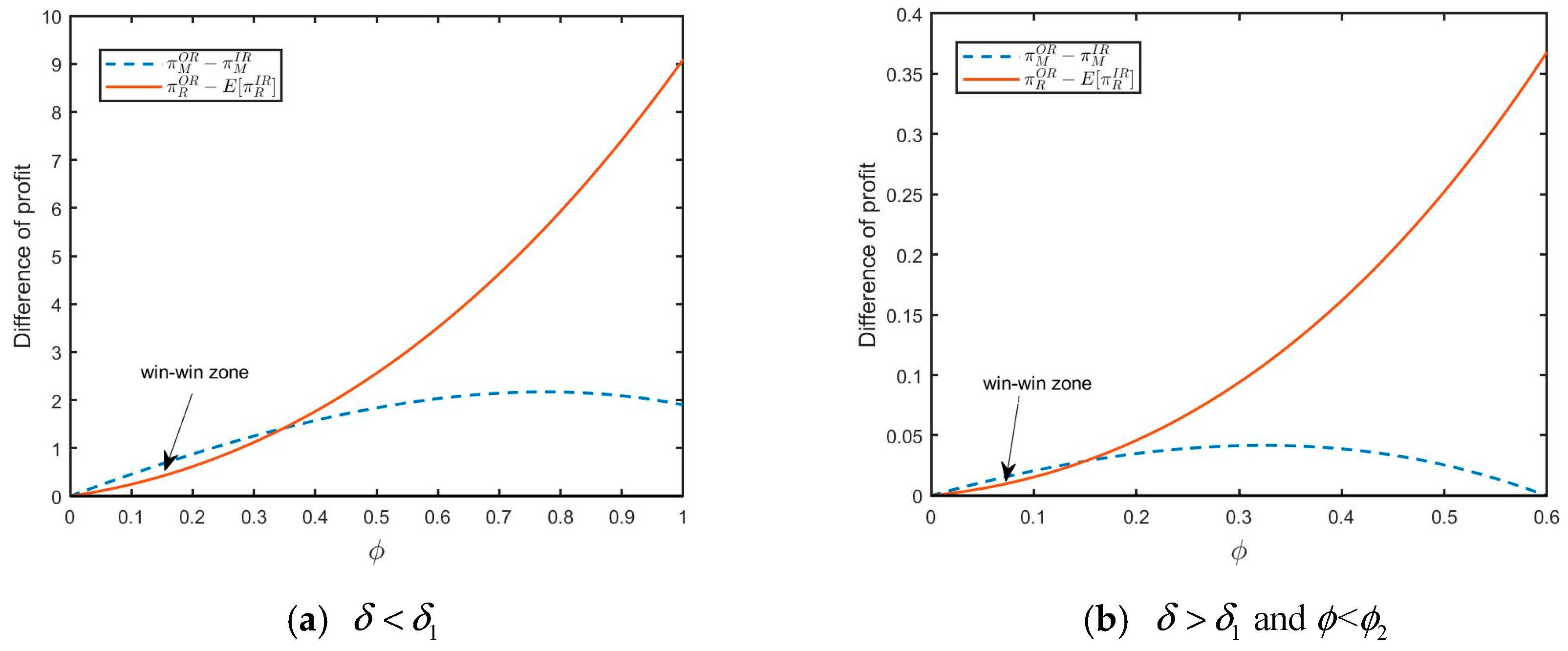

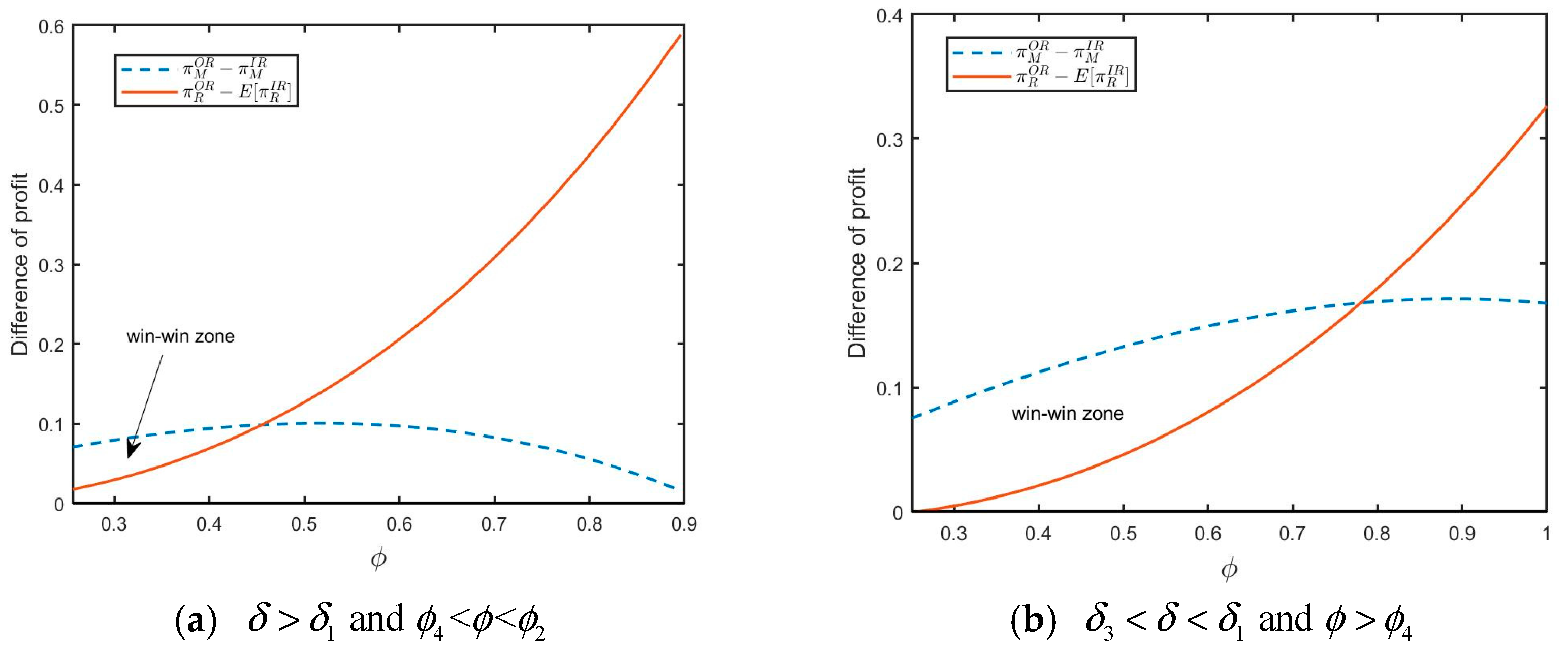

5. Value of Environmental Education

5.1. Value for the Supply Chain

5.2. Value for the Consumers

5.3. Value for the Environment Performance

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Aydin, R.; Mansour, M. Investigating sustainable consumer preferences for remanufactured electronic products. J. Eng. Res. 2023, 11, 100008. [Google Scholar] [CrossRef]

- Forti, V.; Baldé, C.; Kuehr, R.; Bel, G. The Global E-waste Monitor 2020. In Quantities, Flows, and the Circular Economy Potential; United Nations University: Tokyo, Japan; United Nations Institute for Training and Research, International Telecommunication Union, and International Solid Waste Association: Bonn, Germany, 2020. [Google Scholar]

- Ginsburg, J. Manufacturing: Once is not enough. BusinessWeek 2001, 128B–128D. [Google Scholar]

- Vasudevan, H.; Kalamkar, V.; Terkar, R. Remanufacturing for sustainable development: Key challenges, elements, and benefits. Int. J. Innov. Manag. Technol. 2012, 3, 84. [Google Scholar] [CrossRef]

- Khor, K.S.; Hazen, B.T. Remanufactured products purchase intentions and behaviour: Evidence from Malaysia. Int. J. Prod. Res. 2016, 55, 2149–2162. [Google Scholar] [CrossRef]

- Zsoka, A.; Szerenyi, Z.M.; Szechy, A.; Kocsis, T. Greening due to environmental education? Environmental knowledge, attitudes, consumer behavior and everyday pro-environmental activities of Hungarian high school and university students. J. Clean. Prod. 2013, 48, 126–138. [Google Scholar] [CrossRef]

- Zhang, A.; Venkatesh, V.G.; Liu, Y.; Wan, M.; Qu, T.; Huisingh, D. Barriers to smart waste management for a circular economy in China. J. Clean. Prod. 2019, 240, 118198. [Google Scholar] [CrossRef]

- Qu, Y.; Liu, Y.; Guo, L.; Zhu, Q.; Tseng, M. Promoting remanufactured heavy-truck engine purchase in China: Influencing factors and their effects. J. Clean. Prod. 2018, 185, 86–96. [Google Scholar] [CrossRef]

- Li, Y.K.; Chen, J.; Sohail, M.T. Does education matter in China? Myths about financial inclusion and energy consumption. Environ. Sci. Pollut. Res. 2022, 29, 73542–73551. [Google Scholar] [CrossRef] [PubMed]

- Yang, T.J.; Li, C.M.; Yue, X.P.; Zhang, B.B. Decisions for Blockchain Adoption and Information Sharing in a Low Carbon Supply Chain. Mathematics 2022, 10, 2233. [Google Scholar] [CrossRef]

- Niu, B.; Bao, J.; Cao, B. Retailer’s make-or-buy decision for remanufactured products under in-house yield uncertainty. Omega 2022, 110, 102627. [Google Scholar] [CrossRef]

- Alyahya, M.; Agag, G.; Aliedan, M.; Abdelmoety, Z.H.; Daher, M.M. A sustainable step forward: Understanding factors affecting customers’ behaviour to purchase remanufactured products. J. Retail. Consum. Serv. 2023, 70, 103172. [Google Scholar] [CrossRef]

- Dobbelstein, T.; Lochner, C. Factors influencing purchase intention for recycled products: A comparative analysis of Germany and South Africa. Sustain. Dev. 2023. [Google Scholar] [CrossRef]

- Alqahtani, A.Y.; Gupta, S.M. Warranty as a marketing strategy for remanufactured products. J. Clean. Prod. 2017, 161, 1294–1307. [Google Scholar] [CrossRef]

- Yan, W.; Xiong, Y.; Xiong, Z.; Guo, N. Bricks vs. clicks: Which is better for marketing remanufactured products? Eur. J. Oper. Res. 2015, 242, 434–444. [Google Scholar] [CrossRef]

- Xue, D.; Teunter, R.H.; Zhu, S.X.; Zhou, W. Entering the high-end market by collecting and remanufacturing a competitor’s high-end cores. Omega 2021, 99, 102168. [Google Scholar] [CrossRef]

- Alegoz, M. Simultaneous remanufacturing and government incentives in remanufacturing systems. Eur. J. Ind. Eng. 2022, 16, 757–781. [Google Scholar] [CrossRef]

- Xia, Y.; Tan, D.; Wang, B. Use of a product service system in a competing remanufacturing market. Omega 2021, 102, 102387. [Google Scholar] [CrossRef]

- Jin, M.; Nie, J.; Yang, F.; Zhou, Y. The impact of third-party remanufacturing on the forward supply chain: A blessing or a curse? Int. J. Prod. Res. 2017, 55, 6871–6882. [Google Scholar] [CrossRef]

- Huang, H.; Meng, Q.; Xu, H.; Zhou, Y. Cost information sharing under competition in remanufacturing. Int. J. Prod. Res. 2019, 57, 6579–6592. [Google Scholar] [CrossRef]

- Baghdadi, E.; Shafiee, M.; Alkali, B. Upgrading Strategy, Warranty Policy and Pricing Decisions for Remanufactured Products Sold with Two-Dimensional Warranty. Sustainability 2022, 14, 7232. [Google Scholar] [CrossRef]

- Qiao, H.; Su, Q. The prices and quality of new and remanufactured products in a new market segment. Int. Trans. Oper. Res. 2020, 28, 872–903. [Google Scholar] [CrossRef]

- Hsieh, C.-C.; Lai, H.-H. Pricing and ordering decisions in a supply chain with downward substitution and imperfect process yield. Omega 2020, 95, 102064. [Google Scholar] [CrossRef]

- Hsu, A.; Bassok, Y. Random yield and random demand in a production system with downward substitution. Oper. Res. 1999, 47, 277–290. [Google Scholar] [CrossRef]

- Metzker, P.; Thevenin, S.; Adulyasak, Y.; Dolgui, A. Robust optimization for lot-sizing problems under yield uncertainty. Comput. Oper. Res. 2023, 149, 16. [Google Scholar] [CrossRef]

- Freeman, N.K.; Narayanan, A.; Keskin, B.B. Optimal use of downward substitution in a manufacturing operation subject to uncertainty. Omega 2021, 103, 102372. [Google Scholar] [CrossRef]

- Peng, Y.; Yan, X.M.; Zhou, A.; Cheng, T.C.E.; Ji, M. Entry Game in Supply Chains with Yield Uncertainty. J. Ind. Manag. Optim. 2023, 19, 4989–5010. [Google Scholar] [CrossRef]

- Sharma, B.P.; Yu, T.E.; English, B.C.; Boyer, C.N.; Larson, J.A. Stochastic optimization of cellulosic biofuel supply chain incorporating feedstock yield uncertainty. In Proceedings of the 10th International Conference on Applied Energy (ICAE), Hong Kong, China, 22–25 August 2018. [Google Scholar]

- Cai, J.H.; Sun, H.N.; Li, X.J.; Ergu, D.J. Input Quantity Decision and Coordination Mechanism with Two Production Chances and Yield Uncertainty. Int. J. Inf. Technol. Decis. Mak. 2022, 21, 315–349. [Google Scholar] [CrossRef]

- Cai, J.H.; Sun, H.N.; Wei, B. Supply chain coordination with strategic customers: Yield uncertainty and replenishment tactic. J. Oper. Res. Soc. 2022, 13. [Google Scholar] [CrossRef]

- Kouvelis, P.; Li, J. Offshore Outsourcing, Yield Uncertainty, and Contingency Responses. Prod. Oper. Manag. 2013, 22, 164–177. [Google Scholar] [CrossRef]

- Yuan, X.; Bi, G.; Fei, Y.; Liu, L. Supply chain with random yield and financing. Omega 2021, 102, 102334. [Google Scholar] [CrossRef]

- Talay, I.; Ozdemir-Akyildirim, O. Optimal procurement and production planning for multi-product multi-stage production under yield uncertainty. Eur. J. Oper. Res. 2019, 275, 536–551. [Google Scholar] [CrossRef]

- Shao, L.S.; Wang, D.R.; Wu, X.L. Competitive trading in forward and spot markets under yield uncertainty. Prod. Oper. Manag. 2022, 31, 3400–3418. [Google Scholar] [CrossRef]

- Lowe, J.J.; Khademi, A.; Mason, S.J.; IEEE. Robust Semiconductor Production Planning under Yield Uncertainty. In Proceedings of the Winter Simulation Conference (WSC), Arlington, VA, USA, 11–14 December 2016. [Google Scholar]

- Liao, H.; Zhang, Q.; Shen, N.; Nie, Y.; Li, L. Coordination between forward and reverse production streams for maximum profitability. Omega 2021, 104, 102454. [Google Scholar] [CrossRef]

- Zhu, X.; Wang, M.; Pei, J.; Pardalos, P.M. Investigating remanufacturing competition with yield uncertainty on market share, profit, and consumer surplus. Int. T. Oper. Res. 2020, 27, 2584–2615. [Google Scholar] [CrossRef]

- Begum, A.; Liu, J.W.; Qayum, H.; Mamdouh, A. Environmental and Moral Education for Effective Environmentalism: An Ideological and Philosophical Approach. Int. J. Environ. Res. Public Health 2022, 19, 15549. [Google Scholar] [CrossRef] [PubMed]

- Yang, B.; Wu, N.N.; Tong, Z.P.; Sun, Y. Narrative-Based Environmental Education Improves Environmental Awareness and Environmental Attitudes in Children Aged 6–8. Int. J. Environ. Res. Public Health 2022, 19, 6483. [Google Scholar] [CrossRef]

- Niu, Y.F.; Wang, X.; Lin, C.Y. A Study on the Impact of Organizing Environmental Awareness and Education on the Performance of Environmental Governance in China. Int. J. Environ. Res. Public Health 2022, 19, 12852. [Google Scholar] [CrossRef]

- van de Wetering, J.; Leijten, P.; Spitzer, J.; Thomaes, S. Does environmental education benefit environmental outcomes in children and adolescents? A meta-analysis. J. Environ. Psychol. 2022, 81, 12. [Google Scholar] [CrossRef]

- Steils, N. Using in-store customer education to act upon the negative effects of impulsiveness in relation to unhealthy food consumption. J. Retail. Consum. Serv. 2021, 59, 102375. [Google Scholar] [CrossRef]

- Lieflander, A.K.; Frohlich, G.; Bogner, F.X.; Schultz, P.W. Promoting connectedness with nature through environmental education. Environ. Educ. Res. 2013, 19, 370–384. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Ferguson, M.; Toktay, L.B.; Thomas, V.M. Is Leasing Greener than Selling? Manag. Sci. 2012, 58, 523–533. [Google Scholar] [CrossRef]

- Merkuryev, Y.; Bikovska, J.; Merkuryeva, G. SUPPLY CHAIN DYNAMICS: SIMULATION-BASED TRAINING AND EDUCATION. In Proceedings of the 13th International Conference on Harbor, Maritime and Multimodal Logistics Modeling and Simulation (HMS), Rome, Italy, 12–14 September 2011. [Google Scholar]

- Zhong, L.; Nie, J.; Lim, M.K.; Xia, S. Agency or Self-Run: The effect of consumer green education on recyclers’ distribution channel choice under platform economy. Int. J. Logist. Res. Appl. 2021, 25, 814–836. [Google Scholar] [CrossRef]

- Zhou, Y.; Xiong, Y.; Jin, M. Less is more: Consumer education in a closed-loop supply chain with remanufacturing. Omega 2021, 101, 102259. [Google Scholar] [CrossRef]

- Wang, M.; Yang, F.; Xia, Q. Design of the reverse channel for the third-party remanufacturing considering consumer education. RAIRO—Oper. Res. 2021, 55, 3513–3540. [Google Scholar] [CrossRef]

- Wang, M.; Ang, S.; Yang, F.; Song, J. Warranty or education?: An analysis of marketing strategy choices for remanufactured products. Asia Pac. J. Mark. Logist. 2022. [Google Scholar] [CrossRef]

- Niu, B.; Li, J.; Zhang, J.; Cheng, H.K.; Tan, Y.R. Strategic Analysis of Dual Sourcing and Dual Channel with an Unreliable Alternative Supplier. Prod. Oper. Manag. 2019, 28, 570–587. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, F. On the Competition between Two Modes of Product Recovery: Remanufacturing and Refurbishing. Prod. Oper. Manag. 2019, 28, 2983–3001. [Google Scholar] [CrossRef]

| Notation | Definition |

|---|---|

| Consumer willingness-to-pay for NPs | |

| Consumer acceptance for RPs | |

| Yield uncertainty in the remanufacturing process | |

| Size of the FOC segment | |

| Unit environmental impact of NPs or defective RPs | |

| Retail price of the NPs or RPs | |

| Profit function | |

| Decision Variables | |

| Order quantity for NPs or RPs | |

| Wholesale price for NPs or RPs | |

| Model IR | Model OR |

|---|---|

| ; | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, C.; Yang, T.; Bian, Z. Does Environmental Education Always Contribute to Remanufacturing Supply Chain Development? Int. J. Environ. Res. Public Health 2023, 20, 4725. https://doi.org/10.3390/ijerph20064725

Li C, Yang T, Bian Z. Does Environmental Education Always Contribute to Remanufacturing Supply Chain Development? International Journal of Environmental Research and Public Health. 2023; 20(6):4725. https://doi.org/10.3390/ijerph20064725

Chicago/Turabian StyleLi, Chunmei, Tianjian Yang, and Zijing Bian. 2023. "Does Environmental Education Always Contribute to Remanufacturing Supply Chain Development?" International Journal of Environmental Research and Public Health 20, no. 6: 4725. https://doi.org/10.3390/ijerph20064725

APA StyleLi, C., Yang, T., & Bian, Z. (2023). Does Environmental Education Always Contribute to Remanufacturing Supply Chain Development? International Journal of Environmental Research and Public Health, 20(6), 4725. https://doi.org/10.3390/ijerph20064725