The Effects of Environmental Tax Revenue on Sustainable Development in China

Abstract

:1. Introduction

2. Materials and Methods

2.1. Convergence Model

2.2. General Temporal and Spatial LMDI Models

2.3. Spatial Within-Between LMDI Decomposition Model

2.4. Social Network Analysis

2.5. Data

3. Results and Discussions

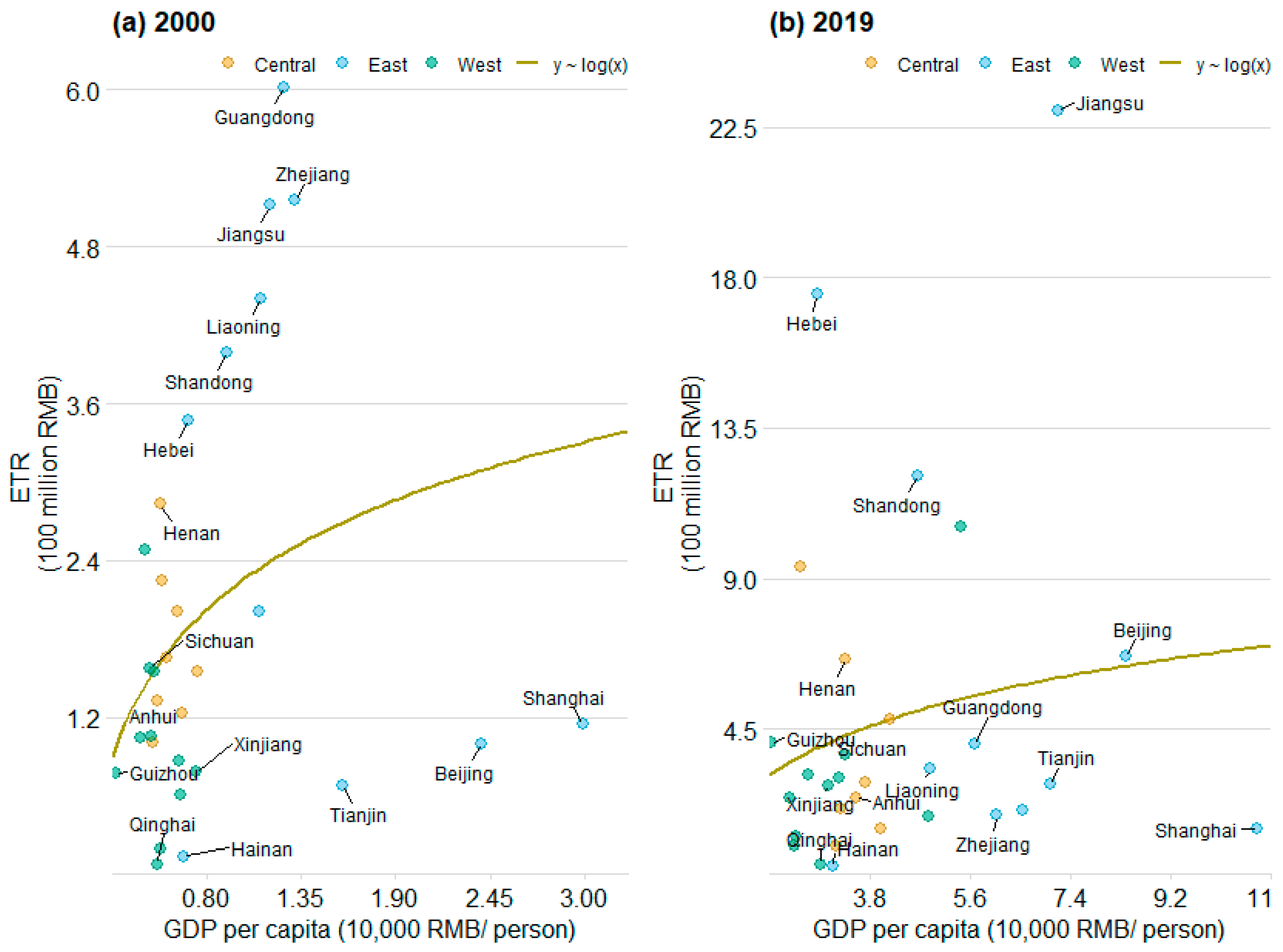

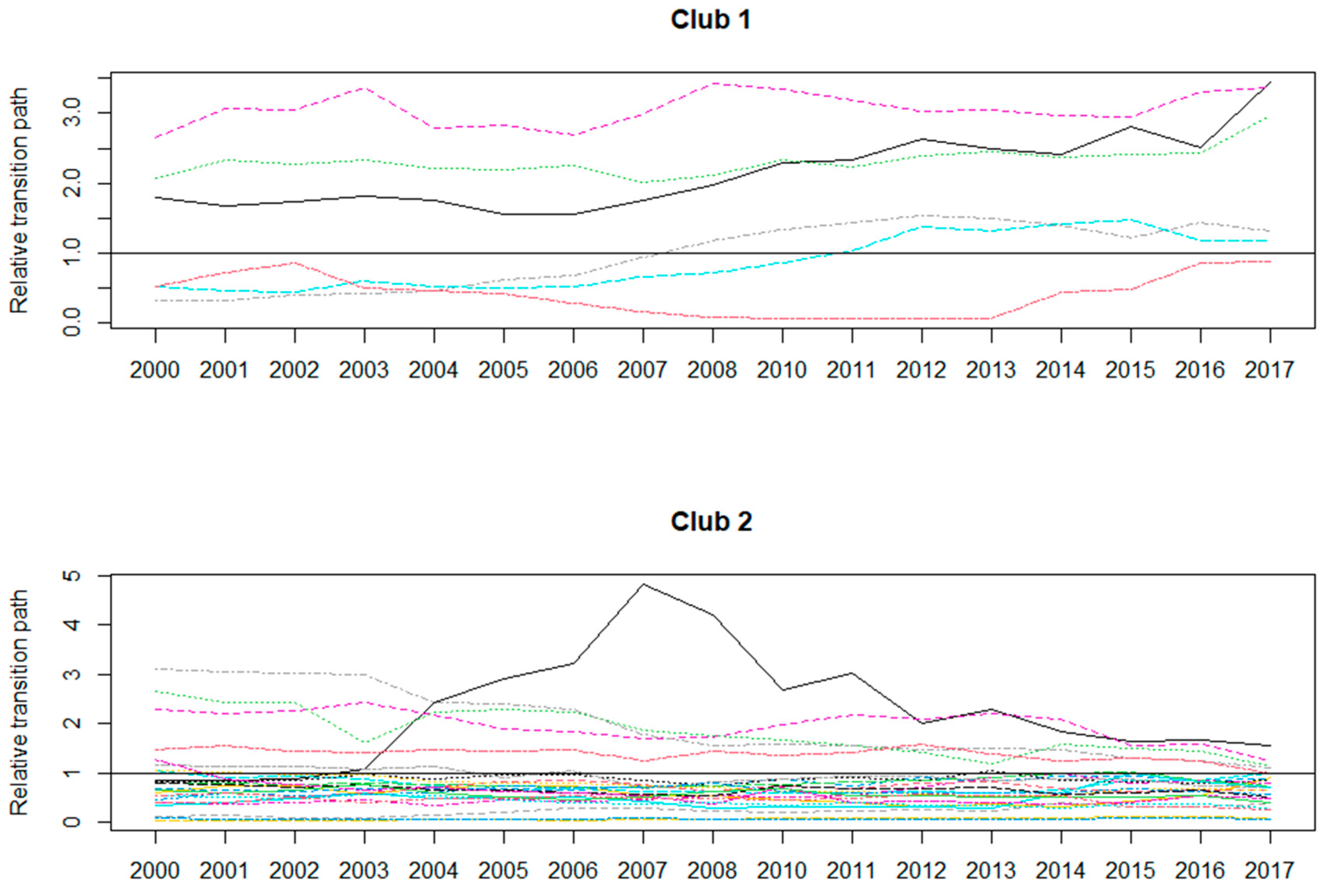

3.1. Changes in Environmental Tax Revenue

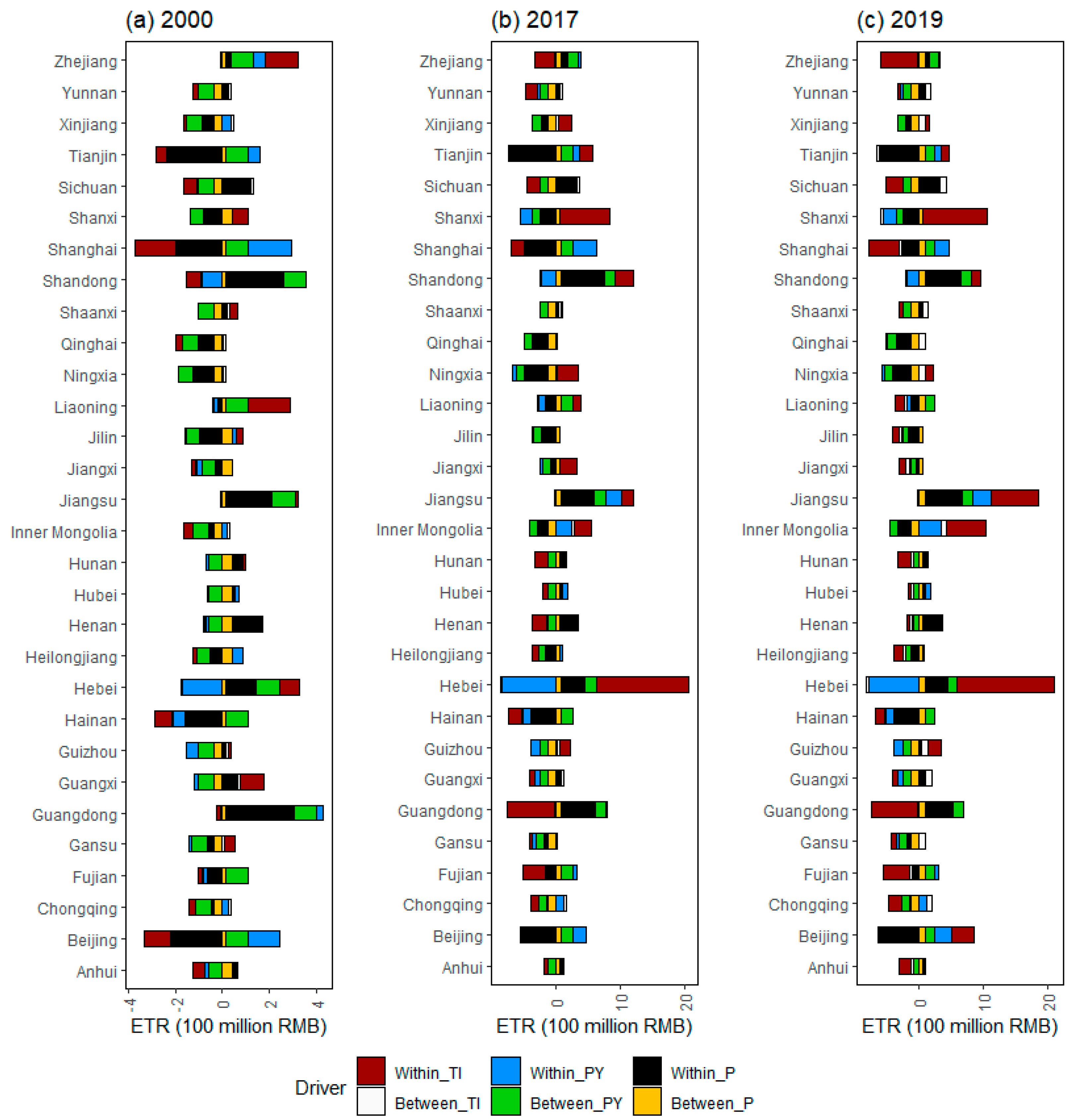

3.2. Temporal Drivers of Environmental Tax Revenue

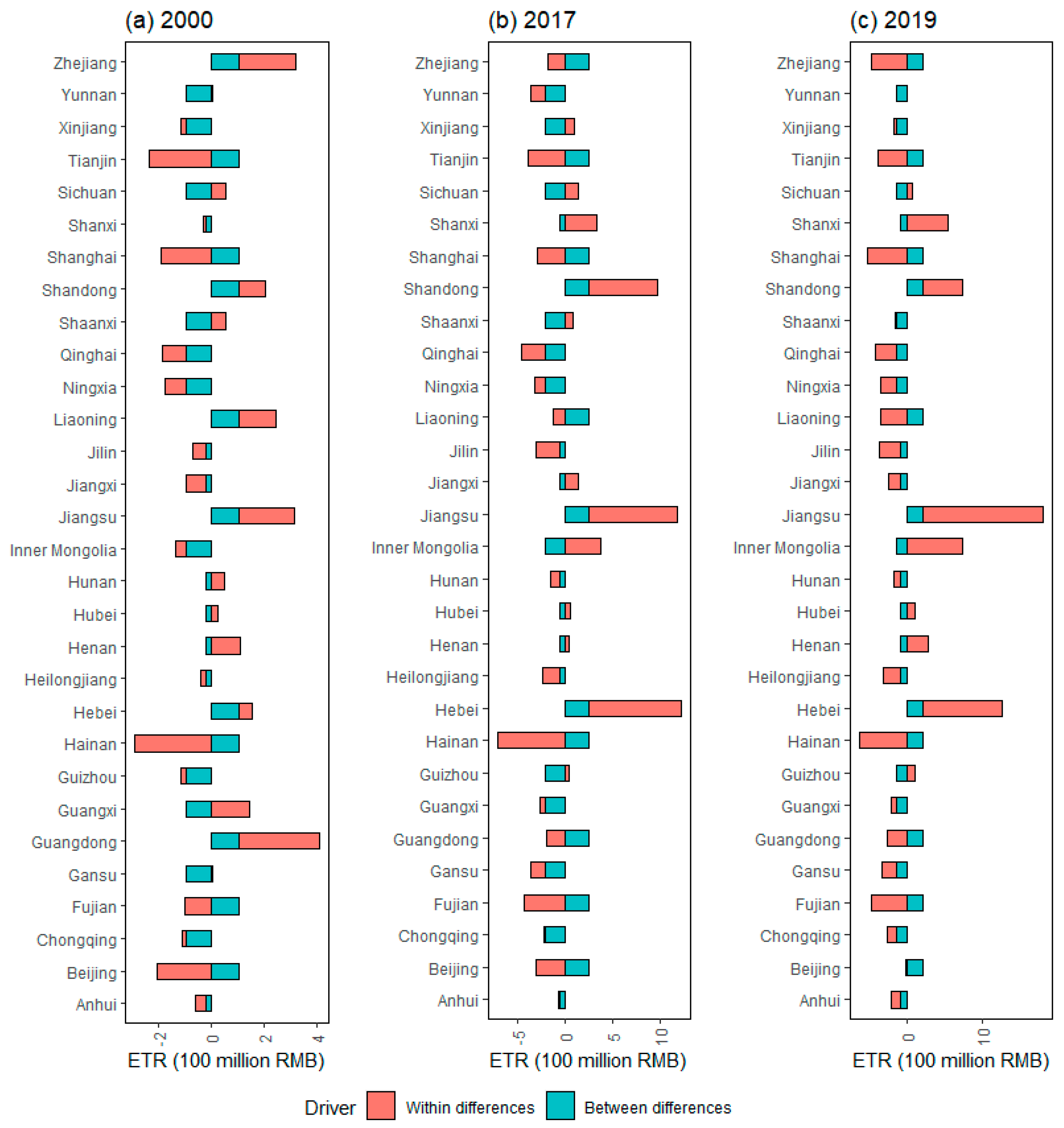

3.3. Spatial Drivers of Environmental Tax Revenue

3.4. Complex Network of Environmental Tax Revenue

4. Concluding Remarks and Policy Implications

5. Limitations and Research Prospect

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Standard | Region | Province |

|---|---|---|

| Normal | North | Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia |

| Northeast | Liaoning, Jilin, Heilongjiang | |

| East | Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong | |

| Central south | Henan, Hubei, Hunan, Guangdong, Guangxi, Hainan | |

| Southwest | Chongqing, Sichuan, Guizhou, Yunnan, Xizang | |

| Northwest | Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang | |

| Hot | Yangtze River Delta | Shanghai, Jiangsu, Zhejiang |

| Bohai Rim region | Beijing, Tianjin, Hebei, Liaoning, Shandong | |

| Pan Pearl River Delta | Fujian, Jiangxi, Hunan, Guangdong, Guangxi, Hainan, Sichuan, Guizhou, Yunnan | |

| Eight | Northeast | Liaoning, Jilin, Heilongjiang |

| North coast | Beijing, Tianjin, Hebei, Shandong | |

| East coast | Shanghai, Jiangsu, Zhejiang | |

| South coast | Fujian, Guangdong, Hainan | |

| Middle reaches of the Yellow River | Shanxi, Inner Mongolia, Henan, Shaanxi | |

| Middle reaches of the Yangtze River | Anhui, Jiangxi, Hubei, Hunan | |

| Southwest | Guangxi, Chongqing, Sichuan, Guizhou, Yunnan | |

| Northwest | Xizang, Gansu, Qinghai, Ningxia, Xinjiang | |

| Three | Eastern | Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, Hainan |

| Central | Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan | |

| Western | Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Xizang, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang |

Appendix B

References

- Jacobs, J.P.; Ligthart, J.E.; Vrijburg, H. Consumption tax competition among governments: Evidence from the United States. Int. Tax Public Financ. 2010, 17, 271–294. [Google Scholar] [CrossRef] [Green Version]

- Richardson, G.; Taylor, G.; Lanis, R. The impact of board of director oversight characteristics on corporate tax aggressiveness: An empirical analysis. J. Account. Public Policy 2013, 32, 68–88. [Google Scholar] [CrossRef]

- Zhai, T.; Li, L.; Wang, J.; Si, W. Will the consumption tax on sugar-sweetened beverages help promote healthy beverage consumption? Evidence from urban China. China Econ. Rev. 2022, 73, 101798. [Google Scholar] [CrossRef]

- Xu, C.; Xu, Y.; Chen, J.; Huang, S.; Zhou, B.; Song, M. Spatio-temporal efficiency of fiscal environmental expenditure in reducing CO2 emissions in China’s cities. J. Environ. Manag. 2023, 334, 117479. [Google Scholar] [CrossRef]

- Andreoni, V. Environmental taxes: Drivers behind the revenue collected. J. Clean. Prod. 2019, 221, 17–26. [Google Scholar] [CrossRef]

- Xu, C. Towards balanced low-carbon development: Driver and complex network of urban-rural energy-carbon performance gap in China. Appl. Energy 2023, 333, 120663. [Google Scholar] [CrossRef]

- Xu, C.; Wang, B.; Chen, J.; Shen, Z.; Song, M.; An, J. Carbon inequality in China: Novel drivers and policy driven scenario analysis. Energy Policy 2022, 170, 113259. [Google Scholar] [CrossRef]

- Castiglione, C.; Infante, D.; Smirnova, J. Non-trivial factors as determinants of the environmental taxation revenues in 27 EU countries. Economies 2018, 6, 7. [Google Scholar] [CrossRef] [Green Version]

- Fan, X.; Li, X.; Yin, J. Impact of environmental tax on green development: A nonlinear dynamical system analysis. PLoS ONE 2019, 14, e0221264. [Google Scholar] [CrossRef]

- Bashir, M.F.; Benjiang, M.A.; Shahbaz, M.; Shahzad, U.; Vo, X.V. Unveiling the heterogeneous impacts of environmental taxes on energy consumption and energy intensity: Empirical evidence from OECD countries. Energy 2021, 226, 120366. [Google Scholar] [CrossRef]

- Hu, X.; Liu, Y.; Yang, L.; Shi, Q.; Zhang, W.; Zhong, C. SO2 emission reduction decomposition of environmental tax based on different consumption tax refunds. J. Clean. Prod. 2018, 186, 997–1010. [Google Scholar] [CrossRef]

- Shang, S.; Chen, Z.; Shen, Z.; Shabbir, M.S.; Bokhari, A.; Han, N.; Klemeš, J. The effect of cleaner and sustainable sewage fee-to-tax on business innovation. J. Clean. Prod. 2022, 361, 132287. [Google Scholar] [CrossRef]

- Bossel, H. Indicators for Sustainable Development: Theory, Method, Applications; IISD: Winnipeg, MB, Canada, 1999. [Google Scholar]

- Chen, B.; Xu, C.; Wu, Y.; Li, Z.; Song, M.; Shen, Z. Spatiotemporal carbon emissions across the spectrum of Chinese cities: Insights from socioeconomic characteristics and ecological capacity. J. Environ. Manag. 2022, 306, 114510. [Google Scholar] [CrossRef]

- Phillips, P.C.; Sul, D. Transition modeling and econometric convergence tests. Econometrica 2007, 75, 1771–1855. [Google Scholar] [CrossRef] [Green Version]

- Furht, B. Handbook of Social Network Technologies and Applications; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Bu, Y.; Wang, E.; Bai, J.; Shi, Q. Spatial pattern and driving factors for interprovincial natural gas consumption in China: Based on SNA and LMDI. J. Clean. Prod. 2020, 263, 121392. [Google Scholar] [CrossRef]

- Chen, J.; Xu, C.; Gao, M.; Ding, L. Carbon peak and its mitigation implications for China in the post-pandemic era. Sci. Rep. 2022, 12, 3473. [Google Scholar] [CrossRef]

- Chen, J.; Xu, C.; Huang, S.; Shen, Z.; Song, M.; Wang, S. Adjusted carbon intensity in China: Trend, driver, and network. Energy 2022, 251, 123916. [Google Scholar] [CrossRef]

- Phillips, P.C.; Sul, D. Economic transition and growth. J. Appl. Econom. 2009, 24, 1153–1185. [Google Scholar] [CrossRef] [Green Version]

- Kaya, Y. Impact of Carbon Dioxide Emission Control on GNP Growth: Interpretation of Proposed Scenarios; Intergovernmental Panel on Climate Change/Response Strategies Working Group: Geneva, Switzerland, 1989. [Google Scholar]

- Ang, B.W. LMDI decomposition approach: A guide for implementation. Energy Policy 2015, 86, 233–238. [Google Scholar] [CrossRef]

- Yan, Z.; Du, K.; Yang, Z.; Deng, M. Convergence or divergence? Understanding the global development trend of low-carbon technologies. Energy Policy 2017, 109, 499–509. [Google Scholar] [CrossRef]

- Chen, J.; Xu, C.; Song, M.; Deng, X.; Shen, Z. Towards sustainable development: Distribution effect of carbon-food nexus in Chinese cities. Appl. Energy 2022, 309, 118470. [Google Scholar] [CrossRef]

- Cole, M.A.; Rayner, A.J.; Bates, J.M. The environmental Kuznets curve: An empirical analysis. Environ. Dev. Econ. 1997, 2, 401–416. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef] [Green Version]

- Hausmann, R.; Stock, D.P.; Yıldırım, M.A. Implied comparative advantage. Res. Policy 2022, 51, 104143. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, B.; Xu, C.; Li, D.; Wu, Y.; Zhang, Y. The Effects of Environmental Tax Revenue on Sustainable Development in China. Int. J. Environ. Res. Public Health 2023, 20, 5022. https://doi.org/10.3390/ijerph20065022

Wang B, Xu C, Li D, Wu Y, Zhang Y. The Effects of Environmental Tax Revenue on Sustainable Development in China. International Journal of Environmental Research and Public Health. 2023; 20(6):5022. https://doi.org/10.3390/ijerph20065022

Chicago/Turabian StyleWang, Bingjie, Chong Xu, Ding Li, Yinyin Wu, and Yaqi Zhang. 2023. "The Effects of Environmental Tax Revenue on Sustainable Development in China" International Journal of Environmental Research and Public Health 20, no. 6: 5022. https://doi.org/10.3390/ijerph20065022