Examining Cash Expenditures and Associated HIV-Related Behaviors Using Financial Diaries in Women Employed by Sex Work in Rural Uganda: Findings from the Kyaterekera Study

Abstract

1. Introduction

2. Methods

2.1. Study Design

2.2. Setting

2.3. Participants

2.4. Financial Diaries Data Collection

2.5. Quantitative Survey Data Collection

2.6. Analysis

3. Results

3.1. Participant Characteristics

3.2. Cash Income and Expenditures

3.3. HIV-Related Behaviors

3.4. Association of Cash Expenditures and HIV-Related Behaviors

4. Discussion

Limitations

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ART | Antiretroviral therapy |

| AOR | Adjusted odds ratio |

| CI | Confidence interval |

| ESI | Economic-strengthening interventions |

| FD | Financial diary |

| GNI | Gross National Income |

| HIV | Human Immunodeficiency Virus |

| OR | Odds ratio |

| PrEP | Pre-exposure prophylaxis |

| SD | Standard deviation |

| UGX | Ugandan Shilling |

| USD | United States Dollar |

| WESW | Women employed by sex work |

References

- UNAIDS Data 2019. Available online: https://www.unaids.org/sites/default/files/media_asset/2019-UNAIDS-data_en.pdf (accessed on 9 December 2022).

- Needle, R.; Fu, J.; Beyrer, C.; Loo, V.; Abdul-Quader, A.S.; McIntyre, J.A.; Li, Z.; Mbwambo, J.K.; Muthui, M.; Pick, B. PEPFAR’s evolving HIV prevention approaches for key populations--people who inject drugs, men who have sex with men, and sex workers: Progress, challenges, and opportunities. J. Acquir. Immune Defic. Syndr. 2012, 60 (Suppl. S3), S145–S151. [Google Scholar] [CrossRef] [PubMed]

- Couture, M.C.; Evans, J.L.; Draughon Moret, J.; Stein, E.S.; Muth, S.; Phou, M.; Len, A.; Ngak, S.; Sophal, C.; Neak, Y.; et al. Syndemic psychosocial health conditions associated with recent client-perpetrated violence against female entertainment and sex workers in Cambodia. Arch. Sex. Behav. 2020, 49, 3055–3064. [Google Scholar] [CrossRef] [PubMed]

- Namey, E.; Lorenzetti, L.; O’Regan, A.; Tenaw, E.; Feleke, E.; Girima, E. The financial lives of female sex workers in Addis Ababa, Ethiopia: Implications for economic strengthening interventions for HIV prevention. AIDS Care 2022, 34, 379–387. [Google Scholar] [CrossRef]

- Sagtani, R.A.; Bhattarai, S.; Adhikari, B.R.; Baral, D.D.; Yadav, D.K.; Pokharel, P.K. Understanding socioeconomic contexts of female sex workers in eastern Nepal. Nepal Med. Coll. J. 2014, 16, 119–124. [Google Scholar] [PubMed]

- Fielding-Miller, R.; Mnisi, Z.; Adams, D.; Baral, S.; Kennedy, C. “There is hunger in my community”: A qualitative study of food security as a cyclical force in sex work in Swaziland. BMC Public Health 2014, 14, 79. [Google Scholar] [CrossRef] [PubMed]

- Cange, C.W.; LeBreton, M.; Saylors, K.; Billong, S.; Tamoufe, U.; Fokam, P.; Baral, S. Female sex workers’ empowerment strategies amid HIV-related socioeconomic vulnerabilities in Cameroon. Cult. Health Sex. 2017, 19, 1053–1065. [Google Scholar] [CrossRef]

- Tsai, L.C.; Witte, S.S.; Aira, T.; Riedel, M.; Hwang, H.G.; Ssewamala, F. “There is no other option; we have to feed our families…who else would do it?”: The financial lives of women engaging in sex work in Ulaanbaatar, Mongolia. Glob. J. Health Sci. 2013, 5, 41–50. [Google Scholar] [CrossRef]

- George, G.; Nene, S.; Beckett, S.; Durevall, D.; Lindskog, A.; Govender, K. Greater risk for more money: The economics of negotiating condom use amongst sex workers in South Africa. AIDS Care 2019, 31, 1168–1171. [Google Scholar] [CrossRef]

- Rao, V.; Gupta, I.; Lokshin, M.; Jana, S. Sex workers and the cost of safe sex: The compensating differential for condom use among Calcutta prostitutes. J. Dev. Econ. 2003, 71, 585–603. [Google Scholar] [CrossRef]

- Gertler, P.; Shah, M.; Bertozzi, S.M. Risky Business: The Market for Unprotected Commercial Sex. J. Politi- Econ. 2005, 113, 518–550. [Google Scholar] [CrossRef]

- Elmes, J.; Nhongo, K.; Ward, H.; Hallett, T.; Nyamukapa, C.; White, P.J.; Gregson, S. The price of sex: Condom use and the determinants of the price of sex among female sex workers in eastern Zimbabwe. J. Infect. Dis. 2014, 210 (Suppl. S2), S569–S578. [Google Scholar] [CrossRef] [PubMed]

- Fehrenbacher, A.E.; Chowdhury, D.; Ghose, T.; Swendeman, D. Consistent condom use by female sex workers in Kolkata, India: Testing theories of economic insecurity, behavior change, life course vulnerability and empowerment. AIDS Behav. 2016, 20, 2332–2345. [Google Scholar] [CrossRef]

- Jennings, L.; Rompalo, A.M.; Wang, J.; Hughes, J.; Adimora, A.A.; Hodder, S.; Soto-Torres, L.E.; Frew, P.M.; Haley, D.F.; HIV Prevention Trials Network (HPTN 064) Women’s HIV SeroIncidence Study (ISIS). Prevalence and correlates of knowledge of male partner HIV testing and serostatus among African-American women living in high poverty, high HIV prevalence communities (HPTN 064). AIDS Behav. 2015, 19, 291–301. [Google Scholar] [CrossRef]

- Jennings, L.; Pettifor, A.; Hamilton, E.; Ritchwood, T.D.; Gómez-Olivé, F.X.; MacPhail, C.; Hughes, J.; Selin, A.; Kahn, K.; The HPTN 068 Study Team. Economic resources and HIV preventive behaviors among school-enrolled young women in rural South Africa (HPTN 068). AIDS Behav. 2017, 21, 665–677. [Google Scholar] [CrossRef] [PubMed]

- Weiser, S.D.; Leiter, K.; Bangsberg, D.R.; Butler, L.M.; Percy-de Korte, F.; Hlanze, Z.; Phaladze, N.; Iacopino, V.; Heisler, M. Food insufficiency is associated with high-risk sexual behavior among women in Botswana and Swaziland. PLoS Med. 2007, 4, 1589–1597; discussion 1598. [Google Scholar] [CrossRef] [PubMed]

- Mueller, T.; Gavin, L.; Oman, R.; Vesely, S.; Aspy, C.; Tolma, E.; Rodine, S. Youth assets and sexual risk behaviors: Differences between male and female adolescents. Health Educ. Behav. 2010, 37, 343–356. [Google Scholar] [CrossRef]

- Logan, T.K.; Cole, J.; Leukefeld, C. Women, sex, and HIV: Social and contextual factors, meta-analysis of published interventions, and implications for practice and research. Psychol. Bull. 2002, 128, 851–885. [Google Scholar] [CrossRef] [PubMed]

- Greig, F.E.; Koopman, C. Multilevel analysis of women’s empowerment and HIV prevention: Quantitative survey results. from a preliminary study in Botswana. AIDS Behav. 2003, 7, 195–208. [Google Scholar] [CrossRef]

- Cavazos-Rehg, P.; Xu, C.; Kasson, E.; Byansi, W.; Bahar, O.S.; Ssewamala, F.M. Social and economic equity and family cohesion as potential protective factors from depression among adolescents living with HIV in Uganda. AIDS Behav. 2020, 24, 2546–2554. [Google Scholar] [CrossRef]

- Yadama, G.N.; Sherraden, M. Effects of assets on attitudes and behaviors: Advance test of a social policy proposal. Soc. Work Res. 1996, 20, 3–11. [Google Scholar]

- Sherraden, M. Stakeholding: Notes on a theory of welfare based on assets. Soc. Serv. Rev. 1990, 64, 580–601. [Google Scholar] [CrossRef]

- Thaler, R.H.; Sunstein, C.R. Nudge: Improving Decision about Health, Wealth, and Happiness; Penguin Book: London, UK; Yale University Press: London, UK, 2009. [Google Scholar]

- OhIarlaithe, M.; Grede, N.; de Pee, S.; Bloem, M. Economic and social factors are some of the most common barriers preventing women from accessing maternal and newborn child health (MNCH) and prevention of mother-to-child transmission (PMTCT) services: A literature review. AIDS Behav. 2014, 18 (Suppl. 5), S516–S530. [Google Scholar] [CrossRef]

- Yacobson, I.; Malkin, M.; Lebetkin, E. Increasing access and adherence to the PMTCT cascade: Is there a role for economic strengthening interventions? Int. J. Popul. Res. 2016, 2016, 4039012. [Google Scholar] [CrossRef]

- Jennings, L.; Conserve, D.F.; Merrill, J.; Kajula, L.; Iwelunmor, J.; Linnemayr, S.; Maman, S. Perceived cost advantages and disadvantages of purchasing HIV self-test kits among urban Tanzanian men: An inductive content analysis. J. AIDS Clin. Res. 2017, 8, 725. [Google Scholar] [CrossRef] [PubMed]

- Jennings Mayo-Wilson, L.; Ssewamala, F.M. Financial and behavioral economic factors associated with HIV testing in AIDS-affected adolescents in Uganda: A cross-sectional analysis. J. Health Care Poor Underserved 2019, 30, 339–357. [Google Scholar] [CrossRef]

- Wallace, S.A.; McLellan-Lemal, E.; Harris, M.J.; Townsend, T.G.; Miller, K.S. Why Take an HIV Test? Concerns, Benefits, and Strategies to Promote HIV Testing Among Low-Income Heterosexual African American Young Adults. Health Educ. Behav. 2011, 38, 462–470. [Google Scholar] [CrossRef] [PubMed]

- Maheswaran, H.; Petrou, S.; MacPherson, P.; Choko, A.T.; Kumwenda, F.; Lalloo, D.G.; Clarke, A.; Corbett, E.L. Cost and quality of life analysis of HIV self-testing and facility-based HIV testing and counselling in Blantyre, Malawi. BMC Med. 2016, 14, 1. [Google Scholar] [CrossRef]

- Nakigozi, G.; Atuyambe, L.; Kamya, M.; Makumbi, F.E.; Chang, L.W.; Nakyanjo, N.; Kigozi, G.; Nalugoda, F.; Kiggundu, V.; Serwadda, D.; et al. A Qualitative Study of Barriers to Enrollment into Free HIV Care: Perspectives of Never-in-Care HIV-Positive Patients and Providers in Rakai, Uganda. BioMed Res. Int. 2013, 2013, 470245. [Google Scholar] [CrossRef]

- Swann, M. Economic strengthening for HIV prevention and risk reduction: A review of the evidence. AIDS Care 2018, 30 (Suppl. S3), 37–84. [Google Scholar] [CrossRef]

- Gibbs, A.; Jacobson, J.; Kerr Wilson, A. A global comprehensive review of economic interventions to prevent intimate partner violence and HIV risk behaviours. Glob. Health Action 2017, 10 (Suppl. S2), 1290427. [Google Scholar] [CrossRef] [PubMed]

- Kennedy, C.E.; Fonner, V.A.; O’Reilly, K.R.; Sweat, M.D. A systematic review of income generation interventions, including microfinance and vocational skills training, for HIV prevention. AIDS Care 2014, 26, 659–673. [Google Scholar] [CrossRef]

- Cui, R.R.; Lee, R.; Thirumurthy, H.; Muessig, K.E.; Tucker, J.D. Microenterprise development interventions for sexual risk reduction: A systematic review. AIDS Behav. 2013, 17, 2864–2877. [Google Scholar] [CrossRef] [PubMed]

- Lorenzetti, L.; Swann, M.; Martinez, A.; O’Regan, A.; Taylor, J.; Hoyt, A. Using financial diaries to understand the economic lives of HIV-positive pregnant women and new mothers in PMTCT in Zomba, Malawi. PLoS ONE 2021, 16, e0252083. [Google Scholar] [CrossRef]

- Namey, E.; Perry, B.; Headley, J.; Yao, A.K.; Ouattara, M.L.; Shighata, C.; Ferguson, M. Understanding the financial lives of female sex workers in Abidjan, Cote d’Ivoire: Implications for economic strengthening interventions for HIV prevention. AIDS Care 2018, 30 (Suppl. S3), 6–17. [Google Scholar] [CrossRef]

- Ferguson, A.G.; Morris, C.N.; Kariuki, C.W. Using diaries to measure parameters of transactional sex: An example from the Trans-Africa highway in Kenya. Cult. Health Sex. 2006, 8, 175–185. [Google Scholar] [CrossRef] [PubMed]

- Collins, D.; Morduch, J.; Rutherford, S.; Ruthven, O. Portfolios of the Poor: How the World’s Poor Live on $2 a Day; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Collins, D. Financial instruments of the poor: Initial findings from the South African financial diaries study. Dev. S. Africa 2005, 22, 717–728. [Google Scholar] [CrossRef]

- Collins, D. Debt and household finance: Evidence from the financial diaries study. Dev. S. Africa 2008, 25, 469–479. [Google Scholar] [CrossRef]

- Morduch, J.; Siwicki, J. In and out of poverty: Episodic poverty and income volatility in the U.S. financial diaries. Soc. Serv. Rev. 2017, 91, 390–421. [Google Scholar] [CrossRef]

- Tsai, L.C. Family financial roles assumed by sex trafficking survivors upon community re-entry: Findings from a financial diaries study in the Philippines. J. Hum. Behav. Soc. Environ. 2017, 27, 334–345. [Google Scholar] [CrossRef]

- Ssewamala, F.M.; Sensoy Bahar, O.; Tozan, Y.; Nabunya, P.; Mayo-Wilson, L.J.; Kiyingi, J.; Kagaayi, J.; Bellamy, S.; McKay, M.M.; Witte, S.S. A combination intervention addressing sexual risk-taking behaviors among vulnerable women in Uganda: Study protocol for a cluster randomized clinical trial. BMC Womens Health 2019, 19, 111. [Google Scholar] [CrossRef]

- Matovu, J.K.; Ssebadduka, B.N. Sexual risk behaviours, condom use and sexually transmitted infection treatment-seeking behaviours among female sex workers and truck drivers in Uganda. Int. J. STD AIDS 2012, 4, 267–273. [Google Scholar] [CrossRef] [PubMed]

- Vandepitte, J.; Bukenya, J.; Weiss, H.A.; Nakubulwa, S.; Francis, S.C.; Hughes, P.; Hayes, R.; Grosskurth, H. HIV and Other Sexually Transmitted Infections in a Cohort of Women Involved in High-Risk Sexual Behavior in Kampala, Uganda. Sex. Transm. Dis. 2011, 38, 316–323. [Google Scholar] [CrossRef] [PubMed]

- Ssembatya, J.L.; Kagaayi, J.; Ssemanda, J.B.; Kairania, R.; Kato, E.; Nalubega, I. Interventions for commercial sexual workers: Lessons and challenges from Rakai, Uganda. In Proceedings of the 8th AIS Conference on HIV Pathogenesis, Treatment and Prevention, Vancouver, BC, Canada, 19–22 July 2015. [Google Scholar]

- UNAIDS. The Gap Report; UNAIDS: Washington, DC, USA, 2014. [Google Scholar]

- Uganda AIDS Commission, Ministry of Health, UNAIDS. HIV and AIDS Uganda Country Progress Report; Uganda AIDS Commission: Kampala, Uganda, 2013. [Google Scholar]

- Yang, L.S.; Witte, S.S.; Kiyingi, J.; Nabayinda, J.; Nsubuga, E.; Nabunya, P.; Sensoy Bahar, O.; Jennings Mayo-Wilson, L.; Ssewamala, F.M. Using financial diary methodology to examine spending patterns among women engaged in sex work: An example from Southern Uganda. [Under Review 2023].

- XE Mid-Market Currency Coverter. Exchange Rates—US Dollar to Ugandan Shilling Conversion Chart, Data Retrieved for 31 March 2020, 0:00 UTC. Available online: https://www.xe.com (accessed on 11 January 2023).

- World Bank National Accounts Data—OECD, Uganda. GNI Per Capita, Atlas Methods (Current US$)—Uganda. The World Bank. IBRD. IDA. Data. Uganda 2020. Available online: https://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=UG (accessed on 13 January 2023).

| Sub-Study | Non-Sub-Study | p | Parent Study | ||||

|---|---|---|---|---|---|---|---|

| Demographic and sexual behavior characteristics | N | (n/N) % | N | (n/N) % | N | (n/N) % | |

| Total sample | 163 | 100% | 379 | 100% | 542 | 100% | |

| Mean age in years (±SD) | 32.2 (±7.8) | - | 31.0 (±6.9) | - | 0.18 | 31.4 (±7.2) | - |

| Age range in years | 18–55 | - | 18–53 | - | - | 18–55 | - |

| Age in years 18–29 ≥30 | 63 100 | 38.7% 61.3% | 169 210 | 44.6% 55.4% | 0.20 | 232 310 | 42.8% 57.2% |

| Highest level of education Less than primary education Primary school or more | 97 66 | 59.5% 40.5% | 247 132 | 65.2% 34.8% | 0.21 | 344 198 | 63.5% 36.5% |

| Partnership status Single/unpartnered a Married/partnered b | 128 35 | 78.5% 21.5% | 275 104 | 72.6% 27.4% | 0.15 | 403 139 | 74.4% 25.6% |

| Adult household size c One adult Two or more adults | 93 70 | 57.1% 42.9% | 224 155 | 59.1% 40.9% | 0.66 | 317 225 | 58.5% 41.5% |

| Highest household income earner d Yes No | 42 28 | 60.0% 40.0% | 86 69 | 55.5% 44.5% | 0.53 | 128 97 | 56.9% 43.1% |

| Has savings Yes No | 79 84 | 48.5% 51.5% | 181 198 | 47.8% 52.2% | 0.88 | 260 282 | 48.0% 52.0% |

| Has debt Yes No | 119 44 | 73.0% 27.0% | 269 110 | 71.0% 29.0% | 0.63 | 388 154 | 71.6% 28.4% |

| Mean number of paying clients in the past 30 days (±SD) | 26.6 (±36.3) | - | 36.4 (±51.2) | - | 0.54 | 31.3 (±47.1) | - |

| Has other non-sex work employment in last 12 months Yes No | 2 161 | 1.2% 98.8% | 6 373 | 1.6% 98.4% | 0.75 | 8 534 | 1.5% 98.5% |

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | All Months | % of All Cash Expenditures | |

|---|---|---|---|---|---|---|---|---|

| Total cash income a | $10,636.48 | $9896.30 | $9962.72 | $10,064.71 | $10,288.60 | $10,099.50 | $60,948.31 | - |

| Total cash expenditures | $1265.75 | $5516.50 | $9081.91 | $8509.34 | $10,402.34 | $7328.98 | $42,104.82 | 100% |

| % Total cash income | 11.9% | 55.7% | 91.2% | 84.5% | 101.1% | 72.6% | 69.1% | - |

| Expense category | ||||||||

| Food expenses | $732.59 | $2167.73 | $4002.98 | $3572.76 | $4434.17 | $3435.06 | $18,345.28 | 44% |

| Sex work expenditures | $169.46 | $1211.38 | $1898.35 | $1556.05 | $2173.37 | $1352.64 | $8361.26 | 20% |

| Housing expenditures | $75.64 | $452.25 | $1015.85 | $878.68 | $1043.66 | $1042.21 | $4508.29 | 11% |

| Other living expenditures b | $184.67 | $992.42 | $1149.63 | $690.71 | $999.83 | $638.24 | $4655.51 | 11% |

| Education expenditures | $67.34 | $454.70 | $392.35 | $1303.18 | $1381.71 | $589.14 | $4188.42 | 10% |

| Health care expenditures | $36.05 | $238.01 | $622.74 | $ 507.97 | $369.60 | $271.69 | $2046.07 | 5% |

| Number of women with negative cash balance c | 7 | 30 | 49 | 48 | 67 | 54 | 120 | - |

| Total negative cash Balance d | −$663.62 | −$2662.41 | −$4635.19 | −$3905.81 | −$4876.89 | −$3027.64 | −$19,771.55 | - |

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | All Months | % All Cash Expenditures | |

|---|---|---|---|---|---|---|---|---|

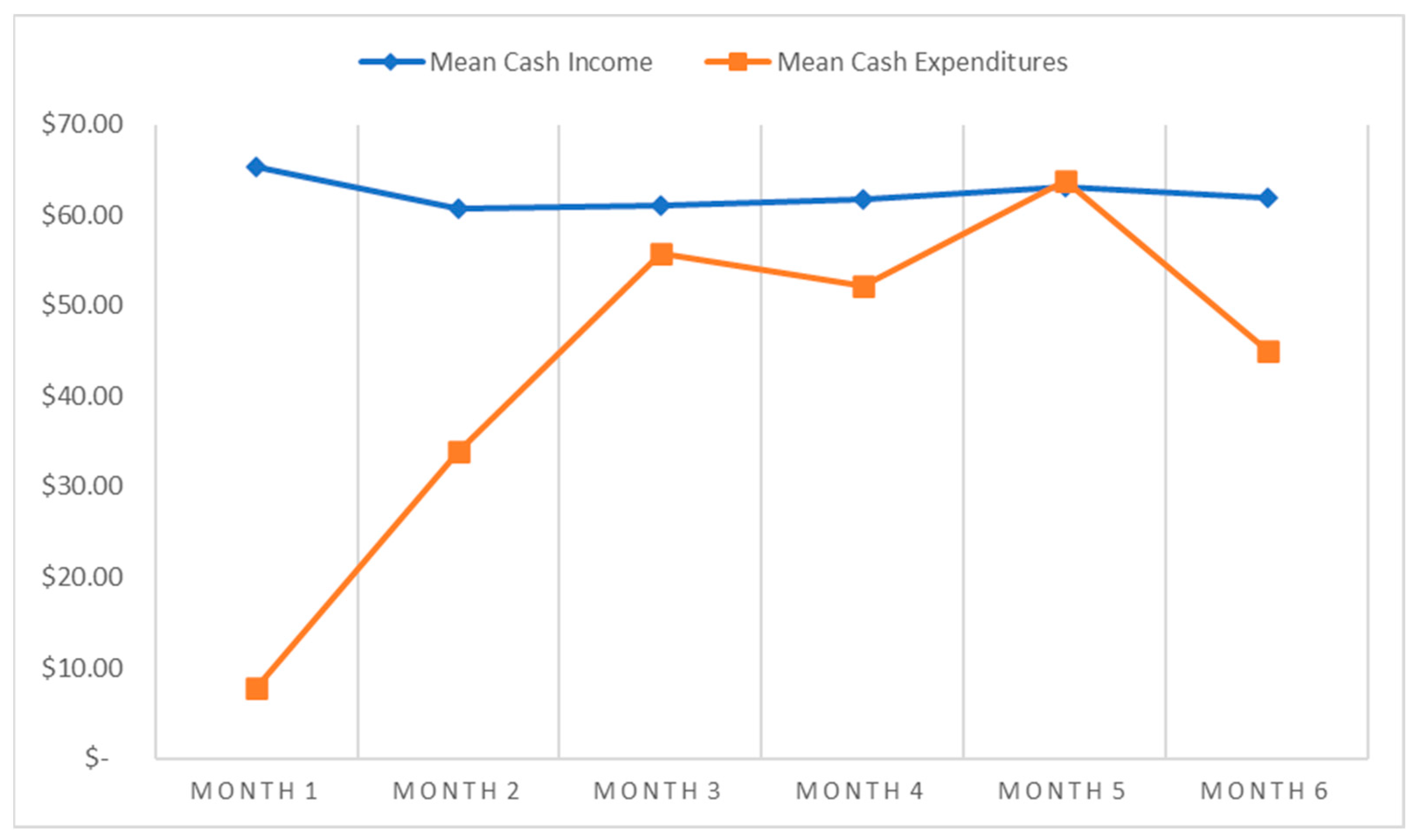

| Mean cash income a | $65.25 | $60.71 | $61.12 | $61.75 | $63.12 | $61.96 | $62.32 b | - |

| Mean cash expenditures | $7.77 | $33.84 | $55.72 | $52.20 | $63.82 | $44.96 | $43.05 b | 100% |

| % Monthly mean cash income | 11.9% | 55.7% | 91.2% | 84.5% | 101.1% | 72.6% | 69.1% | - |

| Expense category | ||||||||

| Food expenditures | $4.49 | $13.30 | $24.56 | $21.92 | $27.20 | $21.07 | $18.76 | 44% |

| Sex work expenditures | $1.04 | $7.43 | $11.65 | $9.55 | $13.33 | $8.30 | $8.55 | 20% |

| Housing expenditures | $0.46 | $2.77 | $6.23 | $5.39 | $6.40 | $6.39 | $4.61 | 11% |

| Other living expenditures c | $1.13 | $6.09 | $7.05 | $4.24 | $6.13 | $3.92 | $4.76 | 11% |

| Education expenditures | $0.41 | $2.79 | $2.41 | $7.99 | $8.48 | $3.61 | $4.28 | 10% |

| Health care expenditures | $0.22 | $1.46 | $3.82 | $3.12 | $2.27 | $1.67 | $2.09 | 5% |

| Number of women with negative cash balance d | 7 | 30 | 49 | 48 | 67 | 54 | 120 | - |

| Mean negative cash balance e | −$94.80 | −$88.75 | −$94.60 | −$81.37 | −$72.79 | −$56.07 | −$81.40 | - |

| N | (n/N) % | |

|---|---|---|

| Cash expenditure scenario | ||

| Had a negative cash balance a Yes No | 120 43 | 73.6% 26.4% |

| Had high sex work costs b Yes No | 46 117 | 28.2% 71.8% |

| Had high health care costs b Yes No | 39 124 | 23.9% 76.1% |

| Had high education costs b Yes No | 45 118 | 27.6% 72.4% |

| HIV-related behaviors | ||

| Had ≥1 act(s) of condomless sex c Yes No | 126 37 | 77.3% 22.7% |

| Had ≥1 acts of sex with alcohol/drugs c Yes No | 114 49 | 69.9% 30.1% |

| Initiated HIV antiretroviral medication (ART/PrEP) Yes No | 74 89 | 45.4% 54.6% |

| Negative Cash Balance | High Sex Work Costs | High Health Care Costs | High Education Costs | |||||

|---|---|---|---|---|---|---|---|---|

| Yes | No | Yes | No | Yes | No | Yes | No | |

| Total (N) | 120 | 43 | 46 | 117 | 39 | 124 | 45 | 118 |

| Condomless sex No Yes | 29 (24.2%) 91 (75.8%) | 8 (18.6%) 35 (81.4%) | 11 (23.9%) 35 (76.1%) | 26 (22.2%) 91 (77.8%) | 8 (20.5%) 31 (79.5%) | 29 (23.4%) 95 (76.6%) | 12 (26.7%) 33 (73.3%) | 25 (21.2%) 93 (78.8%) |

| Sex with alcohol or drugs No Yes | 37 (30.8%) 83 (69.2%) | 12 (27.9%) 31 (72.1%) | 16 (34.8%) 30 (65.2%) | 33 (28.2%) 84 (71.8%) | 13 (33.3%) 26 (66.7%) | 36 (29.0%) 88 (71.0%) | 13 (28.9%) 32 (71.1%) | 36 (30.5%) 82 (69.5%) |

| Initiated ART/PrEP No Yes | 68 (56.7%) 52 (43.3%) | 21 (48.8%) 22 (51.2%) | 26 (56.5%) 20 (43.5%) | 63 (53.8%) 54 (46.2%) | 22 (56.4%) 17 (43.6%) | 67 (54.0%) 57 (46.0%) | 25 (55.6%) 20 (44.4%) | 64 (54.2%) 54 (45.8%) |

| Negative Cash Balance | High Sex Work Costs | High Health Care Costs | High Education Costs | |||||

|---|---|---|---|---|---|---|---|---|

| Crude OR (95% CI) | Adjusted OR a (95% CI) | Crude OR (95% CI) | Adjusted OR a (95% CI) | Crude OR (95% CI) | Adjusted OR a (95% CI) | Crude OR (95% CI) | Adjusted OR a (95% CI) | |

| Condomless sex No Yes | 1.00 0.72 (0.30, 1.72) | 1.00 0.70 (0.28, 1.70) | 1.00 0.91 (0.41, 2.03) | 1.00 0.86 (0.38, 1.96) | 1.00 1.18 (0.49, 2.86) | 1.00 1.07 (0.43, 2.62) | 1.00 0.74 (0.33, 1.64) | 1.00 0.73 (0.32, 1.63) |

| Sex with alcohol or drugs No Yes | 1.00 0.87 (0.40, 1.88) | 1.00 0.93 (0.42, 2.05) | 1.00 0.74 (0.36, 1.53) | 1.00 0.76 (0.37, 1.59) | 1.00 0.82 (0.38, 1.77) | 1.00 0.85 (0.39, 1.86) | 1.00 1.08 (0.51, 2.30) | 1.00 1.04 (0.48, 2.22) |

| Initiated ART/PrEP No Yes | 1.00 0.73 (0.25, 1.47) | 1.00 0.80 (0.39, 1.67) | 1.00 0.90 (0.45, 1.78) | 1.00 0.99 (0.49, 2.03) | 1.00 0.91 (0.44, 1.87) | 1.00 1.10 (0.52, 2.35) | 1.00 0.95 (0.48, 1.89) | 1.00 0.90 (0.44, 1.85) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jennings Mayo-Wilson, L.; Peterson, S.K.; Kiyingi, J.; Nabunya, P.; Sensoy Bahar, O.; Yang, L.S.; Witte, S.S.; Ssewamala, F.M. Examining Cash Expenditures and Associated HIV-Related Behaviors Using Financial Diaries in Women Employed by Sex Work in Rural Uganda: Findings from the Kyaterekera Study. Int. J. Environ. Res. Public Health 2023, 20, 5612. https://doi.org/10.3390/ijerph20095612

Jennings Mayo-Wilson L, Peterson SK, Kiyingi J, Nabunya P, Sensoy Bahar O, Yang LS, Witte SS, Ssewamala FM. Examining Cash Expenditures and Associated HIV-Related Behaviors Using Financial Diaries in Women Employed by Sex Work in Rural Uganda: Findings from the Kyaterekera Study. International Journal of Environmental Research and Public Health. 2023; 20(9):5612. https://doi.org/10.3390/ijerph20095612

Chicago/Turabian StyleJennings Mayo-Wilson, Larissa, Summer K. Peterson, Joshua Kiyingi, Proscovia Nabunya, Ozge Sensoy Bahar, Lyla S. Yang, Susan S. Witte, and Fred M. Ssewamala. 2023. "Examining Cash Expenditures and Associated HIV-Related Behaviors Using Financial Diaries in Women Employed by Sex Work in Rural Uganda: Findings from the Kyaterekera Study" International Journal of Environmental Research and Public Health 20, no. 9: 5612. https://doi.org/10.3390/ijerph20095612

APA StyleJennings Mayo-Wilson, L., Peterson, S. K., Kiyingi, J., Nabunya, P., Sensoy Bahar, O., Yang, L. S., Witte, S. S., & Ssewamala, F. M. (2023). Examining Cash Expenditures and Associated HIV-Related Behaviors Using Financial Diaries in Women Employed by Sex Work in Rural Uganda: Findings from the Kyaterekera Study. International Journal of Environmental Research and Public Health, 20(9), 5612. https://doi.org/10.3390/ijerph20095612