1. Introduction

The demand for electricity in Malaysia is growing parallel with the Gross Domestic Product (GDP). This demand received a welcome boost from the roll-out of projects under the ongoing Five-Year Malaysia Plans and the Economic Transformation Programme (ETP). The generation of electricity has shown an increase of 3.7% in 2012 as compared to 3.1% in 2011 [

1]. This growth has been driven by strong demands from commercial and domestic sectors. For the period until 2020, the average projected demand for electricity is expected to rise by 3.1%. Based on this forecast, the country is going to need even more energy as it strives to move towards a high-income economy. An estimated 10.8 GW of new generation capacity will be needed by 2020 given that 7.7 GW of the existing capacity is due for retirement. By 2020, the total installed capacity will see an increase of 16% over the total installed capacity in 2012. Of this new capacity, gas and coal will continue to feature strongly in Malaysia’s energy mix in the power sector, with coal probably taking up a bigger share on the basis of rising gas prices. However, due to the non-renewable nature of gas and coal, the resources are depleting at an alarming rate. In addition, the generation of energy from these non-renewable resources can emit greenhouse gases into the atmosphere, which is the principal cause of global warming. According to the recent publication by [

2], the projected renewable energy (RE) share in the energy mix is expected to gradually increase up to 3–4% of total energy generated in years 2015 to 2025. This is very small compared to the non-renewable energy resources such as coal (48–66%), gas (23–46%) and hydroelectric (5%). In Malaysia, the mini-hydroelectric share is recognized as an RE resource in the Malaysia Renewable Energy Act 2011 [

3], but not the large hydroelectric share. This is the reason the energy contribution of large hydroelectric is separated from the renewable energy in the national energy mix. Similar to Malaysia, the energy mix in other Southeast Asian countries such as the Philippines, Vietnam and Thailand is also largely comprised of the non-renewable energy resource such as coal and gas [

4]. The projected contribution of RE in ASEAN countries from 2013 to 2040 is expected to decline from 26% to 21% due to the decreasing traditional use of biomass. The share of non-renewable energy in the energy mix is rising, from 74% in 2013 to a projected 78% in 2040 [

4].

The government of Malaysia has thus realized the importance of renewable energy technology to generate electricity in the country. As early as 2007, the topic of renewable energy was suggested and debated in the parliament. In 2011, the Renewable Energy Act was passed by parliament, which set the framework for the remuneration of power producers for each kilowatt of electricity produced under the FiT scheme. Malaysia’s national target on the cumulative capacity of renewable energy is generated from four eligible RE resources: solar photovoltaics, mini-hydro, biomass and biogas. The targets for the year 2015, 2020, and 2030 are 985, 2080 and 4000 MW, respectively. However, the actual progress is dramatically different from the target thus far, where the cumulative capacity for the year 2015 was 320 MW, which is less than 50% of the original target of 985 MW [

5]. According to a recent report by [

6], the subsequent target also appears to be unachievable, as the projected capacity of RE-based energy in 2020 would be only 1464 MW assuming all the RE power plants were commissioned. Thus, the target for the year 2030 is sure to be completely off. Accordingly, one of the best solutions is to introduce a new renewable energy technology into the Malaysian RE mix to enhance electricity generation [

5].

Wind energy is touted as the best candidate for newly eligible RE expansion in Malaysia. However, to initiate a wind energy project in Malaysia, a good policy needs to be established. The existing policies that implemented solar photovoltaic, mini-hydro, biogas, and biomass initiatives are not suitable for wind energy, as the nature of wind energy differs in several aspects, such as the site-dependent characteristics and the variation of specifications for wind turbine technology. The policy should cover a FiT system that corresponds to the wind conditions in Malaysia. The proper estimation of feed-in tariff rates is crucial, as the mishandling of tariff computations could lead to excessive or meager tariff payments that could either overburden the rate payer or cause the power producer to lose profit. Vietnam has experienced the negative effects of having tariff rates set lower than the actual generation costs, and it affected investors’ interest in the country’s wind energy industry. Although Vietnam has a high potential for wind energy compared to its neighboring countries like Thailand, the level of existing FiT rates will likely cause investors to lose profits as well as create a long pay-back period [

6]. The FiT rate in Vietnam has been 0.0780 USD/kWh, compared to 0.1750 USD/kWh in Thailand [

6].

The aim of this paper is to identify the baseline FiT rates for the wind-based energy producer in Malaysia. The tariff rates are based on the cost of generation for the recent practices in pricing the eligible renewable energy resources in Malaysia [

7].

2. The Optimal Generation Cost-Based Tariff Model

The net present value (NPV) approach is selected for the cost-of-generation -based tariff determination. It is the best and easiest approach to define the profitability and levelize the overall costs [

8]. The NPV of an investment is generally obtained by discounting all cash flows over the lifetime of the investment. The utilization of NPV in wind energy economic studies has been carried out in several studies [

9,

10,

11]. The strong limitation of NPV as presented by [

12] is the need for estimation of discounting rates. The uncertainty in the discounting rate estimation would affect the NPV cash flow. Therefore, the value of the discounting rate should be properly estimated. In spite of that, NPV would consider the time value of money and allows the computation of project value with different risk profiles [

12].

In the current scenario, the tariff rates distinguish between the small-scale wind turbine (≤100 kW rated power) and utility-scale wind turbine (>100 kW rated power) [

13], as the influences of economies of scale are considered. Nevertheless, one framework for both scales of wind turbines would be developed. Here, the difference between small and utility wind turbines is only in the initial capital cost per kW, thus the value of initial capital cost (CAPEX) in the equation can simply be adjusted without affecting the validity of the equation.

For the current study, the computation of FiT rates is comprised of four steps. First, CAPEX, annual operation and maintenance costs (OPEX), and the wind turbine (WT) component replacement costs were identified. The WT component replacement costs are costs associated with the replacement of any system component such as inverters, controllers or other electrical parts. The component should be replaced due to reduction of performance or failure to function. The replacement cost is assumed only once along the wind turbine lifetime.

Second, the debt calculation was considered in the investment cash flow. Third, the annual income generated by the electricity of wind turbines that transmitted to the grid were evaluated. Finally, the effects of capital allowance to the level of FiT were accounted.

The components of NPV that are utilized in the determination of FiT rates are divided into two: the cash inflow and outflow, as shown in

Table 1. The derivation followed the simplified net present value [

14] with small modification by considering the specific parameter assumption for Malaysia. The similar derivations were presented by [

15,

16].

The starting point to determine the optimal FiT rate in this case is to identify all costs involved in the cash outflow. Firstly, the initial capital cost (R) includes all upfront costs of the wind energy system: the cost of wind turbine modules, replacement, balance of system (BOS) and installation. Moreover, OPEX is defined annually where the annual percentage of OPEX is multiplied with the CAPEX. The last cost involved in the cash outflow is the WT components replacement cost, where the estimated percentage of cost of WT components is multiplied with the CAPEX. Certain WT components are assumed to have to be replaced after 10 years, half of a wind turbine’s projected lifetime. Therefore, the WT components replacement cost in 10 years would be discounted to its present value.

Following these steps, the annual cash outflows from the debt repayment and the debt interest were established. The value of the debt is given by the share of debt in the investment (1 − θ) multiplied with the initial capital cost (R). The debt maturity, in years, is given by M. Hence, assuming an equal amount is repaid every year, the annual repayment is: R(1 − θ)(1/M). For the debt interest, the debt share that is still outstanding in that year is multiplied with the interest rate (r) and corporate tax rate (τ).

In Malaysia, the tax savings can be added to the cash inflow by considering the capital allowance (CA), which is a benefit for corporate feed-in approval holders (FiAH) as mentioned in schedule 3 of the Income Tax Act 1967 [

17]. Under CA, the renewable energy system is categorized as plant and machinery and it is qualified for depreciation over the period of six years. The CA in Malaysia comprises the following types of provisions: (i) initial allowance (IA—for the first year allowance); (ii) annual allowance (AA—for subsequent years until the full amount is utilized); and (iii) balancing allowance. The CA percentage of initial allowance is fixed at 20%, the annual allowance is 14% for five years, and the balancing allowance is 10%. The annual tax saving is computed by the CAPEX multiplied with CA percentage and the corporate tax rate.

In addition, the annual income coming from the tariff remuneration for selling electricity to the grid, must be considered. It is computed by the multiplication of FiT rates, wind turbine rated power, capacity factor, and hours in a year (8760 hours/year):

F(

PR)(

CF)(

H). Here, the output of a wind turbine is assumed to degrade annually as mentioned by [

18], therefore the degradation rates,

γ would be included in the income equation. In addition, it is desirable for a FiT policy framework to include a degression rate,

. The inclusion of degression rate in the closed-form equation of FiT rate determination would derive the optimal FiT rate. Both wind turbine degradation and FiT rate degression would occur starting in the second year of operation.

The cash inflow components include the income from energy produced and the capital allowance. Consequently, the components of cash inflow can be presented as the following:

The components of cash outflow include the share equity of total cost, discounted operation and maintenance cost, debt repayment, and the WT component replacement cost. The components of cash outflow can be presented as the following:

Therefore, the NPV for the project over Renewable Energy Power Purchase Agreement (REPPA) periods can be calculated as the following:

where,

N is the REPPA periods;

PR is the rated power of wind turbine;

is the FiT rate;

CF is the capacity factors;

is the hourly loads per year;

τ is the corporate tax;

is the discounting rate;

is the cost degression;

γ is the degradation of AEP;

R is the CAPEX;

θ is the percentage for the share of equity; (1 −

θ) is the percentage for the share of debt;

is the loan maturity periods;

r is the interest rate;

φINV is the percentage of cost of WT component replacements that have to be replaced;

nINV is the specific year component replacement cost; and

φOM is the percentage of annual O & M.

If the NPV for a project is positive, this means that the investment is economically viable. Therefore, if we set the NPV to zero and solve

F, we can obtain the baseline FiT, the breakeven point for the project in which they get the rate of return in the project.

5. Conclusions

This paper introduces the closed-form equation that can be used to determine the optimal feed-in tariff (FiT) rates for wind energy based on generation cost-based approach. This paper also suggests the FiT rates calculation model and FiT rates differentiation method, as well as identifies a number of important financing issues that have to be addressed in the design and implementation of relevant policy. The determination of optimal FiT rates for the different sizes of wind turbine capacity would assist the Malaysian energy policy makers who are interested in supporting the wind energy projects. Besides that, the closed-form FiT rate determination and remuneration model equations can be applied by other countries, besides being a part of the toolbox for any renewable energy policy maker. The model considered specific parameter assumptions based on the conditions and practices in Malaysia; however, the parameters should be altered to fit local conditions and requirements before being applied in other countries.

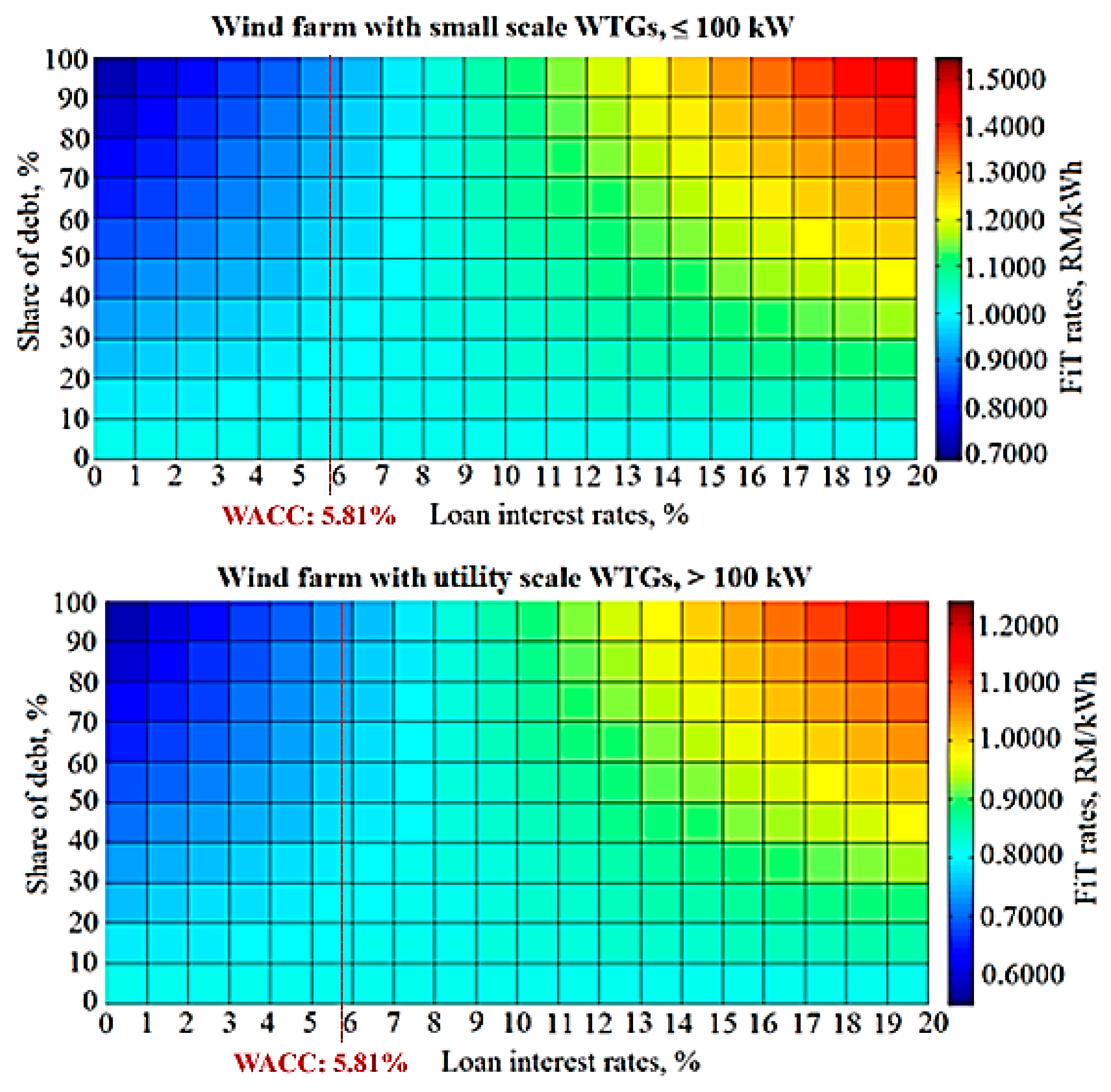

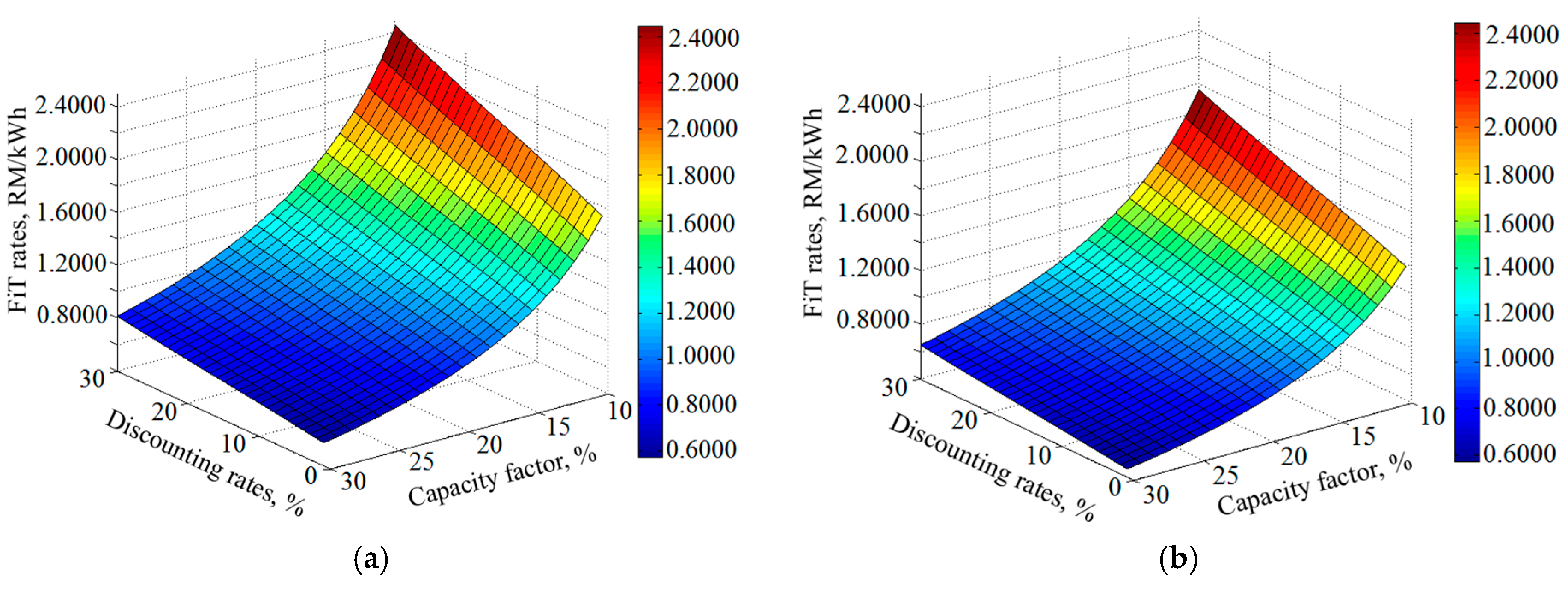

Consequently, by considering the availability of capital allowance, the optimal FiT rates for small-scale wind turbines in Malaysia are between 0.9245 and 1.1313 RM/kWh, while for utility-scale are between 0.7396 and 0.9050 RM/kWh. The level of FiT is changed with the changing value of economic parameters. The FiT rates would rise with the increment value of initial capital costs (CAPEX), operation and maintenance costs (OPEX), debt interest rates, corporate tax rates, and discounting rates. In addition, the FiT rates also increase with the decrement of baseline capacity factor and maturity period of loan.

In sum, the following criteria should be considered for the determination of FiT framework models for the implementation of onshore wind energy projects in Malaysia:

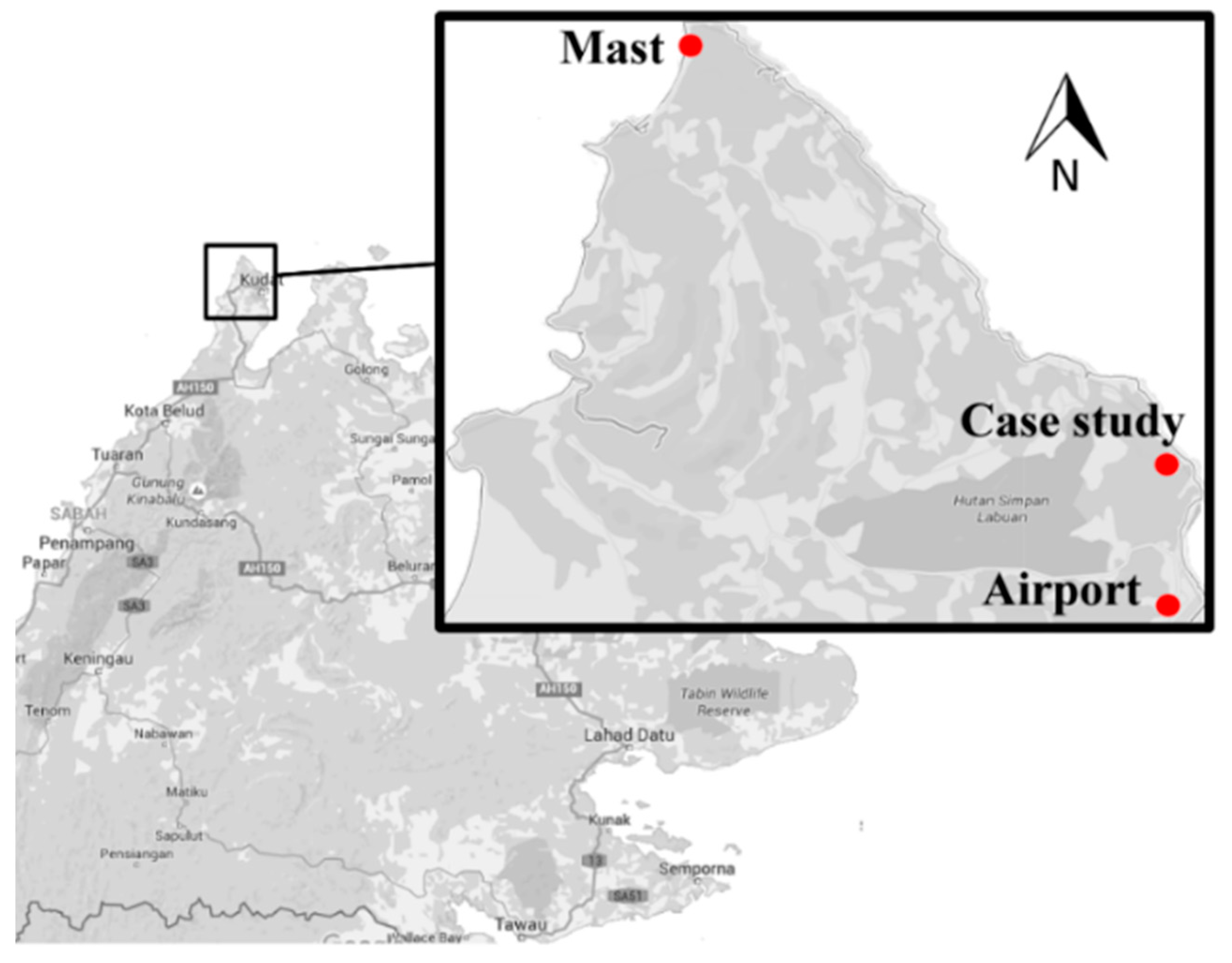

Malaysia is situated in a low-wind-speed region, which means that only certain areas have the potential for wind energy development.

Higher initial cost is needed for the wind energy in Malaysia as the market is still not matured. The wind turbines and their components should be transported from other countries, and this would increase the CAPEX value.

The model should convince the potential FiAH or power producer by including the benefit of capital allowance, as well as setting higher rates in the early years.

When the wind energy uses higher initial cost, the power developer is likely to require less equity, longer debt maturity, lower debt interest rate, and secured long-term agreement.

The design of remuneration should allow predictable project cash flow throughout the REPPA period.

Adopting the minimum projected capacity factor of the new proposed project is important. The project only accepts applicants with feasible project proposal (CF ≥ 20%) for FiT scheme due to the limitations of the National Renewable Energy fund.