On the Use of Causality Inference in Designing Tariffs to Implement More Effective Behavioral Demand Response Programs

Abstract

:1. Introduction

1.1. Context and Motivation

1.2. Related Work and Contributions

1.3. Structure of the Paper

2. Data Collection and Causality Inference Methodology

2.1. Dataset Description

2.2. Causality Inference for Elasticity Estimation

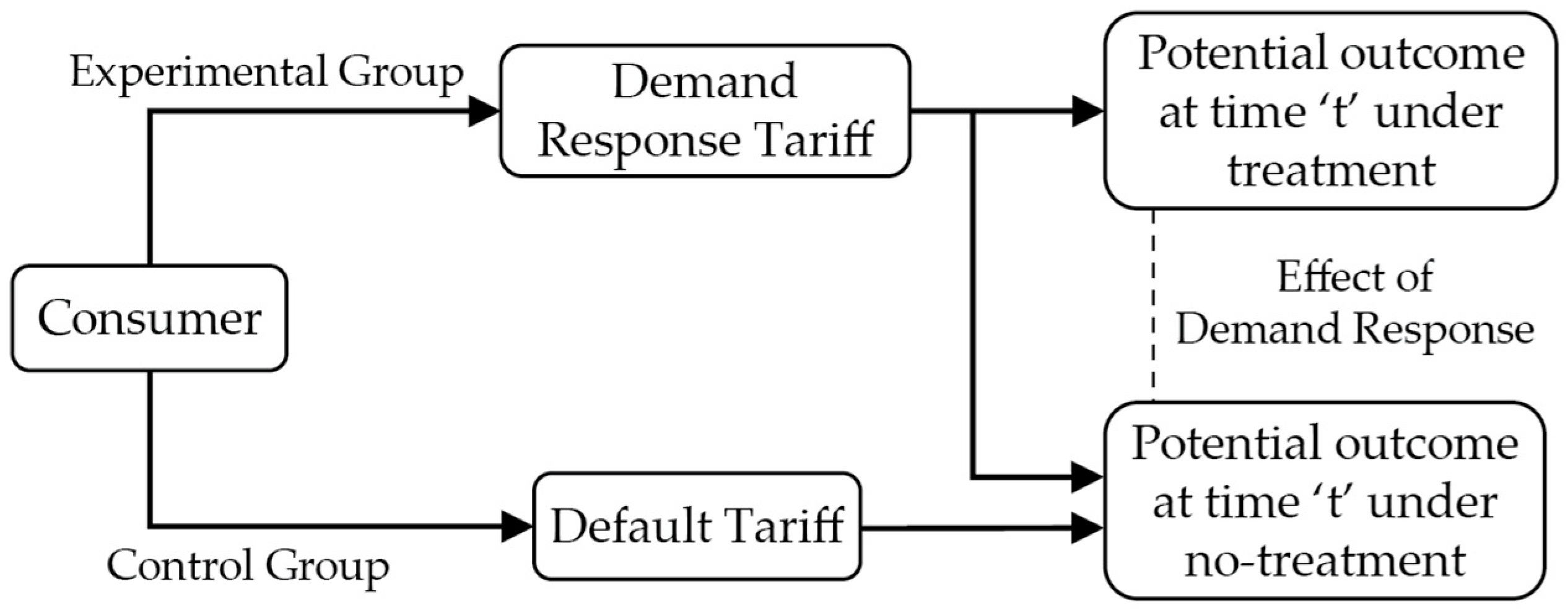

2.2.1. Framework for Applying Causality Inference in DR Data

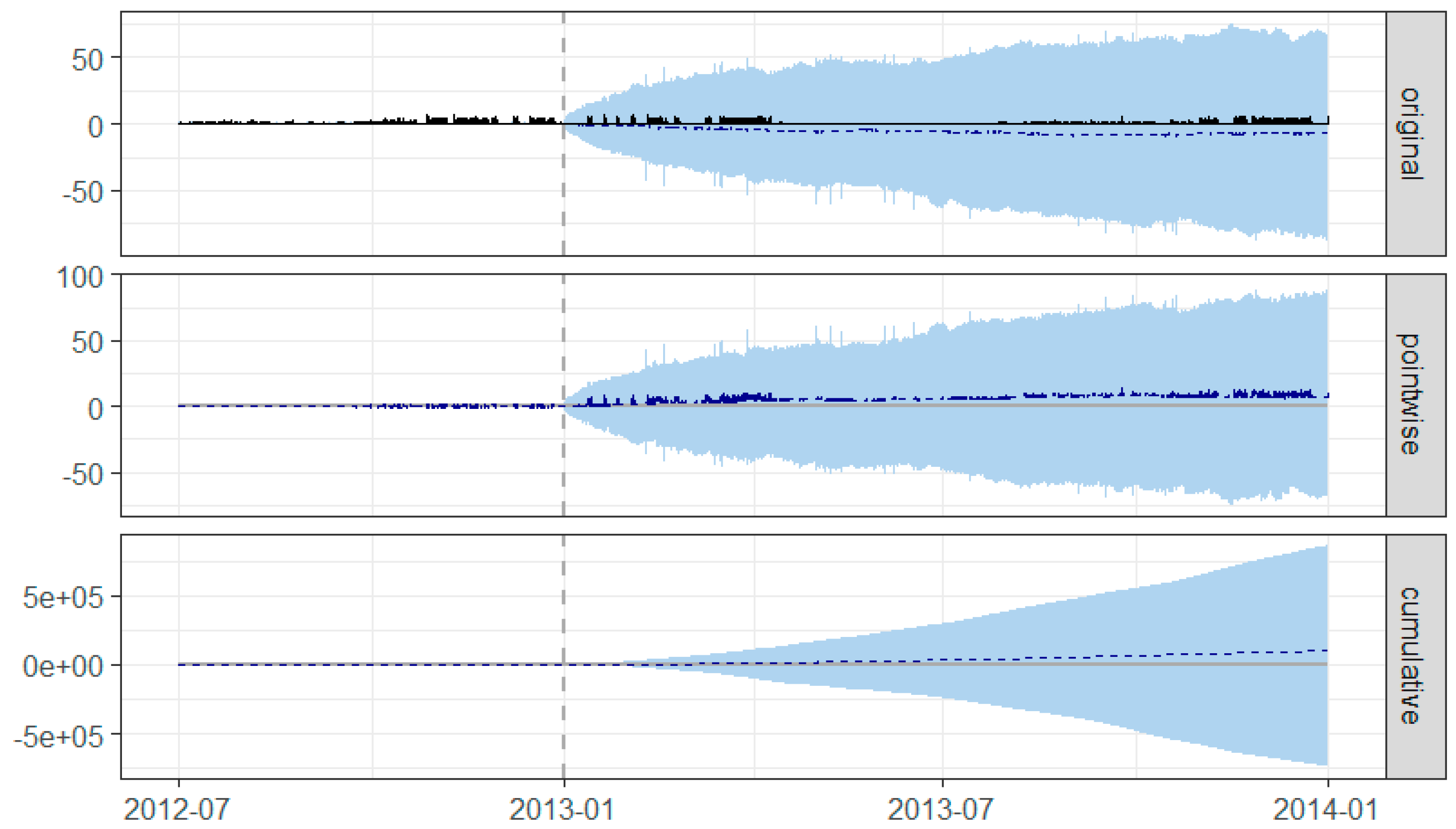

2.2.2. Causality Inference Algorithms

- There is a set control time series (pre-period) that is itself not affected by the intervention. If they were, it might falsely under or overestimate the true effect. Or it might falsely conclude that there was an effect even though in reality there was no effect.

- The relationship between covariates and the treated time series, as established during the pre-period, remains stable throughout the post-period.

- The relationship between the covariates (the time components) and the treated time series (electricity consumption) remains stable throughout the post-period.

3. Results and Discussion

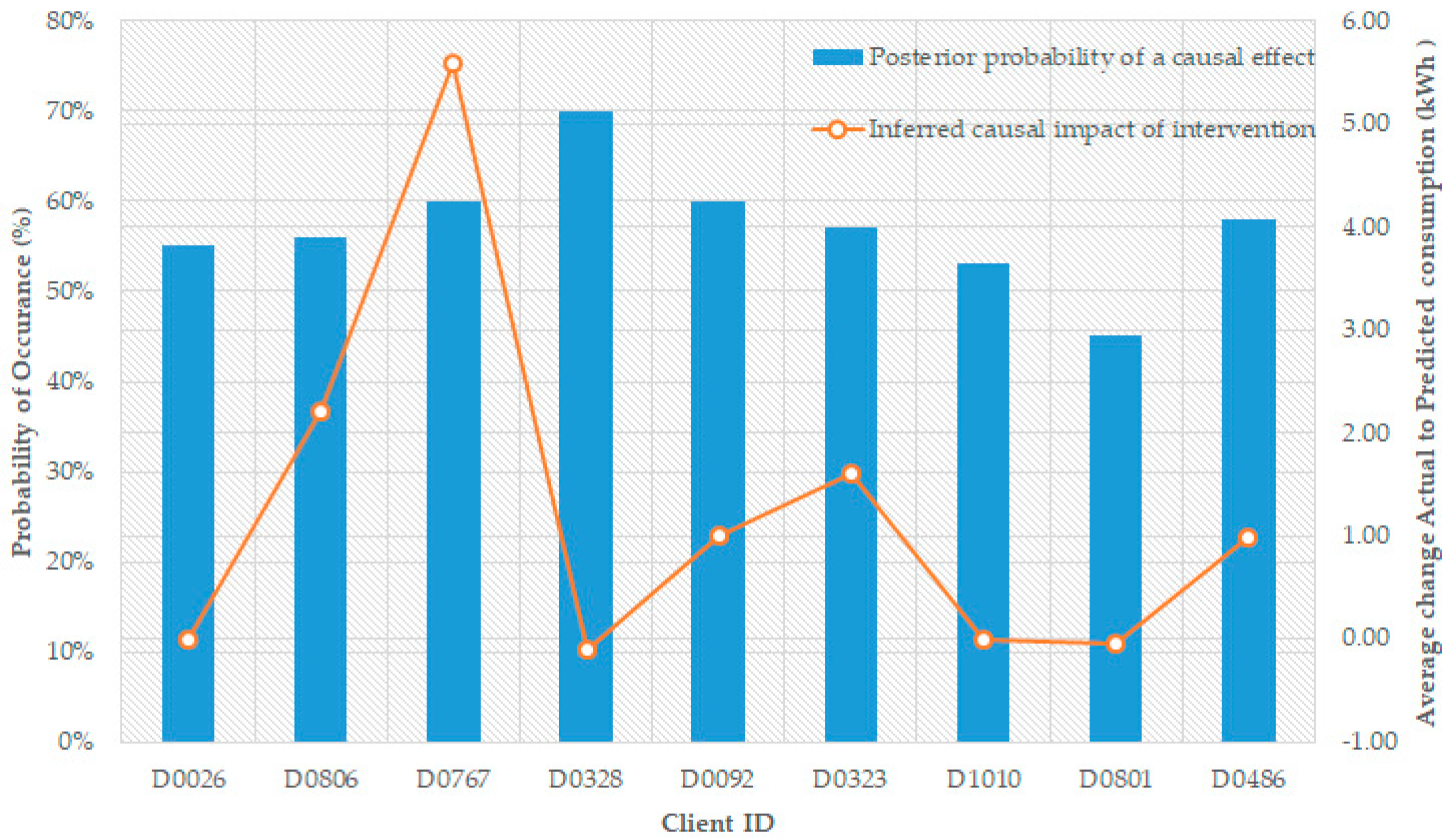

3.1. Low Carbon London (LCL) Dataset

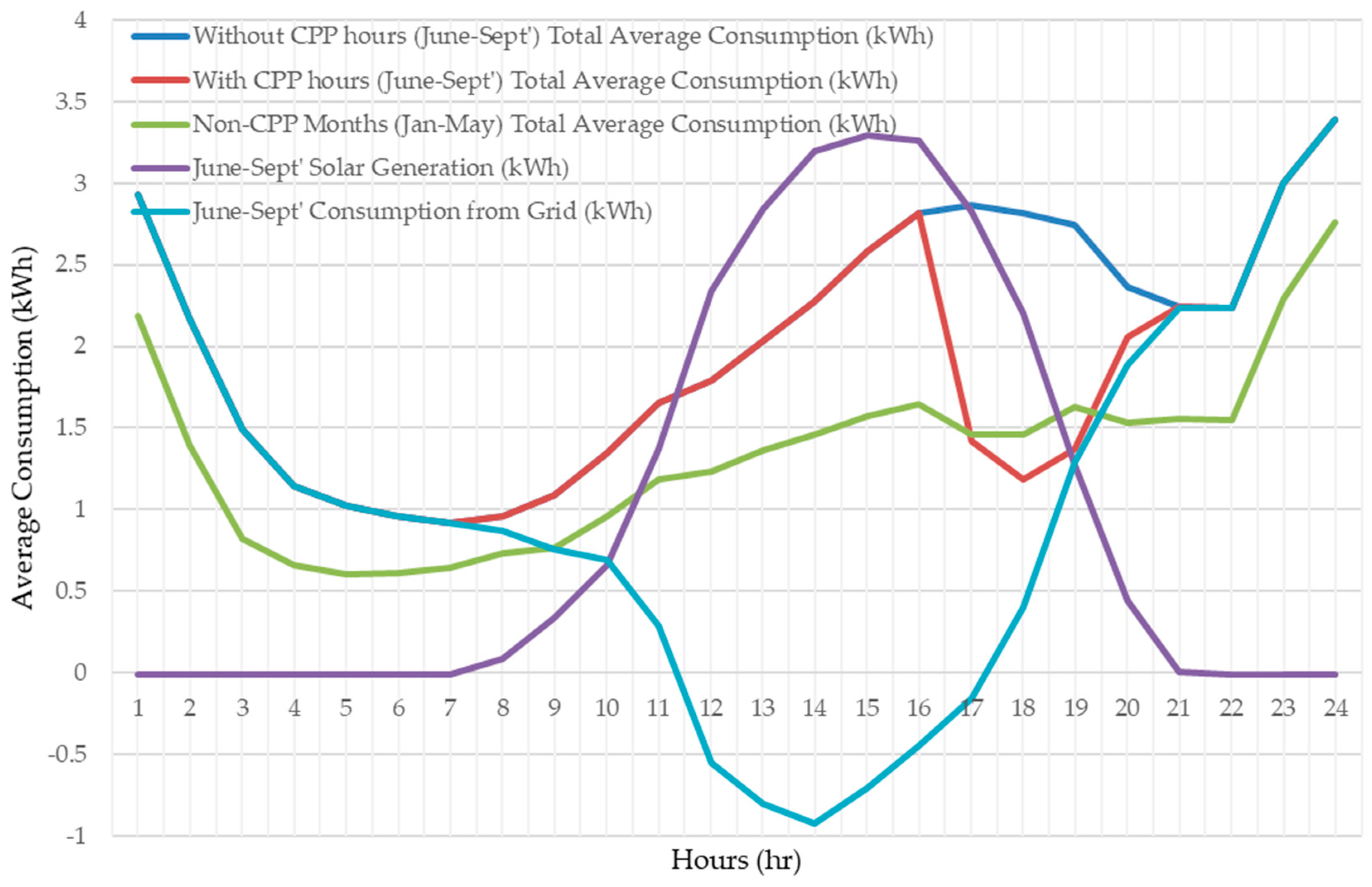

3.2. Pecan Street Inc. Dataset

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Siano, P. Demand response and smart grids-A survey. Renew. Sustain. Energy Rev. 2014, 30, 461–478. [Google Scholar] [CrossRef]

- Zhu, X.; Li, L.; Zhou, K.; Zhang, X.; Yang, S. A meta-analysis on the price elasticity and income elasticity of residential electricity demand. J. Clean. Prod. 2018, 201, 169–177. [Google Scholar] [CrossRef]

- Hesser, T.; Succar, S. Renewables Integration Through Direct Load Control and Demand Response. Smart Grid 2012. [Google Scholar] [CrossRef]

- Herter, K. Residential implementation of critical-peak pricing of electricity. Energy Policy 2007, 35, 2121–2130. [Google Scholar] [CrossRef] [Green Version]

- Ruiz, N.; Cobelo, I.; Oyarzabal, J. A direct load control model for virtual power plant management. IEEE Trans. Power Syst. 2009, 24, 959–966. [Google Scholar] [CrossRef]

- Mohsenian-Rad, A.H.; Leon-Garcia, A. Optimal residential load control with price prediction in real-time electricity pricing environments. IEEE Trans. Smart Grid 2010, 1, 120–133. [Google Scholar] [CrossRef]

- Belgium, C. Impact Assessment Support Study on Downstream Flexibility, Demand Response and Smart Metering; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- Observation, G.; Algorithms, R.; Gas, S.F.-B.P.; Holding, E. Assessment of Demand Response and Advanced Metering Staff Report Federal Energy Regulatory Commission; Federal Energy Regulatory Commission: Washington, DC, USA, 2002; pp. 2–5.

- Puget Sound Energy (PSE). Request for Proposals (RFP)-Technology and Implementation Services-Direct Load Control Program; Puget Sound Energy (PSE): Bellevue, WA, USA, 2016. [Google Scholar]

- Bertoldi, P.; Zancanella, P.; Boza-Kiss, B. Demand Response Status in EU Member States; European Union: Brussels, Belgium, 2016; pp. 1–153. [Google Scholar]

- Anca-Diana Barbu, N.G.; Morton, G. Achieving Energy Efficiency through Behaviour Change What Does it Take; European Environment Agency and Ricardo-AEA: Luxembourg, 2013. [Google Scholar]

- Hassan, N.; Pasha, M.; Yuen, C.; Huang, S.; Wang, X. Impact of Scheduling Flexibility on Demand Profile Flatness and User Inconvenience in Residential Smart Grid System. Energies 2013, 6, 6608–6635. [Google Scholar] [CrossRef]

- Asadinejad, A.; Rahimpour, A.; Tomsovic, K.; Qi, H.; Chen, C.-F. Evaluation of residential customer elasticity for incentive based demand response programs. Electr. Power Syst. Res. 2018, 158, 26–36. [Google Scholar] [CrossRef]

- Klaassen, E.A.M.; Kobus, C.B.A.; Frunt, J.; Slootweg, J.G. Responsiveness of residential electricity demand to dynamic tariffs: Experiences from a large field test in the Netherlands. Appl. Energy 2016, 183, 1065–1074. [Google Scholar] [CrossRef] [Green Version]

- Baker, P.; Blundell, R.; Micklewright, J. Modelling Household Energy Expenditures Using Micro-Data. Econ. J. 2006, 99, 720. [Google Scholar] [CrossRef]

- Kamerschen, D.R.; Porter, D.V. The demand for residential, industrial and total electricity, 1973–1998. Energy Econ. 2004, 26, 87–100. [Google Scholar] [CrossRef]

- Schleich, J.; Klobasa, M.; Gölz, S.; Brunner, M. Effects of feedback on residential electricity demand-findings from a field trial in Austria. Energy Policy 2013, 61, 1097–1106. [Google Scholar] [CrossRef]

- Zhou, D.; Balandat, M.; Tomlin, C. Residential demand response targeting using machine learning with observational data. In Proceedings of the 2016 IEEE 55th Conference on Decision and Control, Las Vegas, NV, USA, 12–14 December 2016; pp. 6663–6668. [Google Scholar]

- Kravitz, R. Distributed Energy Resources, SCE Slides for California Energy Commission; California Energy Commission: Sacramento, CA, USA, 2017.

- Larsen, E.M.; Pinson, P.; Leimgruber, F.; Judex, F. Demand response evaluation and forecasting—Methods and results from the EcoGrid EU experiment. Sustain. Energy Grids Netw. 2017, 10, 75–83. [Google Scholar] [CrossRef]

- Ray, G.L.; Larsen, E.M.; Pinson, P. Evaluating Price-Based Demand Response in Practice—With Application to the EcoGrid EU Experiment. IEEE Trans. Smart Grid 2018, 9, 2304–2313. [Google Scholar]

- Kwac, J.; Rajagopal, R. Data-driven targeting of customers for demand response. IEEE Trans. Smart Grid 2016, 7, 2199–2207. [Google Scholar] [CrossRef]

- Behl, M.; Smarra, F.; Mangharam, R. DR-Advisor: A data-driven demand response recommender system. Appl. Energy 2016, 170, 30–46. [Google Scholar] [CrossRef] [Green Version]

- Fotouhi Ghazvini, M.A.; Soares, J.; Morais, H.; Castro, R.; Vale, Z. Dynamic Pricing for Demand Response Considering Market Price Uncertainty. Energies 2017, 10, 1245. [Google Scholar] [CrossRef]

- Schofield, J.R.; Carmichael, R.; Schofield, J.R.; Tindemans, S.H.; Bilton, M.; Woolf, M.; Strbac, G. Low Carbon London Project: Data from the Dynamic Time-of-Use Electricity Pricing Trial; UK Data Service: Colchester, UK, 2013; p. 7857. [Google Scholar]

- Weather Underground Historic Weather Data. 2014. Available online: https://www.wunderground.com/history/ (accessed on 5 August 2018).

- Pecan Street Inc. Pecan Street Dataport. 2018. Available online: https://dataport.pecanstreet.org/ (accessed on 23 July 2018).

- Rhodes, J.D.; Upshaw, C.R.; Harris, C.B.; Meehan, C.M.; Walling, D.A.; Navrátil, P.A.; Beck, A.L.; Nagasawa, K.; Fares, R.L.; Cole, W.J.; et al. Experimental and data collection methods for a large-scale smart grid deployment: Methods and first results. Energy 2014, 65, 462–471. [Google Scholar] [CrossRef]

- Keil, A.P.; Edwards, J.K.; Richardson, D.B.; Naimi, A.I.; Cole, S.R. The parametric g-formula for time-to-event data: intuition and a worked example. Epidemiology 2014, 25, 889–897. [Google Scholar] [CrossRef]

- Pearl, J. Causality: Models, Reasoning, and Inference; MIT Press: Cambridge, MA, USA, 2009; p. 464. [Google Scholar]

- Naimi, A.I.; Cole, S.R.; Kennedy, E.H. An introduction to g methods. Int. J. Epidemiol. 2017, 46, 756–762. [Google Scholar] [CrossRef]

- Kelleher, A. Tools for Causal Analysis. 2017. Available online: https://github.com/akelleh/causality (accessed on 5 July 2018).

- Brodersen, K.H.; Gallusser, F.; Koehler, J.; Remy, N.; Scott, S.L. Inferring causal impact using Bayesian structural time-series models. Ann. Appl. Stat. 2015, 9, 247–274. [Google Scholar] [CrossRef]

- Kay, H.; Brodersen, A.H. An R Package for Causal Inference Using Bayesian Structural Time-Series Models; Google, Inc.: Mountain View, CA, USA; GitHub: San Francisco, CA, USA, 2014–2017. [Google Scholar]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ganesan, K.; Tomé Saraiva, J.; Bessa, R.J. On the Use of Causality Inference in Designing Tariffs to Implement More Effective Behavioral Demand Response Programs. Energies 2019, 12, 2666. https://doi.org/10.3390/en12142666

Ganesan K, Tomé Saraiva J, Bessa RJ. On the Use of Causality Inference in Designing Tariffs to Implement More Effective Behavioral Demand Response Programs. Energies. 2019; 12(14):2666. https://doi.org/10.3390/en12142666

Chicago/Turabian StyleGanesan, Kamalanathan, João Tomé Saraiva, and Ricardo J. Bessa. 2019. "On the Use of Causality Inference in Designing Tariffs to Implement More Effective Behavioral Demand Response Programs" Energies 12, no. 14: 2666. https://doi.org/10.3390/en12142666

APA StyleGanesan, K., Tomé Saraiva, J., & Bessa, R. J. (2019). On the Use of Causality Inference in Designing Tariffs to Implement More Effective Behavioral Demand Response Programs. Energies, 12(14), 2666. https://doi.org/10.3390/en12142666