Impact of Sustainable Financial and Economic Development on Greenhouse Gas Emission in the Developed and Converging Economies

Abstract

:1. Introduction

- to identify disparities between European Union (EU) countries in the scope of financial and economic development and greenhouse gas emissions;

- to determine the differences between developed and converging economies in the field of greenhouse gas emissions and sustainable financial and economic development and provide policy recommendations;

- to diagnose if, when, and how sustainable finance matters for the amount of greenhouse gas emissions.

2. Review of Literature (Background)

3. Materials and Methods

- GGEit—the dependent variable (the greenhouse gases (CO2, N2O in CO2 equivalent, CH4 in CO2 equivalent) emissions in kilograms per capita);

- Cit—set of explanatory variables (k variables) describing countries’ environmental characteristics;

- Eit—set of explanatory variables (l variables) describing countries’ economic development indicators;

- Fit—set of explanatory variables (m variables) describing countries’ sustainable financial development indicators;

- i—the cross-sectional dimension, representing individual countries analysed (from 1 to the N-th country); i ∈ {1, N};

- t—the time dimension—annual data from 2007 to 2017;

- α—the intercept;

- β—the structural parameters for respective sets of explanatory variables (1, …, k; 1, …, l; 1, …, m);

- vi—error term representing time invariant unobserved characteristics;

- εit—random error term.

- GGEit—the greenhouse gases (CO2, N2O in CO2 equivalent, CH4 in CO2 equivalent) emissions in kilograms per capita;

- Cit—energy productivity (measured as the amount of economic output produced per unit of gross available energy);

- Eit—set of explanatory variables consisting of employment in high- and medium-high technology manufacturing sectors and knowledge-intensive service sectors; purchasing power adjusted GDP per capita; Investment share of GDP; inequality of income distribution (S80/S20 income quintile share ratio);

- Fit—set of explanatory variables consisting of gross domestic expenditure on R&D as % of GDP, shares of environmental taxes in total tax revenues;

- i—the cross-sectional dimension, representing individual countries analysed (from 1 to the N-th country); i ∈ {1, N};

- t—the time dimension—annual data from 2007 to 2017;

- α—the intercept;

- β—the structural parameters for respective sets of explanatory variables (1, …, k; 1, …, l; 1, …, m);

- vi—error term representing time invariant unobserved characteristics;

- εit—random error term.

- GGEit—the greenhouse gases (CO2, N2O in CO2 equivalent, CH4 in CO2 equivalent) emissions in kilograms per capita;

- —average value of GGEit variable for each country;

- σ(GGEit)—standard deviation of GGEit variable for each country

- FECit—final energy consumption in households per capita in kg of oil equivalent;

- —average value of FECit variable for each country;

- σ(FECit)—standard deviation of FECit variable for each country;

- i—the cross-sectional dimension, representing individual countries analysed (from 1 to the N-th country); i ∈ {1, N};

- t—the time dimension—annual data from 2007 to 2017.

4. Results

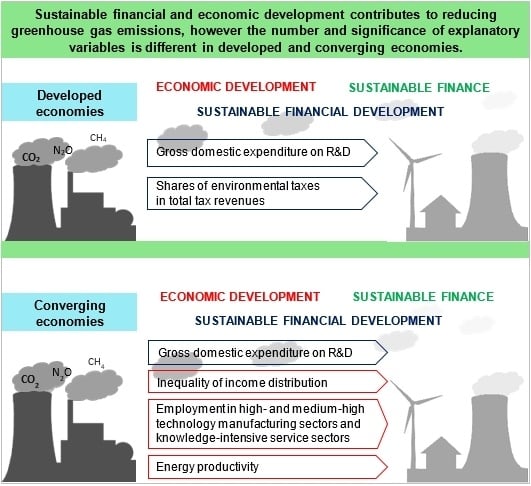

- for both groups of countries, the impact of economic and financial development on greenhouse gas emissions is confirmed;

- the patterns in the field of greenhouse gas emissions and explanatory variables vary between both groups of the countries in the scope of their impact directions (a drop or increase) and the number and significance of their explanatory variables (more variables explain the impact in converging economies case);

- the dependencies between economic and financial development are much stronger for the group of converging economies than those of the developed one;

- energy productivity has an impact on the greenhouse gas emissions in both groups of countries (a drop-in emission for converging economies, and for developed economies, an increase in emissions);

- gross domestic expenditures on R&D and shares of environmental taxes in total tax revenues are two variables that have the strongest impact on reducing greenhouse gas emissions in developed countries;

- employment in high- and medium-high technology manufacturing sectors and knowledge-intensive service sectors; inequality of income distribution (income quintile share ratio); gross domestic expenditure on R&D; and, energy productivity are four variables responsible for reducing greenhouse gas emissions in converging economies;

- sustainable finance variables (Shares of environmental taxes in total tax revenues, gross domestic expenditure on R&D, inequality of income distribution) matter for both groups of countries, but the impact of the inequality of income distribution is confirmed only for converging economies.

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Author(s), Year | Title | Variables Considered for the Study | Research Methodology | Results Determined | Implications of the Study | |

|---|---|---|---|---|---|---|

| 1 | Schumpeter J.A., (1961) [13] | The theory of economic development: an inquiry into profits, capital, credit, interest, and the business cycle | Theoretical study on economic development. | Review of the basic economic concepts that describe the recurring economic processes of a commercially organized state in which private property, division of labor, and free competition prevail. | Economic development is the key to explaining the features of a modern economy | Overall implication on knowledge of economy. |

| 2 | Georgescu-Roegen N. (1971) [4] | The Entropy Law and the Economic Process | Economic processes are entropic | Review of scientific theories and definitions. | Economy is not a theoretical science and is connected to the environment. | Reveals that the economic processes influence the environment. |

| 3 | Georgescu-Roegen N. (1975) [5] | Energy and Economic Myths | The book is a collection of materials that deal with various issues and concerns in economics. | Review of scientific and economic theories and issues. | Discussion of issues in natural resources and the economics of production, problems in institutional economics and epistemological and methodological concerns in economics. | Overall implication on knowledge of economy. |

| 4 | King R.G., Levine R., (1993) [16] | Finance, entrepreneurship, and growth: Theory and evidence | Identifying variables strongly correlated with provincial income growth in the Philippines by applying robustness procedures in determining which variables are strongly correlated with income growth. | Empirical study. | The tests show that among the fifteen variables, five variables stand out as being robust. The log of initial income, the ARMM indicator, the expenditure GINI and its square and the proportion of young dependents are all considered as strongly correlated to growth. | Indication of key variables correlated with income growth in Philippines. |

| 5 | Frankel J.A., Romer D., (1999) [24] | Does trade cause growth? | The impact of international trade on standards of living. | Empirical study | The results show that trade raises income. The relation between the geographic component of trade and income suggest that a rise of one percentage 6 point in the ratio of trade to GDP increases income per person by at least one-half percent. | Trade has a significant impact on income. |

| 6 | Rajan R.G., Zingales L., (2001) [30] | Financial systems, industrial structure, and growth | Impact of development of the financial sector on industrial growth. Relative importance of financial institutions and markets. Differences between financial systems in their vulnerability to crisis. | Review of theories, empirical study. | There seem to be a casual relationship between financial development and economic growth. Improvements to the accounting, legal, and supervisory infrastructure tend to diminish risk. | From the policy perspective an economic development needs fixing of financial plumbing: accounting and disclosure system and legal and bankruptcy code. |

| 7 | Talukdar D., Meisner C.M., (2001) [32] | Does the private sector help or hurt the environment? Evidence from carbon dioxide pollution in developing countries | The relationship between degree of private sector involvement in an economy and the CO2 emission level | Empirical study using panel data across 44 developing countries in the period of 1987–1995. | The study shows significantly negative relationship between degree of private sector involvement in an economy and the CO2 emission level. | Allowing greater private sector involvement and foreign direct investment in its economic activities as well as possessing well-developed financial capital market help improving environmental quality of a country. |

| 8 | Levine R., (2004) [10] | Finance and growth: theory and evidence | Review of theoretical and empirical work on the relationship between financial development and economic growth. | Review of theoretical papers about financial development and economic growth. Empirical studies: firm-level, industry-level, individual country-studies, time-series, panel-investigations, and broad cross-country comparisons. | Theory and evidence imply that better developed financial systems ease external financing constraints facing firms, which illuminates one mechanism through which financial development influences economic growth. | The paper highlights many areas needing additional research. |

| 9 | Acemoğlu D., Johnson S., Robinson A.J., (2005) [12] | Institutions as a fundamental cause of long-run growth | Developing the empirical and theoretical case that differences in economic institutions are the fundamental cause of differences in economic development. | Documenting the empirical importance of institutions and developing the basic outline of a framework for thinking about why economic institutions differ across countries. | Illustration of the assumptions, the workings and the implications of the developed framework using a number of historical examples. | Evidence of theory that differences in economic institutions are the fundamental cause of differences in economic development. |

| 10 | Arestis P., (2006) [11] | Financial liberalization and the relationship between finance and growth | Exploring the issues of the relationship between financial development and growth from the perspective of evaluation of the effects of financial liberalization. | Literature study and empirical studies review. | Theoretical propositions of the financial liberalization thesis are marred by serious difficulties. The available empirical evidence does not offer much support to the thesis. | Relationship between financial development and growth is not clear so it needs more future studies. |

| 11 | Tamazian A., Chousa J.P., Vadlamannati C., (2009) [7] | Does higher economic and financial development lead to environmental degradation: evidence from the BRIC countries | The linkage between economic and financial development and environmental quality. | Empirical study based on CO2 emission data and economic growth factors over period 1992–2004. | The economic development addressed by GDP growth rate, industry share and R&D expenditure has significant impact on per capita CO2 emissions. While emissions increase with the growth of economic development, the financial development decreases them. | Government policies directed to financial openness and liberalization to attract higher levels of R&D-related foreign direct investment can decrease the environmental degradation. |

| 12 | Tamazian A., Rao B.B., (2010) [8] | Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies | The linkage between economic and financial development and institutional quality and environmental quality. | Empirical analysis using panel data methods and follow standard approaches in the existing EKC literature. The study considers 24 transition economies and panel data for 1993–2004. | Economic development decreases environmental degradation when controlled for endogeneity of the explanatory variables and the effects of institutional quality are taken into account. | Governments should support the development of new technologies that lead to a less carbon-intensive Economy. |

| 13 | Jalil A, Feridun M. (2011) [17] | The Impact of Growth, Energy and Financial Development on the Environment in China. A Cointegration Analysis. | The impact of financial development, economic growth and energy consumption on environmental pollution in China from 1953 to 2006. The the long run equilibrium relationship between financial development and environmental pollution. | Literature review. Autoregressive Distributed Lag (ARDL) bounds testing procedure | The analysis reveals a negative sign for the coefficient of financial development, suggesting that financial development in China has not taken place at the expense of environmental pollution. Carbon emissions are mainly determined by income, energy consumption and trade openness in the long run. | The findings confirm the existence of an Environmental Kuznets Curve in the case of China. These findings suggest some lessons regarding policies related to energy consumption and import policies. |

| 14 | Zhang Y.J., (2011) [25] | The impact of financial development on carbon emissions: An empirical analysis in China | The influence of financial development on carbon emissions. | Empirical analysis using econometric techniques, including cointegration theory, Granger causality test, and variance decomposition. | The results indicate that, China’s financial development acts as an important driver for carbon emissions increase, the influence of financial intermediation scale on carbon emissions outweighs that of other financial development indicators, China’s stock market scale has relatively larger influence on carbon emissions but the influence of its efficiency is very limited. | With the increase of China’s FDI in the future, many efforts should be made to adapt its utilizing directions and play its positive role in promoting low-carbon development. |

| 15 | Todaro M.P., Smith S.C., (2012) [14] | Economic development | The book provides a complete and balanced introduction to the requisite theory, driving policy issues, and latest research. | A policy-oriented approach, presenting economic theory in the context of critical policy debates and country-specific case studies. | The book shows how theory relates to the problems and prospects of developing countries. | For courses on economic development. A complete, balanced introduction to the theory, issues, and latest research. |

| 16 | Apergis N., Eleftheriou S., & Payne, J.E., (2013) [49] | The relationship between international financial reporting standards, carbon emissions, and R&D expenditures: Evidence from European manufacturing firms | The impact of research and development (R&D) expenditures on carbon dioxide (CO2) emissions prior to and under the mandatory adoption of International Financial Reporting Standards at the firm level within the manufacturing sectors of three European countries. | Estimation of a threshold autoregressive model using quarterly data from 1998 to 2011. | In the post-IFRS mandatory adoption year R&D expenditures show a reduction in CO2 emissions to firms, i.e., rising CO2 abatement. | The results remain robust in terms of a sector analysis, firm size, and the introduction of the European Union Emission Trading Scheme (EU-ETS) across the three countries. |

| 17 | Shahbaz M., Solarin S.A., Mahmood H., Arouri M., (2013) [9] | Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis | Evaluation of the relationship of financial development, energy consumption and economic growth with CO2 emissions in case of Malaysia in the period of 1971–2011. | Literature review. Analysis of the following data: CO2 emissions, financial development, real GDP per capita for economic growth, energy consumption, real foreign direct investment, real trade (exports + imports). | Confirmation of long run relationship between the examined variables. Economic growth, energy consumption and foreign direct investment are shown to retard environmental quality. Financial development reduces CO2 emissions for Malaysian Economy. | Financial development can play positive and significant role in combating environmental degradation in the country as greater financial sector development can facilitate more financing at lower costs. |

| 18 | Friede G., Busch T., Bassen A., (2015) [2] | ESG and financial performance: aggregated evidence from more than 2000 empirical studies | relation between environmental, social, and governance (ESG) criteria and corporate financial performance (CFP) | Second-level review of 60 review studies: analysis of findings from vote-count studies and aggregation the findings of econometric review studies –meta-analyses | Approximately 90% of studies find a nonnegative ESG–CFP relation, of which 47.9% in vote-count studies and 62.6% in meta-analyses yield positive findings with a central average correlation level in studies of around 0.15. | The review of studies shows the evidence for the business case for ESG investing. The orientation toward long term responsible investing should be important for all kinds of rational investors. Detailed and profound understanding of how to integrate ESG criteria into investment processes is required in order to harvest the full potential of value-enhancing ESG factors. |

| 19 | Lee K.-H, & Min B., (2015) [48] | Green R&D for eco-innovation and its impact on carbon emissions and firm performance | The impact of green research and development investment for eco-innovation on environmental and financial performance. | Empirical study using a sample of Japanese manufacturing firms during the period of 2001–2010. | The results show the presence of a negative relationship between green research and development and carbon emissions, while green research and development is positively related to financial performance at the firm level. | The findings of this study provide valuable insights and basis of scientific debate on how firms to engage unique organizational resources and capabilities for superior corporate environmental and financial performance. |

| 20 | Lee J.M., Chen K.H., Cho C.H., (2015) [18] | The relationship between CO2 emissions and financial development: evidence from OECD countries | The relationships among CO2 emissions, energy use, GDP, and financial development for 25 OECD countries over the 1971–2007 period. | Literature survey and empirical study based on the analysis of the data by means of a panel approach. | The results don’t confirm an existence of the EKC for OECD countries. Moreover, the results present that the coefficient of financial development to CO2 emissions is negative and statistically significant for eight countries. | The study shows that financial development can help EU countries to adjust their CO2 emissions. |

| 21 | Omri A., Daly S., Rault Ch., Chaibi A., (2015) [20] | Financial development, environmental quality, trade and economic growth: What causes what in MENA countries | The relationship between financial development, CO2 emissions, trade and economic growth in MENA countries. | Empirical study using simultaneous-equation panel data models for a panel of 12 MENA countries over the period 1990–2011. | There is evidence of bidirectional causality between CO2 emissions and economic growth. The results also verified the existence of environmental Kuznets curve. | The empirical insights are of particular interest to policymakers as they help build sound economic policies to sustain economic development and to improve the environmental quality |

| 22 | Abbasi F., Riaz K., (2016) [23] | CO2 emissions and financial development in an emerging economy: An augmented VAR approach | The influence of economic and financial development on carbon emissions in a small emerging economy. | Empirical study using ARDL approach, an Error Correction Model (ECM), Granger causality in an augmented VAR framework, and variance decomposition based on an estimated Vector Error Correction Model (VECM). | The financial variables played a role in emission mitigation only in the latter period where greater degree of liberalization and financial sector development occurred. Even then the relative magnitude of emissions mitigation attributable to financial variables was much smaller compared to the emissions raising impact of rising per capita incomes. | Governments need to adopt other mitigation policies for reducing carbon footprints in those emerging economies where a sufficient degree of financial deepening and financial sector development has not yet taken place. |

| 23 | Al-Mulali U., Ozturk I., Lean H.H., (2016) [21] | The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe | The influence of disaggregated renewable electricity production by source on CO2 emission in 23 selected European countries for the period of 1990–2013 | Empirical study using panel data techniques. | The results indicated that CO2 emission, GDP growth, urbanization, financial development, and renewable electricity production by source were cointegrated. The fully modified ordinary least-square results revealed that GDP growth, urbanization, and financial development increase CO2 emission in the long run, while trade openness reduces it | A number of policy recommendations were provided for the European countries. |

| 24 | Dogan E., Turkekul B., (2016) [22] | CO2 Emissions, Real Output, Energy Consumption, Trade, Urbanization and Financial Development: Testing the EKC Hypothesis for the USA | The relationship between carbon dioxide (CO2) emissions, energy consumption, real output (GDP), the square of real output (GDP2), trade openness, urbanization, and financial development in the USA for the period 1960–2010. | Literature review and empirical study based on the time series data from 1960 to 2010 obtained from the World Development Indicators. | The analysed variables are cointegrated. In the long run, energy consumption and urbanization increase environmental degradation while financial development has no effect on it, and trade leads to environmental improvements. | The US government should take into account the importance of trade openness, urbanization, and financial development in controlling for the levels of GDP and pollution |

| 25 | Shahbaz M., Shahzad, S. J. H., Ahmad, N., & Alam, S. (2016) [6] | Financial development and environmental quality: the way forward. | Bank-and Stock market-based financial development indicators, energy consumption, GDP per capita. Quarterly data from 1985 to 2014 for Pakistan. | Wide literature review; non-linearity assessment with Fourier ADF function and the optimal lag length selected by using the Akaike Information Criterion. | Inefficient use of energy adversely affects the environmental quality; bank-based financial development impedes environmental quality. | Adoption of energy efficient technology at both production and consumption levels. Government should encourage lenders to ease the funding for energy sector and allocate financial resources for environment friendly ventures |

| 26 | Schoenmaker D., (2017) [27] | Investing for the Common Good: A Sustainable Finance Framework | Discussing the issue of sustainable development. | Literature review and empirical study. | The essay shows how sustainable finance has the potential to move from finance as a goal (profit maximization) to finance as a means. also examines obstacles to the adoption of sustainable finance. | This essay provides a new framework for sustainable Finance. |

Appendix B

| Variable | Abbreviation | Unit of Measurement | Meaning of the Variable | Author(s), Year, Title |

|---|---|---|---|---|

| Greenhouse gases (CO2, N2O in CO2 equivalent, CH4 in CO2 equivalent) | GGE | kg per capita | Amount of gases emitted per capita. CO2 equivalent is calculated using Global Warming Potential (GWP) factor which compares components based on radiative forcing, integrated up to a chosen time horizon. According to IPCC Climate Change 2014: Synthesis Report, GWP for N2O is 265 over 100 years and 28 for CH4 (GWP for CO2 is 1). [59] | Sterpu M., Soava G., Mehedintu A. (2018). Impact of Economic Growth and Energy Consumption on Greenhouse Gas Emissions: Testing Environmental Curves Hypotheses on EU Countries [19]. Tamazian A., Chousa J.P., Vadlamannati C. (2009). Does higher economic and financial development lead to environmental degradation: evidence from the BRIC countries [7] Talukdar D., Meisner C.M. (2001). Does the private sector help or hurt the environment? Evidence from carbon dioxide pollution in developing countries [32]. Shahbaz M., Shahzad S. J. H., Ahmad N., & Alam, S. (2016). Financial development and environmental quality: the way forward [6]. |

| Final energy consumption in households per capita | FEC | kg of oil equivalent | The indicator measures how much electricity and heat every citizen consumes at home excluding energy used for transportation. Since the indicator refers to final energy consumption, only energy used by end consumers is considered. The related consumption of the energy sector itself is excluded [60]. | Chang S.C., (2015), Effects of financial developments and income on energy consumption [28]; Rafindadi A.A., Ozturk I. (2017). Dynamic effects of financial development, trade openness and economic growth on energy consumption: Evidence from South Africa [29]. |

| Energy productivity | C1 | economic output produced per unit of gross available energy, in Euro | The indicator results from the division of the gross domestic product (GDP) by the gross available energy for a given calendar year. It measures the productivity of energy consumption and provides a picture of the degree of decoupling of energy use from growth in GDP. [61] | Atalla T., Bean P., (2017) Determinants of energy productivity in 39 countries: An empirical investigation [62]. |

| Employment in high and medium-high technology manufacturing sectors and knowledge-intensive service sectors | E1 | % of total employment | The definition of high- and medium-high technology manufacturing sectors and of knowledge-intensive services is based on a selection of relevant items of NACE Rev. 2 on 2-digit level and is oriented on the ratio of highly qualified working in these areas [63]. | Kabaklarli E., Duran M. S., Üçl Y. T. (2018). High-technology exports and economic growth: panel data analysis for selected OECD countries [64]. Desmarchelier B., Djellal F., Gallouj F., (2012) Knowledge intensive business services and long term growth. Structural Change and Economic Dynamics [65]. |

| Investment as share in GDP | E2 | % of GDP | This indicator shows the investment for the total economy, government, business as well as household sectors. The indicator gives the share of GDP that is used for gross investment (rather than being used for e.g., consumption or exports). It is defined as gross fixed capital formation (GFCF) expressed as a percentage of GDP for the government, business and household sectors [66]. | McQuinn K., Whelan K., (2016) The Prospects for Future Economic Growth in the Euro Area [67]. |

| Purchasing power adjusted GDP | E3 | per capita, in EUR | Gross domestic product (GDP) is a measure for the economic activity. It refers to the value of the total output of goods and services produced by an economy, less intermediate consumption, plus net taxes on products and imports. GDP per capita is calculated as the ratio of GDP to the average population in a specific year. Purchasing power standards (PPS) represents a common currency that eliminates the differences in price levels between countries to allow meaningful volume comparisons of GDP [68]. | Magnien F. (2002) The measure of GDP per capita in Purchasing Power Standards: a statistical indicator tricky to interpret [69]. |

| Inequality of income distribution (income quintile share ratio) | E4 | ratio | The income quintile share ratio or the S80/S20 ratio is a measure of the inequality of income distribution. It is calculated as the ratio of total income received by the 20 % of the population with the highest income (the top quintile) to that received by the 20 % of the population with the lowest income (the bottom quintile) [70] | Razvan B., Boldea B.I. (2012). Sustainability of Economic Growth and Inequality In Incomes Distribution, Annals of Faculty of Economics, University of Oradea, Faculty of Economics, vol. 1(1), pages 249–254 [71]. |

| Gross domestic expenditure on R&D as % of GDP | F1 | % of GDP | Gross domestic spending on R&D is defined as the total expenditure (current and capital) on R&D carried out by all resident companies, research institutes, university and government laboratories, etc., in a country. It includes R&D funded from abroad but excludes domestic funds for R&D performed outside the domestic economy [72]. | Sokolov-Mladenović S., Cvetanović S., Mladenović I., (2015) R&D expenditure and economic growth: EU28 evidence for the period 2002–2012 [73]. |

| Shares of environmental taxes in total tax revenues | F2 | % | Environmental taxes are defined as taxes whose tax base is a physical unit (or proxy of it) of something that has a proven, specific negative impact on the environment [74]. | Morley B., Abdullah S., 2010, Environmental Taxes and Economic Growth: Evidence from Panel Causality Tests [75]. |

Appendix C

| Coefficient | Std. Error | t-Ratio | p Value | ||

|---|---|---|---|---|---|

| const | 312.878 | 131.553 | 2.3783 | 0.02029 | ** |

| E1_Employment_in_high_&_medium_sect. | −36.7144 | 11.1462 | −3.2939 | 0.00159 | *** |

| E2_Investment_share_in_GDP | 1.88834 | 0.572549 | 3.2981 | 0.00157 | *** |

| E3_Purchasing_power_adjusted_GDP | 0.0232716 | 0.00552749 | 4.2102 | 0.00008 | *** |

| E4_Inequality_of_income_distribution | −44.0712 | 18.7171 | −2.3546 | 0.02153 | ** |

| sq_E1_ Employment_in_high_&_medium_sect. | 1.59173 | 0.649312 | 2.4514 | 0.01688 | ** |

| sq_E3_ Purchasing_power_adjusted_GDP | −3.87894 × 10−7 | 1.41501 × 10−7 | −2.7413 | 0.00787 | *** |

| sq_E4_ Inequality_of_income_distribution | 3.42417 | 1.46424 | 2.3385 | 0.02240 | ** |

| F1_Gross_domestic_expendit._on_R&D | −57.3884 | 25.5744 | −2.2440 | 0.02819 | ** |

| F2_Share_of_environmental_taxes | 50.3474 | 15.3024 | 3.2902 | 0.00161 | *** |

| sq_F1_ Gross_domestic_expendit._on_R&D | 17.451 | 8.29294 | 2.1043 | 0.03916 | ** |

| sq_F2_ Share_of_environmental_taxes | −3.09356 | 0.868313 | −3.5627 | 0.00069 | *** |

| C1_Energy_productivity | −247.151 | 40.931 | −6.0382 | <0.00001 | *** |

| sq_C1_Energy_productivity | 25.8838 | 4.8883 | 5.2950 | <0.00001 | *** |

| Coefficient | Std. Error | t-Ratio | p Value | ||

|---|---|---|---|---|---|

| const | 75.1963 | 76.6459 | 0.9811 | 0.33157 | |

| E1_Employment_in_high_&_medium_sect. | 8.71666 | 4.04418 | 2.1554 | 0.03629 | ** |

| E2_Investment_share_in_GDP | 2.69757 | 0.581461 | 4.6393 | 0.00003 | *** |

| F1_Gross_domestic_expendit_on_R&D | −31.2026 | 12.3697 | −2.5225 | 0.01510 | ** |

| F2_Share_of_environmental_taxes | −26.4802 | 10.7626 | −2.4604 | 0.01761 | ** |

| sq_F2_ Share_of_environmental_taxes | 1.63712 | 0.765336 | 2.1391 | 0.03765 | ** |

| C1_Energy_productivity | 15.8301 | 16.8244 | 0.9409 | 0.35157 | |

| sq_C1_Energy_productivity | −2.33032 | 0.899868 | −2.5896 | 0.01275 | ** |

| Statistics and Test Results | |||||

| Mean-dependent var | −17.32799 | S.D.-dependent var | 64.19933 | ||

| Sum-squared resid | 1693.969 | S.E. of regression | 6.003490 | ||

| LSDV R-squared | 0.993034 | Within R-squared | 0.923540 | ||

| LSDV F(12, 47) | 558.3266 | p value (F) | 2.14 × 10−46 | ||

| Log-likelihood | −185.3509 | Akaike criterion | 396.7017 | ||

| Schwarz criterion | 423.9282 | Hannan-Quinn | 407.3515 | ||

| rho | −0.119704 | Durbin-Watson | 2.164931 | ||

| Joint test on named regressors: F(7, 47) = 81.0997 with p = 4.58951 × 10−24 | |||||

| Test for differing group intercepts: F(5, 47) = 167.085 with p = 1.00783 × 10−28 | |||||

References

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Beckerman, W. Economic Growth and the Environment: Whose Growth? Whose Environment? World Dev. 1992, 20, 481–496. [Google Scholar] [CrossRef]

- Georgescu-Roegen, N. The Entropy Law and the Economic Process; Harvard University Press: Cambridge MA, USA, 1971. [Google Scholar]

- Georgescu-Roegen, N. Energy and Economic Myths. South. Econ. J. 1975, 41, 347–381. [Google Scholar] [CrossRef]

- Shahbaz, M.; Shahzad, S.J.H.; Ahmad, N.; Alam, S. Financial development and environmental quality: The way forward. Energy Policy 2016, 98, 353–364. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, C. Does higher economic and financial development lead to environmental degradation: Evidence from the BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Tamazian, A.; Rao, B.B. Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 2010, 32, 137–145. [Google Scholar] [CrossRef]

- Shahbaz, M.; Solarin, S.A.; Mahmood, H.; Arouri, M. Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ. Model. 2014, 35, 145–152. [Google Scholar] [CrossRef]

- Levine, R. Finance and Growth: Theory and Evidence; Working Paper 10766; National Bureau of Economic Research: Cambridge, MA, USA, 2004; pp. 1–5. [Google Scholar]

- Arestis, P. Financial liberalization and the relationship between finance and growth. In A Handbook of Alternative Monetary Economics; Arestis, P., Sawyer, M., Eds.; Edward Elgar Publishing: Cheltenham/Northampton, UK, 2006; pp. 346–364. [Google Scholar]

- Acemoğlu, D.; Johnson, S.; Robinson, A.J. Institutions as a fundamental cause of long-run growth. In Handbook of Economic Growth; Aghion, P., Durlauf, S.N., Eds.; Elsevier Science Publishers: Amsterdam, The Netherlands, 2005; Volume 1A, pp. 385–472. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Oxford University Press: Oxford, UK, 1961. [Google Scholar]

- Todaro, M.P.; Smith, S.C. Economic Development; Pearson Education: Boston, MA, USA, 2012. [Google Scholar]

- Levine, R. Finance and growth: Theory and evidence. In Handbook of Economic Growth; Aghion, P., Durlauf, S.N., Eds.; Elsevier Science Publishers: Amsterdam, The Netherlands, 2005; Volume 1A, pp. 865–934. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance, entrepreneurship, and growth: Theory and evidence. J. Monet. Econ. 1993, 32, 513–542. [Google Scholar] [CrossRef]

- Jalil, A.; Feridun, M. The Impact of Growth, Energy and Financial Development on the Environment in China: A Cointegration Analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Lee, J.M.; Chen, K.H.; Cho, C.H. The relationship between CO2 emissions and financial development: Evidence from OECD countries. Singap. Econ. Rev. 2015, 60, 1550117. [Google Scholar] [CrossRef]

- Sterpu, M.; Soava, G.; Mehedintu, A. Impact of Economic Growth and Energy Consumption on Greenhouse Gas Emissions: Testing Environmental Curves Hypotheses on EU Countries. Sustainability 2018, 10, 3327. [Google Scholar] [CrossRef]

- Omri, A.; Daly, S.; Rault, C.; Chaibi, A. Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ. 2015, 48, 242–252. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Ozturk, I.; Lean, H.H. The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat. Hazards 2016, 79, 621–644. [Google Scholar] [CrossRef]

- Dogan, E.; Turkekul, B. CO2 Emissions, Real Output, Energy Consumption, Trade, Urbanization and Financial Development: Testing the EKC Hypothesis for the USA. Environ. Sci. Pollut. Res. 2016, 23, 1203–1213. [Google Scholar] [CrossRef]

- Abbasi, F.; Riaz, K. CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 2016, 90, 102–114. [Google Scholar] [CrossRef]

- Frankel, J.A.; Romer, D. Does trade cause growth? Am. Econ. Rev. 1999, 89, 379–399. [Google Scholar] [CrossRef]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 49, 488–498. [Google Scholar] [CrossRef]

- Sustainable Financial System: Nine Priority Conditions to Address (2017). Principles for Responsible Investment. Available online: https://www.unpri.org/download?ac=5510 (accessed on 1 October 2019).

- Schoenmaker, D. Investing for the Common Good: A Sustainable Finance Framework; Bruegel Essay and Lecture Series; Bruegel: Brussels, Belgium, 2017; ISBN 978-9-078910-43-5. [Google Scholar]

- Chang, S.C. Effects of financial developments and income on energy consumption. Int. Rev. Econ. Financ. 2015, 35, 28–44. [Google Scholar] [CrossRef]

- Rafindadi, A.A.; Ozturk, I. Dynamic effects of financial development, trade openness and economic growth on energy consumption: Evidence from South Africa. Int. J. Energy Econ. Policy 2017, 7, 74–85. [Google Scholar]

- Rajan, R.G.; Zingales, L. Financial systems, industrial structure, and growth. Oxf. Rev. Econ. Policy 2001, 17, 467–482. [Google Scholar] [CrossRef]

- Allen, F.; Gu, X.; Kowalewski, O. Financial structure, economic growth and development. In Handbook of Finance and Development; Beck, T., Levine, R., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2018; pp. 31–62. [Google Scholar]

- Talukdar, D.; Meisner, C.M. Does the private sector help or hurt the environment? Evidence from carbon dioxide pollution in developing countries. World Dev. 2001, 29, 827–840. [Google Scholar] [CrossRef]

- Lapinskienė, G.; Peleckis, K.; Radavičius, M. Economic development and greenhouse gas emissions in the European Union countries. J. Bus. Econ. Manag. 2015, 16, 1109–1123. [Google Scholar] [CrossRef]

- Kumar, R.R.; Stauvermann, P.J.; Patel, A.; Kumar, R.D. Exploring the effects of energy consumption on output per worker: A study of Albania, Bulgaria, Hungary and Romania. Energy Policy 2014, 69, 575–585. [Google Scholar] [CrossRef]

- Kumar, R.R.; Stauvermann, P.J.; Patel, A.; Kumar, N. The effect of energy on output per worker in the Balkan Peninsula: A country-specific study of 12 nations in the energy community. Renew. Sustain. Energy Rev. 2017, 70, 1223–1239. [Google Scholar] [CrossRef]

- Malik, M.N.A.; Masih, M. The Relationship between Energy Consumption, Financial Development and Economic Growth: An Evidence from Malaysia Based on ARDL. 2017. Available online: https://www.researchgate.net/publication/324829394 (accessed on 13 August 2019).

- Musolesi, A.; Mazzanti, M.; Zoboli, R. A Bayesian Approach to the estimation of EKC for CO2. Appl. Econ. 2010, 42, 2275–2287. [Google Scholar] [CrossRef]

- Piaggio, M.; Padilla, E. CO2 emissions and economic activity: Heterogeneity across countries and non-stationary series. Energy Policy 2012, 46, 370–381. [Google Scholar] [CrossRef]

- Tiba, S.; Omri, A. Literature survey on the relationships between energy, environment and economic growth. Renew. Sustain. Energy Rev. 2017, 69, 1129–1146. [Google Scholar] [CrossRef]

- Lin, B.; Li, X. The effect of carbon tax on per capita CO2 emissions. Energy Policy 2011, 39, 5137–5146. [Google Scholar] [CrossRef]

- Plumer, B.; Popovic, N. These Countries Have Prices on Carbon. Are They Working? 2019. Available online: https://www.nytimes.com/interactive/2019/04/02/climate/pricing-carbon-emissions.html (accessed on 1 October 2019).

- Aydin, C.; Esen, Ö. Reducing CO2 emissions in the EU member states: Do environmental taxes work? J. Environ. Plan. Manag. 2018, 61, 2396–2420. [Google Scholar] [CrossRef]

- Morris, J.; Paltsev, S.; Reilly, J. Marginal abatement costs and marginal welfare costs for greenhouse gas emissions reductions: Results from the EPPA model. Environ. Modeling Assess. 2012, 17, 325–336. [Google Scholar] [CrossRef] [Green Version]

- Goldsmith, R.W. Financial Structure and Development; Yale University Press: New Haven, CT, USA, 1969; ISBN1 0300011806. ISBN2 978-0300011807. [Google Scholar]

- Scrimgeour, F.; Oxley, L.; Fatai, K. Reducing carbon emissions? The relative effectiveness of different types of environmental tax: The case of New Zealand. Environ. Model. Softw. 2005, 20, 1439–1448. [Google Scholar] [CrossRef] [Green Version]

- Fisher, C. Emissions pricing, spillovers, and public investment in environmentally friendly technologies. Energy Econ. 2008, 30, 487–502. [Google Scholar] [CrossRef] [Green Version]

- Bosetti, V.; Carraro, C.; Massettiand, E.; Tavoni, M. International energy. Energy Econ. 2008, 30, 2912–2929. [Google Scholar] [CrossRef]

- Lee, K.-H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar] [CrossRef] [Green Version]

- Apergis, N.; Eleftheriou, S.; Payne, J.E. The relationship between international financial reporting standards, carbon emissions, and R&D expenditures: Evidence from European manufacturing firms. Ecol. Econ. 2013, 88, 57–66. [Google Scholar] [CrossRef]

- Lapinskienė, G.; Peleckis, K.; Slavinskaitė, N. Energy consumption, economic growth and greenhouse gas emissions in the European Union countries. J. Bus. Econ. Manag. 2017, 18, 1082–1097. [Google Scholar] [CrossRef] [Green Version]

- Li, L.; Liu, D.; Hou, J.; Xu, D.; Chao, W. The Study of the Impact of Carbon Finance Effect on Carbon Emissions in Beijing-Tianjin-Hebei Region—Based on Logarithmic Mean Divisia Index Decomposition Analysis. Sutstainability 2019, 11, 1465. [Google Scholar] [CrossRef] [Green Version]

- Lewis, I.J. The evolving role of carbon finance in promoting renewable energy development in China. Energy Policy 2010, 38, 2875–2886. [Google Scholar] [CrossRef]

- Shahbaz, M.; Tiwari, A.K.; Nasir, M. The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 2013, 61, 452–1459. [Google Scholar] [CrossRef] [Green Version]

- Sadarosky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Sadarosky, P. Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 2011, 38, 999–1006. [Google Scholar] [CrossRef]

- Boutabba, M.A. The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 2014, 40, 33–41. [Google Scholar] [CrossRef] [Green Version]

- Islam, F.; Shahbaz, M.; Ahmed, A.U.; Alam, M.M. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Econ. Model. 2013, 30, 435–441. [Google Scholar] [CrossRef] [Green Version]

- Borghesi, S.; Vercelli, A. Greenhouse gas emissions and the energy system: Are current trends sustainable? Int. J. Glob. Energy Issues 2009, 32. [Google Scholar] [CrossRef] [Green Version]

- Pachauri, R.K.; Meyer, L.A. (Eds.) Climate Change 2014: Synthesis Report. In Contribution of Working Groups I, II and III to the Fifth Assessment; Report of the Intergovernmental Panel on Climate Change; IPCC: Geneva, Switzerland, 2014; p. 87. [Google Scholar]

- Available online: https://ec.europa.eu/eurostat/web/products-datasets/product?code=sdg_07_20 (accessed on 1 November 2019).

- Available online: https://ec.europa.eu/eurostat/web/products-datasets/-/t2020_rd310 (accessed on 1 November2019).

- Atalla, T.; Bean, P. Determinants of energy productivity in 39 countries: An empirical investigation. Energy Econ. 2017, 62, 217–229. [Google Scholar] [CrossRef]

- Available online: https://ec.europa.eu/eurostat/web/products-datasets/product?code=tsc00011 (accessed on 1 November 2019).

- Kabaklarli, E.; Duran, M.S.; Üçl, Y.T. High-technology exports and economic growth: panel data analysis for selected OECD countries. Forum Sci. Oeconomia 2018, 6, 47–60. [Google Scholar]

- Desmarchelier, B.; Djellal, F.; Gallouj, F. Knowledge intensive business services and long term growth. Struct. Chang. Econ. Dyn. 2013, 25, 188–205. [Google Scholar] [CrossRef] [Green Version]

- Available online: https://ec.europa.eu/eurostat/web/products-datasets/product?code=sdg_08_11 (accessed on 1 November 2019).

- McQuinn, K.; Whelan, K. The Prospects for Future Economic Growth in the Euro Area; ZBW—Leibniz Information Centre for Economics: Kiel, Germany, 2016; pp. 305–311. [Google Scholar]

- Available online: https://ec.europa.eu/eurostat/web/products-datasets/-/sdg_10_10 (accessed on 1 November 2019).

- Magnien, F. The Measure of GDP Per Capita in Purchasing Power Standards: A Statistical Indicator Tricky to Interpret; OECD Meeting of National Accounts Experts; OECD: Paris, France, 2002. [Google Scholar]

- Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Glossary:Income_quintile_share_ratio (accessed on 1 November 2019).

- Razvan, B.; Boldea, B.I. Sustainability of Economic Growth and Inequality in Incomes Distribution. Ann. Fac. Econ. 2012, 1, 249–254. [Google Scholar]

- OECD Data. Available online: https://data.oecd.org/rd/gross-domestic-spending-on-r-d.htm (accessed on 1 November 2019).

- Sokolov-Mladenović, S.; Cvetanović, S.; Mladenović, I. R&D expenditure and economic growth: EU28 evidence for the period 2002–2012. J. Econ. Res. Ekon. Istraživanja 2015, 29, 1005–1020. [Google Scholar] [CrossRef] [Green Version]

- EU Open Data Portal. Available online: http://data.europa.eu/euodp/data/dataset/PmWRwlFr5uB3Fn1oD9Orw (accessed on 1 November 2019).

- Morley, B.; Abdullah, S. Environmental Taxes and Economic Growth: Evidence from Panel Causality Tests. Bath Econ. Res. Pap. 2010, 42, 27–33. [Google Scholar]

| EU 28 | Developed Economies (WE) | Converging Economies (CEE) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Average | France | Germany | Italy | UK | Czech Rep. | Hungary | Lithuania | Poland | |

| 2008 | 8424 | 6025 | 10,111 | 7399 | 8897 | 11,461 | 5549 | 7477 | 9387 |

| 2011 | 7622 | 5397 | 9674 | 6330 | 7512 | 10,448 | 5009 | 6996 | 9325 |

| 2014 | 6988 | 4935 | 9491 | 5203 | 6747 | 9554 | 4634 | 7365 | 8752 |

| 2017 | 6903 | 4869 | 9126 | 5197 | 5738 | 9528 | 5067 | 8294 | 9290 |

| EU 28 | Developed Economies (WE) | Converging Economies (CEE) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Average | France | Germany | Italy | UK | Czech Rep. | Hungary | Lithuania | Poland | |

| 2008 | 605 | 688 | 738 | 571 | 688 | 627 | 599 | 485 | 516 |

| 2011 | 568 | 595 | 680 | 545 | 597 | 654 | 659 | 506 | 528 |

| 2014 | 525 | 562 | 636 | 486 | 554 | 622 | 556 | 478 | 499 |

| 2017 | 563 | 608 | 684 | 543 | 561 | 678 | 643 | 515 | 525 |

| EU 28 | Developed Economies (WE) | Converging Economies (CEE) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Average | France | Germany | Italy | UK | Czech Rep. | Hungary | Lithuania | Poland | |

| 2008 | 7.1 | 7.3 | 7.7 | 8.9 | 8.5 | 3.5 | 3.9 | 3.4 | 3.4 |

| 2011 | 7.4 | 7.6 | 8.3 | 9.3 | 9.4 | 3.6 | 3.9 | 4.1 | 3.7 |

| 2014 | 8.0 | 8.1 | 8.7 | 10.2 | 10.5 | 3.8 | 4.4 | 4.9 | 4.3 |

| 2017 | 8.3 | 8.4 | 9.0 | 9.9 | 11.3 | 4.2 | 4.3 | 4.8 | 4.3 |

| EU 28 | Developed Economies (WE) | Converging Economies (CEE) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Average | France | Germany | Italy | UK | Czech Rep. | Hungary | Lithuania | Poland | |

| 2008 | 1.83 | 2.06 | 2.60 | 1.16 | 1.62 | 1.24 | 0.98 | 0.79 | 0.60 |

| 2011 | 1.97 | 2.19 | 2.80 | 1.21 | 1.66 | 1.56 | 1.19 | 0.90 | 0.75 |

| 2014 | 2.03 | 2.23 | 2.87 | 1.34 | 1.66 | 1.97 | 1.35 | 1.03 | 0.94 |

| 2017 | 2.06 | 2.19 | 3.02 | 1.35 | 1.66 | 1.79 | 1.35 | 0.89 | 1.03 |

| EU 28 | Developed Economies (WE) | Converging Economies (CEE) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Average | France | Germany | Italy | UK | Czech Rep. | Hungary | Lithuania | Poland | |

| 2008 | 6.03 | 4.32 | 5.68 | 6.22 | 6.54 | 6.81 | 6.76 | 5.34 | 7.74 |

| 2011 | 6.37 | 4.43 | 5.83 | 7.36 | 7.22 | 6.95 | 7.17 | 6.20 | 8.27 |

| 2014 | 6.33 | 4.45 | 5.21 | 8.32 | 7.47 | 6.18 | 6.52 | 6.31 | 8.08 |

| 2017 | 6.14 | 4.96 | 4.62 | 7.91 | 7.02 | 5.86 | 6.61 | 6.48 | 7.86 |

| EU 28 | Developed Economies (WE) | Converging Economies (CEE) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Average | France | Germany | Italy | UK | Czech Rep. | Hungary | Lithuania | Poland | |

| 2008 | 22.91 | 23.60 | 20.33 | 21.24 | 17.15 | 28.96 | 23.15 | 26.04 | 23.10 |

| 2011 | 20.60 | 22.42 | 20.27 | 19.65 | 15.53 | 26.45 | 19.67 | 18.48 | 20.68 |

| 2014 | 19.88 | 21.82 | 19.99 | 16.74 | 16.58 | 25.13 | 22.17 | 18.88 | 19.73 |

| 2017 | 20.77 | 22.51 | 20.31 | 17.62 | 17.15 | 24.77 | 22.23 | 19.19 | n/a |

| Coefficient | Std. Error | t-Ratio | p Value | ||

|---|---|---|---|---|---|

| Const | 18,358.3 | 4780.27 | 3.8404 | 0.00028 | *** |

| E1_Employment_in_high_&_medium_sect. | −1345.83 | 405.022 | −3.3229 | 0.00146 | *** |

| E2_Investment_share_in_GDP | 88.9586 | 20.8048 | 4.2759 | 0.00006 | *** |

| E3_Purchasing_power_adjusted_GDP | 0.939344 | 0.200854 | 4.6768 | 0.00001 | *** |

| E4_Inequality_of_income_distribution | −1286.72 | 680.127 | −1.8919 | 0.06290 | * |

| sq_E1_ Employment_in_high_&_medium_sect. | 57.6071 | 23.5942 | 2.4416 | 0.01731 | ** |

| sq_E3_ Purchasing_power_adjusted_GDP | −1.63274 × 10−5 | 5.14176 × 10−6 | −3.1754 | 0.00227 | *** |

| sq_E4_ Inequality_of_income_distribution | 103.603 | 53.2065 | 1.9472 | 0.05577 | * |

| F1_Gross_domestic_expendit_on_R&D | −2165.68 | 929.304 | −2.3304 | 0.02285 | ** |

| F2_Share_of_environmental_taxes | 1350.97 | 556.048 | 2.4296 | 0.01784 | ** |

| sq_F1_ Gross_domestic_expendit_on_R&D | 640.327 | 301.342 | 2.1249 | 0.03734 | ** |

| sq_F2_ Share_of_environmental_taxes | −79.8611 | 31.5521 | −2.5311 | 0.01376 | ** |

| C1_Energy_productivity | −8689.06 | 1487.32 | −5.8421 | <0.00001 | *** |

| sq_C1_Energy_productivity | 913.765 | 177.627 | 5.1443 | <0.00001 | *** |

| Statistics and Test Results | |||||

| Mean-dependent var. | 7823.511 | S.D.-dependent var | 3000.654 | ||

| Sum-squared resid | 10,020,500 | S.E. of regression | 389.6483 | ||

| LSDV R-squared | 0.987208 | Within R-squared | 0.660897 | ||

| LSDV F(21, 66) | 242.5464 | p value (F) | 2.80 × 10−54 | ||

| Log-likelihood | −637.1501 | Akaike criterion | 1318.300 | ||

| Schwarz criterion | 1372.802 | Hannan-Quinn | 1340.257 | ||

| Rho | −0.012608 | Durbin-Watson | 1.785745 | ||

| Joint test on named regressors: F(13, 66) = 9.89471 with p = 4.60643 × 10−11 | |||||

| Test for differing group intercepts: F(8, 66) = 53.0673 with p = 8.39721 × 10−26 | |||||

| Coefficient | Std. Error | t-Ratio | p Value | ||

|---|---|---|---|---|---|

| Const | 3449.59 | 2178.2 | 1.5837 | 0.11997 | |

| E1_Employment_in_high_&_medium_sect. | 350.195 | 114.932 | 3.0470 | 0.00379 | *** |

| E2_Investment_share_in_GDP | 120.109 | 16.5245 | 7.2685 | <0.00001 | *** |

| F1_Gross_domestic_expendit._on_R&D | −1032.17 | 351.535 | −2.9362 | 0.00513 | *** |

| F2_Share_of_environmental_taxes | −873.614 | 305.862 | −2.8562 | 0.00636 | *** |

| sq_F2_ Share_of_environmental_taxes | 52.3494 | 21.7501 | 2.4069 | 0.02007 | ** |

| C1_Energy_productivity | 1747.49 | 478.134 | 3.6548 | 0.00065 | *** |

| sq_C1_Energy_productivity | −134.512 | 25.5734 | −5.2598 | <0.00001 | *** |

| Statistics and Test Results | |||||

| Mean-dependent var | 7405.777 | S.D.-dependent var | 2070.904 | ||

| Sum-squared resid | 1,368,118 | S.E. of regression | 170.6133 | ||

| LSDV R-squared | 0.994593 | Within R-squared | 0.929965 | ||

| LSDV F(12, 47) | 720.4606 | p value (F) | 5.59 × 10−49 | ||

| Log-likelihood | −386.1744 | Akaike criterion | 798.3488 | ||

| Schwarz criterion | 825.5752 | Hannan-Quinn | 808.9985 | ||

| Rho | −0.083384 | Durbin-Watson | 1.976225 | ||

| Joint test on named regressors: F(7, 47) = 89.1566 with p = 5.93021 × 10−25 | |||||

| Test for differing group intercepts: F(5, 47) = 287.814 with p = 4.98846 × 10−34 | |||||

| 2008 | 2011 | 2014 | 2017 | |

|---|---|---|---|---|

| E1_Employment_in_high_&_medium_sect. | 12% | 11% | 11% | 12% |

| E2_Investment_share_in_GDP | 5% | 4% | 4% | 4% |

| E3_Purchasing_power_adjusted_GDP | 22% | 23% | 23% | 24% |

| E4_Inequality_of_income_distribution | 8% | 8% | 8% | 8% |

| F1_Gross_domestic_expendit._on_R&D | 3% | 3% | 3% | 3% |

| F2_Share_of_environmental_taxes | 11% | 12% | 11% | 11% |

| C1_Energy_productivity | 39% | 39% | 39% | 39% |

| 2008 | 2011 | 2014 | 2017 | |

|---|---|---|---|---|

| E1_Employment_in_high_&_medium_sect. | 13% | 12% | 12% | 13% |

| E2_Investment_share_in_GDP | 18% | 16% | 16% | 17% |

| F1_Gross_domestic_expendit_on_R&D | 12% | 13% | 14% | 14% |

| F2_Share_of_environmental_taxes | 22% | 23% | 24% | 24% |

| C1_Energy_productivity | 36% | 36% | 34% | 33% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ziolo, M.; Kluza, K.; Spoz, A. Impact of Sustainable Financial and Economic Development on Greenhouse Gas Emission in the Developed and Converging Economies. Energies 2019, 12, 4514. https://doi.org/10.3390/en12234514

Ziolo M, Kluza K, Spoz A. Impact of Sustainable Financial and Economic Development on Greenhouse Gas Emission in the Developed and Converging Economies. Energies. 2019; 12(23):4514. https://doi.org/10.3390/en12234514

Chicago/Turabian StyleZiolo, Magdalena, Krzysztof Kluza, and Anna Spoz. 2019. "Impact of Sustainable Financial and Economic Development on Greenhouse Gas Emission in the Developed and Converging Economies" Energies 12, no. 23: 4514. https://doi.org/10.3390/en12234514