Water-Energy Management for Demand Charges and Energy Cost Optimization of a Pumping Stations System under a Renewable Virtual Power Plant Model

Abstract

:1. Introduction

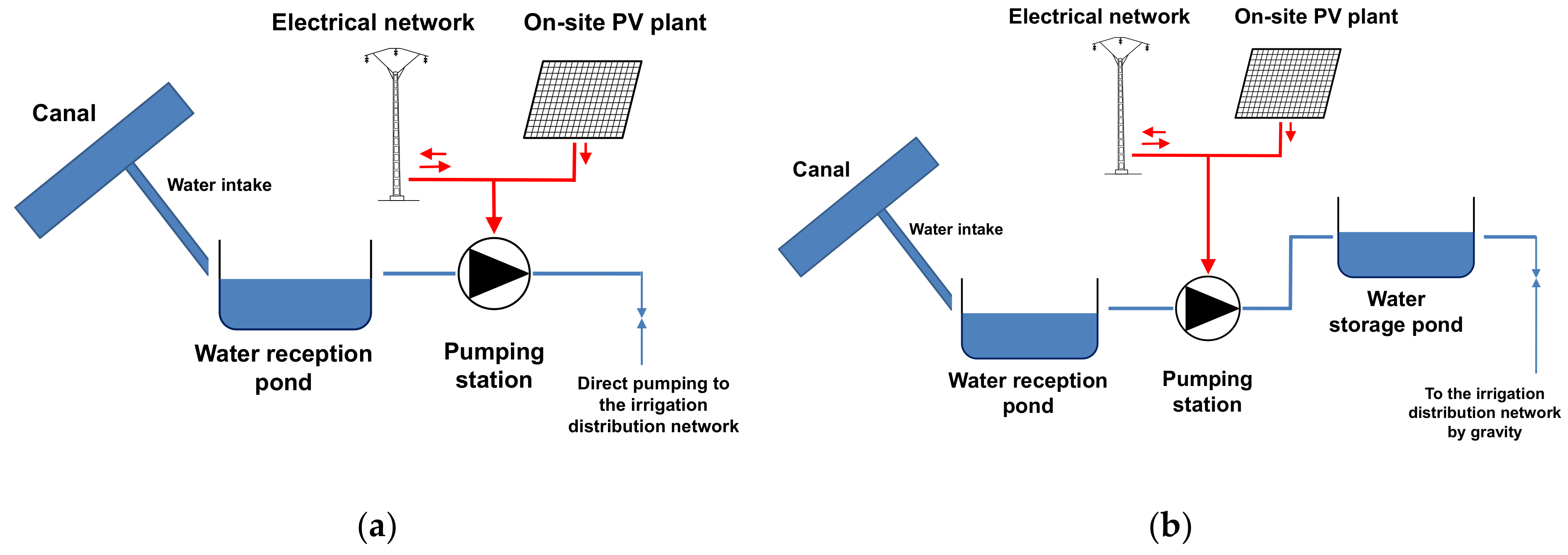

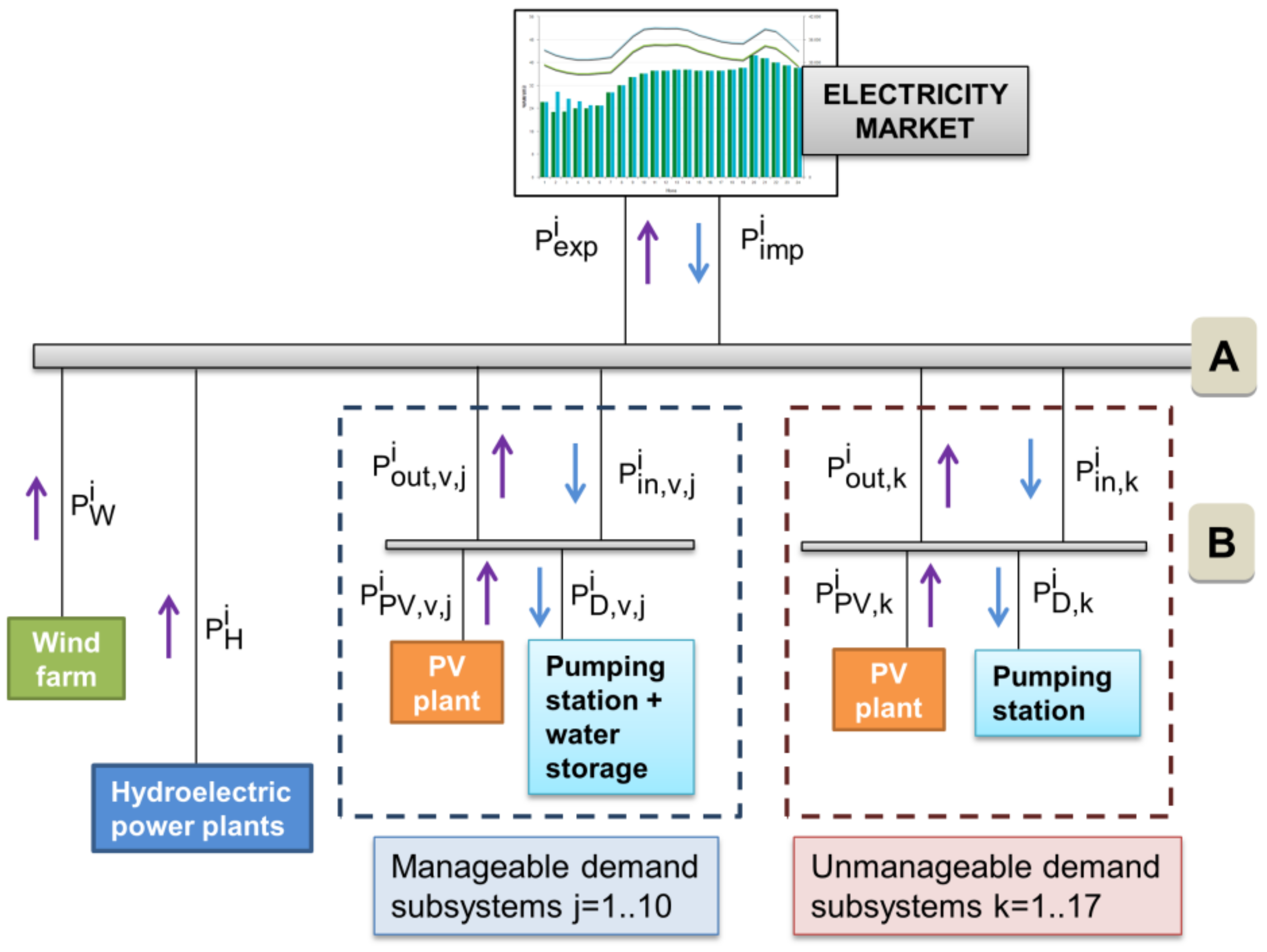

2. Problem Statement

3. Mathematical Model

- import/export of energy from the global system (/)

- import/export of energy from each pumping station with self-consumption (, /, )

- excess power ()The model also returns, in each hour, the optimal hourly values of:

- production of electricity from its own sources with renewable energy: hydroelectric, wind, photovoltaic ()

- energy imported/exported from the global system (/) and subsystems (, /, )

- hourly electricity demand in each pumping station with water storage ()

- Objective function

- Constraints

4. Case Study

4.1. Data

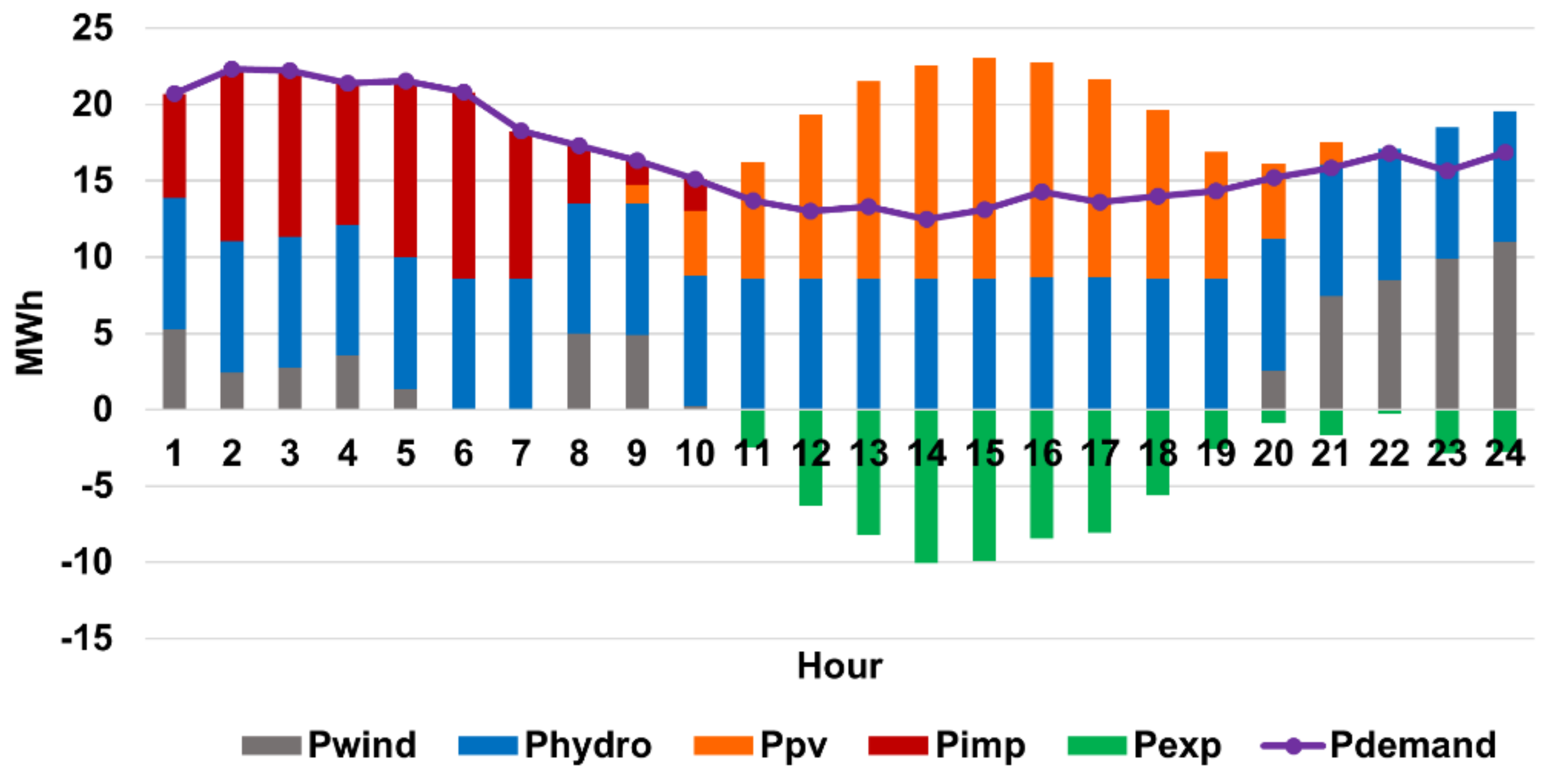

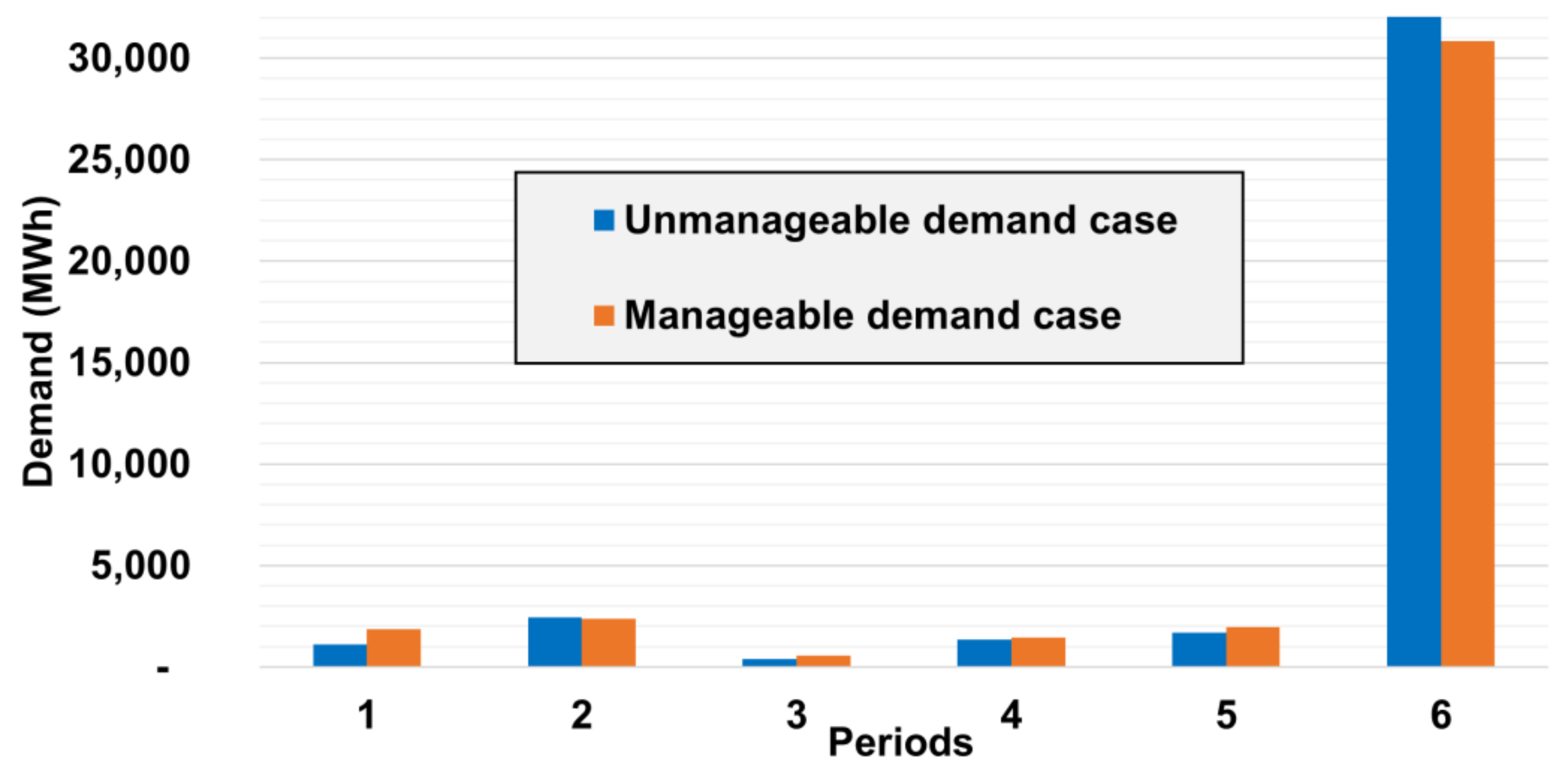

4.2. Results and Discussion

5. Analysis of the Influence of the Electricity Market Price

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Indexes | |

| i | index for number of hours |

| p | index for pricing periods |

| n | index for number of hours exceeding the maximum contracted demand |

| m | index for number of months |

| z | index for number of days |

| j | index for pumping stations with manageable demand |

| k | index for pumping stations with unmanageable demand |

| Data | |

| hourly price for selling energy | |

| hourly price for purchasing energy | |

| wind technology operation and maintenance cost | |

| hydroelectric technology operation and maintenance cost | |

| photovoltaic technology operation and maintenance cost | |

| price of the annual power term according to pricing period p | |

| hourly demand of each pumping station k | |

| daily demand of each pumping station j | |

| maximum hourly demand of each pumping station j | |

| hourly power from photovoltaic generation | |

| maximum available hourly power from wind generation | |

| maximum available hourly power from hydroelectric generation | |

| maximum hourly power exported from the global system | |

| maximum hourly power imported from the global system | |

| constant of excess power according to pricing period p | |

| Kex | excess power factor (€/kW) |

| Variables | |

| hourly power exported from the global system | |

| hourly power imported from the global system | |

| hourly power from wind generation | |

| hourly power from hydroelectric generation | |

| hourly power imported from subsystems k/j | |

| hourly power exported from subsystems k/j | |

| hourly demand in each pumping station with water storage j | |

| binary variable equal to 1 if power is exported from the global system; otherwise, it will be equal to 0 | |

| binary variable equal to 1 if power is imported to the global system and, otherwise, it will be equal to 0 | |

| binary variable equal to 1 if power is imported to the pumping stations k/j and, otherwise, it will be equal to 0 | |

| binary variable equal to 1 if power is exported from pumping stations k/j and, otherwise, it will be equal to 0 | |

| demand contracted in each pricing period p (p = 1.6) | |

| positive excess power in each pricing period p (p = 1.6) | |

| excess power in each pricing period p (p = 1.6) | |

| binary variable equal to 1 if excess power is produced; otherwise, it will be equal to 0 | |

| total hourly incoming power from the general bus to pumping stations | |

Appendix A

| Pumping Station | Electricity Consumption (MWh) | Pumping Station | Electricity Consumption (MWh) | Pumping Station | Electricity Consumption (MWh) |

|---|---|---|---|---|---|

| 1 | 746 | 10 | 284 | 19 | 656 |

| 2 | 2223 | 11 | 1011 | 20 | 900 |

| 3 | 965 | 12 | 1282 | 21 | 1615 |

| 4 | 4419 | 13 | 1045 | 22 | 1592 |

| 5 | 2112 | 14 | 2361 | 23 | 2688 |

| 6 | 2555 | 15 | 450 | 24 | 2014 |

| 7 | 843 | 16 | 622 | 25 | 1053 |

| 8 | 530 | 17 | 3732 | 26 | 192 |

| 9 | 2036 | 18 | 278 | 27 | 801 |

| Total electricity consumption (GWh) | 39 | ||||

| Hydroelectric Power Plant | Installed Capacity |

|---|---|

| 1 | 4.4 |

| 2 | 0.9 |

| 3 | 1.2 |

| 4 | 1.1 |

| 5 | 5.0 |

| 6 | 2.1 |

| Total capacity | 14.7 |

| Pumping Station | Installed PV Capacity (kW) | Pumping Station | Installed pv Capacity (kw) | Pumping Station | Installed PV Capacity (kW) |

|---|---|---|---|---|---|

| 1 | 325 | 10 | 225 | 19 | 255 |

| 2 | 700 | 11 | 400 | 20 | 350 |

| 3 | 300 | 12 | 420 | 21 | 750 |

| 4 | 975 | 13 | 230 | 22 | 750 |

| 5 | 941 | 14 | 600 | 23 | 715 |

| 6 | 1106 | 15 | 575 | 24 | 815 |

| 7 | 367 | 16 | 230 | 25 | 445 |

| 8 | 301 | 17 | 1005 | 26 | 877 |

| 9 | 1000 | 18 | 230 | 27 | 585 |

| Total installed capacity (MW) | 15.5 | ||||

| Period | Hydropower Generation | Wind Power Generation | Photovoltaic Generation |

|---|---|---|---|

| P1 | 3206 | 6806 | 3874 |

| P2 | 3841 | 10,684 | 2473 |

| P3 | 2416 | 4879 | 2057 |

| P4 | 4007 | 9224 | 3099 |

| P5 | 6239 | 10,014 | 5588 |

| P6 | 29,226 | 63,096 | 10,553 |

| Total generation | 48,934 | 104,703 | 27,645 |

References

- Saboori, H.; Mohammadi, N.A.; Taghe, R. Virtual Power Plant (VPP), Definition, Concept, Components and Types. In Proceedings of the 2011 Asia-Pacific Power and Energy Engineering Conference, Institute of Electrical and Electronics Engineers (IEEE), Wuhan, China, 25–28 March 2011; pp. 1–4. [Google Scholar]

- El Bakari, K.; Kling, W.L. Virtual power plants: An answer to increasing distributed generation. In Proceedings of the 2010 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT Europe), Gothenberg, Sweden, 11–13 October 2010; pp. 1–6. [Google Scholar] [CrossRef] [Green Version]

- Ghavidel, S.; Li, L.; Aghaei, J.; Yu, T.; Zhu, J. A review on the virtual power plant: Components and operation systems. In Proceedings of the 2016 IEEE International Conference on Power System Technology (POWERCON), Institute of Electrical and Electronics Engineers (IEEE), Wollongong, NSW, Australia, 28 September–1 October 2016; pp. 1–6. [Google Scholar]

- Cheng, L.; Zhou, X.; Yun, Q.; Tian, L.; Wang, X.; Liu, Z. A Review on Virtual Power Plants Interactive Resource Characteristics and Scheduling Optimization. In Proceedings of the 2019 IEEE 3rd Conference on Energy Internet and Energy System Integration (EI2), Institute of Electrical and Electronics Engineers (IEEE), Changsha, China, 8–10 November 2019; pp. 514–519. [Google Scholar]

- Zhang, G.; Jiang, C.; Wang, X. Comprehensive review on structure and operation of virtual power plant in electrical system. IET Gener. Transm. Distrib. 2019, 13, 145–156. [Google Scholar] [CrossRef]

- Yavuz, L.; Onen, A.; Muyeen, S.; Kamwa, I.; Innocent, K. Transformation of microgrid to virtual power plant–a comprehensive review. IET Gener. Transm. Distrib. 2019, 13, 1994–2005. [Google Scholar] [CrossRef]

- Nosratabadi, S.M.; Hooshmand, R.-A.; Gholipour, E. A comprehensive review on microgrid and virtual power plant concepts employed for distributed energy resources scheduling in power systems. Renew. Sustain. Energy Rev. 2017, 67, 341–363. [Google Scholar] [CrossRef]

- Kakran, S.; Chanana, S. Smart operations of smart grids integrated with distributed generation: A review. Renew. Sustain. Energy Rev. 2018, 81, 524–535. [Google Scholar] [CrossRef]

- Wang, X.; Liu, Z.; Zhang, H.; Zhao, Y.; Shi, J.; Ding, H. A Review on Virtual Power Plant Concept, Application and Challenges. In Proceedings of the 2019 IEEE Innovative Smart Grid Technologies-Asia (ISGT Asia), Institute of Electrical and Electronics Engineers (IEEE), Chengdu, China, 21–24 May 2019; pp. 4328–4333. [Google Scholar]

- Plancke, G.; De Vos, K.; Belmans, R.; Delnooz, A.; Glenn, P. Virtual power plants: Definition, applications and barriers to the implementation in the distribution system. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Institute of Electrical and Electronics Engineers (IEEE), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar]

- Pudjianto, D.; Ramsay, C.; Strbac, G. Virtual Power Plant and System Integration of Distributed Energy Resources. IET Renew. Power Gener. 2007, 1, 10–16. [Google Scholar] [CrossRef]

- Moreno, B.; Díaz, G. The impact of virtual power plant technology composition on wholesale electricity prices: A comparative study of some European Union electricity markets. Renew. Sustain. Energy Rev. 2019, 99, 100–108. [Google Scholar] [CrossRef]

- Paraschiv, F.; Erni, D.; Pietsch, R. The impact of renewable energies on EEX day-ahead electricity prices. Energy Policy 2014, 73, 196–210. [Google Scholar] [CrossRef] [Green Version]

- Beguin, A.; Nicolet, C.; Kawkabani, B.; Avellan, F. Virtual power plant with pumped storage power plant for renewable energy integration. In Proceedings of the 2014 International Conference on Electrical Machines (ICEM), Institute of Electrical and Electronics Engineers (IEEE), Berlin, Germany, 2–5 September 2014; pp. 1736–1742. [Google Scholar]

- Vuc, G.; Borlea, I.; Jigoria-Oprea, D.; Teslovan, R. Virtual power plant strategy for renewable resources aggregation. Eurocon 2013, 737–743. [Google Scholar] [CrossRef]

- Pandzic, H.; Kuzle, I.; Capuder, T. Virtual power plant mid-term dispatch optimization. Appl. Energy 2013, 101, 134–141. [Google Scholar] [CrossRef]

- Tajeddini, M.A.; Rahimi-Kian, A.; Soroudi, A. Risk averse optimal operation of a virtual power plant using two stage stochastic programming. Energy 2014, 73, 958–967. [Google Scholar] [CrossRef] [Green Version]

- Shabanzadeh, M.; Eslami-Kalantari, M.; Haghifam, M.-R. An interactive cooperation model for neighboring virtual power plants. Appl. Energy 2017, 200, 273–289. [Google Scholar] [CrossRef]

- Liu, Z.; Zheng, W.; Qi, F.; Wang, L.; Zou, B.; Wen, F.; Xue, Y. Optimal Dispatch of a Virtual Power Plant Considering Demand Response and Carbon Trading. Energies 2018, 11, 1488. [Google Scholar] [CrossRef] [Green Version]

- Soares, J.; Ghazvini, M.A.F.; Borges, N.; Vale, Z. A stochastic model for energy resources management considering demand response in smart grids. Electr. Power Syst. Res. 2017, 143, 599–610. [Google Scholar] [CrossRef] [Green Version]

- Naval, N.; Sánchez, R.; Yusta, J.M. A virtual power plant optimal dispatch model with large and small-scale distributed renewable generation. Renew. Energy 2020, 151, 57–69. [Google Scholar] [CrossRef]

- Mohammadi, S.; Soleymani, S.; Mozafari, B. Scenario-based stochastic operation management of MicroGrid including Wind, Photovoltaic, Micro-Turbine, Fuel Cell and Energy Storage Devices. Int. J. Electr. Power Energy Syst. 2014, 54, 525–535. [Google Scholar] [CrossRef]

- Qiu, J.; Meng, K.; Zheng, Y.; Dong, Z.Y. Optimal scheduling of distributed energy resources as a virtual power plant in a transactive energy framework. IET Gener. Transm. Distrib. 2017, 11, 3417–3427. [Google Scholar] [CrossRef]

- Nosratabadi, S.M.; Hooshmand, R.-A.; Gholipour, M. Stochastic profit-based scheduling of industrial virtual power plant using the best demand response strategy. Appl. Energy 2016, 164, 590–606. [Google Scholar] [CrossRef]

- Hadayeghparast, S.; Farsangi, A.S.; Shayanfar, H. Day-ahead stochastic multi-objective economic/emission operational scheduling of a large scale virtual power plant. Energy 2019, 172, 630–646. [Google Scholar] [CrossRef]

- Zamani, A.G.; Zakariazadeh, A.; Jadid, S. Day-ahead resource scheduling of a renewable energy based virtual power plant. Appl. Energy 2016, 169, 324–340. [Google Scholar] [CrossRef]

- Huang, C.; Yue, N.; Xie, J.; Yu, H.; Wang, K. Economic dispatch of power systems with virtual power plant based interval optimization method. CSEE J. Power Energy Syst. 2016, 2, 74–80. [Google Scholar] [CrossRef]

- Bourbon, R.; Ngueveu, S.U.; Roboam, X.; Sareni, B.; Turpin, C.; Hernandez-Torres, D. Energy management optimization of a smart wind power plant comparing heuristic and linear programming methods. Math. Comput. Simul. 2019, 158, 418–431. [Google Scholar] [CrossRef] [Green Version]

- Karimyan, P.; Hosseinian, S.H.; Khatami, R.; Abedi, M. Stochastic approach to represent distributed energy resources in the form of a virtual power plant in energy and reserve markets. IET Gener. Transm. Distrib. 2016, 10, 1792–1804. [Google Scholar] [CrossRef]

- Zamani, A.G.; Zakariazadeh, A.; Jadid, S.; Kazemi, A. Stochastic operational scheduling of distributed energy resources in a large scale virtual power plant. Int. J. Electr. Power Energy Syst. 2016, 82, 608–620. [Google Scholar] [CrossRef]

- Baringo, A.; Baringo, L.; Arroyo, J.M. Day-Ahead Self-Scheduling of a Virtual Power Plant in Energy and Reserve Electricity Markets Under Uncertainty. IEEE Trans. Power Syst. 2018, 34, 1881–1894. [Google Scholar] [CrossRef]

- Jafari, M.; Foroud, A.A. A medium/long-term auction-based coalition-forming model for a virtual power plant based on stochastic programming. Int. J. Electr. Power Energy Syst. 2020, 118, 105784. [Google Scholar] [CrossRef]

- Shabanzadeh, M.; Eslami-Kalantari, M.; Haghifam, M.-R. A medium-term coalition-forming model of heterogeneous DERs for a commercial virtual power plant. Appl. Energy 2016, 169, 663–681. [Google Scholar] [CrossRef]

- Tan, Z.; Wang, G.; Ju, L.; Tan, Q.; Yang, W. Application of CVaR risk aversion approach in the dynamical scheduling optimization model for virtual power plant connected with wind-photovoltaic-energy storage system with uncertainties and demand response. Energy 2017, 124, 198–213. [Google Scholar] [CrossRef] [Green Version]

- Pazouki, S.; Haghifam, M.-R. Optimal planning and scheduling of energy hub in presence of wind, storage and demand response under uncertainty. Int. J. Electr. Power Energy Syst. 2016, 80, 219–239. [Google Scholar] [CrossRef]

- Kardakos, E.G.; Simoglou, C.K.; Bakirtzis, A. Optimal Offering Strategy of a Virtual Power Plant: A Stochastic Bi-Level Approach. IEEE Trans. Smart Grid 2015, 7, 1. [Google Scholar] [CrossRef]

- Wozabal, D.; Rameseder, G. Optimal bidding of a virtual power plant on the Spanish day-ahead and intraday market for electricity. Eur. J. Oper. Res. 2020, 280, 639–655. [Google Scholar] [CrossRef]

- Riveros, J.Z.; Bruninx, K.; Poncelet, K.; D’Haeseleer, W. Bidding strategies for virtual power plants considering CHPs and intermittent renewables. Energy Convers. Manag. 2015, 103, 408–418. [Google Scholar] [CrossRef]

- Rahimiyan, M.; Baringo, L. Strategic Bidding for a Virtual Power Plant in the Day-Ahead and Real-Time Markets: A Price-Taker Robust Optimization Approach. IEEE Trans. Power Syst. 2015, 31, 2676–2687. [Google Scholar] [CrossRef]

- Baringo, A.; Baringo, L. A Stochastic Adaptive Robust Optimization Approach for the Offering Strategy of a Virtual Power Plant. IEEE Trans. Power Syst. 2017, 32, 3492–3504. [Google Scholar] [CrossRef]

- Baringo, A.; Baringo, L.; Arroyo, J.M. Self Scheduling of a Virtual Power Plant in Energy and Reserve Electricity Markets: A Stochastic Adaptive Robust Optimization Approach. In Proceedings of the 2018 Power Systems Computation Conference (PSCC), Institute of Electrical and Electronics Engineers (IEEE), Dublin, Ireland, 11–15 June 2018. [Google Scholar]

- Loßner, M.; Böttger, D.; Bruckner, T. Economic assessment of virtual power plants in the German energy market—A scenario-based and model-supported analysis. Energy Econ. 2017, 62, 125–138. [Google Scholar] [CrossRef]

- Candra, D.I.; Hartmann, K.; Nelles, M. Economic Optimal Implementation of Virtual Power Plants in the German Power Market. Energies 2018, 11, 2365. [Google Scholar] [CrossRef]

- Royal Decree 1164/2001. Access Tariffs to Electricity Transmission and Distribution Networks. Available online: https://www.boe.es/buscar/doc.php?id=BOE-A-2001-20850 (accessed on 18 March 2020).

- Orden IET/107/2014. Review of Access Tolls for Electricity. Available online: https://www.boe.es/buscar/doc.php?id=BOE-A-2014-1052 (accessed on 18 March 2020).

- Lingo. Available online: https://www.lindo.com/index.php/products/lingo-and-optimization-modeling?catid=89&id=88:powerful-lingo-solvers (accessed on 10 January 2020).

- Hillier, F.S.; Lieberman, G.J. Advance Praise for Introduction to Operations Research, 7th ed.; McGraw-Hill: New York, NY, USA, 2000. [Google Scholar]

- Home|CNMC. Available online: https://www.cnmc.es/ (accessed on 20 January 2020).

| Period | Kp | |

|---|---|---|

| P1 | 39.139427 | 1 |

| P2 | 19.586654 | 0.5 |

| P3 | 14.334178 | 0.37 |

| P4 | 14.334178 | 0.37 |

| P5 | 14.334178 | 0.37 |

| P6 | 6.540177 | 0.17 |

| Total Installed Capacity (MW) | Total Energy (MWh) | Operating and Maintenance Cost (€/MWh) | |

|---|---|---|---|

| Demand | - | 39,003 | - |

| Hydropower generation | 14.7 | 48,934 | 16.19 |

| Wind power generation | 30 | 104,703 | 16.49 |

| hotovoltaic generation | 15.5 | 27,645 | 7.40 |

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| P1 | 132 | 120 | - | - | - | 88 | 168 | - | - | - | - | 114 | 622 |

| P2 | 220 | 200 | - | - | - | 88 | 168 | - | - | - | - | 190 | 866 |

| P3 | - | - | 138 | - | - | 66 | - | - | 120 | - | 120 | - | 444 |

| P4 | - | - | 230 | - | - | 110 | - | - | 200 | - | 200 | - | 740 |

| P5 | - | - | - | 320 | 368 | - | - | - | - | 352 | - | - | 1040 |

| P6 | 392 | 352 | 376 | 400 | 376 | 368 | 408 | 744 | 400 | 392 | 400 | 440 | 5048 |

| Total | 744 | 672 | 744 | 720 | 744 | 720 | 744 | 744 | 720 | 744 | 720 | 744 | 8760 |

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| P1 | 13 | 10 | - | - | - | 316 | 754 | - | - | - | - | 30 | 1124 |

| P2 | 23 | 18 | - | - | - | 613 | 1724 | - | - | - | - | 54 | 2432 |

| P3 | - | - | 57 | - | - | 129 | - | - | 197 | - | 23 | - | 405 |

| P4 | - | - | 91 | - | - | 392 | - | - | 808 | - | 42 | - | 1334 |

| P5 | - | - | - | 378 | 1111 | - | - | - | - | 187 | - | - | 1676 |

| P6 Total | 88 125 | 74 102 | 452 601 | 1239 1617 | 2834 3945 | 4459 5910 | 7372 9849 | 10,647 10,647 | 3475 4480 | 941 1128 | 145 210 | 307 391 | 32,032 39,003 |

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| P1 | 6 | 7 | - | - | - | 533 | 1289 | - | - | - | - | 24 | 1858 |

| P2 | 12 | 13 | - | - | - | 617 | 1669 | - | - | - | - | 47 | 2358 |

| P3 | - | - | 50 | - | - | 183 | - | - | 313 | - | 15 | - | 562 |

| P4 | - | - | 64 | - | - | 415 | - | - | 930 | - | 32 | - | 1442 |

| P5 | - | - | - | 392 | 1265 | - | - | - | - | 296 | - | - | 1952 |

| P6 Total | 107 125 | 82 102 | 486 601 | 1225 1617 | 2681 3945 | 4162 5910 | 6891 9849 | 10,647 10,647 | 3236 4480 | 832 1128 | 162 210 | 320 391 | 30,832 39,003 |

| CASES | PPV (MWh) | PH (MWh) | PW (MWh) | Pexp (MWh) | Pimp (MWh) | PD (MWh) | Demand coverage |

|---|---|---|---|---|---|---|---|

| Case 1 (unmanageable demand) | 27,645 | 48,703 | 103,634 | 143,071 | 2092 | 39,003 | 94.60% |

| Case 2 (manageable demand) | 27,645 | 48,699 | 103,634 | 141,116 | 140 | 39,003 | 99.64% |

| CASES | P1 (kW) | P2 (kW) | P3 (kW) | P4 (kW) | P5 (kW) | P6 (kW) |

|---|---|---|---|---|---|---|

| Case 1 (unmanageable demand) | 859 | 1447 | 1447 | 2178 | 2299 | 22,075 |

| Case 2 (manageable demand) | 548 | 1022 | 1022 | 1575 | 1807 | 24,852 |

| Case 1 (Unmanageable Demand) | Case 2 (Manageable Demand) | |

|---|---|---|

| Rexp (€) | 6,819,763 | 6,760,377 |

| Cprod (€) | 2,775,854 | 2,644,919 |

| Cpower (€) | 291,252 | 266,812 |

| Cexc (€) | 403,612 | 392,589 |

| Operating profit (€) | 3,349,045 | 3,456,057 |

| Rexp ∆ | - | 0.87% |

| Cprod ∆ | - | 4.72% |

| Cpower ∆ | - | 8.39% |

| Cexc ∆ | - | 2.73% |

| Profit ∆ | - | 3.20% |

| CASES | PPV (MWh) | PH (MWh) | PW (MWh) | Pexp (MWh) | Pimp (MWh) | PD (MWh) | Demand coverage | |

|---|---|---|---|---|---|---|---|---|

| Case 1 (unmanageable demand) | Case 1.1 (OMIE ref) | 27,645 | 48,703 | 103,634 | 143,071 | 2092 | 39,003 | 94.60% |

| Case 1.2 (OMIE +10%) | 27,645 | 48,725 | 103,774 | 143,232 | 2092 | 39,003 | 94.60% | |

| Case 1.3 (OMIE 30%) | 27,645 | 48,521 | 102,695 | 141,949 | 2092 | 39,003 | 94.60% | |

| Case 2 (manageable demand) | Case 2.1 (OMIE ref) | 27,645 | 48,699 | 103,634 | 141,116 | 140 | 39,003 | 99.64% |

| Case 2.2 (OMIE +10%) | 27,645 | 48,722 | 103,774 | 141,279 | 141 | 39,003 | 99.64% | |

| Case 2.3 (OMIE 30%) | 27,645 | 48,516 | 102,702 | 139,982 | 122 | 39,003 | 99.69% | |

| CASES | P1 (kW) | P2 (kW) | P3 (kW) | P4 (kW) | P5 (kW) | P6 (kW) | |

|---|---|---|---|---|---|---|---|

| Case 1 (unmanageable demand) | Case 1.1 (OMIE ref) | 859 | 1447 | 1447 | 2178 | 2299 | 22,075 |

| Case 1.2 (OMIE +10%) | 859 | 1447 | 1447 | 2178 | 2299 | 22,075 | |

| Case 1.3 (OMIE 30%) | 859 | 1447 | 1447 | 2178 | 2299 | 22,075 | |

| Case 2 (manageable demand) | Case 2.1 (OMIE ref) | 548 | 1022 | 1022 | 1575 | 1807 | 24,852 |

| Case 2.2 (OMIE +10%) | 548 | 1000 | 1000 | 1547 | 1817 | 25,038 | |

| Case 2.3 (OMIE 30%) | 548 | 1008 | 1008 | 1627 | 1790 | 24,510 | |

| Case 1 (Unmanageable Demand) | Case 2 (Manageable Demand) | |||||

|---|---|---|---|---|---|---|

| Case 1.1 (OMIE ref) | Case 1.2 (OMIE +10%) | Case 1.3 (OMIE −30%) | Case 2.1 (OMIE ref) | Case 2.2 (OMIE +10%) | Case 2.3 (OMIE −30%) | |

| Rexp (€) | 6,819,763 | 7,511,725 | 4,735,724 | 6,760,377 | 7,447,771 | 4,689,484 |

| Cprod (€) | 2,775,854 | 2,789,113 | 2,725,618 | 2,644,919 | 2,649,604 | 2,618,743 |

| Cpower (€) | 291,252 | 291,252 | 291,252 | 266,812 | 267,303 | 264,881 |

| Cexc (€) | 403,612 | 403,612 | 403,612 | 392,589 | 400,093 | 401,655 |

| Operating profit (€) | 3,349,045 | 4,027,748 | 1,315,242 | 3,456,057 | 4,130,771 | 1,404,205 |

| Rexp ∆ | - | 10.15% | 30.56% | - | 10.17% | 30.63% |

| Cprod ∆ | - | 0.38% | 1.45% | - | 0.18% | -0.99% |

| Cpower ∆ | - | - | - | - | 0.18% | -0.72% |

| Cexc ∆ | - | - | - | - | 1.91% | 2.31% |

| Profit ∆ | - | 20.27% | 60.73% | - | 19.52% | 59.37% |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Naval, N.; Yusta, J.M. Water-Energy Management for Demand Charges and Energy Cost Optimization of a Pumping Stations System under a Renewable Virtual Power Plant Model. Energies 2020, 13, 2900. https://doi.org/10.3390/en13112900

Naval N, Yusta JM. Water-Energy Management for Demand Charges and Energy Cost Optimization of a Pumping Stations System under a Renewable Virtual Power Plant Model. Energies. 2020; 13(11):2900. https://doi.org/10.3390/en13112900

Chicago/Turabian StyleNaval, Natalia, and Jose M. Yusta. 2020. "Water-Energy Management for Demand Charges and Energy Cost Optimization of a Pumping Stations System under a Renewable Virtual Power Plant Model" Energies 13, no. 11: 2900. https://doi.org/10.3390/en13112900