Hedging Strategies of Green Assets against Dirty Energy Assets

Abstract

:1. Introduction

2. Related Studies

3. Methodology

3.1. The Dynamic conditional correlation-Generalized Autoregressive Conditional Heteroskedasticity (DCC-GARCH)

3.2. Dynamic Portfolio Analysis

3.2.1. Hedge Ratios

3.2.2. Hedging Effectiveness

3.3. Drivers of the Hedge Portfolio Returns

- (1)

- The VIX reflects the market’s expectation of 30-day volatility of the S&P 500 index. Given the stock nature of clean energy stocks, increases in the level of VIX have larger impacts on the energy stock index than on the price of crude oil, which makes the hedge portfolio return to decrease. Thus, a negative sign is expected for the DVIX.

- (2)

- For the case of green bonds, the authors use the TYVIX, which measures the 30-day expected volatility of 10-year Treasury Note futures prices. The dynamics of the implied volatility of this interest rate-based indicator is important for the fixed income market. Specifically, the TYVIX increases when 10-year Treasury note and futures prices exhibit large (down)swings, which makes the TYVIX to exert larger impact on green bonds than dirty energy assets. Therefore, the authors expect a negative sign for the DTYVIX.

- (3)

- The OVX measures the market’s expectation of 30-day volatility of crude oil prices. Increases in the level of the OVX have a larger effect on oil prices (a s well as other dirty assets) than clean energy stocks (green bonds), which lead to a decrease in the level of the hedge portfolio return. Furthermore, there is empirical evidence on the negative association between the OVX and crude oil prices [38]. Thus, a negative sign is expected for the DOVX.

- (4)

- (5)

- The DXY measures the value of the US dollar relative to a basket of six major currencies (euro, Swiss Franc, Japanese Yen, Canadian dollar, British pound, and Swedish Krona). Increases (decreases) in the value of the US dollar makes stronger (weaker) the integration of the oil-stock portfolio relationship, which in turn leads to a decrease in the returns of the hedge portfolio. Furthermore, US dollar depreciations are inversely related to crude oil prices [42], and possibly but to a lesser extent to energy ETF given the energy intensive nature of this ETF. Therefore, a negative sign is expected for the DDXY.

- (6)

- The US term structure is measured by the spread between the 10-year and 2-year Treasury bond yields (D10Y-2Y). An increase in the level of this prospective growth indicator is beneficial for crude oil and stock returns, and vice versa. Therefore, a positive is expected for the Δ10Y-2Y, which might depend on which of crude oil or clean energy stock returns would increase more.

- (7)

- Inflation expectation is measured by the spread between 10-year Treasuries and 10-year Treasury Inflation-Protected Security (TIPS) yields. The authors opt for this measure because of the lack of daily data on the US Consumer Price Index. Generally, there is a positive association between the level of inflation and crude oil prices [43], which can translate into an increase in the returns of the hedge portfolio. The positive effect can be magnified by the interactions between the level of inflation and equity prices. In fact, increases in the level of inflation can lead to an increase to key interest rates by the Federal Open Market Committee (FOMC), which in turn might bring down (lift) equity prices (bond yields). Therefore, a positive sign is expected for the DInflation.

- (8)

- Gold is widely regarded as a safe haven asset in financial markets [24,44]. Specifically, both gold and crude oil prices are inversely related with clean energy stock indices [14]. This suggests a negative association between gold (crude oil) prices and clean energy stock indices and potentially a positive association or cointegration between gold and crude oil markets (among other authors, Narayan et al. [45] find evidence of cointegration between the gold and oil markets). It follows that increases in gold prices are positively associated with the hedge portfolio returns. Thus, a positive sign is expected for the RGold. This is relevant not only to the case when clean energy stocks are the safe haven asset but also to the other case (i.e., when green bonds are the hedge asset), because both gold and green (bonds) are often seen as hedges during crisis periods (see, among others Reboredo [11]).

4. Data and Stylized Facts

5. Empirics

5.1. Results of Corrected Dynamic Conditional Correlations

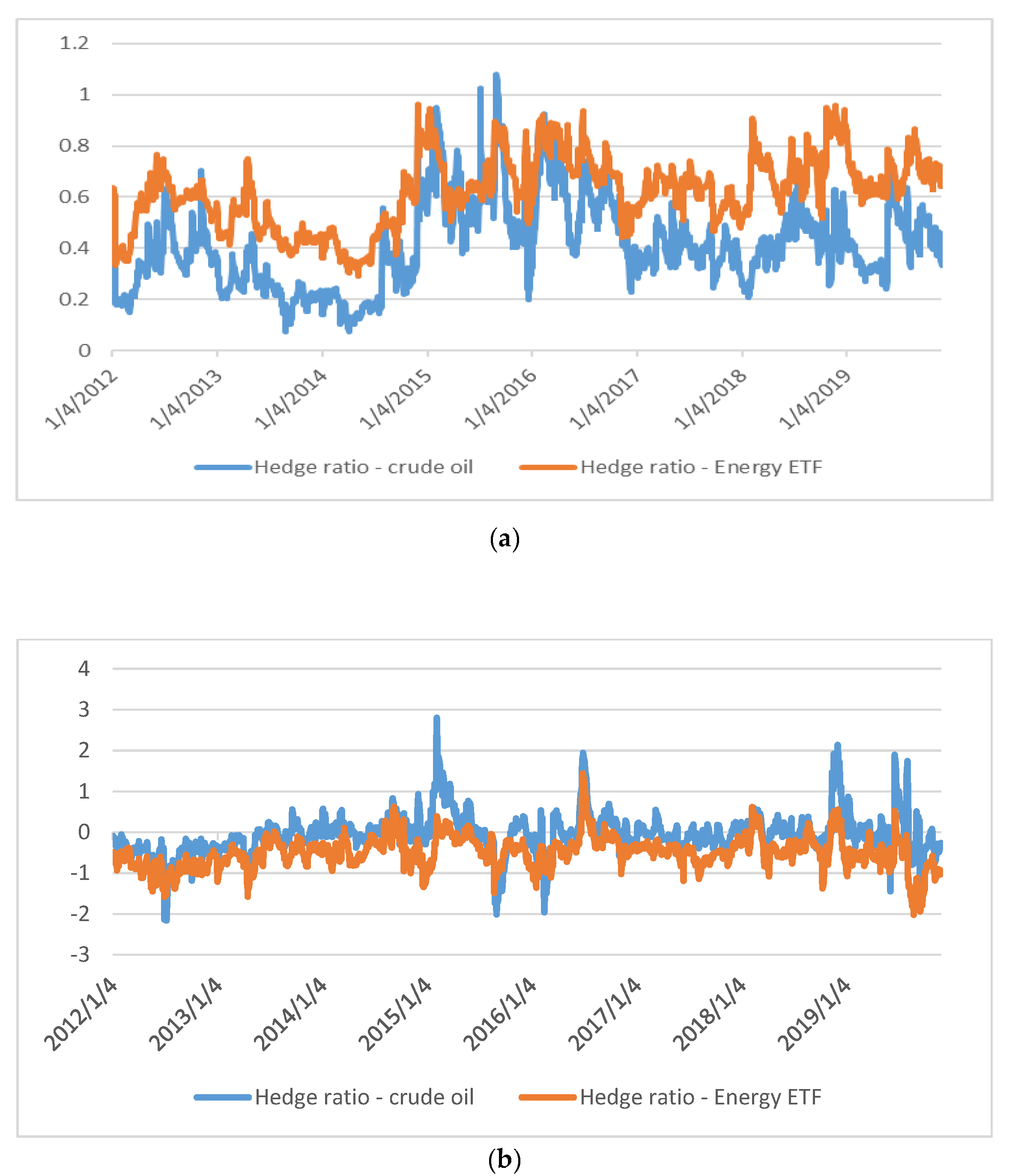

5.2. Results of Dynamic Optimal Hedge Ratios

5.3. Results of Dynamic Hedge Effectiveness

5.4. Results of the Drivers of the Hedge Portfolio Returns

6. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Kyritsis, E.; Serletis, A. Oil Prices and the Renewable Energy Sector. Energy J. 2019, 40. [Google Scholar] [CrossRef]

- Xia, T.; Ji, Q.; Zhang, D.; Han, J. Asymmetric and extreme influence of energy price changes on renewable energy stock performance. J. Clean. Prod. 2019, 241, 118338. [Google Scholar] [CrossRef]

- De Schryver, P.; De Mariz, F. What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market? J. Risk Finance Manag. 2020, 13, 61. [Google Scholar] [CrossRef] [Green Version]

- Zhou, X.; Cui, Y. Green Bonds, Corporate Performance, and Corporate Social Responsibility. Sustainability 2019, 11, 6881. [Google Scholar] [CrossRef] [Green Version]

- Ahmad, W.; Sadorsky, P.; Sharma, A. Optimal hedge ratios for clean energy equities. Econ. Model. 2018, 72, 278–295. [Google Scholar] [CrossRef]

- Bondia, R.; Ghosh, S.; Kanjilal, K. International crude oil prices and the stock prices of clean energy and technology companies: Evidence from non-linear cointegration tests with unknown structural breaks. Energy 2016, 101, 558–565. [Google Scholar] [CrossRef]

- Dutta, A. Oil price uncertainty and clean energy stock returns: New evidence from crude oil volatility index. J. Clean. Prod. 2017, 164, 1157–1166. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; López, R.; Jareño, F. Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ. 2018, 76, 1–20. [Google Scholar] [CrossRef]

- Kocaarslan, B.; Soytas, U. Dynamic correlations between oil prices and the stock prices of clean energy and technology firms: The role of reserve currency (US dollar). Energy Econ. 2019, 84, 104502. [Google Scholar] [CrossRef]

- Lee, D.; Baek, J. Stock Prices of Renewable Energy Firms: Are There Asymmetric Responses to Oil Price Changes? Economies 2018, 6, 59. [Google Scholar] [CrossRef] [Green Version]

- Reboredo, J.C. Green bond and financial markets: Co-movement, diversification and price spillover effects. Energy Econ. 2018, 74, 38–50. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A.; Ugolini, A. Wavelet-based test of co-movement and causality between oil and renewable energy stock prices. Energy Econ. 2017, 61, 241–252. [Google Scholar] [CrossRef]

- Sadorsky, P. Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ. 2012, 34, 248–255. [Google Scholar] [CrossRef]

- Bouri, E.I.; Jalkh, N.; Dutta, A.; Uddin, G.S. Gold and crude oil as safe-haven assets for clean energy stock indices: Blended copulas approach. Energy 2019, 178, 544–553. [Google Scholar]

- Ahmad, W. On the dynamic dependence and investment performance of crude oil and clean energy stocks. Res. Int. Bus. Finance 2017, 42, 376–389. [Google Scholar] [CrossRef]

- Paiva, A.S.S.; Rivera-Castro, M.A.; Andrade, R.F.S.; Castro, M. DCCA analysis of renewable and conventional energy prices. Phys. A: Stat. Mech. Appl. 2018, 490, 1408–1414. [Google Scholar] [CrossRef]

- Aielli, G.P. Dynamic Conditional Correlation: On Properties and Estimation. J. Bus. Econ. Stat. 2013, 31, 282–299. [Google Scholar] [CrossRef]

- Engle, R.F. Dynamic Conditional Correlation—A Simple Class of Multivariate GARCH Models. SSRN Electron. J. 2000, 20, 339–350. [Google Scholar] [CrossRef] [Green Version]

- Batten, J.A.; Kinateder, H.; Szilagyi, P.G.; Wagner, N.F. Hedging stocks with oil. Energy Econ. 2019, 104422. [Google Scholar] [CrossRef]

- Wen, X.; Bouri, E.I.; Cheng, H. The Crude Oil–Stock Market Dependence and Its Determinants: Evidence from Emerging Economies. Emerg. Mark. Finance Trade 2019, 55, 2254–2274. [Google Scholar] [CrossRef]

- Uddin, G.S.; Rahman, L.; Hedström, A.; Ahmed, A. Cross-quantilogram-based correlation and dependence between renewable energy stock and other asset classes. Energy Econ. 2019, 80, 743–759. [Google Scholar] [CrossRef]

- Yu, L.; Zha, R.; Stafylas, D.; He, K.; Liu, J. Dependences and volatility spillovers between the oil and stock markets: New evidence from the copula and VAR-BEKK-GARCH models. Int. Rev. Financ. Anal. 2020, 68, 101280. [Google Scholar] [CrossRef]

- Ciner, C.; Gurdgiev, C.; Lucey, B.M. Hedges and safe havens: An examination of stocks, bonds, gold, oil and exchange rates. Int. Rev. Finance Anal. 2013, 29, 202–211. [Google Scholar] [CrossRef]

- Junttila, J.; Pesonen, J.; Raatikainen, J. Commodity market based hedging against stock market risk in times of financial crisis: The case of crude oil and gold. J. Int. Finance Mark. Inst. Money 2018, 56, 255–280. [Google Scholar] [CrossRef]

- Batten, J.A.; Kinateder, H.; Szilagyi, P.G.; Wagner, N. Can stock market investors hedge energy risk? Evidence from Asia. Energy Econ. 2017, 66, 559–570. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. Oil prices and the stock prices of alternative energy companies. Energy Econ. 2008, 30, 998–1010. [Google Scholar] [CrossRef]

- Kumar, S.; Managi, S.; Matsuda, A. Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis. Energy Econ. 2012, 34, 215–226. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Cao, H.; Zhang, D. Oil shocks and their impact on energy related stocks in China. Energy Econ. 2012, 34, 1888–1895. [Google Scholar] [CrossRef] [Green Version]

- Managi, S.; Okimoto, T. Does the price of oil interact with clean energy prices in the stock market? Jpn. World Econ. 2013, 27, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Dutta, A.; Bouri, E.I.; Das, D.; Roubaud, D. Assessment and optimization of clean energy equity risks and commodity price volatility indexes: Implications for sustainability. J. Clean. Prod. 2020, 243, 118669. [Google Scholar] [CrossRef]

- Maghyereh, A.; Awartani, B.; Abdoh, H. The co-movement between oil and clean energy stocks: A wavelet-based analysis of horizon associations. Energy 2019, 169, 895–913. [Google Scholar] [CrossRef]

- Kroner, K.F.; Sultan, J. Time-Varying Distributions and Dynamic Hedging with Foreign Currency Futures. J. Financ. Quant. Anal. 1993, 28, 535. [Google Scholar] [CrossRef]

- Dale, C. The hedging effectiveness of currency futures markets. J. Futur. Mark. 1981, 1, 77–88. [Google Scholar] [CrossRef] [Green Version]

- Cho, J.H.; Parhizgari, A.M. East Asian financial contagion under DCC-GARCH. Int. J. Bank. Finance 2008, 6, 17–30. [Google Scholar]

- Bollerslev, T. A Conditionally Heteroskedastic Time Series Model for Speculative Prices and Rates of Return. Rev. Econ. Stat. 1987, 69, 542. [Google Scholar] [CrossRef] [Green Version]

- Glosten, L.R.; Jagannathan, R.; Runkle, D.E. On the Relation Between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. J. Finance 1993, 48, 1779–1801. [Google Scholar] [CrossRef]

- Ji, Q.; Fan, Y. Modelling the joint dynamics of oil prices and investor fear gauge. Res. Int. Bus. Finance 2016, 37, 242–251. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef] [Green Version]

- Brogaard, J.; Detzel, A. The Asset-Pricing Implications of Government Economic Policy Uncertainty. Manag. Sci. 2015, 61, 3–18. [Google Scholar] [CrossRef] [Green Version]

- Joy, M. Gold and the US dollar: Hedge or haven? Finance Res. Lett. 2011, 8, 120–131. [Google Scholar] [CrossRef]

- Choi, S.; Furceri, D.; Loungani, P.; Mishra, S.; Poplawski-Ribeiro, M. Oil prices and inflation dynamics: Evidence from advanced and developing economies. J. Int. Money Finance 2018, 82, 71–96. [Google Scholar] [CrossRef]

- Beckmann, J.; Berger, T.; Czudaj, R.L. Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Econ. Model. 2015, 48, 16–24. [Google Scholar] [CrossRef] [Green Version]

- Narayan, P.K.; Narayan, S.; Zheng, X. Gold and oil futures markets: Are markets efficient? Appl. Energy 2010, 87, 3299–3303. [Google Scholar] [CrossRef]

- Racicot, F.-É.; Théoret, R. Hedge fund return higher moments over the business cycle. Econ. Model. 2019, 78, 73–97. [Google Scholar] [CrossRef]

- Akay, O.O.; Senyuz, Z.; Yoldas, E. Hedge fund contagion and risk-adjusted returns: A Markov-switching dynamic factor approach. J. Empir. Finance 2013, 22, 16–29. [Google Scholar] [CrossRef] [Green Version]

- Shahzad, S.J.H.; Bouri, E.; Kayani, G.M.; Nasir, R.M.; Kristoufek, L. Are clean energy stocks efficient? An asymmetric multifractal scaling behavior. Phys. A Stat. Mech. Appl. 2020, 550, 124519. [Google Scholar] [CrossRef]

| Panel A: Descriptive Statistics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | Mean | Std. Dev. | Skewness | Kurtosis | Jarque-Bera | ADF | PP | ARCH |

| Clean energy stocks | 0.0093 | 1.5000 | −0.2355 | 3.7205 | 61.4385 * | −41.0353 * | −41.0774 * | 9.0404 * |

| Green bonds | 0.0064 | 0.3080 | −0.1651 | 5.2616 | 433.1319 * | −46.3038 * | −46.3468 * | 6.8180 * |

| Crude oil | −0.0287 | 2.1231 | 0.1689 | 6.7709 | 1188.4810 * | −48.2513 * | −48.2457 * | 23.0860 * |

| Energy ETF | −0.0112 | 1.6320 | −0.1961 | 4.9273 | 320.7515 * | −45.2267 * | −45.2241 * | 15.8790 * |

| Panel B: Pearson correlation | ||||||||

| Clean Energy Stocks | Green Bonds | Crude Oil | Energy ETF | |||||

| Clean energy stocks | 1.0000 | |||||||

| Green bonds | −0.0803 | 1.0000 | ||||||

| Crude oil | 0.3020 | 0.0052 | 1.0000 | |||||

| Energy ETF | 0.5923 | −0.0865 | 0.6180 | 1.0000 | ||||

| Variable | Mean | Min. | Max. | Std. Dev. | Skewness | Kurtosis | 5% Quantile |

|---|---|---|---|---|---|---|---|

| Clean energy stocks & crude oil | 0.3020 | 0.0925 | 0.5126 | 0.0611 | −0.1563 | 0.2405 | 0.3060 |

| Clean energy stocks & energy ETF | 0.5837 | 0.3678 | 0.7379 | 0.0522 | −0.5202 | 1.2458 | 0.5992 |

| Green bonds & crude oil | −0.0127 | −0.2754 | 0.3268 | 0.0690 | 0.2388 | 2.1365 | 0.0077 |

| Green bonds & energy ETF | −0.0948 | −0.2789 | 0.2901 | 0.0695 | 0.7030 | 2.2353 | −0.0826 |

| Variable | Mean | Min. | Max. | Std. Dev. | Skewness | Kurtosis |

|---|---|---|---|---|---|---|

| Clean energy stocks & crude oil | 0.4103 | 0.1689 | 0.0720 | 1.0817 | 0.6030 | 0.2610 |

| Clean energy stocks & energy ETF | 0.6192 | 0.1379 | 0.2894 | 0.9625 | −0.0686 | −0.4881 |

| Green bonds & crude oil | −0.0617 | −2.1594 | 2.7992 | 0.5132 | 0.4578 | 4.1269 |

| Green bonds & energy ETF | −0.5022 | −2.0208 | 1.4408 | 0.3967 | 0.0865 | 2.0925 |

| Variable | Mean | Min. | Max. | Std. Dev. |

|---|---|---|---|---|

| Clean energy stocks & crude oil | 0.0949 | 0.0086 | 0.2627 | 0.0368 |

| Clean energy stocks & energy ETF | 0.3435 | 0.1353 | 0.5444 | 0.0597 |

| Green bonds & crude oil | 0.0049 | 0.0000 | 0.1068 | 0.0096 |

| Green bonds & energy ETF | 0.0138 | 0.0000 | 0.0841 | 0.0135 |

| Variable | Panel A: Clean Energy Stocks | Panel B: Green Bonds | ||

|---|---|---|---|---|

| HE Crude Oil | HE Energy ETF | HE Crude Oil | HE Energy ETF | |

| HE energy ETF | 0.6073 | 1.0000 | 0.4581 | 1.0000 |

| Variable | Mean | Min. | Max. | Std. Dev. |

|---|---|---|---|---|

| Clean energy stocks & crude oil | 0.0314 | −9.7815 | 13.8198 | 2.0027 |

| Clean energy stocks & energy ETF | 0.0217 | −6.6724 | 8.3494 | 1.2831 |

| Green bond & crude oil | 0.0272 | −11.2056 | 14.2486 | 2.1041 |

| Green bond & energy ETF | 0.0085 | −9.3586 | 8.2881 | 1.6146 |

| Variable | Panel A: Clean Energy Stocks | Panel B: Green Bonds | ||

|---|---|---|---|---|

| Crude Oil | Energy ETF | Crude Oil | Energy ETF | |

| Constant | 0.0244 | 0.0142 | 0.0211 | 0.0011 |

| 0.0398 | 0.0280 | 0.0399 | 0.0272 | |

| AR(1) | 0.1059 *** | 0.0448 * | 0.0754 *** | 0.0123 |

| 0.0291 | 0.0256 | 0.0264 | 0.0236 | |

| DVIX | 0.1362 *** | −0.1009 *** | −0.0793 ** | −0.4539 *** |

| 0.0409 | 0.0234 | 0.0365 | 0.0526 | |

| DTYVIX | −0.0605 | 0.1194 | ||

| 0.2248 | 0.1680 | |||

| DOVX | −0.3431 *** | −0.1406 *** | −0.3896 *** | −0.2138 *** |

| 0.0691 | 0.0319 | 0.0736 | 0.0361 | |

| DEPU | 0.0005 | 0.0004 | 0.0005 | 0.0005 |

| 0.0008 | 0.0006 | 0.0009 | 0.0006 | |

| DDXY | −0.5076 *** | −0.1104 | −0.4387 *** | −0.3219 *** |

| 0.1357 | 0.0729 | 0.1346 | 0.0826 | |

| D10Y-2Y | 0.7690 | 2.0740 ** | 1.1970 | 1.8843 * |

| 1.6670 | 0.9511 | 1.6964 | 1.0385 | |

| DInflation | 14.1276 *** | 6.7681 *** | 16.6097 *** | 9.6058 *** |

| 2.3160 | 1.2228 | 2.4174 | 1.4677 | |

| Rgold | 14.6631 ** | 9.9668 *** | 16.3291 *** | 12.3658 *** |

| 6.3895 | 3.6982 | 6.2979 | 3.6571 | |

| Adjusted R2 | 0.1630 | 0.1243 | 0.2260 | 0.3690 |

| F-statistic | 48.8687 | 35.8931 | 64.8158 | 128.8176 |

| P-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saeed, T.; Bouri, E.; Tran, D.K. Hedging Strategies of Green Assets against Dirty Energy Assets. Energies 2020, 13, 3141. https://doi.org/10.3390/en13123141

Saeed T, Bouri E, Tran DK. Hedging Strategies of Green Assets against Dirty Energy Assets. Energies. 2020; 13(12):3141. https://doi.org/10.3390/en13123141

Chicago/Turabian StyleSaeed, Tareq, Elie Bouri, and Dang Khoa Tran. 2020. "Hedging Strategies of Green Assets against Dirty Energy Assets" Energies 13, no. 12: 3141. https://doi.org/10.3390/en13123141

APA StyleSaeed, T., Bouri, E., & Tran, D. K. (2020). Hedging Strategies of Green Assets against Dirty Energy Assets. Energies, 13(12), 3141. https://doi.org/10.3390/en13123141