1. Introduction

The increasing share of electricity delivered by intermittent renewable sources has increased the need for balancing and flexible generation in the GB’s electricity system. In the UK, the National Grid electricity system operator (NG) is responsible for procuring services to balance supply and demand and ensure system security. To achieve this they have a number of services that companies can bid into if they meet the technical requirements. These services include, frequency response services, reserve services and the balancing mechanism [

1,

2,

3,

4]. Frequency response services (FFR) are about providing changes in generation based on the frequency of the system. Generation (or load) can be either dynamically changed or discretely triggered (non-dynamic) to respond to changes in frequency. The reserve services are used to allow NG to access extra sources of power when load or renewable generation is greater than forecast. These include services such as short term operating reserve (STOR). The balancing mechanism (BM) is used to balance supply and demand in each half hour trading period of every day where plant can be run for short periods of time.

Aurora, a UK based energy consultancy firm [

5], estimates that the main flexibility market, the BM, will increase by nearly 200% between 2018–2030. The decision whether to accept the offer of a BM Unit (BMU) or not is made by NG. This decision is made with the aim of delivering electricity to GB’s consumers as economically and efficiently as possible. NG operators select the BMUs, with the lowest offer prices, which can balance the system. The ability of a unit in terms of balancing the system is determined by its dynamics. A unit’s dynamics consists of a range of parameters which define the operational capabilities of a BMU. In the BM’s terminology, the term minimum non-zero time (MNZT) refers to the minimum time a unit is required to be operational after starting. The term run-up rate export (RURE) and run-down rate export (RDRE) are values in MW/minute which are used to quantify the unit ramp-up and ramp-down rate of a BMU. These are the key parameters considered before dispatching flexible BMUs.

There are a range of plants that operate in the BM, including pumped storage and gas engines. The gas engines that already operate in this space have been through an assessment process and have a bilateral agreement in place with NG to provide this service. They can adjust pricing of their service offering in advance. Pumped storage has better dynamic performance and can command a higher price than gas engines. Adding a battery system to an existing gas plant would improve the dynamic performance of the site. This could improve the competitiveness of the system and command a higher market price. Existing battery system hardware is already available that competes in the electricity markets, so hardware development is minimal. However, additional control system development would be required to integrate the gas engines and battery storage system into a hybrid system. It is unlikely that any additional legal contracts would be required.

Hybrid systems including battery energy storage for electricity supply-based applications have been previously researched for feasibility. This includes research into hybrid systems with wind and energy storage [

6,

7,

8,

9], with the addition of PV only [

10] or with PV-battery [

11,

12,

13,

14,

15] and with added bio generation [

16] or diesel engines [

17,

18,

19]. These are mainly concentrated around rural communities. Some work has been undertaken on cost analysis of hybrid systems [

3,

4,

8,

12,

13] and this paper uses the same standard methodology to look at NPV. There have also been some publications looking at gas engine—energy storage hybrids [

20,

21] on the microgrid of a marine vessel. These have primarily been geared towards small power systems in a marine environment where a hybrid system helps reduce CO

2 emissions. The use of a hybrid-energy storage system in the maritime sector may have different objectives aside from CO

2 reduction. Some vessels have issues with power quality. A hybrid battery system has been suggested as a means of mitigating against voltage and frequency deviations [

22]. In vessels that exercise dangerous operations, energy storage may be used to help improve reliability [

23].

On a larger scale, some work has been undertaken looking at islanded systems using a gas engine and energy storage system [

24] to help meet transients. The focus of this work was to integrate a highly efficient gas engine combined heat and power (CHP) system with power storage devices, to establish stability during islanding operations, and provide an uninterrupted emergency power supply for critical loads. There is indication that hybrid gas/battery systems are now commercially available [

25,

26] for use, but application notes, technical details and pricing are unavailable at this time from the supplier.

To summarise, existing work on gas-energy storage hybrids has been limited to marine and isolated systems where the focus of the work has been around emissions, transient performance and reliability. The work presented in this paper is different from previous work as it focuses on the application of gas engine-energy storage hybrids, competing in large scale networks as part of the BM using standard NPV techniques.

The market application (BM) in this paper is different from other published literature and has not been considered before in relation to energy storage hybrids. As the income from the BM market is higher than the primary response market—this paper investigates the potential for including energy storage as part of a hybrid system in this market. However, it is complex because the energy management system needs to be considered in relation to sizing to establish if there is a business case. The design of the hybrid system, the sizing of the component parts and the control of the energy management is therefore different from previously published work as it is based on market performance requirements rather than technical constraints.

This paper uses a prism of practical evaluation to understand if an energy storage system may be hybridised with an existing gas generator unit in the BM in order to enhance the unit performance offering in the BM. This paper covers the sources of data, the analysis of the data, sizing and energy management control of a gas engine-energy storage system hybrid and the likely profitability of such a unit.

Section 3 provides a background on the methodology, data sources and data analysis.

Section 4 looks at the battery management control and

Section 5 looks at the business case model with a non-ideal battery.

Section 6 looks at a range of sensitivity scenarios and discusses the results.

2. Methodology

A key task is to understand under what conditions a hybridised system between a gas engine and battery energy storage system could be sufficiently profitable to be implemented. In this paper, profitability is defined as a positive net income (after tax) over the number of operational years of the battery. Batteries were chosen over other types of energy storage because their fast response time, power and energy capability offer a good match to a gas engine. The case for profitability is complex as it relies on future market estimates and depends on battery sizes & configurations, site location, different BM operational scenarios and includes the energy management strategy.

The criteria for optimality (or the business case) is based on economic return. This paper uses Net Present Value (NPV) analysis as shown in Equation (1) [

2,

3]:

where:

number of operational years,

index for counting years,

: net cashflow during the jth year,

: discount rate.

A case is an economically feasible case if , and economically infeasible otherwise.

The net cash flow,

is calculated as:

where:

: is the Net BM revenue in the jth year- set equal to the BM revenue minus the capital cost in (3).

: is the hybrid generation marginal cost in the jth year.

The initial capital cost

for a given case are:

where:

is the battery cost,

is the connection cost,

is the land cost and

is the planning cost of the estimated cost of the items listed in

Table 1. With the exception of

, which is included every year, these are assigned to the first year of operation. These are estimated values provided by the company based on their experience of setting up a new site, tailored to look at the expansion of an existing site. While, these values are indicative of real costs, they might be differences in practice due to locational reasons.

In broad terms, NPV equals the present discounted value of the investment. This value is driven by revenue, cost and discount rates. If required, additional economic analyses—such as discounted payback, internal rate of return & tolerable capital costs—can be added as appropriate.

At this time, additional revenue from the capacity market is not included, as the energy storage is planned as a means of adjusting operational parameters rather than increasing registered site capacity. Since the site capacity is not increasing, no additional connection costs will be required because there will be no need to upgrade cabling or switchgear to the site as this is not a new build.

2.1. Historical Planning Input Data

This paper uses a case study approach using real data related to an existing fleet of gas engines operated by Viridis Power (VP). VP builds, operates & trades fast-start flexible, small-scale generation sites across the UK. At the time of writing this paper, VP’s total generation capacity was 226 MW gas and 250 diesel in the following markets—short term operating reserve (STOR), BM, Fast Frequency Response (FFR) and prompt power markets. Key competitors of VP, in the BM, are PS units. The BMUs data are published on regular basis and can be accessed from ELEXON’s website publicly [

27].

To narrow down the scope of the study, the comparison in this paper is currently between VP’s engines and PS BMUs.

Table 2 provides general information about VP and PS units which were active in the BM in 2018.

The hybrid system will replace VP’s asset in the BM market. Therefore, the hybrid unit needs to generate enough cash flow to return what VP is already earning from the BM, and to return its discounted, capital cost. The current average profit is deducted from the hybrid system’s profit to account for existing VP income. To analyse the impact of having a hybridised system, it was deemed necessary to look at data over the course of a year starting 5 May 2017 and ending 5 May 2018. The data was imported from ELEXON [

27]. The ELEXON’s API system was used to download BMUs raw data. On a BMU basis, the imported data covers two features:

- (1)

Physical notification: this is the electricity forward sold by traders in a market other than the BM. If this value equals zero it means no forward selling has occurred and the capacity can be utilised in the BM,

- (2)

Bid or offer acceptances: for a given BMU, bid and offer acceptances correspond to decrease and increase in pre-declared physical notification generation or demand, respectively. Bids and offers are accepted by NG. This data is imported as electric capacity (MWs) and prices (£/MWh).

The data had to go through several preparation stages. These stages are downloading, cleaning, naming, assembling, validating and analysing the data.

2.2. Data Analysis

The most prominent operating benefits of PS units over gas engines are quicker run-up rates and shorter MNZT.

Table 3 shows the listed operational parameters of some of the different units [

28]. These values are fixed by the company and alter only occasionally under exceptional circumstances. There are numerous occasions in which PS units are selected over VP’s units due to these flexible plant dynamics. To understand the impact of the plant dynamics,

Figure 1 shows accepted offers based on their durations. Each row corresponds to PS or engine BMUs where each column represents a certain interval for offer calls’ durations. For instance, Lester Way (E_LSTWY-1) has made 91 runs which have been between 14 to 16 min. The analysis is useful because it shows where the gas engines are missing out on market opportunities and identifies these as areas where a hybrid gas-battery solution could capture some of the market. The impact of changes to the declared dynamic performance in

Table 3 will have limited impact on the analysis in this paper as the PS units dominate the fast response market and so a reduction in their response would provide more impetus for NG to call a hybrid gas-battery solution.

The figure shows that VP’s operation is lower when the offer calls are less than 12 min. This is because VP’s assets’ RURE and MNZT are two and ten minutes, respectively. The sum of these two would result in 12 min. Therefore, NG would utilise these assets for balancing needs which they forecast would last at least 12 min. PS is more expensive than VP so is used less for higher offer durations. Conversely,

Figure 2 shows that the main part of the PS’s populations are skewed towards offer calls which are shorter than those observed for VP’s units. This skew is because of fast RURE and MNZT periods of PS units. Due to offering better dynamics, the offer calls of PS units are accepted at higher prices relative to VP’s calls.

By providing the highest flexibility, PS units in GB’s system had played a pivotal role. However, these plants had been operational for several decades and they are not scalable for locational reasons. The offers of PS units are accepted more often and, in some cases, extended for longer durations. This paper suggests this observation is due to the difference in dynamic features between gas engine and PS units where the latter are called more often for offering at quicker and more flexible rates. To achieve better plant dynamics, an alternative is for a gas engine to hybridise with a battery system at a site. Batteries are widely considered as an alternative for PS units. This is because batteries can provide highly flexibility services by matching and surpassing the ramp-rates and minimum operational times of PS units. Unlike large-scale PS units, though, batteries health/lifetime is affected by the depth of discharge (DOD) and has a limited number of cycles depending on the DOD. For the PS, this is much less important. Also, batteries are incapable of sustaining hours of balancing output due to high operational and economic costs. This is a key aspect for the system’s operator as they are unaware of how long the balancing need is going to be required. Engines, on the other hand, are less flexible compared to batteries or PS units; however, they can sustain their balancing services for as long as necessary.

Considering the above points, hybridising a battery unit with engines would enable high flexibility balancing services with the possibility to extend the offer duration. Then the following questions would be needed to assess whether such a hybrid application can have an economic case:

- (1)

What are the existing gas-engine only revenues?

- (2)

What are the economic potentials of upgrading gas engine units to a hybridised system?

2.3. Revenue Model with an Ideal Hybrid Gas Engine-Battery

In operational terms, the ideal battery is a storage unit which discharges prior to operation of VP’s pre-existing engines and charges at the end of the engine’s operation. These added features will effectively improve VP’s RURE and MNZT parameters; thereby, improving its dynamic features. In this case, the ideal hybrid unit is a viable alternative for PS units. In economic terms, a hybridised system could offer at higher prices, due to its improved dynamics. This research assumes that the hybridised system offers at the same price to those offered by PS units.

Figure 2 shows the number of accepted offer calls which are suitable for a hybridised system, based on the criteria defined in

Table 4. The stacked bars are separated based on the duration of offer calls. 67% of the offer calls are less than 12 min. Above this duration, VP’s BMUs should operate in theory (RURE = 9.5 MW/minute, MNZT = 10 min). In other words, a typical VP site misses 67% of the offer calls because it is not sufficiently quick or flexible.

In total, NG had accepted PS offers 7088 times, from 5 May 2017 until 5 May 2018, which were suitable for a hybridised system. If an offer is accepted—then the hybrid systems has to run. The battery would run for the first two minutes while the gas engine ramps up—so this acts as an indicator that the battery is about to discharge. This means, the ideal battery system could maximally cycle 7088 per year. The number of cycles (in conjunction with depth of discharge) is a factor in determining the levels of degradation. Based on this observation, the number of accepted offers can be used to help estimate the level of degradation as it triggers a calculation of capacity loss; thereby, estimating the life of a battery system.

Figure 3 shows the average accepted offer prices of individual BMUs. The green bar represents the average price at which the VP site was offered. This value is £92.40/MWh. The other bars represent the same value for a specific PS BMU. Dinorwig units offer at the highest average prices of £145.40/MWh. This is followed by Ffestiniog, Cruachen, and Foyers with average offer prices of £122.90, £103.30, and £98.90 per MWhs, respectively.

Figure 3 indicates that the additional income that could be available by the replacement of PS offers, ranges between £6/MWh and £53/MWh. This highlights the importance of unit dynamics in terms of economic returns. A battery system can be economically viable only if it generates enough income to cover its capital and operational and maintenance (O&M) costs. This revenue depends on the amount of balancing for which the NG operator would find the hybridised VP appropriate for.

Table 5 lists the potential revenues of VP’s site, if it is hybridised with an ideal battery system. On the left side of the table, the frequency of acceptance states how often NG’s operator chooses hybridised VP over PS units. In terms of operational parameters, the number of cycles and runtimes have been calculated for different rates of acceptances. The runtime is expressed for only engine and hybridised systems. The runtime for the only engine case is constant and it equals 980 h/year. This is the total runtime at present and includes when the engine is not running in the BM, the revenue figure is the recorded revenue for this site from company proprietary data.

The runtime for the hybridised system, however, changes with the frequency of the NG accepting VP’s offer.

Table 5 shows that the runtimes of the hybridised system range from 1061 up to 2598 h/year. This study assumes VP’s 19MW site has an environmental permit and assumes a 1500 h/year limit on its annual run-time. Based on this restriction, the frequency of acceptances which results in 1500 h/year operation is 31% of the market size. Therefore, the values which are equal to or greater than 40% are not allowed with existing environmental permits (indicated with red font in

Table 5).

The table shows an economic case may exist in the BM for the hybridised system. For instance, if NG prefers hybridised VP over PS units only 5% of time, this would increase this site’s revenue £9200/MW/year. This is from a weighted average of the PS offer price multiplied by the additional runtime. The total revenue is the sum of the current engine revenue and the additional revenue from hybrid operation. A case study site size of 19 MW was chosen, this amount of unit surplus corresponds to an annual increase of £174,800/year. Additionally, the duration of the displaced calls average to 13.8 min. The highest feasible value, showed in

Table 5, increases site’s revenue £55,200/MW/year. This would result in a total revenue of £1,748,570/year.

Certainly, these values are not definitive as the operation of the battery system is assumed ideal. The table above only shows that there is extra revenue available based on historical data. As this data is historical, there are a number of risks in using this data:

offer prices could drop if newer, more efficient non pumped storage plant competes in this space of the market with lower offer prices,

the emissions limits on gas engines could be further reduced to help with plans for “net-zero” limiting the time available for a hybrid unit to operate,

the technical requirements could be changed by National Grid making it easier for battery only systems to compete in this market without needing to offer long term export capability.

It is difficult to quantify these risks, but all of these would act to reduce the likelihood that a hybrid gas-battery system will make economic sense. The next key step is to develop a storage model which accounts for key operational features of batteries such as size, rating, degradation and efficiencies of these systems. In the following section, an energy management control system is described which accounts for all key operational parameters.

3. Battery Control Options

The operation of the hybrid system must match the operation of the PS plants, to be able to claim a space in the high flexibility-tier of the BM market. PS units typically offer with MNZT of 2 or 5 min whereas VP’s assets have MNZT of 10 min. This difference between MNZT values will have profound impact on hybrid system’s battery size (MWh). The battery unit needs to be large enough to accommodate the surplus energy generated by VP’s asset during 10 min MNZT. Furthermore, the business case depends on the battery cost which in turn depends on battery size. This paper looks at two different methods of calculating battery size:

The engine run time is defined at present as 14 min (two ramp on, two ramp off and 10 fixed output). Under operation strategy 1, this results in a minimum bid time of 12 min as shown in

Figure 4. The battery can ramp to full power in less than 1 minute so the response is significantly faster. This minimum run time does not offer significant benefit over that of the current engine only solution and more importantly from

Figure 1 would not compete in the high value part of the market. This minimum run time could be decreased by running the engine at part load rather than full load, but this could have implications on efficiency and maintenance. This would produce a profile similar to that in

Figure 5, reducing minimum bid time to 5 min which still would not allow competition with the faster acting PS plant. This method of operation will not be considered further, as to get a minimum 2 min of run time is not possible without a varying control system.

A more flexible approach is to use method 2. This involves four processes:

- (1)

Determine if the engine needs to be started

Evaluate whether or not the gas engines will be activated during a given accepted offer call or not. To make this evaluation, the code hypothetically meets the offered energy for each minute with the battery system. If the energy content of the battery is sufficiently high enough to meet all minutes of the offer period and still has enough energy to meet VP’s energy requirement during the next run-up period, then engines are not activated. Otherwise, the activation signal will be sent to start the engine and the time is set as VP’s activation minute.

- (2)

Calculate the operation cycle

The operation cycle of the hybrid unit always starts with discharging the battery unit. The key unknown parameter is the period allocated for charging the battery unit. The charging phase follows the discharging phase only for offer calls for which the activation signal is enabled (calculated in step 1). If the engine has been started, the offer period remaining after the activation moment is calculated. If this period is long enough to accommodate an entire MNZT of VP’s engine, then only the minimum required period required for the next run-up is allocated as a charging duration. Otherwise, the remaining MNZT’s are calculated after the end of the offer period. Finally, the total cycle’s duration is calculated as the sum of the offer and charging periods as shown in

Figure 6.

- (3)

Hybrid system operation

The model sets the outputs of the VP and battery components of the hybrid system, for every minute of the calculated operation cycle and calculates battery energy throughput. At cycle start full output is met by the batteries. If the engine is activated the energy during ramp up is split between the energy storage and engine. After ramp-up the energy is attributed to the engine.

If the engine MNZT has been met, once the operation cycle is over, the engine is used to charge the battery by the minimum amount including through the engine run down time. If the MNZT has not been met the battery is charged from the end of the cycle until the MNZT is reached and also through the ramp down period.

- (4)

Update battery life cycle

It is then necessary to update the battery remaining life cycle. In the last section, the battery model calculates the energy throughput of the battery. This is added to a running total of energy throughput (

TE(t)). The total energy throughput is used to calculate the remaining, effective capacity of the battery system (

) from the starting capacity of the battery (

) [

29]:

A degradation factor (

) for lithium titanate batteries was estimated based on operational values reported in [

30] from experimental testing. The reported results from this study are from a 250 kWh/1 MW lithium titanate battery operating for nearly three calendar years undertaking frequency response and wind smoothing. During this period, the system’s energetic throughput and capacity reduction were given. Based on these numbers, the degradation factor value was estimated to be equal to 1.25 × 10

−5 using (4) and then used in the analysis in this research. A LI battery degradation factor of 3.37 × 10

−5 is used [

29]. Using Equation (3), the batteries remaining capacity is calculated. At a given time, if the remaining capacity is below the value required to operate the hybrid plant then the life span is considered over.

Some examples of how the control system works in practice are shown in

Table 6 and

Figure 7,

Figure 8 and

Figure 9. The range of case studies and the capacity loss lead to different battery sizing depending on the battery chemistry.

4. NPV with Non-Ideal Battery

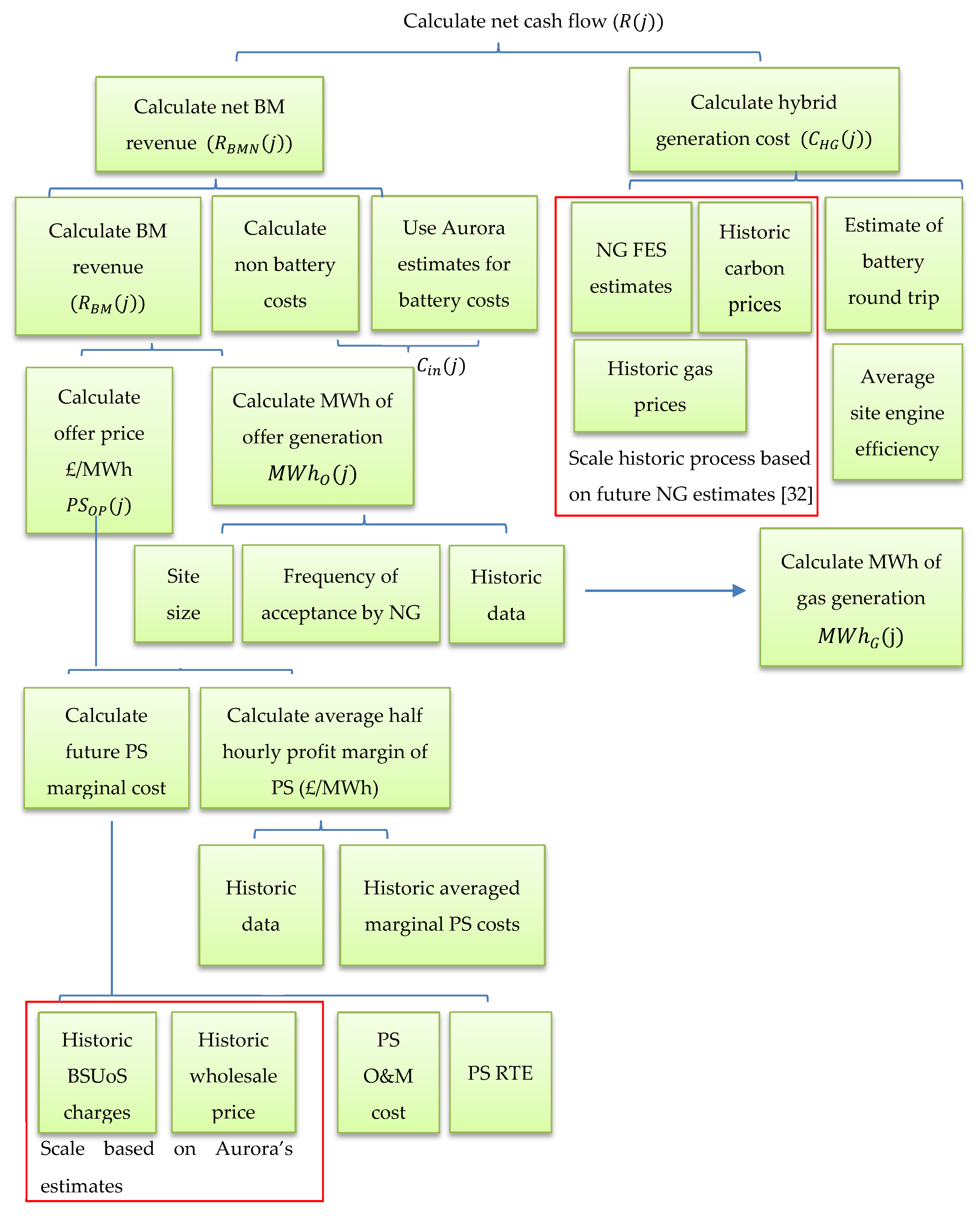

To determine the business case with a non-ideal battery, the process in

Figure 10 is completed for each year of the number of operational years in the NPV calculation. The process starts by using a random historic year between 2014 and 2018 to source the data. The randomisation process is such that a calendar year is not repeated for two consecutive years. The BM revenues and calculated hybrid cost are both required for the NPV.

The BM revenue of the hybrid system is calculated from the sum over a year of the income from all the offer acceptances:

where,

is the offer duration multiplied by the site size in MW.

is the PS offer price.

To calculate the BM revenues, two key inputs are required:

Future £/MWh offer price of hybridised system (),

MWhs of delivered electricity ().

NG states its purpose as trying to deliver electricity in cheapest and most efficient possible way. Based on this, it is assumed that if the hybridised system offers with better/equal plant dynamics and lower prices, then, it is eligible to displace PS units in future. Based on this rationale, it is assumed that the future offer prices of the hybridised system are a function of future offer prices of the PS BM units. There are two types of inputs which are needed to estimate their future values. These are:

Aurora’s GB distributed & flexible energy services publish a forecast report [

5] about GB’s grid once every 6 months where the annual averages of the above values are reported up to 2050. The half-hourly values of wholesale electricity and BSUoS prices from 5 May 2017 to 5 May 2018 have been collated. Then, the annual average of these values scaled based on Auroras future estimates such that it would be equal to a future value for the year in the NPV calculation.

The £/MWh of PS BM units are set equal to the sum of their marginal cost of generation plus their profit margin. Marginal cost of PS units is the sum of the following:

Future £/MWh of wholesale electricity used to “charge” the system (pump water),

Future £/MWh of Balancing Use of System (BSUoS) payments during charging phase.

Future £/MWh of BSUoS payment during discharging,

Future £/MWh of O&M cost—constant £7/MWh (based on BEIS [

31]),

Constant RTE of 75% (based on BEIS [

31]).

Note it is possible that the BSUoS charges may change in the future. Depending on dynamic parameters, PS BM units offer capacity at different profit margins. This value is calculated on a half-hourly basis, for each PS BM unit. The following steps are taken for calculating this value:

Collate the PS BM offer data for the random year. Calculate the daily averaged marginal generation cost of PS units. The averaged profit margin of a PS BM unit equals the average of the differences between half-hourly offer prices & the averaged marginal cost of generation. The offer price of £/MWh of PS BM units are thus set.

To calculate the net cash flow, it is necessary to subtract the hybrid generation cost as shown in

Figure 10. The gas engine marginal cost (

MC) is calculated from (6). As the battery is charged from the engine and not the grid, the costs for the battery are included in the Gas Cost, RTE and O&M:

The hybrid generation cost is therefore the marginal cost (per MWh) times the estimated MWh running of gas generation .

To calculate the MWhrs of generation depends on the site’s generation capacity and the frequency of NG accepting hybridised unit over PS units, and which PS unit is displaced. Key input scenarios are set as input data including the cycles per day that the battery will run based on

Table 5. For example, an acceptance rate of seven cycles per day means that there are 2555 cycles per year. The total number of cycles is 7088, and therefore this equates to 2555/7088 or 36% of all the cycles. The historical data is used with a Monte-carlo method to determine which 36% of all valid combinations from the historical BM data will be met by the hybrid system as opposed to the PS system.

The battery system is operated under operation method 2 and the charge and discharge cycles are calculated for the entire year—an example of the first 100 cycles can be seen in

Figure 11. This allows effects of battery degradation to be calculated based on energy throughput. The battery system has to have enough operational capacity to accommodate energy generated during the maximum charge case. The maximum charge case happens when the NG’s acceptance lasts for the shortest possible period of 2 min (For example on a 19MW site this equates to 12 min of battery charging and is approximately 4 MWh as a minimum after degradation in the last year of operation).

Table 7,

Table 8 and

Table 9 list all the inputs to the model in terms of historical data, fixed data (minimal impact on results) and data used for sensitivity studies. In terms of battery technology, lithium ion (LI) and lithium titanate (LT) batteries were considered as potential battery candidates as these have already been built and operated at MW levels and therefore offer reduced risk at this power and energy scale. They also have good life span. This study investigates a 5 MWh LT battery and 5.5 MWh LI battery. These sizes were suggested by battery manufacturers after detailed explanation of the application these batteries are going to be used for.

Besides the MNZT, the hybrid system must input MZT as a BM unit. This value specifies the minimum duration that it needs to stay unavailable. Among other key dynamic parameters, the corresponding MZT values for VP and PS units are reported in

Table 3. The MZT of the hybrid unit needs to be long enough to accommodate MNZT and MZT of engine. Based on values reported in

Table 3, this would add up to 20 min.

There are a number of key assumptions within the calculation. These include:

The described hybrid unit meets the operational flexibility of all PS units. Therefore, by providing capacity at the same offer price,

The future offer price of the hybrid unit is the sum of the future marginal cost of PS units and averaged PS profit margins,

A hybrid unit can accept an offer only if the gas engine is not forward sold and is available.

The existing revenue from the gas engines only operation is subtracted from the hybrid system’s revenue. If the remaining discounted revenue is high enough to meet the capital and operational costs of the battery system, it will have a positive NPV and have commercial viability.

5. Results and Discussion

Figure 11 shows the cumulative charge & discharge durations of the first 100 calls for a case with an average seven cycles/day. The average duration for charge & discharge durations, for the first 100 calls out of the total 2555 cycles per year, are nearly 5 & 6 min, respectively as shown in

Figure 12. Furthermore,

Figure 12 shows the total operation time of the hybrid system on the vertical axis on the right hand-side. The average cycle duration is 15.1 min whereas the remainder of duration not met by charge or discharge cycles are met with gas engines. This figure shows that there are occasions that the required balancing need can be a long duration. Across the shown sample, the offered period reaches nearly 120 min. The BM frequently needs long sustained balancing actions which also require immediate response and quick ramp rates. Neither engine nor battery only systems are capable of delivering this type of service. Hence, a clear opportunity for a hybrid operation.

The hybrid operating strategy will discharge for longer periods only if the battery is not sufficiently empty to accommodate the surplus engine-generated energy during its MNZT. Once the hybrid unit activates the engine, the engine needs to run at least 10 min. There is a small likelihood that the battery is empty enough to need to be charged with energy equivalent to the MNZT of the engine sites. Furthermore,

Figure 12 shows the cumulative distribution of charge and discharge durations with yellow and blue lines, respectively. It is shown that more than 73% of hybrid operational cycles discharged for six minutes or less. Six minutes of discharge equals 1.58 MWh of discharged energy. This is four minutes of full discharge and two minutes of partial discharge during the engine ramp-up period. This would equate to 1.58 MWh which translates into a 28.7% and 31.6% DOD for a battery sized at 5 MWh and 5.5 MWh, respectively. The longest discharge duration is 11 min & it happens 31 times/year (~1%). This is equivalent to 63% and 57% DOD for LT’s 5 MWh and LI’s 5.5 MWh batteries, respectively.

Table 10 shows the NPV of a hybrid with LT battery for different operation frequency & discount rates. Except for two positive cases, all business cases return negative NPV. These two positive cases operate the hybrid unit frequently, which is very likely to lead to extra O&M costs, both for the battery & engines. Additionally, both of these cases are achieved at 0% discount rate. This implies a hybrid system with engine and LT batteries is not economically feasible at this time.

Furthermore,

Table 10 shows the NPV of the LT-based, hybrid system is strongly affected by the impact of compounding interest. This is because LT’s degradation rate is lower than Lithium Ion and it ends up staying operational for a long period. The longer it takes an investment to pay itself back, the lower the present value of the marginal profit is.

Figure 13 shows the effect of changing the key inputs on the business cases for a 5 MWh, 19 MW LT-based hybrid system, which cycles seven times/day for a discount rate of 8% as an example. Across the horizontal axis, the sensitivity of the business cases are assessed for varying offer, wholesale and gas prices. The scope of the sensitivity analysis is from ±20% of the estimated values obtained from the data from

Table 7. The results indicate that a gas price reduction of 20% would result in an improvement to the NPV of approximately £1 m over 15 years. An increase in offer price of 20% would improve the NPV by approximately £3 m over 15 years. The likely impact of a no-deal Brexit would be an increase in both wholesale electricity and gas price. This will make the business case for a hybrid unit less likely [

34].

These are big swings in value that would still not guarantee a positive NPV for an LT battery for lower daily cycles and the current compound interest rate. Offer prices increases NPV as it directly impacts the hybrid system’s revenue: higher offer prices higher revenue. Increasing gas prices decreases NPVs. This is because the competitive margin that the hybrid unit could achieve reduces as the higher gas prices increases the marginal costs of the VP’s engines. This analysis also analyses the sensitivity of changing wholesale price. The NPV of the hybrid systems tends to increase for higher wholesale power prices. This is because higher wholesale power prices drive-up the marginal cost of PS units and increases their offered price.

An alternative to LT technology, is LI, this type of battery is cheaper; however, it degrades much quicker and a larger battery is needed to compensate.

Table 11 shows the NPV of a LI battery- engine hybrid. The economic returns from the LI technology are better than the LT technology. The capital cost of LI is nearly three times cheaper than LT. Despite degrading quicker than LT technology, the NPV analysis suggests better economic returns for the LI technology. There are two main reasons for this. Firstly, this is driven by the lower capital costs. As indicated in

Table 9, the capital cost of LT is more than three times of its LI counterpart. Secondly, a LI battery generates most of its revenue with lower compounded interest rate. For instance, while LI system of 5.5 MWh/19 MW with 7 cycles/day reaches the end of its lifespan after 5 years, a LT system stays operational for 15 years, under the same conditions. Under real-world investment practices; therefore, LI has a better chance for generating a quick return on investment, despite having a higher degradation rates. Having said that, an NPV of £600 k over 5 years (highest value in

Table 11), is not sufficiently high with the assumptions in the model to risk investment at this time.

It is possible to encounter minor inconsistencies in

Table 10 and

Table 11. For instance on

Table 11, for 4% discount rates, the generated NPV values are lower for 9 cycles/day than 8 cycles/day. This is because of the probabilistic approach used in allocating offers in various scenarios. In this case, the 8 cycles/day scenario has been allocated offers that had generated higher profit either by being operated for a longer period or with a higher profit margin. While this random behaviour has generated marginal differences from one scenario to another, it does not have material impact on this study’s results.

The goal of this paper was to assess the economic potential hybridisation of a gas engine-energy storage hybrid using a case study approach in the GB’s Balancing Mechanism (BM) market. To assess the economic potential of hybrid system in the investigated market, this study quantified the frequency and prices of the BM offers provided by the PS unit. Between May 2017 and May 2018, there were 7088 offer calls that a hybrid unit with a minimum run-time of 2 min/offer and instantaneous ramp rates could have met. These offers varied greatly in length and the offer prices depended on operational and market conditions.

As an initial assessment, this study quantified the potential revenue of the hybrid system with an ideal battery unit. The ideal system did not account for battery-related operational limitations such as cell degradation or round-trip efficiency. The results suggested that the ideal hybrid system can generate up to £3.4 million/year without any environmental restrictions on site for a 19 MW site. This value, however, reduces to £1.08 million/year when an annual operation time cap on engine units was introduced.

Additionally, this study developed a novel hybrid operating approach to govern the operation of engine and battery. Two battery technologies were considered: lithium ion (LI) and lithium titanate (LT). While both technologies are suitable for quick response, short-duration applications, the former is cheaper and degrades quicker relative to the latter. Nearly all the assessed scenarios for the LT technology generated negative NPV values. Under discounted scenarios, the high capital cost of the LT technology penalises its long-term returns, despite assuming high utilisation frequencies such as seven cycles/day. The sensitivity of hybrid system’s NPV on key gas, wholesale market price and offer were evaluated. While, NPV values increased with higher offer and wholesale market prices, increasing gas prices reduced the competitiveness of hybrid system. The NPV of the hybrid battery-gas engine system is highly dependent on battery cost, battery life span, offer price, gas price, compound interest rate and the percentage of times National Grid would choose a hybrid unit over a PS unit with the same operating parameters. All of these would need to be favourable for there to be a positive NPV.

LI batteries, on the other hand, performed relatively better in terms of achieved NPV. Unlike the LT, some discounted scenarios based on the LI generated positive NPV for 4% and 8% discount rates. Despite these positive values, the hybrid system with LI batteries did not generate significant NPV to be considered a clear low-risk investment. Battery-gas engine hybrids are not guaranteed to be economic at present in the BM unless subsidies are provided or the system can participate in higher revenue streams.

6. Conclusions

This paper undertook to analyse a new application for grid connected battery energy storage as part of a hybrid system with gas engines competing in the BM. The paper looked at the characteristics of current competitive plants within the BM from both a technical perspective and a cost perspective. Currently pumped storage is able to demand more income form the BM because it is more flexible, operates faster and has a lower minimum run time. In order to be competitive, the hybrid gas-BESS would have to operate with a much reduced minimum run time. Due to restrictions on gas engine minimum run time it is necessary to size the energy storage system carefully in order to be able to undertake the energy management control needed to match a pumped storage scheme. Degradation of the battery operating in the BM needs to be accounted for within the analysis. A theoretical means of doing this using typical published data has been included in this paper, but this should be validated experimentally prior to any investment in conjunction with the battery manufacturer to look more closely at application specific operation.

The paper presented a NPV analysis of a range of different options for operating a gas-BESS hybrid. The key factors relating to whether or not a system is profitable include gas, wholesale market price, offer price and discount rate. All of these would need to be favorable to generate a positive NPV, indicating that investment at this time is unlikely. The paper also shows that a LI battery offers a better investment than a LT battery even though it theoretically has a lower number of operational cycles [

35].

The paper concludes that battery cost and lifespan are still issues and that battery-engine hybrids are not economic at present. There is indication in the modelling that under very favourable conditions such as low compound interest rates, an acceptance of offers above 7 times/day and low gas price, it is possible to see a return on investment of a LI based battery-gas engine hybrid. However, this combination of favourable conditions is unlikely at this time.

Future work could be to extend this analysis to allow battery charging from the grid, to look at a centralized battery system for a distributed fleet of engines and the impact of changing the import/export rating of a site. This alternative source of revenue for a battery hybrid system could easily become more profitable with time and similar analysis could be used in other countries where the market conditions may be more favourable. In addition, other variations such as investigation of changing the site capacity or a centralised energy storage unit working in conjunction with multiple engines could be looked into as an alternative extension of this work.