1. Introduction

In regulated markets, electricity firms often hold control over a complete process, from generation all the way down to end-users. Electricity deregulation takes some of the ownership/operation away from the electric power process under vertically-integrated structures. In contrast, in deregulated markets, they may control part of the generation, distribution, maintenance of wires and poles, and invoicing of consumers for those services. Some expected benefits of the deregulation include (a) improved energy technologies, (b) lower rates, (c) additional energy options, (d) advanced customer service, and (e) economic growth. The deregulation in the electric power industry is a world-wide trend, because we may expect many benefits due to the deregulation. Both Japan and South (S) Korea belong to the global trend of deregulation.

A difficulty in assessing such a competitive and deregulated industry is that we do not have a practical method to assess firms from both their economic and technological developments on multiple production factors. To partly deal with the methodological difficulty, this research proposes a new use of Data Envelopment Analysis (DEA) that we have previously utilized as a practical approach for performance assessment on various organizations in private and public sectors [

1].

In the previous studies [

2] on DEA, we observed that the assessment had a wide range of applications, because it could avoid specifying a functional form that connects among multiple components of

X (inputs) and

G (outputs) in the assessment. The method can relatively evaluate an efficiency level of many organizations, often referred to as Decision-Making Units (DMUs: electric power firms in this research), by a percentile expression (so, measuring operational efficiency). Such unique features indicate the practicality of DEA in the area of energy.

However, the practicality is still limited in the scope of this study. For example, in the comparison of two electric power sectors, we find two methodological difficulties. One of them is that the proposed approach needs to handle “zero” in our data set. This study uses the amount of R&D expenditure (as an input) and the number of patents (as an output) to measure technology progress in the power sectors. The number of patents contains zero in our data set. The conventional DEA usually assumes strict positivity on all observations so that a straight forward use of DEA does not function in this study. To handle the zero in a data set, we select a “non-radial model” as a tool for our performance assessment. The other difficulty is that we need to consider multiplier restriction, in which multipliers are weights among inputs and outputs, without any prior information to attain empirical reliability. In conventional use, DEA usually produces many efficient DMUs as a result of not using multiplier restriction. For example, the conventional DEA result shows that 90% of DMUS are efficient and the remaining 10% are inefficient. Such a result is mathematically acceptable but practically not ideal. To reduce the number of efficient DMUs in DEA, scholars have developed many multiplier restriction techniques, such as assurance region analysis [

3] and cone ration [

4], based upon prior information (e.g., experimental results and common sense). A problem is that this study cannot assess such prior information. Thus, it is necessary for us to develop an approach for multiplier restriction without prior information.

Research motivation: In addition to the two methodological difficulties identified in this study, we need to mention two research motivations. One of the two is that for our international comparison, the Japanese power sector has suffered from the occurrence of the Fukushima Daiichi nuclear plant′s disaster on 11 March 2011. The use of nuclear energy has been limited and it is almost impossible to resume the nuclear power plants in Japan [

5]. The nation needs other energy sources, such as liquid natural gas and renewable energies. In contrast, S. Korea did not have such a nuclear problem in the operation of electric power plants. Even so, some previous administrations have implemented pro-nuclear policies. Due to the difference in their fuel mixes, we expect that S. Korea may operate more efficiently than Japan in terms of their operational efficiencies. The other concern is that the two nations may have different industrial structures. So, it is important for us to examine the performance of the electric power firms by considering whether their industrial structures influence their operational efficiencies. No study has explored this type of research issue.

This article is organized as follows.

Section 2 summarizes a literature review.

Section 3 compares Japan and S. Korea in terms of their industrial restructures.

Section 4 describes the methodological features of DEA and explains why we use the method for this research. We also explain the extensions in the proposed approach.

Section 5 summarizes the DEA-based empirical results.

Section 6 concludes this study, along with future research tasks.

Appendix A compares differences in the fuel mixes and industrial structures between the two nations.

All abbreviations used in this study are summarized as follows: CNIPA: China National Intellectual Property Administration, DEA: Data Envelopment Analysis, DMU: Decision-Making Unit, EPO: European Patent Office, EPSIS: Electric Power Statistics Information System, FTE: Full Time Equivalent, GDP: Gross Domestic Product. GHG: Greenhouse Gas, GWh: Gigawatt hours, IPC: International Patent Classification, JPO: Japan Patent Office, KEPCO: Korea Electric Power Corporation, KIPO: Korean Intellectual Property Office, KPX: Korea Power Exchange, METI: Ministry of Economy, Trade and Industry, OCCT: Organization for Cross-regional Coordination Transmission, OE: Operational Efficiency, OECD: Organization for Economic Co-operation and Development, PV: Photovoltaic, R&D: Research and Development, RTS: Returns to Scale, URS: Unrestricted, US: United States, USPTO: U.S. Patent and Trademark Office and WIPO: World Intellectual Property Organization.

2. Literature Review

In reviewing previous efforts on DEA, the works [

1,

2] have provided their historical review on the developments from the contribution of Professor W.W. Cooper, who was the first inventor. The research [

1] has examined a research trend on the DEA applications from the 1980s to 2010s. Many researchers have paid serious attention to the environmental issues regarding how to combat various difficulties in the areas of energy and environment. As a result, the number of articles that used DEA environmental assessment has dramatically increased, particularly after the 2000s. The book [

2] extended the previous work [

1] by adding previous studies on conventional DEA. The work listed more than 800 peer-reviewed articles on DEA and these applications in performance assessment. Since the two previous efforts [

1,

2] have summarized most of previous works on DEA environmental assessment, this research does not provide a detailed description on previous research efforts here.

Considering its significant contribution to reduce carbon emissions as well as industrial base (particularly manufacturing base), the electric power sector has attracted attention among DEA researchers. While there is a great body of DEA applications in many countries (e.g., [

6] in Australia and [

7] in China), this study focuses on comparing Japanese with S. Korean electric power sectors.

Table 1 summarizes major literature in the area. While they contributed to closing gaps in the pre-existing literature by (a) assessing efficiencies of electric power sector at multiple levels (power plant, company, and country) and (b) incorporating the emissions of CO

2 or other air pollutants to reflect the importance of environmental sustainability, there is still room for new studies from the perspective of deregulation and technology development.

Note that Japan and S. Korea have some similarities in deregulation. Both countries started the liberalization efforts in the late 1990s. S. Korea implemented actual policy programs (particularly divesting one state-owned, vertically-integrated company of power generation part) in the early 2000s [

8]. With globalization, both nations accepted the liberalization of the electric power industry as a global standard and sought to take advantage of (through competition) lowering the price of electricity, which was critical for maintaining their industrial competitiveness (particularly in electricity-intensive industries such as information and communications technology and automobile manufacturing). On the other hand, both nations were concerned about the unintended consequences of rapid liberalization shown in California, U.S.A. and the United Kingdom (e.g., the price of electricity dropped right after the deregulation but it went up again after a while in the U.S.A. [

9]; and a power pool market in the U.K. did not function as well as expected [

10]). Thus, they adopted an incremental reform rather than a revolutionary one.

However, there are also differences between the two nations, particularly in the speed of liberalization. Although both nations sought a gradual transition from the generation competition to the wholesale competition and further to the retail competition market, Japan reached the last stage through a series of reforms whereas S. Korea stagnates in the first stage [

11]. Japan already opened its wholesale and retail market to the private sector, but S. Korea remains in the competitive generation market, which is still not completely privatized yet. Six major power generation companies are subsidiaries of Korea Electric Power Company (KEPCO), which monopolizes the transmission, distribution, and retail of electric power. Also, more than 50% of KEPCO′s shares are owned by the government [

12].

The two countries have also faced different challenges. While Japan has improved the efficiency, independence, and transparency of its electric power industry over time, the nation was confronted with an unforeseen event, the Fukushima Daiichi disaster, which disrupted its electricity market [

13,

14]. On the other hand, S. Korea has experienced deteriorating productivity issues primarily because of technical regress stemming from increasing generation cost [

15]. One of the potential reasons was increased peak-load generation, rather than base-load generation, which is related to the expansion of power plant facilities. Another reason was the inefficiency of technological innovation activities. There may be a lack of R&D investment or insufficient technology development in the Korean electricity industry.

Position of this study: To the best of our knowledge, no DEA study has explored the comparison between Japanese and Korean electric power industries, although both countries have a strong manufacturing focus and similar industrial base (particularly in information and communications technology, as well as automobile manufacturing). In addition to their energy-intensive industries, they also share some other similarities. Both nations are highly reliant on imported energy sources, given their scarce fossil energy reserves. They have also embraced the global trend of deregulation in the electric power sector (particularly in the power generation area) in a relatively similar timeframe.

Another concern to be noted is the issue of data and period length used in the DEA literature. While there are some non-DEA studies that show more recent datasets related to the electric power sector, existing DEA literature unveiled the Japanese or Korean electric power sector relatively long time ago. In the former, for instance, [

16] employed the negative binomial panel regression model but used Japanese electric power companies′ 1999–2018 data, although the data focused on the R&D activities. The work [

17] investigated the efficiency issue of Korean electric power companies by employing cost function (rather than production function) and used 1982–2016 data. In the latter, however, they used 2005–2010 and 1990–2010 data, respectively, to study Japanese and S. Korean cases. This study may be a timely effort to update the performance of the current electric power sector in both countries. Additionally, with the emergence of electronic government initiatives (e.g., Open Government Data Projects in Japan and Public Data Portal such as data.go.kr in S. Korea), both nations have tended to open more data to the public and have become more transparent. In S. Korea, for instance, the ALIO (All Public Information In-One) system offers various types of management information of public agencies, including utility companies since 2015. This study takes advantage of using more reliable and consistent datasets containing more recent information.

In addition, the existing literature tends to belittle the role of technological development and does not include any relevant measures. Japan and S. Korea have both invested enormous amount of money in R&D (Japan: US$185.5 billion (3.21% of GDP) and S. Korea: US$69.7 billion (4.55% of GDP) in 2017) and belong to the top five global R&D spenders. This is also true for the electric power sector. Both countries have actively invested in the R&D of not only power generation, distribution, and transmission technologies, but also green technologies.

The two countries are also strongly interested in protecting their R&D outcomes via intellectual property rights. This is evidenced by their affiliations with IP5 (Intellectual Property 5: five major patent offices including the U.S. Patent and Trademark Office (USPTO), the European Patent Office (EPO), the Japan Patent Office (JPO), the Korean Intellectual Property Office (KIPO), and the National Intellectual Property Administration in China (CNIPA)).

In this regard, this study seeks to add value to the existing DEA applications to the Japanese and S. Korean electric power sectors by (a) comparing the performance of electric power companies in the two industrialized countries with similar performance base, (b) looking into more recent data after game-changing events (including financial crisis, deregulation, Fukushima Daiichi Accident, and global race for technological innovation), and (c) incorporating technological development-related measure (e.g., patents) and shedding light on the technological trajectories and portfolios of electric power companies in both countries.

3. Electric Power Industry in Japan and South Korea

3.1. Deregulation in Japan

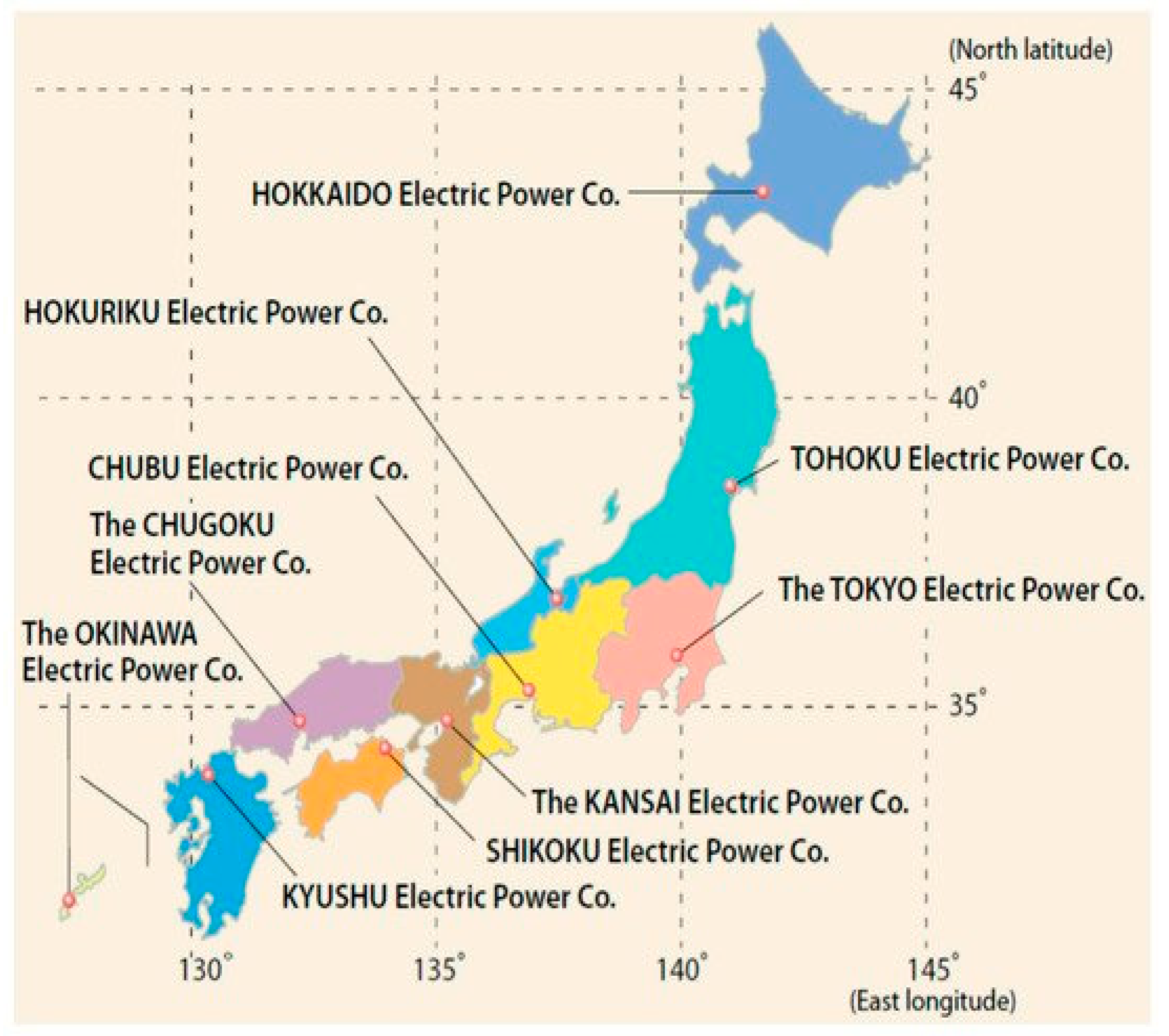

In Japan, nine electric power companies have provided their utility services as a regional monopoly.

Figure 1 lists the nine companies from north to south. They include: (a) Hokkaido Electric Power, (b) Tohoku Electric Power, (c) Chubu Electric Power, (d) Hokuriku Electric Power, (e) Kansai Electric Power, (f) Chugoku Electric Power, (g) Shikoku Electric Power, and (h) Kyushu Electric Power. We know that there is Okinawa Electric Power Company, but its business scale is much smaller than the other nine firms to be examined, so this research does not include the firm for our international comparison.

Japan has been gradually deregulating the electric power market since 1995. Although the Japanese government tried to facilitate institutional reforms, the challenge belonged to a slow process of market restructuring. The situation has advanced after the Great East Japan Earthquake on 1 March 2011. The Fukushima Daiichi nuclear disaster occurred with the earthquake. After the disaster, a major reform started the following three plans [

27].

First, Japan established the Organization for Cross-regional Coordination of Transmission Operators (OCCTO) in 2015, whose missions were to promote the development of transmission and distribution networks, both of which were necessary for cross-regional electricity uses. The organization also enhanced the nationwide function of maintaining a supply and demand balance of electricity in normal or emergency conditions.

Second, Japan implemented the full deregulation of the retail market in 2016, which gave regulated residential users eligibility to choose an electricity supplier from incumbent and new entrant firms. Licensing unbundling was also introduced in 2016, under which the electricity supply had different licenses on generation, transmission, distribution, and retail. Currently, any firm can enter the power generation by just notifying the government. Entrants into the retail sector need to register for starting their businesses. The transmission and distribution have remained in regional monopoly. The power businesses are still constrained under governmental regulation.

Finally, in 2020, the nation implemented legal unbundling between transmission and distribution from generation and retail sectors. The purpose of the separation is to secure a high level of fairness for all players in electricity generation and retail markets and to facilitate a high level of competition among players, because incumbent companies have an advantage in transmission and distribution.

Note that [

16] has recently discussed a marginal effect of R&D on the deregulation of the Japanese electric power industry. The research used an econometric approach (i.e., negative binomial panel data regression) to assess the influence of R&D on the Japanese market from 1999 to 2018. Meanwhile, the purpose of this study is to compare the Japanese electric power sector with that of S. Korea. The DEA is a non-parametric approach to measure the level of operational efficiency, so different from the econometric approach utilized in [

16]. The research has considered neither international comparison nor efficiency measurement. We borrow the Japanese data set from the research in [

16], but we obtain the S. Korean data set by our research effort. The observed annual periods are from 2014 to 2018. The observed periods are less than those of [

16], because we have difficulty in accessing a data set prior to 2014 on the S. Korean electric power industry.

3.2. Deregulation/Liberalization in South Korea

Different from Japan, to start the deregulation/liberalization process of an electric power sector that was originally monopolized by a state-owned giant, the S. Korean government has changed it by partially opening the electricity generation market. The government privatized companies for improving efficiency, cutting debt, and improved transparency. See research [

29,

30] that describes the process for deregulation and liberalization in S. Korea.

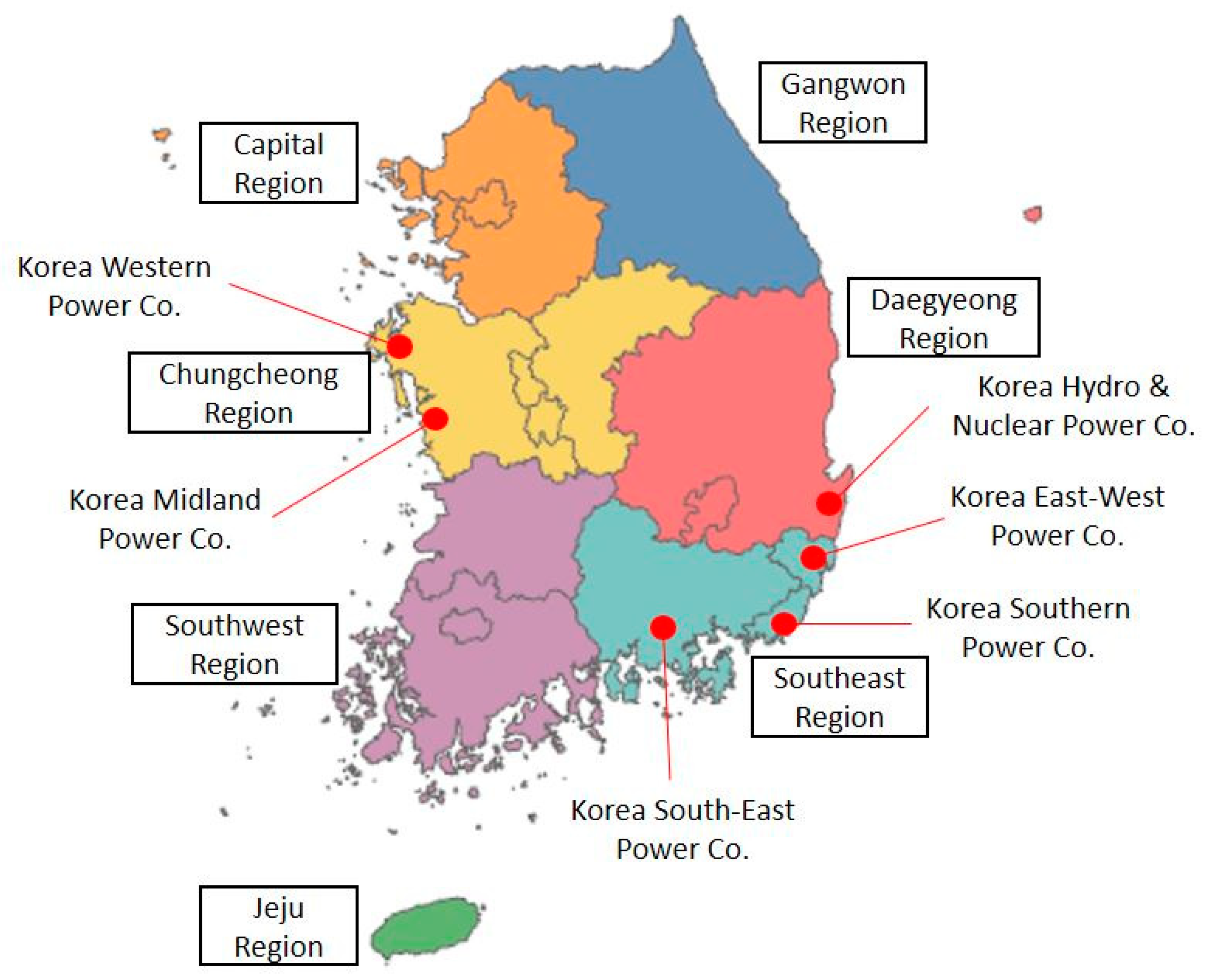

The process of S. Korea started from the liberalization, implying that the state-owned KEPCO has separated its power generation part into five subsidiaries: (a) Korea South-East Power, (b) Korea Midland Power, (c) Korea Western Power, (d) Korea Southern Power, and (e) Korea East-West Power. It also includes (f) Korea Hydro and Nuclear Power, which is KEPCO′s wholly-owned subsidiary. The company owns and operates the nation′s 21 nuclear power plants and produces a third of the country′s power. While there are several independent power producers, their portion is minimal when compared to the six power generation companies. In addition, the Korea Power Exchange (KPX) plays as an independent power system operator.

Figure 2 visually describes the six firms in S. Korea.

In privatizing KEPCO after the financial crisis in 1997, the government attempted to increase private holdings of the company′s 40% shares, drawing on the basic plan for the restructuring of the Korean power industry in 1999, whose purposes were (a) to increase the efficiency of the power industry through competition, (b) to ensure the long-term viability of electricity supply, and (c) to promote consumer convenience and choice. However, the privatization did not prove easy, owing to the company′s size and the low price of power. Since then, the government has been discouraged from continuing its electricity market restructuring process by anti-nuclear activists, as well as labor unions and environmental issues. Today, transmission and retail services are still monopolized by KEPCO. The S. Korean government holds about 51% of the company′s shares. This aspect of shareholding is very different from Japan, where electric power companies do not have such public ownership, of course being under governmental regulation.

The government has reported that it could cap the private sector′s stake in KEPCO entities at 20% to 30% to preserve the government′s majority share. However, it may also allow renewable energy companies to sell power directly to consumers. Currently, private companies and individuals must trade and distribute power through the KEPCO.

3.3. Technology Differences between Japan and S. Korea

Appendix A of this article discusses differences in fuel mixes and industrial structures in the two nations. The discussion implies that a dwarfed portion of nuclear-based power generation may negatively influence the performance of Japanese electric power generation companies. Meanwhile, S. Korea shows a similar trajectory in the fuel mix but not in the technology portfolio (e.g., a shift from electricity to chemistry). S. Korea′s inconsistent technological innovations activities may lead to its technical regress in maintaining power generation technology. See

Appendix A, which summarizes numerical analysis on the concern.

4. Methodology

4.1. Primary

Nomenclatures used in this study are summarized as follows:

is the observed ith input of the jth DMU (i = 1, …, m & j = 1, …, n) at the tth period, is the observed rth output of the jth DMU (r = 1, …, s & j = 1, …, n) at the tth period, is a measure of inefficiency, is an unknown slack variable of the ith input at the tth period, is an unknown slack variable of the rth output at the tth period, is an unknown intensity (or structural) variable of the jth DMU at the tth period, is a prescribed small number.

Before applying the proposed DEA models, we need to specify the following data ranges on X and G:

is a data range on the

ith input, which is specified as:

is a data range on the

rth desirable output, which is specified as:

The data ranges are applied to the all DMUs (j = 1, …, n) in all periods (t = 1, …, T) in the proposed performance assessment. We use the data ranges to avoid an occurrence of zero in dual variables (i.e., multipliers). Such an occurrence implies that corresponding production factors (X and G) are not utilized in our DEA applications. However, the data restriction does not function for reducing the number of efficient DMUs.

Here, it is important to note that this study uses a DEA non-radial approach that determines the level of Operational Efficiency (

OE) on the specific

kth DMU at the

tth period. The proposed approach has two differences from the conventional use. One of the two is that we evaluate the performance of the

kth DMU to be examined. The DMU is one of all (

Jt) at the

tth period. The subscription (

j) is used to express each DMU (

j = 1, …,

n) in the total set (

J). Even if a DMU(s) has negative or zero in its value, the proposed approach can handle the data set. See

Section 4.3 that explains our mathematical rationale. The other DEA models (i.e., radial and intermediate) do not have such a desirable property. The other difference is that the proposed approach measures the level of inefficiency in

OE and then it determines the degree of efficiency by subtracting it from unity. The analytical feature cannot be found in the conventional DEA.

4.2. Operational Efficiency under Variable RTS

Using the data ranges (1) and (2), this study proposes the following formulation to measure the degree of Operational Efficiency (

) on the

kth DMU at the

tth period:

The superscript (v) of

indicates variable RTS in the scale treatment.

We measure the degree of the

kth DMU at the

tth period by:

where the inefficiency score and all slack variables are determined on the optimality of Model (3). Thus, the equation within the parenthesis is obtained from the optimality of Model (3).

Here, it is important to note that the conventional use of an output-oriented DEA model, for example, is different from that of Model (3). The major difference is that the former maximizes in the objective function, where is a non-Archimedean small number. We use the very small number, but not non-Archimedean, to control the magnitude of the degree of operational efficiency. Assuming all slacks are zero, the efficiency measure is determined by 1/ on optimality in the conventional use. Thus, the measurement of Model (3) is different from the previous models. Accordingly, the constraints of Model (3) need to incorporate the direction () for maximization, given the observed . The conventional DEA does not have such a direction for optimal projection. As a result, it often suffers from an occurrence of multiple projections.

Next, Model (3) has the following dual formulation:

where

(

i = 1, …,

m) and

(

r = 1, …,

s) are all positive dual variables (i.e., multipliers, implying weights among production factors) related to the first and second groups of constraints in Model (3). The dual variable (

), representing a constant, is unrestricted (URS) in the sign.

The comparison between Models (3) and (5) provides the following three concerns: First, the objective value of Model (3) equals that of Model (5) on optimality. So, we have the following relationship:

on optimality. We measure the operational efficiency (

) of the

kth DMU by the following equation:

Second, an important feature of Model (5) is that all the dual variables, except

, are positive as, formulated in (5). Thus, the information on all production factors is fully utilized as specified in the last three constraints of Model (5). Finally, each dual variable indicates an amount of change in operational inefficiency (1-

) due to a unit change in each production factor.

4.3. Translation Invariance: Handling Zero in A Data Set

To handle zero and/or negative values in a data set, we use the property of “translation invariance”. The proposed approach has the property. This study starts with a description of specifying the following data shift on all DMUs (

j = 1, …,

n):

The two Greek symbols are specific positive numbers (e.g., 1 and 100) that can be subjectively selected by a user(s). As a result of the data shifts, all production factors of the

jth DMU become

(

i = 1,…,

m) and

, where the inequality implies strict positivity in sign.

To examine the property of translation invariance, let us return to Model (3) and modify the two groups of constraints as follows:

Equation (9) maintains the following conditions:

and

because of

. Consequently, the two constraints of Equations (9) become:

The above two groups of constraints are the same as Model (3). Thus, the proposed data shifts do not influence the constraints of Model (3).

Next, paying attention to the objective function of Model (3), the data shifts change the two types of slacks as follows:

Equation (11) indicates the translation invariance on the objective value of (3). Thus, the proposed data shifts from zero or negative to positive do not influence the objective value of Model (3). The proposed model (3) can solve a data set with zero for our international comparison.

4.4. Multiplier Restriction

To extend Model (3) further into rank analysis and a statistical test on null hypotheses, we need to consider multiple (weights among inputs and outputs) restrictions for our empirical results. To conduct the restriction, we start describing a supporting hyperplane(s) of the

kth DMU at the specific

tth period that becomes as follows:

where dual variables,

(

i = 1,…,

m) and

(

r = 1,…,

s) are unknown parameters for indicating the direction of the supporting hyperplane (

s), and

indicates an intercept of the supporting hyperplane. The following equations determine these parameters:

where

stands for “a reference set” of the

kth DMU at the

tth period. Model (3) determines

that is part of efficient DMUs.

If the supporting hyperplane is in a simple case (i.e., a single component of each production factor), Equation (12) becomes at the tth period. The ratio between factors becomes . Since these factors have lower and upper bounds, the ratios are expressed by the following conditions: . The superscripts (L and U) indicate Lower and Upper bounds of each production factor. Note that we determine these values on the observed production factors (x and g) at the tth period.

The extension to multiple components of

X and

G produces the following conditions:

After incorporating (14), Model (5) becomes:

The level of

OE on the

kth DMU at the

tth period is measured by:

where all dual variables (i.e., multipliers) are determined by Model (15).

Methodological contribution: For our international comparison between Japanese and S. Korean electric power industries, we used the new model (15) because it has two unique features. First, the proposed approach can handle “zero” in a dataset, as found in Model (3). The capability is important because our data set contained zero in an output (i.e., the number of patents). The proposed approach, structured by Model (3), has the property of “translation invariance” that allows us to handle zero or negative values by shifting them to positive. The data shift does not change the degree of

OE. Second, we extended Model (3) to Model (15). The model incorporates an analytical capability to restrict multipliers without any prior information. The multiplier restriction has been long used as assurance region analysis [

3] and cone ration [

4] in the conventional DEA. However, these techniques need prior information. In contrast, Model (15) is structured by the dual formulation so that it can mathematically express a range of supporting hyperplane(s). The importance of the proposed approach is that we restrict multiplier(s) by the upper and lower bounds of the supporting hyperplane(s). As a result, multipliers are all positive in a required range. Here, the positivity of multipliers implies that all data are fully used in the proposed DEA assessment so that it reduces the number of efficient DMUs.

6. Conclusions

This research compared the operational performance of Japanese and S. Korean electric power sectors. Both have different and similar industrial and organizational structures at the same time. For instance, they showed similar fuel mixes but it became heterogeneous after the Fukushima Daiichi Disaster. The Japanese companies have been under private ownership from the beginning, while the S. Korean ones started as public entities, but changed to public/private joint entities. To assess their operational progress, we used DEA as a measurement tool that allowed us to examine the level of simultaneous achievements on economic and technological factors. The method assessed the degree of their holistic development. The DEA-based OE measurement, including the amount of R&D expenditure (an input) and the number of patents (an output) served as a useful tool for the comparison because it can handle multiple production factors without any functional specification between multiple inputs and outputs.

The proposed approach first discussed how to handle zero in an observed data set (i.e., the number of patents) by using the property of “translation invariance”. Model (3) had the property. Then, we extended the model by restricting multipliers without any prior information so that we could reduce the number of efficient firms. Model (15) was the final model that addressed the two methodological issues (i.e., the existence of zeroes in a data set and too many efficient firms). Without addressing these issues, it was impossible for this study to conduct an empirical investigation on the comparison between Japan and S. Korea. Thus, the proposed approach documented the DEA practicality by comparing them in terms of their operational efficiencies.

Our empirical study identified two important implications. One of them was that the electric power industry of S. Korean outperformed Japan in the observed period (2014–2018). For example,

Figure 4 visually documented that the OE measures of S. Korea were 100% in 2014, 99.9% in 2015, 99.2% in 2016, 97.4% in 2017, and 96.7% in 2018, which were about 5% higher than the Japanese ones (i.e., 93.9%, 94.4%, 93.0%, 93.2%, and 94.0%, respectively). We conjecture the reason from the fact that the Japanese power sector has suffered from the occurrence of the Fukushima Daiichi nuclear disaster on 11 March 2011. A rationale is that despite nuclear energy′s significant contribution to the efficient power generation, its use has been limited and it has been almost impossible to resume the power plants in Japan. As a consequence, Japan needed other energy sources, such as liquid natural gas and renewable energies. See the previous work [

31] that discussed a new direction on the Japanese electric power industry.

Another implication was that the difference in performance between the two nations has gradually diminished partly because the Japanese electric power sector has been gradually recovering from the disaster. Another explanation is partly possible from the structure of heterogeneous technology portfolios. For example, S. Korea′s inconsistent technological innovation activities may lead to its technical regress. Particularly, the technological shift (including R&D expenditure and patents) from electrical engineering and instruments, which are fundamental technologies for the electric power generation sector, to chemistry may interfere with maintaining the nation′s relatively higher performance in operational efficiency.

The proposed DEA approach evidences its usefulness in the application to the electric power industry. However, it is necessary for us to overcome five empirical difficulties in future extensions. First, technology development occurs between different periods. This study needs to incorporate the analytical structure (e.g., the measurement of a frontier shift) within a time horizon. This indicates a methodological limit to be fixed in the future. Second, examination at company level may provide more detailed insights than a national level. A future extension needs to examine the company or sector-based OE measures. Third, it is necessary to explore how innovation activities (e.g., R&D expenditure) may influence corporate performance in the industry. In this case, we may need to consider a time lag between R&D and technological innovations. Fourth, another future extension needs to include more industrialized nations, such as the United States and European nations, where the deregulation of electricity was implemented before Japan and S. Korea. Such a research extension is an important future task. Finally, we have not yet investigated operational progress due to technology development (not only patents discussed in this study) on electricity among other industries and other nations. The issue is an important research concern, as well.

In conclusion, it is hoped that this study can contribute to the advancement of the electric power industry. We look forward to seeing future development as discussed in this article.