Alternative Incentive Policies against Purchase Subsidy Decrease for Battery Electric Vehicle (BEV) Adoption

Abstract

:1. Introduction

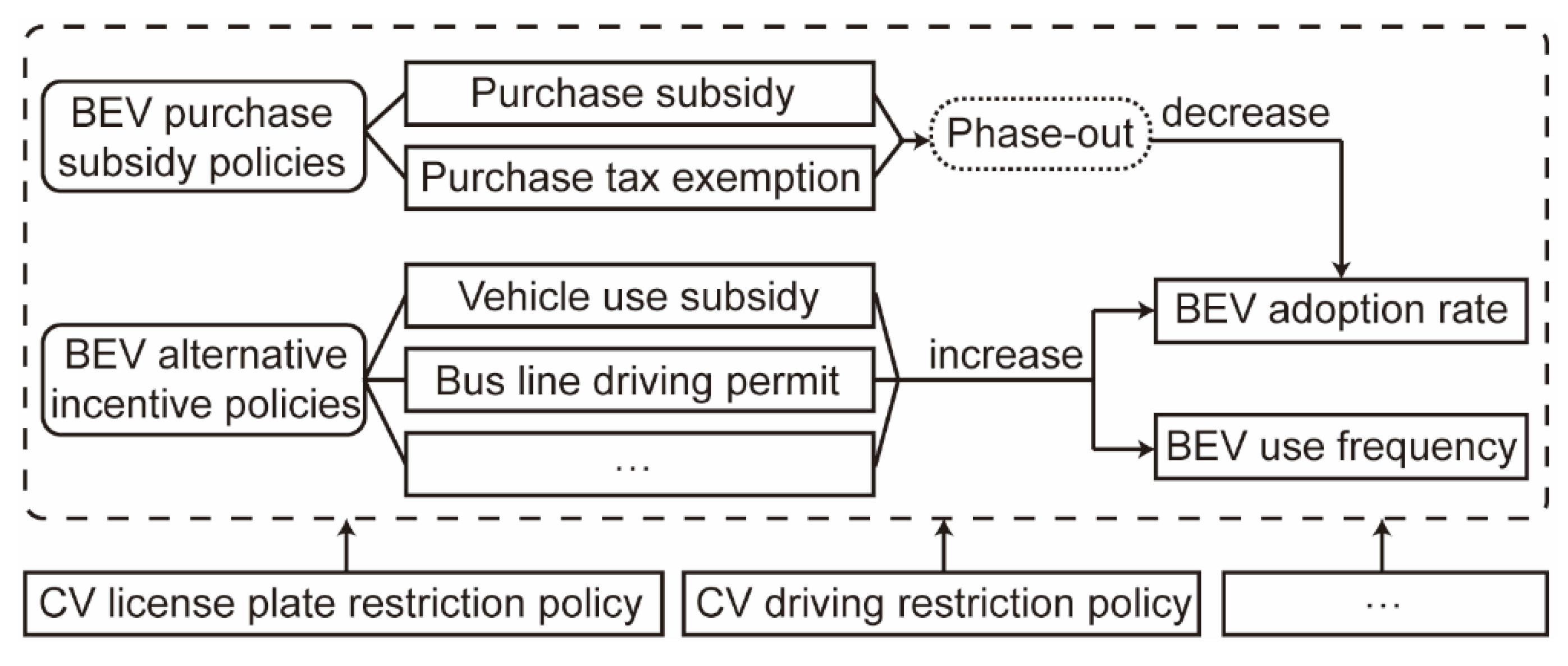

1.1. Backgrounds

1.2. Motivations

1.3. Research Objectives and Contributions

- How does the abolishment of the BEV subsidy policy affect the BEV purchase probability?

- In addition to the subsidy policy, how do other incentive policies (e.g., driving restrictions and license plate restrictions) affect BEV adoption intentions?

- How to formulate specific alternative incentive policies to maintain or improve the original BEV adoption probability when subsidy policies phase out.

2. Literature Review

2.1. Personal Attributes/Vehicle Technical Features

2.2. Subsidy Policies

2.3. Other Incentive Policies

- (1)

- Existing studies lack research on the impact of purchase subsidy phase-outs on BEV adoption, and there is no research on alternative incentive policies against purchase subsidy phase-outs.

- (2)

- Quantitative research on the effects of other incentive policies on BEV adoption is lacking, such as China’s restrictive policy.

3. Methodology

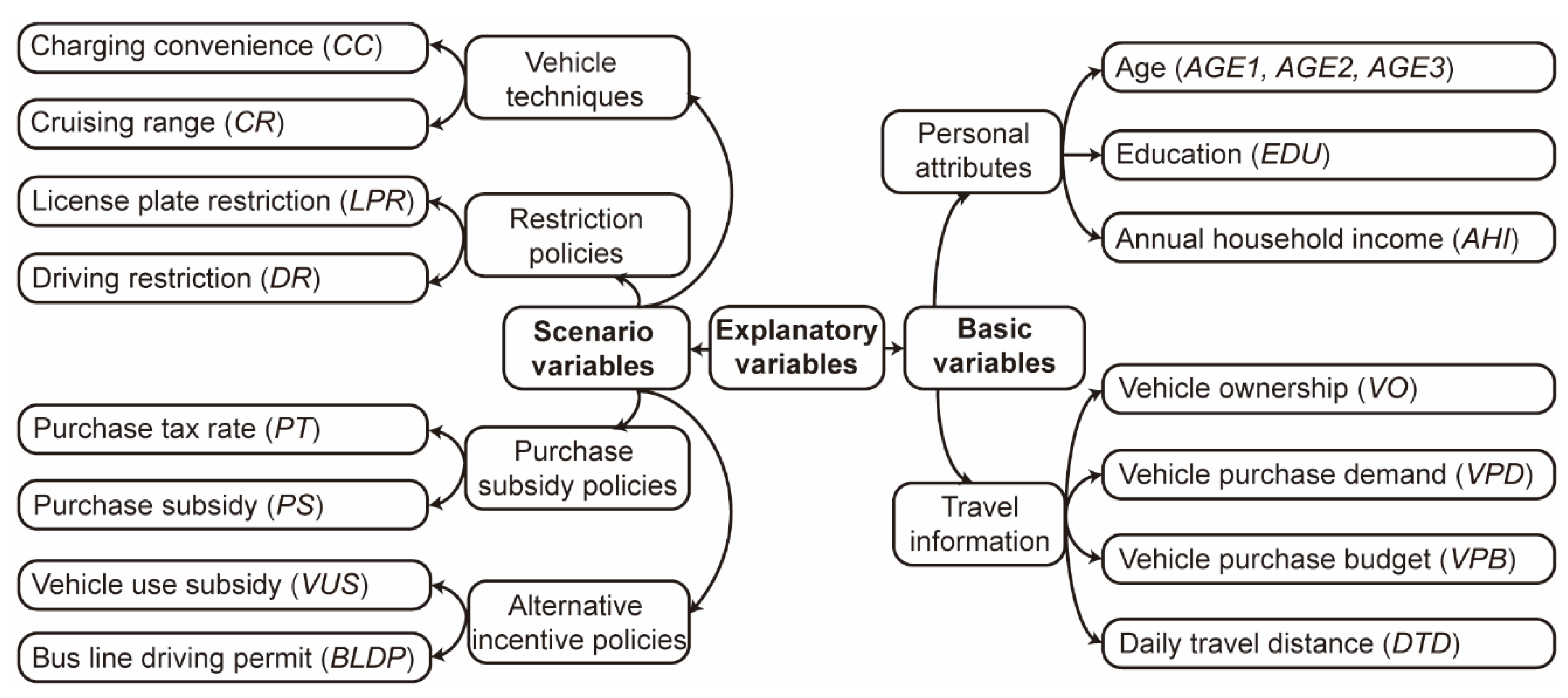

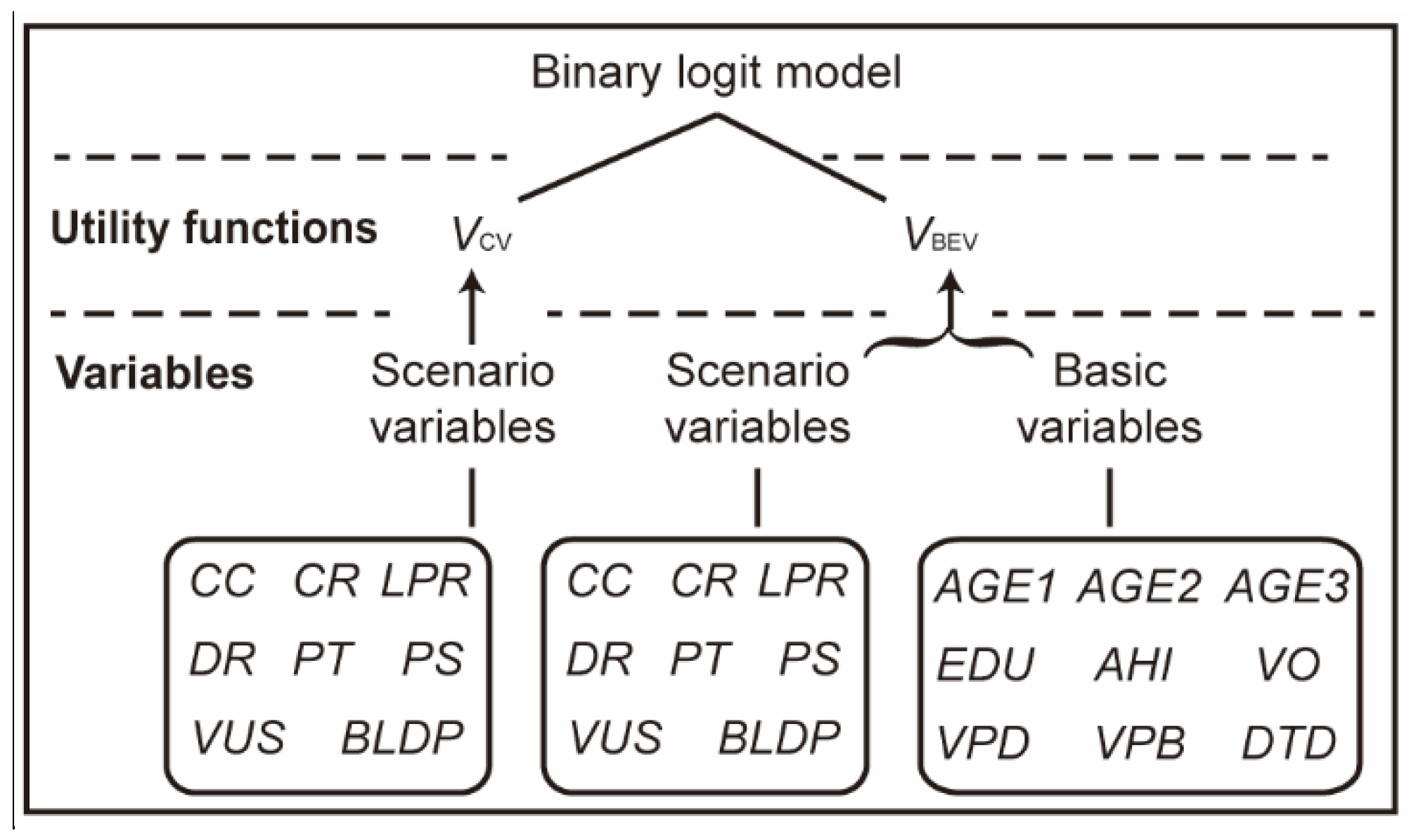

3.1. Model

3.2. Model Specification

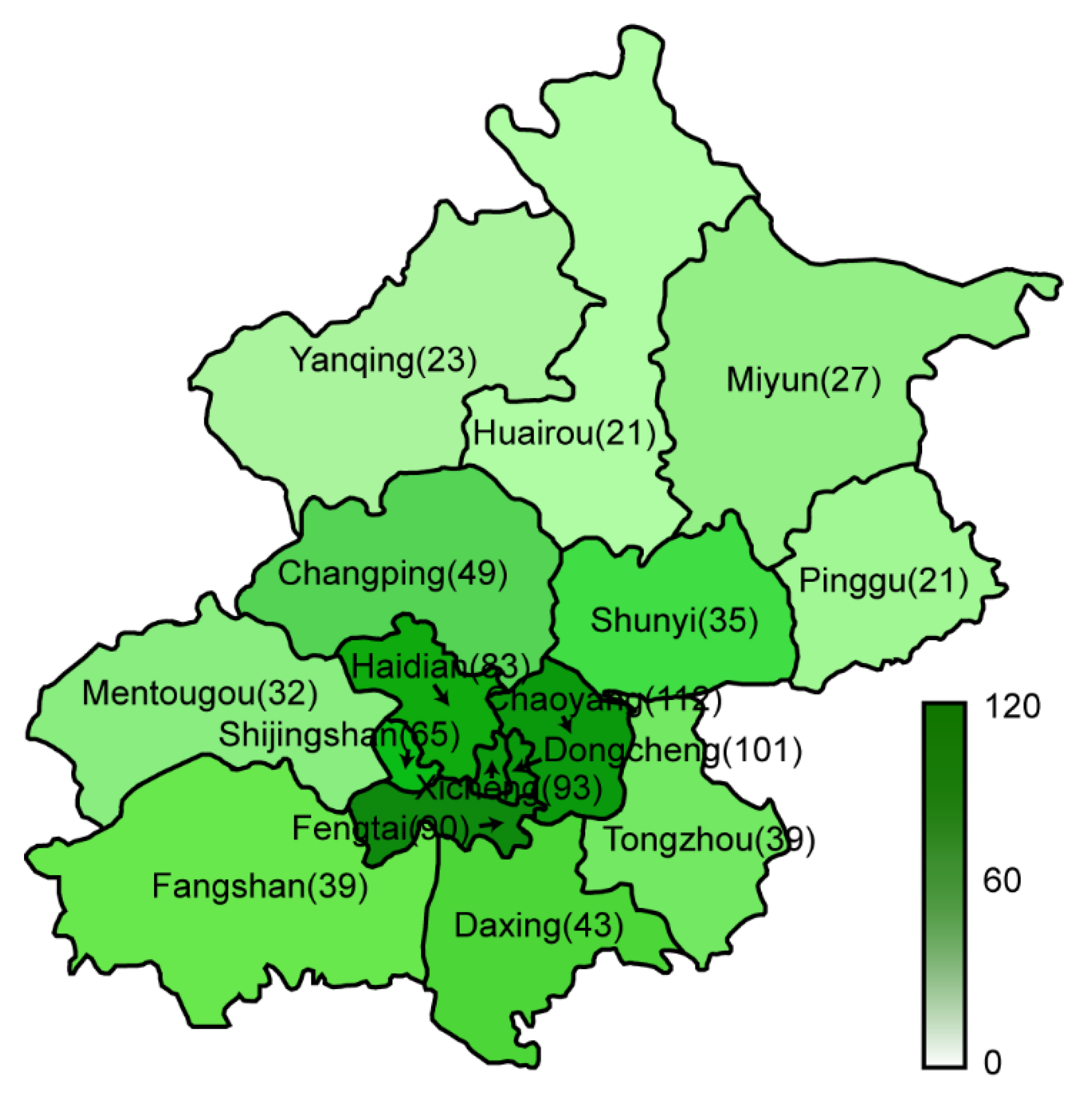

3.3. Data Collection

- The annual subsidy limit is 2000 CNY/year (287.9 USD/year), e.g., the mileage subsidy 0.5 CNY/km (0.072 USD/km), subsidy distance limit 4000 km/year, or the electricity subsidy 0.1 CNY/kWh (0.014 USD/kWh), subsidy electricity limit 20,000 kWh/year.

- The annual subsidy limit is 3000 CNY/year (431.8 USD/year), e.g., the mileage subsidy 0.5 CNY/km (0.072 USD/km), subsidy distance limit 6000 km/year, or the electricity subsidy 0.1 CNY/kWh (0.014 USD/kWh), subsidy electricity limit 30,000 kWh/year.

- The annual subsidy limit is 4000 CNY/year (575.8 USD/year), e.g., the mileage subsidy 0.5 CNY/km (0.072 USD/km), subsidy distance limit 8000 km/year, or the electricity subsidy 0.1 CNY/kWh (0.014 USD/kWh), subsidy electricity limit 40,000 kWh/year.

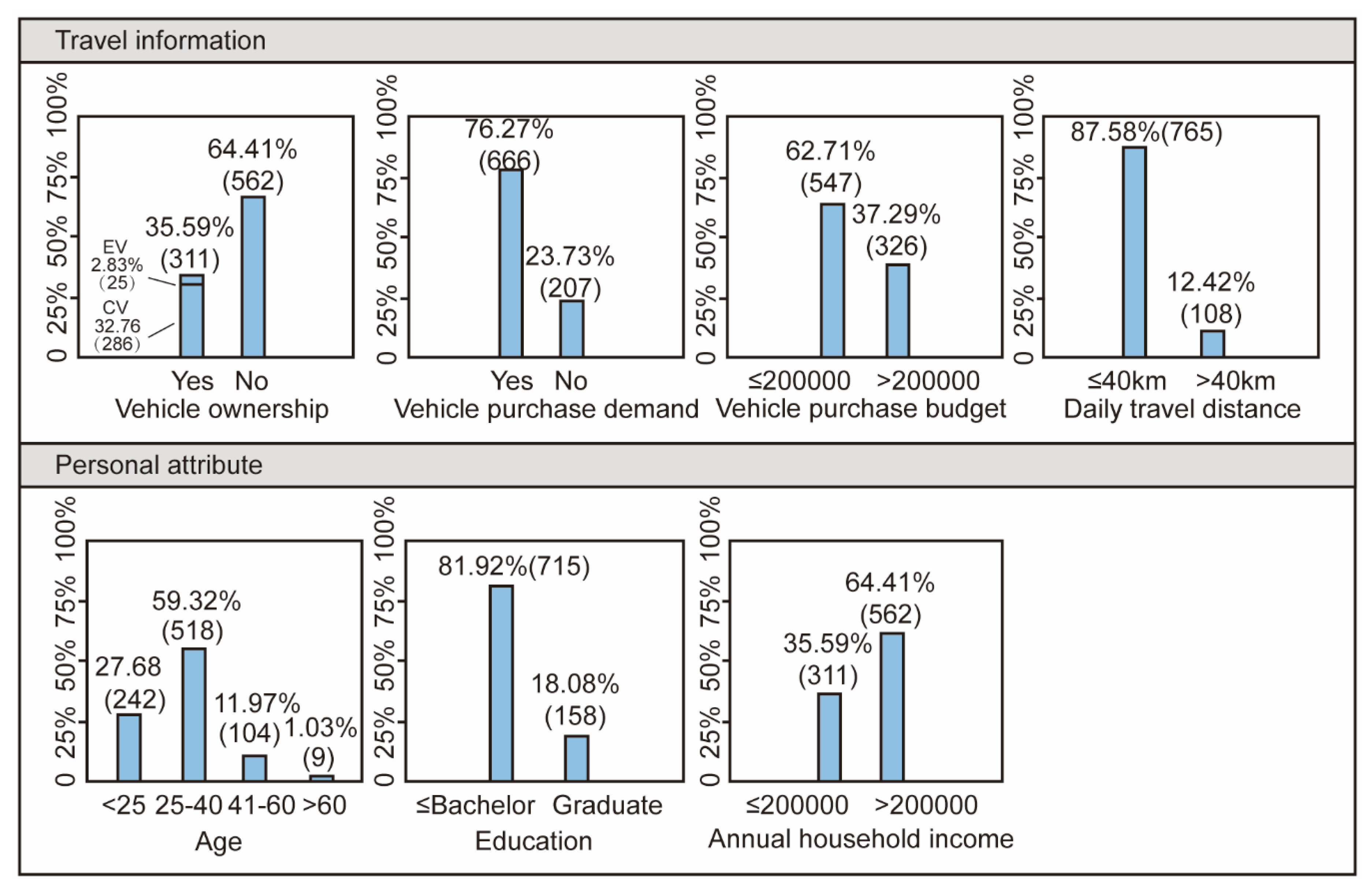

3.4. Statistical Analysis

4. Results and Analysis

4.1. Parameter Estimation Results Analysis

- Vehicle technique parameters. The values of and are both positive, showing that the improvement of charging convenience and cruising range have strong promotion effects on BEV adoption intentions. It reveals that the improvement of the two in the future is crucial for potential consumers to purchase BEVs.

- Restriction policy parameters. The values of and are both negative, indicating that the license plate restriction and driving restriction policies for BEVs have strong negative effects on the BEV choice probability. The root cause of these results is that people’s increasing demands for vehicles cannot be directly met. Besides, the absolute value of WTPLPR is 47.6, and the rank of LPR is 1, which is the highest among all variables. It shows that the CV license plate restriction is the most significant factor in promoting BEV adoption.

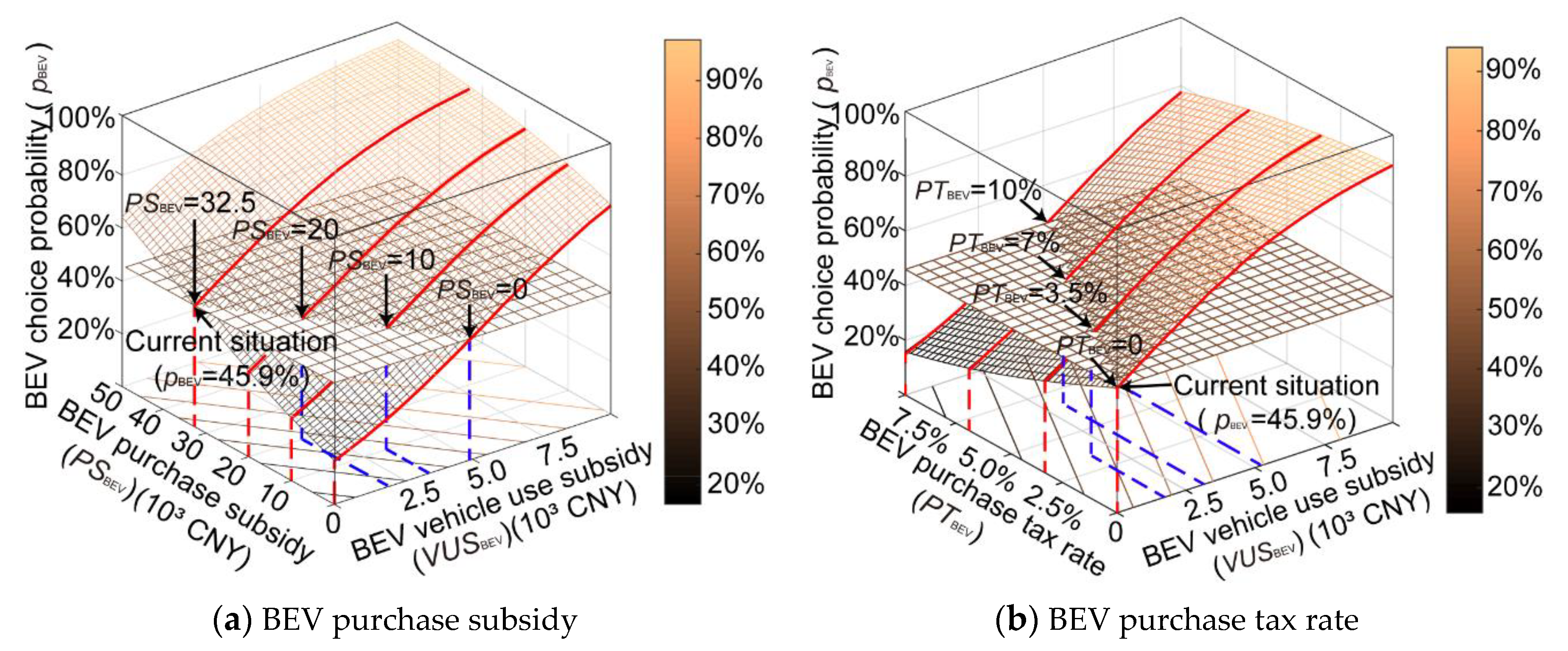

- Purchase subsidy policy parameters. The values of and are negative and positive, respectively, which indicates that as the BEV purchase tax rate increases or purchase subsidy decreases, the BEV choice probability will gradually decline. The value of WTPPT is −3.39, which means that a 1% increase in the purchase tax rate has the same effect on the BEV choice probability as a reduction of 3390 CNY (488.0 USD) in the purchase subsidy. This value indicates that the attitude of potential consumers to these two policies depends not only on economic factors but also on the difference between their characteristics, which may include the following two aspects: On the one hand, the purchase tax is linearly related to the purchase price, while the purchase subsidy is less relevant. On the other hand, the tax exemption policy is a direct exemption which does not need the consumer to pay, while the purchase subsidy requires the consumer to pay first and then subsidizes the consumer.

- Alternative incentive policy parameters. The values of and are both positive, which show that the BEVs’ vehicle use subsidy and bus line driving permit policy could increase the BEV choice probability. The value of WTPVUS is 6.61, which means that the impact of the vehicle use subsidy increases by 1000 CNY/year (143.9 USD/year) (six years in total) on BEV choice probability, equivalent to a purchase subsidy of 6610 CNY (951.5 USD). It shows that the potential consumers’ perception differences between the purchase subsidy and vehicle use subsidy are not only in terms of the subsidy amount, but there may also be another reason: The purchase subsidy is a one-time subsidy when purchasing a vehicle. The vehicle use subsidy is a sub-annual subsidy, and its annual subsidy amount is related to the vehicle use frequency. The value of WTPBLDP is 38.8, meaning that when the bus lanes allow BEVs to use them, their effects on BEV adoption is equivalent to a purchase subsidy of 38,800 CNY (5585.1 USD). The Rank of the BLDP is 2, revealing that the bus lane permission policy has a strong stimulating effect on BEV adoption intentions. The reason may be that severe traffic congestion during peak hours in Beijing prompts people to pay attention to this policy.

- Personal attribute parameters. The values of the age (AGE1, AGE2, and AGE3) parameters are positive, which shows that the potential consumer under 60 years old is more likely to purchase a BEV, and the relationship between AGE parameter values is , indicating that the younger the potential consumer, the more inclined to purchase a BEV. The ranks of AGE1, AGE2, and AGE3 are 4, 6, and 8, respectively, which are the largest in the basic parameters. It indicates that, for potential consumers’ personal attributes, age is the most significant factor affecting the BEV choice probability. The value of shows that potential consumers with a graduate degree are more inclined to purchase a BEV than others. The value of is negative, which indicates that potential consumers with annual household incomes below 200,000 CNY (28,789.4 USD) are more likely to purchase a BEV.These parameters illustrate that BEVs are more prevalent among potential consumers who are younger, with higher educations or lower household incomes. It reveals that the problem of how to improve BEV adoption intentions for potential consumers with different attributes needs to be further explored.

- Travel information parameters. The value of is negative, which shows that the potential consumer whose daily travel distance is less than 40 km is more likely to purchase a BEV. It reveals that BEVs are more suitable for short-distance travel needs in the context of the shortcomings of its cruising range and charging convenience. The value of is positive, indicating that potential consumers who already own vehicles are more likely to purchase a BEV. The reason for this phenomenon may be that the majority of vehicle ownership in Beijing is of CVs, whose driving restriction policy has a stimulating effect on BEVs, so users are more willing to purchase a BEV as a supplement to their travel needs. The value of is positive, which indicates that potential consumers with an urgent vehicle purchase demand are more likely to purchase a BEV, mainly because Beijing’s license plate restriction policy makes CV adoptions extremely difficult. The value of parameter is negative, showing that potential consumers with a vehicle purchase budget below 200,000 CNY (28,789.4 USD) are more inclined to purchase a BEV. This is most likely due to the more significant incentives of the BEV purchase subsidy and tax exemption policy for low-purchase budget consumers.

4.2. Alternative Incentive Policy Analysis

5. Conclusions and Discussion

5.1. Conclusions

- According to the model results related to subsidy policies, the intensity of the alternative incentive policies against the subsidy decrease is quantified, including the vehicle use subsidy and bus lane permission. The results show that the alternative incentive policies have better economic and incentive effects than the subsidy policy, so they could play a good transition role during the period of subsidy policy decrease. When the purchase subsidy or purchase tax exemption policy is canceled, the BEV choice probability will be reduced from the original 45.94% to 16.62% and 16.15%. In this case, the implementation of the bus line driving permit policy would increase the BEV choice probability to 52.56% and 49.56%, respectively, which are higher than the original level of 45.94%. For the vehicle use subsidy policy, it needs to be set at the level of 4962 CNY/year and 5130 CNY/year (714.3 USD/year and 738.4 USD/year), respectively, to maintain the original choice probability.

- This paper analyzed the impact of Beijing’s unique restriction policies, including license plate restrictions and driving restrictions. The results showed that these two policies have significant negative effects on BEV adoption intentions. Notably, the license plate restriction policy is the most significant factor compared with other factors. Therefore, restriction policies for CVs, especially the license plate restriction policy, are the effective measures to promote the development of BEVs.

- In terms of basic factors, the results show that BEVs are more acceptable among people who meet the following criteria: young, high education level, already owning vehicles, urgent vehicle purchase demand, lower income, short travel distance, and lower vehicle purchase budget. In terms of vehicle technical factors, charging convenience and cruising range have significant positive impacts on BEV adoption intentions, which show that these two factors urgently need to be improved for the BEV choice probability.

5.2. Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Lopez-Carreiro, I.; Monzon, A. Evaluating sustainability and innovation of mobility patterns in Spanish cities. Analysis by size and urban typology. Sustain. Cities Soc. 2018, 38, 684–696. [Google Scholar] [CrossRef]

- Jung, J.; Jayakrishnan, R. High-coverage point-to-point transit: Electric vehicle operations. Transp. Res. Rec. J. Transp. Res. Board 2012, 329, 44–53. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Global EV Outlook 2018; IEA: Paris, France, 2018. [Google Scholar]

- Weldon, P.; Morrissey, P.; O’Mahony, M. Long-term cost of ownership comparative analysis between electric vehicles and internal combustion engine vehicles. Sustain. Cities Soc. 2018, 39, 578–591. [Google Scholar] [CrossRef]

- Berckmans, G. Cost projection of state of the art lithium-ion batteries for electric vehicles up to 2030. Energies 2017, 10, 1314. [Google Scholar] [CrossRef] [Green Version]

- Pan, L.; Yao, E.; MacKenzie, D. Modeling EV charging choice considering risk attitudes and attribute non-attendance. Transp. Res. Part C Emerg. Technol. 2019, 102, 60–72. [Google Scholar] [CrossRef]

- Vidhi, R.; Shrivastava, P. A review of electric vehicle lifecycle emissions and policy recommendations to increase EV penetration in India. Energies 2018, 11, 483. [Google Scholar] [CrossRef]

- Li, W.; Long, R.; Chen, H. Consumers’ evaluation of national new energy vehicle policy in China: An analysis based on a four paradigm model. Energy Policy 2016, 99, 33–41. [Google Scholar] [CrossRef]

- Wang, N.; Tang, L.; Zhang, W.; Guo, J. How to face the challenges caused by the abolishment of subsidies for electric vehicles in China? Energy 2018, 166, 359–372. [Google Scholar] [CrossRef]

- Han, H. China’s electric vehicle subsidy scheme: Rationale and impacts. Energy Policy 2014, 73, 722–732. [Google Scholar]

- Liao, F.; Molin, E.; Wee, B. Consumer preferences for electric vehicles: A literature review. Transp. Rev. A Transnatl. Transdiscipl. J. 2017, 37, 1–24. [Google Scholar] [CrossRef] [Green Version]

- Plötz, P.; Schneider, U.; Globisch, J.; Dütschke, E. Who will buy electric vehicles? Identifying early adopters in Germany. Transp. Res. Part A Policy Pract. 2014, 67, 96–109. [Google Scholar] [CrossRef]

- Moons, I.; De Pelsmacker, P. Emotions as determinants of electric car usage intention. J. Mark. Manag. 2012, 28, 195–237. [Google Scholar] [CrossRef]

- Lieven, T.; Mühlmeier, S.; Henkel, S.; Waller, J.F. Who will buy electric cars? An empirical study in Germany. Transp. Res. Part D Transp. Environ. 2011, 16, 236–243. [Google Scholar] [CrossRef]

- Carley, S.; Krause, R.; Lane, B.; Graham, J.D. Intent to purchase a plug-in electric vehicle: A survey of early impressions in large US cites. Transp. Res. Part D Transp. Environ. 2013, 18, 39–45. [Google Scholar] [CrossRef]

- Egbue, O.; Long, S.; Samaranayake, V.A. Mass deployment of sustainable transportation: Evaluation of factors that influence electric vehicle adoption. Clean Technol. Environ. Policy 2017, 19, 1927–1939. [Google Scholar] [CrossRef]

- Jensen, A.F.; Cherchi, E.; Mabit, S.L. On the stability of preferences and attitudes before and after experiencing an electric vehicle. Transp. Res. Part D Transp. Environ. 2013, 25, 24–32. [Google Scholar] [CrossRef] [Green Version]

- Johan, J.; Annika, N.; Kerstin, W. Examining drivers of sustainable consumption: The influence of norms and opinion leadership on electric vehicle adoption in Sweden. J. Clean. Prod. 2017, 154, 176–187. [Google Scholar]

- Dumortier, J.; Siddiki, S.; Carley, S.; Cisney, J.; Krause, R.M.; Lane, B.W.; Rupp, J.A.; Graham, J.D. Effects of providing total cost of ownership information on consumers’ intent to purchase a hybrid or plug-in electric vehicle. Transp. Res. Part A Policy Pract. 2015, 72, 71–86. [Google Scholar] [CrossRef] [Green Version]

- Javid, R.J.; Nejat, A. A comprehensive model of regional electric vehicle adoption and penetration. Transp. Policy 2017, 54, 30–42. [Google Scholar] [CrossRef]

- Jakobsson, J.; Gnann, T.; Plötz, P.; Sprei, F.; Karlsson, S. Are multi-car households better suited for battery electric vehicles? Driving patterns and economics in Sweden and Germany. Transp. Res. Part C Emerg. Technol. 2016, 65, 1–15. [Google Scholar] [CrossRef]

- Karlsson, S. What are the value and implications of two-car households for the electric car? Transp. Res. Part C Emerg. Technol. 2017, 81, 1–17. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, Z.; Shi, J.; Wu, G.; Wang, R. Joint optimal policy for subsidy on electric vehicles and infrastructure construction in highway network. Energies 2018, 11, 2479. [Google Scholar] [CrossRef] [Green Version]

- Wang, N.; Tang, L.; Pan, H. A global comparison and assessment of incentive policy on electric vehicle promotion. Sustain. Cities Soc. 2019, 44, 597–603. [Google Scholar] [CrossRef]

- Morton, C.; Lovelace, R.; Anable, J. Exploring the effect of local transport policies on the adoption of low emission vehicles: Evidence from the London congestion charge and hybrid electric vehicles. Transp. Policy 2017, 60, 34–46. [Google Scholar] [CrossRef]

- Glerum, A.; Stankovikj, L.; Thémans, M. Forecasting the demand for electric vehicles: Accounting for attitudes and perceptions. Transp. Sci. 2014, 48, 483–499. [Google Scholar] [CrossRef] [Green Version]

- Zhang, X.; Bai, X.; Shang, J. Is subsidized electric vehicles adoption sustainable: Consumers’ perceptions and motivation toward incentive policies, environmental benefits, and risks. J. Clean. Prod. 2018, 192, 71–79. [Google Scholar] [CrossRef]

- Helveston, J.P.; Liu, Y.; Feit, E.M. Will subsidies drive electric vehicle adoption? Measuring consumer preferences in the U.S. and China. Transp. Res. Part A Policy Pract. 2015, 73, 96–112. [Google Scholar] [CrossRef] [Green Version]

- Zheng, X.; Lin, H.; Liu, Z.; Li, D. Manufacturing decisions and government subsidies for electric vehicles in China: A maximal social welfare perspective. Sustainability 2018, 10, 672. [Google Scholar] [CrossRef] [Green Version]

- Jenn, A.; Azevedo, I.L.; Fischbeck, P. How will we fund our roads? A case of decreasing revenue from electric vehicles. Transp. Res. Part A Policy Pract. 2015, 74, 136–147. [Google Scholar] [CrossRef]

- Hardman, S. Understanding the impact of reoccurring and non-financial incentives on plug-in electric vehicle adoption—A review. Transp. Res. Part A Policy Pract. 2019, 119, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Zhao, F.; Chen, K.; Hao, H.; Wang, S.; Liu, Z. Technology development for electric vehicles under new energy vehicle credit regulation in China: Scenarios through 2030. Clean Technol. Environ. Policy 2018, 21, 275. [Google Scholar] [CrossRef]

- Zhang, X.; Bai, X.; Zhong, H. Electric vehicle adoption in license plate-controlled big cities: Evidence from Beijing. J. Clean. Prod. 2018, 202, 191–196. [Google Scholar] [CrossRef]

- Wang, N.; Tang, L.; Pan, H. Effectiveness of policy incentives on electric vehicle acceptance in China: A discrete choice analysis. Transp. Res. Part A Policy Pract. 2017, 105, 210–218. [Google Scholar] [CrossRef]

- Yao, E.; Shao, C.; Jin, F.; Pan, L.; Zhang, R. Chapter 8—Battery electric vehicles in China: Ownership and usage. In Transport and Energy Research; Elsevier: Amsterdam, The Netherlands, 2020; pp. 177–222. [Google Scholar]

- Luce, D. Individual Choice Behavior; John Wiley and Sons: New York, NY, USA, 1959. [Google Scholar]

- McFadden, D. Conditional Logit Analysis of Qualitative Choice Behavior; Zarembka, P., Ed.; Academic Press: New York, NY, USA, 1974. [Google Scholar]

- Bierlaire, M. PythonBiogeme: A Short Introduction, Report TRANSP-OR 160706, Series on Biogeme; Transport and Mobility Laboratory, School of Architecture, Civil and Environmental Engineering, Ecole Polytechnique Fédérale de Lausanne: Lausanne, Switzerland, 2016. [Google Scholar]

- Świąder, M.; Lin, D.; Szewrański, S.; Kazak, J.K.; Iha, K.; Hoof, J.V.; Belčáková, I.; Altiok, S. The application of ecological footprint and biocapacity for environmental carrying capacity assessment: A new approach for European cities. Environ. Sci. Policy 2020, 105, 56–74. [Google Scholar]

| Category | Name | Type | Description | Values in Beijing’s Real Situation | |

|---|---|---|---|---|---|

| BEVs | CVs | ||||

| Vehicle technique | CC | 0–1 | Whether the charging is convenient (1: yes, 0: no) | 0 (no) | 1 (yes) |

| CR | 0–1 | Whether cruising range is long enough (1: yes, 0: no) | 0 (no) | 1 (yes) | |

| Restriction policy | LPR | 0–1 | Whether a license plate restriction policy is implemented (1: yes, 0: no) | 0 (no) | 1 (yes) |

| DR | 0–1 | Whether a driving restriction policy is implemented (1: yes, 0: no) | 0 (no) | 1 (yes) | |

| Purchase subsidy policy | PT | Continuous | Purchase tax rate (%) | 0 (%) | 10 (%) |

| PS | Continuous | Purchase subsidy | 32,500 (CNY) (4678.3 USD) | 0 (CNY) | |

| Alternative incentive policy | VUS | Continuous | Vehicle use subsidy | 0 (CNY/year) | 0 (CNY/year) |

| BLDP | 0–1 | Whether the bus line is permitted to drive (1: yes, 0: no) | 0 (no) | 0 (no) | |

| Category | Name | Type | Description |

|---|---|---|---|

| Personal attributes | AGE1 | 0–1 | Whether the age is 18–25 years old (1: yes, 0: no) |

| AGE2 | 0–1 | Whether the age is 25–40 years old (1: yes, 0: no) | |

| AGE3 | 0–1 | Whether the age is 40–60 years old (1: yes, 0: no) | |

| EDU | 0–1 | Whether the education level is postgraduate education (1: yes, 0: no) | |

| AHI | 0–1 | Whether the annual household income is more than 200,000 CNY (28,789.4 USD) (1: yes, 0: no) | |

| Travel information | VO | 0–1 | Whether the respondent already owns a vehicle (1: yes, 0: no) |

| VPD | 0–1 | Whether the respondent has urgent vehicle purchase demand (1: yes, 0: no) | |

| VPB | 0–1 | Whether the vehicle purchase budget is more than 200,000 CNY (28,789.4 USD) (1: yes, 0: no) | |

| DTD | 0–1 | Whether the daily travel distance is more than 40km (1: yes, 0: no) |

| Scenario Type | Scenario Name | Scenario Description | Variable Change |

|---|---|---|---|

| Real situation | 0 No change | The current real situation in Beijing | None |

| Vehicle technique change scenario | 1 Charging convenient (CC) change | BEV charging becomes convenient (the same as CV) | CCBEV = 1 |

| 2 Cruising range (CR) change | BEV cruising range increased (the same as CV) | CRBEV = 1 | |

| Restriction policy change scenario | 3 License plate restriction (LPR) change | BEV purchase becomes restricted (the same as CV) | PRBEV = 1 |

| 4 Driving restriction (DR) change | BEV driving becomes restricted (the same as CV) | DRBEV = 1 | |

| Subsidy policy change scenario | 5 Purchase tax rate (PT) change | BEV purchase tax rate becomes 3.5% (CV is 10%) | PTBEV = 3.5 |

| BEV purchase tax rate becomes 7.0% (CV is 10%) | PTBEV = 7.0 | ||

| BEV purchase tax rate becomes 10% (CV is 10%) | PTBEV = 10.0 | ||

| 6 Purchase subsidy (PS) change | BEV purchase subsidy becomes 45000 CNY (6477.6 USD) (CV is 0) | PSBEV = 45.0 | |

| BEV purchase subsidy becomes 20000 CNY (2878.9 USD) (CV is 0) | PSBEV = 20.0 | ||

| BEV purchase subsidy becomes 7500 CNY (1079.6 USD) (CV is 0) | PSBEV = 7.5 | ||

| BEV purchase subsidy becomes 0 (CV is 0) | PSBEV = 0.0 | ||

| Alternative incentive policy change scenario | 7 Vehicle use subsidy (VUS) change | BEV purchase subsidy becomes 0, and the vehicle use subsidy limit becomes 2000 CNY/year (287.9 USD/year) (CV is 0) | VUSBEV = 2.0 PSBEV = 0.0 |

| BEV purchase subsidy becomes 0, and the vehicle use subsidy limit becomes 3000 CNY/year (431.8 USD/year) (CV is 0) | VUSBEV = 3.0 PSBEV = 0.0 | ||

| BEV purchase subsidy becomes 0, and the vehicle use subsidy limit becomes 4000 CNY/year (575.8 USD/year) (CV is 0) | VUSBEV = 4.0 PSBEV = 0 | ||

| 8 Bus line driving permit (BLDP) change | BEV purchase subsidy becomes 0, and BEV is permitted to drive on bus lane (CV is not permitted) | BLDPBEV = 1 PSBEV = 0.0 |

| Category | Subcategories | Variable | Parameter (Par) | t value | WTPX | Rank | |

|---|---|---|---|---|---|---|---|

| BEV | CV | ||||||

| Scenario variable | Vehicle technique | Charging convenience (CC) | 1.23 *** | 1.23 *** | 7.24 | 27.8 | 5 |

| Cruising range (CR) | 1.11 *** | 1.11 *** | 6.75 | 25.1 | 7 | ||

| Restriction policy | License plate restriction (LPR) | −2.11 *** | −2.11 *** | −12.14 | −47.6 | 1 | |

| Driving restriction (DR) | −1.67 *** | −1.67 *** | −10.69 | −37.7 | 3 | ||

| Purchase subsidy policy | Purchase tax (PT) (%) | −0.150 *** | −0.150 *** | −10.95 | −3.39 | 15 | |

| Purchase subsidy (PS) (unit: 1000 CNY, i.e., 143.9 USD) | 0.0443 *** | 0.0443 *** | 11.75 | 1.0 | 17 | ||

| Alternative incentive policy | Vehicle use subsidy (VUS) (unit: 1000 CNY/year, i.e., 143.9 USD/year) | 0.293 *** | 0.293 *** | 8.16 | 6.61 | 12 | |

| Bus line driving permit (BLDP) | 1.72 *** | 1.72 *** | 11.2 | 38.8 | 2 | ||

| Basic variable | Personal attribute | Age (AGE1) (<25) | 1.54 *** | - | 3.27 | 34.8 | 4 |

| Age (AGE2) (25–40) | 1.16 ** | - | 2.47 | 26.2 | 6 | ||

| Age (AGE3) (41–60) | 0.896 * | - | 1.88 | 20.2 | 8 | ||

| Education (EDU) | 0.190 ** | - | 2.22 | 4.29 | 14 | ||

| Annual household income (AHI) | −0.0972 ** | - | −2.28 | −2.19 | 16 | ||

| Travel information | Daily travel distance (DTD) | −0.303 *** | - | −3.04 | −6.84 | 11 | |

| Vehicle ownership (VO) | 0.550 *** | - | 7.66 | 12.4 | 9 | ||

| Vehicle purchase demand (VPD) | 0.506 *** | - | 6.27 | 11.4 | 10 | ||

| Vehicle purchase budget (VPB) | −0.229 *** | - | −2.92 | −5.17 | 13 | ||

| Constant | −5.68 *** | - | −8.17 | −128 | − | ||

| 0.237 | |||||||

| Sample size | 8730: 873 respondents × 10 questions | ||||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, T.; Yao, E.; Jin, F.; Pan, L. Alternative Incentive Policies against Purchase Subsidy Decrease for Battery Electric Vehicle (BEV) Adoption. Energies 2020, 13, 1645. https://doi.org/10.3390/en13071645

Lu T, Yao E, Jin F, Pan L. Alternative Incentive Policies against Purchase Subsidy Decrease for Battery Electric Vehicle (BEV) Adoption. Energies. 2020; 13(7):1645. https://doi.org/10.3390/en13071645

Chicago/Turabian StyleLu, Tianwei, Enjian Yao, Fanglei Jin, and Long Pan. 2020. "Alternative Incentive Policies against Purchase Subsidy Decrease for Battery Electric Vehicle (BEV) Adoption" Energies 13, no. 7: 1645. https://doi.org/10.3390/en13071645