Market Trading Model of Urban Energy Internet Based on Tripartite Game Theory

Abstract

:1. Introduction

2. Materials and Methods

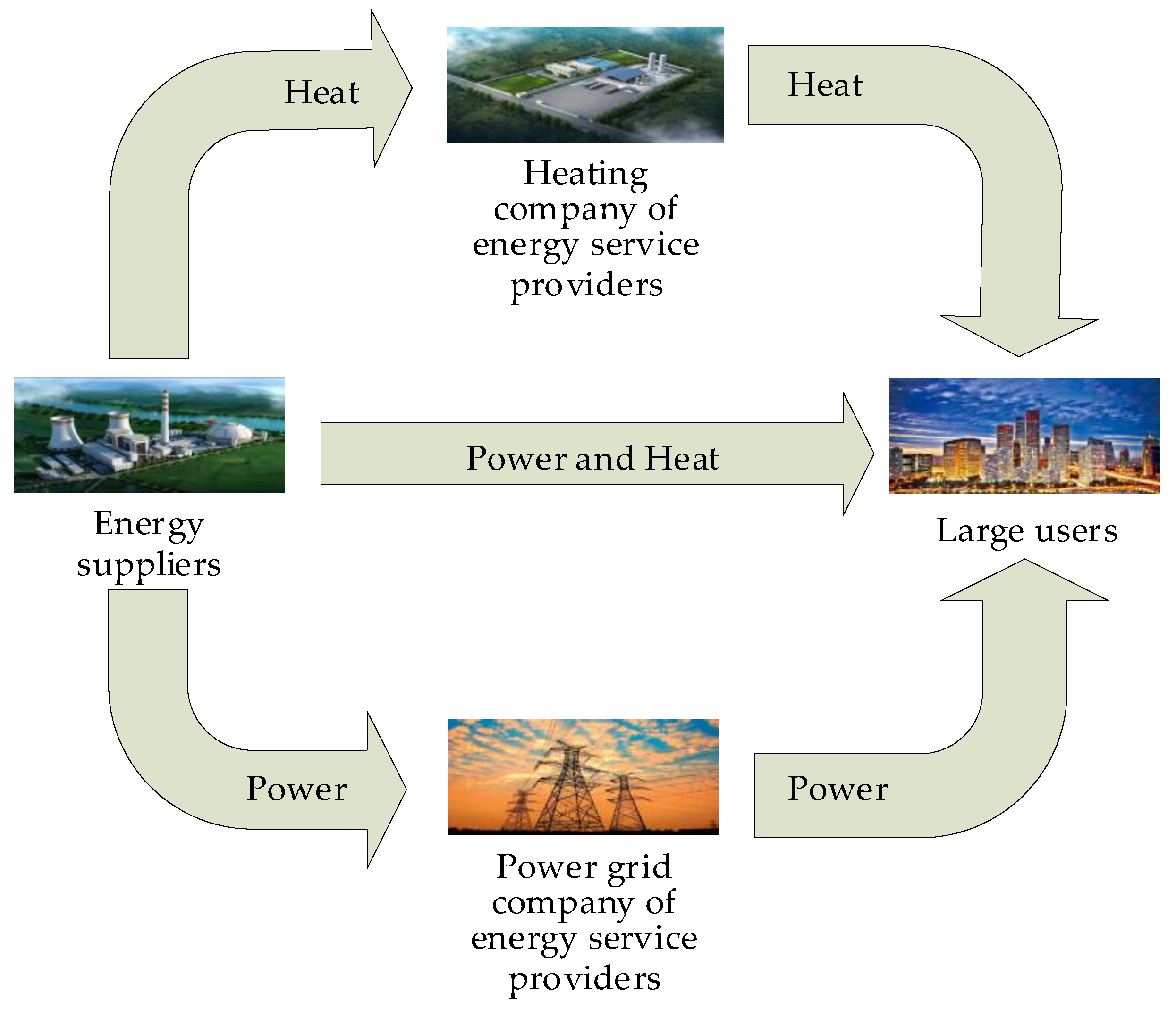

2.1. Tripartite Game Model for the Energy Internet Market

2.1.1. Market Trading Mechanism

2.1.2. Tripartite Game Model

- (1)

- Game entities : energy internet market entities include all of the energy suppliers ,, energy service providers of both power grid companies and heating companies , and the large users .

- (2)

- Game strategies : in the energy internet market, the game strategy of each participant is its quotation price.

- (3)

- Game utilities : every rational participant wants to make a deal and get a payoff under the Nash equilibrium.

2.2. Market Entities’ Cost–Income Model

2.2.1. Energy Suppliers

- (a)

- Transaction revenue function : For each energy supplier ,, its transaction revenue by trading electricity and heat can be represented aswhere is the number of energy suppliers; and represent, respectively, the amount of heat and its price that the -th energy supplier trades with the large user; and mean the amount of electricity and its price that the -th energy supplier trades with large user, respectively; and mean the amount of heat and its price, respectively, that the -th energy supplier trades with power grid company; and mean the amount of heat and its price, respectively that the -th energy supplier trades with the heating company.

- (b)

- Service fee function : Energy service providers charge service fees for transactions between energy suppliers and large user:where is the electricity service fee charged by the power grid company when the energy suppliers trade electricity directly with the large user and is the heat service fee charged by the heating company when the energy suppliers trade heat directly with the large user.

- (c)

- Other benefit function : other benefits of energy suppliers are expressed only at cost. In order to show the relationship between energy suppliers’ electricity and heat energy transactions and their respective costs, the electricity and heat energy costs are calculated separately in the cost model. Therefore, other benefit of energy suppliers can be expressed aswhere and are the power generation amount and unit power generation cost of the -th energy supplier and and are the heat production amount and unit heat production cost of the -th energy supplier.

2.2.2. Large User

- (a)

- Transaction revenue function : can be formulated aswhere and represent the amount of electricity and its price that the power grid company trades with the large, user as an energy service provider, and and represent the amount of heat and its price that the heating company trades with the large user, as an energy service provider.

- (b)

- Service fee function : can be formulated as:

- (c)

- Other benefit function : large users have no other benefits, which is assumed to be , since the large user can use electric heating equipment to convert electrical energy bought from the grid company into heat so as to meet the heat demand.

2.2.3. Power Grid Company as an Energy Service Provider

- (a)

- Transaction revenue function :

- (b)

- Service fee :

- (c)

- Other benefit : Other benefits for the power grid company as an energy service provider are only related to its own costs:where is the unit cost of electricity sold by the power grid company.

2.2.4. Heating company as an energy service provider

- (a)

- Transaction revenue :

- (b)

- Service fee function :

- (c)

- Other benefit function . Other benefits for the heating company as an energy service provider are only related to its own costs:where is the unit cost of heat sold by the heating company.

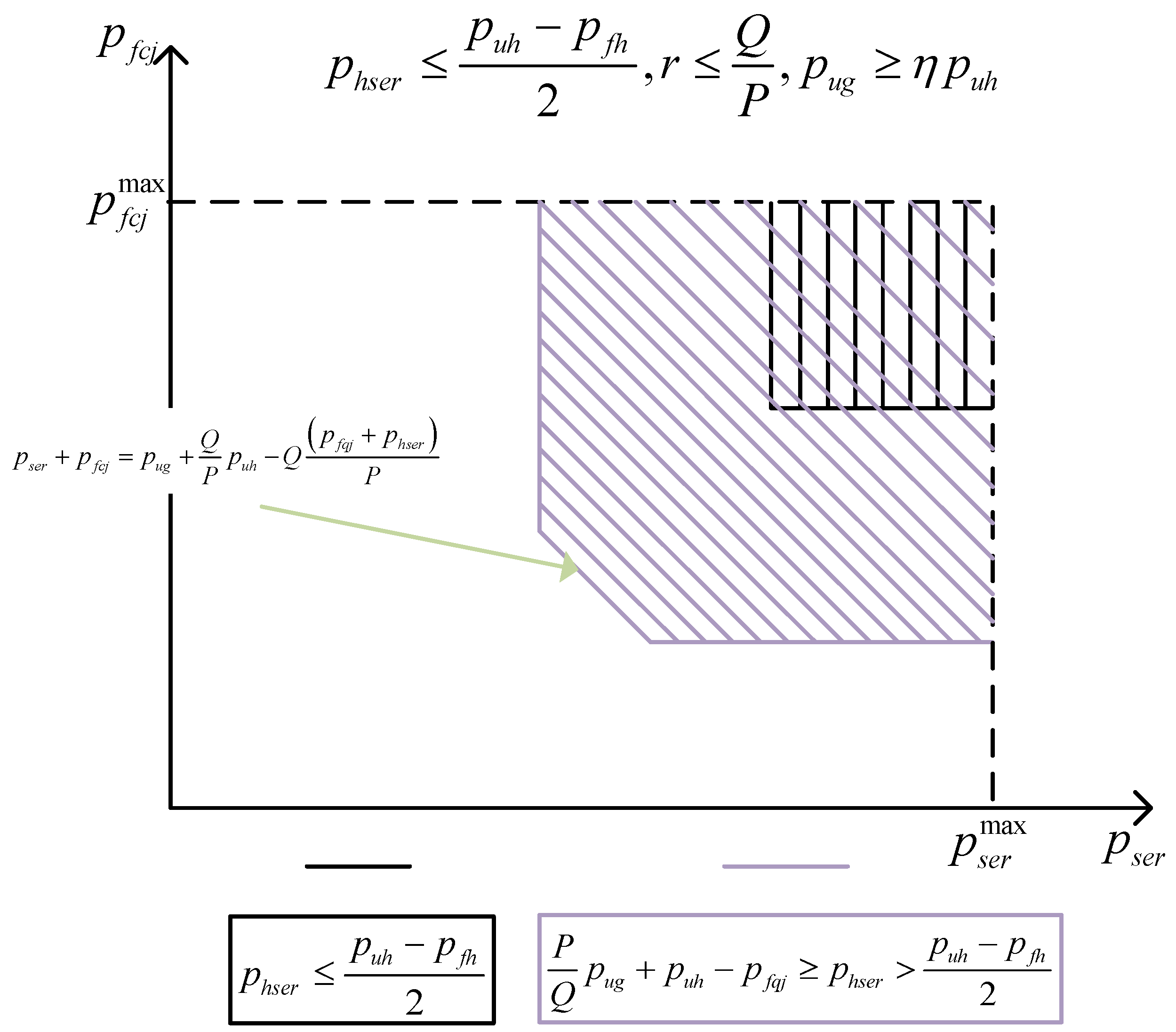

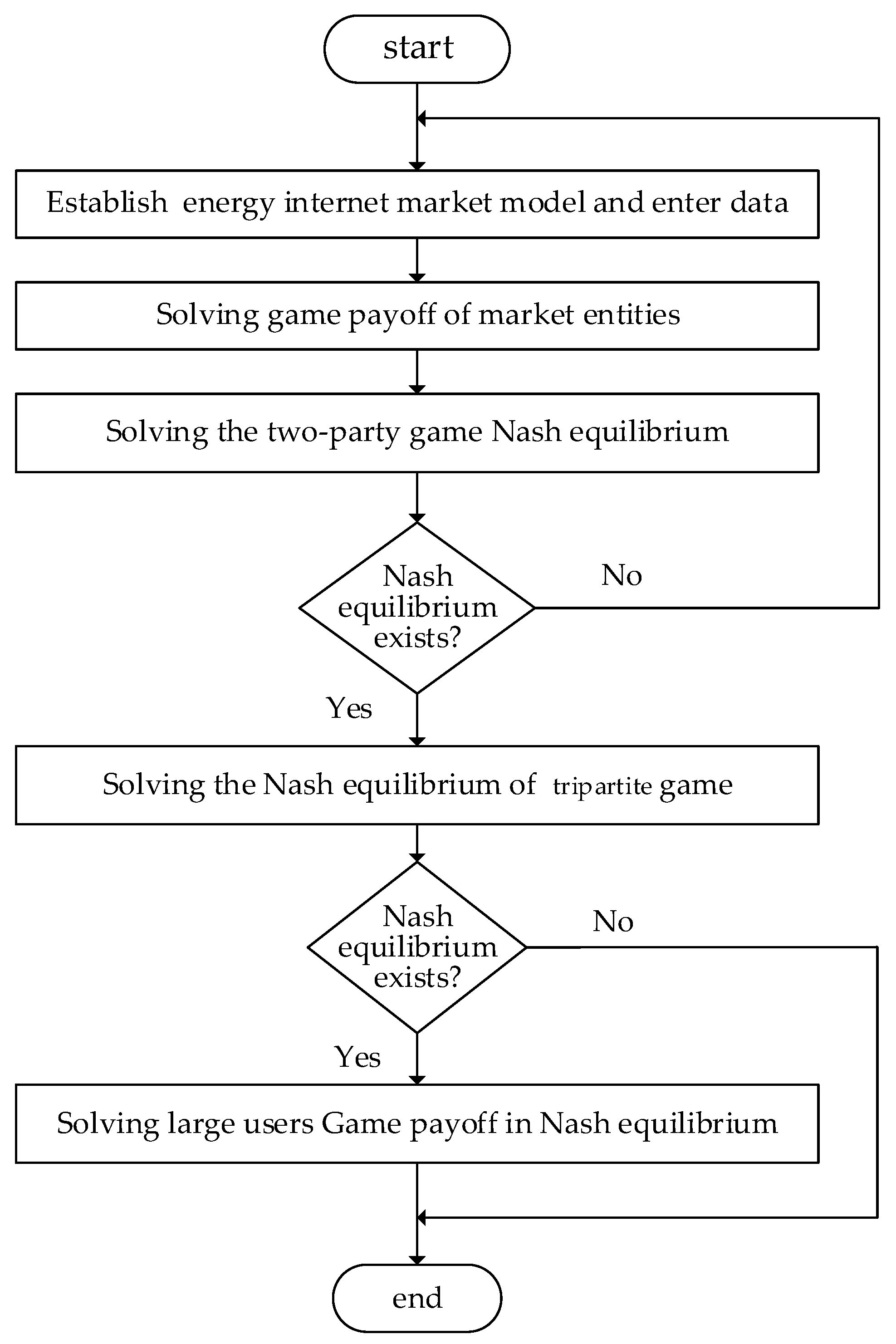

2.3. A New Nash Equilibrium Solving Method for the Tripartite Game Model

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Huang, A.Q.; Crow, M.L.; Heydt, G.T.; Zheng, J.P.; Dale, S.J. The Future Renewable Electric Energy Delivery and Management (FREEDM) System: The Energy Internet. Proc. IEEE 2011, 99, 133–148. [Google Scholar] [CrossRef]

- Zhou, K.; Yang, S.; Shao, Z. Energy Internet: The business perspective. Appl. Energy 2016, 178, 212–222. [Google Scholar] [CrossRef]

- Ma, Z.; Zhou, X.X.; Shang, Y.W.; Sheng, W.X. Exploring the concept, key technologies and development model of energy Internet. Power Syst. Technol. 2015, 39, 3014–3022. [Google Scholar] [CrossRef]

- Liu, F.; Bie, Z.H.; Liu, S.Y.; Li, G.F. Framework design, transaction mechanism and key issues of Energy Internet Market. Automat. Electr. Power Syst. 2018, 42, 108–117. [Google Scholar] [CrossRef]

- Lu, Q.; Lü, S.; Leng, Y. A Nash-Stackelberg game approach in regional energy market considering users’ integrated demand response. Energy 2019, 175, 456–470. [Google Scholar] [CrossRef]

- Gabriel, S.A.; Conejo, A.J.; Fuller, J.D.; Hobbs, B.F.; Ruiz, C. Complementarity Modeling in Energy Markets; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2012; p. 1. ISBN 9781441961235. [Google Scholar]

- Durvasulu, V.; Hansen, T.M. Benefits of a demand response exchange participating in existing bulk-power markets. Energies 2018, 11, 3361. [Google Scholar] [CrossRef] [Green Version]

- Zhang, C.; Yan, W. Spot market mechanism design for the electricity market in china considering the impact of a contract market. Energies 2019, 12, 1064. [Google Scholar] [CrossRef] [Green Version]

- Cheng, C.T.; Chen, F.; Li, G.; Tu, Q.T. Market equilibrium and impact of market mechanism parameters on the electricity price in Yunnan’s electricity market. Energies 2016, 9, 463. [Google Scholar] [CrossRef] [Green Version]

- Wang, C.; Wei, W.; Wang, J.; Liu, F.; Mei, S. Strategic offering and equilibrium in coupled gas and electricity markets. IEEE Trans. Power Syst. 2017, 33, 290–306. [Google Scholar] [CrossRef]

- Chen, R.Z.; Wang, J.H.; Sun, H.B. Clearing and pricing for coordinated gas and electricity day-ahead markets considering wind power uncertainty. IEEE Trans. Power Syst. 2018, 33, 2496–2508. [Google Scholar] [CrossRef]

- Zhao, S.N.; Wang, B.B.; Li, Y.C.; Li, Y. Integrated energy transaction mechanisms based on blockchain technology. Energies 2018, 11, 2412. [Google Scholar] [CrossRef] [Green Version]

- Fudenberg, D.; Levine, D.K. The Theory of Learning in Games; MIT Press Books: Cambridge, MA, USA, 1998; p. 1. ISBN 9780262061940. [Google Scholar]

- Zhao, N.; Xia, T.; Yu, T.; Liu, C. Subsidy-related deception behavior in energy-saving products based on game theory. Front. Energy Res. 2020, 7, 1–10. [Google Scholar] [CrossRef] [Green Version]

- Von Neumann, J.; Morgenstern, O.; Kuhn, H.W. Theory of Games and Economic Behavior (Commemorative Edition); Princeton University Press: Princeton, NJ, USA, 2007; p. 1. ISBN 9781400829460. [Google Scholar]

- Saad, W.; Zhu, H.; Poor, H.V. Coalitional game theory for cooperative micro-grid distribution networks. In Proceedings of the 2011 IEEE International Conference on Communications Workshops (ICC), Kyoto, Japan, 5–9 June 2011; pp. 1–5. [Google Scholar]

- Kasbekar, G.S.; Sarkar, S. Pricing games among interconnected microgrids. In Proceedings of the 2012 IEEE Power and Energy Society General Meeting (PESGM), San Diego, CA, USA, 22–26 July 2012; pp. 1–8. [Google Scholar]

- Mohsenian-Rad, A.H.; Wong, V.W.S.; Jatskevich, J.; Schober, R.; Leon-Garcia, A. Autonomous demand-side management based on game-theoretic energy consumption scheduling for the future smart grid. IEEE Trans. Smart Grid 2010, 1, 320–331. [Google Scholar] [CrossRef] [Green Version]

- Han, X.J.; Wang, F.; Tian, C.G.; Xue, K.; Zhang, J.F. Economic evaluation of actively consuming wind power for an integrated energy system based on game theory. Energies 2018, 11, 1476. [Google Scholar] [CrossRef] [Green Version]

- Zang, T.; Xiang, Y.; Yang, J. The tripartite game model for electricity pricing in consideration of the power quality. Energies 2017, 10, 2025. [Google Scholar] [CrossRef] [Green Version]

- Gao, B.T.; Zhang, W.H.; Tang, Y.; Hu, M.J.; Zhu, M.C.; Zhan, H.Y. Game-theoretic energy management for residential users with dischargeable plug-in electric vehicles. Energies 2014, 7, 7499–7518. [Google Scholar] [CrossRef]

- Karavas, C.S.; Arvanitis, K.; Papadakis, G. A game theory approach to multi-agent decentralized energy management of autonomous polygeneration microgrids. Energies 2017, 10, 1756. [Google Scholar] [CrossRef] [Green Version]

- Dong, F.G.; Ding, X.H.; Shi, L. Wind power pricing game strategy under the china’s market trading mechanism. Energies 2019, 12, 3456. [Google Scholar] [CrossRef] [Green Version]

- He, Y.X.; Song, D.; Xia, T.; Li, W.Y. Mode of generation right trade between renewable energy and conventional energy based on cooperative game theory. Power Syst. Technol. 2017, 41, 2485–2490. [Google Scholar] [CrossRef]

- Yang, Z.; Peng, S.C.; Liao, Q.F.; Liu, D.C.; Xu, Y.Y.; Zhang, Y.J. Non-cooperative trading method for three market entities in integrated community energy system. Automat. Electr. Power Syst. 2018, 42, 32–39. [Google Scholar] [CrossRef]

- Fang, Y.J.; Chen, L.J.; Mei, S.W.; Huang, S.W. Marketing equilibria of integrated heating and power system considering locational marginal pricing in distribution networks. J. Eng. 2017, 14, 2609–2614. [Google Scholar] [CrossRef]

- Liu, J.; Wang, C.; Chen, J.C.; Liu, X.M.; Liu, Y.W. Game theory based profit model for multiple market entities of urban energy internet. Automat. Electr. Power Syst. 2019, 43, 90–96. [Google Scholar] [CrossRef]

- Ma, Z.; Callaway, D.S.; Hiskens, I.A. Decentralized charging control of large populations of plug-in electric vehicles. IEEE Trans. Control Syst. Technol. 2012, 21, 67–78. [Google Scholar] [CrossRef]

- Kanzow, C.; Steck, D. Augmented Lagrangian methods for the solution of generalized Nash equilibrium problems. SIAM J. Optim. 2018, 26, 2034–2058. [Google Scholar] [CrossRef] [Green Version]

- Schiro, D.A.; Pang, J.S.; Shanbhag, U.V. On the solution of affine generalized Nash equilibrium problems with shared constraints by Lemke’s method. Math. Program. 2013, 142, 1–46. [Google Scholar] [CrossRef]

- Mei, S.W. The Basis of Engineering Game Theory and its Power System Application; China Science Press: Beijing, China, 2016; p. 1. ISBN 9787030500106. [Google Scholar]

- Gibbons, R. Game Theory for Applied Economist; Pricenton University Press: Princeton, NJ, USA, 1992; p. 1. ISBN 9780691003955. [Google Scholar]

- Luo, Y.F. Game Theory; Tsinghua University Press; Beijing Jiaotong University Press: Beijing, China, 2007; p. 1. ISBN 9787811231052. [Google Scholar]

| Parameters | Values (unit) | Parameters | Values (unit) |

|---|---|---|---|

| 3 MW | 5 MW | ||

| 0.5 yuan/(kW·h) | 0.6 yuan/(kW·h) | ||

| 0.5 yuan/(kW·h) | 0.9 | ||

| 0.2 yuan /(kW·h) | 0.2 yuan/(kW·h) | ||

| 1.2 yuan/(kW·h) | 0.8 yuan/(kW·h) | ||

| 0.8 yuan/(kW·h) | yuan/(kW·h) | ||

| yuan /(kW·h) | yuan/(kW·h) |

| Variables | User Trading Mode | Strategy Combination | Large User (yuan) | Energy Supplier (yuan) | Power Grid Company (yuan) | Heating Company (yuan) |

|---|---|---|---|---|---|---|

| With the power grid company | Equilibrium strategy 0 | −5000 | 0 | 2000 | 900 | |

| Energy supplier’s | With the heating company | Non-equilibrium strategy 1 | −4700 | -500 | 3000 | 600 |

| With the power grid company | Equilibrium strategy 2 | −5000 | 0 | 2000 | 900 | |

| Power grid company’s | With the heating company | Non-equilibrium strategy 3 | −4700 | 500 | 1000 | 600 |

| With the power grid company | Equilibrium strategy 4 | −5000 | 0 | 2000 | 900 | |

| Heating company’s | With the power grid company | Equilibrium strategy 5 | −5000 | 0 | 2000 | 900 |

| With the power grid company | Equilibrium strategy 6 | −5000 | 0 | 2000 | 900 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Chen, J.; Wang, C.; Chen, Z.; Liu, X. Market Trading Model of Urban Energy Internet Based on Tripartite Game Theory. Energies 2020, 13, 1834. https://doi.org/10.3390/en13071834

Liu J, Chen J, Wang C, Chen Z, Liu X. Market Trading Model of Urban Energy Internet Based on Tripartite Game Theory. Energies. 2020; 13(7):1834. https://doi.org/10.3390/en13071834

Chicago/Turabian StyleLiu, Jun, Jinchun Chen, Chao Wang, Zhang Chen, and Xinglei Liu. 2020. "Market Trading Model of Urban Energy Internet Based on Tripartite Game Theory" Energies 13, no. 7: 1834. https://doi.org/10.3390/en13071834

APA StyleLiu, J., Chen, J., Wang, C., Chen, Z., & Liu, X. (2020). Market Trading Model of Urban Energy Internet Based on Tripartite Game Theory. Energies, 13(7), 1834. https://doi.org/10.3390/en13071834