1. Introduction

The future distribution network is a peer-to-peer (P2P) community based on distributed energy resources (DERs) and distributed intelligence. On the one hand, the boundaries between electricity producers and consumers are blurring fast, leading to the emergence of prosumers. A prosumer can play a time-variant dual-role in electricity transaction, as either a buyer or a seller at different times. On the other hand, advanced information technologies make prosumers capable of active perception, comprehension, decision, and interaction in terms of various energy behaviors, such as production, consumption, and storage. This paper proposes the concept of active energy agent (AEA) to characterize the autonomous interactive entities in electricity market. Numbers of AEAs form a P2P community and each AEA is an equivalent peer of the community, regardless of physical implementations. An AEA in reality can be a smart appliance, a rooftop photovoltaic, an electric vehicle, a household energy management system, a microgrid, a virtual power plant, etc.

The P2P transaction is generally adopted among entities that are organized in a P2P manner, due to the advantages with respect to renewable energy use and economic benefit. Reference [

1,

2] developed the P2P transactions between renewable energy modules and electric vehicles. The use of renewable energy is significantly improved, since electric vehicles can charge batteries to consume the excess output of renewable energy modules which would, otherwise, be curtailed to avoid over-voltage issues. Reference [

3] proposed the P2P power sharing mechanism in a microgrid through two-level battery management, and verified that P2P could lead to higher benefits for both parties in the transaction than the traditional mode of the feed-in grid. The matchmaking and negotiation are the two key factors of the P2P transaction. Firstly, matchmaking refers to the mechanism and criterion according to which the two parties in the P2P transaction are successfully matched. Reference [

4] believes that the matchmaking is solely dependent on price, and the seller chooses the buyer who has a low bid price. Reference [

5,

6] aimed to find the optimal match among nodes by minimizing the energy output of the central node. Meanwhile, connection cannot be set up if the distance between two nodes exceeds the threshold. By considering the distance between two nodes, sellers would give more power to buyers who is closer to them [

7]. Reference [

8] integrates the cost and quantity of electricity in the utility function to describe the agent’s preference or value for an offer. Secondly, the negotiation refers to the strategies according to which the two parties in P2P transaction dynamically update their bids. The classical zero intelligence strategy simply locks the bid price into not being below the cost or above the value [

9]. The closing rate can significantly increase, but the market players cannot dynamically respond to the changing market since the price is independent of the willingness of market players. The unilateral bidding mechanism is modified to improve the flexibility of P2P energy trading. The zero intelligence plus strategy provides all traders with the right to choose counterparties, significantly improving the benefits of both parties in the transaction [

10]. Reference [

11] adopts an adaptive and aggressive trading strategy that reflects the willingness of market players in P2P energy trading. By using agent modelling to capture the preferences of entities, the impact of three negotiation strategies on transaction process are discussed in reference [

8]. Most existing work offers the P2P market players with the principal one chance to select the counterparty. This paper attempts to propose a modification that can offer more right to market players by comprehensively regarding their willingness.

Despite of the efficiency and flexibility of P2P transactions, it is of high risk to solely rely on P2P transactions in a real distribution network. For example, some orders cannot be successfully matched, and some lines can be congested. It is crucial to apply centralized coordination or intervention after spontaneous P2P transactions. In the context of setting up the electricity market, economic measures such as electricity prices are the preferred options. Demand response is a typical centralized coordination scheme, and falls into two categories—price-based and incentive-based—which have significant effects on transferring load and reducing load, respectively [

12]. Demand response programs are applied in various scenarios to improve the rationality of electricity consumption [

13], reduce peak-to-valley differences of load demand [

14], alleviate power supply demand imbalances and save energy [

15], realize the reliability and economical operation [

16]. Reference [

17] proposes a joint program that makes the demand side actively participate in scheduling, and a load change rate following wind power fluctuations to optimize the load curve. Reference [

18] adopts the demand-price elasticity model to increase the allocation capacity of renewable energy while reducing the use of energy storage and the thermal power. Reference [

13] integrates demand response and the robust stochastic optimization to deal with the uncertainty of wind power. The cited work mainly focuses on the management of demand side, while neglects the impact of the power flow on the safety of power system. Generally speaking, the flow of electric power can be calculated by using the Power-Flow or Load-Flow methods [

19]. Reference [

20] includes a Power-Flow algorithm in the model to determine the network currents and voltages. Reference [

21] sets up a general approach for modeling multi-carrier energy systems. However, little effort is made in terms of imposing power flow constraints on demand response in case of line congestion.

The setting up of electricity markets has been undergoing progress [

22]. Documents issued by NDRC (National Development and Reform Commission of China) and NEA (National Energy Administration of China) strongly promote near-site bilateral transactions and encourage the local consumption of distributed energies [

23]. With the opening of retail markets and the construction of incremental distribution networks, a number of novel distribution companies (DisCo) have emerged. DisCo is the dual-role participant in the electricity transaction. On the one hand, DisCo is a self-interested market player that maximizes profit from electricity transactions, on the other hand, DisCo is the system operator responsible for ensuring the basic rights of users and the safety of the distribution network [

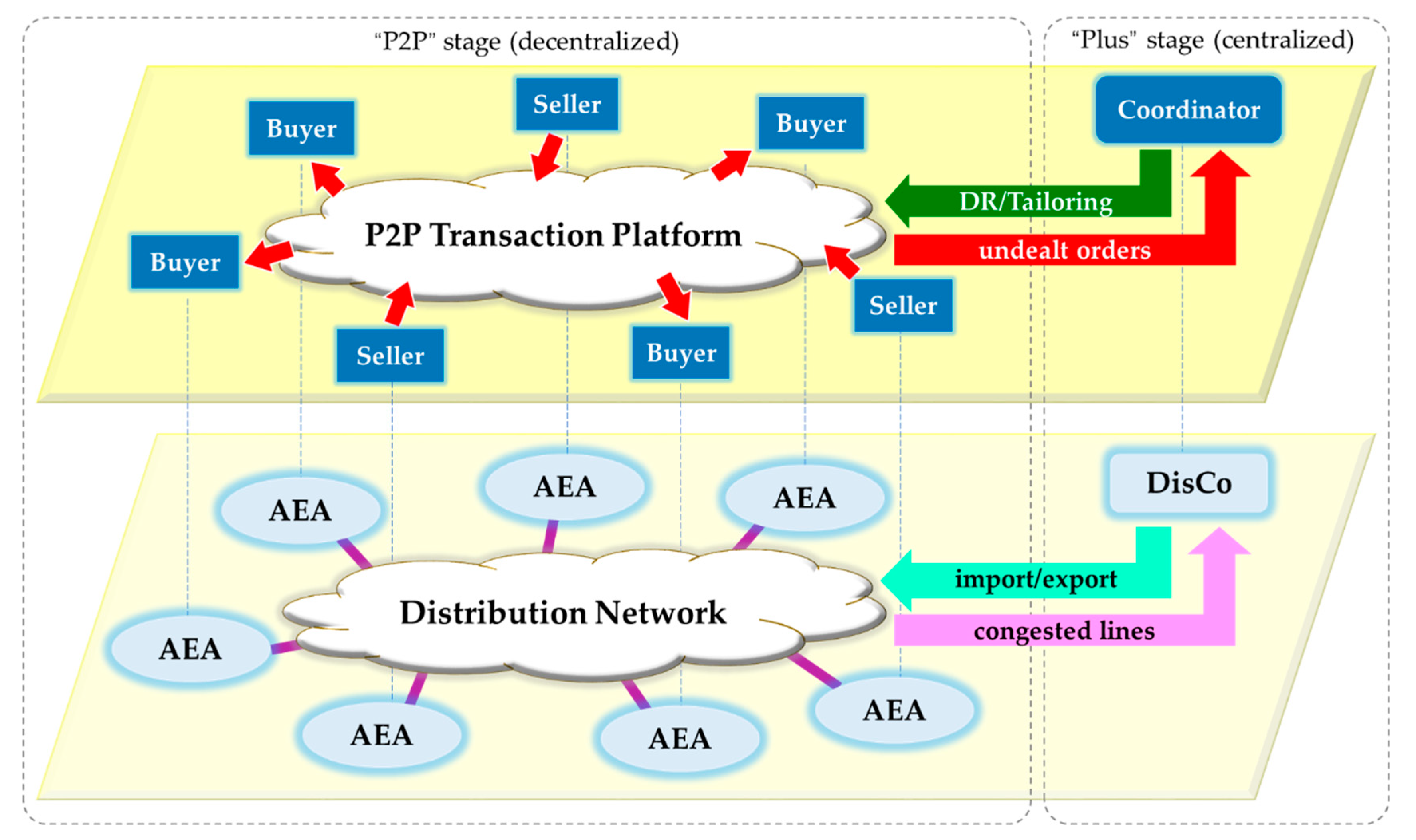

24]. In this context, this paper proposes a two-stage “P2P Plus” mechanism of transaction that is a hybrid of the decentralized P2P transaction with centralized coordination. The mechanism takes full account of the willingness of the AEA and guarantees the energy supply and the safety of the distribution network. The innovative contributions of this article can be outlined as follows:

- (1).

The concept of the “active energy agent” is proposed to characterize any autonomous entity exhibiting active energy behavior in electricity transaction, regardless of their specific physical appearance.

- (2).

The two-stage “P2P Plus” mechanism is developed, which integrates the decentralized transaction and centralized coordination or intervention by considering the benefits of all parties in electricity transaction.

- (3).

Realistic constraints, such as users’ basic rights and line ratings, are incorporated in the optimization model. The tailoring algorithm based on power transfer distribution factor is designed to locate and tailor orders causing congestion.

- (4).

This study is performed in the context of setting up electricity market in China. The proposed methodology and the results obtained can provide a reference for accelerating the local energy transaction and distributed renewable energy use.

The remainder of this paper is organized as follows:

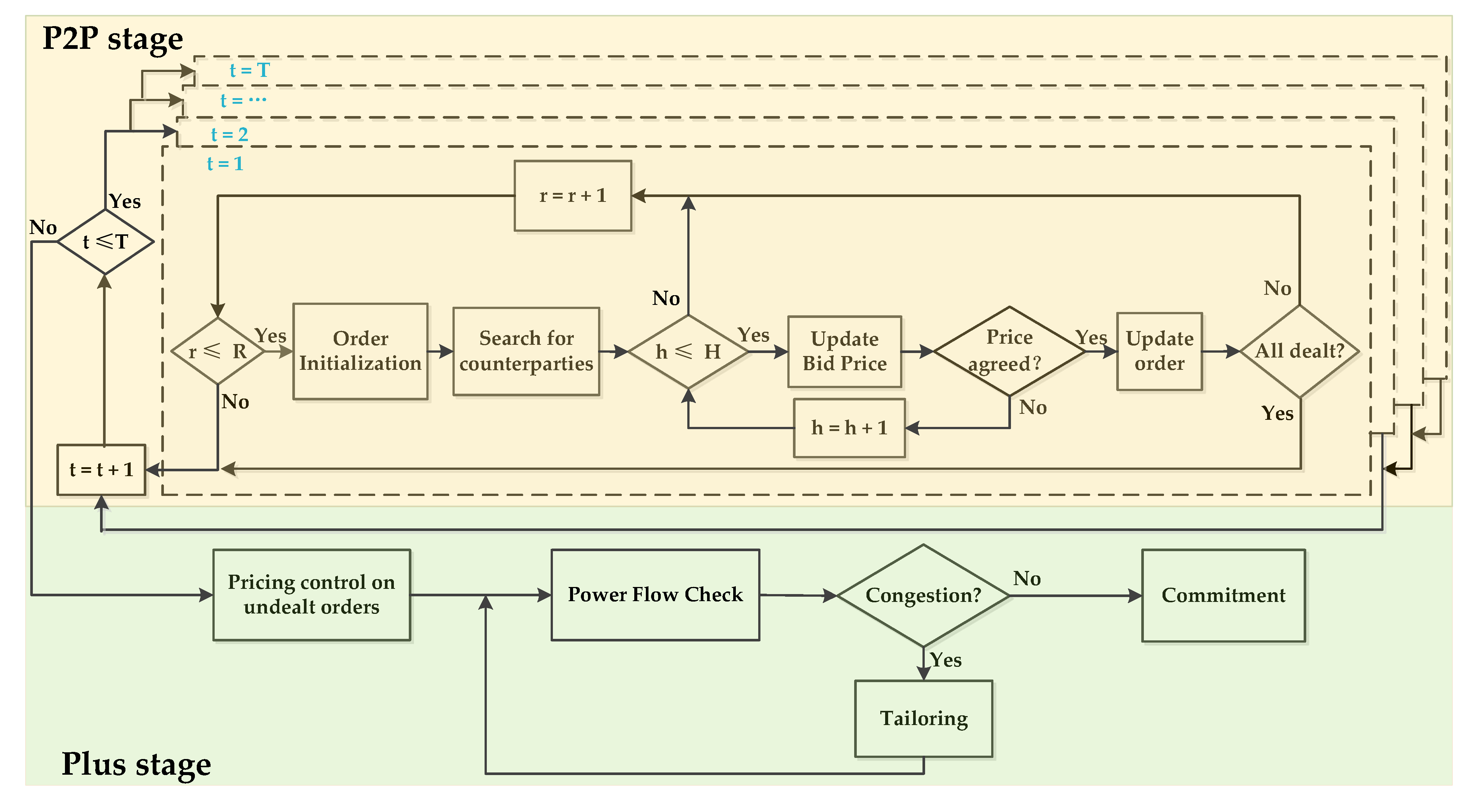

Section 2 presents the structure and process of the “P2P Plus” transaction mechanism.

Section 3 and

Section 4 establish the mathematical models and performs a numeric case study, respectively. The concluding remarks are drawn in

Section 5.

5. Conclusions

This paper proposes the concept of AEA and the “P2P Plus” mechanism for the electricity transactions within AEA community. In the first “P2P stage”, all AEAs perform decentralized matchmaking of transaction orders through multiple rounds of price bidding. The procedure of P2P matchmaking is developed and the strategy of multi-dimensional willingness is adopted, which comprehensively considers overall and individual factors, such as supply demand factor, transaction record, time pressure, and matching degree. In the second “Plus stage”, DisCo conducts the centralized coordination to handle the undealt electricity and congested lines. The centralized coordination is formulated as a constrained optimization problem. DisCo can benefit from applying pricing control in plus stage though it subject to constraints of distribution network power flow and basic rights of AEAs.

Numeric study is performed on a 30-bus test system, which includes 29 AEAs on 29 nodes and connects to main grid on 30th node. The multi-bout convergence processes of price bidding among three representative bidding pairs are demonstrated and analyzed. It is revealed that the deal price is positively correlated with the supply demand ratio of the market. In addition, it is illustrated that the peak-shaving impact of retail price on the accumulated demand. The deals causing congestion can be accurately located by computing the network PTDFs and then tailored by solving the constrained optimization problem of DisCo.

Comparative discussion validates the advantage of P2P transaction over centralized methodology as all AEAs can improve net incomes by participating in P2P transaction, the combined search for counterparty can achieve faster convergence and higher transaction quantity than the search solely based on price or quantity, and DisCo can always benefit from applying pricing control in various scales of AEA communities.

It is verified that the proposed “P2P Plus” transaction is equitable and mutually beneficial for market players, as well as flexible and reliable for the system operator. This contribution provides a reference for the establishment of future distribution network and the implementation of power market reform in China.