Cost-Effective Increase of Photovoltaic Electricity Feed-In on Congested Transmission Lines: A Case Study of The Netherlands

Abstract

:1. Introduction

2. Methods

- Infrastructure cost scenario (denoted as INFRA)

- Azimuth variation scenario (AV)

- Curtailment scenario (CUR)

- Battery storage scenario (BAT)

2.1. Case Study

2.2. Electricity Prices

2.3. PV System Model

2.4. Scenarios

2.4.1. Infrastructure Cost (INFRA) Scenario

2.4.2. Azimuth Variation Scenario (AV)

- demand on the transmission line at t in range (T), provided by the TSO

- limiting capacity on the transmission grid: 300 MW

- discount rate. Cost guidelines suggest a discount rate of 7% for OECD countries, however note that this is just an estimated value which could vary for each unique project [48]. For infrastructure cost a discount rate of 3% is estimated by TenneT [49], resulting from the stability in income for such investments.

- electricity price, provided by TSO/EPEX [50], see Section 2.2

- lifetime, assumed to be 20 years

- investment and O&M costs, from a market study, see Section 2.6

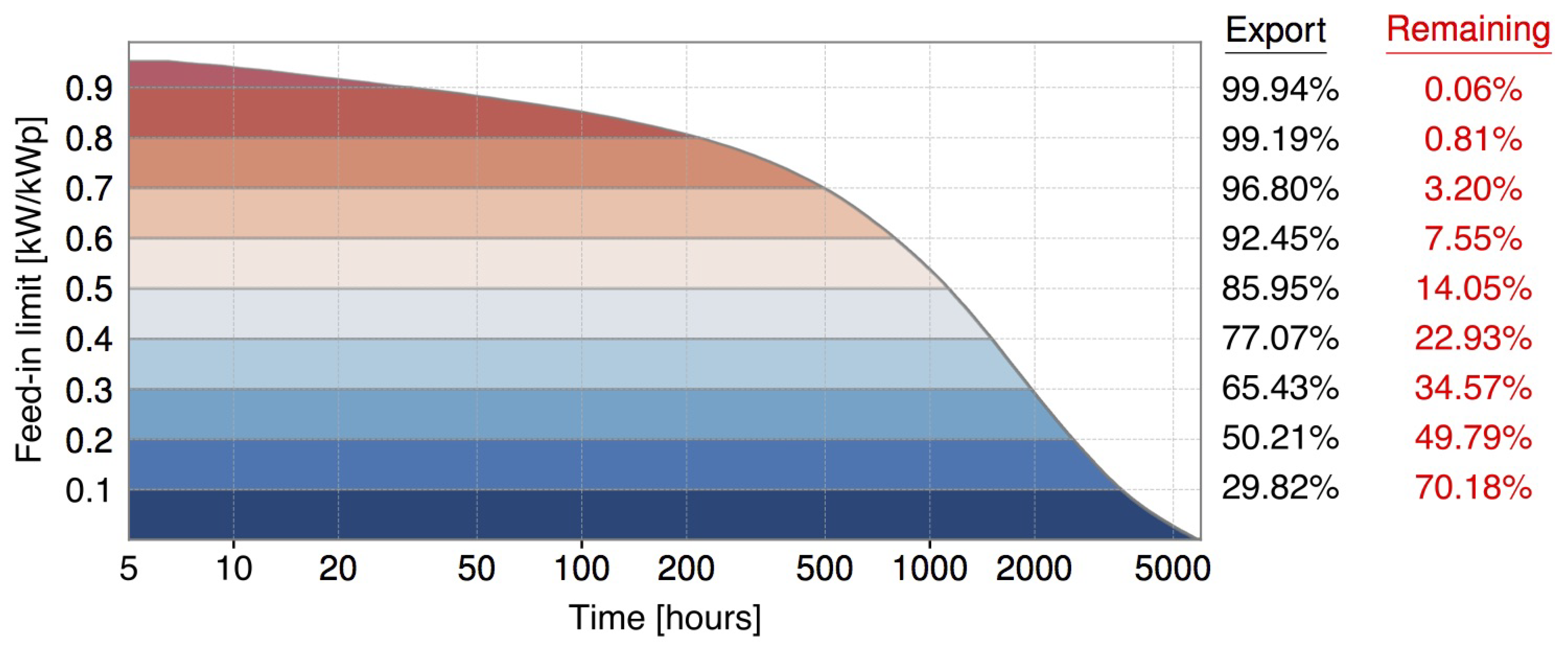

2.4.3. Curtailment Scenario (CUR)

2.4.4. Battery Storage Scenario (BAT)

2.5. NPV

- Cable and plant investments costs that are paid to TenneT for the connection

- Land costs

- Investment costs for the inverter

- Investment costs for the PV modules

- Infrastructure costs

2.6. Investment and O&M Cost

2.7. Network Costs

2.8. Sensitivity Analysis

3. Results

3.1. Azimuth Variation (AV) Scenario

3.2. Infrastructure (INFRA), Curtailment (CUR) & Battery (BAT) Scenarios

Sensitivity Analysis

3.3. AV & CUR Scenario

3.4. BAT & CUR Scenario

4. Discussion

4.1. Model Limitations

4.1.1. Energy Curtailment

4.1.2. Grid Requirements

4.1.3. Battery System

4.1.4. Infrastructure Connection Cost

4.2. Impact TSOs

4.3. Recommendations for Further Research

5. Conclusions

- with increasing overbuild PV capacity, curtailment is the most cost-effective solution, whereas after a certain overbuild factor investments in infrastructure become more cost-effective.

- the optimal overbuild factor varies with different azimuth angles, electricity prices, battery integration, or different forms of compensation.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- European Commission. COM(2011) 112—A Roadmap for Moving to a Competitive Low Carbon Economy in 2050; European Commission: Brussels, Belgium, 2011. [Google Scholar]

- Louwen, A.; Van Sark, W.; Faaij, A.; Schropp, R. Re-assessment of net energy production and greenhouse gas emissions avoidance after 40 years of photovoltaics development. Nat. Commun. 2016, 7, 13728. [Google Scholar] [CrossRef] [PubMed]

- NOS.nl. Geen Plek Voor Nieuwe Zonneparken op Stroomnetwerk (Dutch) [No Availability for New Solar Parks on Electricity Network]. 2019. Available online: https://nos.nl/artikel/2266953-geen-plek-voor-nieuwe-zonneparken-op-stroomnetwerk.html (accessed on 10 February 2019).

- Schram, W.L.; Lampropoulos, I.; van Sark, W.G. Photovoltaic systems coupled with batteries that are optimally sized for household self-consumption: Assessment of peak shaving potential. Appl. Energy 2018, 223, 69–81. [Google Scholar] [CrossRef]

- Beperkte Capaciteit Voor Nieuwe Initiatieven Voor Duurzame Opwek op Meerdere Locaties in Groningen, Drenthe en Overijssel (Dutch) [Limited Capacity for New Initiatives for Sustainable Generation at Multiple Locations in Groningen, Drenthe and Overijssel]. TenneT, 1 August 2019.

- Kadaster. Kwartaalbericht Agrarische Grondmarkt (Dutch) [Quarterly Report Agricultural LAND Prices]. 2018. Available online: https://zakelijk.kadaster.nl/kwartaalbericht-2018-1 (accessed on 23 March 2019).

- Enexis en TenneT Onderzoeken Capaciteit Netten in Brabant en Limburg (Dutch) [Enexis and TenneT Investigate Capacity of Grids in Brabant and Limburg]. TenneT, 9 February 2021.

- Congestiemelding in Zeeland (Dutch) [Report of congestion in Zeeland]. TenneT, 24 July 2021.

- TenneT Extra Investering €215 Miljoen in Hoogspanningsnet Noord-Nederland (Dutch) [TenneT Extra Investment of €215 Million in the High-Voltage Grid in the Northern Netherlands]. TenneT. 9 October 2019. Available online: https://www.tennet.eu/nl/nieuws/nieuws/tennet-extra-investering-EUR-215-miljoen-in-hoogspanningsnet-noord-nederland/(accessed on 9 October 2019).

- Lampropoulos, I.; Alskaif, T.; Schram, W.; Bontekoe, E.; Coccato, S.; van Sark, W. Review of Energy in the Built Environment. Smart Cities 2020, 3, 248–288. [Google Scholar] [CrossRef] [Green Version]

- European Commission. 2030 Targets, EU Policy, Strategy and Legislation for 2030 Environmental, Energy and Climate Targets. Available online: https://ec.europa.eu/info/energy-climate-change-environment/overall-targets/2030-targets_en (accessed on 10 January 2021).

- European Network of Transmission System Operators for Electricity (ENTSO-E). Supporting Document for the Network Code on Operational Security; ENTSO-E: Brussels, Belgium, 2013. [Google Scholar]

- ACM. Besluit van de Autoriteit Consument en Markt Op Grond van Artikel 37a van de Elektriciteitswet 1998, Betreffende de Ontheffingsaanvraag TenneT Codebepalingen Enkelvoudige Storingsreserve, ACM/UIT/534445. 2020. Available online: https://www.acm.nl/nl/publicaties/besluit-ontheffing-tennet-storingsreserve-noord-nederland (accessed on 14 January 2021).

- Tweede Kamer der Staten-Generaal. Brief van de Minister van Economische Zaken en Klimaat. 2020. Available online: https://zoek.officielebekendmakingen.nl/kst-29023-260.html (accessed on 14 January 2021).

- Klinge Jacobsen, H.; Schröder, S.T. Curtailment of renewable generation: Economic optimality and incentives. Energy Policy 2012, 49, 663–675. [Google Scholar] [CrossRef] [Green Version]

- Steurer, M.; Fahl, U.; Voß, A.; Deane, P. Chapter 15—Curtailment: An Option for Cost-Efficient Integration of Variable Renewable Generation? In Europe’s Energy Transition; Welsch, M., Pye, S., Keles, D., Faure-Schuyer, A., Dobbins, A., Shivakumar, A., Deane, P., Howells, M., Eds.; Academic Press: Cambridge, MA, USA, 2017; pp. 97–104. [Google Scholar] [CrossRef]

- Litjens, G.B.M.A.; Worrell, E.; Van Sark, W.G.J.H.M. Influence of demand patterns on the optimal orientation of photovoltaic systems. Sol. Energy 2017, 115, 1002–1014. [Google Scholar] [CrossRef] [Green Version]

- Perez, M.; Perez, R.; Rábago, K.R.; Putnam, M. Overbuilding & curtailment: The cost-effective enablers of firm PV generation. Sol. Energy 2019, 180, 412–422. [Google Scholar] [CrossRef]

- Lin, C.H.; Hsieh, W.L.; Chen, C.S.; Hsu, C.T.; Ku, T.T. Optimization of photovoltaic penetration in distribution systems considering annual duration curve of solar irradiation. IEEE Trans. Power Syst. 2012, 27, 1090–1097. [Google Scholar] [CrossRef]

- Grana, P. Push It to the Limit: Rethinking Inverter Clipping. 2017. Available online: https://www.solarpowerworldonline.com/2017/09/folsom-rethinking-inverter-clipping/ (accessed on 10 June 2020).

- Ochoa, L.F.; Dent, C.J.; Harrison, G.P. Distribution network capacity assessment: Variable DG and active networks. IEEE Trans. Power Syst. 2010, 15, 87–95. [Google Scholar] [CrossRef] [Green Version]

- Litjens, G. Here Comes the Sun, Improving Local Use of Energy Generated by Rooftop Photo-Voltaic Systems. Ph.D. Thesis, Utrecht University, Utrecht, The Netherlands, 2018. [Google Scholar]

- Litjens, G.; Worrell, E.; Van Sark, W. Economic benefits of combining self-consumption enhancement with frequency restoration reserves provision by photovoltaic-battery systems. Appl. Energy 2018, 223, 172–187. [Google Scholar] [CrossRef]

- Dobos, A.P. PVWatts Version 5 Manual; Technical Report NREL/TP-6A20-62641; NREL: Golden, CO, USA, 2014.

- Deetjen, T.A.; Garrison, J.B.; Rhodes, J.D.; Webber, M.E. Solar PV integration cost variation due to array orientation and geographic location in the Electric Reliability Council of Texas. Appl. Energy 2016, 180, 607–616. [Google Scholar] [CrossRef] [Green Version]

- Krauter, S. Simple and effective methods to match photovoltaic power generation to the grid load profile for a PV based energy system. Sol. Energy 2018, 159, 768–776. [Google Scholar] [CrossRef]

- Li, P.; Fan, G.; Wang, W.; Huang, Y.; Zhang, L. Proportion optimization of wind and solar power capacity for regional power network. In Proceedings of the 2016 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Xi’an, China, 25–28 October 2016; pp. 2424–2428. [Google Scholar]

- Cebeci, M.E.; Tor, O.B.; Oprea, S.; Bara, A. Consecutive market and network simulations to optimize investment and operational decisions under different RES penetration scenarios. IEEE Trans. Sustain. Energy 2018, 10, 2152–2162. [Google Scholar] [CrossRef]

- Conlon, T.; Waite, M.; Modi, V. Assessing new transmission and energy storage in achieving increasing renewable generation targets in a regional grid. Appl. Energy 2019, 250, 1085–1098. [Google Scholar] [CrossRef]

- Udawalpola, R.; Masuta, T.; Yoshioka, T.; Takahashi, K.; Ohtake, H. Reduction of Power Imbalances Using Battery Energy Storage System in a Bulk Power System with Extremely Large Photovoltaics Interactions. Energies 2021, 14, 522. [Google Scholar] [CrossRef]

- Hashemi, S.; Østergaard, J. Efficient control of energy storage for increasing the PV hosting capacity of LV grids. IEEE Trans. Smart Grid 2016, 9, 2295–2303. [Google Scholar] [CrossRef] [Green Version]

- Van Der Stelt, S.; AlSkaif, T.; van Sark, W. Techno-economic analysis of household and community energy storage for residential prosumers with smart appliances. Appl. Energy 2018, 209, 266–276. [Google Scholar] [CrossRef]

- IEA. Energy Storage; IEA: Paris, France, 2019. [Google Scholar]

- Rahman, M.M.; Oni, A.O.; Gemechu, E.; Kumar, A. Assessment of energy storage technologies: A review. Energy Convers. Manag. 2020, 223, 113295. [Google Scholar] [CrossRef]

- Tarashandeh, N.; Karimi, A. Utilization of energy storage systems in congestion management of transmission networks with incentive-based approach for investors. J. Energy Storage 2021, 33, 102034. [Google Scholar] [CrossRef]

- KNMI. Uurgegevens van Het Weer in Nederland (Dutch) [Hourly Weather Data in The Netherlands]. 2021. Available online: http://projects.knmi.nl/klimatologie/uurgegevens/selectie.cgi (accessed on 20 January 2021).

- RVO. Aanvragen Stimulering Duurzame Energieproductie en Klimaattransitie (SDE++) (Dutch) [Subsidy Schemes: Incentives Sustainable Energy Production and Climate Transition]. 2021. Available online: https://www.rvo.nl/subsidie-en-financieringswijzer/stimulering-duurzame-energieproductie-en-klimaattransitie-sde/aanvragen-sde (accessed on 19 January 2021).

- Wiebes, E.D. Verbreding van de SDE+ naar de SDE++ (Dutch) [Broadening of SDE+ to SDE++]; Letter to Parliament, Kamerstuk 31 239, Nr. 300; Tweede Kamer der Staten-Generaal: The Hague, The Netherlands, 2019.

- TenneT. The Imbalance Pricing System; TenneT: Arnhem, The Netherlands, 2020. [Google Scholar]

- Liu, L.; Chang, D.; Xie, J.; Ma, Z.; Sun, W.; Yin, H.; Wennersten, R. Prediction of short-term PV power output and uncertainty analysis. Appl. Energy 2018, 228. [Google Scholar] [CrossRef]

- RVO. Subsidie Regelingen: Stimulering Duurzame Energieproductie (Dutch) [Subsidy Schemes: Incentives Sustainable Energy Production]. 2019. Available online: https://www.rvo.nl/subsidies-regelingen/stimulering-duurzame-energieproductie (accessed on 16 May 2019).

- TenneT. Kwaliteits en Capaciteitsdocument 2017. Deel II: Investeringen Net Op Land 2018–2027 (Dutch) [Quality and Capacitydocument 2017. Part II: Investments Grid on Land 2018–2027)]. 2017. Available online: https://www.tennet.eu/fileadmin/user_upload/Company/Publications/Technical_Publications/Dutch/TenneT_KCD2017_Deel_II.pdf (accessed on 10 June 2020).

- Holmgren, W.F.; Hansen, C.W.; Mikofski, M.A. pvlib python: A python package for modeling solar energy systems. J. Open Source Softw. 2018, 3, 884. [Google Scholar] [CrossRef] [Green Version]

- Louwen, A.; De Waal, A.C.; Schropp, R.E.I.; Faaij, A.; Van Sark, W. Comprehensive characterisation and analysis of PV module performance under real operating conditions. Prog. Photovolt. Res. Appl. 2017, 25, 218–232. [Google Scholar] [CrossRef]

- Lave, M.; Hayes, W.; Pohl, A.; Hansen, C.W. Evaluation of global horizontal irradiance to plane-of-array irradiance models at locations across the United States. IEEE J. Photovolt. 2015, 5, 597–606. [Google Scholar] [CrossRef]

- Anonymous; Arnhem, The Netherlands. Engineer at PV Company Investing at Stadskanaal. Personal communication, 16 May 2019. [Google Scholar]

- Chabot, B. From Costs to Prices: Economic Analysis of Photovoltaic Energy and Services. Prog. Photovolt. Res. Appl. 1998, 6, 55–68. [Google Scholar] [CrossRef]

- IRENA. Renewable Power Generation Costs in 2017; IRENA: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- Tennet. TenneT Financial Statements 2018. 2018. Available online: https://annualreport.tennet.eu/2018/annualreport/userfiles/pdf/TenneT-Financial-Statements-2018.pdf (accessed on 16 March 2019).

- EPEX. 2021. Available online: https://www.epexspot.com/en (accessed on 20 January 2021).

- Lampropoulos, I.; van den Broek, M.; van der Hoofd, E.; Hommes, K.; van Sark, W. A system perspective to the deployment of flexibility through aggregator companies in the Netherlands. Energy Policy 2018, 118, 534–551. [Google Scholar] [CrossRef]

- Borsche, T.; Ulbig, A.; Koller, M.; Andersson, G. Power and energy capacity requirements of storages providing frequency control reserves. In Proceedings of the 2013 IEEE Power & Energy Society General Meeting, Vancouver, BC, Canada, 21–25 July 2013; pp. 1–5. [Google Scholar]

- Parra, D.; Patel, M.K. Effect of tariffs on the performance and economic benefits of PV-coupled battery systems. Appl. Energy 2016, 164, 175–187. [Google Scholar] [CrossRef]

- Goldie-Scot. A Behind the Scenes Take on Lithium-ion Battery Prices. 2019. Available online: https://about.bnef.com/blog/behind-scenes-take-lithium-ion-battery-prices/ (accessed on 18 April 2019).

- TenneT. Market Review. Report, TenneT, Arnhem, The Netherlands. 2017. Available online: https://www.tennet.eu/fileadmin/user_upload/Company/Publications/Technical_Publications/Dutch/2017_TenneT_Market_Review.pdf (accessed on 27 April 2019).

- Kuiper, P.P.; Voskuilen, M. Waardering Verpachte Landbouwgrond: Onderzoek op Basis van Kadastrale Transactiegegevens en een Enquete; Wageningen Economic Research: Wageningen, The Netherlands, 2018. [Google Scholar]

- Schachinger, M. Module Price Index. 2019. Available online: https://www.pv-magazine.com/features/investors/module-price-index/ (accessed on 10 May 2019).

- Sarasa-Maestro, C.J.; Dufo-López, R.; Bernal-Agustín, J.L. Evaluating the Effect of Financing Costs on PV Grid Parity by Applying a Probabilistic Methodology. Appl. Sci. 2019, 9, 425. [Google Scholar] [CrossRef] [Green Version]

- Beurskens, L.; Lemmers, J. Kostenonderzoek zonne-energie SDE+ 2018 (zon-PV vanaf 15 kWp en zonthermie vanaf 140 kW) (Dutch) [Cost study solar energy SDE + 2018 (solar PV from 15 kWp and solar thermal from 140 kW)]. 2017. Available online: https://www.pbl.nl/sites/default/files/downloads/kostenoderzoek_zonne-energie_sde_2018.pdf (accessed on 27 April 2019).

- ACM. Regulation Tariffs Electricity ACM/DE/2016/202153. 2016. Available online: https://wetten.overheid.nl/BWBR0037951/2019-02-01#Hoofdstuk2 (accessed on 27 April 2019).

- Anonymous; TenneT, Arnhem, The Netherlands. Relation Manager at Tenne. Personal communication, 8 April 2019. [Google Scholar]

- TenneT. Integrating Wind Power Into The Dutch System. 2005. Available online: https://www.tennet.eu/fileadmin/user_upload/Company/Publications/Technical_Publications/Dutch/TP_2005_Report_Integrating_Wind_Power_into_the_Dutch_System.pdf (accessed on 27 April 2019).

- Marshall, A. Principles of Economics, 8th ed.; Macmillan and Co.: London, UK, 1920. [Google Scholar]

- De Vos, K. Negative wholesale electricity prices in the German, French and Belgian day-ahead, intra-day and real-time markets. Electr. J. 2015, 28, 36–50. [Google Scholar] [CrossRef]

- Grana, P. Too Much of a Good Thing: Inverter Hyper-Clipping. 2018. Available online: https://www.solarpowerworldonline.com/2018/06/too-much-of-a-good-thing-inverter-hyper-clipping/ (accessed on 10 June 2020).

- Gagrica, O.; Nguyen, P.H.; Kling, W.L.; Uhl, T. Microinverter curtailment strategy for increasing photovoltaic penetration in low-voltage networks. IEEE Trans. Sustain. Energy 2015, 6, 369–379. [Google Scholar] [CrossRef] [Green Version]

- Latif, A.; Gawlik, W.; Palensky, P. Quantification and mitigation of unfairness in active power curtailment of rooftop photovoltaic systems using sensitivity based coordinated control. Energies 2016, 9, 436. [Google Scholar] [CrossRef] [Green Version]

- TenneT. Reactive Power Strategy—Background Information. 2015. Available online: https://www.tennet.eu/fileadmin/user_upload/Our_Grid/Offshore_Netherlands/Consultatie_proces_net_op_zee/Technical_Topics/38_ONL_15-356_Reactive_Power_Strategy.pdf (accessed on 10 June 2020).

- Lampropoulos, I.; Garoufalis, P.; van den Bosch, P.P.; de Groot, R.J.W.; Kling, W.L. Day-ahead Economic Optimisation of Energy Storage. In Proceedings of the 18th Power Systems Computation Conference (PSCC’14), Wroclaw, Poland, 18–22 August 2014; pp. 1–7. [Google Scholar]

- Lampropoulos, I.; Garoufalis, P.; van den Bosch, P.P.; Kling, W.L. Hierarchical predictive control scheme for distributed energy storage integrated with residential demand and photovoltaic generation. IET Gener. Transm. Distrib. 2015, 9, 2319–2327. [Google Scholar] [CrossRef] [Green Version]

- Lampropoulos, I.; Alskaif, T.; Blom, J.; van Sark, W. A framework for the provision of flexibility services at the transmission and distribution levels through aggregator companies. Sustain. Energy Grids Netw. 2017, 17, 100187. [Google Scholar] [CrossRef] [Green Version]

- Schram, W.L.; Alskaif, T.; Lampropoulos, I.; Henein, S.; van Sark, W. On the Trade-Off Between Environmental and Economic Objectives in Community Energy Storage Operational Optimization. IEEE Trans. Sustain. Energy 2020, 11, 2653–2661. [Google Scholar] [CrossRef]

- TenneT. Infrastructure Outlook 2050. 2019. Available online: https://www.tennet.eu/fileadmin/user_upload/Company/News/Dutch/2019/Infrastructure_Outlook_2050_appendices_190214.pdf (accessed on 10 June 2020).

- Skyllas-Kazacos, M.; Cao, L.; Kazacos, M.; Kausar, N.; Mousa, A. Vanadium electrolyte studies for the vanadium redox battery—A review. ChemSusChem 2016, 9, 1521–1543. [Google Scholar] [CrossRef] [PubMed]

- Palmer, G.; Floyd, J. An Exploration of Divergence in EPBT and EROI for Solar Photovoltaics. Biophys. Econ. Resour. Qual. 2017, 2, 15. [Google Scholar] [CrossRef] [Green Version]

- de Wild-Scholten, M.M. Energy payback time and carbon footprint of commercial photovoltaic systems. Sol. Energy Mater. Sol. Cells 2013, 119, 296–305. [Google Scholar] [CrossRef]

- Haar, L.N.; Haar, L. An option analysis of the European Union renewable energy support mechanisms. Econ. Energy Environ. Policy 2017, 6, 131–148. [Google Scholar] [CrossRef]

- US Energy Information Administration. Levelized Costs of New Generation Resources in the Annual Energy Outlook 2021. 2021. Available online: https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf (accessed on 5 May 2021).

| Price Elasticity | SDE+ Prices | 2030 Prices |

|---|---|---|

| Battery investment cost (€/kWp) | −0.0018 | −0.0016 |

| Inverter investment cost (€/MWp) | −0.0005 | −0.0005 |

| Solar panels investment cost (€/MWp) | −0.0005 | −0.0005 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Braat, M.; Tsafarakis, O.; Lampropoulos, I.; Besseling, J.; van Sark, W.G.J.H.M. Cost-Effective Increase of Photovoltaic Electricity Feed-In on Congested Transmission Lines: A Case Study of The Netherlands. Energies 2021, 14, 2868. https://doi.org/10.3390/en14102868

Braat M, Tsafarakis O, Lampropoulos I, Besseling J, van Sark WGJHM. Cost-Effective Increase of Photovoltaic Electricity Feed-In on Congested Transmission Lines: A Case Study of The Netherlands. Energies. 2021; 14(10):2868. https://doi.org/10.3390/en14102868

Chicago/Turabian StyleBraat, Maaike, Odysseas Tsafarakis, Ioannis Lampropoulos, Joris Besseling, and Wilfried G. J. H. M. van Sark. 2021. "Cost-Effective Increase of Photovoltaic Electricity Feed-In on Congested Transmission Lines: A Case Study of The Netherlands" Energies 14, no. 10: 2868. https://doi.org/10.3390/en14102868