Comparative Analysis of Carbon Capture and Storage Finance Gaps and the Social Cost of Carbon

Abstract

1. Introduction

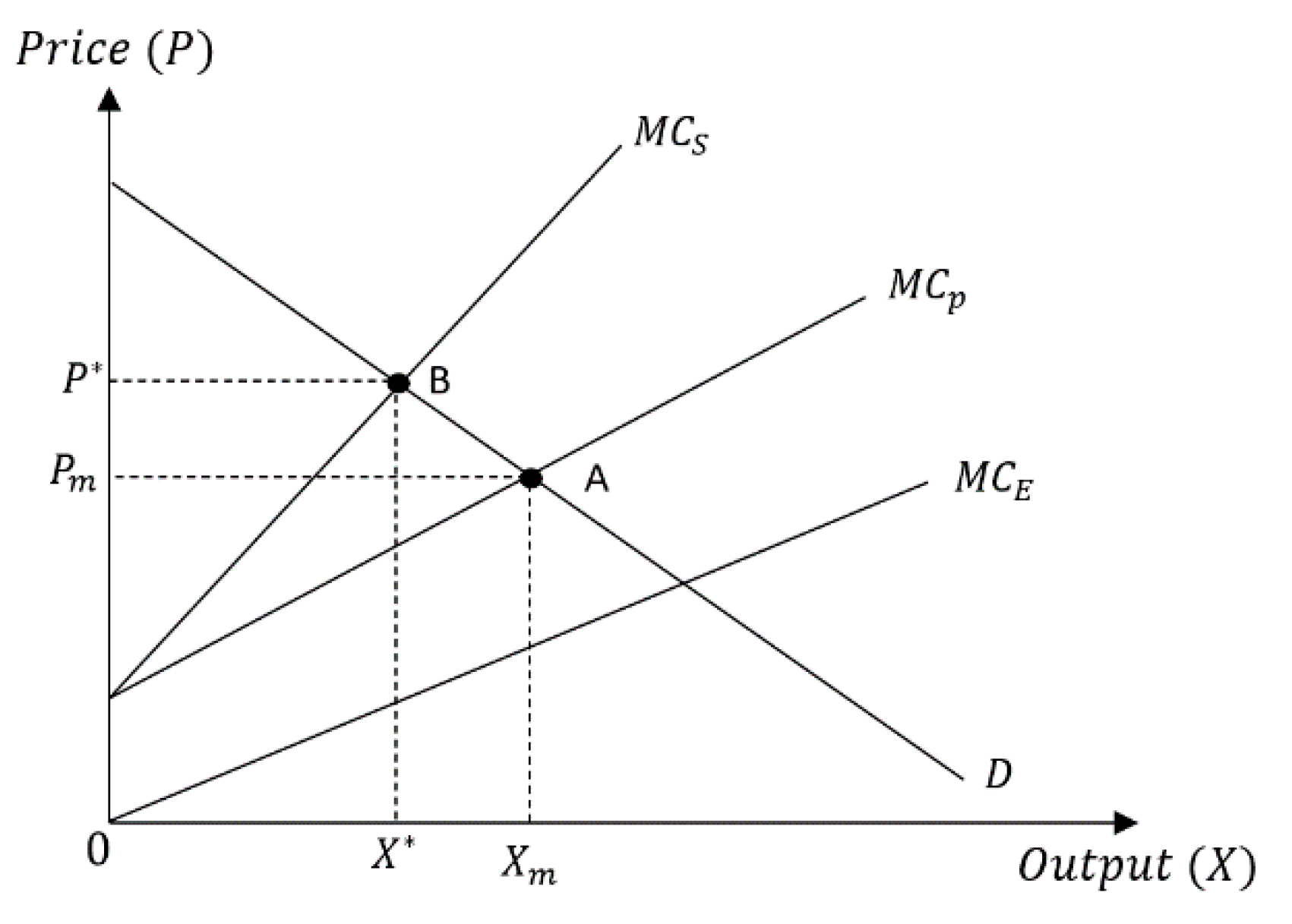

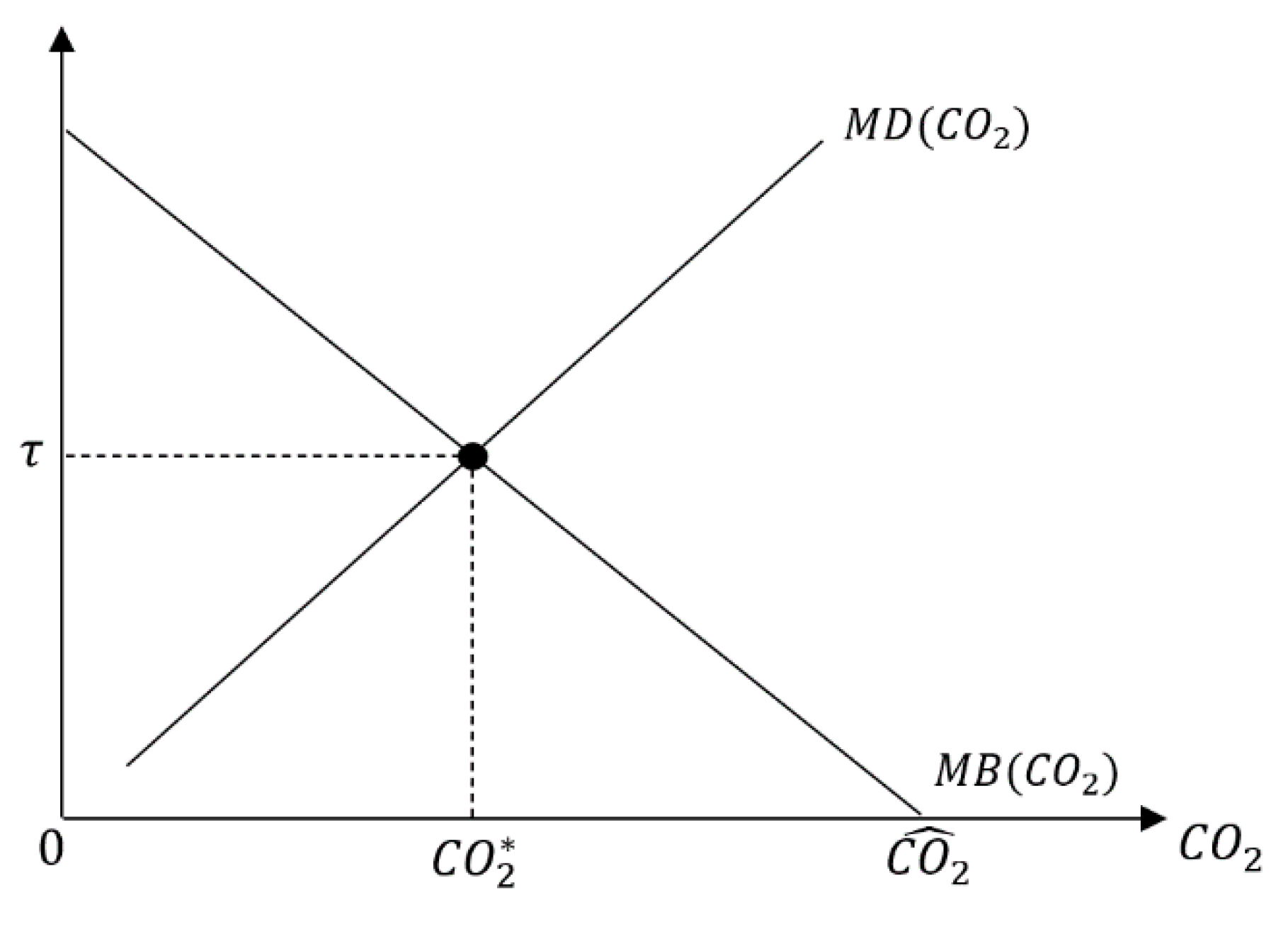

2. Materials: Negative Externalities and the Social Cost of Carbon

3. Methods and Scenarios

- (1)

- Business as usual (BAU)

- (2)

- BAU with per-unit tax on CO2 emissions set equal to the SCC (BAU_SCC)

- (3)

- BAU_SCC with CCS and no incentives (CCS_NI)

- (4)

- CCS_NI employing non-refundable Section 45Q tax credits with 12 years of eligibility per current regulations (NR45Q)

- (5)

- NR45Q with Section 45Q tax credit amended to be fully refundable (FR45Q)

- (6)

- FR45Q with Section 45Q tax credit amended for unlimited (equal to 30 years) eligibility (30FR45Q)

- (7)

- 30FR45Q with addition of transportation costs to power plant waived (i.e., free transportation) (30FR45Q_FT)

- (8)

- 30FR45Q_FT with addition of saline storage PISC reduced from 50 years (current U.S. EPA default requirement) to 10 years (30FR45Q_FT_10PISC)

- (9)

- 30FR45Q_FT with addition of storage costs to power plant waived (i.e., free storage) (30FR45Q_FT_FS)

- NETL retrofit data (BB4R) (forthcoming 2021–2022) for power plants featured in NETL’s publicly available Cost and Performance Baseline for Fossil Energy Plants, Volume 1: Bituminous Coal and Natural Gas to Electricity report (Baseline Study) (part of NETL’s baseline studies series) to evaluate costs associated with the power plant components [33];

- A modified version of the publicly available 2018 version of the Fossil Energy (FE)/NETL CO2 Transport Cost Model (CO2_T_COM) to obtain costs for transporting captured CO2 from a source to the saline storage site [48];

- A modified version of the publicly available 2017 version of the FE/NETL CO2 Saline Storage Cost Model (CO2_S_COM) to determine costs for storing CO2 in the saline storage formation [49].

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Disclaimer

Appendix A. Additional Details on Study Components

Appendix A.1. Methodology Steps

- (1)

- Utilized National Energy Technology Laboratory (NETL)-developed resources and models to evaluate CCS network economics:

- NETL retrofit data (BB4R) (forthcoming 2021–2022) for power plants featured in the NETL’s publicly available Cost and Performance Baseline for Fossil Energy Plants, Volume 1: Bituminous Coal and Natural Gas to Electricity report (Baseline Study) (part of NETL’s baseline studies series) to evaluate costs associated with the power plant components [33].

- A modified version of the publicly available 2018 version of the Fossil Energy (FE)/NETL CO2 Transport Cost Model (CO2_T_COM) to obtain costs for transporting captured CO2 from a source to the saline storage site [48].

- A modified version of the publicly available 2017 version of the FE/NETL CO2 Saline Storage Cost Model (CO2_S_COM) to determine costs for storing CO2 in the saline storage formation [49].

- (2)

- Developed business as usual, social cost of carbon (SCC), and various policy scenarios to determine the LCOE for each scenario when A/TRORAVG is equal to 7.84%.

- (3)

- Employed aggregated finances from the power plants and CCS network components (i.e., CO2 capture, transport, and storage) mentioned above to solve for the LCOE (in 2018$ per megawatt-hour (2018 $/MWh)) required by each power plant type considered to meet the specified A/TRORAVG under each policy scenario. The LCOEs calculated were based on the resulting financial conditions for each plant given the imposed SCC-based per-unit tax, costs associated with retrofitting and operating CO2 management via CCS, as well as any recompence from the policies assumed in each scenario. SCC values in 2018$ ranged from $20 to $180 per metric ton of CO2 emitted (2018$/tCO2) to the atmosphere, for each plant, for each scenario.

Appendix A.2. Details behind the Capture Component of the CCS Network

| Parameter Type | Specification or Result | Unit | SubC PC Plant | NGCC Plant |

|---|---|---|---|---|

| Pre-retrofit | Net plant output | MW | 650 | 727 |

| Capacity factor | % | 85 | ||

| Net output electricity production rate | MWh/yr. | 4,839,602 | 5,409,876 | |

| LCOE | 2018 $/MWh | 51.64 | 46.86 | |

| Fuel (delivered to Midwest) | Type | Illinois No. 6 coal | Natural gas | |

| Fuel cost | 2018 $/MMBtu | 6.2077 | 3.2449 | |

| CO2 atmospheric emissions rate | tCO2/yr. | 3,922,661 | 1,852,300 | |

| Post-retrofit | Retrofit CO2 capture (separation) technology | None | Cansolv (amine based) | |

| Nameplate capacity | MW | 491 | 641 | |

| Net output electricity production rate | MWh/yr. | 3,654,273 | 4,776,222 | |

| CO2 captured | % | 90 | ||

| CO2 capture rate | tCO2/yr. | 3,530,395 | 1,677,070 | |

| CO2 emissions rate | tCO2/yr. | 392,226 | 185,230 | |

| Financial | After tax rate of return (i.e., cost of equity) | % | 7.84 | |

| Cost of debt | % | 2.94 | ||

| Debt/equity ratio | Dimensionless | 55/45 | ||

| Escalation/inflation rate | % | 2 | ||

| Federal income tax rate | % | 21 | ||

| State and local income tax rate | % | 6 | ||

| Tax equity partnership allocation of tax equity investment to retrofit power plant | After tax Revenue/$45Q | 0.54 | ||

| Incremental cost of electricity generation (i.e., capture cost) | 2018 $/MWh | 65.03 | 39.39 | |

| 2018 $/tCO2 | 67.31 | 112.85 | ||

- Power plants are brownfield pre-retrofit with all capital costs paid off;

- Developer/owner is investor-owned utility;

- Retrofit capture equipment would capture 90% of CO2 (i.e., 10% of pre-retrofit emissions are still emitted to the atmosphere post-retrofit);

- Retrofitted capital costs have 3-year capital expenditure period; and

- Additionally, 7.84% specified A/TRORAVG based on NETL methodology as presented within NETL’s Quality Guidelines for Energy Systems Studies: Cost Estimation Methodology for NETL Assessments of Power Plant Performance [47].

Appendix A.3. Details behind the Transport Component of the CCS Network

| Parameter Type | Parameter | Unit | SubC PC | NGCC | |

|---|---|---|---|---|---|

| Inputs | Schedule | Project start year | year | 2018 | |

| Design | Pipeline length | mi | 328 | ||

| Capacity factor | % | 85 | |||

| Elevation change from source to sink | ft | −390 | |||

| Operations | CO2 transportation rate | tCO2/year | 3,530,395 | 1,677,070 | |

| Financial | After tax rate of return (i.e., cost of equity) | % | 13 | ||

| Cost of debt | % | 6 | |||

| Debt/equity ratio | Dimensionless | 60/40 | |||

| Escalation rate from start 2011 to 2018 | % | 2.2 | |||

| Escalation rate beyond 2018 | % | 2 | |||

| Federal income tax rate | % | 21 | |||

| State and local income tax rate | % | 6 | |||

| Outputs | Optimal pipe diameter | in | 12 | 8 | |

| Optimal number of pumps | Number | 5 | 10 | ||

| First-year break-even transportation cost | 2018 $/tCO2 | 11.62 | 20.37 | ||

Appendix A.4. Details behind the Storage Component of the CCS Network

| Geologic Storage Reservoir Parameter | Unit | Value |

|---|---|---|

| Areal extent | mi2 | 20,633 |

| Depth | ft | 4270 |

| Net thickness of reservoir | ft | 1000 |

| Porosity | % | 12 |

| Permeability | mD | 125 |

| Storage coefficient (dome) | % | 15.28 |

- NR45Q scenario: Calculates the maximum amount of non-refundable general business credits that could be used to lower the federal tax liability for each of the 30 operating years. The amount of the Section 45Q tax credits needed in the first 12 years (assuming transfer from the CCE operator) to be used in the first 12 years plus 18 more using carry-forward is also calculated. The federal tax liability is reduced accordingly to calculate the first-year break-even cost in 2018$/tCO2.

- CCS with fully refundable Section 45Q tax incentive (sunset) (FR45Q) scenario: Variants allow the CCS equipment owner (the power plant) to monetize all Section 45Q tax credits; therefore, no transfer of Section 45Q tax credits to the storage operator, nor reduced storage cost associated with Section 45Q tax credits, is assessed for these scenarios.

- CCS with fully refundable 45Q tax incentive (no sunset) with free transportation and 10-year post-injection site care (PISC) (30FR45Q_FT_10PISC) scenario: Assesses the impact of 10-year PISC on the first-year break-even cost instead of 50-year PISC, by changing the PISC duration input within the model.

| Parameter Type | Parameter | Unit | SubC PC | NGCC | |

|---|---|---|---|---|---|

| Inputs | Schedule | Project start year | year | 2018 | |

| Site screening duration | year | 0.5 | |||

| Site selection and site characterization duration | year | 0.5 | |||

| Theoretical policy PISC option | year | 10 | |||

| Geology | Saline storage reservoir | Reservoir name | Mount Simon 3 | ||

| Saline storage structure setting | Description | Dome | |||

| Operations | Multiplier for annual to maximum daily rate of CO2 injection (represents 85% capacity factor) | Dimensionless | 1.18 | ||

| CO2 injection rate (storage rate) | tCO2/year | 3,530,395 | 1,677,070 | ||

| Financial | After tax rate of return (i.e., cost of equity) | % | 13 | ||

| Cost of debt | % | 6 | |||

| Debt/equity ratio | Ratio | 60/40 | |||

| Escalation rate from 2008 to 2018 | % | 1.3 | |||

| Escalation rate beyond 2018 | % | 2 | |||

| Federal income tax rate | % | 21 | |||

| State and local income tax rate | % | 6 | |||

| Outputs | First-year break-even cost for all policies except NR45Q and 10-year PISC | 2018 $/tCO2 | 5.05 | 7.01 | |

| First-year break-even cost for NR45Q | 2018 $/tCO2 | 4.97 | 6.90 | ||

| Total Section 45Q transferred from source to storage operator | 2018 MM $/12 years | 6.82 | 6.46 | ||

| First-year break-even cost for 10-year PISC | 2018 $/tCO2 | 4.01 | 5.50 | ||

Appendix A.5. Scenario Details

- Business as usual (BAU): Non-capture plant configuration, where no penalty for CO2 emissions exists; LCOE equals the baseline market price for a brownfield power plant.

- Per-unit tax set equal to the SCC (BAU_SCC): Non-capture plant configuration that pays a per-unit tax set equal to the SCC for each tCO2 emitted into the atmosphere (100% of BAU emissions).

- CCS with no market incentive (CCS_NI): Plants are retrofitted with CCE that captures 90% of BAU emissions, pays a per-unit tax set equal to the SCC for each tCO2 emitted into the atmosphere (10% of BAU’s emissions), and bares all of the costs associated with installing the capture equipment, transporting, and storing the captured CO2.

- CCS with non-refundable Section 45Q tax incentive (sunset) (NR45Q): Comparable to CCS_NI, but the costs associated with installing the equipment, transporting, and storing the captured CO2 are partially offset by the Section 45Q tax incentive. Plants claim and monetize the Section 45Q tax incentive for 12 years of operation following the installation of their CCE equipment. Plants transfer the maximum allowable amount of the incentive they can in exchange for reduced CO2 storage costs and transfer the remaining amount to tax equity investors through a tax equity partnership, in exchange for $0.54 after-tax revenue for each $1 of Section 45Q tax credit allocated. Based on a Sargent & Lundy scoping study for the San Juan Generating Station Carbon Capture Retrofit, a 10% discount rate for tax equity financing is assumed [57]. To achieve A/TRORAVG of 7.84% for 30 operating years, the power plants operate above 7.84% A/TRORAVG for each of the first 12 operating years of Section 45Q eligibility, and operate below 7.84% for operating years 13 through 30.

- CCS with fully refundable Section 45Q tax incentive (sunset) (FR45Q): Comparable to NR45Q, but the costs associated with installing the equipment, transporting, and storing the captured CO2 are partially offset by the Section 45Q tax incentive amended to be fully refundable. Plants claim and monetize the Section 45Q tax incentive for 12 years of operation following the installation of their CCE equipment. Plants do not transfer part of the incentive to a storage system operator or tax equity investor. Instead, the tax incentive reduces the plants’ federal tax liability to below zero and results in a tax refund set equal to the after-tax revenue being received by the plant.

- CCS with fully refundable Section 45Q tax incentive (no sunset) (30FR45Q): Comparable to FR45Q, except the plants claim and monetize a fully refundable Section 45Q tax incentive for a 30-year operating timeframe rather than only 12 years.

- CCS with fully refundable Section 45Q tax incentive (no sunset) with free transportation (30FR45Q_FT): Comparable to 30FR45Q, except the power plant has access to zero-cost CO2 pipeline(s) to transport captured CO2 to a saline storage site during its 30-year operating timeframe.

- CCS with fully refundable Section 45Q tax incentive (no sunset) with free transportation and 10-year PISC (30FR45Q_FT_10PISC): Comparable to 30FR45Q_FT, except the power plant must pay to store its captured CO2 at a saline storage site that is subject to a 10-year PISC period, as opposed to a 50-year PISC as a default currently under the United States Environmental Protection Agency’s Underground Injection Control Class VI injection well regulations. The result of which may provide substantial cost savings [58].

- CCS with fully refundable Section 45Q tax incentive (no sunset) with free transportation and free storage (30FR45Q_FT_FS): Comparable to 30FR45Q_FT, except the power plant can also store its captured CO2 for free over its 30-year operating timeframe and assumes no financial commitment toward PISC.

| Scenario | Scenario Name | Scenario Description by Policy (“X” Denotes POLICIES in Place) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SCC Per-Unit Tax | % of Pre-Retrofit Emissions Subject to SCC | CCS | NR45Q (12-yr Sunset) | FR45Q (12-yr Sunset) | FR45Q (No Sunset) | Free Transport | 10-yr PISC at Storage | Free Storage | ||

| BAU | Business as usual (baseline for context) | 0 | ||||||||

| BAU_SCC | BAU + social cost of carbon (baseline for finance gap calculations) | X | 100 | |||||||

| CCS_NI | BAU_SCC + CCS (no incentives) | X | 10 | X | ||||||

| NR45Q | BAU_SCC + CCS + non-refundable 45Q (12-year sunset) | X | 10 | X | X | |||||

| FR45Q | BAU_SCC + CCS + fully refundable 45Q (12-year sunset) | X | 10 | X | X | |||||

| 30FR45Q | FR45Q with no sunset | X | 10 | X | X | |||||

| 30FR45Q_FT | 30FR45Q + free transportation | X | 10 | X | X | X | ||||

| 30FR45Q_FT_10PISC | 30FR45Q_FT + storage with 10-year PISC duration | X | 10 | X | X | X | X | |||

| 30FR45Q_FT_FS | 30FR45Q_FT + free storage | X | 10 | X | X | X | X | |||

Appendix A.6. Scenario Analysis Aggregating Finances across Components of the CCS Network

Appendix A.7. Results from Aggregation of Costs across the CCS Network

| Scenario | SCC (2018 $/tCO2 Emitted) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 20 | 40 | 60 | 80 | 100 | 120 | 140 | 160 | 180 | |

| LCOE (2018 $/MWh) | |||||||||

| BAU | 51.64 | 51.64 | 51.64 | 51.64 | 51.64 | 51.64 | 51.64 | 51.64 | 51.64 |

| BAU_SCC | 69.56 | 87.48 | 105.41 | 123.33 | 141.25 | 159.17 | 177.09 | 195.02 | 212.94 |

| CCS_NI | 160.46 | 162.84 | 165.21 | 167.59 | 169.96 | 172.33 | 174.71 | 177.08 | 179.45 |

| NR45Q | 148.96 | 151.32 | 153.69 | 156.05 | 158.42 | 160.78 | 163.15 | 165.51 | 167.88 |

| FR45Q | 140.95 | 143.27 | 145.58 | 147.90 | 150.21 | 152.53 | 154.84 | 157.16 | 159.47 |

| 30FR45Q | 116.22 | 118.53 | 120.85 | 123.16 | 125.48 | 127.79 | 130.11 | 132.42 | 134.74 |

| 30FR45Q_FT | 104.11 | 106.43 | 108.74 | 111.06 | 113.37 | 115.69 | 118.00 | 120.32 | 122.63 |

| 30FR45Q_FT_10PISC | 103.03 | 105.34 | 107.66 | 109.97 | 112.29 | 114.60 | 116.92 | 119.23 | 121.55 |

| 30FR45Q_FT_FS | 98.85 | 101.16 | 103.48 | 105.79 | 108.11 | 110.42 | 112.74 | 115.06 | 117.37 |

| Scenario | SCC (2018 $/tCO2 Emitted) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 20 | 40 | 60 | 80 | 100 | 120 | 140 | 160 | 180 | |

| LCOE (2018 $/MWh) | |||||||||

| BAU | 46.86 | 46.86 | 46.86 | 46.86 | 46.86 | 46.86 | 46.86 | 46.86 | 46.86 |

| BAU_SCC | 54.43 | 62.00 | 69.57 | 77.14 | 84.71 | 92.28 | 99.86 | 107.43 | 115.00 |

| CCS_NI | 108.05 | 108.91 | 109.76 | 110.62 | 111.48 | 112.34 | 113.19 | 114.05 | 114.91 |

| NR45Q | 103.72 | 104.58 | 105.43 | 106.29 | 107.14 | 108.00 | 108.85 | 109.71 | 110.56 |

| FR45Q | 100.47 | 101.33 | 102.19 | 103.05 | 103.90 | 104.76 | 105.62 | 106.48 | 107.33 |

| 30FR45Q | 90.83 | 91.67 | 92.50 | 93.34 | 94.18 | 95.01 | 95.85 | 96.69 | 97.52 |

| 30FR45Q_FT | 83.16 | 84.00 | 84.84 | 85.67 | 86.51 | 87.35 | 88.18 | 89.02 | 89.86 |

| 30FR45Q_FT_10PISC | 82.60 | 83.43 | 84.27 | 85.11 | 85.94 | 86.78 | 87.61 | 88.45 | 89.29 |

| 30FR45Q_FT_FS | 80.53 | 81.36 | 82.20 | 83.04 | 83.87 | 84.71 | 85.54 | 86.38 | 87.22 |

| Scenario | SCC (2018 $/tCO2 Emitted) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 20 | 40 | 60 | 80 | 100 | 120 | 140 | 160 | 180 | |

| Finance Gap (2018 $/MWh) [Scenario X LCOE–Scenario 2 LCOE] | |||||||||

| CCS_NI | 90.90 | 75.35 | 59.81 | 44.26 | 28.71 | 13.16 | −2.39 | −17.94 | −33.49 |

| NR45Q | 79.39 | 63.84 | 48.28 | 32.72 | 17.17 | 1.61 | −13.95 | −29.50 | −45.06 |

| FR45Q | 71.39 | 55.78 | 40.18 | 24.57 | 8.96 | −6.64 | −22.25 | −37.86 | −53.46 |

| 30FR45Q | 46.65 | 31.05 | 15.44 | −0.17 | −15.77 | −31.38 | −46.99 | −62.59 | −78.20 |

| 30FR45Q_FT | 34.55 | 18.94 | 3.33 | −12.27 | −27.88 | −43.49 | −59.09 | −74.70 | −90.31 |

| 30FR45Q_FT_10PISC | 33.46 | 17.86 | 2.25 | −13.36 | −28.96 | −44.57 | −60.18 | −75.78 | −91.39 |

| 30FR45Q_FT_FS | 29.29 | 13.68 | −1.93 | −17.53 | −33.14 | −48.75 | −64.35 | −79.96 | −95.57 |

| Scenario | SCC (2018 $/tCO2 Emitted) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 20 | 40 | 60 | 80 | 100 | 120 | 140 | 160 | 180 | |

| Finance Gap (2018 $/MWh) [Scenario X LCOE–Scenario 2 LCOE] | |||||||||

| CCS_NI | 53.62 | 46.90 | 40.19 | 33.48 | 26.76 | 20.05 | 13.34 | 6.62 | −0.09 |

| NR45Q | 49.29 | 42.58 | 35.86 | 29.14 | 22.43 | 15.71 | 9.00 | 2.28 | −4.44 |

| FR45Q | 46.04 | 39.33 | 32.62 | 25.90 | 19.19 | 12.48 | 5.76 | −0.95 | −7.66 |

| 30FR45Q | 36.40 | 29.67 | 22.93 | 16.20 | 9.46 | 2.73 | −4.01 | −10.74 | −17.47 |

| 30FR45Q_FT | 28.73 | 22.00 | 15.26 | 8.53 | 1.80 | −4.94 | −11.67 | −18.41 | −25.14 |

| 30FR45Q_FT_10PISC | 28.17 | 21.43 | 14.70 | 7.96 | 1.23 | −5.51 | −12.24 | −18.98 | −25.71 |

| 30FR45Q_FT_FS | 26.09 | 19.36 | 12.63 | 5.89 | −0.84 | −7.58 | −14.31 | −21.05 | −27.78 |

References

- International Energy Agency. Energy Technology Perspectives 2017; IEA: Paris, France, 2017; Available online: https://www.iea.org/etp2017/summary/ (accessed on 29 June 2018).

- International Energy Agency. The Role of CO2 Storage; International Energy Agency: Paris, France, 2019. [Google Scholar]

- Tcvetkov, P. Climate Policy Imbalance in the Energy Sector: Time to Focus of the Value of CO2 Utilization. Energies 2021, 14, 411. [Google Scholar] [CrossRef]

- Bergstrom, J.; Ty, D. Economics of Carbon Capture and Storage, Recent Advances in Carbon Capture and Storage; Yun, Y., Ed.; IntechOpen: London, UK, 2017. [Google Scholar]

- Gonzales, V.; Krupnick, A.; Dunlap, L. Carbon Capture and Storage 101. 6 May 2020. Available online: https://www.rff.org/publications/explainers/carbon-capture-and-storage-101/ (accessed on 15 March 2021).

- National Energy Technology Laboratory. Carbon Capture Program. May 2017. Available online: https://netl.doe.gov/sites/default/files/2020-04/Program-116.pdf (accessed on 15 March 2021).

- National Energy Technology Laboratory. DOE/NETL Carbon Capture Program: Carbon Dioxide Capture Handbook. August 2015. Available online: https://netl.doe.gov/sites/default/files/netl-file/Carbon-Dioxide-Capture-Handbook-2015.pdf (accessed on 15 March 2021).

- Mac Dowell, N.; Fennell, P.S.; Shah, N.; Maitland, G.C. The role of CO2 capture and utilization in mitigating climate change. Nat. Clim. Chang. 2017, 7, 243–249. [Google Scholar] [CrossRef]

- Rogelj, J.; den Elzen, M.; Höhne, N.; Fransen, T.; Fekete, H.; Winkler, H.; Schaeffer, R.; Sha, F.; Riahi, K.; Meinshausen, M. Paris Agreement climate proposals need a boost to keep warming well below 2 °C. Nature 2016, 543, 631–639. [Google Scholar] [CrossRef] [PubMed]

- Townsend, A.; Raji, N.; Zapantis, A. 2020 Thought Leadership: The Value of Carbon Capture and Storage (CCS); Global CCS Institute: Melbourne, Australia, 2020. [Google Scholar]

- Edwards, R.; Celia, M. Infrastructure to enable deployment of carbon capture, utilization, and storage in the United States. Proc. Natl. Acad. Sci. USA 2018, 115, E8815–E8824. [Google Scholar] [CrossRef] [PubMed]

- Friedmann, S.; Zapantis, A.; Page, B.; Consoli, C.; Fan, Z.; Havercroft, I.; Liu, H.; Ochu, E.; Raji, N.; Rassool, D.; et al. Net-Zero and Geospheric Return: Actions Today for 2030 and Beyond; Center on Global Energy Policy at Columbia University and Global CCS Institute: New York, NY, USA, 2020. [Google Scholar]

- Global CCS Institute. The Global Status of CCS: 2017; Global CCS Institute: Canberra, Australia, 2017. [Google Scholar]

- International Energy Agency; Carbon Capture and Storage Unit. Carbon Capture and Storage: Opportunities and Challenges; IEA: Abu Dhabi, United Arab Emirates, 2011. [Google Scholar]

- Vikara, D.; Shih, Y.; Guinan, A.; Lin, S.; Wendt, A.; Grant, T.; Balash, P. Assessing Key Drivers Impacting the Cost to Deploy Integrated CO2 Capture, Utilization, Transportation, and Storage (CCUS); United States Associated for Energy Economics: Washington, DC, USA, 2018. [Google Scholar]

- Grant, T.; Guinan, A.; Shih, C.; Lin, S.; Vikara, D.; Morgan, D.; Remson, D. Comparative analysis of transport and storage options from a CO2 source perspective. Int. J. Greenh. Gas Control. 2018, 72, 175–191. [Google Scholar] [CrossRef]

- Nordhaus, W.D. Revisiting the social cost of carbon. Proc. Natl. Acad. Sci. USA 2017, 114, 1518–1523. [Google Scholar] [CrossRef] [PubMed]

- Rennert, K.; Kingdon, C. Social Cost of Carbon 101. 1 August 2019. Available online: https://www.rff.org/publications/explainers/social-cost-carbon-101/?gclid=Cj0KCQiArvX_BRCyARIsAKsnTxOr1kD9EqUDu1spse_vCuq-GJiJ3L6aEsATEaU28-TbK24MP-cdF0oaAm8aEALw_wcB (accessed on 1 March 2021).

- Tol, R. A social cost of carbon for (almost) every country. Energy Econ. 2019, 89, 555–566. [Google Scholar] [CrossRef]

- Newbold, S.; Griffiths, C.; Moore, C.; Wolverton, A.; Kopits, E. The “Social Cost of Carbon” Made Simple; U.S. Environmental Protection Agency National Center for Environmental Economics: Washington, DC, USA, 2010. [Google Scholar]

- Christensen, J.; Wade, S. US Regulatory Programs & the International Standard for Quantifying Geologic Storage through CO2-EOR: A Side-by-Side Comparison; Carbon Capture Coalition: Washington, DC, USA, 2019. [Google Scholar]

- Energy Futures Initiative. Advancing Large Scale Carbon Management: Expansion of the 45Q Tax Credit; Energy Futures Initiative: Washington, DC, USA, 2018. [Google Scholar]

- Martin, K. Tax Equity and Carbon Sequestration Credits. Norton Rose Fulbright. 17 December 2018. Available online: https://www.projectfinance.law/publications/2018/april/tax-equity-and-carbon-sequestration-credits (accessed on 1 February 2021).

- Esposito, R.; Kuuskraa, V.; Rossman, C.; Corser, M. Reconsidering CCS in the US fossil-fuel electricity industry under section 45Q tax credits. Greenh. Gas Sci. Technol. 2019, 9, 1288–1301. [Google Scholar] [CrossRef]

- State CO2-EOR Deployment Work Group. Capturing and Utilizing CO2 from Ethanol: Adding Economic Value and Jobs to Rural Economies and Communities While Reducing Emissions; State CO2-EOR Deployment Work Group: Great Plains, KS, USA, 2017. [Google Scholar]

- Jossi, F. An FAQ on 45Q: What Federal Carbon Storage Tax Credit Means for Midwest. 10 July 2018. Available online: https://energynews.us/2018/07/10/midwest/an-faq-on-45q-what-federal-carbon-storage-tax-credit-means-for-midwest/ (accessed on 18 April 2020).

- Moore, A. U.S. 45Q Tax Credit Key to Developing Carbon-Capture Facility in Colorado. 8 January 2020. Available online: https://www.spglobal.com/platts/en/market-insights/latest-news/coal/010820-us-45q-tax-credit-key-to-developing-carbon-capture-facility-in-colorado (accessed on 18 April 2020).

- Nagabhushan, D.; Thompson, J. Carbon Capture & Storage in The United States Power Sector—The Impact of 45Q Federal Tax Credits; Clean Air Task Force: Boston, MA, USA, 2019. [Google Scholar]

- Bennett, S.; Stanley, T. Commentary: US Budget Bill May Help Carbon Capture Get Back on Track. 8 January 2020. Available online: https://www.iea.org/newsroom/news/2018/march/commentary-us-budget-bill-may-help-carbon-capture-get-back-on-track.html (accessed on 24 July 2018).

- U.S. Department of Energy. Carbon Capture, Utilization and Storage: Climate Change, Economic Competitiveness and Energy Security; U.S. Department of Energy: Washington, DC, USA, 2016. [Google Scholar]

- Bezdek, R. The Economic Impacts of CCUS Tax Credits. 15 July 2019. Available online: http://acclive.com/2019/07/15/the-economic-impacts-of-ccus-tax-credits/ (accessed on 2 April 2020).

- Zapantis, A.; Townsend, A.; Rassool, D. Policy Priorities to Incentivise Large Scale Deployment of CCS; Global CCS Institute: Docklands, Australia, 2019. [Google Scholar]

- James, R.; Zoelle, A.; Keairns, D.; Turner, M.; Woods, M.; Kuehn, N. Bituminous Coal and Natural Gas to Electricity. In Cost and Performance Baseline for Fossil Energy Plants; U.S. Department of Energy, National Energy Technology Laboratory, NETL-Pub-22638: Pittsburgh, PA, USA, 2019; Volume 1. [Google Scholar]

- Snyder, B.; Layne, M.; Dismukes, D. A cash flow model of an integrated industrial CCS-EOR project in a petrochemical corridor: A case study in Louisiana. Int. J. Greenh. Gas Control. 2020, 93, 102885. [Google Scholar] [CrossRef]

- Sanchez, D.; Johnson, N.; McCoy, S.; Turner, P.; Mach, K. Near-term deployment of carbon capture and sequestration from biorefineries in the United States. Proc. Natl. Acad. Sci. USA 2018, 115, 4875–4880. [Google Scholar] [CrossRef] [PubMed]

- Victor, N.; Balash, P.; Nichols, C. The Role of CCUS in North America Energy System Decarbonization. J. Strateg. Innov. Sustain. 2019, 14, 79–94. [Google Scholar]

- King, B.; Herndon, W.; Larsen, J.; Hiltbrand, G. Opportunities for Advancing Industrial Carbon Capture. 10 September 2020. Available online: https://rhg.com/research/industrial-carbon-capture/#_ftnref7 (accessed on 10 March 2021).

- U.S. Energy Information Administration. Levelized Costs of New Generation Resources in the Annual Energy; U.S. Energy Information Administration: Washington, DC, USA, 2021. [Google Scholar]

- Perman, R.; Ma, Y.; McGilvray, J.; Common, M. Natural Resource and Environmental Economics; Pearson Education Limited: Upper Saddle River, NJ, USA, 2003. [Google Scholar]

- Tietenberg, T.; Lewis, L. Environmental & Natural Resource Economics, Upper Saddle River; Pearson Education: Upper Saddle River, NJ, USA, 2012; pp. 25–42. [Google Scholar]

- Pindyck, R. Climate Change Policy: What do the Models Tell Us? J. Econ. Lit. 2013, 51, 860–872. [Google Scholar] [CrossRef]

- National Academies of Sciences, Engineering and Medicine. Valuing Climate Damages: Updating Estimation of the Social Cost of Carbon; National Academic Press: Washington, DC, USA, 2017. [Google Scholar]

- Interagency Working Group on Social Cost of Greenhouse Gases, United States Government. Technical Support Document: Technical Support of the Social Cost of Carbon for Regulatory Impact Analysis—Under Executive Order 12866; U.S. Environmental Protection Agency: Washington, DC, USA, 2016. [Google Scholar]

- Johnson, L.; Hope, C. The social cost of carbon in U.S. regulatory impact analyses: An introduction and critique. J. Environ. Stud. Sci. 2012, 2, 205–221. [Google Scholar] [CrossRef]

- U.S. Government Accountability Office. Social Cost of Carbon: Identifying a Federal Entity to Address the National Academies Recommendations Could Strengthen Regulatory Analysis; GAO-20-254; U.S. Government Accountability Office: Washington, DC, USA, 2020. [Google Scholar]

- Environment and Climate Change Canada. Technical Update to Environment and Climate Change—Canada’s Social Cost of Greenhouse Gas Estimates; Environment and Climate Change Canada: Gatineau, QC, Canada, 2016. [Google Scholar]

- National Energy Technology Laboratory. Quality Guidelines for Energy System Studies: Cost Estimation Methodology for NETL Assessments of Power Plant Performance; U.S. Department of Energy: Pittsburgh, PA, USA, 2021. [Google Scholar]

- National Energy Technology Laboratory. FE/NETL CO2 Transport Cost Model (2018). 1 May 2018. Available online: https://netl.doe.gov/energy-analysis/search?search=CO2TransportCostModel (accessed on 18 March 2021).

- National Energy Technology Laboratory. FE/NETL CO2 Saline Storage Cost Model. 30 September 2017. Available online: https://netl.doe.gov/energy-analysis/search?search=CO2SalineCostModel (accessed on 18 March 2021).

- U.S. Environmental Protection Agency. Underground Injection Control Program: Criteria and Standards; U.S. Environmental Protection Agency: Washington, DC, USA, 2017. [Google Scholar]

- U.S. Environmental Protection Agency. Final Greenhouse Gas Reporting Rule for Geologic Sequestration and Injection of Carbon Dioxide: Subparts RR and UU. November 2010. Available online: https://www.epa.gov/sites/production/files/2015-07/documents/subpart-rr-uu-ppt.pdf (accessed on 1 March 2021).

- Simbeck, D.; Beecy, D. The CCS Paradox: The Much Higher CO2 Avoidance Costs of Existing versus New Fossil Fuel Power Plants. Energy Procedia 2011, 4, 1917–1924. [Google Scholar] [CrossRef][Green Version]

- Intergovernmental Panel on Climate Change. Carbon Dioxide Capture and Storage; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar]

- Clark, V.; Herzog, H. Can “stranded” fossil fuel reserves drive CCS deployment? Energy Procedia 2014, 63, 7261–7271. [Google Scholar] [CrossRef]

- Clearpath Action. SCALE Act (H.R. 1992/S. 799). 2021. Available online: https://static.clearpathaction.org/2021/03/210218-cpa-scale-act.pdf (accessed on 26 March 2021).

- Fleurbaey, M.; Ferrana, M.; Budolfson, M.; Dennig, F.; Mintz-Woo, K.; Socolow, R.; Spears, D.; Zuber, S. The Social Cost of Carbon: Valuing Inequality, Risk, and Population for Climate Policy. Monist 2019, 102, 84–109. [Google Scholar] [CrossRef]

- Enchant Energy. Carbon Capture Retrofit of San Juan Generating Station Presentation to United States Energy Association. 27 June 2019. Available online: https://www.enchantenergy.com/wp-content/uploads/2019/07/Enchant-SJGS-Presentation-1.pdf. (accessed on 1 March 2021).

- Bacon, D.; Yonkofski, C.; Brown, C.; Demirkanli, D.; Whiting, J. Risk-based post injection site care and monitoring for commercial-scale carbon storage: Reevaluation of the FutureGen 2.0 site using NRAP-Open-IAM and DREAM. Int. J. Greenh. Gas Control. 2019, 90, 102784. [Google Scholar] [CrossRef]

| Source | Source Year | Discount Rate (Percent) | SCC Value in 2020 (2018 $USD/tCO2 Emitted) | $ Base Year |

|---|---|---|---|---|

| U.S. Government Interagency Working Group [43] | 2016 | 2.5 | $73 | 2007 |

| 3 | $50 | |||

| 3 at P95 | $145 | |||

| 5 | $14 | |||

| Nordhaus [17] | 2017 | 4.25 a | $41.5 to $42.2 | 2010 |

| $150 to $259 | ||||

| 1.4 b | $301 | |||

| 2.5 | $158 | |||

| 3 | $99 | |||

| 4 | $46 | |||

| 5 | $26 | |||

| Johnson and Hope [44] | 2012 | 1 c | $383 | 2007 |

| 3 c | $30 | |||

| 5 c | $7 | |||

| U.S. Government Accountability Office [45] | 2020 | 3 | $7 | 2018 |

| 7 | $1 | |||

| Environment and Climate Change Canada [46] | 2016 | 3 | $42 | 2018 d |

| $178 |

| Policy Scenario | SubC PC Plant Case | NGCC Plant Case | ||

|---|---|---|---|---|

| SCC (2018 $/tCO2) | LCOE (2018 $/MWh) | SCC (2018 $/tCO2) | LCOE (2018 $/MWh) | |

| CCS_NI | 137.00 | 174.35 | 180.00 | 114.91 |

| NR45Q | 123.00 | 161.14 | 167.00 | 110.00 |

| FR45Q | 112.00 | 151.61 | 158.00 | 106.40 |

| 30FR45Q | 80.00 | 123.16 | 129.00 | 95.39 |

| 30FR45Q_FT | 65.00 | 109.32 | 106.00 | 86.76 |

| 30FR45Q_FT_10PISC | 63.00 | 108.01 | 104.00 | 86.11 |

| 30FR45Q_FT_FS | 58.00 | 103.25 | 98.00 | 83.79 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Harker Steele, A.; Warner, T.; Vikara, D.; Guinan, A.; Balash, P. Comparative Analysis of Carbon Capture and Storage Finance Gaps and the Social Cost of Carbon. Energies 2021, 14, 2987. https://doi.org/10.3390/en14112987

Harker Steele A, Warner T, Vikara D, Guinan A, Balash P. Comparative Analysis of Carbon Capture and Storage Finance Gaps and the Social Cost of Carbon. Energies. 2021; 14(11):2987. https://doi.org/10.3390/en14112987

Chicago/Turabian StyleHarker Steele, Amanda, Travis Warner, Derek Vikara, Allison Guinan, and Peter Balash. 2021. "Comparative Analysis of Carbon Capture and Storage Finance Gaps and the Social Cost of Carbon" Energies 14, no. 11: 2987. https://doi.org/10.3390/en14112987

APA StyleHarker Steele, A., Warner, T., Vikara, D., Guinan, A., & Balash, P. (2021). Comparative Analysis of Carbon Capture and Storage Finance Gaps and the Social Cost of Carbon. Energies, 14(11), 2987. https://doi.org/10.3390/en14112987