Digitalisation and Innovation in the Steel Industry in Poland—Selected Tools of ICT in an Analysis of Statistical Data and a Case Study

Abstract

:1. Introduction

2. Literature Review about Digitalisation in the Steel Industry

- -

- Legacy equipment;

- -

- Uncertainty about the impact of digitisation on jobs;

- -

- Issues connected with data protection and safety.

- Problems with the integration of new processes and technologies with site workers, which is especially important in the case of older employees;

- Big gaps between workers which are now employed and the prospective employees in the case of knowledge transfer;

- Lack of investment in education and training from steelmaking companies as well as an insufficient number of others types of training provided by companies.

3. Materials and Methods

- Cloud computing refers to ICT services that are used over the Internet (Virtual Private Networks (VPN) connections are also included) to access software, use certain computing power and store data.

- A broadband connection is a type of connection characterised by a high speed of information flow, measured in Mb/s (megabits per second). Broadband access is enabled by, among others: DSL family technologies (ADSL, SDSL, etc.), cable TV networks (cable modem), satellite connections and wireless connections via a modem or a 3G phone.

- Mobile Internet connection is a type of connection of mobile devices connected to the Internet via mobile telecommunications networks for business purposes.

- Information systems—use of ERP and CRM.

- Innovativeness—enterprises innovating within the scope of product innovations and business processes in the industry for the last 3 years in the field of metal production, as well as enterprises which introduced new or improved products or business processes: in total, with 50–249 employees or with 250 and more employees, new or improved products and new or significantly improved business processes (in % of the total number of enterprises).

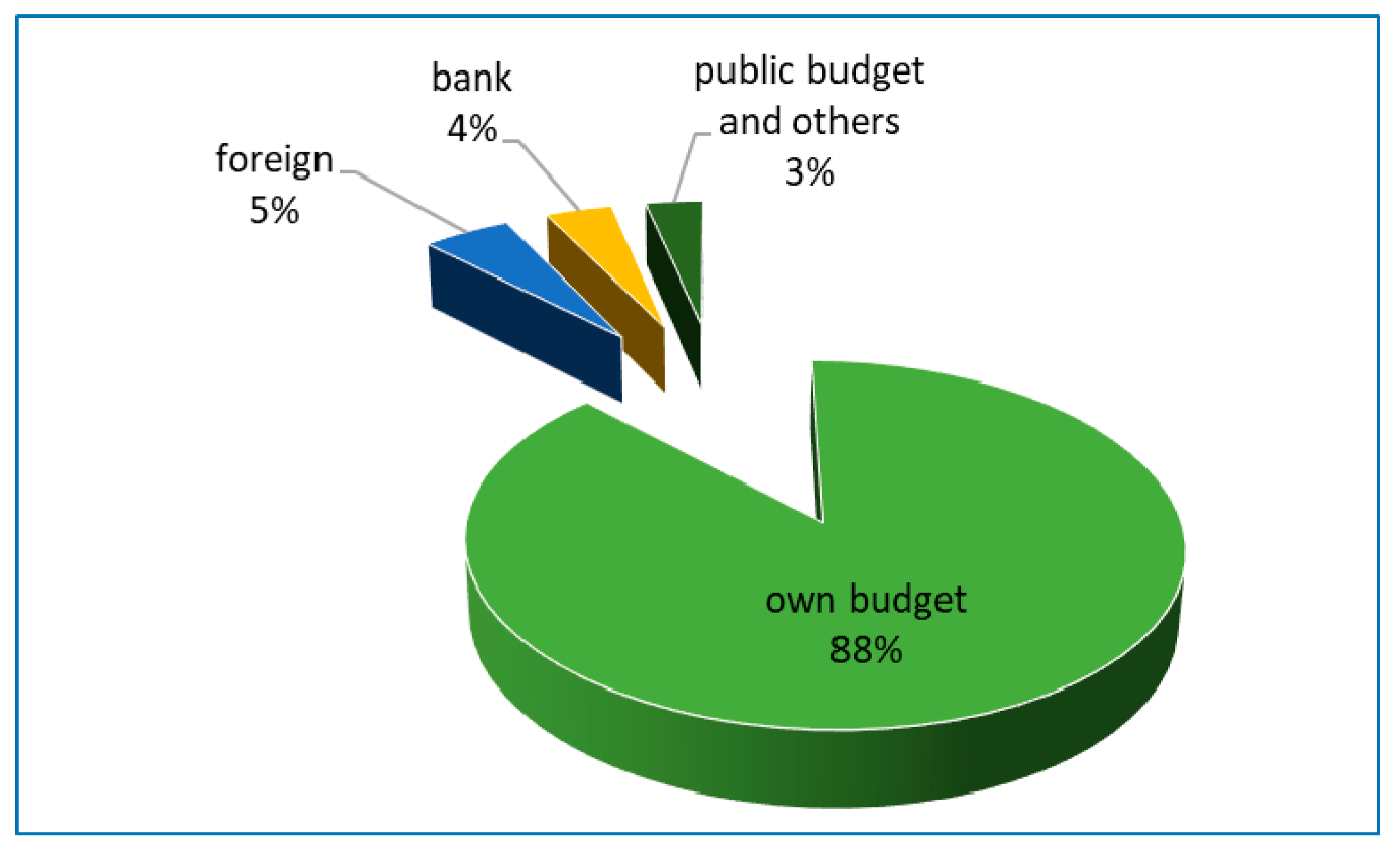

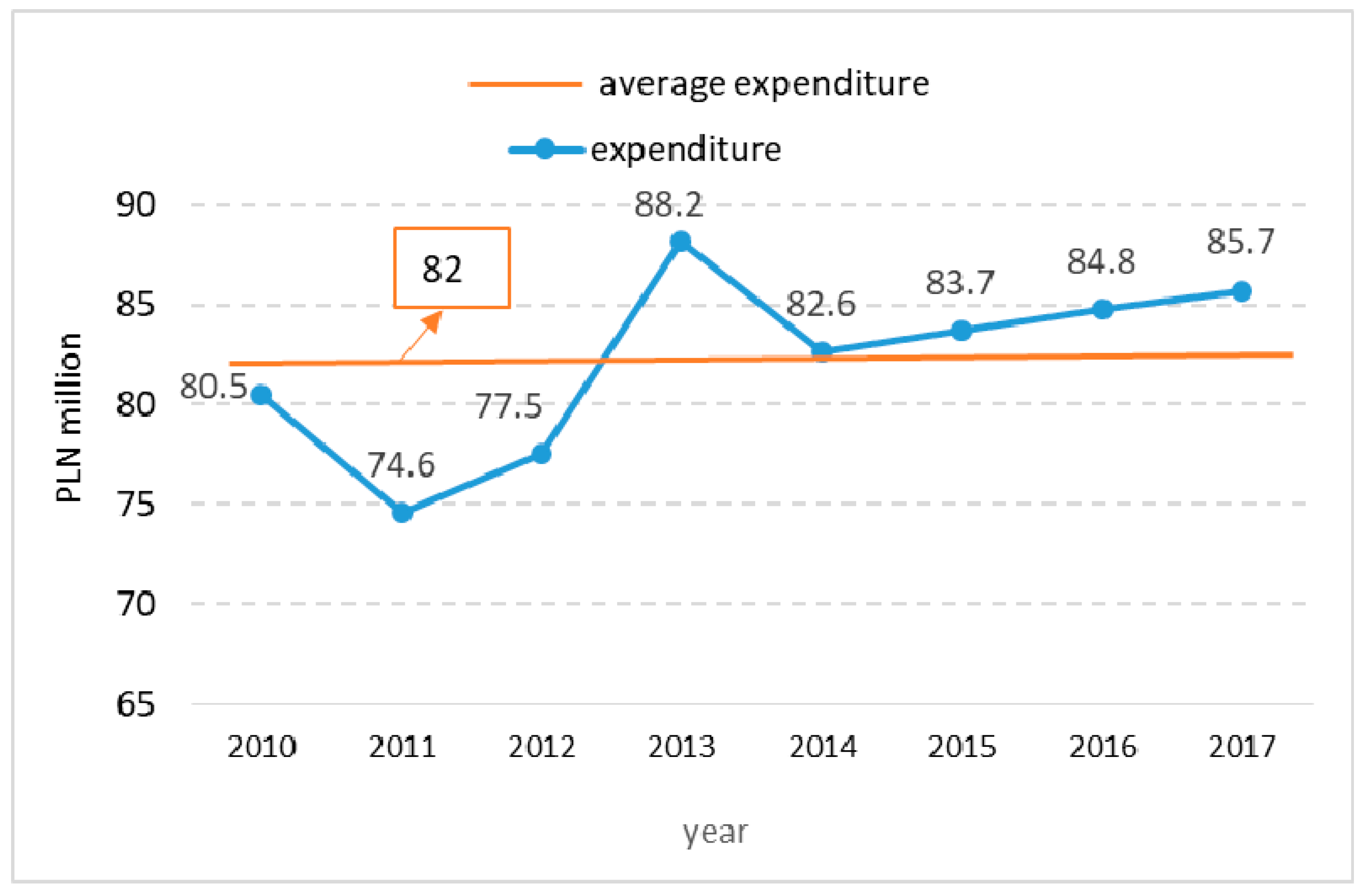

- Sources of financing of outlays (in PLN million): own; acquired from abroad; credits, loans and other financial liabilities from financial institutions; national, from institutions disposing of public funds.

- Share of the net revenue from sales of new or improved products of the net revenue from sales in industry in the division of metal production: products—in percentage—introduced to the market in the last 3 years.

4. Background for the Analysis

4.1. The Steel Industry in Poland

4.2. Digitalisation in the Steel industry in Poland

- Low production scale, which translates into no need to introduce processes related to robotisation;

- A specific production profile where robots are not needed;

- Not taking into account robotisation in the company’s development plans;

- Financial barriers;

- No need to develop production processes.

4.3. Digitisation in Steelworks—A Case Study of the Corporation ArcelorMittal Poland

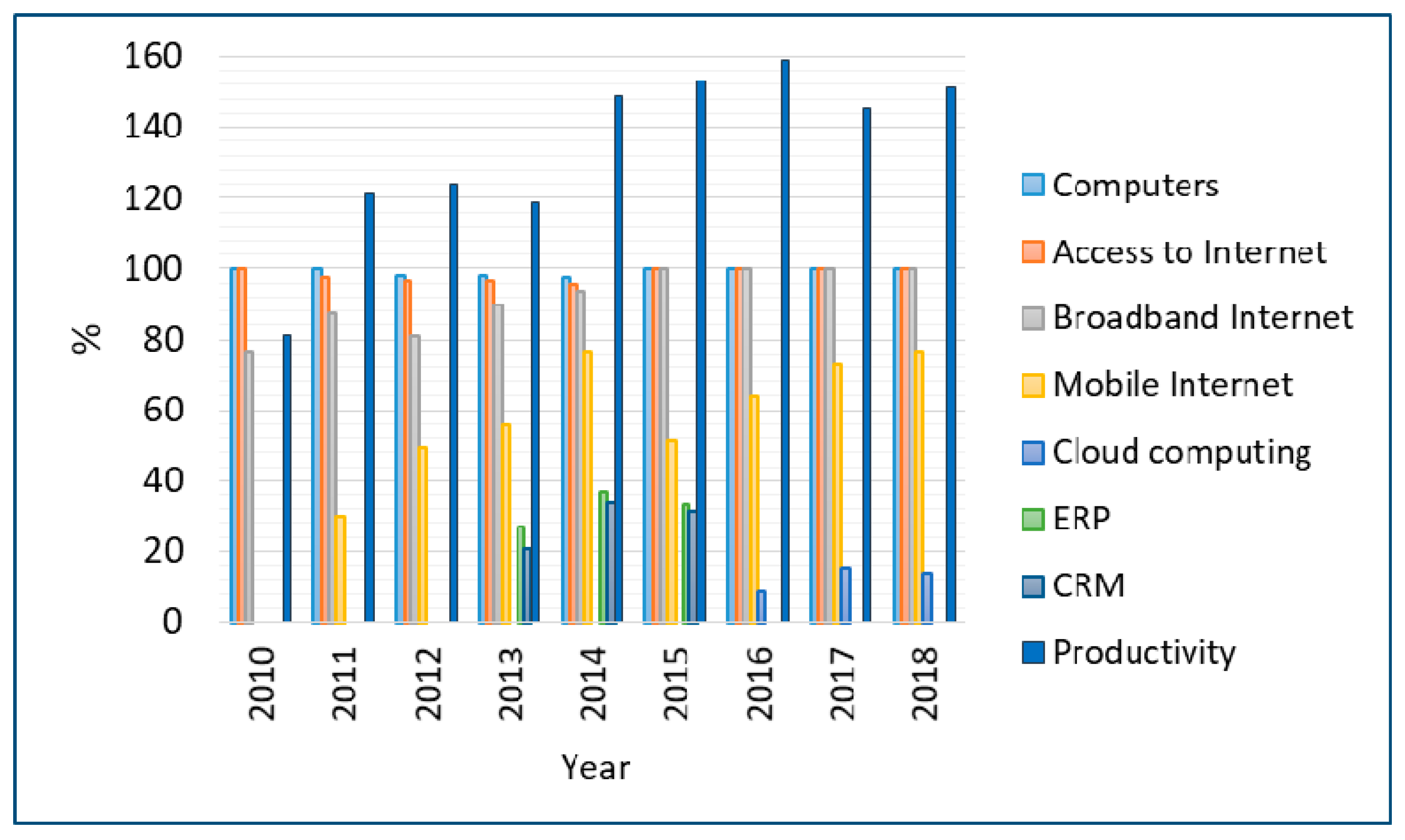

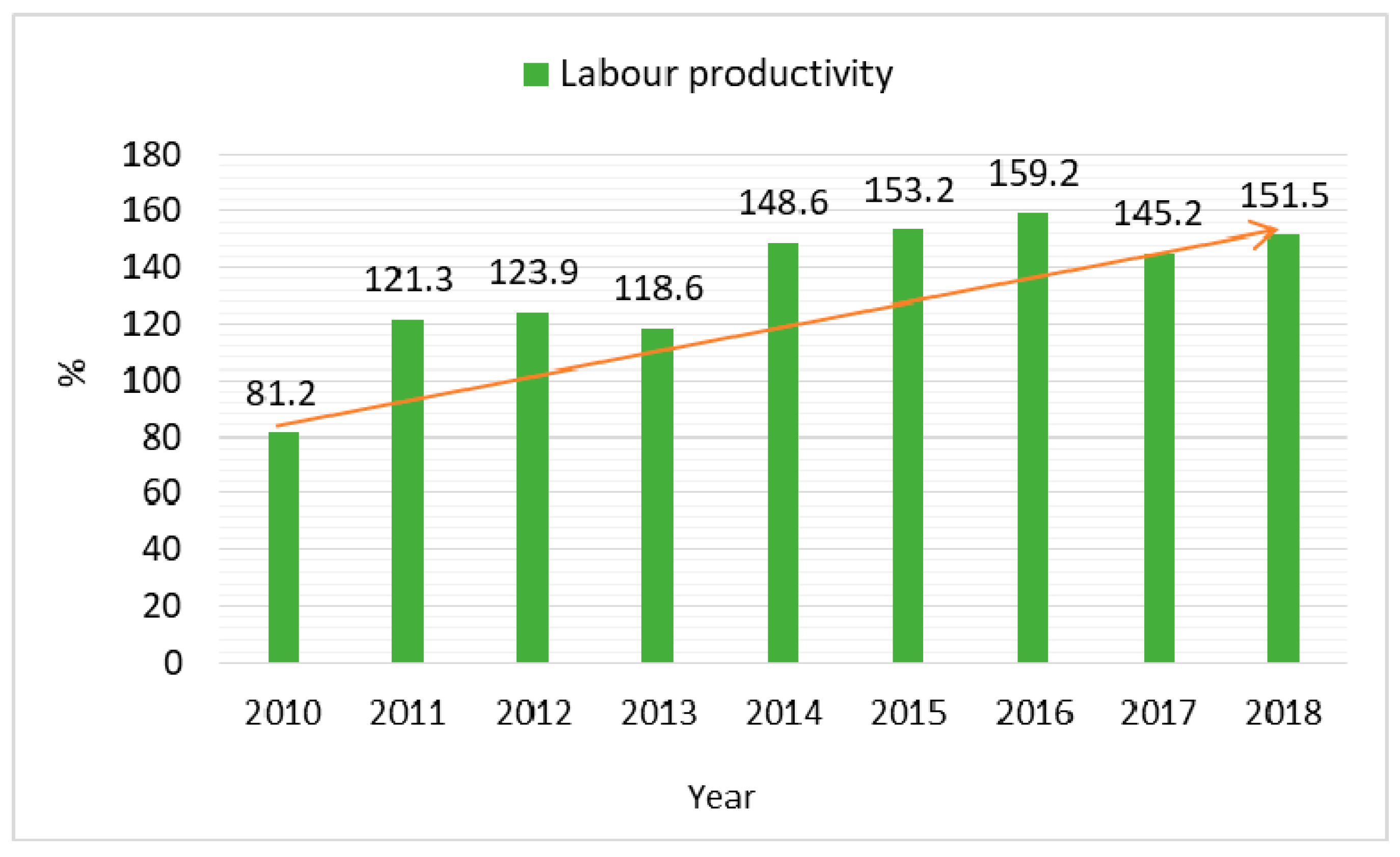

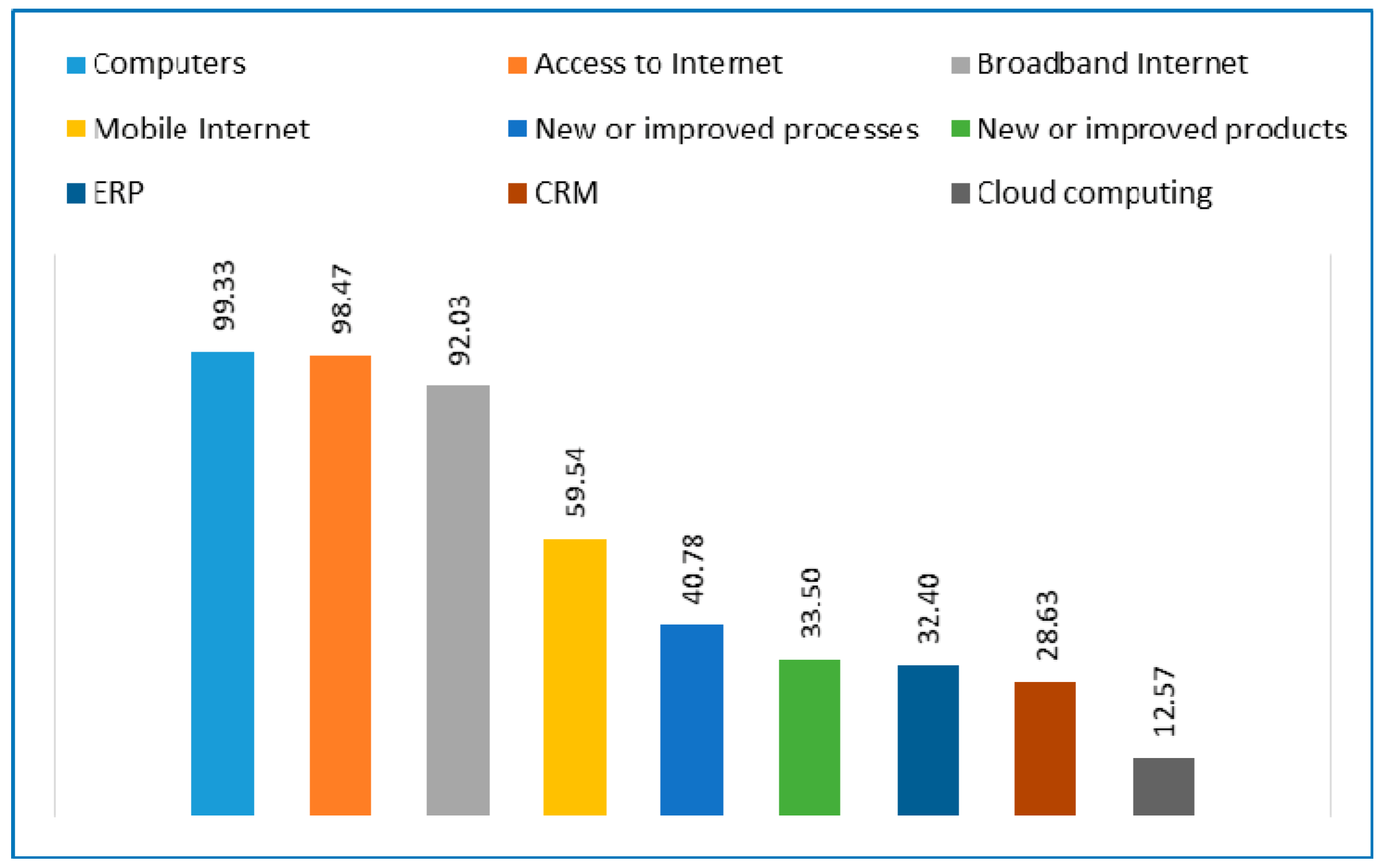

5. Steel Digitalisation in Statistics

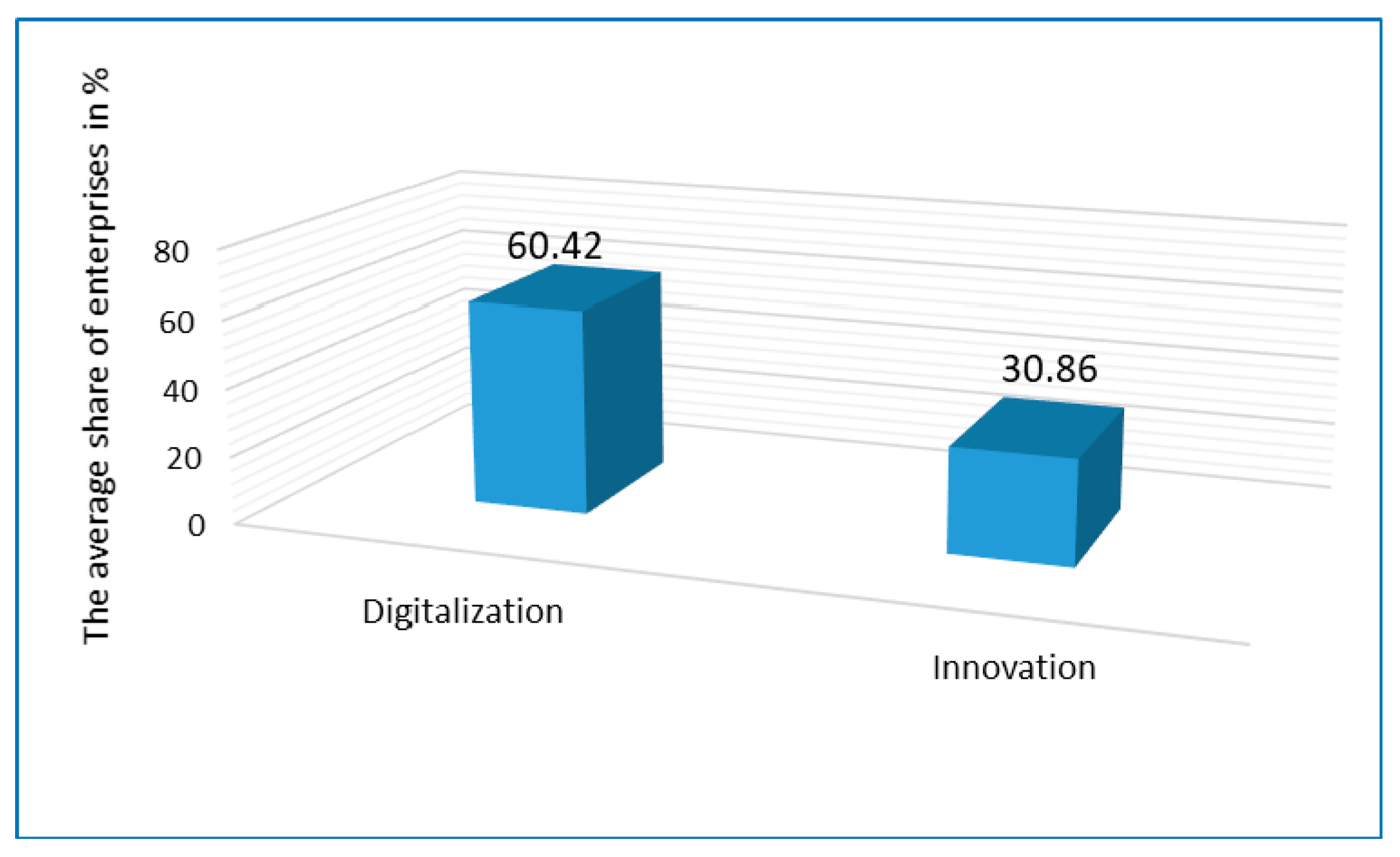

Results of Analysis

6. Discussion and Conclusions

- The level of digitalisation of the steel sector in Poland is differentiated in terms of the use of particular ICT tools in enterprises and is as follows: the share of enterprises having computers is almost 100%, while 98.5% of the Polish steel enterprises are Internet users, of which 92% are broadband Internet users and 59.5% of the researched enterprises are mobile Internet users;

- Cloud computing—the purchase of this service by steel companies is small because it is a new ICT tool; 12.6% of metallurgical users have been reported to use it so far;

- ERP and CRM are popular information systems; these systems are installed in every third company (metallurgical companies also use SAP systems);

- The relation of digitalisation to innovation is 2 to 1;

- Investments in the steel industry in Poland are financed mainly from the companies’ own resources (86% share of the total financial sources).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ADSL | Asymmetric Digital Subscriber Line |

| AI | Artificial Intelligence |

| AMP | ArcelorMittal Poland |

| BF | Blast Furnace |

| BFN | Blast Furnace Network |

| BOF | Basic Oxygen Furnace |

| CAx | Computer Aided |

| CMC | Commercial Metals Company |

| CPPS | Cyber Physical Production Systems |

| CRM | Customer Relationship Management |

| DSL | Digital Subscriber Line |

| DTC | Dynamic Capability Theory |

| EC | European Commission |

| ERP | Enterprise Resource Planning |

| FP7 | Seventh Framework Programme |

| GDP | Gross Domestic Product |

| GUS | Głowny Urząd Statystyczny—Statistics Poland |

| HIPH | Hutnicza Izba Przemysłowo-Handlowa—Polish steel Industry |

| IC | Information and Communication |

| ICT | Information and Communication Technologies |

| ID | Identification number |

| IoT | Internet of things |

| IT | Information Technology |

| KET | Key Enabling Technologies |

| KPI | Key Performance Indicator |

| LCA | Life Cycle Assessment |

| LED | Light-emitting diode |

| M2M | Machine to Machine |

| MES | Manufacturing Execution System |

| ML | Machine Learning |

| MRP | Material Requirements Planning |

| MRP II | Manufacturing Resource Planning |

| PLN | Polish Zloty |

| PUDS | Polska Unia Dystrybutorów Stali—Polish Union of Steel Distributors |

| QR | Quick Response |

| RFCS | Research Fund for Coal and Steel |

| RFID | Radio Frequency Identification |

| SAP | Systems, Applications and Products in Data Processing |

| SDSL | Symmetric Digital Subscriber Line |

| SR | Social Responsibility |

| VPN | Virtual private network |

| WCM | World Class Manufacturing |

References

- Snabe, H.J.; Weinelt, B. Digital Transformation of Industries; World Economic Forum: Geneva, Switzerland, 2016. [Google Scholar]

- Tihinen, M.; Kääriäinen, J.; Teppola, S.; Parviainen, P. Tackling the digitization challenge: How to benefit from digitization in practice. Int. J. Inf. Syst. Proj. Manag. 2017, 5, 63–77. [Google Scholar]

- Rojko, A. Industry 4.0 Concept: Background and Overview. Int. J. Interact. Mob. Technol. 2017, 11, 77–90. [Google Scholar] [CrossRef] [Green Version]

- Vernersson, F.; Lindblad, F.; Enerbäck, O. Den Smarta Industrin-Industriellt Internet Skapar Möjligheter För Svenska Tillverkande Företag. 2015. Available online: https://www.pwc.se/sv/pdf-reports/den-smarta-industrin.pdf (accessed on 19 May 2021).

- Kagermann, H.; Helbig, J.; Hellinger, A.; Wahlster, W. Recommendations for Implementing the Strategic Initiative Industry 4.0: Securing the Future of German Manufacturing Industry. Final Report of the Industry 4.0 Working Group Forschungsunion. 2013. Available online: http://www.acatech.de/fileadmin/user_upload/Baumstruktur_nach_Website/Acatech/root/de/Material_fuer_Sonderseiten/Industrie_4.0/Final_report__Industrie_4.0_accessible.pdf (accessed on 2 February 2020).

- Kagermann, H.; Wahlster, W.; Helbig, J. Final Report of the Industrie 4.0 Working Group; Acatech-National Academy of Science and Engineering: München, Germany, 2013; Available online: http://forschungsunion.de/pdf/industrie_4_0_final_report.pdf (accessed on 10 January 2020).

- Kagermann, H. Change Through Digitization—Value Creation in the Age of Industry 4.0; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2015; pp. 23–45. [Google Scholar]

- Hecht, M. Industrie 4.0 der Dillinger Weg. Stahl Eisen 2017, 137, 61–70. [Google Scholar]

- Herzog, K.; Winter, G.; Kurka, G.; Ankermann, K.; Binder, R.; Ringhofer, M.; Maierhofer, A.; Flick, A. The Digitalization of Steel Production. BHM Berg-Hüttenmännische Monatshefte 2017, 162, 504–513. [Google Scholar] [CrossRef]

- Oxford English Dictionary; Digitization, Oxford University Press: Oxford, UK, 2020.

- Schumacher, A.; Sihn, W.; Erol, S. Automation, digitization and digitalisation and their implications for manufacturing processes. In Proceedings of the Innovation and Sustainability 2016, International Scientific Conference, Bucharest, Romania, 28–29 October 2016. [Google Scholar]

- Feldman, T. An Introduction to Digital Media; Routledge: Vienna, Austria, 2003; p. 2. [Google Scholar]

- Pepperell, R. The Posthuman Condition: Consciousness Beyond the Brain; Intellect: Bristol, UK, 2003; p. 126. [Google Scholar]

- Robinson, D. “Analog,” in Software Studies: A Lexicon; MIT Press: Cambridge, UK, 2008; pp. 21–31. [Google Scholar]

- Pinch, T.J.; Trocco, F. Analog Days: The Invention and Impact of the Moog Synthesizer; Harvard Univ. Press: Cambridge, UK, 2004; p. 7. [Google Scholar]

- Castells, M.; Castells, M. The Rise of the Network Society, 2nd ed.; Wiley-Blackwell: Malden, MA, USA, 2010. [Google Scholar]

- Wachal, R. Humanities and Computers; North Am. Review: Boston, MA, USA, 1971; pp. 30–32. [Google Scholar]

- Van Dijk, J. The Network Society: Social Aspects of New Media; Sage Publications: Thousand Oaks, CA, USA, 2006; p. 46. [Google Scholar]

- Verhulst, S. About Scarcities and Intermediaries: The Regulatory Paradigm Shift of Digital Content Reviewed. In The Handbook of New Media; Sage Publications: London, UK, 2002; pp. 432–477. [Google Scholar]

- Sassen, S.; Appiah, K.A. Globalization and its Discontents: Essays on the New Mobility of People and Money; The New Press: New York, NY, USA, 1998. [Google Scholar]

- Bloomberg, J. Digitization, Digitalisation, and Digital Transformation: Confuse Them at Your Peril. Forbes. 2018. Retrieved 4 February 2020. Available online: https://www.forbes.com/sites/jasonbloomberg/2018/04/29/digitizationDigitization-and-digital-transformation-confuse-them-at-yourperil/#45328d792f2c (accessed on 20 April 2021).

- Stolterman, E.; Fors, A.C. Information Technology and the Good Life. Collab. Hyperconnected World 2004, 143, 687–692. [Google Scholar] [CrossRef] [Green Version]

- Gajdzik, B.; Grabowska, S.; Saniuk, S. A Theoretical Framework for Industry 4.0 and Its Implementation with Selected Practical Schedules. Energies 2021, 14, 940. [Google Scholar] [CrossRef]

- Di Nardo, M. Developing a Conceptual Framework Model of Industry 4.0 for Industrial Management. Ind. Eng. Manag. Syst. 2020, 19, 551–560. [Google Scholar] [CrossRef]

- Haddara, M.; Elragal, A. The Readiness of ERP Systems for the Factory of the Future. Procedia Comput. Sci. 2015, 64, 721–728. [Google Scholar] [CrossRef] [Green Version]

- Manavalan, E.; Jayakrishna, K. A review of Internet of Things (IoT) embedded sustainable supply chain for industry 4.0 requirements. Comput. Ind. Eng. 2019, 127, 925–953. [Google Scholar] [CrossRef]

- Peralta, G.; Iglesias-Urkia, M.; Barcelo, M.; Gomez, R.; Moran, A.; Bilbao, J. Fog computing based efficient IoT scheme for the Industry 4.0. In Proceedings of the 2017 IEEE International Workshop of Electronics, Control, Measurement, Signals and their Application to Mechatronics (ECMSM), Donostia, Spain, 24–26 May 2017; IEEE: Chem, Switzerland, 2017; pp. 1–6. [Google Scholar]

- Thomas, B.G. Review on Modeling and Simulation of Continuous Casting. Steel Res. Int. 2018, 89, 1700312. [Google Scholar] [CrossRef]

- Solodovnikovv, S.Y.; Sergievich, T.V. Challenges and prospects for the development of ferrous metallurgy in the republic of Belarus. Chernye Met. 2020, 11, 62–68. [Google Scholar] [CrossRef]

- Dai, H.; Zuo, X. Industry 4.0 boosts the steel industry into a new era of digitalisation and smart technology. AISTech-Iron Steel Technol. Conf. Proc. 2020, 3, 1829–1841. [Google Scholar]

- Salo, J.; Tan, T.M.; Makkonen, H. Digitalisation of the buyer–seller relationship in the steel industry. J. Bus. Ind. Mark. 2020. [Google Scholar] [CrossRef]

- Brankley, L.; Camci, L.; Tugrul, A.; Yap, C.S.; Woolnough, A. Digital Transformation for the Reinforcing Steel Supply Chain. In Proceedings of the fib Symposium 2020: Concrete Structures for Resilient Society, Shanghai, China, 22–24 November 2020; pp. 344–350, 2020 fib Symposium: Concrete Structures for Resilient Society; Virtual; Code 167100. [Google Scholar]

- Simovic, V. Uvod u Informacijske Sustave, Introduction to Information Systems; Golden Marketing-Tehnička knjiga: Zagreb, Croatia, 2009. [Google Scholar]

- Stojkic, Z.; Saravanja, L.; Bosnjak, I. The Enchanting of Information Systems with Digital Technologies. In Proceedings of the 29th International DAAAM Symposium 2018, Zadar, Croatia, 24–27 October 2018; DAAAM International: Vienna, Austria, 2020; pp. 0771–0779. [Google Scholar]

- Skyrme, D.J. The realities of virtuality. In Proceedings of the First VONet- Workshop, Berne, Switzerland, 27–28 April 1998; Simova Verlag: Bern, Switzerland, 1998. [Google Scholar]

- Gajdzik, B. World Class Manufacturing in metallurgical enterprise. Metalurgija 2013, 1, 131–134. [Google Scholar]

- Peters, H. How could Industry 4.0 Transform the Steel Industry? Presentation at Future Steel Forum, Poland, Warsaw 2017, 14.-15.6.2017. Available online: https://futuresteelforum.com/content-images/speakers/Prof.-Dr-Harald-Peters-Industry-4.0-transform-the-steel-industry.pdf (accessed on 10 January 2021).

- Erboz, G. How to Define Industry 4.0: Main Pillars of Industry 4.0. In Proceedings of the 7th International Conference on Management (ICoM), Nitra, Slovakia, 4 November 2017; Available online: https://www.researchgate.net/publication/326557388_How_To_Define_Industry_40_Main_Pillars_Of_Industry_40 (accessed on 9 June 2019).

- Clerck, J. Digitization, Digitization and Digital Transformation: The Differences. i-SCOOP 2017. Available online: https://www.i-scoop.eu/digital-transformation/digitization-Digitization-digital-transformation-disruption/ (accessed on 20 February 2020).

- Lee, J.; Bagheri, B.; Kao, H. Research Letters: A Cyber-Physical Systems architecture for Industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Liu, Y.; Peng, Y.; Wang, B.; Yao, S.; Liu, Z. Review on cyber-physical systems. IEEE/CAA J. Autom. Sin. 2017, 4, 27–40. [Google Scholar] [CrossRef]

- Gajdzik, B.; Sroka, W. Resource Intensity vs. Investment in Production Installations—The Case of the Steel Industry in Poland. Energies 2021, 14, 443. [Google Scholar] [CrossRef]

- Wolniak, R.; Saniuk, S.; Grabowska, S.; Gajdzik, B. Identification of Energy Efficiency Trends in the Context of the Development of Industry 4.0 Using the Polish Steel Sector as an Example. Energies 2020, 13, 2867. [Google Scholar] [CrossRef]

- Gajdzik, B.; Grabowska, S.; Saniuk, S.; Wieczorek, T. Sustainable Development and Industry 4.0: A Bibliometric Analysis Identifying Key Scientific Problems of the Sustainable Industry 4.0. Energies 2020, 13, 4254. [Google Scholar] [CrossRef]

- Saniuk, S.; Grabowska, S.; Gajdzik, B. Social Expectations and Market Changes in the Context of Developing the Industry 4.0 Concept. Sustainability 2020, 12, 1362. [Google Scholar] [CrossRef] [Green Version]

- Gubbi, J.; Buyya, R.; Marusic, S.; Palaniswami, M. Internet of Things (IoT): A vision, architectural elements, and future directions. Futur. Gener. Comput. Syst. 2013, 29, 1645–1660. [Google Scholar] [CrossRef] [Green Version]

- Wollschlaeger, M.; Sauter, T.; Jasperneite, J. The Future of Industrial Communication: Automation Networks in the Era of the Internet of Things and Industry 4.0. IEEE Ind. Electron. Mag. 2017, 11, 17–27. [Google Scholar] [CrossRef]

- Patel, M. The Future of Maintenance. White Paper. Bengaluru: Infosys. 2018. Available online: https://www.infosys.com/industries/aerospace-defense/white-papers/Documents/enabled-predictive-maintenance.pdf (accessed on 16 July 2019).

- Dai, Q.; Zhong, R.; Huang, G.Q.; Qu, T.; Zhang, T.; Luo, T.Y. Radio frequency identification-enabled real-time manufacturing execution system: A case study in an automotive part manufacturer. Int. J. Comput. Integr. Manuf. 2012, 25, 51–65. [Google Scholar] [CrossRef]

- Monsreal, M.M.; HongYan, D.; Mitchell, T.; David, B. Tracking Technologies in Supply Chains. Wiley Encycl. Oper. Res. Manag. Sci. 2010. [Google Scholar] [CrossRef]

- Li, H.N.; Sun, S.D.; Zhang, Y.F. Using Auto-ID Technologies to Implement Real-Time Manufacturing Resources Tracking and Tracing. Appl. Mech. Mater. 2011, 121–126, 1574–1578. [Google Scholar] [CrossRef]

- Wang, K.-S. Intelligent and integrated RFID (II-RFID) system for improving traceability in manufacturing. Adv. Manuf. 2014, 2, 106–120. [Google Scholar] [CrossRef] [Green Version]

- Tiwari, S. An Introduction to QR Code Technology. In Proceedings of the 2016 International Conference on Information Technology (ICIT), Bhubaneswar, India, 22–24 December 2016; IEEE: Chem, Switzerland, 2016; pp. 39–44. [Google Scholar]

- Santos, K.; Loures, E.; Piechnicki, F.; Canciglieri, O. Opportunities Assessment of Product Development Process in Industry 4.0. Procedia Manuf. 2017, 11, 1358–1365. [Google Scholar] [CrossRef]

- Lee, J.; Kao, H.-A.; Yang, S. Service Innovation and Smart Analytics for Industry 4.0 and Big Data Environment. Procedia CIRP 2014, 16, 3–8. [Google Scholar] [CrossRef] [Green Version]

- Wang, K.S. Intelligent Predictive Maintenance (IPdM) system-Industry 4.0 scenario. WIT Trans. Eng. Sci. 2016, 113, 260–268. [Google Scholar]

- Bokrantz, J.; Skoogh, A.; Berlin, C.; Stahre, J. Maintenance in digitalised manufacturing: Delphi-based scenarios for 2030. Int. J. Prod. Econ. 2017, 191, 154–169. [Google Scholar] [CrossRef]

- Gopalakrishnan, M.; Skoogh, A.; Salonen, A. Machine criticality assessment for productivity improvement: Smart maintenance decision support. Int. J. Prod. Perform. Manag. 2019, 68, 858–878. [Google Scholar] [CrossRef]

- Rødseth, H.; Schjølberg, P.; Marhaug, A. Deep digital maintenance. Adv. Manuf. 2017, 5, 299–310. [Google Scholar] [CrossRef] [Green Version]

- Rødseth, H.; Eleftheriadis, R.J.; Li, Z.; Li, J. Smart Maintenance in Asset Management-Application with Deep Learning. In Lecture Notes in Electrical Engineering; Springer Science and Business Media LLC: Berlin, Germany, 2020; pp. 608–615. [Google Scholar]

- Li, Z.; Li, J.; Wang, Y.; Wang, K. A deep learning approach for anomaly detection based on SAE and LSTM in mechanical equipment. Int. J. Adv. Manuf. Technol. 2019, 103, 499–510. [Google Scholar] [CrossRef]

- Wang, J.; Ma, Y.; Zhang, L.; Gao, R.X.; Wu, D. Deep learning for smart manufacturing: Methods and applications. J. Manuf. Syst. 2018, 48, 144–156. [Google Scholar] [CrossRef]

- Schlegel, P.; Briele, K.; Schmitt, R.H. Autonomous data-driven quality control in self-learning production systems. In Proceedings of the 8th Congress of the German Academic Association for Production Technology (WGP), Aachen, Germany, 19–20 November 2018; pp. 679–689. [Google Scholar]

- Groover, M.P. Automation, Production Systems, and Computer-Integrated Manufacturing; Prentice Hall Press: Upper Saddle River, NJ, USA, 2007; Available online: https://scholar.google.com/scholar_lookup?title=Automation,+Production+Systems,+and+Computer-Integrated+Manufacturing&author=Groover,+M.P.&publication_year=2007 (accessed on 21 April 2021).

- Romero, D.; Noran, O.; Stahre, J.; Bernus, P. Fast-Berglund, Åsa Towards a Human-Centred Reference Architecture for Next Generation Balanced Automation Systems: Human-Automation Symbiosis. Collab. Hyperconnected World 2015, 460, 556–566. [Google Scholar] [CrossRef] [Green Version]

- Romero, D.; Bernus, P.; Noran, O.; Stahre, J.; Berglund, Å.F. The operator 4.0: Human cyber-physical systems & adaptive automation towards human-automation symbiosis work systems. In IFIP Advances in Information and Communication Technology; Springer: New York, NY, USA, 2016; Volume 488, pp. 677–686. [Google Scholar]

- Ten, R.E.A.; St, S. Digitaliseringens Betydelse för Industrins Förnyelse. En Rapport frĺn Teknikföretagen. 2015. Available online: https://www.yumpu.com/en/document/read/54879334/digitaliseringens-betydelse-for-industrins-fornyelse (accessed on 4 February 2021).

- Keinänen & Inas-Kukkonen. Virtual organizing as a strategic approach to stay competitive—A conceptual analysis and case study. In Knowledge Management and Virtual Organizations; Idea Group Publishing: Hershey, PA, USA, 2000. [Google Scholar]

- Matende, S.; Ogao, P. Enterprise Resource Planning (ERP) System Implementation: A Case for User Participation. Procedia Technol. 2013, 9, 518–526. [Google Scholar] [CrossRef] [Green Version]

- DAAAM Proceedings. In Proceedings of the 29th International DAAAM Symposium 2018, Zadar, Croatia, 24–27 October 2018; DAAAM International: Vienna, Austria, 2016; pp. 0912–0919.

- Almada-Lobo, F. The Industry 4.0 revolution and the future of Manufacturing Execution Systems (MES). J. Innov. Manag. 2016, 3, 16–21. [Google Scholar] [CrossRef]

- Lee, J.; Ardakani, H.D.; Yang, S.; Bagheri, B. Industrial Big Data Analytics and Cyber-physical Systems for Future Maintenance & Service Innovation. Procedia CIRP 2015, 38, 3–7. [Google Scholar] [CrossRef] [Green Version]

- Ferrari, A.M.; Volpi, L.; Settembre-Blundo, D.; García-Muiña, F.E. Dynamic life cycle assessment (LCA) integrating life cycle inventory (LCI) and Enterprise resource planning (ERP) in an industry 4.0 environment. J. Clean. Prod. 2021, 286, 125314. [Google Scholar] [CrossRef]

- Tajudeen, F.P.; Nadarajah, D.; Jaafar, N.I.; Sulaiman, A. The impact of digitalisation vision and information technology on organisations’ innovation. Eur. J. Innov. Manag. 2021. [Google Scholar] [CrossRef]

- Hamel, G. The way, what, and how of management innovation. Harv. Bus. Rev. 2006, 84, 72–84. [Google Scholar] [PubMed]

- Branca, T.A.; Fornai, B.; Colla, V.; Murri, M.M.; Streppa, E.; Schröder, A.J. The Challenge of Digitalization in the Steel Sector. Metals 2020, 10, 288. [Google Scholar] [CrossRef] [Green Version]

- Peters, K.; Malfa, E.; Colla, V. The European steel technology platform’s strategic research agenda: A further step for the steel as backbone of EU resource and energy intense industry sustainability. Metall. Ital. 2019, 111, 5–17. [Google Scholar]

- Neef, C.; Hirzel, S.; Arens, M. Industry 4.0 in the European Iron and Steel Industry: Towards an Overview of Implementations and Perspectives; Fraunhofer Institute for Systems and Innovation Research; ISI: Karlsruhe, Germany, 2018. [Google Scholar]

- European Commission. Blueprint for Sectoral Cooperation on Skills-towards an EU Strategy Addressing the Skills Needs of the Steel Sector: European Vision on Steel-Related Skills of Today and Tomorrow—Study; European Commission: Bruxelles, Belgium, 2019. [Google Scholar]

- Murri, M.; Streppa, E.; Colla, V.; Fornai, B.; Branca, T.A. ESSA: Digital Transformation in European Steel Industry: State of Art and Future Scenario. Blueprint “New Skills Agenda Steel”: Industry-Driven Sustainable European Steel Skills Agenda and Strategy. 2019. Available online: https://www.estep.eu/assets/Uploads/Technological-and-Economic-Development-in-the-Steel-Industry-ESSA-D6.1.pdf (accessed on 21 April 2021).

- Man and Machine in Industry 4.0: How Will Technology Transform the Industrial Workforce through 2015? Available online: http://englishbulletin.adapt.it/wpcontent/uploads/2015/10/BCG_Man_and_Machine_in_Industry_4_0_Sep_2015_tcm80-197250.pdf (accessed on 2 April 2021).

- Xia, F.; Yang, L.T.; Wang, L.; Vinel, A. Internet of Things. Int. J. Commun. Syst. 2012, 25, 1101–1102. [Google Scholar] [CrossRef]

- Zhang, F.; Liu, M.; Zhou, Z.; Shen, W. An IoT-Based Online Monitoring System for Continuous Steel Casting. IEEE Internet Things J. 2016, 3, 1355–1363. [Google Scholar] [CrossRef]

- Hsu, C.-Y.; Kang, L.-W.; Weng, M.-F. Big Data Analytics: Prediction of Surface Defects on Steel Slabs Based on One Class Support Vector Machine. In Proceedings of the ASME 2016 Conference on Information Storage and Processing Systems; ASME International: New York, NY, USA, 2016. [Google Scholar]

- Fragassa, C.; Babic, M.; Bergmann, C.P.; Minak, G. Predicting the Tensile Behaviour of Cast Alloys by a Pattern Recognition Analysis on Experimental Data. Metals 2019, 9, 557. [Google Scholar] [CrossRef] [Green Version]

- Tian, S.; Xu, K. An Algorithm for Surface Defect Identification of Steel Plates Based on Genetic Algorithm and Extreme Learning Machine. Metals 2017, 7, 311. [Google Scholar] [CrossRef]

- Xu, X. From cloud computing to cloud manufacturing. Robot. Comput. Manuf. 2012, 28, 75–86. [Google Scholar] [CrossRef]

- Rauch, Ł.; Bzowski, K.; Kuziak, R.; Uranga, P.; Gutierrez, I.; Isasti, N.; Jacolot, R.; Kitowski, J. Computer-Integrated Platform for Automatic, Flexible, and Optimal Multivariable Design of a Hot Strip Rolling Technology Using Advanced Multiphase Steels. Metals 2019, 9, 737. [Google Scholar] [CrossRef] [Green Version]

- Yang, J.; Zhang, J.; Guan, M.; Hong, Y.; Gao, S.; Guo, W.; Liu, Q. Fine Description of Multi-Process Operation Behavior in Steelmaking-Continuous Casting Process by a Simulation Model with Crane Non-Collision Constraint. Metals 2019, 9, 1078. [Google Scholar] [CrossRef] [Green Version]

- Hanoglu, U.; Šarler, B. Hot Rolling Simulation System for Steel Based on Advanced Meshless Solution. Metals 2019, 9, 788. [Google Scholar] [CrossRef] [Green Version]

- Sustainable ArcelorMittal Poland. Report 2018. Available online: https://poland.arcelormittal.com/en/sustainability/#c2492018, (accessed on 21 April 2021).

- Sustainable ArcelorMittal Poland. Report 2019. Available online: https://poland.arcelormittal.com/en/sustainability/#c249 (accessed on 4 February 2021).

- Gajdzik, B. Changes in the steel industry in Poland in the period from 1990 to 2020. Innovation and digitization on the way to steel mills 4.0. In MDPI Books: Volume 9 of the Series: Transitioning to Sustainable Industry, Innovation and Infrastructure; (Expected Publication Date: February 2022); MDPI: Basel, Switzerland, in press.

- Gajdzik, B. Towards industry 4.0 versus COVID-19 crisis data about selected information and communications technologies (ICT) in metal industry in Poland. In Taylor & Francis Book: The Book: Cyber-Physical Systems: Solutions to Pandemic Challenges, Semwal; Taylor & Francis: Abingdon, UK, 2021. [Google Scholar]

- Gajdzik, B. A Metallurgical Plant after Restructuring; Silesian University of Technology: Gliwice, Poland, 2012. [Google Scholar]

- Polish Steel Industry. HIPH. Polish Steel Association. (In Polish: HIPH). Report 2019. Poland, Katowice. Available online: https://www.hiph.org/ANALIZY_RAPORTY/zamowienia.php (accessed on 21 April 2021).

- Rocznik Statystyczny Przemysłu; GUS, Statistics: Warsaw, Poland, 2018.

- Zagórska, M. Analiza wpływu przemysłu stalowego na gospodarkę. Hutnik-Wiadomości Hutnicze 2019, 7, 216–219. [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R. Influence of the COVID-19 Crisis on Steel Production in Poland Compared to the Financial Crisis of 2009 and to Boom Periods in the Market. Resources 2021, 10, 4. [Google Scholar] [CrossRef]

- Gospodarka Paliwowo-Energetyczna w Latach 2017 i 2018, GUS. Available online: https://stat.gov.pl/obszary-tematyczne/srodowisko-energia/energia/gospodarka-paliwowo-energetyczna-w-latach-2017-i-2018,4,14.html (accessed on 4 February 2021).

- GUS. Table 2. Energy Intensity of Industry Branches. In Polish: Efektywność Wykorzystania Energii w Latach 2008–2018, Tablice. Available online: www.stat.gov.pl (accessed on 21 April 2021).

- Borowiecki, R.; Wysłocka, E. Możliwości i kierunki optymalizacji kosztów produkcji w polskim hutnictwie. Zesz. Nauk. Uniw. Ekon. Krakowie 2003, 618, 16–33. [Google Scholar]

- Peters, H. Application of Industry 4.0 Concepts at Steel Production from an Applied Research Perspective, Presentation at 17th IFAC Symposium on Control, Optimisation, and Automation in Mining, Mineral and Metal Processing 2016. Available online: Ttps://tc.ifac-control.org/6/2/files/symposia/vienna-2016/mmm2016_keynotes_peters (accessed on 4 February 2021).

- Gajdzik, B.; Sroka, W. Analytic study of the capital restructuring process in metallurgical enterprises around the World and in Poland. Metalurgija 2012, 2, 265–268. [Google Scholar]

- Re-Finding Industry-Report from the High-Level Strategy Group on Industrial Technologies; European Commission: Bruxelles, Belgium, 2018; Available online: https://scholar.google.com/scholar_lookup?title=Re-Finding+Industry-Report+from+the+High-Level+Strategy+Group+on+Industrial+Technologies&author=European+Commission&publication_year=2018 (accessed on 4 February 2021).

- Gajdzik, B. Autonomous and professional maintenance in metallurgical enterprises as activities within Total Productive Maintenance. Metalurgija 2014, 53, 269–272. [Google Scholar]

- Gajdzik, B.; Śląska, P. Scenarios of machine operation and maintenance in the cyber-physical production systems in Industry 4.0. Gospod. Mater. Logistyka 2020, 2020, 2–8. [Google Scholar] [CrossRef]

- Śliwczyński, B. Modelowanie Systemu Zarządzania Przepływem Materiałów i Oceny Efektywności Procesów; Wyższa Szkoła Logistyki: Poznań, Poland, 2015. [Google Scholar]

- Pichlak, M. Współpraca w działalności ekoinnowacyjnej wspierającej wdrażanie Przemysłu 4.0, w: Przemysł 4.0 w organizacjach; CeDeWu: Warsaw, Poland, 2020; pp. 99–107. [Google Scholar]

- Torn, I.A.R.; Vaneke, T.H.J. Reconfigurable and Virtual Production Mass Personalization with Industry 4.0 by SMEs: A concept for collaborative networks. Procedia Manuf. 2019, 28, 135–141. [Google Scholar] [CrossRef]

- Kiel, D.; Müller, J.M.; Arnold, C.; Voigt, K.-I. Sustainable industrial value creation: Benefits and challenges of industry 4.0. Int. J. Innov. Manag. 2017, 21, 1–34. [Google Scholar] [CrossRef]

- Peraković, D.; Periša, M.; Zorić, P. Challenges and Issues of ICT in Industry 4.0. In Design, Simulation, Manufacturing: The Innovation Exchange DSMIE 2019: Advances in Design, Simulation and Manufacturing II; Springer: Berlin/Heidelberg, Germany, 2019; pp. 259–266. [Google Scholar]

- Miskiewicz, R. Industry 4.0 in Poland selected aspects of its implementation. Sci. Pap. Sil. Univ. Technol. 2019, 136, 403–413. [Google Scholar]

- Miśkiewicz, R.; Wolniak, R. Practical Application of the Industry 4.0 Concept in a Steel Company. Sustainability 2020, 12, 5776. [Google Scholar] [CrossRef]

- VIZUM. 2021. Available online: https://vizumlab.com/ (accessed on 16 April 2021).

- European Economic Forecast. Spring 2019, European Commission Directorate-General for Economic and Financial Affairsanalyse. Available online: https://ec.europa.eu/info/sites/info/files/economy-finance/ip102_en.pdf (accessed on 4 February 2021).

- European Economic Forecast. Autum 2019, European Commission Directorate-General for Economic and Financial Affairsanalyse9. Available online: https://ec.europa.eu/info/sites/info/files/economy-finance/ip115_en_0.pdf (accessed on 4 February 2021).

- Michalowski, B.; Jarzynowski, M.; Pacek, P. Szanse i wyzwania polskiego Przemysłu 4.0. Report. Poland, Warszawa Agencja Rozwoju Przemysłu, S.A. 2019. Available online: https://www.arp.pl/__data/assets/pdf_file/0008/89918/_Raport_ARP_druk_po_stronie_calosc.pdf (accessed on 4 February 2021).

- Robots Density Rises Globally. 2018. Available online: https://ifr.org/ifr-press-releases/news/robot-density-rises-globally (accessed on 8 May 2021).

- Cséfalvay, Z. Robotization in Central and Eastern Europe: Catching up or dependence? Eur. Plan. Stud. 2019, 28, 1534–1553. [Google Scholar] [CrossRef]

- Galuba, G. Przyszłość Przemysłu Roboty i Automatyzacja. 2020. Available online: https://botland.com.pl/blog/przyszlosc-przemyslu-roboty-i-automatyzacja/ (accessed on 4 February 2021).

- Statistics Poland (GUS): www.stat.gov.pl: Research Topic: Use of Information and Communication Technologies in Enterprises. Available online: https://stat.gov.pl/obszary-tematyczne/nauka-i-technika-spoleczenstwo-informacyjne/spoleczenstwo-informacyjne/wykorzystanie-technologii-informacyjno-komunikacyjnych-w-jednostkach-administracji-publicznej-przedsiebiorstwach-i-gospodarstwach-domowych-w-2020-roku,3,19.html (accessed on 4 February 2021).

- Stahlmarkt 2016. Stahl 2025 Quo vadis? PwC, Frankfurt am Main, Februar 2016. Available online: https://www.pwc.at/de/branchen/assets/industrielle-produktion/folder-stahlmarkt-2016.pdf (accessed on 15 January 2020).

- Gajdzik, B. Restrukturyzacja Przedsiębiorstw Hutniczych w Zestawieniach Statystycznych i Badaniach Empirycznych; Silesian University of Technology Publisher: Gliwice, Poland, 2013. [Google Scholar]

- Geissbauer, R.; Vedso, J.; Schrauf, S. Industry 4.0: Building the Digital Enterprise. Report; PwC: London, UK, 2016; pp. 1–36. [Google Scholar]

- Darvishi, H.; Ciuonzo, D.; Eide, E.R.; Rossi, P.S. Sensor-Fault Detection, Isolation and Accommodation for Digital Twins via Modular Data-Driven Architecture. IEEE Sens. J. 2021, 21, 4827–4838. [Google Scholar] [CrossRef]

- Napolitano, M.R.; An, Y.; Seanor, B.A. A fault tolerant flight control system for sensor and actuator failures using neural networks. Aircr. Des. 2000, 3, 103–128. [Google Scholar] [CrossRef]

- Campa, G.; Fravolini, M.; Napolitano, M.; Seanor, B. Neural networks-based sensor validation for the flight control system of a B777 research model. In Proceedings of the 2002 American Control Conference, Anchorage, AK, USA, 8–10 May 2002; Institute of Electrical and Electronics Engineers IEEE: Chem, Switzerland, 2003; pp. 412–417. [Google Scholar]

- Hussain, S.; Mokhtar, M.; Howe, J.M. Sensor Failure Detection, Identification, and Accommodation Using Fully Connected Cascade Neural Network. IEEE Trans. Ind. Electron. 2014, 62, 1683–1692. [Google Scholar] [CrossRef]

- Pham, H.-T.; Bourgeot, J.-M.; Benbouzid, M.E.H. Comparative Investigations of Sensor Fault-Tolerant Control Strategies Performance for Marine Current Turbine Applications. IEEE J. Ocean. Eng. 2017, 43, 1024–1036. [Google Scholar] [CrossRef]

- Thiyagarajan, K.; Kodagoda, S.; Van Nguyen, L.; Ranasinghe, R. Sensor Failure Detection and Faulty Data Accommodation Approach for Instrumented Wastewater Infrastructures. IEEE Access 2018, 6, 56562–56574. [Google Scholar] [CrossRef]

- Mandal, S.; Santhi, B.; Sridhar, S.; Vinolia, K.; Swaminathan, P. Nuclear Power Plant Thermocouple Sensor Fault Detection and Classification using Deep Learning and Generalized Likelihood Ratio Test. IEEE Trans. Nucl. Sci. 2017, 64, 1. [Google Scholar] [CrossRef]

- Pourbabaee, B.; Meskin, N.; Khorasani, K. Sensor Fault Detection, Isolation, and Identification Using Multiple-Model-Based Hybrid Kalman Filter for Gas Turbine Engines. IEEE Trans. Control. Syst. Technol. 2016, 24, 1184–1200. [Google Scholar] [CrossRef] [Green Version]

- Heletje, E. The effect of multi-sensor data on condition-based maintenance policies. Eur. J. Oper. Res. 2021, 290, 585–600. [Google Scholar]

- Jagtap, S.S.; Shankar Sriram, V.S.; Subramaniyaswamy, V. A hypergraph based Kohonen map for detecting intrusions over cyber–physical systems traffic, 2021. Future Gener. Comput. Syst. 2019, 119, 84–109. [Google Scholar] [CrossRef]

- Iaiani, M.; Tugnoli, A.; Bonvicini, S.; Cozzani, V. Analysis of Cybersecurity-related Incidents in the Process Industry. Reliab. Eng. Syst. Saf. 2021, 209, 107485. [Google Scholar] [CrossRef]

- Cheung, K.-F.; Bell, M.G.; Bhattacharjya, J. Cybersecurity in logistics and supply chain management: An overview and future research directions. Transp. Res. Part. E Logist. Transp. Rev. 2021, 146, 102217. [Google Scholar] [CrossRef]

- Arens, M.; Neef, C.; Becket, B.; Hirzel, S. Perspectives for digitising energy-intensive industries findings from the European iron and steel industry. ECEEE Ind. Sumer Study Proc. 2018, pp. 259–268. Available online: https://www.eceee.org/library/conference_proceedings/eceee_Industrial_Summer_Study/2018/2-sustainable-production-towards-a-circular-economy/perspectives-for-digitising-energy-intensive-industries-findings-from-the-european-iron-and-steel-industry/2018/2-118-18_Arens.pdf/ (accessed on 19 May 2021).

| Technology | Characteristic |

|---|---|

| Internet of Things | Internet of Things in the steel industry refers to the use of many electronic devices and an inter-networking work environment. Steel industry organisations use sensors, actuators and other types of digital devices, which are networked and connected between themselves with the main purpose of implementing a system based on an Internet of Things architecture. This type of system consists of four layers: network, sensing, application and service resource layers. This type of system was implemented in many real steel casting production lines [76,81]. |

| Big data analysis | In the steel industry, the conventional way of managing the data can have nowadays some difficulties in the process of finishing the storage, capture, analysis and management of large volumes of structured and unstructured data. The new method of big data analysis is related to new algorithms based on historical data, which can be used to identify quality problems and for reducing the failure of products. In the steel industry sector, the big data solutions are used in many organisation for monitoring the quality of the products. The technology can enable new processing modes to obtain significant, new information from different data types. In this way, we can understand the data in-depth and make better decisions on the basis of them [76]. |

| Cloud computing | Cloud computing use in the steel industry give on-demand computing services. Those type of services have a high level of reliability, scalability and availability in a steel industry environment. Using this technology, all data can be treated as a service [82]. |

| Robotisation of production processes | The use of technology based on the use of humanoids in the steel industry in order to perform operations is especially important in the field of assembly and packaging. It is widespread due to the higher demand for better quality, faster delivery time and the reduction of cost in the steel industry. In many organisations with business activities in the steel industry, the use of robots leads to an increase of the surface quality of the steel products and minor improvements of the whole production process [76,83]. |

| Simulations | Organisations in steel sectors can use new technology to try doing simulations to find a way to optimise the production processes. For example, decision support systems are used in the steel industry to investigate the potential changes in design operations. The simulations use many statistical and mathematical methods [84]. |

| Augmented reality | Organisations in the steel industry are using the digital solution in augmented work, maintenance and service. In the steel industry, organisations are using remote guidance to apply the fourth dimension. This technology usage can enable steel industry companies to improve the level of the maintenance services. Those organisations use remote maintenance equipment based on a remote connection used by technicians virtually connected to the system. The usage of augmented reality can result in decreasing travel costs and operation times. Additionally, this technology solves problems more quickly [76,85]. |

| Cyber security | Cyber security is an important problem for organisations in the steel industry. The technology is especially important for Internet-based services and in every situation when computers or equipment are connected to the Internet. With the increase of Internet of Things usage, almost all equipment can be connected to the Internet, which leads to an increased role of cyber security in organisations [86]. |

| Customisation and personalisation of production | Among steel industry organisations, we can spot an increasing number of vertical integration usage. This leads to an improvement of communication between the supplier and the organisation and also the organisation and its customer. The online connection between them and the faster data transfer can enable an intelligent factory solution as well as personalised customer manufacturing [87]. |

| Drones and others self-driving vehicles | The steel industry can also benefit from drone usage, especially in logistic processes. This type of technology is based on automated systems of transportation. Intelligent software is used to support the operation of drones and helps steel industry companies to improve processes and make them much faster. In the steel industry, the logistics (supply, disposal and transport of products and raw materials) are a very important part of the industrial processes. The usage of drones and others autonomous self-driving vehicles can lead to better planning and controlling of the internal transport orders. The result of this is an increase of the service and productivity level and a decrease of the costs of logistic processes [76,88]. |

| Knowledge management system | In a competitive market, the knowledge management can also be digitalised in the steel industry. The knowledge and experience of the workers—especially technical staff—can represent the basis for improvement. In the steel industry, we spot problems in the distribution of this knowledge. Especially older workers do not have enough digital competencies and should learn from more experienced staff. On the other hand, older technical workers have excellent knowledge about production processes. This knowledge should be digitalised and handed over to younger workers. The digital system of knowledge management usage can enable a better distribution of knowledge between workers within the steel industry organisation as a whole [89,90]. |

| Modules | Characteristic |

|---|---|

| Vizum Workforce | The system is used for vehicle monitoring. The Optitrack system allows for the fully automatic recording of every entry and exit, monitoring of attendance and time spent in them and checking the employee’s reaction to random tests. At the end of the day, an automatic report will show any irregularities identified (e.g., lateness, too long breaks or absenteeism). The Opitrack system is used to detect any potentially dangerous situations, such as falls, fainting, changes in environmental conditions (temperature) or staying too long in certain areas of the site. The Optitrack system allows for a continuous survey of the safety status of people present on site and their knowledge of health and safety. Employees walk around equipped with unattended Vizum ID cards and/or a mobile app on a smartphone. Vizum ID cards are automatically detected by checkpoints. Employees can also reflect and assign themselves to projects on touchscreens. Mobile applications on smartphones send data non-stop from any location. In one panel, you can see the current situation of the entire workforce in individual plants. Summaries and detailed periodical reports of individual employees are updated every hour. |

| Vizum Vehicles | The system is used for vehicle monitoring. The Opitrack system enables continuous tracking of location and work of vehicles both in open spaces (field trips) and in closed spaces (warehouses, garages). The Optitrack Vehicles system, besides recording the location and working time, also collects information about the vehicle operator and passengers [114]. The vehicles are equipped with VizumBox devices, whose sensors continuously monitor the immediate surroundings. Maintenance-free and non-invasive so-called position markers are installed in confined spaces. VizumBox devices collect data from motion sensors, GPS data and information about detected position markers in confined spaces and detected Vizum ID cards worn by employees. All data are sent to the cloud. The current status of the entire fleet can be viewed in a single administration panel. Summaries of periodical reports and detailed reports of all vehicles are updated every hour [115]. |

| Investments in Digitalisation | Effects |

|---|---|

| Introduction of a video-based image processing system to analyse converter vibration in the production line [91]. | Better analysis of the vibration—improvement of the production process [91]. |

| 3D visualisation of the hall [91]. | Better work planning and optimisation of the production area layout [92]. |

| The use of drones to observe the areas around the steelworks and belonging to the steelworks [92]. | Better and faster identification of problems in the production line. Improvement of production processes [93]. Allows monitoring of observation areas that are too dangerous to be inspected by humans [91]. |

| An IT system for digital product location in warehouses [92]. | Faster identification of products in the warehouse. Faster delivery of the products to production or to the customer [92]. |

| The logistic system to monitor the movement of cars on the road and in the car parks of the mill [92]. | Better control over the usage of vehicles. The reduction of the downtime of vehicles [92]. |

| The usage of mobile equipment by employees in the steel mill [91]. | Possibility of doing inspections and many others activities remotely. The automatic integration of the scanned information with the organisation’s SAP system [91]. |

| Rail production tracking system in the Dabrowa Gornicza mill [91]. | The system allows better identification and monitoring of products. Optimisation of logistic and production processes [91]. |

| The system for measuring the filling of the coking chamber after backfilling with a coal mixture [91]. | The optimisation chamber backfilling operations. Reduction of the negative environmental impact of the production process [92]. |

| The AMP IT system used for the detection of defects [91]. | Decrease in the number of defects. Better product quality and better customer satisfaction [86]. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gajdzik, B.; Wolniak, R. Digitalisation and Innovation in the Steel Industry in Poland—Selected Tools of ICT in an Analysis of Statistical Data and a Case Study. Energies 2021, 14, 3034. https://doi.org/10.3390/en14113034

Gajdzik B, Wolniak R. Digitalisation and Innovation in the Steel Industry in Poland—Selected Tools of ICT in an Analysis of Statistical Data and a Case Study. Energies. 2021; 14(11):3034. https://doi.org/10.3390/en14113034

Chicago/Turabian StyleGajdzik, Bożena, and Radosław Wolniak. 2021. "Digitalisation and Innovation in the Steel Industry in Poland—Selected Tools of ICT in an Analysis of Statistical Data and a Case Study" Energies 14, no. 11: 3034. https://doi.org/10.3390/en14113034