Identification of Market Gap as a Chance for Enterprise Development—Example of Polish Raw Materials Industry

Abstract

1. Introduction

- Analysis of the mineral raw materials market in Poland.

- Analysis of business activity profiles according to the Statistical Classification of Economic Activities in the European Community (NACE) aimed at the identification of areas in which activities are related to the mineral resources market in Poland.

- Analysis of data from RM projects carried out in Poland (based on four databases).

- Analysis of keywords in selected projects aimed at the identification of the most popular ones.

- Aggregation of relevant keywords for individual areas of activity according to NACE.

- Determination of current trends (concerning a sector gap) in the raw materials industry in Poland.

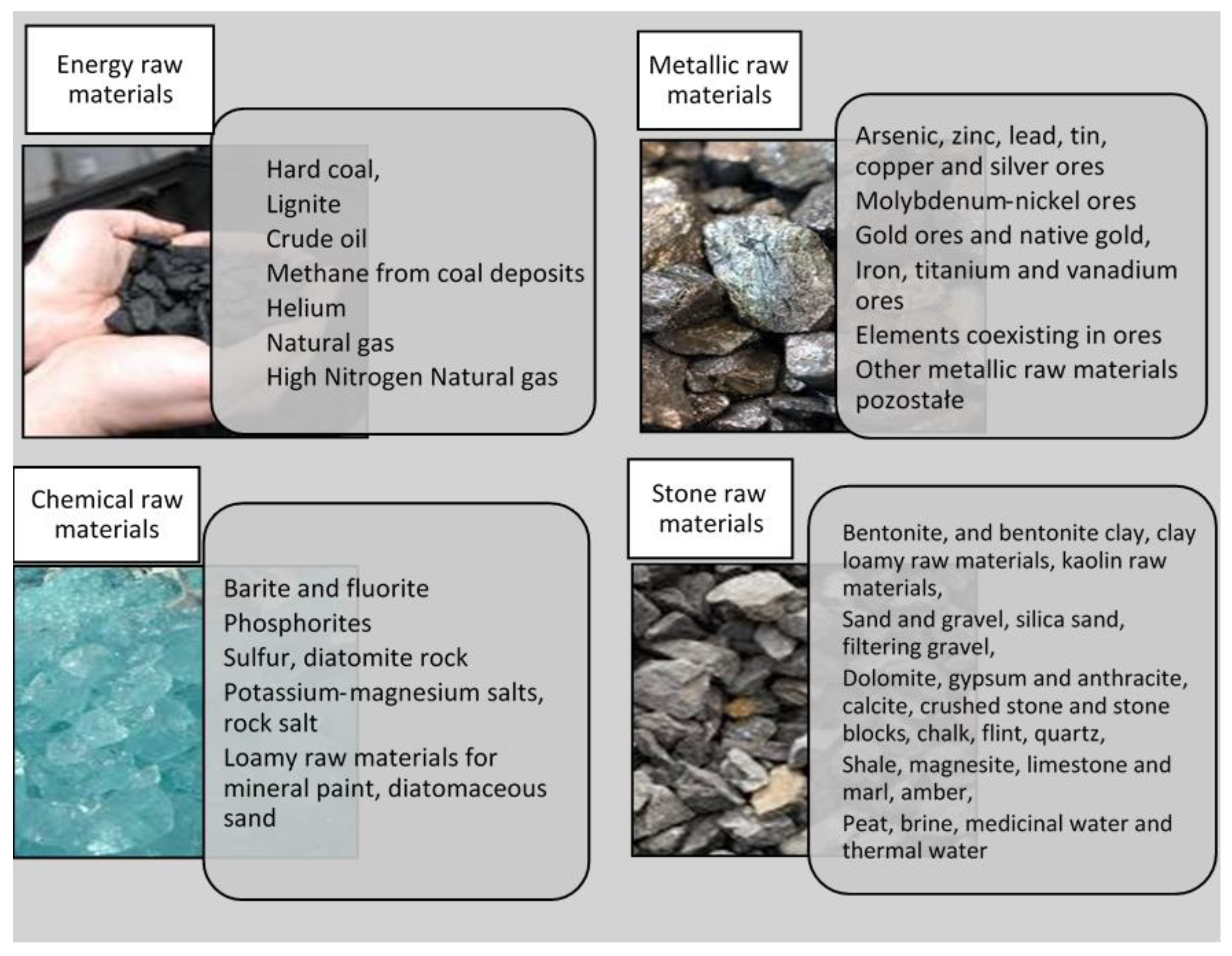

2. Mineral Raw Materials in Poland

3. Materials and Methods

3.1. Raw Material Sector Definition According to NACE Classification

- Section B—MINING AND EXTRACTION

- Section C—INDUSTRIAL PROCESSING

- Dept. 35—ELECTRICITY, GAS, STEAM, HOT WATER AND AIR CONDITIONING SUPPLY

- Section E—WATER SUPPLY, SEWERAGE, WASTE MANAGEMENT AND RECLAMATION ACTIVITIES

- Section F—CONSTRUCTION

- Section J—INFORMATION AND COMMUNICATION

- Section M—PROFESSIONAL, SCIENTIFIC AND TECHNICAL ACTIVITIES

- Section N—ADMINISTRATIVE AND SUPPORT SERVICE ACTIVITIES

- Section P—EDUCATION

- Mining of hard coal, lignite, ornamental and building stone, limestone, gypsum, chalk and slate, gravel and sand, clay and kaolin, salt, etc.

- Mining of crude oil, natural gas, iron ore, uranium and thorium ores, other non-ferrous metal ores, etc.

- Support activities for petroleum and natural gas extraction and other mining and extraction

- Manufacture and processing of coke and refined petroleum products

- Manufacture of technical gases, dyes and pigments, basic inorganic and organic chemicals, fertilizers and nitrogen compounds, explosives, chemical fibers, basic pharmaceutical products, plastic packaging, flat glass, ceramic tiles, insulators made of lime and plaster, concrete construction products, plaster products, pig iron, ferro-alloys, cast iron and steel and metallurgical products, tubes, pipes, hollow sections and fittings of steel, production of precious metals—lead, zinc, and tin copper—and other non-ferrous metals

- Manufacture of nuclear fuel

- Casting of iron, steel, light metals, copper and copper alloys, other non-ferrous metals

- Manufacture, transmission, distribution and trading of electricity

- Manufacture, distribution and trade in gaseous fuels

- Steam, hot water and air manufacture and supply

- Water and sewage collection, treatment and supply

- Collection, treatment and disposal of hazardous and non-hazardous waste

- Treatment and neutralization of hazardous waste

- Recovery of sorted materials

- Reclamation and waste management

- Building works related to the erection of residential and non-residential buildings

- Construction of roads and highways, construction of railways and underground railroads, construction of bridges and tunnels, transmission pipelines and distribution networks, waterworks

- Demolition

- Preparation of the site for the construction

- Excavation and geological and engineering drilling, electrical installations, plumbing, heating, gas and air conditioning installations.

- Hard coal mining (4th place in the world),

- Silver extraction (6th place in the world),

- Hard coal mining:

- ○

- Coking (8th place in the world),

- ○

- Energy sector (10th place in the world),

- Copper mining (13th place in the world),

- Salt extraction (15th place in the world).

3.2. Analysis of Current Trends in the Raw Materials Industry in Poland

- more precise methods and new technological solutions of locating, researching, drilling and exploiting the deposits and analyzing its parameters, in particular: oil and gas deposits.

- bioleaching—Extraction of metals without installing underground infrastructure (deeper seams).

- use of innovative technologies:

- ○

- of difficult to quarry rocks extraction in coal mining,

- ○

- for gasifying, co-incineration and transport (coal drying technology),

- ○

- directed at limiting impact on the environment, of the trade of natural stones (extraction, processing and forwarding),

- ○

- of oil processing,

- ○

- that decrease the consumption of energy and work needed for extraction raw materials (clastic raw materials from flooded mine seams),

- process of underground gasifying of coal,

- use of new technological solutions:

- ○

- for improving the technology of quarrying rocks by blasting,

- ○

- improving the efficiency and industrial safety of basic machinery in mining,

- use of new methods of improving the calorific value of raw materials,

- use of modern tools for numerical modeling of newly built opencast mines,

- diagnostics systems and tools cause the limit of failure frequency of machinery and equipment,

- new systems for improving the safety of workers,

- reclamation of excavations.

- Subject (officially notified to the relevant unit),

- Acronym,

- Date of project commencement,

- Date of project completion,

- Keywords of the implemented project.

- Cordis, which is a database run by the Community Research and Development Information Service and is the main source of information on projects which are funded by the European Commission under the EU Framework Programmes for Research and Innovation (from FP1 to Horizon 2020) and their results. The mission statement of the organization and the operation of the database is to provide research results to experts in specific fields in order to support open science, create innovative products and services and stimulate growth across Europe. CORDIS is a rich and structured public repository containing all project information held by the European Commission, such as: project information sheets, participants, reports, results and links to open access publications,

- KIC—EIT Raw Materials. The European Institute of Innovation and Technology (EIT) was established in 2008 as the EU initiative to promote innovation and entrepreneurship in Europe according to the motto: united in diversity. The EIT brings together leading universities, research laboratories and companies to form dynamic cross-sector partnerships. These partnerships, called Knowledge and Innovation Communities (KICs), develop innovative products and services, start new companies, and train a new generation of entrepreneurs. They also bring new ideas to the market, turn students into entrepreneurs and introduce innovations. KIC initiatives address many societal challenges, including the EIT KIC Raw Materials, which aims to ensure the availability and sustainable use of raw materials for the benefit of the economy and the people,

- The National Center for Research and Development (NCBR) is a Polish government implementing agency; it is the key center for supporting and creating innovative technological and social solutions, and it creates a knowledge ecosystem and information on them. It initiates and implements projects contributing to the civilizational development of the country. NCRD aims to effectively support innovations in the Polish economy,

- The National Science Center (NCN) is an implementing agency established to support scientific activity in the field of basic research, i.e., empirical or theoretical work aimed primarily at gaining new knowledge about the foundations of phenomena and observable facts without aiming at direct commercial application.

4. Results and Discussion

- 3—Head offices activity; management consulting services

- 5—Computer programming, consultancy and related activities

- 6—Activity related to reclamation and other service activities related to waste management

- 7—Activity related to collection, processing and disposal of waste; raw materials recovery

- 8—Education

- 12—Other professional, scientific and technical activity

- 13—Other mining and extraction

- 16—Manufacture of computers, electronic and optical products

- 21—Distinguishing hard coal and brown coal (lignite)

- 22—Manufacturing and supplying electricity, gas, water steam, hot water and air for air conditioning systems.

- technologies: of artificial intelligence for manufacturing systems, intelligent sensor network, semantic network and RFID (radio-frequency identification) technologies,

- systems of: special navigations, observation and identification (different ranges of electromagnetic waves from visible light and infrared), cyberspace protection (eradicating risks by developing IT infrastructure), infrastructure and technologies of the distributed systems for e-business and of logistic support and supply chain management, intelligent control traffic.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kowal, B.; Domaracká, L.; Tobór-Osadnik, K. Innovative activity of companies in the raw material industry on the example of Poland and Slovakia—Selected aspects. J. Pol. Miner. Eng. Soc. 2020, 2, 71–77. Available online: http://www.potopk.com.pl/Full_text/2020_n2_v2_full/IM%202-2020-v2-a11.pdf (accessed on 26 March 2021). [CrossRef]

- Królikowska, E.; Sierpińska-Sawicz, A.; Królikowski, M. Volatility in the Raw Materials Market and Risk Mitigation Methods. J. Pol. Miner. Eng. Soc. 2019, 1, 237–243. Available online: http://www.potopk.com.pl/Full_text/2019_full/IM%201-2019-a43.pdf (accessed on 28 March 2021). [CrossRef]

- Energy Industry and COVID-19 (Coronavirus): Strategising for the ‘New Normal’. Available online: https://www.pwc.com/gx/en/issues/crisis-solutions/covid-19/energy-utilities-resources-coronavirus.html (accessed on 6 April 2021).

- Sukiennik, M.; Kapusta, M.; Bąk, P. Transformation of corporate culture in the aspect of European Green Deal—Polish raw materials industry. J. Pol. Miner. Eng. Soc. 2020, 2, 177–182. Available online: http://www.potopk.com.pl/Full_text/2020_n2_v2_full/IM%202-2020-v2-a25.pdf (accessed on 28 March 2021).

- Manowska, A. Analysis and Forecasting of the Primary Energy Consumption in Poland Using Deep Learning. J. Pol. Miner. Eng. Soc. 2020, 2, 217–222. [Google Scholar] [CrossRef]

- Manowska, A.; Nowrot, A. The importance of heat emission caused by global energy production in terms of climate impact. Energies 2019, 12, 3069. [Google Scholar] [CrossRef]

- Bluszcz, A. The emissivity and energy intensity in EU countries—Consequences for the Polish economy. Conference proceedings Energy and clean technologies. Recycl. Air Pollut. Clim. Chang. 2018, 18, 631–638. [Google Scholar] [CrossRef]

- Kijewska, A.; Bluszcz, A. Analysis of greenhouse gas emissions in the European Union with the use of agglomeration algorithm. J. Sustain. Min. 2016, 15, 133–142. [Google Scholar] [CrossRef]

- Sobczyk, W.; Pelc, P.; Kowal, B.; Ranosz, R. Ecological and economical aspects of solar energy use E3S Web of Conferences [Electronic document]. Electron. Period. 2017, 14, 01011. [Google Scholar]

- Kapusta, M.; Bąk, P.; Sukiennik, M. A strategic analysis of selected factors that create the culture of occupational health and safety in mining companies in Poland. J. Pol. Miner. Eng. Soc. 2019, 21 Pt 1, 287–292. Available online: http://www.potopk.com.pl/Full_text/2019_full/IM%202-2019-a46.pdf (accessed on 29 March 2021).

- Bluszcz, A. European Economies in terms of energy dependence. Qual. Quant. 2017, 51, 1531–1548. [Google Scholar] [CrossRef]

- Kijewska, A.; Bluszcz, A. Research of varying levels of greenhouse gas emissions in European countries using the k-means method. Atmos. Pollut. Res. 2016, 7, 935–944. [Google Scholar] [CrossRef]

- Roszkowska, P. A Revolution in Business Reporting; Stakeholders, Competitiveness, Social Responsibility, Difin: Warsaw, Poland, 2011. [Google Scholar]

- Howaniec, H. The impact of corporate social responsibility on consumer loyalty to the brand. Nierówności Społeczne a Wzrost Gospodarczy 2016, 45, 32–40. [Google Scholar] [CrossRef]

- Tobór-Osadnik, K.; Wyganowska, M.; Brejdak, A.; Kowal, B. Pro-social Activities within the CSR by the Jastrzębska Spółka Węglowa SA—A Case Study. J. Pol. Miner. Eng. Soc. 2020, 2, 47–52. Available online: http://www.potopk.com.pl/Full_text/2020_n2_v2_full/IM%202-2020-v2-a7.pdf (accessed on 25 July 2021). [CrossRef]

- Kowal, B. New Trends in Remuneration Schemes for Underground Workers in Hard-Coal Mines; Wydawnictwa AGH: Kraków, Poland, 2019; ISSN 0867-6631. (In Polish) [Google Scholar]

- Ranosz, R. Analysis of the structure and cost of capital in mining enterprises. Miner. Resour. Manag. 2017, 33, 77–91. [Google Scholar] [CrossRef][Green Version]

- Bluszcz, A.; Manowska, A. Differentiation of the Level of Sustainable Development of Energy Markets in the European Union Countries. Energies 2020, 13, 4882. Available online: https://www.researchgate.net/publication/345028843_Differentiation_of_the_Level_of_Sustainable_Development_of_Energy_Markets_in_the_European_Union_Countries (accessed on 20 March 2021). [CrossRef]

- European Commission. Available online: https://ec.europa.eu/clima/policies/strategies/2050_en (accessed on 18 March 2021).

- European Commission. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/europeangreen-deal_en (accessed on 18 March 2021).

- Culková, K.; Pavolová, H.; Khouri, S.; Шутькo, Л. Development of the economy of the mineral sector: An example of the countries of the eastern european quarter. Econ. Innov. Manag. 2020, 3, 77–87. Available online: https://www.researchgate.net/publication/347617363_DEVELOPMENT_OF_THE_MINERAL_SECTOR_ECONOMY_THE_EXAMPLE_OF_THE_COUNTRIES_OF_THE_EASTERN_EUROPEAN_QUARTET (accessed on 6 April 2021). [CrossRef]

- Liu, D.; Yang, X.; Tian, X.; Wu, R.; Wang, L. Simple Analysis of Energy Utilization and Sustainable Development in China. Procedia Environ. Sci. 2011, 5, 120–130. [Google Scholar] [CrossRef]

- Тюленев, М.А.; Лесин, Ю.B. Wastewater treatment technology at the operating open-pit mines of Kuzbass. Mining information and analytical bulletin. Sci. Tech. J. 2012, 6, 104–109. [Google Scholar]

- Ranosz, R.; Bluszcz, A.; Kowal, D. Conditions for the innovation activities of energy sector enterprises shown on the example of mining companies. J. Pol. Miner. Eng. Soc. 2020, 22, 249–256. Available online: http://www.potopk.com.pl/Full_text/2020_v1_full/IM%201-2020-v1-a36.pdf (accessed on 5 April 2021). [CrossRef]

- “Energy Policy of Poland until 2040 r.—Development Strategy for the Fuel and Energy Sector” (PEP2040). Available online: https://www.gov.pl (accessed on 3 April 2021).

- Jakóbik, W. The Energy Strategy Leaked into the Grid. Transformation with Renewable Energy and Nuclear Energy for PLN 1.6 Trillion. Available online: https://biznesalert.pl/strategia-energetyczna-pep2040-dokument-w-sieci-energetyka-oze-atom/ (accessed on 2 March 2021).

- Witajewski-Baltvilks, J. (Ed.) Risks Associated with the Decarbonisation of the Polish Power Sector, Ibs Research Report 05/2018 November 2018. Available online: https://ibs.org.pl/app/uploads/2018/11/IBS_Research_Report_05_2018.pdf (accessed on 19 March 2021).

- Tabaka, M. Thirteen Mines to Be Liquidated. There Is a Government Plan but No Dates Yet. Available online: https://spidersweb.pl/bizblog/umowa-spoleczna-rzadu-z-gornikami/ (accessed on 17 March 2021).

- JD. Closure of Mines. Support Will Be Required up to 36 Thousand Miners. Available online: https://www.wnp.pl/gornictwo/likwidacja-kopaln-wsparcia-wymagac-bedzie-nawet-36-tys-gornikow,445844.html (accessed on 19 March 2021).

- Folwarczny, M. Crisis Management in Mining Companies in the Event of an Epidemic Threat. J. Pol. Miner. Eng. Soc. 2020, 2, 33–40. [Google Scholar] [CrossRef]

- Kowal, B.; Wiśniowski, R.; Ogrodnik, R.; Młynarczykowska, A. Selected Elements of a Safe Work Environment in Hard Coal Mines in the Polish Mining Sector. J. Pol. Miner. Eng. Soc. 2020, 2, 215–223. [Google Scholar] [CrossRef]

- Kapusta, M.; Bąk, P.; Sukiennik, M. Strategic analysis of selected factors shaping the occupational health and safety culture of mining companies in Poland. J. Pol. Miner. Eng. Soc. 2020, 22 Pt 2, 243–247. Available online: http://www.potopk.com.pl/Full_text/2020_v1_full/IM%201-2020-v1-a35.pdf (accessed on 12 April 2021).

- Sukiennik, M.; Bąk, P.; Kapusta, M. The impact of the management system on developing occupational safety awareness among employees. J. Pol. Miner. Eng. Soc. 2019, 21, 245–250. [Google Scholar]

- Grubiak, P. The Coronavirus Has Rocked Commodity Prices. Published on 12 June 2020. Available online: https://www.parkiet.com/Surowce/306129984-Koronawirus-zachwial-cenami-surowcow.html (accessed on 6 April 2021).

- Osowski, D. A Long Bull Market Is Coming? Published on 6 February 2021. Available online: https://www.parkiet.com/Analizy/302069970-Nadchodzi-dluga-hossa-na-rynku-surowcow.html (accessed on 6 April 2021).

- Litvinenko, V. Digital Economy as a Factor in the Technological Development of the Mineral Sector. Nat. Resour. Res. 2019, 29, 1521–1541. [Google Scholar] [CrossRef]

- Strzelec-Łobodzińska, J. Selected Aspects of Mining Operation in Poland, 3rd ed.; Górnictwo i Geologia: Wrocław, Poland, 2010; Volume 5. [Google Scholar]

- Hardygóra, M.; Sikora, M.; Ślusarczyk, S. Mining Industry in Poland. 2012. Available online: https://depot.ceon.pl/handle/123456789/478 (accessed on 12 February 2020).

- Fuel and Energy Economy in 2018–2019—Energy Statistics in 2018 and 2019. Available online: https://stat.gov.pl/en/topics/environment-energy/energy/energy-statistics-in-2018-and-2019,4,15.html (accessed on 15 April 2021).

- The Balance of Mineral Resources in Poland, National Geological Institute; National Research Institute: Warsaw, Poland, 2020.

- Reichl, C.; Schatz, M. World Mining Data 2020; Minerals Production: Vienna, Austria, 2020; Volume 35. Available online: http://www.wmc.org.pl/sites/default/files/WMD2020_0.pdf (accessed on 6 April 2021).

- PMG R&D Consulting, Mineral resources. Available online: http://pmgconsulting.eu/branze/surowce-mineralne/ (accessed on 15 April 2021).

| Keywords | Frequency | NACE |

|---|---|---|

| Access | 970,000.00 | activity related to IT software and consulting services and associated activity |

| big data | 568,000.00 | activity related to IT software and consulting services and associated activity |

| BIM | 1,660,000.00 | other professional, scientific and technical activities |

| Business | 1,800,000.00 | head offices activities; management consulting |

| Data | 541,000.00 | activity related to IT software and consulting services and associated activity |

| Development | 601,000.00 | other professional, scientific and technical activities |

| Education | 911,000.00 | education |

| Efficiency | 545,000.00 | head offices activities; management consulting |

| Energy | 526,000.00 | electricity, gas, steam, hot water and air conditioning supply |

| Environment | 735,000.00 | other professional, scientific and technical activities |

| Exploration | 591,000.00 | mining of hard coal and brown coal (lignite) |

| Gas | 968,000.00 | electricity, gas, steam, hot water and air conditioning supply |

| Internet | 2,440,000.00 | activity related to IT software and consulting services and associated activity |

| IT | 3,850,000.00 | activity related to IT software and consulting services and associated activity |

| Magnesium | 775,000.00 | other mining and extraction |

| Management | 533,000.00 | head offices activities; management consulting |

| Mining | 580,000.00 | mining of hard coal and brown coal (lignite) |

| mobile phone | 1,040,000.00 | manufacture of computer, electronic and optical products |

| Network | 867,000.00 | activity related to IT software and consulting services and associated activity |

| Pollution | 515,000.00 | remediation activities and other waste management services |

| Recycling | 712,000.00 | waste collection, treatment and neutralising activities; recovery of materials |

| Salts | 710,000.00 | other mining and extraction |

| Science | 929,000.00 | other professional, scientific and technical activities |

| Shafts | 792,000.00 | mining of hard coal and brown coal (lignite) |

| Software | 977,000.00 | activity related to IT software and consulting services and associated activity |

| Teaching | 1,000,000.00 | education |

| waste management | 840,000.00 | waste collection, treatment and neutralising activities; recovery of materials |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sukiennik, M.; Kowal, B.; Bąk, P. Identification of Market Gap as a Chance for Enterprise Development—Example of Polish Raw Materials Industry. Energies 2021, 14, 4678. https://doi.org/10.3390/en14154678

Sukiennik M, Kowal B, Bąk P. Identification of Market Gap as a Chance for Enterprise Development—Example of Polish Raw Materials Industry. Energies. 2021; 14(15):4678. https://doi.org/10.3390/en14154678

Chicago/Turabian StyleSukiennik, Marta, Barbara Kowal, and Patrycja Bąk. 2021. "Identification of Market Gap as a Chance for Enterprise Development—Example of Polish Raw Materials Industry" Energies 14, no. 15: 4678. https://doi.org/10.3390/en14154678

APA StyleSukiennik, M., Kowal, B., & Bąk, P. (2021). Identification of Market Gap as a Chance for Enterprise Development—Example of Polish Raw Materials Industry. Energies, 14(15), 4678. https://doi.org/10.3390/en14154678