Assessment of the Total Cost of Ownership of Electric Vehicles in Poland

Abstract

1. Introduction

- ✓

- Greenhouse gas emissions contributing to climate change;

- ✓

- Emission of air pollutants with negative impact on human health and natural environment;

- ✓

- Occupation of valuable natural areas and cutting their continuity (fragmentation) with newlybuilt technical infrastructure routes, contributing to the loss of biodiversity;

- ✓

- Emission of noise hazardous to human health.

- −

- The Electromobility Development Plan;

- −

- A national policy framework for alternative fuel infrastructure development;

- −

- The Low-Emission Transport Fund.

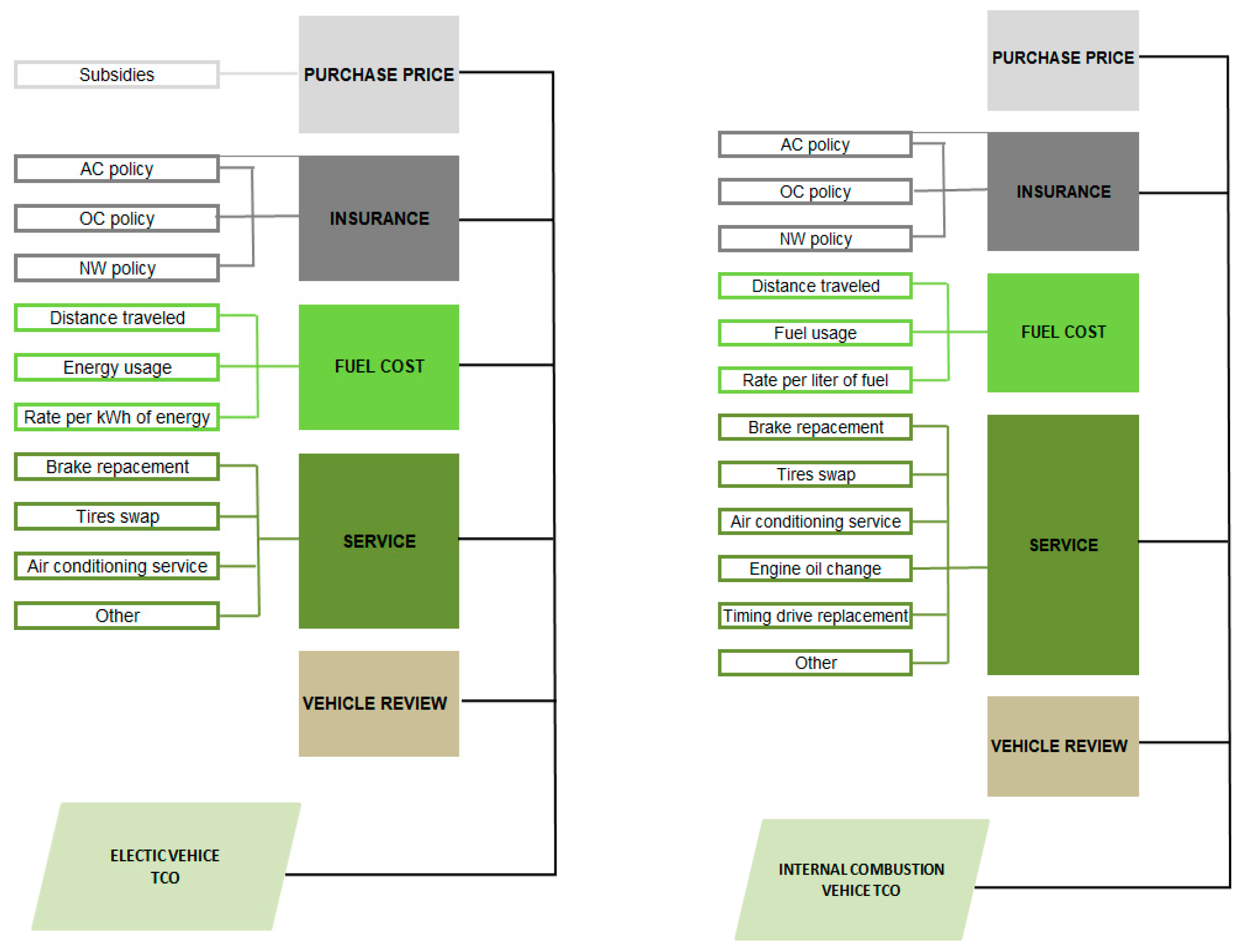

2. Case Study

2.1. Description of the Analysis Methodology Adopted

- −

- One-off: purchase cost, purchase subsidy;

- −

- Recurrent: costs of fuel, service, maintenance, etc.

2.1.1. One-Off Costs

2.1.2. Recurring Costs

2.2. Scenarios Analyzed

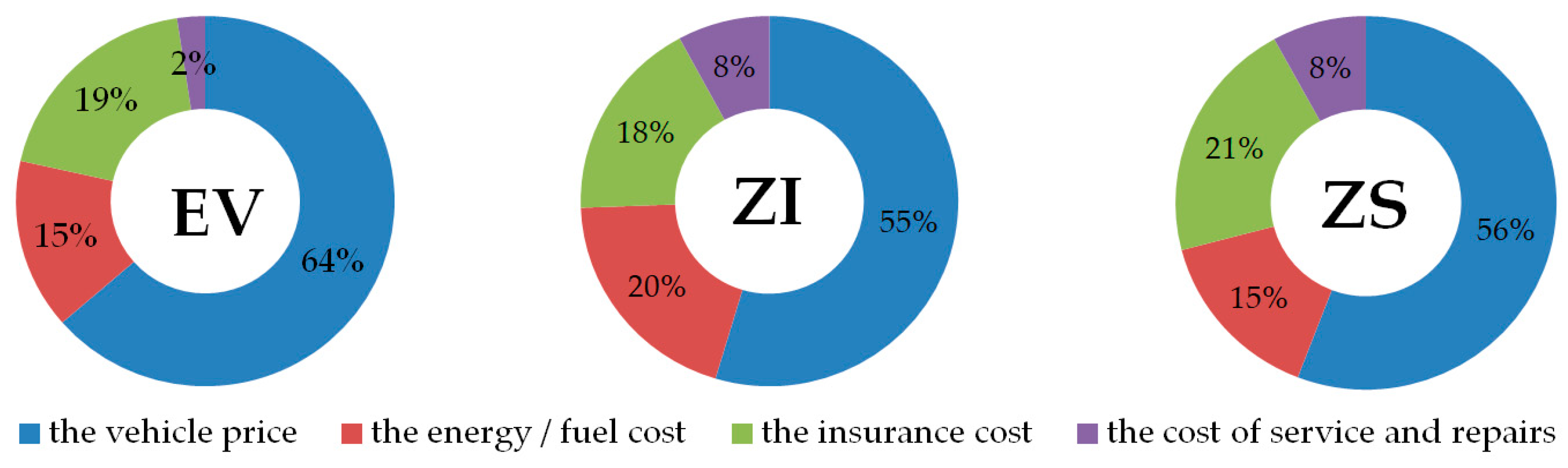

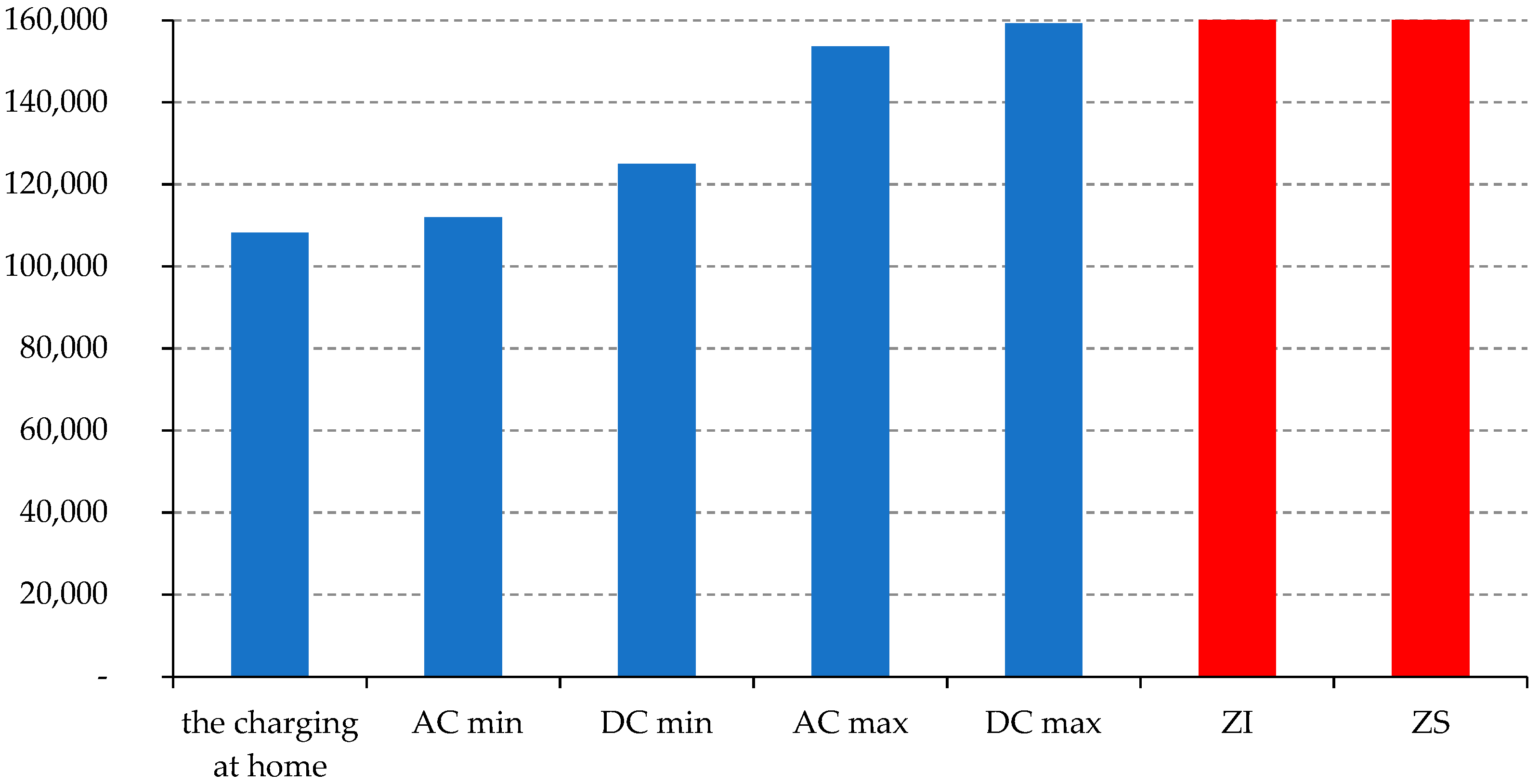

2.3. Results of the Analysis

- −

- −

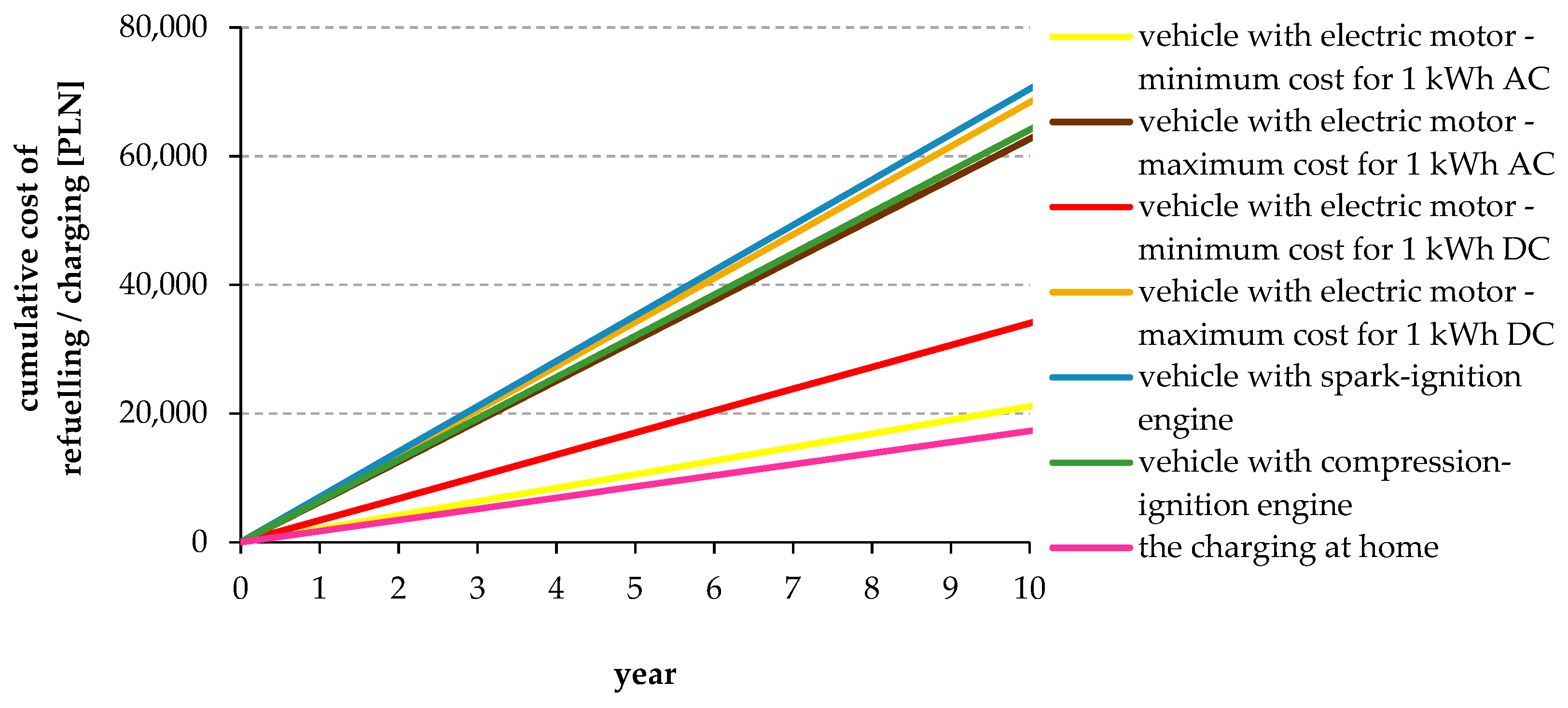

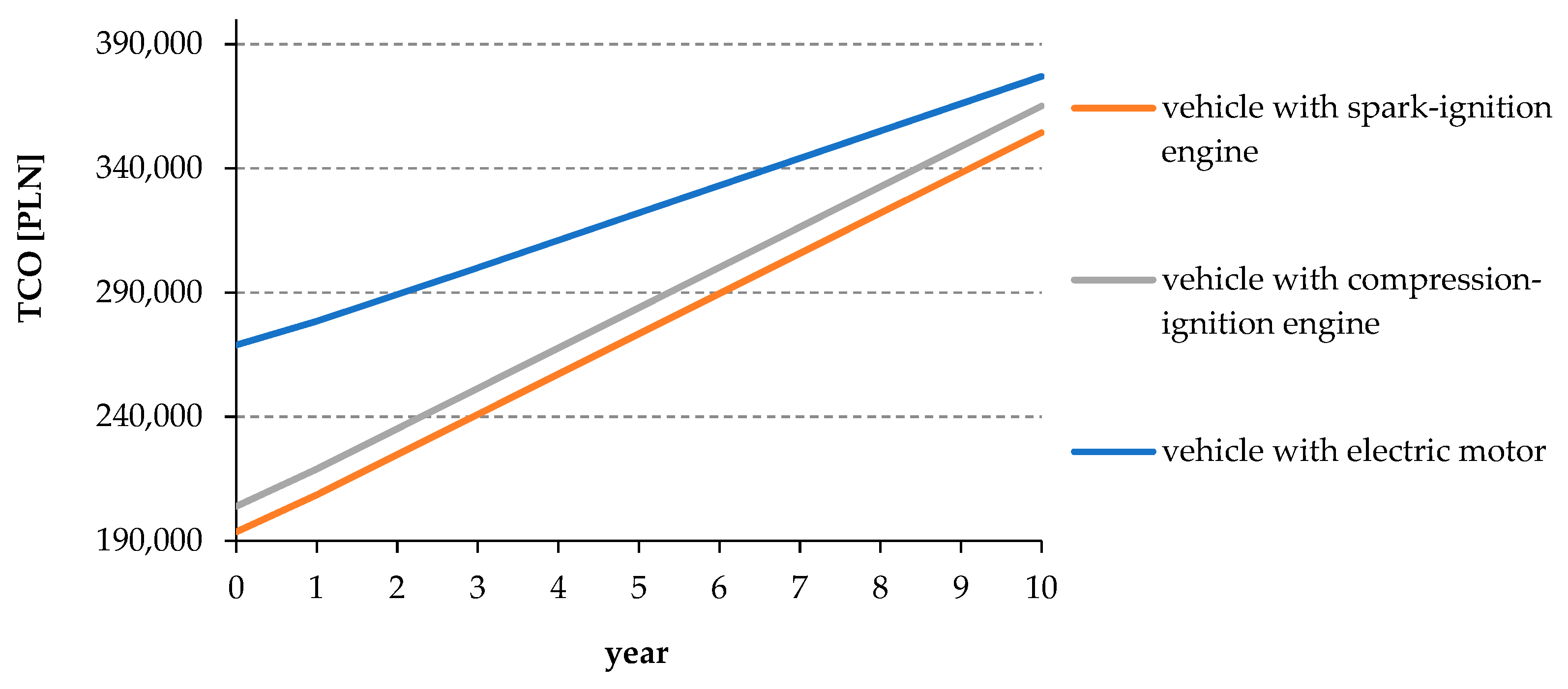

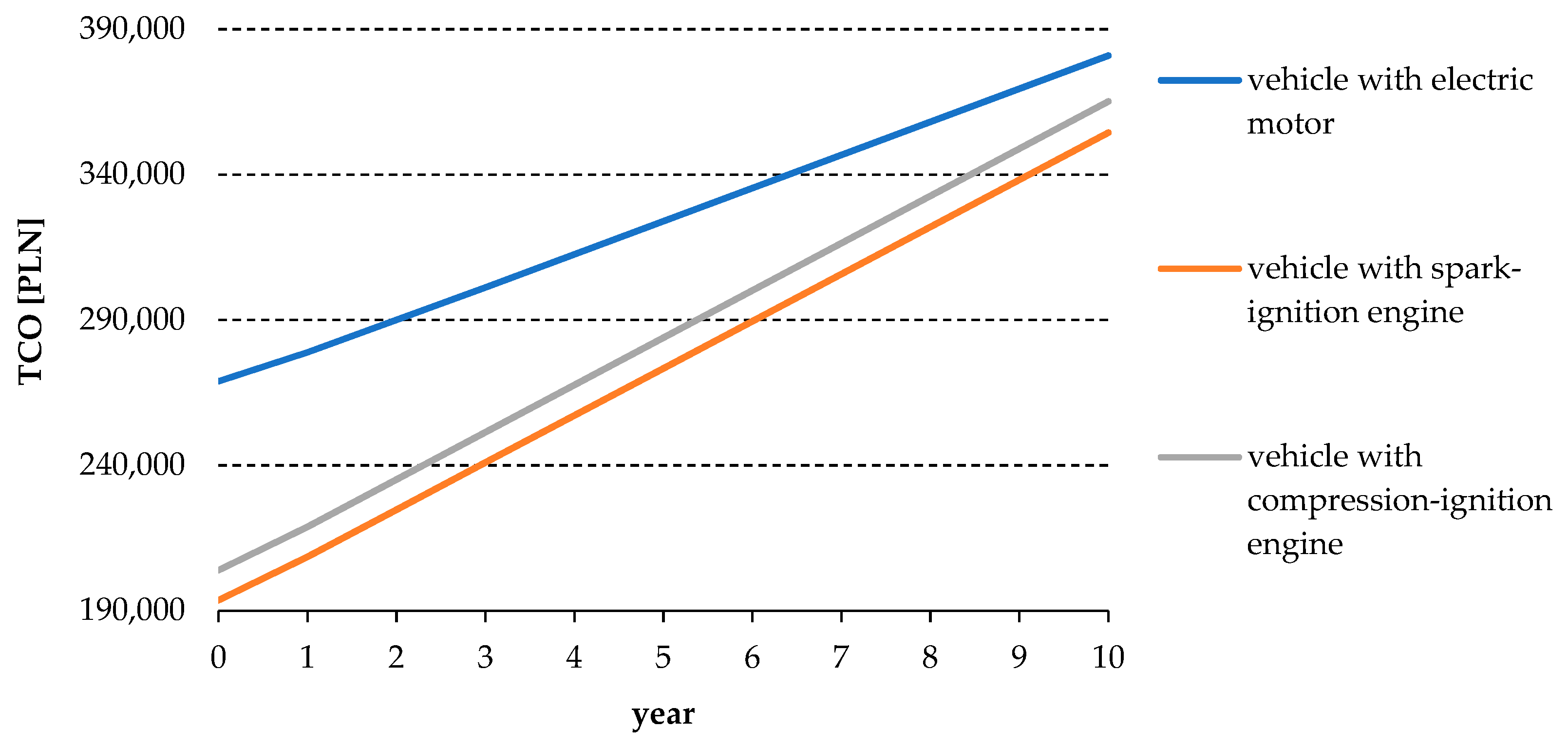

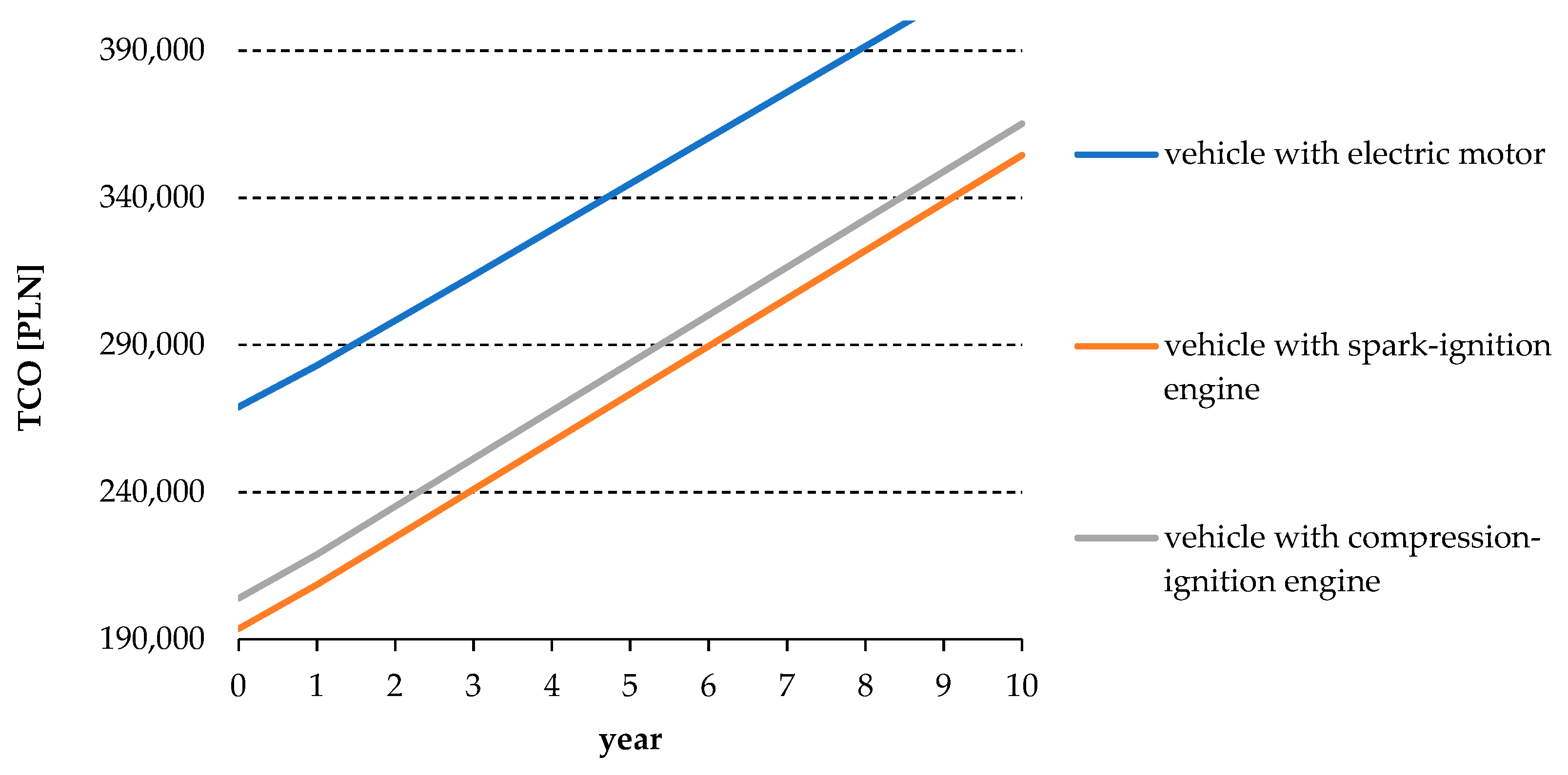

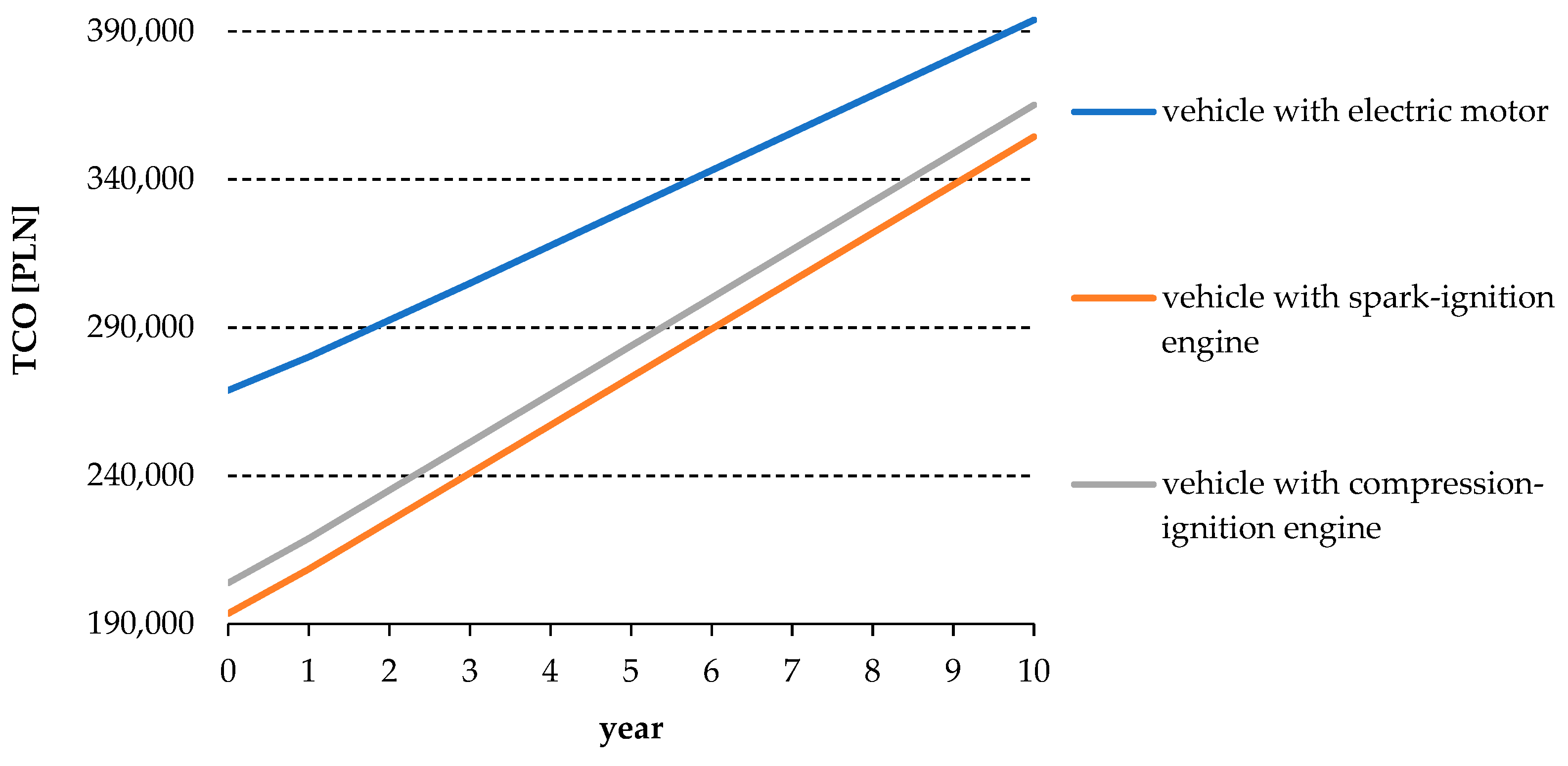

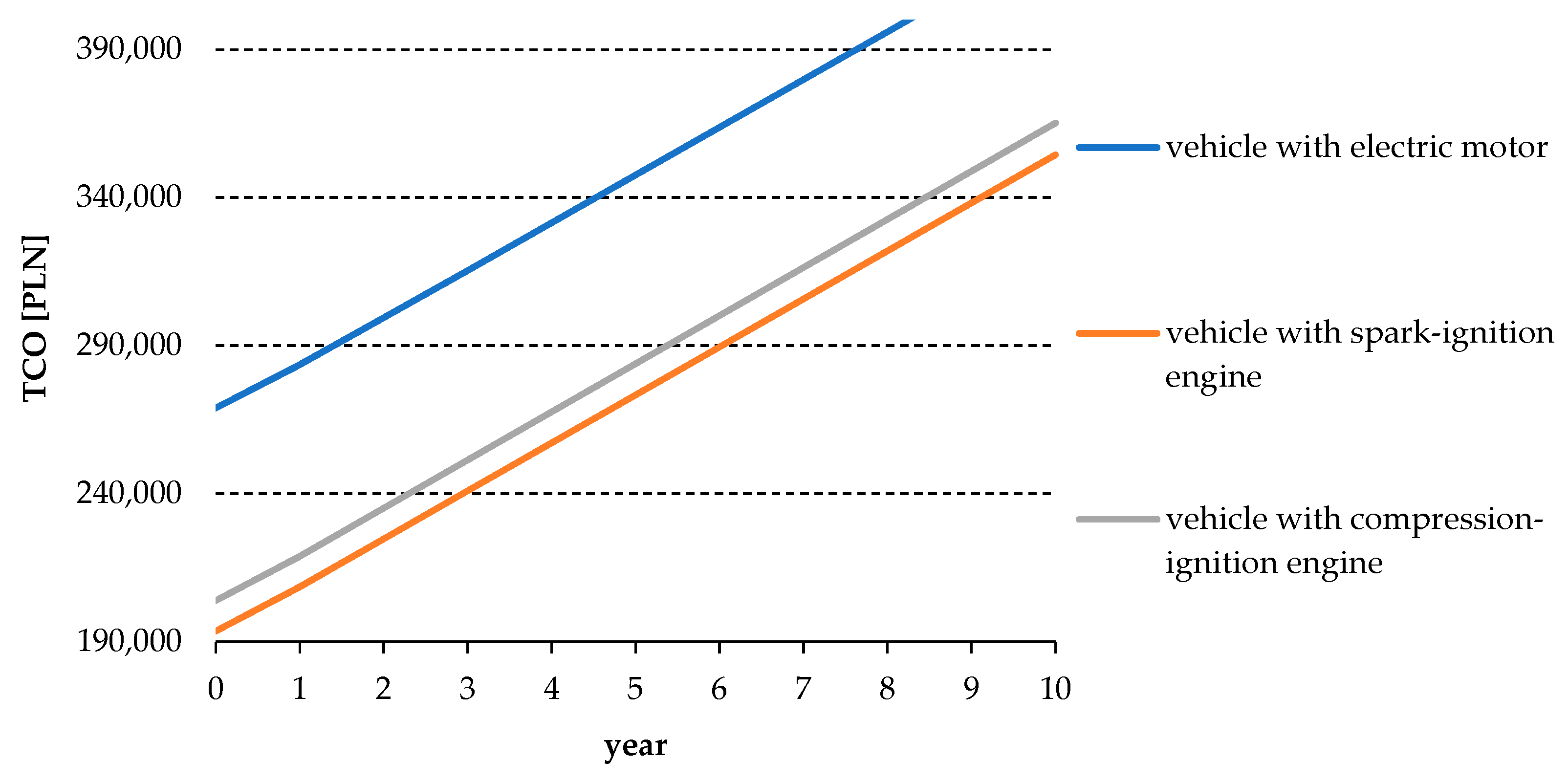

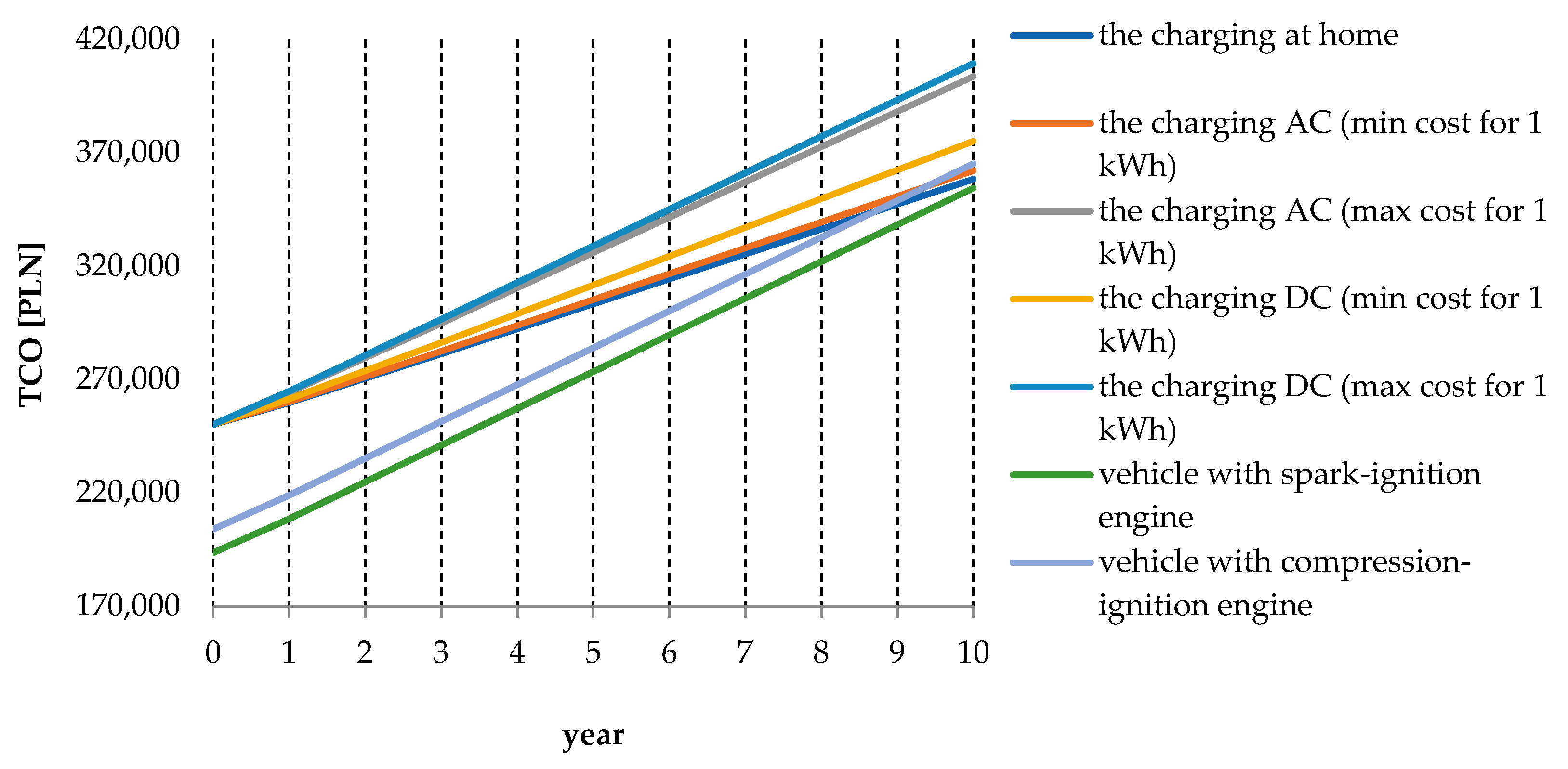

- Scenario 2 (charging of an electric car is carried out only at public AC charging stations (the calculation takes into account the minimum amount per 1 kWh). For the analyzed scenario, Figure 13 demonstrates the total cost of BEV ownership over 10 years, while Figure 14 compares it with the TCO for vehicles with an internal combustion engine.

- −

- Scenario 3 (charging of an electric car is carried out only at public AC charging stations (the calculation takes into account the maximum amount per 1 kWh). For the analyzed scenario, Figure 15 demonstrates the total cost of BEV ownership over 10 years, while Figure 16 compares it with the TCO for vehicles with an internal combustion engine.

- −

- Scenario 4 (charging of an electric car is carried out only at public DC charging stations (the calculation takes into account the minimum amount per 1 kWh). For the analyzed scenario, Figure 17 demonstrates the total cost of BEV ownership over 10 years, while Figure 18 compares it with the TCO for vehicles with an internal combustion engine.

- −

- Scenario 5 (charging of an electric car is carried out only at public DC charging stations (the calculation takes into account the maximum amount per 1 kWh). For the analyzed scenario, Figure 19 demonstrates the total cost of BEV ownership over 19 years, while Figure 20 compares it with the TCO for vehicles with an internal combustion engine.

3. Results

4. Conclusions

- −

- Subsidies for their purchase regardless of their price;

- −

- Tax relief, i.e., a significant reduction in the price of the vehicle already at the time of purchase

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Piontek, F. Controversies and dilemmas around sustainable and balanced development. Economics and sustainable development. Theory Educ. 2001, 1, 17–44. [Google Scholar]

- Koreleski, K. Semantic, theoretical and practical problems of sustainable development-eco-development. Sci. J. Agric. Acad. Kraków 1999, 18, 61–68. [Google Scholar]

- Merkisz, J.; Jacyna, M.; MerkiszGuranowska, A.; Pielecha, J. Exhaust emissions from modes of transport under actual traffic conditions. In Energy Production and Management in the 21st Century; WIT Press: Southampton, UK, 2014; Volume 190. [Google Scholar]

- European Environment Agency. Transport and Environment, On the Way to a New Common Transport Policy; Office for Official Publications of the European Communities: Copenhagen, UK, 2007. Available online: https://www.eea.europa.eu/publications/eea_report_2007_1/file (accessed on 3 June 2021).

- JATO. Available online: https://www.jato.com/ (accessed on 3 June 2021).

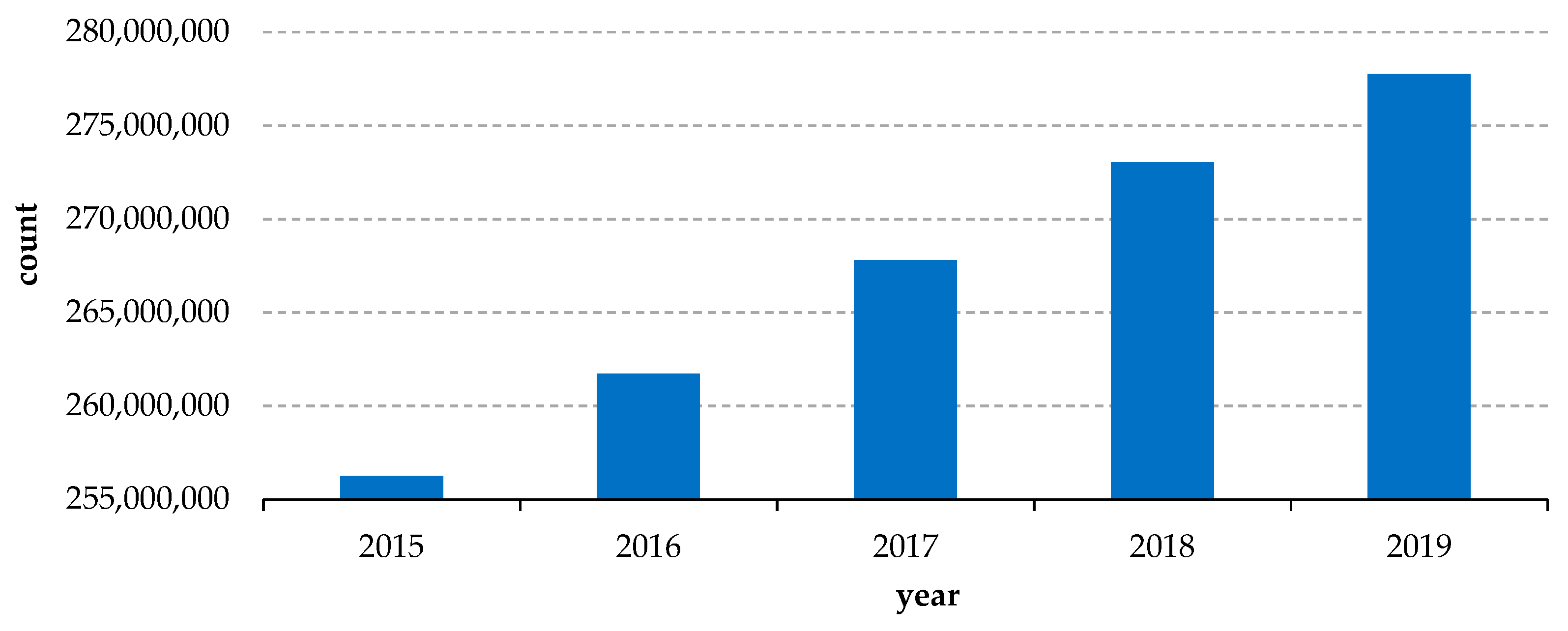

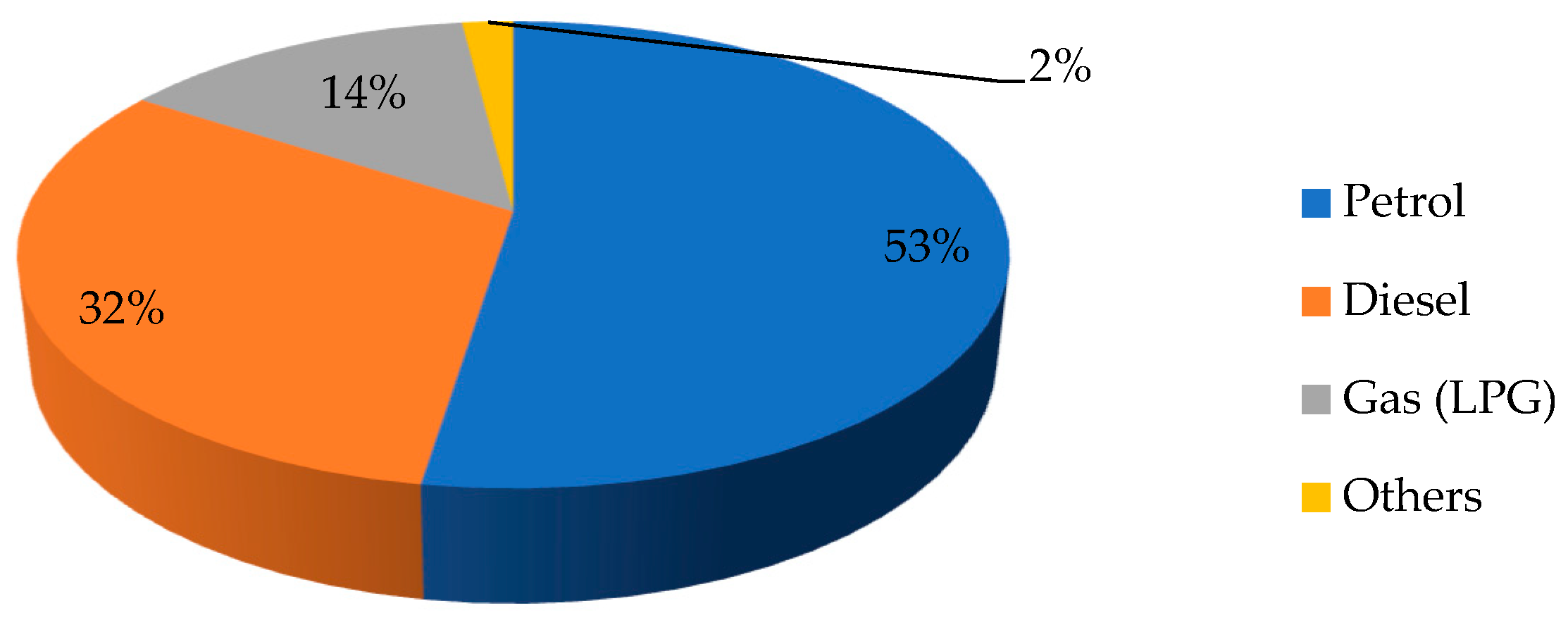

- European Automobile Manufacturers’ Association. Available online: https://www.acea.be/uploads/publications/report-vehicles-in-use-europe-january-2021.pdf (accessed on 3 June 2021).

- Sendek-Matysiak, E. Electric cars as a new mobility concept complying with sustainable development principles, Computational technologies in engineering (TKI’2018). In Proceedings of the 15th Conference on Computational Technologies in Engineering, Almaty, Kazakhstan, 19–23 August 2019; Volume 2078, pp. 1–6. [Google Scholar]

- Eberle, U.; von Helmolt, R. Sustainable transportation based on electric vehicle concepts: A brief overview. Energy Environ. Sci. 2010, 3, 689–699. [Google Scholar] [CrossRef]

- Omahne, V.; Knez, M.; Obrecht, M. Social Aspects of Electric Vehicles Research—Trends and Relations to Sustainable Development Goals. World Electr. Veh. J. 2021, 12, 15. [Google Scholar] [CrossRef]

- Faria, R.; Moura, P.; Delgado, J.; de Almeida, A.T. A sustainability assessment of electric vehicles as a personal mobility system. Energy Convers. Manag. 2012, 61, 19–30. [Google Scholar] [CrossRef]

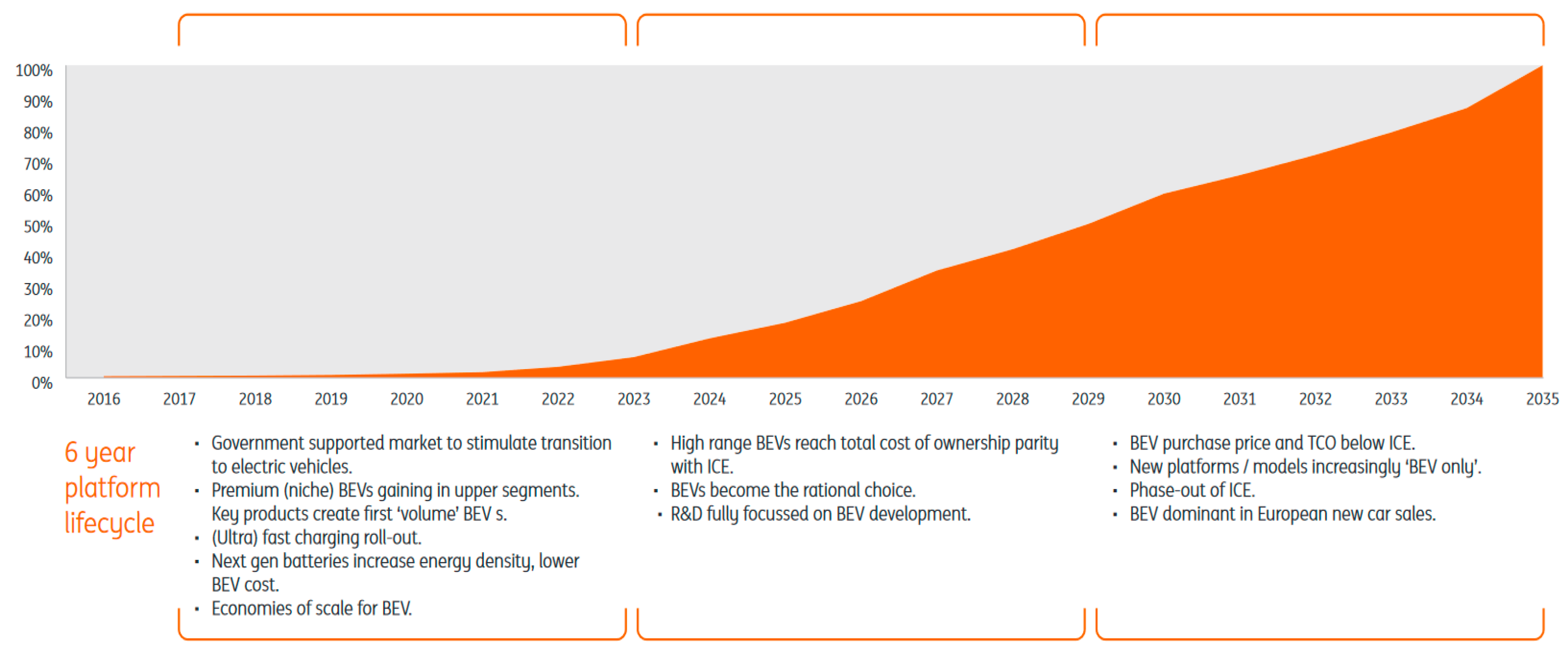

- ING Economics Department. Raport ING-Breakthrough of Electric Vehicle Threatens European Car Industry. Available online: https://www.ing.nl/media/ing_ebz_breakthrough-of-electric-vehicle-threatens-european-car-industry_tcm162-128687.pdf (accessed on 3 June 2021).

- European Commission. White Paper on Transport, Roadmap to a Single European Transport Area—Towards a Competitive and Resource-Efficient Transport System. Available online: https://ec.europa.eu/transport/sites/transport/files/themes/strategies/doc/2011_white_paper/white-paper-illustrated-brochure_en.pdf (accessed on 2 June 2021).

- Ministry of Energy. Available online: https://seo.org.pl/ministerstwo-energii-pakiet-na-rzecz-czystego-transportu/ (accessed on 2 June 2021).

- Ministry of Energy. Available online: https://www.gov.pl/attachment/75d21d4a-fd28-400e-b480-a3bbc3f7db5e (accessed on 3 June 2021).

- Ministry of Energy. Available online: http://www.subregioncentralny.pl/downloadnews/krajowe-ramy-polityki-rozwoju-infrastruktury-paliw-alternatywnych.pdf (accessed on 3 June 2021).

- Ministry of State Assets. Available online: https://www.gov.pl/web/aktywa-panstwowe/fundusz-niskoemisyjnego-transportu (accessed on 3 June 2021).

- Gov.pl Web Portal. Available online: https://www.gov.pl (accessed on 3 June 2021).

- Polish Alternative Fuels Association. Available online: https://pspa.com.pl (accessed on 3 June 2021).

- Volkswagen Poland. Available online: https://www.volkswagen.pl (accessed on 3 June 2021).

- Zaniewska-Zielińska, D. Problems of electromobility development in Poland. Eur. Reg. 2018, 35, 63–78. [Google Scholar] [CrossRef]

- Krawiec, S.; Krawiec, K. Development of electromobility in Poland. Determinants, objectives and barriers. Sci. J. Univ. Econ. Katow. 2017, 332, 17–24. [Google Scholar]

- Nikołajewka, A.; Adey, P.; Cresswell, T.; Lee, J.Y.; Nóvoa, A.; Temenos, C. Commoning mobility: Towards a new politics of mobility transitions. Trans. Inst. Br. Geogr. 2019, 44, 346–360. [Google Scholar]

- Correa, D.F.; Beyer, H.L.; Fargionec, J.E.; Hill, J.D.; Possingham, H.P.; Thomas-Hall, S.R.; Schenka, P.M. Towards the implementation of sustainable biofuel production systems. Renew. Sustain. Energy Rev. 2019, 107, 250–263. [Google Scholar] [CrossRef]

- Standing, C.; Standing, S.; Biermann, S. The implications of the sharing economy for transport. Transp. Rev. 2018, 39, 226–242. [Google Scholar] [CrossRef]

- Pisonia, E.; Christidis, P.; Thunis, P.; Trombetti, M. Evaluating the impact of “Sustainable Urban Mobility Plans” on urban background air quality. J. Environ. Manag. 2019, 231, 249–255. [Google Scholar] [CrossRef] [PubMed]

- Sendek-Matysiak, E. Key barriers to electromobility development in Poland. Transp. Overv. 2020, 3, 8–14. [Google Scholar]

- European Automobile Manufacturers’ Association. Available online: https://www.acea.be/statistics/tag/category/passenger-car-fleet-by-fuel-type (accessed on 3 June 2021).

- Statistics Poland. Available online: https://stat.gov.pl/ (accessed on 7 June 2021).

- European Automobile Manufacturers’ Association. Available online: https://www.acea.be/statistics/tag/category/average-vehicle-age (accessed on 3 June 2021).

- AAA AUTO. Available online: https://www.aaaauto.pl (accessed on 3 June 2021).

- OTOMOTO. Available online: https://www.otomoto.pl (accessed on 3 June 2021).

- Samar; Automotive Market; Research Institute. Available online: https://www.samar.pl (accessed on 3 June 2021).

- Żebrowski, K.; Detka, T.; Małek, K. Comparative analysis of report data on CO2 emissions and total cost of ownership (TCO) of an electric vehicle with respect to a conventionally powered vehicle. Electr. Mach. Probl. Pap. 2018, 3, 161–170. [Google Scholar]

- Lebeau, K.; Lebeau, P.; Macharis, C.; Van Mierlo, J. How expensive are electric vehicles? A total cost of ownership analysis. World Electr. Veh. J. 2013, 6, 996–1007. [Google Scholar] [CrossRef]

- Hagman, J.; Ritzen, S.; Janhager, J.; Susilo, Y. Total cost of ownership and its potential implications for battery electric vehicle diffusion. Res. Transp. Bus. Manag. 2016, 18, 11–17. [Google Scholar] [CrossRef]

- Plotz, P.; Gnann, T.; Wietschel, M. Total Ownership Cost Projection for the German Electric Vehicle with Implications for Its Future Power and Electricity Demand, 7th Conference on Energy Economics and Technology Infrastructure for the Energy Transformation. 2021. Available online: https://www.researchgate.net/publication/267825503_Total_Ownership_Cost_Projection_for_the_German_Electric_Vehicle_Market_with_Implications_for_its_Future_Power_and_Electricity_Demand (accessed on 3 June 2021).

- Wu, G.; Inderbitzin, A.; Bening, C. Total cost of ownership of electric vehicles compared to conventional vehicles: A probabilistic analysis and projection across market segments. Energy Policy 2015, 80, 196–214. [Google Scholar] [CrossRef]

- Sendek-Matysiak, E.; Łosiewicz, Z. Analysis of the Development of the Electromobility Market in Poland in the Context of the Implemented Subsidies. Energies 2021, 14, 222. [Google Scholar] [CrossRef]

- Palmer, K.J.; Tate, E.; Wadud, Z.; Nellthorp, J. Total cost of ownership and market share for hybrid and electric vehicles in the UK, US and Japan. Appl. Energy 2018, 209, 108–119. [Google Scholar] [CrossRef]

- ISAP. Internet System of Legal Acts. Regulation of the Minister of Infrastructure of 29 September 2004 on the Fees Associated with Running a Vehicle Inspection Station and Carrying out Technical Inspections of Vehicles. Available online: http://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20042232261 (accessed on 3 June 2021).

| Brand | EV Model | Price | Model with ZS | Price | Model with ZI | Price |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Nissan | Leaf | 126,100 | - | - | Juke | 79,930 |

| Renault | Zoe | 124,900 | - | - | Clio | 52,400 |

| Volkswagen | i-d3 | 136,890 | New Golf | 96,700 | New Golf | 80,890 |

| Hyundai | KONA Electric | 155,900 | - | - | KONA | 79,900 |

| Peugeot | e-208 Active | 124,900 | Active | 76,200 | Active | 62,700 |

| Opel | CORSA-E | 132,490 | CORSA | 67,090 | CORSA | 61,490 |

| BMW | iX3 | 268,900 | X3 | 188,200 | X3 | 193,600 |

| Brand | Model | Year | Price |

|---|---|---|---|

| 1 | 2 | 3 | 4 |

| Nissan | Leaf | 2012–2019 | 29,900–142,900 |

| Renault | Zoe | 2015–2020 | 42,500–125,600 |

| BMW | i3 | 2013–2020 | 59,900–205,900 |

| Skoda | Citigo | 2020–2021 | 89,900–264,490 |

| Mazda | MX-30 | 2020 | 129,900–144,444 |

| Hyundai | Kona | 2020–2021 | 134,900–189,900 |

| Kia | Niro | 2018–2020 | 135,300–169,900 |

| Audi | e-tron | 2019–2020 | 264,900–390,000 |

| Porsche | Taycan | 2020 | 599,999–739,900 |

| Parameters | BMW | ||

|---|---|---|---|

| X3 | |||

| Complete vehicle kerb weight [kg] | 1810 | 1910 | 2725 |

| Load capacity [kg] | 665 | 655 | 540 |

| Overall length [m] | 4.71 | 4.71 | 4.73 |

| Overall width [m] | 2.14 | 2.14 | 1.89 |

| Type of “fuel” | Petrol | Diesel | Electric current |

| Average consumption of petrol [l]/diesel [l]/electricity [kWh] per 100 km travel | 8.6 | 6.7 | 15.70 |

| Maximum power output [kW] | 135 | 140 | 210 |

| Maximum torque [Nm] | 300 | 350 | 400 |

| Maximum speed [km/h] | 215 | 213 | 180 |

| Acceleration to 100 km/h [s] | 8.3 | 7.9 | 6.8 |

| Total range (mixed cycle) [km] | 65l | 68l | 455 |

| Vehicle purchase cost [PLN] * | 193,600 | 203,900 | 268,900 |

| Price per 1 l petrol/1 l diesel/1 kWh [PLN] * | 5.46 | 5.41 | 0.73 |

| Mileage [km/year] | 15,000 | 15,000 | 15,000 |

| Analysis time [years] | 10 | 10 | 10 |

| FUELLING COST | ||

| Petrol | 47.64 | |

| Diesel | 34.58 | |

| CHARGING COST | ||

| Operator | Type of charging | |

| AC | DC | |

| Greenway | 17.42–22.7 | 22.70–45.58 |

| ORLEN | 39.17 | 35.02–42.06 |

| EV+ | 14.08–41.80 | 28.16–35.20 |

| PGE | 18.03–18.13 | 32.32–34.68 |

| REVENET | 19.18 | 32.56 |

| LOTOS | 24 | 24 |

| Innogy | 26.22 | - |

| GO+Eauto | 20.24–35.20 | 28.16–35.20 |

| TAURON | 21.3 | 38.9 |

| Charging at home | 11.53 | - |

| Electric Vehicle | Internal Combustion Vehicle | |

|---|---|---|

| Annual maintenance | ||

| Oil change | No | Yes |

| Oil filter replacement | No | Yes |

| Air filter replacement | No | Yes |

| Cabin filter replacement | Yes | Yes |

| General diagnostics | Yes | Yes |

| Operation maintenance | ||

| Timing gear replacement | No | Yes |

| Clutch replacement | No | Yes |

| Spark plug replacement/cleaning | No | Yes |

| Accessory belt replacement | No | Yes |

| Gasket replacement | No | Yes |

| Traction battery replacement | Yes (when its efficiency is below 70%) | No |

| Brake pad and disc replacement | Yes (ca. every 80,000 km) | Yes |

| Operating fluid change | Yes | Yes |

| Ad hoc maintenance | ||

| Turbocompressor failure | No | Yes |

| Head gasket failure | No | Yes |

| DPF replacement | No | Yes |

| Gearbox failure | No | Yes |

| Equipment failures | Yes | Yes |

| BEV Charging Method | Vehicle with Spark-Ignition Engine | Vehicle with Compression-Ignition Engine |

|---|---|---|

| At home from an electrical outlet | 6% | 3% |

| Public AC charging stations (calculations take into account the lowest amount per 1 kWh) | 7% | 4% |

| Public AC charging stations (calculations take into account the highest amount per 1 kWh) | 16% | 14% |

| Public DC charging stations (calculations take into account the lowest amount per 1 kWh) | 10% | 7% |

| Public DC charging stations (calculations take into account the highest amount per 1 kWh) | 17% | 15% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sendek-Matysiak, E.; Grysa, K. Assessment of the Total Cost of Ownership of Electric Vehicles in Poland. Energies 2021, 14, 4806. https://doi.org/10.3390/en14164806

Sendek-Matysiak E, Grysa K. Assessment of the Total Cost of Ownership of Electric Vehicles in Poland. Energies. 2021; 14(16):4806. https://doi.org/10.3390/en14164806

Chicago/Turabian StyleSendek-Matysiak, Ewelina, and Krzysztof Grysa. 2021. "Assessment of the Total Cost of Ownership of Electric Vehicles in Poland" Energies 14, no. 16: 4806. https://doi.org/10.3390/en14164806

APA StyleSendek-Matysiak, E., & Grysa, K. (2021). Assessment of the Total Cost of Ownership of Electric Vehicles in Poland. Energies, 14(16), 4806. https://doi.org/10.3390/en14164806