In March 2020, the Gas Transmission system operator (TSO) of Ukraine provided transportation of 4.6 bcm of natural gas to the EU and Moldova. This is 18% more than the previous month and 36% or 2.6 bcm less than the same month year before. As a result of twelve months of 2020, gas transit through the Ukrainian gas transport system amounted to 42.83 bcm. That is 54.8% less than in the same period last year. Transit volumes decreased by twice compared to the average annual value for 2014–2019. However, since the beginning of 2020, transit capacities from the Russian Federation are fully paid by Gazprom for the specified period under the new transit contract and are equal to 65 bcm per year (or 0.178 bcm per day). Additionally, in the first quarter of this year, a new short-haul service was launched from the new Ukrainian TSO. It enables customers to order gas transit between EU countries through the Ukrainian transmission system. In March, Gas TSO of Ukraine had already transited the first volumes of gas on the Hungary-Slovakia route. In total, January–March 2020, 9.8 bcm of gas was transited in the western direction. That is 7.2 bcm or 42% less than the results of the same period a year earlier (

Figure 4). In the Southern (Balkan) direction, the transit has decreased by 70% to 1.2 bcm of gas since the beginning of 2020. In particular, the transit to Romania via gas metering station (GMS) Orlovka amounted to 0.3 bcm which represents a 90% of decrease, to Moldova 0.9 bcm which is a 10% decrease. The decrease in transit volumes through the Trans-Balkan corridor is largely due to the launch of the TurkStream pipeline [

56].

So far, due to the transit agreement between the Russian Federation and the Republic of Ukraine, the Ukrainian side has been paid according to full ship or pay deal where the Russian side has been obliged to either ship or pay the full amount for transmission of 65 bcm of natural gas for 2020, and 40 bcm annually for the period of 2021–2024. The deal also included the payment of USD 2.918 billion in compensation that Gazprom is required to pay to the Ukrainian side. The payment of this compensation closed the arbitration processes between Gazprom and Ukraine side from December 2017 and February 2019, for which a final decision has not yet been made. Furthermore, all Gazprom‘s assets, funds, and monetary funds were released and future claims to contracts signed in January 2009 were prevented. After the release of the information on contract signing, there were no major market movements visible, and none of the major reporting and commodity trading news portals have referred to the deal as a long-waited relief. Meaning that the capacities of bypass interconnections and capacities in western Ukrainian gas storages were sufficient to cover the EU demand. Comparative analyses of monthly and quarterly physical flows on exit points from the transmission system of Ukraine in 2019 and 2020 are shown in

Table 3,

Table 4,

Table 5 and

Table 6.

7.4. Ukraine to Romania Interconnector Flows Analysis: Isaccea/Orlovka—Ukraine to Romania Interconnection

The last interconnection in this analysis is also “the first victim” of previously mentioned Ukraine bypass projects and is an excellent benchmark for observation and conclusions for the future of Ukrainian transmission of Russian gas towards its buyers in Europe (

Table 10). Isaccea/Orlovka interconnection, historically bringing Russian gas to Romania, Bulgaria, Greece, Moldova, and biggest regional customer, Turkey, has been totally shut down at the start of January 2020. Total shipped and imported quantity decrease in comparison to the same period in 2019 values 94.77% decrease in January, 90.72% in February, 96.11% in March, and a total decrease of 94.29% in Q1 2020. Romania as an almost net exporter rather than an importer of natural gas is covered, but from January 2020, imported Russian natural gas for Turkey, Bulgaria, and Greece is not passing any more through Ukraine but via TurkStream. The total annual comparison of flows ends with such results: flow on Isaccea in 2019 equal to 106.877 GWh and flow in 2020 equal to 7235.93 GWh. A total decrease of 92.73 %.

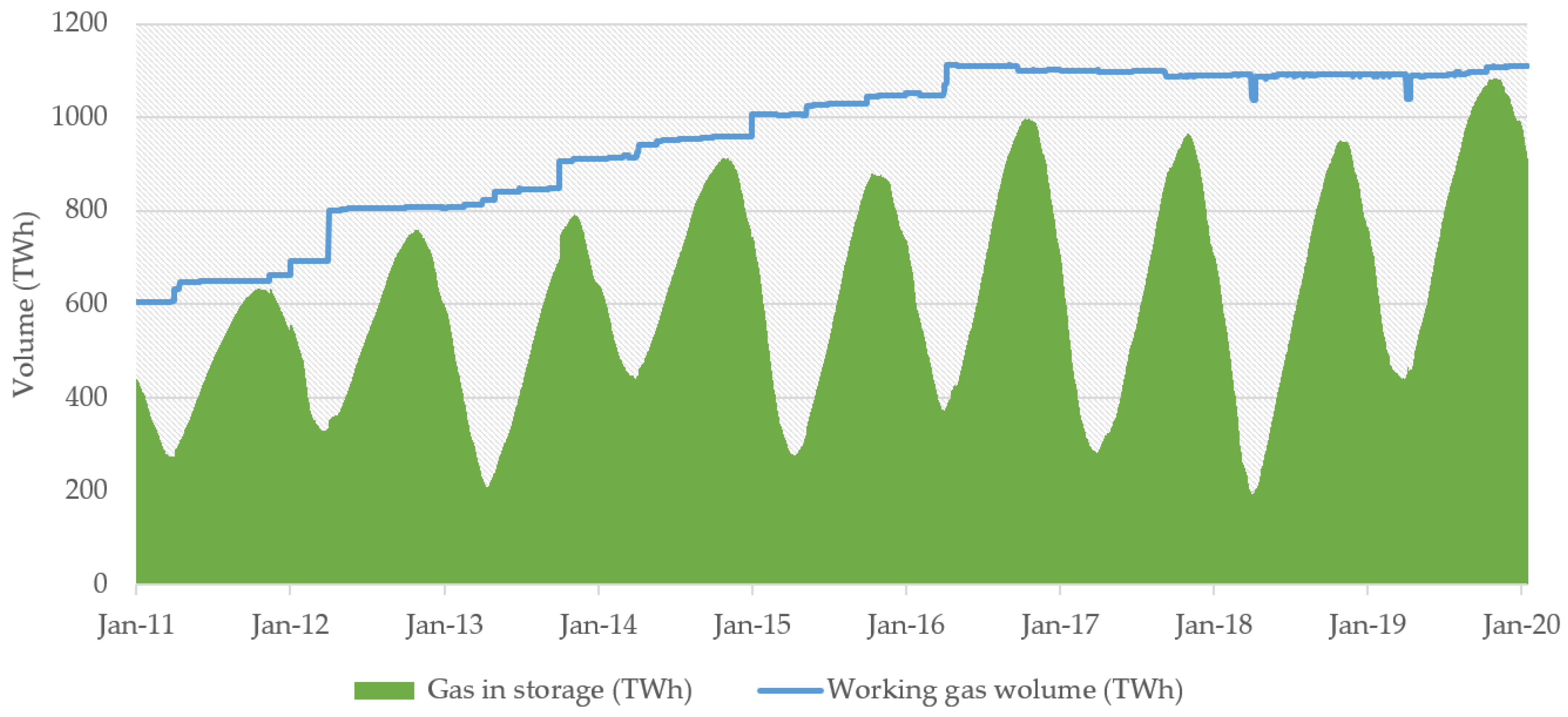

Transmission of Russian gas via Ukraine was stabilized during the rest of 2020, especially in the last quarter of 2020 and aftermath in certain quantities until the full operability of Nord Stream 2 project will not be familiar. Ukraine being a large market of natural gas itself, with import demand between 10 and 15 bcm annually and with more than 30 bcm of storage capacities, will still exist on the European natural gas map as an important factor, but will have to be ready for fast changes of the entire national gas market and potentially highly prepared for the increase of its own production. According to the Ukrainian government, the shale gas field Yuzivska contains approximately 86 to 100 bcm of natural gas. The optimistic scenario drawn up before the armed conflict in eastern Ukraine predicted the production of 0.58 bcm annually by 2030, effectively doubling Ukrainian gas production from 2011. Ukrainian tariff systems will be under strong impact of full implementation of European legislation in order to maintain its geostrategic transmission position [

58].

Transmission of gas via Ukraine strongly depends on the transmission tariffs that are published on yearly basis by the new Ukrainian TSO, but the tariff system needs to be changed due to European energy policy. Transparent information on transmission tariffs gives the opportunity to choose economically reasonable route, at least partially, by European shippers. New innovative ideas, such as the “short-haul project” presented by the new TSO of Ukraine “TSOUA” which enables network users to transport gas between European countries (Poland, Slovakia, Hungary, and, in future, Romania) through the territory of Ukraine at low cost and higher utilization and storing of gas for EU traders, is the most probable future business model for Ukrainian gas market.

However, the main question lies in future European demand for natural gas. In case of further decrease of natural gas demand that has been predicted according to all projections for Europe as the only continent with a decrease in demand, and abandonment of natural gas as green fuel will leave huge amounts of unutilized pipelines, interconnections, and storages in any case. A fast transitional period towards renewable production of energy in Europe without hydrocarbons will lead to strong energy decarbonization that will certainly result with, and countries’ economies and TSO’s in a never-ending business model of transmission tariff reduction and adjustment in order to sustain at least a minimum of profitability for existing gas infrastructures. Further development of the COVID-19 pandemic and consequently economic crises will give the main direction towards European energy trends. If the European economy strongly adopts decarbonization trends it will certainly influence on fast gas consumption decrease, but in case the European economy will use natural gas instead of renewables for fuel switching from coal it will slow gas consumption decrease and give a new perspective to not only Ukrainian but also to other existing gas systems in the European region.

7.5. Impact of Lower Transit through Ukraine to EU Purchase Bargaining Position

Observation of the provided data, along with the current further development trend of non-solved disputes such as Nord Stream 2 or capacities booking after TurkStream suggests that the period until 2025 will face a slow gradual decrease of transit of Russian gas through Ukraine. Sziklai et al. [

59] conclude in their paper, published in 2020, how the potential impact of low prices of natural gas delivered through Nord stream 2 benefits will never reach eastern Europe who will have to seek its cheaper gas through Ukrainian or Turkish route. In which case, the ground is left for third, nonstandard big suppliers of natural gas to find their own place on the market, such as Iran, Azerbaijan, Romania with its increased production, and Turkey with its increased production, which would completely close any opportunity to see Ukraine as a transit route, au cotrair, Ukraine is facing a potential role of the last in chain buyer. Sziklai et al. [

59] in their paper think alike, were suggesting that the best alternative for diversifying supply from Russian gas is to connect Central Asian gas fields with the European market. The Southern Gas Corridor consists of three individual pipelines: the South Caucasus Pipeline (SCP), the Trans-Anatolian Natural Gas Pipeline (TANAP), and the Trans-Adriatic Pipeline (TAP). The purpose of this gas corridor is to connect significant quantities of natural gas in Central Asia with Turkey and the EU, transporting it through Georgia, Turkey, Greece, and Albania to Italy. The SCP connects the Shah Deniz gas field through Georgia with the eastern part of Turkey. The pipeline from eastern Turkey to the border with Greece is called TANAP and has a current capacity of 16 bcm annually although the capacity of the SCP is 25 bcm annually. Given the significant consumption of natural gas in Turkey but also the higher capacity of the SCP, the capacity of TANAP is planned to increase to 22 bcm annually. With this increase in TANAP capacity and the commissioning of TurkStream, TAP will certainly not be left without quantities that could be transported through it. Turkstream will also supply the Tesla pipeline which in turn is planned to link the Black Sea with the Baumgarten gas hub in Austria. The Ionian Adriatic Pipeline (IAP) would connect TAP with the new LNG terminal in Krk, Croatia. Sure, the diversification of potential supply routes is present, as well as diversified suppliers in each route, which will leave SEE with sufficient alternatives to Russian gas.

7.6. Energy Policy Issues and Implications of North Stream 2

The authors intend to indicate in this paper the duration of the Russian Ukrainian conflict and the connected losses which are hardly quantitatively measured in a way which could satisfy all involved parties. In a geopolitical aspect the authors want to impose that the solution to the dispute is close and to evaluate the aftermath of the issue with changed, new setup: Turkish stream is built and fully operable, Nord Stream 2 is built and fully operable, Ukraine has opened its transmission and storage systems to the EU shippers and brought its legislation as close to the European one under the 3rd energy package, and United states are hitting historical records with natural gas imports to Europe.

The Crimea annexation and independence referendums, as well as the so-called Republics of Donetsk and Luhansk, is country integrity and highly political mater and by authors it is has never played a role in the subject of this paper, especially if evaluated that the physical transmission of the gas has continued in all the years of the conflicts from Russian federation through Ukraine to third parties/countries even though the natural gas export from Russia and its transit to Ukraine has been in the background of all political disputes between Russia and Ukraine. The US Administration has always pointed this out as the main reason for the disputes and posed sanctions to Nord Stream 2 project development during the Trump administration. The Biden administration after Biden–Merkel agreement which is not known in detail have stressed out that sanctions will not prevent Nord Stream 2 from being realized but on the other hand, they pointed out that US Administration will not tolerate geopolitical use of Nord Stream 2 operation. This will certainly be an issue of German energy policy towards Ukraine and Russia.

Development and improvements of the Ukrainian energy sector in the last five years has shown thorough preparation of Ukrainian national companies for all outcome scenarios as it has been clear that some adjustments and improvements on several levels were necessary. Opening of the storage capacities for European traders, redefining of its legislation that regulates the energy sector according to requirements of EU 3rd energy package, contracts and correlation with the Energy community, offering of short-haul tariffs product and customs-free storage called “customs warehouse product” as well as publishing of all important data and legislation in English language along with Russian and Ukrainian language clearly indicate the position which Ukraine has took. When it comes to the Nord Stream 2, Ukraine, Poland, and the USA see it as a political tool and a clear threat to their security of supply. They oppose the deepening dependence on one source, one route, and one supplier in the EU. Certainly, Ukraine and their allies will continue to work on solutions, which will allow them to mitigate the geopolitical impact of the Nord Stream 2 in the terms of an increase in gas prices in Central and Eastern Europe.

Russia communicates Nord Stream 2 project as a commercial project that meets the interests of Russia and Germany, and by putting the project into operation, additional the shortest diversification of gas supply routes is ensured for Gazprom. The finalization of Nord Stream 2 construction, now imminent, marks the success of Russia’s strategy of minimizing the risks of third country transit and brings bigger insecurity for the energy position of Ukraine as a transit country. Moreover, it brings Germany to position more dependent on Russian supplies and changing its position to gas supplier to Ukraine which will certainly have negative economic influences for Ukraine and positive on Germany.

7.7. Impact of European Green Deal on Natural Gas Demand

The development of natural gas supply also needs to be analyzed in the context of the new green oriented strategy of the European Union. According to Communication from the EU Commission concerning 2030 climate ambition, Europe has set a new climate plan. The fact that global average temperature increased by 1.1 °C above preindustrial levels by 2019 has triggered more ambitious climate targets [

60]. Therefore, the EU Commission has made the European Green Deal the top political priority, with the aim of transforming the EU into an environmentally friendly, sustainable but also competitive economy that will achieve climate neutrality by 2050 [

61]. On the other hand, global human, economic, and environmental systems are experiencing a health crisis with an unprecedented socioeconomic impact. Both climate and health crisis must not worsen another and therefore postponing climate action was not an option for the European Union. Both crises are influencing the natural gas supply. Due to the relatively mild winter of 2019/2020, the need for heating decreased by 5% across the main consumption regions if compared to the year before. Demand for gas in the residential and commercial sectors decreased by 3% during the first quarter of 2020 [

62]. Natural gas demand in Europe in the first half of 2020 decreased by 8% or 19 bcm due to the impact of the COVID-19 pandemic, mild winter, and the high share of renewable energy sources in electricity generation. Despite a significant decline, demand for natural gas remained higher than in 2014 and 2015 when the demand for natural gas was at a record low in the last two decades due to the reduced use of natural gas in the heating sector and the generation of electricity. As mentioned earlier gas demand in Europe was already on low levels due to mild winter and the high share of renewable energy sources in electricity generation. As a result, gas demand decreased by 10% year on year in January and by 3% in February [

62].

The European economic response to COVID-19 offers an opportunity to accelerate the transition to a climate neutral economy continuing fair energy transition with more than 1.8 trillion euros funds for it. With the use of these funds, goal of the EU is to achieve carbon neutrality along with the economic growth. In 2019, harmful greenhouse gas emissions in the EU were reduced by approximately 25% when compared to 1990. In the same period, economic growth of as much as 62% was achieved, which clearly proves the possibility of successfully combating climate change with the sustainability of economic development [

60]. Currently, the European Commission is proposing to change the guidelines for achieving climate neutrality by 2050 in the form of the European Climate Law, which would continue to support these climate goals along with increasing the long-term sustainability and competitiveness of renewable energy sources and a significant positive impact on recovery from COVID-19 crisis. Due to the crisis and lockdowns caused by the COVID-19 pandemic in 2020, significant reductions in greenhouse gas emission were achieved, but this emission are also expected to increase to some extent as a result of the recovery of the European economy [

60]. Therefore, natural gas supply and gas infrastructure will be significantly important in the post COVID-19 economic recovery. According to European Commission estimates, during the recovery of the European economy (2020–2030) investments in energy projects will have to increase significantly compared to the last decade. This increase is estimated at around EUR 350 billion more than in the last decade to meet the 2030 climate targets [

60].

The increased climate ambition in all energy and industrial sectors and households can have a positive impact on the economic development of the EU. Especially, this will be important in countries where there is still space for increasing economy’s performance. Since, EU countries, sectors, and households start the transition towards climate neutrality from different points, a proposed more ambitious climate target will be challenging in countries with a higher greenhouse gas emissions which are mostly result of higher share of fossil fuels in the energy mix, lower GDP per capita, and higher energy intensity. Some carbon intensive sectors and regions will undergo substantial transformations. Due to the energy transition, the EU’s energy system will become more secure and resilient. The natural gas market in Europe has faced volatile prices and supply disruption and a majority of the European supply of natural gas is covered by imports. Higher share of renewable energy sources in the EU will help reduce this exposure thereby increasing the security of supply. Decreasing natural gas imports would on the other hand save on the import value significantly by 2050, but concerning the need for COVID-19 recovery, it would not start before 2030.

As can be seen in the graph (

Figure 5), achieving a 55% reduction in greenhouse gas emissions will require the implementation of various measures to achieve climate neutrality in all sectors. Greenhouse gas emissions from the use of fossil fuels but also from fugitive emissions in the life cycle of their use are responsible for as much as 75% of total EU greenhouse gas emissions. The large presence or high use of fossil fuels in the EU energy mix indicates the need for a significant increase in the share of renewable energy sources. The European Commission estimates that the production of electricity from renewable energy sources must double, from today is 32% to approximately 65% or more in order to achieve set goals [

60]. This emphasizes the importance of energy infrastructure along with the natural gas transport sector in the transition to a climate neutral economy. In the circumstances where the renewable energy will become the most cost-effective source for power generation, the energy system integration and energy storage will give additional importance to natural gas infrastructure.

There are three main courses of action for achieving target emission reduction. The first course of action is certainly the Emission Trading System Directive, which sets a limit on greenhouse gas emissions for large industrial energy consumers, the electricity production sector, and the aviation sector. The second course is the Effort Sharing Regulation with binding amounts attributed to emissions for remaining greenhouse gas emissions, and the third course of action is the application of land use, land-use change, and forestry (LULUCF) in order to reduce greenhouse gas emissions. In addition to the above, strict energy legislation and policies will certainly have a major role in achieving the ambitious climate targets for 2030 and progressive reduction of emission towards climate neutrality in 2050. This will enable governments to act swiftly. Consequently, coal and natural gas fuel switch is expected in this decade, and gas transmission system with sufficient import capacity will have significant importance during this decade. In this case, natural gas supply from Russia via Ukraine transit route will certainly keep its role in the first half of this decade. Poland, for example, will need additional amounts of natural gas due to the coal-gas fuel switch but it needs to be stressed that natural gas has been omitted from European Taxonomy meaning that all projects that include natural gas will not be eligible for EU support funding. In the case of prolongation of coal-gas fuel switch, it will have a negative environmental impact, but if it will impact the increasing of RES that the environmental consequences will be positive.

7.8. Impact of LNG Import on Pipeline Transit in Europe

According to the US Department of Energy and the Energy Information Administration, US exports of LNG continued to grow in the first six months of 2021 representing an increase of 42%, compared with the same period in 2020. Due to the pandemic during the summer months of 2020, US LNG exports fell to record lows, but they set record highs by the end of 2020. US LNG exports increased in the first half of 2021 as international natural gas and LNG spot prices increased in Asia and Europe due to cold weather and increasing demand. Rising global LNG demand after COVID-19 restrictions began to ease, as well as continuous unplanned outages at LNG export facilities in several countries (including Australia, Malaysia, Nigeria, Algeria, Norway, and Trinidad and Tobago), also resulted in increased US LNG exports. Natural gas demand at the beginning of 2021 continued to rise due to low post-winter inventories and high natural gas prices and especially higher demand for more flexible LNG supplies as is the case with the US cargoes. European underground storage capacities were filled at a low level after a cold winter. Even though, European natural gas spot prices have historically been lower than prices in Asia, in 2021 European natural gas prices are following Asia’s spot LNG prices closely attracting flexible global shipments. The US Henry Hub natural gas benchmark and US LNG spot market prices in 2021 have been lower than prices for international natural gas and spot LNG. This price difference resulted in record exports volumes. US LNG exports also increased because of new export units added in 2020 that increased total US LNG export capacity. Similar to 2020, Asia further remained the top destination for US LNG exports with 46% of the total and was followed by Europe with a share of 37% and increased exports to Latin America [

63].

Yermakov and Sharples [

64] have investigated the development of Russian LNG and its impact on Russian pipeline trades. It is obvious that LNG trade has developed significantly from the beginning of the 21st century and that substantially changed global gas markets. They conclude that the volume of inter-continental gas trade has grown, the contracts have become flexible with destination-free clausulae, the number of portfolio players increased, infrastructure has been developed for re-export cargoes from import terminals, and the share of spot trades increased allowing an increase of flexibility of deliveries. All that influenced the dominance of conventional, oil-indexed, long-term gas contracts with a specified destination. It is expected that the development and growth of LNG facilities will continue, with the share of LNG in the global gas trade that will equal the share of pipeline trade by the end of the next decade [

64]. Europe has sufficient regasification capacity and specifically, the EU has liquid traded markets with price-determined ability to attract LNG shipments. Therefore, for Russia, LNG represents a threat to its firm position as the main gas exporter. Yermakov and Sharples [

64] also indicated that the Russian authorities appear to acknowledge that the state-controlled gas giant, Gazprom, does not have the flexibility and expertise to develop Russian LNG potential and therefore focused on Novatek with significant financial and political state support. Novatek expansion with LNG started with the Yamal LNG in 2017 and continued with Arctic LNG 2 that is planned to start operating from 2023 to 2026 in a few stages. The plans for Russia include the export of 80–140 million tonnes per annum (mtpa) in the early 2030s bringing Russia among the top exporters alongside the USA, Qatar, and Australia. Russia’s LNG ambitions have increased in 2021 according to the publication of its official long-term LNG development plan according to Yermakov and Sharples [

64]. With the five terminals in operation or under construction, seven “probable or possible” projects are mentioned that could rise LNG production to mentioned 140 mtpa and additional seven speculative terminals with a huge additional probable capacity (127–143 mtpa). It is obvious that all these projects will not be realized, but it illustrates Russian ambitions concerning LNG market share in it will certainly compete with Russian pipeline exports especially to North-West Europe and will consequently diminish Gazprom’s market share. In the case that Russia attempts to limit the deliveries of its LNG to Europe, this could help the global LNG competitors with their bigger shares in Europe, therefore the pipeline shipments are the better subject to limitation for controlling the market than LNG due to its global market dimension.