Manual Frequency Restoration Reserve Activation Clearing Model

Abstract

:1. Introduction

- (a)

- The incorporation of all BEO types as defined in the guidelines of the MARI project and the analytical presentation of the mathematical equations of their clearing conditions;

- (b)

- The consideration of both self-scheduling and central-scheduling markets in the same modeling framework; for the latter, the BEOs submitted by BSPs are being converted to “standard products” by the respective TSOs before the mFRR BE clearing process, as required by EBGL;

- (c)

- The modeling of the conversion process for the preparation of the BEOs, before entering the mFRR BE clearing process;

- (d)

- The modeling of interconnection controllability;

- (e)

- The modeling of the TSO-defined tolerance band in the clearing model constraints;

- (f)

- The incorporation of elastic and inelastic orders defined by the TSOs to satisfy their mFRR balancing energy needs.

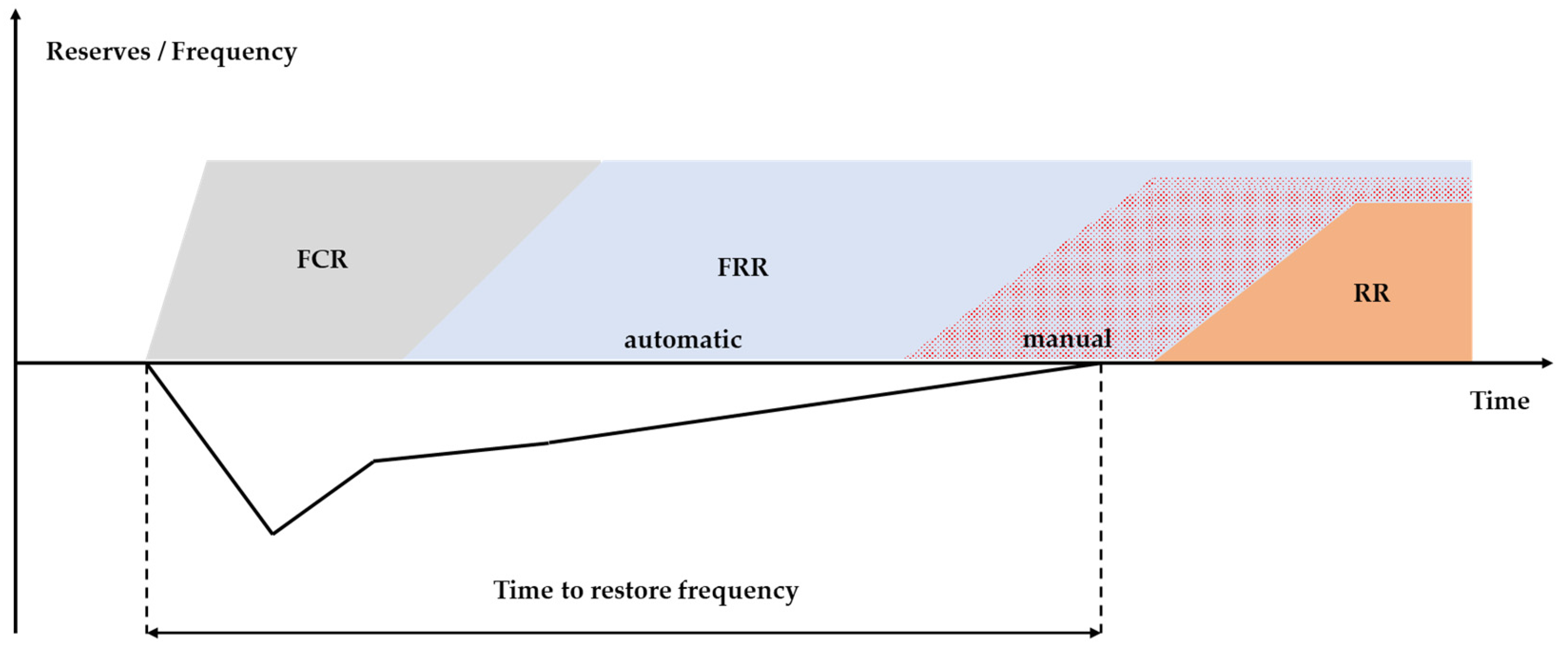

2. Balancing Processes and Timings

3. mFRR Platform Order Types

- Fully divisible/divisible/indivisible orders: For these types of orders, the same rules and clearing conditions apply as the respective set of fully divisible/divisible/indivisible orders that can be submitted in the LIBRA platform for the RR BE activation. The only difference is the validity period of the order, which is equal to one RTU (15 min), while in the LIBRA platform the submitted orders can be valid for four RTUs. Therefore, a one-shot 15 min clearing for mFRR BE activation is feasible and likewise presented in this paper, whereas for the RR BE activation, a forward-looking solution incorporating four 15 min intervals in necessary [23]. An analytical conceptual description of these order types can be found in [23].

- Exclusive in volume orders: Similarly, for this order type, the same rules and clearing conditions apply as the respective set of exclusive in volume orders that can be submitted in the LIBRA platform for the RR BE activation. The analytical conceptual description of this order type is again presented in [23].

- Multi-part or parent–child order: This order type concerns the combination of an indivisible parent order (see grey area in Figure 3a,b) with a divisible (see blue area in Figure 3a) or indivisible (see blue area in Figure 3b) child order submitted for a specific RTU. These two orders may bear different quantities and prices. In addition, the child order can only be activated if the parent order is activated as well, not vice versa. To put it differently, the acceptance of a subsequent order can be made dependent on the acceptance of the preceding order. This parent–child linking could be useful for power generators in order to more accurately model the technical/operating constraints of their conventional (thermal or large hydro) generating units. It is worth referring that this type of order (multi-part) has a different meaning/definition from the respective multi-part orders submitted in the LIBRA platform for the RR BE activation, as referred in [23].

4. Conversion Process of BEOs for Control Areas Applying Central-Scheduling Scheme

5. Manual Frequency Restoration Reserve Balancing Energy (mFRR BE) Clearing Model

5.1. Mathematical Formulation

5.1.1. Objective Function

5.1.2. Order Clearing Constraints

5.1.3. Power Balance Constraints

5.1.4. Cross-Zonal Capacity Constraints

5.1.5. Tolerance Band Constraints

5.1.6. Interconnection Controllability Constraints

5.2. Solution Methodology

- Step 1: Conversion of the orders submitted in the central-scheduling control areas, by solving the optimization problem presented in Section 4. The converted mFRR BEOs are then inserted in the subsequent mFRR BE clearing process in Step 2.

- Step 2: Execution of the mFRR BE clearing process jointly for the control areas applying the self-scheduling and central-scheduling schemes, by solving the optimization problem described in Section 5.1, in order to acquire the clearing results (optimal cleared mFRR BE orders, BE clearing prices, CZCs covered by the cross-zonal BE exchanges).

- Step 3: Check for paradoxically accepted orders (PAOs): A check is carried out in order to remove PAOs from the order book. In case PAOs are identified, they are removed, and Step 2 is executed again with the remaining BE orders. In the case that no more PAOs are present, the iterative process is terminated.

6. Results

6.1. Case Setup

6.2. Test Results

6.3. Computational Issues

7. Conclusions

- (a)

- The incorporation of all BEO types and the analytical presentation of the mathematical equations of their clearing conditions;

- (b)

- The incorporation of both self-scheduling and central-scheduling systems in the same modeling framework; for the latter, a conversion process of the submitted BEOs is executed before the mFRR BE clearing process;

- (c)

- The modeling of the conversion process for the preparation of the BEOs, before entering the mFRR BE clearing process;

- (d)

- The modeling of interconnection controllability;

- (e)

- The inclusion of elastic and inelastic orders defined appropriately by the TSOs;

- (f)

- The consideration of the constraint concerning the tolerance band submitted by the participating TSOs.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| aFRR | automatic frequency restoration reserve |

| AGC | automatic generation control |

| AOF | activation optimization function |

| BE | balancing energy |

| BEO | balancing energy order |

| BRP | balance responsible party |

| BSE | balancing service entity |

| BSP | balance service provider |

| CMOL | common merit order list |

| CZC | cross-zonal capacity |

| DC | direct current |

| DP | delivery period |

| EBGL | Commission Regulation (EU) 2017/2195 of 23 November 2017 establishing a guideline on electricity balancing |

| ENTSO-E | European Network of Transmission System Operators for Electricity |

| FAT | full activation time |

| FCR | frequency containment reserve |

| IGCC | International Grid Control Cooperation |

| ISP | integrated scheduling process |

| LFC | load frequency control |

| LP | linear programming |

| mFRR | manual frequency restoration reserve |

| MAF | mid-term adequacy forecast |

| MAR | minimum acceptance ratio |

| MARI | Manually Activated Reserves Initiative |

| MCP | market clearing price |

| MILP | mixed integer linear programming |

| OCGT | open cycle gas turbine |

| PAO | paradoxically accepted order |

| PICASSO | Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation |

| RR | replacement reserve |

| RTU | real-time unit |

| SO | Commission Regulation (EU) 2017/1485 of 2 August 2017 establishing a guideline on electricity transmission system operation |

| TERRE | Trans European Replacement Reserves Exchange |

| TSO | transmission system operator |

Nomenclature

Sets and Indices

| Real-Time Units (RTUs) of mFRR BE clearing model horizon; | |

| Set of BSEs (only generating units from central-scheduling systems) submitting orders for the MARI platform | |

| Set of BEOs submitted by BSPs/BSEs, where | |

| Set of orders (inelastic and/or elastic) submitted by TSOs where are the respective subsets of upward and downward TSO orders | |

| Set of BEOs submitted by the BSPs of the self-scheduling markets, where are the respective subsets of upward and downward BEOs | |

| Set of BEOs submitted by BSPs of the central-scheduling markets per BSE, where are the respective subsets of upward and downward BEOs | |

| Set of control areas, where are the respective subsets of the control areas applying the self-scheduling scheme and the central-scheduling scheme respectively | |

| Set for the direction of BEOs submitted by the TSO and the BSPs (upward or downward) | |

| Set of transmission lines, where are the respective subsets of AC and DC transmission lines | |

| Set of the fully divisible BEOs submitted by BSPs | |

| Set of the divisible BEOs submitted by BSPs | |

| Set of the indivisible BEOs submitted by BSPs | |

| Set of the exclusive in volume fully divisible BEOs submitted by BSPs | |

| Set of the exclusive in volume divisible BEOs submitted by BSPs | |

| Set of the exclusive in volume indivisible BEOs submitted by BSPs | |

| Set of the multi-part divisible BEOs submitted by BSPs | |

| Set of the multi-part indivisible BEOs submitted by BSPs | |

| Set of the exclusive in volume groups |

Parameters

| Price of BEO or in direction dr in RTU t (€/MWh) | |

| Price of parent BEO or in direction dr in RTU t (€/MWh) | |

| Price of child BEO or in direction dr in RTU t (€/MWh) | |

| Price of BEO in direction dr in RTU t (€/MWh) | |

| Technical limit of type c (soak, des, min, max, AGCmin, AGCmax) of BSE bse in RTU t (MW). | |

| Quantity of BEO or in direction dr in RTU t (MW) | |

| Quantity of parent BEO or in direction dr in RTU t (MW) | |

| Quantity of child BEO or in direction dr in RTU t (MW) | |

| Quantity of BEO in direction dr in RTU t (€/MWh) | |

| Minimum Acceptance Ratio of BEO or in direction dr in RTU t (p.u.), where | |

| Minimum Acceptance Ratio of parent BEO in direction dr in RTU t (p.u.) | |

| Minimum Acceptance Ratio of child BEO in direction dr in RTU t (p.u.) | |

| Parameter indicating that DC transmission line l begins/ends from/to control area ca, if equal to 1; otherwise it is equal to 0 | |

| Commitment (binary) result taken from the solution of ISP; equal to 1 if BSE bse is in operating state n (syn, soak, disp, des) during RTU t. | |

| Award of BSE bse in RTU t for reserve type r (, , , ), taken from the solution of ISP (MW) | |

| Market schedule of BSE bse in RTU t (MW) | |

| Ramp rate (up/down) of BSE bse (MW/min) | |

| RR activation by the TERRE platform of BSE bse in direction dr in RTU t (MW) | |

| Manual RR activation by the TSO (in central-scheduling markets) of BSE bse in RTU t (MW) | |

| Initial power output of BSE bse in the mFRR Quantity Maximization Process [MW]. | |

| Penalty (non-physical) price for BSE’s bse operating constraint violations during RTU t [€/MWh]. | |

| Loss factor of DC transmission line l (%) | |

| Available CZC of transmission line l in RTU t (MW) in both directions (+ corresponds to the CZC from control area ca to control area ca’ and − corresponds to the CZC from control area ca’ to control area ca) | |

| Tolerance band of BEO in direction dr in RTU t (MW) | |

| Intended flow of transmission line l in RTU t (MW) submitted by TSOs for controllability reasons (+ corresponds to the flow from control area ca to control area ca’ and—corresponds to the flow from control area ca’ to control area ca) |

Variables

| mFRR BEO of BSE bse in direction dr and RTU t, to be maximized during the mFRR Quantity Maximization Process [MW]. | |

| Deficit / surplus of BSE bse in RTU t, denoting the mFRR BE to be manually activated by the TSOs [MW]. | |

| Acceptance ratio of BEO or submitted by BSPs in direction dr and in RTU t | |

| Acceptance ratio of parent BEO or submitted by BSPs in direction dr and in RTU t | |

| Acceptance ratio of child BEO or submitted by BSPs in direction dr and in RTU t | |

| Acceptance ratio of BEO submitted by the TSO in direction dr and in RTU t | |

| Binary variable indicating if BEO is activated in direction dr in RTU t | |

| Binary variable indicating if parent BEO is activated in direction dr in RTU t | |

| Binary variable indicating if child BEO is activated in direction dr in RTU t | |

| Binary variable indicating if BEO or is activated in direction dr where | |

| BE exchange in transmission line l in RTU t (MW) | |

| Positive variables used in the power flow variable decomposition schema for DC transmission line l in RTU t (MW) (+ corresponds to the flow from control area ca to control area ca’ and—corresponds to the flow from control area ca’ to control area ca) | |

| Cleared quantity of BEO in direction dr in RTU t (MW) | |

| Cleared tolerance band of BEO in direction dr in RTU t (MW) |

References

- ENTSO-E. Balancing Report 2020. Available online: https://bit.ly/36oR8Nb (accessed on 10 July 2021).

- ENTSO-E. Commission Regulation (EU) 2017/1485 of 2 August 2017 Establishing a Guideline on Electricity Transmission System Operation. Available online: https://bit.ly/3xyYPMq (accessed on 10 July 2021).

- ENTSO-E. Commission Regulation (EU) 2017/2195 of 23 November 2017 Establishing a Guideline on Electricity Balancing. Available online: https://bit.ly/3563hDD (accessed on 10 July 2021).

- ENTSO-E. Frequency Containment Reserves. Available online: https://bit.ly/36c8j2L (accessed on 10 July 2021).

- ENTSO-E. Imbalance Netting. Available online: https://bit.ly/2u5jmMZ (accessed on 10 July 2021).

- ENTSO-E. PICASSO Project. Available online: https://bit.ly/2F7I7KA (accessed on 10 July 2021).

- ENTSO-E. Manually Activated Reserves Initiative. Available online: https://bit.ly/3562UJf (accessed on 10 July 2021).

- ENTSO-E. Explanatory Document to the Proposal of all Transmission System Operators for the Implementation Framework for a European Platform for the Exchange of Balancing Energy from Frequency Restoration Reserves with Manual Activation. Available online: https://bit.ly/3hudeUI (accessed on 10 July 2021).

- Svenska Kraftnat; Energinet; Fingrid; Statnett. Nordic Balancing Model. Available online: https://bit.ly/2VsV25n (accessed on 10 July 2021).

- APG. Joint Use of mFRR in Germany and Austria. Available online: https://bit.ly/3hvalCW (accessed on 10 July 2021).

- ENTSO-E. TERRE Project. Available online: https://bit.ly/2QvOKM9 (accessed on 10 July 2021).

- ENTSO-E. Explanatory Document to the Proposal of all Transmission System Operators Performing the Reserve Replacement for the Implementation Framework for the Exchange of Balancing Energy from Replacement Reserves. Available online: https://bit.ly/357gImv (accessed on 10 July 2021).

- ELEXON. Project MARI. Available online: https://bit.ly/3k9A5a1 (accessed on 10 July 2021).

- Bellenbaum, J.; Weber, C.; Doorman, G.; Farahmand, H. Balancing market integration—Model-Based analysis of potential cross-border reserve exchange between Norway and Germany. In Proceedings of the 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; pp. 1–5. [Google Scholar]

- Gebrekiros, Y.; Doorman, G. Balancing energy market integration in Northern Europe—Modeling and case study. In Proceedings of the IEEE Power and Energy Society General Meeting, National Harbor, MD, USA, 27–31 July 2014. [Google Scholar]

- Haberg, M. Optimal Activation and Congestion Management in the European Balancing Energy Market. Ph.D. Thesis, Norwegian University of Science and Technology, Trondheim, Norway, November 2019. [Google Scholar]

- Farahmand, H.; Doorman, G. Balancing market integration in the Northern European continent. Appl. Energy 2012, 96, 316–326. [Google Scholar] [CrossRef]

- Zani, A.; Rossi, S.; Migliavacca, G.; Auer, H. Toward the integration of balancing markets. In Proceedings of the 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar]

- N-SIDE. MARI Algorithm Design Principles. Available online: https://bit.ly/3hvbPx5 (accessed on 10 July 2021).

- Energy Community. Final Report: Models of Regional Cooperation for Balancing Energy—Exchange of Balancing Energy. Available online: https://www.energy-community.org (accessed on 10 July 2021).

- ACER. Decision on the Implementation Framework for A European Platform for the Exchange of Balancing Energy from Frequency Restoration Reserves with Manual Activation. Available online: https://bit.ly/2TPM5Tk (accessed on 10 July 2021).

- ENTSO-E. Proposal of all Transmission System Operators for the Implementation Framework for the Exchange of Balancing Energy from Frequency Restoration Reserves with Automatic Activation. Available online: https://bit.ly/2TYh3bR (accessed on 10 July 2021).

- Roumkos, C.; Biskas, P.; Marneris, I. Modeling Framework Simulating the TERRE Activation Optimization Function. Energies 2020, 13, 2966. [Google Scholar] [CrossRef]

- Fedele, A.; Benedettto, G.D.; Pascucci, A.; Pecoraro, G.; Allella, F.; Carlini, E.M. European electricity market integration: The exchange of manual frequency restoration reserves among Terna and the other TSOs. In Proceedings of the AEIT International Annual Conference (AEIT), Catania, Italy, 23–25 September 2020; pp. 1–5. [Google Scholar]

- Marneris, I.G.; Roumkos, C.; Biskas, P. Towards balancing market integration: Conversion process for balancing energy offers of central-dispatch systems. IEEE Trans. Power Syst. 2019, 35, 293–303. [Google Scholar] [CrossRef]

- Marneris, I.G.; Biskas, P.N. Integrated scheduling model for central dispatch systems in Europe. In Proceedings of the IEEE PowerTech Conference, Eindhoven, The Netherlands, 29 June–2 July 2015; pp. 1–6. [Google Scholar]

- ENTSO-E. Transparency Platform. Available online: https://bit.ly/3bRsupu (accessed on 10 July 2021).

- ENTSO-E. Mid-Term Adequacy Forecast 2020. Available online: https://bit.ly/3ksIrcE (accessed on 10 July 2021).

- ResearchGate. MARIdataset. Available online: https://bit.ly/3i23AZG (accessed on 25 July 2021).

- General Algebraic Modeling System. Available online: http://www.gams.com (accessed on 10 July 2021).

| Ref. | Central-/Self-Scheduling Scheme | Perform Orders’ Conversion Process | Type of Orders Modeled | Handling of Paradoxically Accepted Orders | Modeling Tolerance Band | Modeling of Interconnection Controllability |

|---|---|---|---|---|---|---|

| [14] | not specified | no | not specified | no | no | no |

| [15] | not specified | no | not specified | no | no | no |

| [16] | not specified | no | not specified | no | no | no |

| [17] | not specified | no | not specified | no | no | no |

| [18] | not specified | no | only fully divisible | no | no | no |

| [19] | not specified | no | all | no | no | no |

| [20] | not specified | no | only fully divisible | no | no | no |

| This paper | both | yes | all | yes | yes | yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Roumkos, C.; Biskas, P.N.; Marneris, I. Manual Frequency Restoration Reserve Activation Clearing Model. Energies 2021, 14, 5793. https://doi.org/10.3390/en14185793

Roumkos C, Biskas PN, Marneris I. Manual Frequency Restoration Reserve Activation Clearing Model. Energies. 2021; 14(18):5793. https://doi.org/10.3390/en14185793

Chicago/Turabian StyleRoumkos, Christos, Pandelis N. Biskas, and Ilias Marneris. 2021. "Manual Frequency Restoration Reserve Activation Clearing Model" Energies 14, no. 18: 5793. https://doi.org/10.3390/en14185793

APA StyleRoumkos, C., Biskas, P. N., & Marneris, I. (2021). Manual Frequency Restoration Reserve Activation Clearing Model. Energies, 14(18), 5793. https://doi.org/10.3390/en14185793