1. Introduction

There are doubts if today’s liberalized electricity markets (e.g., in the US, EU and UK) are able to provide investment incentives for sufficient capacity to guarantee resource adequacy (Resource adequacy denotes a system’s ability to satisfy demand at all times, while security of supply describes the ability to balance sudden changes in demand [

1], p. 7 even though there still might be overcapacity. Resource adequacy can, therefore, be defined as long-term security of supply), e.g., [

2,

3,

4,

5].

These doubts intensified by decreasing spot prices induced by subsidized renewable energy sources (RES), since lower spot prices decrease the return on investment that power plant operators assumed when the investment was made (The connection between increasing use of RES and decreasing spot prices is known as the merit order effect of renewable energy [

6,

7,

8,

9,

10]).

There is an ongoing discussion about the necessity of different capacity mechanisms to tackle this problem, e.g., [

11,

12,

13,

14,

15]. In addition to the traditional system of a liberalized electricity market, which mainly consists of an electricity market where generated electricity is traded (energy-only markets), a capacity mechanism shall provide resource adequacy by a payment for provided capacity, thus, eventually creating a stable environment for investment. Capacity auctions with reliability options (ROs) are discussed as one promising possibility [

3,

16,

17,

18].

In this system, electricity consumers buy ROs from power plant operators offered in an auction (The regulator who may be represented by the transmission system operator or another group or institution may buy ROs on behalf of all electricity consumers instead of every single consumer to take part in the auction. If so, consumers buy ROs indirectly).

ROs act like a call option for the buyer against high electricity prices. Power plant operators offer ROs based on their expectations about future revenues from generated electricity [

19]; see also

Section 2 for details. The first authors who described this type of capacity markets were Vázquez et al. [

19], Pérez-Arriaga [

20].

This market design was extended by Cramton and Ockenfels [

21] suggesting a uniform-price auction of ROs. Uniform pricing may result in capacity payments above the placed bids for a certain type of power plants. Thus, operators of such power plants receive a higher payment than necessary leading to an additional profit. This is a desired effect because it increases investments in this type of power plants. Higher investments result in a capacity increase of this “superior” type. This, in the next step, reduces the cost advantage until it finally vanishes.

In a stable environment, a situation without cost advantages for any power plant will appear in the long-run. Then, the capacity market is in its equilibrium and the mix of different types of power plants is in its optimum meaning that total costs for electricity generation are minimized (see Schäfer and Altvater [

22] for a detailed and formal description of the equilibrium). The described market behavior is comparable to the equilibrium at the spot market.

However, most of today’s electricity markets are transitioning towards high shares of renewable energy. In this situation the described general capacity auction might not be an adequate tool because it faces two problems. First, incomplete internalization of emission costs prevents a general capacity auction to reach the described equilibrium with an optimal mix of power plants. The reason is the disparate effect of applied policy instruments on electricity prices although they all aim at emission reduction.

Carbon taxes and the emission trading system (ETS), on the one hand, price CO emissions. This leads to an internalization of emission costs. The generation costs of electricity change as a function of CO emissions. As a consequence, emission-intensive power plants require a higher price at the spot market to generate electricity. They are, thus, used less often, which changes the merit order.

On the other hand, renewable-based electricity generation, despite substantial cost reductions and partial internalization of emission costs, still highly depends on subsidies (see penultimate paragraph of

Section 3.2.2 and [

23,

24]). These subsidies are usually charged to electricity consumers or tax payers. Thus, in contrast to an ETS or a carbon tax, subsidies do not lead to an emission-based increase of electricity prices at the energy-only market.

There is no internalization of emission costs induced by subsidized RES although they contribute to the desired emission reduction, too. Electricity prices, thus, indicate an emission intensity of generated electricity which is higher than the true emission intensity under consideration of subsidized RES (There is, of course, an indirect effect of subsidized RES on prices at the energy-only market, which is known as the merit order effect of RES; however, subsidies do not increase generation costs for emission-intensive power plants).

This results in a cost advantage for emission-intensive power plants, which directly affects the outcome of a capacity auction because offers of power plant operators are based on their expectations about future revenues for generated electricity. Thus, the capacity auction will guide investments to power plants with a too-high emission intensity. This slows down the transition process. The slowdown is enhanced by the fact that already existing power plants have a comparative advantage when compared to new investments [

22].

The second problem of a general capacity auction is insufficient acceptance among electricity consumers. As explained above, cost advantages play an important role to direct the capacity mix to its long-run optimum. However, many of today’s electricity markets will not reach this long-run optimum with vanishing cost advantages for years or even decades because there is a transition to a RES-based electricity generation. Thus, cost advantages for several power plants will persist for years as long as the transition period to a RES-based electricity generation lasts.

This means windfall profits for their operators (According to Rutherford [

25] a windfall profit is defined as an unexpected profit arising from a circumstance not controlled by a firm or an individual. These profits constitute transitory income and can give rise to unusual consumer behavior. The introduction of a capacity market generates windfall profits for already existing power plants during the transition phase).

Windfall profits create inefficiencies by a distorted market outcome and reduce the acceptance of a policy instrument (see, e.g., the debate about windfall profits created after the introduction of the EU ETS [

26]). In particular, emission-intensive power plants will realize windfall profits because they face cost advantages as a result of missing internalization of subsidies for RES (see the first problem described above).

In Germany, for instance, consumers might accept costs stemming from capacity payments to allow a transition to less emission-intensive electricity generation, but there is no acceptance for payments to dirty power plants [

27] (While windfall profits should always be avoided, the acceptance of payments for emission-intensive power plants may be different from country to country [

28]) Windfall profits for power plant operators compromise political feasibility since consumers request burden-sharing.

Considering these problems, Matthes et al. [

27] suggested a capacity auction that targets certain types of technology. In contrast to a

general capacity auction, this

focused capacity auction formulates critical values for emission factors, flexibility requirements and annual utilization times of power plants. Only clean and flexible power plants with a low annual utilization (e.g., specific gas or biomass power plants) are eligible for capacity payments.

Even though such exogenous limits deal with the discussed two problems of a

general capacity auction, they create other difficulties. First, these limits are direct market interventions which prevent the long-run equilibrium with lowest cost to realize. Second, lobbying may lead to additional inefficiencies [

29] as there are groups with conflicting interests, and the regulator has only incomplete information. For example, manufacturers of efficient power plants are interested in strict emission limits while manufacturers of coal power plants prefer a higher emission intensity. The regulator does not know the “right” value. The risk to produce an inefficient market outcome persists for the complete transition period because the values have to be adjusted repeatedly over time.

Seen in this context, we contribute to the literature on capacity mechanisms by introducing endogenously discriminated prices to the general capacity auction. This mechanism treats the acceptance and the internalization problem, while it avoids the described shortcomings of a focused capacity auction. We abstain from engaging in the discussion on whether the introduction of a capacity mechanism is necessary in the first place.

Although RES are still broadly subsidized, we assume that RES will dominate electricity generation in the future to achieve long-run objectives for emission reduction [

30,

31]. In fact, the levelized costs of electricity generation (LCOE) from RES are already in the range of new fossil-based power plants [

24]. Consequently, we develop a capacity auction that enhances the adjustment of residual fossil capacity to intermittent renewable electricity generation, which is currently still subsidized and, thus, exogenously given from a market point of view.

The suggested mechanism is relevant for all electricity markets with the following properties. First, there is a liberalized electricity market. Second, a capacity market with ROs is discussed as a possible guarantee for resource adequacy or has been introduced already. Third, an increasing share of electricity is generated from RES. Fourth, RES-based electricity generation is still subsidized and subsidies are not internalized (e.g., paid by electricity consumers or tax payers). The progressive loss of relevance of subsidies due to decreasing LCOE from RES does not affect our mechanism since discriminated prices endogenously adapt. These four properties apply to most electricity markets in Europe, the USA and parts of South America.

The next section briefly describes the

general capacity auction developed by Vázquez et al. [

19], Pérez-Arriaga [

20] and extended by Cramton and Ockenfels [

21] as the basis for our model. In

Section 3, we describe our model, which allows to account for subsidized renewable energy in a capacity auction. The result is a capacity auction with endogenously discriminated prices that converge to a single price in the long-run when full internalization of emissions from electricity generation is achieved and subsidies for RES become obsolete.

An exemplary calculation to illustrate our model is made for Germany. Endogenously adjusting prices save further market interventions. Discriminated prices treat both the internalization problem and the acceptance problem. The functioning of this capacity market is schematically illustrated in

Section 4 and implications are briefly discussed in

Section 5. The last section concludes the paper.

2. General Capacity Auction Design

This paper is based on a capacity auction with so-called ROs. In this system, the target capacity needs to be evaluated as a first step. The target capacity is the capacity that limits unsatisfied electricity demand to a certain tolerable extent. The tolerable extent can be, for example, determined by an average system interruption of ten minutes per year and consumer or a similar value. The target capacity is the basis of the capacity auction.

In these auctions ROs are offered by (future) power plant operators. The ROs act like a call option for the buyer during a predefined time period. In the contracted time period, the buyer acquires the right to be delivered with the contracted amount of electricity for a certain strike price, which is also defined and published before the auction.

In practice, this means that, for spot market prices above the strike price, the seller of the RO has to pay the difference between the spot market price and the strike price to the holder of the RO. Power plant operators can offset the payment by selling electricity at the spot market during periods with prices above the strike price. Consequently necessary incentives to actually deliver contracted electricity are provided. Since the call option ensures reliability of electricity generation in times of scarcity, it is called RO.

A rational power plant operator who wants to take part in the capacity auction calculates the bid in several steps. First, they estimate the expected amount that has to be paid to the future buyer due to ROs when the spot price exceeds the strike price. This payment in periods of spot prices above the predefined strike price is called peak energy rent (PER). The PER per capacity unit determines the minimum bid for the capacity auction because it simply means a temporal redistribution of money. The capacity market transforms the volatile PER into a continuous capacity payment.

In a second step, the power plant operator calculates the expected revenue from the electricity market. The main part of this revenue will consist of revenues from the energy-only market while balancing energy may also contribute. In a third step, the operator evaluates if expected revenues at the electricity market are sufficient to cover all costs (including an appropriate profit). If this is the case, they can simply place the minimum bid amounting to the PER per capacity unit. Otherwise the bid is increased until cost coverage is achieved reducing, however, the chance of a successful bid.

All power plant operators who take part in the capacity auction place bids offering a certain quantity of ROs for a certain price (sealed bid reverse auction: In a reverse auction, the roles of buyer and seller are reversed. Several sellers place bids, while there is only one buyer. In a sealed bid auction bidders only place one bid and do not know the other participants’ bids [

32]). Bids are sorted from the lowest price to the highest until the target capacity determining the number of necessary ROs is reached. This assures that the target capacity is met with lowest costs. The first authors who designed such a

general capacity auction were Pérez-Arriaga [

20] and Vázquez et al. [

19]. Cramton and Ockenfels [

21] suggested the use of uniform pricing in the capacity auction leading to an equilibrium with an optimal capacity mix (see Schäfer and Altvater [

22] for a formal and detailed description of the equilibrium).

Strategic bidding behavior may distort the path to the equilibrium. For example, operators with several already existing power plants have an incentive to withhold capacity of some power plants in order to increase the clearing price for all other power plants they own. The same effect would occur if they placed an inflated bid for some of their power plants. Since only the bidder knows if they bid truthfully or place an inflated bid, the regulator is confronted with asymmetric information. The type of bidder is private information. Thus, the solution of the capacity auction is the solution of an adverse selection problem [

33].

In response to that problem, Cramton and Ockenfels [

21] and Cramton et al. [

34] suggested that the already existing capacity is obliged to participate in the capacity auction with a bid of zero or to leave the market permanently. This idea works as long as there are new power plants necessary to meet the target capacity. Then, new power plants set the clearing price, while existing power plants cannot interfere. A problem will occur if the existing power plants are sufficient to meet the target capacity as, in this case, operators would not receive any payment while they still have to pay the difference between the spot market price and the strike price in times when the strike price is exceeded.

This would apply all over Europe, for example in Germany, Spain, the Netherlands, Portugal or Italy and also in China where we find a temporary excess of generation capacity [

35]. Thus, Schäfer and Altvater [

22] suggested that operators of already existing power plants should be allowed to bid a minimum bid amounting to their expectation about the PER per capacity unit. Since the minimum bid is equal for all operators, it can be calculated and published by the auctioneer.

A capacity auction with a clearing price above the minimum bid incentivizes generators to pretend higher capacities than available. Then, operators receive more money than what they have to pay during periods with spot prices above the strike price, although they do not deliver any capacity. The payment obligation of the ROs, which works like an implicit penalty, is not sufficient to offset this incentive. A solution for this problem is the introduction of an explicit penalty that operators have to pay in addition to when they do not deliver electricity although the spot price is above the strike price. Schäfer and Altvater [

22] develop a mechanism, which allows to set an optimal penalty on the basis of available data.

In the following, we take the described

general capacity auction designed by Vázquez et al. [

19], Cramton and Ockenfels [

21] and Cramton et al. [

34] with the extensions of Schäfer and Altvater [

22] as a basis for necessary adjustments to account for subsidized renewable energy. First, we discuss the internalization of external costs (

Section 3.1). Based on this theoretical background, we derive a model to consider subsidies for renewable energy in capacity auctions (

Section 3.2). This allows us to derive a price markup that is to be used in our modified capacity auction (

Section 3.3).

3. Modeling the Internalization of External Costs

For several decades, it has been a well-known fact that CO

emissions are the driving force for anthropogenic climate change [

36]. Climate change and, thus, CO

emissions cause huge costs (see Stern [

37] as a popular example). As long as there is no regulation to charge emissions, these costs are paid by the general public. They are external costs. Thus, carbon pricing is widely seen as the key instrument to combat climate change [

38]. This pricing system makes polluters pay for their CO

emissions. It internalizes formerly external emission costs.

3.1. Theoretical Background on External Costs

In an ETS, every emitted unit of CO

requires a respective certificate. The total number of certificates is limited and determines the amount of emissions that is allowed. Thus, certificates become a scarce good resulting in a positive certificate price. A carbon tax is also a market-based policy instrument but it works the other way round [

39]. It directly prices emissions, while the residual amount of emissions is the resulting variable.

The introduction of a carbon price incentivizes emission abatement because abatement costs are now confronted with potential tax savings or profits from the ETS. If an emitter has the choice to either pay, e.g., 1000 USD for a measure to reduce emissions or to pay 1200 USD for allowances/taxes instead, they will reduce emissions. If the carbon price is below 1000 USD, they will not adopt the measure.

A rational emitter will always reduce emissions if costs for CO abatement are lower than the equivalent value of certificates in case of the ETS or potential tax savings in case of a carbon tax. In an optimal system, a carbon tax and certificate price correspond to abatement costs of the last marginal emission unit (The certificate price or the carbon tax may include other factors, like speculation, in reality). Therefore, the certificate price and carbon tax rate can be regarded as being approximately equal to marginal abatement cost (MAC).

Standard environmental economics assumes increasing MAC with increasing emission savings [

40]. This is a plausible assumption because a progressive decrease of emissions requires a sequential introduction of more and more expensive measures, e.g., [

41,

42,

43]: Considering electricity generation, emission reduction may be achieved by rather cheap efficiency gains in the use of fossil fuels at the beginning.

Any additional increase in efficiency will be more and more difficult and, thus, increasingly costly. Then, a transition to less carbon intensive fuels may be necessary causing again higher costs than the previous mitigation measure. Eventually, RES will replace fossil fuels. Due to the vast potential of renewables, they can be regarded as the last necessary mitigation measure with the highest MAC in electricity generation.

Carbon pricing affects prices for generated electricity. The introduction of an ETS or a carbon tax means higher costs for emission-intensive power plants when compared to clean power plants [

44]. This changes the merit order. Emission-intensive power plants will be used less, and their revenues from generated electricity will decrease. This will also change the bidding behavior in a capacity market. Lower revenues from the energy-only market can only be compensated by higher bids in the capacity auction. However, this decreases the chance to succeed in the auction. A high carbon price means advantages for clean power plants and, thus, more investments in this technology.

The internalization of emission costs via carbon pricing does not take place at once but gradually [

45]. There are, for instance, different trading periods for the ETS with a decreasing number of certificates from one trading period to the next [

23]. Higher emission savings cause higher MAC eventually leading to an increasing carbon price. A carbon tax also increases over time to promote higher emission reductions [

46].

According to these considerations, RES which face comparatively high MAC will enter the market as soon as the carbon price reaches the MAC level of renewables. Until now, this level has not been reached in most countries because RES-based power plants have to compete with already running old fossil-based power plants. Thus, renewable-based electricity generation, despite substantial cost reductions, still depends on subsidies [

23].

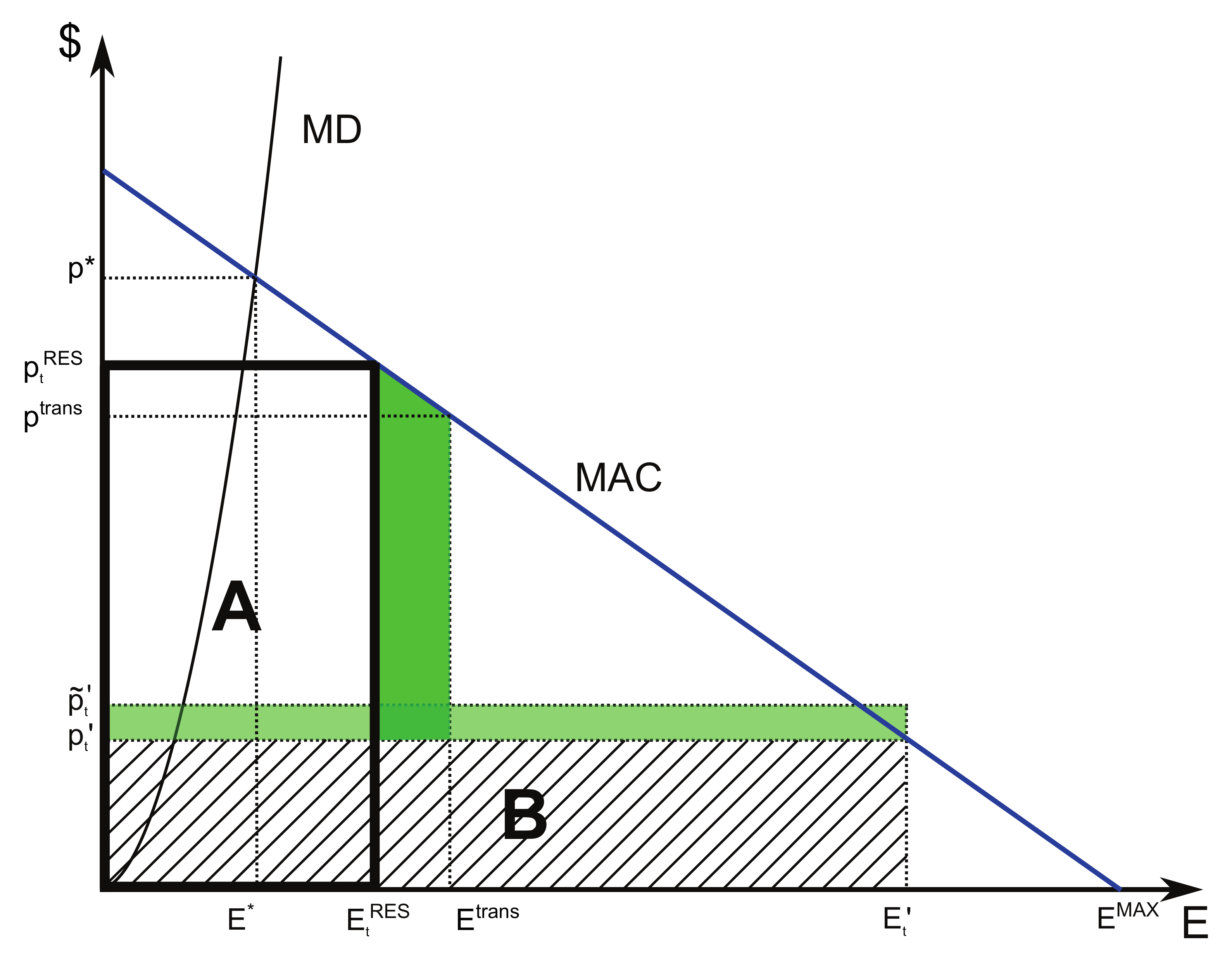

Figure 1 illustrates the considerations above. The schematic diagram depicts CO

emissions with a linearly increasing MAC curve for decreasing emission levels. This reflects an increasing mitigation effort.

corresponds to the emission level in the absence of any emission regulation like carbon pricing. Consequently MAC(

), which is equal to the tax rate, respectively, the certificate price is zero.

Assuming a perfect carbon tax,

in

Figure 1 corresponds to a possible tax rate with

as the resulting emission level. In a perfect ETS, the quantity of emissions is controlled, such that

reflects the emissions cap and

is the resulting certificate price. The area below the MAC-curve corresponds to the abatement costs

.

Thus, the integral with respect to MAC from to equals abatement costs , which are necessary to reduce emissions from to . The integral from zero to equals future abatement costs , which would be necessary to mitigate all remaining emissions. The crosshatched area B corresponds to the tax revenue or the ETS costs. It is the part of abatement costs, which are internalized because of the carbon price . We define this as internalized costs . In contrast, the rest of future abatement costs are still external costs.

For our further analysis, we will use the ratio of internalized costs on future abatement costs and define it as the degree of internalization

The degree of internalization is also used as a concept to describe the progress of internalization in the transportation sector [

47,

48]. According to Equation (

1), a high degree of internalization, e.g., 0.8, indicates that 80% of costs stemming form CO

emissions are already internalized. A low degree of internalization, e.g., 0.2, means that 20% of emission costs are internalized, whereas 80% are still not covered by the polluter but paid by the general public.

In

Appendix A, we show that, for linearly increasing MAC as depicted in

Figure 1, any increase in the degree of internalization means an increasing carbon price. We further prove that this relation holds for any MAC approximated by an increasing power function fulfilling

with

E as emission level (see

Figure 1) and

d and

n as parameters. While

corresponds to the linear case depicted in

Figure 1, MAC has a concave shape for

and a convex shape for

. Equation (

2) offers a broad variety of shapes to describe MAC. Since an increasing degree of internalization is always linked to an increasing carbon price for this group of functions, we use the carbon price as indicator for the degree of internalization in the following analysis.

Coming back to

Figure 1,

t indicates the time dependency since certificate price/tax rate and respective emission levels vary over time. Every increase of the carbon price leads to an additional reduction of CO

(this is a schematic simplification since the real MAC-curve is more likely a step function [

43]). The negative externalities associated with CO

emissions are illustrated by the marginal damage curve (MD).

The intersection of MAC and MD results in

characterizing the optimal long-run emission level with the resulting price

. This value is easily identified in theory, but it is an assumption in reality and eventually a political objective. The long-run objective of the EU, for instance, claims 80–95% CO

mitigation until 2050 when compared to 1990 levels [

49]. The EU ETS, which was introduced in 2005, is the main instrument to achieve this goal [

50].

The transition price

corresponds to the MAC level from which on renewable energy becomes the cheapest mitigation measure. It indicates the transition to a RES-based electricity generation.

is the resulting emission level. There are good reasons why renewable energy may face less increasing or even decreasing MAC. Moreover, MAC are not static but, for example, depend on the use of RES as learning effects have an impact on MAC, see e.g., [

51,

52].

Since these effects are not decisive for our purpose, we assume linearly increasing and static MAC of identical slope for all CO

reduction measures. If, as depicted in

Figure 1, there is a gap between

and the present carbon price

, carbon pricing is not sufficient to incentivize renewable-based electricity generation. This is still the case in many countries (e.g., most EU Member States, USA).

3.2. The Effect of Subsidies for RES

Subsidies for RES bridge the gap between the carbon price and MAC induced by emission abatement from RES-based electricity generation. Referring to

Figure 1, this corresponds to the gap between

and

. However, in reality, different renewable energy technologies exist that also differ in their cost structure. Thus, we regard

as an average of these prices in the following.

In this paper, we focus on how to design a capacity market to receive the best answer to the simultaneous subsidization of RES. Of course, the capacity market cannot correct potential shortcomings of the support scheme for RES (e.g., a too-high remuneration resulting in too-fast capacity increases of RES). They are propagated to the energy-only market and, thus, to the capacity market as bids are based on expectations about prices at the energy-only market.

Nevertheless, the discussion about an efficient support scheme see, e.g., [

53,

54,

55] is beyond the scope of this paper. We assume a perfect support scheme for RES and static MAC. Today’s subsidies for RES are seen as shifting investments (which would have been undertaken under a higher carbon price in the future anyway) to an early stage. Thus, subsidies for RES correspond to abatement costs, which also would have been paid in the future without a support scheme for RES as soon as the carbon price reached a correspondingly high level.

3.2.1. Impact of Subsidized RES on Internalization

Despite the assumed perfect support scheme for RES, there is a decisive difference with respect to the capacity market outcome when a scenario with subsidies for RES is compared to a scenario without such subsidies. Without subsidies, RES enter the market when the carbon price reaches a certain level (

in

Figure 1).

This comparatively high carbon price reflects a respectively high degree of internalization. In contrast, this does not necessarily apply to a scenario with subsidies for RES. Subsidies are usually financed by taxes or levies, but they are not charged to polluters according to their emission intensity. Thus, subsidies for RES do not lead to an internalization of emission costs among power plant operators. This affects prices on the electricity market and thus the outcome of the capacity auction.

The following thought experiment illustrates the consequences of the considerations above. Let us assume two scenarios. First, we assume that a model economy sets a carbon price which reduces CO emissions by 20 percent. Second, the same model economy sets a lower carbon price, which cuts emissions only by 10 percent, while another 10 percent of CO is mitigated by subsidies for RES. In both scenarios, there is an emission reduction of 20 percent.

However, the carbon price in the first scenario is higher than in the second scenario. The consequence is that emission-intensive power plants have an advantage in the second scenario when compared to the first. Since bids in the capacity auction depend on expected profits at the electricity market, this result propagates to the capacity market. Thus, in the scenario with subsidies for RES, a usual capacity market directs investments to more emission-intensive power plants.

There are several possibilities to tackle this problem. First, the problem will vanish if there is no support scheme for RES. However, this trivial solution is not expedient because it would eliminate the advantages of supported RES, such as the exploitation of learning effects, see e.g., [

51,

52]. Second, the described problem will disappear if costs for the support scheme are charged to the polluters according to their emission intensity leading to higher spot market prices.

This is, without a doubt, the economically efficient solution. However, it is not without reason that the support schemes for RES are usually financed by taxes or levies. Apart from possible implementation difficulties this approach faces a high risk of failure due to a lack of political feasibility. Every increase of the carbon price and hence the spot price entails the risk of competitive disadvantages because of carbon leakage [

56,

57].

Moreover, higher carbon prices decrease the profit for emission-intensive power plants which is, on the one hand, a desired effect. On the other hand, it increases the risk of sunk investments consumers will pay for eventually. Indeed, there are often very controversial debates about the carbon price so that the introduction of efficient measures is eventually abandoned [

58,

59,

60].

While the described lack of political feasibility prevents a correction of low internalization degrees at spot markets, conditions are different for capacity markets. Instead of cutting profits for existing power plants, a capacity market in the first place uses payments as incentive to direct investments to an efficient equilibrium (Nevertheless, an additional profit only occurs if new capacity is necessary to satisfy demand while otherwise the payment equals expenses from reliability options [

22]).

Among power plant operators, opposition against capacity markets is, thus, lower than against a higher carbon price. However, it is necessary to correct the distorted degree of internalization on the level of the capacity market to direct investments to the true equilibrium. This is not only a question of efficiency but also of political feasibility because electricity consumers who have to pay for capacity markets’ incentives will not accept to pay for a support of emission-intensive power plants. This calls for a well-balanced capacity mechanism.

In the next section, we present a mechanism how to correct the distorted degree of internalization on the level of a capacity market. The result is an emission-dependent capacity price. In

Section 4, we show how to use this mechanism to prevent generous payments to emission intensive power plants. This enhances the political feasibility.

3.2.2. Correcting the Distorted Degree of Internalization

In the following, we use

Figure 1 again for a little thought experiment. Let us assume our model economy from

Section 3.1 with a carbon price

and the respective emission level

additionally introduces subsidies for RES-based electricity generation. The support scheme of the economy may reduce emissions from

to

. Assuming an efficient promotion mechanism, paid subsidies

are equal to abatement costs

, which correspond to the integral of MAC from

to

.

In analogy to

Section 3.1, we can also calculate the internalized costs

as a product of

and the remaining emissions

(framed area A in

Figure 1). However, in this case, the internalized costs are nothing more but a theoretical value because these costs are not covered by the polluter. Only the part of area A that overlaps with the crosshatched area B is internalized due to the carbon price

. The additional subsidies for RES, in contrast, do not internalize any costs although they contribute to emission reductions.

Thus, the carbon price

does not reflect the true degree of internalization. The capacity mix is already less emission-intensive than the carbon price indicates. Considering the contribution of RES to emission reduction, the adjusted emission price

should be somewhere between

and

to reflect the true degree of internalization (This implies the assumption that the promotion of renewable energy does not violate the optimal mitigation path. Referring to

Figure 1, the abatement by renewables must not exceed

in this case [

61]).

There are different conceivable approaches to define such an adjusted emission price. We could stipulate that the adjusted emission price should reflect MAC, which would have occurred if emission reduction by renewables (

) would have been induced by emissions trading or a carbon tax instead, both leading to a higher carbon price. The result would be

(compare

Figure 1). The problem is that we know

but we do not know the course of MAC for higher emission abatement (lower emissions) in reality.

A second approach is to use the price difference caused by subsidies for renewables () as a markup for the emission price. The result would be . For linearly increasing MAC both approaches lead to the same result. However, can be zero or negative if MAC for renewables is constant or even decreasing. The adjusted emission price would be lowered in this case, although the degree of internalization increased. That would not make sense because the decrease in MAC after the market entry of RES requires a significant increase before (until ) is reached). Following approach 2 means neglecting this increase.

We suggest to use the gap between MAC assigned to renewables and the carbon price (

) together with a weighting factor to define the markup

. We choose the weighting factor in a first step as ratio between emissions abated by renewable energy (

) and emissions

, which define the gap between carbon pricing and emission reduction with RES. This yields

with

corresponding to subsidies (

) for RES in year

t. In fact subsidies

are a bit smaller than

if MAC are increasing with abatements (see

Figure 1). Therefore, the use of subsidies in Equation (

4) leads to a slight underestimation of

for increasing MAC. Assuming linearly increasing MAC Equation (

3) leads to the same result as approach one and two because, according to the intercept theorem, we find

in this case. The advantage of Equation (

4) when compared to the other two approaches is that the future course of MAC needs not to be known and that

is positive even in the case

is negative.

As we do not know

in reality we suggest to use the approximation

instead (Note that

also includes emissions, which are already mitigated by RES (

)), which can be calculated with easily available data (see

Section 3.3) and eventually results in a conservative estimate for

.

Including the preceding considerations, we define the markup as

Referring to

Figure 1, the product of

and

yields the light-shaded area between

,

and

, 0 which is as large as the dark-shaded one because both are equal to subsidies for RES

. The suggested mechanism regards subsidies for RES as internalized costs and transforms them into a respective markup.

3.3. Calculation of the Adjusted Emission Price

To calculate the price markup , it is necessary to find annual data on the one hand for subsidies of electricity generation from renewable energy sources () and on the other hand for emissions of fossil power plants and emissions, which are mitigated by the use of RES summing up to .

Annual subsidies for RES are well-known in reality. In countries that use a remuneration for renewables (fixed or via reverse auction) they are mainly the difference between the remuneration for renewables and the market value of generated electricity from the respective renewable energy source, denoted as difference costs.

Using difference costs as subsidies, we neglect the merit order effect of RES, which leads to a decrease of the respective market value resulting in higher difference costs. This inflates subsidies at least in the short run. Moreover, high profits for generators of renewable-based power plants may inflate subsidies. In this case, there is no efficient promotion scheme for RES; thus, subsidies do not reflect MAC, and it might be better to use another estimate for MAC.

The estimation of total annual emissions and emissions that are already mitigated by the use of renewable energy requires two steps. Annual emissions of all k fossil power plants () are well known in industrialized countries. They are published in the national inventory reports, which are, e.g., part of the reporting obligations of the EU ETS.

The identification of those emissions, mitigated by renewable energy, cannot be observed directly. Following Schäfer [

61], we can assume that renewable energy will substitute fossil power plants with average emission intensity in the long run. Since non-adjustable renewables (wind and solar) require some backup capacity or storage facility, reduced emissions may be less than the average emissions from fossil power plants.

This is indicated by the factor

, which equals one for adjustable power plants while it is lower than one for non-adjustable power plants. Memmler et al. [

62] suggest

for wind and solar power plants. The annual emission reduction by renewables can be calculated if the amount of individual annual electricity generation

of all

k fossil and all

renewable energy power plants is known.

Since the individual annual electricity generation is usually subject to taxation, information on the generated amount of electricity is available. This yields

with

n being the total number of power plants.

corresponds to generated electricity of power plant

i in year

t. Since fossil power plants are always adjustable in the sense that they do not depend on a fluctuating energy source like the wind or sun,

is only applied to renewable power plants. The fraction in Equation (

6) is the ratio between the total annual electricity generation and electricity, which is generated solely by fossil energy sources per year.

In the following, we will show two different ways to calculate the markup for Germany as an example. Icha and Kuhs [

63] reported total emissions from German electricity generation in 2018 amounting to 269 Mt. AGEB [

64] provided data about electricity generation for the same year, which allows calculation of the fraction from Equation (

6) to be 1.51. This yields, according to Equation (

6),

= 406.2 Mt. The total subsidies paid for RES-based electricity generation in Germany was € 25.6 B in 2018 [

65]. With these data, the markup is

= 63 €/t. In the same year the certificate price of the EU ETS was 15.29 €/t on average [

66]. This shows the potential for distortions in a capacity market if subsidies for RES are not considered.

However,

maybe overestimated due to inflated promotion costs. First, the merit order effect leads to lower spot prices which automatically increases the difference between paid remuneration and spot prices. Second, promotion costs may include high rents for generators. This for example applied for the solar-boom in Germany around the year 2010 [

67]. This effect still inflates subsidies for RES because remuneration is fixed for 20 years.

Thus, it might make sense to calculate the price markup using estimates for recent RES-based generation costs instead of paid subsidies. This yields an estimate for subsidies necessary to generate the same amount of electricity with today’s costs. In a first step, we can calculate difference costs for different renewable energy sources using levelized cost of electricity (LCOE) according to Kost et al. [

68] and the 2018 average market value for the different RES ranging between 3.18 €-cents/kWh for wind energy and 4.45 €-cents/kWh for biomass [

69].

This yields a difference in costs ranging between 0,81 and 5.05 €-cents/kWh for wind power plants, between −0.68 and 3,84 €-cents/kWh for solar power plants and between 5.69 and 10.29 €-cents/kWh for biomass. Negative difference cost indicate that subsidies are not necessary. This applies for good sites of solar power plants. The product of difference costs and generated electricity from subsidized RES [

65] and division by

= 406.2 Mt yields a price markup

ranging between 7.1 €/t and 27.5 €/t while wind, solar and biomass covered more than 95% of German electricity generation from subsidized RES in 2018. The significant price markup indicates that renewable-based electricity generation still highly depends on subsidies.

The integration of the price markup into the capacity auction requires its transformation into a measure per capacity unit as a last step. A capacity auction ensures sufficient payments to cover total costs of a generator. Thus, a truthful bid is the difference between revenue and costs. If the markup was applied at the spot market, it would produce additional costs, which are given by multiplying the price markup by the generator’s expectations about emissions

. Since price bids in a capacity auction refer to capacity units, these costs have to be divided by the individual capacity

of each generator

i. This yields

reflecting the price markup per capacity unit for each power plant

i. While the price markup

can be easily calculated by the auctioneer based on reliable data, expected emissions are individual information of every power plant operator. How to deal with this problem and other aspects of the suggested market design are illustrated in an example in the next section.

4. Results Illustrated by an Exemplary Capacity Auction Outcome

We propose a step-wise procedure that incorporates up to four different capacity premiums with respective limits for emissions. Power plants are handled differently, depending on whether they were installed before the existence of a capacity market (existing power plants) or after (new power plants). If the investment decision already happened, a capacity payment is actually not necessary because capacity markets shall only provide incentives for necessary future investments. Nevertheless, capacity payments might make sense in a framework of decreasing spot prices induced by subsidized RES. This we will discuss in the following description of the step-wise procedure.

Figure 2 illustrates the simplified sequence of events.

In our mechanism, new power plants emitting only a low amount of emissions can achieve highest payments. Existing and more emission-intensive power plants will receive less or no payment at all. We suggest a time horizon of the capacity market of one year for existing power plants and a longer period for new power plants. This decreases the investment risk for new power plants, while it obtains the flexibility of a faster exchange of existing power plants by superior new power plants in the following years.

At first, generators offer their capacity for example in a sealed-bid reverse auction. A descending-clock reverse auction as suggested by Cramton and Ockenfels [

21] is also feasible (However, see for example Harbord and Pagnozzi [

70] for a critical assessment of the descending-clock auction in the context of capacity auctions). This results in a merit order of capacities as depicted in the lower graph of

Figure 3 as an example.

To reduce market power abuse, all existing power plants have to participate in the auction or to leave the market permanently. In contrast to Cramton and Ockenfels [

21], Schäfer and Altvater [

22], Cramton et al. [

34], we accept positive bids from existing power plants since these bids are used for a differentiation in step 2 and 3 of the suggested mechanism.

Nevertheless, only the last new power plant which is needed to meet the target capacity

C̠, is considered for price determination. In so far, the resulting clearing price

of the first step is in accordance with Cramton and Ockenfels [

21] if new power plants are needed to satisfy the target capacity. In

Figure 3, power plant 8 determines the clearing price, although number 9 is needed, too.

For the second step in our mechanism, the auctioneer needs to know the adjusted price markup

, according to Equation (

7), for every participating power plant. This, at first, requires to estimate the price markup

. The simplest way to determine

is to refer to historic data while the application of a projection for the next years is possible as well.

is equal for all generators and can be calculated with already available data. The auctioneer announces

before the auction takes place. The higher

, the more pronounced are emission costs, so that emission-intensive power plants are put under pressure. Individual capacity

, which, according to Equation (

7), is necessary to transform the price markup

into the adjusted price markup

, is known as generators have to report it to take part in the capacity auction.

The estimation of expected emissions for each generator (), the last necessary variable to calculate the adjusted price markup, is more challenging. While recent emissions of existing power plants are known because of reporting obligations, emissions of new power plants have to be estimated. There is an incentive to claim less emissions as it decreases the price markup. This may lead to a higher chance to be awarded in the auction. Nevertheless, estimations for generators entering the market are acceptable if the effect of an overshooting of declared emissions is corrected ex post.

The auctioneer is able to check the claimed emissions by simulating the awarding process on completion of the contracted trading period using an adjusted price markup based on observed ex-post emissions for each formerly awarded bidder. If the ex-post analysis results in a different classification of formerly awarded bidders leading to a changed capacity payment, the auctioneer checks for each formerly awarded bidder, that is in a new group now, if this result remains unchanged although emissions are reduced/raised by, e.g., 10% for the considered bidder. In that case, the capacity payment is corrected ex post.

The correction can be combined with an additional penalty if a too low markup was declared to incentivize to report true information. If this correction mechanism is applied, bidders may simply specify their individual adjusted price markup when they place the bid since it minimizes the regulatory effort and a deviation is corrected ex post according to existing reporting obligations.

Summing up the adjusted price markup and the price bid yields the upper graph of

Figure 3, which reflects the total costs for generators considering a more realistic degree of internalization. The merit order of capacities may change and the new hypothetical clearing price increases to

because it includes the respective adjusted price markup (see

Figure 4). If generators with a successful bid received

as a capacity payment, they could cover subsidies for renewable energy. Since this is conceivable in principle but most probably politically unfeasible (see

Section 3.2.1), we use step 2 only to identify the proper merit order of capacity.

Step two of the mechanism enables the auctioneer to classify four groups by price discrimination (see

Figure 5). Existing power plants with a successful bid in step 1 only (power plant 6 in our example) emit so much CO

that they would leave the market if the proper degree of internalization was applied. They form group I and do not receive any capacity payment (

) to induce their fade out instead of providing incentives for further investments in such a technology. No capacity payment means a financial burden for these power plants because reliability options still make them pay the PER to electricity consumers. This acts like a carbon tax for the dirtiest power plants.

To prevent market power abuse, existing power plants that placed a bid higher than new power plants in step 1 but were still successful in step 2 (power plant 9 in

Figure 3), receive only the PER per capacity unit. This means neither a disadvantage nor a big advantage when compared to the situation without capacity market. The same can be applied to existing power plants which do not belong to group I (zero payment) and which are behind new power plants in the adjusted merit order (power plant 1 and 9 in

Figure 5). These power plants form group II. The hazard of being penalized with a capacity premium, limited to the PER per capacity unit, decreases incentives for generators to place bids above their costs.

All other already existing power plants which are necessary to satisfy C̠ form group III. These power plants provide capacity at relatively low cost even though the adjusted merit order is considered. In a framework of decreasing spot prices induced by the promotion of renewable energy a capacity payment corresponding to the PER per capacity unit may not be sufficient to incentivize further market participation.

It might be more profitable to shut-down an old power plant and to take part in the capacity auction with a new power plant. Therefore, power plants of group III might receive a payment , which equals the highest price bid of this group (power plant 5 in the example). This provides incentives to stay in the market, which eventually limits costs. Nevertheless, it is also possible to cancel a differentiation between group II and III so that all existing generators only receive the PER per capacity unit.

Group IV consists of new power plants that are necessary to satisfy demand. The highest bid in this group determines the respective capacity price

. Capacity costs including the adjusted price markup

are decisive for the success of new power plants. That is why power plant 11 is part of our optimal capacity mix instead of 7 (see

Figure 5). Group IV payments incentivize investments in power plants considering the actual degree of internalization.

Non-awarded bidders do not receive any capacity payment but they also do not have to pay the PER like awarded bidders of group I have to do. At first sight, this is an advantage compared to awarded bidders in group I. Thus, operators of emission-intensive power plants could have an incentive to place a higher bid so that they are not awarded instead of facing an additional payment in group I. However, non-awarded bidders who are not awarded again should have the obligation to leave the market because they are obviously not needed to satisfy demand. This consequence is not too harsh since bidders can always choose to place a lower bid. The awarding process is summarized in

Figure 6.

5. Discussion of the Suggested Capacity Auction Design

The consideration of subsidies for RES-based electricity generation allows to design a general capacity auction with endogenous limits for emission levels. This leads to discriminated prices without direct market interventions. Furthermore, the limits adjust endogenously over time.

In the long run, the price markup and associated price discrimination will vanish as soon as the carbon price induced by the ETS or a carbon tax is high enough to incentivize an investment in renewable energy without subsidies (The negative difference costs for good solar sites calculated in

Section 3.3 indicate that this scenario will already start in the near future). Connecting the price markup to the carbon price also increases certainty of investments in emission reduction. An increasing carbon price leads to a decreasing price markup and vice versa. Therefore, emission costs are more predictable leading to decreasing risk premiums for investors.

Emission-intensive power plants using, for instance, coal or lignite, and that, additionally, could not place successful bids under consideration of the adjusted price markup (group I) will leave the market earlier because they do not receive a capacity payment but still have to make payments due to their obligations from ROs. Clean power plants with low utilization rates as highly efficient gas turbines, to the contrary, can get higher payments than in a general capacity auction (group IV) to enter the market earlier.

This corrects the distorted degree of internalization so that the capacity market directs investments to the actual equilibrium. Price discrimination therefore incentivizes investments in power plants with lower emission levels and hampers investments in less clean technologies. This accelerates the transition process towards less emission-intensive electricity generation. The comparatively low payments to emission-intensive power plants (group I—III) will also increase consumers’ acceptance to pay for this mechanism. This enhances the political feasibility.

In a

focused capacity auction, numerous power plants do not receive payments. This stimulates generators to close down old power plants and build new ones instead. The design is criticized for this incentive, since it might cause extra costs [

4]. This critique does not apply for our framework because non-payment is only directed to power plants, which should leave the market according to an undistorted degree of internalization. All other required power plants receive a capacity payment.

The suggested market design with its division into groups also reduces potential market power abuse. A generator knows neither in which group his or her power plants will appear, nor the size of the group as it depends on other market participants’ behavior. Withholding capacity by old power plants (by placing a very high bid) does not make sense, as it is penalized. Competition will increase, since market entry barriers are reduced because of lower risks associated with continuous capacity payments.

6. Conclusions

We develop modifications to the

general capacity auction developed by Vázquez et al. [

19], Pérez-Arriaga [

20] and extended by Cramton and Ockenfels [

21], Schäfer and Altvater [

22]. We use paid subsidies for RES-based electricity generation or the levelized costs of electricity generation from RES to approximate the true degree of internalization of CO

costs. The result is a price markup per capacity unit depending on the power plant’s individual emissions.

Thus, it considers the emission-intensity and utilization time. This can be easily calculated by the auctioneer of the capacity market with data available from established reporting obligations. The comparison of successful bids with and without the price markup allows the auctioneer to calculate three threshold values for emissions. This leads to four different groups of power plants with increasing capacity payments as a result of decreasing emissions.

The first group receives no premium because power plants emit so much CO that the true degree of internalization would make them leave the market. Group two receives the PER per capacity unit as minimum bid which neutralizes the introduction of a capacity market for group members. The remaining two groups receive premiums determined by the last required power plant (highest bid) in each group. The fourth group with the cleanest technology gets the highest payments, while power plants in the second and third group receive lower premiums. Moreover, an analysis of bids allows the identification of power plants that intend to gain additional profits. To restrict this behavior, these are penalized by receiving the PER per capacity unit only.

This market-based mechanism regulates the necessary adjustment of residual fossil capacity to an increasing share of renewables. It presents several advantages compared to other mechanisms, which are mostly based on direct market interventions. The endogenously determined emission limits ensure that an exogenous readjustment of the limits is not necessary. This enhances the robustness and efficiency in contrast to mechanisms with exogenously defined threshold values for emissions. It also avoids lobbying as an ongoing discussion about these exogenous limits is not necessary.

Price discrimination of capacity payments evolves endogenously leading to a redistribution of money from emission-intensive to cleaner power plants. This sets sufficient incentives to direct the capacity mix to its long-run equilibrium where discriminated payments converge to one equilibrium price. Furthermore, it accelerates the transition process and prevents capital erosion, since the fading out of the emission-intensive first group is induced. Redistribution will also increase consumer acceptance because avoided payments for emission-intensive power plants do not result in full insurance for generators but in burden sharing. These results improve the political feasibility.

The suggested mechanism is applicable to liberalized electricity markets with subsidized RES in transition to RES-based electricity generation. Most electricity markets in Europe, the USA and parts of South America are subject to these conditions. In this context, the suggested endogenous focused capacity market has advantages compared to a general capacity auction.

Future research should refine the calculation of the adjusted capacity price and study the effects of discriminated prices in more detail. Moreover, the effect of possible strategic bidding behavior will be an interesting topic to explore in further studies.