A Pattern New in Every Moment: The Temporal Clustering of Markets for Crude Oil, Refined Fuels, and Other Commodities

Abstract

1. Introduction

1.1. The Motivation for this Research

1.2. A Section-by-Section Summary

2. Literature Review

- Price volatility in oil and refined fuel markets;

- Comovement and volatility spillovers between these energy-related commodities and other commodity markets;

- Similar connections between energy-related commodity markets, other financial markets, and the real economy;

- Methods for identifying cyclicality and other time-varying effects in commodity markets, stock markets, and the real economy.

2.1. Price Volatility in Crude Oil and Refined Fuels

2.1.1. Oil Price Volatility

2.1.2. Refined Fuels: Gasoline and Gasoil (Diesel)

2.2. Comovement and Volatility Spillovers within Commodity Markets

2.2.1. The Financialization of Commodities and Hedging Strategies

2.2.2. Precious Metals

2.2.3. Base Metals

2.2.4. Agricultural Commodities

2.2.5. The Geopolitics of Energy-Related and Agricultural Commodities

2.3. Broader Financial and Macroeconomic Effects of Oil and Fuel Price Volatility

2.3.1. Financial Markets beyond Commodities

2.3.2. Macroeconomic Effects

2.4. Identifying Cyclicality and Critical Periods in Energy Markets, Finance, and the Real Economy

3. Materials and Methods

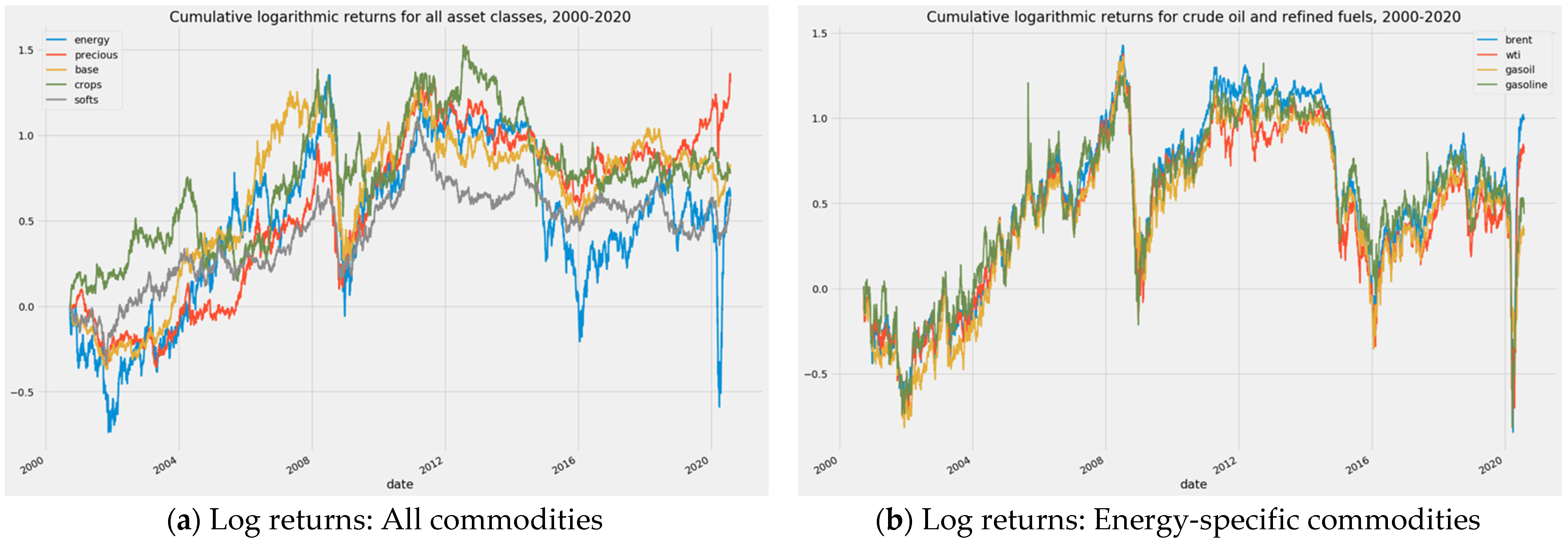

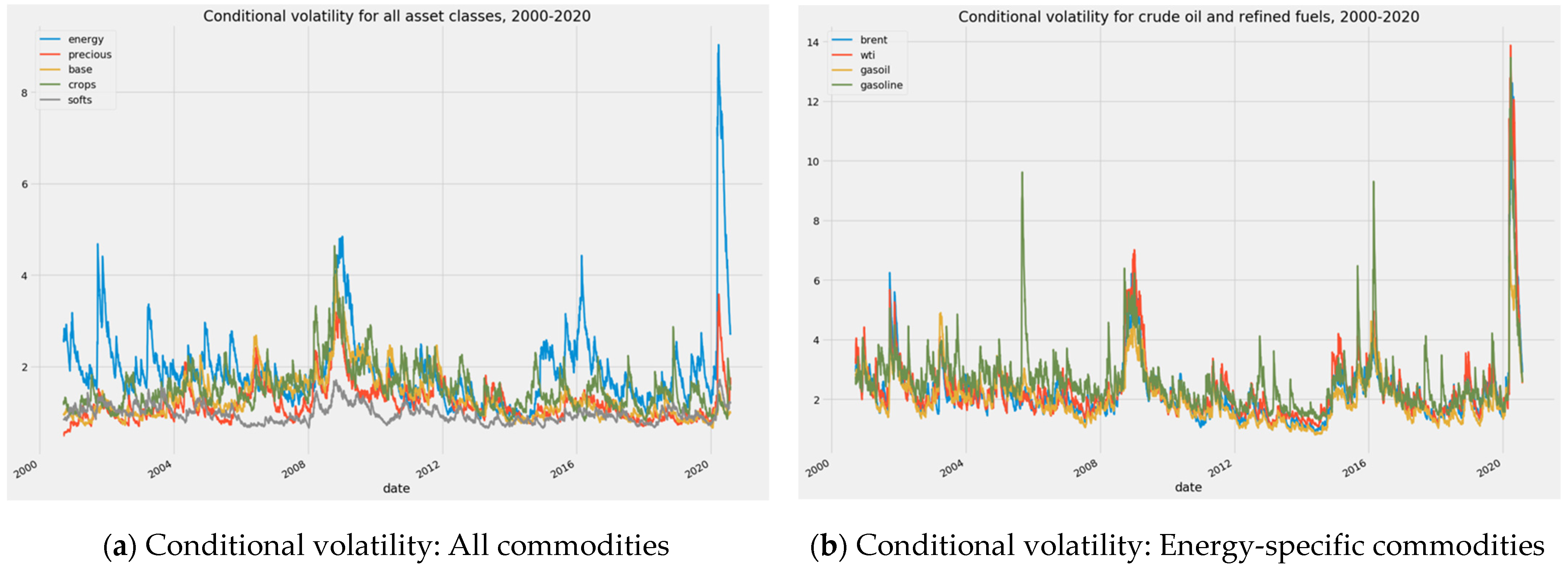

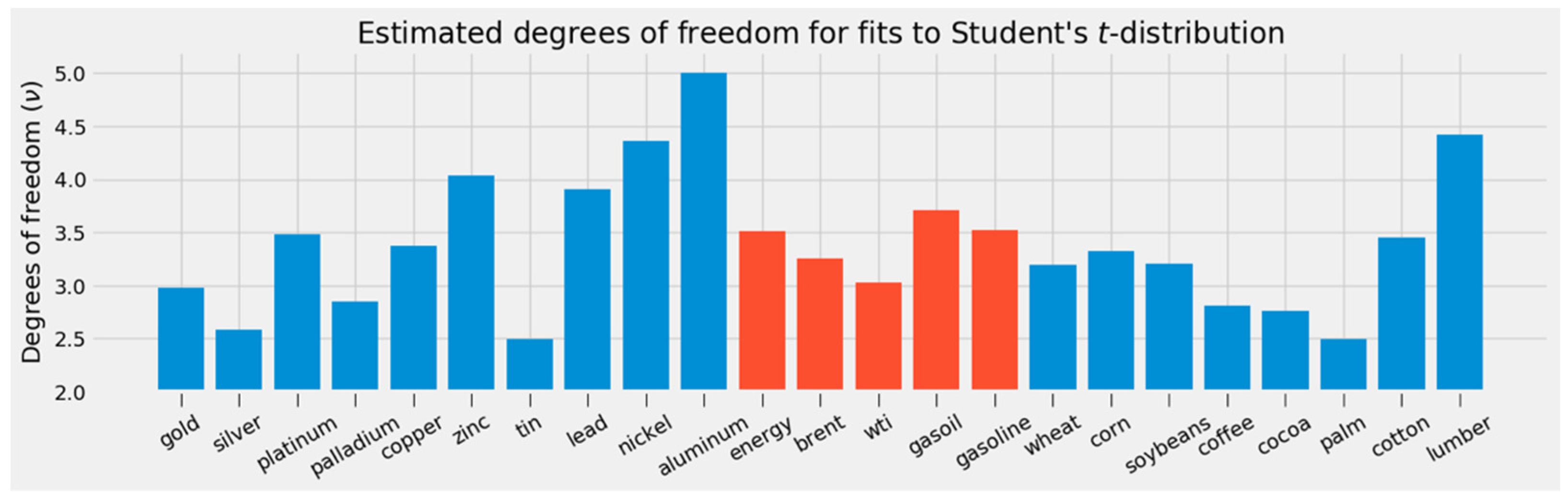

3.1. Data

3.1.1. Data Sources and Preprocessing

- Energy (crude oil and refined fuels): Brent, WTI, gasoil, gasoline;

- Precious metals: Gold, silver, platinum, palladium;

- Base metals: Copper, zinc, tin, lead, nickel, aluminum;

- Temperate crops: Wheat, corn, soybeans;

- Tropical and semitropical “softs”: Cocoa, palm oil, coffee, cotton, lumber.

3.1.2. Visualizations of Logarithmic Return and Conditional Volatility Data

3.2. Clustering Methods

3.2.1. General Considerations

3.2.2. Spectral Clustering

3.2.3. Mean-Shift Clustering

3.2.4. Hierarchical Agglomerative Clustering

3.2.5. Affinity Propagation

3.2.6. k-Means Clustering

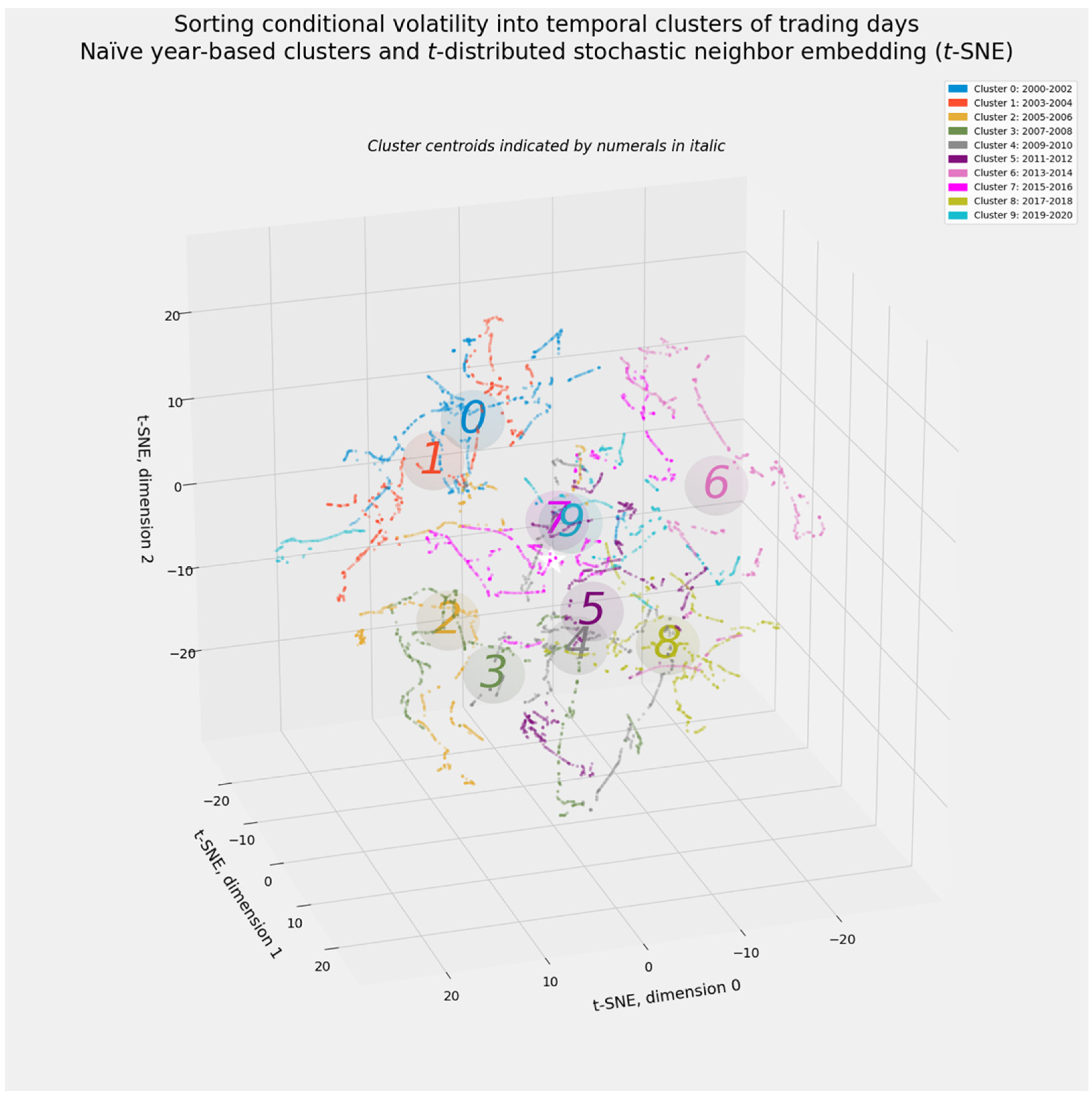

3.3. t-Distributed Stochastic Neighbor Embedding (t-SNE)

4. Results, Part 1: Temporal Clustering

4.1. Temporal Clustering of the Full Array of Conditional Volatility Forecasts

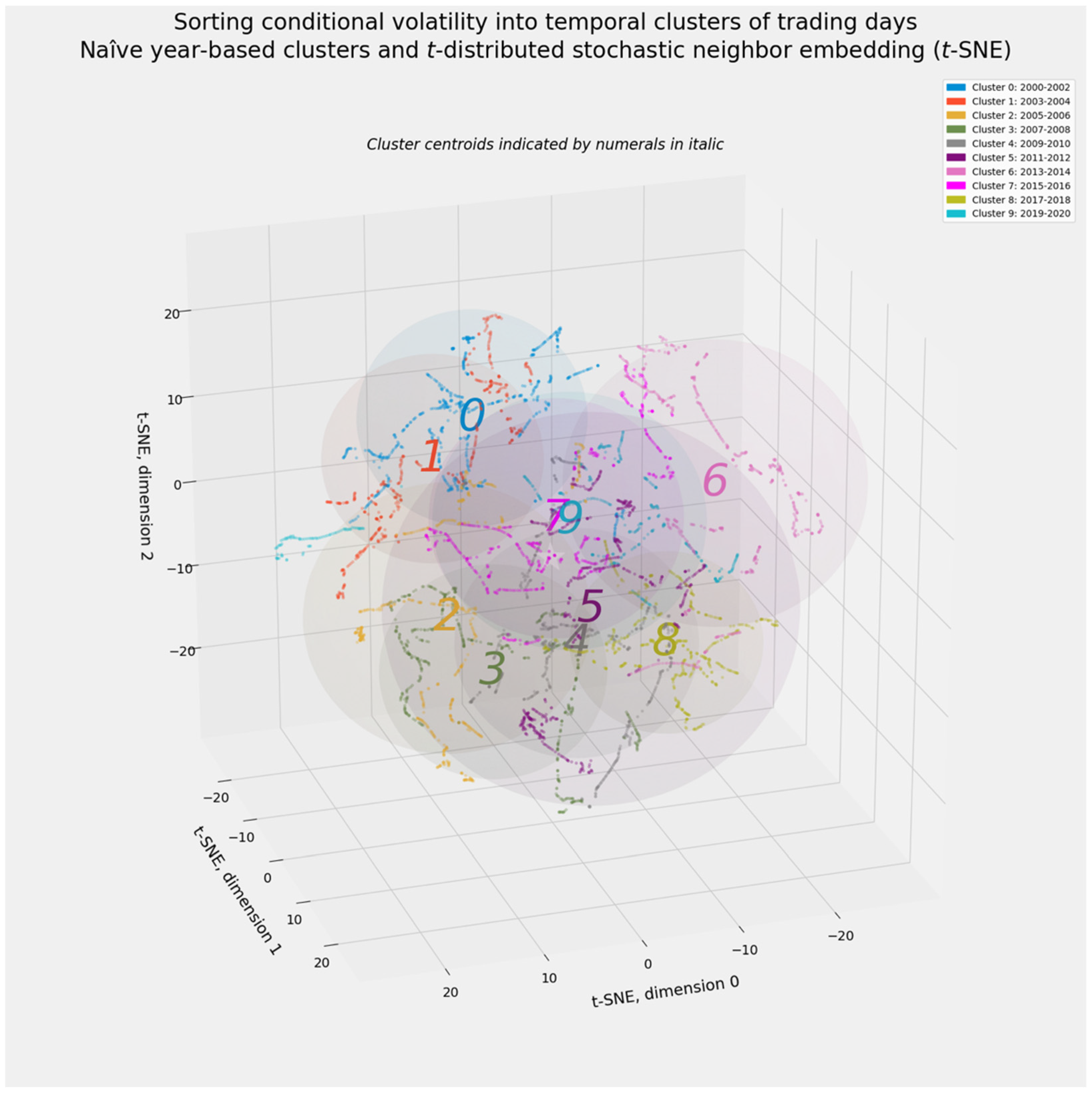

4.1.1. The Naïve Biennial Baseline

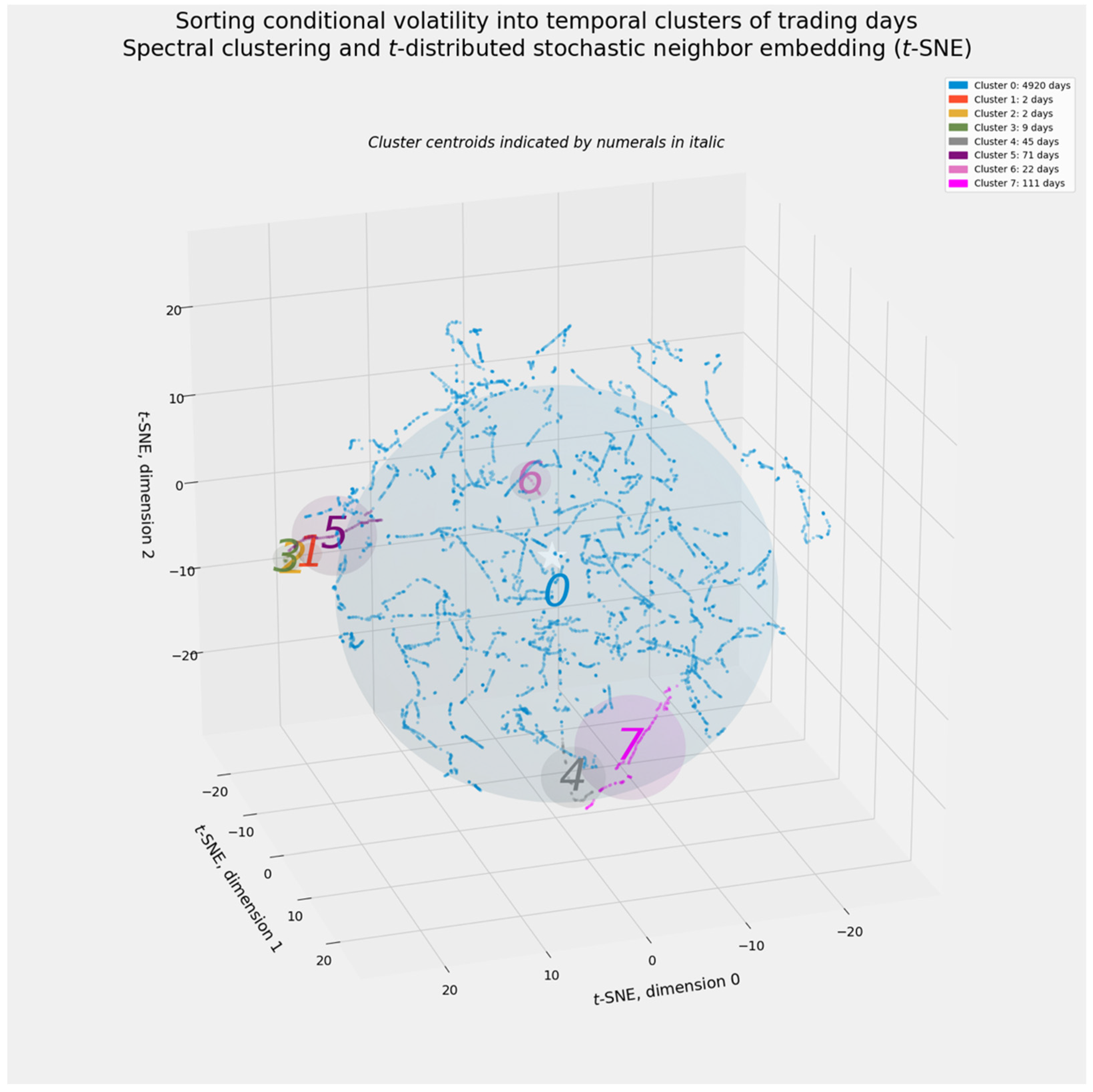

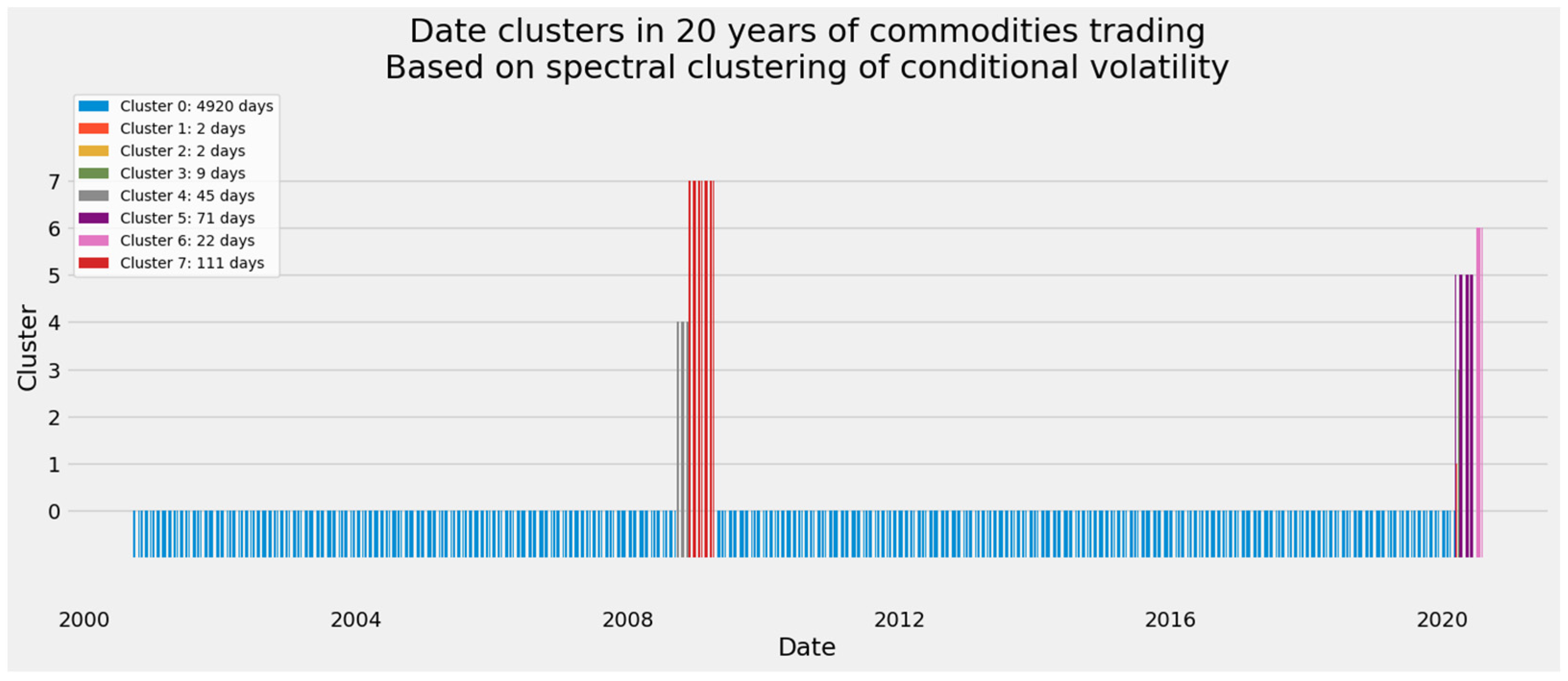

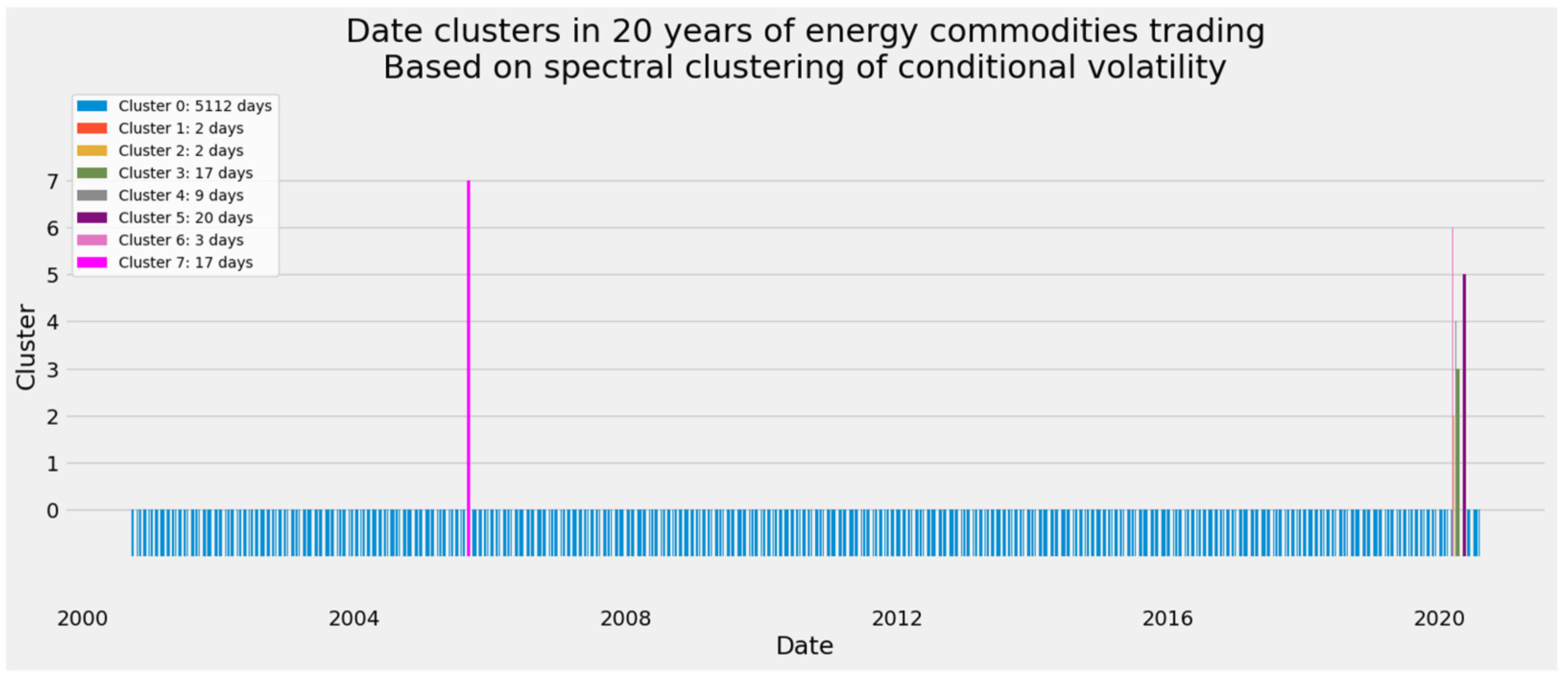

4.1.2. Spectral Clustering

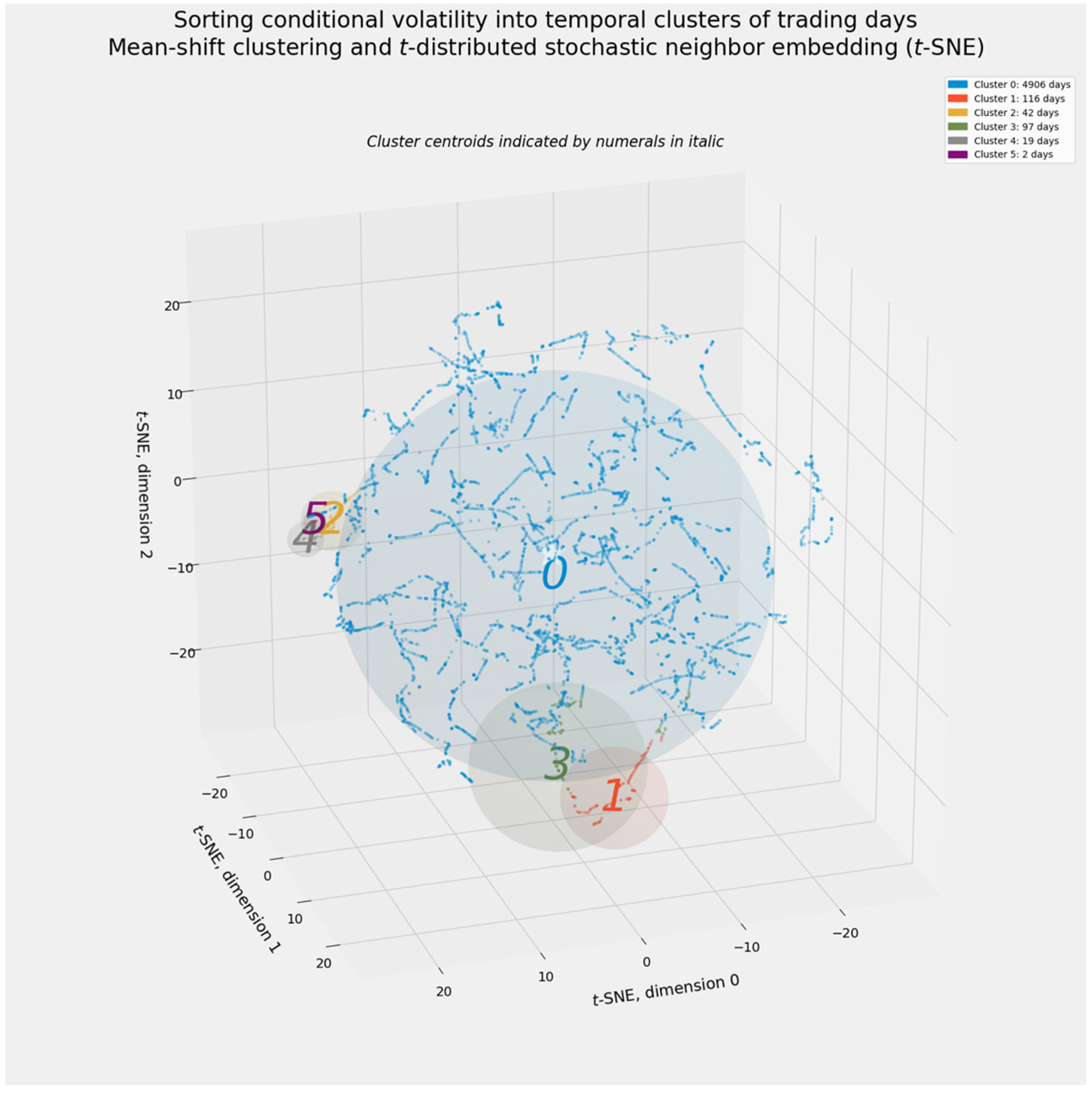

4.1.3. Mean-Shift Clustering

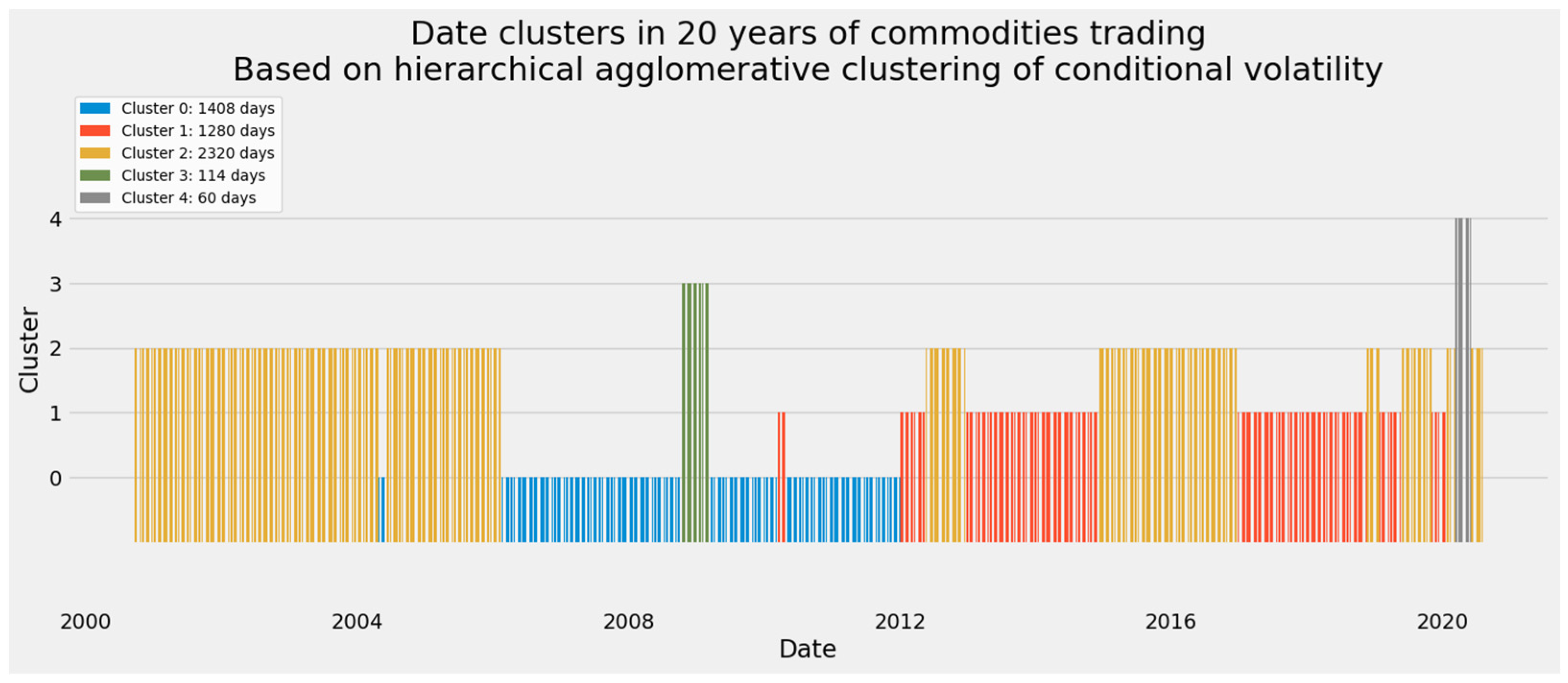

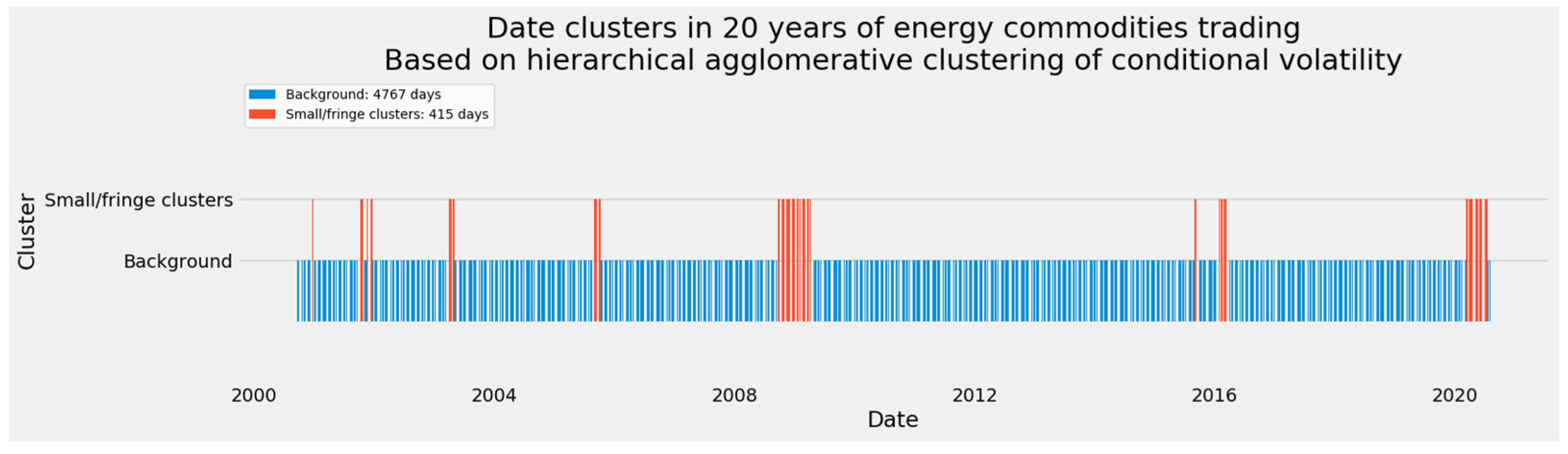

4.1.4. Hierarchical Agglomerative Clustering

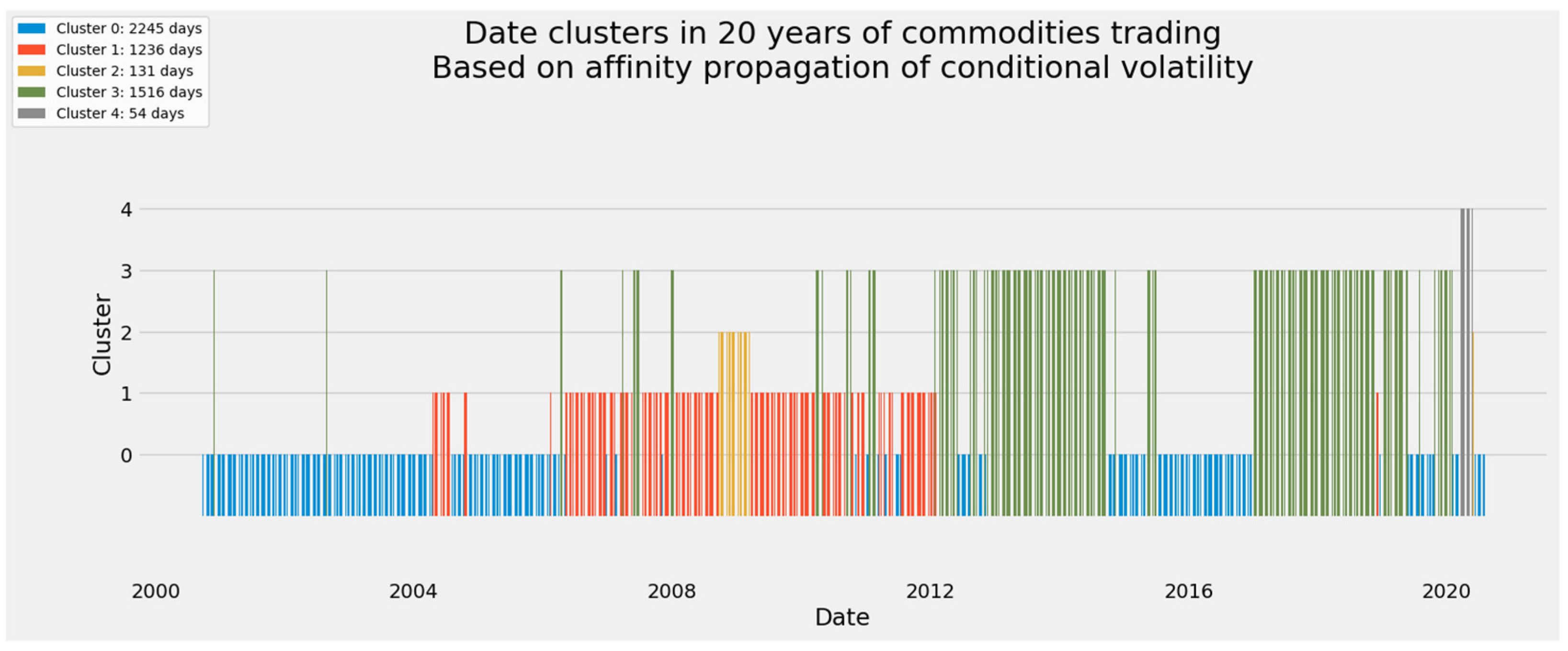

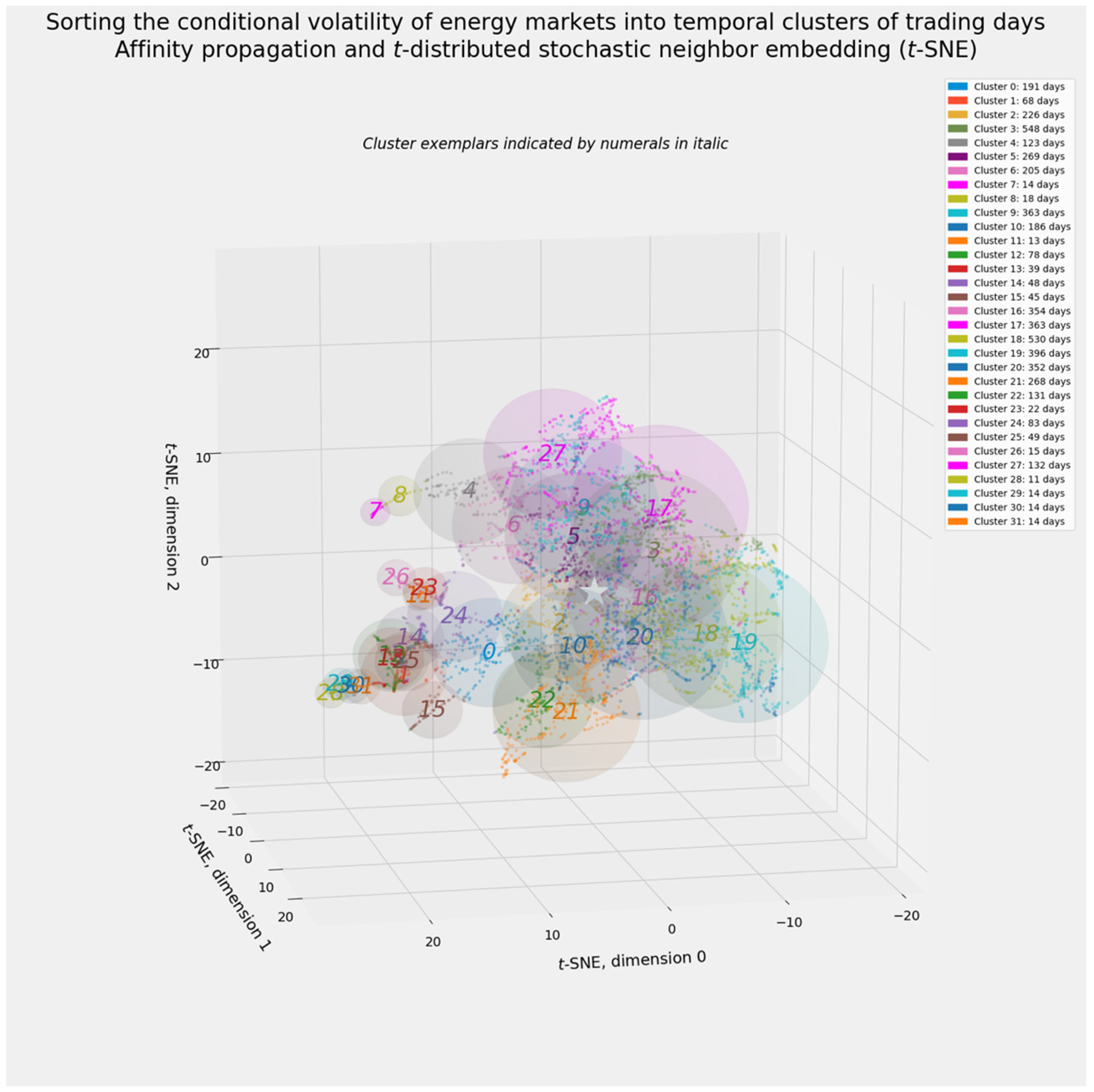

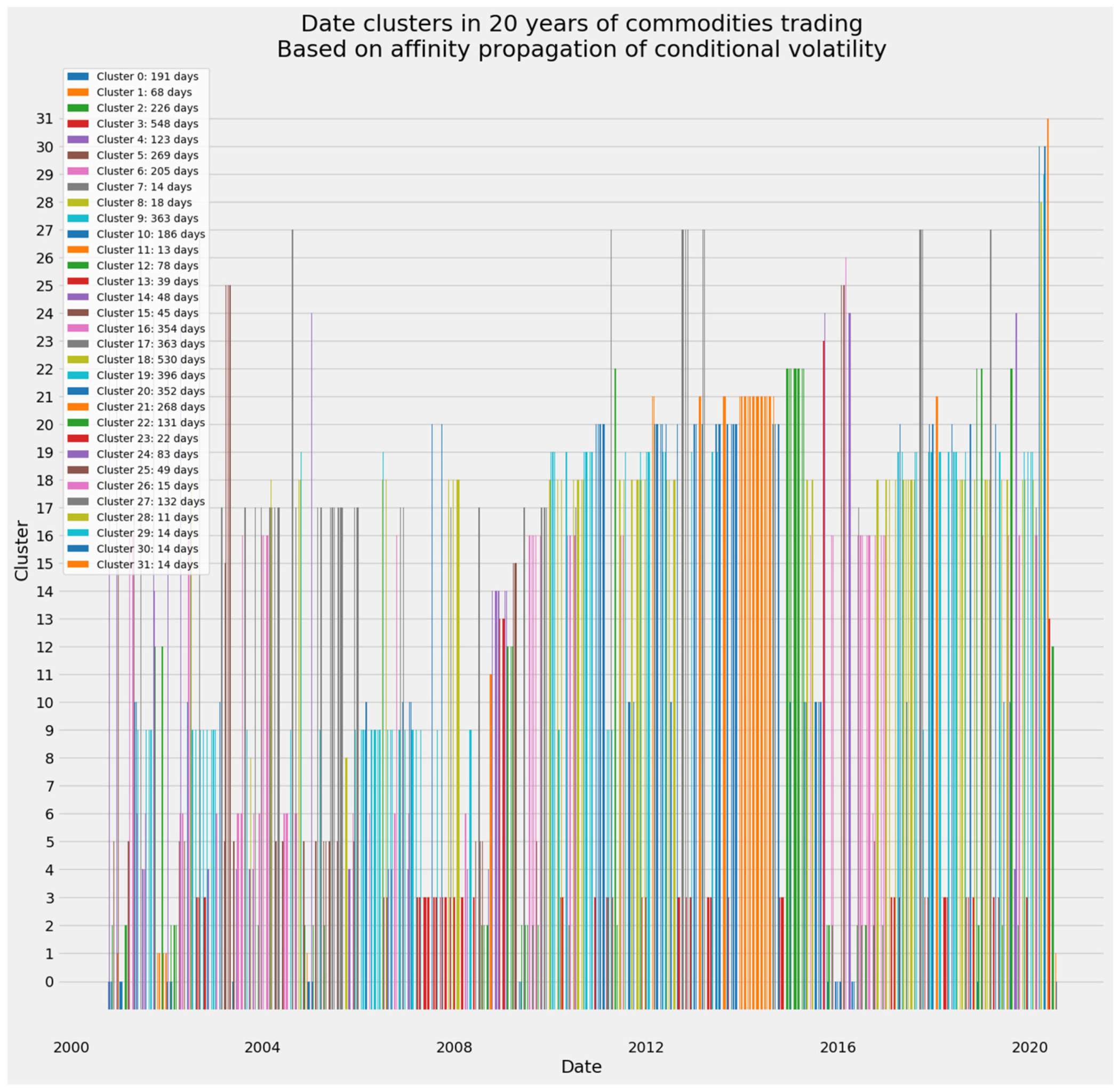

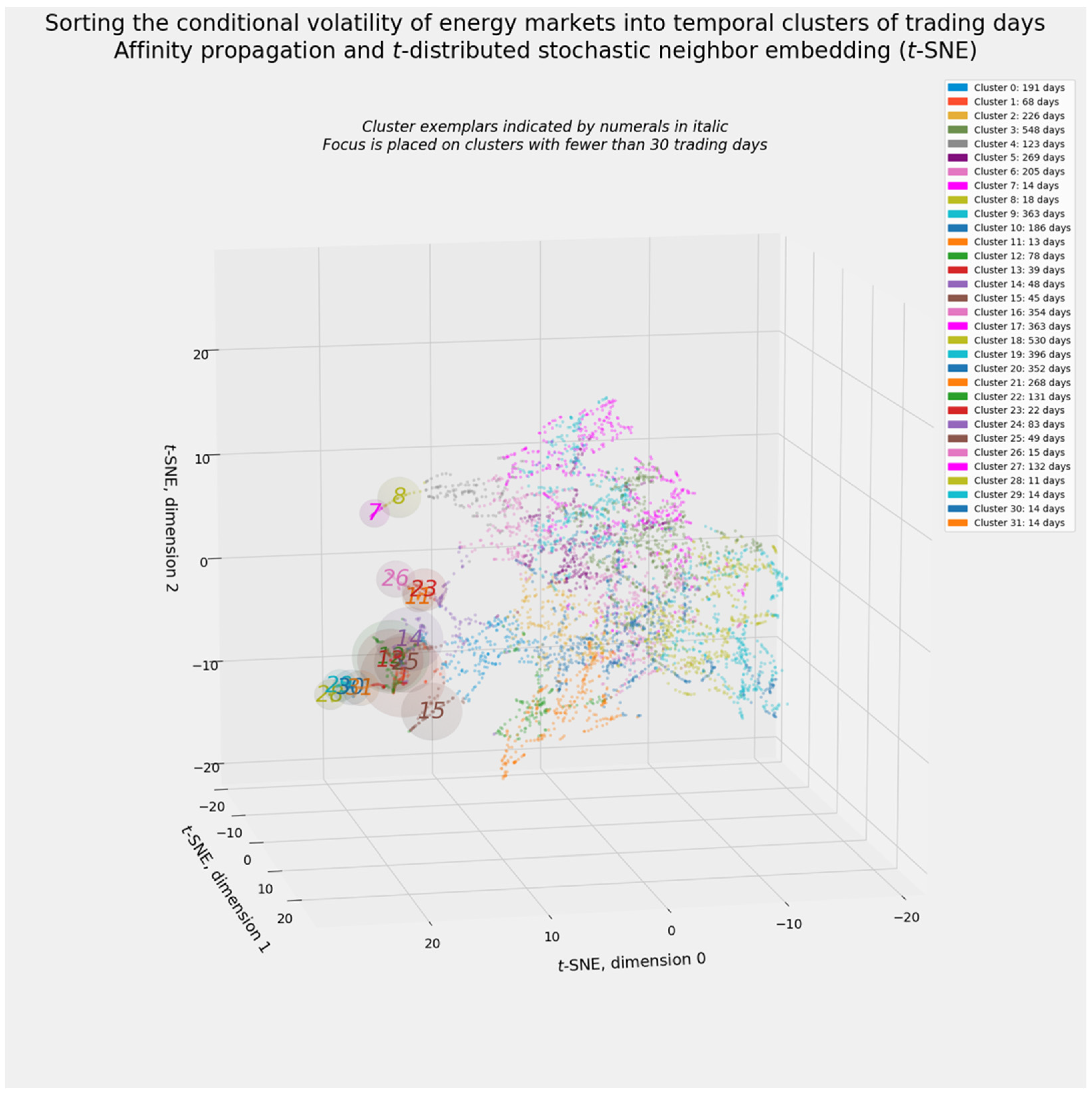

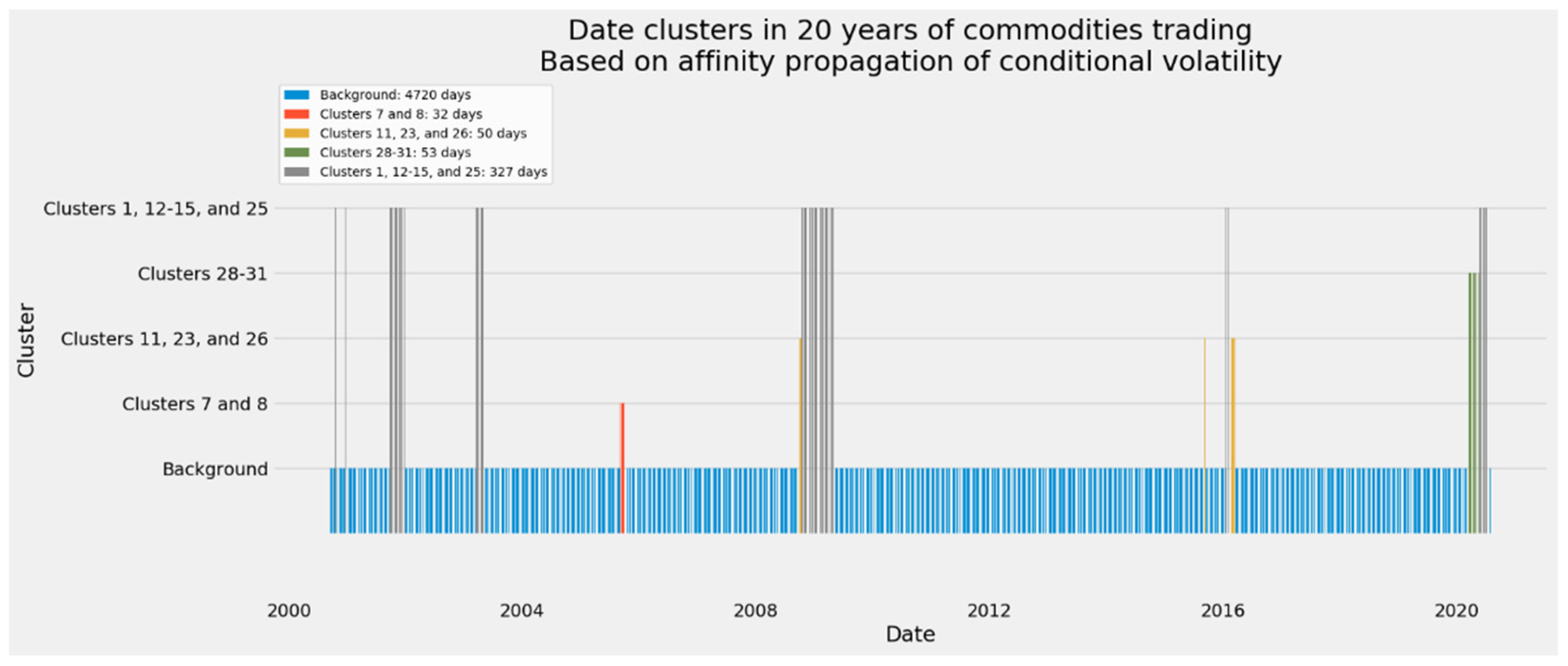

4.1.5. Affinity Propagation

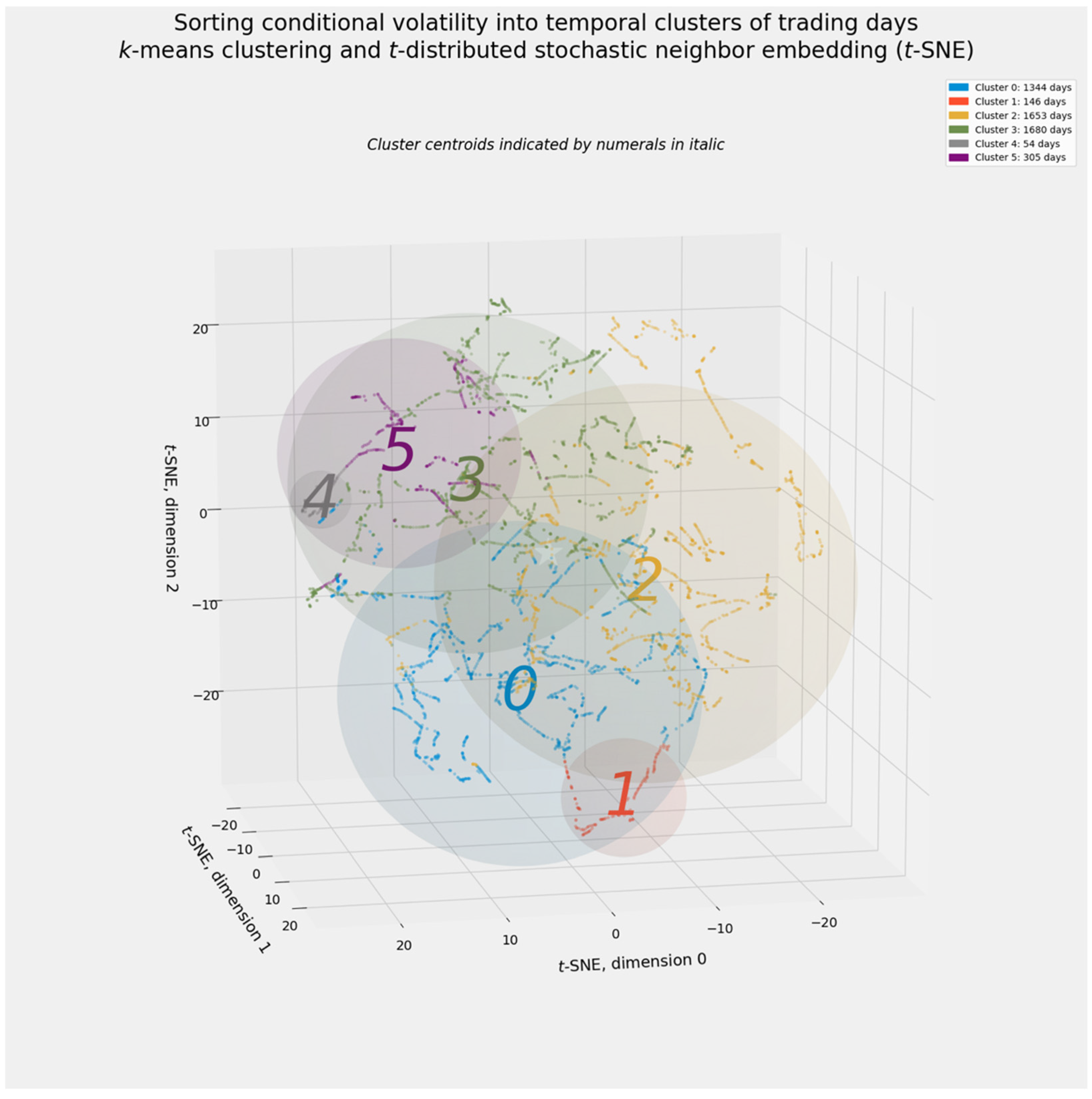

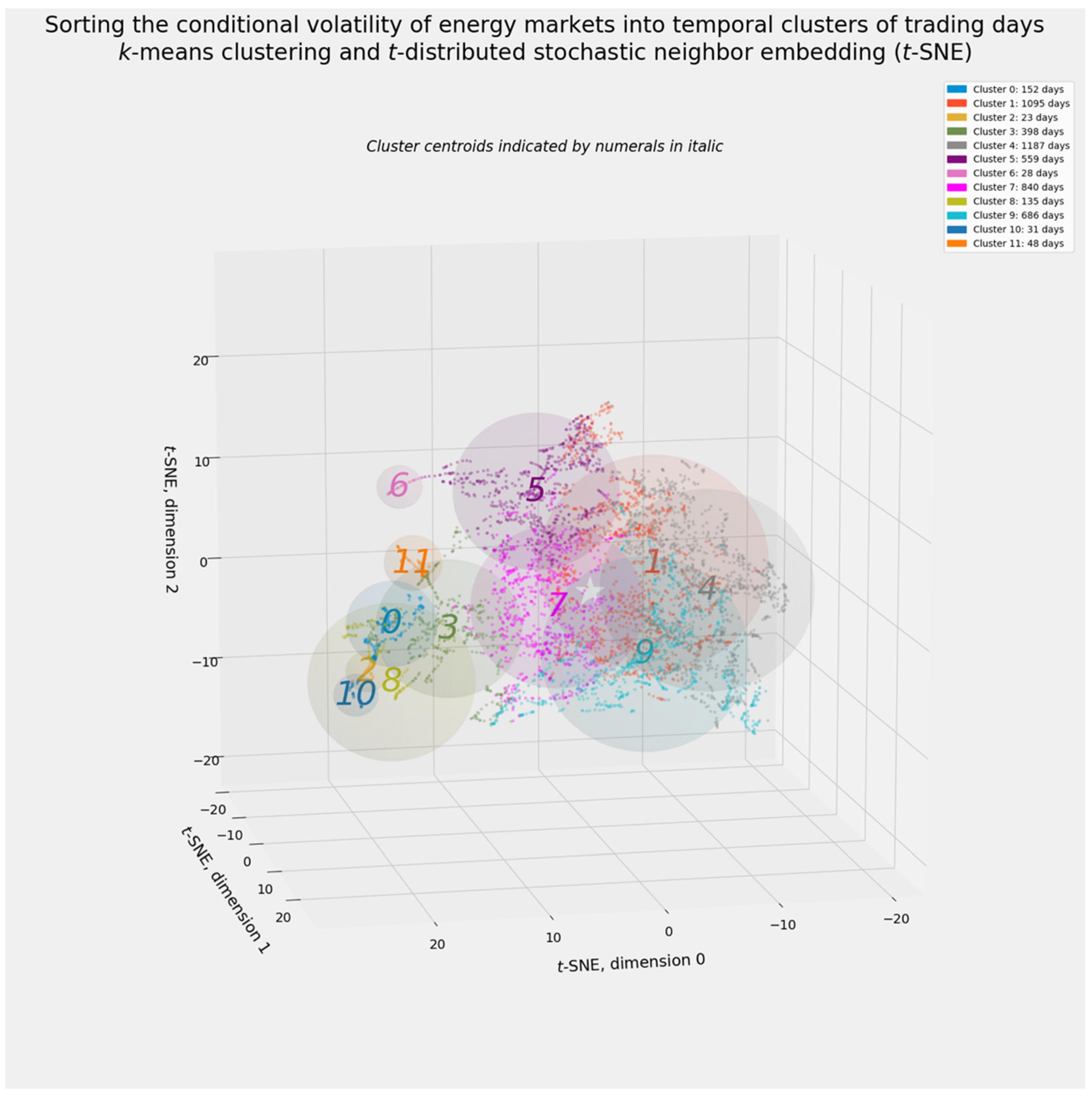

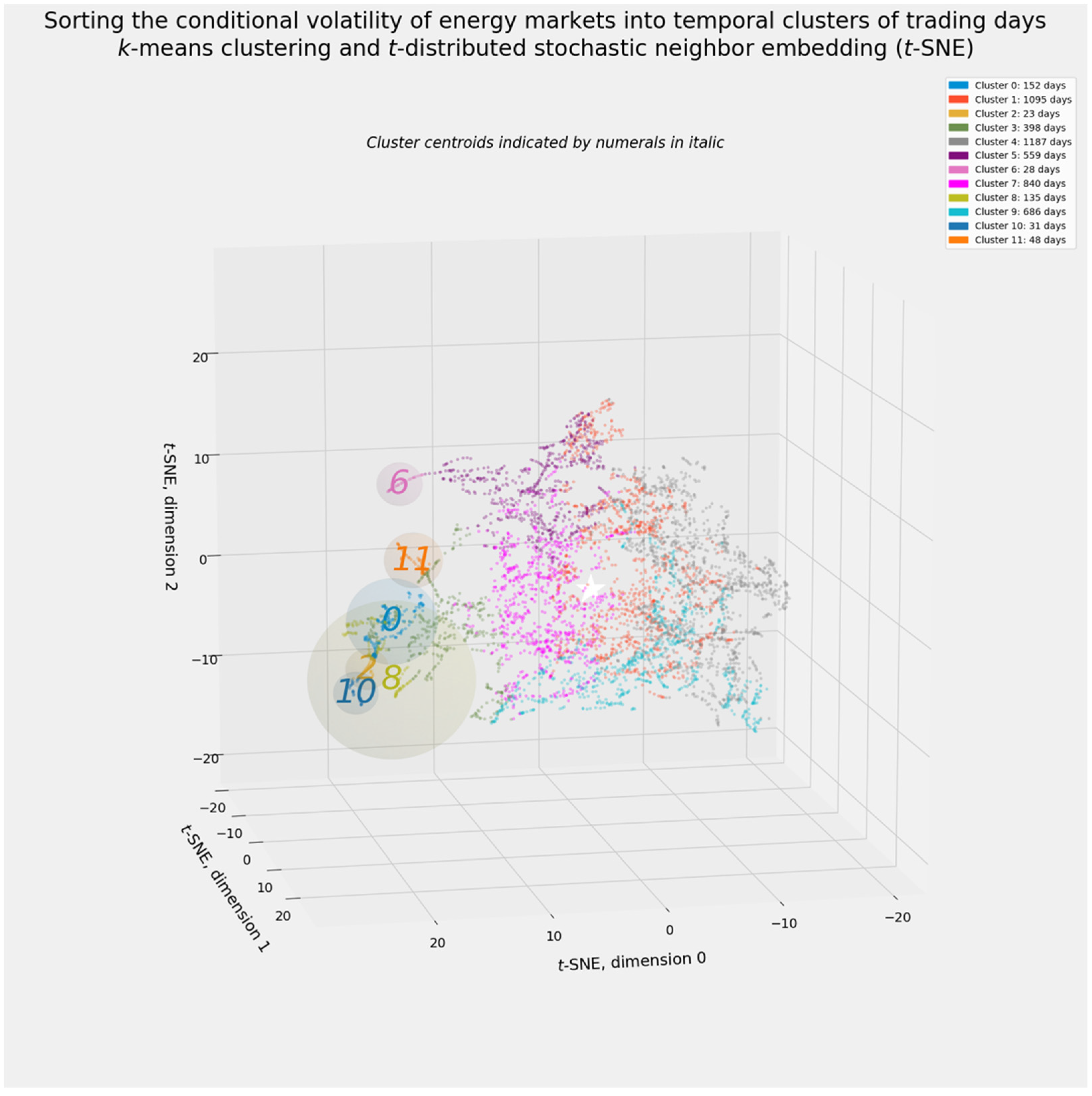

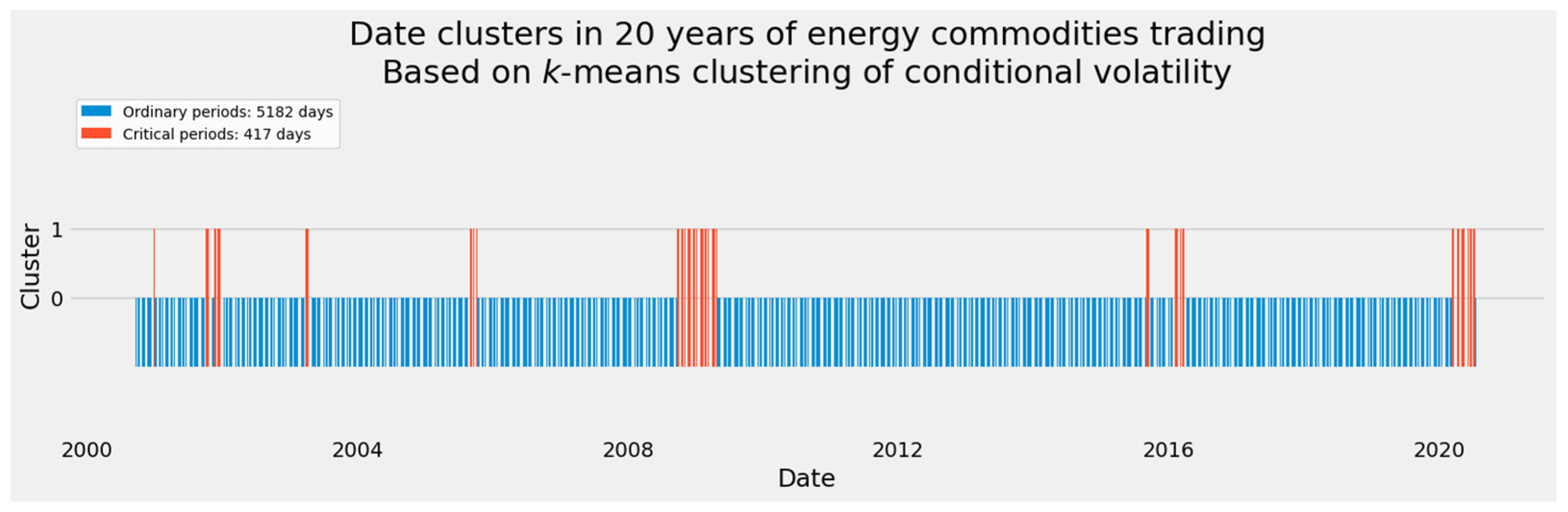

4.1.6. k-Means Clustering

4.1.7. The Union and Intersection of Clustering Results for the Full Volatility Array

4.2. Temporal Clustering of the Energy-Specific Array of Conditional Volatility Forecasts

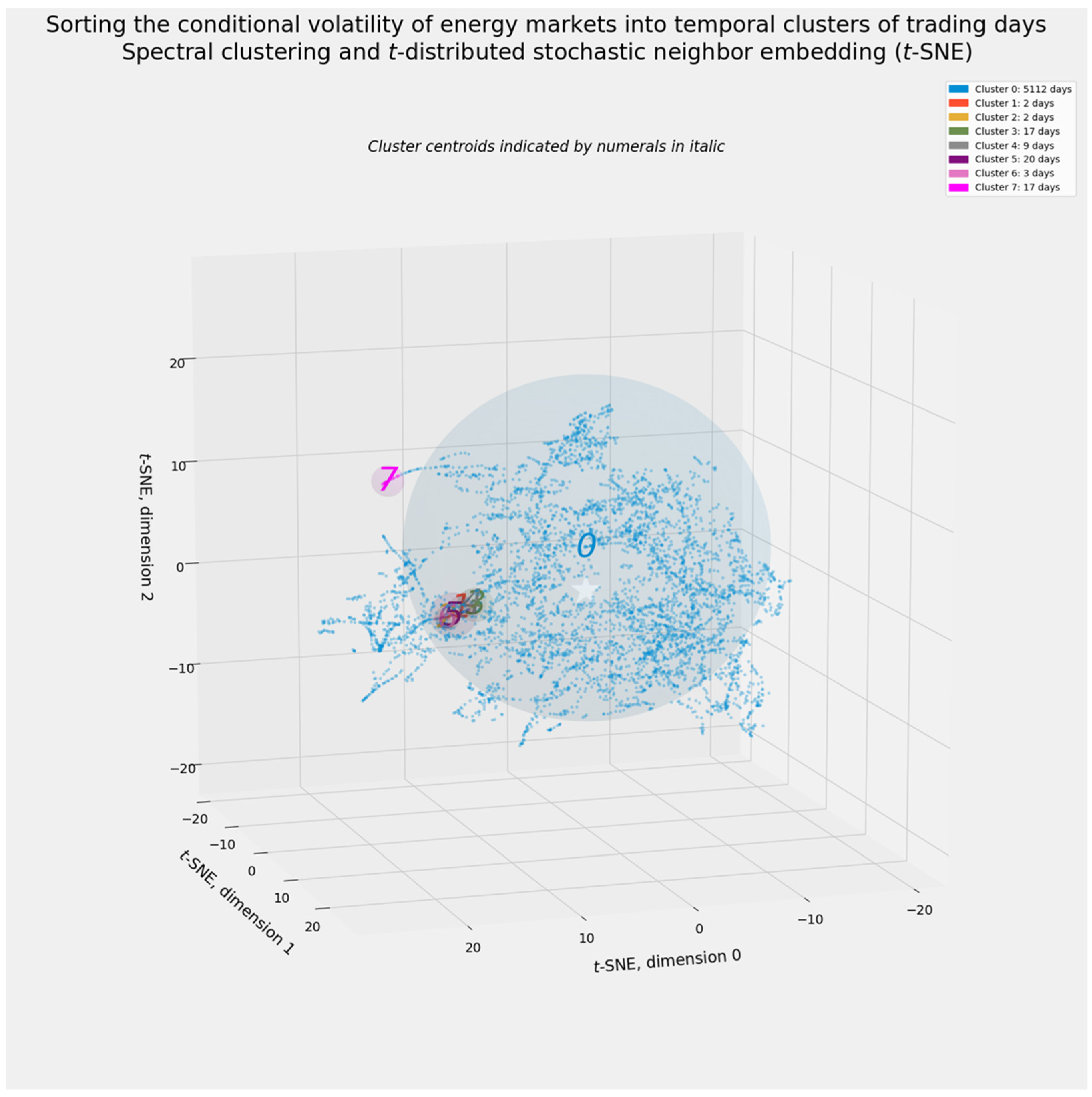

4.2.1. Spectral Clustering

4.2.2. Mean-Shift Clustering

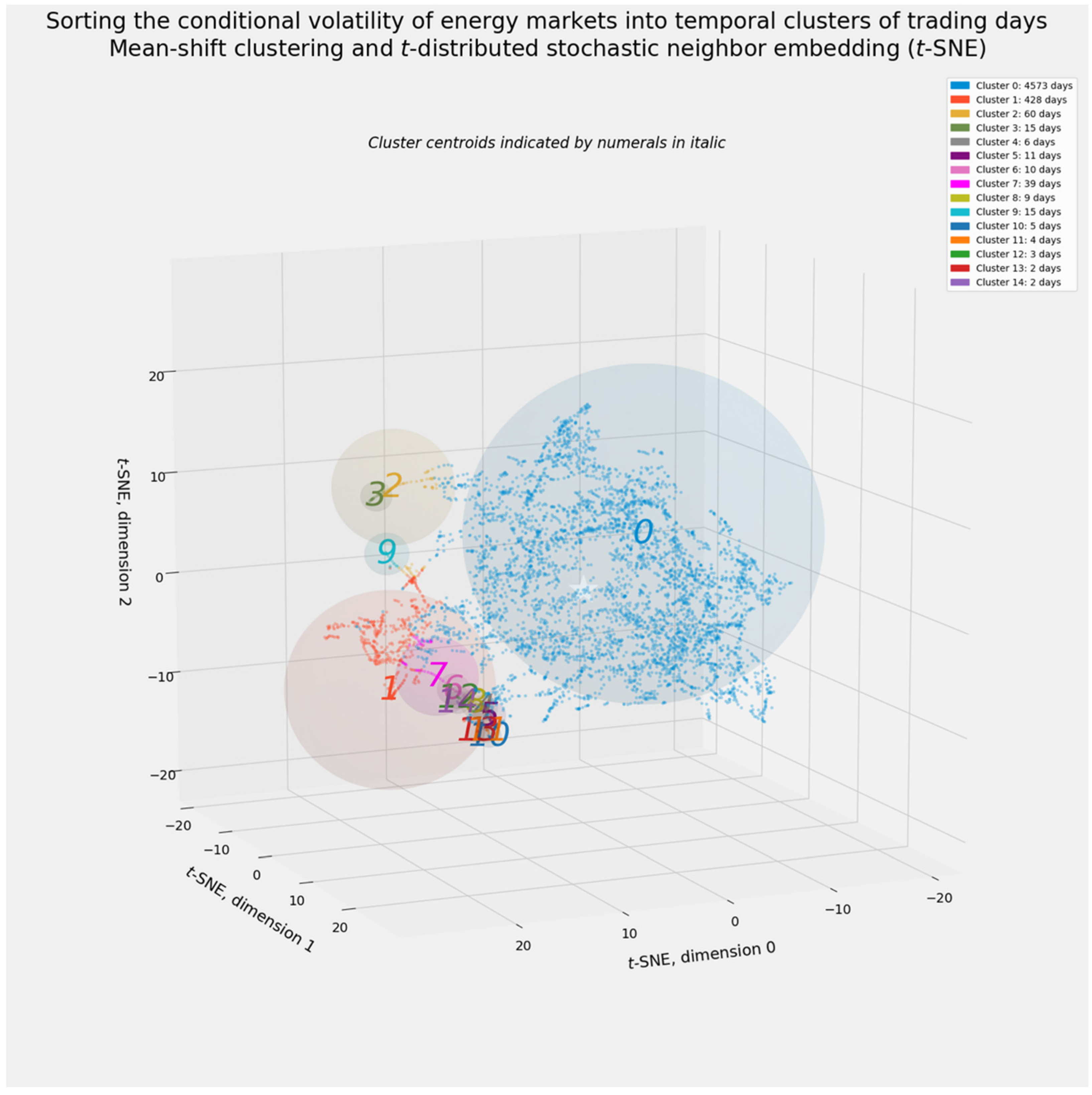

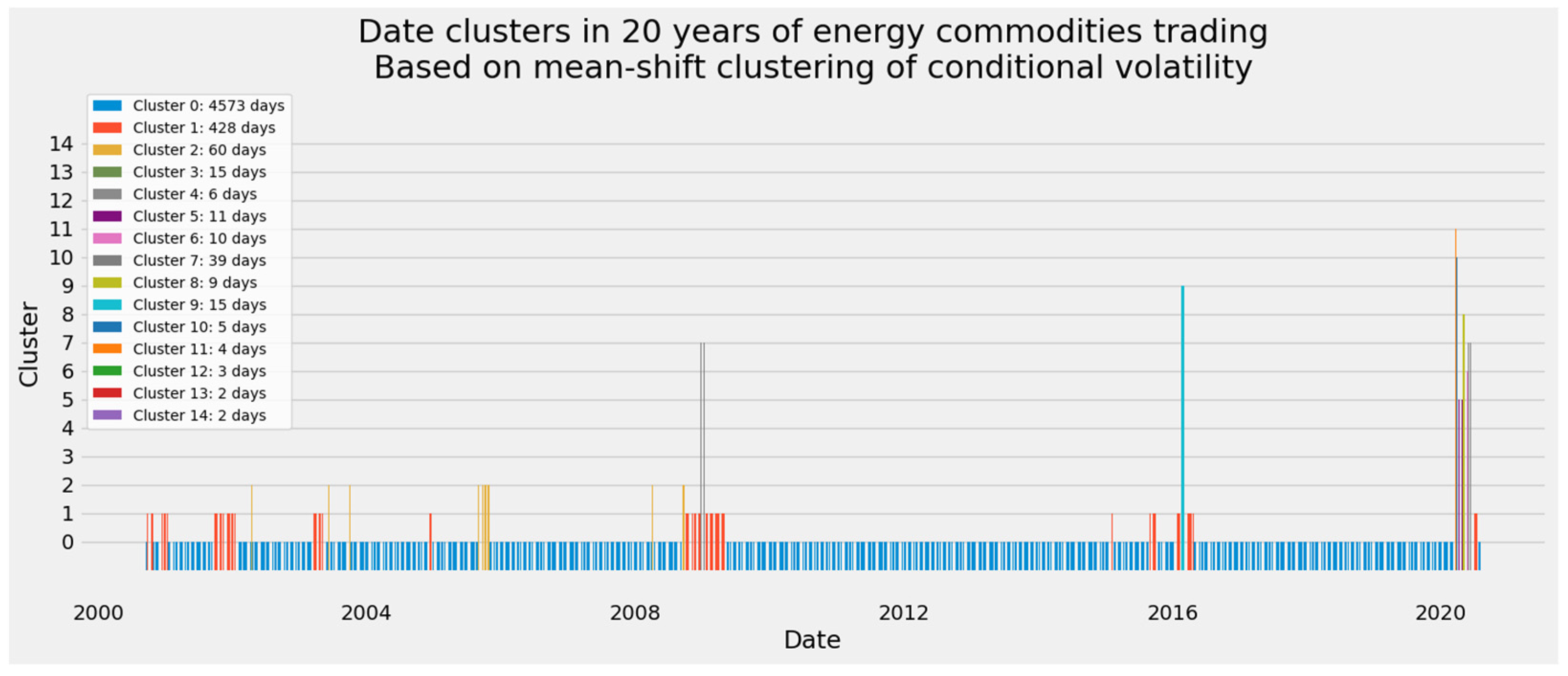

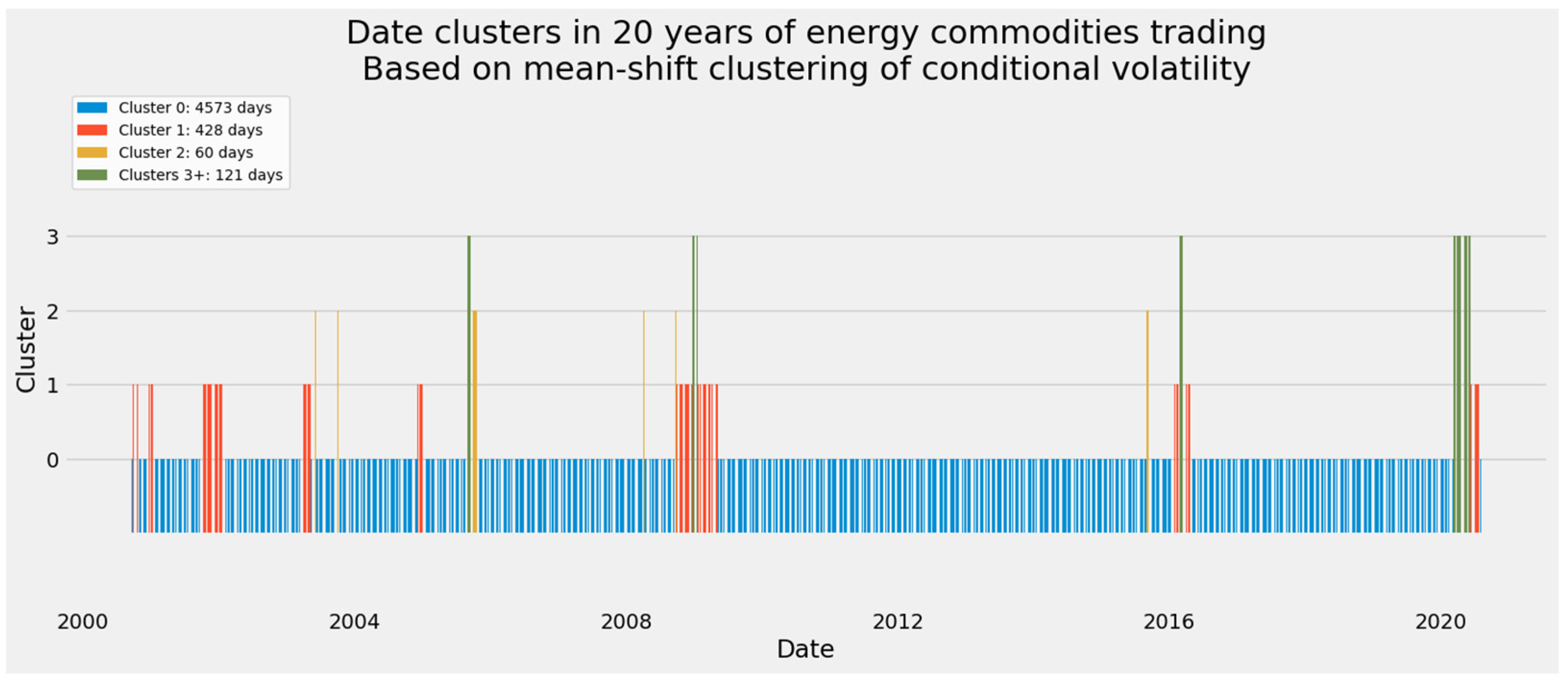

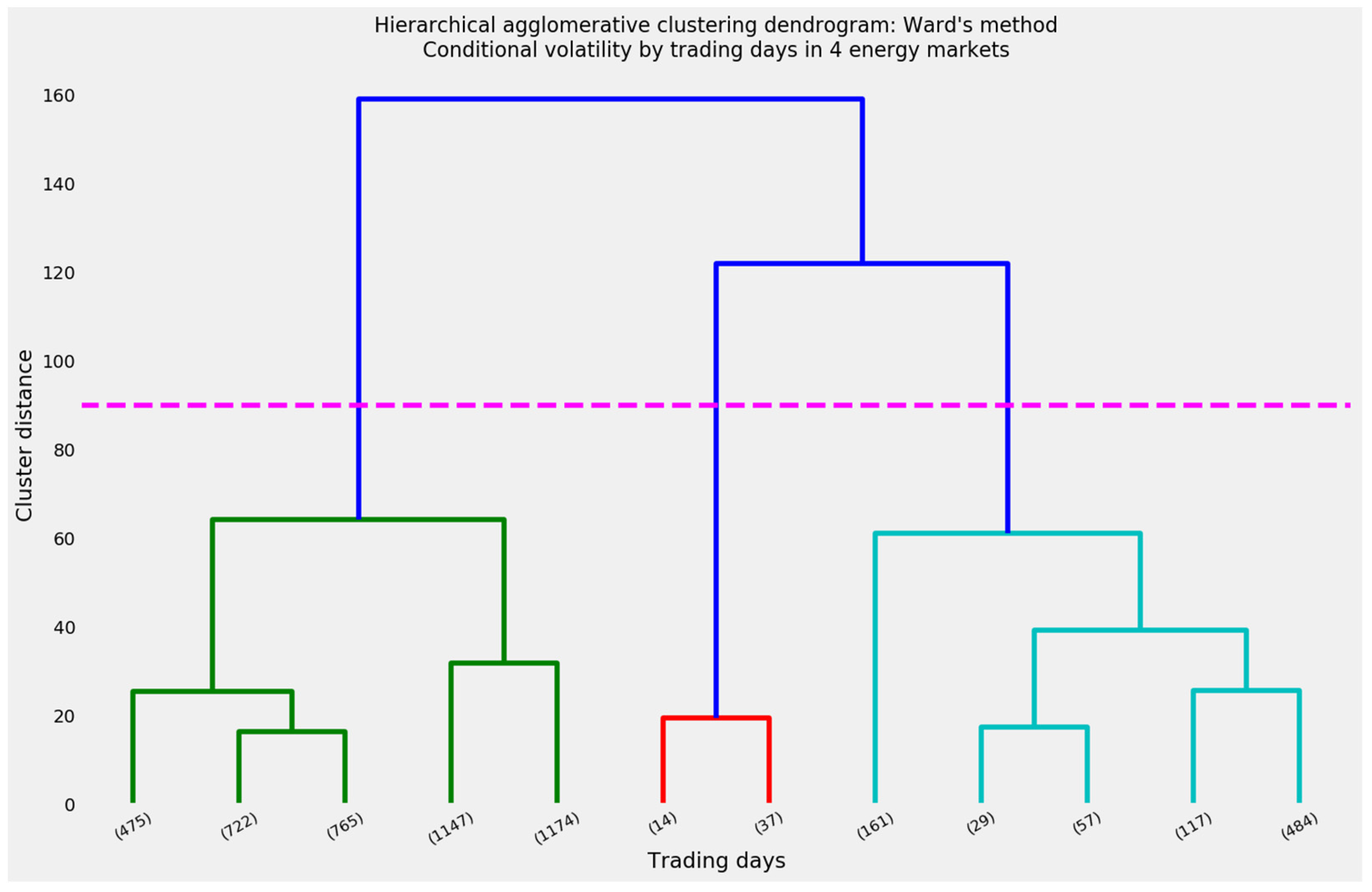

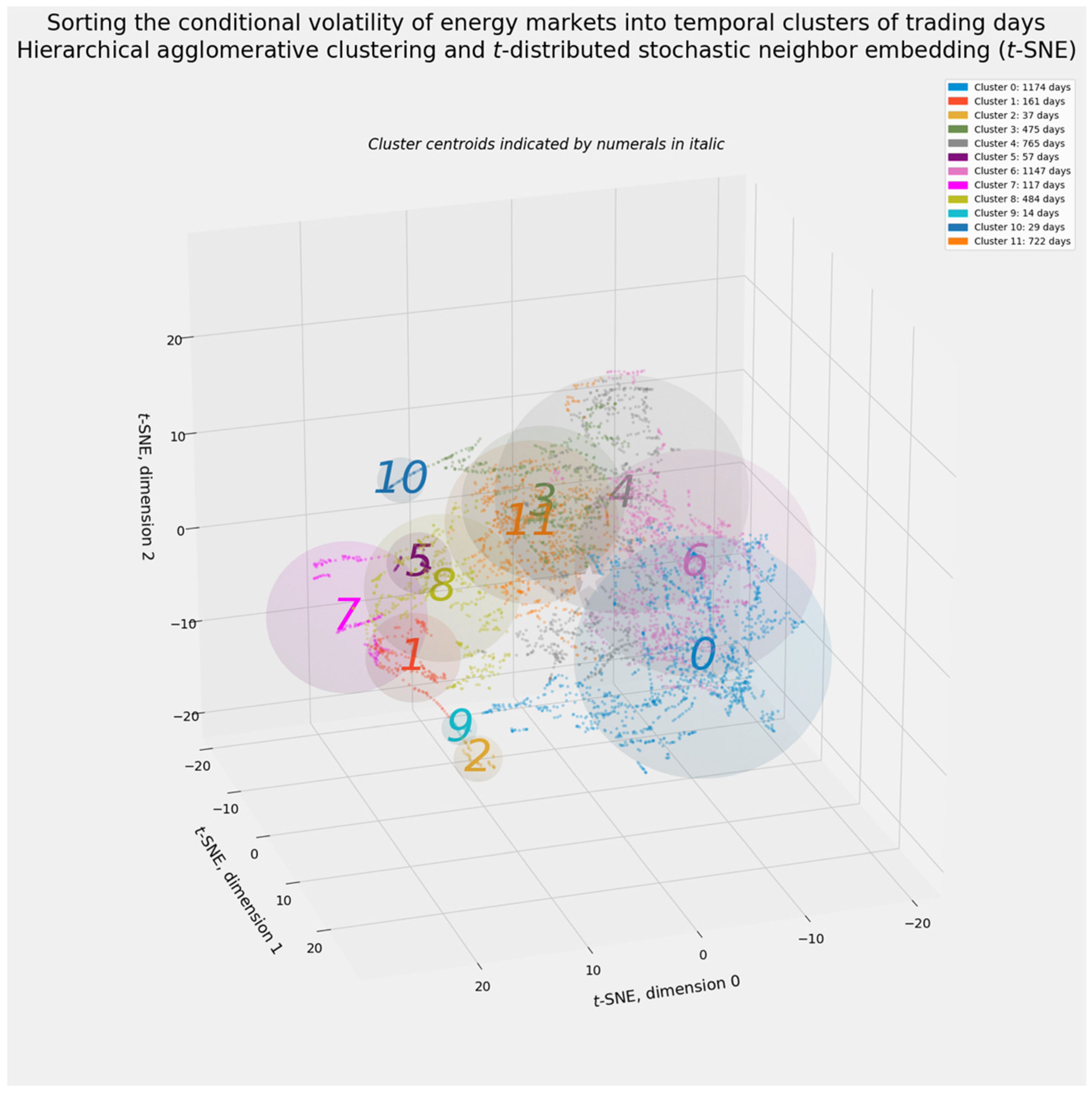

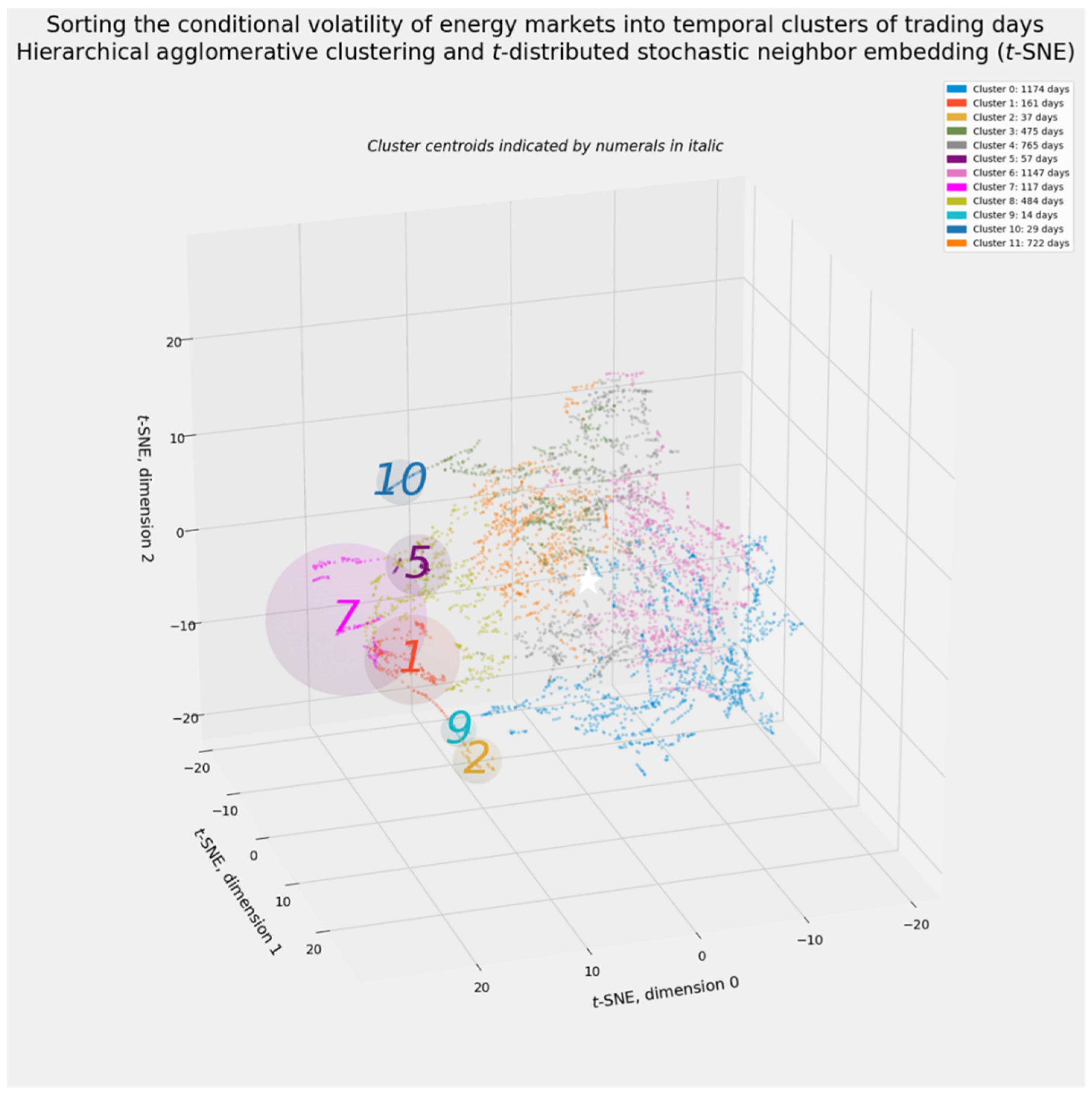

4.2.3. Hierarchical Agglomerative Clustering

4.2.4. Affinity Propagation

4.2.5. k-Means Clustering

4.2.6. Aggregating Clustering Results through Voting

5. Results, Part 2: Evaluating Critical Periods in Energy-Related Markets

5.1. Identifying and Classifying Critical Periods Located through Temporal Clustering

- Five noncontiguous days in 2000: 26, 27, and 29 September, plus 18 and 19 October;

- The December 2000 event: 15 December 2000 through 2 January 2001;

- The immediate aftermath of the 11 September 2001 terrorist attacks: 25 September 2001 through 7 November 2001;

- The American invasion of Afghanistan: 13 November 2001 through 27 December 2001;

- The second Gulf War: 19 March 2003 through 5 May 2003;

- The single day of 30 September 2013;

- Five noncontiguous days in 3, 6, 7, 8 December 2004 and 16 December 2004;

- The aftermath of Hurricane Katrina: 31 August 2005 through 12 October 2005;

- The global financial crisis: 19 September 2008 through 30 April 2009;

- The September 2015 event: 2 September 2015 through 22 September 2015;

- The winter 2016 event: 18 January 2016 through 25 March 2016;

- The COVID-19 pandemic: 9 March 2020 through 17 July 2020.

5.2. Visualizing and Evaluating Critical Periods Uncovered by Temporal Clustering

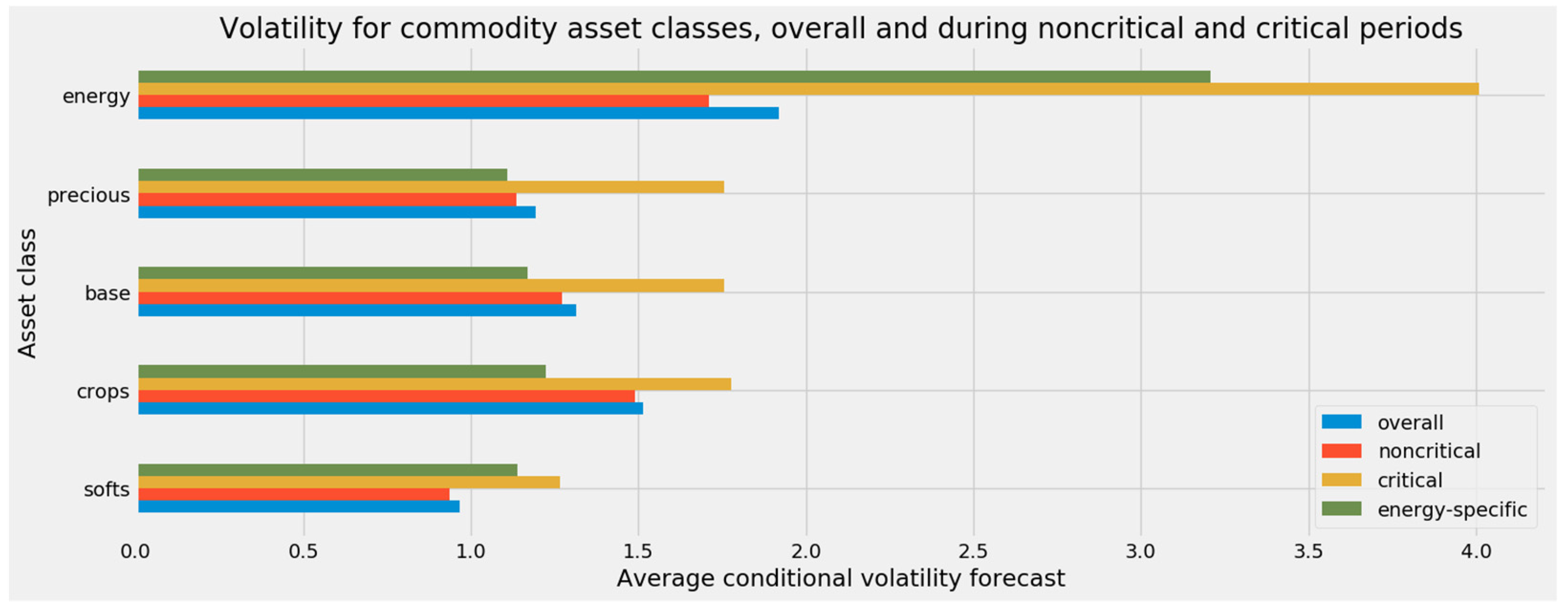

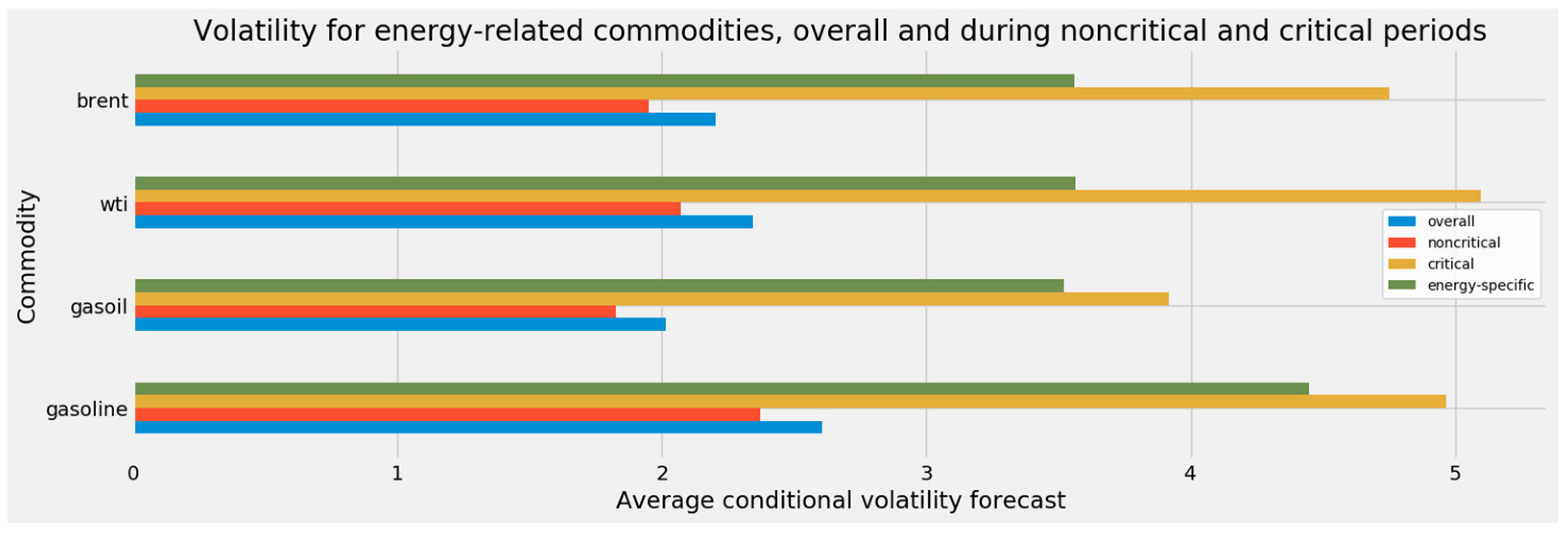

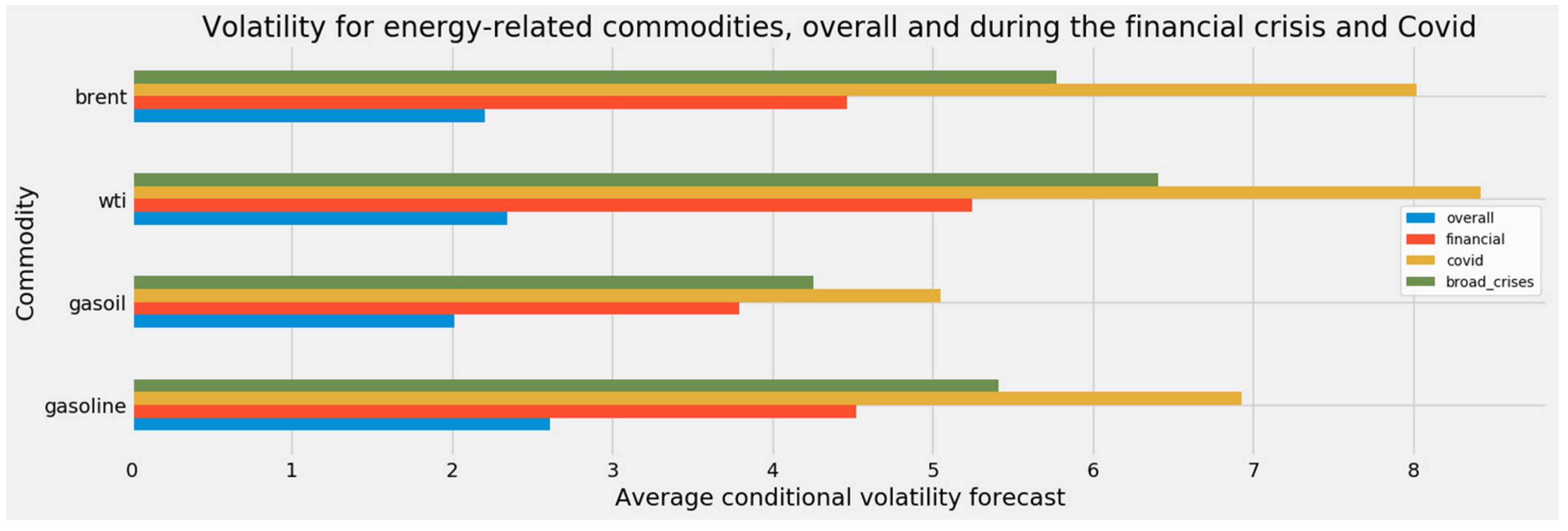

5.2.1. Condiitonal Volatility Forecasts

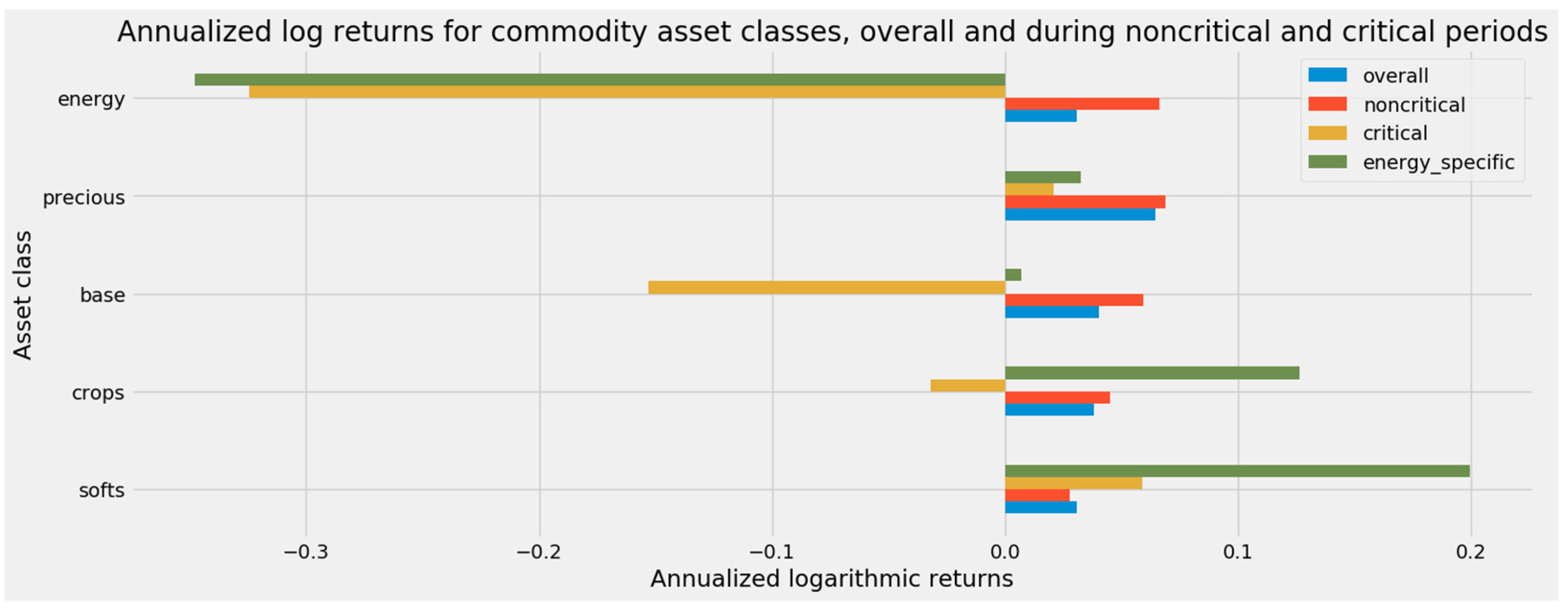

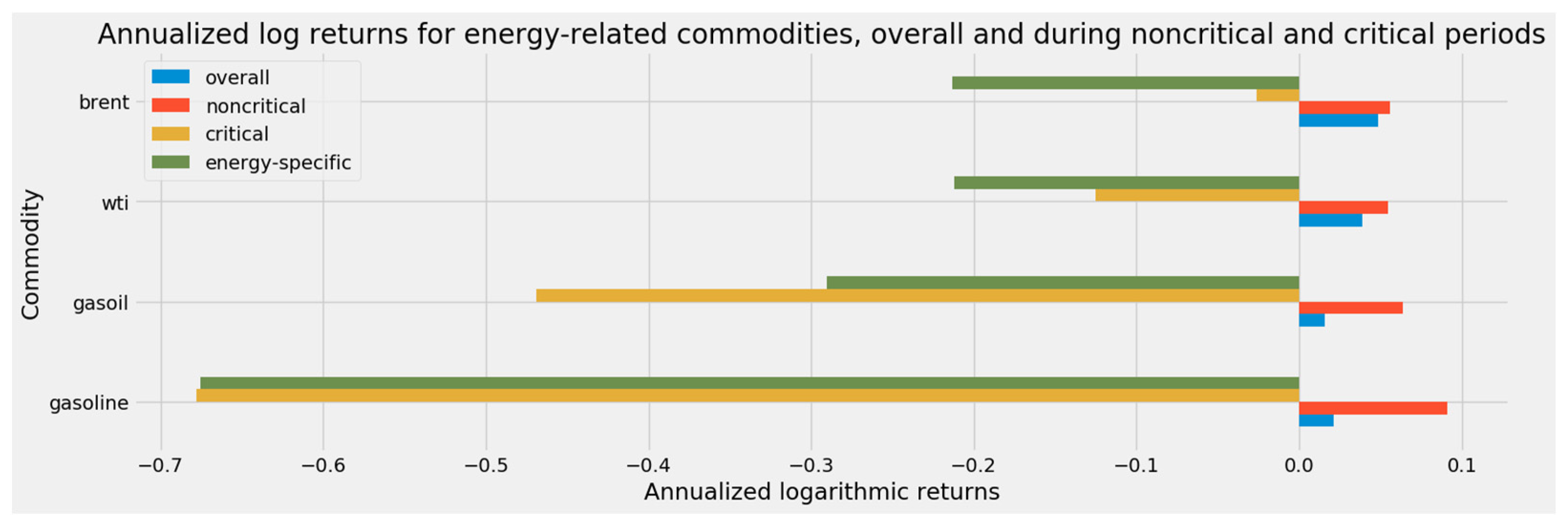

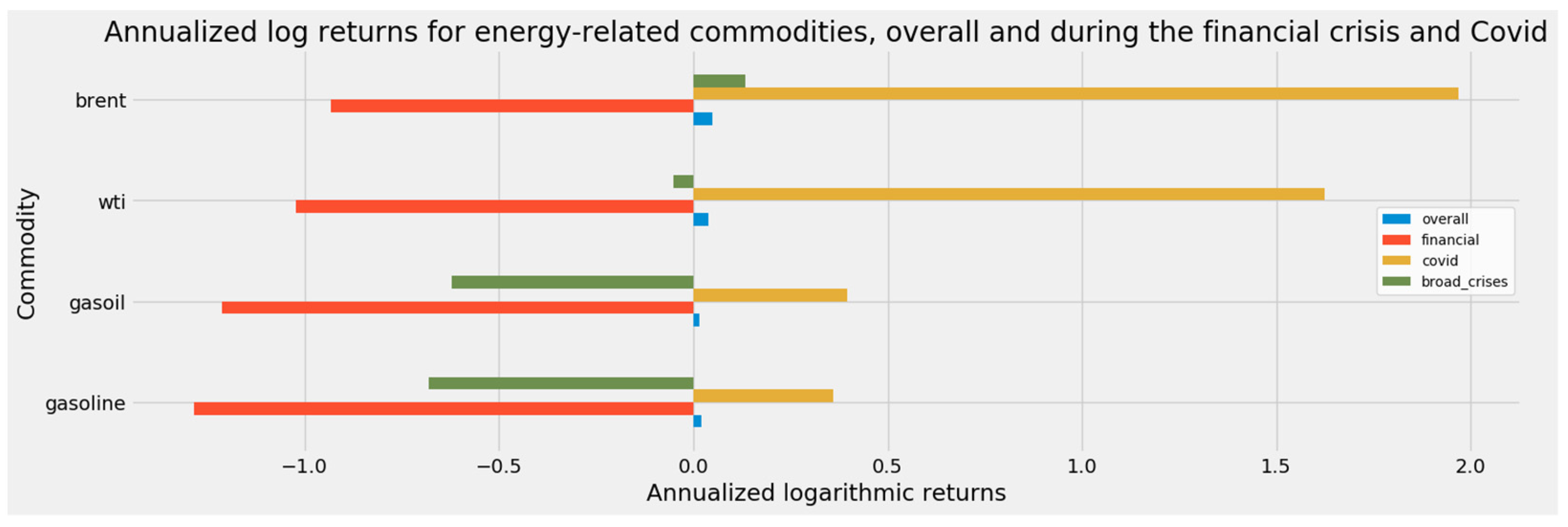

5.2.2. Logarithmic Returns

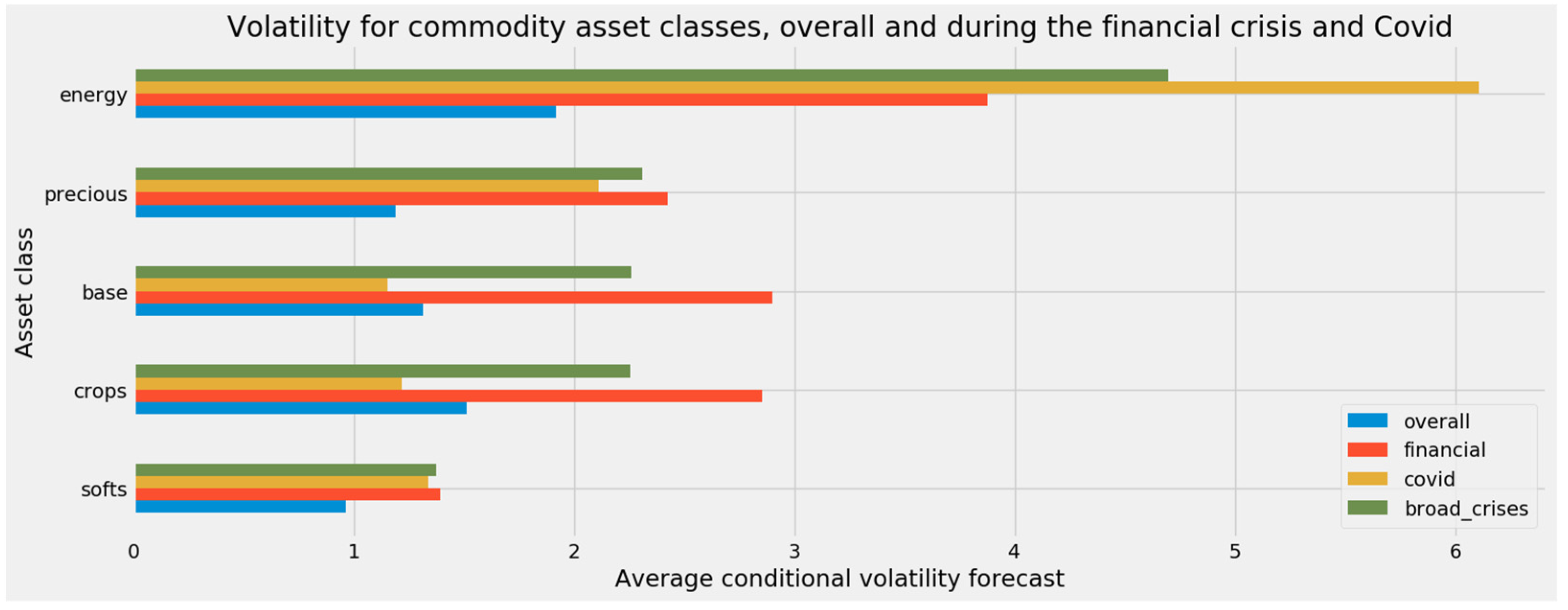

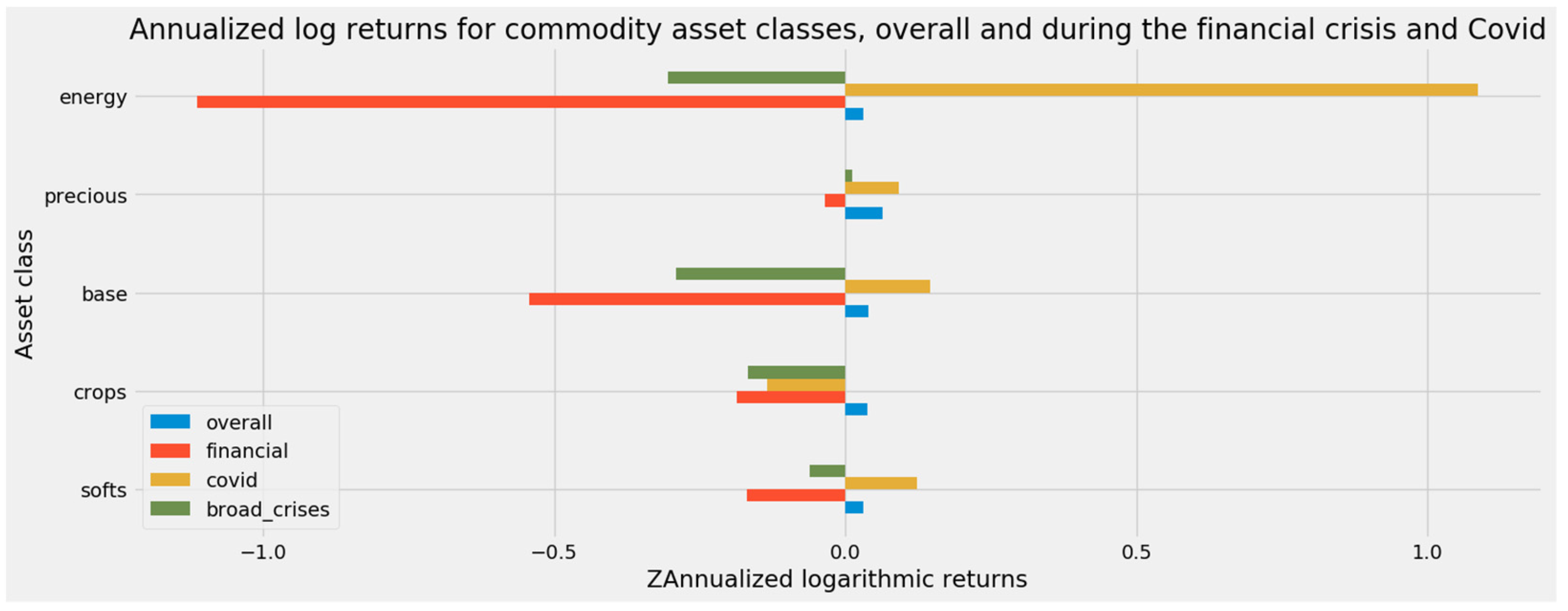

5.3. Comparing Energy-Market Impacts with Other Commodity Asset Classes

- The gas shock, March 2001 through December 2001;

- The Iraq invasion, November 2002 through July 2003;

- Oil price increases, June 2007 through August 2008;

- Global oil and food crises, July 2008 through January 2009;

- The coffee shock, June 2010 through March 2011;

- Chinese deceleration, June 2015 through February 2016;

- The COVID-19 pandemic, 10 March 2020 through 17 July 2020.

5.4. Comparing Crude Oil with Refined Fuels

6. Discussion

6.1. Implications for Firms, Investors, and Governments

6.2. Additional Directions for Research: Temporal Clustering and Machine Learninng

“The knowledge imposes a pattern, and falsifies, /For the pattern is new in every moment/And every moment is a new and shocking/Valuation of all we have been.”

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Chen, J.M.; Rehman, M.U.; Vo, X.V. Clustering commodity markets in space and time: Clarifying returns, volatility, and trading regimes through unsupervised machine learning. Resour. Policy 2021, 73, 102162. [Google Scholar] [CrossRef]

- Cashin, P.; McDermott, C.; Pattillo, C. Terms of trade shocks in Africa: Are they short-lived or long-lived? J. Dev. Econ. 2004, 73, 727–744. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Erdem, C.; Soytas, U. Volatility spillover between oil and agricultural commodity markets. Energy Econ. 2013, 36, 658–665. [Google Scholar] [CrossRef]

- Křehlík, T.; Barunik, J. Cyclical properties of supply-side and demand-side shocks in oil-based commodity markets. Energy Econ. 2017, 65, 208–218. [Google Scholar] [CrossRef]

- Falkowski, M. Financialization of commodities. Contemp. Econ. 2011, 5, 4–17. [Google Scholar] [CrossRef]

- Chatziantoniou, I.; Filippidis, M.; Filis, G.; Gabauer, D. A closer look into the global determinants of oil price volatility. Energy Econ. 2021, 95, 105092. [Google Scholar] [CrossRef]

- Degiannakis, S.; Filis, G. Forecasting oil price realized volatility using information channels from other asset classes. J. Int. Money Finance 2017, 76, 28–49. [Google Scholar] [CrossRef]

- Efimova, O.; Serletis, A. Energy markets volatility modelling using GARCH. Energy Econ. 2014, 43, 264–273. [Google Scholar] [CrossRef]

- Zaremba, A.; Umar, Z.; Mikutowski, M. Commodity financialisation and price co-movement: Lessons from two centuries of evidence. Finance Res. Lett. 2021, 38, 101492. [Google Scholar] [CrossRef]

- Narayan, P.K.; Narayan, S. Modelling oil price volatility. Energy Policy 2007, 35, 6549–6553. [Google Scholar] [CrossRef]

- Abel, A.B. Optimal investment under uncertainty. Am. Econ. Rev. 1983, 73, 228–233. Available online: https://www.jstor.org/stable/1803942 (accessed on 30 August 2021).

- Abel, A.; Eberly, J. A unified model of investment under uncertainty. Am. Econ. Rev. 1994, 84, 1369–1384. Available online: https://www.jstor.org/stable/2117777 (accessed on 30 August 2021).

- Abel, A.B.; Eberly, J.C. Optimal investment with costly reversibility. Rev. Econ. Stud. 1996, 63, 581–593. [Google Scholar] [CrossRef]

- Abel, A.B.; Eberly, J.C. An exact solution for the investment and value of a firm facing uncertainty, adjustment costs, and irreversibility. J. Econ. Dyn. Control. 1997, 21, 831–852. [Google Scholar] [CrossRef]

- Charles, A.; Darné, O. The efficiency of the crude oil markets: Evidence from variance ratio tests. Energy Policy 2009, 37, 4267–4272. [Google Scholar] [CrossRef]

- Ji, Q.; Guo, J.-F. Oil price volatility and oil-related events: An Internet concern study perspective. Appl. Energy 2015, 137, 256–264. [Google Scholar] [CrossRef]

- Salisu, A.; Fasanya, I.O. Modelling oil price volatility with structural breaks. Energy Policy 2013, 52, 554–562. [Google Scholar] [CrossRef]

- Klein, T.; Walther, T. Oil price volatility forecast with mixture memory GARCH. Energy Econ. 2016, 58, 46–58. [Google Scholar] [CrossRef]

- Wei, Y.; Wang, Y.; Huang, D. Forecasting crude oil market volatility: Further evidence using GARCH-class models. Energy Econ. 2010, 32, 1477–1484. [Google Scholar] [CrossRef]

- Chanol, E.; Collet, O.; Kostyuchyk, N.; Mesbah, T.; Nguyen, Q.H.L. Co-integration for soft commodities with non constant volatility. Int. J. Trade Econ. Finance 2015, 6, 32–36. [Google Scholar] [CrossRef][Green Version]

- Havranek, T.; Kokes, O. Income elasticity of gasoline demand: A meta-analysis. Energy Econ. 2015, 47, 77–86. [Google Scholar] [CrossRef]

- Labandeira, X.; Labeaga, J.M.; López-Otero, X. A meta-analysis on the price elasticity of energy demand. Energy Policy 2017, 102, 549–568. [Google Scholar] [CrossRef]

- Havranek, T.; Irsova, Z.; Janda, K. Demand for gasoline is more price-inelastic than commonly thought. Energy Econ. 2012, 34, 201–207. [Google Scholar] [CrossRef]

- Borenstein, S.; Cameron, A.C.; Gilbert, R. Do gasoline prices respond asymmetrically to crude oil price changes? Q. J. Econ. 1997, 112, 305–339. [Google Scholar] [CrossRef]

- Douglas, C.; Herrera, A.M. Why are gasoline prices sticky? A test of alternative models of price adjustment. J. Appl. Econ. 2010, 25, 903–928. [Google Scholar] [CrossRef]

- Douglas, C.C.; Herrera, A.M. Dynamic pricing and asymmetries in retail gasoline markets: What can they tell us about price stickiness? Econ. Lett. 2014, 122, 247–252. [Google Scholar] [CrossRef]

- Karrenbrock, J.D. The behavior of retail gasoline prices: Symmetric or not? Rev. Fed. Reserve Bank St. Louis. 1991, 73, 19–29. [Google Scholar] [CrossRef]

- Bremmer, D.S.; Kesselring, R.G. The relationship between U.S. retail gasoline and crude oil prices during the Great Recession: “rockets and feathers” or “balloons and rocks” behavior? Energy Econ. 2016, 55, 200–210. [Google Scholar] [CrossRef]

- Eleftheriou, K.; Nijkamp, P.; Polemis, M.L. Asymmetric price adjustments in US gasoline markets: Impacts of spatial dependence on the ‘rockets and feathers’ hypothesis. Reg. Stud. 2019, 53, 667–680. [Google Scholar] [CrossRef]

- Galeotti, M.; Lanza, A.; Manera, M. Rockets and feathers revisited: An international comparison on European gasoline markets. Energy Econ. 2003, 25, 175–190. [Google Scholar] [CrossRef]

- Radchenko, S.; Shapiro, D. Anticipated and unanticipated effects of crude oil prices and gasoline inventory changes on gasoline prices. Energy Econ. 2011, 33, 758–769. [Google Scholar] [CrossRef]

- Lewis, M.; Noel, M. The speed of gasoline price response in markets with and without edgeworth cycles. Rev. Econ. Stat. 2011, 93, 672–682. [Google Scholar] [CrossRef]

- Noel, M.D.; Chu, L. Forecasting gasoline prices in the presence of edgeworth price cycles. Energy Econ. 2015, 51, 204–214. [Google Scholar] [CrossRef]

- Dilaver, Z.; Hunt, L.C. Modelling U.S. gasoline demand: A structural time series analysis with asymmetric price responses. Energy Policy 2021, 156, 112386. [Google Scholar] [CrossRef]

- Lin, C.-Y.C.; Prince, L. Gasoline price volatility and the elasticity of demand for gasoline. Energy Econ. 2013, 38, 111–117. [Google Scholar] [CrossRef]

- Bachmeier, L.J.; Griffin, J.M. New evidence on asymmetric gasoline price responses. Rev. Econ. Stat. 2003, 85, 772–776. [Google Scholar] [CrossRef]

- Venditti, F. From oil to consumer energy prices: How much asymmetry along the way? Energy Econ. 2013, 40, 468–473. [Google Scholar] [CrossRef]

- Apergis, N.; Vouzavalis, G. Asymmetric pass through of oil prices to gasoline prices: Evidence from a new country sample. Energy Policy 2018, 114, 519–528. [Google Scholar] [CrossRef]

- Kuper, G. Inventories and upstream gasoline price dynamics. Energy Econ. 2012, 34, 208–214. [Google Scholar] [CrossRef]

- Rahman, S. Another perspective on gasoline price responses to crude oil price changes. Energy Econ. 2016, 55, 10–18. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Gupta, R.; Olubusoye, O.; Yaya, O.S. Time series analysis of persistence in crude oil price volatility across bull and bear regimes. Energy 2016, 109, 29–37. [Google Scholar] [CrossRef]

- Hamilton, J.D. Oil and the macroeconomy since World War II. J. Political Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Dahl, C.A. Measuring global gasoline and diesel price and income elasticities. Energy Policy 2012, 41, 2–13. [Google Scholar] [CrossRef]

- Aklilu, A.Z. Gasoline and diesel demand in the EU: Implications for the 2030 emission goal. Renew. Sustain. Energy Rev. 2020, 118, 109530. [Google Scholar] [CrossRef]

- Wadud, Z. Diesel demand in the road freight sector in the UK: Estimates for different vehicle types. Appl. Energy 2016, 165, 849–857. [Google Scholar] [CrossRef]

- Andrews, A.; Perl, L. The Northeast Heating Oil Supply, Demand, and Factors Affecting Its Use. Congressional Research Service Report 7-5700, 28 April 2014. Available online: http://nationalaglawcenter.org/wp-content/uploads/assets/crs/R43511.pdf (accessed on 5 September 2021).

- Naeem, M.; Farid, S.; Nor, S.; Shahzad, S. Spillover and drivers of uncertainty among oil and commodity markets. Mathematics 2021, 9, 441. [Google Scholar] [CrossRef]

- Al-Yahyaee, K.H.; Mensi, W.; Rehman, M.U.; Vo, X.V.; Kang, S.H. Do Islamic stocks outperform conventional stock sectors during normal and crisis periods? Extreme co-movements and portfolio management analysis. Pac. Basin Financ. J. 2020, 62, 101385. [Google Scholar] [CrossRef]

- Rehman, M.U.; Apergis, N. Determining the predictive power between cryptocurrencies and real time commodity futures: Evidence from quantile causality tests. Resour. Policy 2019, 61, 603–616. [Google Scholar] [CrossRef]

- Umar, Z. The demand of energy from an optimal portfolio choice perspective. Econ. Model. 2017, 61, 478–494. [Google Scholar] [CrossRef]

- Liu, C.; Naeem, M.A.; Rehman, M.U.; Farid, S.; Shahzad, S.J.H. Oil as hedge, safe-haven, and diversifier for conventional currencies. Energies 2020, 13, 4354. [Google Scholar] [CrossRef]

- Awartani, B.; Aktham, M.; Cherif, G. The connectedness between crude oil and financial markets: Evidence from implied volatility indices. J. Commod. Mark. 2016, 4, 56–69. [Google Scholar] [CrossRef]

- Uddin, G.S.; Shahzad, S.J.H.; Boako, G.; Hernandez, J.A.; Lucey, B.M. Heterogeneous interconnections between precious metals: Evidence from asymmetric and frequency-domain spillover analysis. Resour. Policy 2019, 64, 101509. [Google Scholar] [CrossRef]

- Ahmadi, M.; Behmiri, N.B.; Manera, M. How is volatility in commodity markets linked to oil price shocks? Energy Econ. 2016, 59, 11–23. [Google Scholar] [CrossRef]

- Guhathakurta, K.; Dash, S.R.; Maitra, D. Period specific volatility spillover based connectedness between oil and other commodity prices and their portfolio implications. Energy Econ. 2020, 85, 104566. [Google Scholar] [CrossRef]

- Ji, Q.; Fan, Y. How does oil price volatility affect non-energy commodity markets? Appl. Energy 2012, 89, 273–280. [Google Scholar] [CrossRef]

- Maitra, D.; Guhathakurta, K.; Kang, S.H. The good, the bad and the ugly relation between oil and commodities: An analysis of asymmetric volatility connectedness and portfolio implications. Energy Econ. 2021, 94, 105061. [Google Scholar] [CrossRef]

- Kearney, A.A.; Lombra, R.E. Gold and platinum: Toward solving the price puzzle. Q. Rev. Econ. Finance 2009, 49, 884–892. [Google Scholar] [CrossRef]

- Aguilera, R.F.; Radetzki, M. The synchronized and exceptional price performance of oil and gold: Explanations and prospects. Resour. Policy 2017, 54, 81–87. [Google Scholar] [CrossRef]

- Husain, S.; Tiwari, A.K.; Sohag, K.; Shahbaz, M. Connectedness among crude oil prices, stock index and metal prices: An application of network approach in the USA. Resour. Policy 2019, 62, 57–65. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A.; Ugolini, A. Downside and upside risk spillovers between exchange rates and stock prices. J. Bank. Financ. 2016, 62, 76–96. [Google Scholar] [CrossRef]

- Plourde, A.; Watkins, G. Crude oil prices between 1985 and 1994: How volatile in relation to other commodities? Resour. Energy Econ. 1998, 20, 245–262. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is gold a safe haven? International evidence. J. Bank. Financ. 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Mensi, W.; Hammoudeh, S.; Reboredo, J.C.; Nguyen, D.K. Are Sharia stocks, gold and U.S. Treasury hedges and/or safe havens for the oil-based GCC markets? Emerg. Mark. Rev. 2015, 24, 101–121. [Google Scholar] [CrossRef]

- Lili, L.; Chengmei, D. Research of the Influence of macro-economic factors on the price of gold. Procedia Comput. Sci. 2013, 17, 737–743. [Google Scholar] [CrossRef][Green Version]

- Chen, M.-H. Understanding world metals prices—returns, volatility and diversification. Resour. Policy 2010, 35, 127–140. [Google Scholar] [CrossRef]

- Demiralay, S.; Ulusoy, V. Non-linear volatility dynamics and risk management of precious metals. N. Am. J. Econ. Financ. 2014, 30, 183–202. [Google Scholar] [CrossRef]

- Naeem, M.A.; Balli, F.; Shahzad, S.J.H.; de Bruin, A. Energy commodity uncertainties and the systematic risk of US industries. Energy Econ. 2020, 85, 104589. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Filis, G. Oil price shocks and stock market returns: New evidence from the United States and China. J. Int. Financ. Mark. Inst. Money 2014, 33, 417–433. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Santos, P.A.; Al-Hassan, A. Downside risk management and VaR-based optimal portfolios for precious metals, oil and stocks. N. Am. J. Econ. Financ. 2013, 25, 318–334. [Google Scholar] [CrossRef]

- Kang, S.H.; McIver, R.; Yoon, S.-M. Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets. Energy Econ. 2017, 62, 19–32. [Google Scholar] [CrossRef]

- Rehman, M.U.; Shahzad, S.J.H.; Uddin, G.S.; Hedström, A. Precious metal returns and oil shocks: A time varying connectedness approach. Resour. Policy 2018, 58, 77–89. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Yuan, Y. Metal volatility in presence of oil and interest rate shocks. Energy Econ. 2008, 30, 606–620. [Google Scholar] [CrossRef]

- Liu, F.; Zhang, C.; Tang, M. The impacts of oil price shocks and jumps on China’s nonferrous metal markets. Resour. Policy 2021, 73, 102228. [Google Scholar] [CrossRef]

- Umar, Z.; Jareño, F.; Escribano, A. Oil price shocks and the return and volatility spillover between industrial and precious metals. Energy Econ. 2021, 99, 105291. [Google Scholar] [CrossRef]

- Du, X.; Yu, C.L.; Hayes, D. Speculation and volatility spillover in the crude oil and agricultural commodity markets: A bayesian analysis. Energy Econ. 2011, 33, 497–503. [Google Scholar] [CrossRef]

- Koirala, K.H.; Mishra, A.K.; D’Antoni, J.M.; Mehlhorn, J.E. Energy prices and agricultural commodity prices: Testing correlation using copulas method. Energy 2015, 81, 430–436. [Google Scholar] [CrossRef]

- Roman, M.; Górecka, A.; Domagała, J. The linkages between crude oil and food prices. Energies 2020, 13, 6545. [Google Scholar] [CrossRef]

- Serra, T. Volatility spillovers between food and energy markets: A semiparametric approach. Energy Econ. 2011, 33, 1155–1164. [Google Scholar] [CrossRef]

- Kumar, S.; Tiwari, A.K.; Raheem, I.D.; Hille, E. Time-varying dependence structure between oil and agricultural commodity markets: A dependence-switching CoVaR copula approach. Resour. Policy 2021, 72, 102049. [Google Scholar] [CrossRef]

- Lucotte, Y. Co-movements between crude oil and food prices: A post-commodity boom perspective. Econ. Lett. 2016, 147, 142–147. [Google Scholar] [CrossRef]

- Umar, Z.; Jareño, F.; Escribano, A. Agricultural commodity markets and oil prices: An analysis of the dynamic return and volatility connectedness. Resour. Policy 2021, 73, 102147. [Google Scholar] [CrossRef]

- Sun, Y.; Mirza, N.; Qadeer, A.; Hsueh, H.-P. Connectedness between oil and agricultural commodity prices during tranquil and volatile period. Is crude oil a victim indeed? Resour. Policy 2021, 72, 102131. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; López, R.; Jareño, F. Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ. 2018, 76, 1–20. [Google Scholar] [CrossRef]

- Carpio, L.G.T. The effects of oil price volatility on ethanol, gasoline, and sugar price forecasts. Energy 2019, 181, 1012–1022. [Google Scholar] [CrossRef]

- Reboredo, J.C. Do food and oil prices co-move? Energy Policy 2012, 49, 456–467. [Google Scholar] [CrossRef]

- Fernandez-Perez, A.; Frijns, B.; Tourani-Rad, A. Contemporaneous interactions among fuel, biofuel and agricultural commodities. Energy Econ. 2016, 58, 1–10. [Google Scholar] [CrossRef]

- Karyotis, C.; Alijani, S. Soft commodities and the global financial crisis: Implications for the economy, resources and institutions. Res. Int. Bus. Financ. 2016, 37, 350–359. [Google Scholar] [CrossRef]

- McPhail, L.L.; Babcock, B.A. Impact of US biofuel policy on US corn and gasoline price variability. Energy 2012, 37, 505–513. [Google Scholar] [CrossRef]

- Gardebroek, C.; Hernandez, M.A. Do energy prices stimulate food price volatility? Examining volatility transmission between US oil, ethanol and corn markets. Energy Econ. 2013, 40, 119–129. [Google Scholar] [CrossRef]

- Cabrera, B.L.; Schulz, F. Volatility linkages between energy and agricultural commodity prices. Energy Econ. 2016, 54, 190–203. [Google Scholar] [CrossRef]

- Enciso, S.R.A.; Fellmann, T.; Dominguez, I.P.; Santini, F. Abolishing biofuel policies: Possible impacts on agricultural price levels, price variability and global food security. Food Policy 2016, 61, 9–26. [Google Scholar] [CrossRef]

- Zhang, C.; Qu, X. The effect of global oil price shocks on China’s agricultural commodities. Energy Econ. 2015, 51, 354–364. [Google Scholar] [CrossRef]

- Luo, J.; Ji, Q. High-frequency volatility connectedness between the US crude oil market and China’s agricultural commodity markets. Energy Econ. 2018, 76, 424–438. [Google Scholar] [CrossRef]

- Rafiq, S.; Salim, R.; Bloch, H. Impact of crude oil price volatility on economic activities: An empirical investigation in the Thai economy. Resour. Policy 2009, 34, 121–132. [Google Scholar] [CrossRef]

- Vo, L.H.; Le, T.-H. Eatery, energy, environment and economic system, 1970–2017: Understanding volatility spillover patterns in a global sample. Energy Econ. 2021, 100, 105391. [Google Scholar] [CrossRef]

- Morgan, C.; Rayner, A.; Ennew, C. Price instability and commodity futures markets. World Dev. 1994, 22, 1729–1736. [Google Scholar] [CrossRef]

- Mehlum, H.; Moene, K.O.; Torvik, R. Institutions and the resource curse. Econ. J. 2006, 116, 1–20. [Google Scholar] [CrossRef]

- Robinson, J.A.; Torvik, R.; Verdier, T. Political foundations of the resource curse. J. Dev. Econ. 2006, 79, 447–468. [Google Scholar] [CrossRef]

- Ross, M. The political economy of the resource curse. World Politics 1999, 51, 297–322. [Google Scholar] [CrossRef]

- Ross, M. What have we learned about the resource curse? Annu. Rev. Political Sci. 2015, 18, 239–259. [Google Scholar] [CrossRef]

- Filis, G.; Degiannakis, S.; Floros, C. Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. Int. Rev. Financ. Anal. 2011, 20, 152–164. [Google Scholar] [CrossRef]

- Guesmi, K.; Fattoum, S. Return and volatility transmission between oil prices and oil-exporting and oil-importing countries. Econ. Model. 2014, 38, 305–310. [Google Scholar] [CrossRef]

- Huntington, H.G. The oil security problem. In International Handbook on the Economics of Energy; Evans, J., Hunt, L., Eds.; Edward Elgar Publishing: Cheltenham, UK; Northampton, MA, USA, 2009; pp. 383–400. [Google Scholar]

- Tazhibayeva, K.; Husain, A.M.; Ter-Martirosyan, A. Fiscal policy and economic cycles in oil-exporting countries. IMF Work. Pap. 2008, 253, 1. [Google Scholar] [CrossRef]

- Chen, X.; Fazilov, F. Re-centering Central Asia: China’s “new great game” in the old Eurasian Heartland. Palgrave Commun. 2018, 4, 71. [Google Scholar] [CrossRef]

- Kumar, S.; Khalfaoui, R.; Tiwari, A.K. Does geopolitical risk improve the directional predictability from oil to stock returns? Evidence from oil-exporting and oil-importing countries. Resour. Policy 2021, 74, 102253. [Google Scholar] [CrossRef]

- Van Eyden, R.; Difeto, M.; Gupta, R.; Wohar, M.E. Oil price volatility and economic growth: Evidence from advanced economies using more than a century’s data. Appl. Energy 2019, 233–234, 612–621. [Google Scholar] [CrossRef]

- Chen, S.-S.; Hsu, K.-W. Reverse globalization: Does high oil price volatility discourage international trade? Energy Econ. 2012, 34, 1634–1643. [Google Scholar] [CrossRef]

- Creti, A.; Joëts, M.; Mignon, V. On the links between stock and commodity markets’ volatility. Energy Econ. 2013, 37, 16–28. [Google Scholar] [CrossRef]

- Naeem, M.; Umar, Z.; Ahmed, S.; Ferrouhi, E.M. Dynamic dependence between ETFs and crude oil prices by using EGARCH-Copula approach. Phys. A Stat. Mech. Appl. 2020, 557, 124885. [Google Scholar] [CrossRef]

- Baghyani, Z.; Farid, D.; Abtahi, S.Y. Check contagion of price fluctuations in the index of currency and oil with the index of stock prices in the Stock Exchange. UCT J. Mgmt. Account. Stud. 2015, 3, 61–66. [Google Scholar] [CrossRef]

- Masih, R.; Peters, S.; De Mello, L. Oil price volatility and stock price fluctuations in an emerging market: Evidence from South Korea. Energy Econ. 2011, 33, 975–986. [Google Scholar] [CrossRef]

- Urom, C.; Onwuka, K.O.; Uma, K.E.; Yuni, D.N. Regime dependent effects and cyclical volatility spillover between crude oil price movements and stock returns. Int. Econ. 2020, 161, 10–29. [Google Scholar] [CrossRef]

- Ashfaq, S.; Tang, Y.; Maqbool, R. Volatility spillover impact of world oil prices on leading Asian energy exporting and importing economies’ stock returns. Energy 2019, 188, 116002. [Google Scholar] [CrossRef]

- Khalfaoui, R.; Sarwar, S.; Tiwari, A. Analysing volatility spillover between the oil market and the stock market in oil-importing and oil-exporting countries: Implications on portfolio management. Resour. Policy 2019, 62, 22–32. [Google Scholar] [CrossRef]

- Sim, N.; Zhou, H. Oil prices, US stock return, and the dependence between their quantiles. J. Bank. Financ. 2015, 55, 1–8. [Google Scholar] [CrossRef]

- Xu, Y.; Han, L.; Wan, L.; Yin, L. Dynamic link between oil prices and exchange rates: A non-linear approach. Energy Econ. 2019, 84, 104488. [Google Scholar] [CrossRef]

- Ferderer, J.P. Oil price volatility and the macroeconomy. J. Macroecon. 1996, 18, 1–26. [Google Scholar] [CrossRef]

- Ebrahim, Z.; Inderwildi, O.R.; King, D.A. Macroeconomic impacts of oil price volatility: Mitigation and resilience. Front. Energy 2014, 8, 9–24. [Google Scholar] [CrossRef]

- Mork, K.A. Oil and the macroeconomy when prices go up and down: An extension of hamilton’s results. J. Political Econ. 1989, 97, 740–744. [Google Scholar] [CrossRef]

- Guo, H.; Kliesen, K.L. Oil price volatility and U.S. macroeconomic activity. Fed. Reserve Bank St. Louis Rev. 2005, 87, 669–683. [Google Scholar] [CrossRef]

- Van Robays, I. Macroeconomic uncertainty and oil price volatility. Oxf. Bull. Econ. Stat. 2016, 78, 671–693. [Google Scholar] [CrossRef]

- Hamilton, J.D. What is an oil shock? J. Econ. 2003, 113, 363–398. [Google Scholar] [CrossRef]

- Karali, B.; Ramirez, O.A. Macro determinants of volatility and volatility spillover in energy markets. Energy Econ. 2014, 46, 413–421. [Google Scholar] [CrossRef]

- Kilian, L. The economic effects of energy price shocks. J. Econ. Lit. 2008, 46, 871–909. [Google Scholar] [CrossRef]

- Joëts, M.; Mignon, V.; Razafindrabe, T. Does the volatility of commodity prices reflect macroeconomic uncertainty? Energy Econ. 2017, 68, 313–326. [Google Scholar] [CrossRef]

- Roll, R. A critique of the asset pricing theory’s tests Part I: On past and potential testability of the theory. J. Financ. Econ. 1977, 4, 129–176. [Google Scholar] [CrossRef]

- Coase, R.H. The nature of the firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Lunde, A.; Timmermann, A. Duration dependence in stock prices: An analysis of bull and bear markets. J. Bus. Econ. Stat. 2004, 22, 253–273. [Google Scholar] [CrossRef]

- Maheu, J.M.; McCurdy, T.H.; Song, Y. Components of bull and bear markets: Bull corrections and bear rallies. J. Bus. Econ. Stat. 2012, 30, 391–403. [Google Scholar] [CrossRef]

- Pagan, A.R.; Sossounov, K.A. A simple framework for analysing bull and bear markets. J. Appl. Econ. 2003, 18, 23–46. [Google Scholar] [CrossRef]

- Hanna, A.J. A top-down approach to identifying bull and bear market states. Int. Rev. Financ. Anal. 2018, 55, 93–110. [Google Scholar] [CrossRef]

- Chauvet, M. An economic characterization of business cycle dynamics with factor structure and regime switching. Intl. Econ. Rev. 1998, 39, 969–996. [Google Scholar] [CrossRef]

- Chauvet, M.; Piger, J.M. Identifying business cycle turning points in real time. Rev. Fed. Reserve Bank St. Louis 2003, 85, 47–60. [Google Scholar] [CrossRef][Green Version]

- Chauvet, M.; Piger, J. A comparison of the real-time performance of business cycle dating methods. J. Bus. Econ. Stat. 2008, 26, 42–49. [Google Scholar] [CrossRef]

- Harding, D.; Pagan, A. A comparison of two business cycle dating methods. J. Econ. Dyn. Control 2003, 27, 1681–1690. [Google Scholar] [CrossRef]

- FRED, Federal Reserve Bank of St. Louis. Smoothed U.S. Recession Probabilities [RECPROUSM156N]. Available online: https://fred.stlouisfed.org/series/RECPROUSM156N (accessed on 13 July 2021).

- FRED, Federal Reserve Bank of St. Louis. What Dates Are Used for the U.S. Recession Bars? Available online: https://fredhelp.stlouisfed.org/fred/data/understanding-the-data/recession-bars (accessed on 13 July 2021).

- Binder, J. The event study methodology since 1969. Rev. Quant. Financ. Account. 1998, 11, 111–137. [Google Scholar] [CrossRef]

- MacKinlay, A.C. Event studies in economics and finance. J. Fin. Lit. 1997, 35, 13–39. Available online: https://www.jstor.org/stable/2729691 (accessed on 25 August 2021).

- Draper, D.W. The behavior of event-related returns on oil futures contracts. J. Futur. Mark. 1984, 4, 125–132. [Google Scholar] [CrossRef]

- Zhang, X.; Yu, L.; Wang, S.; Lai, K.K. Estimating the impact of extreme events on crude oil price: An EMD-based event analysis method. Energy Econ. 2009, 31, 768–778. [Google Scholar] [CrossRef]

- Demirer, R.; Kutan, A.M. The behavior of crude oil spot and futures prices around OPEC and SPR announcements: An event study perspective. Energy Econ. 2010, 32, 1467–1476. [Google Scholar] [CrossRef]

- Lin, S.X.; Tamvakis, M. OPEC announcements and their effects on crude oil prices. Energy Policy 2010, 38, 1010–1016. [Google Scholar] [CrossRef]

- Kaiser, M.J.; Yu, Y. The impact of hurricanes Gustav and Ike on offshore oil and gas production in the Gulf of Mexico. Appl. Energy 2010, 87, 284–297. [Google Scholar] [CrossRef]

- Eggers, A.C.; Ellison, M.; Lee, S.S. The economic impact of recession announcements. J. Monet. Econ. 2021, 120, 40–52. [Google Scholar] [CrossRef]

- National Bureau of Economic Research. Business Cycle Dating. Available online: https://www.nber.org/research/business-cycle-dating (accessed on 29 August 2021).

- Peláez, R.F. Dating business-cycle turning points. J. Econ. Financ. 2005, 29, 127–137. [Google Scholar] [CrossRef]

- Stone, A.; Gup, B.E. Corporate liquidity and nber recession announcements. J. Financ. Res. 2019, 42, 637–669. [Google Scholar] [CrossRef]

- Einav, L.; Levin, J. Economics in the age of big data. Science 2014, 346, 1243089. [Google Scholar] [CrossRef] [PubMed]

- Campbell, J.Y.; Lo, A.W.; Mackinlay, A.C.; Whitelaw, R.F. The Econometrics of Financial Markets; Princeton University Press: Princeton, NJ, USA, 1998; Volume 2, pp. 559–562. [Google Scholar] [CrossRef]

- Harvey, C.R.; Siddique, A. Conditional Skewness in Asset Pricing Tests. J. Finance 2000, 55, 1263–1295. [Google Scholar] [CrossRef]

- Cashin, P.; McDermott, C.; Scott, A. Booms and slumps in world commodity prices. J. Dev. Econ. 2002, 69, 277–296. [Google Scholar] [CrossRef]

- Rehman, M.U.; Narayan, S. Analysis of dependence structure among investor sentiment, policy uncertainty and international oil prices. Int. J. Oil Gas Coal Technol. 2021, 27, 286. [Google Scholar] [CrossRef]

- Herrera, A.M.; Hu, L.; Pastor, D. Forecasting crude oil price volatility. Int. J. Forecast. 2018, 34, 622–635. [Google Scholar] [CrossRef]

- Narayan, P.K.; Popp, S. A new unit root test with two structural breaks in level and slope at unknown time. J. Appl. Stat. 2010, 37, 1425–1438. [Google Scholar] [CrossRef]

- Narayan, P.K.; Popp, S. Size and power properties of structural break unit root tests. Appl. Econ. 2013, 45, 721–728. [Google Scholar] [CrossRef]

- Yin, L.; Yang, Q. Predicting the oil prices: Do technical indicators help? Energy Econ. 2016, 56, 338–350. [Google Scholar] [CrossRef]

- Zellou, A.M.; Cuddington, J.T. Is there evidence of supercycles in oil prices? SPE Econ. Manag. 2012, 4, 171–181. [Google Scholar] [CrossRef]

- Zhao, L.-T.; Liu, L.-N.; Wang, Z.-J.; He, L.-Y. Forecasting oil price volatility in the era of big data: A text mining for VaR approach. Sustainability 2019, 11, 3892. [Google Scholar] [CrossRef]

- Li, J.; Tang, L.; Li, L. The Co-movements between crude oil price and internet concerns: Causality analysis in the frequency domain. J. Syst. Sci. Inf. 2020, 8, 224–239. [Google Scholar] [CrossRef]

- Li, Z.; Sun, J.; Wang, S. An information diffusion-based model of oil futures price. Energy Econ. 2013, 36, 518–525. [Google Scholar] [CrossRef]

- Fernández-Avilés, G.; Montero, J.-M.; Sanchis-Marco, L. Extreme downside risk co-movement in commodity markets during distress periods: A multidimensional scaling approach. Eur. J. Financ. 2020, 26, 1207–1237. [Google Scholar] [CrossRef]

- Alexander, C.; Lazar, E.; Stanescu, S. Analytic moments for GJR-GARCH (1, 1) processes. Int. J. Forecast. 2021, 37, 105–124. [Google Scholar] [CrossRef]

- Bollerslev, T.; Wooldridge, J.M. Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econ. Rev. 1992, 11, 143–172. [Google Scholar] [CrossRef]

- Nugroho, D.B.; Kurniawati, D.; Panjaitan, L.P.; Kholil, Z.; Susanto, B.; Sasongko, L.R. Empirical performance of GARCH, GARCH-M, GJR-GARCH and log-GARCH models for returns volatility. J. Phys. Conf. Ser. 2019, 1307, 012003. [Google Scholar] [CrossRef]

- Górska, A.; Krawiec, M. Statistical analysis of soft commodities returns in the period 2007–2016. Probl. World Agric. 2017, 17, 85–94. [Google Scholar] [CrossRef]

- Le Roux, C. Relationships between soft commodities, the FTSE/JSE top 40 index and the South African rand. Procedia Econ. Financ. 2015, 24, 353–362. [Google Scholar] [CrossRef][Green Version]

- Evans, G. International soft commodities. In ICCH Commodities Yearbook 1990; Evans, G., Ed.; Palgrave Macmillan: London, UK, 1990; pp. 177–219. [Google Scholar]

- Bullard, J. Measuring inflation: The core is rotten. Fed. Reserve Bank St. Louis Rev. 2011, 93, 223–233. [Google Scholar] [CrossRef]

- Clark, T.E. Comparing measures of core inflation. Econ. Rev. Fed. Reserve Bank Kans. City 2001, 86, 5–32. [Google Scholar]

- Quah, D.; Vahey, S.P. Measuring core inflation. Econ. J. 1995, 105, 1130–1144. [Google Scholar] [CrossRef]

- Wynne, M.A. Core inflation: A review of some conceptual issues. Fed. Reserve Bank St. Louis Rev. 2008, 90, 205–228. [Google Scholar] [CrossRef]

- D’Urso, P.; De Giovanni, L.; Massari, R. GARCH-based robust clustering of time series. Fuzzy Sets Syst. 2016, 305, 1–28. [Google Scholar] [CrossRef]

- Kou, G.; Peng, Y.; Wang, G. Evaluation of clustering algorithms for financial risk analysis using MCDM methods. Inf. Sci. 2014, 275, 1–12. [Google Scholar] [CrossRef]

- Musmeci, N.; Aste, T.; Di Matteo, T. Relation between financial market structure and the real economy: Comparison between Clustering Methods. PLoS ONE 2015, 10, e0116201. [Google Scholar] [CrossRef] [PubMed]

- Pattarin, F.; Paterlini, S.; Minerva, T. Clustering financial time series: An application to mutual funds style analysis. Comput. Stat. Data Anal. 2004, 47, 353–372. [Google Scholar] [CrossRef]

- Tsoumakas, G.; Katakis, I.; Vlahavas, I. Effective voting of heterogeneous classifiers. In Machine Learning: ECML 2004. Lecture Notes in Computer Science, Proceedings of the 15th European Conference on Machine Learning, Pisa, Italy, 20–24 September 2004; Boulicaut, J.F., Esposito, F., Giannotti, F., Pedreschi, D., Eds.; Springer: Berlin/Heidelberg, Germany, 2004; pp. 465–476. [Google Scholar]

- Delgado, R. A semi-hard voting combiner scheme to ensemble multi-class probabilistic classifiers. Appl. Intell. 2021, 9, 1–25. [Google Scholar] [CrossRef]

- Hassan, A.N.; El-Hag, A. Two-layer ensemble-based soft voting classifier for transformer oil interfacial tension prediction. Energies 2020, 13, 1735. [Google Scholar] [CrossRef]

- Liu, J.; Han, J. Spectral clustering. In Data Clustering: Algorithms and Applications; Aggarwal, C.C., Reddy, C.K., Eds.; Chapman and Hall: Boca Raton, FL, USA; CRC Press: Boca Raton, FL, USA, 2014; pp. 177–200. [Google Scholar]

- Von Luxburg, U. A tutorial on spectral clustering. Stat. Comput. 2007, 17, 395–416. [Google Scholar] [CrossRef]

- Yang, X.; Deng, C.; Zheng, F.; Yan, J.; Liu, W. Deep spectral clustering using dual autoencoder network. In Proceedings of the 2019 IEEE/CVF Conference on Computer Vision and Pattern Recognition (CVPR), Long Beach, CA, USA, 16–20 June 2019. [Google Scholar]

- Yu, S.X.; Shi, J. Multiclass spectral clustering. In Proceedings of the Ninth IEEE International Conference on Computer Vision, Nice, France, 13–16 October 2003. [Google Scholar]

- Collins, M.D.; Liu, J.; Xu, J.; Mukherjee, L.; Singh, V. spectral clustering with a convex regularizer on millions of images. In Transactions on Petri Nets and Other Models of Concurrency XV; Springer Science and Business: Berlin/Heidelberg, Germany, 2014; Volume 8691, pp. 282–298. [Google Scholar]

- Shi, J.; Malik, J. Normalized cuts and image segmentation. IEEE Trans. Pattern Anal. Mach. Intell. 2000, 22, 888–905. [Google Scholar] [CrossRef]

- Comaniciu, D.; Meer, P. Mean shift: A robust approach toward feature space analysis. IEEE Trans. Pattern Anal. Mach. Intell. 2002, 24, 603–619. [Google Scholar] [CrossRef]

- Yuan, X.-T.; Hu, B.-G.; He, R. Agglomerative mean-shift clustering. IEEE Trans. Knowl. Data Eng. 2010, 24, 209–219. [Google Scholar] [CrossRef]

- Bouguettaya, A.; Yu, Q.; Liu, X.; Zhou, X.; Song, A. Efficient agglomerative hierarchical clustering. Expert Syst. Appl. 2015, 42, 2785–2797. [Google Scholar] [CrossRef]

- Day, W.H.E.; Edelsbrunner, H. Efficient algorithms for agglomerative hierarchical clustering methods. J. Classif. 1984, 1, 7–24. [Google Scholar] [CrossRef]

- Manning, C.D.; Raghavan, P.; Schutze, H. Introduction to Information Retrieval; Cambridge University Press: Cambridge, UK, 2008. [Google Scholar]

- Murtagh, F. A survey of recent advances in hierarchical clustering algorithms. Comput. J. 1983, 26, 354–359. [Google Scholar] [CrossRef]

- Ishizaka, A.; Lokman, B.; Tasiou, M. A stochastic multi-criteria divisive hierarchical clustering algorithm. Omega 2021, 103, 102370. [Google Scholar] [CrossRef]

- Roux, M. A comparative study of divisive and agglomerative hierarchical clustering algorithms. J. Classif. 2018, 35, 345–366. [Google Scholar] [CrossRef]

- Blashfield, R.K. Mixture model tests of cluster analysis: Accuracy of four agglomerative hierarchical methods. Psychol. Bull. 1976, 83, 377–388. [Google Scholar] [CrossRef]

- Kuiper, F.K.; Fisher, L. 391: A Monte Carlo comparison of six clustering procedures. Biometrics 1975, 31, 777. [Google Scholar] [CrossRef]

- Milligan, G.W. An examination of the effect of six types of error perturbation on fifteen clustering algorithms. Psychometrika 1980, 45, 325–342. [Google Scholar] [CrossRef]

- Saraçli, S.; Doğan, N.; Doğan, I. Comparison of hierarchical cluster analysis methods by cophenetic correlation. J. Inequalities Appl. 2013, 2013, 203. [Google Scholar] [CrossRef]

- Puerto, J.; Rodríguez-Madrena, M.; Scozzari, A. Clustering and portfolio selection problems: A unified framework. Comput. Oper. Res. 2020, 117, 104891. [Google Scholar] [CrossRef]

- Tumminello, M.; Lillo, F.; Mantegna, R.N. Correlation, hierarchies, and networks in financial markets. J. Econ. Behav. Organ. 2010, 75, 40–58. [Google Scholar] [CrossRef]

- Hepsen, A.; Vatansever, M. Using hierarchical clustering algorithms for Turkish residential market. Int. J. Econ. Financ. 2011, 4, 138. [Google Scholar] [CrossRef]

- Li, K.; Yang, R.; Robinson, D.; Ma, J.; Ma, Z. An agglomerative hierarchical clustering-based strategy using shared nearest neighbours and multiple dissimilarity measures to identify typical daily electricity usage profiles of university library buildings. Energy 2019, 174, 735–748. [Google Scholar] [CrossRef]

- Kumar, S.; Deo, N. Correlation and network analysis of global financial indices. Phys. Rev. E 2012, 86, 026101. [Google Scholar] [CrossRef]

- Song, J.Y.; Chang, W.; Song, J.W. Cluster analysis on the structure of the cryptocurrency market via. bitcoin-ethereum filtering. Phys. A Stat. Mech. Appl. 2019, 527, 121339. [Google Scholar] [CrossRef]

- Conlon, T.; McGee, R. Safe haven or risky hazard? Bitcoin during the Covid-19 bear market. Financ. Res. Lett. 2020, 35, 101607. [Google Scholar] [CrossRef] [PubMed]

- Münnix, M.C.; Shimada, T.; Schäfer, R.; Leyvraz, F.; Seligman, F.L.T.H.; Guhr, T.; Stanley, H. Identifying states of a financial market. Sci. Rep. 2012, 2, 644. [Google Scholar] [CrossRef]

- Frey, B.J.; Dueck, D. Clustering by passing messages between data points. Science 2007, 315, 972–976. [Google Scholar] [CrossRef] [PubMed]

- Bodenhofer, U.; Kothmeier, A.; Hochreiter, S. APCluster: An R package for affinity propagation clustering. Bioinformatics 2011, 27, 2463–2464. [Google Scholar] [CrossRef] [PubMed]

- Shang, F.; Jiao, L.; Shi, J.; Wang, F.; Gong, M. Fast affinity propagation clustering: A multilevel approach. Pattern Recognit. 2012, 45, 474–486. [Google Scholar] [CrossRef]

- Li, P.; Ji, H.; Wang, B.; Huang, Z.; Li, H. Adjustable preference affinity propagation clustering. Pattern Recognit. Lett. 2017, 85, 72–78. [Google Scholar] [CrossRef]

- Kiddle, S.J.; Windram, O.P.F.; McHattie, S.; Mead, A.; Beynon, J.; Buchanan-Wollaston, V.; Denby, K.J.; Mukherjee, S. Temporal clustering by affinity propagation reveals transcriptional modules in Arabidopsis thaliana. Bioinformatics 2009, 26, 355–362. [Google Scholar] [CrossRef][Green Version]

- Liu, H.; Zhou, S.; Guan, J. Detecting microarray data supported microRNA-mRNA interactions. Int. J. Data Min. Bioinform. 2010, 4, 639–655. [Google Scholar] [CrossRef]

- Tang, D.; Zhu, Q.; Yang, F. A Poisson-based adaptive affinity propagation clustering for SAGE data. Comput. Biol. Chem. 2010, 34, 63–70. [Google Scholar] [CrossRef]

- Yang, F.; Zhu, Q.; Tang, D.; Zhao, M. Using affinity propagation combined post-processing to cluster protein sequences. Protein Pept. Lett. 2010, 17, 681–689. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Gao, Y.; Wang, K.; Sangaiah, A.; Lim, S.-J. An affinity propagation-based self-adaptive clustering method for wireless sensor networks. Sensors 2019, 19, 2579. [Google Scholar] [CrossRef]

- Guan, R.; Shi, X.; Marchese, M.; Yang, C.; Liang, Y. Text clustering with seeds affinity propagation. IEEE Trans. Knowl. Data Eng. 2011, 23, 627–637. [Google Scholar] [CrossRef]

- Chen, X.; Xie, H.; Wang, F.L.; Liu, Z.; Xu, J.; Hao, T. A bibliometric analysis of natural language processing in medical research. BMC Med. Inform. Decis. Mak. 2018, 18, 14. [Google Scholar] [CrossRef] [PubMed]

- Kazantseva, A.; Szpakowicz, S. Linear text segmentation using affinity propagation. In Proceedings of the 2011 Conference on Empirical Methods in Natural Language Processing, Edinburgh, UK, 27–31 July 2011; Association for Computational Linguistics: Stroudsburg, PA, USA, 2011; pp. 284–293. [Google Scholar]

- Qian, Y.; Yao, F.; Jia, S. Band selection for hyperspectral imagery using affinity propagation. IET Comput. Vis. 2009, 3, 213–222. [Google Scholar] [CrossRef]

- Xie, L.; Tian, Q.; Zhou, W.; Zhang, B. Fast and accurate near-duplicate image search with affinity propagation on the ImageWeb. Comput. Vis. Image Underst. 2014, 124, 31–41. [Google Scholar] [CrossRef]

- MacQueen, J. Some methods for classification and analysis of multivariate observations. In Proceedings of the Fifth Berkeley Symposium on Mathematical Statistics and Probability, Berkeley, CA, USA, 21 June–18 July 1965. [Google Scholar]

- Soni, K.G.; Patel, A. Comparative analysis of k-means and k-medoids algorithm on IRIS data. Intl. J. Comput. Intell. Res. 2017, 13, 899–906. [Google Scholar]

- Fashoto, S.G.; Owolabi, O.; Adeleye, O.; Wandera, J. Hybrid methods for credit card fraud detection using K-means clustering with hidden markov model and multilayer perceptron algorithm. Br. J. Appl. Sci. Technol. 2016, 13, 1–11. [Google Scholar] [CrossRef]

- Tsai, C.-F. Combining cluster analysis with classifier ensembles to predict financial distress. Inf. Fusion 2014, 16, 46–58. [Google Scholar] [CrossRef]

- Nanda, S.; Mahanty, B.; Tiwari, M. Clustering Indian stock market data for portfolio management. Expert Syst. Appl. 2010, 37, 8793–8798. [Google Scholar] [CrossRef]

- Xu, Y.; Yang, C.; Peng, S.; Nojima, Y. A hybrid two-stage financial stock forecasting algorithm based on clustering and ensemble learning. Appl. Intell. 2020, 50, 3852–3867. [Google Scholar] [CrossRef]

- Zhu, Z.; Liu, N. Early warning of financial risk based on k-means clustering algorithm. Complexity 2021, 5, 5571683. [Google Scholar] [CrossRef]

- Jain, A.K.; Murty, M.N.; Flynn, P.J. Data clustering. ACM Comput. Surv. 1999, 31, 264–323. [Google Scholar] [CrossRef]

- Xu, S.; Qiao, X.; Zhu, L.; Zhang, Y.; Xue, C.; Li, L. Reviews on determining the number of clusters. Appl. Math. Inf. Sci. 2016, 10, 1493–1512. [Google Scholar] [CrossRef]

- Capó, M.; Pérez, A.; Lozano, J.A. An efficient approximation to the k-means clustering for massive data. Knowl. Based Syst. 2017, 117, 56–69. [Google Scholar] [CrossRef]

- Kaushik, M.; Mathur, B. Comparative study of k-means and hierarchical clustering techniques. Intl. J. Softw. Hardw. Res. Eng. 2014, 2, 93–98. [Google Scholar]

- Van der Maaten, L.J.P. Accelerating t-SNE using tree-based algorithms. J. Mach. Learn. Res. 2014, 15, 3221–3245. [Google Scholar] [CrossRef]

- Van der Maaten, L.J.P.; Hinton, G.E. Visualizing high-dimensional data using t-SNE. J. Mach. Learn. Res. 2008, 9, 2579–2605. [Google Scholar]

- Van Der Maaten, L.; Hinton, G. Visualizing non-metric similarities in multiple maps. Mach. Learn. 2012, 87, 33–55. [Google Scholar] [CrossRef]

- Perez, H.; Tah, J.H.M. Improving the accuracy of convolutional neural networks by identifying and removing outlier images in datasets using t-SNE. Mathematics 2020, 8, 662. [Google Scholar] [CrossRef]

- Wolpert, D.H. The lack of a priori distinctions between learning algorithms. Neural Comput. 1996, 8, 1341–1390. [Google Scholar] [CrossRef]

- Sagi, O.; Rokach, L. Ensemble learning: A survey. Wiley Interdiscip. Rev. Data Min. Knowl. Discov. 2018, 8, 1249. [Google Scholar] [CrossRef]

- Blair, B.F.; Rezek, J.P. The effects of hurricane Katrina on price pass-through for Gulf Coast gasoline. Econ. Lett. 2008, 98, 229–234. [Google Scholar] [CrossRef]

- Kaiser, M.J.; Yu, Y.; Jablonowski, C.J. Modeling lost production from destroyed platforms in the 2004–2005 Gulf of Mexico hurricane seasons. Energy 2009, 34, 1156–1171. [Google Scholar] [CrossRef]

- Bumpass, D.; Douglas, C.; Ginn, V.; Tuttle, M. Testing for short and long-run asymmetric responses and structural breaks in the retail gasoline supply chain. Energy Econ. 2019, 83, 311–318. [Google Scholar] [CrossRef]

- Sullivan, J.L.; Baker, R.E.; Boyer, B.A.; Hammerle, R.H.; Kenney, T.E.; Muniz, L.; Wallington, T.J. CO2 emission benefit of diesel (versus gasoline) powered vehicles. Environ. Sci. Technol. 2004, 38, 3217–3223. [Google Scholar] [CrossRef]

- Tschöke, H.; Mollenhauer, K.; Maier, R. Handbuch Dieselmotoren, 8th ed.; Springer: Wiesbaden, Germany, 2018. [Google Scholar]

- Alaali, F. The effect of oil and stock price volatility on firm level investment: The case of UK firms. Energy Econ. 2020, 87, 104731. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The effect of oil price volatility on strategic investment. Energy Econ. 2011, 33, 79–87. [Google Scholar] [CrossRef]

- Pirgaip, B.; Arslan-Ayaydin, Ö.; Karan, M.B. Do Sukuk provide diversification benefits to conventional bond investors? Evidence from Turkey. Glob. Financ. J. 2020, 1, 100533. [Google Scholar] [CrossRef]

- Bloom, N. Fluctuations in uncertainty. J. Econ. Perspect. 2014, 28, 153–176. [Google Scholar] [CrossRef]

- Eliot, T.S. Four Quartets, 2nd ed.; Houghton Mifflin Harcourt: New York, NY, USA, 1968. [Google Scholar]

- Verstyuk, S. Modeling Multivariate Time Series in Economics: From Auto-Regressions to Recurrent Neural Networks. 2019. Available online: http://www.verstyuk.net/papers/VARMRNN.pdf (accessed on 18 September 2021).

- Kuhn, T.S. The Structure of Scientific Revolutions, 4th ed.; University of Chicago Press: Chicago, IL, USA, 2012. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, J.M.; Rehman, M.U. A Pattern New in Every Moment: The Temporal Clustering of Markets for Crude Oil, Refined Fuels, and Other Commodities. Energies 2021, 14, 6099. https://doi.org/10.3390/en14196099

Chen JM, Rehman MU. A Pattern New in Every Moment: The Temporal Clustering of Markets for Crude Oil, Refined Fuels, and Other Commodities. Energies. 2021; 14(19):6099. https://doi.org/10.3390/en14196099

Chicago/Turabian StyleChen, James Ming, and Mobeen Ur Rehman. 2021. "A Pattern New in Every Moment: The Temporal Clustering of Markets for Crude Oil, Refined Fuels, and Other Commodities" Energies 14, no. 19: 6099. https://doi.org/10.3390/en14196099

APA StyleChen, J. M., & Rehman, M. U. (2021). A Pattern New in Every Moment: The Temporal Clustering of Markets for Crude Oil, Refined Fuels, and Other Commodities. Energies, 14(19), 6099. https://doi.org/10.3390/en14196099