Modeling Dynamic Multifractal Efficiency of US Electricity Market

Abstract

1. Introduction

2. Data and Descriptive Statistics

3. Methodology

- The profile value of is determined.where

- The profile is divided into equal time scale length of numerous non-overlapping components. As a result, the total number of components becomes . However, if is not a multiple of the time scale , a similar backward process is repeated to cover the full sample. After this, a total of are obtained, which is followed by calculating the local trend s for each of the segments by the kth-order polynomial fit.

- Ordinary Least Square (OLS) is employed within each component to fit the sample appropriately, and then, the local trend is estimated for each component. In this study, the fitting polynomial for each component is denoted as .with

- 4.

- The fluctuation function of order is estimated for all components through:

- 5.

- The log–log plots of vs. are analyzed at different levels. The generalized Hurst exponent [33] is specified by Equation (7) if a long-range power law correlation is present in sample series.

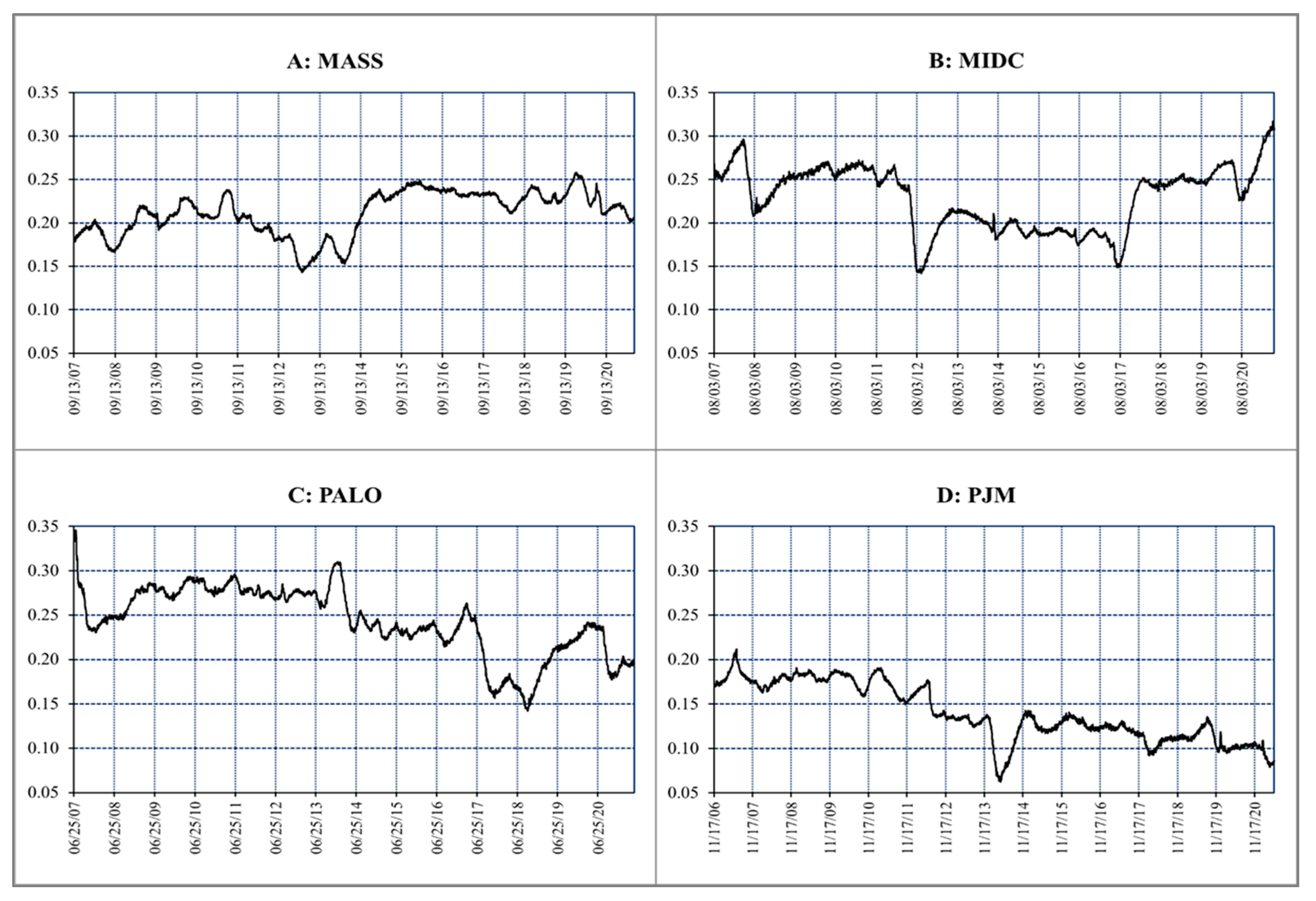

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Brehm, P.A.; Zhang, Y. The efficiency and environmental impacts of market organization: Evidence from the Texas electricity market. Energy Econ. 2021, 101, 105359. [Google Scholar] [CrossRef]

- Dertinger, A.; Hirth, L. Reforming the electric power industry in developing economies evidence on efficiency and electricity access outcomes. Energy Policy 2020, 139, 111348. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J. The US Electricity Industry after 20 Years of Restructuring. Annu. Rev. Econ. 2015, 7, 437–463. [Google Scholar] [CrossRef]

- Rosellón, J.; Myslíková, Z.; Zenón, E. Incentives for transmission investment in the PJM electricity market: FTRs or regulation (or both?). Util. Policy 2011, 19, 3–13. [Google Scholar] [CrossRef]

- Kristjanpoller, W.; Minutolo, M.C. Asymmetric multi-fractal cross-correlations of the price of electricity in the US with crude oil and the natural gas. Phys. A Stat. Mech. Appl. 2021, 572, 125830. [Google Scholar] [CrossRef]

- Joskow, P.L. Lessons Learned from Electricity Market Liberalization. Energy J. 2008, 29. [Google Scholar] [CrossRef]

- Dias, J.G.; Ramos, S.B. Heterogeneous price dynamics in U.S. regional electricity markets. Energy Econ. 2014, 46, 453–463. [Google Scholar] [CrossRef]

- Heydari, A.; Nezhad, M.M.; Pirshayan, E.; Garcia, D.A.; Keynia, F.; De Santoli, L. Short-term electricity price and load forecasting in isolated power grids based on composite neural network and gravitational search optimization algorithm. Appl. Energy 2020, 277, 115503. [Google Scholar] [CrossRef]

- Uniejewski, B.; Weron, R. Efficient Forecasting of Electricity Spot Prices with Expert and LASSO Models. Energies 2018, 11, 2039. [Google Scholar] [CrossRef]

- Hong, Y.-Y.; Wu, C.-P. Day-Ahead Electricity Price Forecasting Using a Hybrid Principal Component Analysis Network. Energies 2012, 5, 4711–4725. [Google Scholar] [CrossRef]

- Lin, X.; Yu, H.; Wang, M.; Li, C.; Wang, Z.; Tang, Y. Electricity Consumption Forecast of High-Rise Office Buildings Based on the Long Short-Term Memory Method. Energies 2021, 14, 4785. [Google Scholar] [CrossRef]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef]

- Lin, W.-M.; Gow, H.-J.; Tsai, M.-T. An enhanced radial basis function network for short-term electricity price forecasting. Appl. Energy 2010, 87, 3226–3234. [Google Scholar] [CrossRef]

- Keles, D.; Scelle, J.; Paraschiv, F.; Fichtner, W. Extended forecast methods for day-ahead electricity spot prices applying artificial neural networks. Appl. Energy 2016, 162, 218–230. [Google Scholar] [CrossRef]

- Agrawal, R.K.; Muchahary, F.; Tripathi, M.M. Ensemble of relevance vector machines and boosted trees for electricity price forecasting. Appl. Energy 2019, 250, 540–548. [Google Scholar] [CrossRef]

- Luo, S.; Weng, Y. A two-stage supervised learning approach for electricity price forecasting by leveraging different data sources. Appl. Energy 2019, 242, 1497–1512. [Google Scholar] [CrossRef]

- Matsumoto, T.; Yamada, Y. Simultaneous hedging strategy for price and volume risks in electricity businesses using energy and weather derivatives. Energy Econ. 2021, 95, 105101. [Google Scholar] [CrossRef]

- Nakajima, T.; Toyoshima, Y. Examination of the Spillover Effects among Natural Gas and Wholesale Electricity Markets Using Their Futures with Different Maturities and Spot Prices. Energies 2020, 13, 1533. [Google Scholar] [CrossRef]

- Fama, E. Efficient market hypothesis: A review of theory and empirical work. J. Financ. 1970, 25, 28–30. [Google Scholar] [CrossRef]

- Zhu, X.; Bao, S. Multifractality, efficiency and cross-correlations analysis of the American ETF market: Evidence from SPY, DIA and QQQ. Phys. A Stat. Mech. Appl. 2019, 533, 121942. [Google Scholar] [CrossRef]

- Mandelbrot, B.B.; Mandelbrot, B.B. The Fractal Geometry of Nature; WH Freeman: New York, NY, USA, 1982; Volume 1. [Google Scholar]

- Lahmiri, S.; Uddin, G.S.; Bekiros, S. Nonlinear dynamics of equity, currency and commodity markets in the aftermath of the global financial crisis. Chaos Solitons Fractals 2017, 103, 342–346. [Google Scholar] [CrossRef]

- Yang, Y.-H.; Shao, Y.-H.; Shao, H.-L.; Stanley, H.E. Revisiting the weak-form efficiency of the EUR/CHF exchange rate market: Evidence from episodes of different Swiss franc regimes. Phys. A Stat. Mech. Appl. 2019, 523, 734–746. [Google Scholar] [CrossRef]

- Aloui, C.; Mabrouk, S. Value-at-risk estimations of energy commodities via long-memory, asymmetry and fat-tailed GARCH models. Energy Policy 2010, 38, 2326–2339. [Google Scholar] [CrossRef]

- Herrera, R.; Rodriguez, A.; Pino, G. Modeling and forecasting extreme commodity prices: A Markov-Switching based extreme value model. Energy Econ. 2017, 63, 129–143. [Google Scholar] [CrossRef]

- Oh, G.; Kim, S.; Eom, C. Long-term memory and volatility clustering in high-frequency price changes. Phys. A Stat. Mech. Appl. 2008, 387, 1247–1254. [Google Scholar] [CrossRef]

- Adrangi, B.; Chatrath, A.; Dhanda, K.K.; Raffiee, K. Chaos in oil prices? Evidence from futures markets. Energy Econ. 2001, 23, 405–425. [Google Scholar] [CrossRef]

- Naeem, M.A.; Bouri, E.; Peng, Z.; Shahzad, S.J.H.; Vo, X.V. Asymmetric efficiency of cryptocurrencies during COVID19. Phys. A Stat. Mech. Appl. 2021, 565, 125562. [Google Scholar] [CrossRef]

- He, L.-Y.; Chen, S.-P. Multifractal Detrended Cross-Correlation Analysis of agricultural futures markets. Chaos Solitons Fractals 2011, 44, 355–361. [Google Scholar] [CrossRef]

- Mandelbrot, B. The Variation of Some Other Speculative Prices. J. Bus. 1967, 40, 393. [Google Scholar] [CrossRef]

- Peters, E.E. Fractal Market. Analysis: Applying Chaos Theory to Investment and Economics; John Wiley & Sons: Hoboken, NJ, USA, 1994; Volume 24. [Google Scholar]

- Mensi, W.; Tiwari, A.K.; Al-Yahyaee, K.H. An analysis of the weak form efficiency, multifractality and long memory of global, regional and European stock markets. Q. Rev. Econ. Financ. 2019, 72, 168–177. [Google Scholar] [CrossRef]

- Hurst, H.E. Long-Term Storage Capacity of Reservoirs. Trans. Am. Soc. Civ. Eng. 1951, 116, 770–799. [Google Scholar] [CrossRef]

- Lo, A.W. Long-Term Memory in Stock Market Prices. Econom. J. Econom. Soc. 1991, 59, 1279. [Google Scholar] [CrossRef]

- Aloui, C.; Shahzad, S.J.H.; Jammazi, R. Dynamic efficiency of European credit sectors: A rolling-window multifractal detrended fluctuation analysis. Phys. A Stat. Mech. Appl. 2018, 506, 337–349. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Zschiegner, S.A.; Koscielny-Bunde, E.; Havlin, S.; Bunde, A.; Stanley, H. Multifractal detrended fluctuation analysis of nonstationary time series. Phys. A Stat. Mech. Appl. 2002, 316, 87–114. [Google Scholar] [CrossRef]

- Peng, C.-K.; Buldyrev, S.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685–1689. [Google Scholar] [CrossRef]

- Fisher, A.J.; Calvet, L.E.; Mandelbrot, B.B. Multifractality of Deutschemark/US Dollar Exchange Rates; Elsevier: Amsterdam, The Netherlands, 1997. [Google Scholar]

- Pasquini, M.; Serva, M. Multiscale behaviour of volatility autocorrelations in a financial market. Econ. Lett. 1999, 65, 275–279. [Google Scholar] [CrossRef][Green Version]

- Kwapien, J.; Oswiecimka, P.; Drożdż, S. Components of multifractality in high-frequency stock returns. Phys. A Stat. Mech. Appl. 2005, 350, 466–474. [Google Scholar] [CrossRef]

- Oświe, P.; Kwapień, J.; Drożdż, S. Multifractality in the stock market: Price increments versus waiting times. Phys. A Stat. Mech. Appl. 2005, 347, 626–638. [Google Scholar] [CrossRef]

- Aslam, F.; Mohti, W.; Ferreira, P. Evidence of Intraday Multifractality in European Stock Markets during the Recent Coronavirus (COVID-19) Outbreak. Int. J. Financ. Stud. 2020, 8, 31. [Google Scholar] [CrossRef]

- Aslam, F.; Latif, S.; Ferreira, P. Investigating Long-Range Dependence of Emerging Asian Stock Markets Using Multifractal Detrended Fluctuation Analysis. Symmetry 2020, 12, 1157. [Google Scholar] [CrossRef]

- Aslam, F.; Nogueiro, F.; Brasil, M.; Ferreira, P.; Mughal, K.S.; Bashir, B.; Latif, S. The footprints of COVID-19 on Central Eastern European stock markets: An intraday analysis. Post-Communist Econ. 2020, 33, 751–769. [Google Scholar] [CrossRef]

- Maganini, N.D.; Filho, A.C.S.; Lima, F.G. Investigation of multifractality in the Brazilian stock market. Phys. A Stat. Mech. Appl. 2018, 497, 258–271. [Google Scholar] [CrossRef]

- Aslam, F.; Aziz, S.; Nguyen, D.K.; Mughal, K.S.; Khan, M. On the efficiency of foreign exchange markets in times of the COVID-19 pandemic. Technol. Forecast. Soc. Chang. 2020, 161, 120261. [Google Scholar] [CrossRef] [PubMed]

- Diniz-Maganini, N.; Rasheed, A.A.; Sheng, H.H. Exchange rate regimes and price efficiency: Empirical examination of the impact of financial crisis. J. Int. Financ. Mark. Inst. Money 2021, 73, 101361. [Google Scholar] [CrossRef]

- Kakinaka, S.; Umeno, K. Cryptocurrency market efficiency in short- and long-term horizons during COVID-19: An asymmetric multifractal analysis approach. Financ. Res. Lett. 2021, 102319. [Google Scholar] [CrossRef]

- Mnif, E.; Jarboui, A.; Mouakhar, K. How the cryptocurrency market has performed during COVID 19? A multifractal analysis. Financ. Res. Lett. 2020, 36, 101647. [Google Scholar] [CrossRef]

- Telli, Ş.; Chen, H. Multifractal behavior in return and volatility series of Bitcoin and gold in comparison. Chaos Solitons Fractals 2020, 139, 109994. [Google Scholar] [CrossRef]

- Fernandes, L.H.; de Araújo, F.H.; Silva, I.E. The (in)efficiency of NYMEX energy futures: A multifractal analysis. Phys. A Stat. Mech. Appl. 2020, 556, 124783. [Google Scholar] [CrossRef]

- Guo, Y.; Yao, S.; Cheng, H.; Zhu, W. China’s copper futures market efficiency analysis: Based on nonlinear Granger causality and multifractal methods. Resour. Policy 2020, 68, 101716. [Google Scholar] [CrossRef]

- Mensi, W.; Vo, X.V.; Kang, S.H. Upside-Downside Multifractality and Efficiency of Green Bonds: The Roles of Global Factors and COVID-19. Financ. Res. Lett. 2021, 101995. [Google Scholar] [CrossRef]

- Lee, Y.-J.; Kim, N.-W.; Choi, K.-H.; Yoon, S.-M. Analysis of the Informational Efficiency of the EU Carbon Emission Trading Market: Asymmetric MF-DFA Approach. Energies 2020, 13, 2171. [Google Scholar] [CrossRef]

- Choi, S.-Y. Analysis of stock market efficiency during crisis periods in the US stock market: Differences between the global financial crisis and COVID-19 pandemic. Phys. A Stat. Mech. Appl. 2021, 574, 125988. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, L.; Gu, R. Analysis of efficiency for Shenzhen stock market based on multifractal detrended fluctuation analysis. Int. Rev. Financ. Anal. 2009, 18, 271–276. [Google Scholar] [CrossRef]

- Li, J.; Lu, X.; Jiang, W.; Petrova, V.S. Multifractal Cross-correlations between foreign exchange rates and interest rate spreads. Phys. A Stat. Mech. Appl. 2021, 574, 125983. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Bouri, E.; Kayani, G.M.; Nasir, R.M.; Kristoufek, L. Are clean energy stocks efficient? Asymmetric multifractal scaling behaviour. Phys. A Stat. Mech. Appl. 2020, 550, 124519. [Google Scholar] [CrossRef]

- He, L.-Y.; Chen, S.-P. Are crude oil markets multifractal? Evidence from MF-DFA and MF-SSA perspectives. Phys. A Stat. Mech. Appl. 2010, 389, 3218–3229. [Google Scholar] [CrossRef]

- Cajueiro, D.; Gogas, P.; Tabak, B.M. Does financial market liberalization increase the degree of market efficiency? The case of the Athens stock exchange. Int. Rev. Financ. Anal. 2009, 18, 50–57. [Google Scholar] [CrossRef]

- Caraiani, P. Evidence of Multifractality from Emerging European Stock Markets. PLoS ONE 2012, 7, e40693. [Google Scholar] [CrossRef]

- Zunino, L.; Tabak, B.; Figliola, A.; Pérez, D.; Garavaglia, M.; Rosso, O. A multifractal approach for stock market inefficiency. Phys. A Stat. Mech. Appl. 2008, 387, 6558–6566. [Google Scholar] [CrossRef]

- Zhan, C.; Liang, C.; Zhao, L.; Zhang, Y.; Cheng, L.; Jiang, S.; Xing, L. Multifractal characteristics analysis of daily reference evapotranspiration in different climate zones of China. Phys. A Stat. Mech. Appl. 2021, 583, 126273. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, G.; Qiu, L.; Zhang, B.; Sun, Y.; Gui, Z.; Zhang, Q. A modified multifractal detrended fluctuation analysis (MFDFA) approach for multifractal analysis of precipitation in dongting lake basin, China. Water 2019, 11, 891. [Google Scholar] [CrossRef]

- Liu, H.; Zhang, X.; Zhang, X. Multiscale multifractal analysis on air traffic flow time series: A single airport departure flight case. Phys. A Stat. Mech. Appl. 2020, 545, 123585. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Koscielny-Bunde, E.; Rybski, D.; Braun, P.; Bunde, A.; Havlin, S. Long-term persistence and multifractality of precipitation and river runoff records. J. Geophys. Res. Atmos. 2006, 111. [Google Scholar] [CrossRef]

- Wang, Y.; Wei, Y.; Wu, C. Cross-correlations between Chinese A-share and B-share markets. Phys. A Stat. Mech. Appl. 2010, 389, 5468–5478. [Google Scholar] [CrossRef]

- Mujeeb, S.; Javaid, N. ESAENARX and DE-RELM: Novel schemes for big data predictive analytics of electricity load and price. Sustain. Cities Soc. 2019, 51, 101642. [Google Scholar] [CrossRef]

- Lavin, L.; Murphy, S.; Sergi, B.; Apt, J. Dynamic operating reserve procurement improves scarcity pricing in PJM. Energy Policy 2020, 147, 111857. [Google Scholar] [CrossRef]

- Weron, R. Energy price risk management. Phys. A Stat. Mech. Appl. 2000, 285, 127–134. [Google Scholar] [CrossRef]

- Weron, R.; Przybyłowicz, B. Hurst analysis of electricity price dynamics. Phys. A Stat. Mech. Appl. 2000, 283, 462–468. [Google Scholar] [CrossRef]

- Cajueiro, D.O.; Tabak, B.M. Testing for time-varying long-range dependence in volatility for emerging markets. Phys. A Stat. Mech. Appl. 2005, 346, 577–588. [Google Scholar] [CrossRef]

- Liu, L.; Wan, J. A study of correlations between crude oil spot and futures markets: A rolling sample test. Phys. A Stat. Mech. Appl. 2011, 390, 3754–3766. [Google Scholar] [CrossRef]

- Zhao, R.; Cui, Y. Dynamic Cross-Correlations Analysis on Economic Policy Uncertainty and US Dollar Exchange Rate: AMF-DCCA Perspective. Discret. Dyn. Nat. Soc. 2021, 2021, 1–9. [Google Scholar] [CrossRef]

- EIA. Summer Average Wholesale Electricity Prices in Western U.S. Were Highest since 2008. 2018. Available online: https://www.eia.gov/todayinenergy/detail.php?id=37112 (accessed on 10 September 2021).

- EIA. In 2017, U.S. Electricity Sales Fell by the Greatest Amount since the Recession. 2018. Available online: https://www.eia.gov/todayinenergy/detail.php?id=35612 (accessed on 10 September 2021).

- Woo, C.K.; Ho, T.; Zarnikau, J.; Olson, A.; Jones, R.; Chait, M.; Horowitz, I.; Wang, J. Electricity-market price and nuclear power plant shutdown: Evidence from California. Energy Policy 2014, 73, 234–244. [Google Scholar] [CrossRef]

- EIA. New England and Pacific Northwest Had Largest Power Price Increases in 2013. 2014. Available online: https://www.eia.gov/todayinenergy/detail.php?id=14511 (accessed on 10 September 2021).

- Assereto, M.; Byrne, J. The Implications of Policy Uncertainty on Solar Photovoltaic Investment. Energies 2020, 13, 6233. [Google Scholar] [CrossRef]

- Rizvi, S.A.R.; Arshad, S.; Alam, N. A tripartite inquiry into volatility-efficiency-integration nexus—Case of emerging markets. Emerg. Mark. Rev. 2018, 34, 143–161. [Google Scholar] [CrossRef]

- Chung, D.; Hrazdil, K. Liquidity and market efficiency: A large sample study. J. Bank. Financ. 2010, 34, 2346–2357. [Google Scholar] [CrossRef]

- Al-Yahyaee, K.H.; Mensi, W.; Ko, H.-U.; Yoon, S.-M.; Kang, S.H. Why cryptocurrency markets are inefficient: The impact of liquidity and volatility. N. Am. J. Econ. Financ. 2020, 52, 101168. [Google Scholar] [CrossRef]

- Green, E.; Hanan, W.; Heffernan, D. The origins of multifractality in financial time series and the effect of extreme events. Eur. Phys. J. B 2014, 87, 1–9. [Google Scholar] [CrossRef]

- Wei, Y.; Huang, D. Multifractal analysis of SSEC in Chinese stock market: A different empirical result from Heng Seng index. Phys. A Stat. Mech. Appl. 2005, 355, 497–508. [Google Scholar] [CrossRef]

- Grech, D.; Pamuła, G. The local Hurst exponent of the financial time series in the vicinity of crashes on the Polish stock exchange market. Phys. A Stat. Mech. Appl. 2008, 387, 4299–4308. [Google Scholar] [CrossRef]

- Kumar, S.; Deo, N. Multifractal properties of the Indian financial market. Phys. A Stat. Mech. Appl. 2009, 388, 1593–1602. [Google Scholar] [CrossRef]

- Tabak, B.; Cajueiro, D. Are the crude oil markets becoming weakly efficient over time? A test for time-varying long-range dependence in prices and volatility. Energy Econ. 2007, 29, 28–36. [Google Scholar] [CrossRef]

- Dewandaru, G.; Rizvi, S.A.R.; Bacha, O.I.; Masih, M. What factors explain stock market retardation in Islamic Countries. Emerg. Mark. Rev. 2014, 19, 106–127. [Google Scholar] [CrossRef]

- Dragotă, V.; Ţilică, E.V. Market efficiency of the Post Communist East European stock markets. Cent. Eur. J. Oper. Res. 2014, 22, 307–337. [Google Scholar] [CrossRef]

- Su, Z.-Y.; Wang, Y.-T. An Investigation into the Multifractal Characteristics of the TAIEX Stock Exchange Index in Taiwan. J. Korean Phys. Soc. 2009, 54, 1385–1394. [Google Scholar] [CrossRef]

| S. No. | Index | Symbol | Data Range | No. of Observations |

|---|---|---|---|---|

| 1 | Mass Hub | MASS | 8 January 2001–18 May 2021 | 4787 |

| 2 | Mid-C Hub | MIDC | 29 March 2001–18 May 2021 | 4903 |

| 3 | Palo Verde Hub | PALO | 8 January 2001–18 May 2021 | 4933 |

| 4 | PJM West Hub | PJM | 3 January 2001–18 May 2021 | 5164 |

| Statistics | MASS | MIDC | PALO | PJM |

|---|---|---|---|---|

| Mean | −0.0002 | −0.0015 | −0.0003 | −0.0001 |

| Median | −0.0044 | −0.0029 | −0.0029 | −0.0033 |

| Maximum | 1.2667 | 4.3909 | 1.5718 | 1.1173 |

| Minimum | −1.0956 | −4.3160 | −2.1324 | −1.5302 |

| Standard Deviation | 0.1782 | 0.2964 | 0.1541 | 0.1772 |

| Skewness | 0.2485 | −0.2305 | −0.0597 | −0.2077 |

| Kurtosis | 5.4886 | 50.9029 | 21.8383 | 8.1933 |

| Order q | MASS | MIDC | PALO | PJM |

|---|---|---|---|---|

| −5 | 0.3971 | 0.5249 | 0.4339 | 0.3100 |

| −4 | 0.3766 | 0.4912 | 0.4154 | 0.2902 |

| −3 | 0.3510 | 0.4500 | 0.3943 | 0.2686 |

| −2 | 0.3194 | 0.4015 | 0.3695 | 0.2454 |

| −1 | 0.2816 | 0.3462 | 0.3384 | 0.2204 |

| 0 | 0.2406 | 0.2831 | 0.2963 | 0.1930 |

| 1 | 0.2020 | 0.2134 | 0.2399 | 0.1622 |

| 2 | 0.1691 | 0.1449 | 0.1743 | 0.1272 |

| 3 | 0.1416 | 0.0872 | 0.1119 | 0.0893 |

| 4 | 0.1185 | 0.0430 | 0.0611 | 0.0517 |

| 5 | 0.0989 | 0.0104 | 0.0224 | 0.0174 |

| Hurst Average | Delta h | Delta Alpha | Fractal Dimension | MLM | Ranking | |

|---|---|---|---|---|---|---|

| MASS | 0.2451 | 0.5040 | 0.4586 | 1.7549 | 0.2520 | 1 |

| MIDC | 0.2723 | 0.5145 | 0.7797 | 1.7277 | 0.2573 | 2 |

| PALO | 0.2598 | 0.5437 | 0.6403 | 1.7402 | 0.2719 | 3 |

| PJM | 0.1796 | 0.6726 | 0.5090 | 1.8204 | 0.3363 | 4 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ali, H.; Aslam, F.; Ferreira, P. Modeling Dynamic Multifractal Efficiency of US Electricity Market. Energies 2021, 14, 6145. https://doi.org/10.3390/en14196145

Ali H, Aslam F, Ferreira P. Modeling Dynamic Multifractal Efficiency of US Electricity Market. Energies. 2021; 14(19):6145. https://doi.org/10.3390/en14196145

Chicago/Turabian StyleAli, Haider, Faheem Aslam, and Paulo Ferreira. 2021. "Modeling Dynamic Multifractal Efficiency of US Electricity Market" Energies 14, no. 19: 6145. https://doi.org/10.3390/en14196145

APA StyleAli, H., Aslam, F., & Ferreira, P. (2021). Modeling Dynamic Multifractal Efficiency of US Electricity Market. Energies, 14(19), 6145. https://doi.org/10.3390/en14196145