A Decarbonization Roadmap for Singapore and Its Energy Policy Implications

Abstract

:1. Introduction

2. Purpose and Methodology of Study

3. Singapore’s Decarbonization Commitment

4. Singapore’s Energy Landscape

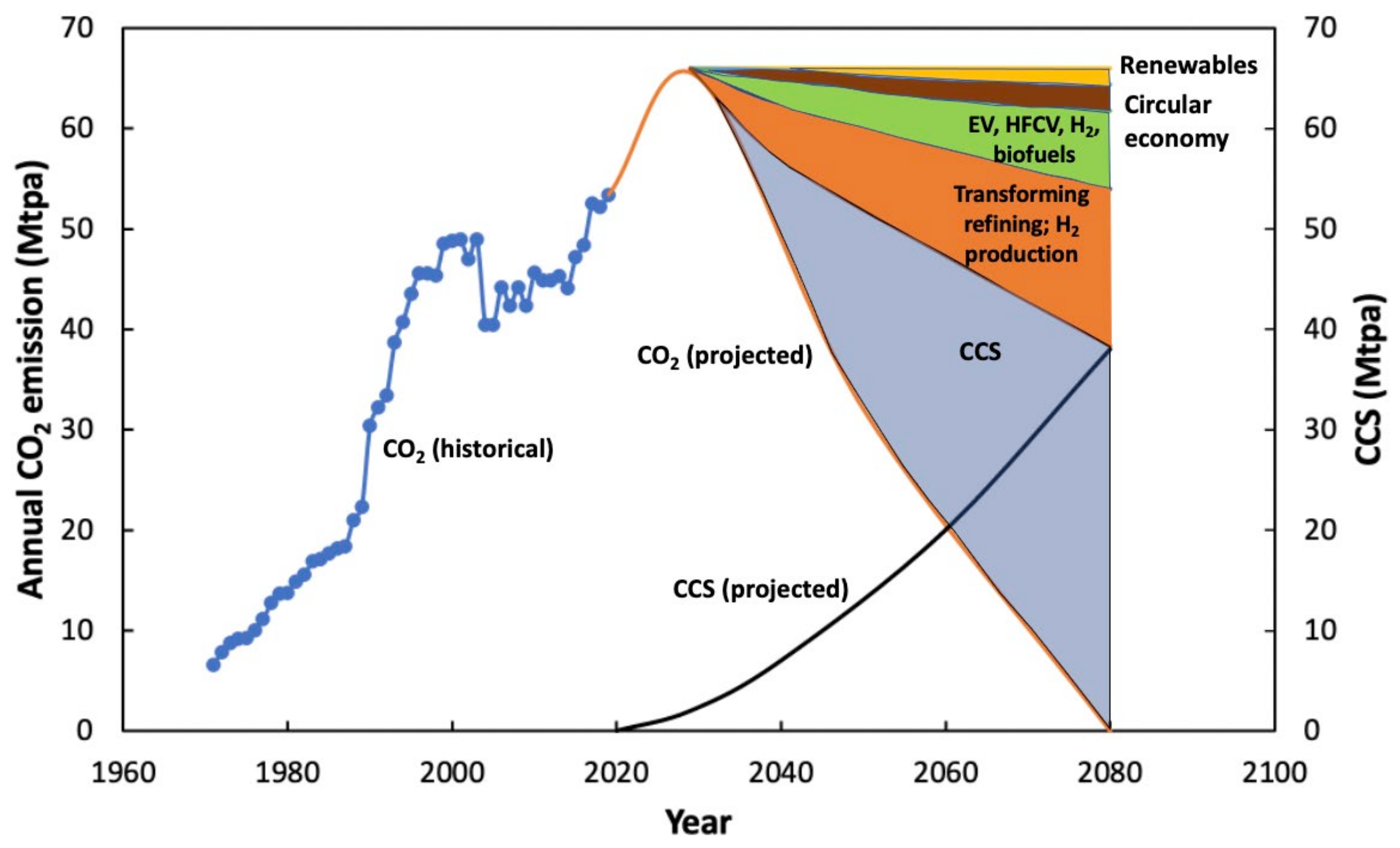

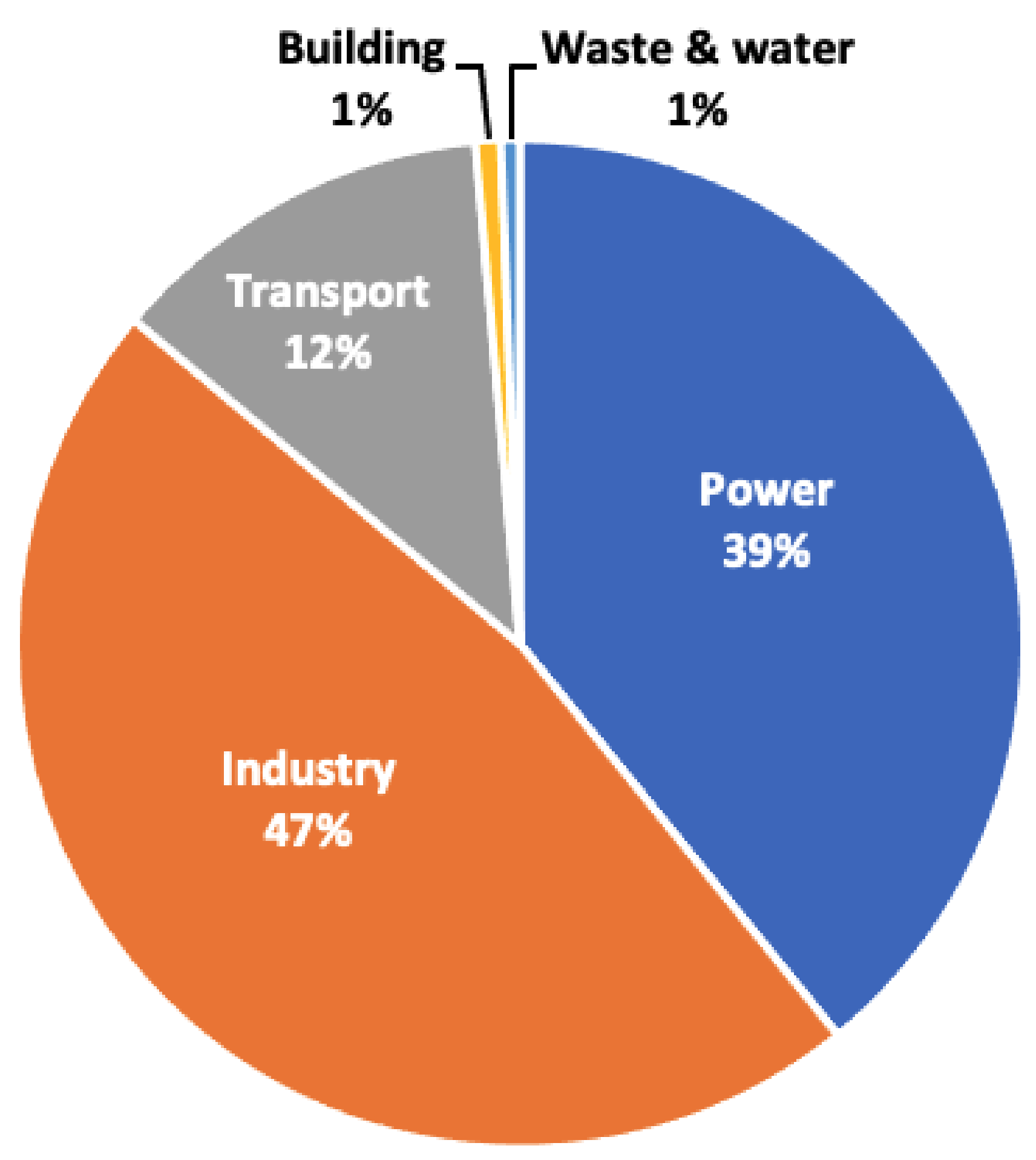

Singapore’s Emission Profile

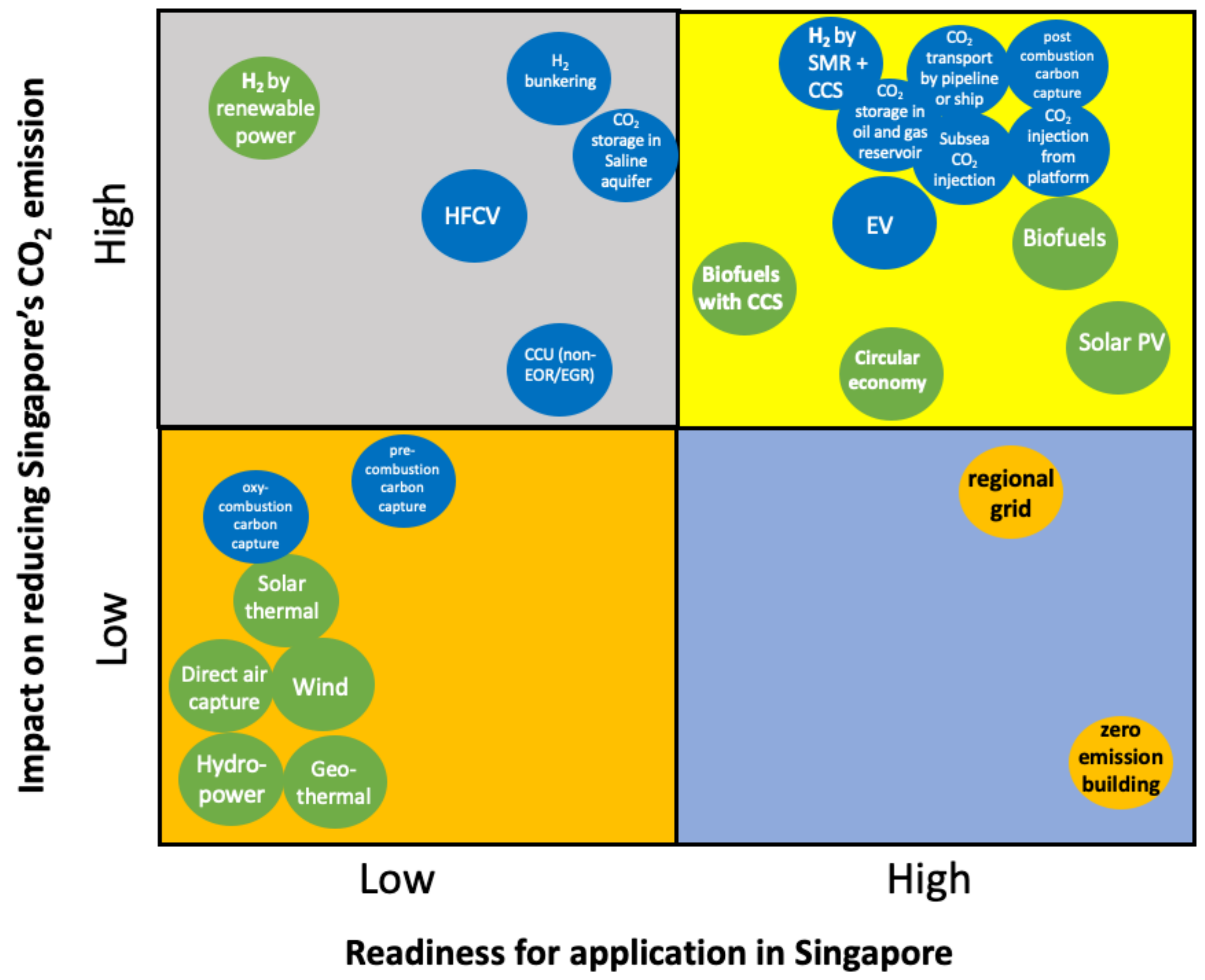

5. Technology Mapping

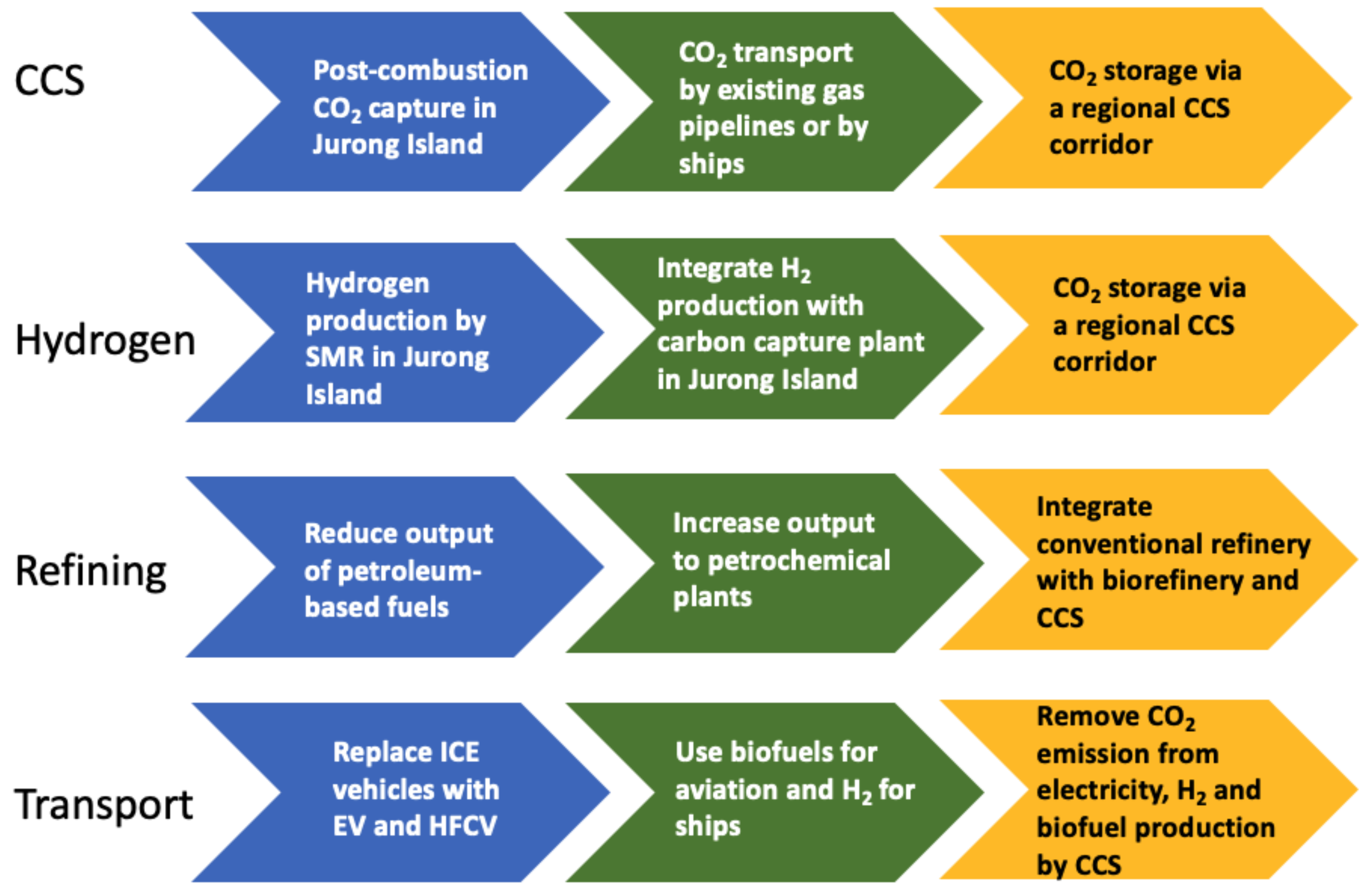

6. Decarbonization Roadmap

6.1. Carbon Capture and Storage (CCS)

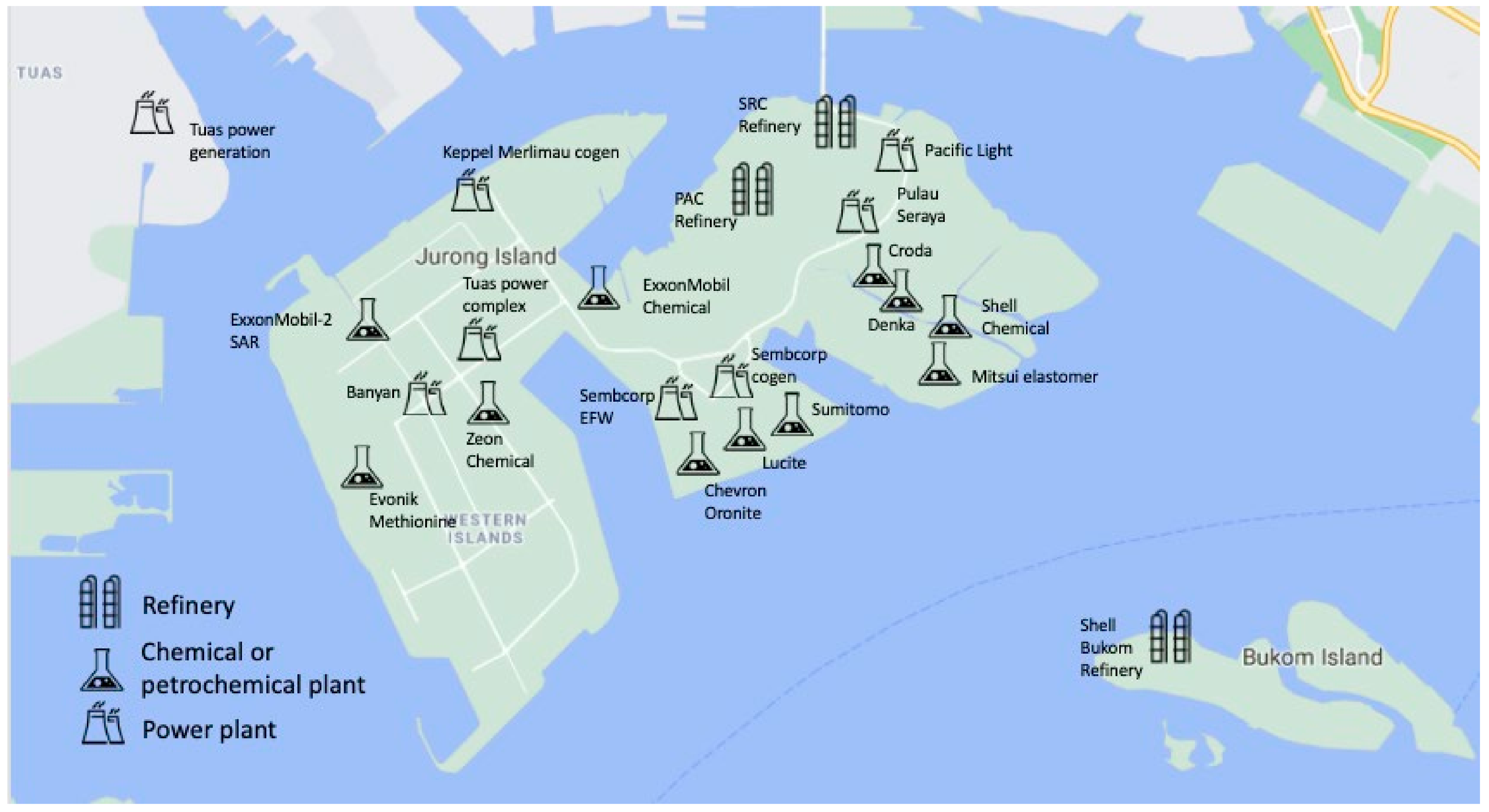

6.1.1. Centralized Post-Combustion CO2 Capture

6.1.2. CO2 Transportation from Singapore

6.1.3. CO2 Storage Using a Regional CCS Corridor

6.1.4. CO2 Storage in Subsurface Reservoirs

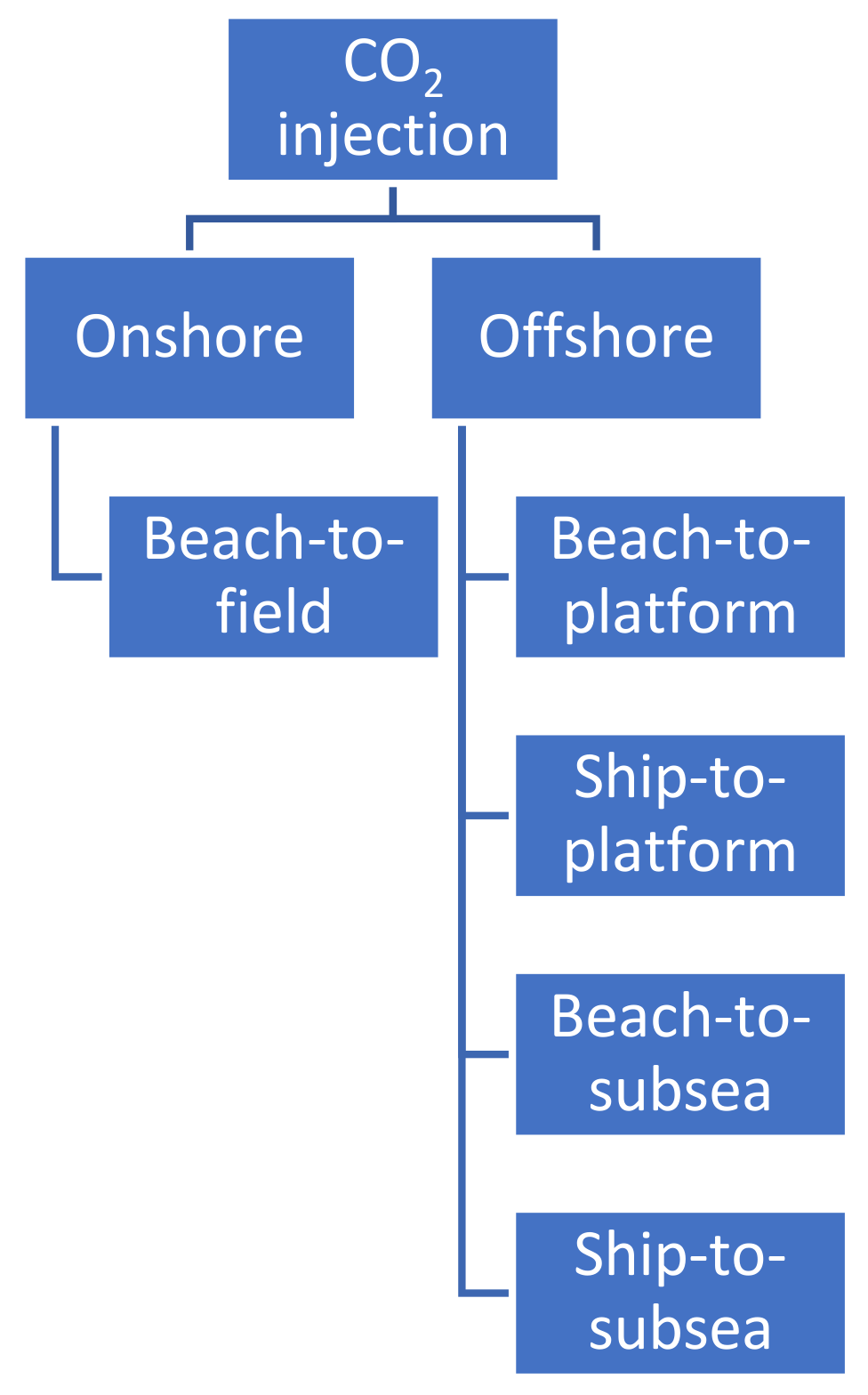

6.1.5. Development Concepts for CO2 Injection

6.1.6. Southern Lights: A Cross-Border CCS Project in ASEAN

6.2. Hydrogen Production

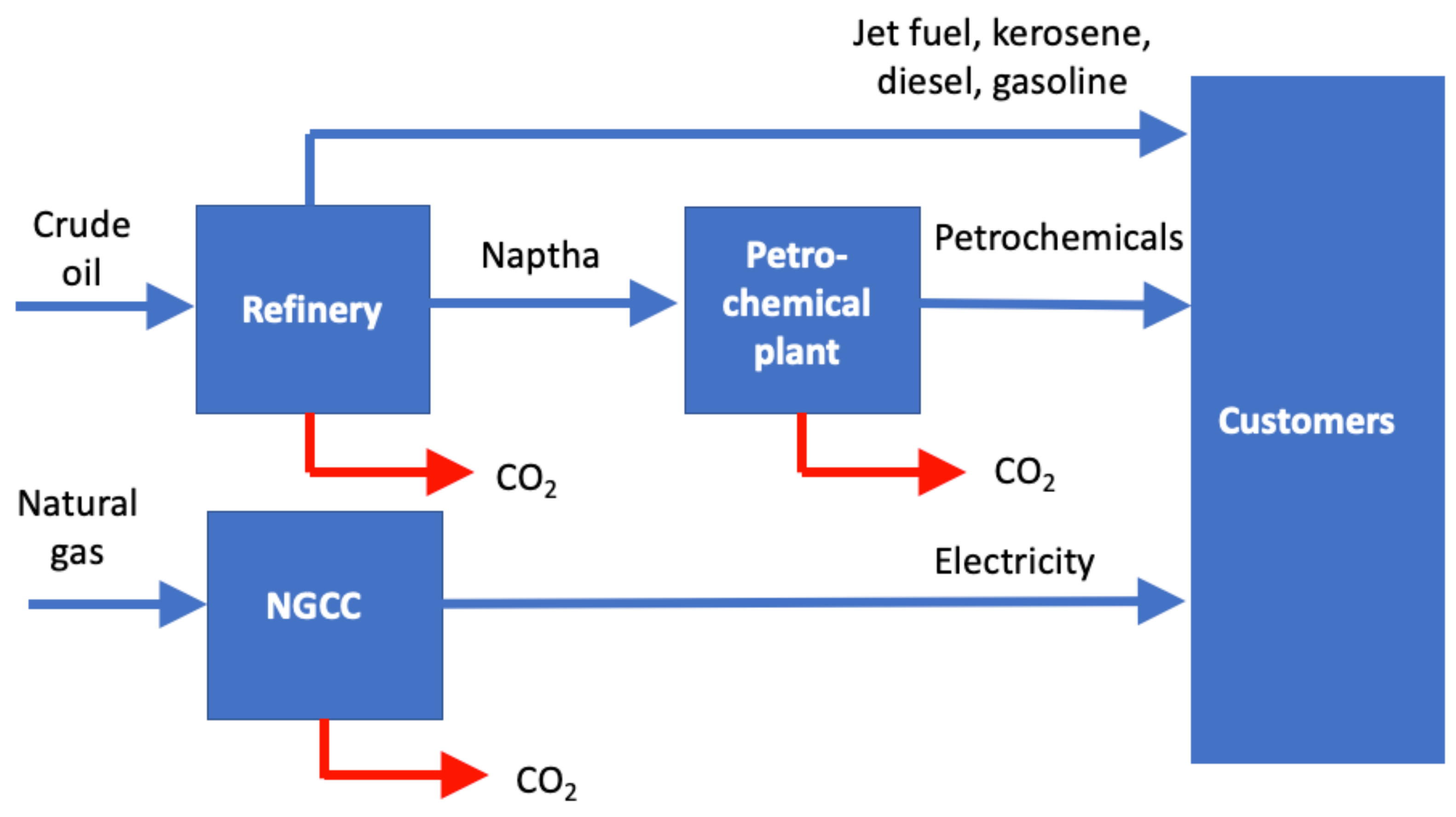

6.3. Transforming Refining

6.4. Refueling Transport

7. Energy Policy Implications

7.1. Energy Policy

7.1.1. Carbon Tax

7.1.2. Target for Renewable Fuels

7.1.3. A Hydrogen Roadmap

7.1.4. Public Engagement on CCS

7.1.5. ASEAN Engagement on a Regional CCS Corridor

7.1.6. CCS Regulations

7.1.7. Public-Private Partnership

7.1.8. Funding CCS Research and Development

8. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| ASEAN | Association of Southeast Asian Nations. They include Indonesia, Malaysia, Thailand, Philippines, Vietnam, Laos, Myanmar, Cambodia, Singapore, and Brunei Darussalam. |

| bbl/d | Barrels per day |

| CCS | Carbon capture and storage |

| CCU | Carbon capture and utilization |

| CO2 | Carbon dioxide |

| CO2e | Carbon dioxide equivalent |

| DEA | Diethanolamine |

| EV | Electric vehicle |

| GHG | Greenhouse gas |

| Gt | Giga ton, 109 tons |

| HFCV | Hydrogen fuel cell vehicle |

| H2 | Hydrogen |

| ICE | Internal combustion engine |

| MDEA | Methyl diethanolamine |

| MEA | Monoethanolamine |

| MMbbl | Million barrels |

| MMP | Minimum miscibility pressure of CO2 with oil |

| Mtpa | Million tons per year |

| NaOH | Sodium hydroxide |

| NGCC | Natural gas combined cycle |

| OGIP | Original-gas-in-place |

| OOIP | Original-oil-in-place |

| PPP | Public private partnership |

| PSC | Production sharing contract |

| SMR | Steam methane reforming |

| Solar PV | Solar photovoltaic |

| $ | US dollar |

| SGD | Singaporean dollar |

| Tcf | Trillion standard cubic feet, 1012 ft3 |

References

- National Climate Change Secretariat (NCCS). Impact of Climate Change in Singapore. 2021. Available online: https://www.nccs.gov.sg/singapores-climate-action/impact-of-climate-change-in-singapore/ (accessed on 19 June 2021).

- Houghton, J. Global Warming: The Complete Briefing, 4th ed.; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar]

- Archer, D.; Rahmstorf, S. The Climate Crisis: An Introductory Guide to Climate Change, 4th ed.; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- National Climate Change Secretariat (NCCS). Singapore’s Emissions Profile. 2021. Available online: https://www.nccs.gov.sg/singapores-climate-action/singapore-emissions-profile/ (accessed on 12 June 2021).

- Our World in Data. Singapore: Energy Country Profile. 2021. Available online: https://ourworldindata.org/energy/country/singapore?country=~SGP (accessed on 20 June 2021).

- Straits Times, Parliament: About 75% of Industrial Emissions are from Refining and Petrochemical Sector. 7 October 2019b. Available online: https://www.straitstimes.com/politics/parliament-about-75-of-industrial-emissions-are-from-refining-and-petrochemicals-sectorsia-pacific/ (accessed on 18 June 2021).

- NS Energy. Top Five Countries in Asia-Pacific Region for Oil Refining Capacities. 2020. Available online: https://www.nsenergybusiness.com/features/countries-oil-refining-asia-pacific/ (accessed on 15 June 2021).

- Economic Development Board (EDB). 2021. Available online: https://www.edb.gov.sg/en/our-industries/energy-and-chemicals.html (accessed on 1 October 2021).

- Lau, H.C.; Ramakrishna, S. Why Carbon Capture Should be Included in Singapore’s Green Toolkit. The Straits Times, 3 June 2021. Available online: https://www.straitstimes.com/opinion/why-carbon-capture-should-be-in-singapores-green-toolkit (accessed on 18 June 2021).

- Leung, D.Y.C.; Caramanna, G.; Maroto-Valer, M.M. An Overview of Current Status of Carbon Dioxide Capture and Storage Technologies. Renew. Sustain. Energy Rev. 2014, 39, 426–443. [Google Scholar] [CrossRef] [Green Version]

- Jansen, D.; Gazzani, M.; Manzolini, G.; van Dijk, E.; Carbo, M. Pre-combustion CO2 Capture. Int. J. Greenhouse Gas. Control. 2015, 40, 167–187. [Google Scholar] [CrossRef] [Green Version]

- Symonds, R.T.; Hughes, R.W.; Loscertales, M.D.L.O. Oxy-pressured Fluidized Bed Combustion: Configuration and Options Analysis. Appl. Energy 2020, 262, 114531. [Google Scholar] [CrossRef]

- Onyebuchi, V.E.; Kolios, A.; Hanak, D.P.; Biliyok, C.; Manovic, V. A systematic Review of Key Challenges of CO2 Transport Via Pipelines. Renew. Sustain. Energy Rev. 2018, 81, 2561–2583. [Google Scholar] [CrossRef] [Green Version]

- Al Baroudi, H.; Awoyomi, A.; Patchigolla, K.; Jonnalagadda, K.; Anthony, E.J. A Review of Large-Scale CO2 Shipping and Marine Emissions Management for Carbon Capture, Utilisation and Storage. Appl. Energy 2021, 287, 116510. [Google Scholar] [CrossRef]

- Neele, F.; de Kler, R.; Nienoord, M.; Brownsort, P.; Koornneef, J.; Belfroid, S.; Peters, L.; van Wijhe, A.; Loeve, D. CO2 Transport by Ship: The Way Forward in Europe. Energy Procedia 2016, 114, 6824–6834. [Google Scholar] [CrossRef]

- Aspelund, A.; Molnvik, M.J.; de Koeijer, G. Ship Transport of CO2 Technical Solutions and Analysis of Costs, Energy Utilization, Energy Efficiency and CO2 Emissions. Chem. Eng. Res. Design 2006, 84, 847–855. [Google Scholar] [CrossRef]

- Ha, G.T.; Tran, N.D.; Vu, H.H.; Takagi, S.; Mitsuishi, H.; Hatakeyama, A.; Uchiyama, T.; Ueda, Y.; Nguyen, T.V.; Phan, T.N.P.; et al. Design and Implementation of CO2- Huff-n-Puff Operation in a Vietnam Offshore Field. In Proceedings of the Abu Dhabi International Petroleum Exhibition and Conference, Abu Dhabi, United Arab Emirates, 11–14 November 2012. SPE-161835. [Google Scholar]

- Seaver, J. Malampaya Deep Water Gas-to-Power Project: Malampaya Subsea Development. In Proceedings of the Offshore Technology Conference, Houston, TX, USA, 6–9 May 2002. OTC 14041. [Google Scholar]

- Dash, B.K. Deepwater Growth in Asia Pacific and Growing Regional Installation and Pipelay Vessels Capability to Meet the Challenges. In Proceedings of the Offshore Technology Conference, Houston, TX, USA, 15–28 March 2014. OTC-25002-MS. [Google Scholar]

- Kumar, A.; Ozah, R.; Noh, M.; Pope, G.A.; Bryant, S.; Sepehmoori, K.; Lake, L.W. Reservoir Simulation of CO2 Storage in Deep Saline Aquifers. SPE J. 2005. [Google Scholar] [CrossRef]

- Usman; Iskandar, U.P.; Sugihardjo, S.; Lastiadi, S.H. A Systematic Approach to Source-Sink Matching for CO2-EOR and Sequestration in South Sumatera. Energy Procedia 2014, 63, 7750–7760. [Google Scholar] [CrossRef] [Green Version]

- Hedriana, O.; Sugihardjo; Usman. Assessment of CO2-EOR and Storage Capacity in South Sumatera and West Java Basins. Energy Procedia 2017, 114, 4666–4678. [Google Scholar] [CrossRef]

- Energy Voice. Repsol Eyes Giant Carbon Storage Scheme in Indonesia. 17 March 2021. Available online: https://www.energyvoice.com/oilandgas/asia/307399/repsol-eyes-giant-carbon-storage-scheme-in-indonesia/ (accessed on 18 June 2021).

- Khan, M.H.A.; Daiyan, R.; Neal, P.; Haque, N.; MacGill, I.; Amal, R. A Framework for Assessing Economics of Blue Hydrogen Production from Steam Methane Reforming Using Carbon Capture Storage & Utilisation. Int. J. Hydrogen Energy 2021, 46, 22685–22706. [Google Scholar]

- Navas-Anguita, Z.; Garcia-Gusano, D.; Dufour, J.; Iribarren, D. Revisiting the Role of Steam Methane Reforming with CO2 Capture and Storage for Long-term Hydrogen Production. Sci. Total Environ. 2021, 771, 145432. [Google Scholar] [CrossRef] [PubMed]

- Channel News Asia (CNA). 28,000 Charging Stations for Electric Cars is Possible—But Where? Industry Players Weigh in. 11 March 2020. Available online: https://www.channelnewsasia.com/news/singapore/electric-vehicles-budget-2020-charging-points-energy-12512194 (accessed on 18 June 2021).

- Channel News Asia (CNA). Finland’s Neste Expands Singapore Refinery as It Taps Renewable Growth. 31 July 2019. Available online: https://www.channelnewsasia.com/news/business/finland-s-neste-expands-singapore-refinery-as-it-taps-renewable-11770298 (accessed on 18 June 2021).

- Straits Times, Singapore to Ramp Up Solar Energy Production to 350,000 Homes by 2030. 16 June 2021. Available online: https://www.straitstimes.com/singapore/environment/solar-energy-to-meet-4-of-singapores-energy-demand-by-2030-up-from-less-than-1 (accessed on 18 June 2021).

- Straits Times. EMA Seeks Approval for Trial to Import Electricity from Malaysia. 5 March 2021. Available online: https://www.straitstimes.com/business/economy/ema-seeks-proposals-for-trial-to-import-electricity-from-malaysia (accessed on 12 June 2021).

- Channel News Asia (CNA). SP Group Launches First Zero-Emission Building in Southeast Asia Powered by Green Hydrogen. 30 October 2019. Available online: https://www.channelnewsasia.com/news/singapore/sp-group-first-zero-emission-building-green-hydrogen-12046124 (accessed on 18 June 2021).

- Straits Times, NUS Launches Singapore’s First Net-zero Energy Building to be Built from Scratch. 30 Jan 2019. Available online: https://www.straitstimes.com/singapore/environment/nus-launches-singapores-first-net-zero-energy-building-to-be-built-from (accessed on 18 June 2021).

- Eco-Business. Singapore’s Recycling Rate Falls to 10-year Low. 23 April 2021. Available online: https://www.eco-business.com/news/singapores-recycling-rate-falls-to-10-year-low/ (accessed on 16 June 2021).

- Ministry of Environment and Water Resources of Singapore (MEWR). Zero Waste Masterplan Singapore. 2019. Available online: https://www.towardszerowaste.gov.sg/images/zero-waste-masterplan.pdf (accessed on 1 October 2021).

- Ministry of Economy, Trade and Industry of Japan (METI). Basic Hydrogen Strategy. 2017. Available online: https://www.meti.go.jp/english/press/2017/pdf/1226_003b.pdf (accessed on 1 October 2021).

- Australian Renewable Energy Agency (ARENA). Opportunities for Australia from Hydrogen Exports. 2018. Available online: https://arena.gov.au/assets/2018/08/opportunities-for-australia-from-hydrogen-exports.pdf (accessed on 1 October 2021).

- Intralink. The Hydrogen Economy South Korea. 2021. Available online: https://www.intralinkgroup.com/Syndication/media/Syndication/Reports/Korean-hydrogen-economy-market-intelligence-report-January-2021.pdf (accessed on 1 October 2021).

- Ministry of Business, Innovation & Employment (MBIE). A Vision for Hydrogen in New Zealand. New Zealand Government. 2019. Available online: https://www.mbie.govt.nz/dmsdocument/6798-a-vision-for-hydrogen-in-new-zealand-green-paper (accessed on 1 October 2021).

- Straits Times. Singapore Firm to Make Hydrogen Fuel Cell Vehicles. 6 December 2020. Available online: https://www.straitstimes.com/singapore/transport/singapore-firm-to-make-hydrogen-fuel-cell-vehicles (accessed on 18 June 2021).

- Argus. Australia, Singapore Partner on Maritime Hydrogen. 17 June 2021. Available online: https://www.argusmedia.com/en/news/2225624-australia-singapore-partner-on-maritime-hydrogen (accessed on 18 June 2021).

- Channel News Asia (CNA). Shell to Trail First Hydrogen Cells for Ships in Singapore. 21 April 2021b. Available online: https://www.channelnewsasia.com/news/business/shell-to-trial-first-hydrogen-fuel-cells-for-ships-in-singapore-14664100 (accessed on 18 June 2021).

- Bui, M.; Adjiman, C.; Bardow, A.; Anthony, E.J.; Boston, A.; Brown, S.; Fennell, P.S.; Fuss, S.; Galindo, A.; Hackett, L.A.; et al. Carbon Capture and Storage (CCS): The Way Forward. Energy Environ. Sci. 2018, 11, 1062. [Google Scholar]

- Kumar, L.; Hasanuzzaman, M.; Rahim, N.A. Global Advancement of Solar Thermal Energy Technologies Process Heat and Its Future Prospects: A Review. Energy Convers. Manag. 2019, 195, 885–908. [Google Scholar] [CrossRef]

- Lau, H.C. Offshore Wind Energy in Asia: Technical Challenges and Opportunities. In Proceedings of the Paper presented at the Offshore Technology Conference, Kuala Lumpur, Malaysia, 2–6 November 2020. OTC-30244-MS. [Google Scholar]

- Renewable Energy World. Singapore Wants to Trade Renewable Energy with Its Neighbors. 11 April 2019. Available online: https://www.renewableenergyworld.com/solar/singapore-wants-to-trade-renewable-energy-with-its-neighbors/#gref (accessed on 18 June 2019).

- Bina, S.M.; Jalilinasrabady, S.; Fujii, H.; Pambudi, N.A. Classification of Geothermal Resources in Indonesia by Applying Exergy Concept. Renew. Sustain. Energy Rev. 2018, 93, 499–506. [Google Scholar] [CrossRef]

- Sanz-Perez, E.S.; Murdock, C.R.; Didas, S.A.; Jones, C.W. Direct Capture of CO2 from Ambient Air. Chem. Rev. 2016, 116, 11840–11876. [Google Scholar] [CrossRef] [PubMed]

- International Energy Agency (IEA). Direct Air Capture Tracking Report—June 2020. Available online: https://www.iea.org/reports/direct-air-capture (accessed on 22 June 2021).

- Global CCS Institute. Global Status of CCS 2020. Melbourne, Australia. Available online: https://www.globalccsinstitute.com/wp-content/uploads/2020/11/Global-Status-of-CCS-Report-2020_FINAL.pdf (accessed on 1 October 2021).

- Li, H.; Lau, H.C.; Wei, X.; Liu, S. CO2 Storage Potential in Major Oil and Gas Reservoirs in the Northern South China Sea. Int. J. Greenhouse Gas Control 2021, 108, 103328. [Google Scholar] [CrossRef]

- Global CCS Institute. ASEAN CCS Strategic Considerations. Melbourne, Australia. 2014. Available online: https://aseanenergy.org/asean-ccs-strategic-considerations/ (accessed on 1 October 2021).

- Asian Development Bank (ADB). Prospects for Carbon Capture and Storage in Southeast Asia. Manila, Philippines 2013. Available online: https://www.adb.org/sites/default/files/publication/31122/carbon-capture-storage-southeast-asia.pdf (accessed on 1 October 2021).

- Indonesia CCS Study Working Group. Understanding Carbon Capture and Storage Potential in Indonesia. 2009. Available online: https://ukccsrc.ac.uk/sites/default/files/publications/ccs-reports/DECC_CCS_117.pdf (accessed on 1 October 2021).

- Lau, H.C.; Ramakrishna, S.; Zhang, K.; Radhamani, A.V. The Role of Carbon Capture and Storage in the Energy Transition. Energy Fuels 2021, 35, 7364–7386. [Google Scholar] [CrossRef]

- Tanner, C.S.; Baxley, P.T.; Crump, J.G.; Miller, W.C. Production Performance of the Wasson Denver Unit CO2 Flood. In Proceedings of the SPE/DOE Enhanced Oil Recovery Symposium, Tulsa, OK, USA, 22–24 April 1992. Paper SPE-24156-MS. [Google Scholar]

- Heidug, W.; Lipponen, J.; McCoy, S.; Bonoit, P. Storing CO2 Through Enhanced Oil Recovery: Combining EOR with CO2 Storage (EOR+) for Profit; International Energy Publications: Paris, France, 2015. [Google Scholar]

- Hansen, O.; Eiken, O.; Ostmo, S.; Johansen, R.L.; Smith, A. Monitoring CO2 Injection into a Fluvial Brine-filled Sandstone Formation at the Snohvit Field. In Proceedings of the SEG Annual Meeting, San Antonio, TX, USA, 18–23 September 2011. [Google Scholar]

- Equinor. Northern Lights Project Concept Report RE-PM673-00001; Equinor: Stavanger, Norway, 2019. [Google Scholar]

- Equinor. Northern Lights CCS. 2021. Available online: https://www.equinor.com/en/what-we-do/northern-lights.html (accessed on 19 June 2021).

- Lau, H.C.; Ramakrishna, S.A. Roadmap for Decarbonization of Singapore and Its Implications for ASEAN—Opportunities for 4IR Technologies and Sustainable Development. In Asia Pacific Tech Monitor; April–June; Asian and Pacific Centre for Transfer of Technology: New Delhi, India; United Nations Economic and Social Commission for Asia and the Pacific: Bangkok, Thailand, 2021. [Google Scholar]

- Commonwealth Scientific and Industrial Research Organization (CSIRO). National Hydrogen Roadmap: Pathways to an Economically Sustainable Hydrogen Industry in Australia. 2018. Available online: https://www.csiro.au/en/work-with-us/services/consultancy-strategic-advice-services/csiro-futures/futures-reports/hydrogen-roadmap (accessed on 1 October 2021).

- Reuters. Saudi NEOM JV Working with Lazard on $5 billion Hydrogen Project-Sources. 13 January 2021. Available online: https://www.reuters.com/article/saudi-neom-hydrogen-lazard-int-idUSKBN29I1IE (accessed on 22 June 2021).

- World Oil. Abu Dhabi Targets Hydrogen as a Future Export Fuel. 17 January 2021. Available online: https://www.worldoil.com/news/2021/1/15/abu-dhabi-targets-hydrogen-as-a-future-export-fuel (accessed on 22 June 2021).

- Power Engineering International (PEI). Hydrogen Use Needs to Hit 212 million Mt by 2030 for Net-Zero: IEA. 18 May 2021. Available online: https://www.spglobal.com/platts/en/market-insights/latest-news/electric-power/051821-hydrogen-use-needs-to-hit-212-million-mt-by-2030-for-net-zero-iea (accessed on 22 June 2021).

- Augusmedia. Shell to Cut Singapore Bukom Refinery Capacity in July. 5 May 2021. Available online: https://www.argusmedia.com/en/news/2211860-shell-to-cut-singapore-bukom-refinery-capacity-in-july#:~:text=Shell%20will%20reduce%20capacity%20at,to%20cut%20its%20carbon%20emissions (accessed on 1 October 2021).

- Reuters. Shell to Cut Jobs and Capacity at Major Singapore Refinery. 10 November 2020. Available online: https://www.reuters.com/article/us-shell-singapore-idUSKBN27Q1N5 (accessed on 20 July 2021).

- Straits Times. Exxon Says It Remains Committed to Singapore Refinery Expansion. 12 November 2020. Available online: https://www.straitstimes.com/business/companies-markets/exxon-says-it-remains-committed-to-singapore-refinery-expansion (accessed on 1 October 2021).

- Channel News Asia (CNA). ExxonMobil Commits to Multi-billion Dollar Expansion of Singapore Manufacturing Complex. 02 April 2019c. Available online: https://www.exxonmobil.com/en/basestocks/news-insights-and-resources/press-coverage/singapore-refinery-expansion (accessed on 20 July 2021).

- Schonsteiner, K.; Massier, T.; Hamacher, T. Sustainable Transport by Use of Alternative Marine and Aviation Fuels—A Well-to-tank Analysis to Assess Interactions with Singapore’ Energy System. Renew. Sustain. Energy Rev. 2016, 65, 853–871. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). The Future of Petrochemicals: Towards More Sustainable Plastics and Fertilisers; IEA Publications: Paris, France, 2018. [Google Scholar]

- Channel News Asia (CNA). Commentary: Electric Vehicles Will Take Over Singapore. But Here’s What Must Happen First. 23 February 2021a. Available online: https://www.channelnewsasia.com/news/commentary/singapore-budget-2020-electric-vehicles-ice-ves-hybrid-car-2040-12457240#:~:text=Singapore%20has%20announced%20ambitious%20targets,EVs)%20in%20the%20intervening%20years (accessed on 22 June 2021).

- Chemical Engineer. Neste Expands Singapore Biofuels Refinery. 9 August 2019. Available online: https://www.thechemicalengineer.com/news/neste-expands-singapore-biofuels-refinery (accessed on 1 October 2021).

- Marine and Port Authority of Singapore (MPA). Facts and Trivia. Available online: https://www.mpa.gov.sg/web/portal/home/maritime-singapore/introduction-to-maritime-singapore/facts-and-trivia (accessed on 20 July 2021).

- International Energy Agency (IEA). Carbon Capture and Storage and the London Protocol: Options for Enabling Transboundary CO2 Transfer; IEA Publications: Paris, France, 2011. [Google Scholar]

- United Nations Environmental Program (UNEP). Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal. 1989. Available online: https://www.basel.int/Portals/4/Basel%20Convention/docs/text/BaselConventionText-e.pdf (accessed on 1 October 2021).

| Technology | Impact on Singapore’s CO2 Emission | Readiness for Application in Singapore | Comment | Reference |

|---|---|---|---|---|

| Post-combustion carbon capture | High. Capturing CO2 from existing power plants, refineries, and chemical plants. | High. Post-combustion carbon capture technology with amines is mature. | Centralized post-combustion carbon capture in Jurong Island to take advantage of economies of scale. | [9,10] |

| Pre-combustion carbon capture | Medium. Used only for new plants. Potential integration with hydrogen production. | Low. Not cost competitive with post-combustion carbon capture in NGCC due to the high cost of syngas generation. | Difficult to apply in Singapore’s integrated refinery-petrochemical complex. | [11] |

| Oxy-combustion carbon capture | Low. Used only for new plants. | Low. Not cost-competitive with post-combustion carbon capture in NGCC because of costly air separation unit. | Difficult to apply in Singapore’s integrated refinery-petrochemical complex. | [10,12] |

| CO2 transport by pipeline | High. Capable of transporting large quantities of CO2 at low cost. | High. CO2 can be shipped as supercritical fluid in pipelines. Uses existing trans-ASEAN gas pipelines. | Two existing natural gas pipelines connect Singapore to Indonesia. One or both may be used for CO2 transport in 2023. | [13] |

| CO2 transport by ship | High. Capable of transporting large quantities of CO2 over long distances. | High. Liquid CO2 can be shipped by LPG tankers. | Capitalize on Singapore’s marine industry. Modify existing LNG terminals to handle liquid CO2. | [14,15,16] |

| CO2 injection from a platform well | High. Capable of injecting large quantities of CO2. | High. Many existing offshore platforms in the region. | CO2 ”Huff-n-puff” system in Rang Dong oilfield in Vietnam. | [17] |

| CO2 injection from a subsea well | High. Capable of injecting large quantities of CO2. | High. Significant experience with subsea wells in the region, including Malampaya in Philippines, Gumusut-Kakap and Rotan in Malaysia and West Seno in Indonesia. | Significant subsea well experience in Malaysia and Indonesia. | [18,19] |

| CO2 storage in a saline aquifer | High. Very large CO2 storage capacity, possibly exceeding 100 Gt. | Medium. Detailed characterization of saline aquifers in the region is lacking. | Choice of aquifers awaits subsurface characterization. | [20] |

| CO2 storage in an oil reservoir | High. Adequate for many years of CO2 storage. | High. Many oil reservoirs within 1000 km from Singapore | Potential oilfields for CO2-EOR in South Sumatra. | [21,22] |

| CO2 storage in a gas reservoir | High. Adequate for many years of CO2 storage. | High. Many gas reservoirs within 1000 km from Singapore | Repsol to pilot CCS in Dayung gas field in South Sumatra. | [23] |

| Hydrogen production by SMR with CCS | High. The hydrogen industry may become growth engine for economy. | High. Mature technology. | May be considered as part of the modernization of the refining sector. | [24,25] |

| Electric vehicles | High. The electrification of cars transfers mobile emission to stationary emission which can be removed by CCS. | High. EVs are ideal for Singapore, where driving distances are short. | Singapore will be phasing out internal combustion cars by 2040. | [26] |

| Biofuels | High. Biofuels may be used for cars, ship, and aviation. | High. One biorefinery in Singapore converts used cooking oil and food waste to renewable jet fuel for North American and European markets. | Singapore already has a biorefinery with a capacity of 1 Mtpa. There is a plan to expand it to 1.3 Mtpa. | [27] |

| Solar PV | Moderate. Solar PV constitutes less than 1% of Singapore’s energy mix. | High. Used on rooftops of apartment buildings in Singapore. | There is a plan to increase solar PV capacity from 350 MW to 2 GW by 2030. | [28] |

| Regional power grid | Moderate | High. There is a plan to construct an ASEAN power grid. | There is a plan to import 100 MW of low-carbon electricity from Malaysia for 2 years. | [29] |

| Zero-emissions buildings | Moderate | High. Singapore launched the first zero-emissions building in Southeast Asia powered by green hydrogen in 2019. | National University of Singapore launched Singapore’s first zero-emission building powered by solar PV in 2019. | [30,31] |

| Circular economy | Moderate. Singapore’s domestic and overall recycling rate was 17% and 52%, respectively in 2020. | High. Singapore issued its Zero Waste Masterplan in 2019. | Singapore plans to reduce waste sent to Semakau Landfill by 30% by 2030. | [32,33] |

| Green hydrogen by renewable electricity | High. Green H2 eliminates most CO2 emissions. | Low. No commercial-scale green H2 production in Singapore. Purchase from overseas possible but costly. | Within Asia, Japan has announced plans to import hydrogen, whereas Australia plans to export hydrogen. South Korea and New Zealand have published their goals for a hydrogen economy. | [34,35,36,37] |

| Hydrogen fuel cell vehicles | High. HFCVs will eliminate mobile CO2 emission from vehicles. | Moderate. Currently, Singapore has no H2 infrastructure. However, development is possible due to its small area. | Despite no government policy favoring HFCVs, one local company plans to make HFCVs. | [38] |

| Hydrogen bunkering for ships | High. As a bunkering center for ships, Singapore can benefit from H2 bunkering for zero-emissions ships. | Moderate. Singapore has no hydrogen production for transport. However, development is possible as part of industry modernization. | Singapore signed an SGD 23 million deal with Australia to develop maritime hydrogen. Shell is to trial hydrogen fuel cell for ships in Singapore. | [39,40] |

| Carbon capture and utilization (Non EOR/EGR) | Moderate. The utilization of CO2-based chemicals is small compared to CO2-based fuels. Both are under R&D. | Moderate. Most CCU technologies are in the R&D stage and are not commercial. | CO2-based fuels such as methane and methanol are not cost-competitive and require breakthroughs in catalysis technology. | [41] |

| Solar thermal | Low | Low. Limited roof space for solar thermal installation in Singapore’s buildings. May be seen as competition to solar PV. | Space heating not in demand due to Singapore’s hot climate. | [42] |

| Wind energy | Low | Low. Wind speed around Singapore is too low for wind turbine. | Inadequate land and sea space for wind turbines. | [43] |

| Hydroelectricity | Low | Low. Singapore lacks river for hydroelectricity. | Singapore can invest in hydroelectricity in Laos and use renewable energy credits to import electricity from Malaysia. | [44] |

| Geothermal energy | Low | Low. No geothermal resources in Singapore. | Geothermal energy in SE Asia resides mainly in Indonesia and Philippines. | [45] |

| Direct air capture | Low | Low. Technology not commercial. | Global DAC capacity is 9000 tons/y, mostly in US | [46,47] |

| Sector | CO2 Mitigation Method |

|---|---|

| Power | Post-combustion CCS More solar PV Importing electricity from regional grids Hydrogen for power generation |

| Refining | Reduce output of petroleum-based fuels Increase output to petrochemical plants Incorporate and integrate with biorefineries Post-combustion CCS |

| Petrochemical | Post-combustion CCS Hydrogen for heat and as feedstock |

| Transport | Replacing passenger cars by EV Replacing buses and heavy vehicles by HFCV Biofuels for aviation Hydrogen for ships |

| Building and others | Zero-emissions buildings Adoption of a circular economy |

| Basin | Distance to Singapore (km) | Oil Field (OOIP > 100 MMbbl) | Gas Field (OGIP > 1 Tcf) | Saline Aquifer |

|---|---|---|---|---|

| North Sumatra | 890 | Arun * | Various | |

| 800 | Kuala Langsa | |||

| 860 | S. Lhok Sukon | |||

| 810 | Offshore NSB | |||

| 740 | Rantau | |||

| Central Sumatra | 210 | Bentu-Seng-Seat | Various | |

| 270 | Duri | |||

| 200 | Minas | |||

| 310 | Bangko | |||

| 260 | Bekasap | |||

| 310 | Mengala | |||

| 300 | Balam | |||

| 230 | Petapahan | |||

| 210 | Kotabatak | |||

| 270 | North Pulai | |||

| South Sumatra | 400 | Kaliberau | Various | |

| 410 | Dayung | |||

| 440 | Suban * | |||

| 350 | Sumpal | |||

| 440 | Musi | |||

| 440 | Kuang | |||

| 470 | Kaji-Semoga | |||

| 500 | Sopa | |||

| 510 | Jene | |||

| NW Java | 850 | Parigi | Various | |

| 740 | Cinta-ama | |||

| 720 | Krisna | |||

| 670 | Widuri | |||

| 720 | Bima | |||

| 690 | Farida-Zelda | |||

| 650 | Sundari | |||

| 650 | Nurbani | |||

| 890 | Ardjuna | |||

| 830 | Arimbi | |||

| 900 | Jatibarang | |||

| West Natuna | 360 | Anoa * | ||

| 400 | Udang | |||

| East Natuna | 690 | D-Alpha | Various |

| Basin | Distance to Singapore (km) | Oil Field (OOIP > 100 MMbbl) | Gas Field (OGIP > 1 Tcf) | Saline Aquifer |

|---|---|---|---|---|

| Malay | 350 | Angsi * | Various | |

| 350 | Duyong | |||

| 510 | Jerneh | |||

| 510 | Lawit | |||

| 400 | Resak | |||

| 500 | Bintang | |||

| 500 | Tangga | |||

| 430 | Bujang | |||

| 390 | Seligi | |||

| 400 | Tapis | |||

| 380 | Pulai | |||

| 390 | Bekok | |||

| 420 | Guntong | |||

| 390 | Sotong | |||

| 390 | Belumut | |||

| 440 | Dulang | |||

| Pengyu | 230 | Ruh-Ara | Various |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations All authors have read and agreed to the published version of the manuscript.. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lau, H.C.; Ramakrishna, S.; Zhang, K.; Hameed, M.Z.S. A Decarbonization Roadmap for Singapore and Its Energy Policy Implications. Energies 2021, 14, 6455. https://doi.org/10.3390/en14206455

Lau HC, Ramakrishna S, Zhang K, Hameed MZS. A Decarbonization Roadmap for Singapore and Its Energy Policy Implications. Energies. 2021; 14(20):6455. https://doi.org/10.3390/en14206455

Chicago/Turabian StyleLau, Hon Chung, Seeram Ramakrishna, Kai Zhang, and Mohamed Ziaudeen Shahul Hameed. 2021. "A Decarbonization Roadmap for Singapore and Its Energy Policy Implications" Energies 14, no. 20: 6455. https://doi.org/10.3390/en14206455

APA StyleLau, H. C., Ramakrishna, S., Zhang, K., & Hameed, M. Z. S. (2021). A Decarbonization Roadmap for Singapore and Its Energy Policy Implications. Energies, 14(20), 6455. https://doi.org/10.3390/en14206455