Analysis of Interrelationships between Markets of Fuels in the Visegrad Group Countries from 2016 to 2020

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Testing for Stationarity

3.2. Testing for Cointegration

3.3. Testing for Granger Causality

4. Results and Discussion

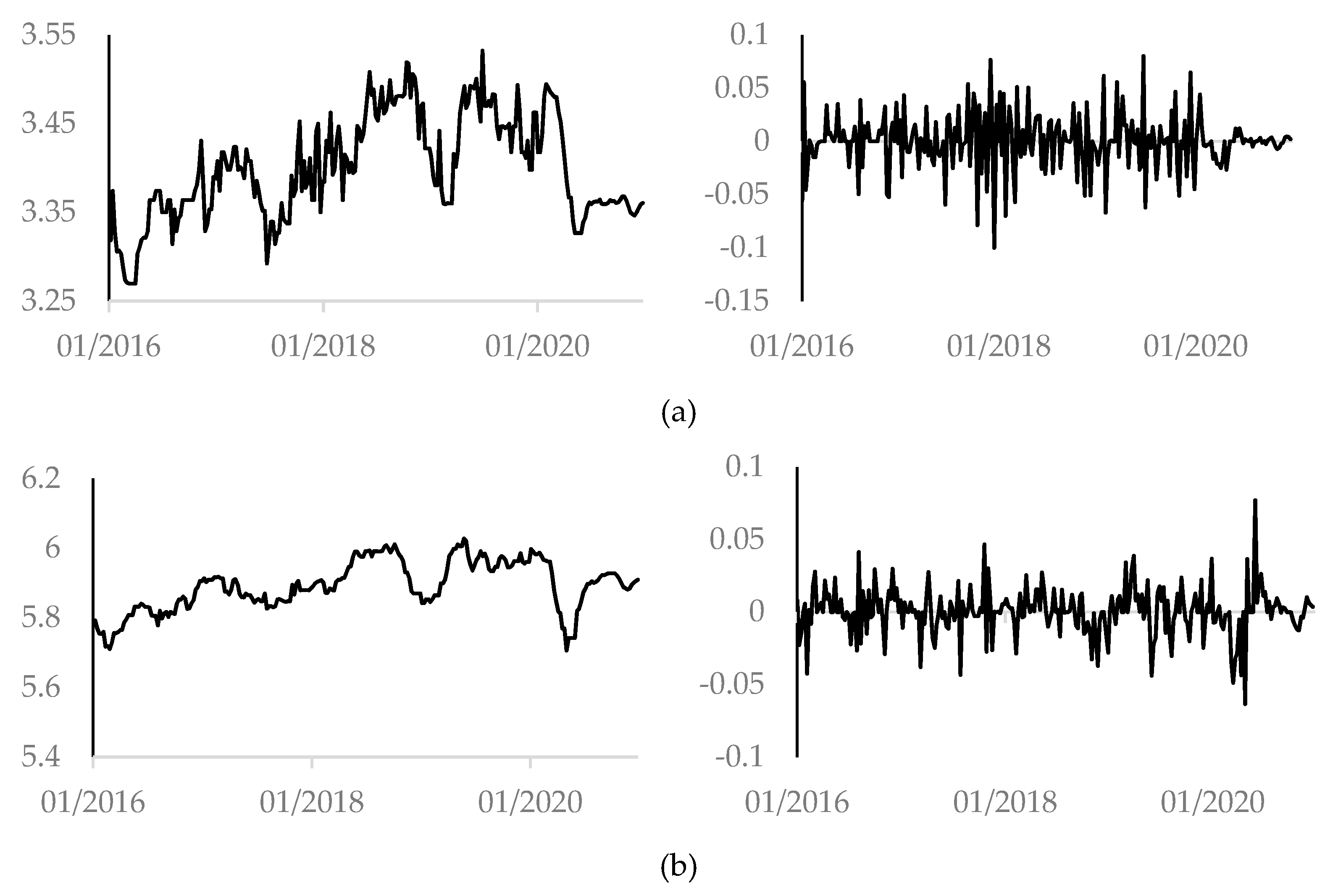

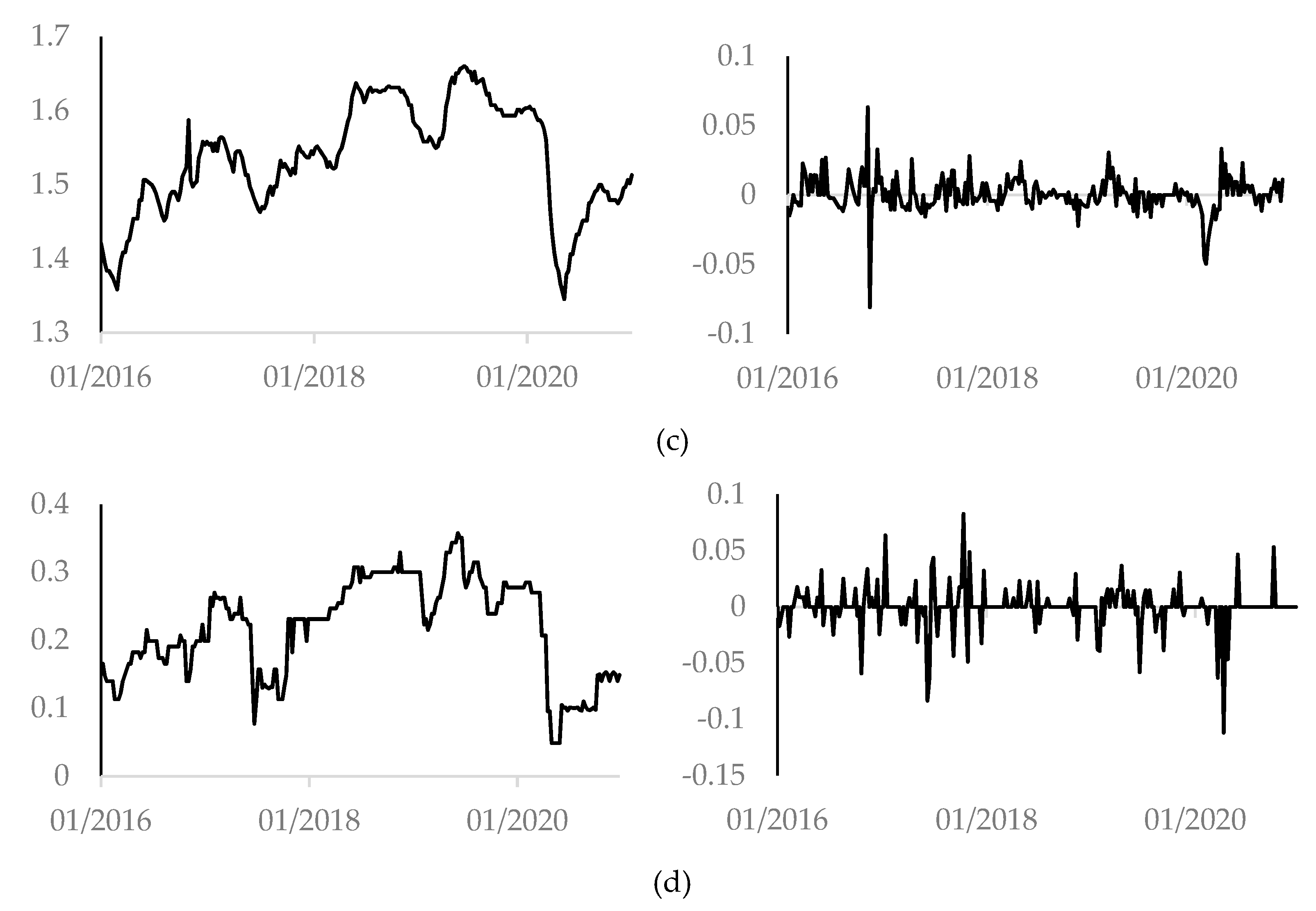

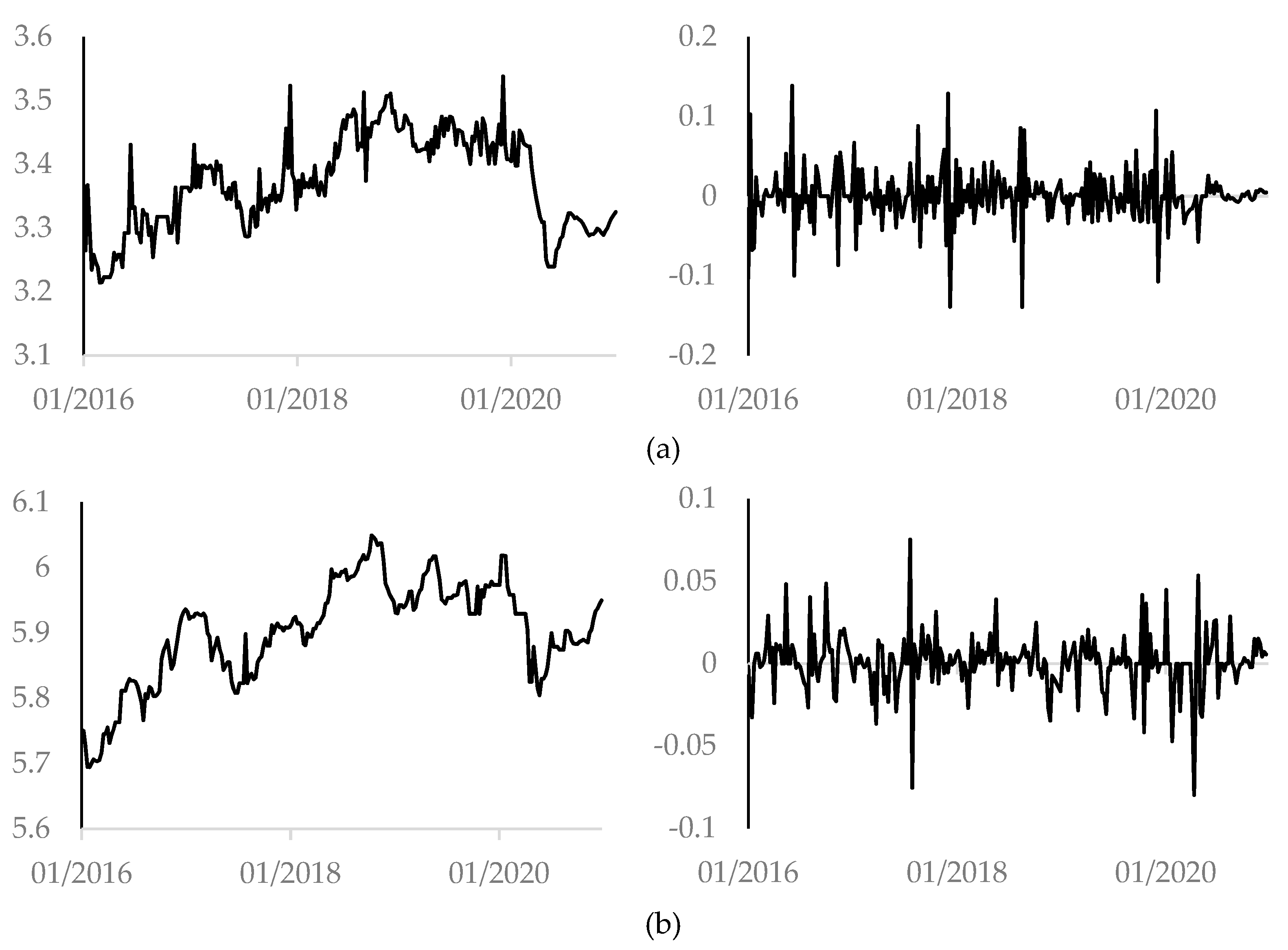

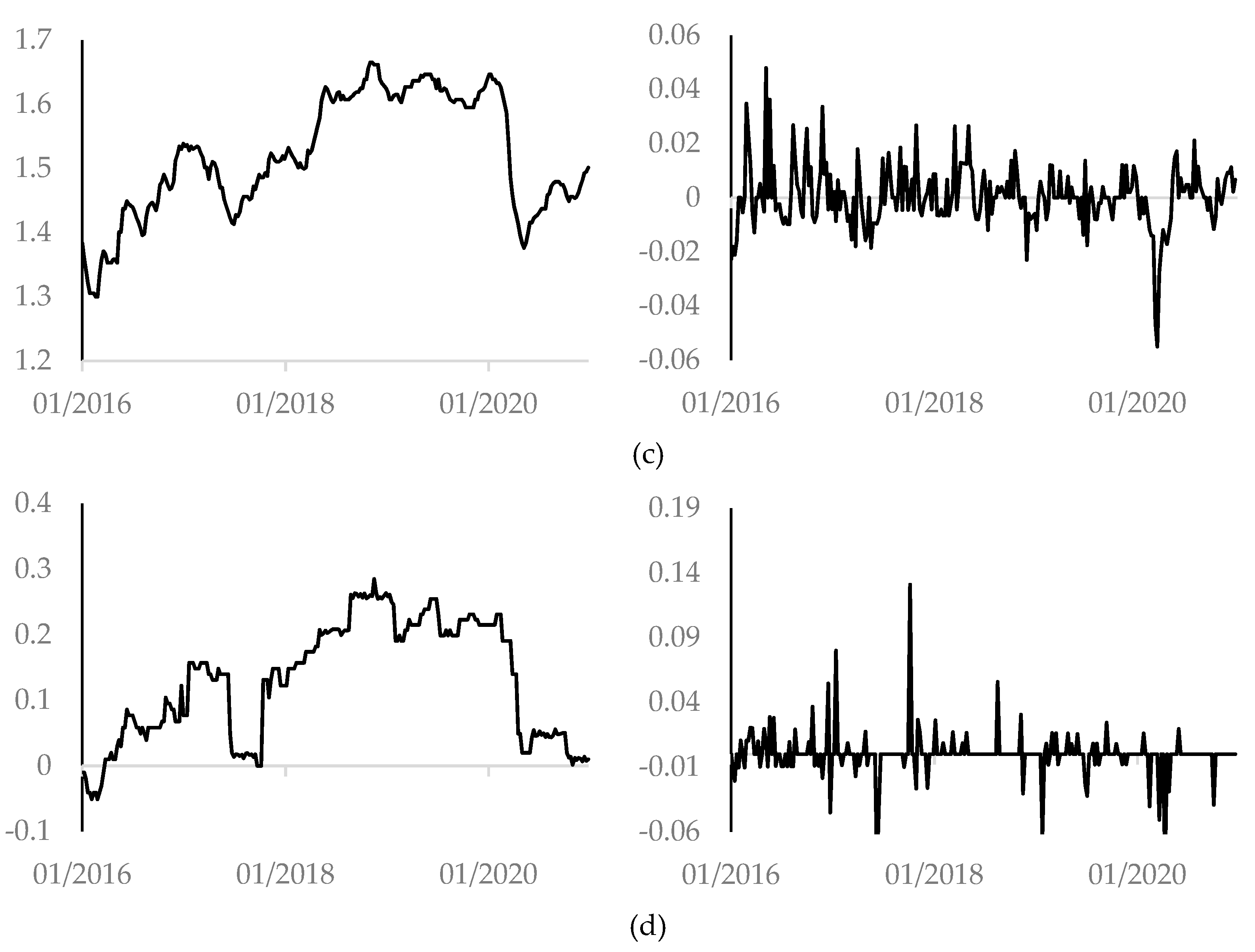

4.1. Preliminary Statistical Analysis

4.2. The ADF Test Results

4.3. The CRDW Test Results

4.4. Granger Causality Test Results

5. Concluding Remarks and Future Work

Author Contributions

Funding

Conflicts of Interest

References

- Ambroziak, Ł.; Chojna, J.; Gniadek, J.; Juszczak, A.; Miniszewski, M.; Strzelecki, J.; Szpor, A.; Śliwowski, P.; Święcicki, I.; Wąsiński, M. The Visegrad Group—30 Years of Transformation, Integration and Development; Polish Economic Institute: Warsaw, Poland, 2020. [Google Scholar]

- Šimáková, J. Cointegration Approach to the Estimation of the Long-Run Relations between Exchange Rates and Trade Balances in Visegrad Countries. Financ. Assets Invest. 2016, 7, 37–57. [Google Scholar] [CrossRef]

- Grodzicki, T. Selected Economic Conditions of the Visegrad Countries. Education Excellence and Innovation Management: A 2025 Vision to Sustain Economic Development during Global Challenges. In Proceedings of the 35th IBIMA Conference, Seville, Spain, 1–2 April 2020; pp. 1453–1460. [Google Scholar]

- Asche, F.; Gjølberg, O.; Völker, T. Price relationships in the petroleum market: An analysis of crude oil and refined product prices. Energy Econ. 2003, 25, 289–301. [Google Scholar] [CrossRef] [Green Version]

- Papież, M.; Śmiech, S. The analysis of relation between primary fuel prices on the European market in the period 2001–2011. Energy Market J. 2011, 5, 139–144. [Google Scholar]

- Kristoufek, L.; Janda, K.; Zilberman, D. Relationship between Prices of Food, Fuel and Biofuel. In Proceedings of the 131st EAAE Seminar “Innovation for Agricultural Competitiveness and Sustainability of Rural Areas”, Prague, Czech Republic, 18–19 September 2012. [Google Scholar]

- Waściński, T.H.; Przekota, G.; Sobczak, L.M. Reaction of retail fuels prices to changes in PKN Orlen and Lotos wholesale prices. Quant. Methods Econ. 2010, XI, 273–280. [Google Scholar]

- Zhang, Y.-J.; Wei, Y.-M. The crude oil market and the gold market: Evidence for cointegration, causality and price discovery. Resour. Policy 2010, 35, 168–177. [Google Scholar] [CrossRef]

- Jain, A.; Ghosh, S. Dynamics of global oil prices, exchange rate and precious metal prices in India. Resour. Policy 2013, 38, 88–93. [Google Scholar] [CrossRef]

- Eissa, M.A.; Al Refai, H. Modelling the symmetric and asymmetric relationships between oil prices and those of corn, barley, and rapeseed oil. Resour. Policy 2019, 64, 101511. [Google Scholar] [CrossRef]

- Sarwar, M.N.; Hussain, H.; Maqbool, M.B. Pass through effects of oil price on food and non-food prices in Pakistan: A nonlinear ARDL approach. Resour. Policy 2020, 69, 101876. [Google Scholar] [CrossRef]

- Singhal, S.; Choudhary, S.; Biswal, P.C. Return and volatility linkages among International crude oil price, gold price, exchange rate and stock markets: Evidence from Mexico. Resour. Policy 2019, 60, 255–261. [Google Scholar] [CrossRef]

- Çatık, A.N.; Kışla, G.H.; Akdeniz, C. Time-varying impact of oil prices on sectoral stock returns: Evidence from Turkey. Resour. Policy 2020, 69, 101845. [Google Scholar] [CrossRef]

- Zaighum, I.; Aman, A.; Sharif, A.; Suleman, M.T. Do energy prices interact with global Islamic stocks? Fresh insights from quantile ARDL approach. Resour. Policy 2021, 72, 102068. [Google Scholar] [CrossRef]

- Kırca, M.; Canbay, Ş.; Pirali, K. Is the relationship between oil-gas prices index and economic growth in Turkey permanent? Resour. Policy 2020, 69, 101838. [Google Scholar] [CrossRef] [PubMed]

- Aye, G.C.; Odhiambo, N.M. Oil prices and agricultural growth in South Africa: A threshold analysis. Resour. Policy 2021, 73, 102196. [Google Scholar] [CrossRef]

- Zakaria, M.; Khiam, S.; Mahmood, H. Influence of oil prices on inflation in South Asia: Some new evidence. Resour. Policy 2021, 71, 102014. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, C.; Liu, Z. The Linkage Between the Fuel Oil Markets of Singapore and China. Chin. Econ. 2008, 41, 76–83. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- MacKinnon, J.G. Critical values of cointegration tests. In Long-Run Economic Relationships: Readings in Cointegration, 1st ed.; Engle, R.E., Granger, C.W.J., Eds.; Oxford University Press: New York, NY, USA, 1991; pp. 267–276. [Google Scholar]

- Gujarati, D.N. Basic Econometrics, 4th ed.; McGraw-Hill: New York, NY, USA, 2008. [Google Scholar]

- Granger, C.W.J. Some properties of time series data and their use in econometrics. J. Econom. 1981, 16, 121–130. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-integration and error correction models. J. Time Ser. Anal. 1987, 23, 509–522. [Google Scholar]

- Ramanathan, R. Introductory Econometrics with Applications, 5th ed.; South-Western Thomson Learning: Mason, OH, USA, 2002. [Google Scholar]

- Greene, W.H. Econometric Analysis, 6th ed.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2008. [Google Scholar]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 1969, 37, 424. [Google Scholar] [CrossRef]

- Maddala, G.S. Introduction to Econometrics, 3rd ed.; John Wiley & Sons: Chichester, England, 2001. [Google Scholar]

- The Polish Organisation of Oil Industry and Trade. Oil Industry and Trade. Annual Report 2020; The Polish Organisation of Oil Industry and Trade: Warsaw, Poland, 2021. [Google Scholar]

- Baek, E.; Brock, W. A General Test for Nonlinear Granger Causality: Bivariate Model. Working Paper; Iowa State University and University of Wisconsin-Madison: Madison, WI, USA, 1992. [Google Scholar]

- Hiemstra, C.; Jones, J. Testing for linear and nonlinear Granger causality in the stock price-volume relation. J. Financ. 1994, 49, 1639–1664. [Google Scholar]

| Country | Measure | |||||

|---|---|---|---|---|---|---|

| Mean | Std. Dev. | Coeff. of Var. | Assymetry | Kurtosis | JB | |

| Czech Rep. | −0.000519 | 0.025200 | 485.400 | −0.23499 | 1.8572 | 39.607 * |

| Hungary | 0.000479 | 0.016328 | 34.063 | −0.11461 | 3.0632 | 101.827 * |

| Poland | 0.000351 | 0.012432 | 34.912 | −0.67453 | 10.0450 | 1108.560 * |

| Slovakia | −0.000066 | 0.018784 | 284.600 | −1.07920 | 8.9212 | 909.171 * |

| Country | Measure | |||||

|---|---|---|---|---|---|---|

| Mean | Std. Dev. | Coeff. of Var. | Assymetry | Kurtosis | JB | |

| Czech Rep. | −0.000163 | 0.033940 | 208.010 | −0.04877 | 4.3024 | 99.859 * |

| Hungary | 0.000763 | 0.016874 | 22.117 | −0.30817 | 5.0614 | 280.562 * |

| Poland | 0.000456 | 0.011298 | 24.785 | −0.03537 | 4.2141 | 191.700 * |

| Slovakia | 0.000039 | 0.017487 | 450.640 | 0.72764 | 1.3670 | 4070.42 * |

| Variable | Pb95 | Diesel | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Czech Rep. | Hungary | Poland | Slovakia | Czech Rep. | Hungary | Poland | Slovakia | ||

| Pb95 | Czech Rep. | 1 | |||||||

| Hungary | 0.159 * | 1 | |||||||

| Poland | 0.021 | 0.354 * | 1 | ||||||

| Slovakia | 0.134 * | 0.256 * | 0.066 | 1 | |||||

| Diesel | Czech Rep. | 0.137 * | 0.060 | 0.069 | 0.007 | 1 | |||

| Hungary | 0.074 | 0.358 * | 0.262 * | 0.189 * | 0.006 | 1 | |||

| Poland | 0.052 | 0.358 * | 0.724 * | 0.168 * | 0.135 * | 0.281 * | 1 | ||

| Slovakia | 0.159 * | 0.216 * | 0.112 * | 0.506 * | 0.034 | 0.109 * | 0.125 * | 1 | |

| Country and Fuel Type | Tau (p-Value) | ||

|---|---|---|---|

| without Constant | with Constant | with Constant and Trend | |

| Czech Rep. Pb95 | 0.058 (0.701) | −2.284 (0.172) | −2.260 (0.455) |

| Hungary Pb95 | 0.4213 (0.804) | −3.177 (0.021) | −3.309 (0.064) |

| Poland Pb95 | 0.319 (0.778) | −3.152 (0.023) | −3.000 (0.321) |

| Slovakia Pb95 | −0.697 (0.414) | −2.036 (0.271) | −1.989 (0.604) |

| Czech Rep. diesel | 0.032 (0.693) | −2.295 (0.173) | −2.195 (0.491) |

| Hungary diesel | 0.698 (0.865) | −2.226 (0.198) | −2.246 (0.461) |

| Poland diesel | 0.414 (0.802) | −2.617 (0.089) | −2.366 (0.397) |

| Slovakia diesel | −0.902 (0.324) | −1.602 (0.479) | −1.155 (0.916) |

| Country and Fuel Type | Tau (p-Value) | ||

|---|---|---|---|

| without Constant | with Constant | with Constant and Trend | |

| Czech Rep. Pb95 | −12.116 (3.874 × 10−25) | −12.092 (5.23 × 10−26) | −12.105 (6.762 × 10−29) |

| Hungary Pb95 | −7.161 (6.935 × 10−12) | −7.163 (1.189 × 10−10) | −7.179 (7.413 × 10−10) |

| Poland Pb95 | −6.502 (2.975 × 10−10) | −6.506 (6.621 × 10−9) | −7.950 (2.849 × 10−12) |

| Slovakia Pb95 | −15.478 (4.952 × 10−31) | −15.447 (3.11 × 10−27) | −15.445 (3.7 × 10−28) |

| Czech Rep. diesel | −27.324 (6.879 × 10−34) | −27.270 (1.259 × 10−18) | −27.245 (2.85 × 10−23) |

| Hungary diesel | −16.180 (2.847 × 10−32) | −16.182 (4.684 × 10−28) | −16.179 (2.921 × 10−29) |

| Poland diesel | −6.907 (3.021 × 10−11) | −6.917 (5.515 × 10−10) | −7.002 (2.445 × 10−9) |

| Slovakia diesel | −16.080 (4.21 × 10−32) | −16.045 (6.419 × 10−28) | −16.185 (2.864 × 10−29) |

| Independent Variable | Dependent Variable | d | Independent Variable | Dependent Variable | d |

|---|---|---|---|---|---|

| Czech Rep. Pb95 | Hungary Pb95 | 0.457 * | Czech Rep. diesel | Hungary diesel | 0.608 * |

| Poland Pb95 | 0.523 * | Poland diesel | 0.930 * | ||

| Slovakia Pb95 | 0.455 * | Slovakia diesel | 0.919 * | ||

| Hungary Pb95 | Czech Rep. Pb95 | 0.591 * | Hungary diesel | Czech Rep. diesel | 0.770 * |

| Poland Pb95 | 0.207 | Poland diesel | 0.325 | ||

| Slovakia Pb95 | 0.140 | Slovakia diesel | 0.197 | ||

| Poland Pb95 | Czech Rep. Pb95 | 0.681 * | Poland diesel | Czech Rep. diesel | 1.125 * |

| Hungary Pb95 | 0.231 | Hungary diesel | 0.357 | ||

| Slovakia Pb 95 | 0.315 | Slovakia diesel | 0.259 | ||

| Slovakia Pb95 | Czech Rep. Pb95 | 0.576 * | Slovakia diesel | Czech Rep. diesel | 1.092 * |

| Hungary Pb95 | 0.126 | Hungary diesel | 0.207 | ||

| Poland Pb95 | 0.277 | Poland diesel | 0.237 |

| Relationship | Lag Length | Relationship | Lag Length | ||||

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 1 | 2 | 3 | ||

| Czech Rep.→Hungary | 0.428 | 2.851 | 1.697 | Poland→Czech Rep. | 13.076 * | 21.379 * | 20.857 * |

| Czech Rep.→Poland | 5.233 * | 1.571 | 1.249 | Poland→Hungary | 60.774 * | 26.253 * | 16.528 * |

| Czech Rep.→Slovakia | 0.192 | 3.810 * | 2.994 * | Poland→Slovakia | 8.512 * | 6.068 * | 6.578 * |

| Hungary→Czech Rep. | 2.682 | 10.513 * | 11.522 * | Slovakia→Czech Rep. | 2.962 | 2.063 | 1.746 |

| Hungary→Poland | 29.507 * | 9.418 * | 5.963 * | Slovakia→Hungary | 0.610 | 0.279 | 0.207 |

| Hungary→Slovakia | 0.487 | 7.301 * | 5.338 * | Slovakia→Poland | 10.706 * | 4.522 * | 3.355 * |

| Relationship | Lag Length | Relationship | Lag Length | ||||

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 1 | 2 | 3 | ||

| Czech Rep.→Hungary | 0.045 | 1.402 | 1.468 | Poland→Czech Rep. | 12.752 * | 11.487 * | 8.298 * |

| Czech Rep.→Poland | 0.116 | 0.524 | 0.220 | Poland→Hungary | 22.814 * | 13.692 * | 9797 * |

| Czech Rep.→Slovakia | 1.106 | 3.258 * | 2.624 | Poland→Slovakia | 12.220 * | 10.638 * | 10.070 * |

| Hungary→Czech Rep. | 4.063 * | 3.022 | 4.834 * | Slovakia→Czech Rep. | 2.243 | 4.264 * | 3.743 * |

| Hungary→Poland | 2.696 | 1.322 | 1.216 | Slovakia→Hungary | 0.518 | 0.273 | 0.477 |

| Hungary→Slovakia | 3.042 | 3.420 * | 4.056 * | Slovakia→Poland | 1.650 | 0.477 | 0.970 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Górska, A.; Krawiec, M. Analysis of Interrelationships between Markets of Fuels in the Visegrad Group Countries from 2016 to 2020. Energies 2021, 14, 6536. https://doi.org/10.3390/en14206536

Górska A, Krawiec M. Analysis of Interrelationships between Markets of Fuels in the Visegrad Group Countries from 2016 to 2020. Energies. 2021; 14(20):6536. https://doi.org/10.3390/en14206536

Chicago/Turabian StyleGórska, Anna, and Monika Krawiec. 2021. "Analysis of Interrelationships between Markets of Fuels in the Visegrad Group Countries from 2016 to 2020" Energies 14, no. 20: 6536. https://doi.org/10.3390/en14206536

APA StyleGórska, A., & Krawiec, M. (2021). Analysis of Interrelationships between Markets of Fuels in the Visegrad Group Countries from 2016 to 2020. Energies, 14(20), 6536. https://doi.org/10.3390/en14206536