Optimal Bi-Level Scheduling Method of Vehicle-to-Grid and Ancillary Services of Aggregators with Conditional Value-at-Risk

Abstract

:1. Introduction

- (1)

- The optimisation method has taken into account the risk of loss of revenue due to lack of vehicle charging capacity to provide service and EV battery degradation, and the CVaR was used to mitigate the uncertainties. (CVaR, also known as expected shortfall, was originally used to evaluate the market and credit risk of investment portfolios [22,23]).

- (2)

- A preferred operating point will be suggested within the ancillary capacity, with consideration of the onsite renewable generation and the above risk.

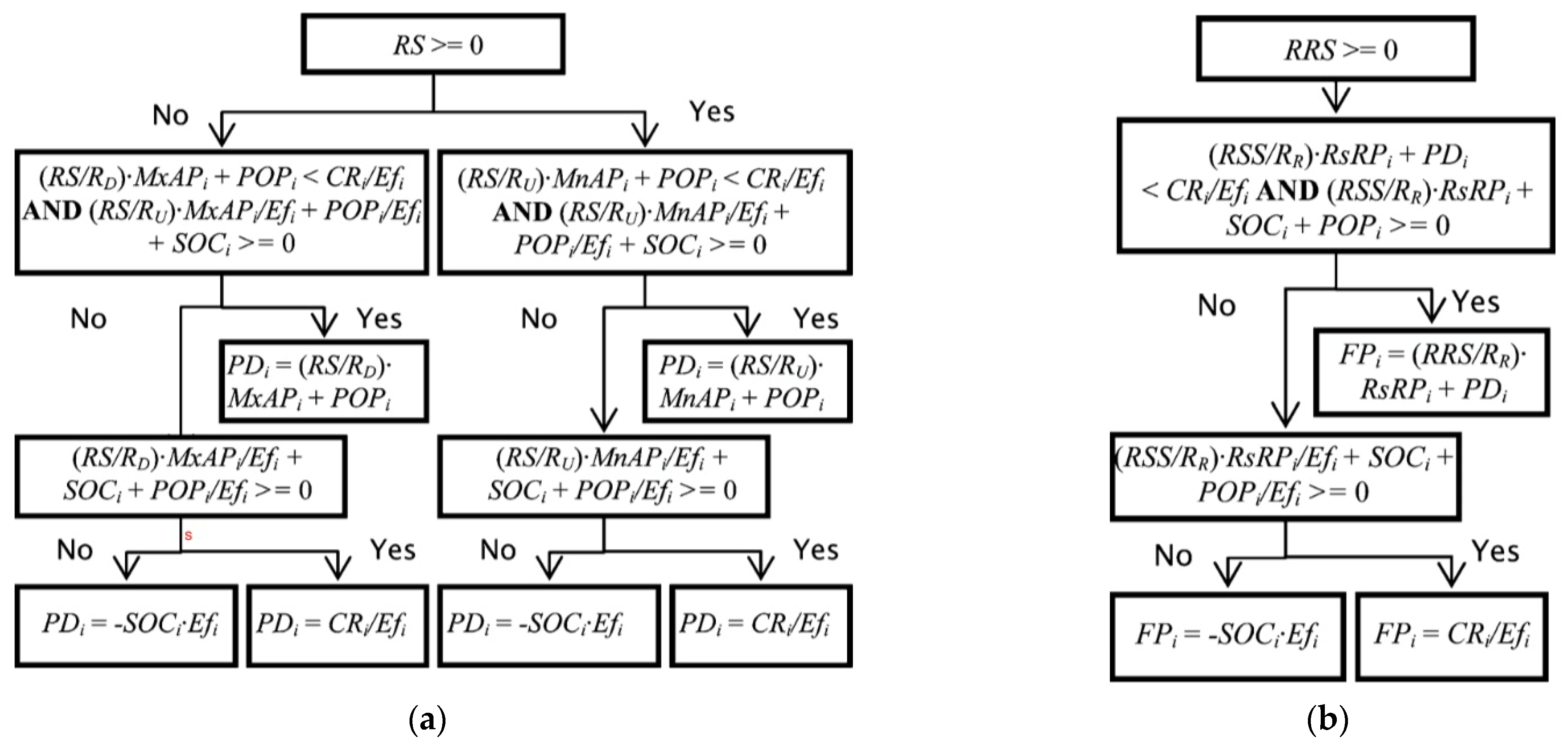

2. Bi-Level Scheduling Method for Vehicle-to-Grid and Ancillary Services

2.1. Upper-Level Problem

2.2. Lower-Level Problem

2.3. Uncertainties Study Methodology

2.4. Profit Risk Management of Electric Vehicle (EV) Charging Stations

2.5. The System Adjustment Signal of Aggregator

3. Solution to the Bi-Level Problem

4. Case Study

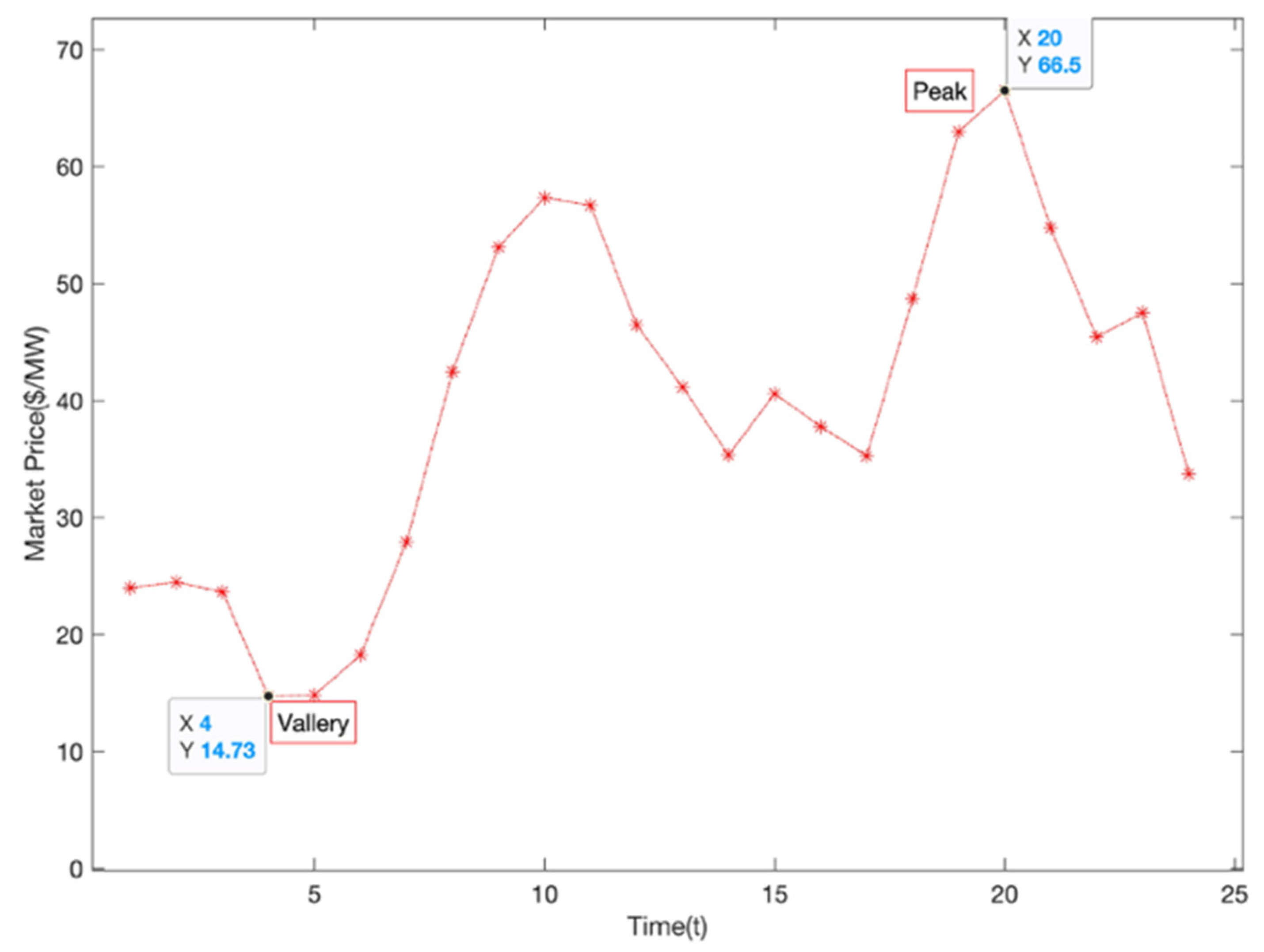

4.1. Electricity Spot Price Data

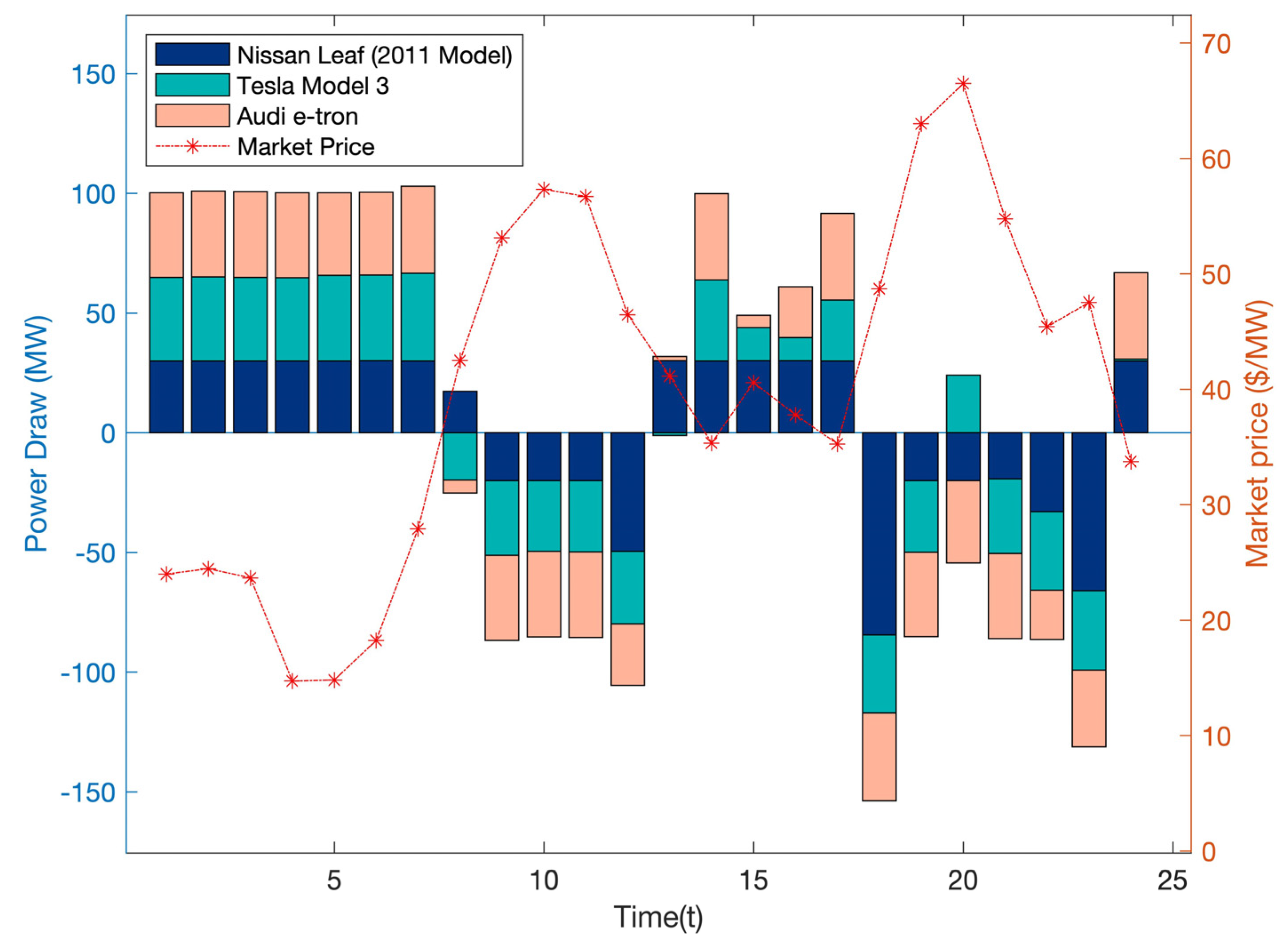

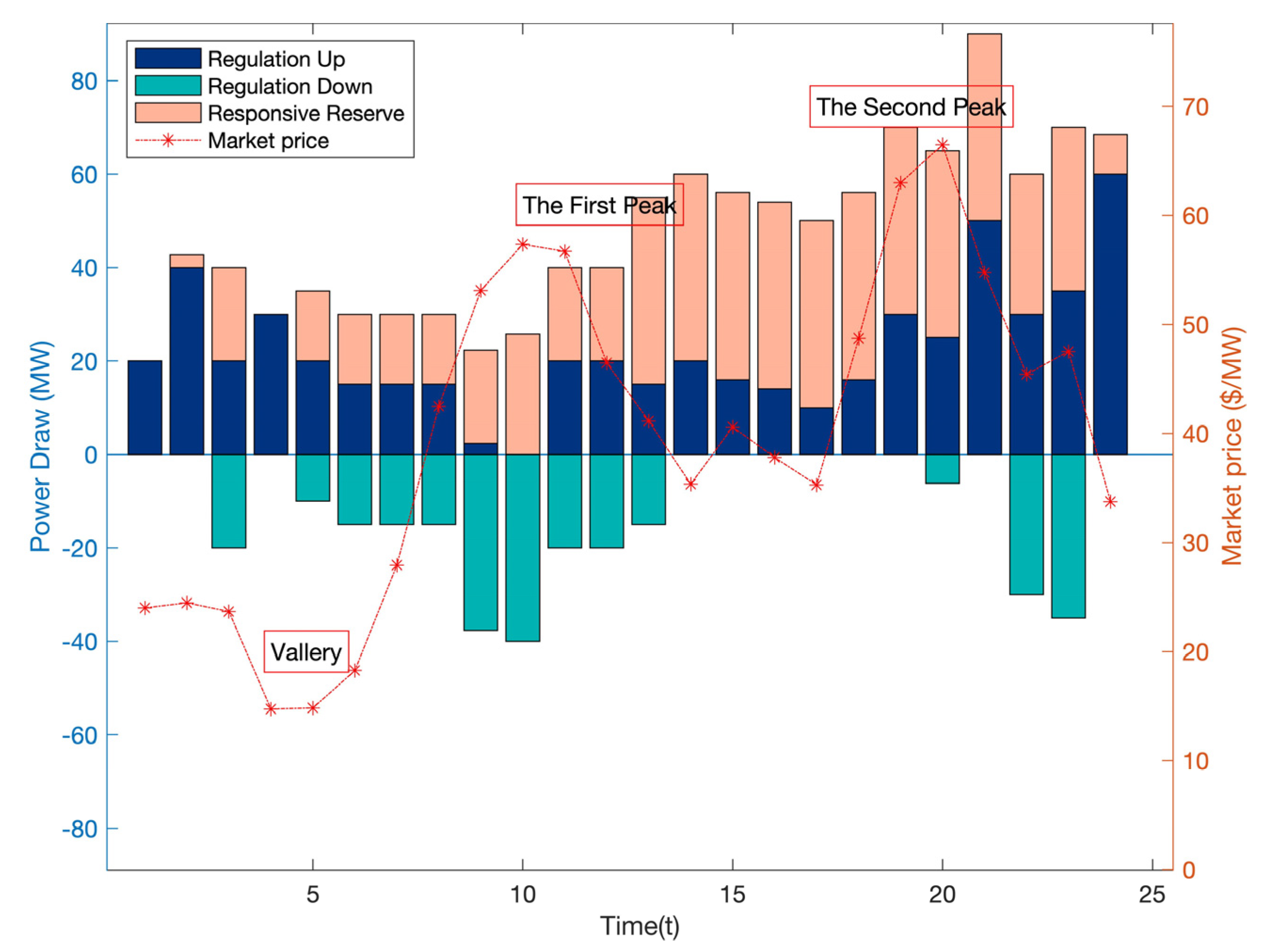

4.2. Application of a BASIC Bi-Level Service Scheduling Method

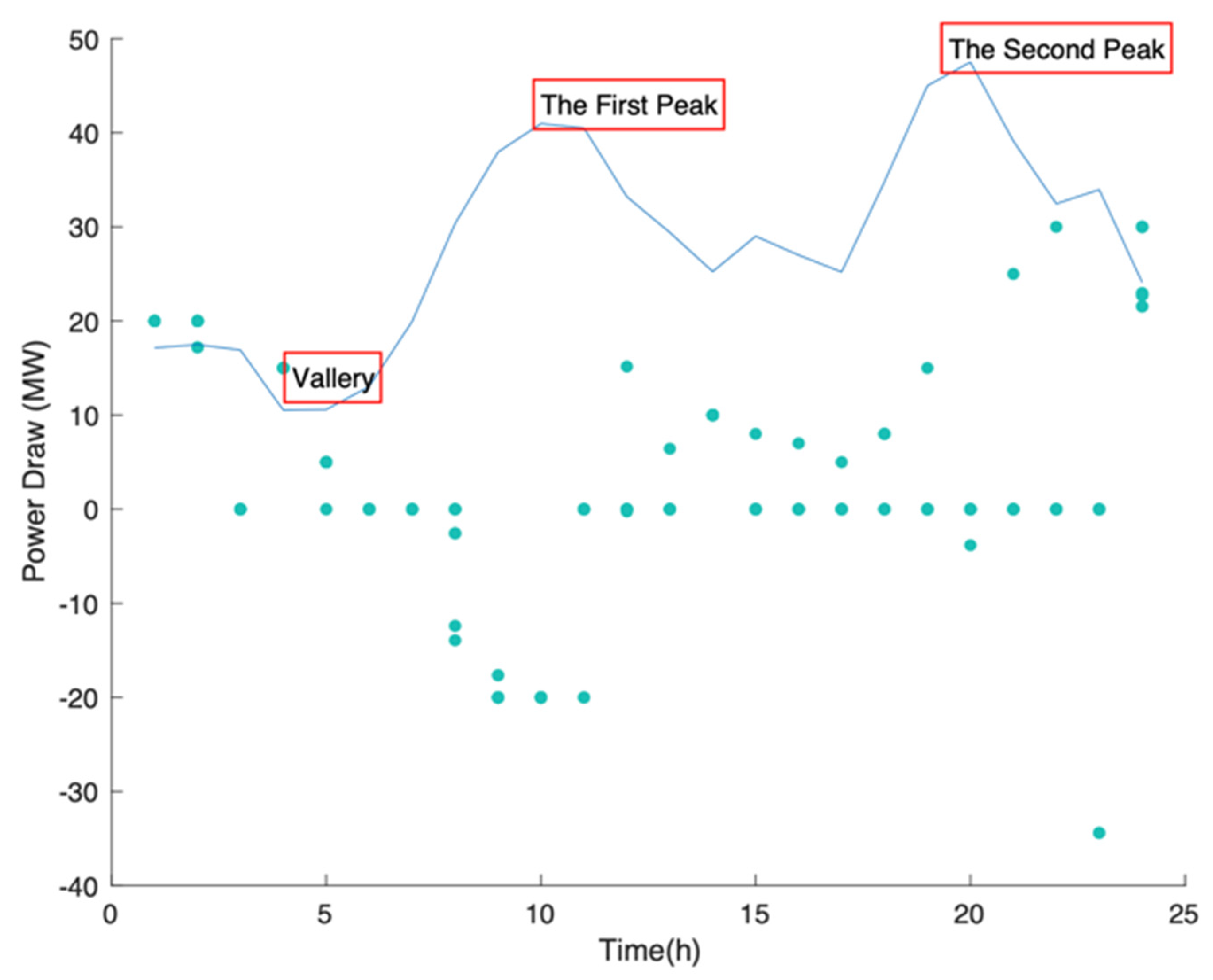

4.3. Uncertainties of EV Charging Behavior

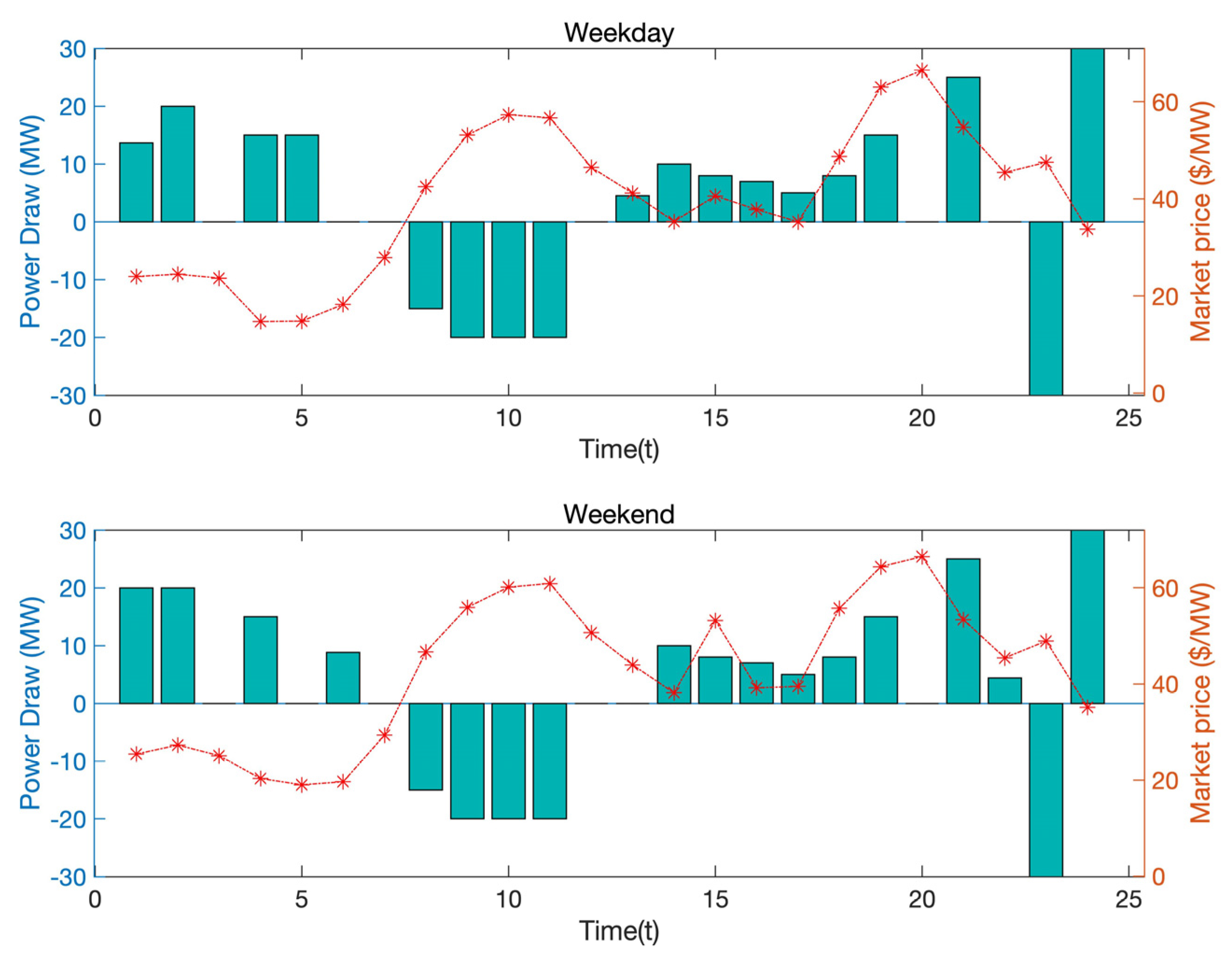

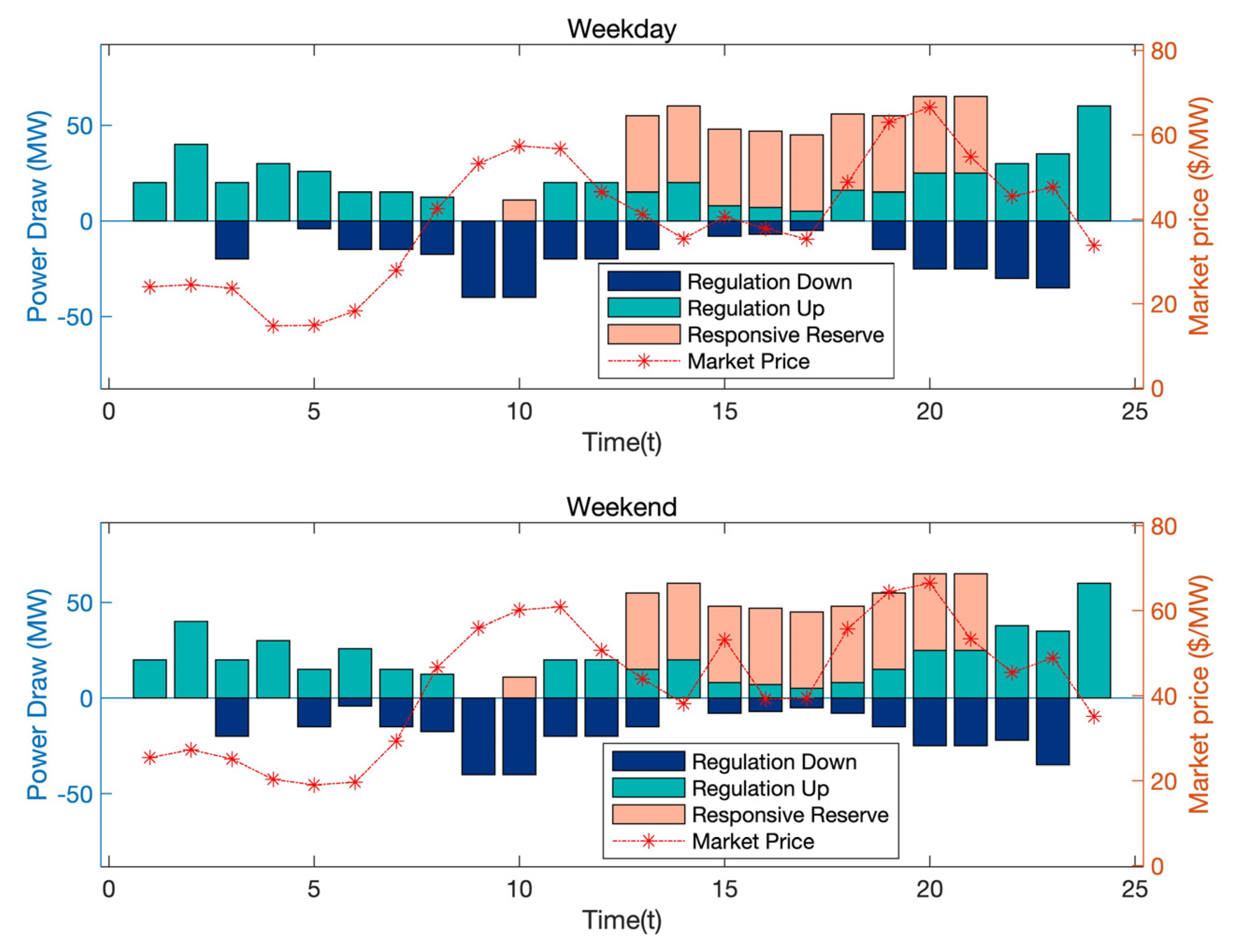

4.4. The Different Result of Peak Time and Workdays

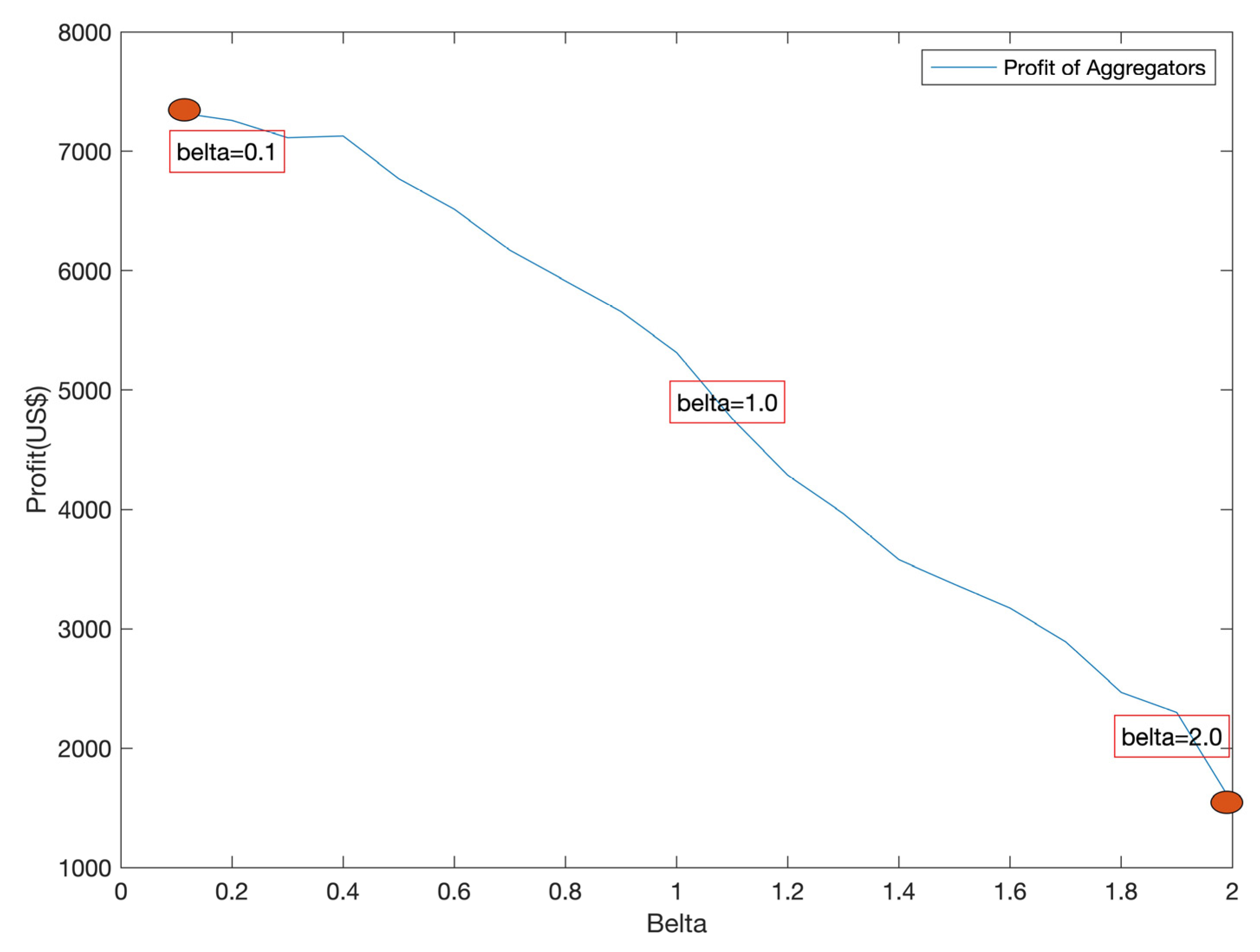

4.5. Conditional Risk Sensitivity Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kempton, W.; Tomić, J. Vehicle-to-grid power implementation: From stabilizing the grid to supporting large-scale renewable energy. J. Power Sources 2005, 144, 280–294. [Google Scholar] [CrossRef]

- Liu, H.; Zhang, Y.; Zheng, S.; Li, Y. Electric Vehicle Power Trading Mechanism Based on Blockchain and Smart Contract in V2G Network. IEEE Access 2019, 7, 160546–160558. [Google Scholar] [CrossRef]

- Aluisio, B.; Conserva, A.; Dicorato, M.; Forte, G.; Trovato, M. Optimal operation planning of V2G-equipped Microgrid in the presence of EV aggregator. Electr. Power Syst. Res. 2017, 152, 295–305. [Google Scholar] [CrossRef]

- Khan, S.U.; Mehmood, K.K.; Haider, Z.M.; Bukhari, S.B.A.; Lee, S.J.; Rafique, M.K.; Kim, C.H. Energy management scheme for an EV smart charger V2G/G2V application with an EV power allocation technique and voltage regulation. Appl. Sci. 2018, 8, 648. [Google Scholar] [CrossRef] [Green Version]

- Kempton, W.; Udo, V.; Huber, K.; Komara, K.; Letendre, S.; Baker, S.; Pearre, N. A test of vehicle-to-grid (V2G) for energy storage and frequency regulation in the PJM system. Results Ind.-Univ. Res. Partnersh. 2008, 9–12. Available online: https://www1.udel.edu/V2G/resources/test-v2g-in-pjm-jan09.pdf (accessed on 14 September 2021).

- Triviño-Cabrera, A.; Aguado, J.A.; de la Torre, S. Joint routing and scheduling for electric vehicles in smart grids with V2G. Energy 2019, 175, 113–122. [Google Scholar] [CrossRef]

- Mouli, G.R.C.; Kefayati, M.; Baldick, R.; Bauer, P. Integrated PV charging of EV fleet based on energy prices, V2G, and offer of reserves. IEEE Trans. Smart Grid 2017, 10, 1313–1325. [Google Scholar] [CrossRef]

- Pillai, J.R.; Bak-Jensen, B. Integration of Vehicle-to-Grid in the Western Danish Power System. IEEE Trans. Sustain. Energy 2010, 2, 12–19. [Google Scholar] [CrossRef]

- Shafie-khah, M.; Heydarian-Forushani, E.; Osório, G.J.; Gil, F.A.; Aghaei, J.; Barani, M.; Catalão, J.P. Optimal Behavior of Electric Vehicle Parking Lots as Demand Response Aggregation Agents. IEEE Trans. Smart Grid 2016, 7, 2654–2665. [Google Scholar] [CrossRef]

- Moradijoz, M.; Moghaddam, M.P.; Haghifam, M.; Alishahi, E. A multi-objective optimization problem for allocating parking lots in a distribution network. Int. J. Electr. Power Energy Syst. 2013, 46, 115–122. [Google Scholar] [CrossRef]

- Hafez, O.; Bhattacharya, K. Optimal design of electric vehicle charging stations considering various energy resources. Renew. Energy 2017, 107, 576–589. [Google Scholar] [CrossRef]

- Fazelpour, F.; Vafaeipour, M.; Rahbari, O.; Rosen, M.A. Intelligent optimization to integrate a plug-in hybrid electric vehicle smart parking lot with renewable energy resources and enhance grid characteristics. Energy Convers. Manag. 2013, 77, 250–261. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, Q.; Farnoosh, A.; Chen, S.; Li, Y. GIS-Based Multi-Objective Particle Swarm Optimization of charging stations for electric vehicles. Energy 2018, 169, 844–853. [Google Scholar] [CrossRef]

- Szinai, J.; Sheppard, C.J.; Abhyankar, N.; Gopal, A.R. Reduced grid operating costs and renewable energy curtailment with electric vehicle charge management. Energy Policy 2019, 136, 111051. [Google Scholar] [CrossRef]

- Aliasghari, P.; Mohammadi-Ivatloo, B.; Alipour, M.; Abapour, M.; Zare, K. Optimal scheduling of plug-in electric vehicles and renewable micro-grid in energy and reserve markets considering demand response program. J. Clean. Prod. 2018, 186, 293–303. [Google Scholar] [CrossRef]

- Rui, T.; Hu, C.; Li, G.; Tao, J.; Shen, W. A distributed charging strategy based on day ahead price model for PV-powered electric vehicle charging station. Appl. Soft Comput. 2019, 76, 638–648. [Google Scholar] [CrossRef]

- Gopal, A.R.; Park, W.Y.; Witt, M.; Phadke, A. Hybrid- and battery-electric vehicles offer low-cost climate benefits in China. Transp. Res. Part D Transp. Environ. 2018, 62, 362–371. [Google Scholar] [CrossRef]

- Choi, H.; Shin, J.; Woo, J. Effect of electricity generation mix on battery electric vehicle adoption and its environmental impact. Energy Policy 2018, 121, 13–24. [Google Scholar] [CrossRef]

- Rotering, N.; Ilic, M.D. Optimal Charge Control of Plug-In Hybrid Electric Vehicles in Deregulated Electricity Markets. IEEE Trans. Power Syst. 2010, 26, 1021–1029. [Google Scholar] [CrossRef]

- Vagropoulos, S.I.; Bakirtzis, A. Optimal Bidding Strategy for Electric Vehicle Aggregators in Electricity Markets. IEEE Trans. Power Syst. 2013, 28, 4031–4041. [Google Scholar] [CrossRef]

- Wu, H.; Shahidehpour, M.; AlAbdulwahab, A.; Abusorrah, A. A Game Theoretic Approach to Risk-Based Optimal Bidding Strategies for Electric Vehicle Aggregators in Electricity Markets with Variable Wind Energy Resources. IEEE Trans. Sustain. Energy 2015, 7, 374–385. [Google Scholar] [CrossRef]

- Wu, J.; Wu, Z.; Wu, F.; Tang, H.; Mao, X. CVaR risk-based optimization framework for renewable energy management in distribution systems with DGs and EVs. Energy 2018, 143, 323–336. [Google Scholar] [CrossRef]

- Paul, S.; Padhy, N.P. Resilient Scheduling Portfolio of Residential Devices and Plug-In Electric Vehicle by Minimizing Conditional Value at Risk. IEEE Trans. Ind. Inform. 2018, 15, 1566–1578. [Google Scholar] [CrossRef]

- Zeng, B.; Dong, H.; Xu, F.; Zeng, M. Bilevel Programming Approach for Optimal Planning Design of EV Charging Station. IEEE Trans. Ind. Appl. 2020, 56, 2314–2323. [Google Scholar] [CrossRef]

- Khan, S.U.; Mehmood, K.K.; Haider, Z.M.; Rafique, M.K.; Kim, C.-H. A Bi-Level EV Aggregator Coordination Scheme for Load Variance Minimization with Renewable Energy Penetration Adaptability. Energies 2018, 11, 2809. [Google Scholar] [CrossRef] [Green Version]

- Hu, J.; Li, H. A New Clustering Approach for Scenario Reduction in Multi-Stochastic Variable Programming. IEEE Trans. Power Syst. 2019, 34, 3813–3825. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, J.; Guan, Y. Price-Based Unit Commitment with Wind Power Utilization Constraints. IEEE Trans. Power Syst. 2013, 28, 2718–2726. [Google Scholar] [CrossRef]

- Bai, X.; Qiao, W. Robust Optimization for Bidirectional Dispatch Coordination of Large-Scale V2G. IEEE Trans. Smart Grid 2015, 6, 1944–1954. [Google Scholar] [CrossRef] [Green Version]

- Clairand, J.-M.; Rodriguez-Garcia, J.; Alvarez-Bel, C. Smart Charging for Electric Vehicle Aggregators Considering Users’ Preferences. IEEE Access 2018, 6, 54624–54635. [Google Scholar] [CrossRef]

- Department for Transport. Vehicles Registered for the First Time by Make and Model: Great Britain and United Kingdom. London, UK, 2020. [Google Scholar]

| Symbol | Mean | Standard Deviation | Max | Min |

|---|---|---|---|---|

| Initial State of Charge (%) | 50 | 20 | 70 | 20 |

| Arrive time (h) | 8 | 4 | 14 | 6 |

| Departure time (h) | 16 | 4 | 24 | 12 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Jia, Z.; Li, J.; Zhang, X.; Zhang, R. Optimal Bi-Level Scheduling Method of Vehicle-to-Grid and Ancillary Services of Aggregators with Conditional Value-at-Risk. Energies 2021, 14, 7015. https://doi.org/10.3390/en14217015

Wang Y, Jia Z, Li J, Zhang X, Zhang R. Optimal Bi-Level Scheduling Method of Vehicle-to-Grid and Ancillary Services of Aggregators with Conditional Value-at-Risk. Energies. 2021; 14(21):7015. https://doi.org/10.3390/en14217015

Chicago/Turabian StyleWang, Yilu, Zixuan Jia, Jianing Li, Xiaoping Zhang, and Ray Zhang. 2021. "Optimal Bi-Level Scheduling Method of Vehicle-to-Grid and Ancillary Services of Aggregators with Conditional Value-at-Risk" Energies 14, no. 21: 7015. https://doi.org/10.3390/en14217015