Appendix A

Table A1.

The historical volumes of coal demand from the “Export” consumers in the years 2014–2020, (Mg).

Table A1.

The historical volumes of coal demand from the “Export” consumers in the years 2014–2020, (Mg).

| Years | Name of Consumer Group |

|---|

| Export 1 | Export 2 | Export 3 | Export 4 | Export 5 | Export 6 | Export 7 |

|---|

| 2014 | 38,707 | 509,597 | 371,252 | 208,049 | 378,926 | 144,389 | 1,918,295 |

| 2015 | 35,126 | 462,456 | 336,809 | 180,803 | 353,873 | 135,032 | 1,840,840 |

| 2016 | 35,790 | 471,187 | 343,269 | 192,868 | 350,365 | 133,506 | 1,773,707 |

| 2017 | 34,076 | 443,624 | 326,832 | 183,156 | 333,588 | 127,113 | 1,688,772 |

| 2018 | 29,274 | 385,412 | 280,781 | 157,349 | 286,585 | 109,203 | 1,450,821 |

| 2019 | 28,234 | 371,708 | 270,797 | 151,754 | 276,394 | 105,320 | 1,389,234 |

| 2020 | 27,414 | 360,914 | 262,933 | 147,348 | 268,368 | 102,261 | 1,353,602 |

Table A2.

The historical volumes of coal demand from the domestic consumers in the years 2010–2020, (Mg).

Table A2.

The historical volumes of coal demand from the domestic consumers in the years 2010–2020, (Mg).

| Years | Name of Consumer Group |

|---|

Indv.

Consumers 1 | Indv.

Consumers 2 | Cokerys 1 | Cokerys 2 | Cokerys 3 | Dust Kettles |

|---|

| 2010 | 473,581 | 1,924,126 | 951,233 | 114,324 | 1,266,780 | 8,308,837 |

| 2011 | 469,230 | 1,906,447 | 942,493 | 113,273 | 1,255,141 | 8,232,494 |

| 2012 | 439,106 | 1,784,055 | 881,986 | 106,001 | 1,174,562 | 7,703,977 |

| 2013 | 436,654 | 1,774,092 | 877,061 | 105,409 | 1,168,003 | 7,860,956 |

| 2014 | 423,062 | 1,718,873 | 859,762 | 102,129 | 1,131,648 | 7,422,504 |

| 2015 | 427,639 | 1,737,466 | 858,954 | 103,233 | 1,143,890 | 7,502,796 |

| 2016 | 434,257 | 1,774,354 | 872,247 | 104,831 | 1,161,592 | 7,618,905 |

| 2017 | 411,055 | 1,670,086 | 825,643 | 99,230 | 1,079,529 | 7,211,832 |

| 2018 | 365,582 | 1,485,336 | 734,308 | 88,253 | 977,895 | 6,414,035 |

| 2019 | 348,864 | 1,417,410 | 700,727 | 89,217 | 933,175 | 6,120,715 |

| 2020 | 335,198 | 1,361,885 | 673,277 | 80,918 | 896,620 | 5,880,946 |

Table A3.

The historical volumes of coal demand from the domestic consumers in the years 2010–2020, (Mg).

Table A3.

The historical volumes of coal demand from the domestic consumers in the years 2010–2020, (Mg).

| Years | Name of Consumer Group |

|---|

| Grates 1 | Grates 2 | Chamber Grates 1 | Chamber Grates 2 |

|---|

| 2010 | 178,326 | 92,439 | 69,338 | 53,848 |

| 2011 | 176,687 | 91,590 | 68,701 | 53,353 |

| 2012 | 165,344 | 85,710 | 64,290 | 49,928 |

| 2013 | 164,421 | 83,232 | 63,931 | 49,649 |

| 2014 | 159,303 | 82,579 | 61,941 | 48,104 |

| 2015 | 161,026 | 83,472 | 62,611 | 48,624 |

| 2016 | 169,518 | 84,764 | 63,580 | 49,377 |

| 2017 | 154,782 | 80,235 | 60,183 | 46,788 |

| 2018 | 137,659 | 71,359 | 53,526 | 41,568 |

| 2019 | 131,364 | 68,096 | 51,078 | 39,667 |

| 2020 | 126,218 | 65,428 | 49,077 | 38,113 |

Table A4.

The optimal production and sales plan for mine “A” for 2021.

Table A4.

The optimal production and sales plan for mine “A” for 2021.

| Name of Consumer Group | Coal Size Grade | Sales Quantity | Total Sales | Profit: | Mine

Reserves |

|---|

| (Mg) | (Mg) | (PLN) | (Mg) |

|---|

| Dust kettles | fine coal I | 264,765 | 597,902 | 4,843,299 | 0 |

| Dust kettles | fine coal II | 317,136 | | (€1,059,803) | |

| Grates 2 | slurry | 16,003 | | | |

| Dumping coal | cobble | 160,023 | | | |

| Dumping coal | nut coal | 21,821 | | | |

| Dumping coal | fine coal IIA | 675,004 | | | |

Table A5.

The optimal production and sales plan for mine “B” for 2021.

Table A5.

The optimal production and sales plan for mine “B” for 2021.

| Name of Consumer Group | Coal Size Grade | Sales Quantity | Total Sales | Profit: | Mine

Reserves |

|---|

| (Mg) | (Mg) | (PLN) | (Mg) |

|---|

| Grates 1 | fine coal II | 113,486 | 113,486 | −4,880,293 | 427,416 |

| Dumping coal | coking coal | 252,598 | | (€−1,067,898) | |

Table A6.

The optimal production and sales plan for mine “C” for 2021.

Table A6.

The optimal production and sales plan for mine “C” for 2021.

| Name of Consumer Group | Coal Size Grade | Sales Quantity | Total Sales | Profit: | Mine

Reserves |

|---|

| (Mg) | (Mg) | (PLN) | (Mg) |

|---|

| Export 5 | coking coal | 123,542 | 989,348 | 49,931,963 | 121,552 |

| Cokerys 3 | coking coal | 865,806 | | (€10,926,031) | |

Table A7.

The optimal production and sales plan for mine “D” for 2021.

Table A7.

The optimal production and sales plan for mine “D” for 2021.

| Name of Consumer Group | Coal Size Grade | Sales Quantity | Total Sales | Profit: | Mine

Reserves |

|---|

| (Mg) | (Mg) | (PLN) | (Mg) |

|---|

| Export 2 | coking coal | 292,713 | 1,662,027 | 77,472,349 | 1,493,506 |

| Export 3 | coking coal | 220,455 | | (€16,952,374) | |

| Indv. consumers 1 | cobble | 36,934 | | | |

| Indv. consumers 2 | fine coal IIA | 637,566 | | | |

| Grates 1 | fine coal II | 8394 | | | |

| Chamber grates 1 | fine coal IIA | 47,390 | | | |

| Cokerys 1 | coking coal | 418,575 | | | |

| Dumping coal | fine coal I | 18,467 | | | |

Table A8.

The optimal production and sales plan for mine “E” for 2021.

Table A8.

The optimal production and sales plan for mine “E” for 2021.

| Name of Consumer Group | Coal Size Grade | Sales Quantity | Total Sales | Profit: | Mine

Reserves |

|---|

| (Mg) | (Mg) | (PLN) | (Mg) |

|---|

| Export 1 | coking coal | 22,984 | 2,952,728 | 76,118,502 | 0 |

| Export 2 | coking coal | 9893 | | (€16,656,127) | |

| Export 6 | nut coal | 38,855 | | | |

| Indv. consumers 1 | cobble | 215,197 | | | |

| Dust kettles | fine coal I | 206,231 | | | |

| Dust kettles | fine coal IIA | 1,545,236 | | | |

| Dust kettles | fine coal II | 863,778 | | | |

| Grates 2 | slurry | 13,752 | | | |

| Chamber grates 2 | slurry | 36,803 | | | |

| Dumping coal | slurry | 36,122 | | | |

Table A9.

The optimal production and sales plan for mine “G” for 2021.

Table A9.

The optimal production and sales plan for mine “G” for 2021.

| Name of Consumer Group | Coal Size Grade | Sales Quantity | Total Sales | Profit: | Mine

Reserves |

|---|

| (Mg) | (Mg) | (PLN) | (Mg) |

|---|

| Indv. consumers 1 | cobble | 53,039 | 1,915,771 | 34,031,639 | 0 |

| Export 7 | fine coal IIA | 932,482 | | (€7,446,748) | |

| Export 7 | fine coal II | 206,632 | | | |

| Indv. consumers 2 | fine coal IIA | 677,516 | | | |

| Dust kettles | fine coal IIA | 521 | | | |

| Dust kettles | fine coal II | 12,155 | | | |

| Grates 2 | slurry | 33,426 | | | |

| Dumping coal | cobble | 53,315 | | | |

| Dumping coal | nut coal | 15,194 | | | |

| Dumping coal | coking coal | 1,057,470 | | | |

Table A10.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “A”.

Table A10.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “A”.

| Coal Size Grade | Quantity According to Plan | Minimum Quantity | Maximum Quantity | Probability of Achieving the Quantity |

|---|

| According to the Plan | min | max |

|---|

| (Mg) | (Mg) | (Mg) | (-) | (-) | (-) |

|---|

| fine coal I | 264,765 | 0 | 264,765 | 0.008 | 0.881 | 0.881 |

| fine coal II | 317,136 | 0 | 317,136 | 0.008 | 0.881 | 0.881 |

| slurry | 16,003 | 0 | 16,003 | 0.008 | 0.881 | 0.881 |

Table A11.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “B”.

Table A11.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “B”.

| Coal Size Grade | Quantity According to Plan | Minimum Quantity | Maximum Quantity | Probability of Achieving the Quantity |

|---|

| According to the Plan | min | max |

|---|

| (Mg) | (Mg) | (Mg) | (-) | (-) | (-) |

|---|

| coking coal | 113,486 | 81,002 | 142,488 | 0.001 | 0.001 | 0.496 |

Table A12.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “C”.

Table A12.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “C”.

| Coal Size Grade | Quantity According to Plan | Minimum Quantity | Maximum Quantity | Probability of Achieving the Quantity |

|---|

| According to the Plan | min | max |

|---|

| (Mg) | (Mg) | (Mg) | (-) | (-) | (-) |

|---|

| coking coal | 123,542 | 92,798 | 152,237 | 1 | 0.004 | 0.506 |

| coking coal | 865,806 | 658,213 | 1,001,054 | 1 | 0.011 | 0.565 |

Table A13.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “D”.

Table A13.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “D”.

| Coal Size Grade | Quantity According to Plan | Minimum Quantity | Maximum Quantity | Probability of Achieving the Quantity |

|---|

| According to the Plan | min | max |

|---|

| (Mg) | (Mg) | (Mg) | (-) | (-) | (-) |

|---|

| cobble | 36,934 | 0 | 69,758 | 0.005 | 0.071 | 0.505 |

| fine coal II | 8394 | 0 | 15,854 | 0.003 | 0.106 | 0.526 |

| fine coal IIA | 637,566 | 0 | 1,293,697 | 0.003 | 0.038 | 0.529 |

| fine coal IIA | 47,390 | 0 | 57,314 | 0.277 | 0.006 | 0.442 |

| coking coal | 292,713 | 0 | 371,593 | 0.277 | 0.002 | 0.335 |

| coking coal | 220,455 | 0 | 270,714 | 0.003 | 0.006 | 0.376 |

| coking coal | 418,575 | 0 | 788,355 | 0.217 | 0.005 | 0.562 |

Table A14.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “E”.

Table A14.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “E”.

| Coal Size Grade | Quantity According to Plan | Minimum Quantity | Maximum Quantity | Probability of Achieving the Quantity |

|---|

| According to the Plan | min | max |

|---|

| (Mg) | (Mg) | (Mg) | (-) | (-) | (-) |

|---|

| cobble | 215,197 | 0 | 215,197 | 0.018 | 0.949 | 0.949 |

| nut coal | 38,855 | 24,684 | 38,855 | 0.001 | 0.994 | 0.994 |

| fine coal I | 206,231 | 0 | 206,231 | 0.111 | 0.852 | 0.852 |

| fine coal IIA | 1,545,236 | 1,545,236 | 1,545,236 | 1 | 1 | 1 |

| fine coal IIA | 863,778 | 0 | 863,778 | 0.096 | 0.836 | 0.836 |

| slurry | 13,752 | 0 | 68,867 | 0.001 | 0.725 | 0.725 |

| slurry | 36,803 | 0 | 44,779 | 0.043 | 0.007 | 0.444 |

| coking coal | 22,984 | 0 | 26,172 | 0.780 | 0.007 | 0.063 |

| coking coal | 9893 | 0 | 32,877 | 0.661 | 0.193 | 0.197 |

Table A15.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “G”.

Table A15.

A summary of the volumes of sales of the individual coal grades with the probability of their achievement at σyprog for mine “G”.

| Coal Size Grade | Quantity According to Plan | Minimum Quantity | Maximum Quantity | Probability of Achieving the Quantity |

|---|

| According to the Plan | min | max |

|---|

| (Mg) | (Mg) | (Mg) | (-) | (-) | (-) |

|---|

| cobble | 53,039 | 0 | 106,355 | 0.515 | 0.039 | 0.267 |

| fine coal II | 12,155 | 0 | 12,155 | 0.339 | 0.657 | 0.657 |

| fine coal IIA | 932,482 | 0 | 1,313,094 | 0.646 | 0.001 | 0.146 |

| fine coal IIA | 677,516 | 0 | 1,310,936 | 0.475 | 0.01 | 0.221 |

| fine coal IIA | 521 | 0 | 1,610,518 | 0.145 | 0.433 | 0.855 |

| fine coal II | 206,632 | 0 | 206,632 | 0.024 | 0.840 | 0.840 |

| slurry | 33,426 | 0 | 33,426 | 0.227 | 0.731 | 0.731 |

Figure A1.

Histogram showing frequencies of achieving given quantity of sales fine coal I for mine “A” with σyprog.

Figure A1.

Histogram showing frequencies of achieving given quantity of sales fine coal I for mine “A” with σyprog.

Figure A2.

Histogram showing frequencies of achieving given quantity of sales fine coal II for mine “A” with σyprog.

Figure A2.

Histogram showing frequencies of achieving given quantity of sales fine coal II for mine “A” with σyprog.

Figure A3.

Histogram showing frequencies of achieving given quantity of sales slurry for mine “A” with σyprog.

Figure A3.

Histogram showing frequencies of achieving given quantity of sales slurry for mine “A” with σyprog.

Figure A4.

Histogram showing frequencies of achieving given quantity of sales of coking coal for mine “B” with σyprog.

Figure A4.

Histogram showing frequencies of achieving given quantity of sales of coking coal for mine “B” with σyprog.

Figure A5.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 5”) for mine “C” with σyprog.

Figure A5.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 5”) for mine “C” with σyprog.

Figure A6.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Cokerys 3”) for mine “C” with σyprog.

Figure A6.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Cokerys 3”) for mine “C” with σyprog.

Figure A7.

Histogram showing frequencies of achieving given quantity of sales of cobble for mine “D” with σyprog.

Figure A7.

Histogram showing frequencies of achieving given quantity of sales of cobble for mine “D” with σyprog.

Figure A8.

Histogram showing frequencies of achieving given quantity of sales of fine coal II for mine “D” with σyprog.

Figure A8.

Histogram showing frequencies of achieving given quantity of sales of fine coal II for mine “D” with σyprog.

Figure A9.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Indv. Consumers 2”) for mine “D” with σyprog.

Figure A9.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Indv. Consumers 2”) for mine “D” with σyprog.

Figure A10.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Chamber grates 1”) for mine “D” with σyprog.

Figure A10.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Chamber grates 1”) for mine “D” with σyprog.

Figure A11.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 2”) for mine “D” with σyprog.

Figure A11.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 2”) for mine “D” with σyprog.

Figure A12.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 3”) for mine “D” with σyprog.

Figure A12.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 3”) for mine “D” with σyprog.

Figure A13.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Cokerys 1”) for mine “D” with σyprog.

Figure A13.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Cokerys 1”) for mine “D” with σyprog.

Figure A14.

Histogram showing frequencies of achieving given quantity of sales of cobble for mine “E” with σyprog.

Figure A14.

Histogram showing frequencies of achieving given quantity of sales of cobble for mine “E” with σyprog.

Figure A15.

Histogram showing frequencies of achieving given quantity of sales of nut coal for mine “E” with σyprog.

Figure A15.

Histogram showing frequencies of achieving given quantity of sales of nut coal for mine “E” with σyprog.

Figure A16.

Histogram showing frequencies of achieving given quantity of sales of fine coal I for mine “E” with σyprog.

Figure A16.

Histogram showing frequencies of achieving given quantity of sales of fine coal I for mine “E” with σyprog.

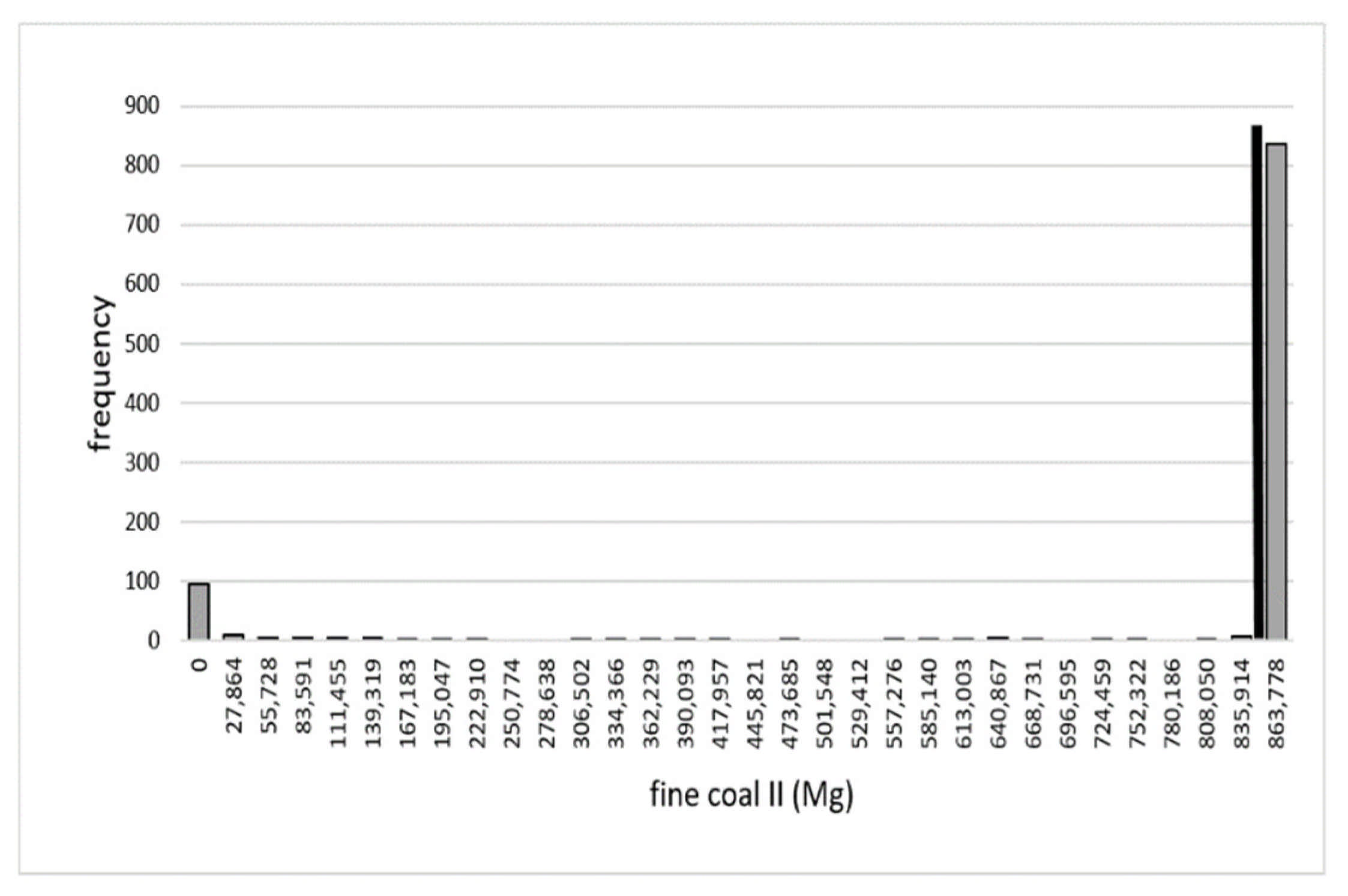

Figure A17.

Histogram showing frequencies of achieving given quantity of sales of fine coal II for mine “E” with σyprog.

Figure A17.

Histogram showing frequencies of achieving given quantity of sales of fine coal II for mine “E” with σyprog.

Figure A18.

Histogram showing frequencies of achieving given quantity of sales of slurry (“Grates 2”) for mine “E” with σyprog.

Figure A18.

Histogram showing frequencies of achieving given quantity of sales of slurry (“Grates 2”) for mine “E” with σyprog.

Figure A19.

Histogram showing frequencies of achieving given quantity of sales of slurry (“Chamber grates 2”) for mine “E” with σyprog.

Figure A19.

Histogram showing frequencies of achieving given quantity of sales of slurry (“Chamber grates 2”) for mine “E” with σyprog.

Figure A20.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 1”) for mine “E” with σyprog.

Figure A20.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 1”) for mine “E” with σyprog.

Figure A21.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 2”) for mine “E” with σyprog.

Figure A21.

Histogram showing frequencies of achieving given quantity of sales of coking coal (“Export 2”) for mine “E” with σyprog.

Figure A22.

Histogram showing frequencies of achieving given quantity of sales of cobble for mine “G” with σyprog.

Figure A22.

Histogram showing frequencies of achieving given quantity of sales of cobble for mine “G” with σyprog.

Figure A23.

Histogram showing frequencies of achieving given quantity of sales of fine coal II (“Dust kettles”) for mine “G” with σyprog.

Figure A23.

Histogram showing frequencies of achieving given quantity of sales of fine coal II (“Dust kettles”) for mine “G” with σyprog.

Figure A24.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Export 9”) for mine “G” with σyprog.

Figure A24.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Export 9”) for mine “G” with σyprog.

Figure A25.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Indv. consumers 2”) for mine “G” with σyprog.

Figure A25.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Indv. consumers 2”) for mine “G” with σyprog.

Figure A26.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Dust kettles”) for mine “G” with σyprog.

Figure A26.

Histogram showing frequencies of achieving given quantity of sales of fine coal IIA (“Dust kettles”) for mine “G” with σyprog.

Figure A27.

Histogram showing frequencies of achieving given quantity of sales of fine coal II (“Export 7”) for mine “G” with σyprog.

Figure A27.

Histogram showing frequencies of achieving given quantity of sales of fine coal II (“Export 7”) for mine “G” with σyprog.

Figure A28.

Histogram showing frequencies of achieving given quantity of sales of slurry for mine “G” with σyprog.

Figure A28.

Histogram showing frequencies of achieving given quantity of sales of slurry for mine “G” with σyprog.