Pitfalls of the EU’s Carbon Border Adjustment Mechanism

Abstract

:1. Introduction

2. Literature Review

2.1. “Fit for 55” and the CBAM

2.2. Limitations of the CBAM

3. Analysis of WTO-Compatibility with the CBAM

3.1. Overview

3.2. GATT/WTO Articles Subject to Potential Violation

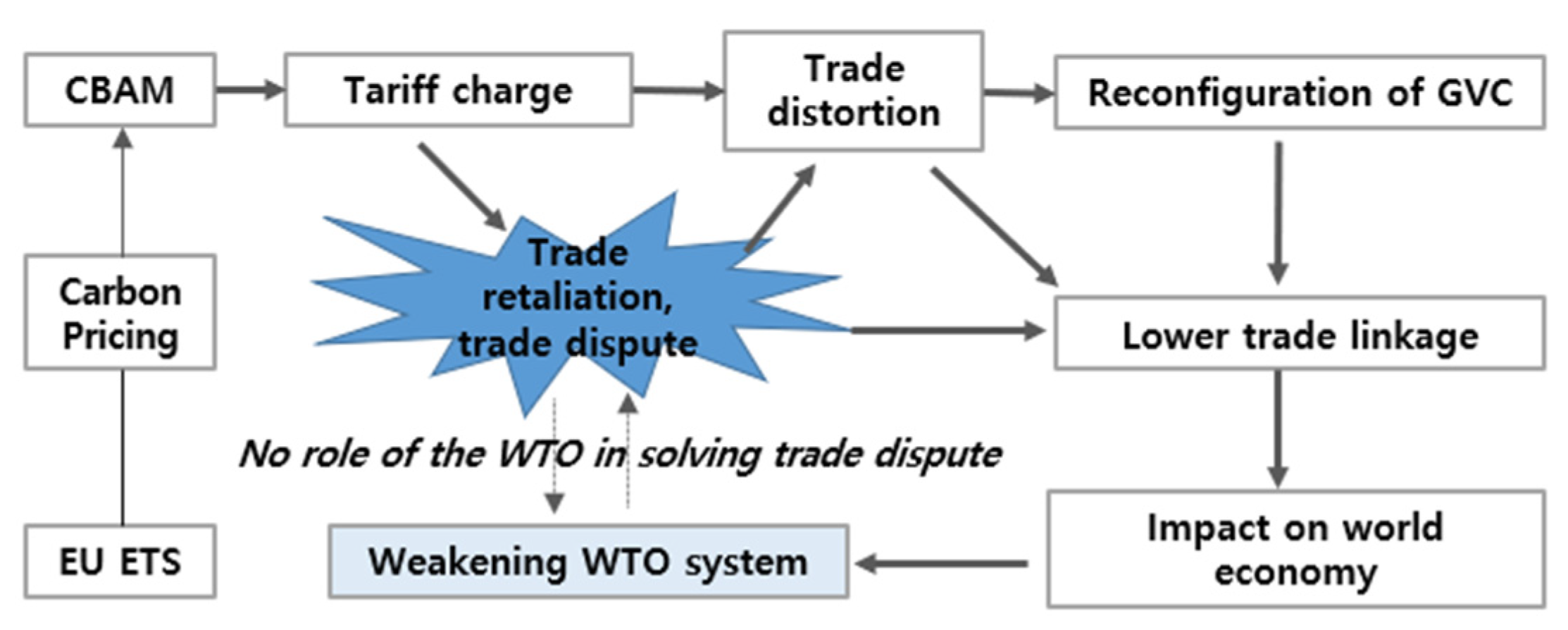

4. The Impact of the CBAM: Analysis from the Perspective of Trade Retaliation

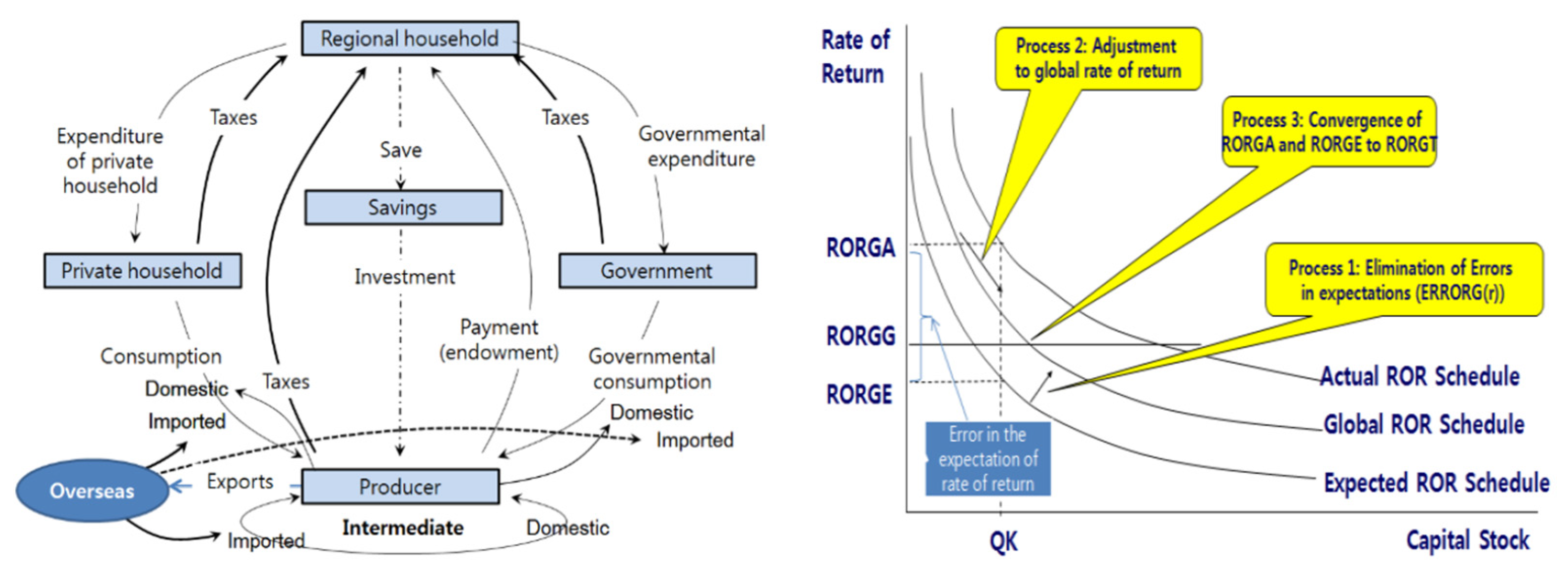

4.1. Model and Data Used for Analysis

4.2. Scenarios

4.2.1. Target Countries

4.2.2. Carbon Pricing

4.2.3. Increases in the Efficiency of Carbon-Related Technology

4.3. Simulation Results and Interpretation

4.3.1. Impacts on the Trade of Energy Products

4.3.2. Changes in Trade by Country

4.3.3. Change in Trade of Steel and Aluminum

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chase, P.; Pinkert, R. The EU’s Triangular Dilemma on Climate and Trade. German Marshall Fund, Policy Brief. 2021. Available online: https://www.gmfus.org/sites/default/files/2021-09/Chase%20%26%20Pinkert%20-%20CBAM%20-%20brief_0.pdf (accessed on 4 October 2021).

- Bacchus, J. Legal Issues with the European Carbon Border Adjustment Mechanism; CATO Briefing Paper, No.125; CATO Institute: Washington, WA, USA, 2021; pp. 3–6. [Google Scholar]

- International Institute for Sustainable Development (IISD). An EU Carbon Border Adjustment Mechanism: Can It Make Global Trade Greener While Respecting WTO Rules? Commentary, 17 May 2021. Available online: https://sdg.iisd.org/commentary/guest-articles/an-eu-carbon-border-adjustment-mechanism-can-it-make-global-trade-greener-while-respecting-wto-rules/(accessed on 4 October 2021).

- Horn, H.; Mavroidis, P.C. To B(TA) or not to B(TA)? On the Legality and Desirability of Border Tax Adjustments from a Trade Perspective. World Econ. 2011, 34, 1911–1937. [Google Scholar] [CrossRef] [Green Version]

- IMF. World Economic Outlook Annex 3.1. In The Impact of Environmental Policy on Clean Innovation; Working Paper No. 2021/213; IMF: Washington, DC, USA, 2021. [Google Scholar]

- Clerc, L.; Bontemps-Chanel, A.; Diot, S.; Overton, G.; De Soares Albergaria, S.; Vernet, L.; Louardi, M. A First Assessment of Financial Risks Stemming from Climate Change: The Main Results of the 2020 Climate Pilot Exercise. Bangue de France, No.122-2021, Analysis et Synthèsis. 2021. Available online: https://c2e2.unepdtu.org/kms_object/a-first-assessment-of-financial-risks-stemming-from-climate-change-results-of-the-2020-climate-pilot-exercise/ (accessed on 1 October 2021).

- Bellora, C.; Fontagné, L. EU in Search of a WTO—Compatible Carbon Border Adjustment Mechanism. 2021. Available online: http://www.lionel-fontagne.eu/uploads/9/8/3/3/98330770/cblf_cba_2021.pdf (accessed on 4 October 2021).

- Balistreri, E.J.; Kaffine, D.T.; Yonezawa, H. Optimal Environmental Border Adjustments under the General Agreement on Tariffs and Trade; CARD Working Papers; Center for Agricultural and Rural Development, Iowa State University: Ames, IA, USA, 2019; p. 25. Available online: https://lib.dr.iastate.edu/card_workingpapers/603 (accessed on 4 October 2021).

- Kahn, M.E.; Mohaddes, K.; Ng, R.N.C.; Pesaran, M.H.; Raissi, M.; Yang, J.C. Long-Term Macroeconomic Effects of Climate Change: A Cross-Country Analysis; Working Paper 26167; National Bureau of Economic Research: Cambridge, MA, USA, 2019. [Google Scholar]

- Gläser, A.; Caspar, O.; Li, L.; Kardish, C.; Holovko, I.; Makarov, I. Less Confrontation, More Cooperation. German Watch Policy Brief 21-3-2e. 2021. Available online: https://germanwatch.org/en/20355 (accessed on 1 October 2021).

- Appunn, K. Emission Reduction Panacea or Recipe for Trade War? The EU’s Carbon Border Tax Debate. Clean Energy Wire Editorial, 23 July 2021. Available online: https://www.cleanenergywire.org/factsheets/emission-reduction-panacea-or-recipe-trade-war-eus-carbon-border-tax-debate(accessed on 2 October 2021).

- Dias, A.; Bret, B.L.; Prost, O.; Rard, R. Carbon Border Adjustment Mechanism (CBAM)—EU Proposal 2021. GIDE LOYRETTE NOUEL CARBON 2021. Available online: https://www.gide.com/en/actualites/carbon-border-adjustment-mechanism-cbam-eu-proposal (accessed on 1 October 2021).

- Christoffersen, P.S. The Carbon Border Adjustment Mechanism. Teneo Editorial, 9 June 2021. Available online: https://www.teneo.com/the-carbon-border-adjustment-mechanism/(accessed on 24 September 2021).

- Sapir, A. The European Union’s Carbon Border Mechanism and the WTO. Bruegel, 19 July 2021. Available online: https://www.bruegel.org/2021/07/the-european-unions-carbon-border-mechanism-and-the-wto/(accessed on 1 October 2021).

- De Vos, B. The Carbon Border Adjustment Mechanism: Ensuring Fairness. EURACTIV Editorial, 29 October 2020. Available online: https://www.euractiv.com/section/energy-environment/opinion/the-carbon-border-adjustment-mechanism-ensuring-fairness/(accessed on 4 October 2021).

- Kulovesi, K.; van Asselt, H. Three Decades of Learning-by-Doing: The Evolving Climate Change Mitigation Policy of the European Union. In Climate and Energy Policies in the EU, China and Korea—Transition, Policy Cooperation and Linkage; Edward Elgar Forthcoming: Cheltenham, UK, 2021; Available online: https://ssrn.com/abstract=3859498 (accessed on 4 October 2021).

- Sebastian, O.; Kelly, C.R. EU Leadership in International Climate Policy: Achievements and Challenges. Int. Spect. 2008, 43, 35–50. [Google Scholar] [CrossRef]

- Jordan, A.; van Asselt, H.; Berkhout, F.; Huitema, D.; Rayner, T. Understanding the Paradoxes of Multilevel Governing: Climate Change Policy in the European Union. Global Environ. Polit. 2012, 12, 43–66. [Google Scholar] [CrossRef] [Green Version]

- KIET. Major contents of EU’s CBAM and Implications. i-KIET Industry and Economic Issue. 2021, 119, 1–11. Available online: https://www.kiet.re.kr/kiet_web/?sub_num=9&state=view&idx=58168 (accessed on 5 September 2021).

- Markusen, J.R. International externalizes and optimal tax structures. J. Int. Econ. 1975, 5, 15–29. [Google Scholar] [CrossRef]

- Hoel, M. Should a carbon tax be differentiated across sectors. J. Public Econ. 1996, 59, 17–32. [Google Scholar] [CrossRef]

- Jakob, M.; Marschinski, R.; Hübler, M. Between a Rock and a Hard Place: A Trade-Theory Analysis of Leakage Under Production- and Consumption-Based Policies. Environ. Resour. Econ. 2013, 56, 47–72. [Google Scholar] [CrossRef]

- Keen, M.; Kotsogiannis, C. Coordinating climate and trade policies: Pareto efficiency and the role of border tax adjustments. J. Int. Econ. 2014, 94, 119–128. [Google Scholar] [CrossRef] [Green Version]

- Aichele, R.; Felbermayr, G. Kyoto and the carbon footprint of nations. J. Environ. Econ. Manag. 2012, 63, 336–354. [Google Scholar] [CrossRef] [Green Version]

- Aichele, R.; Felbermayr, G. Kyoto and Carbon Leakage: An Empirical Analysis of the Carbon Content of Bilateral Trade. Rev. Econ. Stat. 2015, 97, 104–115. [Google Scholar] [CrossRef] [Green Version]

- Shapiro, J.S. The environmental bias of trade policy. Q. J. Econ. 2020, 136, 831–886. [Google Scholar] [CrossRef]

- Nevalainen, A. EU’s Carbon Border Adjustment Mechanism—Its Purpose and Effects on Carbon Leakage. Bachelor’s Thesis, Aalto University School of Business, Helsinki, Finland, 2021. [Google Scholar]

- Zhong, J.; Pei, J. Beggar Thy Neighbor? On the Competitiveness and Welfare Impacts of the EU’s Proposed Carbon Border Adjustment Mechanism. 2021, pp. 19–23. Available online: https://ssrn.com/abstract=3891356 (accessed on 4 October 2021).

- Fischer, C.; Fox, A. Comparing policies to combat emissions leakage: Border carbon adjustments versus rebates. J. Environ. Econ. Manag. 2012, 64, 199–216. [Google Scholar] [CrossRef]

- Branger, F.; Quirion, P. Would border carbon adjustments prevent carbon leakage and heavy industry competitiveness losses? Insights from a meta-analysis of recent economic studies. Ecol. Econ. 2014, 99, 29–39. [Google Scholar] [CrossRef] [Green Version]

- Larch, M.; Wanner, J. Carbon tariffs: An analysis of the trade, welfare, and emission effects. J. Int. Econ. 2017, 109, 195–213. [Google Scholar] [CrossRef] [Green Version]

- Elliott, J.; Foster, I.; Kortum, S.; Munson, T.; Cervantes, F.P.; Weisbach, D. Trade and carbon taxes. Am. Econ. Rev. 2010, 100, 465–469. [Google Scholar] [CrossRef] [Green Version]

- Elliott, J.; Foster, I.; Kortum, S.; Jush, G.K.; Munson, T.; Weisbach, D. Unilateral Carbon Taxes, Border Tax Adjustments and Carbon Leakage. Theor. Inq. Law 2013, 14, 207–244. [Google Scholar] [CrossRef] [Green Version]

- Mehling, M.A.; van Asselt, H.; Das, K.; Droege, S.; Verkuijl, C. Designing border carbon adjustments for enhanced climate action. Am. J. Int. Law 2019, 113, 433–481. [Google Scholar] [CrossRef] [Green Version]

- Palacková, E. Saving face and facing climate change: Are border adjustments a viable option to stop carbon leakage? Eur. View 2019, 18, 149–155. [Google Scholar] [CrossRef]

- Lowe, S. The EU’s Carbon Border Adjustment Mechanism: How to Make It Work for Developing Countries. Centre for European Reform. 2021. Available online: https://www.cer.eu/publications/archive/policy-brief/2021/eus-carbon-border-adjustment-mechanism-how-make-it-work (accessed on 11 September 2021).

- Eicke, L.; Goldthau, A. Are we at risk of an uneven low-carbon transition? Assessing evidence from a mixed-method elite study. Environ. Sci. Policy 2021, 124, 370–379. [Google Scholar] [CrossRef]

- Eicke, L.; Weko, S.; Apergi, M.; Marian, A. Pulling up the carbon ladder? Decarbonization, dependence, and third-country risks from the European carbon border adjustment mechanism. Energy Res. Soc. Sci. 2021, 80, 102240. [Google Scholar] [CrossRef]

- Wall Street Journal, Here Come the Climate Protectionists. 11 July 2021. Available online: https://www.wsj.com/articles/here-come-the-climate-protectionists-11626042142 (accessed on 4 August 2021).

- UNCTAD. A European Union Carbon Border Adjustment Mechanism: Implications for Developing Countries. 2021. Available online: https://unctad.org/webflyer/european-union-carbon-border-adjustment-mechanism-implications-developing-countries (accessed on 27 September 2021).

- Quick, R. Carbon Border Adjustment: A Dissenting View on Its Alleged GATT-Compatibility. Nomos eLibrary. 2021. Available online: https://www.nomos-elibrary.de/10.5771/1435-439X-2020-4-549.pdf?download_full_pdf=1 (accessed on 5 August 2021).

- Englisch, J.; Falco, T. EU Carbon Border Adjustments for Imported Products and WTO Law. 2021, pp. 14–75. Available online: https://ssrn.com/abstract=3863038 (accessed on 4 October 2021).

- Krenek, A. How to Implement a WTO-Compatible Full Border Carbon Adjustment as an Important Part of the European Green Deal. Österreichische Gesellschaft für Europapolitik, ÖGfE Policy Brief. 2020. Available online: https://www.oegfe.at/policy-briefs/wto-compatible-bca-green-deal/?lang=en (accessed on 22 July 2021).

- Han, J.H. Competition and Coexistence of International Trade Norms and Environmental Norms: Focusing on the EU Carbon Border Adjustment Mechanism. Rev. Int. Area Stud. 2021, 30, 156–162. [Google Scholar]

- Kim, H. Carbon Border Adjustment and Its WTO Compatibility Issues: GATT Articles II, III & XX. Int. Trade Law 2021, 151, 3–54. [Google Scholar]

- Falcao, T. Ensuring and EU Carbon Tax Complies with WTO Rules. Tax Notes Int. 2021, 101, 43–47. [Google Scholar]

- Lehne, J. The EU Can’t ‘Go it Alone’ on Border Carbon Adjustments. E3G Commentary, 8 October 2020. Available online: https://www.e3g.org/news/the-eu-can-t-go-it-alone-on-border-carbon-adjustments/(accessed on 4 October 2021).

- Pauwelyn, J.; Kleimann, D. Trade-Related Aspects of a Carbon Border Adjustment Mechanism; A Legal Assessment; European Parliament, Directorate-General for External Policies: Brussel, Belgium, 2020. [Google Scholar]

- Van Asselt, H. The Prospects of Trade and Climate Disputes before the WTO. In Climate Change Litigation: Global Perspectives; Brill Publishing: Leiden, The Netherlands, 2020. [Google Scholar]

- KOTRA. Progress of EU CBAM and Prospect. Global Market Report 21-010, 2021, 7. Available online: https://news.kotra.or.kr/user/reports/kotranews/20/usrReportsView.do?reportsIdx=12965 (accessed on 1 September 2021).

- European Parliament. REPORT towards a WTO-Compatible EU Carbon Border Adjustment Mechanism. 2021. Available online: https://www.europarl.europa.eu/doceo/document/A-9-2021-0019_EN.html (accessed on 4 October 2021).

- Kang, S. Carbon Border Tax Adjustment from WTO Point of View; Working Paper No. 2010/08; Society of International Economic Law (SIEL): London, UK, 2010; pp. 5–11. [Google Scholar]

- Hertel, T.W.; Walmsley, T. China’s Accession to the WTO: Timing Is Everything; GTAP Working Papers 403; Center for Global Trade Analysis, Department of Agricultural Economics, Purdue University: West Lafayette, IN, USA, 2000. [Google Scholar]

- Hertel, T.; Tsigas, M. Structure of the GTAP model. In Global Trade Analysis: Modeling and Applications; The Press Syndicate of the University of Cambridge: New York, NY, USA, 1997. [Google Scholar]

- Ianchovichina, E.; Walmsley, T.L. Dynamic Modeling and Applications for Global Economic Analysis; Cambridge University Press: New York, NY, USA, 2012. [Google Scholar]

- Cheong, I.; Cho, J. The impact of Korea’s FTA network on seaborne logistics. Marit. Policy Manag. 2013, 40, 146–160. [Google Scholar] [CrossRef]

- Cho, J.; Hong, E.K.; Yoo, J.; Cheong, I. The Impact of Global Protectionism on Port Logistics Demand. Sustainability 2020, 12, 1444. [Google Scholar] [CrossRef] [Green Version]

- UNCTAD. UNCTAD Comtrade Database. Available online: https://comtrade.un.org/data/ (accessed on 29 September 2021).

- World Bank. Carbon Pricing Dashboard. 2021. Available online: https://carbonpricingdashboard.worldbank.org/map_data (accessed on 29 September 2021).

| GATT/WTO Article | Key Issues | Possible Incompatibility | Note |

|---|---|---|---|

| GATT Article I: General Most-Favoured-Nation (MFN) Treatment | Article I is the most fundamental GATT principle banning discriminatory treatment between members. Thus, there should not be any discrimination in tariffs, fines, import/export regulations, procedures, and more, for all members. | The EU will assess the border adjustment tax in different ways considering CO2 content, environmental regulations, and technology of exporters on a particular item. Therefore, this is clearly incompatible with the MFN treatment principle. | There is no way to resolve the incompatibility issue with Article I as of now (Englisch and Falcao, 2021). |

| GATT Article II: Schedules of Concessions; Clause (a) Border Adjustment Tax (BAT) | “A penalty, commensurate to an inland tax, on all or partial goods which contribute to manufacturing or production of imports or domestic goods” is included in Article II Clause (a). Whether the CBAM does apply to the BAT or not is a critical issue. | Although the EU maintains the CBAM is not a BAT, non-EU countries with higher tariff burdens tend to view it as a BAT. | If the CBAM tariffs exceed the EU’s binding tariffs, the situation could get worse. |

| GATT Article III: National Treatment on Internal Taxation and Regulation | In principle, an inland tax or other penalties that are normally not imposed on domestic goods must not be imposed on foreign goods (the GATT’s second principle). | The carbon adjustment tax is imposed only based on carbon content. This can violate the national treatment principle. | There is a limitation on the EU when assessing the carbon content of all imports. Also, other technical issues can arise. |

| GATT Article XX: General Exceptions | The CBAM-related aspects in Article XX are clauses (b) and (g) as well as the chapeau clause. Clause (b): A measure on health and life protection of humans and animals/plants. Clause (g): A measure on preservation of limited natural resources. Chapeau: The environmental preventive measures must not be used as a “willful” or “unfair discriminatory tool” between countries in similar conditions. | Clauses (b) and (g) can be compatible. However, the CBAM must be applied in the same manner as a domestic carbon tax. There must not be any willful or unfair discriminatory tool, as declared in the chapeau. It depends on the regulations mentioned in the chapeau clause. | If the CBAM is permitted as a general exception, other countries’ imposition of carbon taxes must also be allowed. That is, there is the possibility that protectionism will prevail. |

| GATT Article XI: General Elimination of Quantitative Restrictions (QR) | This is one of the GATT’s top three principles. The article bans quantity restrictions and import licensing; only tariffs, taxes, and penalties are allowed. | Based on this article, the way the CBAM enforces foreign producer participation in the EU ETS can be interpreted as a form of QR. Thus, this is incompatible with the WTO agreement. | In this case, the costs of the CBAM can be increased due to the QR. |

| GATT Article XXI: Security Exceptions | When members seek to protect critical national security interests, they can take exceptionally necessary measures under this article (specifically, during wartime or other internationally urgent circumstances). | Whether the Intergovernmental Panel on Climate Change (IPCC) announcement can be construed as being for security purposes or not will be a critical point. | Similar measures adopted by their countries will also have to be approved as a national security exception. |

| WTO Agreement Clause 3 of Article IX and Clause 4 of Article XVI | If it is difficult for a member country to implement a WTO agreement due to an “exceptional circumstance” the country can ask for a waiver of duties, but all member countries must agree to grant the waiver. | If the CBAM is considered a critical situation, it can be deemed an “exceptional circumstance”, and thus, the EU can request a waiver. | Since the WTO requires unanimity, the likelihood of receiving a waiver is remote. |

| Classification | Major Summary |

|---|---|

| Purpose |

|

| Time of introduction |

|

| Target countries |

|

| Types of items |

|

| Measures |

|

| Country | Aluminum | Cement | Electricity | Fertilizer | Iron and Steel | Total |

|---|---|---|---|---|---|---|

| China | 4.2 | 0.0 | 0.0 | 0.1 | 15.1 | 19.4 |

| Russian Federation | 2.8 | 0.0 | 0.7 | 1.7 | 5.9 | 11.1 |

| Turkey | 1.8 | 0.1 | 0.1 | 0.1 | 7.4 | 9.5 |

| India | 0.5 | 0.0 | 0.0 | 0.0 | 4.1 | 4.6 |

| USA | 1.0 | 0.0 | 0.0 | 0.1 | 3.4 | 4.6 |

| Rep. of Korea | 0.3 | 0.0 | 0.0 | 0.0 | 4.0 | 4.3 |

| Ukraine | 0.0 | 0.0 | 0.4 | 0.1 | 3.8 | 4.3 |

| Serbia | 0.3 | 0.0 | 0.5 | 0.1 | 1.0 | 2.0 |

| Brazil | 0.0 | 0.0 | 0.0 | 0.0 | 1.8 | 1.9 |

| United Arab Emirates | 1.5 | 0.0 | 0.0 | 0.0 | 0.3 | 1.8 |

| South Africa | 0.5 | 0.0 | 0.0 | 0.0 | 1.1 | 1.5 |

| Japan | 0.1 | 0.0 | 0.0 | 0.0 | 1.3 | 1.4 |

| Belarus | 0.0 | 0.0 | 0.0 | 0.5 | 0.7 | 1.3 |

| Egypt | 0.4 | 0.0 | 0.0 | 0.5 | 0.2 | 1.2 |

| Vietnam | 0.1 | 0.0 | 0.0 | 0.0 | 1.1 | 1.2 |

| Mozambique | 1.1 | 0.0 | 0.0 | 0.0 | 0.0 | 1.1 |

| Bosnia Herzegovina | 0.3 | 0.0 | 0.3 | 0.0 | 0.5 | 1.0 |

| Canada | 0.3 | 0.0 | 0.0 | 0.2 | 0.3 | 0.8 |

| Malaysia | 0.2 | 0.0 | 0.0 | 0.0 | 0.6 | 0.8 |

| Countries and Sectors | Disaggregated Countries and Sectors | |

|---|---|---|

| Countries (18) | Belarus, Brazil, Canada, China, Egypt, India, Japan, Rep. of Korea, Malaysia, Russia, South Africa, Turkey, United Arab Emirates, Ukraine, U.S., U.K., Mozambique, Rest of the World (ROW) | |

| Sectors (GTAP code, 35) | Energy-intensive Sectors (10) | Coal, Oil, Gas, Paper, Aluminum, Steel, Oil_pcts, Cement, Chemicals, Electricity |

| Others (25) | Afs, Cmn, Cns, Edu, Eeq, Ele, Fmp, Fsh, Ins, Lum, Mvh, Oap, Obs, Ofd, Ofi, Ome, Omf, Otp, Ros, Tex, Trd, Whs, Wtp, Wtr, Oth_ind_ser | |

| Scenario | Target Countries | Time Period | Carbon Price | Energy Efficiency |

|---|---|---|---|---|

| 1 | EU → the world (except those that have implemented an ETS or anticipate implementation) | Analysis of change in trends over 15 years (‘21~’36) | 67.2 USD/t~122.5 USD | Increasing by 1.5% for 5 years in technology efficiency of the EU |

| 2 | EU → the world | |||

| 3 | EU → the world; the world → EU | |||

| 4 | The world → the world |

| Status | Country | Title of Initiative | Year of Execution | GHG Emission (MtCO2e) |

|---|---|---|---|---|

| Implementation (10) | China | China’s national ETS | 2021 | 3996.90 |

| EU, EFTA | EU ETS | 2005 | 1725.77 | |

| South Korea | Korea ETS | 2015 | 513.42 | |

| Germany | Germany ETS | 2021 | 398.62 | |

| Mexico | Mexico pilot ETS | 2020 | 328.72 | |

| United Kingdom | U.K. ETS | 2021 | 192.43 | |

| Kazakhstan | Kazakhstan ETS | 2013 | 156.52 | |

| Canada | Canada federal OBPS | 2019 | 73.52 | |

| New Zealand | New Zealand ETS | 2008 | 45.25 | |

| Switzerland | Switzerland ETS | 2008 | 6.04 | |

| Review of implementation (11) | Chile, Colombia, Indonesia, Japan, Montenegro, Serbia, Thailand, Turkey, Ukraine, Vietnam, Pakistan | |||

| No implementation | ROW | |||

| Country | Paper | Aluminum | Steel | Oil_Pcts | Cement | Chemicals | Electricity | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Belarus | 1.7 | (0) | 0.7 | (1.9) | 2.9 | (0) | 1.4 | (1.4) | 30.3 | (2.8) | 4.4 | (3.4) | 11.3 | (0) |

| Brazil | 0.8 | (0) | 4.4 | (1) | 3.3 | (1) | 0.9 | (1.9) | 7 | (0) | 0.8 | (4) | (0) | |

| Canada | 1.3 | (0.2) | 1.3 | (1.4) | 2.2 | (0.3) | 1.3 | (1.4) | 4.1 | (0.1) | 2.2 | (1.1) | (0) | |

| China | 1.7 | (0.1) | 2.4 | (5.3) | 3.7 | (0.5) | 2.3 | (0) | 10.3 | (4.6) | 3 | (4.6) | (0) | |

| Egypt | 2.3 | (0) | 2.4 | (0) | 5.9 | (0) | 0.7 | (0) | 10.6 | (0) | 5.4 | (0) | (0) | |

| India | 4 | (0) | 5.6 | (1.8) | 12.6 | (0) | 0.9 | (1.4) | 22.1 | (0.3) | 4.6 | (3.4) | (0) | |

| Japan | 1 | (0.1) | 0.4 | (2.7) | 1 | (0.1) | 0.8 | (0.9) | 5 | (2.7) | 1.4 | (3.8) | (0) | |

| Rep. of Korea | 1 | (0) | 0.6 | (0) | 1.5 | (0) | 0.8 | (0) | 4.8 | (0.1) | 1.2 | (0.3) | (0) | |

| Malaysia | 1.4 | (0.1) | 2.6 | (2.4) | 3.3 | (0.3) | 4.6 | (1.1) | 6.4 | (5) | 2.6 | (3) | (0) | |

| Russia | 5.1 | (0.1) | 3 | (2.5) | 5.3 | (0.3) | 1.3 | (1.8) | 10.5 | (0.2) | 7 | (3.2) | 20.8 | (0) |

| South Africa | 1.7 | (0) | 6.4 | (0.1) | 6.2 | (0) | 10.4 | (0) | 11.7 | (0) | 4.2 | (0.4) | (0) | |

| Turkey | 1.1 | (0) | 1.2 | (0) | 2.9 | (0) | 1.2 | (0) | 12.3 | (0) | 2 | (0) | 16.6 | (0) |

| United Arab Emirates | 3.1 | (0.1) | 0.8 | (4.5) | 1.9 | (0.3) | 0.7 | (1.4) | 7.6 | (0.4) | 3.7 | (3.2) | (0) | |

| Ukraine | 1.6 | (0) | 5.3 | (0.9) | 9.2 | (0) | 3.1 | (0) | 18.7 | (0) | 10.8 | (1.3) | 15.6 | (0) |

| U.S. | 0.7 | (0.1) | 1.2 | (2.3) | 1.5 | (0.5) | 1.3 | (1.4) | 3.2 | (2.1) | 1.2 | (2) | (0) | |

| U.K. | 0.2 | (0) | 0.1 | (0) | 0.3 | (0) | 0.6 | (0) | 0.6 | (0) | 0.1 | (0) | 7.8 | (0) |

| Mozambique | 0.3 | (0) | 4.6 | (0) | 11.3 | (0) | 1 | (0) | 1.8 | (0) | 0.8 | (0) | (0) | |

| ROW | 0.3 | (0) | 4.6 | (0.2) | 11.3 | (0.1) | 1 | (0.7) | 1.8 | (0.1) | 0.8 | (0.9) | (0) | |

| Energy Products | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Export | Import | Export | Import | Export | Import | Export | Import | |

| Paper | −2.7 | −2.6 | −2.8 | −2.6 | −4.0 | −3.8 | −15.6 | −15.5 |

| Aluminum | −1.8 | −1.7 | −1.8 | −1.7 | −3.0 | −3.0 | −12.6 | −12.6 |

| Steel | −3.8 | −3.6 | −3.9 | −3.7 | −6.5 | −6.3 | −14.2 | −14.1 |

| Oil_pcts | −4.9 | −4.8 | −5.0 | −4.8 | −5.3 | −5.1 | −13.7 | −13.6 |

| Cement | −2.7 | −2.5 | −3.1 | −3.0 | −5.1 | −4.9 | −11.2 | −11.1 |

| Chemicals | −1.4 | −1.4 | −1.5 | −1.5 | −3.3 | −3.3 | −12.8 | −12.8 |

| Electricity | −2.1 | −2.1 | −2.2 | −2.2 | −4.9 | −4.9 | −17.6 | −17.6 |

| Average | −2.8 | −2.7 | −2.9 | −2.8 | −4.6 | −4.5 | −14.0 | −13.9 |

| Countrie (Order of Carbon Exports) | S1 | S2 | S3 | S4 | Difference | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Export | Import | Export | Import | Export | Import | Export | Import | S3 minus S2 | S4 minus S2 | |

| Russia | −23.7 | −2.2 | −23.5 | −2.1 | −20.3 | −12.4 | −17.3 | −15.3 | 3.2 | 6.2 |

| China | −9.9 | 0.9 | −12.2 | 0.6 | −8.5 | −0.7 | −20.9 | −14.2 | 3.7 | −8.7 |

| Turkey | −12.2 | 0.1 | −20.2 | −0.5 | −17.2 | −6.2 | −23.4 | −10.9 | 3 | −3.2 |

| U.K. | −13.5 | 0.9 | −18.0 | 0.9 | −16.4 | −4.0 | −26.4 | −11.4 | 1.6 | −8.4 |

| Ukraine | −11.0 | −2.5 | −21.5 | −6.1 | −16.6 | −10.7 | −22.4 | −14.3 | 4.9 | −0.9 |

| Rep. of Korea | −7.6 | −1.7 | −8.2 | −1.8 | −4.6 | −1.0 | −20.8 | −13.9 | 3.6 | −12.6 |

| India | −14.6 | −0.4 | −14.5 | −0.4 | −12.0 | −3.4 | −20.5 | −12.1 | 2.5 | −6 |

| Brazil | −9.9 | −0.6 | −9.7 | −0.5 | −7.1 | −2.2 | −19.4 | −12.7 | 2.6 | −9.7 |

| U.S. | −10.5 | 0.1 | −10.3 | 0.2 | −7.1 | −0.8 | −20.3 | −13.5 | 3.2 | −10 |

| South Africa | −11.0 | −1.8 | −10.9 | −1.8 | −9.7 | −5.1 | −16.4 | −13.7 | 1.2 | −5.5 |

| Argentina | −7.3 | −1.4 | −7.1 | −1.4 | −3.0 | −2.4 | −16.2 | −11.9 | 4.1 | −9.1 |

| Mozambique | −8.9 | −7.9 | −8.6 | −7.8 | −5.6 | −7.9 | −18.5 | −8.8 | 3 | −9.9 |

| Egypt | −16.0 | −2.0 | −15.7 | −2.0 | −13.6 | −4.1 | −22.7 | −9.8 | 2.1 | −7 |

| Belarus | −25.9 | −4.3 | −25.7 | −4.0 | −18.9 | −4.3 | −26.1 | −12.7 | 6.8 | −0.4 |

| Canada | −6.4 | −2.3 | −7.4 | −2.4 | −5.3 | −2.2 | −19.1 | −15.0 | 2.1 | −11.7 |

| Malaysia | −8.9 | −1.2 | −8.7 | −1.1 | −4.8 | −0.8 | −20.1 | −10.5 | 3.9 | −11.4 |

| Japan | −7.8 | −0.2 | −8.4 | −0.3 | −4.7 | 0.0 | −19.7 | −14.3 | 3.7 | −11.3 |

| EU27 | 15.7 | −6.6 | 16.5 | −7.0 | 3.5 | −10.1 | −0.4 | −16.9 | −13 | −16.9 |

| ROW | −10.7 | −1.4 | −10.5 | −1.3 | −7.9 | −1.7 | −19.9 | −11.9 | 2.6 | −9.4 |

| Countries (Order of Carbon Exports) | S1 | S2 | S3 | S4 | ||||

|---|---|---|---|---|---|---|---|---|

| Aluminum | Steel | Aluminum | Steel | Aluminum | Steel | Aluminum | Steel | |

| Russia | −16.1 | −18.9 | −15.4 | −18.8 | −14.0 | −12.6 | −12.3 | −18.1 |

| China | −13.6 | −9.6 | −16.2 | −11.4 | −10.2 | −1.9 | −21.3 | −20.0 |

| Turkey | −16.4 | −12.3 | −19.7 | −14.9 | −17.0 | −8.3 | −28.7 | −22.0 |

| U.K. | −9.5 | −18.7 | −9.3 | −19.0 | −0.1 | −15.2 | −25.4 | −30.1 |

| Ukraine | −15.7 | −14.3 | −14.7 | −24.7 | −11.3 | −18.7 | −24.8 | −21.6 |

| Rep. of Korea | −9.0 | −8.7 | −8.8 | −9.3 | −3.5 | −1.7 | −29.7 | −22.4 |

| India | −8.9 | −22.0 | −8.7 | −21.9 | −14.7 | −13.1 | −19.4 | −22.0 |

| Brazil | −10.1 | −12.7 | −9.8 | −12.5 | −4.3 | −6.6 | −14.3 | −20.4 |

| U.S. | −14.1 | −8.9 | −13.7 | −8.8 | −7.8 | −0.3 | −21.9 | −17.6 |

| South Africa | −12.2 | −12.6 | −12.0 | −12.5 | −9.8 | −7.2 | −12.3 | −16.2 |

| Argentina | −6.7 | −3.6 | −6.4 | −3.6 | −2.8 | 6.5 | −17.3 | −13.3 |

| Mozambique | −57.2 | 0.5 | −56.2 | 0.4 | −58.5 | 14.4 | −23.6 | −16.7 |

| Egypt | −19.8 | −21.4 | −18.8 | −20.9 | −19.0 | −12.0 | −25.8 | −23.4 |

| Belarus | −13.7 | −29.5 | −12.9 | −28.7 | −8.8 | −25.3 | −37.9 | −33.4 |

| Canada | −11.9 | −6.9 | −11.5 | −6.9 | −8.6 | −2.7 | −28.3 | −19.2 |

| Malaysia | −11.4 | −8.9 | −11.0 | −8.9 | −4.8 | 2.3 | −25.4 | −20.1 |

| Japan | −11.0 | −7.5 | −10.7 | −7.5 | −4.3 | 1.7 | −24.4 | −18.5 |

| EU27 | 43.8 | 13.1 | 43.6 | 14.7 | 20.3 | −7.8 | 20.5 | −2.3 |

| ROW | −14.6 | −17.9 | −14.3 | −17.8 | −10.7 | −11.5 | −19.6 | −20.9 |

| Average | −1.8 | −3.8 | −1.8 | −3.9 | −3.0 | −6.5 | −12.6 | −14.2 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lim, B.; Hong, K.; Yoon, J.; Chang, J.-I.; Cheong, I. Pitfalls of the EU’s Carbon Border Adjustment Mechanism. Energies 2021, 14, 7303. https://doi.org/10.3390/en14217303

Lim B, Hong K, Yoon J, Chang J-I, Cheong I. Pitfalls of the EU’s Carbon Border Adjustment Mechanism. Energies. 2021; 14(21):7303. https://doi.org/10.3390/en14217303

Chicago/Turabian StyleLim, Byeongho, Kyoungseo Hong, Jooyoung Yoon, Jeong-In Chang, and Inkyo Cheong. 2021. "Pitfalls of the EU’s Carbon Border Adjustment Mechanism" Energies 14, no. 21: 7303. https://doi.org/10.3390/en14217303

APA StyleLim, B., Hong, K., Yoon, J., Chang, J.-I., & Cheong, I. (2021). Pitfalls of the EU’s Carbon Border Adjustment Mechanism. Energies, 14(21), 7303. https://doi.org/10.3390/en14217303