Abstract

This study provides a workflow and preliminary estimations of the estimated ultimate recovery (EUR) volumes for natural gas and condensate liquids in the Tuwaiq Mountain Formation, the principal target in the Jafurah Field development project in Saudi Arabia. The strategic need for the field development is reviewed and the field characteristics are outlined based on public data sources complemented with data from analogous reservoirs. The target zone in the Jafurah Basin is a carbonaceous shale, being developed with up to 10,000-ft-long multistage-fractured laterals with 30 ft perforation cluster spacing and an assumed typical 1250 ft well spacing. The field will come on stream in 2024, when the gas-gathering pipeline system, natural gas processing plant, and underground gas storage facilities will all be in place. The range of uncertainties in the key reservoir parameters is taken into account to estimate preliminary EUR volumes (P90, P50, and P10) for both gas and condensates. Based on the present and prior EUR estimations, it can be concluded that the Jafurah Basin comprises one of the largest unconventional field development projects outside of North America.

1. Introduction

The development of unconventional gas fields has become a high strategic priority for the government of Saudi Arabia. The Kingdom aims to meet a fast-growing power generation demand by a combination of natural-gas-fired stations and power supply from renewables. Natural gas production in Saudi Arabia grew from 70.7 bcm (2.5 Tcf) in 2007 to 111.4 bcm (3.93 Tcf) in 2017, corresponding to an average 4.4% growth per year [1]. The produced gas is principally used to fuel electrical power generation plants and as feedstock for the petrochemical industry. Currently, the domestic gas production feeds 2/3 to the power generation sector, and 1/3 of the gas production is sold to the petrochemical industry [2].

In spite of the robust annual growth in domestic gas production, still not nearly enough gas is being produced in Saudi Arabia to match its burgeoning growth in demand. The power generation sector continues to consume costly hydrocarbon liquids; nearly 1 million bbls/day of liquid feedstock (crude oil and diesel) is used by electrical power generation plants. The crude oil and diesel feeds could technically be replaced by environmentally cleaner natural gas, but that would require about 55 bcm (1.94 Tcf) of additional annual gas supplies [3].

Notably, gas imports via pipelines from nearby Qatar would be much cheaper than expensive LNG imports from afar, but this is impeded by geopolitical constraints for the development of cross-border gas pipelines and gas-by-wire networks in the Gulf region [4]. A principal conclusion of the latter authors was that the Gulf region could benefit from increased collaboration on energy supply peak-shaving and cross-border energy transfers. However, until such collaboration projects materialize, costlier LNG imports from afar, rather than affordable gas pipeline imports from nearby Qatar, provide more viable solutions to close the gas supply gap.

Given that the world’s regional gas markets are currently awash with relatively cheap liquefied natural gas (LNG) [5], a reconnaissance study by investigators at the King Abdullah Petroleum Studies and Research Center (KAPSARC) has used a World Gas Model to explore whether LNG imports could possibly complement and support other policies and gas development initiatives in the Kingdom [2,6].

Two scenarios were evaluated for LNG imports to help close the domestic gas supply deficit for the year 2035: (a) a 6.8 bcm (0.24 Tcf) import base case, and (b) a 30 bcm (1.06 Tcf) import high case [6]. The analysis included a cost comparison between a floating storage with regasification unit, and an onshore terminal located in the port of Jeddah. Based on the model assumptions, the projected price for Saudi Arabia of natural gas imports from LNG supply sources abroad would—under the base case scenario—range between USD 7.3/MMBtu in 2023 and around USD 9.5/MMBtu~(Mcf) in 2035 [2,6]. Under the 30 bcm (1.06 Tcf) high supply deficit case scenario, the cost for Saudi gas supply from remote LNG sources could reach around USD 10/MMBtu in 2035.

Clearly, the cost of covering the future demand for natural gas in the Kingdom with LNG imports warrants concurrent efforts for the development of cheaper and geopolitically viable alternatives, such as tapping into the Kingdom’s technically recoverable shale gas resources estimated at 18 Tcm or 645 Tcf [7]. Saudi Arabia’s non-associate, unconventional gas resources may offer an affordable alternative to costlier LNG imports. Additionally, Aramco has identified conventional gas reserves of 298.7 Tcf. However, sales of conventional gas resources have, meanwhile, been disincentivized (rendered less economic) by the government’s recent downward adjustments to the price of associated gas. Aramco’s permissible charges for sales of conventional associated gas after 2020 and onward were sharply adjusted downward to USD 0.31/MMBtu—from USD 1.25/MMBtu that the company had been allowed to charge through 2016 till 2019. Use of associated gas is clearly prioritized—not for sales—but for reinjection in conventional fields to maintain pressure conducive for maximum oil recovery.

To help close the current gas supply gap, the country is primarily targeting the production of 31 bcm (1.09 Tcf) from unconventional resources over the next decade of 2024–2035. The Saudi government has been stimulating the development of unconventional gas fields via price policy incentives [8]. For example, the government-regulated domestic natural gas prices were abruptly raised in 2016, from a prior USD 0.75/MMBtu to USD 1.25/MMBtu [8]. The hike in gas prices coincided—more or less—with the period covered in the release of Aramco’s first audited financial statements (for fiscal years 2016, 2017, and 2018) [9].

The commercially viable development of unconventional gas fields remains clearly a high strategic priority for the Kingdom, as signaled by the priority in the government’s gas pricing policy. A new gas pricing incentive scheme was implemented in 2020, with the government granting Aramco sales prices for northern non-associated gas of USD 3.84/MMBtu and southern non-associated gas of USD 1.52/MMBtu. Gas deliveries from fields with so-called non-associated gas related to the Fadhili project were raised to USD 3.81/MMBtu. These policy incentives in effect amount to what has been coined—based on US gas market dynamics—as gas price-floor regulation [10].

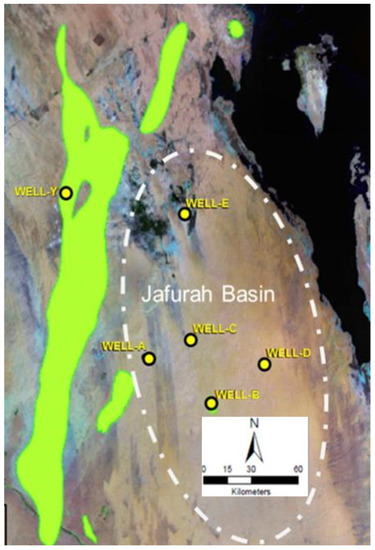

Meanwhile, Saudi Aramco has evaluated the viability of unconventional gas development in detail over the past decade. During the reconnaissance studies, the Jafurah carbonaceous shale play was identified as a foremost development target, based on numerous appraisal wells. Exploration appraisal started in the year 2013 by drilling 150 wells. The Jafurah Basin, delineated east of the giant Ghawar oil field, harnesses one of the largest unconventional gas fields in Saudi Arabia, with an elliptical outline measuring 170 km long and 100 km wide (Figure 1). The wet gas window in the Eagle Ford shale play—the second largest shale gas in the United States—is considered a close analog for the Jafurah Field [11]. All unconventional carbonate wells require multi-stage fracturing as part of the completion strategy. The Jafurah’s development cost is estimated at around USD 110 billion; the field is expected to come on stream by 2024. Saudi Aramco announced on 22 February 2020 in a press briefing that it had been given regulatory approval by the government’s Supreme Committee for Hydrocarbon Affairs to develop the Jafurah unconventional gas project.

Figure 1.

Outline of the Jafurah Condensate Basin (dashed ellipse), with five early exploration wells marked (Wells A–E), and major Ghawar oil field (green). Well Y was used for facies correlation. Modified from Hakami [12].

In the present study, we proceed to estimate and classify the estimated ultimate resource volumes in the Jafurah Basin, using both deterministic and probabilistic estimation methods. The Jafurah unconventional gas field was analyzed with a graduate student team from King Fahd University of Petroleum and Minerals for several compelling reasons. The field provides a prime example of a shale condensate field development. Sufficient technical data on the Jafurah Filed have already been published in scientific journals to allow an advanced analysis of the Jafurah field using public data only, complemented with detailed data from field analogs from the Eagle Ford condensate window in the United States. Reserves reporting guidelines applicable to Saudi Arabia were recently reviewed [13].

The publication of our results will not conflict with any formal company statements about reserves and resources because estimates of the hydrocarbon volumes in the Jafurah Basin have not yet been included in Aramco annual reports. The Jafurah reserves were previously estimated in a WoodMackenzie consultancy report of April 2020 [14], which have been echoed in press reports. The latter study was limited to deterministic estimation methods. Our study nuances the prior estimates of WoodMackenzie with a probabilistic analysis that quantifies uncertainty. Probabilistic in-depth analyses still remain relatively rare in our industry, but are especially useful when uncertainty remains high, such as prior to field development. Noteworthy, our study quantifies the Jafurah resources such that the uncertainty is preserved in the various estimations prior to field development; estimations are split out into different product types (gas and condensate) and classified into different categories of certainty, such as P10, P50, and P90, as well as proved (P90), probable (P50–P90) and possible (P10–P50), in accordance with the SPE-PRMS reserves and resources classification system [15,16].

2. Study Region Characteristics

This section outlines the reservoir characteristics of the Jafurah Field (Section 2.1, Section 2.2, Section 2.3, Section 2.4, Section 2.5, Section 2.6, Section 2.7, Section 2.8 and Section 2.9) as a basis for the subsequent volumetric resource estimations using both deterministic and probabilistic methods (Section 3 and Section 4).

2.1. Petroleum System

The principal target zone for the Jafurah Basin, onshore in Saudi Arabia, is the Tuwaiq Mountain Formation (TWQ), comprised of organic-rich, laminated lime–mudstone strata [17,18]. Bahrain is also targeting the same emergent unconventional TWQ play in the nearby Khalifa Al Bahrain Basin, both onshore and offshore Bahrain [19]. Opportunities for multi-bench development exist, with Hanifa and Jubaila source rocks overlying the TWQ. All three source units (TWQ, Hanifa, and Jubaila) are dominantly carbonaceous sequences, accumulated in the intra-shelf basin of the Jurassic Neo-Tethys [12,20].

Both the TWQ and Hanifa are the principal source rocks contributing to the Jurassic petroleum system, with hydrocarbon migrating upward into the gentle anticline of the Ghawar field where the Arab A–D provide conventional, high-permeability reservoir rocks [20]. In comparison, the unconventional shale plays in North America have traditionally been regarded as zones where the petroleum source fluids could hardly migrate, due to ultra-low permeability. In the case of the TWQ and Hanifa, the distinction of what is truly unconventional and conventional source rock becomes somewhat blurred, as was previously noted by Alansari et al. [19].

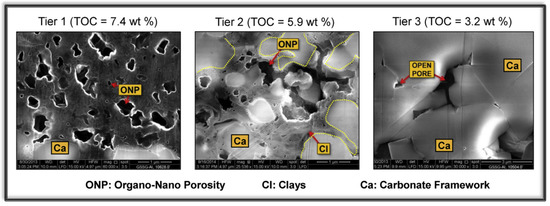

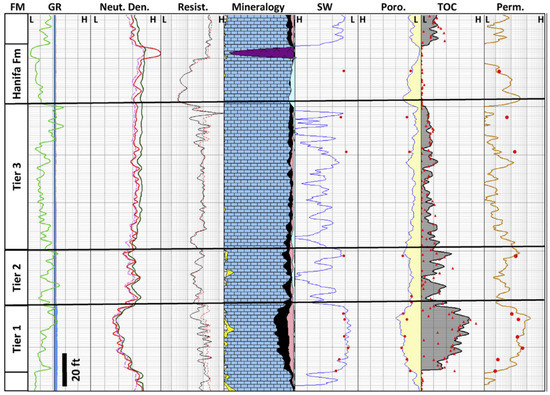

Some of the hydrocarbons matured in the Jafurah’s Jurassic petroleum system may have migrated out of the key formations over time—particularly where natural fracture systems aid fluid migration—a portion of the fluids remained trapped in the kerogen and micro-pores (Figure 2). The three tiers in the TWQ formation are distinguished as determined from wireline logs and core studies (Figure 3).

Figure 2.

Typical TOC and micro-pore structure in the three benches or tiers of the TWQ target formation, according to Hakami et al. [17,18].

Figure 3.

Three tiers in the Tuwaiq Mountain Formation (TWQ), as determined from wireline logs and core studies [17,18].

2.2. Thermal Maturity

The TWQ thermal maturity varies over the region, and the Jafurah Basin is of particular interest because of its elevated vitrinite reflectance, indicating hydrocarbon maturity ranging from black oil into the condensate and dry gas windows [12]. The TWQ burial and thermal maturation history of the TWQ has been modeled in considerable detail to explain the occurrence of hydrogen indices of 450–820 mg oil/g TOC. The initial HC generated from the TOC of 12 wt% would give an initial hydrogen index of 775 mg HC/g TOC [21]. Detailed sample studies have revealed that the TWQ is the most prolific source rock, with TOC wt% ranging between 2 and 12, while the Hanifa and Jubaila have slightly lower TOC and lower hydrocarbon indices [17,18].

The thermal maturity based on vitrinite reflectance (Ro) ranges between 0.8 and 1.25%. Exploration wells have revealed that the TOC varies vertically due to depositional cycles, resulting in variable litho-facies, as can be inferred from gamma-ray (GR) logs [17,18]. Mud gas isotope logging in exploration wells has improved the HC maturity characterization of the Jafurah Basin petroleum system [17,18]. The total section of TWQ, Hanifa, and Jubaila is about 400 ft thick in the Jafurah Basin [12]. The thermal maturity of TWQ rock in the five pilot wells studied ranges between 1.05 and 1.55% [17,18]. The thermal maturity ranges well into the gas condensate maturity window.

2.3. Sorbed Gas

For estimations of the original gas in place, the gas adsorption capacity—based on Langmuir’s mechanism—is important. The Jafurah Basin is a relatively shallow basin, with strata gently dipping eastward at an average angle of 2° as part of the Arabian Platform sequence [22]. The subsidence modeling also gives a slight variation in gas–oil ratios, without providing any scaled numbers due to confidentiality reasons [17,18]. Even with oil migrating, source rock is rarely depleted by the migration, due to a considerable sorption capacity of kerogen, retaining as much as 200 mg HC/g TOC [23]. For the purpose of estimating the amount of hydrocarbon trapped in the TWQ under Jafurah conditions, conservative assumptions were made, with just 100 mg oil/g TOC assumed residual in the kerogen network. When cracked in the gas-generation maturity window, using an oil-to-gas conversion factor of 0.7 would yield about 7 m3 (250 scf) methane per ton of source rock. US analogs suggest the generated methane meets the requirement for adsorption capacity, which may range from 40 to 75 scf/ton at 10,000 psi [24,25]. Shales with higher TOC may have an adsorption capacity of 275 scf/ton at about 3600 psi [26].

2.4. Target Zones

The thickness of TWQ interval ranges between 110 and 150 ft across the Jafurah Basin, with thickness increasing westward [21,27]. (The TWQ target zone has been subdivided into three tiers based on petrophysical study of source rock quality, including TOC, water saturation, porosity, and permeability estimations (Figure 3). The Tier 1 target landing zone for horizontal is near the base of the TWQ formation. Isopach maps show that the Tier 3 target layer ranges from 30 ft in the east to about 40 ft in the west part of the basin. Tier 2 has a comparable thickness range. The remaining part of the 110–150 ft TWQ is occupied by Tier 3 layer. The typical organic content ratios for each tier were tracked in Figure 3 (and averages were included in Figure 2). Total interconnected porosity averages around 10%. The mineralogy of the formation is mainly calcite (averaging 74% by volume) and a low amount of dolomite (averaging 11%) and quartz (averaging 3%). The clay content is also low (averaging 5%). Thus, water saturation is low due to low clay content, and TOC reaches up to 14% [28,29].

2.5. TWQ and Eagle Ford Shale Analog

Building on analogs in North America, the Eagle Ford Plays wet gas maturity window has been identified as a close analog for the TWQ target zone in the Jafurah Basin [30]. The Eagle Ford spans across the various windows of increasing hydrocarbon maturity (black oil, condensate, wet gas, dry gas). Companies are presently focusing on the Eagle Ford’s oil and condensate windows, because production wells in the dry gas window are deeper and low gas prices over the past decade have not been conducive for further development in the dry gas window.

A comparison table between Eagle Ford and TWQ in the Jafurah Basin was given in Almubarak et al. [21], disclosing that TWQ porosity ranges between 5 and 12%, permeability is in the nanoDarcy range, R0 is 1–1.3, and condensate ratios range between 20 and 400 bbls/MMscf. The decline curve for Jafurah wells gave gas rates and condensate rates within the common range of Eagle Ford wells in the wet gas window [21]. The collection of down-hole PVT samples is costly and only one such sample was provisioned for in the 2017 update on the Jafurah field-scoping status [21]. For comparison, a typical PVT compositional summary for an Eagle Ford well in the wet gas window is given in Table 1. The compositional breakdown confirms the presence of ethane and propane, in addition to methane, indicative of natural gas liquids and pentane (oil) phases.

Table 1.

PVT data typical of an Eagle Ford well based on gas–oil ratios (scf/bbl) (after Gala and Sharma [31]).

2.6. Natural Fractures and Permeability

Samples taken from TWQ core show the presence of abundant micro-fractures and natural fractures, which will support production when hydraulic fracture stimulation treatment operations are applied to all wells. Early production data were given in Al-Momin et al. [32]. However, it is not entirely correct to assume high initial flow rates are due to linear flow from fluid stored in fracture systems. The transition from fast early transient flow to apparent boundary dominated flow has been pinpointed to correspond to the time when the pressure transients—of two adjacent hydraulic fractures—coalesce [33], after which the pressure gradient in the central space between the fractures ceases to exist due to pressure depletion. After the onset of apparent boundary-dominated flow, fluid is mostly drained via the tips of the hydraulic fractures. The permeability range of the TWQ target zone is 200 nD–100 μD. The low recovery factors from unconventional rocks lie in the important delay of the convective rate of fluid flow as compared to the diffusion rate of the pressure transient [34].

2.7. Tectonic Closure Pressure and Fluid Overpressure

Closure pressure in the TWQ ranges between 0.98 and 1.05 psi/ft, based on DFITs [35]. The direction of the minimum regional stress is directed NNW, prompting for development with laterals extending in a NNW–SSE direction. The company has tested multi-well pad completions with the impact on well productivity of well spacing variations, lateral lengths (5000–7000 ft), and type of frack fluid and proppant loads [27], including slick water, gelled frack fluid, and hydraulic fracturing treatment via acidized channels [18]. Well design parameters are given in Table 4 of Hakami et al. [18]. Pressure communication well shut-in tests and tracer-response data were given in Kurison et al. [36].

Maturity of the wet gas/condensate window in the US is reached at greater depth than for the TWQ currently developed in the Jafurah Basin, suggesting considerable Neogene uplift may have occurred in the Jafurah Basin after the burial in its earlier subsidence. Two reasons for overpressure of the TWQ are uplift and thermogenesis into gas maturity, but this also means one may infer poor pressure communication with the overlying formations. A hydrostatic pressure gradient would be 0.45 psi/ft, but the TWQ has 0.7 psi/ft, indicating an overpressure gradient of 0.25 psi/ft or 1750 psi at reservoir target depth. The total vertical depth (TVD) is 6500 ft, with a total well length of 10,000 ft, indicating a 3500 ft lateral. The local stress field is characterized by strike–slip conditions, with Sv = 1.1 psi/ft, SH_max = 1.2 psi/ft, and Sh_min = 0.96 psi/ft [32].

2.8. Exploration Wells

The Jafurah pilot well program had laterals of 5000–7000 ft long, typically drilled in 30–40 days, which is twice as long as typical US drilling rates. The Jafurah wells showed a production decline between 72 and 75% within the first 12 months of production [27]. Similar decline rates occur in wells completed in mudstone shale plays in the Permian Basin and the Eagle Ford Shale in Texas [37]. Practical constraints precluded flowing the Jafurah pilot wells for longer than 14- to 30-day flowback for well clean-up—wells are drilled but uncompleted (DUCs) waiting for future tie-in when production facilities and oil- and gas-gathering pipeline systems have been built [27]. Only a few wells have been produced for up to 6 months for well test studies, using modular early production facilities across the basin or stimulated wells that needed tie-in for productivity tests to establish the estimated ultimate recovery (EUR).

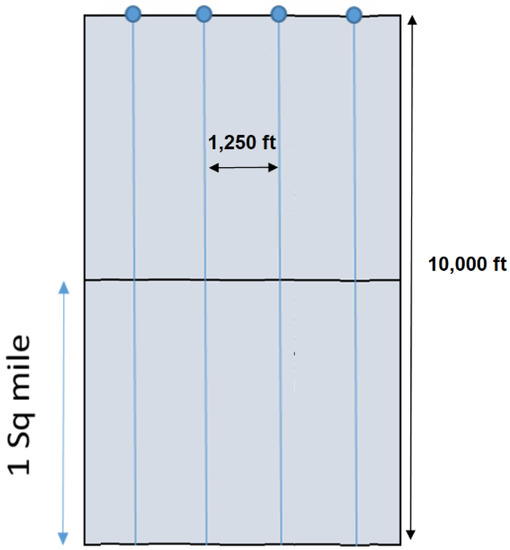

2.9. Drilling Program

Based on the US shale basin analogy, each Section (1 square mile) in the Jafurah Basin can be developed with eight 5000 ft laterals at 625-ft spacing. If 10,000 ft long laterals are used at 625 ft spacing, only half the number of wells is needed per Section of 1 square mile. Henceforth, we would have 8 wells per 2 Sections or a density of 4 wells/Section. As the Jafurah field is covering about 5153 Sections (or square miles), the total number of wells that could be drilled amounts to 4 times 5153, or over 20,000 wells. In this paper, we assume that the company wants to avoid unnecessary well interference, and adopts a 1250-ft initial well spacing of the laterals, leaving infill drilling space. This means a plausible initial well plan could project to drill 10,000 wells over the next 10–20 years, or approximately 500–1000 wells per year using laterals of 10,000 ft long, spaced at 1250 ft. Each 10,000-ft lateral spans two Sections. When spaced at 1250 ft, the two sections will have four single laterals to sweep the hydrocarbons, which amounts to a well density of 2 wells/Section, as illustrated in Figure 4.

Figure 4.

Four 10,000 ft single lateral producers (Wells A–D) are drilled to drain two sections at 1250-ft well spacing.

Although drilling 1000 wells per year may seem a huge number of wells, we recall that, in the combined US shale plays, the drilling rate was ~30,000 wells in 2014, 16,000 in 2015, a dip—due to lasting low oil prices—to 10,000 new wells drilled in 2016, with a steady recovery since to about 21,000 new shale wells drilled in 2021 [38]. The Bakken shale play in North Dakota alone has 17,484 producing wells as of 2019 [39]. The state of Texas, as of 2019, had no less than 301,584 producing oil and gas wells. These are mostly in the unconventional completion zones [40].

2.10. Completions

Stimulations in early horizontal wells were designed with 16 stages per lateral, each stage with three 1.5-ft clusters [41]. Central Jafurah wells have a true vertical depth (TVD) of around 10,000 ft and lateral lengths exceed 5000 ft [28,41]. The low clay content of the Tuwaiq Mountain Formation of Jafurah Basin leads to both increased fracability (high brittleness) and reduced risk of clay swelling during and after completion. The dominant clay types are kaolinite, illite, and chlorite. Thus, the presence of non-swelling clays also makes the formation suitable for hydraulic fracturing. However, the treating pressure needed for wells is higher (around 0.98 psi/ft–1.05 psi/ft) [42]. The significant amount of condensate produced during testing of horizontal wells [41] draws attention due to possible risks of condensate banking and possible liquid loading in the wellbores. The wells are drilled in NW-SE direction to align with the least principal stress of a strike-slip regime that can be readily inferred from the regional tectonics [22].

3. Method of Solution and Data Inputs

A deterministic base case and probabilistic estimations for gas and condensate EUR/section will be presented (later in Section 4), using the equations given in Section 3.1. We proceed to describe the adopted deterministic input parameters used for a base case assessment of resource volumes (Section 3.2). Next, a comprehensive set of probabilistic input parameters is specified (Section 3.3 and onward). We specifically focus on the estimated ultimate recovery (EUR), because the term lacks the constraints and stringent reporting compliance required from reserves classification (e.g., [13]). Reserves are volumes that are discovered, recoverable with current technology, and economic from a given date forward as remaining assets in the reservoir of concern (Appendix A gives a detailed breakdown of reserves categorization in accordance with the level of uncertainty associated with the estimates and may be subclassified, based on project maturity and/or characterized by development and production status. In contrast, the EUR is not referring to any particular reporting date with forward remaining production potential. Instead, the EUR gives the total estimated recovery for the reservoir or well of concern, without any specific referral to economic viability, but commonly specifying a 30-year EUR/well or EUR/section (see below).

3.1. Volumetric Equations

The volumetric OGIP estimations are first performed to generate estimations of the EUR/section, after which the results are multiplied by the number of sections (5153) comprised in the Jafurah Basin to arrive at EUR estimations for the entire basin. Free gas is an essential part of the OGIP in the unconventional reservoir. For example, in the Barnett shale, Marcellus shale, and Haynesville shale reservoir in the US, the free gas fraction in OGIP is 62.01%, 72.30%, and 93.75%, respectively [43].

This study adopts the volumetric method to calculate both the free gas and sorbed gas, which is the typical approach for resource volume estimations in unconventional reservoirs. The volumetric method to estimate the target resources in Jafurah Basin assumes the shale gas in the field () is comprised of free gas () and adsorbed gas (). The free gas consists in the pores of the shale reservoir, while the sorbed gas is accumulated in the matrix and on the pore surfaces:

The original free gas in place () is determined using Equation (2). The original free gas is calculated from the formation volume multiplied by the rock porosity, using field area (), formation height (), matrix porosity (), matrix water saturation (), fracture porosity (), fracture water saturation (), water–oil ratio (), oil formation volume factor (), and gas formation volume factor (). A unit conversion factor () is applied based on the field units used in the equation:

The original adsorbed gas in place () is shown in Equation (3). The original sorbed gas in place is calculated by the formation rock mass multiplied by the unit rock mass’ gas content, using field area (), formation height (), matrix porosity (), fracture porosity (), rock density (), and gas content of the unit rock mass (). The unit conversion factor () is applied based on the equation parameter units. The Langmuir adsorption capacitance model is used to compute the gas content, based on the Langmuir volume (), reservoir pressure (), and Langmuir pressure (). The Langmuir volume is defined as the maximum volume of gas that can be adsorbed to shale, and the Langmuir pressure expresses the pressure at which half of the Langmuir volume of gas is adsorbed. The calculation of gas content is shown in Equation (4).

Next, the estimated ultimate recovery of gas () is determined using Equation (5). The estimated ultimate recovery of gas is calculated by the original gas in place () multiplied by the gas recovery factor ():

The original condensate in place () is calculated based on the original gas in place () divided by the gas–oil ratio (), as shown in Equation (6). Finally, the estimated ultimate recovery of condensate () is determined using Equation (7), which multiplies the original condensate in place () by the recovery factor of oil ().

3.2. Deterministic Inputs

First, a deterministic approach is adopted to estimate the original gas in place (), and ultimate recovery of gas (), original condensate in place (), and ultimate recovery of condensate () for the Jafurah Field. The input parameters were derived from published articles on the Jafurah Field (Table 2), complemented with data from analog reservoirs. Critical data used include formation height, matrix porosity, fracture porosity, formation pressure, gas–oil ratio (), water–oil ratio (), gas formation volume factor, oil formation volume factor, Langmuir volume, Langmuir pressure, oil recovery factor, gas recovery factor, rock density, matrix water saturation, and fracture water saturation. The and formation pressure values were assumed constant to facilitate the calculation. The data sources for physical quantities and values are listed in Table 2.

Table 2.

Input parameters for resource estimation.

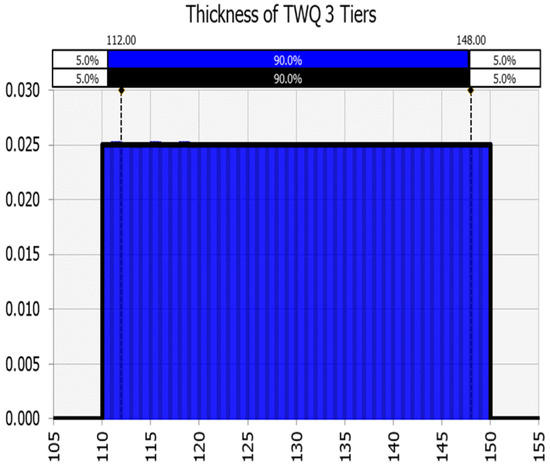

3.3. Probabilistic Inputs: Thickness and Distributions

In this section, the details and basis of probabilistic estimation of Jafurah resources are described. The range and uncertainty of several input parameters for the analyzed unconventional play are represented by probability density functions. When the data set is limited, which is the case for the nascent Jafurah Shale Basin development, one resorts to Monte Carlo simulation, setting broad uncertainty ranges, to account for uncertainty.

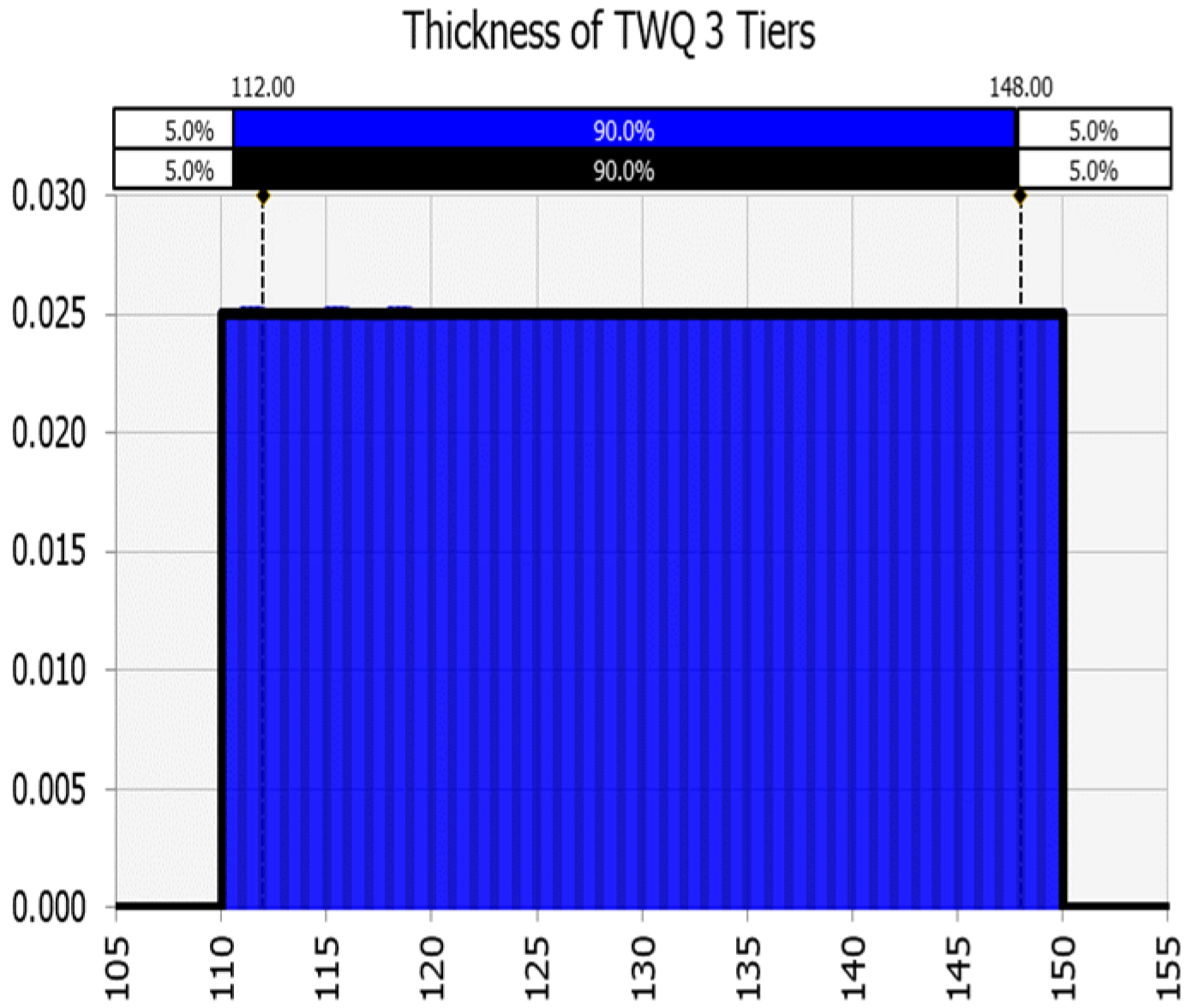

Uncertainty distributions were generated with 10,000 iterations for each key parameter. For example, the thickness of Jafurah formation (i.e., Tiers 1, 2, and 3) gradually increases from 110 ft in the west toward 150 ft in the east [27], which means the uncertainty is spatially constrained and can be conveniently represented by a uniform distribution (Figure 5). The type of distribution selected for the key input parameters in the volumetric estimations is summarized in Table 3. For data fitting, chi-square was used as an evaluator of the best fitting method. The software used was @Risk plug-in for Excel from Palisade. The uncertainty range for the distributions was constrained, as briefly explained in the following subsections.

Figure 5.

Fitted uniform distribution of Jafurah Formation thickness (Tiers 1 to 3).

Table 3.

Summary of probabilistic base case distribution of inputs.

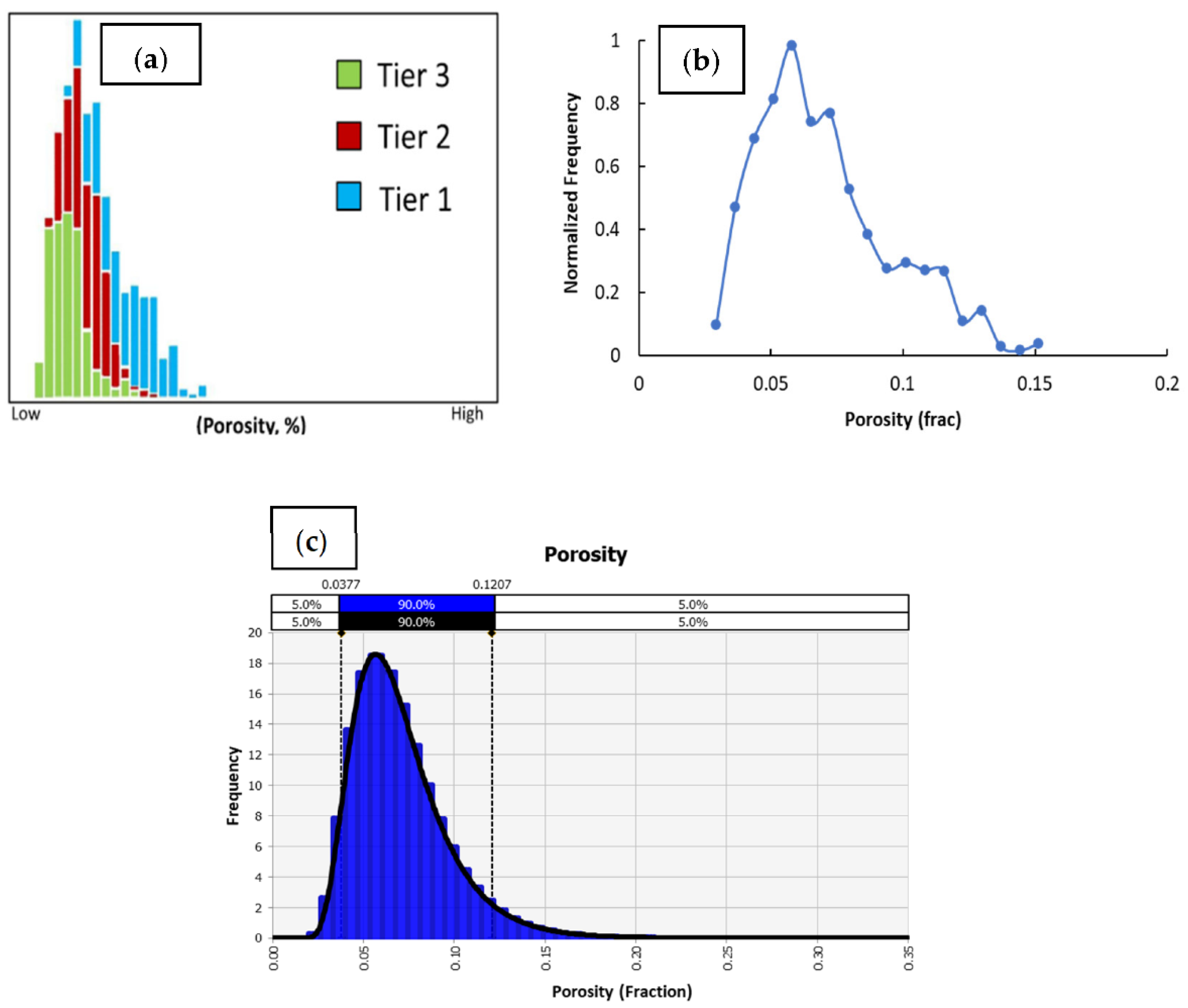

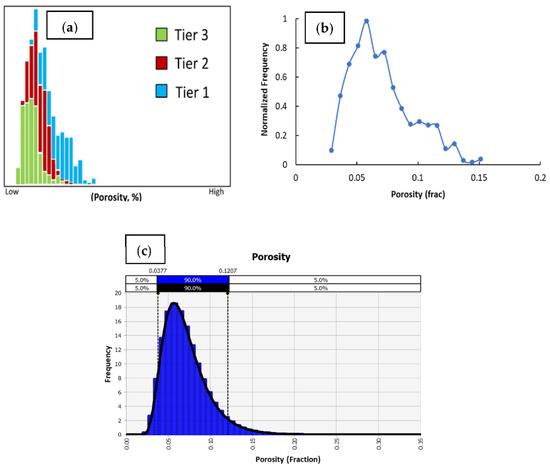

3.4. Porosity

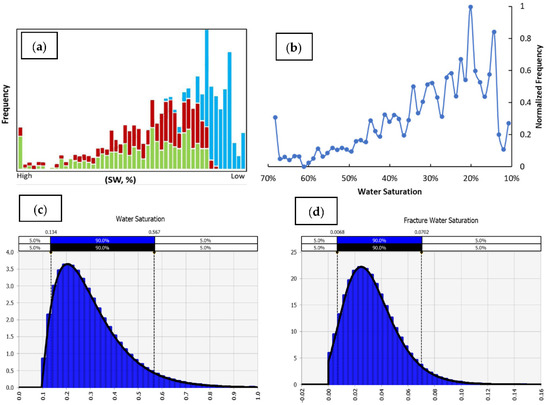

Hakimi et al. [17,18] presented a qualitatively scaled porosity distribution of the three tiers of Jafurah basin, as in Figure 6. Assuming that the targeted formation encompasses all three tiers (Figure 6a,b), the normalized porosity frequency scale (0 to 1) was used to generate a least square fit with 1000 random points that constitute a lognormal distribution (Figure 6c).

Figure 6.

(a) Qualitatively scaled porosity distribution of Jafurah Basin [17,18]. (b) Normalized frequency obtained by digitization of (a) plotted with the midpoint of each histogram porosity column. (c) Adopted porosity distribution.

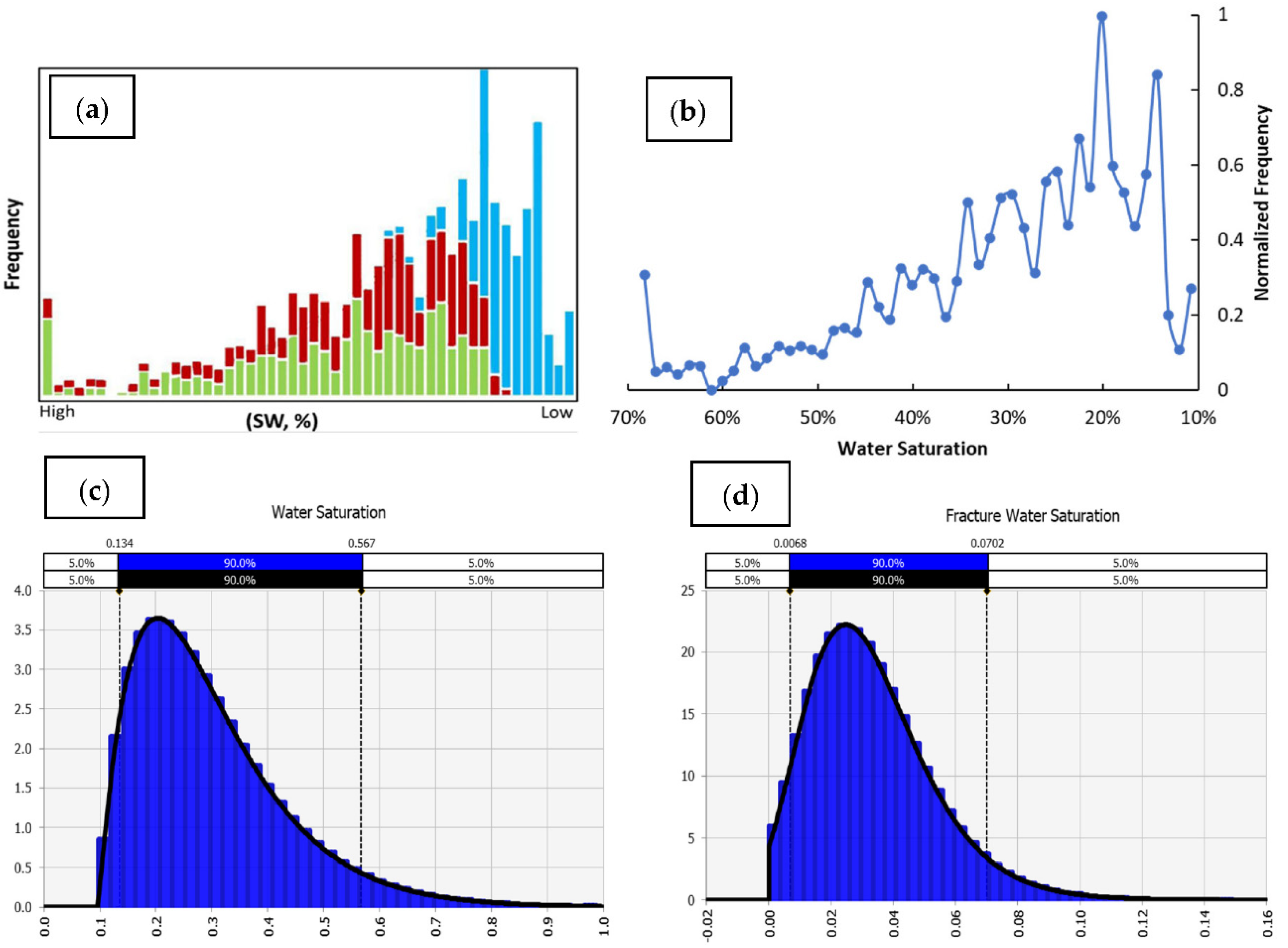

3.5. Formation Water Saturation

Figure 7a presents a published (qualitatively scaled) water saturation distribution for the three tiers of the Jafurah Basin [17,18]. Based on the Eagle Ford analogy, the maximum and minimum water saturation were assumed to be 0.1 and 0.7, respectively, as presented by Hammes et al. [50]. Assuming that all three TWQ tiers are prolific target zones, a digitization technique was utilized using the midpoint of each water saturation histogram column to obtain a normalized frequency distribution (Figure 7b). Next, 2500 random points were selected to fit the histogram to Figure 7b, and then were used to fit a gamma distribution (Figure 7c). Fracture water saturation was assumed to follow a lognormal distribution (Figure 7d).

Figure 7.

(a) Qualitatively scaled water saturation distribution of Jafurah basin (after Hakimi et al. [17,18]. (b) Normalized frequency obtained by digitization of plotted with the midpoint of each histogram porosity column. (c) Distribution of formation water saturation. (d) Distribution of fracture water saturation.

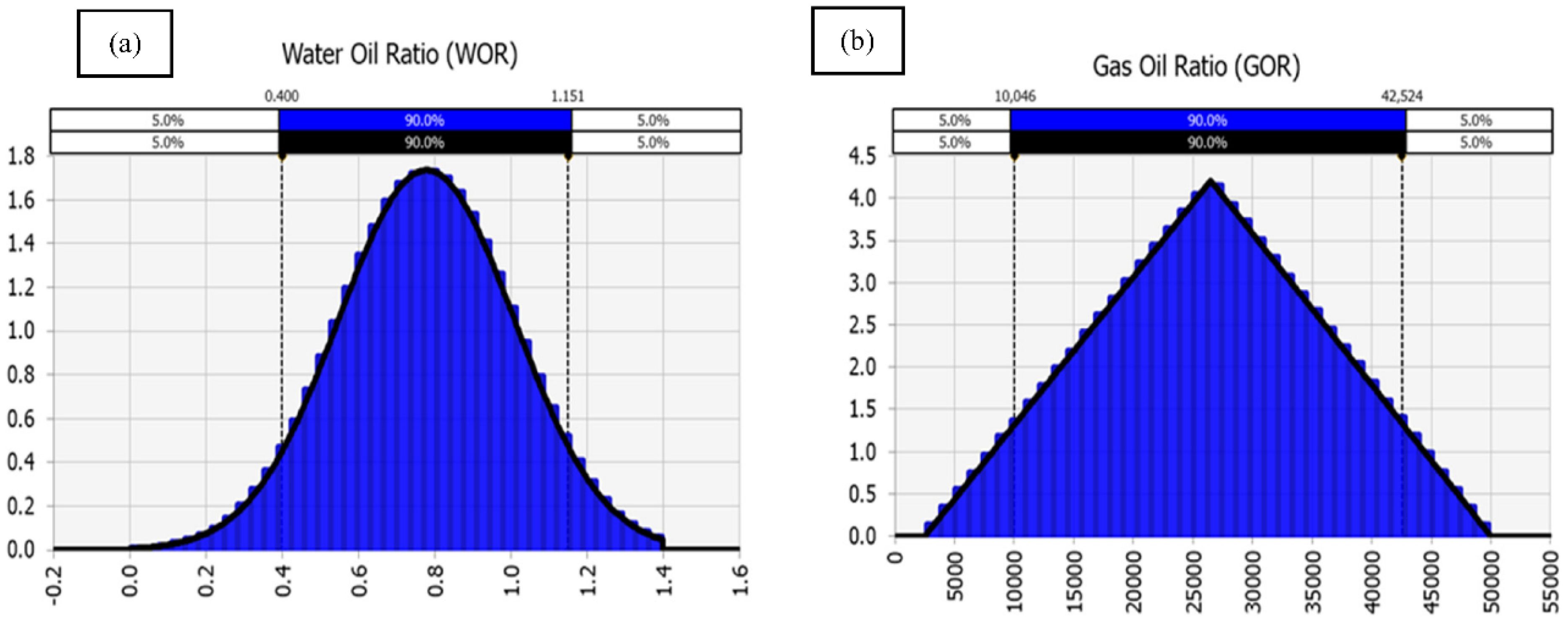

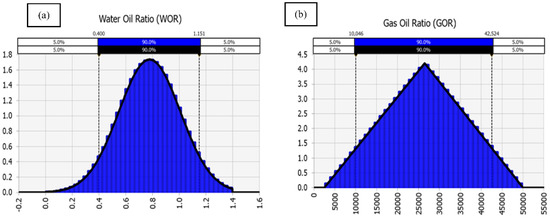

3.6. Water–Oil Ratio (WOR) and Gas–Oil Ratio (GOR)

The Jafurah Basin was assumed to have WOR distributions similar to that observed in the Eagle Ford condensate window. WOR data from the Eagle Ford were fitted with a distribution (Figure 8a). According to Hakimi et al. [17,18], the GOR ranges from 2500 to 50,000 scf/stb, which was fitted with a triangular distribution (Figure 8b).

Figure 8.

Distributions of (a) water–oil ratios (WOR) and (b) gas–oil ratios (GOR).

3.7. Gas and Oil Formation Volume Factors

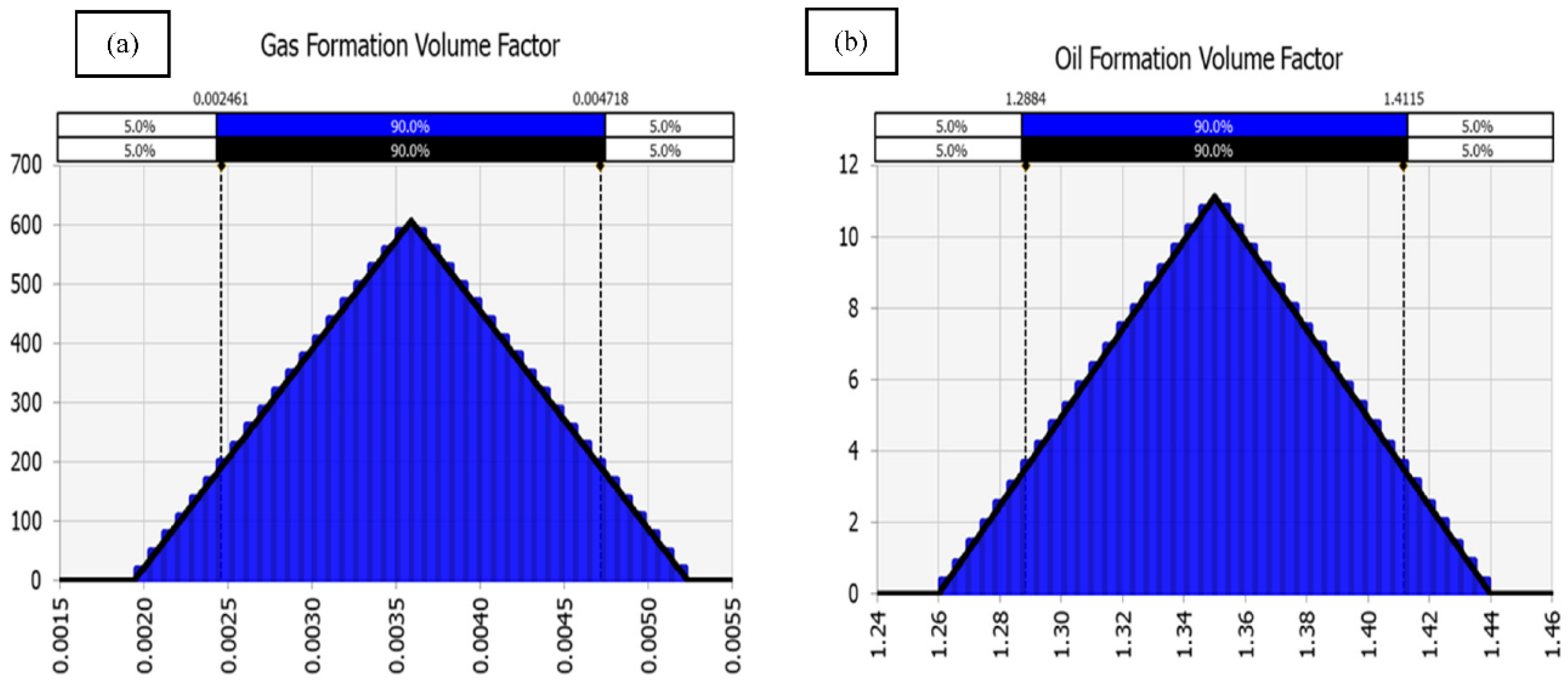

Gas and oil formation volume factors were assumed to be in the range of (1.29 × 10−3 –5.24 × 10−3 rcf/scf) and (1.3–1.4 bbl/stb), accordingly. With minimal knowledge of the type of distribution for the Jafurah Basin, triangular distributions were adopted (Figure 9a,b), with key assumptions as given in Table 4.

Figure 9.

Distributions of formation volume factors for (a) gas (Bg) and (b) oil (Bo).

Table 4.

Triangular distribution parameters.

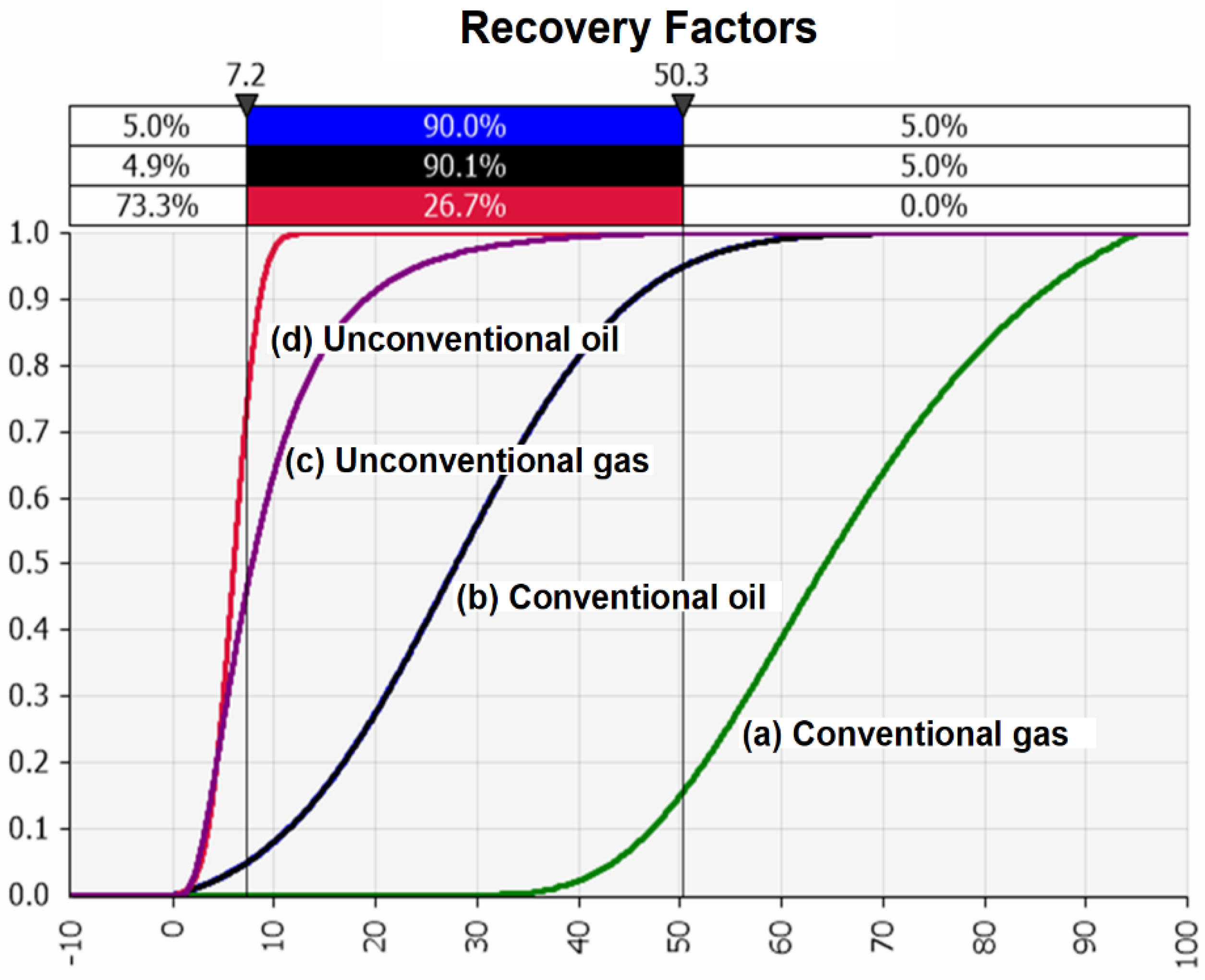

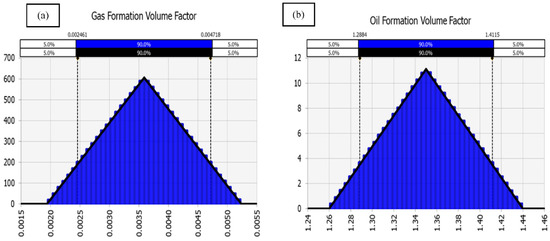

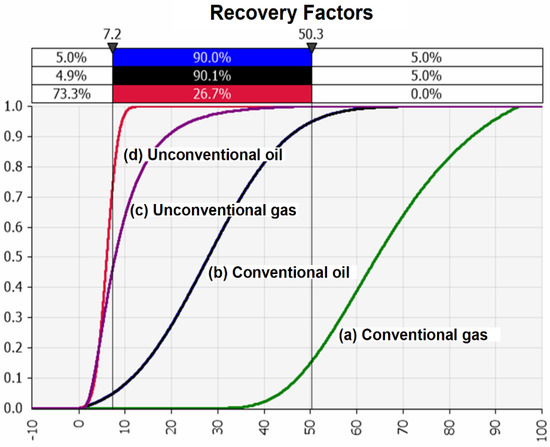

3.8. Recovery Factor

We used one probability density function (pdf) for oil condensate recovery and one for gas recovery (Figure 10), as applicable to a wet gas product range in various ratios weighed by the GOR. The conventional curves were based on conference data compiled by Laherrere [51], which were previously used to argue unconventional resources may have similar distributions—but shifted toward the left in the plot of cumulative recovery probabilities [44,45]. We found that the conventional oil recovery factors fit well to a normal distribution, with a mean at 28% and standard deviation of about 14%. Data for recovery factors of shale oil are still sparse, but consensus seems to exist that these values range between 1 and 10% [46]. A normal distribution was adopted for the shale oil recovery factor, with a mean of 6% and standard deviation of 2% (Figure 10).

Figure 10.

Overlay of four pdfs representing the likelihood of recovery factors for hydrocarbons in place from (a) conventional gas, (b) conventional oil, (c) shale gas, and (d) shale oil. Curves (a) and (b) are based on primary data by Laherrere [51]. Curves (c) and (d) were inferred by shifting the distributions to the left and using recovery factor constraints from unconventional shale plays cited in the literature.

For shale gas, the technical literature suggests recovery factors ranging between 10 and 20% [46], with more optimistic values ranging into 25 to 30% (EIA, 2013). A Weibull distribution was proposed by Dong [44], which can in fact be closely matched by a skewed lognormal distribution, with a mean of 55% and standard deviation of 20% (Figure 10). The lognormal distribution was based off the pdf for conventional recovery factors, shifted leftward to cover the range from 0 to 30%, with 69% of the data clustering between 5 and 25%. Only 4.5% of the shale plays would have recovery factors reaching above 25%.

4. Results

Given the importance of resource volume estimations, various methods were applied. First, a baseline EUR was estimated deterministically (Section 4.1). Next, probabilistic EUR estimations were made, taking into account the uncertainty range of key input parameters based on an iterative sensitivity analysis (Section 4.2).

4.1. Deterministic EUR Estimations

Deterministic estimates for the Jafurah , , , and were made, distinguishing a minimum, mean, and maximum value (which corresponds to the most conservative, most likely, and most optimistic estimation, respectively). The reservoir parameters were classified into two types based on their correlation to the estimation target. One type is positively correlated, such as formation height, matrix/fracture porosity, formation pressure, , Langmuir volume, oil/gas recovery factor, and rock density. The other type has a negative correlation, which includes , oil/gas formation volume factor, Langmuir pressure, and matrix/fracture water saturation. Then, the minimum, mean, and maximum values of each reservoir parameter were selected according to their ranges. The maximum values of negative correlation parameters correspond to the minimum target estimation, while the minimum values correspond to maximum target estimation. For instance, maximum matrix water saturation was used to estimate minimum EUR. The values of all relevant input parameters for the three output values (minimum, mean, and maximum) are listed in Table 5 and are largely based on the values given in Table 2.

Table 5.

Input parameters for three cases.

After the abovementioned steps, the input parameters’ values for three cases were respectively substituted into the volumetric equations in Section 3.1, and the results are shown in Table 6. The minimum values of targets represent the most conservative estimations, which correspond to P90 values in a probabilistic approach. The expected values represent the most likely estimations, which correspond to the P50 values in the probabilistic method. The maximum values of targets denote the most optimistic estimations, which correspond to the P10 values in a probabilistic approach.

Table 6.

EUR estimates for three cases.

From the minimum estimations of Table 6, (7.24 Tscf) is much lower than (87.38 Tscf), which indicates more shale gas is stored in a sorbed state rather than the free state in Jafurah Basin. Moreover, the range of (7.24~1359.55 Tscf) is much broader than (87.38~288.32 Tscf), which shows the higher uncertainty of free gas estimation in shale reservoirs. The ratio of maximum to minimum estimation of the doubles , revealing that the gas recovery factor is the crucial point for the development of the field, according to Equation (5). Comparison of and with illustrates the importance of gas–oil ratio and oil recovery factor, respectively, in resource estimation and economic evaluation.

4.2. Probabilistic EUR Estimations

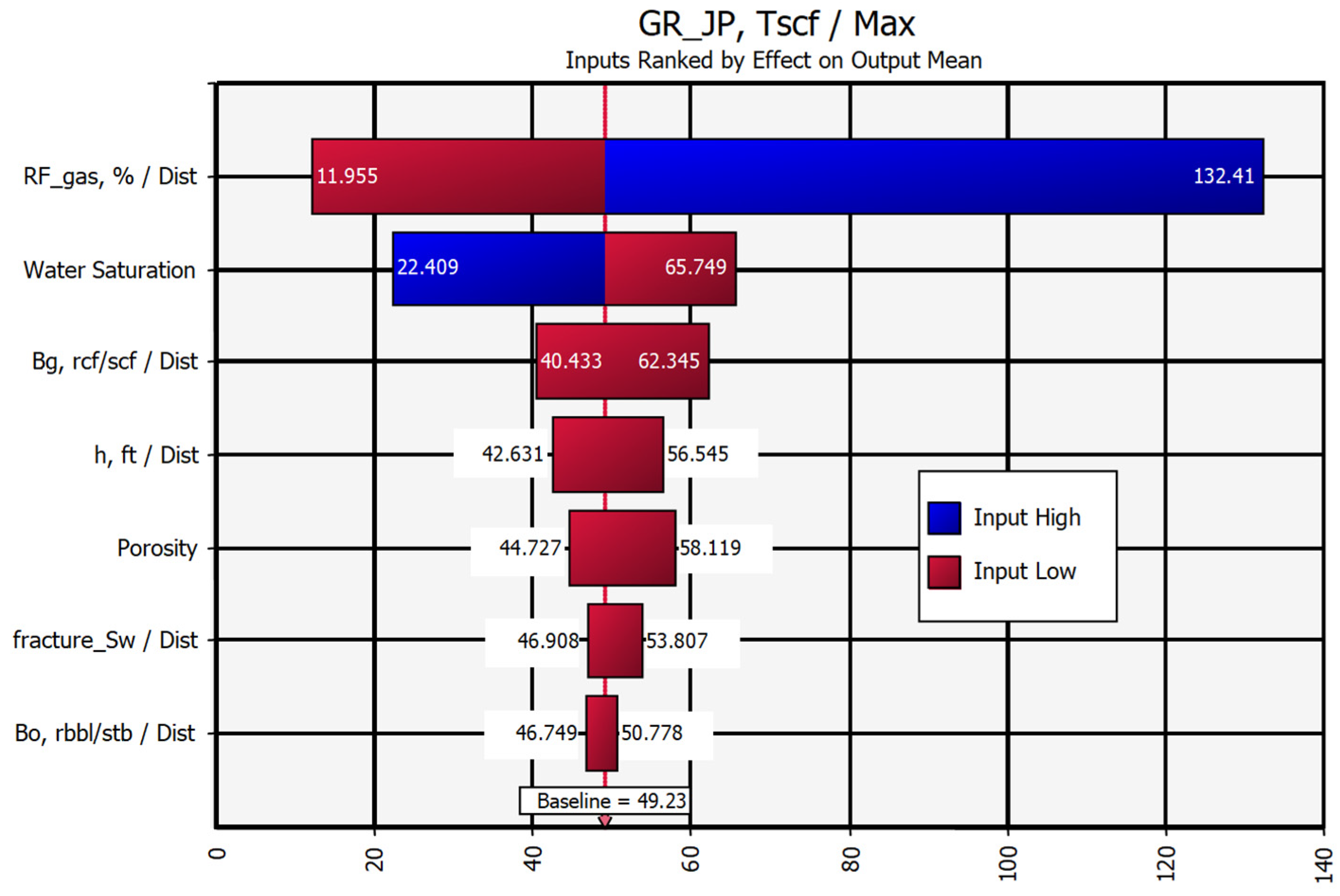

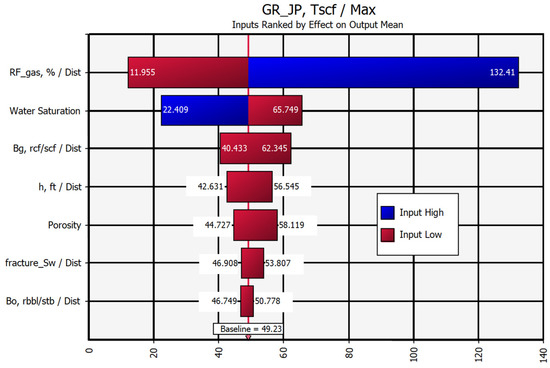

This section estimates the Jafurah resources with probabilistic methods, using the input distributions detailed in Section 3.3, Section 3.4, Section 3.5, Section 3.6, Section 3.7 and Section 3.8. Based on the tornado plot (Figure 11), it became apparent that the assumed recovery factor had the largest impact on the Jafurah resource estimation.

Figure 11.

Tornado chart of Scenario 1, which is a base case (see Figure 12).

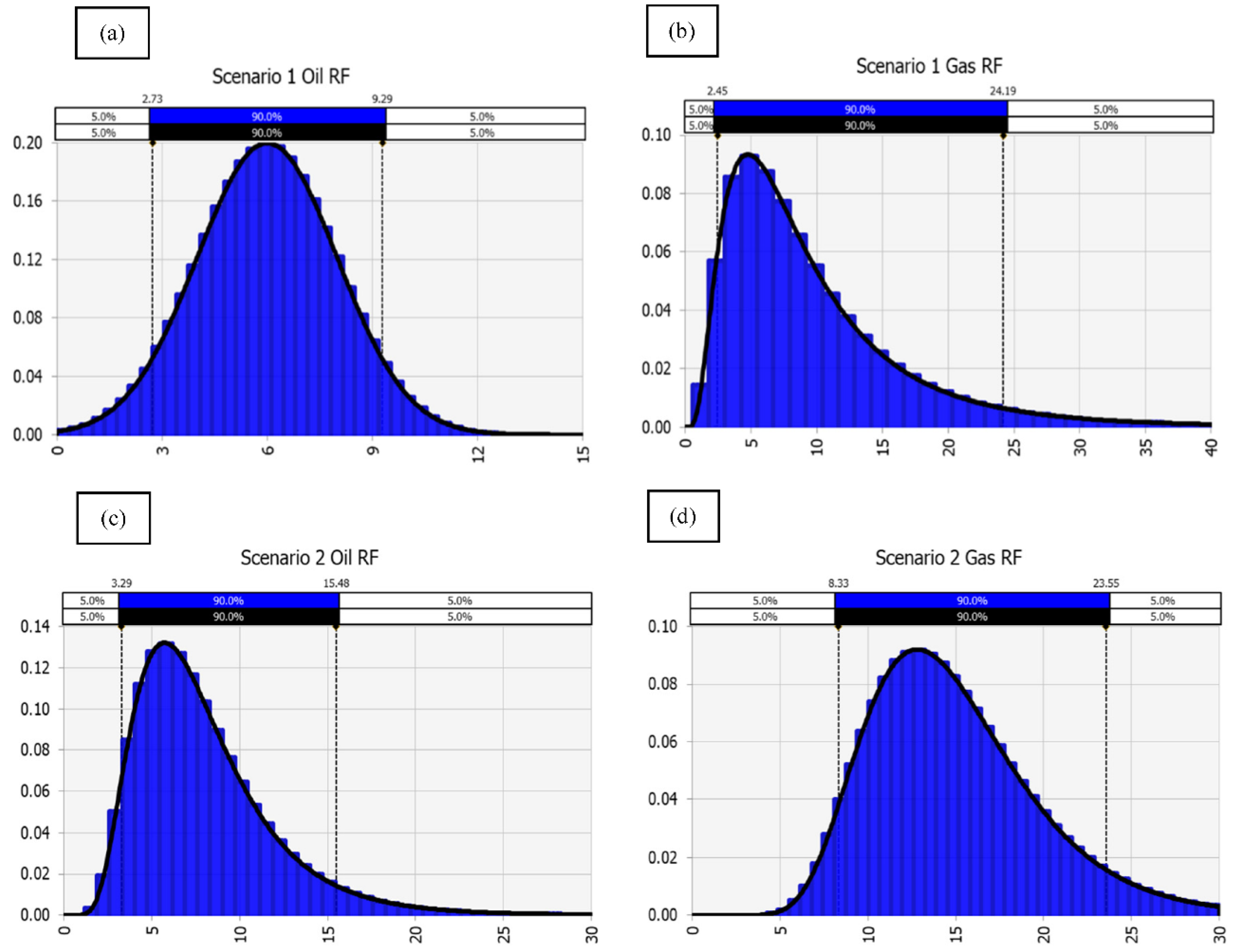

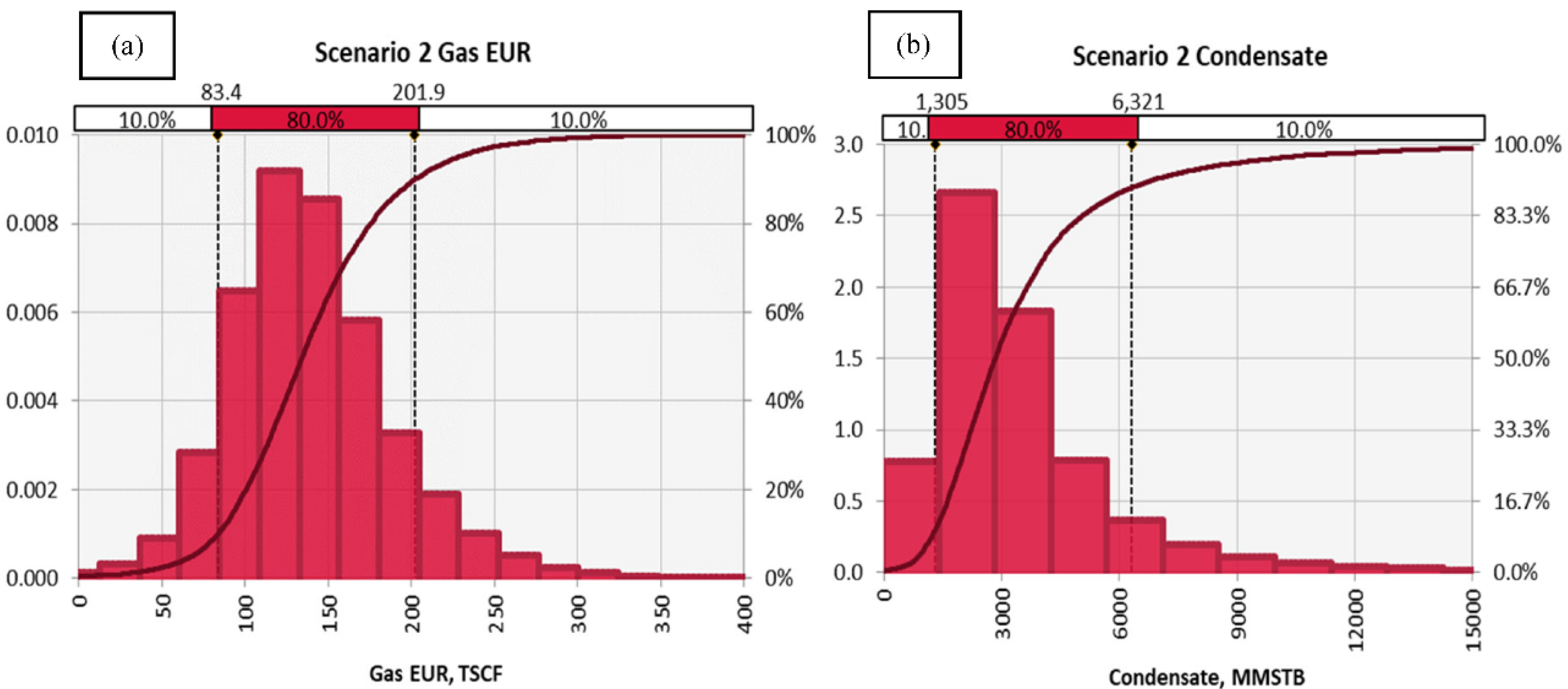

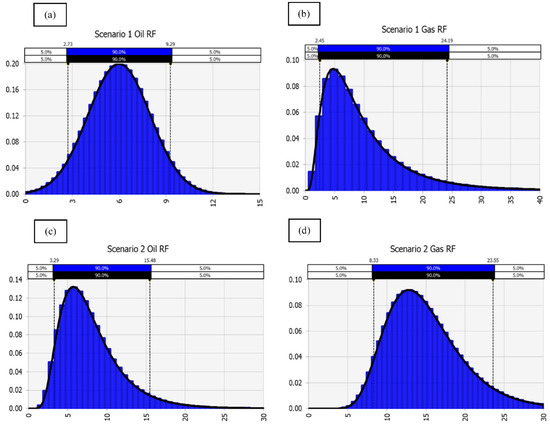

Recovery factors. For the deterministic EUR estimations, recovery factors were assumed as given in Table 5. For the probabilistic EUR estimations, probabilistic recovery factors were used. As the recovery factors played such a major role in the EUR estimations, two scenarios were developed to evaluate the EUR with probabilistic recovery factors. Scenario 1 (Figure 12a,b) is regarded as the base case with conservative oil and gas recovery factor distributions. These conservative recovery factors (RF) were modeled after recovery factors of shale plays in the US Eagle Ford Basin (Figure 10). Scenario 2 assumes a more optimistic recovery factor (Figure 12c,d). For both scenarios, 10,000 iterations were used to generate the distributions. Table 7 provides a summary of parameters used to generate the RF distributions for Scenario 1 (Figure 12a,b) and Scenario 2 (Figure 12c,d).

Figure 12.

Recovery factors of Scenario 1 for (a) oil and (b) gas, and recovery factors of Scenario 2 for (c) oil and (d) gas.

Table 7.

Summary of distribution inputs of recovery factors.

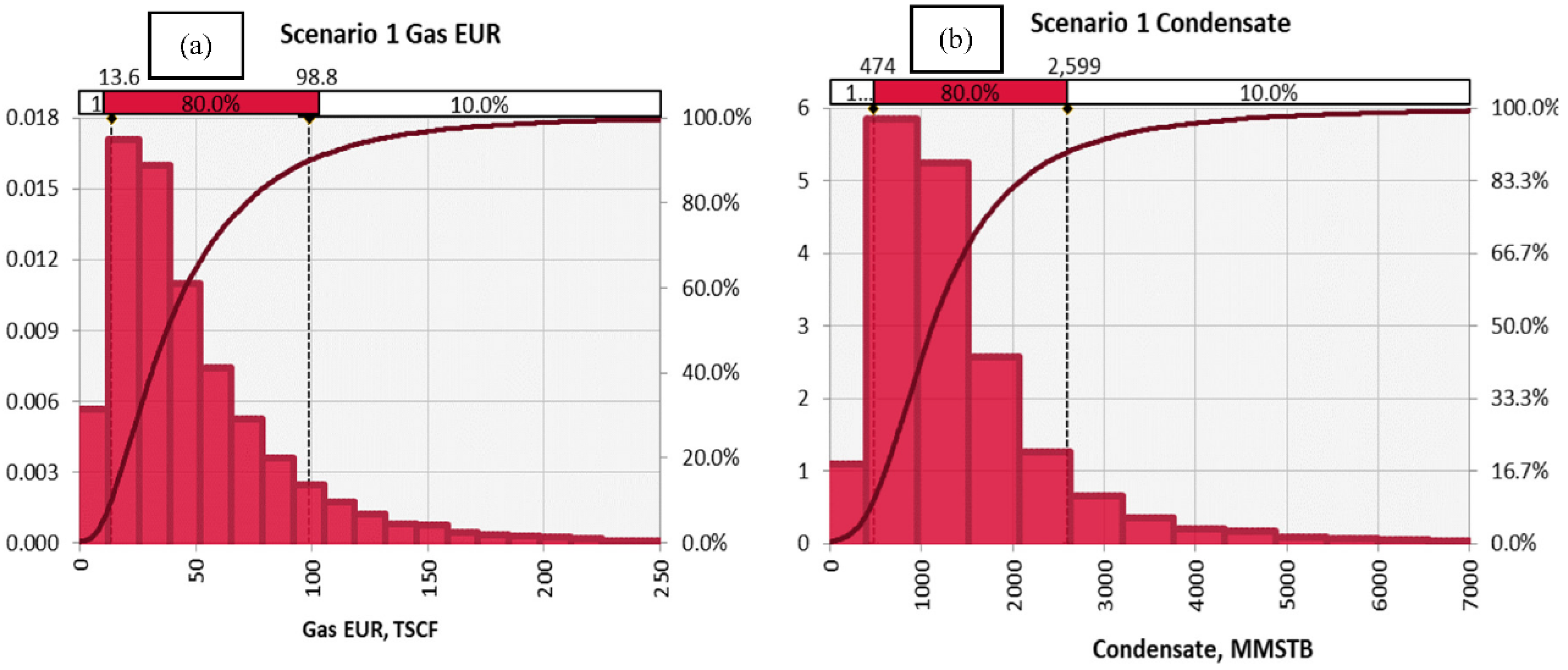

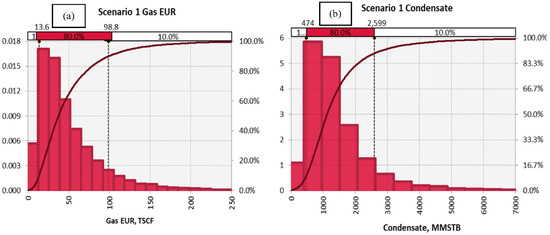

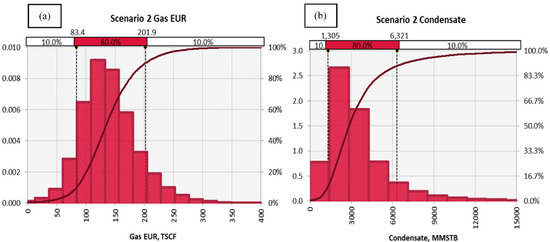

EUR estimations. With the two scenarios in place, we are able to provide two sets of EUR estimations based on probabilistic inputs, as summarized in Table 8. According to Scenario 1, the P10 EUR estimates for gas and condensate (Figure 13a,b) are almost double that of Scenario 2 (Figure 14a,b). We assume the base case Scenario 1 is the more likely, while Scenario 2 is the more optimistic one.

Table 8.

Probabilistic EUR estimations for the 5153 Sections (see Section 2.9) covered by the Jafurah Field.

Figure 13.

Scenario 1. Estimated ultimate recovery (EUR) of (a) gas EUR and (b) condensate.

Figure 14.

Scenario 2. Estimated ultimate recovery (EUR) of (a) gas EUR and (b) condensate.

5. Discussion

The Jafurah Field is currently part of the vast lease agreement granted by the government to Saudi Aramco. About 500–1000 wells per year must be drilled over the next decade; hundreds of wells have already been drilled but are currently shut-in for lack of gathering and processing facilities. Full-scale field development has been slated to start in 2023, with first production distribution in 2024. By then, all the required infrastructure and facilities for handling the gas and liquid streams produced by the wells in full-scale development mode must be ready. The required components are (1) laying out the raw gas-gathering trunk lines, (2) the Hawiyah NGL processing capacity expansion project, and (3) the Hawiyah Unayzah Gas Reservoir Storage (HUGRS) Project, required to buffer seasonal changes in gas demand.

5.1. Probabilistic Aggregation Effects

In this section, the discussion will be focused on a technical analysis of resource aggregation effects at the field scale. It has been demonstrated before that probabilistic aggregation (here performed using Excel with @RiskTM from Palisades as an add-in function) is highly sensitive to the size of the drilling program. However, applying probabilistic aggregation means the P90 and P10 EUR estimations will both converge on the P50 value, and thus uncertainty is assumed to reduce over time. Table 9 summarizes an example of how the size of the drilling program, ramping up from 1 well to 10 wells, to 100 wells, then 1000 wells, and ultimately 10,000 wells, will affect the resource estimation per well; the mean value and P50 converge after drilling about 100 wells.

Table 9.

Summary of the simulated results of the drilling program.

5.2. Comparison of Various Resources Estimations

Assuming the P50 EUR estimations will be most representative at this stage prior to field development, Table 10 compiles the various estimations. The deterministic P50 estimations from a consultancy report by WoodMackenzie [14] are also given for comparison with our new results using both deterministic and fully probabilistic estimations.

Table 10.

P50 EUR estimations for Jafurah field development project.

The comparison of Table 10 shows that the P50 condensate EUR estimations prior to field development range between 856 and 8264 million barrels. The total gas equivalent volumes range between 43.7 and 151.2 Tcfe. It was stated in the report by WoodMackenzie [14] that Saudi Aramco expects to recover at least 200 Tcfe of gas and liquids (“raw” gas) from the Jafurah play over the next 50 to 100 years. Our optimistic Scenario 2 P50 EUR estimations arrived at 151.2 Tcfe, based on an assumed initial well spacing of 1250 ft. The prospect of infill wells or use of well spacing tighter than 1250 ft was not included in our analysis. Nonetheless, our P50 EUR estimations of 151.2 Tcfe with 1250-ft well spacing is in the same order of magnitude as Aramco’s 200 Tcfe estimation, and the numbers will converge if tighter well spacing and/or infill wells are assumed.

5.3. Limitations

In order to facilitate the computation, the Langmuir model was adopted in this paper to estimate the shale gas adsorption capacity. However, the adsorbed gas volume might be described more accurately by the Brunauer–Emmett–Teller (BET) model in shale gas reservoir. The BET model is determined by the adsorption layer amount, the maximum gas adsorption volume for a single layer, and the constant related to the adsorption net heat, and its main strength is considering the multilayer adsorption of natural gas [47,48]. The limitation of the gas adsorption model selection could be solved in future research when the relevant experimental data become available.

6. Conclusions

The emergence of new unconventional resource plays around the world is commonly accompanied by early statements about the potential resource volumes, later followed by estimations of the actual reserves, with episodic updates on the detailed nature of these reserves. Saudi Arabia has recently committed—via gas price policy incentives granted to Saudi Aramco—to the development of its unconventional resources. The Jafurah condensate field was approved for full development in 2020 and is scheduled to come on stream in 2024.

One of the aims for developing this field is to displace the use of oil in the Kingdom’s power stations with natural gas, such that the displaced oil consumption volume can instead be exported. In addition, the wells in the Jafurah condensate window are expected to produce considerable volumes of natural gas liquids that will be handled by expansion of existing NGL processing plants. The P50 EUR volume for the Jafurah Field was estimated at 151.2 Tcfe, assuming initial field development, with 10,000 laterals to be drilled over the coming decade(s). The play is anticipated to eventually produce about 200 Tcfe of gas and liquids.

For comparison, the Permian Basin in the US, which has multilayer production from both conventional and unconventional target zones, had, as of 2018, produced (over about a century) 118 Tcfe natural gas and 33 billion (198 Tcfe) of oil (EIA, 2018). However, recent estimates project 19 Tcf natural gas and 5 billion barrels (30 Tcfe) of oil remaining in the Permian Basin. Based on the early resource volume estimations, the Jafurah unconventional field development project in Saudi Arabia may be in the league of the US Permian Basin. However, as stated before, the condensate window in the US Eagle Ford play provides a closer analog to the petroleum system and maturity of hydrocarbons currently targeted in the Jafurah Basin.

Author Contributions

Conceptualization, R.W.; methodology, R.W. and M.J.; validation, R.W., M.J., N.I.K.; formal analysis, M.J. and N.I.K.; investigation, R.W., M.J., N.I.K.; resources, R.W.; data curation, R.W.; writing—original draft preparation, R.W. and M.J.; writing—review and editing, R.W.; visualization, M.J.; supervision, R.W.; project administration, R.W.; funding acquisition, R.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

This study was conducted as part of the new training course in reserves estimation and production forecasting developed at King Fahd University of Petroleum & Minerals (KFUPM) to meet the future needs of the oil industry, government agencies, and investment firms. Public data and analogy to similar basins elsewhere were utilized to classify the resources and complete their economic appraisal. The authors acknowledge the generous support provided by the College of Petroleum Engineering & Geosciences (CPG) at King Fahd University of Petroleum & Minerals (KFUPM).

Conflicts of Interest

The authors declare no conflict of interest.

Nomenclature

| Field area, acres | |

| Gas formation volume factor, rcf/scf | |

| Oil formation volume factor, rbbl/stb | |

| 1359, a constant based on equation units | |

| 43,560, a constant based on equation units | |

| Gas estimated ultimate recovery, scf | |

| Condensate estimated ultimate recovery, stb | |

| Gas content, scf/ton | |

| Gas–oil ratio, scf/stb | |

| Formation height, ft. | |

| Original condensate in place, stb | |

| Free gas in place, scf | |

| Sorbed gas in place, scf | |

| Original gas in place, scf | |

| Pressure, psi | |

| Langmuir pressure, psi | |

| Gas recovery factor, % | |

| Oil recovery factor, % | |

| Fracture water saturation | |

| Matrix water saturation | |

| Langmuir volume scf/ton | |

| Water–oil ratio, stb/stb | |

| Fracture porosity | |

| Matrix porosity | |

| Rock density, g/cc |

Appendix A. Definition of Reserves

Petroleum reserves, according to the petroleum reservoir management system (PRMS) approved by the Society of Petroleum Engineers, the World Petroleum Council, the American Association of Petroleum Geologists, and the Society of Petroleum Evaluation Engineers [15,16]. are those quantities of petroleum anticipated to be commercially recoverable by application of development projects to known accumulations from a given date forward under defined conditions. Reserves must further satisfy four criteria: they must be discovered, recoverable, commercial, and remaining (as of the evaluation date) based on the development project(s) applied. Reserves are further categorized in accordance with the level of certainty associated with the estimates and may be subclassified based on project maturity and/or characterized by development and production status.

It is emphasized here that PRMS is a resource and reserves classification system but does not fulfill the role of a reserves reporting and regulation system; the important distinction has been detailed in Weijermars and Al-Shehri [13]. The following reserves categories are distinguished in PRMS for internal resource management by companies, which as stated need to comply with an additional, country-specific set of guidelines for reserves reporting. Because the test of economic viability was not included in the present study, our estimations are not claimed to be reserves or resources equivalent. What we report is estimated ultimate recovery (EUR), which mostly focuses on technically recoverable resource volumes under the given uncertainty. As is permissible and commendable for EUR estimations under uncertainty, we use P90, P50, and P10 categories in same way as applied to distinguish reserves volumes, as explained below.

Proved Reserves are those quantities of petroleum which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be commercially recoverable, from a given date forward, from known reservoirs and under defined economic conditions, operating methods, and government regulations. If deterministic methods are used, the term reasonable certainty is intended to express a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90-percent probability (1P) that the quantities actually recovered will equal or exceed the estimate. For clarity, we recall that 1P reserves refer to the P90 certainty category.

Unproved Reserves are based on geoscience and/or engineering data similar to those used in estimates of Proved Reserves, but technical or other uncertainties preclude such reserves being classified as Proved. Unproved Reserves may be further categorized as Probable Reserves and Possible Reserves.

Probable Reserves are those additional Reserves which analysis of geoscience and engineering data indicates are less likely to be recovered than Proved Reserves but more certain to be recovered than Possible Reserves. It is equally likely that actual remaining quantities recovered will be greater than or less than the sum of the estimated Proved plus Probable Reserves (2P). In this context, when probabilistic methods are used, there should be at least a 50-percent probability that the actual quantities recovered will equal or exceed the 2P estimate. For clarity we recall that 2P reserves refer to Proved (P90) plus Probable (P50–P90) Reserves, such that 2P reserves refer to the P50 certainty category. Probable reserves equal 2P-1P.

Possible Reserves are those additional reserves which analysis of geoscience and engineering data suggests are less likely to be recoverable than Probable Reserves. The total quantities ultimately recovered from the project have a low probability to exceed the sum of Proved plus Probable plus Possible Reserves (3P), which is equivalent to the high estimate scenario. In this context, when probabilistic methods are used, there should be at least a 10-percent probability that the actual quantities recovered will equal or exceed the 3P estimate. For clarity we recall that 3P reserves refer to Proved (P90) plus Probable (P50–P90) plus Possible (P10–P50) Reserves, such that 3P reserves refer to the P10 certainty category. Possible Reserves equal 3P-2P.

Reserves Status Categories are defined by the development and producing status of wells and reservoirs.

Developed Reserves are expected quantities to be recovered from existing wells and facilities. Reserves are considered developed only after the necessary equipment has been installed, or when the costs to do so are relatively minor compared to the cost of a well. Where required facilities become unavailable, it may be necessary to reclassify Developed Reserves as Undeveloped. Developed Reserves may be further subclassified as Producing or Non-Producing.

Developed Producing Reserves are expected to be recovered from completion intervals that are open and producing at the time of the estimate. Improved recovery reserves are considered producing only after the improved recovery project is in operation.

Developed Non-Producing Reserves include shut-in and behind-pipe Reserves. Shut-in Reserves are expected to be recovered from (1) completion intervals which are open at the time of the estimate but which have not yet started producing, (2) wells which were shut-in for market conditions or pipeline connections, or (3) wells not capable of production for mechanical reasons. Behind-pipe Reserves are expected to be recovered from zones in existing wells which will require additional completion work or future recompletion prior to the start of production. In all cases, production can be initiated or restored with relatively low expenditure compared to the cost of drilling a new well.

Undeveloped Reserves are quantities expected to be recovered through future investments: (1) from new wells on undrilled acreage in known accumulations, (2) from deepening existing wells to a different (but known) reservoir, (3) from infill wells that will increase recovery, or (4) where a relatively large expenditure (e.g., when compared to the cost of drilling a new well) is required to (a) recomplete an existing well or (b) install production or transportation facilities for primary or improved recovery projects. The extent to which probable and possible reserves ultimately may be recategorized as proved reserves is dependent upon future drilling, testing, and well performance. The degree of risk to be applied in evaluating probable and possible reserves is influenced by economic and technological factors, as well as the time element.

References

- BP. BP Statistical Review of World Energy 67th Edition. 2018. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf (accessed on 28 November 2021).

- Shabaneh, R.; Schenckery, M. Assessing energy policy instruments: LNG imports into Saudi Arabia. Energy Policy 2019, 137, 1–28. [Google Scholar] [CrossRef]

- Mills, R. Under a Cloud: The Future of Middle East Gas Demand. 2020. Available online: www.energypolicy.columbia.edu/MiddleEastGas_CGEP-Report_042920 (accessed on 28 November 2021).

- Shabaneh, R.; Rioux, B.; Griffiths, S. Can Cooperation Enhance Natural Gas Utilization in the GCC? 2020. Available online: https://www.kapsarc.org/research/publications/can-cooperation-enhance-natural-gas-utilization-in-the-gcc/ (accessed on 28 November 2021).

- Talipova, A.; Parsegov, S. Evolution of natural gas business model with deregulation, financial instruments, technology solutions, and rising LNG export. Comparative study of projects inside the US and abroad. In Proceedings of the SPE Annual Technical Conference and Exhibition, Dallas, TX, USA, 24–26 September 2018. [Google Scholar] [CrossRef]

- Shabaneh, R.; Suwailem, M.A. The Prospect of Unconventional Gas Development in Saudi Arabia. 2020. Available online: https://www.kapsarc.org/research/publications/the-prospect-of-unconventional-gas-development-in-saudi-arabia/ (accessed on 28 November 2021).

- Elass. Saudi Aramco Looks to Expand Shale Gas Production. 2018. Available online: https://thearabweekly.com/saudi-aramco-looks-expand-shale-gas-production (accessed on 28 November 2021).

- Aldubyan, M.; Gasim, A. Energy price reform in Saudi Arabia: Modeling the economic and environmental impacts and understanding the demand response. Energy Policy 2021, 148, 111941. [Google Scholar] [CrossRef]

- Weijermars, R.; Moeller, J. Saudi Aramco Privatization in Perspective: Financial Analysis and Future Implications. J. Financ. Econ. 2020, 8, 161–170. [Google Scholar] [CrossRef]

- Weijermars, R. Weighted Average Cost of Retail Gas (WACORG) highlights pricing effects in the US gas value chain: Do we need wellhead price-floor regulation to bail out the unconventional gas industry? Energy Policy 2016, 1139, 6291–6300. [Google Scholar] [CrossRef]

- Kurison, C.; Kuleli, H.S.; Al-Mubarak, A.H. Early and reliable estimation of shale deliverability and spatial drainage parameters from stimulated exploration vertical wells: Case study on Eagle Ford. J. Nat. Gas Sci. Eng. 2020, 84, 103501. [Google Scholar] [CrossRef]

- Hakami, A.M. Characterization of the Carbonate Mud Rocks of the Middle Jurassic Tuwaiq Mountain Formation, Jafurah Sub-basin, Saudi Arabia; Implication for Unconventional Reservoir Quality Prediction. Ph.D. Thesis, King Fahd University of Petroleum and Minerals, Dhahran, Saudi Arabia, December 2016. [Google Scholar]

- Weijermars, R.; Al-Shehri, D. Regulation of Oil and Gas Reserves Reporting in Saudi Arabia: Review and Recommendations. J. Pet. Sci. Eng. 2021, 2021, 109806. [Google Scholar] [CrossRef]

- WoodMackenzie. Jafurah Basin Unconventional Gas. 2020. Available online: https://www.woodmac.com/reports/upstream-oil-and-gas-jafurah-basin-unconventional-gas-70631314/ (accessed on 28 November 2021).

- SPE. Petroleum Reserves Definition. 1997. Available online: https://www.spe.org/en/industry/petroleum-reserves-definitions/ (accessed on 28 November 2021).

- SPE; WPC; AAPG; SPEE; SEG; SPWLA; EAGE. Petroleum Resources Management System. 2018, p. 208. Available online: https://netherlandsewell.com/wpcontent/uploads/2018/09/SPE_Petroleum_Resources_Management_System_2018.pdf (accessed on 28 November 2021).

- Hakami, A.; Al-Mubarak, A.; Al-Ramadan, K.; Kurison, C.; Leyva, I. Characterization of carbonate mudrocks of the Jurassic Tuwaiq Mountain Formation, Jafurah basin, Saudi Arabia: Implications for unconventional reservoir potential evaluation. J. Nat. Gas Sci. Eng. 2016, 33, 1149–1168. [Google Scholar] [CrossRef]

- Hakami, A.; Ellis, L.; Al-Ramadan, K.; Abdelbagi, S. Mud gas isotope logging application for sweet spot identification in an unconventional shale gas play: A case study from Jurassic carbonate source rocks in Jafurah Basin, Saudi Arabia. Mar. Pet. Geol. 2016, 76, 133–147. [Google Scholar] [CrossRef]

- Al Ansari, Y.; Fateh, A.; Shehab, A.; Almoulani, G.; Ghosh, A.; Ahmed, A.; Thampi, S. Hanifa-Tuwaiq Mountain Zone: The edge between conventional and unconventional systems? In Proceedings of the 12th Middle East Geosciences Conference and Exhibition, Manama, Bahrain, 7–10 June 2016; pp. 1–14. [Google Scholar]

- Cantrell, D.L.; Nicholson, P.G.; Hughes, G.W.; Miller, M.A.; Buhllar, A.G.; Abdelbagi, S.T.; Norton, A.K. Tethyan petroleum systems of Saudi Arabia. AAPG Mem. 2014, 106, 613–639. [Google Scholar] [CrossRef]

- Hakami, A.; İnan, S. A basin modeling study of the Jafurah Sub-Basin, Saudi Arabia: Implications for unconventional hydrocarbon potential of the Jurassic Tuwaiq Mountain Formation. Int. J. Coal Geol. 2016, 165, 201–222. [Google Scholar] [CrossRef]

- Weijermars, R. Plio-Quaternary Movement of the East Arabian Block. GeoArabia 1998, 3, 509–540. [Google Scholar] [CrossRef]

- Pepper, A.S.; Corvi, P.J. Simple kinetic models of petroleum formation. Part III: Modelling an open system. Mar. Pet. Geol. 1995, 12, 417–452. [Google Scholar] [CrossRef]

- Montgomery, S.L.; Jarvie, D.M.; Bowker, K.A.; Pollastro, R.M. Mississippian Barnett Shale, Forth Worth basin, north-central Texas: Gas-shale play with multi-trillion cubic foot potential. AAPG Bull. 2005, 89, 155–175. [Google Scholar] [CrossRef]

- Heller, R.; Zoback, M. Adsorption of methane and carbon dioxide on gas shale and pure mineral samples. J. Unconv. Oil Gas Resour. 2014, 8, 14–24. [Google Scholar] [CrossRef] [Green Version]

- Gasparik, M.; Bertier, P.; Gensterblum, Y.; Ghanizadeh, A.; Krooss, B.M.; Littke, R. Geological controls on the methane storage capacity in organic-rich shales. Int. J. Coal Geol. 2014, 123, 34–51. [Google Scholar] [CrossRef]

- Almubarak, A.; Hakami, A.; Leyva, I.; Kurison, C. Saudi Arabia’s unconventional program in the Jafurah basin: Transforming an idea to reality with the Jurassic Tuwaiq mountain formation. In Proceedings of the 22nd World Petroleum Congress, Istanbul, Turkey, 9–13 July 2017. [Google Scholar]

- Al-Momin, A.; Mechkak, K.; Bartko, K.; McClelland, K.; Tineo, R.; Drouillard, M.; Muhammad, N. Cluster Spacing Optimization through Data Integration Workflow for Unconventional Jurassic Mudrocks, Saudi Arabia, SPE184830. Presented at the SPE Hydraulic Fracturing Technology Conference and Exhibition, The Woodlands, TX, USA, 24–26 January 2017. [Google Scholar] [CrossRef]

- Ba Geri, M.; Ellafi, A.; Flori, R.; Belhaij, A.; Ethar, H.A. New Opportunities and Challenges to Discover and Develop Unconventional Plays in the Middle East and North Africa: Critical Review, SPE197271. Presented at the Abu Dhabi International Petroleum Exhibition & Conference, Abu Dhabi, United Arab Emirates, 11–14 November 2019. [Google Scholar] [CrossRef]

- Kurison, C.; Kuleli, H.S.; Mubarak, A.H. Unlocking well productivity drivers in Eagle Ford and Utica unconventional resources through data analytics. J. Nat. Gas Sci. Eng. 2019, 71, 102976. [Google Scholar] [CrossRef]

- Gala, D.; Sharma, M. Compositional and geomechanical effects in Huff-n-Puff gas injection ior in tight oil reservoirs. In Proceedings of the SPE Annual Technical Conference and Exhibition, Dallas, TX, USA, 24–26 September 2018. [Google Scholar] [CrossRef]

- Al-Momin, A.; Kurdi, M.; Baki, S.; Mechkak, K.; Al-Saihati, A. Proving the concept of unconventional gas reservoirs in Saudi through multistage fractured horizontal wells. In Proceedings of the SPE Asia Pacific Unconventional Resource Conference and Exhibition, Brisbane, Australia, 9–11 November 2015. [Google Scholar] [CrossRef]

- Weijermars, R.; Nandlal, K.; Khanal, A.; Tugan, M.F. Comparison of Pressure Front with Tracer Front Advance and Principal Flow Regimes in Hydraulically Fractured Wells in Unconventional Reservoirs. J. Pet. Sci. Eng. 2019, 183, 106407. [Google Scholar] [CrossRef]

- Weijermars, R. Improving Well Productivity—Ways to Reduce the Lag between the Diffusive and Convective Time of Flight in Shale Wells. J. Pet. Sci. Eng. 2020, 193, 107344. [Google Scholar] [CrossRef]

- Al-Mulhim, N.I.; Korosa, M.; Ahmed, A.; Hakami, A.; Sadykov, A.; Baki, S.; Asiri, K.S.; Al Ruwaished, A. Saudi Arabia’s Emerging Unconventional Carbonate Shale Resources: Moving to Horizontals with an Integrated Engineering and Geosciences Approach, SPE 176936. Presented at the SPE Asia Pacific Unconventional Resources Conference and Exhibition, Brisbane, Austria, 9–11 November 2015. [Google Scholar]

- Kurison, C.; Kuleli, H.S.; Mubarak, A.H.; Al-Sultan, A.; Shehri, S.J. Reducing uncertainty in unconventional reservoir hydraulic fracture modeling: A case study in Saudi Arabia. J. Nat. Gas Sci. Eng. 2019, 71, 102948. [Google Scholar] [CrossRef]

- Weijermars, R.; van Harmelen, A.; Zuo, L.; Nascentes Alves, I.; Yu, W. Flow interference between hydraulic fractures. SPE Reserv. Eval. Eng. 2018, 21, 942–960. [Google Scholar] [CrossRef]

- Energent. Overview of Wells Drilled in US Shale Basin on an Annual Basis. 2021. Available online: https://www.westwoodenergy.com/business-division/research/world-land-drilling-rig-market-forecast-2021-2025 (accessed on 28 November 2021).

- EIA. Permian Basin: Wolfcamp Shale Play Geology Review, Independent Statistics & Analysis; U.S. Energy Information Administration: Washington, DC, USA, 2018. [Google Scholar]

- EIA. The Distribution of U.S. Oil and Natural Gas Wells by Production Rate; U.S. Energy Information Administration: Washington, DC, USA, 2020. Available online: https://www.eia.gov/petroleum/wells/pdf/full_report.pdf (accessed on 28 November 2021).

- Al-Mulhim, N.; Saihati, A.; Hakami, A.; Al Harbi, M.; Asiri, K. First successful proppant fracture for unconventional carbonate source rock in Saudi Arabia. In Proceedings of the International Petroleum Technology Conference, Kuala Lumpur, Malaysia, 10–12 December 2014; pp. 581–593. [Google Scholar] [CrossRef]

- Al-Sulami, G.; Boudjatit, M.; Al-Duhailan, M.; Salvatore, D.S. The Unconventional Shale Reservoirs of Jafurah Basin: An Integrated Petrophysical Evaluation Using Cores and Advanced Well Logs. SPE 183771. Presented at the SPE Middle East Oil & Gas Show and Conference, Manama, Bahrain, 6–9 March 2017; Available online: https://doi.org/10.2118/183771-MS (accessed on 28 November 2021).

- Aguilera, R. Shale gas reservoirs: Theoretical, practical and research issues. Pet. Res. 2016, 1, 10–26. [Google Scholar] [CrossRef]

- Dong, Z. A New Global Unconventional Natural Gas Resource Assessment. Ph.D. Thesis, Texas A&M University, College Station, TX, USA, August 2012. [Google Scholar]

- Dong, Z.; Holditch, S.A.; McVay, D.A.; Ayers, W.B.; Lee, W.J.; Morales, E. Probabilistic assessment of world recoverable shale gas resources. In Proceedings of the European Unconventional Resources Conference and Exhibition, Vienna, Austria, 25–27 February 2014. [Google Scholar] [CrossRef]

- EIA. shale gas and shale oil resource assessment methodology. In EIA/ARI World Shale Gas and Shale Oil Resource Assessment; U.S. Energy Information Administration: Washington, DC, USA, 2013; pp. 1–23. [Google Scholar]

- Richardson, J.; Yu, W.; Weijermars, R. Benchmarking recovery factors of individual wells using a probabilistic model of original gas in place to pinpoint the good, bad and ugly producers. In Proceedings of the SPE/AAPG/SEG Unconventional Resources Technology Conference, San Antonio, TX, USA, 1–3 August 2016. [Google Scholar] [CrossRef]

- Richardson, J.; Yu, W. Calculation of estimated ultimate recovery and recovery factors of shale-gas wells using a probabilistic model of original gas in place. SPE Reserv. Eval. Eng. 2018, 21, 638–653. [Google Scholar] [CrossRef]

- Yu, W.; Sepehrnoori, K.; Patzek, T.W. Modeling gas adsorption in Marcellus shale with langmuir and bet isotherms. SPE J. 2016, 21, 589–600. [Google Scholar] [CrossRef] [Green Version]

- Hammes, U.; Eastwood, R.; McDaid, G.; Vankov, E.; Gherabati, S.A.; Smye, K.; Tinker, S. Regional assessment of the Eagle Ford group of South Texas, USA: Insights From lithology, pore volume, water saturation, organic richness, and productivity correlations. Interpretation 2016, 4, 1F–T121. [Google Scholar] [CrossRef]

- Laherrere, J. Oil and Gas: What Future ? In Groningen Annual Energy Convention; 2006. Available online: http://aspofrance.viabloga.com/files/JL-Groningen-long.pdf (accessed on 28 November 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).