1. Introduction

Global warming caused by greenhouse gas (GHG) is one of the critical problems facing humanity. GHG emissions from shipping accounted for about 2.89% of global emissions in 2018. Various solutions have been proposed to decrease CO2 emissions from shipping, including improvement in hull design, the use of an enhanced power and propulsion system, increasing operational efficiency, and the use of alternative energies. Alternative energy is considered a practical solution to meet tightened international, national, and local regulations. Alternative energies include LNG, LPG, methanol, ethanol, ammonia, hydrogen biofuels, batteries, solar power, and wind power. Among various alternative energies, ammonia and hydrogen are considered the most feasible solutions. Although hydrogen is an environment-friendly fuel, it is difficult to store due to its very low density. The density of liquefied hydrogen is about 71.00 kg/m3 and that of heavy fuel oil (HFO) is approximately 1010 kg/m3. Ammonia has a higher volumetric energy density than liquid hydrogen. Although ammonia has a lower gravimetric energy density (18.8 MJ/kg) compared to hydrogen (120.0 MJ/kg), the density of liquid ammonia (682 kg/m3) is significantly higher than that of liquid hydrogen (70.8 kg/m3). So the volumetric energy density of liquid ammonia (12,822 MJ/m3) is higher than liquid hydrogen (8496 MJ/m3). Additionally, the hydrogen content of ammonia is higher than pure liquid hydrogen. The hydrogen density of pure liquid hydrogen is 70.8 kg/m3, whereas that of ammonia is 121 kg/m3. This means that more hydrogen can be transported than liquid hydrogen when hydrogen is converted into ammonia for transportation.

Several agencies have predicted that ammonia will be the main fuel for ships by 2050. The IEA has forecast that ammonia will account for 45% of energy demand for shipping in 2050 to achieve net-zero emissions [

1]. DNV has published a report about ammonia as a marine fuel and it is expected that ammonia will potentially play an important role in the decarbonization of deep-sea vessels. Although ammonia is toxic with an energy density lower than oil-based fuels, it could be a suitable fuel with internal combustion engines. The production and utilization of ammonia, engine technologies, emissions to air, safety considerations, and financial disadvantages have been described in a previous report [

2]. ABS has also published a report about ammonia as a marine fuel and anticipates that ammonia as a zero-carbon fuel could enter the global market quickly. Safety, regulatory compliance considerations, design considerations, and ongoing research have been presented in [

3]. KR published a report on ammonia-fueled ships and investigated the feasibility of ammonia as a marine fuel. The report discusses the production and use of ammonia, economic efficiency, properties, risk, safety features of ammonia handling facilities, ammonia fuel cells and internal combustion engines, and provides an analysis of IGC/IGF code requirements. KR concluded that revision of rules is required for the application of ammonia-fueled ships [

4]. KR also issued guidelines for a ship using ammonia as fuel. It contains the class society’s latest safety regulations and inspection standards for ammonia-fueled vessels [

5]. Marine industry companies have published the paper to provide an industrial view of ammonia as a marine fuel. The report is focused on cost, availability, safety, technical readiness, emissions, and elimination of risks related to future environmental and climate-related regulations and requirements, and concludes that ammonia is an attractive and low-risk choice of marine fuel [

6]. A Swedish maritime competence center (Lighthouse) has published a report about ammonia as a fuel for shipping. It presented its technical and economic feasibility and considered the safety and environmental aspects including a comparison with other fuels [

7]. DNV and the Norwegian Maritime Authority have presented a safety handbook for ammonia as a marine fuel. They mainly discuss how the ship arrangement is affected by the installation of ammonia fuel systems [

8]. Lloyd’s Register has issued a report including safety and risk information and guidance for ammonia infrastructure with hydrogen. It assessed the risk of (anhydrous) ammonia and hydrogen infrastructure (production, transport, storage, and bunkering) when ammonia and hydrogen are used as marine fuels. The assessment results showed that the refrigerated ammonia facility seemed to be a better solution in regard to the safety aspects [

9].

The demand for ammonia-fueled ships, as well as for ammonia carriers is likely to increase. Ammonia has been mainly utilized in the fertilizer industry. According to the Centre for European Policy Studies, approximately 80% of global ammonia production is used as fertilizer [

10]. Ammonia has been considered as a good means of hydrogen transportation as the hydrogen market has increased [

11,

12,

13,

14,

15]. Although ammonia is conventionally produced from fossil fuels like natural gas or coal (called brown ammonia), it should be produced from renewable energies when it is utilized as a hydrogen energy carrier to combat global warming [

16]. The demand for ammonia as a hydrogen carrier is likely to increase dramatically. Ammonia can be produced in various locations to meet the demand. As ammonia is produced in various areas, ammonia transportation by ship will also be increased.

Ammonia could be used as fuel in an ammonia carrier to improve operational efficiency and to meet reinforced environmental regulations. If ammonia is used as fuel for the ammonia carrier, the operation is easier because it is already handled as cargo. Although the use of ammonia as fuel in a gas carrier is prohibited under the current IGC code due to safety aspects, it is expected that it will be allowed in the future. NYK Line, Nihon Shipyard, ClassNK, and Yara International (a Norwegian chemical company) have started a study on the practical application of ammonia as fuel in an ammonia gas carrier [

17]. They expect that the vessel will achieve zero emissions. Exmar has been awarded an Approval in Principle for an ammonia-fueled mid-size gas carrier [

18].

There are many challenges to using ammonia as fuel in an ammonia carrier, including the use of ammonia in cargo tanks as fuel, the location of ammonia fuel tanks if an ammonia fuel tank is installed, the installation of a service tank (buffer), the design and operating pressure of the fuel tank and the service tank (fully refrigerated, semi-refrigerated, compressed), the concept of a return line from the ammonia engine (in the case of MAN’s ammonia engine, some amount should be returned from the engine), the arrangement of equipment in the fuel supply system, and the ventilation concept. Although there are many challenges to realizing an ammonia carrier fueled by ammonia, one important challenge is whether ammonia can be used in cargo tanks as fuel or whether independent fuel tanks should be installed. Although several studies on an ammonia carrier fueled by ammonia have been initiated, the results have not been reported yet. Therefore, the purpose of this study was to propose two concepts for fuel storage in an ammonia-fueled ammonia carrier and to evaluate the economics to find the optimal concept. The structure of this paper is as follows. The two concepts for fuel storage in ammonia-fueled ammonia carriers are proposed in

Section 2. In

Section 3, the economic evaluation is described. The results are presented in

Section 4. Finally, the conclusions are presented in

Section 5.

2. Description of Concepts for Fuel Storage in Ammonia-Fueled Ammonia Carrier

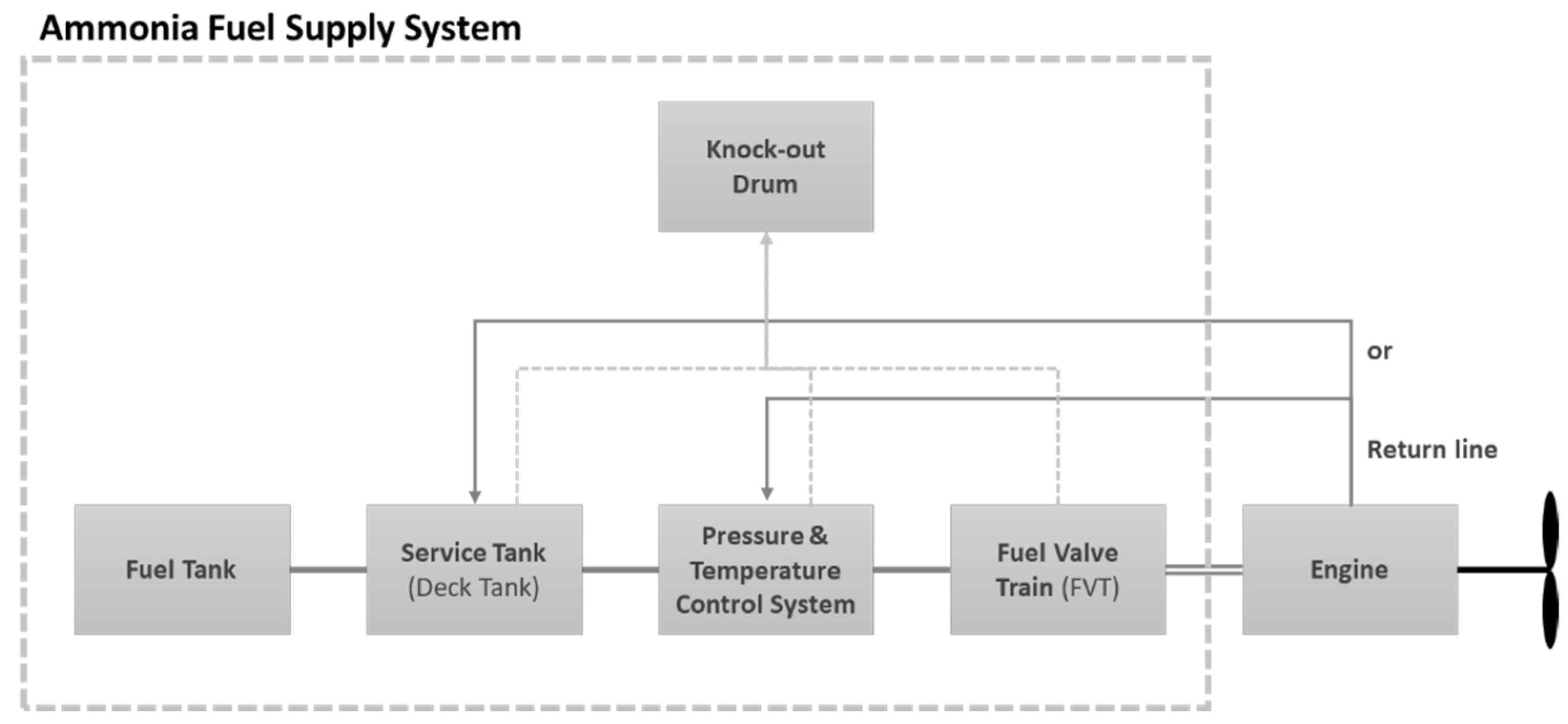

Ammonia is supplied from a fuel tank to an ammonia engine as shown in

Figure 1. Ammonia in the fuel tank is provided through a service tank, a pressure and temperature (P & T) control system, and a fuel valve train (FVT). The unburned ammonia in the engine is returned to the service tank or the P & T control system. In the case of the ammonia engine (MAN Energy Solutions—Two Stroke ME-LGIA concept), excessive ammonia should be supplied to the engine for cooling. Thus, some amounts of ammonia are continuously returned from the engine. Liquid ammonia in the fuel tank can be stored in refrigerated, semi-refrigerated, or compressed conditions. The pressure and temperature of refrigerated ammonia are about 1 bara and −33 °C, respectively, whereas those of compressed ammonia are approximately 10 bara and 25 °C, respectively. Refrigerated ammonia is generally used in the case of large capacity due to its high density. Compressed ammonia is commonly used in the case of small capacity because the construction and operation of the compressed ammonia tank are easier than refrigerated ammonia. The service tank acts as a buffer between the fuel tank and the P & T control system. Although the service tank makes the operation easy, it requires additional costs. The function of the P & T control system is to meet conditions (pressure, temperature, and fineness) required by the engine. The P & T control system consists of pumps, heat exchangers, and filters. The FVT is the interface between the P & T control system and the engine to ensure safe isolation of the engine during shutdown and maintenance.

There are two main ways to store ammonia as fuel in the ammonia carrier. When the ammonia is used as fuel, an ammonia storage tank should be installed in the ship (containership, a crude oil tanker, bulk carrier, etc.). However, the cargo (ammonia) can be used as fuel in the case of an ammonia carrier.

Figure 2 shows storage concepts for ammonia fuel in an ammonia carrier. The main difference between the two concepts is whether the installation of fuel tanks is needed or not. Ammonia in the cargo tank can be directly supplied to the P & T control system using a cargo pump as shown in

Figure 2a and ammonia in the fuel tank can be provided to the P & T control system as presented in

Figure 2b. When the cargo tank is simultaneously utilized as a fuel tank, there are no additional costs for the fuel tank. However, the amount of cargo transported is reduced. If a fuel tank is installed, the operation is easy because different storage conditions can be employed. In addition, there is no cargo loss. However, it requires additional costs for the installation of a fuel tank.

The target ship for this study was an 84,000 m3 ammonia carrier traveling from Kuwait to South Korea. This study assumes that a large amount of ammonia will be transported from countries with abundant renewable energy to countries with insufficient energy. In the future, hydrogen will be produced by abundant renewable energy. It is converted into ammonia for convenient transportation. This study assumed that the voyage distance (round trip) was about 20,000 km. The cargo volume was 84,000 m3. Four cargo tanks of 21,000 m3 size were installed. The cargo storage facility was assumed to be fully refrigerated (1 bara, −33 °C). The engine was assumed to be an ammonia engine developed by MAN Energy Solutions (ME_LGIA, two stroke dual fuel engine).

The required amount of ammonia in the carrier was calculated by converting the lower heating value (LHV) of HFO consumed in the carrier into the LHV of ammonia. This study assumed that auxiliary engines (for electrical power generation) were operated using diesel (marine diesel oil).

Table 1 shows basic specifications for the two proposed concepts. The required amount of ammonia fuel for the round trip was approximately 4170 m

3. If ammonia in the cargo tanks is utilized as the propulsion fuel, 4170 m

3 ammonia cannot be transported. When separate fuel tanks were installed in the carrier, the size of the tank was 4170 m

3. This study assumes that two or four independent fuel tanks are installed in the ammonia carrier because a 4170 m

3 tank is enormous and it was assumed that the effect of the extra weight of the fuel tanks and their ammonia on the required power was negligible because the weight of the ship can be managed by ballast water. Additionally, the difference is small compared to the whole cargo ammonia.

A cylindrical pressure vessel with an elliptical head was selected for the independent tank. The dimensions of the tank were assumed to be: diameter (D) 7.87 m, length (L) 55.09 m, volume (V) 2085 m3, and D 6.25 m, L 43.75 m, V 1042 m3 for 2 tanks and 4 tanks, respectively. The head length was excluded in the length. There are three general head types in the cylindrical pressure vessel: hemispherical, elliptical, and torispherical head types. The hemispherical head type has a hemispherical head. It is mainly used for reactors, which require thick steel to withstand high pressure. The elliptical head type is composed of a 2:1 elliptical profile. It is widely used for towers. The torispherical head type consists of different circles, crown radius, and knuckle radius. It is mainly used for pressure vessels with a small head volume and a low pressure.

The volume of the fuel tank with the elliptical head type was calculated using Equation (1). The front part in the equation is the volume of the cylinder part and the rear part is the head part.

where,

V: volume (m3)

d: inner diameter (m)

L: cylinder length (m)

3. Economic Evaluation

This study employed the life-cycle cost (LCC) for the economic evaluation of an ammonia-fueled ammonia carrier. There are various methods for economic evaluation, such as LCC, net present value (NPV), internal rate of return (IRR), and profitability index (PI) (ISO, 2006). LCC includes all costs involved in design (engineering), construction, operation, maintenance, and disposal. NPV is the difference between the present value of cash flows over a period of time. IRR is a discount rate that makes the NPV of all cash flows equal to zero in a discounted cash flow analysis. PI is the ratio between the present value of future expected cash flows and the initial amount invested in a project. The project with a higher PI is more attractive than the others. This study uses LCC for the economic evaluation because it is widely used for the selection of design alternatives. Additionally, this study considers profit from the transportation of ammonia (cargo) because the amount of ammonia transported is different depending on the design options. This study assumed that the carrier would be purchased by a shipping company even though shipping companies generally charter ships.

LCC is mainly composed of capital expenditure (CAPEX) and operating expenditure (OPEX). CAPEX includes all expenses incurred before the system is operational. It is further divided into direct and indirect costs. The former includes costs incurred by purchasing materials and installation, comprising all costs for equipment, instrumentation, control, piping, electrical systems, and service facilities. The latter includes engineering and supervision costs, legal expenses, contractor fees, and contingencies. OPEX includes all expenses incurred after the system is operational (ISO, 2000). OPEX includes costs needed to run the system in normal operating conditions, including operating labor, direct supervisory and clerical labor, utilities, maintenance and repairs, operating supplies, local taxes, insurance, and overhead costs.

3.1. CAPEX

This study assumed that CAPEX consisted of costs for an ammonia carrier and costs for the additional fuel tanks that were installed. The cost (price of building a new ship) of the 84,000 m

3 ammonia carrier was estimated using the cost of an LPG carrier. An LPG carrier is generally utilized in combination with ammonia. As the physical properties of LPG and ammonia are similar, an LPG carrier is commonly designed to accommodate ammonia. Design conditions for the storage of ammonia and LPG are similar because their boiling points are similar. A shipowner manages carriers depending on the LPG/ammonia market situation.

Table 2 shows the average price to build a new LPG carrier for the last five years [

19]. The price was around USD 70.8 million for an 82,000 m

3 carrier, USD 63.02 million for a 60,000 m

3 carrier, and USD 42 million for a 24,000 m

3 carrier. The price of an 82,000 m

3 carrier was assumed to be similar to that of an 84,000 m

3 carrier.

The cost of an ammonia fuel tank was estimated using a cost estimating software for a chemical process (Aspen Process Economic Analyzer) [

20]. It provides CAPEX and OPEX estimates for comparing and screening various process alternatives. This study assumed that the tank was a process vessel with a capacity of 2800 m

3, a diameter of 7.87 m, a length of 55.09 m, and a design pressure of 1.7 bara. The design pressure (maximum allowable working pressure) was set at 0.69 bara above the working (operating) pressure [

21]. The elliptical head type was selected as mentioned above.

Table 3 presents the results of the cost estimation using the cost estimating software.

3.2. OPEX

The OPEX for the ammonia carrier was assumed to be composed mainly of fuel consumption costs and general maintenance costs. Fuel consumption costs were estimated by multiplying annual fuel consumption by fuel (ammonia) price. The amount of annual fuel consumption was calculated by multiplying the fuel consumption rate per hour by voyage hours per year. The ammonia engine requires not only ammonia, but also HFO for combustion. The required amount of the pilot oil was assumed to be 3% of the total amount of energy required for combustion. Heavy fuel oil (HFO) was used as pilot oil [

22]. The price of ammonia and HFO were assumed to be USD 350/ton and USD 400/ton, respectively. The price of intermediate fuel oil (IFO) 380 was used for the HFO price. There are two main types of HFO depending on the viscosity (IFO 180 and IFO 380). The average value of IF 380 for three years was about USD 350/ton at the Global 20 ports [

23]. The price of ammonia was taken from the trade statistics data [

24]. General maintenance costs were assumed to be 4% of the ammonia carrier price annually.

3.3. Profit

The profit was estimated to compare the two proposed concepts because sales earned by transporting ammonia will be different depending on the concept as mentioned before. In this study, profit was calculated by subtracting the costs required for transporting ammonia from sales. Ammonia transport sales were estimated based on ammonia transport fee, which was assumed to be USD 75/ton [

25].

In this study, the inflation rate and discount rate were considered to reflect changes in the money value. As shown above, it was assumed that fuel consumption costs, general maintenance costs, and ammonia transport fees were constant with the lifespan and that the future value would be the same as the present value. However, it is reasonable to reflect inflation and convert future values to present values for the comparison of design options at the feasibility study stage. Equations (2) and (3) were employed to consider inflation (inflation rate) and value change with time (discount rate). The inflation rate and discount rate were assumed to be 0.015 and 0.018, respectively, based on average values for the last 10 years announced by the Bank of Korea.

where,

FV: future value

EV: initial estimated value

k: inflation rate

PV: present value

d: discount rate

n: year

4. Results and Discussion

4.1. LCC

As shown in

Figure 3, results of the LCC for the two cases revealed little difference. LCC consists of costs for ship, storage tanks installed additionally (for ammonia fuel), fuel consumption, and general maintenance. There was no difference in ship cost between the two cases. The cost for the storage tanks occurred only for Case B. It was small at 0.8% of the LCC. The fuel consumption cost accounted for about 73.05% of the LCC as shown in

Figure 3. Although general maintenance costs for Case B were slightly higher than those for Case A due to additional installation of storage tanks, there was little difference in terms of LCC. The LCCs for Case A and Case B were approximately USD 538.7 million and USD 547.5 million, respectively.

The results of estimating the profits for the two cases showed there was a difference of about USD 64 million in sales and USD 55.2 million in profits as shown in

Figure 4. Sales for the two cases were USD 1223 and 1287 million, respectively. Sales for Case B were higher than those for Case A because more ammonia cargo was transported in Case B after the installation of independent fuel tanks. Profits for Case A and Case B were USD 684.3 and 739.5 million, respectively. Profit was estimated by subtracting LCC from sales generated by transporting ammonia as described above. More profit occurred in Case B because increased sales were higher than increased LCC after installing additional fuel storage tanks. The increase in LCC due to installing the additional fuel storage tanks was about USD 8.8 million, but the increase in sales was about USD 64 million. When inflation and discount rates were considered, profits decreased by about 3.8%.

4.2. Sensitivity Analysis

This study performed a sensitivity analysis to investigate the influence of assumed parameters on the results. The investigated parameters were costs for ship, fuel tanks (for ammonia fuel), ammonia fuel, HFO for pilot oil, and ammonia transport fees. These values can significantly fluctuate based on market situations. In the case of ship costs, changes of ±10% and ±20% were observed. Changes of ±25% and ±50% were observed for the remaining variables. Changes of ±10% and ±20% were assumed in the case of the ship because of the small probability of the change depending on market conditions.

4.2.1. Sensitivity Analysis for Costs of Ship

Profit from the operation of the ammonia carrier changed by about 1% with the variation in ship cost.

Figure 5 indicates profits with changes of ±10 and ±20% in the price of the ship. There were no significant changes in profits depending on ship costs. The profit was slightly changed with ship cost because the influence of ship cost on the profit was insignificant. Case B with fuel tanks installed had higher profits than Case A despite a change in the cost of the ship.

4.2.2. Sensitivity Analysis for Costs of Fuel Tanks

The profit was changed with a 0.3% variation in fuel tank costs only in Case B when fuel tanks were installed.

Figure 6 shows profit changes with cost changes of ±25% and ±50% of fuel tanks. There were no changes in profit in Case A because the fuel tank was not installed. Since costs for fuel tanks were 0.8% of the LCC, profits were not significantly changed with the fluctuation in the costs of fuel tanks. Case B equipped with fuel tanks had higher profits than Case A despite a change in the price of the ship.

4.2.3. Sensitivity Analysis for Price of Ammonia Fuel

The profits of the ammonia carriers were changed by 15% with a 25% change in the price of the ammonia fuel.

Figure 7 shows the changes in profit with changes of ±25% and ±50% in the ammonia price.

Figure 7 presents Case A and Case B using ammonia as well as Case C using HFO as fuel for reference. The profit changed impressively with variations in the price of the ammonia fuel. When the price of the ammonia fuel decreased by 50% from the current price, profits were USD 879.5 million in Case A and USD 934.7 million in Case B. When the price of the ammonia fuel increased by 50%, the revenue was USD 489.2 million in Case A and USD 544.4 million in Case B. When the fuel price of ammonia decreased by about 50%, the profit of Case B was higher than that of Case C when conventional HFO was used as fuel. This means that ammonia fuel is competitive from the viewpoint of economics compared to HFO, which is currently utilized as a fuel in ships when the price of ammonia fuel falls by about 50%. Case B with fuel tanks installed had a higher profit than Case A despite a change in the price of ammonia fuel.

4.2.4. Sensitivity Analysis for Price of HFO (Pilot Oil)

The profit of the ammonia carrier was changed by only about 0.22% with the variation in HFO (pilot oil) price.

Figure 8 shows changes in profit depending on price changes of ±25% and ±50% in HFO. There was no fluctuation shown in

Figure 8 because the amount of HFO required was only 3% of the total fuel required for combustion. The effect of HFO was insignificant.

4.2.5. Sensitivity Analysis for Sales from Ammonia Transport

Profits of ammonia carriers were changed by 45% with a 25% variation in sales (ammonia transport fee).

Figure 9 shows the profits depending on changes in sales by ±25% and ±50%. The profit of the ammonia carrier was greatly affected by the change in sales. When sales of ammonia carrier decreased by 50% from its initially assumed value, profits were USD 72.8 million for Case A and USD 96.8 million for Case B. These profits were USD 1295.8 million for Case A and USD 1383.8 million for Case B if sales of the ammonia carrier increased by 50% from the initially assumed value. Case B with fuel tanks installed had higher profits than Case A.

Results of the sensitivity analysis for the five parameters showed that Case B had a higher return than Case A. In other words, the installation of independent fuel tanks on the ammonia carrier provided higher profits. Ship costs, fuel tank costs, and HFO (pilot oil) price had insignificant effects on profit. However, the effects of ammonia fuel price and sales (ammonia transport fee) on the profit were substantial. It can be seen that ammonia fuel price and sales are important variables affecting the profits of ammonia carriers. Although this study was focused on the ammonia-fueled ammonia carrier, the results of the sensitivity analysis can be utilized to analyze the feasibility of ammonia-fueled vessels. The sensitivity analysis results for ammonia price indicated that ammonia fuel was competitive with conventional fuels like HFO when the price of ammonia dropped by 50% from the current price.

5. Conclusions

This study investigated the influence of the installation of ammonia fuel tanks in ammonia-fueled ammonia carriers. Two concepts were proposed. The first concept was to utilize ammonia in cargo tanks as fuel. The second concept was to install independent fuel tanks above or below the deck. The target ship was an 84,000 m3 ammonia carrier. It traveled from Kuwait to South Korea. The capacity of the fuel tanks required for the voyage was assumed to be 4170 m3. When ammonia in the cargo tanks was utilized as fuel, 4170 m3 of ammonia could not be transported as cargo. In contrast, 4170 m3 of ammonia could be transported if independent ammonia fuel tanks were installed. These fuel tanks were assumed to be cylindrical pressure vessels with two fuel tanks installed above deck. Economic evaluation was performed to compare the two proposed concepts. LCC and sales were estimated. Profits were then calculated using LCC and sales data. The LCC was assumed to be composed of CAPEX, including ship and fuel tank costs and OPEX, including fuel and general maintenance costs. Sales were estimated based on ammonia transport fee. This study also considered the inflation rate and discount rate to reflect changes in the value of money. Additionally, sensitivity analysis was performed to investigate important variables that might affect results.

The LCC was USD 538.7 million for Case A (without fuel tank installation) and was USD 547.5 million for Case B (with fuel tank installation). Although the price of the fuel tank was USD 4.4 million, the LCC increased by about USD 8.8 million due to an increase in maintenance costs caused by fuel tank installation. Sales were USD 1223 million for Case A and USD 1287 million for Case B. Sales of Case A were lower than those of Case B due to the use of ammonia in cargo tanks as fuel. After estimating profits based on LCC and sales, profits were USD 684.3 million for Case A and USD 739.5 million for Case B. This result indicates that installing a fuel tank can lead to higher profits. When the inflation rate and discount rate were taken into account, profits decreased to USD 658.2 million and USD 711.3 million for Case A and Case B, respectively.

Results of the sensitivity analysis indicated that ammonia fuel price and sales from ammonia transport were crucial factors that affected the results. When there was a 15% change in the profit with a ±25% change in ammonia fuel price, there was a 45% change in profit with a ±25% change in sales. From this result, it can be seen that ammonia fuel price and sales have a substantial influence on the business of ammonia carriers. When ammonia fuel is compared to conventional fuel (HFO), the price of ammonia fuel needs to fall by about 50% to be competitive compared to HFO.

One Japanese company (Kawasaki Heavy Industries) developed a liquid hydrogen carrier, and they will demonstrate it in the near future (early 2022) [

26]. Although the carrier for demonstration will be propelled by diesel-electric, a liquid hydrogen carrier will be powered by the boil-off gas (BOG) from the cargo (liquid hydrogen), like LNG carriers in the future. The amount of BOG generated from LNG and liquid hydrogen carriers is huge, but the BOG from ammonia carriers is relatively small because of its relatively low heat ingress. The temperature of LNG and liquid hydrogen are about −161 °C, and −253 °C, respectively; however, that of liquid ammonia is approximately −33 °C. BOG generated in LPG or ammonia carriers is generally re-liquefied by a liquefaction system. However, BOG can be used as fuel in the ammonia-fueled ammonia carrier, and additional study is required to investigate its feasibility.

Ammonia fuel is unattractive at the moment in terms of economics. However, the utilization of ammonia as fuel will increase as environmental regulations tighten. Although this study contains a certain level of uncertainty as it was conducted in the initial stage of design, it is expected to be useful for designers and/or decision-makers.