Electric Vehicles Ready for Breakthrough in MaaS? Consumer Adoption of E-Car Sharing and E-Scooter Sharing as a Part of Mobility-as-a-Service (MaaS)

Abstract

:1. Introduction

2. Literature Review

2.1. Service Bundling in the Mobility Sector

2.2. Overview of MaaS Initiatives, Concepts and Projects

2.3. Consumer Preferences toward MaaS Packages

- Research Question 1: What are the most attractive attributes of MaaS bundles in suburban areas/residential settlements?

- Research Question 2: How high is the potential users’ purchase intention of MaaS bundles that include EVs (i.e., e-car sharing and/or e-scooter sharing)?

- Research Question 3: What differences regarding respondents’ socio-demographic (e.g., gender, age, income), psychological (e.g., climate change concerns) and behavioral (e.g., car usage) characteristics can be identified between (non-)adopter groups in suburban areas/residential settlements?

3. Methodology and Data

3.1. Data Collection and Sample

3.2. Choice-Based Conjoint

3.3. Survey Design

3.4. Data Analysis

4. Results

4.1. Part-Worth Utilities and Relative Importance Scores

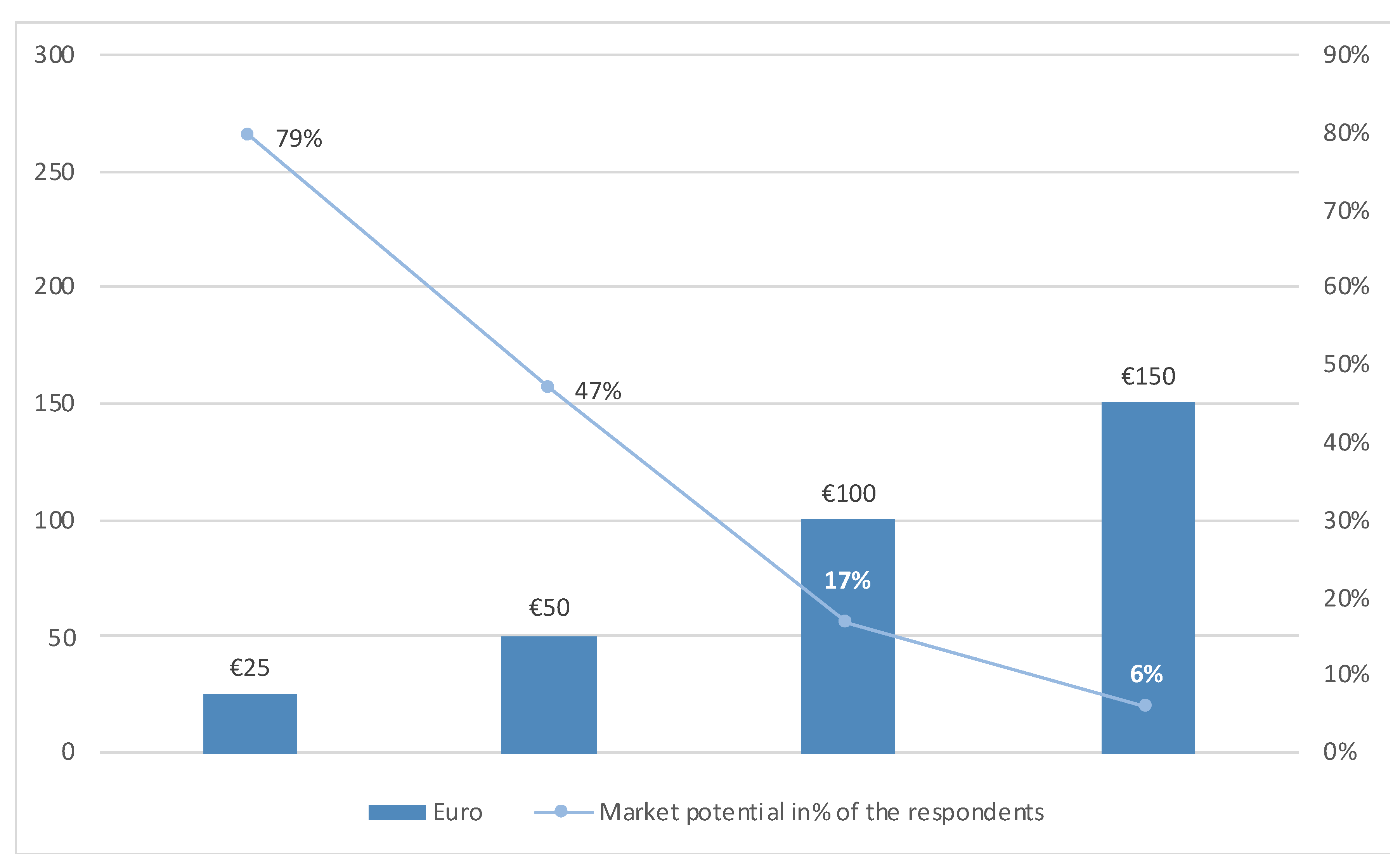

4.2. Willingness-to-Pay

4.3. Customer Segments

4.4. Sensitivity Analysis on Segment Level

4.4.1. Simulation 1: Transport Modes

4.4.2. Simulation 2: Contract Termination Modes

4.4.3. Simulation 3: Modes of Access

4.4.4. Simulation 4: Price (Per Month)

4.5. Insights on Electric Vehicles as a Part of the MaaS Packages

5. Discussion and Conclusions

5.1. Discussion of Results and Implications

5.2. Limitations and Further Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variable | Sample | Convenience Seekers | Price-Sensitive Worriers | Non-Adopters |

|---|---|---|---|---|

| Demographic Variables | ||||

| Age | 46.6 | 44.47 | 43.68 | 52.21 |

| Gender (man) | 34.0% | 32.5% | 35.5% | 33.0% |

| Education | ||||

| Compulsory school | 6.1% | 5.2% | 2.2% | 11.7% |

| Vocational training | 39.3% | 44.2% | 39.8% | 33.8% |

| High school | 25.5% | 24.7% | 26.9% | 24.7% |

| Collage/university | 29.1% | 26.0% | 31.2% | 29.9% |

| Income | €2513.1 | €2664.75 | €2601.24 | €2255.12 |

| Mobility Behavior Related Variables | ||||

| WTP for MaaS | €51.88 | €62.32 | €54.77 | €37.95 |

| WTA 1 MaaS ((most) likely) | 56.7% | 71.4% | 61.3% | 36.4% |

| Car ownership (at least one car) | 89.5% | 93.5% | 91.4% | 83.1% |

| Daily car usage (as driver) | 8.5% | 13% | 9.7% | 2.6% |

| Cost for car (per month) | €238.52 | €257.38 | €230.42 | €225.94 |

| Socio-Psychological Variables | ||||

| Climate change concerns | 3.86 | 3.87 | 3.88 | 3.82 |

| Pro-environmental attitude | 3.36 | 3.40 | 3.30 | 3.41 |

| Values (Schwartz’s value scale) | 3.80 | 3.95 | 3.72 | 3.74 |

| Energy-saving behavior | 3.02 | 3.07 | 2.97 | 3.03 |

| Subjective norm | 2.82 | 3.13 | 2.73 | 2.61 |

| Intention towards using PT | 2.63 | 2.78 | 2.60 | 2.52 |

| Scheme | Psychological Items | Origin |

|---|---|---|

| Climate change concerns (1 = not worried at all; 5 = very worried) | How worried are you, if at all, about climate change? | Leiserowitz et al. (2019) (N/A) |

| Pro-environmental attitude (α = 0.89) (1 = not agree at all; 4 = fully agree) | I would say of myself that I am environmentally conscious. Being environmentally friendly is an important part of my personality. I would describe myself as someone who cares about the environment. | Whitmarsh and O’Neill (2010) (α = 0.70) |

| Values ((short) Schwartz’s value scale) (α = 0.70) (1 = not important at all; 6 = very important) | POWER (social power, authority, wealth) | Schwartz (1992, 1996) (α = 0.89) |

| ACHIEVEMENT (success, capability, ambition, influence on people and events) | ||

| HEDONISM (gratification of desires, enjoyment in life, self-indulgence) | ||

| STIMULATION (daring, a varied and challenging life, an exciting life) | ||

| SELF-DIRECTION (creativity, freedom, curiosity, independence, choosing one’s own goals) | ||

| UNIVERSALISM (broad-mindedness, beauty of nature and arts, social justice, a world at peace, equality, wisdom, unity with nature, environmental protection) | ||

| BENEVOLENCE (helpfulness, honesty, forgiveness, loyalty, responsibility) | ||

| TRADITION (respect for tradition, humbleness, accepting one’s portion in life, devotion, modesty) | ||

| CONFORMITY (obedience, honoring parents and elders, self- discipline, politeness) | ||

| SECURITY (national security, family security, social order, cleanliness, reciprocation of favors) | ||

| Energy-saving behavior (α = 0.68) (1 = never; 4 = always) | Turn off lights, the computer and other electronic devices when they are not needed. | Spence, Leygue, Bedwell and O’Malley (2014) (α = 0.60) |

| Using warmer clothes at home instead of heating more. | ||

| Disconnect the phone and other devices to be charged as soon as they are fully charged. | ||

| Walk short distances or use the bike. | ||

| Choose holiday destinations that do not require a flight. | ||

| Consume seasonal, local and organic foods. | ||

| If possible, avoid the consumption of meat products. | ||

| Engage for energy saving measures writing letters politicians and/or the employer, as well as similar actions. | ||

| Subjective norm (α = 0.87) (1 = not agree at all; 4 = fully agree) | Most people who are important to me would support me using public transport for daily travel. | Bamberg, Rölle and Weber (2003) (N/A) |

| Most people who are important to me think that I should use public transport for daily travel. | ||

| Most people who are important to me think it is good if I would give up on car. | ||

| Intention towards using PT (1 = not agree at all; 4 = fully agree) | My intention to use public transportation on my regular trips (shopping, leisure, university, work) is strong. | Friedrichsmeier, Matthies and Klöckner (2013) |

| Source | Sum of Squares | df | Mean Square | F | p |

|---|---|---|---|---|---|

| Age a,b | 3565.88 | 2 | 1782.94 | 8.12 | 0.000 |

| WTA c,d | 32.86 | 2 | 16.43 | 12.04 | 0.000 |

| WTP e,f | 24,124.66 | 2 | 12,062.33 | 7.09 | 0.001 |

| Values g,h | 2.73 | 2 | 1.36 | 5.56 | 0.004 |

| Subjective norm i,j | 11.25 | 2 | 5.62 | 8.94 | 0.000 |

| Usage Frequency of Different Transport Modes | Daily | Min. Once a Week | Min. Once a Month | Few Times per Year | Rarely or Never |

|---|---|---|---|---|---|

| Car (as driver) | 8.5 | 20.6 | 6.5 | 12.6 | 51.8 |

| Car (as co-driver) | 4.9 | 12.6 | 11.3 | 17.8 | 53.4 |

| PT (e.g., bus, tram, metro) | 12.6 | 8.9 | 17.8 | 27.9 | 32.8 |

| Train (e.g., regional train) | 1.2 | 2.0 | 12.1 | 33.6 | 51.0 |

| Motorbike | 1.2 | 4.0 | 3.2 | 2.0 | 89.5 |

| Bike | 25.9 | 21.9 | 12.1 | 16.2 | 23.9 |

| E-bike | 2.0 | 2.8 | 1.2 | 2.8 | 91.1 |

| Walking | 59.5 | 23.5 | 10.1 | 2.0 | 4.9 |

| Micro-PT | − | − | − | 5.3 | 92.7 |

| Taxi | − | 0.8 | 6.1 | 38.5 | 54.7 |

| (E-)load-cycle | − | - | - | 1.2 | 98.8 |

| (E-)scooter | − | 1.6 | 3.6 | 6.1 | 88.7 |

| Usage Frequency of Different Sharing Modes | Daily | Min. Once a Week | Min. Once a Month | Few Times per Year | Rarely or Never |

|---|---|---|---|---|---|

| Car sharing | 0.8 | 0.8 | 2.0 | 3.6 | 92.7 |

| E-car sharing | − | − | − | 2.0 | 98.0 |

| Bike sharing | − | − | 1.6 | 2.8 | 95.5 |

| E-bike sharing | − | − | − | 1.6 | 98.4 |

| (E-)load-cycle sharing | − | − | 0.4 | − | 99.6 |

| (E-)scooter sharing | − | 0.8 | 3.2 | 4.5 | 91.5 |

| Sample | Convenience Seeker | Price-Sensitive Worrier | Non-Adopter | |

|---|---|---|---|---|

| PT (e.g., bus, tram, metro) | 3.68 | 3.57 | 3.78 | 3.65 |

| Train (e.g., regional train) | 3.03 | 2.88 | 2.91 | 3.42 |

| E-car sharing | 2.88 | 2.90 | 2.83 | 2.94 |

| Car sharing | 3.08 | 3.18 | 3.06 | 2.96 |

| Bike sharing | 2.79 | 2.76 | 2.99 | 2.52 |

| E-bike sharing | 2.81 | 2.83 | 2.87 | 2.69 |

| Micro-PT | 2.37 | 2.32 | 2.27 | 2.60 |

| E-scooter sharing | 2.07 | 1.88 | 2.09 | 2.31 |

| Taxi | 1.99 | 1.96 | 1.92 | 2.15 |

| E-load-cycle sharing | 2.39 | 2.49 | 2.53 | 2.02 |

| Other | 1.30 | 1.41 | 1.29 | 1.20 |

| Attributes | Sample | Connivence Seekers | Non-Adopters | Price-Sensitive Worriers |

|---|---|---|---|---|

| Transport Modes | ||||

| PT + bike sharing | 23.9 | 23.4 | 37.7 | 12.9 |

| PT + bike sharing + e-scooter sharing | 14.6 | 18.2 | 10.4 | 15.1 |

| PT + bike sharing + e-car sharing | 34.8 | 28.6 | 28.6 | 45.2 |

| PT + bike sharing + e-car sharing + e-scooter sharing | 26.7 | 29.9 | 23.4 | 26.9 |

| Contract Termination Modes | ||||

| Annually | 5.7 | 6.5 | 6.5 | 4.3 |

| Bi-annually | 8.9 | 10.4 | 3.9 | 11.8 |

| Monthly | 35.6 | 35.1 | 31.2 | 39.8 |

| Flexible | 49.8 | 48.1 | 58.4 | 44.1 |

| Modes of Access | ||||

| Mobility card | 20.6 | 22.1 | 22.1 | 18.3 |

| Smartphone (via app) | 43.7 | 46.8 | 33.8 | 49.5 |

| Credit or debit card | 13.8 | 14.3 | 13.0 | 14.0 |

| Stadtwerke Klagenfurt user card | 21.9 | 16.9 | 31.2 | 18.3 |

References

- Ellen MacArthur Foundation. Towards a Circular Economy-Economic and Business Rationale for an Accelerated Transition. Greener Management International, 97. Available online: https://doi.org/2012-04-03 (accessed on 25 November 2019).

- Hensher, D.A. Future bus transport contracts under a mobility as a service (MaaS) regime in the digital age: Are they likely to change? Transp. Res. Part. A Policy Practice 2017, 98, 86–96. [Google Scholar] [CrossRef] [Green Version]

- Bert, J.; Collie, B.; Gerrits, M.; Xu, G. What’s Ahead for Car Sharing? The New Mobility and Its Impact on Vehicle Sales. Available online: https://trid.trb.org/view/1399142 (accessed on 29 November 2020).

- Grosse-Ophoff, A.; Hausler, S.; Heineke, K.; Möller, T. How Shared Mobility Will Change the Automotive Industry; McKinsey & Company: Washington DC, USA, 2017. [Google Scholar]

- Global Market Insights. Car Sharing Market. Statistics-Global Growth Trends 2026. Available online: https://www.gminsights.com/industry-analysis/carsharing-market (accessed on 29 November 2020).

- Shaheen, S.A.; Cohen, A.P. Carsharing and personal vehicle services: Worldwide market developments and emerging trends. Int. J. Sustain. Transp. 2013, 7, 5–34. [Google Scholar] [CrossRef]

- Cooper, P.; Tryfonas, T.; Crick, T.; Marsh, A. Electric vehicle mobility-as-a-service: Exploring the “Tri-Opt” of novel private transport business models. J. Urban. Technol. 2019, 26, 35–56. [Google Scholar] [CrossRef]

- Gnann, T.; Plötz, P.; Funke, S.; Wietschel, M. What is the market potential of plug-in electric vehicles as commercial passenger cars? A case study from Germany. Transp. Res. Part. D Transp. Environ. 2015, 37, 171–187. [Google Scholar] [CrossRef]

- Paffumi, E.; de Gennaro, M.; Martini, G.; Scholz, H. Assessment of the potential of electric vehicles and charging strategies to meet urban mobility requirements. Transportmetrica A Transport. Sci. 2015, 1, 22–60. [Google Scholar] [CrossRef]

- Creutzig, F.; Ravindranath, N.H.; Berndes, G.; Bolwig, S.; Bright, R.; Cherubini, F.; Fargione, J. Bioenergy and climate change mitigation: An assessment. Gcb Bioenerg. 2015, 7, 916–944. [Google Scholar] [CrossRef] [Green Version]

- Lutsey, N. Global climate change mitigation potential from a transition to electric vehicles. Int. Counc. Clean Transp. 2015, 2015, 5. [Google Scholar]

- Turcksin, L.; Mairesse, O.; Macharis, C. Private household demand for vehicles on alternative fuels and drive trains: A review. Eur. Transport. Res. Rev. 2013, 5, 149–164. [Google Scholar] [CrossRef] [Green Version]

- Ambrosino, G.; Nelson, J.D.; Boero, M.; Pettinelli, I. Enabling intermodal urban transport through complementary services: From flexible mobility services to the shared use mobility agency: Workshop 4. Developing inter-modal transport systems. Res. Transp. Econ. 2016, 59, 179–184. [Google Scholar] [CrossRef]

- Ho, C.; Hensher, D.A.; Mulley, C.; Wong, Y. Prospects for switching out of conventional transport services to mobility as a service subscription plans–A stated choice study. In Proceedings of the International Conference Series on Competition and Ownership in Land Passenger Transport, (Thredbo 15), Stockholm, Sweden, 13–17 August 2017. [Google Scholar]

- Li, Y.; Voege, T. Mobility as a service (MaaS): Challenges of implementation and policy required. J. Transp. Technol. 2017, 7, 95–106. [Google Scholar] [CrossRef] [Green Version]

- Gould, E.; Wehrmeyer, W.; Leach, M. Transition pathways of e-mobility services. WIT Trans. Ecol. Environ. 2015, 194, 349–359. [Google Scholar]

- Smith, G.; Sarasini, S.; Karlsson, I.M.; Mukhtar-Landgren, D.; Sochor, J. Governing Mobility-as-a-Service: Insights from Sweden and Finland. In The Governance of Smart Transportation Systems; Springer: Cham, Germany, 2019; pp. 169–188. [Google Scholar]

- Karlsson, I.C.M.; Mukhtar-Landgren, D.; Smith, G.; Koglin, T.; Kronsell, A.; Lund, E.; Sochor, J. Development and implementation of Mobility-as-a-Service–A qualitative study of barriers and enabling factors. Transp. Res. Part. A Policy Practice 2020, 131, 283–295. [Google Scholar] [CrossRef]

- Mulley, C.; Nelson, J.D.; Wright, S. Community transport meets mobility as a service: On the road to a new a flexible future. Res. Transp. Econ. 2018, 69, 583–591. [Google Scholar] [CrossRef] [Green Version]

- Audouin, M.; Finger, M. The development of mobility-as-a-service in the Helsinki metropolitan area: A multi-level governance analysis. Res. Transp. Bus. Manag. 2018, 27, 24–35. [Google Scholar] [CrossRef]

- Caiati, V.; Rasouli, S.; Timmermans, H. Bundling, pricing schemes and extra features preferences for mobility as a service: Sequential portfolio choice experiment. Transp. Res.Part. A Policy Practice 2020, 131, 123–148. [Google Scholar] [CrossRef]

- Ho, C.Q.; Hensher, D.A.; Mulley, C.; Wong, Y.Z. Potential uptake and willingness-to-pay for Mobility as a Service (MaaS): A stated choice study. Transp. Res. Part. A Policy Practice 2018, 117, 302–318. [Google Scholar] [CrossRef]

- Kamargianni, M.; Li, W.; Matyas, M.; Schäfer, A. A critical review of new mobility services for urban transport. Transp. Res. Proced. 2016, 14, 3294–3303. [Google Scholar] [CrossRef] [Green Version]

- Matyas, M.; Kamargianni, M. The potential of mobility as a service bundles as a mobility management tool. Transportation 2018, 46, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Mulley, C.; Ho, C.; Balbontin, C.; Hensher, D.; Stevens, L.; Nelson, J.D.; Wright, S. Mobility as a service in community transport in Australia: Can it provide a sustainable future? Transp. Res. Part A Policy Practice 2020, 131, 107–122. [Google Scholar] [CrossRef]

- Goodall, W.; Dovey, T.; Bornstein, J.; Bonthron, B. The rise of mobility as a service. Deloitte Rev. 2017, 20, 112–129. [Google Scholar]

- Kostiainen, J.; Tuominen, A. Mobility as a service—Stakeholders’ challenges and potential implications. In Towards User-Centric Transport in Europe; Springer: Cham, Germany, 2019; pp. 239–254. [Google Scholar]

- Utriainen, R.; Pöllänen, M. Review on mobility as a service in scientific publications. Res. Transp. Bus. Manag. 2018, 27, 15–23. [Google Scholar] [CrossRef]

- Aapaoja, A.; Eckhardt, J.; Nykänen, L.; Sochor, J. MaaS service combinations for different geographical areas. In Proceedings of the 24th world congress on intelligent transportation systems, Montreal, QC, Canada, 29 October–2 November 2017. [Google Scholar]

- Esztergár-Kiss, D.; Kerényi, T. Creation of mobility packages based on the MaaS concept. Travel Behav. Soc. 2019, 21, 307–317. [Google Scholar] [CrossRef]

- Wright, S.; Nelson, J.D.; Cottrill, C.D. MaaS for the suburban market: Incorporating carpooling in the mix. Transp. Res. Part. A Policy Practice 2020, 131, 206–218. [Google Scholar] [CrossRef]

- Heikkilä, S. Mobility as a Service–A Proposal for Action for the Public Administration, Case Helsinki. Master’s Thesis, Aalto University, Espoo, Finland, 2014. [Google Scholar]

- Giesecke, R.; Surakka, T.; Hakonen, M. Conceptualising Mobility as a Service; IEEE: Piscataway, NJ, USA, 2016; pp. 1–11. [Google Scholar]

- Sochor, J.L.; Strömberg, H.; Karlsson, M. An innovative mobility service to facilitate changes in travel behavior and mode choice. In Proceedings of the 22nd World Congress on Intelligent Transportation Systems, Bordeaux, France, 5–9 October 2015. [Google Scholar]

- Sochor, J.; Strömberg, H.; Karlsson, I.C.M. Implementing Mobility as a Service challenges in integrating user, commercial, and societal perspectives. Transp. Res. Record 2015, 4, 1–9. [Google Scholar] [CrossRef]

- Sochor, J.; Strömberg, H.; Karlsson, I.C.M. Trying out mobility as a service experiences from a field trial and implications for understanding demand. In Proceedings of the 95th Transportation Research Board Annual Meeting, Washington, DC, USA, 1 January 2016. [Google Scholar]

- Karlsson, I.M.; Sochor, J.; Strömberg, H. Developing the ‘Service’in Mobility as a Service: Experiences from a field trial of an innovative travel brokerage. Transp. Res. Proced. 2016, 14, 3265–3273. [Google Scholar] [CrossRef] [Green Version]

- Whim. All Your Journeys. Available online: https://whimapp.com (accessed on 2 April 2019).

- Axhausen, K.W.; Simma, A.; Golob, T.F. Pre-commitment and usage: Season tickets, cars and travel. Arbeitsb. Verk. Raumplan. 2000, 495, 24. [Google Scholar]

- Lathia, N.; Capra, L. How Smart is your Smartcard? Measuring Travel Behaviours, Perceptions, and Incentives; ACM: Beijing, China, 2011; pp. 291–300. [Google Scholar]

- Schad, H.; Flamm, M.; Wagner, C.; Frey, T. New, Integrated Mobility Services, NIM; Project A3 of the National Research Programme (NRP): Bern, Switzerland, 2005. [Google Scholar]

- Thøgersen, J. Promoting public transport as a subscription service: Effects of a free month travel card. Trans. Policy 2009, 16, 335–343. [Google Scholar] [CrossRef]

- Huwer, U. Public transport and car-sharing—benefits and effects of combined services. Transport. Policy 2004, 11, 77–87. [Google Scholar] [CrossRef]

- Durand, A.; Harms, L.; Hoogendoorn-Lanser, S.; Zijlstra, T. Mobility-as-a-Service and Changes in Travel Preferences and Travel Behaviour: A Literature Review. KiM| Netherlands Institute for Transport Policy Analysis: Hague, The Netherlands, 2018. [Google Scholar]

- Guidon, S.; Wicki, M.; Bernauer, T.; Axhausen, K. Transportation service bundling–for whose benefit? Consumer valuation of pure bundling in the passenger transportation market. Transp. Res. Part. A Policy Pract. 2020, 131, 91–106. [Google Scholar] [CrossRef]

- Ho, C.Q.; Mulley, C.; Hensher, D.A. Public preferences for mobility as a service: Insights from stated preference surveys. Transp. Res. Part. A Policy Practice 2020, 131, 70–90. [Google Scholar] [CrossRef]

- Matyas, M.; Kamargianni, M. Survey design for exploring demand for Mobility as a Service plans. Transportation 2019, 46, 1525–1558. [Google Scholar] [CrossRef] [Green Version]

- Alonso-González, M.J.; Hoogendoorn-Lanser, S.; van Oort, N.; Cats, O.; Hoogendoorn, S. Drivers and barriers in adopting Mobility as a Service (MaaS)–A latent class cluster analysis of attitudes. Transp.Res. Part. A Policy Pract. 2020, 132, 378–401. [Google Scholar] [CrossRef]

- Diana, M. From mode choice to modal diversion: A new behavioural paradigm and an application to the study of the demand for innovative transport services. Technol. Forecast. Soc. Change 2010, 77, 429–441. [Google Scholar] [CrossRef] [Green Version]

- Gardner, B. Modelling motivation and habit in stable travel mode contexts. Transp. Res. Part. F Traffic Psychol. Behav. 2009, 12, 68–76. [Google Scholar] [CrossRef]

- Wittink, D.R.; Cattin, P. Commercial Use of Conjoint Analysis: An Update. J. Market. 1989, 53, 91–96. [Google Scholar] [CrossRef]

- Green, P.E.; Srinivasan, V. Conjoint analysis in consumer research: Issues and outlook. J. Consum. Res. 1978, 5, 103–123. [Google Scholar] [CrossRef]

- Green, P.E.; Srinivasan, V. Conjoint analysis in marketing: New developments with implications for research and practice. J. Market. 1990, 54, 3–19. [Google Scholar] [CrossRef]

- Louviere, J.J.; Street, D.; Burgess, L.; Wasi, N.; Islam, T.; Marley, A.A. Modeling the choices of individual decision-makers by combining efficient choice experiment designs with extra preference information. J. Choice Modell. 2008, 1, 128–164. [Google Scholar] [CrossRef] [Green Version]

- Golden, B.R. The past is the past—or is it? The use of retrospective accounts as indicators of past strategy. Acad. Manag. J. 1992, 35, 848–860. [Google Scholar]

- Adamowicz, W.; Louviere, J.; Williams, M. Combining revealed and stated preference methods for valuing environmental amenities. J. Environ. Econ. Manag. 1994, 26, 271–292. [Google Scholar] [CrossRef]

- Louviere, J.J.; Hensher, D.A.; Swait, J.D. Stated Choice Methods: Analysis and Applications; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Hampl, N.; Loock, M. Sustainable development in retailing: What is the impact on store choice? Bus. Strategy Environ. 2013, 22, 202–216. [Google Scholar] [CrossRef]

- Kubli, M.; Loock, M.; Wüstenhagen, R. The flexible prosumer: Measuring the willingness to co-create distributed flexibility. Energy Policy 2018, 114, 540–548. [Google Scholar] [CrossRef]

- Priessner, A.; Hampl, N. Can product bundling increase the joint adoption of electric vehicles, solar panels and battery storage? Explorative evidence from a choice-based conjoint study in Austria. Ecol. Econ. 2020, 167, 106381. [Google Scholar] [CrossRef]

- Sawtooth Software. The CBC/HB System for Hierarchical Bayes Estimation Version 5.0 Technical Paper; Sawtooth Software: Sequim, WA, USA, 2009. [Google Scholar]

- Chrzan, K.; Orme, B. An overview and comparison of design strategies for choice-based conjoint analysis. Sawtooth Softw. res. Pap. Ser. 2000, 98382, 360. [Google Scholar]

- Rossi, P.E.; Allenby, G.M. Bayesian statistics and marketing. Market. Sci. 2003, 22, 304–328. [Google Scholar] [CrossRef]

- Huber, J.; Train, K. On the similarity of classical and Bayesian estimates of individual mean partworths. Market. Lett. 2001, 12, 259–269. [Google Scholar] [CrossRef]

- Magidson, J.; Vermunt, J.K. Latent class models. The Sage Handbook of Quantitative Methodology for the Social Sciences; SAGE Publications: Thousand Oaks, CA, USA, 2004; pp. 175–198. [Google Scholar]

- Sawtooth Software. The CBC Latent Class Technical Paper (Version 3); Sawtooth Software: Sequim, WA, USA, 2004. [Google Scholar]

- Bozdogan, H. Model selection and Akaike’s information criterion (AIC): The general theory and its analytical extensions. Psychometrika 1987, 52, 345–370. [Google Scholar] [CrossRef]

- Ramaswamy, V.; de Sarbo, W.S.; Reibstein, D.J.; Robinson, W.T. An empirical pooling approach for estimating marketing mix elasticities with PIMS data. Market. Sci. 1993, 12, 103–124. [Google Scholar] [CrossRef]

- Orme, B.K.; Chrzan, K. Becoming an Expert in Conjoint Analysis: Choice Modelling for Pros; Sawtooth Software: Sun Valley, ID, USA, 2017. [Google Scholar]

- Eggers, F.; Sattler, H.; Teichert, T.; Völckner, F. Choice-based conjoint analysis. Handbook of Market Research; Springer: Cham, Germany, 2018. [Google Scholar]

- Orme, B. Getting Started with Conjoint Analysis: Strategies for Product Design and Pricing Research, 2nd ed.; Research Publishers LLC: Madison, WI, USA, 2010. [Google Scholar]

- Salm, S.; Hille, S.L.; Wüstenhagen, R. What are retail investors’ risk-return preferences towards renewable energy projects? A choice experiment in Germany. Energy Policy 2016, 97, 310–320. [Google Scholar] [CrossRef]

- European Comission. Road Transport: Reducing CO2 Emissions from Vehicles. 2019. Available online: https://ec.europa.eu/clima/policies/transport/vehicles_en (accessed on 20 January 2019).

- Collins, C.M.; Chambers, S.M. Psychological and situational influences on commuter-transport-mode choice. Environ. Behave. 2005, 37, 640–661. [Google Scholar] [CrossRef]

- Mola, L.; Berger, Q.; Haavisto, K.; Soscia, I. Mobility as a service: An exploratory study of consumer mobility behaviour. Sustainability 2020, 12, 8210. [Google Scholar] [CrossRef]

- Choi, J.P. Bundling new products with old to signal quality, with application to the sequencing of new products. Int. J. Ind. Organ. 2003, 21, 1179–1200. [Google Scholar] [CrossRef]

- Reinders, M.J.; Frambach, R.T.; Schoormans, J.P. Using product bundling to facilitate the adoption process of radical innovations. J. Product Innov. Manag. 2010, 27, 1127–1140. [Google Scholar] [CrossRef]

- Simonin, B.L.; Ruth, J.A. Bundling as a strategy for new product introduction: Effects on consumers’ reservation prices for the bundle, the new product, and its tie-in. J. Bus. Res. 1995, 33, 219–230. [Google Scholar] [CrossRef]

- Harris, J.; Blair, E.A. Consumer preference for product bundles: The role of reduced search costs. J. Acad. Market. Sci. 2006, 34, 506–513. [Google Scholar] [CrossRef]

- ElHaffar, G.; Durif, F.; Dubé, L. Towards closing the attitude-intention-behavior gap in green consumption: A narrative review of the literature and an overview of future research directions. J. Clean. Prod. 2020, 275, 122556. [Google Scholar] [CrossRef]

- Schikofsky, J.; Dannewald, T.; Kowald, M. Exploring motivational mechanisms behind the intention to adopt mobility as a service (MaaS): Insights from Germany. Transp. Res. Part. A Policy Practice 2020, 131, 296–312. [Google Scholar] [CrossRef]

- Pinto, J.; Morales, M.E.; Fedoruk, M.; Kovaleva, M.; Diemer, A. Servitization in support of sustainable cities: What are steel’s contributions and challenges? Sustainability 2019, 11, 855. [Google Scholar] [CrossRef] [Green Version]

- Hiscock, R.; Macintyre, S.; Kearns, A.; Ellaway, A. Means of transport and ontological security: Do cars provide psycho-social benefits to their users? Transp. Res. Part. D Transp. Environ. 2002, 7, 119–135. [Google Scholar] [CrossRef]

| Attributes | Description | Levels |

|---|---|---|

| Transport modes | Transport modes included in the package (incl. a specific number of free hours or mileage 1) | PT + bike sharing |

| PT + bike sharing + e-scooter sharing | ||

| PT + bike sharing + e-car sharing PT + bike sharing + e-car sharing + e-scooter sharing | ||

| Contract termination modes | Possibility of changing the package or cancel the contract | Annually |

| Bi-annually | ||

| Monthly | ||

| Flexible | ||

| Modes of access | Possibility of activating the individual mobility offers for use | Mobility card 2 Stadtwerke Klagenfurt user card |

| Credit or debit card | ||

| Credit or debit card | ||

| Smartphone (via app) | ||

| Price (per month) | Total monthly cost for all transport modes included in the package | €30 |

| €60 | ||

| €90 | ||

| €120 |

| Groups | Percent Certainty | CAIC | Chi-Square |

|---|---|---|---|

| 2 | 36.43 | 5467.10 | 2993.70 |

| 3 | 40.45 | 5262.61 | 3324.11 |

| 4 | 42.79 | 5196.31 | 3516.33 |

| 5 | 43.89 | 5232.10 | 3606.46 |

| Attributes and Attribute Levels | Mean | Standard Deviation | Lower 95% CI 1 | Upper 95% CI 1 |

|---|---|---|---|---|

| Transport Modes (m = 27.28; SD = 12.69) | ||||

| PT + bike sharing | −45.12 | 39.10 | −49.99 | −40.24 |

| PT + bike sharing + e-scooter sharing | −18.92 | 32.14 | −22.93 | −14.91 |

| PT + bike sharing + e-car sharing | 26.50 | 42.70 | 21.18 | 31.83 |

| PT + bike sharing + e-car sharing + e-scooter sharing | 37.54 | 28.92 | 33.93 | 41.14 |

| Contract Termination Modes (m = 13.19; SD = 5.69) | ||||

| Annually | −22.51 | 20.62 | −25.08 | −19.94 |

| Bi-annually | −4.57 | 16.40 | −6.62 | −2.52 |

| Monthly | 11.33 | 14.47 | 9.52 | 13.13 |

| Flexible | 15.75 | 14.86 | 13.90 | 17.60 |

| Modes of Access (m = 10.42; SD = 6.14) | ||||

| Mobility card | −0.16 | 21.52 | −2.84 | 2.52 |

| Smartphone (via app) | −1.37 | 19.65 | −3.82 | 1.09 |

| Credit or debit card | −3.83 | 15.29 | −5.73 | −1.92 |

| Stadtwerke Klagenfurt user card | 5.35 | 16.18 | 3.33 | 7.37 |

| Price (per Month) (m = 49.10; SD = 13.62) | ||||

| €30 | 101.62 | 44.88 | 96.02 | 107.21 |

| €60 | 25.23 | 20.11 | 22.72 | 27.74 |

| €90 | −37.97 | 26.62 | −41.29 | −34.65 |

| €120 | −88.88 | 28.87 | −92.48 | −85.28 |

| None | 111.13 | 141.74 | 93.46 | 128.81 |

| Segment 1: Convenience Seekers | Segment 2: Price-Sensitive Worriers | Segment 3: Non-Adopters | |

|---|---|---|---|

| Segment size | n = 77 (31.2%) | n = 93 (37.6%) | n = 77 (31.2%) |

| Transport Modes | |||

| PT + bike sharing | −63.41 | −52.83 | 5.44 |

| PT + bike sharing + e-scooter sharing | −33.47 | −25.11 | −40.48 |

| PT + bike sharing + e-car sharing | 36.18 | 40.29 | 1.10 |

| PT + bike sharing + e-car sharing + e-scooter sharing | 60.70 | 37.65 | 33.95 |

| Contract Termination Modes | |||

| Annually | −7.23 | −22.18 | −75.28 |

| Bi-annually | −11.31 | −0.17 | −6.97 |

| Monthly | 8.02 | 12.30 | 25.09 |

| Flexible | 10.53 | 10.05 | 57.16 |

| Modes of Access | |||

| Mobility card | 18.02 | −0.72 | −6.04 |

| Credit or debit card | −7.69 | −2.41 | −5.58 |

| Smartphone (via app) | −6.61 | −7.88 | −0.83 |

| Stadtwerke Klagenfurt user card | −3.72 | 11.01 | 12.45 |

| Price (per Month) | |||

| €30 | 106.25 | 131.43 | 116.19 |

| €60 | 50.60 | 35.75 | −58.44 |

| €90 | −34.78 | −45.10 | −17.18 |

| €120 | −122.08 | −122.08 | −40.57 |

| None | −150.90 | 114.21 | 353.73 |

| Segment | Segment 1: Convenience Seekers | Segment 2: Price-Sensitive Worriers | Segment 3: Non-Adopters |

|---|---|---|---|

| Segment size | n = 77 (31.2%) | n = 93 (37.6%) | n = 77 (31.2%) |

| Transport modes | 31.0 | 23.3 | 18.6 |

| Contract termination modes | 5.5 | 8.6 | 33.1 |

| Modes of access | 6.4 | 4.7 | 4.6 |

| Price (per month) | 57.1 | 63.4 | 43.7 |

| Total | 100% | 100% | 100% |

| Should Definitely Be Included | Should Be Included | Should Not Be Included | Should Not Be Included at All | Sum of Columns “Should (Definitely) Be Included” | |

|---|---|---|---|---|---|

| PT (e.g., bus, tram, metro) | 78.14% | 14.57% | 2.43% | 4.86% | 92.71% |

| Train (e.g., regional train) | 42.11% | 30.77% | 14.57% | 12.55% | 72.87% |

| E-car sharing | 38.06% | 30.77% | 11.34% | 19.84% | 68.83% |

| Car sharing | 33.20% | 29.96% | 15.38% | 21.46% | 63.16% |

| Bike sharing | 29.55% | 28.74% | 15.38% | 26.32% | 58.30% |

| E-bike sharing | 29.55% | 28.74% | 14.98% | 26.72% | 58.30% |

| Micro-PT | 21.86% | 22.27% | 19.84% | 36.03% | 44.13% |

| E-scooter sharing | 23.08% | 20.24% | 15.38% | 41.30% | 43.32% |

| Taxi | 19.84% | 18.62% | 15.38% | 46.15% | 38.46% |

| E-load-cycle sharing | 12.15% | 15.38% | 22.27% | 50.20% | 27.53% |

| Other | 4.17% | 5.56% | 6.94% | 83.33% | 9.72% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Brezovec, P.; Hampl, N. Electric Vehicles Ready for Breakthrough in MaaS? Consumer Adoption of E-Car Sharing and E-Scooter Sharing as a Part of Mobility-as-a-Service (MaaS). Energies 2021, 14, 1088. https://doi.org/10.3390/en14041088

Brezovec P, Hampl N. Electric Vehicles Ready for Breakthrough in MaaS? Consumer Adoption of E-Car Sharing and E-Scooter Sharing as a Part of Mobility-as-a-Service (MaaS). Energies. 2021; 14(4):1088. https://doi.org/10.3390/en14041088

Chicago/Turabian StyleBrezovec, Paula, and Nina Hampl. 2021. "Electric Vehicles Ready for Breakthrough in MaaS? Consumer Adoption of E-Car Sharing and E-Scooter Sharing as a Part of Mobility-as-a-Service (MaaS)" Energies 14, no. 4: 1088. https://doi.org/10.3390/en14041088

APA StyleBrezovec, P., & Hampl, N. (2021). Electric Vehicles Ready for Breakthrough in MaaS? Consumer Adoption of E-Car Sharing and E-Scooter Sharing as a Part of Mobility-as-a-Service (MaaS). Energies, 14(4), 1088. https://doi.org/10.3390/en14041088